| OMB APPROVAL | ||

OMB Number: | 3235-0059 | |

Expires: | January 31, 2008 | |

Estimated average burden | ||

hours per response | 14 | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

BAY BANKS OF VIRGINIA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 7, 2006

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Bay Banks of Virginia, Inc. on May 15, 2006, at 1:00 p.m., at Indian Creek Yacht & Country Club, Kilmarnock, Virginia. We would be pleased to have you as our guest for a buffet luncheon starting at 12:00 p.m. If you wish to attend, please indicate this on the enclosed luncheon reservation card that must be returned with your completed proxy. This will allow us to have an accurate count of those joining us for the luncheon.

The primary business of the meeting will be the election of a director of the Company and the ratification of the appointment of the Company’s independent registered public accounting firm, as more fully explained in the accompanying proxy statement.

During the meeting, we also will report to you on the condition and performance of the Company and its subsidiaries, the Bank of Lancaster and Bay Trust Company. You will have an opportunity to question management on matters that affect the interests of all stockholders.

We hope you can join us for the luncheon and attend the Annual Meeting on May 15, 2006.Whether or not you plan to attend, please complete, sign and date the enclosed proxy and return itpromptly in the enclosed envelope.

YOUR VOTE IS IMPORTANT

Thank you for your interest in the Company’s affairs. As always, we are most grateful for your continuing support of Bay Banks of Virginia.

Sincerely,

| /s/ Ammon G. Dunton, Jr. | /s/ Austin L. Roberts, III | |||

| Ammon G. Dunton, Jr. | Austin L. Roberts, III | |||

| Chairman of the Board | President and Chief Executive Officer | |||

BAY BANKSOF VIRGINIA, INC.

100 South Main Street

Kilmarnock, Virginia 22482

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 15, 2006

To Our Stockholders:

The Annual Meeting of Stockholders of Bay Banks of Virginia, Inc. (the “Company”) will be held at Indian Creek Yacht & Country Club, Kilmarnock, Virginia, on May 15, 2006 at 1:00 p.m. for the following purposes:

| 1. | To elect one (1) Class II director to serve a three-year term; |

| 2. | To ratify the selection of Yount, Hyde & Barbour P.C., independent registered public accounting firm, as auditors of the Company for the year ending December 31, 2006; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. Management knows of no other business to be brought before the meeting. |

Only stockholders of record at the close of business on March 27, 2006 will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

| By Order of the Board of Directors |

| /s/ Hazel S. Farmer |

| Hazel S. Farmer |

| Corporate Secretary |

April 7, 2006

PLEASE MARK, SIGN, DATE AND RETURN YOUR PROXY PROMPTLY, WHETHER OR

NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

BAY BANKSOF VIRGINIA, INC.

100 S. Main Street

Kilmarnock, Virginia 22482

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 15, 2006

GENERAL

The enclosed proxy is solicited by the Board of Directors of Bay Banks of Virginia, Inc. (the “Company”), the holding company for the Bank of Lancaster and Bay Trust Company (together, the “Subsidiaries”), for the Company’s Annual Meeting of Stockholders to be held on May 15, 2006, at the time and place and for the purposes set forth in the accompanying Notice of the Annual Meeting or any adjournment thereof. The approximate mailing date of this Proxy Statement and accompanying proxy is April 7, 2006.

Revocation and Voting of Proxies

Execution of a proxy will not affect a stockholder’s right to attend the Annual Meeting and to vote in person. Any stockholder who has executed and returned a proxy may revoke it by attending the Annual Meeting and requesting to vote in person. A stockholder may also revoke his proxy at any time before it is exercised by filing a written notice with the Company or by submitting a proxy bearing a later date. Proxies will extend to, and will be voted at, any adjourned session of the Annual Meeting.

Voting Rights and Solicitation

Only stockholders of record at the close of business on March 27, 2006 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. The number of shares of common stock of the Company outstanding and entitled to vote on March 27, 2006 was 2,371,466. The Company has no other class of stock outstanding. A 60% majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum for the transaction of business.

Each share of common stock entitles the record-holder thereof to one vote upon each matter to be voted upon at the Annual Meeting. Shares for which the holder has elected to abstain or to withhold the proxies’ authority to vote (including broker non-votes) on a matter will count toward a quorum, but will not be included in determining the number of votes cast with respect to such matter.

The cost of solicitation of proxies will be borne by the Company. Solicitation is being made by mail, and if necessary may be made in person, by telephone, or special letter by officers and regular employees of the Company, acting without compensation other than regular compensation.

Principal Stockholders

The only beneficial owner of 5% or more of the outstanding common stock of the Company is the Bay Banks of Virginia Employee Stock Ownership Trust (the “Trust”), which owns 131,505 shares, or 5.5% of the Company’s common stock. The Trust was established pursuant to the Company’s Employee Stock Ownership Plan (“ESOP”). Two members of the Board of Directors of the Company and one director of Bank of Lancaster (the “Bank”) are trustees of the ESOP. As of March 27, 2006, all shares held in the Trust

had been allocated to the accounts of participating employees. Under the terms of the ESOP, the trustees must vote all allocated shares held in the ESOP in accordance with the instructions of the participating employees, and allocated shares for which employees do not give instructions will be voted in the same ratio on any matter as to those shares for which instructions are given.

PROPOSAL ONE – ELECTION OF DIRECTOR

The Company’s Board of Directors is divided into three classes (I, II and III). The term of office for the Class II directors will expire at the Annual Meeting. Currently, the Class II directors are Weston F. Conley, Jr. and Robert J. Wittman. Mr. Conley has been a director of the Company since 1997. Mr. Wittman has served as a director of the Bank since 2004 and was appointed to the Company’s Board on February 22, 2006 to fill the director position left vacant by the retirement of Thomas A. Gosse. Pursuant to the Company’s By-Laws, Mr. Conley is not eligible for election as director because he would have attained the age of 72 before the last year of his term, if he was re-elected at the Annual Meeting. Mr. Wittman is the nominee to serve as a Class II director. If elected, the nominee will serve until the Annual Meeting of Stockholders held in 2009.

Messrs. Conley and Gosse will continue to serve our organization as a Directors Emeritus. The Company and the remaining Board members express their sincere appreciation and gratitude to Messrs. Conley and Gosse, who had served as directors of the Company since 1997.

The persons named in the proxy will vote for the election of the nominee named below unless authority is withheld. If for any reason the person named as nominee should become unavailable to serve, an event that management does not anticipate, proxies will be voted for such other person as the Board of Directors may designate.

The Board of Directors recommends the nominee, set forth below, for election. The Board of Directors recommends that stockholders vote FOR the nominee. The nominee receiving the greatest number of affirmative votes cast at the Annual Meeting will be elected.

Name (Age) | Company Director Since | Principal Occupation During Past Five Years | ||

Class II (Nominee): | ||||

| Robert J. Wittman (47) | 2006 | Director of Field Operations, Division of Shellfish Sanitation, Virginia Department of Health | ||

2

Name (Age) | Company Director Since | Principal Occupation During Past Five Years | ||

Class III (Directors Serving Until the 2007 Annual Meeting): | ||||

| Robert C. Berry, Jr. (61) | 2004 | President and Chief Executive Officer of Bay Trust Company since February 2001; Vice President of the Company since February 2005 | ||

| Ammon G. Dunton, Jr. (70) | 1997 | Chairman of the Board of the Company and the Bank; Attorney, Senior Partner of Dunton, Simmons & Dunton, White Stone, Virginia | ||

| Richard A. Farmar, III (48) | 2004 | President of B.H. Baird Insurance Agency, Warsaw, Virginia | ||

Class I (Directors Serving Until the 2008 Meeting): | ||||

| Allen C. Marple (69) | 2005 | Retired (1998) President of Spectrum Investments, Inc., Toronto, Canada | ||

| Austin L. Roberts, III (59) | 1997 | President and Chief Executive Officer of the Company and the Bank | ||

Board of Directors and Committees

Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of the director’s duties, including the attendance at Board and committee meetings. During 2005, there were seven meetings of the Board of Directors. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and its committees. Directors are encouraged to attend stockholders meetings, and all seven directors attended the 2005 Annual Meeting of Stockholders.

There are no family relationships among any of the directors or among any directors and any officer. None of the directors serves as a director of any other publicly-held company.

The Board of Directors has, among others, a standing Compensation Committee and Audit Committee.

Compensation Committee.The Compensation Committee currently consists of Weston F. Conley, Jr., Allen C. Marple, and three non-voting members; Ammon G. Dunton, Jr., Austin L. Roberts, III and Robert C. Berry, Jr. In addition, certain directors of the Company’s subsidiaries have been appointed as voting members of the Compensation Committee. They are Douglas E. Flemer of the Trust Company Board, and David W. Cheek and Patricia N. Lawler of the Bank Board. The function of this committee is to recommend the compensation to be paid to the executive officers of the Company. It also administers the stock option plans for the benefit of such officers and directors eligible to participate in such plans. The Compensation Committee met two times during 2005.

3

Audit Committee.The Audit Committee currently consists of Weston F. Conley, Richard A. Farmar, III, and Allen C. Marple. In addition, certain directors of the Company’s subsidiaries have been appointed as voting members of the Audit Committee. Currently serving in this capacity is Jane Williams of the Trust Company Board.

As required, at least three members of the Audit Committee meet the requirements for independence as set forth in the NASDAQ definition of “independent director,” and meet the definition of an independent director as set forth in the Sarbanes-Oxley Act of 2002. Specifically, Directors Conley, Farmar, Marple and Williams are each independent by definition. In addition, none have participated in the preparation of the financial statements of the Company or any Subsidiary of the Company at any time during the past three years.

Although the Company does not currently have an “audit committee financial expert” as defined by the Sarbanes-Oxley Act of 2002, Ms. Williams and all three directors on the Audit Committee bring diversity of financial knowledge and expertise and have extensive business backgrounds that the Board has determined are sufficient for the proper exercise of their duties on the committee.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm. Accordingly, the independent registered public accounting firm reports directly to the Audit Committee of the Company. It is the responsibility of the Audit Committee to select the Company’s independent registered public accounting firm, to approve the scope of the independent registered public accounting firms audits and to review the reports of examination by the regulatory agencies, the independent registered public accounting firm and the internal auditor. The Committee regularly reports to the Board of Directors of the Company. The Audit Committee met four times during 2005.

Nominating Committee and Procedures

The Company’s Board of Directors does not have a standing nominating committee. The Board of Directors does not believe that it is necessary to have a nominating committee because it has determined that the functions of a nominating committee can be adequately performed by its independent members and that stockholders are best served by having such directors participate in the selection of board nominees.

In accordance with the Company’s By-Laws, nominations for the election of directors shall be made by the Board of Directors or by any stockholder entitled to vote in the election of directors generally. However, any stockholder entitled to vote in the election of directors generally may nominate one or more persons for election as director(s) at a meeting only if written notice of such stockholder’s intent to make such nomination or nominations has been given, either by personal delivery or by U.S. mail, postage prepaid, to the Secretary of the Company not later than (i) with respect to an election to be held at an annual meeting of stockholders, 120 days prior to the date of the anniversary of the immediately preceding Annual Meeting, and (ii) with respect to an election to be held at a special meeting of stockholders for the election of directors, the close of business on the seventh day following the date on which notice of such meeting is first given to stockholders. Each notice shall set forth: (a) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; (d) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy

4

statement filed pursuant to the proxy rules of the Securities and Exchange Commission, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and (e) the consent of each nominee to serve as director of the Company if so elected. The Chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure. The above procedures are in addition to the procedures regarding inclusion of stockholder proposals in proxy materials set forth in “Stockholder Proposals” in this Proxy Statement.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition. However, minimum qualifications include high level leadership experience in business activities, breadth of knowledge about issues affecting the Company and time available for meetings and consultation on Company matters. The independent directors seek a diverse group of candidates who possess the background, skills and expertise to make a significant contribution to the Board, to the Company, and its stockholders. The independent directors, along with the other board members as appropriate, evaluate potential nominees, whether proposed by stockholders or otherwise, by reviewing their qualifications, reviewing results of personal and reference interviews and reviewing other relevant information. Candidates whose evaluations are favorable are then chosen by a majority of the independent directors to be recommended for selection by the full Board. The full Board then selects and recommends candidates for nomination as directors for stockholders to consider and vote upon at an annual meeting.

Directors’ Compensation

Non-employee directors of the Company receive an annual retainer of $3,500 and $350 for each meeting of the Company’s Board of Directors. Directors who are employees of the Company, the Bank or Trust Company are not compensated for attendance at Board or Committee meetings. The Chairman of the Board, Mr. Ammon G. Dunton, Jr., is a Company and Bank employee. As an employee, he received $47,500 in compensation in 2005, but received no annual retainer, board or committee attendance fees from the Company or the Subsidiaries.

In accordance with the 1998 Non-Employee Directors Stock Option Plan, each of the four non-employee directors of the Company and the Subsidiaries were granted 2005 stock options for 500 shares of the Company’s common stock at its then fair market value. This plan, which reserves a total of 50,000 shares of common stock of the Company, provides that each non-employee director of the Company and the Subsidiaries is eligible to receive a stock option grant for 500 shares in May of each year during the term of the plan.

5

OWNERSHIP OF COMPANY COMMON STOCK

The following table sets forth, as of March 27, 2006, certain information with respect to the beneficial ownership of Company common stock held by each director and nominee and by the directors and all executive officers as a group.

Name | Amount and Nature of Beneficial Ownership (1) | Percent of Class | ||||

Robert C. Berry, Jr. | 7,064 | (2)(3) | * | |||

Weston F. Conley, Jr. | 64,853 | (2)(4) | 2.7 | % | ||

Ammon G. Dunton, Jr. | 91,533 | (2)(5) | 3.9 | % | ||

Richard A. Farmar, III | 8,918 | (2)(6) | * | |||

Allen C. Marple | 2,057 | (7) | * | |||

Austin L. Roberts, III | 38,856 | (2)(8) | 1.6 | % | ||

Robert J. Wittman | 1,464 | (9) | * | |||

All directors and executive officers As a group (7 persons) | 214,745 | (2)(10) | 8.9 | % |

| * | Represents less than 1% of Company common stock. |

| (1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he has the right to acquire beneficial ownership of the security within 60 days. |

| (2) | Includes shares held by affiliated corporations, close relatives and children, and shares held jointly with spouses or as custodians or trustees, as follows: Mr. Berry, 1,300 shares; Mr. Conley, 60,253 shares; Mr. Dunton, 47,866 shares; Mr. Farmar, 5,069 shares; and Mr. Roberts, 15,360 shares. |

| (3) | Includes 5,064 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (4) | Includes 4,000 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (5) | Includes 3,106 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (6) | Includes 3,000 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’ stock option plans. |

| (7) | Includes 1,500 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (8) | Includes 20,714 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (9) | Includes 1,000 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

| (10) | Includes 38,384 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s stock option plans. |

6

EXECUTIVE COMPENSATION

No officer receives compensation from the Company. All compensation is paid through the Subsidiaries.

The following table presents compensation information on the President and Chief Executive Officer of the Company. No other executive officer of the Company earned over $100,000 in salary and bonus in 2005.

Summary Compensation Table

Name and Principal Position | Year | Annual Compensation (1) | Long-Term Awards Securities | All Other | ||||||||

| Salary | Bonus | |||||||||||

Austin L. Roberts, III | 2005 | $ | 179,903 | -0- | -0- | $ | 7,086 | |||||

President and CEO | 2004 | 177,544 | -0- | -0- | 6,263 | |||||||

| 2003 | 170,714 | -0- | -0- | 6,493 | ||||||||

| (1) | Mr. Roberts did not receive perquisites or other personal benefits in excess of the lesser of $50,000 or 10% of the total of his salary and bonus. |

| (2) | The Company’s stock option plan does not permit the granting of restricted stock awards or stock appreciation rights, and it is the Company’s only stock-based long-term compensation plan currently in effect in which employees may participate. |

| (3) | Consists of (for 2005): (i) $4,048 accrued on behalf of Mr. Roberts by the Bank under the 401(k) Plan; and (ii) $3,038 contributed to Mr. Roberts by the Company under the Company’s ESOP. |

Stock Option Grants in 2005

The Company’s 2003 stock option plan provides for the granting of incentive stock options to executive officers and key employees of the Company and the Subsidiaries. No stock options were granted to Mr. Roberts during 2005.

7

Stock Option Exercises in 2005 and Year-End Option Values

The following table shows certain information with respect to the number and value of unexercised options at year-end held by Mr. Roberts.

Name | Number of Shares Acquired on Exercise | Value Realized (1) | Number of December 31, 2005 | Value of Unexercised In-the-Money Options at December 31, 2005 (2) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Austin L. Roberts, III | 6,000 | $ | 42,000 | 20,714 | -0- | $ | 33,894 | $ | 0 | ||||||

| (1) | Calculated by subtracting the exercise price from the fair market value of the stock as of the exercise date. |

| (2) | Calculated by subtracting the exercise price from the fair market value of the stock at December 31, 2005. |

Benefit Plans

Pension Plan. The Company has a non-contributory defined benefit pension plan (the “Pension Plan”) which covers substantially all salaried employees who have reached the age of twenty-one and who have completed one year of service. The normal retirement age is 65, but participants may elect early retirement at 55 after 10 years of service at reduced levels of benefits and disability retirement after 10 years of service at full levels of benefits. Vesting is 100% after 5 years of service.

The following table provides information concerning estimated annual benefits that are payable to covered employees at normal retirement age under the terms of the Pension Plan, based on the compensation and years of service classifications specified below. The Pension Plan benefits shown in the table are computed on the basis of a straight life annuity beginning at age 65.

5 YEAR AVERAGE | YEARS OF SERVICE | |||||||||||||||

| 15 | 20 | 25 | 30 | 35 | ||||||||||||

| $ | 25,000 | $ | 3,750 | $ | 5,000 | $ | 6,250 | $ | 6,250 | $ | 6,250 | |||||

| 50,000 | 7,637 | 10,183 | 12,728 | 12,728 | 12,728 | |||||||||||

| 75,000 | 14,012 | 18,683 | 23,353 | 23,353 | 23,353 | |||||||||||

| 100,000 | 20,387 | 27,183 | 33,978 | 33,978 | 33,978 | |||||||||||

| 125,000 | 26,762 | 35,683 | 44,603 | 44,603 | 44,603 | |||||||||||

| 150,000 | 33,137 | 44,183 | 55,228 | 55,228 | 55,228 | |||||||||||

| 175,000 | 39,512 | 52,683 | 65,853 | 65,853 | 65,853 | |||||||||||

| 200,000 | 45,887 | 61,183 | 76,478 | 76,478 | 76,478 | |||||||||||

| 205,000 | 48,437 | 64,583 | 80,728 | 80,728 | 80,728 | |||||||||||

| and above | ||||||||||||||||

The remuneration covered by the Pension Plan is an employee’s “final average earnings,” which, under the terms of the Pension Plan, is defined to be the average of the highest five consecutive calendar years of base salary (reported as “Salary” in the Summary Compensation Table above) earned by the

8

employee during the ten calendar years prior to his or her date of retirement, termination, disability or death. A participant’s monthly retirement benefit (if they have twenty-five years of credited service at their normal retirement date) is 25% of their final average salary, plus an additional 18.75% (scaled down to 16.25% for persons whose Social Security retirement age is 67) if it is in excess of the participant’s Social Security covered salary. The Social Security covered salary is the average of the participant’s salary, up to the Social Security Wage Base, over the participant’s working lifetime prior to the year the participant attains his or her Social Security retirement age. Cash benefits under the Pension Plan generally commence on retirement, death or other termination of employment and are payable in various forms at the election of the participant.

Based on current salary levels and assuming retirement at the normal retirement age of 65, it is estimated that the annual retirement benefit for Mr. Roberts will be $54,827.The final average salary and the respective years of service, as of December 31, 2005, for Mr. Roberts was $171,502 and 15 years.

401(k) Plan. The Subsidiaries have a contributory 401(k) plan. All salaried employees are eligible to participate after having worked six months consecutively and there is no age requirement. Participants may elect to defer between 1% and 15% of their base compensation, which will be contributed to the plan, providing the amount deferred does not exceed the dollar maximum election deferral for each year. The Subsidiaries’ match is 100% up to a 2% deferral; the subsidiaries will provide a 25% match on employee contributions between 2% and 4% of salary. Under the plan, an employee is vested in a Subsidiary’s contribution by 20% after two years and 20% each year thereafter for the next four years of service. If an employee leaves prior to the two-year period, he or she forfeits any accrued match contribution.

Distributions to participants are made at death, retirement or other termination of employment in a lump sum payment. The plan permits certain in-service withdrawals. Normal retirement age is considered 65; early retirement is considered at 55 with 10 years of vested service; disability retirement has no age requirements but a service requirement of 10 years of vested service.

Stock Option Plans. The Company currently has in effect one stock option plan for employees, the 2003 plan. The 1985 and 1994 stock plans have expired, but certain options deemed earned are still exercisable as outlined belowThe 2003 plan provides for the earning of incentive stock options by key employees of the Company upon successful completion of agreed upon goals. The Compensation Committee of the Company makes allocations under the plan and fixes the terms and conditions of each allocation pursuant to a separate agreement entered into with each eligible key employee. The price of shares of stock to be issued upon the exercise of options deemed earned is 100% of the fair market value on the date of the award. The option is not exercisable after the expiration of ten years from the date such option is granted. An option is not transferable by a person to whom it is granted other than by will or the laws of descent and distribution.

Under the 2003 plan, of the 175,000 shares authorized, 137,842 are available for granting purposes. In 2005, of the 24,300 shares granted, the number of shares considered earned has not been determined. Under the 1985 plan, no shares remain available for exercise. Under the 1994 plan, option grants for 110,131 shares are still available for exercise.

Employee Stock Ownership Plan. The ESOP is a non-contributory plan supported by annual contributions made at the discretion of the Company’s Board of Directors. The ESOP is a stock bonus plan qualified under Section 401(a) of the Internal Revenue Code and an employee ownership plan under Section 4975(E)(7) of the Internal Revenue Code. Trustees and an administrative committee as appointed by the Chairman of Company’s Board of Directors for the exclusive benefit of participants administer the

9

ESOP. The ESOP is eligible to each Bank and Trust Company employee over the age of twenty-one and credited with at least 1,000 hours of service for the plan year.

Report of the Board of Directors on Executive Compensation

This report is submitted by the Board of Directors of the Company, which is responsible for establishing and administering the Company’s compensation policies and its incentive stock option plan through its Compensation Committee.

General Compensation Policy

The Company’s compensation policy for executive management is designed to achieve the following objectives: (a) to enhance business results of the Company and increase stockholder value by aligning closely the financial interests of its officers with those of its stockholders; (b) to reward executive management consistent with the Company’s annual performance goals; (c) to recognize individual initiative, leadership and achievement; and (d) to provide competitive compensation that will attract and retain qualified corporate officers and key employees.

Executive Officer Compensation Programs

The compensation program for executive management consists of up to four elements: (1) base salary, which is set on an annual basis; (2) incentive stock options; and (3) participation in the Company’s ESOP program.

The Board of Directors determines general salary and benefit policies and procedures. The Board uses market studies and published compensation data to review competitive rates of pay, to establish salary ranges, and to arrive at base salary levels. The Board approves base salaries at levels competitive with amounts paid to executives with comparable qualifications, experience and responsibilities after comparing salary information of similar sized banks as provided by the Virginia Bankers Association’s Salary Survey of Virginia Banks and other compensation surveys. In addition, the Board considers the recent performance of the Company and assesses the executive’s past performance and its expectation as to future contributions in leading the Company.

Compensation for senior officers other than the Chairman and the President and Chief Executive Officer is recommended to the Compensation Committee by the President and Chief Executive Officer. The Compensation Committee reviews these recommendations and has the authority to revise the proposed compensation proposals. Once approved by the Compensation Committee, the senior officer’s compensation is referred to the Board of Directors for review, discussion, revision if requested, and approval.

The Board uses a subjective approach to the determination of compensation based on the factors noted above. Except concerning incentive stock options, the Board does not rely on formulas or weights of specific factors. Neither the profitability of the Company nor the market value of its stock is directly utilized in computing an officer’s base compensation. The Company’s executive compensation program has substantially relied on base salary as its primary component.

Incentive stock option grants are earned only if the Compensation Committee determines that the objectives set forth in the option plan document are achieved by a specified date. The objective of these options is to create a link between officer compensation and Company performance. In determining the appropriate level of stock-based allotments, the Committee considers the officer’s contribution toward the Company’s performance. To encourage growth in stockholder value, incentive stock options are granted

10

to all officers who are in a position and have a responsibility to make a substantial contribution to the long-term success of the Company. The Board believes this focuses attention on managing the Company from the perspective of an owner with an equity stake in the business.

During 2005, no incentive stock option shares were granted to Mr. Roberts.

Chief Executive Officer Compensation

The compensation paid for 2005 to the Chief Executive Officer of the Company and the Bank, Austin L. Roberts, III, reflects the considered judgment of the Board embracing the policy and process described previously. The Board reviews and fixes the base salary of the Chief Executive Officer based on similar competitive compensation data to other community banks’ senior executives and the Board’s assessment of his past performance and its expectation as to his future contribution in leading the Company. The Compensation Committee also establishes the criteria that would give rise to a cash incentive payment.

Compensation Committee Bay Banks of Virginia, Inc. |

Weston F. Conley, Jr., Chairman David W. Cheek Douglas E. Flemer Patricia N. Lawler Allen C. Marple Robert C. Berry, Jr., Non-Voting Member Ammon G. Dunton, Jr., Non-Voting Member Austin L. Roberts, III, Non-Voting Member |

Compensation Committee Interlocks and Insider Participation

During 2005 and up to the present time, there were transactions between the Bank and certain members of the Company’s Board of Directors, or their associates, all consisting of extensions of credit by the Bank in the ordinary course of business. Each transaction was made on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with the general public. In the opinion of management, none of the transactions involve more than the normal risk of collect ability or present other unfavorable features, other than as set forth in “Interest of Directors and Officers in Certain Transactions” on page 16.

The only members of the Board who served as an officer or employee of the Company or any of its affiliates during 2005 are: Ammon G. Dunton, Jr., Chairman of the Board of the Company and the Bank; Austin L. Roberts, III, President and Chief Executive Officer of the Company and the Bank; and Robert C. Berry, Jr., Vice President of the Company and President and Chief Executive Officer of the Trust Company.

11

STOCK PERFORMANCE GRAPH

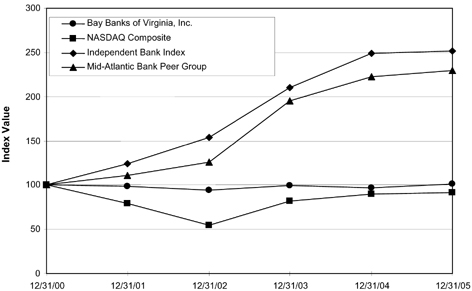

The graph and table below compares the cumulative total stockholder return on the Company’s common stock with the cumulative total return on the NASDAQ Stock Market Composite Index, the Carson Medlin Independent Bank Index and a peer group index (the “Mid-Atlantic Bank Peer Group Index”) that includes financial institutions from the SNL Securities Mid-Atlantic less than $500 million in total assets Bank Index (the “SNL Index”), for the five year period ended December 31, 2005, assuming that an investment of $100 was made on December 31, 2000 and dividends were reinvested. The SNL Index is a published industry index providing a market capitalization weighted measure of the total return of financial institutions with total assets below $500 million. The SNL Index is comprised only of those financial institutions that trade on the NASDAQ stock markets and on the American Stock Exchange. The Mid-Atlantic Bank Peer Group Index contains all of the banks in the SNL Index and also includes financial institutions (from Delaware; Maryland; New Jersey; New York; Pennsylvania; and Washington, D.C.) that have less than $500 million in total assets that trade on the OTC Bulletin Board and the Pink Sheets, an electronic quotation system established by Pink Sheets LLC. The Company believes that the Mid-Atlantic Bank Peer Group Index contains financial institutions more comparable to the Company than does the Carson Medlin Independent Bank Index and, therefore, such index will take the place of the Carson Medlin Index in next year’s proxy statement. The comparisons in the graph below are based upon historical data and are not indicative of, nor intended to forecast, future performance of the Company’s common stock.

Total Return Performance

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | |||||||||||||

Bay Banks of Virginia, Inc. | $ | 100.00 | $ | 98.54 | $ | 94.15 | $ | 99.19 | $ | 97.01 | $ | 100.77 | ||||||

NASDAQ Composite Index | 100.00 | 79.18 | 54.44 | 82.09 | 89.59 | 91.54 | ||||||||||||

Independent Bank Index | 100.00 | 124.00 | 154.00 | 210.00 | 249.00 | 252.00 | ||||||||||||

Mid-Atlantic Bank Peer Group Index | 100.00 | 110.64 | 125.47 | 195.05 | 223.00 | 230.02 | ||||||||||||

12

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of Bay Banks of Virginia oversees the Company’s financial reporting process on behalf of the Board of Directors of the Company. The Audit Committee is elected by the Board of Directors of the Company. All voting members are independent of management. In addition, the Audit Committee operates under a written charter adopted by the Board of Directors. While management has the primary responsibility for the quality and integrity of the Company’s financial statements and reporting processes, the Audit Committee provides assistance to management in fulfilling this responsibility. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements for the Annual Report with management and the independent registered public accounting firm, and discussed the quality and acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosure in the financial statements.

In addition, the committee obtained from the independent registered public accounting firm a formal written statement discussing any disclosed relationship or service which may impact the objectivity and independence of the independent registered public accounting firm, as required by Independence Standards Board Standard No. 1 “Independence Discussions with Audit Committees.” The committee also discussed with the independent registered public accounting firm all communications required by generally accepted auditing standards, including Statement on Auditing Standards No. 61, “Communication with Audit Committees.”

The Audit Committee also monitored the internal audit functions of the Company including the independence and authority of its reporting obligation, the proposed audit plan for the coming year, and the adequacy of management response to internal audit findings and recommendations.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The Company’s Audit Committee has also recommended the selection of the Company’s independent registered public accounting firm.

Audit Committee Bay Banks of Virginia, Inc. |

Allen C. Marple, Chair Weston F. Conley Richard A. Farmar, III Jane M. Williams |

13

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

Yount, Hyde and Barbour, P.C. (“YHB”) audited the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, reviewed the Company’s quarterly reports on Form 10-Q.

The following table presents aggregate fees paid or to be paid by the Company and the Bank for professional services rendered by YHB. Audit fees include audit and review services, consents, and review of documents filed with the SEC. Audit related fees include agreed-upon procedures engagements for STAR Compliance Review, SysTrust Audit of Information Technology, Defined Benefit Plan audit, Defined Contribution plan audit, and consultation concerning financial accounting and reporting standards. Tax fees include preparation of federal and state tax returns and consultation concerning tax compliance issues.

| Fiscal 2005 | Fiscal 2004 | |||||

Audit Fees | $ | 58,000 | $ | 41,700 | ||

Audit-related Fees | 28,764 | 28,750 | ||||

Tax Fees | 3,500 | 3,200 | ||||

Total Fees | $ | 90,264 | $ | 73,650 | ||

The Audit Committee pre-approves all audit, audit related, and tax services on an annual basis, and in addition, authorizes individual engagements that exceed pre-established thresholds. Any additional engagement that falls below the pre-established thresholds must be reported by management at the Audit Committee meeting immediately following the initiation of such an engagement.

PROPOSAL TWO – RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Yount, Hyde and Barbour, P.C. as the Company’s independent registered public accounting firm for 2006, subject to ratification of the stockholders. The services that YHB will perform will consist primarily of the examination and audit of the institution’s financial statements, tax reporting assistance, and other audit and accounting matters. Representatives of YHB are expected to be present at the Annual Meeting and will be given an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Board of Directors recommends that you vote FOR the ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006. Proxies solicited by the Board will be voted in favor thereof unless a stockholder has indicated otherwise on the proxy.

INTEREST OF DIRECTORS AND OFFICERS IN CERTAIN TRANSACTIONS

Some of the Company’s directors, executive officers, and members of their immediate families, and corporations, partnerships and other entities, of which such persons are officers, directors, partners, trustees, executors or beneficiaries, are customers of the Bank. All loans and loan commitments to them were originated in the ordinary course of business, upon substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and, other than as set forth below, do not involve more than normal risk of collectibility or present other

14

unfavorable features. It is the policy of the Bank to provide loans to officers who are not executive officers and to employees at more favorable rates than those prevailing at the time for comparable transactions with other persons. These loans do not involve more than the normal risk of collectibility or present other unfavorable features.

On February 21, 2005, Winn-Dixie Stores, Inc. and certain of its domestic subsidiaries (collectively, “Winn-Dixie”), filed voluntary petitions in the United States Bankruptcy Court for the Southern District of New York seeking reorganization relief under the provisions of Chapter 11 of Title 11 of the United States Code. In connection with the bankruptcy proceedings, Winn-Dixie’s lease of a store location at Chesapeake Commons Shopping Center in Kilmarnock, Virginia was voided. Lancaster Community Investors LC, a Virginia limited liability company (the “LLC”), the managers/members of which include Mr. Thomas A. Gosse, a former director of the Company and each of the Subsidiaries and Ms. Patricia N. Lawler, a director of the Bank, and members Mr. Weston F. Conley, Jr., a director of the Company and of the Bank and Mr. Fletcher L. Brown, III, a director of the Bank, had leased the store location to Winn-Dixie. The shopping center property is wholly owned by the LLC. The Bank currently has a loan outstanding to the LLC in the principal amount of approximately $1.2 million. After Winn-Dixie’s bankruptcy filing, the LLC has had short-term cash difficulties and the loan has been placed on the Bank’s Watch List and has been restructured in accordance with a workout arrangement whereby the LLC has made interest-only payments on the loan. Such arrangement is standard for problem loans of this type. The loan is secured by the shopping center real estate. In addition, Mr. Gosse and Ms. Lawler, along with certain other managers/members of the LLC, have each personally guaranteed the loan, and each such guarantee is limited to $100,000. At this time, the Bank expects that it will incur no loss of the principal amount outstanding due to the value of the real estate that secures the loan and the personal guarantees.

The law firm of Dunton, Simmons & Dunton serves as legal counsel to the Company, the Bank and the Trust Company. Mr. Ammon G. Dunton, Jr. is a senior member of the firm.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, directors and executive officers of the Company are required to file reports with the Securities and Exchange Commission indicating their holdings of and transactions in Company common stock. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, insiders of the Company complied with all filing requirements during 2005.

OTHER MATTERS

General

Management knows of no other business to be brought before the Annual Meeting. Should any other business properly be presented for action at the meeting, the shares represented by the enclosed proxy shall be voted by the persons named therein in accordance with their best judgment and in the best interests of the Company.

15

STOCKHOLDER PROPOSALS

The Company’s By-Laws provide that, in addition to any other applicable requirements, for business (including stockholder nominations of director candidates) to be properly brought before an annual meeting by a stockholder, the stockholder must give timely notice in writing to the Secretary of the Company no later than 120 days before the date of the anniversary of the immediately preceding annual meeting. As to each matter, the notice must comply with certain informational requirements set forth in the By-Laws. These requirements are separate and apart from and in addition to the Securities and Exchange Commission’s requirements that a stockholder must meet to have a proposal included in the Company’s proxy materials. To be considered for inclusion in the Company’s proxy materials relating to the 2007 Annual Meeting of Stockholders pursuant to applicable Securities and Exchange Commission rules, the Secretary of the Company must receive stockholder proposals no later than December 7, 2006. Stockholder proposals should be addressed to Corporate Secretary, Hazel S. Farmer, Bay Banks of Virginia, Inc., 100 S. Main Street, P.O. Box 1869, Kilmarnock, Virginia 22482.

The 2007 Annual Meeting of Stockholders is scheduled for Monday, May 21, 2007.

Shareholder Communication

Bay Banks of Virginia has a process whereby shareholders can contact the Company’s directorship. Corporate shareholder contact information is available on the Company website at www.baybanks.com.

ANNUAL REPORT ON FORM 10-K

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, excluding exhibits, as filed with the Securities and Exchange Commission can be obtained without charge by writing to Austin L. Roberts, III, President and CEO, Bay Banks of Virginia, Inc., 100 South Main Street, P. O. Box 1869, Kilmarnock, Virginia 22482. This information may also be accessed, without charge, by visiting either the Company’s website at www.baybanks.com or the Securities and Exchange Commission’s website at www.sec.gov.

16

BAY BANKS OF VIRGINIA, INC.

This Proxy is solicited on behalf of the Board of Directors

The undersigned, revoking all prior proxies, hereby appoints Ammon G. Dunton, Jr., and Austin L. Roberts, III, or either of them, as proxies with full power of substitution to represent the undersigned and vote, as designated below, all the shares of common stock of Bay Banks of Virginia, Inc. held of record by the undersigned on March 27, 2006, at the Annual Meeting of Stockholders to be held on May 15, 2006, at 1:00 p.m. at the Indian Creek Yacht & Country Club, Kilmarnock, Virginia, or any adjournment thereof, on each of the following matters:

| 1. | To elect one (1) director to serve for a term which expires at the annual meeting of stockholders in 2009 (Class II): |

FOR the nominee listed below (except as marked to the contrary below) | WITHHOLD AUTHORITY to vote for nominee indicated below |

Robert J. Wittman

| 2. | To ratify the selection by the Board of Directors of Yount Hyde and Barbour, P.C., independent certified public accountants, as auditors of the Company for 2006. |

FOR AGAINST ABSTAIN

| 3. | In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Meeting. The Board of Directors has not been notified of any such matters. |

This proxy, when properly executed, will be voted in the manner directed by the undersigned stockholder. If no direction is made, this proxy will be voted “FOR” each proposal. All joint owners MUST sign.

Please sign exactly as your name appears below. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

| Signature |

| Signature (if jointly owned) |

| Dated: , 2006 |

Please mark, sign, date and return this Proxy promptly in the enclosed envelope.