QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ý | | |

Filed by a Party other than the Registrant |

o |

|

|

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

DSI Toys, Inc. |

| | |

(Name of Registrant as Specified in its Charter) |

Not Applicable |

| | |

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

|

Title of each class of securities to which transaction applies: |

|

|

Common Stock, par value $0.01 per share

|

|

|

2) |

|

Aggregate number of securities to which transaction applies: |

|

|

3,314,106*

|

|

|

3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

|

|

$0.47

|

|

|

4) |

|

Proposed maximum aggregate value of transaction: |

|

|

$1,557,630

|

|

|

5) |

|

Total Fee Paid |

|

|

$311.53

|

| | | *Includes shares of the Company's common stock to be converted to cash. Excludes shares held by the Buyer Group (as defined herein), which shall remain outstanding after the transaction. |

ý |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

|

Amount Previously Paid: |

|

|

|

|

2) |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

3) |

|

Filing Party: |

|

|

|

|

4) |

|

Date Filed: |

|

|

DSI TOYS, INC.

Dear Shareholder:

You are cordially invited to attend a Special Meeting of Shareholders of DSI Toys, Inc. (the "Company") on Monday, August 11, 2003, at 3:00 p.m., local time. The meeting will be held at the offices of Carrington, Coleman, Sloman & Blumenthal, LLP, 200 Crescent Court, Suite 1500, Dallas, Texas 75201.

At this important meeting, you will be asked to consider and vote upon the merger of DSI Acquisition, Inc. ("DSI Acquisition") with and into the Company (the "Merger"). Pursuant to the Merger, you will receive $0.47 for each share of the Company's common stock that you own if you are not a member of the Buyer Group (as defined in the proxy statement). If you are a member of the Buyer Group, you shall remain as a shareholder of the Company subsequent to the Merger.

A special committee of the Company's board of directors negotiated the per share consideration and the other terms of the transaction with DSI Acquisition. The Company's board of directors approved the merger agreement with DSI Acquisition (the "Merger Agreement") and has determined that its terms are fair to, and in the best interests of, the Company and its shareholders. Accordingly, the board recommends that the Company's shareholders vote "FOR" approval of the Merger Agreement.

We cannot complete the Merger unless the holders of a majority of the outstanding shares of the Company vote to approve the Merger Agreement and Merger. However, E. Thomas Martin and MVII, LLC, as the principal members of the Buyer Group, hold approximately 61.1% of the outstanding shares of the Company and have indicated an intent to vote in favor of the Merger Agreement and the Merger; therefore, approval of the Merger Agreement and the Merger appears to be assured. Whether or not you plan to attend the meeting, please fill out, sign, date and return the enclosed proxy promptly in the envelope provided. Your shares will then be represented at the meeting. If you attend the meeting, you may, at your discretion, withdraw the proxy and vote in person.

Your vote is very important. If you fail to return the proxy card or vote in person at the special meeting, it will have the same effect as a vote against the Merger.

The accompanying notice of meeting and proxy statement explain the proposed Merger and provide specific information concerning the special meeting. Please read these materials carefully. On behalf of the Company, thank you for your cooperation and continued support.

| | | Sincerely, |

|

|

Joseph S. Whitaker

Chief Executive Officer and President |

, 2003

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the transaction contemplated in this proxy statement, passed upon the merits or fairness of the transaction, or passed upon the adequacy or accuracy of the disclosure in this proxy statement. Any representation to the contrary is a criminal offense.

DSI TOYS, INC.

10110 WEST SAM HOUSTON PARKWAY SOUTH, SUITE 150

HOUSTON, TEXAS 77099

TELEPHONE (713) 365-9900

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MONDAY, AUGUST 11, 2003

A special meeting of the shareholders of DSI Toys, Inc., a Texas corporation (the "Company"), will be held on Monday, August 11, 2003, at 3:00 p.m., local time. The meeting will be held at the offices of Carrington, Coleman, Sloman & Blumenthal, LLP, 200 Crescent Court, Suite 1500, Dallas, Texas 75201, for the following purposes:

- (1)

- To consider and vote upon a proposal to approve the Agreement and Plan of Merger, dated as of March 27, 2003, by and between DSI Acquisition, Inc., a Texas corporation ("DSI Acquisition") and the Company (the "Merger Agreement"), and the related merger, pursuant to which DSI Acquisition will be merged with and into the Company (the "Merger"). You will receive $0.47 per share in cash for each share you own of the Company's common stock at the time of the Merger if you are not a member of the Buyer Group (as defined in the proxy statement). If you are a member of the Buyer Group, you shall remain as a shareholder of the Company subsequent to the Merger.

- (2)

- To vote to adjourn the special meeting if necessary.

The Company's board of directors has fixed the close of business on June 30, 2003, as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting or any adjournments or postponements thereof. Only shareholders of record at the close of business on June 30, 2003 are entitled to notice of, and to vote at, such meeting. As of the record date, there were 10,866,365 shares outstanding, held of record by approximately 118 holders.

A complete list of shareholders entitled to vote at the meeting will be available for examination at 10110 West Sam Houston Parkway South, Suite 150, Houston, Texas 77099, for ten days prior to the meeting. This Notice of Special Meeting of Shareholders is first being mailed to shareholders entitled to notice of, and to vote at, the special meeting on or around , 2003.

Approval of the Merger Agreement and the Merger requires the affirmative vote of the holders of a majority of the outstanding shares of common stock entitled to vote at the special meeting. The board of directors of the Company has approved the Merger Agreement and recommends that you vote "FOR" approval of the Merger Agreement and the related Merger.

The Merger Agreement and the Merger are explained in the accompanying proxy statement, which you are urged to read carefully. A copy of the Merger Agreement is attached asAppendix A to the proxy statement. Under Texas law, you are entitled to appraisal rights in the Merger. A copy of the relevant sections of the Texas statutes relating to dissenting shareholders' appraisal rights is attached asAppendix C to the accompanying proxy statement.

Whether or not you plan to attend the special meeting in person, you are encouraged to fill out, sign, date and mail promptly the enclosed proxy in the accompanying envelope. No postage is required if mailed in the United States. Proxies forwarded by or for brokers or fiduciaries should be returned as requested by them.

| | | BY ORDER OF THE BOARD OF DIRECTORS, |

|

|

Thomas V. Yarnell

Secretary |

Houston, Texas

, 2003

SUMMARY TERM SHEET

This summary highlights information from this proxy statement, but does not contain all information that may be important to consider when evaluating the merits of the Merger Agreement and the Merger. We encourage you to read this proxy statement and the attached appendices before voting. The actual terms and conditions of the Merger are contained in the Merger Agreement, which we have attached to this proxy statement asAppendix A.

The Parties

DSI Toys, Inc. is a Texas corporation engaged in the business of designing, developing, marketing and distributing dolls, toys and consumer electronic products. The Company is publicly traded over the over-the-counter Bulletin Board electronic quotation system, and as of June 30, 2003, had outstanding 10,866,365 shares of common stock held of record by approximately 118 shareholders. Throughout this proxy statement, we will refer to DSI Toys, Inc. as "the Company."

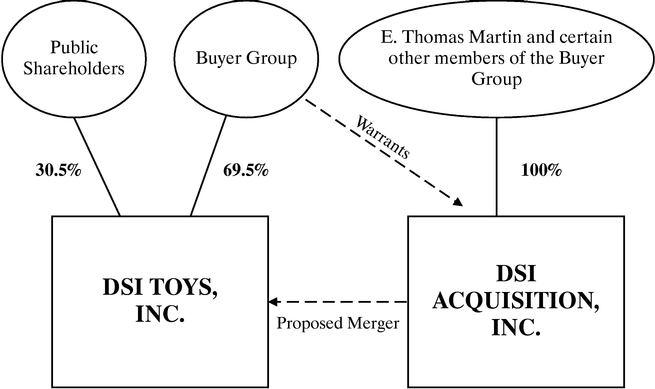

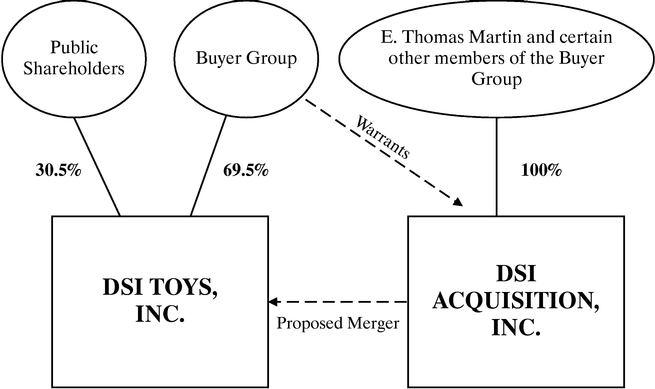

DSI Acquisition, Inc. is a privately-held Texas corporation, with 100% of its outstanding shares owned by E. Thomas Martin, the Chairman of the Company's board of directors, and certain other members of the Buyer Group (as defined immediately below). Throughout this proxy statement, we will refer to DSI Acquisition, Inc. as "DSI Acquisition."

The "Buyer Group" consists of the following shareholders, directors and executive officers of the Company: Mark and Bonnie Barnes, Linda J. Black, Jesse and Zula Blann, Jacob Bowler, Jocean Bowler, John E. Bowler, Jr., Sarah Bowler, Deborah and Danilo Cariaga, Bradford C. Davis, Robert E. Dexter, Christopher Ford, John Hays, Charles Kolligian, E. Thomas Martin, John and Peg Mirolla, Morris & Garritano Insurance Agency, Inc. 401K Profit-Sharing Plan, Joseph E. Nargie, Walter S. and Susan Reiling, Sausal Corporation, Paul Wallace, Jr., James E. Ward, Donald Westfall, Joseph S. Whitaker, Thomas J. Wood, and MVII, LLC ("MVII"). MVII is the largest shareholder of the Company and is controlled by Mr. Martin. Robert L. Burke, John McSorley and Joseph S. Whitaker, directors of the Company, own minority interests in MVII.

For more information on the parties to the Merger, see "The Parties," beginning on page of the proxy statement.

The Merger

If the Merger Agreement is approved by the shareholders of the Company, DSI Acquisition will merge with and into the Company, with the Company surviving the Merger. Holders of the Company's common stock, except for members of the Buyer Group, will receive $0.47 per share for each share of common stock that they own immediately before the Merger. Members of the Buyer Group will not receive any cash compensation for their outstanding shares of the Company's common stock but will instead remain as shareholders of the Company subsequent to the Merger. The shareholders of DSI Acquisition will receive one share of the Company's common stock for each share of DSI Acquisition common stock that they own immediately prior to the Merger. At the closing of the Merger, the Company's shares will be delisted from the over-the-counter Bulletin Board electronic quotation system and its common stock will be deregistered under the Securities Exchange Act of 1934, as amended. The Company will continue in business as a privately-held Texas corporation. DSI Acquisition will cease to exist as a separate entity.

For more information on the Merger,see "Special Factors – Certain Effects of the Merger," beginning on page of the proxy statement, and "The Merger Agreement – Structure and Completion of the Merger" beginning on page of the proxy statement and "The Merger Agreement – Effect of the Merger on Capital Stock," beginning on page of the proxy statement.

i

Date, Time and Place of the Special Meeting

The special meeting to vote on the Merger will be held on Monday, August 11, 2003, at 3:00 p.m., local time. The meeting will be held at the offices of Carrington, Coleman, Sloman & Blumenthal, LLP, 200 Crescent Court, Suite 1500, Dallas, Texas 75201.See "Special Meeting – Date, Time and Place" on page of the proxy statement.

Purposes of the Special Meeting

At the special meeting, you will be asked:

- •

- To consider and vote upon a proposal to approve the Merger Agreement and the related Merger.

- •

- To vote to adjourn the special meeting if necessary.

If the Merger Agreement is approved, DSI Acquisition will be merged with and into the Company. You will receive $0.47 per share in cash for each share you own of the Company's common stock at the time of the Merger if you are not a member of the Buyer Group. If you are a member of the Buyer Group, you will remain as a shareholder of the Company subsequent to the Merger.

See "Special Meeting – Date, Time and Place" on page of the proxy statement, and "Special Factors – Purpose and Reasons for the Merger," beginning on page of the proxy statement.

Voting

The board of directors has set the close of business on June 30, 2003, as the record date for determining the shareholders entitled to notice of, and to vote at, the special meeting. At the special meeting, each share of common stock, par value $0.01 per share, of the Company will be entitled to one vote. As of the record date, there were 10,866,365 shares of common stock outstanding and entitled to vote, and there were approximately 118 holders of record.

Any proxy given by you may be revoked by you at any time before it is voted by:

- •

- delivering a written notice of revocation to the Secretary of the Company,

- •

- executing and delivering a later-dated proxy, or

- •

- attending the meeting and giving oral notice of your intention to vote in person. However, your attendance at the special meeting if you have executed and delivered a proxy to the Company will not in and of itself constitute a revocation of such proxy.

Unless you instruct us otherwise on the proxy, all shares of common stock represented by your valid proxy will be voted for the approval and adoption of the Merger Agreement and the related Merger and for adjournment of the special meeting if the directors present determine that there are not enough votes present to constitute a quorum or to adopt the Merger Agreement.

Please sign and mail your proxy card in the enclosed return envelope as soon as possible so that your shares can be represented at the meeting. You shouldnot send in your stock certificates now. If the Merger is completed, written instructions for exchanging stock certificates for the Merger consideration will be sent to you.See "The Special Meeting – Record Date; Voting at the Meeting; Quorum," "The Special Meeting – Required Vote; Effect of Abstentions and Non-Votes," and "The Special Meeting – Action to Be Taken Under the Proxy," beginning on page of the proxy statement.

Required Vote

Under the Company's articles of incorporation and bylaws, approval of the Merger Agreement and the Merger requires the affirmative vote of holders of at least a majority of the outstanding shares of common stock. The separate approval of the shareholders who are not members of the Buyer Group is not required in order to approve and adopt the Merger Agreement and the Merger. Members of the Buyer Group hold

ii

7,552,259 shares, or 69.5%, of the outstanding common stock of the Company, which we expect to be voted in favor of the Merger Agreement and the Merger.See "The Special Meeting – Required Vote; Effect of Abstentions and Non-Votes" on page of the proxy statement.

What You Will Receive in the Merger

Each holder of common stock (other than members of the Buyer Group and any shareholder that properly perfects his or her appraisal rights under Texas law) will receive $0.47 per share in cash. Members of the Buyer Group will not receive any consideration and will instead remain as shareholders of the Company subsequent to the Merger.See "Special Factors – Background of the Merger," beginning of page of the proxy statement, and "The Merger Agreement – Structure and Completion of the Merger" beginning on page of the proxy statement and "The Merger Agreement – Effect of the Merger on Capital Stock," beginning on page of the proxy statement.

Appraisal Rights

Any shareholder who does not wish to accept the Merger consideration has the right under Article 5.11 of the Texas Business Corporation Act to have the "fair value" of his or her shares of common stock determined by a Texas court. This "right of appraisal" is subject to a number of restrictions and technical requirements. Generally, to exercise appraisal rights, a shareholder must:

- •

- file a written objection with the Company before the special meeting;

- •

- vote against the Merger Agreement or abstain from voting;

- •

- deliver a written demand for payment of the fair value of his or her shares within ten days of receiving notice from the Company of the effectiveness of the Merger;

- •

- surrender his or her share certificates to the Company within 20 days of the written demand for payment of the fair value of the shares for the purpose of permitting the Company to make a notation on the shares that such demand has been made; and

- •

- file a court petition seeking determination of the fair value of the shares within 60 and 120 days of the effectiveness of the Merger if the Company and the shareholder fail to agree on the fair value of the shares.

Merely voting against the Merger Agreement and the Merger will not protect your right of appraisal. Please readAppendix C to this proxy statement, which contains the provisions of the Texas Business Corporation Act regarding appraisal rights.

See also "The Merger Agreement – Dissenters' Rights," beginning on page of the proxy statement, and "Dissenters' Rights of Appraisal," beginning on page of the proxy statement.

Background of the Merger

The Company completed its initial public offering on May 29, 1997. The price of the Company's common stock reached its all time high in October 1997, trading at $10.125 per share. After the Company announced an anticipated loss for 1997 on December 3, 1997, the stock price declined, closing the year at $1.88 per share. The stock price remained at that approximate level (or lower) throughout 1998 and into 1999.

On April 15, 1999, the Company entered into a Stock Purchase and Sale Agreement with MVII, pursuant to which MVII purchased from the Company 566,038 shares of common stock for $1.2 million on April 15, 1999, and an additional 1,792,453 shares of common stock for $3.8 million on June 1, 1999. On April 21, 1999, MVII commenced a tender offer for 1.6 million shares of the Company's outstanding common stock at $4.38 per share, which offer was fully subscribed to and consummated on May 26, 1999.

iii

On June 28, 1999, the price of the Company's common stock reached $4.75 per share. Since that time, the price of the Company's common stock has steadily declined. On November 21, 2002, the stock closed at $0.27 per share and has subsequently closed trading no higher than $0.51 per share during the period between November 21, 2002, and the execution of the Merger Agreement on March 27, 2003.

In January 2003, after other alternatives for the Company had been exhausted, Mr. Martin and certain other officers, directors and shareholders of the Company began serious consideration of a going-private transaction. On January 27, 2003, the board of directors invited this group of persons to submit an offer to the Company for a going-private transaction.

On January 28, 2003, MVII (or an affiliated entity) proposed to purchase the Company's common stock for $0.44 per share. Subsequently, DSI Acquisition, an entity affiliated with MVII, was formed as the acquisition vehicle to effectuate the Merger, and the Buyer Group was formed. The Buyer Group consists of certain existing shareholders of the Company who have preexisting business or personal relationships with Mr. Martin. All of the members of the Buyer Group shall retain their existing shares of the Company subsequent to the Merger. Mr. Martin and those members of the Buyer Group who are shareholders of DSI Acquisition shall receive additional shares of the Company in exchange for their shares of DSI Acquisition pursuant to the Merger. All of the members of the Buyer Group have been provided with the opportunity to own shares in DSI Acquisition.

In anticipation of receiving the initial buyout proposal, the Company's board of directors formed a special committee to protect the interests of the shareholders who are not members of the Buyer Group and to negotiate the terms of the transaction. The special committee engaged its own legal counsel and financial advisor to assist it in evaluating the terms of the proposed Merger. After several weeks of negotiation, a price of $0.47 per share was agreed upon by representatives of DSI Acquisition and the special committee, subject to negotiation of final terms of the Merger Agreement.

In addition to considering the opinion of its financial advisor, the special committee examined trends in the market for small cap securities, previous negotiations to purchase all or a portion of the Company, and the market position of the Company. Based on these and other factors set forth in more detail in "Special Factors – Recommendation of the Special Committee, Board of Directors and Buyer Group; Fairness of the Merger," beginning on page of the proxy statement, the special committee recommended that the board of directors approve the Merger. The board of directors of the Company approved the Merger Agreement on March 26, 2003, and recommended approval of the Merger Agreement to the Company's shareholders.

Purpose and Reasons for the Merger

The Company has determined that, in light of the financial condition and prospects of the Company and for a variety of other reasons, considered in detail in the proxy statement, it is in the best interest of the Company and its shareholders for the Company to be privately held. The Company believes that the Merger is the most expeditious and economical way of liquidating the holdings of the shareholders who are not members of the Buyer Group and changing the Company's status from that of a reporting company to that of a closely held, non-reporting company.

The Company believes that the Merger will relieve the Company of certain expenses incident with being a public company, eliminate various obligations applicable to a public company, and increase management's flexibility to consider and initiate actions that may not be appropriate for a public company.

In connection with the Merger, the outstanding common stock held by shareholders who are not members of the Buyer Group will be purchased at a price determined to be fair by both the special committee and the board of directors in order to (i) eliminate the cost of maintaining

iv

numerous shareholder accounts, (ii) permit shareholders who are not members of the Buyer Group to receive a fair price for their shares without having to pay brokerage commissions or find a private purchaser, (iii) allow the Buyer Group to own the Company and (iv) relieve the Company of the administrative burden, costs and competitive disadvantages associated with complying with the requirements of a public company under the Securities Exchange Act of 1934, as amended.

For additional information on the purposes and reasons for the Merger,see "Special Factors – Purpose and Reasons for the Merger," beginning on page of the proxy statement and "Special Factors – Recommendation of the Special Committee, Board of Directors and Buyer Group; Fairness of the Merger," beginning on page of the proxy statement.

Opinion of Independent Financial Advisor

The special committee of the board of directors retained Chaffe & Associates, Inc. ("Chaffe") as its financial advisor in connection with its evaluation of the Merger. On March 26, 2003, Chaffe delivered to the special committee its opinion that, as of that date and based upon and subject to the various limitations, qualifications and assumptions stated in the opinion, the total Merger consideration of $0.47 per share of common stock to be received by the Company's shareholders, other than members of the Buyer Group, in connection with the Merger is fair to them from a financial point of view. A copy of Chaffe's written opinion, which describes the assumptions made, matters considered and limitations on the review undertaken in connection with the opinion, is included asAppendix B to this proxy statement. You should read Chaffe's opinion carefully and in its entirety.See also "Special Factors – Opinion of Financial Advisor to the Special Committee," beginning on page of the proxy statement.

Approval of the Special Committee and Board of Directors

The special committee of the board of directors unanimously recommended to the board of directors that the board of directors approve the Merger Agreement. Based on the recommendation of the special committee, the board of directors, taking into account the opinion of Chaffe, unanimously determined that the terms of the Merger Agreement and the Merger are fair to, and in the best interests of, the Company and its shareholders.See "Special Factors – Purpose and Reasons for the Merger," beginning of page of the proxy statement, and "Special Factors – Approval of the Special Committee, Board of Directors and Buyer Group; Fairness of the Merger," beginning on page of the proxy statement.

Interests of Certain Persons in the Merger; Consideration of Fairness by Buyer Group

Several of the directors and executive officers of the Company have interests in the Merger that are different from and in addition to the interests of other shareholders. These officers and directors are members of the Buyer Group and will receive certain benefits in the Merger that other shareholders will not receive. For further information on these interests,see "Special Factors – Interests of Certain Persons in the Merger," beginning on page of the proxy statement.

Representatives of DSI Acquisition have negotiated with the special committee for the purpose of reaching an agreement that is fair to the shareholders of the Company. The special committee has determined that a price of $0.47 per share for the Company's common stock is fair to the shareholders of the Company. For more information on the factors considered by the special committee in making such determination,see "Special Factors – Recommendations of the Special Committee, Board of Directors and Buyer Group; Fairness of the Merger," beginning on page of the proxy statement.

v

Effects of the Merger

Following the Merger, the shareholders, except for members of the Buyer Group, will receive cash in exchange for each share of common stock they own. The members of the Buyer Group will not receive any cash consideration for the common stock they own but will instead remain as shareholders of the Company subsequent to the Merger. As a result of the Merger, DSI Acquisition will cease to exist as a separate entity and the shareholders thereof will receive one share of the Company's common stock for each share of DSI Acquisition common stock held by them immediately prior to the Merger. Following the Merger, the Company's shares will be delisted from the over-the-counter Bulletin Board electronic quotation system and its common stock will be deregistered under the Securities Exchange Act of 1934, as amended. The Company will remain as a privately-held Texas corporation immediately after the Merger.

The members of the Buyer Group and the shareholders of DSI Acquisition will be the sole beneficiaries of any future earnings and growth of the Company following the Merger. The shareholders of the Company who will have their shares purchased in the Merger will not benefit from any increase in the value of the Company. On the other hand, the shareholders of the Company who are not members of the Buyer Group will not bear the risk of any decrease in the value of the Company.

In addition, the Company's common stock will not be listed for trading on the over-the-counter Bulletin Board electronic quotation system or any other stock exchange. For members of the Buyer Group, a discussion of the risks associated with owning shares in a private company and the anticipated lack of liquidity of the Company's stock following the Merger begins on page of this document.See "Special Factors – Certain Effects of the Merger," beginning on page of the proxy statement, and "The Merger Agreement – Effect of the Merger on Capital Stock," beginning on page of the proxy statement.

Conditions to the Merger

The obligations of each party to effect the Merger depend on the satisfaction, at or prior to the closing date, of a number of conditions, including:

- •

- the approval of the Merger Agreement and the Merger by no less than a majority of the holders of outstanding common stock of the Company;

- •

- no legal prohibitions may exist to the completion of the Merger;

- •

- all parties to the agreement must satisfactorily perform all covenants and other agreements under the Merger Agreement; and

- •

- the financial advisor to the special committee shall have orally reaffirmed its fairness opinion.

For a more complete description of the closing conditions,see "The Merger Agreement – Conditions," beginning on page of the proxy statement.

Termination of the Merger Agreement

The Merger Agreement may be terminated if:

- •

- a majority of the shareholders of the Company do not vote to approve the Merger Agreement and the Merger;

- •

- a court or other regulatory body issues an order, decree or ruling (which action has become final and nonappealable) permanently restraining the Merger;

- •

- the Merger shall not have been consummated 90 days after the Company files its definitive proxy statement with the Securities and Exchange Commission, subject to extension upon the mutual agreement of the parties;

vi

- •

- there has been a breach by either party of any material representation, warranty, covenant or agreement set forth in the Merger Agreement and the breach is not waived by the non-breaching party to the Merger Agreement; or

- •

- the board of directors or special committee of the board of directors finds, after consultation with outside legal counsel, that completing the Merger would be inconsistent with the board of directors' or special committee's fiduciary duty under applicable law.

See "The Merger Agreement – Termination" on page of the proxy statement.

Federal Income Tax Consequences

The receipt of the cash Merger consideration will be a taxable transaction to shareholders for U.S. federal income tax purposes and may be a taxable transaction for foreign, state and local income tax purposes as well. For U.S. federal income tax purposes, shareholders will recognize gain or loss measured by the difference between (1) the amount of cash received in exchange for their shares of common stock and (2) the amount of their tax basis in such shares.

You should consult your own tax advisor regarding the U.S. federal income tax consequences of the Merger, as well as any tax consequences under state, local or foreign laws.See "Special Factors – U.S. Federal Income Tax Consequences of the Merger," beginning on page of the proxy statement.

Expenses of the Merger

The Company expects to incur approximately $450,000 in expenses in connection with the Merger and related transactions. Except as disclosed in this proxy statement and as described in the Merger Agreement, all fees and expenses incurred in connection with the Merger, the Merger Agreement and any other transactions connected with the Merger will be paid by the party incurring such fees and expenses, regardless of whether the Merger is completed.See "Special Factors – Fees and Expenses of the Merger" on page of the proxy statement, and "The Merger Agreement – Expenses" on page of the proxy statement.

vii

KEY PARTIES TO THE TRANSACTION

The following is a diagram of the key parties to the transaction:

- •

- The "Buyer Group" is comprised of 25 current shareholders of the Company, including MVII, E. Thomas Martin, Walter S. Reiling, and Joseph S. Whitaker. In addition, Joseph S. Whitaker, Robert L. Burke and John McSorley are indirectly part of the Buyer Group as members of MVII.

- •

- The term "Purchasing Group" is used herein to refer to the persons negotiating the terms of the Merger Agreement prior to the point in time at which the composition of the Buyer Group was finalized.

- •

- DSI Acquisition issued warrants to each member of the Buyer Group to acquire a specified number of shares of DSI Acquisition, certain of which were exercised and the remainder of which expired.

viii

TABLE OF CONTENTS

| | Page

|

|---|

| SUMMARY TERM SHEET | | i |

KEY PARTIES TO THE TRANSACTION |

|

viii |

QUESTIONS AND ANSWERS ABOUT THE MERGER |

|

xi |

THE SPECIAL MEETING |

|

1 |

| | Date, Time and Place | | 1 |

| | Purposes of the Special Meeting | | 1 |

| | Record Date; Voting at the Meeting; Quorum | | 1 |

| | Required Vote; Effect of Abstentions and Non-Votes | | 1 |

| | Action To Be Taken Under the Proxy | | 2 |

| | Proxy Solicitation | | 2 |

SPECIAL FACTORS |

|

3 |

| | Background of the Merger | | 3 |

| | Alternatives Considered | | 6 |

| | Purpose and Reasons for the Merger | | 9 |

| | Advantages and Disadvantages of the Merger | | 12 |

| | Recommendation of the Special Committee and Board of Directors; Fairness of the Merger | | 14 |

| | Opinion of Financial Advisor to the Special Committee | | 19 |

| | Certain Effects of the Merger | | 27 |

| | Conduct of the Business of the Company if the Merger is Not Completed | | 29 |

| | Interests of Certain Persons in the Merger | | 30 |

| | Prior Stock Purchases and Other Securities Transactions | | 31 |

| | Financing the Merger | | 31 |

| | Fees and Expenses of the Merger | | 31 |

| | Anticipated Accounting Treatment of the Merger | | 31 |

| | U.S. Federal Income Tax Consequences of the Merger | | 32 |

| | Regulatory Matters | | 33 |

| | Provisions for Unaffiliated Security Holders | | 33 |

FINANCIAL INFORMATION |

|

34 |

| | Selected Historical Financial Data | | 34 |

| | Selected Comparative Financial Data | | 35 |

RECENT DEVELOPMENTS |

|

35 |

LITIGATION |

|

35 |

MARKET PRICES AND DIVIDEND INFORMATION |

|

36 |

RISK FACTORS AND FORWARD LOOKING STATEMENTS |

|

38 |

| | Risks Relating to All Shareholders | | 38 |

| | Risk Factors Relating to Members of the Buyer Group | | 44 |

| | | |

ix

THE PARTIES |

|

46 |

| | DSI Toys, Inc. | | 46 |

| | DSI Acquisition, Inc. | | 46 |

| | The Buyer Group | | 47 |

SECURITIES OWNERSHIP |

|

48 |

| | Current Beneficial Ownership of the Company's Common Stock | | 48 |

| | Beneficial Ownership of the Company's Common Stock Upon Consummation of the Merger | | 50 |

DIRECTORS AND EXECUTIVE OFFICERS |

|

53 |

THE MERGER AGREEMENT |

|

55 |

| | Structure and Completion of the Merger | | 56 |

| | Effect of the Merger on Capital Stock | | 56 |

| | Payment Procedures | | 56 |

| | Dissenters' Rights | | 57 |

| | Representations and Warranties | | 57 |

| | Ordinary Course of Business Covenant | | 60 |

| | Actions to be Taken to Complete the Merger | | 60 |

| | Expenses | | 61 |

| | Conditions | | 61 |

| | Termination | | 62 |

| | Miscellaneous Conditions | | 63 |

DISSENTERS' RIGHTS OF APPRAISAL |

|

64 |

INDEPENDENT ACCOUNTANTS |

|

67 |

WHERE YOU CAN FIND MORE INFORMATION |

|

67 |

SHAREHOLDER PROPOSALS |

|

68 |

OTHER BUSINESS |

|

68 |

| APPENDIX A | | Agreement and Plan of Merger, dated as of March 27, 2003, by and between DSI Toys, Inc. and DSI Acquisition, Inc. | | |

APPENDIX B |

|

Opinion of Chaffe & Associates, Inc. |

|

|

APPENDIX C |

|

Provisions of the Texas Business Corporation Act Regarding Appraisal Rights |

|

|

x

QUESTIONS AND ANSWERS ABOUT THE MERGER

Q: What will happen in the Merger?

A: If the Merger becomes effective, DSI Acquisition, Inc., a Texas corporation ("DSI Acquisition"), will be merged into the Company, with the Company surviving the Merger. DSI Acquisition will cease to exist as a separate entity and the shareholders thereof will receive one share of the Company's common stock for each share of DSI Acquisition common stock held immediately prior to the Merger. These former shareholders of DSI Acquisition along with certain of the current shareholders of the Company (called the "Buyer Group" and identified below) will own 100% of the outstanding shares of the Company's common stock after the Merger is completed.

Q: Who are DSI Acquisition and the Buyer Group?

A: DSI Acquisition is a privately-held Texas corporation, with 100% of its outstanding shares owned by E. Thomas Martin, the chairman of the Company's board of directors, and certain other members of the Buyer Group. The Buyer Group consists of the following shareholders, directors and executive officers of the Company: Mark and Bonnie Barnes, Linda J. Black, Jesse and Zula Blann, Jacob Bowler, Jocean Bowler, John E. Bowler, Jr., Sarah Bowler, Deborah and Danilo Cariaga, Bradford C. Davis, Robert E. Dexter, Christopher Ford, John Hays, Charles Kolligian, E. Thomas Martin, John and Peg Mirolla, Morris & Garritano Insurance Agency, Inc. 401K Profit-Sharing Plan, Joseph E. Nargie, Walter S. and Susan Reiling, Sausal Corporation, Paul Wallace, Jr., James E. Ward, Donald Westfall, Joseph S. Whitaker, Thomas J. Wood, and MVII, LLC ("MVII"). MVII is the largest shareholder of the Company and is controlled by Mr. Martin. Robert L. Burke, John McSorley and Joseph S. Whitaker, directors of the Company, own minority interests in MVII. For a more complete description of DSI Acquisition and the Buyer Group,see the sections entitled "The Parties," "Directors and Officers," and "Securities Ownership" in the proxy statement.

Q: What will I receive in the Merger?

A: If you are not a member of the Buyer Group, you will receive $0.47 in cash, without interest, in exchange for each share of the Company's common stock that you own immediately before the Merger. Members of the Buyer Group will not be entitled to cash compensation for their shares of common stock but will instead remain as shareholders of the Company subsequent to the Merger.

Q: Will there be any changes as a result of the Merger?

A: Yes. Upon completion of the Merger, all of the outstanding shares of common stock of the Company will be owned by the former shareholders of DSI Acquisition and the members of the Buyer Group. The Company's stock will be delisted from the over-the-counter Bulletin Board electronic quotation system and deregistered under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Q: What are the tax consequences of the Merger to me?

A: If you exchange your shares for cash, the cash you receive will be considered a taxable transaction. Your tax consequences will depend on your personal situation. You are urged to consult your tax advisor for a full understanding of the tax consequences of the Merger to you. A summary of the federal income tax consequences of the Merger can be found beginning on page of the proxy statement.

Q: Why is the Company's board of directors recommending the Merger?

A: The Board believes that in light of the financial condition of the Company and its working capital needs, that the Merger and the financing transactions contemplated to occur

xi

subsequent to the Merger offer the shareholders, other than the members of the Buyer Group, fair consideration for their shares and the Company its best opportunity to continue as a going concern. A special committee of two independent directors evaluated the fairness of the Merger. The special committee negotiated the terms of the Merger and recommended that the full board of directors approve the Merger. For a more complete description of the factors considered by the special committee,see "Special Factors – Recommendation of the Special Committee, the Board of Directors and the Buyer Group; Fairness of the Merger," beginning on page .

Q: Why was the special committee formed?

A: Five of the seven members of the board of directors are either members of the Buyer Group or members of MVII, which is a member of the Buyer Group, and therefore have a conflict of interest. Your board of directors formed the special committee of independent directors to protect your interests in evaluating and negotiating the terms of the Merger. The special committee independently selected and retained legal and financial advisors to assist it in the evaluation and negotiation. For a description of these events,see "Special Factors – Background of the Merger" beginning on page .

Q: Does DSI Acquisition have the financial resources to make payment?

A: Yes. DSI Acquisition anticipates that it will have sufficient cash on hand on the effective date of the Merger to cover the total amount of funds required in connection with the Merger and related transactions.

Q: Is the financial condition of DSI Acquisition relevant to my decision on how to vote?

A: Your shares will be purchased in the Merger for cash and the Merger is not subject to any financing condition. Because DSI Acquisition will have sufficient cash to finance the Merger, we do not believe that its financial condition is relevant to your decision on how to vote.

Q: When do you expect to complete the Merger?

A: We are working toward completing the Merger as quickly as possible. We hope to complete the Merger on or shortly after the date of the special meeting. However, we cannot assure you as to when or if the Merger will occur.

Q: What do I need to do now?

A: After carefully reading and considering the information contained in the proxy statement, please complete, date and sign your proxy card. Then mail your completed, dated and signed proxy card in the enclosed prepaid return envelope as soon as possible so that your shares can be voted at the special meeting. If your shares are held in "street name" by your broker or other nominee, your broker or other nominee will provide you instructions on how to have your vote counted.

Q: What happens if I don't return a proxy card?

A: If you fail to return a proxy card, it will have the same effect as voting against the Merger Agreement.

Q: May I change my vote after I have mailed my signed proxy card?

A: Yes. You may change your vote by sending a written notice stating that you would like to revoke your proxy or by completing and submitting prior to the special meeting a new, later dated proxy card to the Secretary of the Company. You also can attend the special meeting and vote in person. If your shares are held in "street name," you must follow the directions provided by your broker to change your vote.

Q: May I vote in person?

A: Yes. You may attend the special meeting and vote your shares in person.

xii

Q: What is the date, time and place of the special meeting?

A: The special meeting will be held on Monday, August 11, 2003, at 3:00 p.m., local time. The meeting will be held at the offices of Carrington, Coleman, Sloman & Blumenthal, LLP, 200 Crescent Court, Suite 1500, Dallas, Texas 75201.

Q: If my shares are held in "street name" by my broker, will my broker vote my shares for me?

A: No. Your broker will not be able to vote your shares without instructions from you. You should follow the directions provided by your broker to vote your shares. If you do not provide instructions to your broker, your shares will not be voted.

Q: Should I send in my stock certificates now?

A: No. After the Merger is completed, the Company will send you written instructions for exchanging your shares of the Company's common stock. You must return your Company stock certificates as described in the instructions to receive the cash payment in connection with the Merger.

Q: May I exercise dissenters' appraisal rights in the Merger?

A: Yes. If you do not vote in favor of the Merger Agreement and you comply with the other requirements and procedures of Texas law, you will not be entitled to receive the $0.47 per share cash price in the Merger. Instead, you will be entitled to receive payment in cash of the appraised "fair value" of your shares of Company's common stock. A description of these rights, as well as the requirements and procedures for dissenting under Texas law, can be found beginning on page of the proxy statement. In addition, the full text of the relevant sections of the Texas statute are reprinted inAppendix C.

Q: Who can help answer my questions?

A: If you have any questions about the Merger or would like additional copies of the proxy statement, you should contact:

Mr. Rob Weisgarber

10110 West Sam Houston Parkway South,

Suite 150

Houston, Texas 77099

(713) 365-9900

rweisgarber@dsitoys.com

xiii

THE SPECIAL MEETING

Date, Time, and Place

This proxy statement is furnished to shareholders of the Company in connection with the solicitation of proxies on behalf of the board of directors for use at the special meeting to be held on Monday, August 11, 2003, at the time and place specified in the attached Notice of Special Meeting, or at any adjournments or postponements of the special meeting.

Purposes of the Special Meeting

At the special meeting, the shareholders of the Company will be asked to consider and vote upon the approval of the Merger Agreement and the Merger and to adjourn the special meeting if necessary.

Upon the unanimous recommendation of an independent special committee of the board of directors, the board of directors has unanimously approved the Merger Agreement and the Merger.

Record Date; Voting at the Meeting; Quorum

The board of directors has fixed the close of business on June 30, 2003, as the record date for the determination of the Company shareholders entitled to receive notice of and to vote at the special meeting. As of the close of business on the record date, the Company had outstanding 10,866,365 shares of common stock held of record by approximately 118 holders. Each outstanding share of common stock is entitled to one vote on all matters coming before the special meeting. The presence, either in person or by proxy, of the holders of a majority of the issued and outstanding shares of common stock entitled to vote at the special meeting is necessary to constitute a quorum for the transaction of business at the meeting.

Required Vote; Effect of Abstentions and Non-Votes

Under the Company's articles of incorporation, the Merger Agreement and the Merger must be approved by the affirmative vote of the holders of at least a majority of the outstanding shares of common stock. Members of the Buyer Group hold approximately 69.5% of the outstanding shares of common stock of the Company, which we expect to be voted in favor of the Merger Agreement and the Merger. At a special meeting of the board of directors held on March 26, 2003, the terms of the Merger were unanimously approved by the board of directors upon the unanimous recommendation of a special committee of the board of directors. The special committee was comprised of two directors who were independent of DSI Acquisition and the Buyer Group and who do not serve as officers of the Company.

The inspectors of election will treat shares of the Company's common stock represented by proxies that are marked "ABSTAIN" as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the special meeting and for purposes of determining the outcome of any question submitted to the shareholders for a vote. Broker's non-votes will be treated in a similar manner. Therefore, abstentions and broker's non-votes will have the same effect as votes against the approval of the Merger Agreement and the Merger.

1

Action to Be Taken Under the Proxy

The enclosed proxy is solicited on behalf of the board of directors. The giving of a proxy does not mean that you cannot vote in person if you attend the special meeting and decide that you wish to vote personally. You have an unconditional right to revoke your proxy at any time prior to its exercise, either by filing with the Company's Secretary at the Company's principal executive offices a written revocation or a properly completed and signed proxy bearing a later date or by voting in person at the special meeting. Attendance at the special meeting without casting a ballot will not, by itself, constitute revocation of a proxy.

All shares of common stock represented at the special meeting by properly executed proxies received prior to or at the special meeting, unless previously revoked, will be voted at the special meeting in the manner described on the proxies. Unless other instructions are given, proxies will be voted FOR the approval of the Merger Agreement and the Merger. As explained below in the section entitled "Dissenters' Rights of Appraisal," a vote in favor of the Merger Agreement and the Merger means that the shareholder owning those shares will not have the right to dissent and seek appraisal of the fair value of such shares.

When considering a motion to adjourn the special meeting to another time and/or place (including, without limitation, for the purpose of allowing additional time for the satisfaction of conditions to the Merger), the persons named in the enclosed form of proxy and acting by the authority in the proxy generally will have discretion to vote on adjournment using their best judgment. However, the persons named in the proxies will not use their discretionary authority to vote upon adjournment of the special meeting for the purpose of soliciting additional proxies or use proxies voting against the Merger Agreement to vote in favor of adjournment or postponement of the special meeting. No matters, other than as described in the Notice of Special Meeting of Shareholders, are to come before the special meeting.

Proxy Solicitation

The cost of preparing, assembling and mailing this proxy statement, the Notice of Special Meeting of Shareholders and the enclosed form of proxy will be borne by the Company. The Company is requesting that any trustees, custodians, nominees and fiduciaries forward copies of the proxy material to their principals and request authority for the execution of proxies. The Company may reimburse those persons for their expenses in so doing. In addition to the solicitation of proxies by mail, the directors, officers and employees of the Company and its subsidiaries may solicit proxies by telephone, facsimile, telegram or in person. These directors, officers and employees will not be additionally compensated for such solicitation but may be reimbursed for out-of-pocket expenses incurred.

No person is authorized to give any information or make any representation not contained in this proxy statement, and if given or made, such information or representation should not be relied upon as having been authorized.

If the Merger Agreement is approved and the Merger is consummated, holders of the Company's common stock will be sent instructions and letters of transmittal regarding the surrender of their certificates representing shares of common stock. Holders shouldnot send their stock certificates until they receive these instructions unless they plan to exercise their dissenters' rights, in which case they should follow the procedures set forth in the provisions of the Texas Business Corporation Act attached asExhibit C.

2

SPECIAL FACTORS

Background of the Merger

The Company completed its initial public offering on May 29, 1997. The price of the Company's common stock reached its all time high in October 1997, trading at $10.125 per share. After the Company announced an anticipated loss for 1997 on December 3, 1997, the stock price declined, closing the year at $1.88 per share. The stock price remained at that approximate level (or lower) throughout 1998 and into 1999.

On April 15, 1999, the Company entered into a Stock Purchase and Sale Agreement with MVII, pursuant to which MVII purchased from the Company 566,038 shares of common stock for $1.2 million on April 15, 1999, and an additional 1,792,453 shares of common stock for $3.8 million on June 1, 1999. On April 21, 1999, MVII commenced a tender offer for 1.6 million shares of the Company's outstanding common stock at $4.38 per share, which offer was fully subscribed to and consummated on May 26, 1999.

On June 28, 1999, the price of the Company's common stock reached $4.75 per share. Since that time, the price of the Company's common stock has steadily declined. On November 21, 2002, the stock closed at $0.27 per share and has subsequently closed trading no higher than $0.51 per share during the period between November 21, 2002, and the execution of the Merger Agreement on March 27, 2003. During the same time period, the financial condition of the Company deteriorated, and the Company's need to raise working capital from an outside source increased.

On March 19, 2001, the Company issued to MVII an Investment Warrant to acquire 1.8 million shares of the Company's common stock at a purchase price of $2.7 million. The Investment Warrant was exercisable in whole or in part for a ten-year period beginning on June 3, 2002. Shares of common stock acquired by MVII upon exercise of the Warrant are subject to the terms of a Shareholders' and Voting Agreement dated as of April 5, 1999, among MVII and certain of the Company's other shareholders. Proceeds from the sale of the Investment Warrant were used by the Company for current working capital. On January 31, 2002, at the request of The Nasdaq Stock Market, Inc. and with the agreement of MVII, the Company issued an amended and restated Investment Warrant, which amended and restated in its entirety the Investment Warrant by removing all anti-dilution provisions. On August 21, 2002, MVII converted the Investment Warrant into 1.8 million shares of common stock. Upon issuance of these shares, MVII beneficially owned 7,265,568 shares of common stock, thereby increasing its beneficial ownership percentage from 60.3% to 66.6% of the outstanding shares of common stock of the Company.

On February 14, 2002, the Company received notice from The Nasdaq Stock Market, Inc. that the Company's common stock had closed below the minimum price of US$1.00 per share requirement for continued listing on the Nasdaq SmallCap Market under Marketplace Rule 4310(c)(4) (the "Rule"). The Company was granted a 180 calendar day grace period to comply with the Rule, but was still not in compliance with the Rule on August 13, 2002, the final day of the grace period. However, at such time the Company was granted an additional 180 calendar day grace period to comply with the Rule because it did meet the initial listing criteria for the Nasdaq SmallCap Market under Marketplace Rule 4310(c)(2)(A). The additional grace period expired on February 10, 2003, without the Company being in compliance with the Rule. On March 18, 2003, the Company received notification that its securities would be delisted from the Nasdaq SmallCap Market at the opening of business on March 27, 2003. The Company elected not to appeal the delisting determination and its common stock commenced trading on the over-the-counter Bulletin Board electronic quotation system effective with the opening of business on March 27, 2003, under the ticker symbol "DSIT."

3

The Company's board of directors first addressed the possibility of a going-private transaction in October, 2001, as one of several alternatives for raising working capital for the Company. The board of directors decided to pursue alternatives other than a going-private transaction at that time. During 2002, the possibility of a going-private transaction continued to be a matter of limited discussion, although the board of directors continued to pursue other alternatives to address the financial needs of the Company.

In October, November and December, 2002, as the financial condition of the Company worsened, the Company explored possible transactions with several third parties.See "Special Factors – Alternatives Considered."

Following the termination of the Company's negotiations with a possible transaction partner on January 8, 2003, and with the Company still needing to raise working capital to continue as a going concern, Mr. Martin and certain other members of the Buyer Group began serious consideration of a going-private transaction. On January 27, 2003, at its regularly scheduled meeting, the board of directors invited MVII to submit an offer for a going-private transaction to the Company. In anticipation of such an offer, and upon consultation with the Company's outside legal counsel, the board of directors appointed directors M.D. Davis and Joseph N. Matlock as a special committee of independent, disinterested directors for the purpose of considering, evaluating and negotiating any proposed transaction on behalf of the shareholders who are not members of the Buyer Group and making a recommendation to the board of directors. The board of directors also authorized the special committee to retain, at the Company's expense, independent legal and financial advisors.

On January 28, 2003, MVII (or an affiliate thereof) proposed to the Company a going-private transaction by way of a merger that would result in the purchase of shares of common stock held by the shareholders who are not members of the Buyer Group for $0.44 per share. As described below, DSI Acquisition, an entity affiliated with MVII, subsequently was formed as the acquisition vehicle to effectuate the Merger. In addition, at this point in time, the composition of the Buyer Group had not yet been fully determined. For purposes of describing the negotiations of the Merger and the Merger Agreement, the representatives of DSI Acquisition who negotiated the Merger and the Merger Agreement are referred to herein as the "Purchasing Group."

On January 29, 2003, the Company issued a press release confirming receipt of MVII's proposal and announcing that its board of directors had formed a special committee of independent, disinterested directors.

The special committee hired Haynes and Boone, LLP ("Haynes and Boone") as legal counsel to the special committee. Then, the special committee considered several investment bankers to serve as independent financial advisors to the special committee. On February 4, 2003, after evaluating, among other factors, each considered investment bank's expertise, responsiveness, knowledge of the Company, fees and toy industry experience, the special committee approved the retention of Chaffe & Associates, Inc. ("Chaffe") as its financial advisor in connection with the buyout proposal made by the Purchasing Group. Chaffe had previously provided financial advisory services to the Company in connection with MVII's 1999 tender offer, and the high quality of those services contributed to the special committee's decision to retain Chaffe in connection with the Purchasing Group's proposal.

4

On February 20, 2003, the special committee met with representatives of Chaffe and Haynes and Boone. The purpose of the meeting was to review and consider the $0.44 per share buyout proposal and to discuss with the special committee's financial and legal advisors a negotiating strategy. Chaffe reviewed with the special committee its evaluation of the Company and the $0.44 per share proposal based upon Chaffe's extensive, though not yet complete, investigation of the Company. Chaffe helped the special committee evaluate the proposed purchase price based upon the information it received from the Company, including financial statements of the Company and certain budgets and projections. The special committee concluded that it would not decide whether to approve the $0.44 per share buyout proposal until Chaffe completed its evaluation of the Company and discussed possible counteroffers to the proposal, including an alternative royalty structure.

On February 28, 2003, the special committee met with representatives of Chaffe and Haynes and Boone. At the meeting, Chaffe reviewed with the special committee the $0.44 per share buyout proposal in light of Chaffe's continuing investigation and evaluation of the Company. Chaffe advised the special committee that, based upon its substantially complete investigation and evaluation, the $0.44 per share offer was likely a fair price for the Company's common stock. Chaffe helped the special committee evaluate the proposal price based on the information it had received from the Company as of the February 20, 2003 meeting as well as information received since that date, including updated sale projections, updated accounts receivable information and a fixed asset analysis. With this advice in mind, and in an attempt to obtain the best price possible for the shareholders of the Company who are not members of the Purchasing Group, the special committee instructed its legal counsel to communicate a counteroffer of $0.61 per share to Andre, Morris & Buttery, Inc. ("AMB"), the Purchasing Group's legal counsel. While the counteroffer did not represent a particular price target of the special committee, the special committee believed that that the counteroffer would help determine whether the Purchasing Group was willing to increase the financial terms of the proposal.

On March 4, 2003, AMB informed the special committee by telephone that the Purchasing Group had rejected the special committee's counter offer of $0.61 per share but had increased its offer to $0.47 per share.

On March 5, 2003, the special committee met with representatives of Chaffe and Haynes and Boone to review and consider the $0.47 per share counteroffer by the Purchasing Group. Chaffe again stated that, subject to the completion of its evaluation, the proposed $0.47 purchase price was fair to the shareholders of the Company who are not members of the Purchasing Group. With this advice in mind and in order to determine whether the Purchasing Group was willing to further raise its offer price, the special committee made another counteroffer of $0.50 per share. M.D. Davis communicated the $0.50 per share counter offer to the Purchasing Group.

On March 5, 2003, in a letter to the special committee, the Purchasing Group rejected the special committee's latest counteroffer and reiterated its offer to purchase the common stock owned by the shareholders who are not members of the Buyer Group for $0.47. The same day, the special committee met with representatives of Chaffe and Haynes and Boone. Representatives of Chaffe delivered an oral opinion (which was subsequently confirmed in writing) that, on the basis of and subject to the matters discussed with the special committee, including final negotiation of the Merger Agreement, the proposed $0.47 per share cash price was fair, from a financial point of view, to the Company's shareholders, other than the members of the Buyer Group. The special committee then unanimously determined that the proposed Merger was fair to, advisable and in the best interests of the Company and its shareholders, subject to final negotiation of the terms of the Merger Agreement. Counsel for the special committee then advised counsel for the Purchasing Group that the special committee had recommended acceptance of the Purchasing Group's proposal of $0.47 per share, subject to final negotiation of the terms of the Merger Agreement.

5

On March 20, 2003, DSI Acquisition, an entity affiliated with MVII, was formed as the acquisition vehicle to effectuate the Merger. The composition of the Buyer Group was subsequently finalized. The Buyer Group consists of certain existing shareholders of the Company who have preexisting business or personal relationships with Mr. Martin. As part of the proposed merger transaction, all of the members of the Buyer Group would retain their existing shares of the Company subsequent to the Merger, and Mr. Martin and those members of the Buyer Group who are shareholders of DSI Acquisition would receive additional shares of the Company in exchange for their shares of DSI Acquisition. DSI Acquisition has issued warrants to each member of the Buyer Group (including, in the case of MVII, its members) to acquire a specified number of shares of the common stock of DSI Acquisition at $0.47 per share (the "Warrants").

Between March 5, 2003 and March 25, 2003, the special committee, DSI Acquisition (and the Purchasing Group prior to the formation of DSI Acquisition), the Company and representatives of Carrington, Coleman, Sloman & Blumenthal, LLP, legal counsel to the Company, AMB, and Haynes and Boone negotiated the non-price terms of the draft Merger Agreement.

On March 26, 2003, the special committee met to review the terms of the Merger Agreement and the Merger. A representative of Chaffe made a presentation to the special committee describing the analysis supporting its opinion that the $0.47 per share cash consideration was fair, from a financial point of view, to the Company's shareholders who are not members of the Buyer Group.See "Special Factors – Opinion of Financial Advisor to the Special Committee." Based upon the opinion provided by Chaffe and its own investigation, the special committee unanimously voted to recommend that the board of directors approve the Merger Agreement and the Merger. Later that day, the Company's board of directors met, received a presentation from Chaffe, and received the recommendation of the special committee. Based upon the opinion of Chaffe and the recommendation of the special committee, the board of directors unanimously determined that the proposed Merger was fair to, advisable and in the best interests of the Company and its shareholders. The board of directors unanimously voted to approve the Merger Agreement and the Merger and recommended that the shareholders of the Company approve the Merger Agreement and the Merger.

On March 27, 2003, the Merger Agreement was signed. The Company issued a press release announcing the Merger Agreement.

On March 28, 2003, the Company reported its 2002 fiscal year-end earnings. On May 15, 2003, the Company reported its earnings for its first quarter ended March 31, 2003.

Alternatives Considered

The Company

In the third quarter of 2002, the financial condition of the Company continued to decline, and its need to raise working capital increased, due to several factors. These factors included manufacturing delays for the Company's products, a general reluctance by the major toy retailers (Wal-Mart, Toys "R" Us, Target and Kmart) to commit to large orders leading into the holiday season, the Kmart bankruptcy filing, and the dock strike on the west coast of the United States. The combination of these factors and the overall competitive environment in the toy industry indicated to the management of the Company that the Company should explore possible business combinations involving the Company.

6

At the meeting of the board of directors on October 17, 2002, Messrs. Martin, Whitaker and Reiling were directed to explore possible business combinations involving the Company.

In mid-October, 2002, Tom Martin contacted an investment banker specializing in the toy industry. This investment banker was asked to consider possible acquirers for the Company. The investment banker indicated an overall lack of merger activity involving the toy industry, but agreed to explore possible scenarios. A single prospect was identified by the investment banker, but the prospect did not pursue a transaction with the Company.

In late October, 2002, Tom Martin contacted the President of a domestic toy company ("Suitor 1") to explore possible business combinations between the two companies. On December 6, 2002, the President of Suitor 1 contacted Mr. Martin and indicated a possible willingness of Suitor 1 to acquire limited assets of the Company. Suitor 1 had no other interest in the Company.

On October 22, 2002, Tom Martin placed a call to the Chairman of the Board of another domestic toy company ("Suitor 2"). Mr. Martin and the Chairman of the Board of Suitor 2 met on November 5, 2002. At the meeting, Suitor 2 indicated the possible willingness to acquire the Company for a value that would have resulted in no return to the shareholders of the Company. The negotiations were terminated.

On October 8, 2002, Mr. Martin telephoned the President of a foreign company involved in the toy industry ("Suitor 3"). Suitor 3 had expressed an interest in a possible acquisition of the Company. Mr. Martin and the President of Suitor 3 spoke again by telephone on October 9, 2002.

Following the execution of a confidentiality agreement, the Company began providing Suitor 3 and its advisors with information regarding the Company's business and financial condition. The Company continued to provide financial and other due diligence information over the next several weeks based upon requests by Suitor 3.

On November 11, 2002, a meeting was held in Houston, Texas between Messrs. Martin, Reiling, Whitaker, Weisgarber and two representatives of Suitor 3. General operational and financial information of the Company was discussed and reviewed.

On November 25, 2002, a letter was sent from Tom Martin to Suitor 3, outlining a possible transaction between the parties. On November 26, 2002, a reply was received from Suitor 3 confirming the proposal.

On November 26, 2002, Mr. Martin replied to Suitor 3's proposal with a counterproposal.

On December 5, 2002, a meeting was held in Vancouver, B.C., between E. Thomas Martin, Rob Weisgarber, Walter Reiling and a representative of Suitor 3.

On December 6, 2002, the Company forwarded a proposed term sheet to Suitor 3. On December 10, 2002, Suitor 3 sent a counterproposal. On December 11, 2002, the Company countered the proposal. On December 13, 2002, Suitor 3 wrote to the Company and gave its final proposal for a transaction involving the Company.

On December 13, 2002, the board of directors of the Company met at its regularly scheduled meeting and considered the term sheet presented by Suitor 3. The board of directors found the term sheet to be acceptable, subject to additional due diligence by the Company and clarification of the working capital commitments to be made by Suitor 3 to the go-forward entity. The Company signed and delivered the non-binding term sheet on December 13, 2002.

7

A meeting was scheduled in Hong Kong to allow the parties to negotiate the substantive terms of definitive agreements pursuant to the term sheet. On January 7, 2003, a meeting was held in Hong Kong between Tom Martin, Walter Reiling, Rob Weisgarber, Todd Mirolla (counsel for MVII), and numerous representatives of Suitor 3. The meeting lasted for several hours. During the course of the meeting Suitor 3 presented a revised proposal, representing a significant departure from the term sheet signed by the parties. The proposal involved a reverse stock split by the Company, a new issuance of common stock by the Company to a new investment entity to be formed by representatives of Suitor 3, further discounts and alterations by MVII of its existing loans to the Company, and a lack of a firm commitment for ongoing working capital for the go-forward entity. Negotiations were held between the parties and their legal advisors throughout the day without mutual agreements being reached. Negotiations were terminated for the day and it was agreed that the parties would meet the next morning with the goal of exchanging final proposals for a possible transaction. The parties met the next morning at 9:00 a.m. A final proposal was presented by the Company and MVII. The proposal was rejected by Suitor 3. No new proposal was presented by Suitor 3. The parties then terminated their negotiations.

On January 27, 2003, with the financial condition of the Company continuing to deteriorate, the board of directors of the Company met to consider its remaining options. During the meeting an invitation was made by the board of directors to Mr. Martin and MVII to make a proposal to the Company for a going-private transaction.

On January 28, 2003, MVII made its written offer to the Company for a going-private transaction.

Subsequent to the announcement of MVII's initial proposal on January 29, 2003, the special committee received preliminary inquiries from two other entities regarding a purchase of the Company or specified assets of the Company. Upon further investigation of the Company, however, both entities chose not to pursue a transaction.

Continuing as a public company was not considered a viable option because of several factors, including the significant costs associated with being a public company and the delisting of the Company's common stock from the Nasdaq SmallCap Market. In addition, because the Company's common stock is thinly traded, shareholders are generally unable to sell any significant number of shares without a negative impact on the trading price of the common stock. Since the Company has no control over sales made by shareholders, any potential sale by one shareholder could decrease the trading price for all shareholders. In analyzing the Company's going-concern and liquidation values, the special committee and board of directors noted the fact that the Company is operating in an extremely competitive environment with companies possessing substantially greater resources and marketing capability than the Company.

In addition, the Company's net losses for the period ended December 31, 2002 and its overall financial condition resulted in the Company being out of compliance with the minimum net worth and net income covenants required under its revolving line of credit with Sunrock Capital Corp. (the "Revolver"). Therefore, the Company's $7.0 million debt under the Revolver as of December 31, 2002 has been reclassified as a current liability. The Company sustained additional net losses during the quarterly period ending March 31, 2003 that resulted in the Company violating other covenants in the Revolver pertaining to limits on further indebtedness and maximum borrowed amounts during a specified period. The Company's $4.5 million debt under the Revolver as of March 31, 2003 is classified as a current liability. As a result, the Company's current liabilities exceeded its current assets by $6.5 million and $8.9 million, respectively as of December 31, 2002 and March 31, 2003. If Sunrock were to accelerate the Revolver, which it has the option to do, the $4.5 million debt outstanding as March 31, 2003 would become immediately due and payable.

8

The Shareholders of DSI Acquisition and the Buyer Group

In addition to considering with the Company the alternatives listed above, prior to reaching its decision to pursue the Merger, MVII considered a two-step acquisition of the Company, consisting of a first step tender offer and a second step merger. The primary benefit of the two-step acquisition alternative would have been the possibility of completing an acquisition of the Company in a short time period. MVII ultimately decided against this alternative, however, primarily because it preferred to negotiate a transaction that the special committee of the board of directors of the Company would support as being fair to, and in the best interests of, the Company's shareholders who are not members of the Buyer Group.

Neither Mr. Martin, MVII nor any of the other shareholders of DSI Acquisition or the Buyer Group considered any other alternatives to the Merger, as no other options were considered to be feasible.

Purpose and Reasons For the Merger

The Company

The Company's financial conditions and prospects have deteriorated for several years, and the Company requires an infusion of working capital if it is to continue as a going concern. As a result, and having exhausted other practical alternatives, the Company believes that the Merger and the financing transactions contemplated to occur subsequent to the Merger provide the shareholders that are not members of the Buyer Group with fair consideration per share while at the same time providing the Company with working capital necessary to continue as a going concern.