FEDERAL-MOGUL LLC Condensed Consolidated Financial Statements For the Three Months Ended March 31, 2018 and 2017 INDEX Page No. Financial Information Condensed Consolidated Financial Statements (Unaudited)........................................................................ Condensed Consolidated Statements of Operations.............................................................................. 3 Condensed Consolidated Statements of Comprehensive Income (Loss).............................................. 4 Condensed Consolidated Balance Sheets.............................................................................................. 5 Condensed Consolidated Statements of Cash Flows............................................................................. 6 Notes to Condensed Consolidated Financial Statements ...................................................................... 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations....................... 29 Signatures............................................................................................................................................................. 40 2

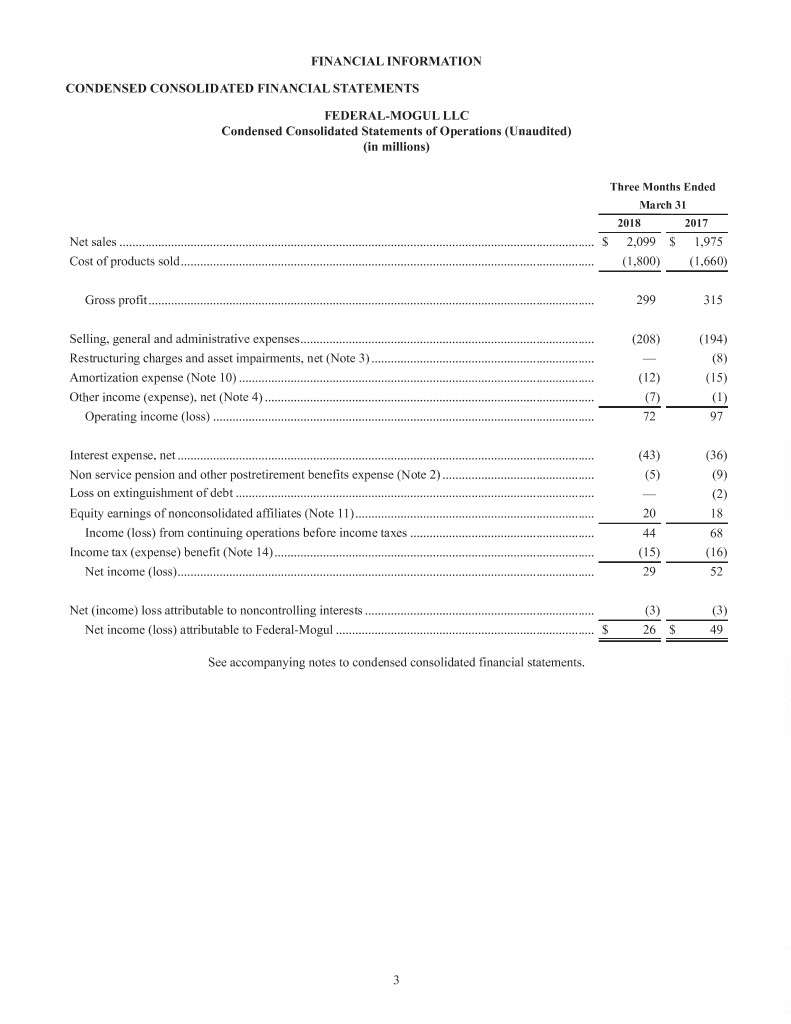

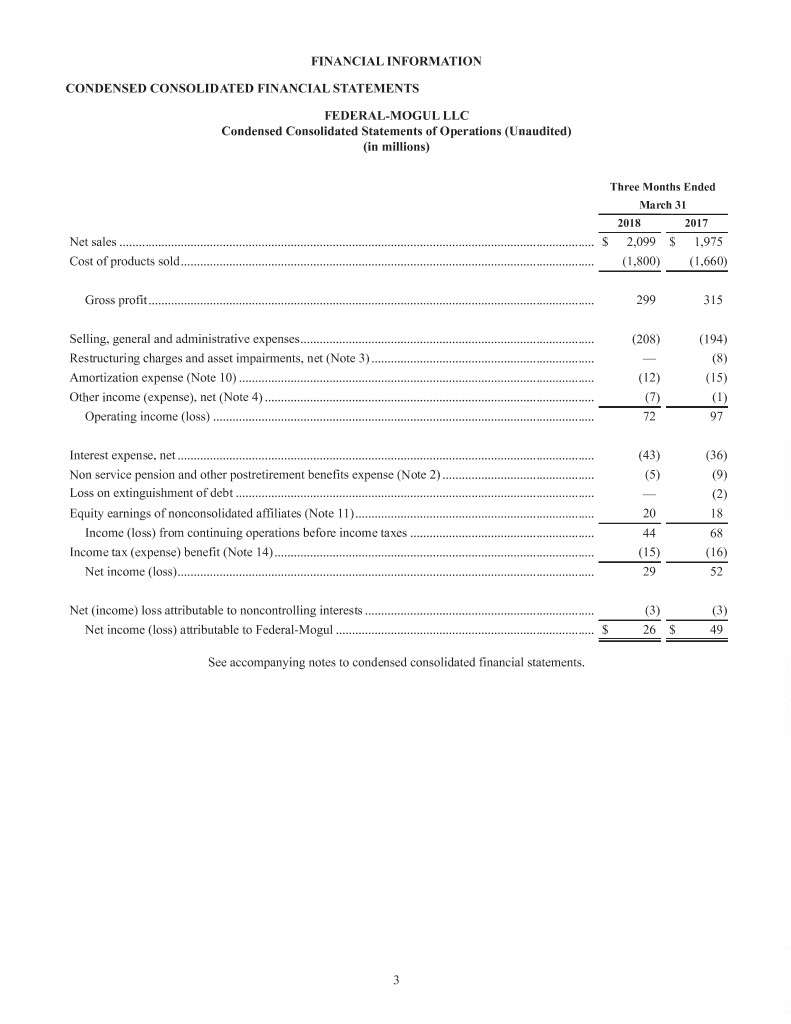

FINANCIAL INFORMATION CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FEDERAL-MOGUL LLC Condensed Consolidated Statements of Operations (Unaudited) (in millions) Three Months Ended March 31 2018 2017 Net sales ................................................................................................................................................... $ 2,099 $ 1,975 Cost of products sold................................................................................................................................ (1,800) (1,660) Gross profit.......................................................................................................................................... 299 315 Selling, general and administrative expenses........................................................................................... (208) (194) Restructuring charges and asset impairments, net (Note 3) ..................................................................... — (8) Amortization expense (Note 10) .............................................................................................................. (12) (15) Other income (expense), net (Note 4) ...................................................................................................... (7) (1) Operating income (loss) ...................................................................................................................... 72 97 Interest expense, net ................................................................................................................................. (43) (36) Non service pension and other postretirement benefits expense (Note 2) ............................................... (5) (9) Loss on extinguishment of debt ............................................................................................................... — (2) Equity earnings of nonconsolidated affiliates (Note 11).......................................................................... 20 18 Income (loss) from continuing operations before income taxes ......................................................... 44 68 Income tax (expense) benefit (Note 14)................................................................................................... (15) (16) Net income (loss)................................................................................................................................. 29 52 Net (income) loss attributable to noncontrolling interests ....................................................................... (3) (3) Net income (loss) attributable to Federal-Mogul ................................................................................ $26$49 See accompanying notes to condensed consolidated financial statements. 3

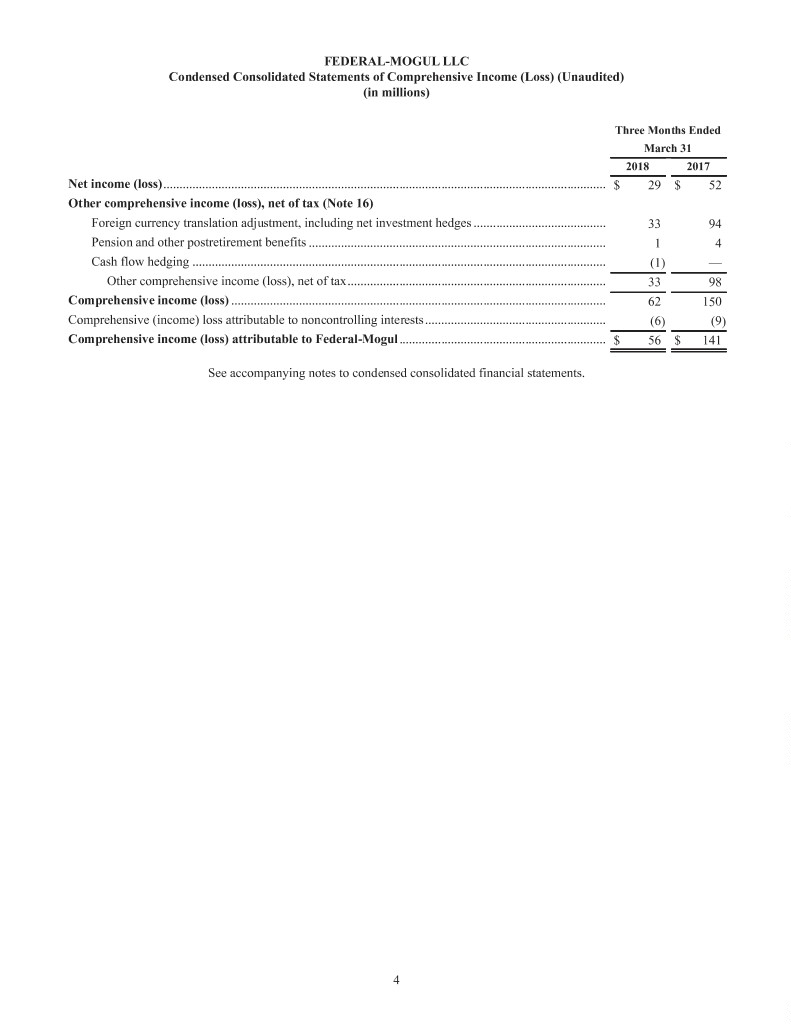

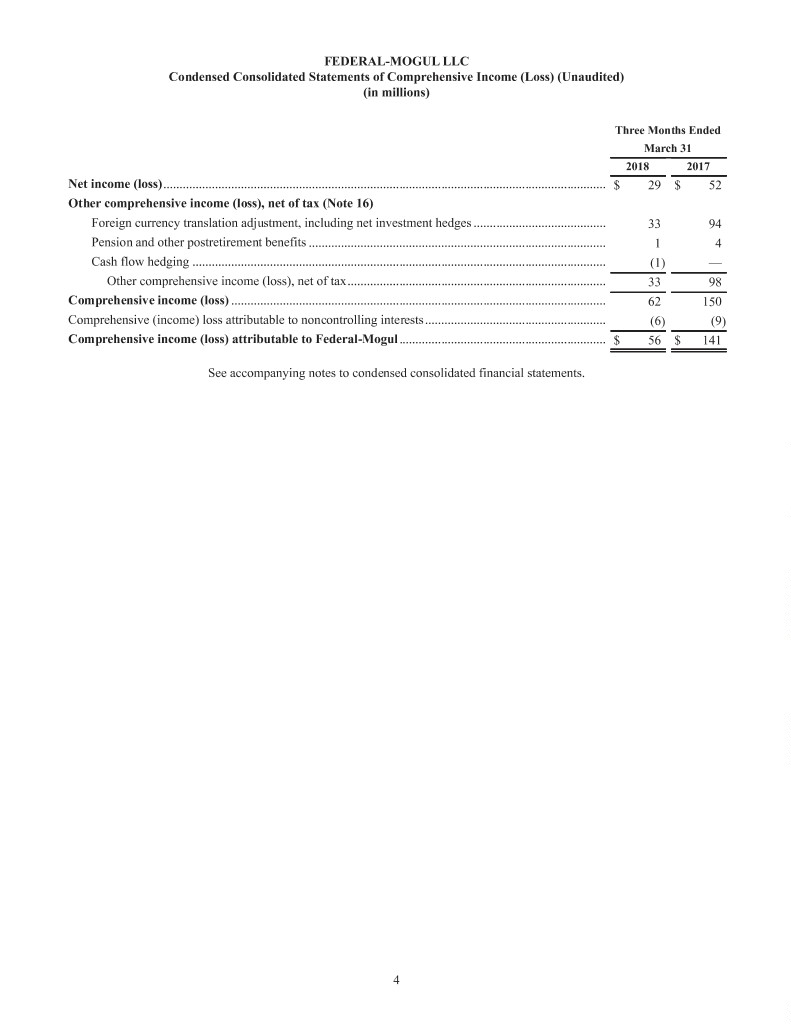

FEDERAL-MOGUL LLC Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) (in millions) Three Months Ended March 31 2018 2017 Net income (loss)......................................................................................................................................... $29$52 Other comprehensive income (loss), net of tax (Note 16) Foreign currency translation adjustment, including net investment hedges ......................................... 33 94 Pension and other postretirement benefits ............................................................................................ 14 Cash flow hedging ................................................................................................................................ (1)— Other comprehensive income (loss), net of tax................................................................................ 33 98 Comprehensive income (loss) .................................................................................................................... 62 150 Comprehensive (income) loss attributable to noncontrolling interests........................................................ (6) (9) Comprehensive income (loss) attributable to Federal-Mogul................................................................ $ 56 $ 141 See accompanying notes to condensed consolidated financial statements. 4

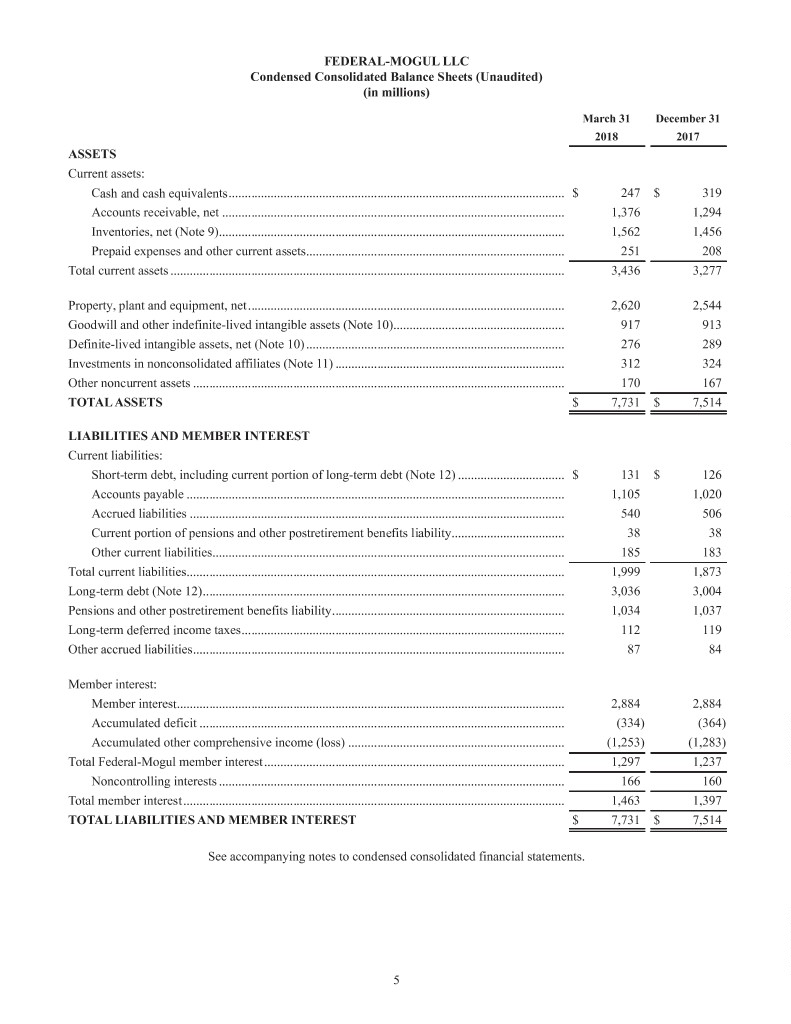

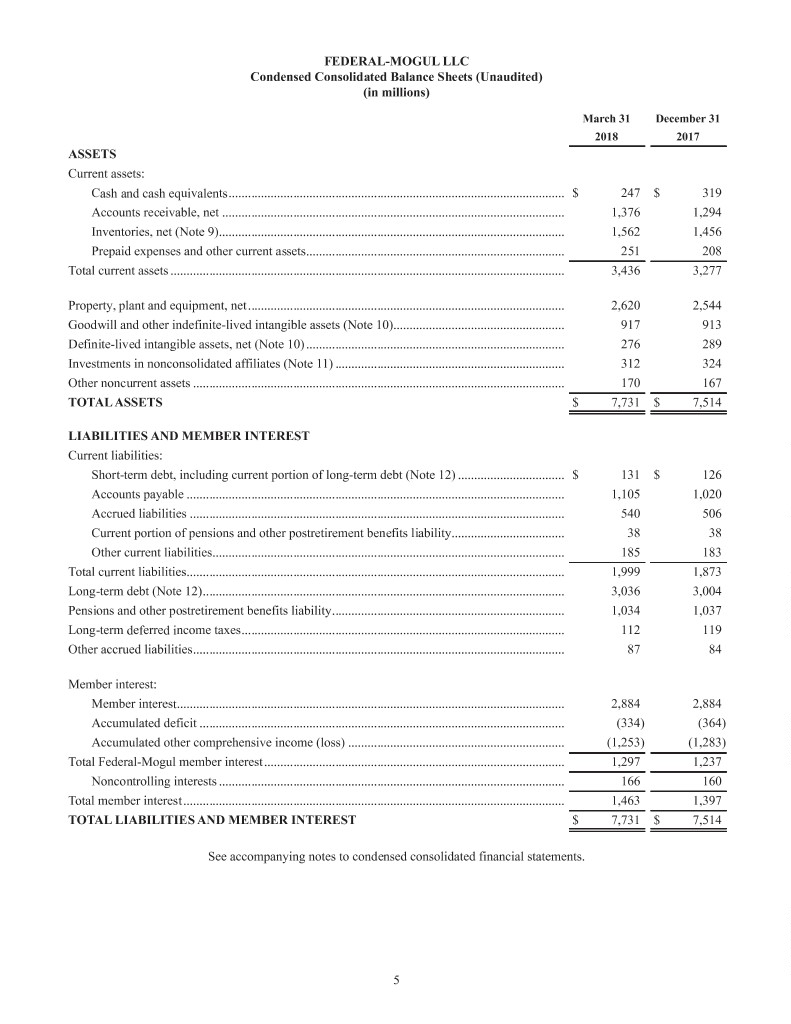

FEDERAL-MOGUL LLC Condensed Consolidated Balance Sheets (Unaudited) (in millions) March 31 December 31 2018 2017 ASSETS Current assets: Cash and cash equivalents........................................................................................................ $ 247 $ 319 Accounts receivable, net .......................................................................................................... 1,376 1,294 Inventories, net (Note 9)........................................................................................................... 1,562 1,456 Prepaid expenses and other current assets................................................................................ 251 208 Total current assets .......................................................................................................................... 3,436 3,277 Property, plant and equipment, net.................................................................................................. 2,620 2,544 Goodwill and other indefinite-lived intangible assets (Note 10)..................................................... 917 913 Definite-lived intangible assets, net (Note 10)................................................................................ 276 289 Investments in nonconsolidated affiliates (Note 11) ....................................................................... 312 324 Other noncurrent assets ................................................................................................................... 170 167 TOTAL ASSETS $ 7,731 $ 7,514 LIABILITIES AND MEMBER INTEREST Current liabilities: Short-term debt, including current portion of long-term debt (Note 12) ................................. $ 131 $ 126 Accounts payable ..................................................................................................................... 1,105 1,020 Accrued liabilities .................................................................................................................... 540 506 Current portion of pensions and other postretirement benefits liability................................... 38 38 Other current liabilities............................................................................................................. 185 183 Total current liabilities..................................................................................................................... 1,999 1,873 Long-term debt (Note 12)................................................................................................................ 3,036 3,004 Pensions and other postretirement benefits liability........................................................................ 1,034 1,037 Long-term deferred income taxes.................................................................................................... 112 119 Other accrued liabilities................................................................................................................... 87 84 Member interest: Member interest........................................................................................................................ 2,884 2,884 Accumulated deficit ................................................................................................................. (334) (364) Accumulated other comprehensive income (loss) ................................................................... (1,253) (1,283) Total Federal-Mogul member interest............................................................................................. 1,297 1,237 Noncontrolling interests ........................................................................................................... 166 160 Total member interest ...................................................................................................................... 1,463 1,397 TOTAL LIABILITIES AND MEMBER INTEREST $ 7,731 $ 7,514 See accompanying notes to condensed consolidated financial statements. 5

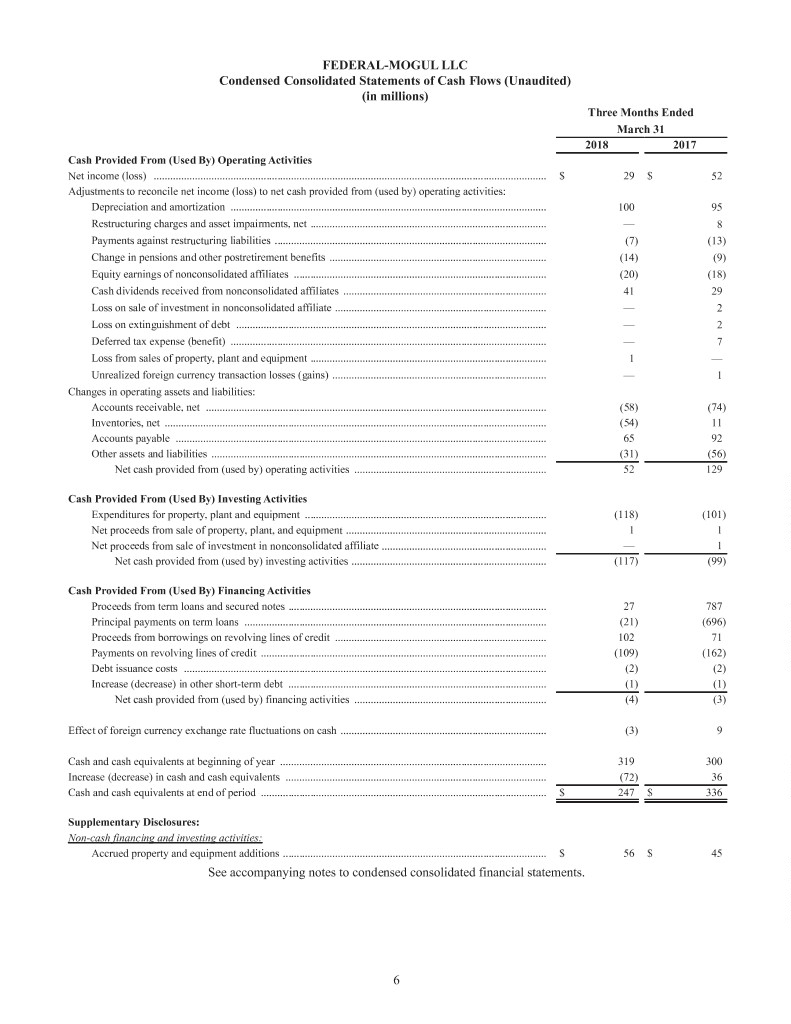

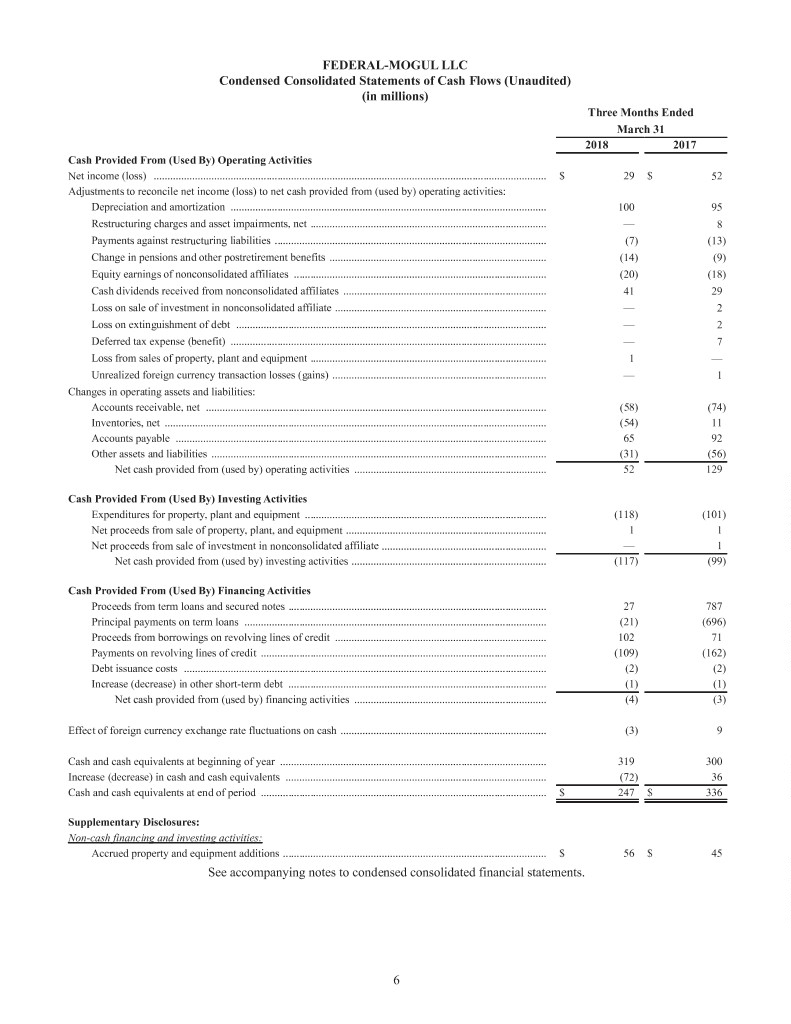

FEDERAL-MOGUL LLC Condensed Consolidated Statements of Cash Flows (Unaudited) (in millions) Three Months Ended March 31 2018 2017 Cash Provided From (Used By) Operating Activities Net income (loss) ............................................................................................................................................... $ 29 $ 52 Adjustments to reconcile net income (loss) to net cash provided from (used by) operating activities: Depreciation and amortization ................................................................................................................... 100 95 Restructuring charges and asset impairments, net ...................................................................................... —8 Payments against restructuring liabilities ................................................................................................... (7) (13) Change in pensions and other postretirement benefits ............................................................................... (14) (9) Equity earnings of nonconsolidated affiliates ............................................................................................ (20) (18) Cash dividends received from nonconsolidated affiliates .......................................................................... 41 29 Loss on sale of investment in nonconsolidated affiliate ............................................................................. —2 Loss on extinguishment of debt ................................................................................................................. —2 Deferred tax expense (benefit) ................................................................................................................... —7 Loss from sales of property, plant and equipment ...................................................................................... 1— Unrealized foreign currency transaction losses (gains) .............................................................................. —1 Changes in operating assets and liabilities: Accounts receivable, net ............................................................................................................................ (58) (74) Inventories, net ........................................................................................................................................... (54)11 Accounts payable ....................................................................................................................................... 65 92 Other assets and liabilities .......................................................................................................................... (31) (56) Net cash provided from (used by) operating activities ...................................................................... 52 129 Cash Provided From (Used By) Investing Activities Expenditures for property, plant and equipment ........................................................................................ (118) (101) Net proceeds from sale of property, plant, and equipment ......................................................................... 1 1 Net proceeds from sale of investment in nonconsolidated affiliate ............................................................ — 1 Net cash provided from (used by) investing activities ....................................................................... (117) (99) Cash Provided From (Used By) Financing Activities Proceeds from term loans and secured notes .............................................................................................. 27 787 Principal payments on term loans .............................................................................................................. (21) (696) Proceeds from borrowings on revolving lines of credit ............................................................................. 102 71 Payments on revolving lines of credit ........................................................................................................ (109) (162) Debt issuance costs .................................................................................................................................... (2) (2) Increase (decrease) in other short-term debt .............................................................................................. (1) (1) Net cash provided from (used by) financing activities ...................................................................... (4) (3) Effect of foreign currency exchange rate fluctuations on cash ........................................................................... (3)9 Cash and cash equivalents at beginning of year ................................................................................................. 319 300 Increase (decrease) in cash and cash equivalents ............................................................................................... (72)36 Cash and cash equivalents at end of period ........................................................................................................ $ 247 $ 336 Supplementary Disclosures: Non-cash financing and investing activities: Accrued property and equipment additions ................................................................................................ $ 56 $ 45 See accompanying notes to condensed consolidated financial statements. 6

FEDERAL-MOGUL LLC NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (tabular information in millions) 1. DESCRIPTION OF BUSINESS Federal-Mogul LLC (the "Company" or "Federal-Mogul") is a limited liability company formed under the laws of Delaware. Icahn Enterprises, L.P. (NASDAQ: IEP) (“IEP”) is a diversified holding company that indirectly owns 100% of the Company's outstanding LLC interest. The Company is a global supplier of technology and innovation in vehicle and industrial products for fuel economy, emissions reduction, and safety systems. The Company serves the world’s foremost original equipment manufacturers (“OEM”) and servicers (and together with OEM, "OE") of automotive, light, medium and heavy-duty commercial vehicles, off-road, agricultural, marine, rail, aerospace, power generation and industrial equipment, as well as the worldwide aftermarket. On April 10, 2018, IEP, American Entertainment Properties Corp., a Delaware corporation, the Company’s parent and an indirect wholly owned subsidiary of IEP (“AEP”), the Company, and Tenneco Inc., a Delaware corporation (“Tenneco”), entered into a Membership Interest Purchase Agreement (the "Purchase Agreement") pursuant to which AEP agreed to sell all of the outstanding membership interests of the Company to Tenneco (the “Transaction”) in exchange for $800 million in cash and 29,444,846 shares of Tenneco common stock. The Transaction is expected to close in the second half of 2018, subject to regulatory approvals, the approval of Tenneco’s shareholders and other customary closing conditions. Following the closing of the Transaction, Tenneco has agreed to use its reasonable best efforts to pursue the separation of the combined company’s powertrain technology business, and its aftermarket and ride performance business into two separate, publicly traded companies in a spin-off transaction that is expected to be treated as a tax-free reorganization for U.S. federal income tax purposes. Subsequent to March 31, 2018, the Company incurred a $10 million success fee to be paid to its financial advisers in connection with the signing of the Purchase Agreement. 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Presentation - Interim Financial Statements Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to such rules and regulations. These statements include all adjustments (consisting of normal recurring adjustments) management believes are necessary for a fair presentation of the results of operations, comprehensive income, financial position, and cash flows. The Company’s management believes the disclosures are adequate to make the information presented not misleading when read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s financial statements for the year ended December 31, 2017 dated February 26, 2018. Operating results for the three months ended March 31, 2018 are not necessarily indicative of the results that may be expected for the year ended December 31, 2018. Principles of consolidation: The Company consolidates into its financial statements the accounts of the Company, all wholly- owned subsidiaries, and any partially-owned subsidiary the Company has the ability to control. Control generally equates to ownership percentage, whereby investments more than 50% owned are consolidated, investments in affiliates of 50% or less but greater than 20% are accounted for using the equity method, and investments in affiliates of 20% or less are accounted for using the cost method. The Company does not consolidate any entity for which it has a variable interest based solely on power to direct the activities and significant participation in the entity’s expected results that would not otherwise be consolidated based on control through voting interests. Further, the Company’s affiliates are businesses established and maintained in connection with the Company’s operating strategy and are not special purpose entities. All intercompany transactions and balances have been eliminated. Reclassifications: Certain reclassifications from the prior year presentation have been made to conform to the current year presentation. 7

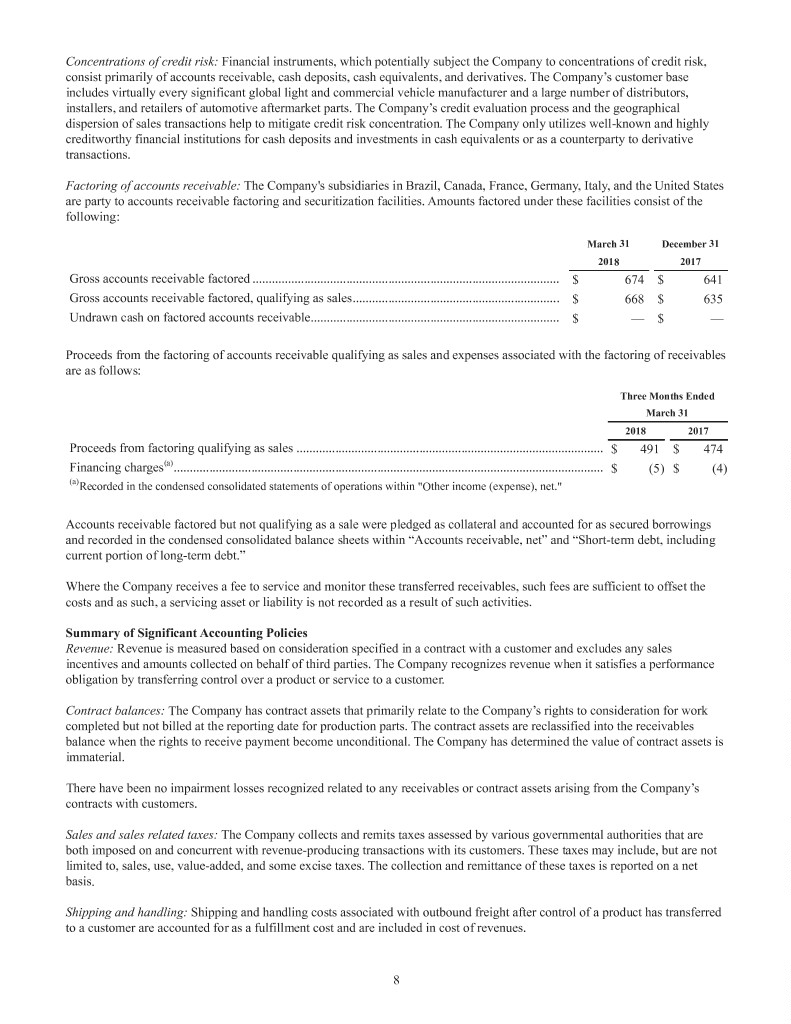

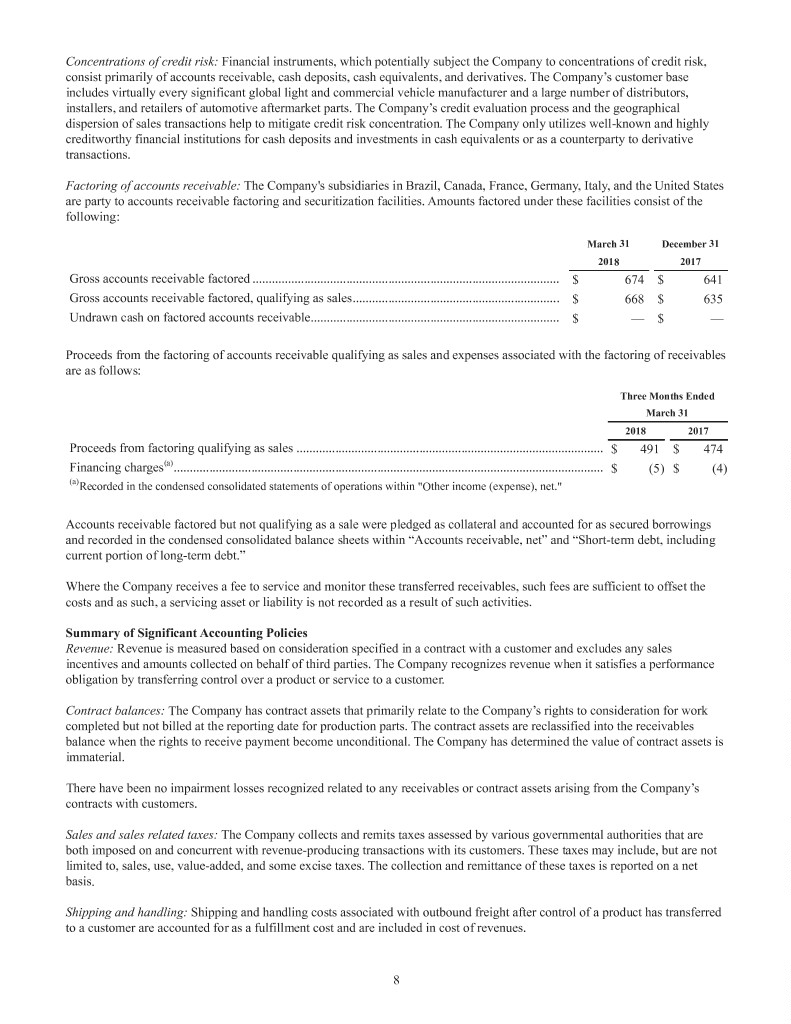

Concentrations of credit risk: Financial instruments, which potentially subject the Company to concentrations of credit risk, consist primarily of accounts receivable, cash deposits, cash equivalents, and derivatives. The Company’s customer base includes virtually every significant global light and commercial vehicle manufacturer and a large number of distributors, installers, and retailers of automotive aftermarket parts. The Company’s credit evaluation process and the geographical dispersion of sales transactions help to mitigate credit risk concentration. The Company only utilizes well-known and highly creditworthy financial institutions for cash deposits and investments in cash equivalents or as a counterparty to derivative transactions. Factoring of accounts receivable: The Company's subsidiaries in Brazil, Canada, France, Germany, Italy, and the United States are party to accounts receivable factoring and securitization facilities. Amounts factored under these facilities consist of the following: March 31 December 31 2018 2017 Gross accounts receivable factored ............................................................................................... $ 674 $ 641 Gross accounts receivable factored, qualifying as sales................................................................ $ 668 $ 635 Undrawn cash on factored accounts receivable............................................................................. $—$— Proceeds from the factoring of accounts receivable qualifying as sales and expenses associated with the factoring of receivables are as follows: Three Months Ended March 31 2018 2017 Proceeds from factoring qualifying as sales ............................................................................................... $ 491 $ 474 Financing charges(a) ..................................................................................................................................... $ (5)$ (4) (a)Recorded in the condensed consolidated statements of operations within "Other income (expense), net." Accounts receivable factored but not qualifying as a sale were pledged as collateral and accounted for as secured borrowings and recorded in the condensed consolidated balance sheets within “Accounts receivable, net” and “Short-term debt, including current portion of long-term debt.” Where the Company receives a fee to service and monitor these transferred receivables, such fees are sufficient to offset the costs and as such, a servicing asset or liability is not recorded as a result of such activities. Summary of Significant Accounting Policies Revenue: Revenue is measured based on consideration specified in a contract with a customer and excludes any sales incentives and amounts collected on behalf of third parties. The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product or service to a customer. Contract balances: The Company has contract assets that primarily relate to the Company’s rights to consideration for work completed but not billed at the reporting date for production parts. The contract assets are reclassified into the receivables balance when the rights to receive payment become unconditional. The Company has determined the value of contract assets is immaterial. There have been no impairment losses recognized related to any receivables or contract assets arising from the Company’s contracts with customers. Sales and sales related taxes: The Company collects and remits taxes assessed by various governmental authorities that are both imposed on and concurrent with revenue-producing transactions with its customers. These taxes may include, but are not limited to, sales, use, value-added, and some excise taxes. The collection and remittance of these taxes is reported on a net basis. Shipping and handling: Shipping and handling costs associated with outbound freight after control of a product has transferred to a customer are accounted for as a fulfillment cost and are included in cost of revenues. 8

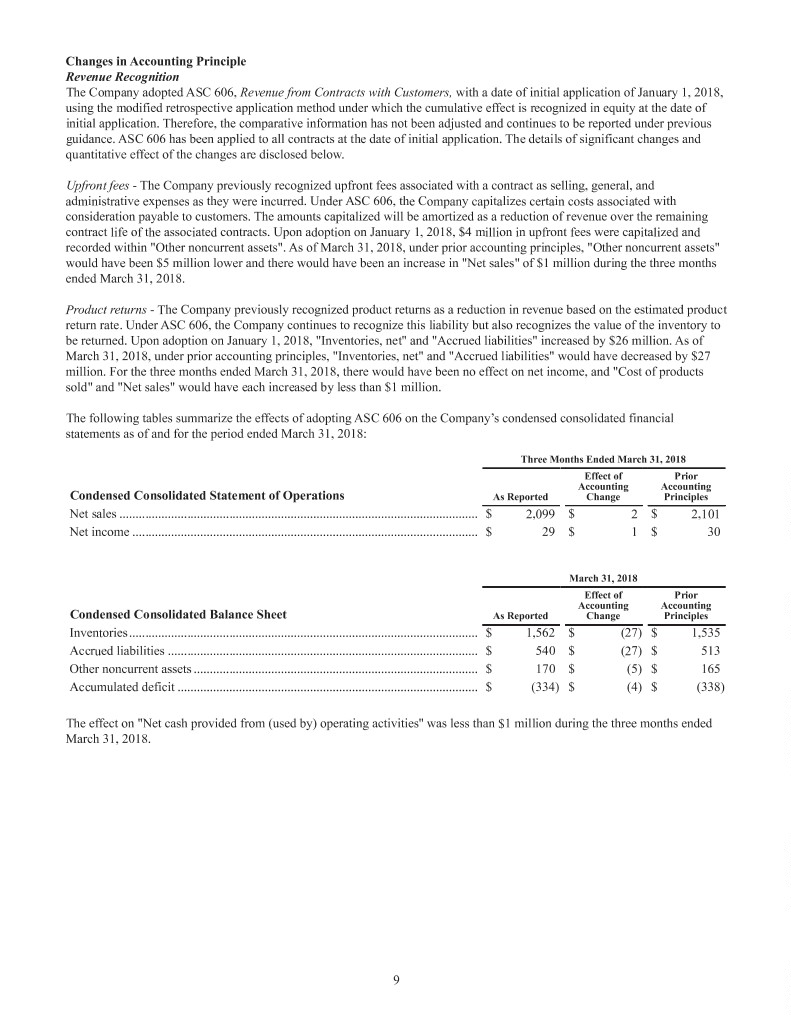

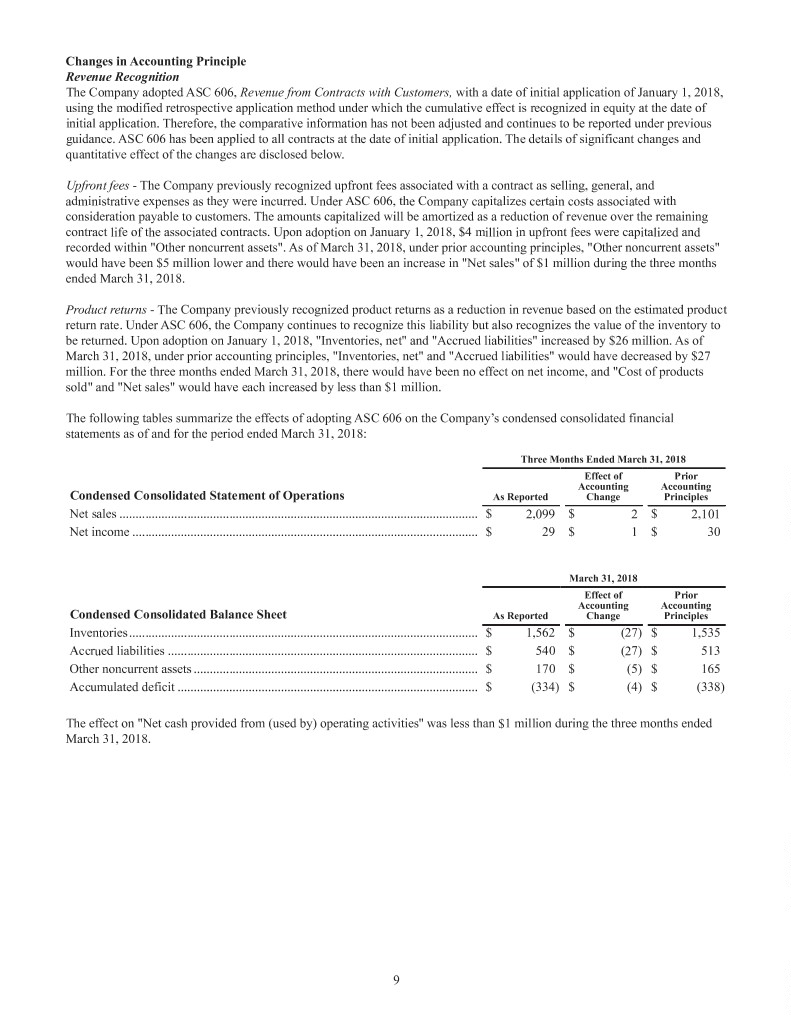

Changes in Accounting Principle Revenue Recognition The Company adopted ASC 606, Revenue from Contracts with Customers, with a date of initial application of January 1, 2018, using the modified retrospective application method under which the cumulative effect is recognized in equity at the date of initial application. Therefore, the comparative information has not been adjusted and continues to be reported under previous guidance. ASC 606 has been applied to all contracts at the date of initial application. The details of significant changes and quantitative effect of the changes are disclosed below. Upfront fees - The Company previously recognized upfront fees associated with a contract as selling, general, and administrative expenses as they were incurred. Under ASC 606, the Company capitalizes certain costs associated with consideration payable to customers. The amounts capitalized will be amortized as a reduction of revenue over the remaining contract life of the associated contracts. Upon adoption on January 1, 2018, $4 million in upfront fees were capitalized and recorded within "Other noncurrent assets". As of March 31, 2018, under prior accounting principles, "Other noncurrent assets" would have been $5 million lower and there would have been an increase in "Net sales" of $1 million during the three months ended March 31, 2018. Product returns - The Company previously recognized product returns as a reduction in revenue based on the estimated product return rate. Under ASC 606, the Company continues to recognize this liability but also recognizes the value of the inventory to be returned. Upon adoption on January 1, 2018, "Inventories, net" and "Accrued liabilities" increased by $26 million. As of March 31, 2018, under prior accounting principles, "Inventories, net" and "Accrued liabilities" would have decreased by $27 million. For the three months ended March 31, 2018, there would have been no effect on net income, and "Cost of products sold" and "Net sales" would have each increased by less than $1 million. The following tables summarize the effects of adopting ASC 606 on the Company’s condensed consolidated financial statements as of and for the period ended March 31, 2018: Three Months Ended March 31, 2018 Effect of Prior Accounting Accounting Condensed Consolidated Statement of Operations As Reported Change Principles Net sales ............................................................................................................... $ 2,099 $ 2 $ 2,101 Net income ........................................................................................................... $ 29 $ 1 $ 30 March 31, 2018 Effect of Prior Accounting Accounting Condensed Consolidated Balance Sheet As Reported Change Principles Inventories............................................................................................................ $ 1,562 $ (27) $ 1,535 Accrued liabilities ................................................................................................ $ 540 $ (27) $ 513 Other noncurrent assets ........................................................................................ $ 170 $ (5) $ 165 Accumulated deficit ............................................................................................. $ (334)$ (4)$ (338) The effect on "Net cash provided from (used by) operating activities'' was less than $1 million during the three months ended March 31, 2018. 9

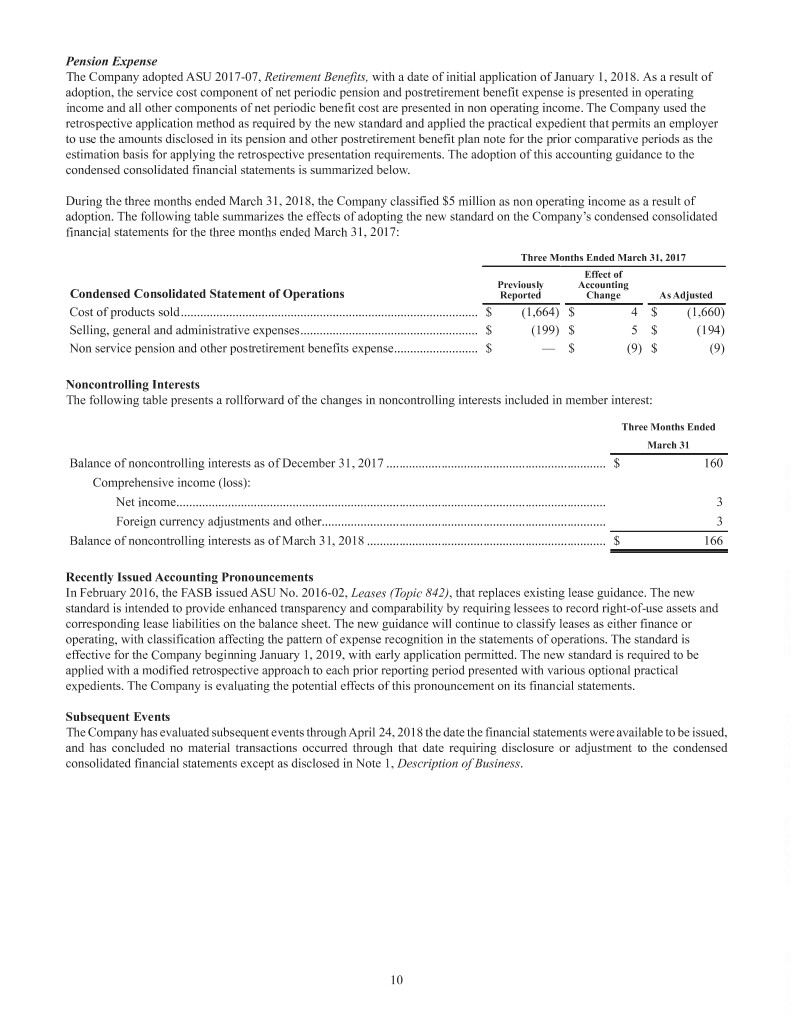

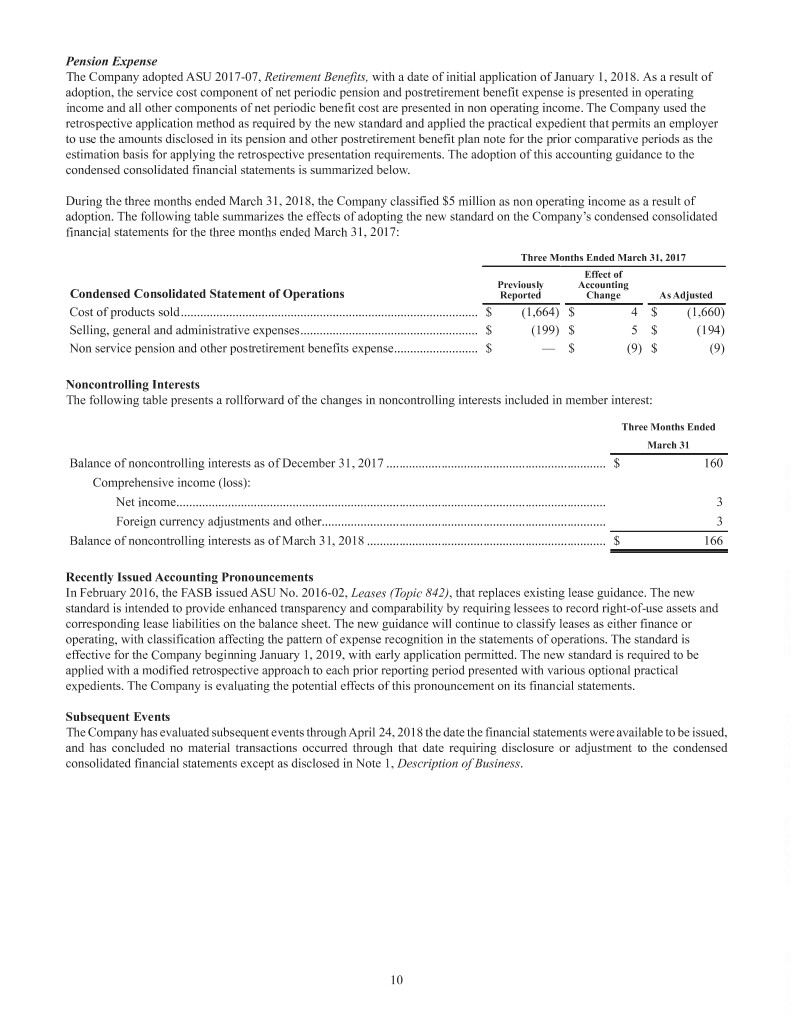

Pension Expense The Company adopted ASU 2017-07, Retirement Benefits, with a date of initial application of January 1, 2018. As a result of adoption, the service cost component of net periodic pension and postretirement benefit expense is presented in operating income and all other components of net periodic benefit cost are presented in non operating income. The Company used the retrospective application method as required by the new standard and applied the practical expedient that permits an employer to use the amounts disclosed in its pension and other postretirement benefit plan note for the prior comparative periods as the estimation basis for applying the retrospective presentation requirements. The adoption of this accounting guidance to the condensed consolidated financial statements is summarized below. During the three months ended March 31, 2018, the Company classified $5 million as non operating income as a result of adoption. The following table summarizes the effects of adopting the new standard on the Company’s condensed consolidated financial statements for the three months ended March 31, 2017: Three Months Ended March 31, 2017 Effect of Previously Accounting Condensed Consolidated Statement of Operations Reported Change As Adjusted Cost of products sold............................................................................................ $ (1,664)$ 4 $ (1,660) Selling, general and administrative expenses....................................................... $ (199)$ 5 $ (194) Non service pension and other postretirement benefits expense.......................... $ — $ (9)$ (9) Noncontrolling Interests The following table presents a rollforward of the changes in noncontrolling interests included in member interest: Three Months Ended March 31 Balance of noncontrolling interests as of December 31, 2017 .................................................................... $ 160 Comprehensive income (loss): Net income..................................................................................................................................... 3 Foreign currency adjustments and other........................................................................................ 3 Balance of noncontrolling interests as of March 31, 2018 .......................................................................... $ 166 Recently Issued Accounting Pronouncements In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), that replaces existing lease guidance. The new standard is intended to provide enhanced transparency and comparability by requiring lessees to record right-of-use assets and corresponding lease liabilities on the balance sheet. The new guidance will continue to classify leases as either finance or operating, with classification affecting the pattern of expense recognition in the statements of operations. The standard is effective for the Company beginning January 1, 2019, with early application permitted. The new standard is required to be applied with a modified retrospective approach to each prior reporting period presented with various optional practical expedients. The Company is evaluating the potential effects of this pronouncement on its financial statements. Subsequent Events The Company has evaluated subsequent events through April 24, 2018 the date the financial statements were available to be issued, and has concluded no material transactions occurred through that date requiring disclosure or adjustment to the condensed consolidated financial statements except as disclosed in Note 1, Description of Business. 10

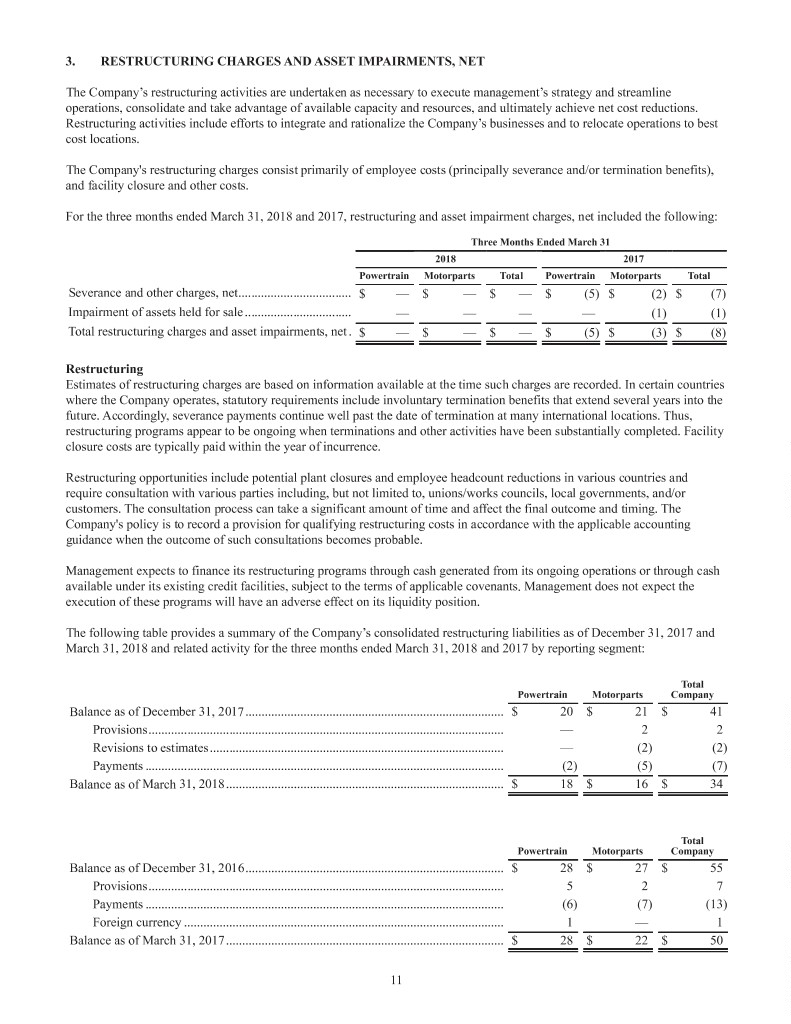

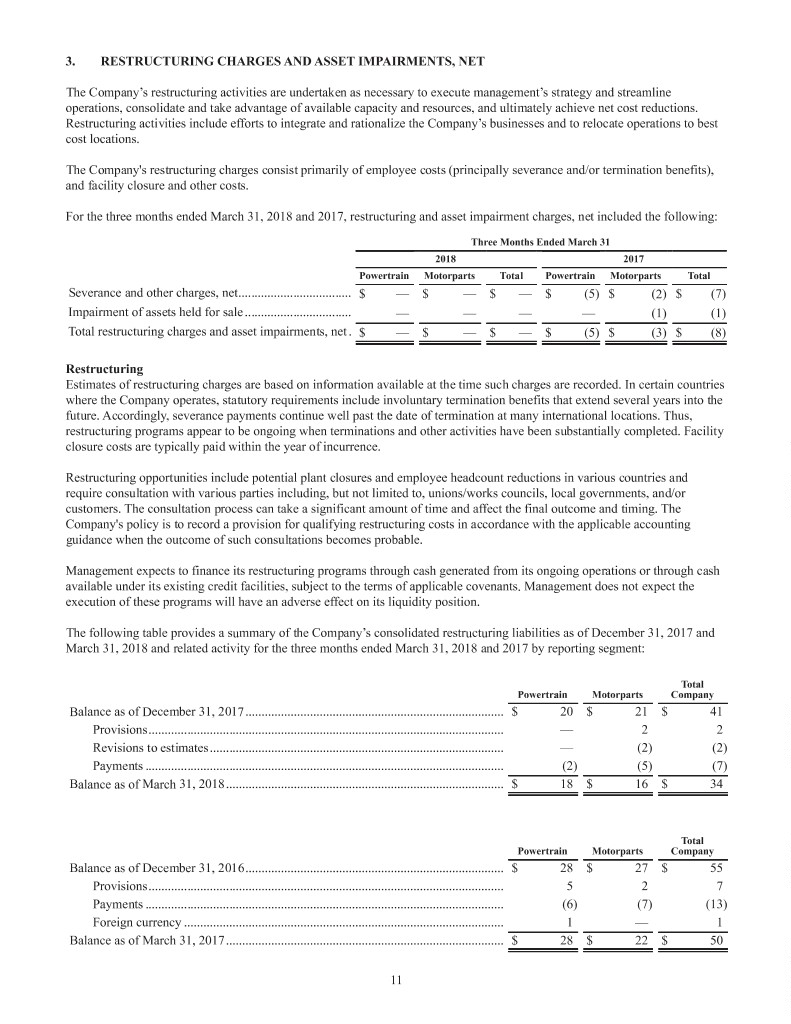

3. RESTRUCTURING CHARGES AND ASSET IMPAIRMENTS, NET The Company’s restructuring activities are undertaken as necessary to execute management’s strategy and streamline operations, consolidate and take advantage of available capacity and resources, and ultimately achieve net cost reductions. Restructuring activities include efforts to integrate and rationalize the Company’s businesses and to relocate operations to best cost locations. The Company's restructuring charges consist primarily of employee costs (principally severance and/or termination benefits), and facility closure and other costs. For the three months ended March 31, 2018 and 2017, restructuring and asset impairment charges, net included the following: Three Months Ended March 31 2018 2017 Powertrain Motorparts Total Powertrain Motorparts Total Severance and other charges, net................................... $—$—$—$ (5)$ (2)$ (7) Impairment of assets held for sale................................. ———— (1) (1) Total restructuring charges and asset impairments, net. $—$—$—$ (5)$ (3)$ (8) Restructuring Estimates of restructuring charges are based on information available at the time such charges are recorded. In certain countries where the Company operates, statutory requirements include involuntary termination benefits that extend several years into the future. Accordingly, severance payments continue well past the date of termination at many international locations. Thus, restructuring programs appear to be ongoing when terminations and other activities have been substantially completed. Facility closure costs are typically paid within the year of incurrence. Restructuring opportunities include potential plant closures and employee headcount reductions in various countries and require consultation with various parties including, but not limited to, unions/works councils, local governments, and/or customers. The consultation process can take a significant amount of time and affect the final outcome and timing. The Company's policy is to record a provision for qualifying restructuring costs in accordance with the applicable accounting guidance when the outcome of such consultations becomes probable. Management expects to finance its restructuring programs through cash generated from its ongoing operations or through cash available under its existing credit facilities, subject to the terms of applicable covenants. Management does not expect the execution of these programs will have an adverse effect on its liquidity position. The following table provides a summary of the Company’s consolidated restructuring liabilities as of December 31, 2017 and March 31, 2018 and related activity for the three months ended March 31, 2018 and 2017 by reporting segment: Total Powertrain Motorparts Company Balance as of December 31, 2017................................................................................ $ 20 $ 21 $ 41 Provisions.............................................................................................................. — 2 2 Revisions to estimates........................................................................................... — (2) (2) Payments ............................................................................................................... (2) (5) (7) Balance as of March 31, 2018...................................................................................... $ 18 $ 16 $ 34 Total Powertrain Motorparts Company Balance as of December 31, 2016................................................................................ $ 28 $ 27 $ 55 Provisions.............................................................................................................. 5 2 7 Payments ............................................................................................................... (6) (7) (13) Foreign currency ................................................................................................... 1 — 1 Balance as of March 31, 2017...................................................................................... $ 28 $ 22 $ 50 11

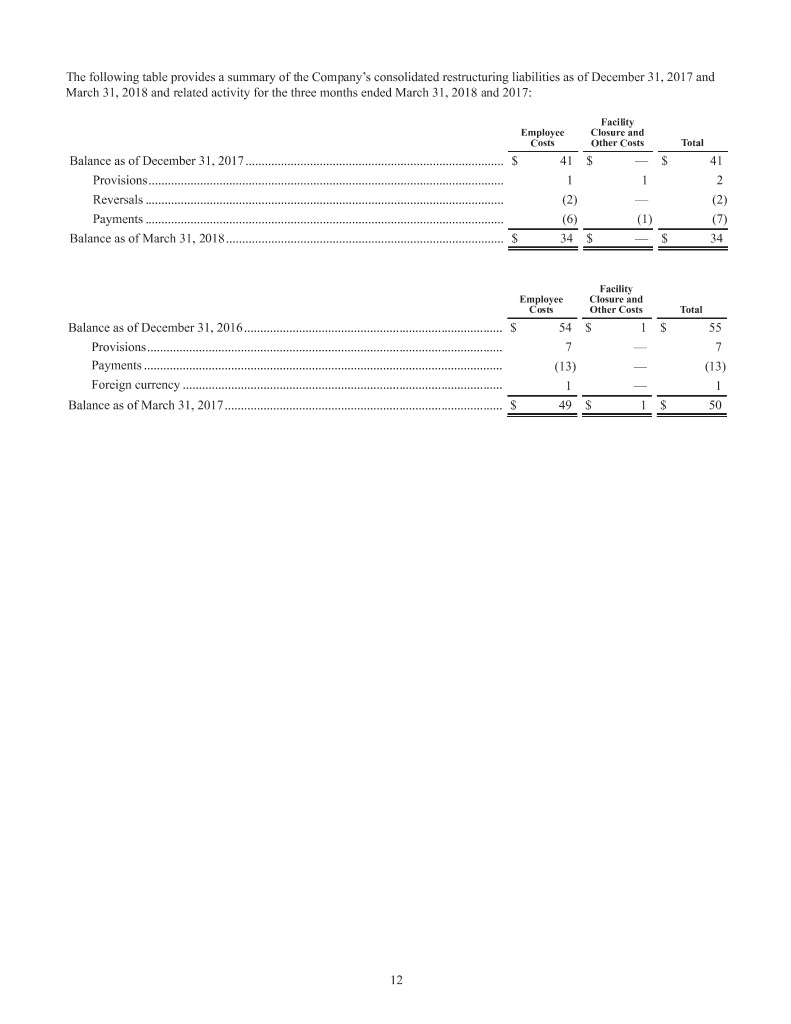

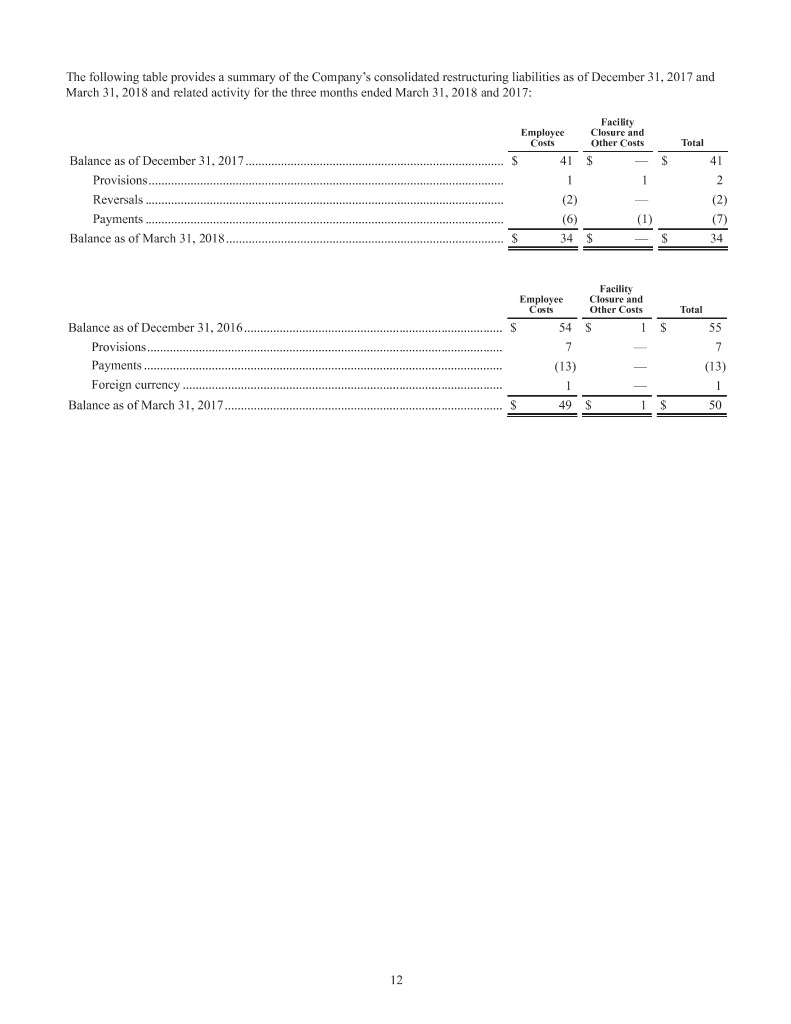

The following table provides a summary of the Company’s consolidated restructuring liabilities as of December 31, 2017 and March 31, 2018 and related activity for the three months ended March 31, 2018 and 2017: Facility Employee Closure and Costs Other Costs Total Balance as of December 31, 2017................................................................................ $ 41$ —$ 41 Provisions.............................................................................................................. 112 Reversals ............................................................................................................... (2)— (2) Payments ............................................................................................................... (6) (1) (7) Balance as of March 31, 2018...................................................................................... $ 34$ —$ 34 Facility Employee Closure and Costs Other Costs Total Balance as of December 31, 2016................................................................................ $ 54$ 1$ 55 Provisions.............................................................................................................. 7— 7 Payments ............................................................................................................... (13)—(13) Foreign currency ................................................................................................... 1— 1 Balance as of March 31, 2017...................................................................................... $ 49$ 1$ 50 12

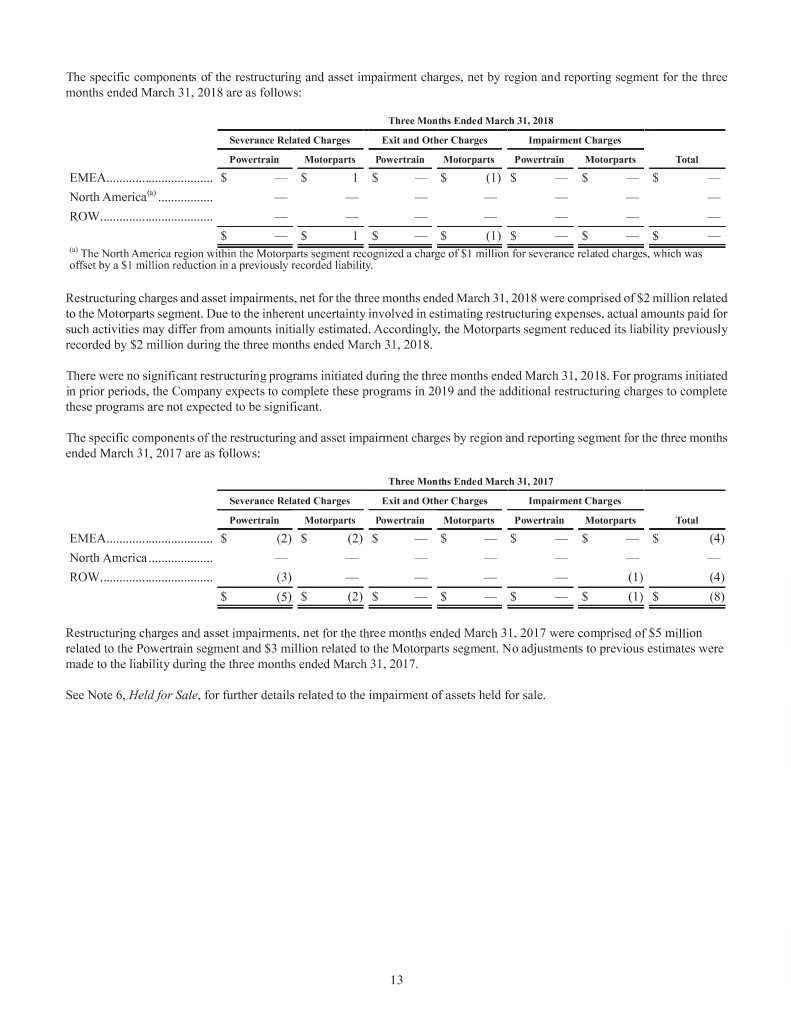

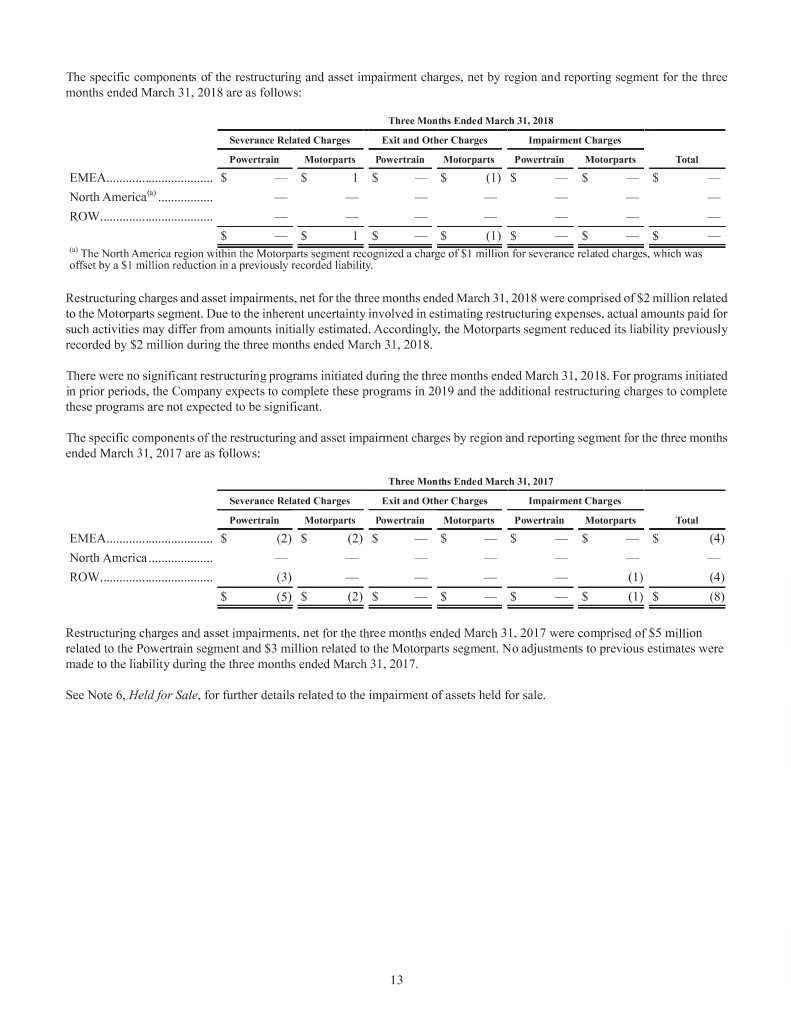

The specific components of the restructuring and asset impairment charges, net by region and reporting segment for the three months ended March 31, 2018 are as follows: Three Months Ended March 31, 2018 Severance Related Charges Exit and Other Charges Impairment Charges Powertrain Motorparts Powertrain Motorparts Powertrain Motorparts Total EMEA................................. $—$1$—$(1)$ —$ —$ — North America(a) ................. —————— — ROW................................... —————— — $—$1$—$(1)$ —$ —$ — (a) The North America region within the Motorparts segment recognized a charge of $1 million for severance related charges, which was offset by a $1 million reduction in a previously recorded liability. Restructuring charges and asset impairments, net for the three months ended March 31, 2018 were comprised of $2 million related to the Motorparts segment. Due to the inherent uncertainty involved in estimating restructuring expenses, actual amounts paid for such activities may differ from amounts initially estimated. Accordingly, the Motorparts segment reduced its liability previously recorded by $2 million during the three months ended March 31, 2018. There were no significant restructuring programs initiated during the three months ended March 31, 2018. For programs initiated in prior periods, the Company expects to complete these programs in 2019 and the additional restructuring charges to complete these programs are not expected to be significant. The specific components of the restructuring and asset impairment charges by region and reporting segment for the three months ended March 31, 2017 are as follows: Three Months Ended March 31, 2017 Severance Related Charges Exit and Other Charges Impairment Charges Powertrain Motorparts Powertrain Motorparts Powertrain Motorparts Total EMEA................................. $ (2) $ (2) $ — $ — $ — $ — $ (4) North America.................... —————— — ROW................................... (3) — — — — (1) (4) $ (5) $ (2) $ — $ — $ — $ (1)$ (8) Restructuring charges and asset impairments, net for the three months ended March 31, 2017 were comprised of $5 million related to the Powertrain segment and $3 million related to the Motorparts segment. No adjustments to previous estimates were made to the liability during the three months ended March 31, 2017. See Note 6, Held for Sale, for further details related to the impairment of assets held for sale. 13

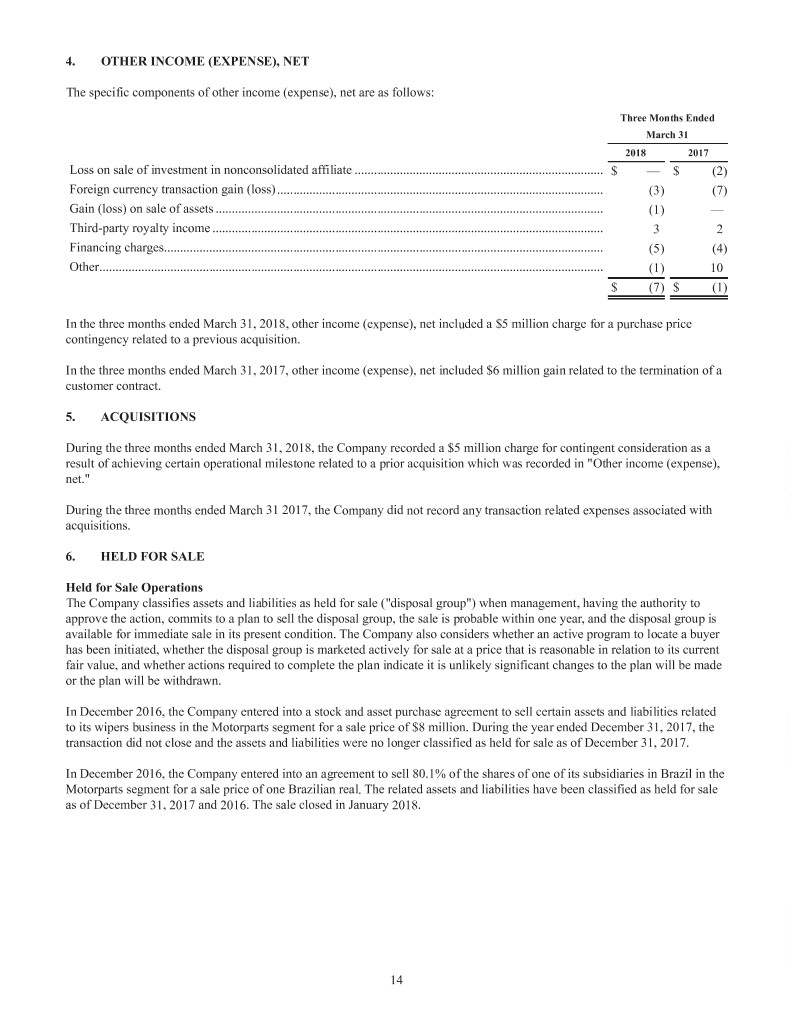

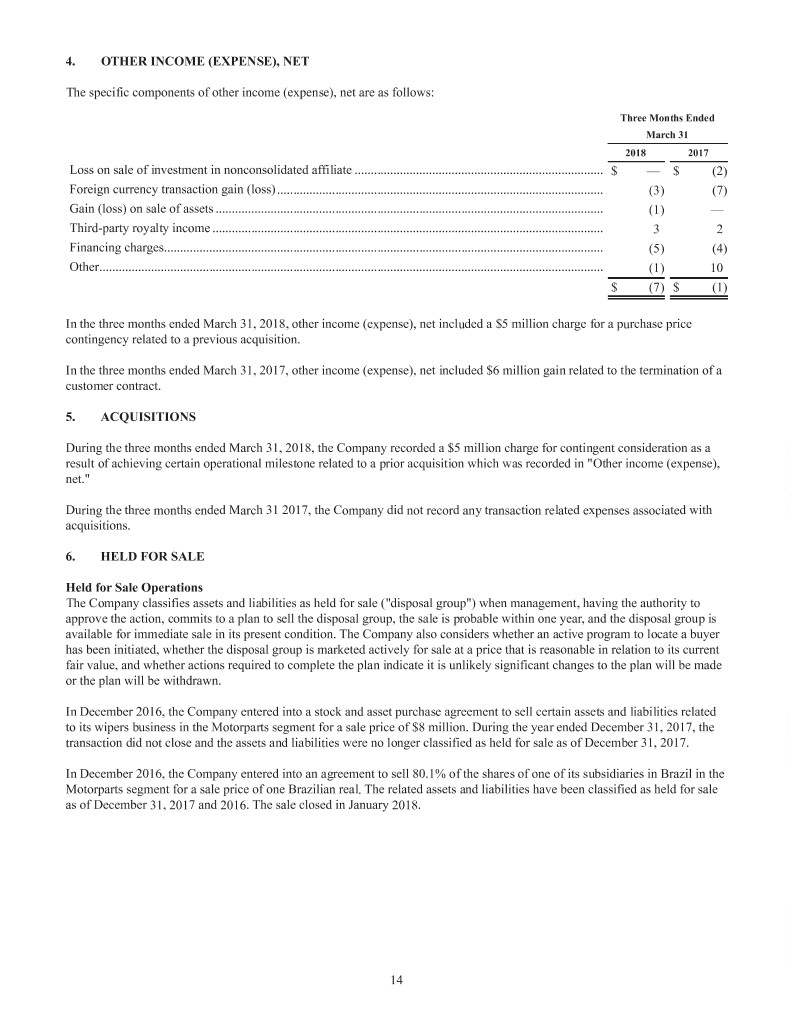

4. OTHER INCOME (EXPENSE), NET The specific components of other income (expense), net are as follows: Three Months Ended March 31 2018 2017 Loss on sale of investment in nonconsolidated affiliate ............................................................................. $—$ (2) Foreign currency transaction gain (loss)..................................................................................................... (3) (7) Gain (loss) on sale of assets ........................................................................................................................ (1)— Third-party royalty income ......................................................................................................................... 32 Financing charges........................................................................................................................................ (5) (4) Other............................................................................................................................................................ (1)10 $ (7)$ (1) In the three months ended March 31, 2018, other income (expense), net included a $5 million charge for a purchase price contingency related to a previous acquisition. In the three months ended March 31, 2017, other income (expense), net included $6 million gain related to the termination of a customer contract. 5. ACQUISITIONS During the three months ended March 31, 2018, the Company recorded a $5 million charge for contingent consideration as a result of achieving certain operational milestone related to a prior acquisition which was recorded in "Other income (expense), net." During the three months ended March 31 2017, the Company did not record any transaction related expenses associated with acquisitions. 6. HELD FOR SALE Held for Sale Operations The Company classifies assets and liabilities as held for sale ("disposal group") when management, having the authority to approve the action, commits to a plan to sell the disposal group, the sale is probable within one year, and the disposal group is available for immediate sale in its present condition. The Company also considers whether an active program to locate a buyer has been initiated, whether the disposal group is marketed actively for sale at a price that is reasonable in relation to its current fair value, and whether actions required to complete the plan indicate it is unlikely significant changes to the plan will be made or the plan will be withdrawn. In December 2016, the Company entered into a stock and asset purchase agreement to sell certain assets and liabilities related to its wipers business in the Motorparts segment for a sale price of $8 million. During the year ended December 31, 2017, the transaction did not close and the assets and liabilities were no longer classified as held for sale as of December 31, 2017. In December 2016, the Company entered into an agreement to sell 80.1% of the shares of one of its subsidiaries in Brazil in the Motorparts segment for a sale price of one Brazilian real. The related assets and liabilities have been classified as held for sale as of December 31, 2017 and 2016. The sale closed in January 2018. 14

The Company did not have any assets or liabilities classified as held for sale as of March 31, 2018. The assets and liabilities classified as held for sale as of December 31, 2017 were as follows: December 31 2017 Assets Receivables.......................................................................................................................................................... $4 Inventories ........................................................................................................................................................... 3 Long-lived assets................................................................................................................................................. 2 Impairment on carrying value ............................................................................................................................. (9) Total assets held for sale ................................................................................................................................... $— Liabilities Trade payables..................................................................................................................................................... $2 Accrued liabilities................................................................................................................................................ 1 Total liabilities held for sale.............................................................................................................................. $3 These held for sale assets and liabilities have been recorded in "Prepaid expenses and other current assets" and "Other current liabilities" as of December 31, 2017. As part of the held for sale assessment, the Company recorded an impairment loss in the amount of $1 million during the three months ended March 31, 2017, which has been included in "Restructuring charges and asset impairments, net" in the condensed consolidated statements of operations. 7. DERIVATIVES AND HEDGING ACTIVITIES The Company is exposed to market risk, such as fluctuations in foreign currency exchange rates, commodity prices, and changes in interest rates, which may result in cash flow risks. To manage the volatility relating to these exposures, the Company aggregates the exposures on a consolidated basis to take advantage of natural offsets. For exposures not offset within its operations, the Company enters into various derivative transactions pursuant to its risk management policies, which prohibit holding or issuing derivative financial instruments for speculative purposes, and designation of derivative instruments is performed on a transaction basis to support hedge accounting. The changes in fair value of these hedging instruments are offset in part or in whole by corresponding changes in the fair value or cash flows of the underlying exposures being hedged. The Company assesses the initial and ongoing effectiveness of its hedging relationships in accordance with its documented policy. Cash Flow Hedges – Commodity Price Risk The Company’s production processes are dependent upon the supply of certain raw materials that are exposed to price fluctuations on the open market. The primary purpose of the Company’s commodity price forward contract activity is to manage the volatility associated with forecasted purchases for up to eighteen months in the future. The Company monitors its commodity price risk exposures regularly to asses the overall effectiveness of its commodity forward contracts. Principal raw materials hedged include copper, nickel, tin, zinc, and aluminum. In certain instances within this program, foreign currency forwards may be used in order to obtain critical terms match for commodity exposure whereby the Company engages the use of foreign exchange contracts. The Company has designated these contracts as cash flow hedging instruments. The Company records unrecognized gains and losses in other comprehensive income (loss) ("OCI or OCL") and makes regular reclassifying adjustments into "Cost of products sold" within the condensed consolidated statement of operations when amounts are recognized. The Company had derivatives outstanding with an equivalent notional amount of $30 million and $20 million as of March 31, 2018 and December 31, 2017. Substantially all of the commodity price hedge contracts mature within one year. 15

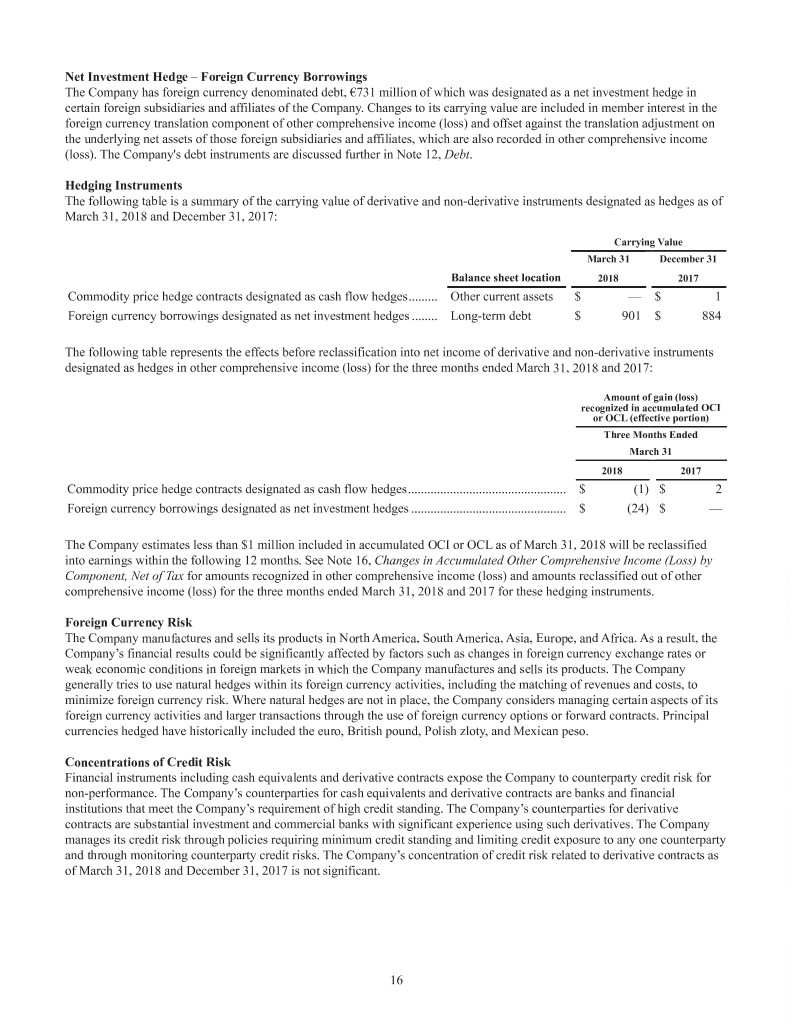

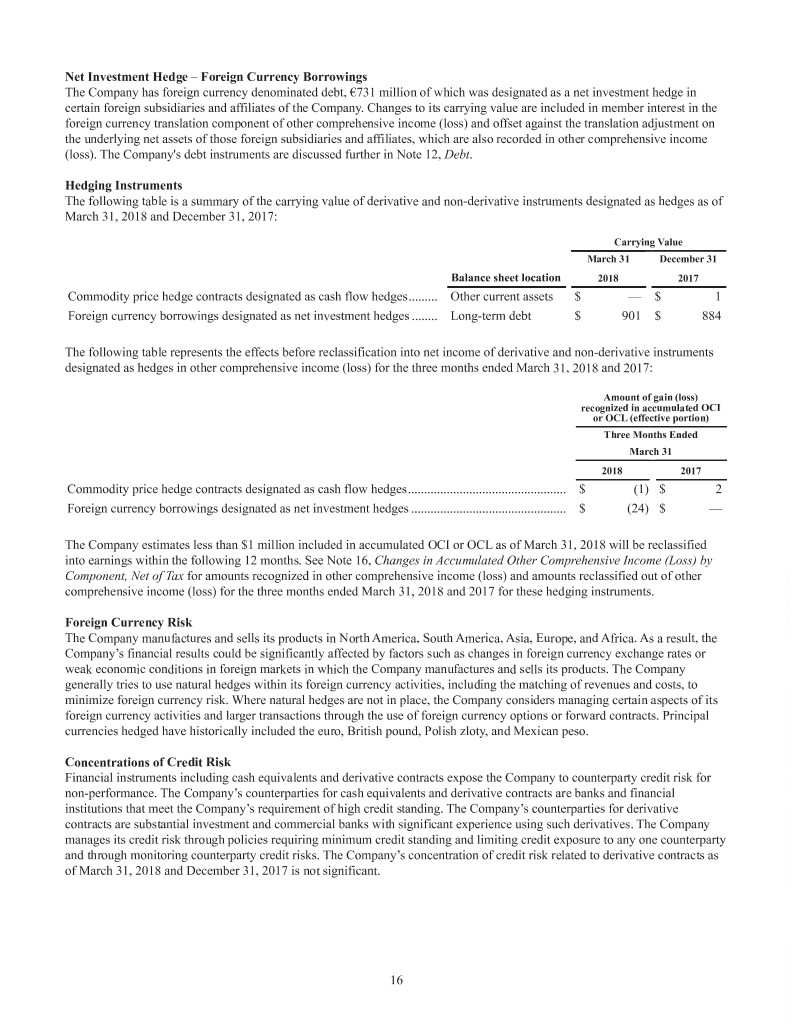

Net Investment Hedge – Foreign Currency Borrowings The Company has foreign currency denominated debt, €731 million of which was designated as a net investment hedge in certain foreign subsidiaries and affiliates of the Company. Changes to its carrying value are included in member interest in the foreign currency translation component of other comprehensive income (loss) and offset against the translation adjustment on the underlying net assets of those foreign subsidiaries and affiliates, which are also recorded in other comprehensive income (loss). The Company's debt instruments are discussed further in Note 12, Debt. Hedging Instruments The following table is a summary of the carrying value of derivative and non-derivative instruments designated as hedges as of March 31, 2018 and December 31, 2017: Carrying Value March 31 December 31 Balance sheet location 2018 2017 Commodity price hedge contracts designated as cash flow hedges......... Other current assets $ — $ 1 Foreign currency borrowings designated as net investment hedges ........ Long-term debt $ 901 $ 884 The following table represents the effects before reclassification into net income of derivative and non-derivative instruments designated as hedges in other comprehensive income (loss) for the three months ended March 31, 2018 and 2017: Amount of gain (loss) recognized in accumulated OCI or OCL (effective portion) Three Months Ended March 31 2018 2017 Commodity price hedge contracts designated as cash flow hedges................................................. $ (1)$ 2 Foreign currency borrowings designated as net investment hedges ................................................ $ (24)$ — The Company estimates less than $1 million included in accumulated OCI or OCL as of March 31, 2018 will be reclassified into earnings within the following 12 months. See Note 16, Changes in Accumulated Other Comprehensive Income (Loss) by Component, Net of Tax for amounts recognized in other comprehensive income (loss) and amounts reclassified out of other comprehensive income (loss) for the three months ended March 31, 2018 and 2017 for these hedging instruments. Foreign Currency Risk The Company manufactures and sells its products in North America, South America, Asia, Europe, and Africa. As a result, the Company’s financial results could be significantly affected by factors such as changes in foreign currency exchange rates or weak economic conditions in foreign markets in which the Company manufactures and sells its products. The Company generally tries to use natural hedges within its foreign currency activities, including the matching of revenues and costs, to minimize foreign currency risk. Where natural hedges are not in place, the Company considers managing certain aspects of its foreign currency activities and larger transactions through the use of foreign currency options or forward contracts. Principal currencies hedged have historically included the euro, British pound, Polish zloty, and Mexican peso. Concentrations of Credit Risk Financial instruments including cash equivalents and derivative contracts expose the Company to counterparty credit risk for non-performance. The Company’s counterparties for cash equivalents and derivative contracts are banks and financial institutions that meet the Company’s requirement of high credit standing. The Company’s counterparties for derivative contracts are substantial investment and commercial banks with significant experience using such derivatives. The Company manages its credit risk through policies requiring minimum credit standing and limiting credit exposure to any one counterparty and through monitoring counterparty credit risks. The Company’s concentration of credit risk related to derivative contracts as of March 31, 2018 and December 31, 2017 is not significant. 16

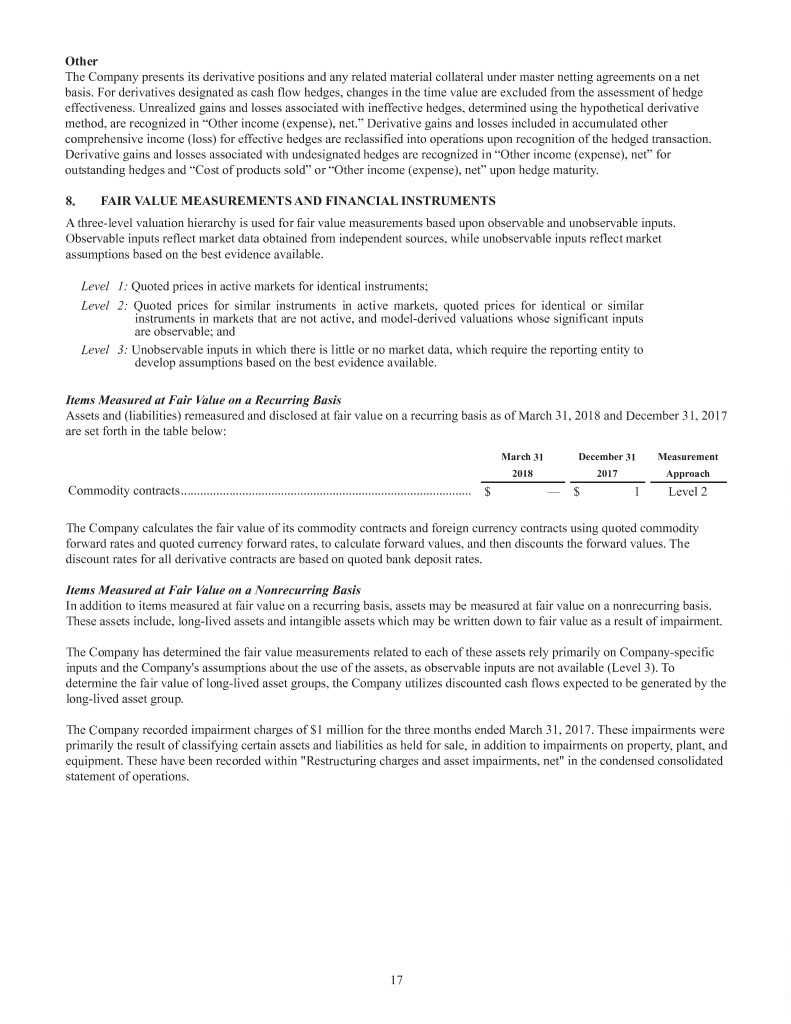

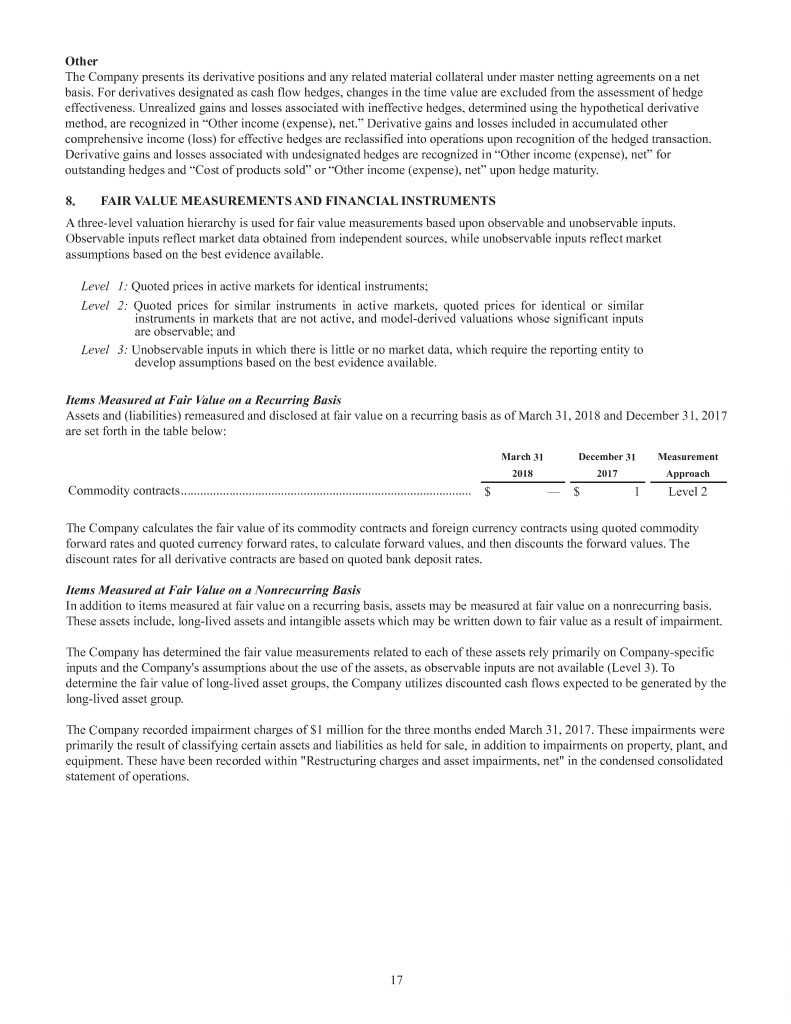

Other The Company presents its derivative positions and any related material collateral under master netting agreements on a net basis. For derivatives designated as cash flow hedges, changes in the time value are excluded from the assessment of hedge effectiveness. Unrealized gains and losses associated with ineffective hedges, determined using the hypothetical derivative method, are recognized in “Other income (expense), net.” Derivative gains and losses included in accumulated other comprehensive income (loss) for effective hedges are reclassified into operations upon recognition of the hedged transaction. Derivative gains and losses associated with undesignated hedges are recognized in “Other income (expense), net” for outstanding hedges and “Cost of products sold” or “Other income (expense), net” upon hedge maturity. 8. FAIR VALUE MEASUREMENTS AND FINANCIAL INSTRUMENTS A three-level valuation hierarchy is used for fair value measurements based upon observable and unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect market assumptions based on the best evidence available. Level 1: Quoted prices in active markets for identical instruments; Level 2: Quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-derived valuations whose significant inputs are observable; and Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop assumptions based on the best evidence available. Items Measured at Fair Value on a Recurring Basis Assets and (liabilities) remeasured and disclosed at fair value on a recurring basis as of March 31, 2018 and December 31, 2017 are set forth in the table below: March 31 December 31 Measurement 2018 2017 Approach Commodity contracts.......................................................................................... $ — $ 1 Level 2 The Company calculates the fair value of its commodity contracts and foreign currency contracts using quoted commodity forward rates and quoted currency forward rates, to calculate forward values, and then discounts the forward values. The discount rates for all derivative contracts are based on quoted bank deposit rates. Items Measured at Fair Value on a Nonrecurring Basis In addition to items measured at fair value on a recurring basis, assets may be measured at fair value on a nonrecurring basis. These assets include, long-lived assets and intangible assets which may be written down to fair value as a result of impairment. The Company has determined the fair value measurements related to each of these assets rely primarily on Company-specific inputs and the Company's assumptions about the use of the assets, as observable inputs are not available (Level 3). To determine the fair value of long-lived asset groups, the Company utilizes discounted cash flows expected to be generated by the long-lived asset group. The Company recorded impairment charges of $1 million for the three months ended March 31, 2017. These impairments were primarily the result of classifying certain assets and liabilities as held for sale, in addition to impairments on property, plant, and equipment. These have been recorded within "Restructuring charges and asset impairments, net" in the condensed consolidated statement of operations. 17

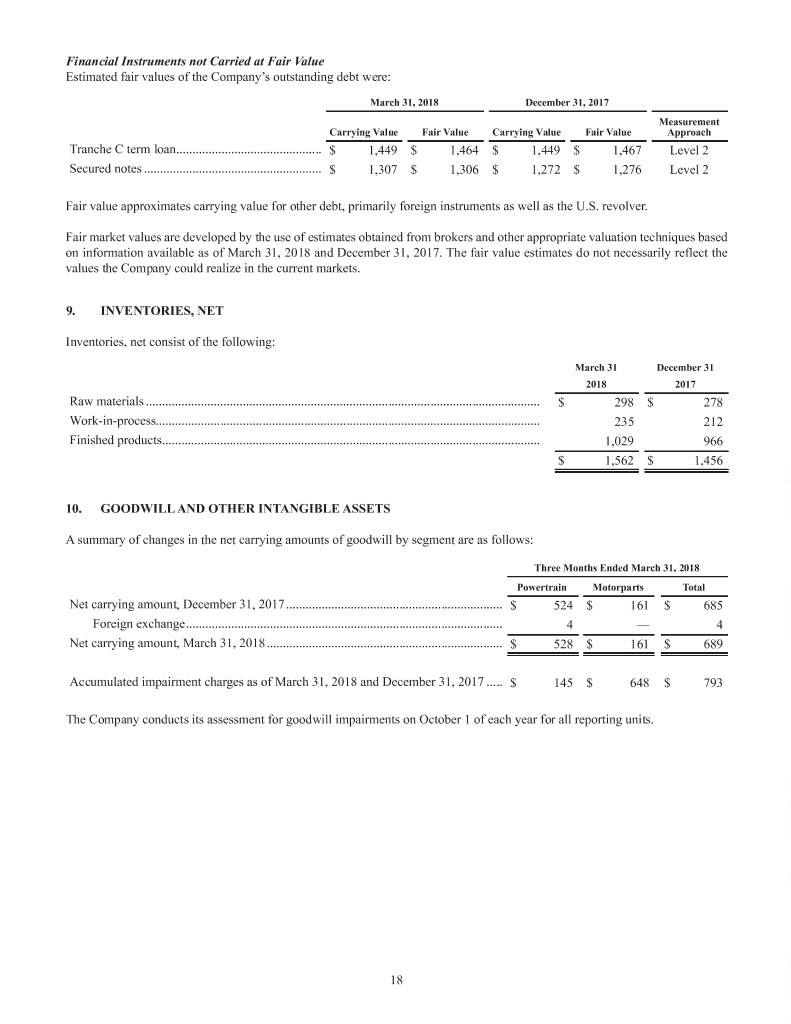

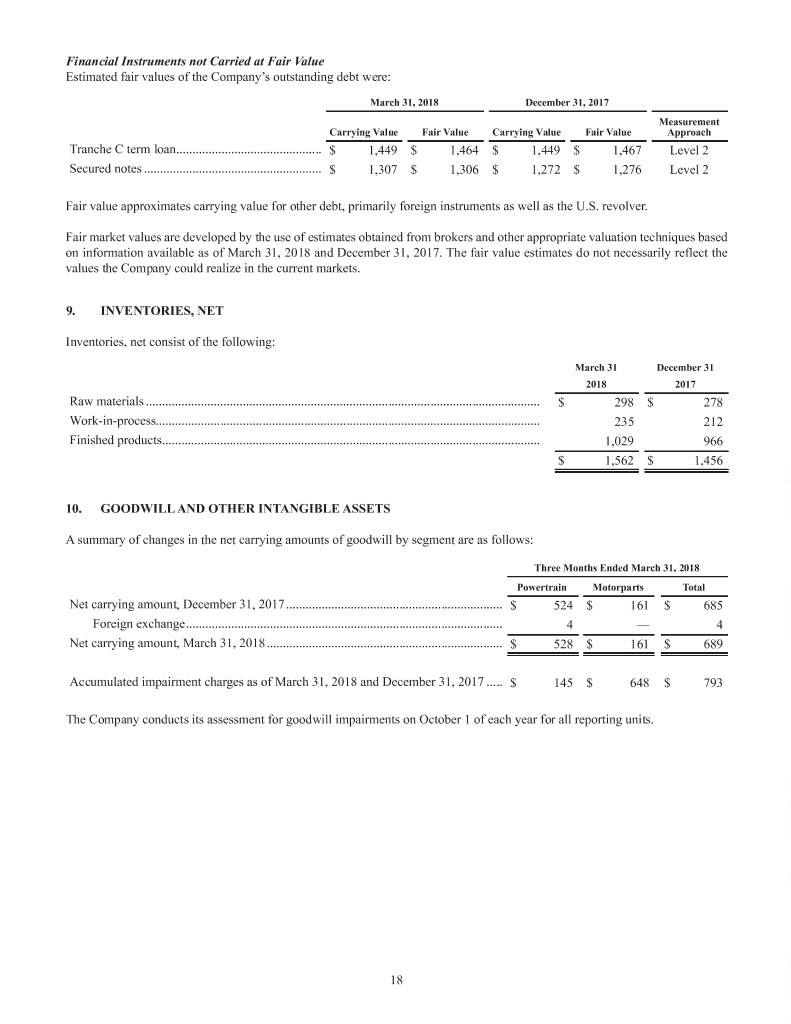

Financial Instruments not Carried at Fair Value Estimated fair values of the Company’s outstanding debt were: March 31, 2018 December 31, 2017 Measurement Carrying Value Fair Value Carrying Value Fair Value Approach Tranche C term loan............................................. $ 1,449 $ 1,464 $ 1,449 $ 1,467 Level 2 Secured notes ....................................................... $ 1,307 $ 1,306 $ 1,272 $ 1,276 Level 2 Fair value approximates carrying value for other debt, primarily foreign instruments as well as the U.S. revolver. Fair market values are developed by the use of estimates obtained from brokers and other appropriate valuation techniques based on information available as of March 31, 2018 and December 31, 2017. The fair value estimates do not necessarily reflect the values the Company could realize in the current markets. 9. INVENTORIES, NET Inventories, net consist of the following: March 31 December 31 2018 2017 Raw materials .......................................................................................................................... $ 298 $ 278 Work-in-process....................................................................................................................... 235 212 Finished products..................................................................................................................... 1,029 966 $ 1,562 $ 1,456 10. GOODWILL AND OTHER INTANGIBLE ASSETS A summary of changes in the net carrying amounts of goodwill by segment are as follows: Three Months Ended March 31, 2018 Powertrain Motorparts Total Net carrying amount, December 31, 2017................................................................... $ 524 $ 161 $ 685 Foreign exchange.................................................................................................. 4— 4 Net carrying amount, March 31, 2018......................................................................... $ 528 $ 161 $ 689 Accumulated impairment charges as of March 31, 2018 and December 31, 2017 ..... $ 145 $ 648 $ 793 The Company conducts its assessment for goodwill impairments on October 1 of each year for all reporting units. 18

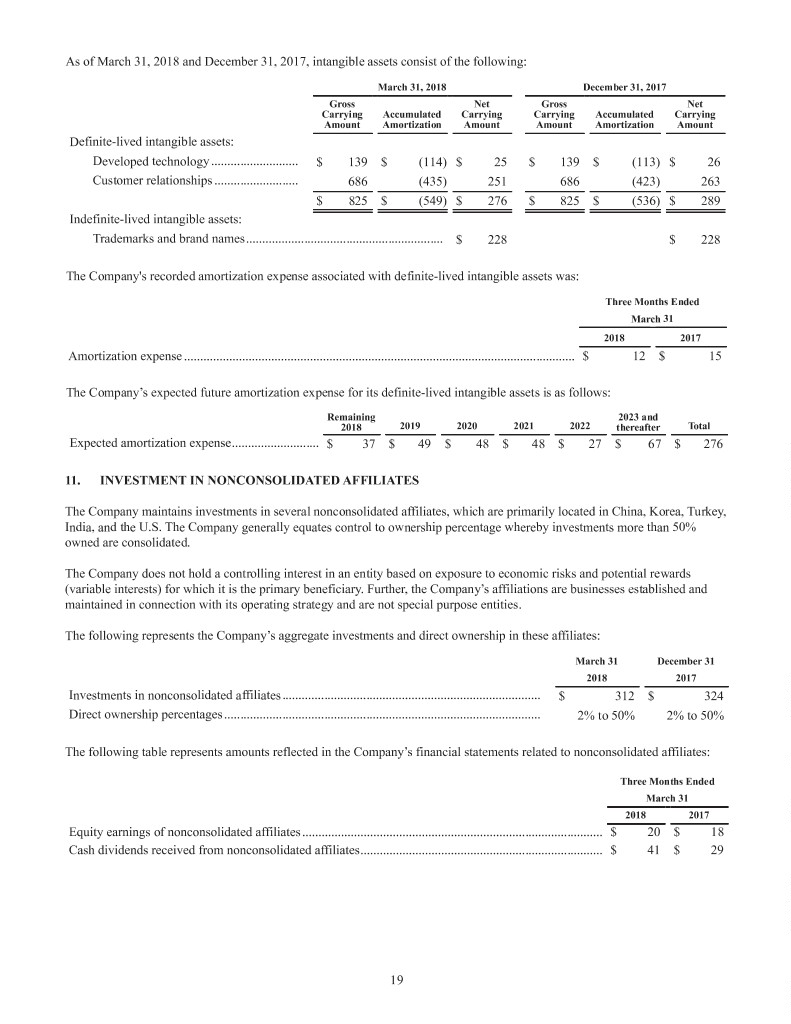

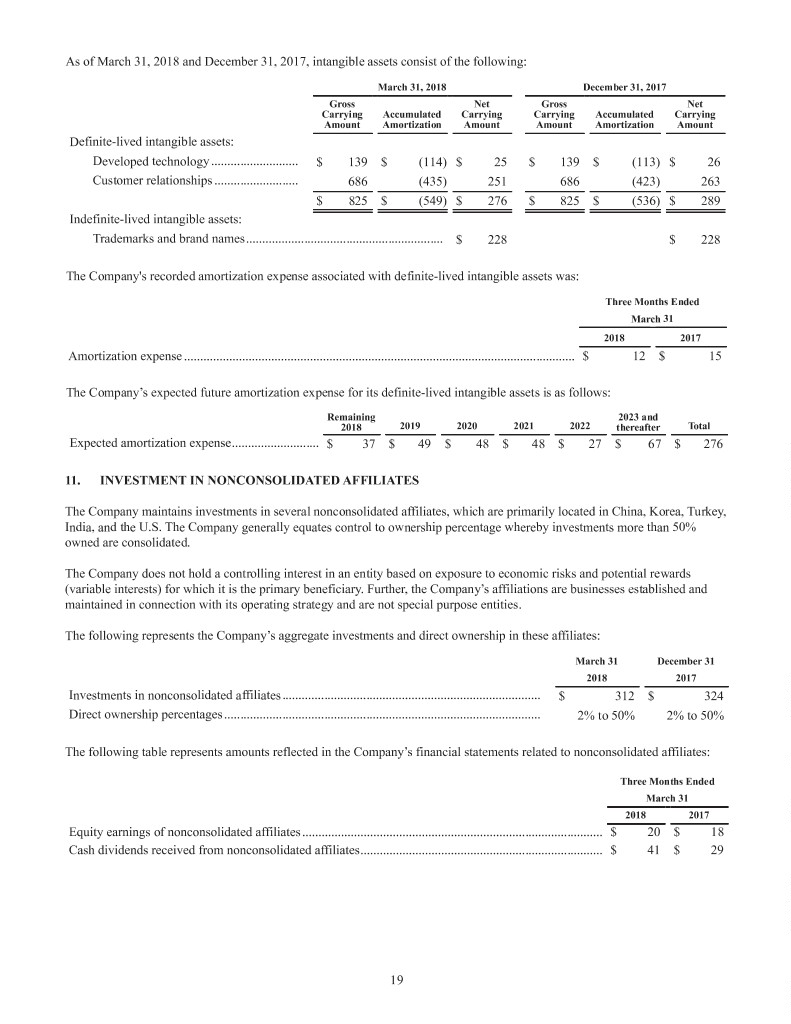

As of March 31, 2018 and December 31, 2017, intangible assets consist of the following: March 31, 2018 December 31, 2017 Gross Net Gross Net Carrying Accumulated Carrying Carrying Accumulated Carrying Amount Amortization Amount Amount Amortization Amount Definite-lived intangible assets: Developed technology........................... $ 139 $ (114) $ 25 $ 139 $ (113)$ 26 Customer relationships .......................... 686 (435) 251 686 (423) 263 $ 825 $ (549) $ 276 $ 825 $ (536) $ 289 Indefinite-lived intangible assets: Trademarks and brand names............................................................. $ 228 $ 228 The Company's recorded amortization expense associated with definite-lived intangible assets was: Three Months Ended March 31 2018 2017 Amortization expense ......................................................................................................................... $12$15 The Company’s expected future amortization expense for its definite-lived intangible assets is as follows: Remaining 2023 and 2018 2019 2020 2021 2022 thereafter Total Expected amortization expense........................... $ 37 $ 49 $ 48 $ 48 $ 27 $ 67 $ 276 11. INVESTMENT IN NONCONSOLIDATED AFFILIATES The Company maintains investments in several nonconsolidated affiliates, which are primarily located in China, Korea, Turkey, India, and the U.S. The Company generally equates control to ownership percentage whereby investments more than 50% owned are consolidated. The Company does not hold a controlling interest in an entity based on exposure to economic risks and potential rewards (variable interests) for which it is the primary beneficiary. Further, the Company’s affiliations are businesses established and maintained in connection with its operating strategy and are not special purpose entities. The following represents the Company’s aggregate investments and direct ownership in these affiliates: March 31 December 31 2018 2017 Investments in nonconsolidated affiliates................................................................................ $ 312 $ 324 Direct ownership percentages.................................................................................................. 2% to 50% 2% to 50% The following table represents amounts reflected in the Company’s financial statements related to nonconsolidated affiliates: Three Months Ended March 31 2018 2017 Equity earnings of nonconsolidated affiliates............................................................................................. $ 20 $ 18 Cash dividends received from nonconsolidated affiliates........................................................................... $ 41 $ 29 19

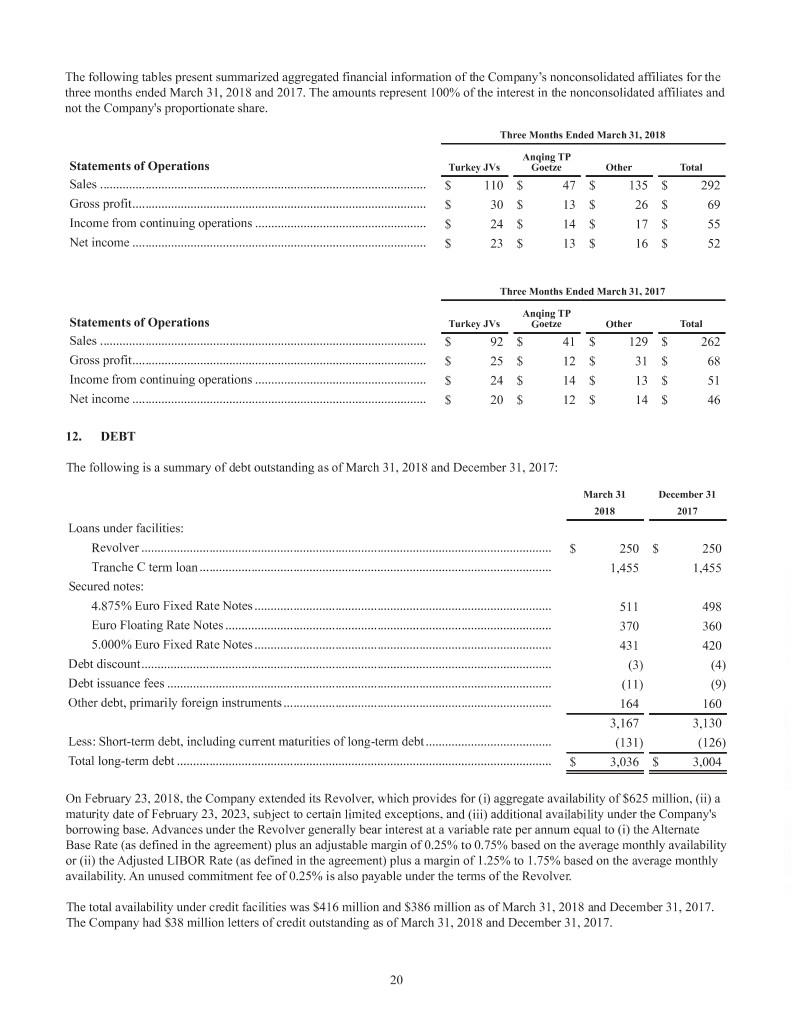

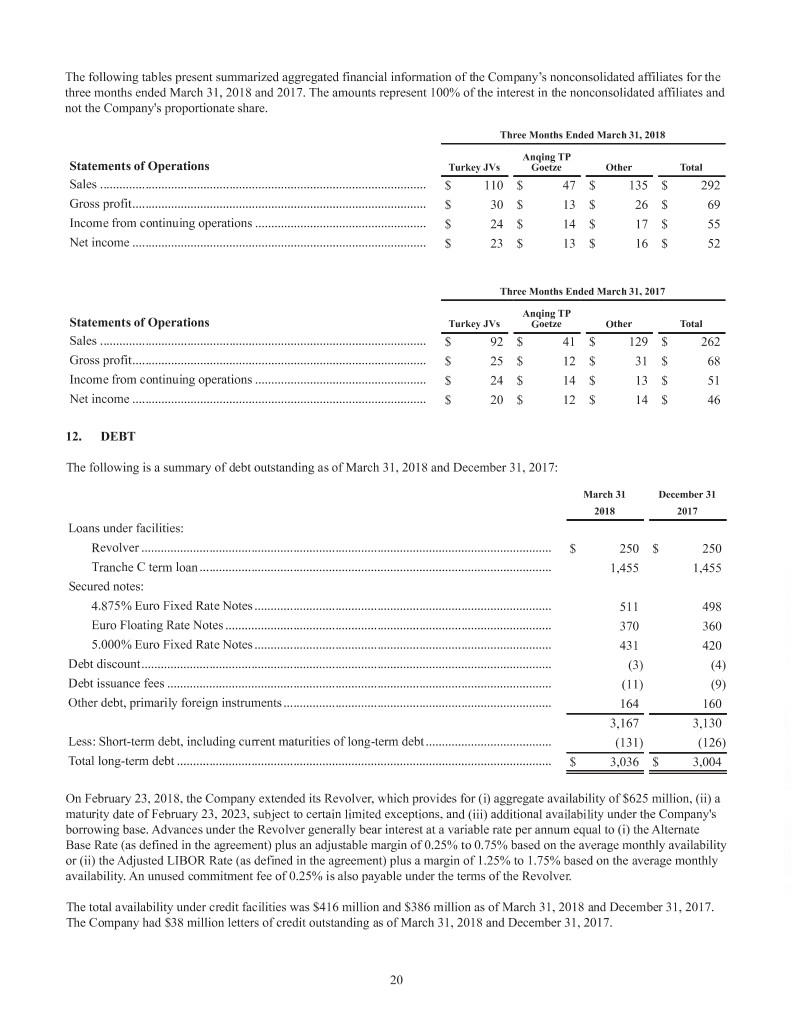

The following tables present summarized aggregated financial information of the Company’s nonconsolidated affiliates for the three months ended March 31, 2018 and 2017. The amounts represent 100% of the interest in the nonconsolidated affiliates and not the Company's proportionate share. Three Months Ended March 31, 2018 Anqing TP Statements of Operations Turkey JVs Goetze Other Total Sales ..................................................................................................... $ 110 $ 47 $ 135 $ 292 Gross profit........................................................................................... $30$13$26$69 Income from continuing operations ..................................................... $24$14$17$55 Net income ........................................................................................... $23$13$16$52 Three Months Ended March 31, 2017 Anqing TP Statements of Operations Turkey JVs Goetze Other Total Sales ..................................................................................................... $ 92 $ 41 $ 129 $ 262 Gross profit........................................................................................... $25$12$31$68 Income from continuing operations ..................................................... $24$14$13$51 Net income ........................................................................................... $20$12$14$46 12. DEBT The following is a summary of debt outstanding as of March 31, 2018 and December 31, 2017: March 31 December 31 2018 2017 Loans under facilities: Revolver ............................................................................................................................... $ 250 $ 250 Tranche C term loan............................................................................................................. 1,455 1,455 Secured notes: 4.875% Euro Fixed Rate Notes............................................................................................ 511 498 Euro Floating Rate Notes ..................................................................................................... 370 360 5.000% Euro Fixed Rate Notes............................................................................................ 431 420 Debt discount............................................................................................................................... (3) (4) Debt issuance fees ....................................................................................................................... (11) (9) Other debt, primarily foreign instruments................................................................................... 164 160 3,167 3,130 Less: Short-term debt, including current maturities of long-term debt....................................... (131) (126) Total long-term debt .................................................................................................................... $ 3,036 $ 3,004 On February 23, 2018, the Company extended its Revolver, which provides for (i) aggregate availability of $625 million, (ii) a maturity date of February 23, 2023, subject to certain limited exceptions, and (iii) additional availability under the Company's borrowing base. Advances under the Revolver generally bear interest at a variable rate per annum equal to (i) the Alternate Base Rate (as defined in the agreement) plus an adjustable margin of 0.25% to 0.75% based on the average monthly availability or (ii) the Adjusted LIBOR Rate (as defined in the agreement) plus a margin of 1.25% to 1.75% based on the average monthly availability. An unused commitment fee of 0.25% is also payable under the terms of the Revolver. The total availability under credit facilities was $416 million and $386 million as of March 31, 2018 and December 31, 2017. The Company had $38 million letters of credit outstanding as of March 31, 2018 and December 31, 2017. 20

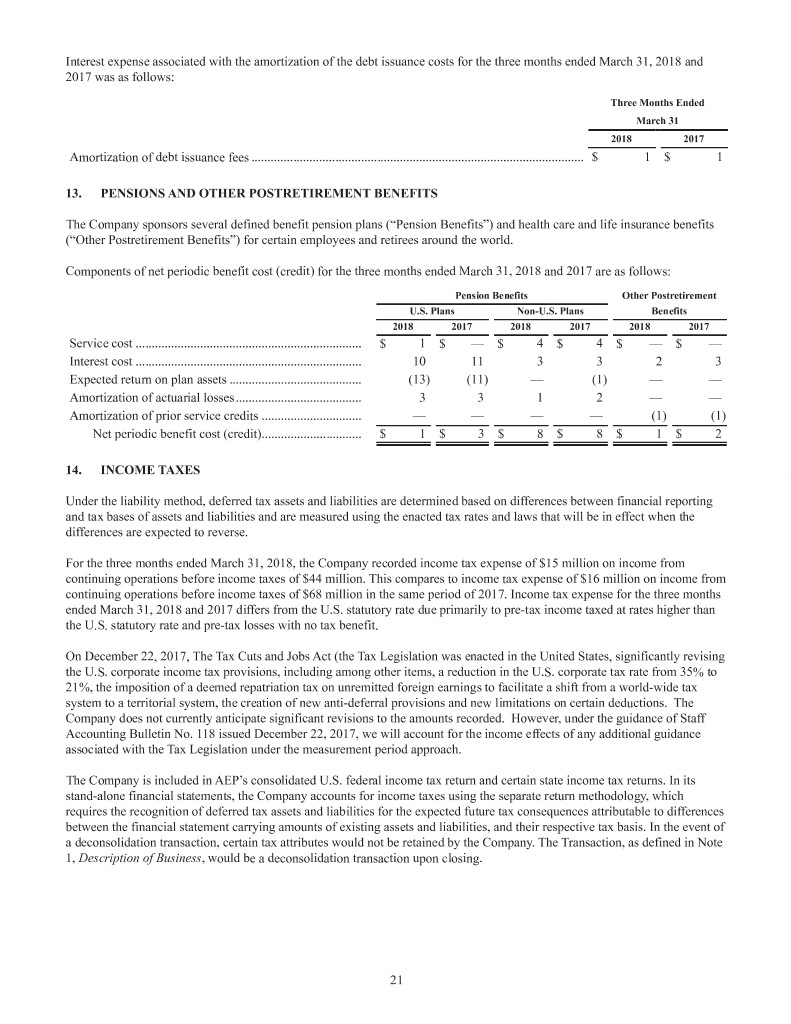

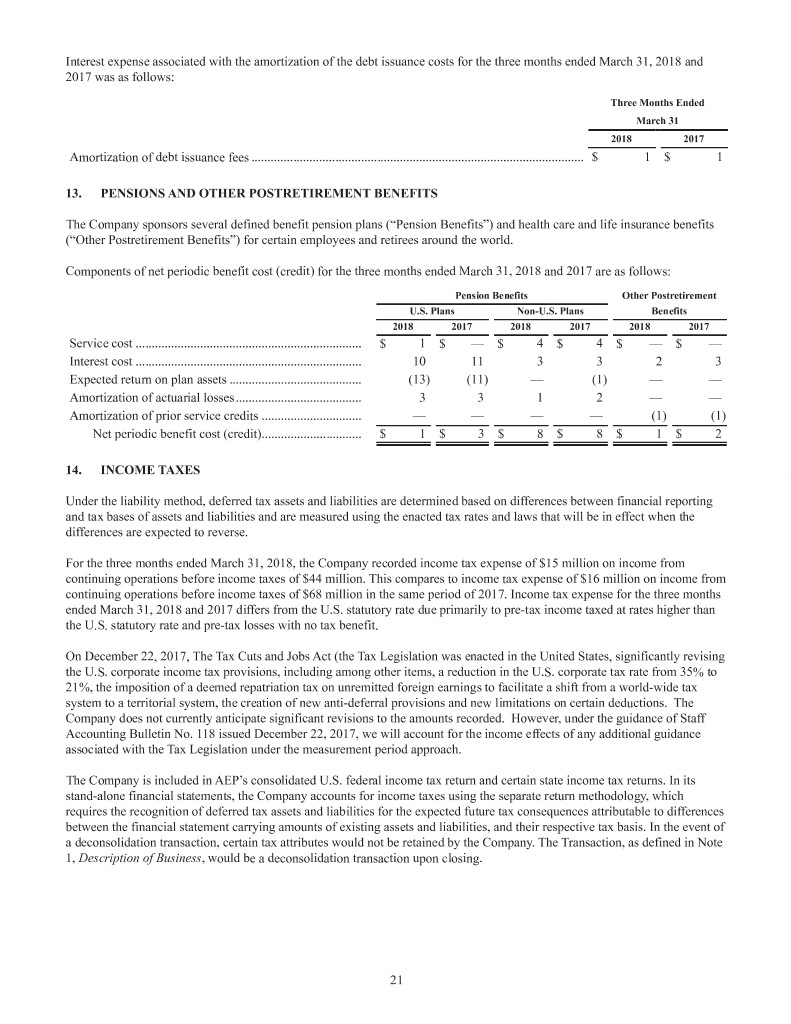

Interest expense associated with the amortization of the debt issuance costs for the three months ended March 31, 2018 and 2017 was as follows: Three Months Ended March 31 2018 2017 Amortization of debt issuance fees ....................................................................................................... $1$1 13. PENSIONS AND OTHER POSTRETIREMENT BENEFITS The Company sponsors several defined benefit pension plans (“Pension Benefits”) and health care and life insurance benefits (“Other Postretirement Benefits”) for certain employees and retirees around the world. Components of net periodic benefit cost (credit) for the three months ended March 31, 2018 and 2017 are as follows: Pension Benefits Other Postretirement U.S. Plans Non-U.S. Plans Benefits 2018 2017 2018 2017 2018 2017 Service cost ...................................................................... $ 1 $ — $ 4 $ 4 $ — $ — Interest cost ...................................................................... 10 113323 Expected return on plan assets ......................................... (13) (11)— (1)— — Amortization of actuarial losses....................................... 3 3 1 2 — — Amortization of prior service credits ............................... — — — — (1) (1) Net periodic benefit cost (credit)............................... $ 1 $ 3 $ 8 $ 8 $ 1 $ 2 14. INCOME TAXES Under the liability method, deferred tax assets and liabilities are determined based on differences between financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. For the three months ended March 31, 2018, the Company recorded income tax expense of $15 million on income from continuing operations before income taxes of $44 million. This compares to income tax expense of $16 million on income from continuing operations before income taxes of $68 million in the same period of 2017. Income tax expense for the three months ended March 31, 2018 and 2017 differs from the U.S. statutory rate due primarily to pre-tax income taxed at rates higher than the U.S. statutory rate and pre-tax losses with no tax benefit. On December 22, 2017, The Tax Cuts and Jobs Act (the Tax Legislation was enacted in the United States, significantly revising the U.S. corporate income tax provisions, including among other items, a reduction in the U.S. corporate tax rate from 35% to 21%, the imposition of a deemed repatriation tax on unremitted foreign earnings to facilitate a shift from a world-wide tax system to a territorial system, the creation of new anti-deferral provisions and new limitations on certain deductions. The Company does not currently anticipate significant revisions to the amounts recorded. However, under the guidance of Staff Accounting Bulletin No. 118 issued December 22, 2017, we will account for the income effects of any additional guidance associated with the Tax Legislation under the measurement period approach. The Company is included in AEP’s consolidated U.S. federal income tax return and certain state income tax returns. In its stand-alone financial statements, the Company accounts for income taxes using the separate return methodology, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities, and their respective tax basis. In the event of a deconsolidation transaction, certain tax attributes would not be retained by the Company. The Transaction, as defined in Note 1, Description of Business, would be a deconsolidation transaction upon closing. 21

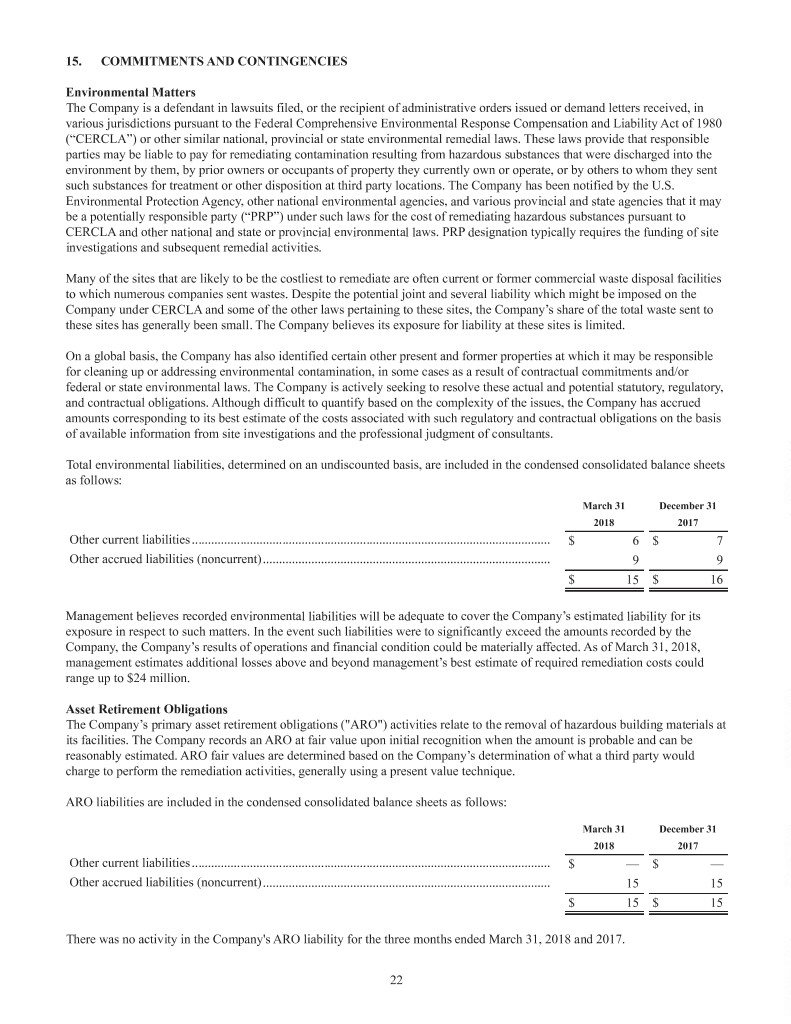

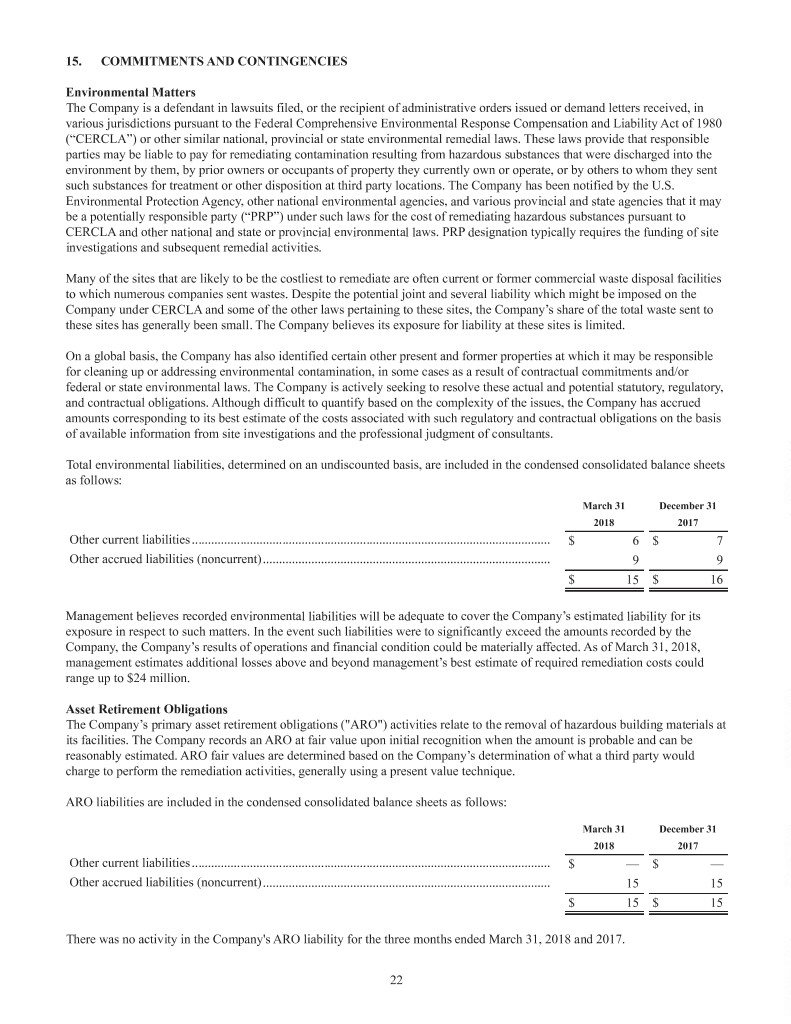

15. COMMITMENTS AND CONTINGENCIES Environmental Matters The Company is a defendant in lawsuits filed, or the recipient of administrative orders issued or demand letters received, in various jurisdictions pursuant to the Federal Comprehensive Environmental Response Compensation and Liability Act of 1980 (“CERCLA”) or other similar national, provincial or state environmental remedial laws. These laws provide that responsible parties may be liable to pay for remediating contamination resulting from hazardous substances that were discharged into the environment by them, by prior owners or occupants of property they currently own or operate, or by others to whom they sent such substances for treatment or other disposition at third party locations. The Company has been notified by the U.S. Environmental Protection Agency, other national environmental agencies, and various provincial and state agencies that it may be a potentially responsible party (“PRP”) under such laws for the cost of remediating hazardous substances pursuant to CERCLA and other national and state or provincial environmental laws. PRP designation typically requires the funding of site investigations and subsequent remedial activities. Many of the sites that are likely to be the costliest to remediate are often current or former commercial waste disposal facilities to which numerous companies sent wastes. Despite the potential joint and several liability which might be imposed on the Company under CERCLA and some of the other laws pertaining to these sites, the Company’s share of the total waste sent to these sites has generally been small. The Company believes its exposure for liability at these sites is limited. On a global basis, the Company has also identified certain other present and former properties at which it may be responsible for cleaning up or addressing environmental contamination, in some cases as a result of contractual commitments and/or federal or state environmental laws. The Company is actively seeking to resolve these actual and potential statutory, regulatory, and contractual obligations. Although difficult to quantify based on the complexity of the issues, the Company has accrued amounts corresponding to its best estimate of the costs associated with such regulatory and contractual obligations on the basis of available information from site investigations and the professional judgment of consultants. Total environmental liabilities, determined on an undiscounted basis, are included in the condensed consolidated balance sheets as follows: March 31 December 31 2018 2017 Other current liabilities............................................................................................................... $6$7 Other accrued liabilities (noncurrent)......................................................................................... 99 $15$16 Management believes recorded environmental liabilities will be adequate to cover the Company’s estimated liability for its exposure in respect to such matters. In the event such liabilities were to significantly exceed the amounts recorded by the Company, the Company’s results of operations and financial condition could be materially affected. As of March 31, 2018, management estimates additional losses above and beyond management’s best estimate of required remediation costs could range up to $24 million. Asset Retirement Obligations The Company’s primary asset retirement obligations ("ARO") activities relate to the removal of hazardous building materials at its facilities. The Company records an ARO at fair value upon initial recognition when the amount is probable and can be reasonably estimated. ARO fair values are determined based on the Company’s determination of what a third party would charge to perform the remediation activities, generally using a present value technique. ARO liabilities are included in the condensed consolidated balance sheets as follows: March 31 December 31 2018 2017 Other current liabilities............................................................................................................... $—$— Other accrued liabilities (noncurrent)......................................................................................... 15 15 $15$15 There was no activity in the Company's ARO liability for the three months ended March 31, 2018 and 2017. 22

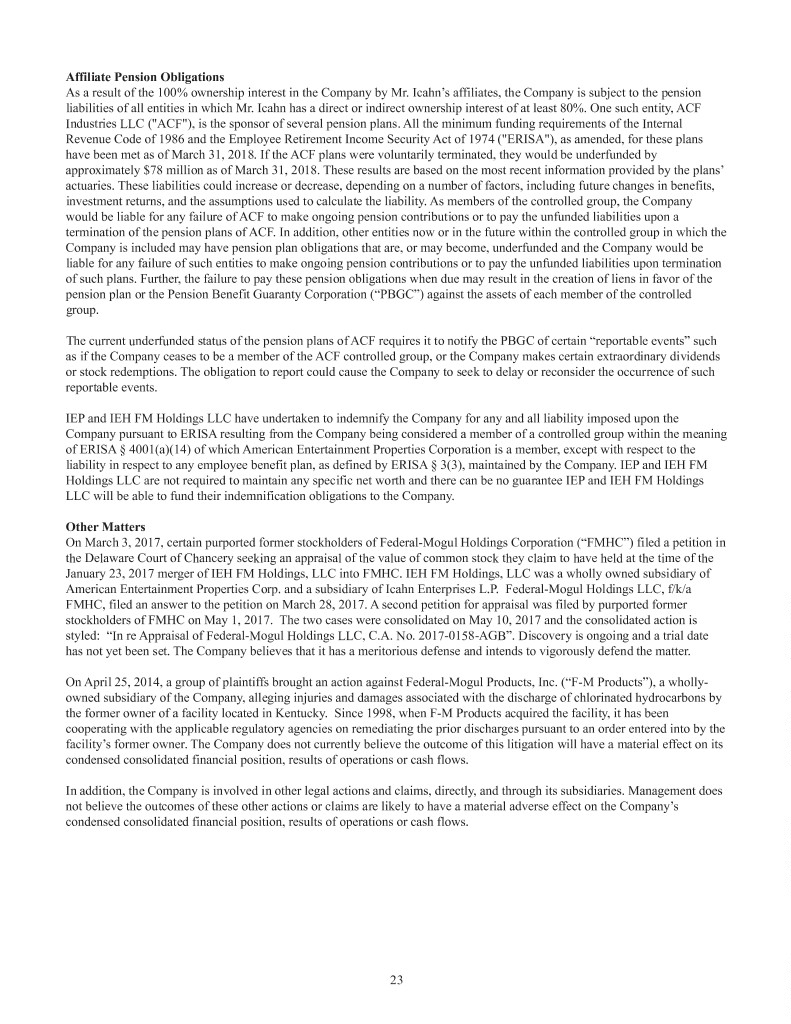

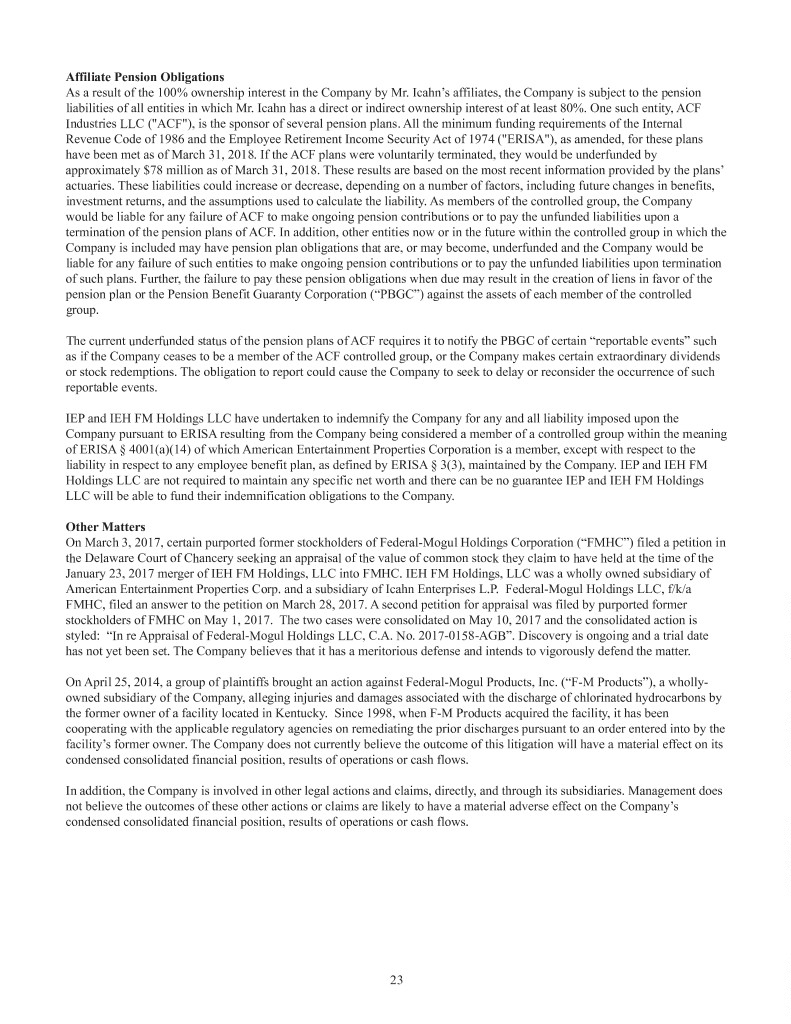

Affiliate Pension Obligations As a result of the 100% ownership interest in the Company by Mr. Icahn’s affiliates, the Company is subject to the pension liabilities of all entities in which Mr. Icahn has a direct or indirect ownership interest of at least 80%. One such entity, ACF Industries LLC ("ACF"), is the sponsor of several pension plans. All the minimum funding requirements of the Internal Revenue Code of 1986 and the Employee Retirement Income Security Act of 1974 ("ERISA"), as amended, for these plans have been met as of March 31, 2018. If the ACF plans were voluntarily terminated, they would be underfunded by approximately $78 million as of March 31, 2018. These results are based on the most recent information provided by the plans’ actuaries. These liabilities could increase or decrease, depending on a number of factors, including future changes in benefits, investment returns, and the assumptions used to calculate the liability. As members of the controlled group, the Company would be liable for any failure of ACF to make ongoing pension contributions or to pay the unfunded liabilities upon a termination of the pension plans of ACF. In addition, other entities now or in the future within the controlled group in which the Company is included may have pension plan obligations that are, or may become, underfunded and the Company would be liable for any failure of such entities to make ongoing pension contributions or to pay the unfunded liabilities upon termination of such plans. Further, the failure to pay these pension obligations when due may result in the creation of liens in favor of the pension plan or the Pension Benefit Guaranty Corporation (“PBGC”) against the assets of each member of the controlled group. The current underfunded status of the pension plans of ACF requires it to notify the PBGC of certain “reportable events” such as if the Company ceases to be a member of the ACF controlled group, or the Company makes certain extraordinary dividends or stock redemptions. The obligation to report could cause the Company to seek to delay or reconsider the occurrence of such reportable events. IEP and IEH FM Holdings LLC have undertaken to indemnify the Company for any and all liability imposed upon the Company pursuant to ERISA resulting from the Company being considered a member of a controlled group within the meaning of ERISA § 4001(a)(14) of which American Entertainment Properties Corporation is a member, except with respect to the liability in respect to any employee benefit plan, as defined by ERISA § 3(3), maintained by the Company. IEP and IEH FM Holdings LLC are not required to maintain any specific net worth and there can be no guarantee IEP and IEH FM Holdings LLC will be able to fund their indemnification obligations to the Company. Other Matters On March 3, 2017, certain purported former stockholders of Federal-Mogul Holdings Corporation (“FMHC”) filed a petition in the Delaware Court of Chancery seeking an appraisal of the value of common stock they claim to have held at the time of the January 23, 2017 merger of IEH FM Holdings, LLC into FMHC. IEH FM Holdings, LLC was a wholly owned subsidiary of American Entertainment Properties Corp. and a subsidiary of Icahn Enterprises L.P. Federal-Mogul Holdings LLC, f/k/a FMHC, filed an answer to the petition on March 28, 2017. A second petition for appraisal was filed by purported former stockholders of FMHC on May 1, 2017. The two cases were consolidated on May 10, 2017 and the consolidated action is styled: “In re Appraisal of Federal-Mogul Holdings LLC, C.A. No. 2017-0158-AGB”. Discovery is ongoing and a trial date has not yet been set. The Company believes that it has a meritorious defense and intends to vigorously defend the matter. On April 25, 2014, a group of plaintiffs brought an action against Federal-Mogul Products, Inc. (“F-M Products”), a wholly- owned subsidiary of the Company, alleging injuries and damages associated with the discharge of chlorinated hydrocarbons by the former owner of a facility located in Kentucky. Since 1998, when F-M Products acquired the facility, it has been cooperating with the applicable regulatory agencies on remediating the prior discharges pursuant to an order entered into by the facility’s former owner. The Company does not currently believe the outcome of this litigation will have a material effect on its condensed consolidated financial position, results of operations or cash flows. In addition, the Company is involved in other legal actions and claims, directly, and through its subsidiaries. Management does not believe the outcomes of these other actions or claims are likely to have a material adverse effect on the Company’s condensed consolidated financial position, results of operations or cash flows. 23

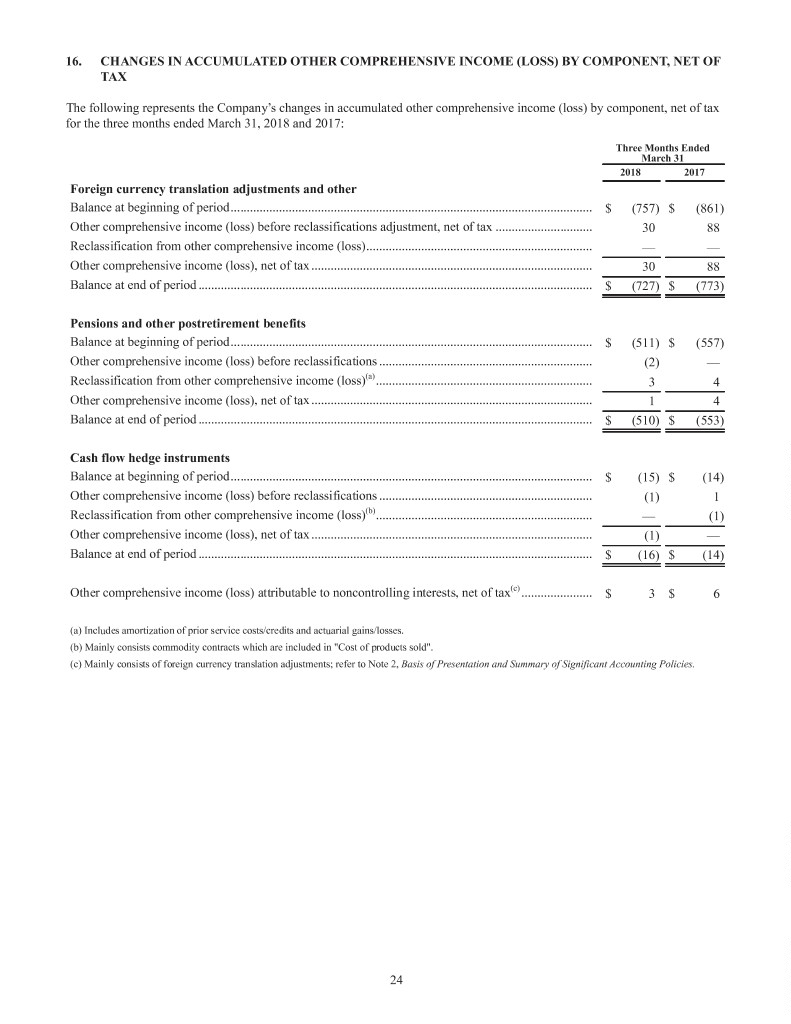

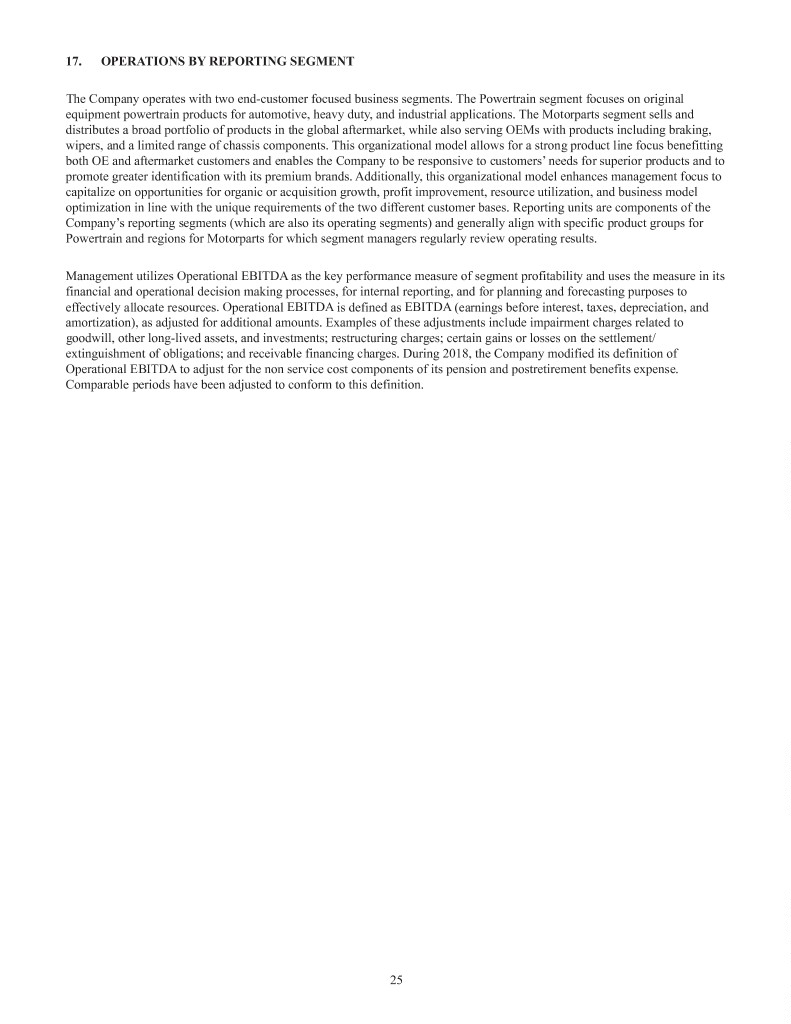

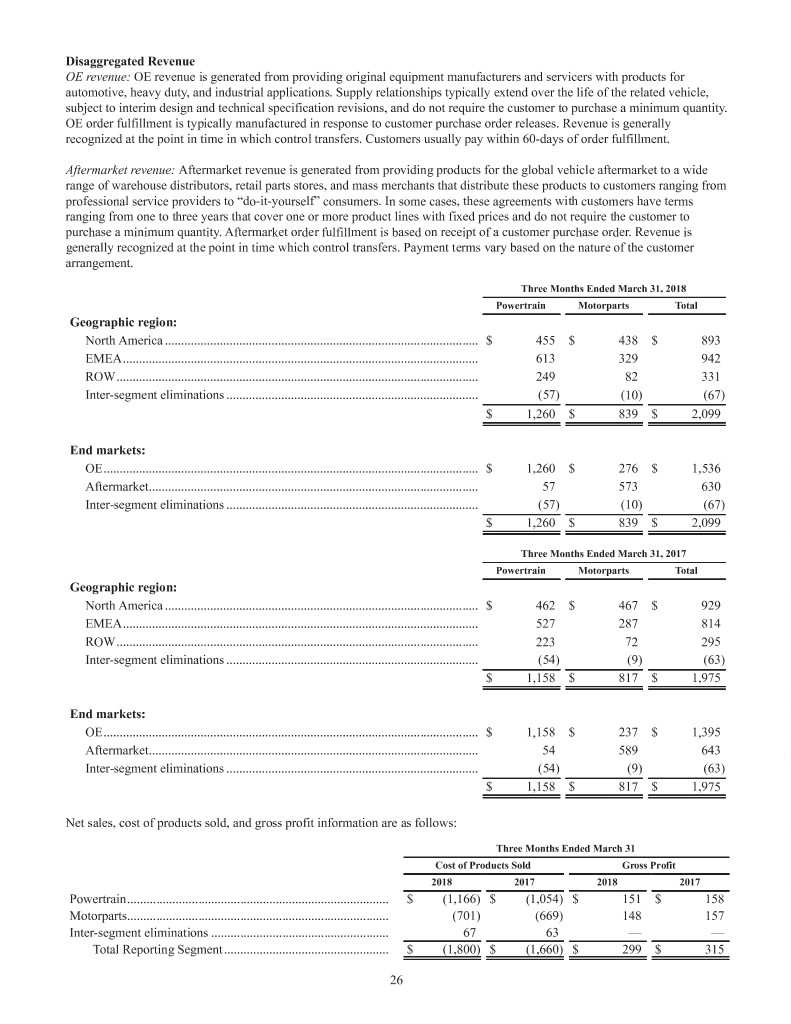

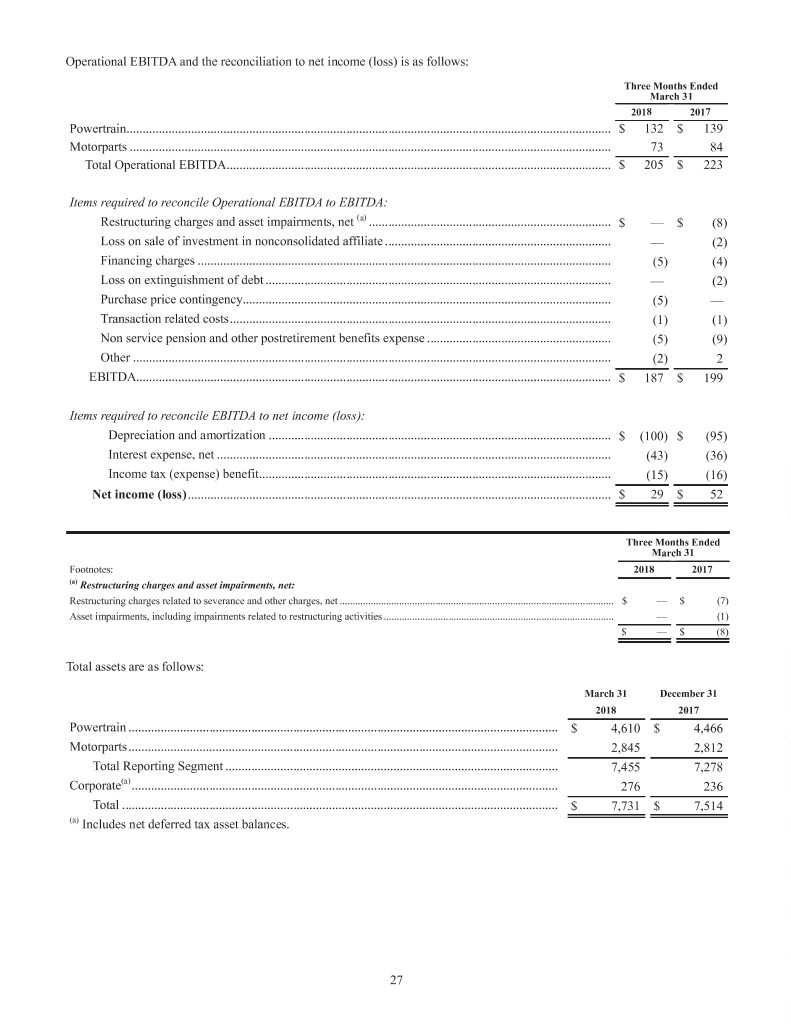

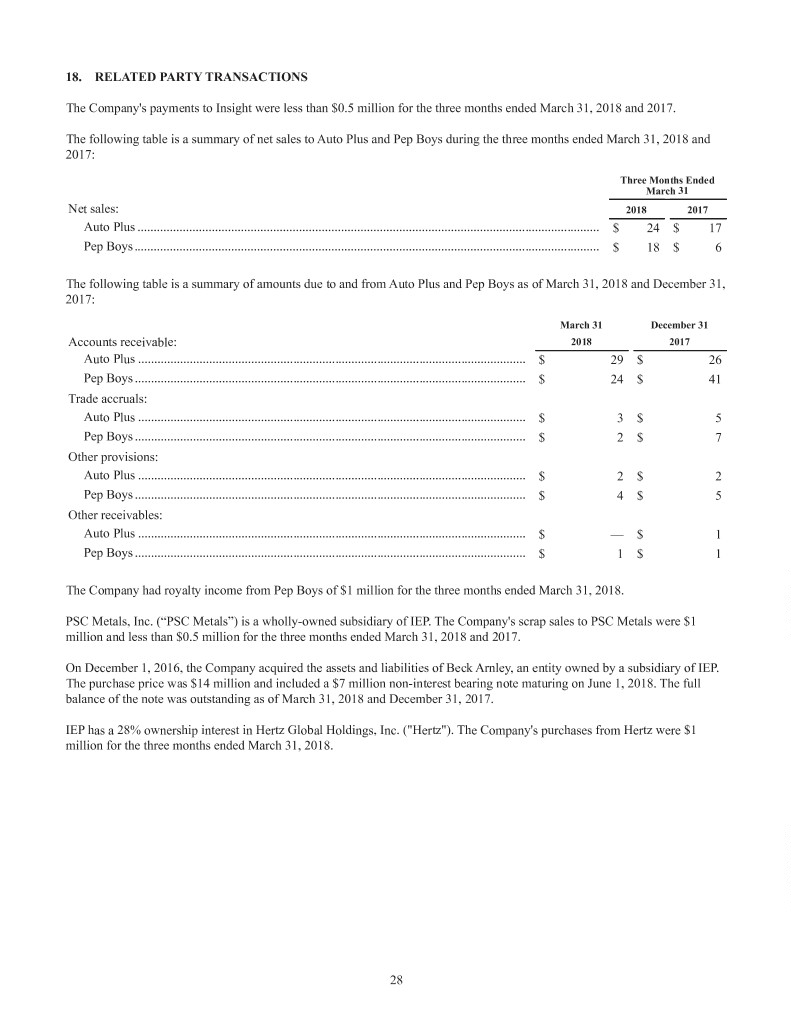

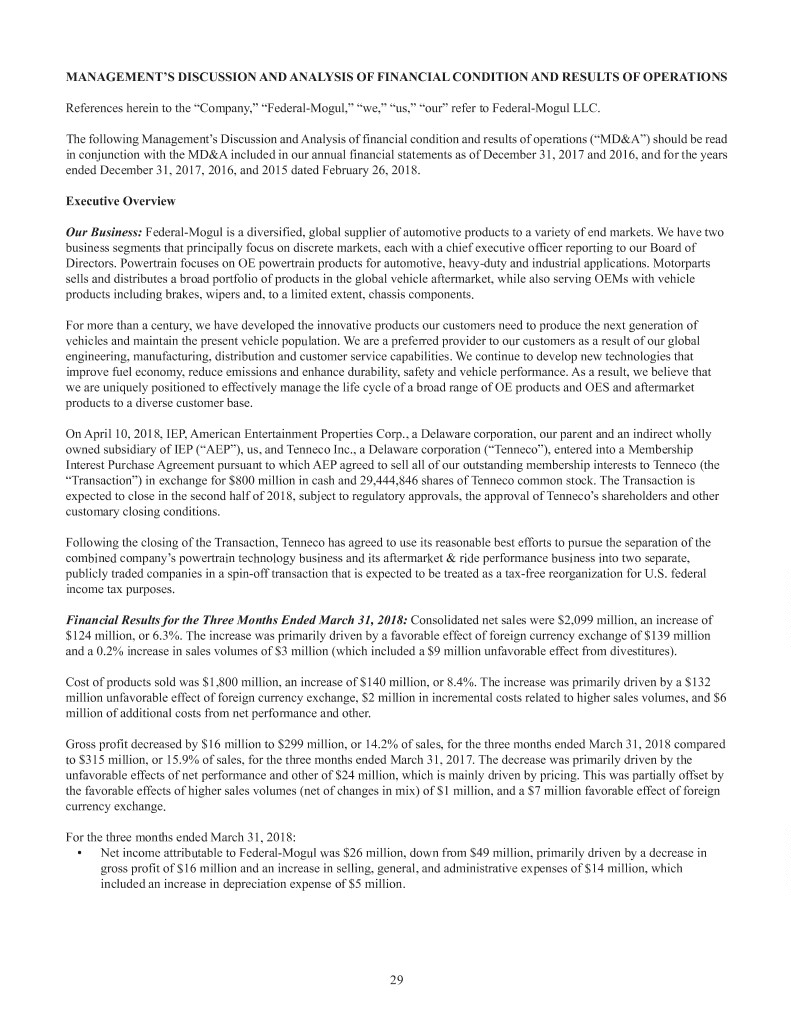

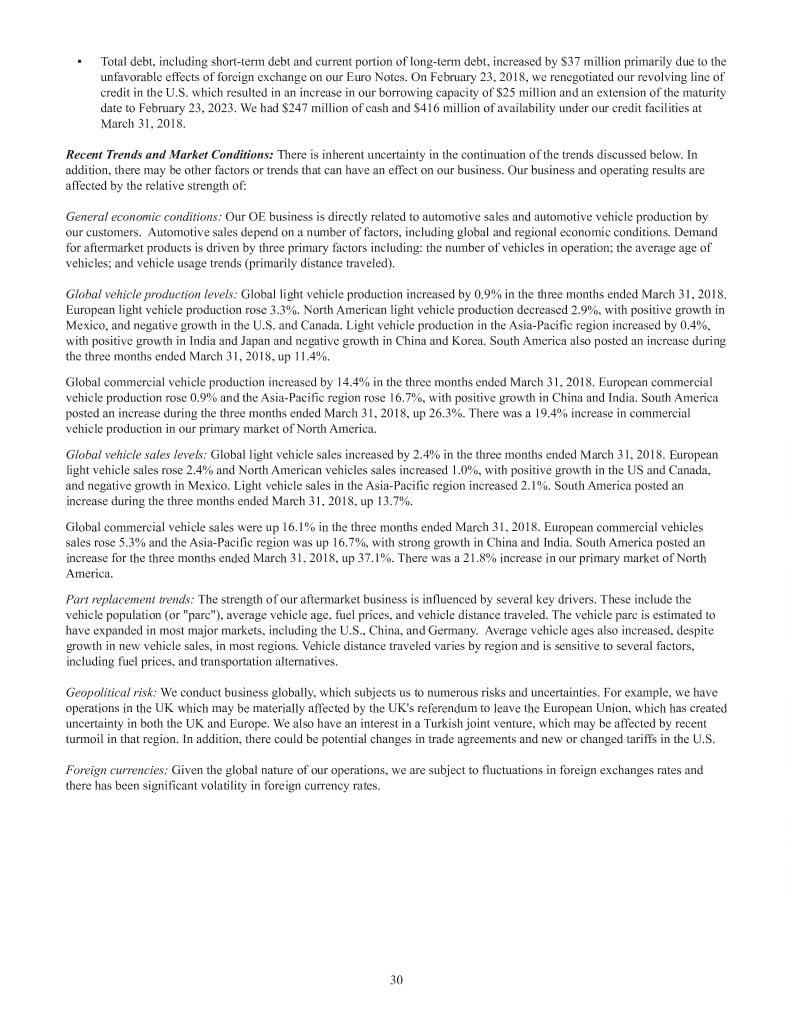

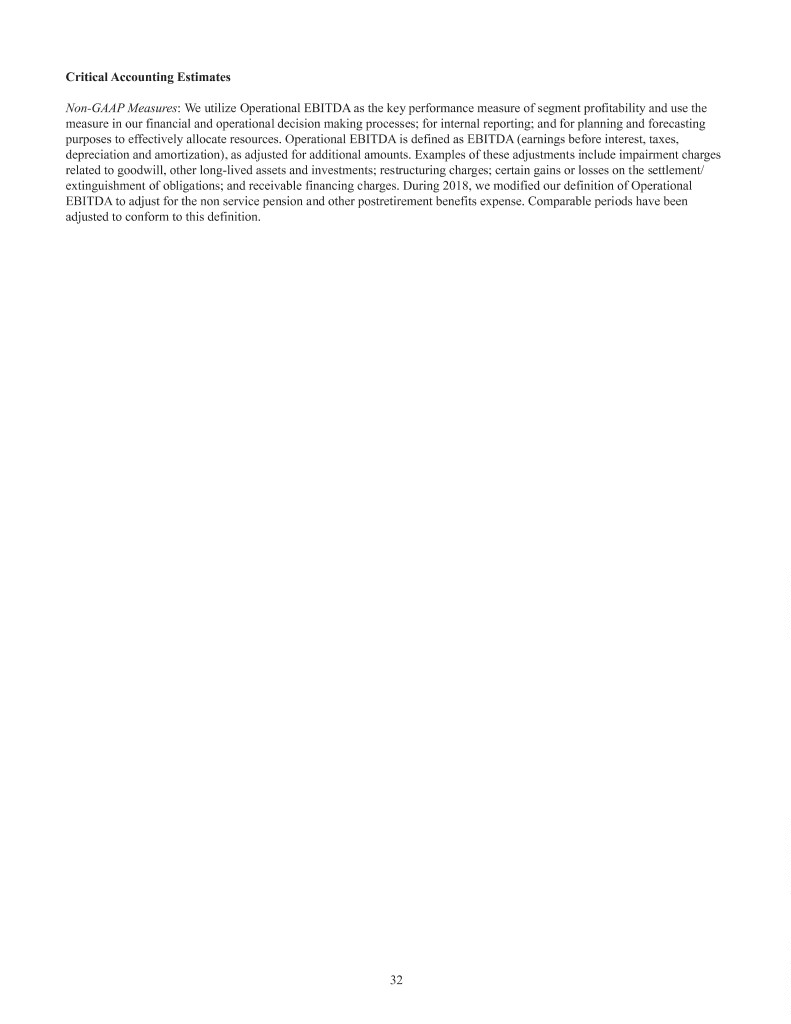

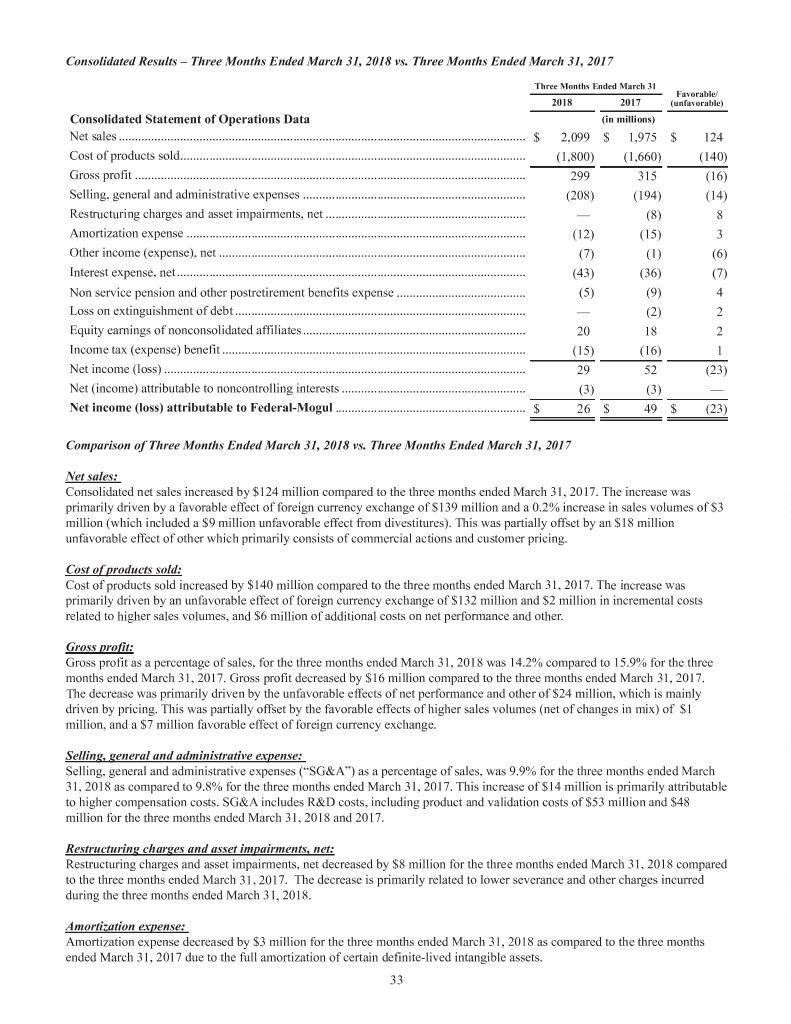

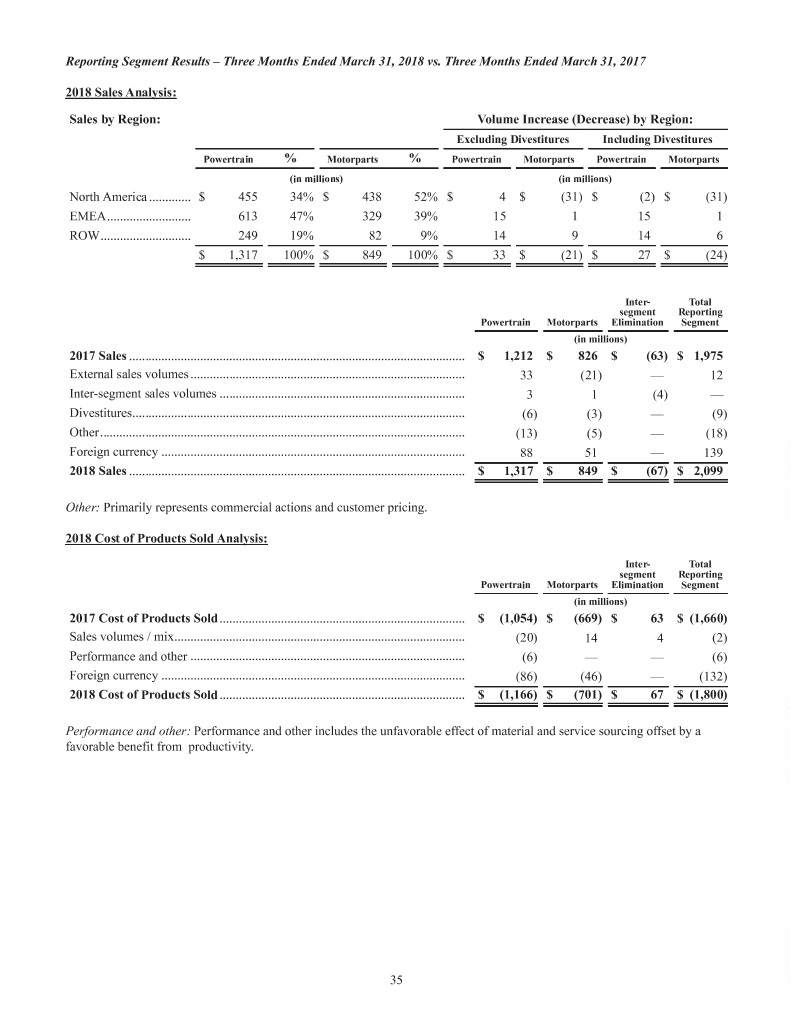

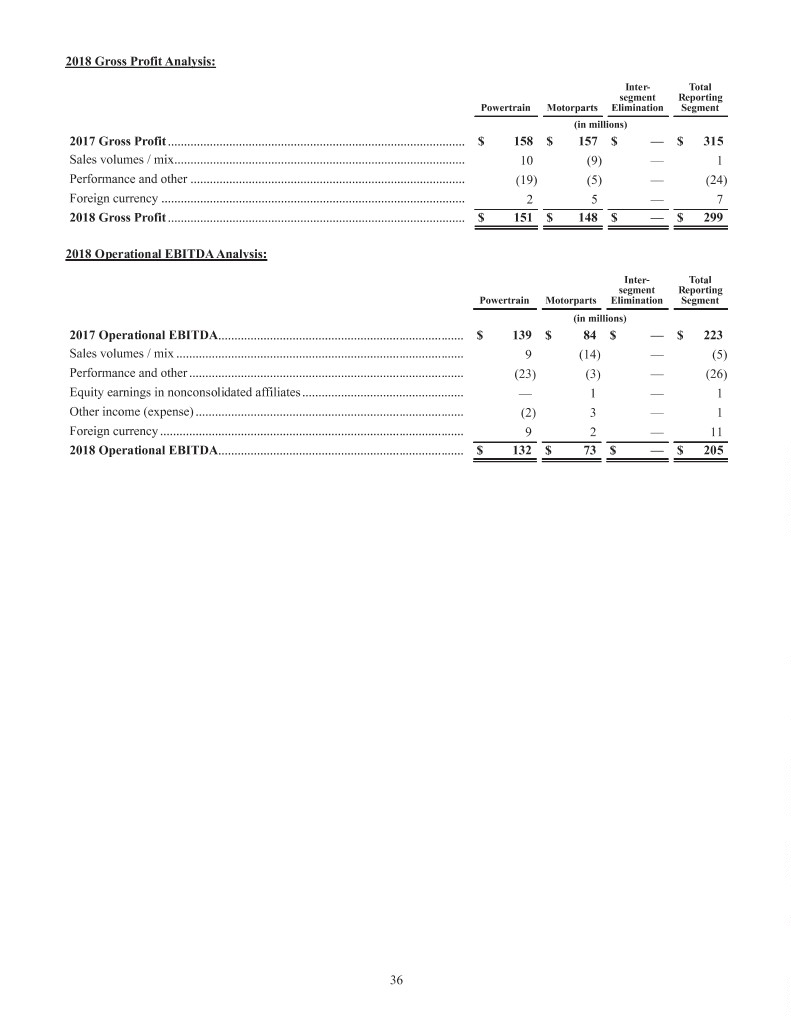

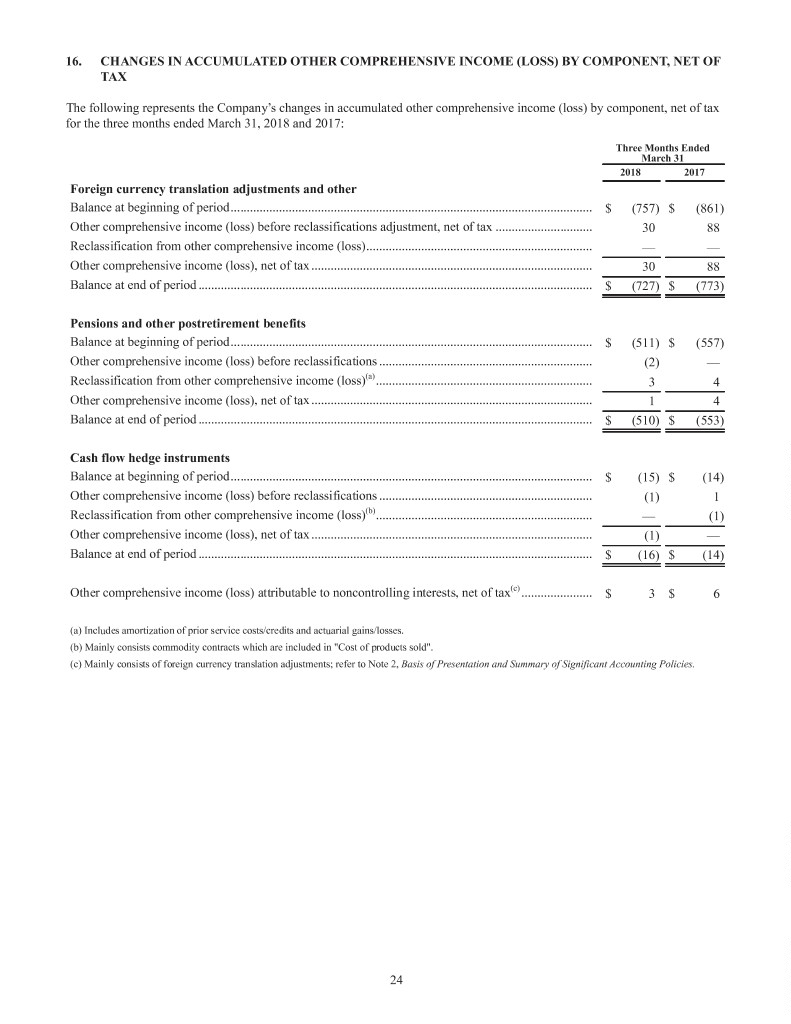

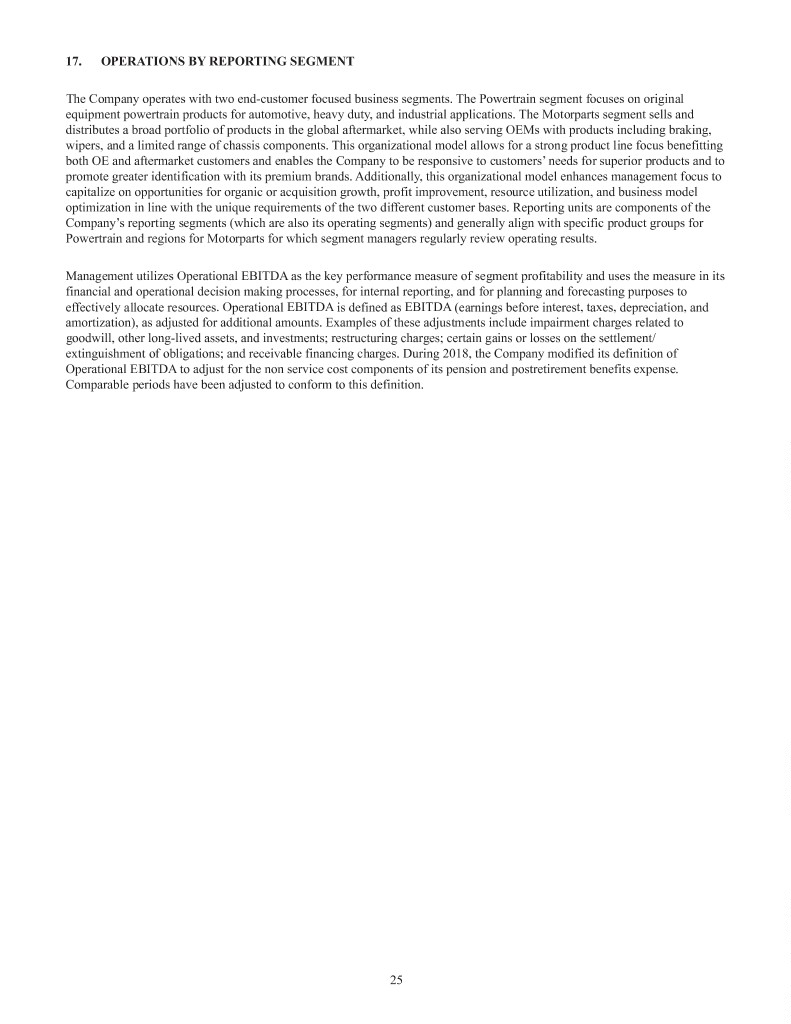

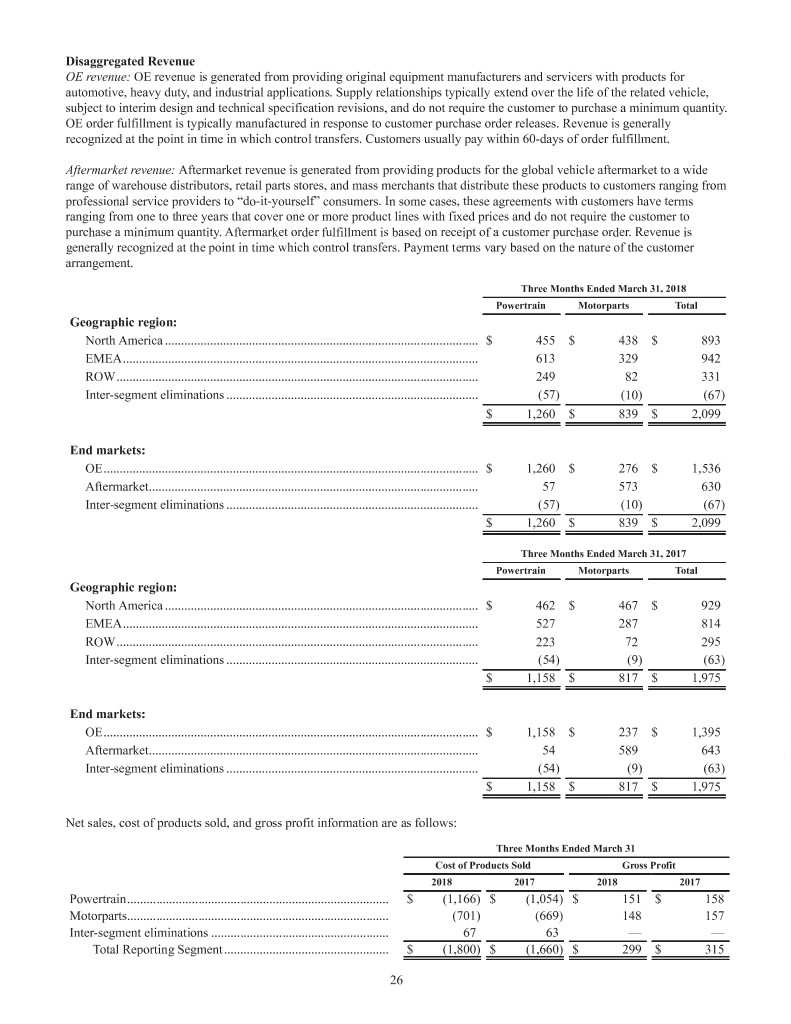

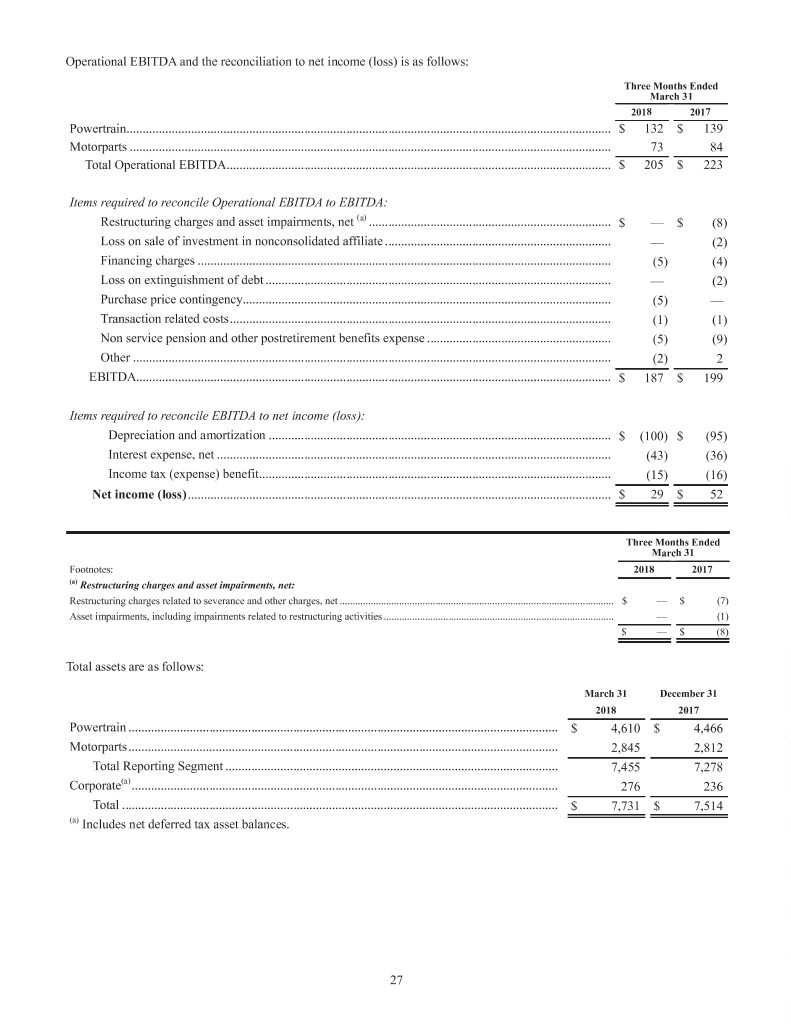

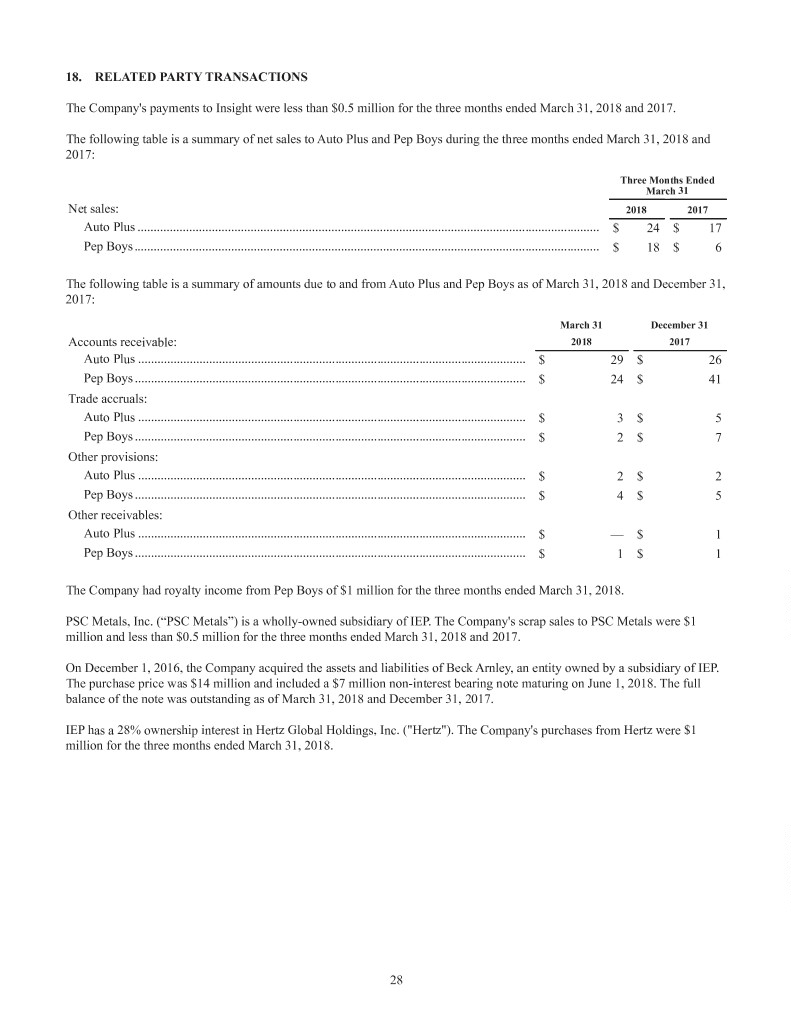

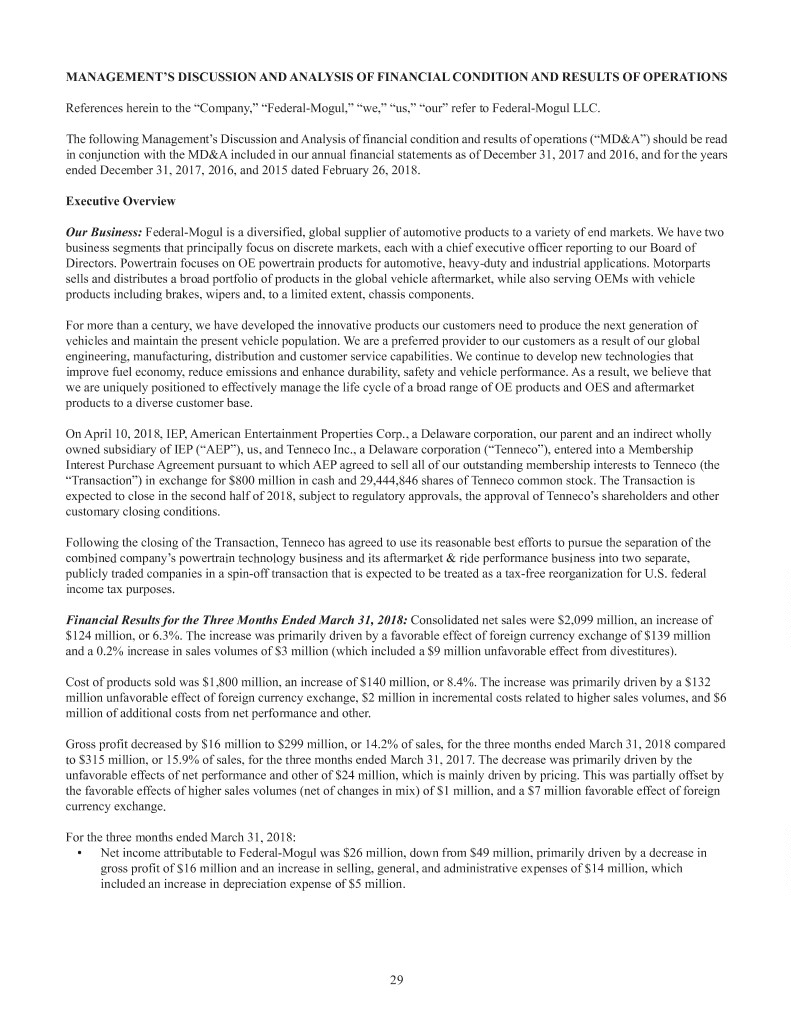

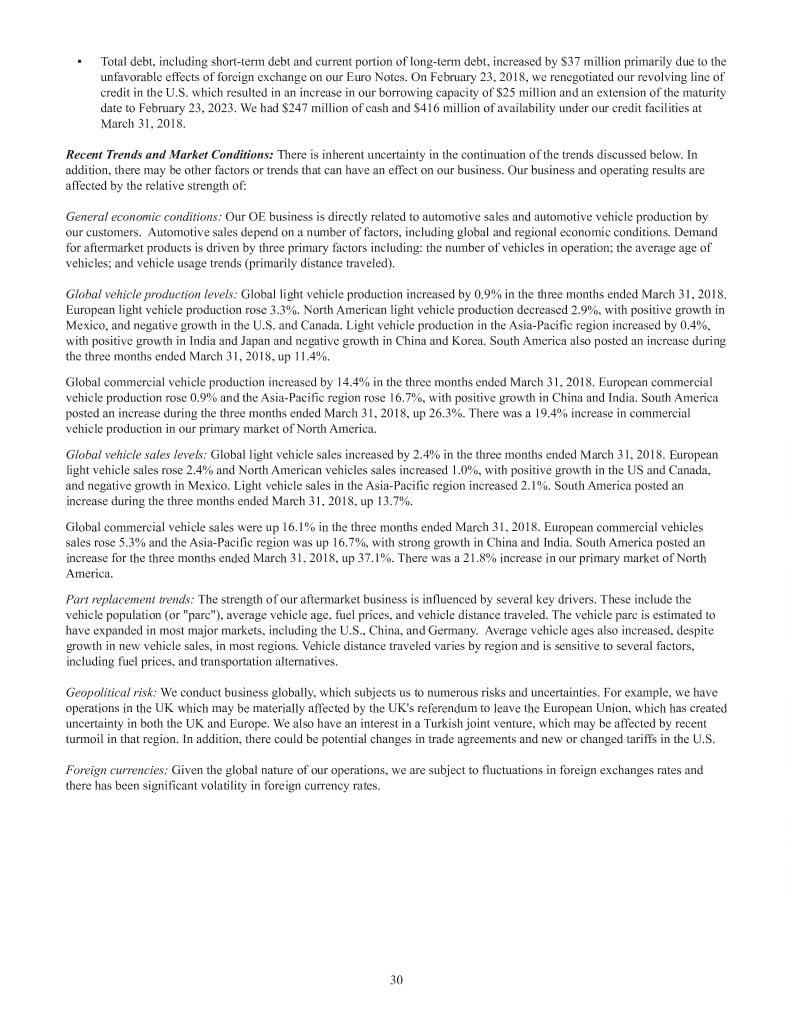

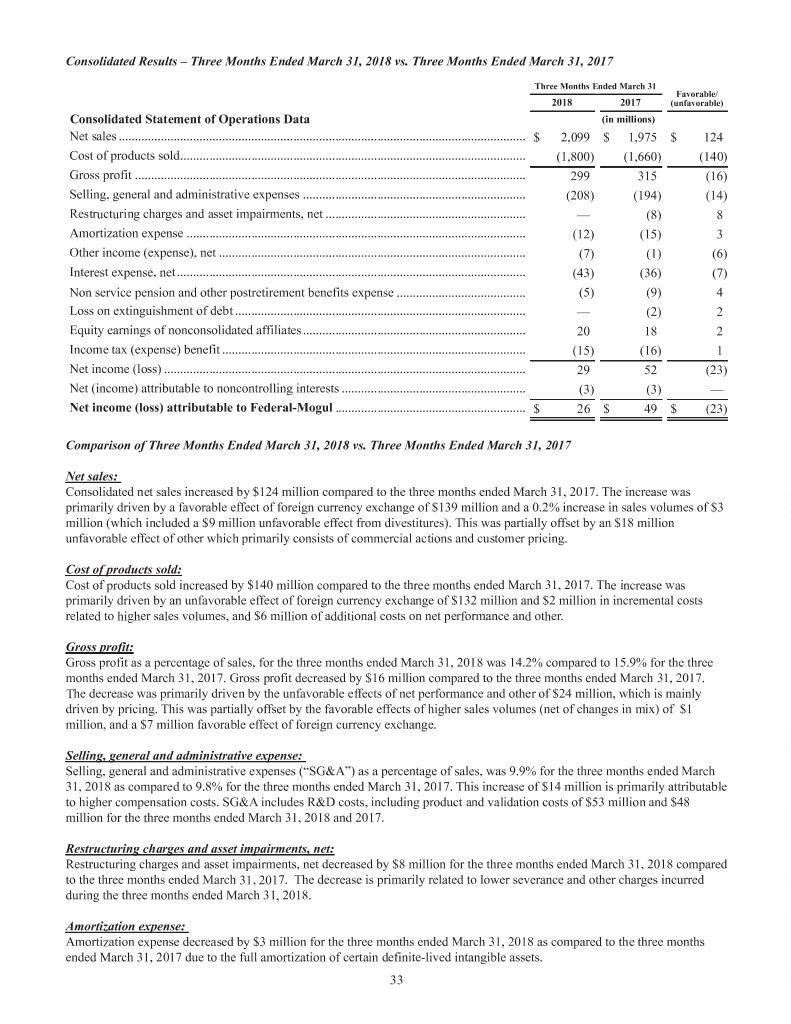

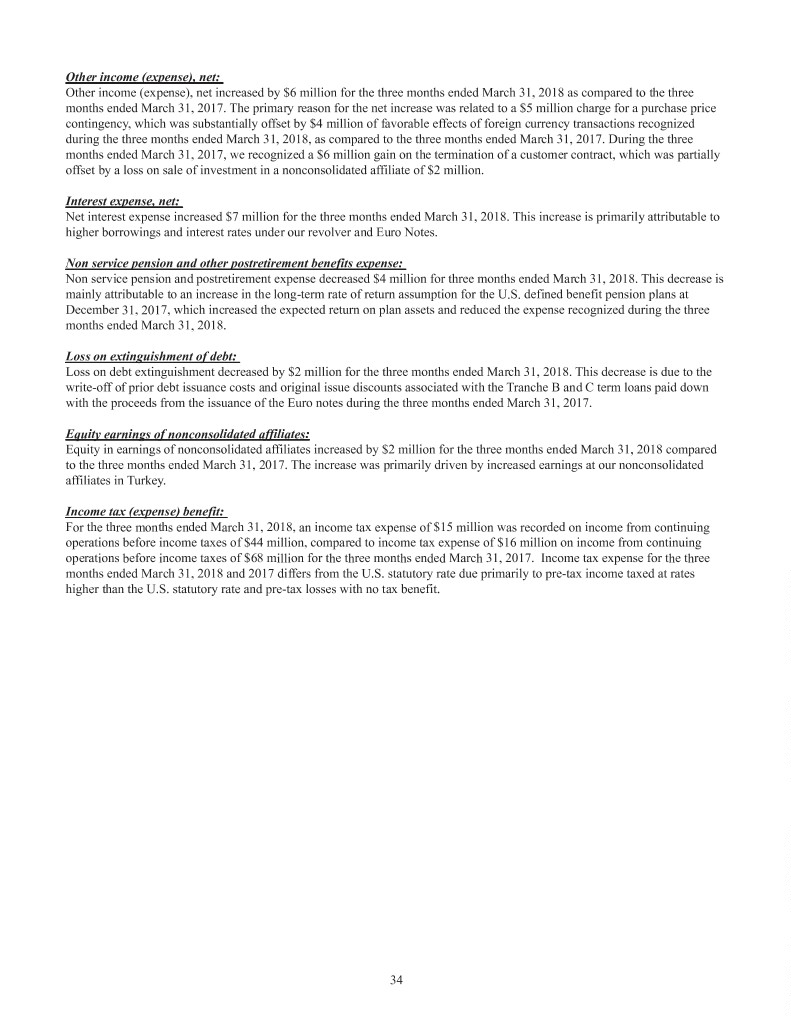

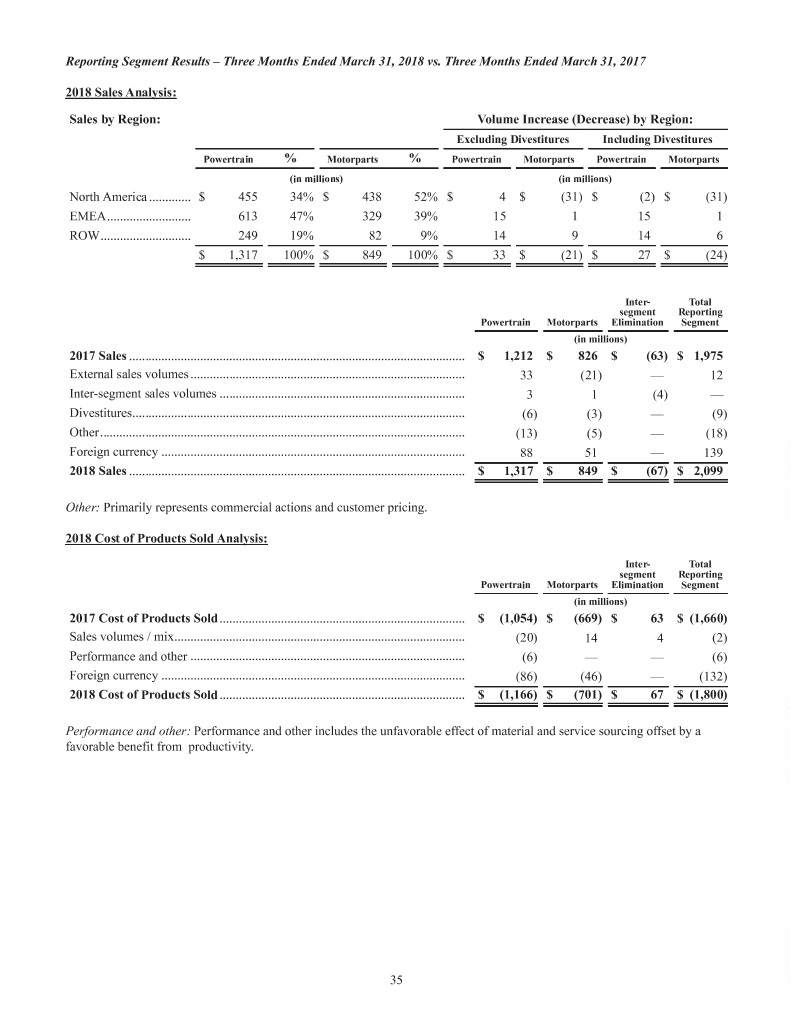

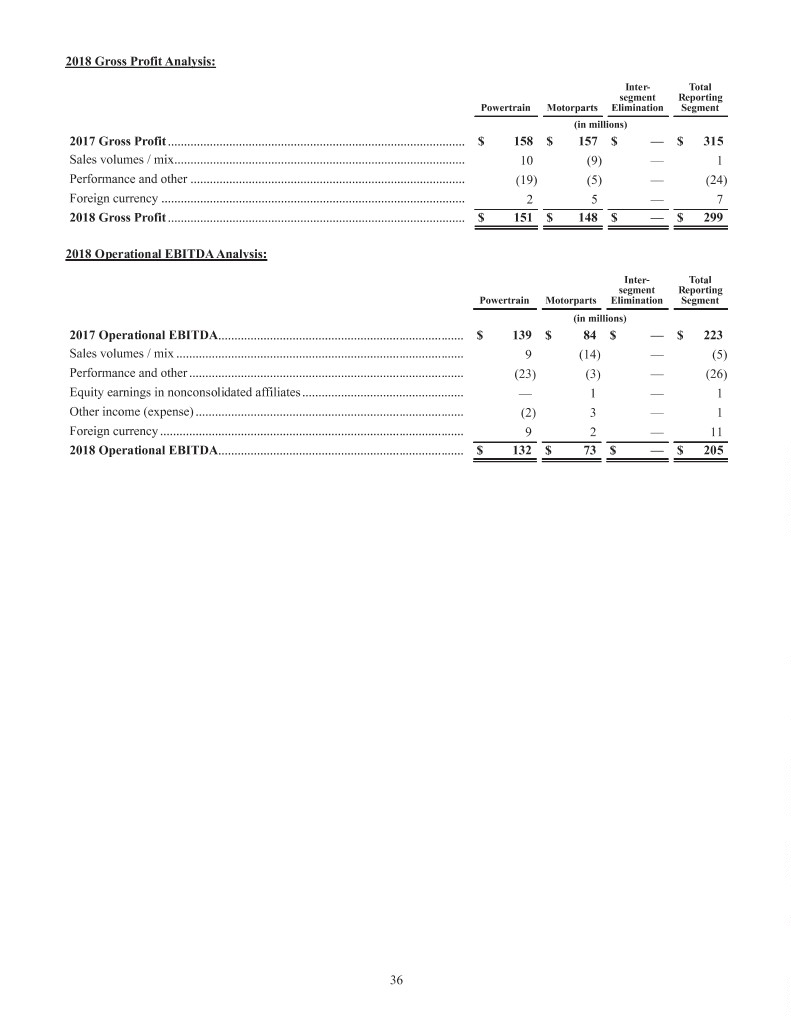

16. CHANGES IN ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) BY COMPONENT, NET OF TAX The following represents the Company’s changes in accumulated other comprehensive income (loss) by component, net of tax for the three months ended March 31, 2018 and 2017: Three Months Ended March 31 2018 2017 Foreign currency translation adjustments and other Balance at beginning of period................................................................................................................ $ (757)$ (861) Other comprehensive income (loss) before reclassifications adjustment, net of tax .............................. 30 88 Reclassification from other comprehensive income (loss)...................................................................... —— Other comprehensive income (loss), net of tax....................................................................................... 30 88 Balance at end of period.......................................................................................................................... $ (727)$ (773) Pensions and other postretirement benefits Balance at beginning of period................................................................................................................ $ (511)$ (557) Other comprehensive income (loss) before reclassifications .................................................................. (2)— Reclassification from other comprehensive income (loss)(a)................................................................... 34 Other comprehensive income (loss), net of tax....................................................................................... 14 Balance at end of period.......................................................................................................................... $ (510)$ (553) Cash flow hedge instruments Balance at beginning of period................................................................................................................ $ (15)$ (14) Other comprehensive income (loss) before reclassifications .................................................................. (1)1 Reclassification from other comprehensive income (loss)(b)................................................................... — (1) Other comprehensive income (loss), net of tax....................................................................................... (1)— Balance at end of period.......................................................................................................................... $ (16)$ (14) Other comprehensive income (loss) attributable to noncontrolling interests, net of tax(c) ...................... $3$6 (a) Includes amortization of prior service costs/credits and actuarial gains/losses. (b) Mainly consists commodity contracts which are included in "Cost of products sold". (c) Mainly consists of foreign currency translation adjustments; refer to Note 2, Basis of Presentation and Summary of Significant Accounting Policies. 24