UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 3)

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Fisher Communications, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

April 12, 2011

Dear Shareholders:

On behalf of the Board of Directors of Fisher Communications, Inc., it is my pleasure to invite you to attend the 2011 Annual Meeting of Shareholders of Fisher Communications, Inc. to be held on May 11, 2011. During the Annual Meeting, shareholders will have the opportunity to vote on each item of business described in the enclosed Notice of Annual Meeting and Proxy Statement.

It is important that your shares be represented at the Annual Meeting, regardless of how many you hold. Whether or not you expect to attend the meeting in person, we urge you to vote as promptly as possible by telephone or by Internet by following the instructions on the enclosed WHITE proxy card or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. If your shares are held in the name of a brokerage firm, bank, or nominee, only they can vote your shares, and only after receipt of your specific instructions. Accordingly, please return any voting instructions form provided by your bank or broker or contact the person responsible for your account and give instructions for such shares to be voted for the Board’s nominees. Promptly voting your shares will save Fisher the expense of additional solicitations. As described in the accompanying Proxy Statement, submitting your vote using the WHITE proxy card will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

We have received a letter from FrontFour Capital Group LLC, a hedge fund whose managing member, David A. Lorber, currently serves on our Board of Directors, and its affiliates (referred to collectively as “FrontFour”) expressing their intention to nominate their own slate of four nominees for election as directors at the 2011 Annual Meeting of Shareholders, in opposition to the four director candidates we have nominated. As of March 9, 2011, FrontFour owned approximately 2% of our outstanding common stock. If all four FrontFour nominees are elected to our Board of Directors, FrontFour’s nominees (including David A. Lorber) will constitute a majority of our Board of Directors. We strongly urge you to vote FOR the nominees proposed by our Board of Directors by using the enclosed WHITE proxy card and NOT to vote your shares using any proxy card you may receive from FrontFour. Even if you sign a proxy card sent to you by FrontFour, you have the right to change your vote by using the enclosed WHITE proxy card. Only the latest dated proxy card you vote will be counted.

Your vote is very important to the future of Fisher Communications. We appreciate your support and look forward to seeing you at the meeting. If you have any questions or require any assistance with voting your shares, please contact:

Georgeson Inc.

199 Water Street

New York, NY 10038

1-866-821-0284

(Banks and brokers please call: 1-212-440-9800)

Very truly yours,

Michael D. Wortsman

Chairman of the Board

FISHER COMMUNICATIONS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 11, 2011

To the Shareholders of Fisher Communications, Inc.:

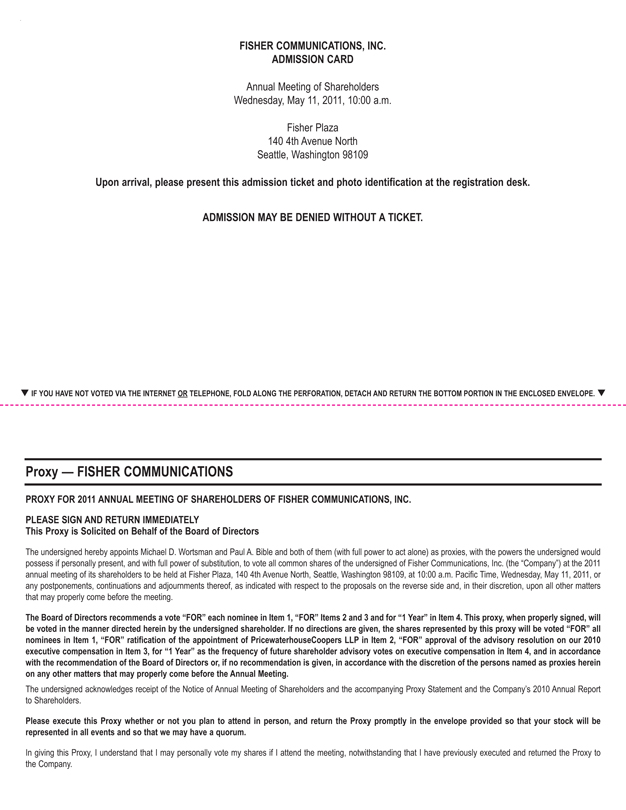

The Annual Meeting of Shareholders of Fisher Communications, Inc. will be held at our corporate offices located atFisher Plaza, 140 4th Avenue North, 5th Floor Studios, Seattle, Washington 98109, at 10:00 a.m., Pacific Time, on Wednesday, May 11, 2011,for the purpose of considering and voting upon the following matters:

1. To elect three Class 3 directors, each for a term of three-years or until their successors have been elected and qualified, and to elect one Class 1 director for a term of one-year or until his or her successor has been elected and qualified.

2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2011.

3. To approve an advisory resolution on the Company’s executive compensation.

4. To conduct an advisory vote on the frequency of future advisory votes on the Company’s executive compensation.

5. To transact such other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Our Board of Directors recommends shareholders vote:

| | • | | “FOR” all of the Board’s nominees to be elected as directors; |

| | • | | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2011; |

| | • | | “FOR” the approval of the advisory resolution on the Company’s executive compensation; and |

| | • | | “FOR” the Company’s proposed frequency of future advisory votes on the Company’s executive compensation. |

Please note that FrontFour Capital Group LLC, a hedge fund whose managing member, David A. Lorber, currently serves on our Board of Directors, and its affiliates (referred to collectively as “FrontFour”) have notified us that they intend to nominate at the Annual Meeting of Shareholders their own slate of four nominees for election as directors, in opposition to the four director candidates we have nominated. As of March 9, 2011, FrontFour owned approximately 2% of our outstanding common stock. If all four FrontFour nominees are elected to our Board of Directors, FrontFour’s nominees (including David A. Lorber) will constitute a majority of our Board of Directors.Our Board of Directors recommends a vote FOR the election of each of the Board’s nominees pursuant to the instructions on the enclosed WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker, and urges you NOT to vote with any proxy card that you may receive from FrontFour.Even if you have previously signed a proxy card sent by FrontFour, you have the right to change your vote by delivering a subsequent proxy using the enclosed WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker. Only the latest dated proxy card or voting instruction form you vote will be counted.

Our Board of Directors has established the close of business on March 9, 2011 as the record date for the determination of shareholders entitled to receive notice of, and to vote at, the Annual Meeting.

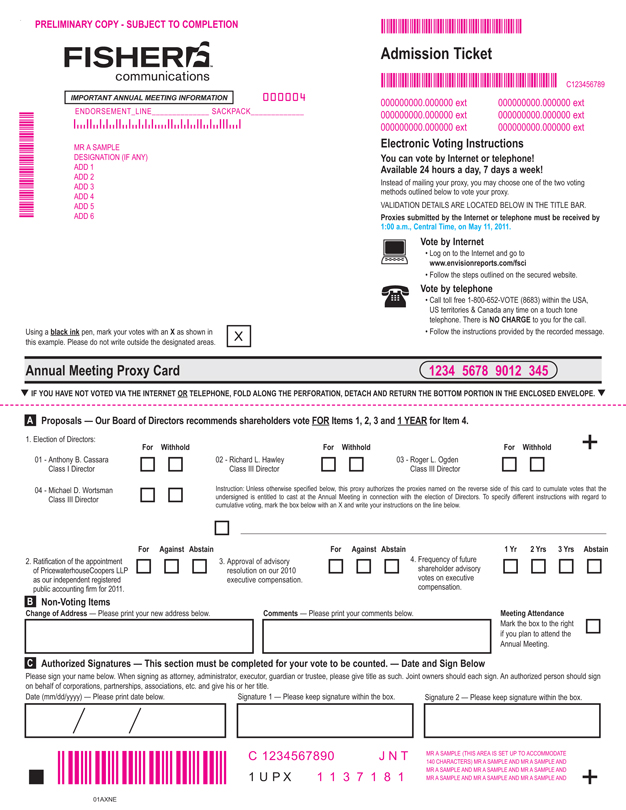

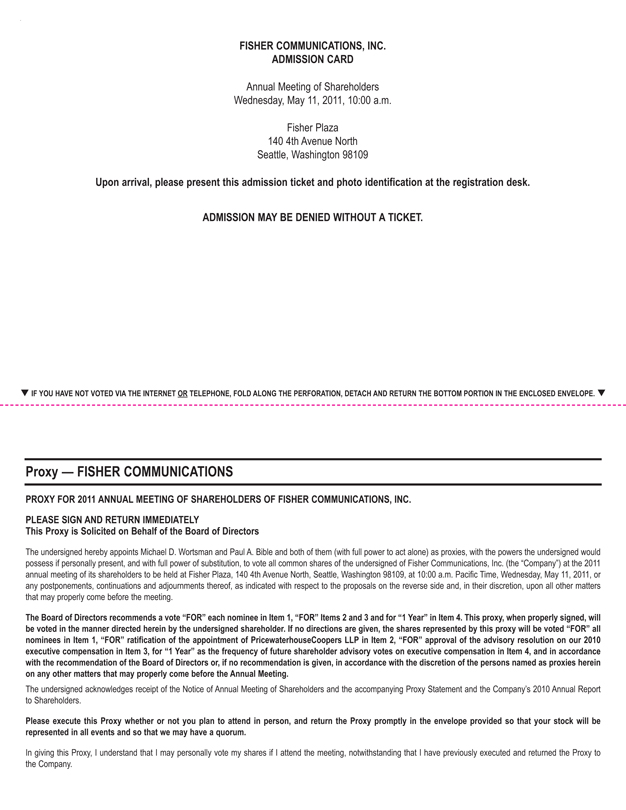

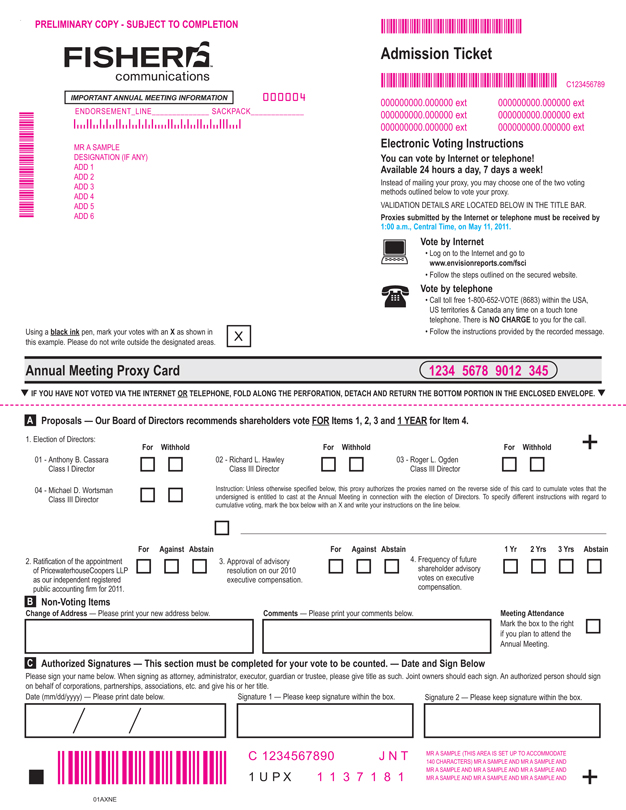

At the Annual Meeting, the Company’s management will report on the performance of the Company and respond to questions from shareholders. Further information regarding voting rights and the business to be transacted at the Annual Meeting is provided in the accompanying Proxy Statement. Admission to the Annual Meeting will be by admission ticket only, and family members are welcome to accompany you. Upon arrival at the Annual Meeting, please present your admission ticket and photo identification at the registration desk. Directions to Fisher Plaza and a map are provided on the back cover of the accompanying Proxy Statement. If you are a registered shareholder, the top half of the enclosed WHITE proxy card is your admission ticket. Neither voting instruction forms provided by your bank, broker or nominee nor proxy cards provided by FrontFour will serve as valid admission tickets. If you hold your shares in “street name” (that is, through a broker or other nominee), you may request an admission ticket by writing or phoning the Company; you will need to bring to the Annual Meeting a letter from the broker or other nominee confirming your beneficial ownership of Company shares as of the record date and photo identification.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting To Be Held on May 11, 2011

The Proxy Statement and 2010 Annual Report to Shareholders are available at http://envisionreports.com/fsci for registered shareholders and at www.edocumentview.com/fsci for all other shareholders.

| | |

April 12, 2011 | | BY ORDER OF THE BOARD OF DIRECTORS |

| |

| |  |

| | Christopher J. Bellavia |

| | Corporate Secretary |

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting, we urge you to vote using the enclosed WHITE proxy card at your earliest convenience via the Internet, by telephone or by signing and dating your WHITE proxy card and returning it in the enclosed postage prepaid envelope. It is important that your shares be represented and that a quorum is present. In addition, promptly voting your shares using the enclosed WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker will save Fisher the expense of additional solicitations. If you attend the Annual Meeting in person, your proxy may be revoked and you may personally vote your shares, even though you have previously voted using a proxy card.

PRELIMINARY COPY — SUBJECT TO COMPLETION

DATED APRIL 12, 2011

PROXY STATEMENT

FISHER COMMUNICATIONS, INC.

140 4th Avenue North

Suite 500

Seattle, Washington 98109

(206) 404-7000

This Proxy Statement and the enclosed WHITE proxy card are being sent to shareholders of Fisher Communications, Inc. (the “Company”) on or about April 12, 2011 for use in connection with the Annual Meeting of Shareholders of the Company to be held on May 11, 2011. In this Proxy Statement all references to “we,” “us” and “our” refer to Fisher Communications, Inc.

On January 27, 2011, the Company received notice from FrontFour Capital Group LLC, a hedge fund whose managing member, David A. Lorber, currently serves on our Board, and its affiliates (referred to collectively as “FrontFour”) that they intend to nominate at the Annual Meeting of Shareholders their own slate of four nominees for election as directors (referred to collectively as the “FrontFour Nominees”), in opposition to the four director candidates we have nominated. Before receiving such notice, we did not have any communications relating to alternative director candidates or similar matters with FrontFour or Mr. Lorber. As of March 9, 2011, FrontFour owned approximately 2% of our outstanding common stock. If all four FrontFour nominees are elected to our Board of Directors, FrontFour’s nominees (including David A. Lorber) will constitute a majority of our Board of Directors.

The FrontFour Nominees are NOT endorsed by our Board. We urge shareholders NOT to use any proxy card that you may receive from FrontFour. Our Board urges you to vote FOR ALL of our nominees for director: Anthony B. Cassara, Richard L. Hawley, Roger L. Ogden, and Michael D. Wortsman.

We are not responsible for the accuracy of any information provided by or relating to FrontFour or the FrontFour Nominees contained in any proxy solicitation materials filed or disseminated by FrontFour by, or on behalf of FrontFour or any other statements that FrontFour may otherwise make or that may be made on its behalf. FrontFour chooses which shareholders receive its proxy solicitation materials.

ABOUT THE ANNUAL MEETING

When and where will the Annual Meeting take place?

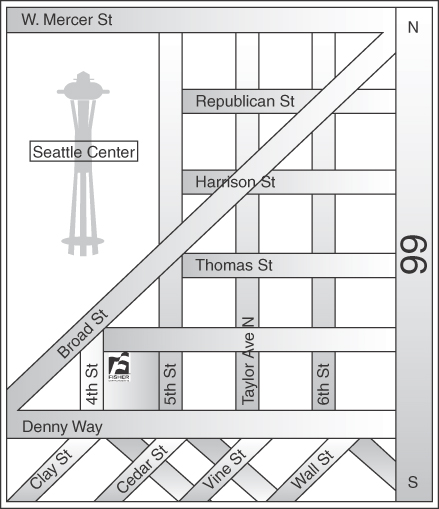

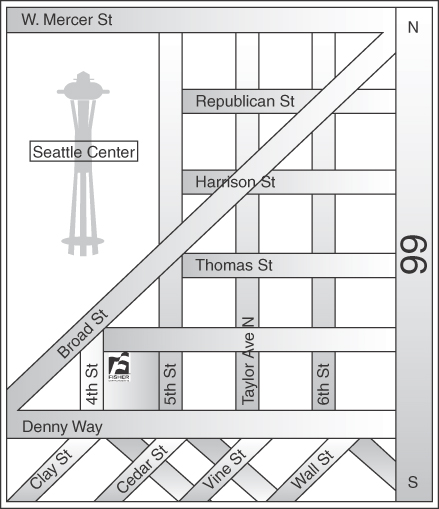

The Annual Meeting of Shareholders of the Company (the “Annual Meeting”) will be held at 10:00 a.m. on Wednesday, May 11, 2011 at Fisher Plaza, 140 4thAvenue North, 5th Floor Studios, Seattle, Washington 98109 (the entrance to the Fisher Plaza parking garage is on John Street). Directions to Fisher Plaza and a map are provided on the back cover of this Proxy Statement.

Who is soliciting my vote?

This Proxy Statement and the WHITE proxy card are provided in connection with the solicitation of proxies by our Board of Directors for the Annual Meeting. Proxy materials, including this Proxy Statement and the WHITE proxy card, were filed with the Securities and Exchange Commission (the “SEC”) on April 12, 2011, and we expect to first make this Proxy Statement available to our shareholders on or around April 12, 2011. Solicitation may be made by directors and officers of the Company, via electronic or regular mail, telephone, facsimile, press releases or personal interview. In addition, we have retained Georgeson Inc. to assist in the distribution and solicitation of proxies. Appendix I sets forth certain information relating to our directors and certain of our officers and employees who are deemed to be “participants” in our solicitation of proxies under the applicable rules of the SEC.

1

On what am I being asked to vote?

You are being asked to vote on the following matters in connection with our Annual Meeting:

| | • | | the election of three Class 3 directors, each for a term of three-years or until their successors have been elected and qualified, and to elect one Class 1 director for a term of one-year or until his or her successor has been elected and qualified; |

| | • | | the ratification of the Company’s independent registered public accounting firm for 2011; |

| | • | | the approval of an advisory resolution on the Company’s executive compensation; and |

| | • | | an advisory vote on the frequency of future shareholder advisory votes on the Company’s executive compensation. |

What are the Board of Directors’ recommendations?

Unless you give other instructions on your WHITE proxy card, the persons named as proxy holders on the WHITE proxy card will vote in accordance with the recommendations of the Board of Directors.As set forth in this ProxyStatement, the Board of Directors recommends a vote:

| | • | | “FOR” all of the Board’s nominees to be elected asdirectors; |

| | • | | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2011; |

| | • | | “FOR” the approval of the advisory resolution on the Company’s executive compensation; and |

| | • | | “FOR” the Company’s proposed frequency of future advisory votes on the Company’s executive compensation. |

Our Board of Directors recommends that you do NOT sign or return or otherwise cast a vote using any proxy card furnished by FrontFour.

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion in accordance with their best judgment.

Who is entitled to vote?

Only shareholders of record at the close of business on the record date, March 9, 2011 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that they held on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting.

Who can attend the Annual Meeting?

All shareholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. Admission to the Annual Meeting will be by admission ticket only. Family members are welcome to accompany you to the Annual Meeting. If you are a registered shareholder, the top half of the enclosed WHITE proxy card is your admission ticket. Neither voting instruction forms provided by your bank, broker or nominee nor proxy cards provided by FrontFour will serve as valid admission tickets. Upon arrival at the Annual Meeting, please present your admission ticket and photo identification at the registration desk. If you hold your shares in “street name” (that is, through a broker or other nominee), you may request an admission ticket by writing or phoning the Company; you will need to bring to the Annual Meeting a letter from the broker or other nominee confirming your beneficial ownership of Company shares as of the record date in addition to your photo identification.

2

How do I vote?

By Mail. Registered shareholders may vote their shares by signing, dating and mailing the enclosed WHITE proxy card using the enclosed postage pre-paid envelope. The Company strongly encourages you, however, to consider using the Internet or telephone voting options described below because these voting methods are faster and less costly than voting by mailing your signed and dated WHITE proxy card to us. If you vote via the Internet or telephone, you do not need to mail your WHITE proxy card.

By Internet. Registered shareholders may vote on the Internet at http://envisionreports.com/fsci. Please have your WHITE proxy card in hand when going online and follow the online instructions. Shareholders that vote by Internet must bear all costs associated with electronic access, including Internet access fees. Internet voting for registered shareholders is available up until 1:00 a.m., Central Time, on May 11, 2011, the day of the Annual Meeting. The Company is incorporated under Washington law, which specifically permits electronically transmitted proxies, provided that the transmission is set forth or submitted with information from which it can reasonably be determined that the transmission was authorized by the shareholder. The Internet voting procedures provided for the Annual Meeting are designed to authenticate each shareholder by use of a control number to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded. The control number can be found on the enclosed WHITE proxy card.

By Telephone. Registered shareholders may also vote by telephone by calling 1-800-652-8683 (toll-free) and using any touch-tone telephone to transmit their votes up to 1:00 a.m., Central Time, on May 11, 2011, the day of the Annual Meeting. Please have your WHITE proxy card in hand when you call and then follow the instructions. The control number necessary to vote your shares by telephone can be found on the enclosed WHITE proxy card.

If you are a registered shareholder and wish to exercise your right to cumulate votes in the election of directors, you must sign and return a proxy card by mail. Voting by internet or telephone is not available for registered shareholders who wish to cumulate their votes. If your shares are held of record in the name of a bank, broker or other nominee, please contact the person responsible for your account if you wish to exercise your right to cumulate votes in the election of directors.

If your shares are held of record in the name of a bank, broker or other nominee you should follow the separate instructions that the nominee provides to you. Although most banks and brokers now offer Internet and telephone voting, availability and specific processes will depend on their voting arrangements.

If you attend the Annual Meeting and wish to vote in person, you may request a ballot when you arrive. Alternatively, if you are a registered shareholder (you own shares in your own name) and attend the Annual Meeting, you may deliver your signed and dated WHITE proxy card in person. If your shares are held of record in the name of your bank, broker or other nominee and you would like to vote in person at the Annual Meeting, you must bring to the Annual Meeting a letter from the nominee indicating that you were the beneficial owner of the Company shares on the Record Date and have been granted a proxy by the your bank, broker or nominee to vote the shares.

What is the difference between holding shares as a registered shareholder and as a beneficial owner?

Registered Shareholders. You are a registered shareholder if at the close of business on the Record Date your shares were registered directly in your name with our transfer agent. We are providing the WHITE proxy cards to our registered shareholders to solicit their proxies to vote at the Annual Meeting.

Beneficial Owner. You are a beneficial owner if at the close of business on the Record Date your shares were held by a brokerage firm or other nominee and not in your name. Being a beneficial owner means that, like most of our shareholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your bank, broker or nominee how to vote your shares by following the voting instructions your bank, broker or other nominee provides. If you do not provide your bank, broker or nominee with instructions on how to vote your shares, your bank, broker or nominee will be able to vote your shares only with respect to Item 2, and not Items 1, 3 and 4.

3

Can I change my vote after I return my proxy card?

After you have submitted your proxy, you may change your vote at any time before the proxy is exercised by submitting to the Secretary of the Company either a written notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders with respect to your shares will be suspended if you attend the Annual Meeting in person and so request to the Secretary of the Company or vote in person, although attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

If you voted by telephone or the Internet and wish to change your vote, you may call the toll-free number or go to the Internet site, as may be applicable in the case of your earlier vote, and follow the directions for changing your vote.

What does it mean if I receive more than one WHITE proxy card or WHITE voting instruction form?

If your shares are registered in more than one name or are held in more than one account, you will receive more than one WHITE proxy card or WHITE voting instruction form. Please sign, date and return all of the WHITE proxy cards or WHITE voting instruction forms that you receive (or vote by telephone or the Internet all of the shares on all of the WHITE proxy cards or WHITE voting instruction forms received) to ensure that all of your shares are voted.

As previously noted, FrontFour has provided notice that it intends to nominate its own slate of four nominees for election as directors at the Annual Meeting. As a result, you may receive proxy cards from both FrontFour and the Company. To ensure shareholders have the Company’s latest proxy information and materials to vote, our Board of Directors expects to conduct multiple mailings prior to the date of the Annual Meeting, each of which will include a WHITE proxy card regardless of whether or not you have previously voted. Only the latest dated proxy card you vote will be counted.

What will happen if I do not vote my shares?

Registered Shareholders. If you are the registered shareholder of your shares and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner of your shares, and you do not provide specific voting instructions to your broker or nominee, your shares will not be voted at the Annual Meeting. Under the rules of the New York Stock Exchange, your broker or nominee does not have discretion to vote your shares at the Annual Meeting.

How may I obtain assistance in voting, completing my WHITE proxy card or with other questions regarding the Annual Meeting?

If you need assistance in voting by telephone or over the Internet or completing your WHITE proxy card or have questions regarding the Annual Meeting, please contact:

Georgeson Inc.

199 Water Street

New York, NY 10038

1-866-821-0284

(Banks and brokers please call: 1-212-440-9800)

What should I do if I receive a proxy card from FrontFour?

FrontFour may solicit proxies.Our Board of Directors recommends that you do NOT sign or return or otherwise cast a vote using any proxy card furnished by FrontFour. Even a vote against FrontFour’s nominees using its card will revoke any previous proxy given to the Company. If you have already sent a proxy card to FrontFour, you may revoke it and provide your support to the Board’s four nominees for director by

4

delivering a subsequent proxy by signing, dating and returning the enclosed WHITE proxy card in the enclosed postage prepaid envelope or using the Internet or telephone voting options described in this Proxy Statement and the enclosed WHITE proxy card. Only the latest dated proxy card you vote will be counted.

How many votes must be present to hold the Annual Meeting?

The presence at the Annual Meeting, in person or by proxy, of the holders of at least a majority of the Company’s shares of common stock outstanding on the Record Date is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purpose of determining the presence or absence of a quorum. As of the Record Date, 8,791,184 shares of common stock of the Company were outstanding.

In order for us to determine that enough votes will be present to hold the Annual Meeting, we urge you to vote by submitting the WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker, even if you plan to attend the meeting.

What vote is required to approve each item?

Election of Directors. Only four directors may be elected at the Annual Meeting. The directors elected will be the four nominees that receive the highest number of “FOR” votes cast at the Annual Meeting (the “Elected Nominees”) by shareholders present, in person or by proxy, and entitled to vote. Three of the Elected Nominees will serve for a three-year term as Class 3 directors, and one will serve for a one-year term as a Class 1 director. If Anthony B. Cassara is among the four Elected Nominees, he will serve as a Class 1 director. If Mr. Cassara is not elected, the Elected Nominee receiving the fourth highest number of “FOR” votes will serve as a Class 1 director. For example, if Mr. Cassara is not an Elected Nominee and a FrontFour nominee is the Elected Nominee receiving the fewest number of “FOR” votes, then such FrontFour nominee will serve as a Class 1 director. As a result, it is possible that a nominee for election as a Class 3 director to serve a three-year term could become a Class 1 director serving for a one-year term in the event that Mr. Cassara is not elected and such Class 3 nominee is an Elected Nominee receiving the fourth highest number of “FOR” votes.

In the election of directors, shareholders have cumulative voting rights. Accordingly, a shareholder may either:

| | • | | give one nominee (or divide in any proportion among some or all nominees) as many votes as the number of shares that such shareholder holds, multiplied by four (the number of directors to be elected); or |

| | • | | vote his or her shares, multiplied by four, equally among the nominees for election. |

If a shareholder wishes to cumulate his or her votes, he or she should multiply the number of votes he or she is entitled to cast by four (the number of directors to be elected) to derive a cumulative total and then write the number of votes for each director next to each director’s name on the proxy card. The total votes cast in this manner may not exceed the cumulative total. If you are a registered shareholder and wish to exercise your right to cumulate votes in the election of directors, you must sign and return a proxy card by mail. Voting by internet or telephone is not available for registered shareholders who wish to cumulate their votes. If your shares are held of record in the name of a bank, broker or other nominee, please contact the person responsible for your account if you wish to exercise your right to cumulate votes in the election of directors.

If a shareholder does not wish to cumulate votes for directors, he or she should indicate a vote “FOR” the nominees or a “WITHHOLD” vote with respect to the nominees, as provided on the proxy card. Unless you specify how your votes are to be cumulated among the Board’s nominees, the proxy solicited by the Board authorizes Michael D. Wortsman or Paul A. Bible, as proxy holders, to cumulate and cast all of the votes that you are entitled to cast at the Annual Meeting in connection with the election of directors in their sole discretion; provided that the proxy holders will not cumulate or cast your votes for any nominee from whom you have withheld authority to vote. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

5

Abstentions will have no effect on the election of directors because they will not represent votes cast for the purpose of voting on the matter. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the broker either does not exercise, or is not permitted to exercise, discretion to vote those shares on a particular matter. Brokers may not exercise discretion to vote shares as to which instructions are not given with respect to the election of directors, and therefore, broker non-votes will have no impact on the election of directors.

Please note that brokers may no longer use discretionary authority to vote shares on the election of directors if they have not received instructions from their clients. As a result, if your shares are held of record by your broker, bank, or other holder and you do not provide instructions as to how your shares are to be voted in the election of directors, your broker, bank, or other holder of record will not be able to vote your shares in the election of directors, and your shares will not be voted for any of the Board of Directors’ nominees. We urge you to provide instructions to your broker, bank, or other holder of record so that your votes may be counted on this important matter. We urge you to vote your shares by following the instructions provided in these proxy materials or the voting instruction form provided by your broker, bank, or other holder of record to ensure that your shares are voted on your behalf. Please vote your proxy so your vote can be counted.

Ratification of the Independent Registered Public Accounting Firm. The proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2011 will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. Each outstanding share will be entitled to one vote. Abstentions and broker non-votes will have no effect on this matter because they will not represent votes cast for the purpose of voting on this proposal.

Approval of the advisory resolution on the Company’s executive compensation and the proposed frequency of future advisory votes on the Company’s executive compensation. The approval of the advisory resolution on the Company’s executive compensation requires the affirmative vote of a majority of the votes cast on the matter, in person or by proxy, at the Annual Meeting. Each outstanding share will be entitled to one vote. Abstentions and broker non-votes are not counted for this advisory vote and, therefore, will have no effect on the outcome of this item. The results of this vote are not binding on the Board of Directors.

The advisory vote on the frequency of future advisory votes on the Company’s executive compensation will be determined based on a plurality of the votes cast. This means that the option that receives the most votes will be recommended by the shareholders to the Board of Directors. Abstentions and broker non-votes are not counted for this advisory vote and, therefore, will have no effect on the outcome of this item. The results of this vote are not binding on the Board of Directors.

Proxies and ballots will be received and tabulated by IVS Associates, Inc., our inspector of election for the Annual Meeting.

Who will bear the cost of soliciting votes for the Annual Meeting?

The Company is bearing the cost of providing this Proxy Statement and the enclosed WHITE proxy card in connection with the solicitation of proxies on behalf of our Board of Directors. The Company does not expect to pay any additional compensation to any of our directors and officers for the solicitation of proxies. We will reimburse brokers, nominees and similar record holders for reasonable expenses in mailing proxy materials to beneficial owners and the fees and expenses of Georgeson Inc. described below.

As a result of the proxy contest conducted by FrontFour, the Company has retained Georgeson Inc. to assist in the distribution and solicitation of proxies for aggregate total fees estimated to be approximately $175,000, plus reimbursement of out-of-pocket expenses. Georgeson expects that approximately 50 of its employees will assist in the solicitation. The Company’s total expenses (other than salaries and wages of officers and employees) related to the solicitation of shareholders as a result of the proxy contest conducted by FrontFour in excess of those normally spent for an annual meeting of shareholders, are currently expected to be between approximately $1,200,000 and $1,400,000, of which approximately $700,000 has been incurred to-date.

6

Your cooperation in promptly voting your shares and submitting your proxy via the Internet or telephone, or by completing and returning the enclosed WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker, will help to avoid additional expense.

What happens if the Annual Meeting is postponed or adjourned?

If we adjourn the Annual Meeting to a later date, we will conduct the same business at the later meeting and, unless Washington law requires us to set a new record date, only the shareholders who were eligible to vote at the original meeting will be permitted to vote at the adjourned meeting. Washington law requires the establishment of a new record date if the Annual Meeting is adjourned to a date more than 120 days after the date fixed for the original meeting. If we are not required to set a new record date, your proxy will still be effective and may be voted at the rescheduled meeting. You will still be able to change or revoke your proxy until it is voted by the proxy holder at the Annual Meeting.

When will the Company announce the results of the voting?

The Company will announce preliminary voting results following the Annual Meeting. Final and official voting results will be disclosed on a Current Report on Form 8-K within four business days after the Annual Meeting (which will be available atwww.sec.govand on our website atwww.fsci.com).

Will your independent registered public accounting firm participate in the Annual Meeting?

Yes. Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have the opportunity to make a statement if they so desire, and will be available to respond to appropriate questions by shareholders.

Proposal No. 1 — Election of Directors

Our Amended and Restated Articles of Incorporation, as amended (“Articles”), provide that our number of directors must fall within a range of 9 to 19, with the exact number to be determined pursuant to the Company’s Bylaws (the “Bylaws”). Our Bylaws currently provide that our Board of Directors consists of 10 directors. Our number of directors may be changed by amending the Bylaws. Our directors, George F. Warren, Jr. and William W. Warren, Jr., will retire from the Board of Directors when their current terms expire as of the 2011 Annual Meeting. We intend to eliminate the seat currently held by Mr. G. Warren and amend our Bylaws to reduce the number of our directors to nine as of such date.

Our directors are divided into three classes, with members of each class elected for terms of three years and until their successors have been elected and qualified. The current terms for our three director classes expire in the following years: Class 1: 2012; Class 2: 2013 and Class 3: 2011. Our Articles and Bylaws require that the terms of our directors be staggered such that approximately one-third of the directors are elected each year to the extent permitted by Washington law and no class may have fewer than three director seats.

In accordance with the above, our Board of Directors has nominated Richard L. Hawley, Roger L. Ogden, and Michael D. Wortsman for election as Class 3 directors at the 2011 Annual Meeting to serve for three-year terms to expire at the 2014 annual meeting. Messrs. Hawley and Wortsman are currently Class 3 directors of the Company previously elected by the shareholders. Our Board has also nominated Anthony B. Cassara for election as a Class 1 director to serve for a one-year term to expire at the 2012 annual meeting. Mr. Cassara is a current director of the Company elected by the Board to fill a Class 1 vacancy in February 2011. Our Bylaws provide that any director elected by the Board to fill a vacancy shall serve an initial term that lasts until the next election of directors by shareholders. In light of the decision by William W. Warren, Jr. to retire from the Board and not stand for re-election when his term expires at the 2011 Annual Meeting, the Board chose to nominate Mr. Ogden as a director nominee. Each of these nominees were recommended to the Board by the Nominating and Corporate Governance Committee and were approved by the Board, except David Lorber, FrontFour’s managing member, who was recused from the deliberations and vote. The recommendation of the Board is based on its

7

carefully considered judgment that the experience, record and qualifications of each of its nominees make them the best candidates to serve on the Board.

Unless a shareholder instructs otherwise on the WHITE proxy card, shares represented by properly signed proxies will be voted “FOR” the Board’s nominees. All four nominees have each agreed to serve if elected, and management and the Board of Directors presently have no reason to believe that they will be unable to serve or will not serve. If any of the Board’s nominees becomes unable to serve or for good cause will not serve as a director, proxies granted using the WHITE proxy card will be voted for the election of such person as will be designated by the Board of Directors to replace such Board nominee. If the Board designates any substitute nominees, the Company will file an amended proxy statement that, as applicable, identifies the substitute nominees, discloses that such nominees have consented to being named in the revised proxy statement and to serve if elected, and includes certain biographical and other information about such nominees required by SEC rules.

Our Board of Directors recommends a vote FOR the election of each of the Board’s nominees in accordance with the instructions on the enclosed WHITE proxy card or, if you do not receive a proxy card, the voting instruction form provided by your bank or broker, and urges you NOT to sign or return or otherwise vote your shares using any proxy card that you may receive from FrontFour.

If you determine to vote for less than all of the Board’s nominees, we strongly urge you to vote all your shares on a cumulative basis for such nominees.

Even if you sign a proxy card sent to you by FrontFour, you have the right to change your vote by using the enclosed WHITE proxy card. Only the latest dated proxy card you vote will be counted.

The Board of Directors Recommends That You Vote

“FOR” All of the Board’s Nominees to Be Elected As Directors.

8

INFORMATION WITH RESPECT TO NOMINEES AND

DIRECTORS WHOSE TERMS CONTINUE

Our Board of Directors is made of up of individuals possessing a diverse set of experience, qualifications, attributes and skills. As a result, each of our directors offers a unique and valuable perspective to the Company. The following tables set forth certain information with respect to director nominees and directors whose terms continue, including (i) the age of each director as of April 8, 2011, (ii) the term of his or her directorship, (iii) the principal occupation(s) of each director during at least the past five years, (iv) the other public company directorships held currently or at any time during at least the past five years, (v) family relationships with other directors and executive officers of the Company (first cousin or closer), if applicable, and (vi) the specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that each of the continuing members of our Board of Directors and each of the nominees should serve as a director as of the date of this Proxy Statement. All nominees have consented to being named in this Proxy Statement and to serve if elected. Proxies cannot be voted for a greater number of persons than the number of nominees named. If any nominee becomes unable to serve, the persons named as proxies may exercise their discretion to vote for a substitute nominated by the Nominating and Corporate Governance Committee and Board of Directors.

DIRECTOR NOMINEES FOR THE 2011 ANNUAL MEETING

| | |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

Class 1 Director Nominee Anthony B. Cassara, 67 | | Mr. Cassara has been a director of the Company since February 2011. Since January 2008, Mr. Cassara has been a principal and founding member of Clocktower Partners LLC, a media management firm. Since April 2011, Mr. Cassara has also been serving as the chief executive officer of New Young Broadcasting Holding Co., Inc. (“Young Broadcasting”). From 2000 until 2008, he served as an executive vice president of Chartwell Partners LLC, an investment firm focused on media and communications, and from 1993 until 2000, served as president of Paramount Pictures’ Television Stations Group. Mr. Cassara also served for over five years as the general manager at KTLA Channel 5 in Los Angeles, California. Mr. Cassara served on the board of directors of Univision Television Group from 2005 until 2008, and currently serves on the boards of directors of Hero Broadcasting and Young Broadcasting, where he is the Chairman of the Compensation Committee. He joined the Young Broadcasting board after the company’s Chapter 11 bankruptcy filing. Mr. Cassara was recently elected to fill a vacancy and was nominated to continue to serve as a director due to his over 30 years of experience in the broadcast industry, including past executive experience at Paramount Pictures’ Television Stations Group, and as a station general manager at KTLA in Los Angeles. The Board also considered Mr. Cassara’s extensive transactional experience in the broadcasting industry through his work with several investment and management firms, and has served on numerous industry boards, including the boards of the National Association of Broadcasters, Univision Television Group, and as Chairman of the Board of Television Bureau of Advertising, Inc. (TVB). In addition, Mr. Cassara is an independent director. |

9

| | |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

Class 3 Director Nominees Richard L. Hawley, 61 | | Mr. Hawley has been a director of the Company since 2003. Mr. Hawley has been Executive Vice President and Chief Financial Officer of Nicor Inc., a publicly-traded holding company, and Nicor Gas, a natural gas distribution company, since 2003. Mr. Hawley was Vice President and Chief Financial Officer of Puget Energy, Inc., a public utility holding company, and Puget Sound Energy, Inc., a public utility, from 1998 to 2002. Mr. Hawley was nominated to continue to serve as a director due to his current and past public company executive experience, including service as a chief financial officer, 25 years of experience with an international public accounting firm, financial and accounting expertise, and his status as independent director. |

| |

| Roger L. Ogden, 65 | | Mr. Ogden currently serves as an independent consultant to several broadcast related companies. From July 2005 until his retirement in July 2007, he was President and Chief Executive Officer of the Gannett Television Division, where he had overall responsibility for 23 television stations owned by Gannett and also served as Senior Vice President of Design, Innovation and Strategy for Gannett Co., Inc., encouraging development of new business ideas and improved processes, from June 2006 until July 2007. From August 1997 to July 2005 he served as President and General Manager of KUSA Television in Denver, Colorado where he had overall management responsibility for this local NBC affiliate station, and as a Senior Vice President of the Gannett Television Division of Gannett Co., Inc. From 1981 to 1997 he served as President and General Manager of KCNC-TV in Denver, Colorado, and President of NBC Europe for The General Electric Company. From 1994 to 1997, Mr. Ogden served on the Board of Directors of The Associated Press, and he currently serves as Chairman of the Board of Directors of Chyron Corporation, a publicly-traded digital and broadcast graphics company, and is a director and Chairman of the Compensation Committee of the Board of Directors at E.W. Scripps Company, a publicly-traded media company with interests in newspaper publishing, broadcast television stations, and licensing and syndication. Mr. Ogden was nominated to be elected as a director due to his over 35 years of experience in the broadcast industry, including past leadership and executive experience at KUSA Television and Gannett. The Board also considered Mr. Ogden’s experience as a current director and Chairman of the Compensation Committee of E.W. Scripps Company, his experience as Chairman of the Board of Directors of Chyron Corporation, and his eligibility to qualify as an independent director. |

10

| | |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

| Michael D. Wortsman, 63 | | Mr. Wortsman has been a director of the Company since July 2007. Since April 2009, Mr. Wortsman has served as our non-executive Chairman of the Board of Directors. From January 2010 until May 2010, Mr. Wortsman served as the interim Chief Executive Officer, and since May 2010, has served as the Chairman, at ImpreMedia, a Spanish-language online and print news publisher. Mr. Wortsman is also currently a private investor focusing on television content and feature film production, and has served as a Senior Managing Partner of Frontera Productions LLC, a film production company he co-founded, since January 2008. He was President of Univision Television Group, the leading Spanish language media company in the United States, from 1997 until the sale of the company in April 2007. Before joining Univision as Executive Vice President, Corporate Development in 1993, Mr. Wortsman held various executive positions at ABC, FOX and NBC-owned television and radio stations. Mr. Wortsman was nominated to continue to serve as a director due to his over 30 years of experience in the broadcasting industry, including his executive positions at Univision Television Group and at ABC, FOX and NBC-owned television and radio stations, and past experience on the board of directors of the National Association of Broadcasters. In addition, Mr. Wortsman is an independent director. |

|

| CONTINUING CLASS 1 DIRECTORS WITH TERM EXPIRING IN 2012 |

| |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

| Paul A. Bible, 70 | | Mr. Bible has been a director of the Company since April 2009. Since 2010, Mr. Bible has been a senior partner in Lewis & Roca LLP, a regional law firm. From 2006 until 2010, Mr. Bible was a principal in Bible Mousel PC, a Nevada law firm specializing in gaming law. From 1984 to 2006, Mr. Bible was a shareholder in Bible Hoy & Trachok PC, a law firm. Mr. Bible is the former Chairman of the Nevada Gaming Commission. After earning his J.D. from Georgetown University Law Center, Mr. Bible served in the Judge Advocate General’s Corps of the U.S. Army and is a veteran of the Vietnam Conflict. Mr. Bible is a current non-director member of the independent governance committee of AMERCO, the publicly-traded parent company of U-Haul International, Inc., a moving and storage company. Mr. Bible possesses over 46 years of experience as a practicing attorney specializing in compliance and corporate governance, experience as the chairman of the compliance committee for three licensed gaming companies, experience as a non-director member of the independent governance committee of a publicly-traded company, and experience as the chairman of a state regulatory agency. In addition, Mr. Bible was nominated by our largest shareholder, GAMCO Asset Management, Inc., and is an independent director. |

11

| | |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

| David A. Lorber, 32 | | Mr. Lorber has been a director of the Company since April 2009. Mr. Lorber is a Co-Founder of FrontFour Capital Group LLC, an event-driven hedge fund, and has served as a Portfolio Manager of FrontFour since 2007. From 2003 to 2006, Mr. Lorber served as Director and Senior Investment Analyst at Pirate Capital LLC, a hedge fund. From 2001 to 2003, Mr. Lorber was an Analyst at Vantis Capital Management LLC, a money management firm and hedge fund. From 2000 to 2001, Mr. Lorber was an Associate at Cushman & Wakefield, Inc., a global real estate firm. Since 2006, Mr. Lorber has been a director of GenCorp Inc., a publicly-traded technology-based manufacturer of aerospace and defense products and systems, where he currently serves as the Chairman of the Organization & Compensation Committee and as a member of the Audit Committee. He also served as a director of International Aviation Terminals (IAT) Inc. during 2008 and as a trustee for the IAT Air Cargo Facilities Income Fund until its merger with Huntingdon Real Estate Investment Trust in 2009. Mr. Lorber currently serves as a director of Huntingdon Real Estate Investment Trust. Mr. Lorber possesses experience in the finance and investment industry and past and current experience as a public company director. In addition, Mr. Lorber was nominated by our largest shareholder, GAMCO Asset Management, Inc., and is an independent director. |

|

| CONTINUING CLASS 2 DIRECTORS WITH TERMS EXPIRING IN 2013 |

| |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

| Colleen B. Brown, 52 | | Ms. Brown has been President and Chief Executive Officer of the Company since October 2005. She has been a director of the Company since October 2006. From 2004 to 2005, Ms. Brown was President and owner of Aberdeen Media Corporation, an entrepreneurial venture founded to pursue opportunities in the U.S. television market. Ms. Brown served as Senior Vice President at Belo Corp., a publicly-traded television company, from 2000 to 2003 and as President of the broadcast group for Lee Enterprises, Incorporated, a provider of local news, information and advertising in primarily midsize markets, from 1998 until the sale of the broadcasting group in 2000. From 1980 to 1998, Ms. Brown served in various senior management capacities for the broadcasting operations of Gannett Co., Inc., an international news and information company. Ms. Brown holds a Master of Business Administration degree from the University of Colorado at Boulder. Ms. Brown is the Company’s President and Chief Executive Officer. She brings valuable insights to the Board based on her involvement with the day-to-day affairs of the Company. She possesses over 30 years of experience in the broadcasting industry, including executive positions at Gannett, Lee and Belo, and has past board experience within the technology industry. |

12

| | |

Name and Age | | Principal Occupation(s) Of Director During Last Five Years |

| |

| Donald G. Graham, III, 56 | | Mr. Graham has been a director of the Company since 1993. Mr. Graham owns Cerberus Productions, LLC, a visual advertising production company based in New York City. He was a Vice President and a director of the O.D. Fisher Investment Company, a private investment company, from 1989 until its liquidation in 2008. Mr. Graham possesses over 30 years of experience in advertising campaign production, and over 20 years of experience as a director of the O.D. Fisher Investment Company. He brings valuable insights to the Board based on his 17 years of service as a Company director. In addition, he is an independent director and a member of the Fisher family, which collectively is a significant holder of Company common stock. |

| |

| Brian P. McAndrews, 52 | | Mr. McAndrews has been a director of the Company since October 2006. Since September 2009, Mr. McAndrews has been a Managing Director of Madrona Venture Group, an investment firm. From August 2007 to December 2008, Mr. McAndrews served as a Senior Vice President of Advertiser and Publisher Solutions at Microsoft Corporation, a provider of software, services and solutions. Prior to its acquisition by Microsoft Corporation, Mr. McAndrews ran aQuantive, Inc., a publicly-traded global digital marketing company, serving as Chief Executive Officer and a director from 1999 to 2007, and as President from 2000 to 2007. From 1990 to 1999, Mr. McAndrews worked for ABC, Inc., a television network and communications company, holding executive positions at ABC Sports, ABC Entertainment and ABC Television Network. Mr. McAndrews served as a director of Blue Nile, Inc., a publicly-traded retailer, from 2004 until 2007, and currently serves as a director of Clearwire Corporation, a publicly-traded provider of high speed internet services to consumers and businesses, WhitePages.com Inc. and the United Way of King County. Mr. McAndrews possesses experience as a chief executive officer for a publicly-traded company in the technology industry, as well as current and past public company director experience and both his digital media and network television experience. In addition, he is an independent director. |

DIRECTOR INDEPENDENCE

The Board of Directors has determined that each of the current directors and nominees listed above under “Information with Respect to Nominees and Directors Whose Terms Continue,” except Ms. Colleen B. Brown, is, or would be if elected, an independent director of the Company within the meaning of Rule 5605(a)(2) of Nasdaq’s Listing Rules. The Board of Directors also determined that Deborah L. Bevier, who resigned as a member of our Board of Directors on December 31, 2010 was independent during 2010, and that George F. Warren Jr. and William W. Warren, Jr., who are retiring from our Board of Directors as of the Annual Meeting, are independent.

13

INFORMATION REGARDING THE BOARD OF DIRECTORS

AND ITS COMMITTEES

The following sets forth information concerning our Board of Directors and its Committees during 2010.

How Often Did the Board of Directors Meet During 2010?

Our Board of Director held six meetings in 2010. During 2010, each current director (except Mr. Cassara who was not a director in 2010) and Ms. Bevier attended at least 75 percent of the aggregate of:

(i) the total number of meetings of the Board of Directors that were held during the period he or she served as a director; and

(ii) the total number of meetings held by all committees of the Board of Directors on which he or she served.

Each of our current directors served during all of 2010, except Mr. Cassara, who joined our Board on February 18, 2011.

The independent directors hold regularly scheduled executive sessions at which only independent directors are present, as required by Rule 5605(b)(1) of Nasdaq’s Listing Rules. Our non-executive Chair of the Board generally presides at such meetings.

We do not have a formal policy regarding attendance by members of the Board of Directors at our Annual Meeting of Shareholders. All of our current directors attended our 2010 Annual Meeting of Shareholders, except Mr. Cassara, who was not a director at that time.

Committees of the Board of Directors

Our Board of Directors currently has the following standing committees:

| | • | | the Compensation Committee; and |

| | • | | the Nominating and Corporate Governance Committee. |

Audit Committee. Our Audit Committee oversees our accounting and financial reporting processes and the audits of our financial statements. The duties and responsibilities of the Audit Committee are governed by a written charter adopted by our Board of Directors. A current copy of the charter is available on our website atwww.fsci.com under the heading “Investor Information.”

Pursuant to the Audit Committee’s charter, the responsibilities of the Audit Committee require it to, among other things:

| | • | | as necessary, consider with management and our outside auditor the rationale for employing audit firms other than the principal outside auditor; |

| | • | | as necessary, take reasonable steps to confirm with our outside auditor that the outside auditor reports directly to the Audit Committee; |

| | • | | resolve disagreements between management and our outside auditor; |

| | • | | approve the compensation of our outside auditor, and, as necessary, review and approve the discharge of our outside auditor; |

| | • | | take reasonable steps to confirm the independence of our outside auditor; |

| | • | | consider, in consultation with our outside auditor, the audit scope and plan; |

| | • | | pre-approve the retention of our outside auditor for all audit services and those non-audit services our outside auditor is permitted to provide to us; |

| | • | | review with our outside auditor the coordination of the audit effort for the effective use of audit resources; |

14

| | • | | at least annually, evaluate our outside auditor’s performance and independence; |

| | • | | ensure that our outside auditor’s lead partner and reviewing partner are replaced every five years; |

| | • | | review filings with the Securities and Exchange Commission; |

| | • | | consider and review with our outside auditor the adequacy of our internal controls; |

| | • | | review and discuss with management and our outside auditor, at the completion of the annual examination, our audited financial statements and related footnotes, our outside auditor’s audit of the financial statements and their report on the financial statements, and any serious difficulties or disputes with management encountered during the course of the audit; |

| | • | | consider and review with management significant findings during the year and management’s responses thereto, any difficulties encountered in the course of our outside auditor’s audits, including any restrictions on the scope of their work or access to required information, and any changes required in the planned scope of the audit plan; |

| | • | | review, develop and monitor compliance with our Code of Ethics for the Chief Executive Officer and senior financial officers; |

| | • | | establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, and establish procedures for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and |

| | • | | review any reports by management regarding the effectiveness of, or any deficiencies in, the design or operation of internal controls. |

During 2010, our Audit Committee held six meetings. The current members of the Audit Committee are Mr. Hawley (Chair), Mr. Lorber, and Mr. W. Warren, Jr. Deborah L. Bevier was a member of the Audit Committee during all of 2010. Our Board of Directors has determined that Mr. Hawley is an audit committee financial expert, within the meaning of applicable Securities and Exchange Commission rules. All of the current members of our Audit Committee are, and all members during 2010 were, independent directors within the meaning of Rules 5605(a)(2) and 5605(c)(2) of Nasdaq’s Listing Rules.

Compensation Committee. Our Compensation Committee has the overall responsibility for approving, administering and evaluating equity and other compensation plans, policies and programs for us. The Compensation Committee may form and delegate authority to subcommittees. The Compensation Committee may also delegate authority to one or more designated members of the Compensation Committee or of the Board of Directors or to our officers to perform certain of its duties on its behalf.

The Compensation Committee acts pursuant to a written charter adopted by our Board of Directors. A current copy of the charter is available on our website atwww.fsci.com under the heading “Investor Information.”

The Compensation Committee:

| | • | | approves the annual cash compensation, including salary, bonus and incentive compensation of our executive officers, other than our Chief Executive Officer; |

| | • | | reviews and approves cash and equity compensation packages for new executive officers and termination packages for executive officers, other than our Chief Executive Officer; and |

| | • | | reviews and approves any new equity awards granted as part of a compensation package for a new Chief Executive Officer and any new equity awards granted as part of a termination package for a departing Chief Executive Officer. |

The Compensation Committee assists our Board of Directors in establishing our Chief Executive Officer’s annual goals and objectives and annually evaluates our Chief Executive Officer’s performance. In addition, the Compensation Committee recommends our Chief Executive Officer’s cash compensation to our Board of Directors for approval consistent with our compensation philosophy. In approving the long-term incentive component of our Chief Executive Officer’s compensation, the Compensation Committee generally considers our

15

performance and relative shareholder return, the value of similar incentive awards to the chief executive officers at comparable companies and the awards given to our Chief Executive Officer in prior years.

The Compensation Committee reviews trends in executive compensation, oversees the development of new compensation plans, and, when necessary, approves revisions to the existing plans. The Compensation Committee also assesses the competitiveness of our executive compensation programs to ensure (a) the attraction and retention of executives, (b) the motivation of executives to achieve our business objectives, and (c) the alignment of the interests of key leadership with the long-term interests of our shareholders.

The Compensation Committee also reviews and recommends to our Board of Directors changes in compensation for members of our Board of Directors and its Chairman, and administers our equity incentive plans. The Compensation Committee approves all equity awards granted to our executive officers under our equity incentive plans.

During 2010, the Compensation Committee held four meetings. The current members of the Compensation Committee are Mr. McAndrews (Chair), Mr. Bible, and Mr. Wortsman. Deborah L. Bevier was the Chair of the Compensation Committee until December 1, 2010 and a member during all of 2010. All of the current members of the Compensation Committee are, and all members during 2010 were: (a) independent directors within the meaning of Rule 5605(a)(2) of Nasdaq’s Listing Rules, (b) “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and (c) “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The Compensation Committee has the sole authority to retain and terminate outside counsel, compensation consultants, or other experts or consultants, as it deems appropriate, including sole authority to approve the fees and other retention terms for these persons. The Compensation Committee periodically retains Towers Watson to serve as its independent compensation consultant. At the request and direction of the Compensation Committee, Towers Watson provides analyses of our executive compensation programs and comparisons to executive compensation programs of peer companies in the media/broadcast industry and other non-broadcast specific companies of similar size to us. In addition to survey data, Towers Watson provided the Compensation Committee with proxy statement data for national market industry peers and local market general industry peers. Towers Watson does not determine or recommend executive compensation, but rather provides the Compensation Committee with guidance based on market practices and Towers Watson’s experience and understanding of our needs and objectives. Please read our “Compensation Discussion and Analysis” beginning on page 25 of this Proxy Statement for a discussion of the work conducted by Towers Watson on behalf of the Compensation Committee in 2010.

Our Chief Executive Officer recommends the compensation structure for our executive officers, other than the Chief Executive Officer. The Compensation Committee reviews and approves our Chief Executive Officer’s recommendations together with any changes or adjustments as the Compensation Committee deems appropriate. The Compensation Committee has periodically provided our Chief Executive Officer with ranges for compensation and equity awards pursuant to which our Chief Executive Officer may make offers to key executives. The Compensation Committee collaborates with our Chief Executive Officer and our Board of Directors to establish our company performance objectives. To establish the individual performance objectives for each named executive officer, the Committee works with our Chief Executive Officer. The Compensation Committee also reviews periodic reports from management on matters relating to our compensation practices. Our Chief Executive Officer typically attends all meetings of the Compensation Committee, except for those meetings, or portions thereof, where her compensation is discussed. Please read our “Compensation Discussion and Analysis” beginning on page 25 of this Proxy Statement for a discussion of the role of our Chief Executive Officer in determining or recommending the amount or form of executive compensation in 2010.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee identifies individuals qualified to become members of our Board of Directors, approves and recommends to our Board of Directors director candidates, and, if necessary or desirable in the opinion of the committee, develops and recommends to our Board of Directors corporate governance principles and policies applicable to the Company.

16

The Nominating and Corporate Governance Committee acts pursuant to a written charter adopted by our Board of Directors. A current copy of the written charter is available on our website atwww.fsci.com under the heading “Investor Information.” During 2010, the Nominating and Corporate Governance Committee held seven meetings. Our Nominating and Corporate Governance Committee currently consists of Mr. Bible (Chair), Mr. Hawley, Mr. Graham, III, and Mr. Wortsman. All of the members of the Nominating and Corporate Governance Committee are independent directors within the meaning of Rule 5605(a)(2) of Nasdaq’s Listing Rules.

Director Candidate Qualifications. When considering potential director candidates for nomination or election, our Nominating and Corporate Governance Committee considers the following qualifications, among others, of each director candidate:

| | • | | high standard of personal and professional ethics, integrity and values; |

| | • | | training, experience and ability at making and overseeing policy in business, government and/or education sectors; |

| | • | | willingness and ability to devote the required time and effort to effectively fulfill the duties and responsibilities related to Board of Directors and committee membership; |

| | • | | willingness not to engage in activities or interests that may create a conflict of interest with a director’s responsibilities and duties to us and our constituents; |

| | • | | willingness to act in our best interests and in the best interests of our constituents, and |

| | • | | willingness to objectively assess the performance of our Board of Directors, Board committees and management. |

Except as discussed in the previous paragraph, there are no stated minimum qualifications for director nominees. However, our Board of Directors believes that its effectiveness depends on the overall mix of the skills and characteristics of its directors. Accordingly, the following factors, among others, relating to overall Board composition are considered when determining Board of Director needs and evaluating director candidates to fill such needs:

| | • | | professional experience; |

| | • | | industry knowledge (e.g., relevant industry or trade association participation); |

| | • | | skills and expertise (e.g., accounting or financial); |

| | • | | public company board and committee experience; |

| | • | | non-business-related activities and experience (e.g., academic, civic, public interest); |

| | • | | board continuity (including succession planning); |

| | • | | number and type of committees, and committee sizes; and |

| | • | | legal requirements and Nasdaq, or other applicable trading exchange or quotation system, requirements and recommendations, and other corporate governance-related guidance regarding board and committee composition. |

Our Nominating and Corporate Governance Committee considers diversity as one of several factors relating to overall composition when making nominations to our Board of Directors. While we do not have a formal policy governing how diversity is considered, the Nominating and Corporate Governance Committee generally considers diversity by examining the entire Board membership and, when making nominations to our Board of Directors, by

17

reviewing the diversity of the entire Board. The Nominating and Corporate Governance Committee construes Board diversity broadly to include many factors. As a result, the Nominating and Corporate Governance Committee strives to ensure that our Board of Directors is represented by individuals with a variety of different opinions, perspectives, personal, professional and industry experience and backgrounds, skills and expertise.

Identification and Evaluation of Director Candidates. Our Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of our Board of Directors willing to continue to serve. In the event of a vacancy on our Board of Directors, the committee’s charter requires the Chairman of the committee to initiate the effort to identify appropriate director candidates. The Nominating and Corporate Governance Committee may choose to maintain a list of director candidates to consider and propose to our Board of Directors, as required. If necessary or desirable in the opinion of the Nominating and Corporate Governance Committee, the committee will determine appropriate means for seeking additional director candidates. These means may involve the engagement of an outside consultant to assist in the identification of director candidates or the solicitation of ideas for possible candidates from a number of sources, including members of our Board of Directors, our executives and individuals personally known to the members of our Board of Directors or executives. The Nominating and Corporate Governance Committee interviews potential candidates and as a result of their evaluations may recommend the candidate for our Board of Directors’ consideration. In addition, background and reference checks generally will be conducted. Mr. Cassara joined our Board in February 2011 and Mr. Ogden is a new nominee. At the request of our Nominating and Corporate Governance Committee for identification of potential director candidates with strong broadcasting industry experience, a non-management director identified and recommended Mr. Cassara and our Chief Executive Officer identified and recommended Mr. Ogden.

Potential director candidates should be referred to the Chairman of the Nominating and Corporate Governance Committee for consideration by the committee and possible recommendation to our Board of Directors. The Nominating and Corporate Governance Committee will evaluate shareholder-recommended nominees based on the same criteria as Board of Director-recommended nominees.

The Nominating and Corporate Governance Committee will also consider nominations made by shareholders. In accordance with our Bylaws, to nominate a director for election to our Board of Directors at an annual meeting of shareholders, a shareholder must deliver written notice of nomination by personal delivery or by registered or certified mail, postage prepaid, to our Secretary at our principal executive offices at 140 4th Avenue North, Suite 500, Seattle, Washington 98109. The nomination must be received by our Secretary not fewer than 90 days nor more than 120 days prior to the anniversary date of the prior year’s annual meeting. If the date of the annual meeting is advanced more than 30 days prior to, or delayed by more than 30 days after, the anniversary of the prior year’s annual meeting, written notice by the shareholder must be received by our Secretary not earlier than the close of business on the 90th day and not later than the close of business on the later of (i) the 90th day prior to the annual meeting or (ii) the tenth day following the day on which the notice of the date of the annual meeting was mailed or public disclosure was made. The shareholder’s notice of an intention to nominate a director must include the required information set forth in Section 3.3.1 of our Bylaws.

Communication with our Board of Directors

Shareholders and other parties interested in communicating directly with the Chairman of our Board of Directors or with our non-management directors as a group may do so by writing to: Chairman of the Board of Directors, Fisher Communications, Inc., 140 4th Avenue North, Suite 500, Seattle Washington 98109.

Compensation Committee Interlocks and Insider Participation

Each of Ms. Bevier, Mr. McAndrews and Mr. Wortsman served as members of the Compensation Committee during all of 2010, and Mr. Bible served from December 1, 2010. None of the members was an officer or employee of our Company or any of our subsidiaries during 2010 or in any prior fiscal year. No executive officer of our Company served on the board of directors or compensation committee of any other entity that has or had one or more executive officers who served as a member of our Board of Directors or Compensation Committee during 2010.

18

Code of Conduct and Code of Ethics

We have a Code of Conduct applicable to all of our directors, officers and employees. We also have a Code of Ethics applicable to our Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Controller, general managers, station managers and business managers. The Code of Conduct and the Code of Ethics are available on our website atwww.fsci.com under the heading “Investor Information.” We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding any amendments to or waivers of our Code of Ethics by posting such information at this location on our website. Upon request, we will provide to any person without charge a copy of our Code of Ethics. Written requests should be addressed to Investor Relations, Fisher Communications, Inc., 140 4th Avenue North, Suite 500, Seattle, Washington 98109.

Board Leadership Structure

Although Colleen B. Brown, our President and Chief Executive Officer, serves as a director, our Board of Directors is led by Michael D. Wortsman, our independent non-executive Chairman of the Board. We currently believe this is the most appropriate Board leadership structure because it provides our Board of Directors with a beneficial balance between the leadership offered by our Chief Executive Officer, who is the only non-independent member of our Board of Directors, and the independent perspective provided by our Chairman. We believe that this structure is generally preferred by our shareholders. Our Board of Directors believes its administration of its risk oversight function as discussed below has not affected its leadership structure.

Risk Oversight