Filed by ALLSCRIPTS-MISYS HEALTHCARE SOLUTIONS, INC. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Eclipsys Corporation Commission File No.: 000-24539 |

2 One Network. One Platform. One Patient. Important Information for Investors and Stockholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication is being made in respect of the proposed merger transaction involving Allscripts- Misys Healthcare Solutions, Inc. (“Allscripts”) and Eclipsys Corporation (“Eclipsys”). In connection with the proposed transaction, Allscripts will file with the SEC a registration statement on Form S-4 and Allscripts and Eclipsys will mail a joint proxy statement/prospectus/information statement to their respective stockholders. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND STOCKHOLDERS ARE URGED TO READ CAREFULLY IN THEIR ENTIRETY THE JOINT PROXY STATEMENT/PROSPECTUS/INFORMATION STATEMENT REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER ALLSCRIPTS OR ECLIPSYS WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The final joint proxy statement/prospectus/information statement will be mailed to Allscripts’ and Eclipsys’ stockholders. Investors and stockholders of Allscripts and Eclipsys will be able to obtain a free copy of the joint proxy statement/prospectus/information statement, as well as other filings containing information about Allscripts and Eclipsys, without charge, at the website maintained by the SEC (http://www.sec.gov). Copies of the joint proxy statement/prospectus/information statement and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus/information statement can also be obtained, without charge, on the investor relations portion of Allscripts’ website (www.allscripts.com) or the investor relations portion of Eclipsys’ website (www.eclipsys.com) or by directing a request to Allscripts’ Investor Relations Department at 222 Merchandise Mart Plaza, Suite 2024, Chicago, Illinois 60654, or to Eclipsys’ Investor Relations Department at Three Ravinia Drive, Atlanta, Georgia 30346. Allscripts and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Allscripts’ directors and executive officers is available in Allscripts’ proxy statement for its 2009 annual meeting of stockholders and Allscripts’ Annual Report on Form 10-K for the year ended May 31, 2009, which were filed with the SEC on August 27, 2009 and July 30, 2009, respectively. Eclipsys and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Eclipsys’ directors and executive officers is available in Eclipsys’ proxy statement for its 2010 annual meeting of stockholders and Eclipsys’ Annual Report on Form 10-K for the year ended December 31, 2009, which were filed with the SEC on March 26, 2010 and February 25, 2010, respectively. Investors and stockholders can obtain free copies of these documents from Allscripts and Eclipsys using the contact information above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus/information statement and other relevant materials to be filed with the SEC when they become available. |

3 One Network. One Platform. One Patient. Forward Looking Statements This communication contains forward-looking statements within the meaning of the federal securities laws. Statements regarding the benefits of the proposed transaction, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, platform and product integration, the connection and movement of data among hospitals, physicians, patients and others, merger synergies and cost savings, client attainment of “meaningful use” and accessibility of federal stimulus payments, enhanced competitiveness and accessing new client opportunities, market evolution, the benefits of the combined companies’ products and services, the availability of financing, future events, developments, future performance, as well as management’s expectations, beliefs, intentions, plans, estimates or projections relating to the future are forward-looking statements within the meaning of these laws. These forward-looking statements are subject to a number of risks and uncertainties, some of which are outlined below. As a result, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of Allscripts, Eclipsys or the combined company or the proposed transaction. Such risks, uncertainties and other factors include, among other things: the ability to obtain governmental approvals of the merger on the proposed terms and schedule contemplated by the parties; the failure of Eclipsys’ stockholders to approve the Merger Agreement; the failure of Allscripts’ stockholders to approve the issuance of shares in the merger; the possibility that the proposed transaction does not close, including due to the failure to satisfy the closing conditions; the possibility that the expected synergies, efficiencies and cost savings of the proposed transaction will not be realized, or will not be realized within the expected time period; potential difficulties or delays in achieving platform and product integration and the connection and movement of data among hospitals, physicians, patients and others; the risk that the contemplated financing is unavailable; the risk that the Allscripts and Eclipsys businesses will not be integrated successfully; disruption from the proposed transaction making it more difficult to maintain business and operational relationships; competition within the industries in which Allscripts and Eclipsys operate; failure to achieve certification under the Health Information Technology for Economic and Clinical Health Act could result in increased development costs, a breach of some customer obligations and could put Allscripts and Eclipsys at a competitive disadvantage in the marketplace; unexpected requirements to achieve interoperability certification pursuant to the Certification Commission for Healthcare Information Technology could result in increased development and other costs for Allscripts and Eclipsys; the volume and timing of systems sales and installations, the length of sales cycles and the installation process and the possibility that Allscripts’ and Eclipsys’ products will not achieve or sustain market acceptance; the timing, cost and success or failure of new product and service introductions, development and product upgrade releases; competitive pressures including product offerings, pricing and promotional activities; Allscripts’ and Eclipsys’ ability to establish and maintain strategic relationships; undetected errors or similar problems in Allscripts’ and Eclipsys’ software products; the outcome of any legal proceeding that has been or may be instituted against Allscripts, Misys plc or Eclipsys and others; compliance with existing laws, regulations and industry initiatives and future changes in laws or regulations in the healthcare industry, including possible regulation of Allscripts’ and Eclipsys’ software by the U.S. Food and Drug Administration; the possibility of product-related liabilities; Allscripts’ and Eclipsys’ ability to attract and retain qualified personnel; the implementation and speed of acceptance of the electronic record provisions of the American Recovery and Reinvestment Act of 2009; maintaining Allscripts’ and Eclipsys’ intellectual property rights and litigation involving intellectual property rights; risks related to third-party suppliers and Allscripts’ and Eclipsys’ ability to obtain, use or successfully integrate third-party licensed technology; and breach of Allscripts’ or Eclipsys’ security by third parties. See Allscripts’ and Eclipsys’ Annual Reports on Form 10-K and Annual Reports to Stockholders for the fiscal years ended May 31, 2009 and December 31, 2009, respectively, and other public filings with the SEC for a further discussion of these and other risks and uncertainties applicable to Allscripts’ and Eclipsys’ respective businesses. The statements herein speak only as of their date and neither Allscripts nor Eclipsys undertakes any duty to update any forward-looking statement whether as a result of new information, future events or changes in their respective expectations. This presentation includes certain financial information not derived in accordance with generally accepted accounting principles (“GAAP”). Allscripts believes that the presentation of this non-GAAP financial information may be useful to investors as it provides general information regarding the proposed business to be acquired and operated by Allscripts, assuming that the stockholders of Allscripts approve the merger transaction and the related matters. |

|

5 One Network. One Platform. One Patient. Agenda > Bill Davis, CFO of Allscripts > CFO designate One Network. One Platform. One Patient. > Mike Lawrie, CEO of Misys and Current Chairman of Allscripts > Glen Tullman, CEO of Allscripts > CEO designate > Phil Pead, CEO of Eclipsys > Chairman designate Financial Overview Transaction and Historical Overview |

6 One Network. One Platform. One Patient. What We are Announcing > Simplified governance structure > Merger of Allscripts and Eclipsys – Creates a market leader in end to end Healthcare IT for physician practices and hospitals in the US > Misys exits controlling interest in Allscripts by selling the majority of its shares > Misys retains a non-controlling stake in newly combined company |

7 One Network. One Platform. One Patient. Key Messages Merger creates leader in end to end solutions for hospitals & physicians Allscripts & Eclipsys shareholders benefit: earnings accretion (1) in year 1 Healthcare IT leaders: Allscripts - ambulatory; Eclipsys - acute Stimulus driving changes in the US healthcare IT industry Different capital & control structure required for continued leadership Compelling, pure play propositions in Healthcare & Financial Services (1) Accretive to CY2011E Non-GAAP EPS. |

8 One Network. One Platform. One Patient. $0 $5 $10 $15 $20 $25 $0 $5 $10 $15 $20 $25 Oct-08 Jan-09 Apr-09 Aug-09 Nov-09 Feb-10 Allscripts Nasdaq composite (indexed to Allscripts share price as of 10 Oct 2008) A Proven Track Record Allscripts-Misys has become a leader in the ambulatory market Misys Healthcare - Allscripts merger completed Share Sale announced > Allscripts-Misys Healthcare merger proved very successful > Misys physician customer base combined with Allscripts Electronic Health Record > Cost, product development and revenue synergies realized > Benefitted from US government stimulus > Significant increase in Allscripts valuation |

9 One Network. One Platform. One Patient. Capital Structure for Continued Industry Leadership > Reduced Misys holding in Allscripts creates flexibility to finance the merger – Allscripts shares issued to Eclipsys shareholders > Long-term flexibility for the business > Simplified governance structure |

10 One Network. One Platform. One Patient. Opportunity to Create Value in Two Pure Play Businesses > Clear objectives: taking to market innovative new products meeting evolving customer requirements > Compelling, pure play investment propositions in Healthcare and Financial Services |

11 One Network. One Platform. One Patient. Significant value for all shareholders Allscripts & Eclipsys > Merger creates leader in end to end solutions for US hospitals & physicians > Participation in growth of end to end clinical solutions, which are required by 35% of the market > Earnings accretion (1) in first year Misys > Value created since the Misys Healthcare-Allscripts merger crystallized and returned to shareholders > Return of cash to shareholders via planned share buyback > Exposure to US healthcare IT market through retained stake in newly combined company (1) Accretive to CY2011E Non-GAAP EPS. |

12 One Network. One Platform. One Patient. Agenda > Bill Davis, CFO of Allscripts > CFO designate One Network. One Platform. One Patient. > Mike Lawrie, CEO of Misys and Current Chairman of Allscripts > Glen Tullman, CEO of Allscripts > CEO designate > Phil Pead, CEO of Eclipsys > Chairman designate Financial Overview Transaction and Historical Overview |

Allscripts and Eclipsys are merging to form one company with the industry’s largest network of clients on the most advanced product platform resulting in a single patient record |

14 One Network. One Platform. One Patient. Key Highlights Financial Strategic > Combines Ambulatory and Acute HCIT Utilization Leaders > Addresses the Market Demand for a True End-to-End Integrated Solution > Expands Company’s Ability to Address $16BB Integrated Market > Expands Client Footprint to Connect Communities > Sets Foundation for ‘Next Wave’ of Information and Connectivity Products > Transaction Valued at $1.3BB > Significant Cost and Revenue Synergy Opportunities > Accretive (1) to Earnings Starting in Calendar 2011 > Strong Free Cash Flow Generation with ~ 60% Recurring Revenue > Flexible Capital Structure from Reduction of Misys Ownership (1) Accretive to CY2011E Non-GAAP EPS |

15 One Network. One Platform. One Patient. The Time is NOW > Quality Issues – 98,000 Deaths/Year from Preventable Medical Errors > Rising Cost: – Healthcare spending projected to rise from $2.5 trillion to $4.5 trillion (1) by 2019 > Significant Waste – Estimated 30% of spend is waste due to misuse, overuse, etc. A National Problem > HCIT is Core to the Fix – All stakeholders agree > Large Market – >$40BB HCIT market > Low Penetration – ~12% of physician practices – ~11% of hospitals using an EHR > Shift in Ambulatory – Over 50% of ambulatory physicians now employed vs. independent > Hospitals Driving the Market – Stark Safe Harbor driving EHR adoption > Significant Funding: – ARRA provides >$30BB of incentives – 70% of funding slated for next 3 yrs. A Market that is Ready (1) According to CMS. ARRA = American Recovery and Reinvestment Act We are at the expect will be the single fastest transformation of any industry in US history A Significant Opportunity beginning of what we |

16 One Network. One Platform. One Patient. The Value Proposition: Two Leaders Become One One Patient. One Network. One Platform. |

17 One Network. One Platform. One Patient. One Network: Connecting the Community of Hospitals, Physicians and Post Acute Care Organizations Eclipsys Hospital Allscripts Hospital Allscripts/Eclipsys Physician Practice Allscripts Post Acute > The ‘Hub’: Over 1,500 Hospitals including 40% of “America’s Best Hospitals” are Clients > The ‘Spokes’: Over 180,000 MDs and 10,000 Post Acute Care Organizations are Connected to other Practices, Patients, Pharmacies, Payors, Labs, Hospitals, etc. |

18 One Network. One Platform. One Patient. One Platform: A Fresh Approach > CLOSED: Won’t Connect and Can’t Connect > OUR WAY OR NO WAY: Single Company for Everything > MONOLITHIC: Old Platforms of the Last 25 Years > FLEXIBLE: End to End System or Best of Breed > OPEN: A Simple Approach to Connect to 3rd Party Applications > MODERN: Advanced Platform for the Next 25 Years |

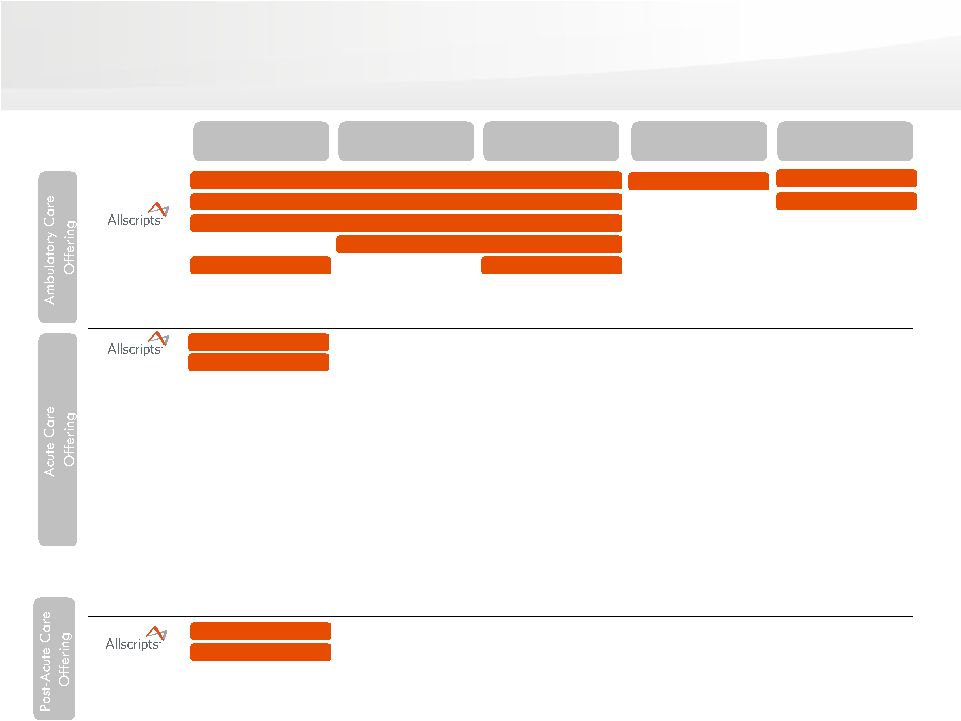

Ambulatory Electronic Health Record Practice Management Revenue Cycle Claims Processing E-Prescribing Acute Clinical Solutions Computerized Physician Order Entry Departmental Revenue Cycle Care Management Decision Support/Analytics Outsourcing/Consulting Post Acute Discharge Planning Homecare Access/Connectivity One Patient: Delivering a Single Patient Record One Network. One Platform. One Patient. |

20 Allscripts Solution Set Enterprise Professional MyWay ePrescribe ePrescribe Payerpath Care Mgt Emergency Dept Clinical Financial/RCM Administrative/ Transactions Intelligence/ Analytics Stand-Alone Services CQS Optimization Academy Homecare Post-Acute |

21 Sunrise Critical Care Sunrise Acute PeakPractice HealthXchange Sunrise Radiology Sunrise Pharmacy Sunrise Emergency Sunrise Surgery Sunrise Cardiology Sunrise Laboratory Sunrise PACs Patient Financials EPSi Registration Outsourcing Scheduling Remote Hosting Analytics Access Consulting Decision Support Enterprise Person ID Network/Desktop Clinical Financial/RCM Administrative/ Transactions Intelligence/ Analytics Services Eclipsys Solution Set Patient Flow KBMA KBC |

22 Enterprise Professional MyWay Sunrise Critical Care Sunrise Acute ePrescribe ePrescribe Payerpath PeakPractice HealthXchange Care Mgmt. Emergency Dept Sunrise Radiology Sunrise Pharmacy Sunrise Emergency Sunrise Surgery Sunrise Cardiology Sunrise Laboratory Sunrise PACs Patient Financials EPSi Registration Outsourcing Scheduling Remote Hosting Analytics Access Consulting Decision Support Enterprise Person ID Network/Desktop Homecare Post-Acute A true end-to-end, integrated solution for the entire community of care Clinical Financial/RCM Administrative/ Transactions Intelligence/ Analytics Services CQS Our Combined Solution Set Optimization Academy Patient Flow KBMA KBC |

23 One Network. One Platform. One Patient. Combination Dramatically Expands Addressable Market Acute/Ambulatory EHR Opportunity 2010-2014 = ~$43BB Source: McKinsey & Company Well positioned to differentiate ourselves to compete in the $16BB (~35%) integrated market Current Opportunity (Ambulatory Stand-Alone) Current Opportunity (Acute Stand-Alone) Currently Addressable Market: Stand-Alone New Addressable Market: Integrated Market Segment Seeking an Integrated/End-to-End Solution Across Hospitals and Physician Practices $16BB $10BB $17BB |

24 Delivering a Formula to Change Healthcare ADOPTION UTILIZATION CONNECTION INFORMATION OUTCOMES > Largest client footprint in market > Highest rates of CPOE and EHR utilization > Rapid Implementation Approach to Attain “Meaningful Use” > Connected to all major pharmacies, labs, payors, clinical research organizations, etc. > Open architecture approach to connecting to third parties (e.g. Helios) > Robust clinical and financial analytics engines > Demonstrated ability to drive clinical and financial outcomes |

25 One Network. One Platform. One Patient. Agenda > Bill Davis, CFO of Allscripts > CFO designate One Network. One Platform. One Patient. > Mike Lawrie, CEO of Misys and Current Chairman of Allscripts > Glen Tullman, CEO of Allscripts > CEO designate > Phil Pead, CEO of Eclipsys > Chairman designate Financial Overview Transaction and Historical Overview |

26 One Network. One Platform. One Patient. Allscripts Exceeds Fourth Quarter Bookings Expectations - Affirms High End of Guidance for FY2010 > Affirming high-end of full year financial guidance: – Revenue in a range of $700-$705MM for fiscal year 2010 – Net income guidance in a range of $67.0-$68.5MM, equating to non-GAAP (1) net income guidance to a range of $97.0-$98.5MM – Diluted earnings per share of $0.44-$0.45, equating to non-GAAP (1) diluted earnings per share of $0.64-$0.65 cents (1) Allscripts non-GAAP net income guidance assumes the following adjustments from GAAP net income: approximately $22.6MM of annual acquisition- related amortization; $16.5MM in stock-based compensation expense; $4.9MM in deferred revenue adjustments; and $11.0MM of transaction-related expense; all on a pre-tax basis. Allscripts 2010 non-GAAP net income and diluted earnings per share guidance assumes a 39% tax rate. > Fiscal fourth quarter bookings ~$117MM – Compares to fourth quarter guidance of between $105-$112MM |

27 One Network. One Platform. One Patient. Transaction Structure Overview > Consideration of 1.2 shares of Allscripts for each share of Eclipsys > Represents a 19% premium to Eclipsys shareholders based on the closing price on June 8, 2010 > Subject to Allscripts and Eclipsys shareholder votes, regulatory approval and other customary conditions and the successful reduction of Misys’s ownership stake in Allscripts through a combination of an equity placement and a share buyback > Total cost of the buyback is $577.4MM, including a $117.4MM premium paid to Misys and the placement of a minimum of 36MM shares of Misys’s Allscripts shares in the public markets this fall. Debt funded by fully committed financing package. > In addition, Misys has an option to sell additional shares to Allscripts at a cost of $101.6MM, including a 1.6MM premium that can be exercised within 10-days following the closing of the Eclipsys transaction > Both the share buyback and the Misys $100MM buyback option are conditioned on the completion of the equity placement > Stake reduction keeps Misys in conformity with UK Listing Authority (UKLA) requirements > Pro forma Misys will retain approximately ~8% ownership in Allscripts following the Eclipsys merger Misys Stake Reduction Proposed Merger with Eclipsys |

28 One Network. One Platform. One Patient. > 24.4MM share buyback for $577MM from Misys via fully committed credit facilities and cash reserves > Placement of a minimum 36MM Allscripts shares currently owned by Misys via marketed secondary offering > All stock merger with Eclipsys – 1.2 shares of Allscripts for each share of Eclipsys > Misys option to sell 5.3MM shares for $102MM to Allscripts after the close of the Eclipsys transaction Misys Stake Reduction/ Eclipsys Merger Current Structure Pro Forma Structure Eclipsys Shareholders ~37% Ownership Eclipsys/Allscripts Combined Misys ~8% Ownership 1 1 Assumes 24.4MM share buyback, minimum 36MM share placement, and 5.3MM put of shares by Misys 2 Includes shareholders who purchased Allscripts shares via marketed secondary offering Other Allscripts Shareholders 2 ~55% Ownership Transaction Structure Overview Eclipsys Allscripts Other Allscripts Shareholders 45% Ownership Misys 55% Ownership |

29 One Network. One Platform. One Patient. Pro Forma Capitalization and Credit Statistics Overview of Revolver and Term Loan > Attractive financing package resulting in a strong pro forma balance sheet – Strong free cash flow generation for the pro forma company available to service debt going forward > $150MM undrawn 5-year revolver – Priced at L+300bps > $570MM of Term Facilities – Priced at L+350bps > Fully committed financing package provided by JPMorgan, Barclays Capital and UBS > Pro forma leverage of 2.1x LTM EBITDA Pro Forma Capitalization 2/28/10 1 Allscripts balance sheet and EBITDA for the period ended and last twelve months ending 2/28/10, respectively. 2 Eclipsys balance sheet and EBITDA for the period ended and last twelve months ending 3/31/10, respectively. Cash excludes $81MM of Auction Rate Securities. 3 Cash adjustment includes a) $64MM of one-time banking, legal, and other professional fees and expenses related to the merger with Eclipsys, b) $30MM of debt repayments, c) $100MM payment associated with Misys‘s put option, d) $9MM of $119MM premiums paid to Misys out of combined cash. Cash adjustments exclude $5mm future retention payments and $23MM of synergy 4 Existing Allscripts and Eclipsys debt was repaid subsequent to respective quarter ends. 5 Pro forma equity adjusted for a) $94MM of upfront fees & expenses and one-time costs, b) $577MM share repurchase, c) merger with Eclipsys reflecting 57.6MM Eclipsys shares at a $22.10 implied offer price based on closing prices on 6/8/10 and a 1.2 exchange ratio, d) Misys’s $100MM put and $2MM additional premium. Capitalization Allscripts Eclipsys Adj. Pro Forma Cash on Balance Sheet $116 $119 ($203) $32 New Revolver ($150mm) -- -- -- -- Existing Long Term Debt 4 14 16 (30) -- New Term Loan -- -- 570 570 Total Debt $14 $16 $540 $570 Equity 5 787 449 100 1,336 Total Capitalization $801 $464 $641 $1,906 Credit Statistics LTM EBITDA 1,2 $173 $93 $266 Total Debt / LTM EBITDA 1,2 0.1x 0.2x 2.1x Debt / Capitalization 1.7% 3.4% 29.9% 1 2 3 realization costs expected to be incurred over the first 2 years post-closing. |

30 One Network. One Platform. One Patient. Significant Key Cost Synergies Projected Cost Synergies of ~$100MM over Three Years > Duplicate management structure > Duplicate public company costs > Duplicate backend office and system integration > Marketing > Management team with strong track record of integrating mergers and delivering and proven ability to realize synergies Key Cost Synergy Drivers ~$25MM ~$35MM Calendar 2011 Calendar 2012 ~$40MM Calendar 2013 & Beyond |

31 One Network. One Platform. One Patient. Revenue Synergy Opportunity of $1.25 Billion Sunrise Clinical Manager, Patient Flow, EPSi Sell Eclipsys Solutions to Allscripts Acute Care Base ~$430MM Sell Allscripts Solutions to Eclipsys Acute Care Base Care Management, Emergency Department, Homecare, Ambulatory Solutions ~$820MM Incremental Revenue Opportunity Total: ~$1,250MM $16BB Integrated Market Provides Additional Opportunity |

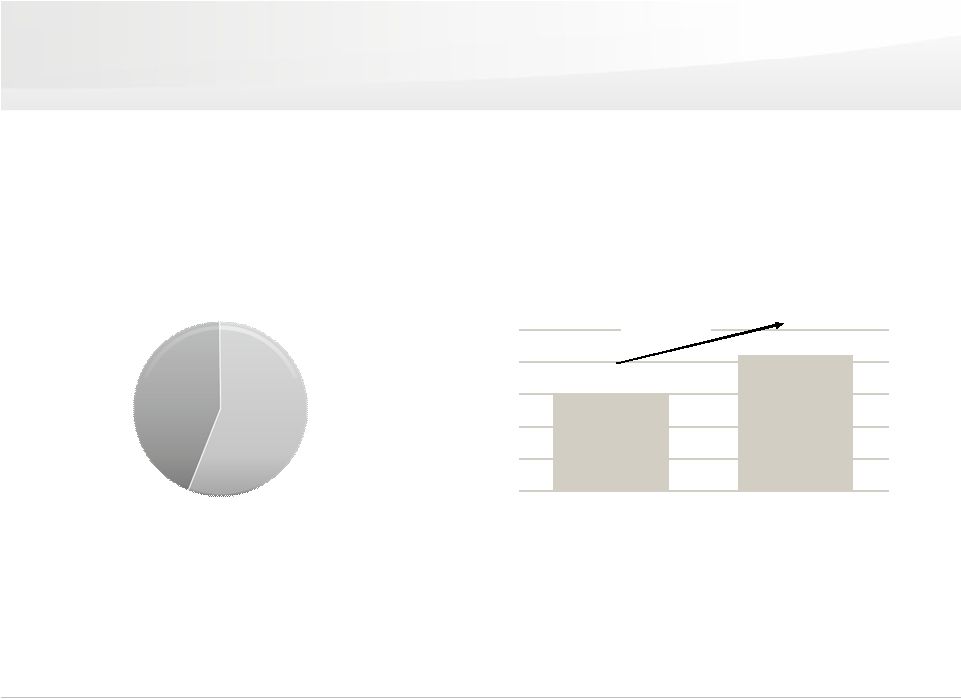

32 One Network. One Platform. One Patient. $151 $212 $0 $50 $100 $150 $200 $250 CY2008 CY2009 Pro Forma Performance Combined Non-GAAP Operating Income ($ millions) Combined Non-GAAP Operating Income ($ millions) 40% Growth 40% Growth Allscripts 56% Eclipsys 44% Combined Non-GAAP Revenue CY 2009 (1) Non-GAAP Revenue: $1,188MM Combined Non-GAAP Revenue CY 2009 (1) Non-GAAP Revenue: $1,188MM (1) Allscripts calendar year assumes a November year end. |

33 One Network. One Platform. One Patient. Pro Forma Financial Outlook Revenue Growth Comment Non-GAAP Operating Margin (1) Non-GAAP EPS Growth (1) 8-10%+ 20%+ 15-18%+ > Similar to Allscripts standalone revenue growth outlook > Eclipsys margins historically lower than Allscripts margins > Cost synergies improve combined margins back towards near Allscripts historical margins > Accretive to CY2011E Non-GAAP EPS > Incorporates new capital structure > Incorporates only cost synergies (1) Excludes stock-based compensation and deal-related amortization. |

34 One Network. One Platform. One Patient. Background to Misys Stake Reduction > Enables Allscripts to acquire Eclipsys with stock as consideration > Misys’s stake is reduced so it is not a majority of Misys’s total assets. This keeps Misys in conformity with the UK Listing Authority (UKLA) requirements that restrict companies from holding a non-controlling stake in a significant asset Facilitates Eclipsys Merger > Misys stake reduction results in a simplified public company ownership structure Benefits Allscripts Shareholders |

35 One Network. One Platform. One Patient. Illustration of Share Reduction by Misys Number of shares > Marketed offering in the fall Placing of Allscripts shares 36.0MM (1) Shares bought-back by Allscripts > Funded by new, attractively priced term loan and cash on hand 24.4MM Allscripts put option available to Misys > Shares bought back by Allscripts if Misys option exercised (2) > Exercisability of option subject to satisfaction of conditions precedent to Eclipsys closing > Funded by combined cash on hand 5.3MM Total shares sold by Misys 65.7MM Misys’s remaining stake in Allscripts 14.1MM (1) Illustrative only. Shares sold and proceeds per share will depend on market conditions. (2) Illustrative only. Exercise of Misys option at the sole discretion of Misys. > Represents approximately 8% pro forma ownership |

36 One Network. One Platform. One Patient. > We become a simplified, fully independent public company > New Board will consist of 10 members, 5 designated by Allscripts, 3 designated by Eclipsys, up to 2 designated by Misys > Misys control rights cease upon the closing of the transactions Allscripts Governance: Management & Board Simplified public company….simplified governance structure |

37 One Network. One Platform. One Patient. Expected Near-Term Timetable > Posting of final documentation > Allscripts/Eclipsys/ Misys shareholder meetings > Placing of Allscripts shares September/October June/July August/September > Filing and review of documentation by the SEC > Obtain regulatory approvals > Closing of Misys $577MM share buy- back and potential $102MM additional share buyback > Closing of Eclipsys acquisition by Allscripts |

38 One Network. One Platform. One Patient. Key Highlights Financial Strategic > Combines Ambulatory and Acute HCIT Utilization Leaders > Addresses the Market Demand for a True End-to-End Integrated Solution > Expands Company’s Ability to Address $16BB Integrated Market > Expands Client Footprint to Connect Communities > Sets Foundation for ‘Next Wave’ of Information and Connectivity Products > Transaction Valued at $1.3BB > Significant Cost and Revenue Synergy Opportunities > Accretive (1) to Earnings Starting in Calendar 2011 > Strong Free Cash Flow Generation with ~ 60% Recurring Revenue > Flexible Capital Structure from Reduction of Misys Ownership (1) Accretive to CY2011E Non-GAAP EPS. |

|