1

This report contains statements concerning the Company’s expectations, plans, objectives, future financial performance and other statements that are not historical facts. These statements may constitute “forward - looking statements” as defined by federal securities laws. These statements may address issues that involve estimates and assumptions made by management, risks and uncertainties, and actual results could differ materially from historical results or those anticipated by such statements. Factors that could have a material adverse effect on the operations and future prospects of the Company include, but are not limited to, changes in: interest rates, general economic conditions, the legislative/regularity climate, monetary and fiscal policies of the U. S. Government, including policies of the U. S. Treasury and Federal Reserve Board, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, acquisitions and dispositions, and accounting principles, polices and guidelines. These risks and uncertainties should be considered in evaluating the forward - looking statements contained herein, and readers are cautioned not to place undue reliance on such statements, which speak only as of the date they are made. 2

Company Overview The history of Bay Banks of Virginia, Inc. begins in 1930 when, in the midst of the Great Depression, a group of financial visionaries in Kilmarnock, Virginia took a bold step and founded a new bank, Bank of Lancaster. Over the years, Bank of Lancaster grew and prospered because it adhered to its founders’ commitment to provide customers with friendly, personal service, a safe haven for their savings and investments, and a sound line of financial products and services to help them build and buy homes, establish businesses and improve the quality of their lives. In 1997, after nearly 70 years of solid growth and customer satisfaction, Bank of Lancaster underwent a corporate reorganization. Bay Banks of Virginia was formed as a bank holding company and assumed ownership of 100% of the stock of Bank of Lancaster. Two years later, Bay Banks of Virginia created a second subsidiary, Bay Trust Company, to purchase the assets of the Bank of Lancaster Trust Department. The sale and transfer of assets was completed on December 31, 1999, at which time Bay Trust Company began operations as a subsidiary of Bay Banks of Virginia. Today, Bay Banks of Virginia conducts substantially all of its operations through its two subsidiaries, Bank of Lancaster and Bay Trust Company. As of June 30, 2014, Bay Banks of Virginia and its subsidiaries had 112 employees, 647 stockholders of record and assets of approximately $341 million. 3

Branching Network Eight branch offices in the Northern Neck Region of Virginia, approximately 75 miles south of Washington, D.C. and 55 miles northeast of Richmond, Virginia, plus one office in Richmond (red) One loan production office in the Middle Peninsula (blue) Two additional branches pending in Richmond (yellow) 4

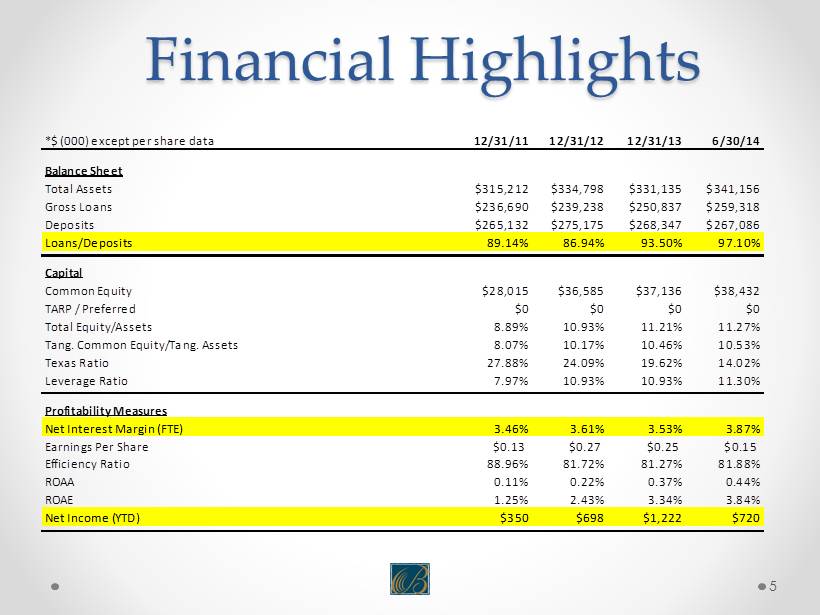

Financial Highlights 5 *$ (000) except per share data 12/31/11 12/31/12 12/31/13 6/30/14 Balance Sheet Total Assets $315,212 $334,798 $331,135 $341,156 Gross Loans $236,690 $239,238 $250,837 $259,318 Deposits $265,132 $275,175 $268,347 $267,086 Loans/Deposits 89.14% 86.94% 93.50% 97.10% Capital Common Equity $28,015 $36,585 $37,136 $38,432 TARP / Preferred $0 $0 $0 $0 Total Equity/Assets 8.89% 10.93% 11.21% 11.27% Tang. Common Equity/Tang. Assets 8.07% 10.17% 10.46% 10.53% Texas Ratio 27.88% 24.09% 19.62% 14.02% Leverage Ratio 7.97% 10.93% 10.93% 11.30% Profitability Measures Net Interest Margin (FTE) 3.46% 3.61% 3.53% 3.87% Earnings Per Share $0.13 $0.27 $0.25 $0.15 Efficiency Ratio 88.96% 81.72% 81.27% 81.88% ROAA 0.11% 0.22% 0.37% 0.44% ROAE 1.25% 2.43% 3.34% 3.84% Net Income (YTD) $350 $698 $1,222 $720

Loan Growth 6/30/14 loan portfolio balance: $259.3 million Portfolio composition as of June 30: $22.2 million C&I (8.6%) $67.5 million Commercial Real Estate (26.0%) $161.7 million Consumer Real Estate (62.4%) $7.8 million Consumer/Other (3.0%) 6/30/14 average yield on loans: 5.07% Loan growth of $12.2 million or 5.2% in 2013 Loan growth of $16.3 million or 6.5% through August 2014 6

$11.2 million of 2014 growth has been in consumer real estate $4.7 million of 2014 growth has been in C&I $3.4 million of 2014 growth has come from Richmond Net interest income of $5.7 million for first six months of 2014; $519,000 higher than $5.2 million for first six months of 2013 6/30/14 ALLL of $2.97 million: ▪ 1.15% of total loans ▪ 170% of non - performing loans 7

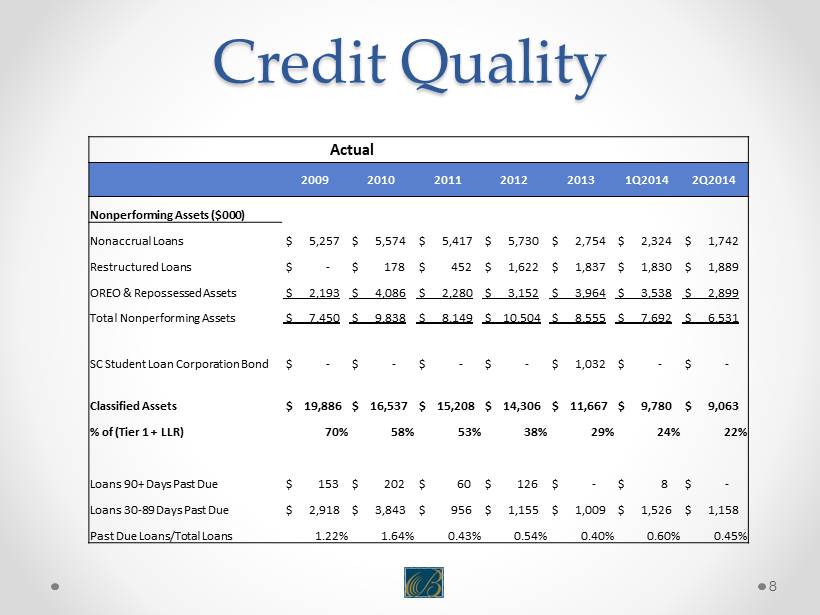

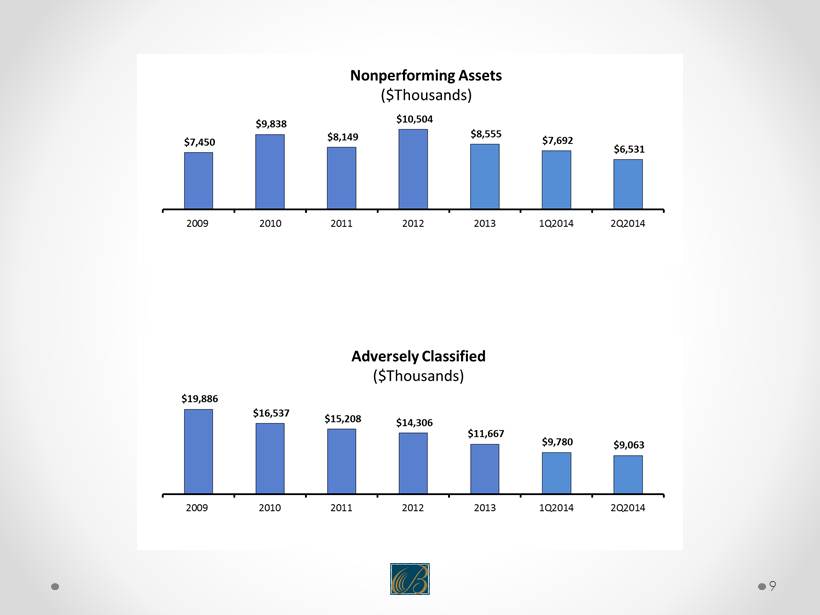

Credit Quality Actual 2009 2010 2011 2012 2013 1Q2014 2Q2014 Nonperforming Assets ($000) Nonaccrual Loans $ 5,257 $ 5,574 $ 5,417 $ 5,730 $ 2,754 $ 2,324 $ 1,742 Restructured Loans $ - $ 178 $ 452 $ 1,622 $ 1,837 $ 1,830 $ 1,889 OREO & Repossessed Assets $ 2,193 $ 4,086 $ 2,280 $ 3,152 $ 3,964 $ 3,538 $ 2,899 Total Nonperforming Assets $ 7,450 $ 9,838 $ 8,149 $ 10,504 $ 8,555 $ 7,692 $ 6,531 SC Student Loan Corporation Bond $ - $ - $ - $ - $ 1,032 $ - $ - Classified Assets $ 19,886 $ 16,537 $ 15,208 $ 14,306 $ 11,667 $ 9,780 $ 9,063 % of (Tier 1 + LLR) 70% 58% 53% 38% 29% 24% 22% Loans 90+ Days Past Due $ 153 $ 202 $ 60 $ 126 $ - $ 8 $ - Loans 30 - 89 Days Past Due $ 2,918 $ 3,843 $ 956 $ 1,155 $ 1,009 $ 1,526 $ 1,158 Past Due Loans/Total Loans 1.22% 1.64% 0.43% 0.54% 0.40% 0.60% 0.45% 8

9

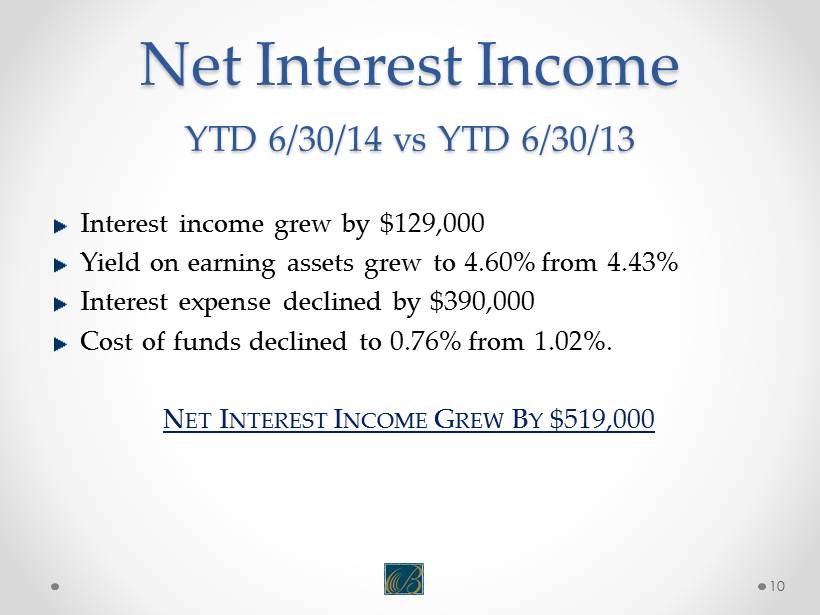

Net Interest Income YTD 6/30/14 vs YTD 6/30/13 Interest income grew by $129,000 Yield on earning assets grew to 4.60% from 4.43% Interest expense declined by $390,000 Cost of funds declined to 0.76% from 1.02%. N ET I NTEREST I NCOME G REW B Y $519,000 10

Interest Rate Sensitivity Our model shows Net Interest Income rises $127,000 when rates are increased by 200 basis points (2.0 percentage points) Model Summary Down 100 BP Base Up 200 BP Year 1 Net Interest Income 11,495 11,675 11,803 Net Interest Income ($ Change) -818 127 Net Interest Income (% Change) -1.55% 1.09% Year 2 Net Interest Income 10,846 11,661 12,212 Net Interest Income ($ Change) -830 -14 536 Net Interest Income (% Change) -7.11% -0.12% 4.59% 11

Financial Targets YTD YTD YTD 6/30/14 12/31/14 12/31/15 Net Interest Margin (FTE) 3.87% 3.90% 4.00% Earnings Per Share $0.15 $0.37 $0.52 Efficiency Ratio 81.88% 80.00% 77.00% ROAA 0.44% 0.50% 0.65% ROAE 3.84% 4.86% 6.22% Net Income ($000's) $720 $1,800 $2,500 Assets ($000's) $341,156 $363,000 $400,000 12

Extreme Banking Product 13

Stock Improvement Greatly improved liquidity - 181,000 shares traded in 2012 - 337,000 shares traded in 2013 - 298,506 shares traded ytd 2014 (Jan - August) Stock price has increased 26% since the capital raise in December of 2012 Continue to trade below book value 14