Exhibit 13

ANNUAL REPORT 2012

Making Driving Safer

Theactive safety system continuously checks the environment around the vehicle for potential dangerous objects using radar and/or cameras and the information is shown using a Head-up Display on the inside of the windshield. The system can be used for many different applications, some of them are described below.

AUTONOMOUS EMERGENCY BRAKING

Many accidents are caused by late braking and/or braking with insufficient force. Autoliv’s autonomous braking system uses radar sensors to help the driver avoid these kinds of accidents or, at least, to reduce their severity.

When the radar sensors detect an obstacle ahead of the car, the driver will be warned, typically 2.5 seconds, before a potential impact. If the driver fails to react, the system will autonomously apply the brakes with full power approximately one second later and, as a precaution, tighten the active seatbelts using reversible electrical pretensioners.

ADAPTIVE CRUISE CONTROL

The radar sensors can also be used for Adaptive Cruise Control (ACC). The ACC is similar to traditional cruise control in that it keeps the vehicle’s pre-set speed automatically. The biggest difference between the two, however, is that ACC can also automatically adjust the vehicle’s speed to keep a pre-set distance from vehicles ahead. For example, if the vehicle ahead slows down, or if another vehicle comes into the lane, the ACC sends a signal to the engine or brake system to keep the pre-set distance. When the road is clear again, the ACC will accelerate the vehicle up to the pre-set speed.

READER’S GUIDE

Autoliv, Inc. is incorporated in Delaware, USA, and follows Generally Accepted Accounting Principles in the United States (U.S. GAAP). This annual report also contains certain non-U.S. GAAP measures, see page 42 and page 54 in the Annual Report. All amounts in this annual report are in U.S. dollars unless otherwise indicated.

“We”, “the Company” and “Autoliv” refer to “Autoliv Inc.” as defined in Note 1 “Principles of Consolidation” on page 60 in the Annual Report. For forward-looking information, refer to the “Safe Harbor Statement” on page 55 in the Annual Report.

Data on markets and competitors are Autolivs’ estimates (unless otherwise indicated). The estimates are based on orders awarded to us or our competitors or other information put out by third parties as well as plans announced by vehicle manufacturers and regulatory agencies.

FINANCIAL INFORMATION

Every year, Autoliv publishes an annual report and a proxy statement prior to the Annual General Meeting of Shareholders, see page 36 in the Annual Report.

The proxy statement provides information not only on the agenda for the meeting, but also on the work of the Board and its committees as well as on compensation paid to and presentation of directors and certain senior executive officers.

For financial information, please also refer to the Form 10-K and Form 10-Q reports and Autoliv’s other filings with the Securities and Exchange Commission (SEC) and the New York Stock Exchange (NYSE). These filings (including the CEO/CFO Section 302 Certifications, Section 16 Insider Filings) are available at www.autoliv.com under Investors/Filings.

The annual and quarterly reports, the proxy statement and Autoliv’s filings with the SEC as well as the Company’s Corporate Governance Guidelines, Charters, Codes of Ethics and other documents governing the Company can be downloaded from the Company’s corporate website. Hard copies of the above-mentioned documents can be obtained free of charge from the Company at the addresses on page 88 in the Annual Report.

CONTENT

|

| President’s Letter |

| Autoliv’s Targets |

| Autoliv in Brief |

| Safety Systems |

| Innovations |

| Testing Capabilities |

| Social Responsibility |

| Employees |

| Global Presence |

| Market |

| Customers |

| Manufacturing & Purchasing |

| Quality |

| Shareholders |

| Share Performance |

Management’s Discussion and Analysis |

| Consolidated Statements of Income |

| Consolidated Balance Sheets |

| Consolidated Statements of Cash Flows |

| Consolidated Statements of Total Equity |

| Notes to Consolidated Financial Statements |

| Auditor’s Reports |

| Glossary and Definitions |

| Corporate Governance |

| Board of Directors |

| Executive Management |

| Contact Information & Calendar |

| Selected Financial Data |

2012 in Summary

– Organic sales1) up 4% with sales of active safety up nearly 40%

– Action program to align capacity in Europe

– Dividends raised to record levels

– The world’s first pedestrian protection airbag introduced

– New “green” airbag inflator with 20% less weight

Over the past ten years, Autoliv’s sales have become better balanced with Europe, the Americas and Asia accounting for 32%, 35% and 33%, respectively, of sales. Compared to 56%, 31% and 13% in 2003.

| 1) | Non-U.S. GAAP measure, see page 42 of the Annual Report. |

Dear Shareholder,

In 2012, we continued to deliver on our growth strategy. Our organic sales grew by 4% despite the fact that light vehicle production (LVP) in the important Western European market dropped by 8%.

We managed to offset this effect with strong performance in China and in active safety where our sales increased by 36%.

We also benefitted from the continued LVP recovery in North America since the 2008-09 financial crisis and the Japanese LVP rebound after the 2011 tsunami. As a result, we achieved new record sales of $8.3 billion. This was in spite of negative currency effects and a small divestiture.

In addition, 2012 was another year with record order intake which confirms our market leadership position.

In light of these achievements, I would like to thank our employees for their hard work and strong contributions in 2012.

ALIGNING CAPACITY LOCALLY

In response to the sharp drop in Western European LVP, we started to implement a capacity alignment program. We announced it at the beginning of the year, before most companies announced their restructuring programs.

Initially, we estimated the cost for our program as “more than $50 million.” In response to the further deterioration in the outlook for European LVP, we raised in April the expected cost to $60-80 million and, in October, to the higher end of that range. Eventually, the cost for the capacity alignment program ended up at $79 million.

We have also decided to expand the program into 2013 and expect capacity alignments to cost another $25-50 million.

These actions should ensure that we have the right resources in the right place at the right time.

HIGHER DIVIDENDS AND INVESTMENTS

Another important achievement during 2012, was our operating cash flow of $689 million. This allowed us – in combination with a strong balance sheet – to continue to raise the quarterly dividends to shareholders. The dividend per share was first raised from 45 cents to 47 cents for the second and the third quarters and then to 50 cents for the fourth quarter. This came after three dividend increases during 2011. In total, the dividend was raised by 15% between 2011 and 2012, which had the effect of returning 54% of the 2012 “free cash flow” (i.e. net cash provided by operating activities less net cash used in investing activities) to shareholders.

The healthy cash flow has also allowed us to invest for the future and to continue to spend almost 4.5% of sales in capital expenditures. These capital investments will not only provide much-needed additional manufacturing capacity in China and other growth markets but also increase our vertical integration. This will thereby enhance our competitive edge and mitigate the pricing pressure effect in our industry.

In 2012, we announced Autoliv’s largest capital investment ever – a $33 million new gas generant plant in China. This investment, in combination with an expansion of our North American gas generant plant, will provide the potential to grow our global airbag manufacturing capacity by approximately 30%. In addition, we are increasing our North American manufacturing capacity for initiators for airbags and for micro gas generators for pyrotechnic seatbelt pretensioners. These capital expenditures will increase our vertical integration and reduce costs, in addition to providing necessary additional manufacturing capacity.

In 2012, we also began the extensions of our technical center in China and of our seatbelt assembly plant in Hungary. A new assembly facility for airbags and seatbelts was completed in Indonesia and a new steering wheel plant in Romania as well as a new seatbelt assembly plant in Russia.

A PRO-ACTIVE BALANCE SHEET

Despite these higher investments for the future and higher dividends, Autoliv’s net cash increased by almost $270 million to more than $360 million at the end of 2012. At present, we believe it is appropriate to maintain a strong balance sheet for the following reasons. The uncertain macro environment could lead to additional needs for capacity alignments. We cannot yet estimate how much the ongoing antitrust investigations (see page 43 in the Annual Report) will cost us. Last, but not least, we want to make acquisitions to accelerate Autoliv’s growth.

However, when it is possible to assess the financial outcome of these three uncertain variables, it could turn out that our company will have more funds than it will need for its operations. In that case, we could be returning even more funds to shareholders than we currently do.

STRATEGY FOR GROWTH

Looking ahead, our strategy is based on the expected growth of global LVP as seen from the graph below. LVP is expected by IHS to grow by 23% or almost 20 million light vehicles to nearly 100 million by 2017. However, virtually all of this growth will be concentrated in China and other growth markets, while the traditional light vehicle markets (Western Europe, North America and Japan) are expected to merely rebound to their historical LVP levels before the financial crisis in 2008-2009. As a result of this shift in global LVP, we and the entire automotive industry need to invest in increased capacity in growth markets, where there still is a significant untapped market potential for our passive safety systems. Hence, our relatively high current capital expenditure level.

We also want to grow in the traditional markets in order to expand faster than the automotive safety market, in line with our strategy. The only way to do this is to introduce new technologies, thereby increasing the safety content per vehicle. Therefore, we are increasing our R,D&E expenses, net; from 5.0% of sales in 2010 and 5.5% in 2012 to more than 5.5% expected in 2013.

Our R,D&E undertakings are paying off in terms of growing sales. For instance, during the past three years, sales of active safety have grown by 73% in 2010 to $85 million, 89% in 2011 to $160 million and by 36% in 2012 to $218 million and are targeted to reach half a billion dollars by 2015.

Our R,D&E spending is also paying off in terms of new products. For instance, in 2012, we, in collaboration with Volvo, introduced the world’s first pedestrian airbag (see photo), which was introduced on the Volvo V40.

Another result of our investments in R,D&E was a new “green” airbag inflator. It leaves no waste products, except for 100% clean water vapor since it uses hydrogen and oxygen to inflate the airbag instead of a traditional “powder”. Additionally, the new airbag inflator has 20% less weight than the inflator it is replacing, thereby reducing fuel consumption and emissions during the long life of a vehicle.

OUTLOOK 2013

2013 is also likely to be a mixed year with continued challenges in Western Europe, balanced by continued growth in the Americas, China, Rest of Asia and Active Safety. Therefore, we are pleased that we initiated our capacity alignment program early since it will help us meet the challenges in Europe, although most of the cost savings will be realized in 2014 and 2015.

For the full year 2013, our current data indicates an organic sales growth in the range of 1-3%. This is despite an expected organic sales decline of 4% in the first quarter due to a 14% drop in Western European LVP. Based on this assumption, consolidated sales are expected to grow in the range of 2-4% during 2013, provided that the mid-January currency exchange rates prevail.

The indication for the operating margin is around 9% for 2013, excluding costs for capacity alignments and antitrust investigations. The capacity alignment costs are currently assumed to reach at least $25 million but not exceed $50 million.

The effective tax rate is projected to be around 27%, excluding discrete items.

Operations are expected to continue to generate a strong cash flow in the magnitude of $0.7 billion, while capital expenditures are expected to amount to approximately 4.5% of sales.

Yours sincerely,

Jan Carlson

Stockholm, February 22, 2013

Autoliv’s Targets

| | |

| LONG TERM TARGETS | | COMMENTS |

| |

Organic Growth Exceed growth of the global light vehicle production (LVP). Definition on page 42 in the Annual Report (Non-U.S. GAAP measure) | | Since there is no public data on the global automotive safety market, we use global LVP as a proxy to measure our sales performance and market share development. Both in 2010 and 2011, we outperformed global LVP by 6 percentage points and grew our market share. However, in 2012 when global LVP grew by 7%, our organic sales growth of 4% was 3 percentage points less than the global LVP growth. This underperformance was due to an 8% decline in Western European LVP. |

| |

Operating Working Capital Less than 10% of last 12-month sales. Definition on page 42 in the Annual Report (Non-U.S. GAAP measure) | | Our operating working capital in relation to sales continues to trend well below our target of less than 10% of sales. This is due to our continued focus on inventory and overall capital management. For 2012, when working capital was 7.0% of sales, we beat our target by 3.0 percentage points (p.p.). |

| |

Labor Productivity At least 5% per year. | | We managed to reach our productivity improvement target of at least 5% per year in 2010-2012 when productivity in manufacturing improved by 6.1%, 6.0% and 6.1%, respectively. This is thanks to the strong focus on continued improvements and standardization in all of our plants world wide. |

| |

Direct Material Cost Reduction At least 3% per year. | | In 2012, we reduced our direct material prices (i.e. component costs) by 3.9%, well in line with our target of 3%. In 2011, we reduced direct material prices by 2.1%, thereby missing our target by 0.9 percentage points. This was due to a 1.6 percentage point negative effect from higher commodity prices. Commodities make up 51% of our direct material costs. |

60 years of innovation

For 60 years Autoliv has been in the business of saving lives and has accounted for virtually all of the major industry break-throughs. This proud tradition spurs us on to develop new ingenious safety innovations and save even more lives.

1956 - Seatbelt

Lennart Lindblad, the founder of Autoliv, develops the Company’s first seatbelt, a 2-point static belt.

1980 - Airbag

Morton ASP, which became an Autoliv company in 1997, starts airbag production.

1989 - Pretensioner

Mercedes introduces our innovation that tightens the seatbelt mechanically at the onset of a crash.

1994 - Side Airbag

Volvo introduces our new airbag that reduces thorax injuries in side-impact collisions.

1995 - Knee Airbag

KIA introduces our new airbag that reduces knee injuries.

1998 - Side Curtain Airbag

Mercedes and Volvo introduce our curtain airbag that covers an upper side of the vehicle in a side impact to protect the occupants’ heads.

2005 - Pedestrian Protection

Jaguar introduces our hood lifter that creates clearance between the hood and the hard engine block underneath when the pedestrian’s head hits the vehicle hood.

2006 - Active Seatbelt

A reversible seatbelt that tightens, as a precaution, immediately before a very likely crash and then releases again if the driver manages to avoid the crash.

2008 - Pedestrian Warning

BMW introduces our second generation of Night Vision Systems which can warn the driver of pedestrians.

2012 - Pedestrian Protection Airbag

Volvo introduces an outside airbag for pedestrian protection. The product helps car manufacturers meet the stricter 2014 EuroNCAP requirements.

OUR VISION

To substantially reduce traffic accidents, fatalities and injuries.

OUR MISSION

To create, manufacture and sellstate-of-the-art automotivesafety systems.

OUR VALUES

Life – we have a passion for saving lives.

Customers – we are dedicated to providing satisfaction for our customers and value for the driving public.

Innovation – we are driven for innovation and continuous improvement.

Employees – we are committed to the development of our employees’ skills, knowledge and creative potential.

Ethics – we adhere to the highest level of ethical and social behavior.

Culture – we are founded on global thinking and local actions.

Who We Are, What We Do

While human suffering cannot be measured, monetary costs to society from automobile accidents are estimated to be in the hundreds of billions of dollars each year for health care, rehabilitation and loss of income.

Innovation and focus on saving lives have been the hallmarks for Autoliv from its inception 60 years ago. Now our products save over 25,000 lives every year and prevent ten times as many severe injuries. The next step is to further reduce road traffic accidents with active safety systems that can assist the driver to avoid an accident or, at least, reduce the speed of impact, thereby substantially mitigating the severity of injuries.

Autoliv, Inc. is incorporated in the state of Delaware, and its global headquarters is located in Stockholm, Sweden.

We are a Fortune 500 company and the world’s largest automotive safety supplier with sales to all the leading car manufacturers in the world. We develop, manufacture and market airbags, seatbelts, steering wheels, passive safety electronics and active safety systems such as radar, night vision and camera vision systems. We also produce anti-whiplash systems, pedestrian protection systems and child seats.

Our leading market position in automotive safety includes a global market share of approximately 36% in passive safety and around 20% in active safety. In 2012, we produced around 140 million seatbelts and around 110 million airbags. Statistically, there were almost two seatbelts and 1.5 airbags from Autoliv in every vehicle produced globally, despite many vehicles not having airbags.

ABOUT AUTOLIV

| | | | |

| OUR PRODUCTS SAVE | | OPERATIONS IN | | CRASH TEST TRACKS |

| >25,000 | | 29 | | 20 |

| Lives annually | | Countries | | Worldwide |

| | |

| AIRBAGS | | FACILITIES | | ASSOCIATES |

| ~110 | | >80 | | >50,000 |

| Million units in 2012 | | Globally | | worldwide |

| | |

| SEATBELTS | | PREVENT/REDUCE SEVERE INJURIES | | TECH CENTERS IN |

| ~140 | | 250,000 | | 18 |

| Million units in 2012 | | Annually | | locations |

ACTIVE SAFETY SYSTEMS

Our Active Safety systems are designed to intervene before a crash by adjusting engine output, steering and braking. These systems can create a “Virtual Crash Zone” using our radar and vision technologies to monitor the environment around the vehicle, in addition to making driving easier and more comfortable.

THANKS TO PASSIVE SAFETY SYSTEMS such as seatbelts and airbags, vehicle safety has substantially improved. Although these systems are effective in mitigating the human consequences of an accident, they can never prevent the accident from occurring.

With the introduction of active safety systems, many accidents and collisions will become avoidable or at least less severe by reducing the speed of impact. This will also result in significant improvements in the protection provided by the passive safety system.

NIGHT DRIVING ASSIST

Thenight driving assist displays an image of the road scene ahead to make night-driving easier and safer. The image generated in the heat-sensing device is processed using different filters to obtain a black and white image with sharp light or dark outlines, in which shapes are easily detected. The system also analyzes the scene content with respect to the motion of the vehicle to determine if a pedestrian or an object is at risk of being hit by the vehicle. It can detect pedestrians and animals up to two times further away than the typical headlight range and, if a threat exists, the driver is warned. The latest generation of our night vision, calledDynamic Spot Light, has a revolutionary function that selectively illuminates pedestrians and animals with a separate marking headlight (see page 17).

RADAR SYSTEMS

Short and medium range radar system provides all-weather object detection and can be used effectively in all directions around the vehicle. By scanning up to 30 meters, the system can provide an advanced warning of an imminent collision. The radar is also used for detecting objects in the blind spots of a vehicle and to control stop-and-go functions in queue assist systems. Ourlong range radarsare utilized for adaptive cruise control systems.

VISION SYSTEMS

Autoliv’s pioneering work with camera-basedvision systems gives the driver, in effect, an additional pair of eyes scanning the road ahead for danger.

Advanced algorithms enable the camera to recognize and track other vehicles, speed signs and lane markings. They can also warn the driver when the car is in danger of colliding with pedestrians, other vehicles or straying out of lane.

To provide a free view, the camera is typically located at the upper edge of the wind shield.

ACTIVE SEATBELTS

An active seatbelt has an electrically driven pretensioner that tightens the belt as a precaution in hazardous situations. The belt system then releases some webbing if the driver manages to avoid the traffic hazard.

This function also warns the driver by letting the pretensioner vibrate the seatbelt webbing.

This technology also offers improved comfort to the occupants while using the seatbelt.

BRAKE CONTROL/ESC

Autoliv has developed the world’s first Integrated Inertial Measurement Unit that combines the controls of the vehicle’s restraint system with those controls for the vehicle’s brakes that can provide Electronic Stability Control (ESC), Anti-locking Brakes (ABS) and Automatic Traction Control (ATC). This merger of the control systems, which will be launched in 2014, provides significant savings and enhanced performance.

ACTIVE AND PASSIVE SAFETY INTEGRATION

To monitor the environment around the vehicle and control the vehicle motion, Autoliv is developing the next generation of electronic integration.

ThisElectronic Safety Domain Controller (ESDC) links all safety sensors (including the environmental sensor) and all actuators that control vehicle motion (brakes, steering, and engine/transmission).

ACTIVE SAFETY FUNCTIONS

Autonomous Emergency Braking (Radar or Vision)

Continuously monitors the area in front of the vehicle to detect slow moving vehicles and other objects.

Function: alerts the driver, tightens the active seatbelt, puts the brakes in an alert mode and applies the brakes autonomously.

Cross-Traffic Assist (Radar)

Helps detect cross traffic when reversing out of a parking space.

Function: acoustic alert.

High/Low Beam Assist (Vision)

The system identifies on-coming vehicles and determines when the head lights need to be dipped in order not to blind the on-coming driver.

Function: automatically switches between high and low beams.

Blind Spot Detection (Radar)

Monitors the presence, direction and velocity of vehicles in adjacent lanes.

Function: alerts the driver by lighting a warning indicator on the appropriate side.

Road/Lane Departure Assist (Vision)

Monitors the lane markings on the road and checks that the vehicle stays within its lane to avoid dangerous situations.

Function: alerts the driver with acoustical or haptic warnings and/or a symbol on the head-up display.

Pedestrian Detection/Warning (Vision)

Detects pedestrians who might be about to step into the road.

Function: warns the driver or even autonomously brakes the vehicle.

Queue Assist (Radar or Vision)

In slow-moving traffic and congestion it makes driving easy and comfortable.

Function: maintains a set speed/distance to a vehicle ahead down to a standstill.

Traffic Sign Recognition (Vision)

The system keeps the driver informed of the speed limit and other traffic signs on the road.

Function: a symbol is displayed in the instrument cluster or on the Head-up Display (on the inside of the vehicle’s windshield) showing the current speed limit or other important road signs.

Adaptive Cruise Control (Radar)

Automatically adjusts the vehicle speed to maintain a safe distance from vehicles ahead.

Function: maintains a set speed/distance to a vehicle ahead.

PASSIVE SAFETY SYSTEMS

Autoliv has accounted for virtually all major technological breakthroughs within passive safety over the last 60 years.

SEATBELT SYSTEMS

Modernseatbelts can reduce the overall risk of serious injuries in frontal crashes by as much as 60% thanks to advanced seatbelt technologies such as pretensioners and load limiters.

Retractor and buckle pretensioners tighten the belt at the onset of a frontal crash, using a small pyrotechnic charge. Slack is eliminated and the occupant is restrained as early as possible, thereby reducing the risk of rib fractures.

Lap pretensioners further tighten the webbing to avoid sliding under the belt which improves lower-leg protection and prevents abdominal injuries from a loose belt. In an accident,load limiters release some webbing in a controlled way to avoid the load on the occupant’s chest from becoming too high. When used in combination,pretensioners,load limiters,lap pretensioners andfrontal airbags, have a 75% reduction of the risk of life-threatening head or chest injuries in frontal crashes.

Supplemental belts prevent occupants from sliding out of the “open side” of the regular 3-point belt in roll overs and far-side collisions.

AIRBAGS AND STEERING WHEELS

Driver and the passenger airbags deploy in 50 milliseconds, half the time of the “blink of an eye”, and can be “smart”, i.e. the power of the airbags can be tuned to the severity of the crash and the size of the occupant, using adaptive output airbag inflators. The driver airbag reduces fatalities in frontal crashes by approximately 25% (for belted drivers) and reduces serious head injuries by over 60%. The airbag for the front-seat passenger reduces fatalities in frontal crashes by approximately 20% (for belted occupants).

Side curtain airbags reduce the risk of life-threatening head injuries in side impacts by approximately 50% for occupants who are sitting on the side of the vehicle that is struck. Curtain airbags cover the whole upper side of the vehicle.

Single-chamberside airbags reduce the risk for chest injuries by approximately 25%. With dual-chamber side airbags, both the pelvis and the chest areas are protected which further reduces the risk of serious injuries in side-impact crashes.

Rear side airbags reduce injuries for rear occupants.

Knee airbags significantly reduce the risk of injuries to the knee, thigh and hip. These injuries today represent 23% of the active-life years lost to injury in frontal crashes involving motor vehicles.

Anti-sliding airbags are installed in the seat cushion. In a crash, the airbag raises the front end of the seat cushion to prevent the occupant from sliding under the seatbelt. This reduces significantly the risk for knee, thigh, and hip injuries for belted occupants. In addition, by keeping the occupant in an upright position, the protection from the frontal airbag becomes more efficient.

Steering wheels offer a variety of control switches and different designs. Some of our steering wheels have an integrated electrical motor that can vibrate the steering wheel, thereby alerting the driver of a dangerous situation. To improve comfort in cold climate, the steering wheel can have a heated rim.

Far-side airbags that inflate between the seats can significantly reduce injuries by preventing the occupants to move sideways. Studies have shown that 30% of all serious injuries in side-impact collisions are related to the far-side occupant hitting the other occupant or hard objects.

Bag-in-belt is a combination of a seatbelt and an airbag to further reduce the load on the occupant’s ribcage in a frontal collision.

CRASH ELECTRONICS

The ECU (Electronic Control Unit) is the “brain” of the car’s safety system. It decides not only if, but also exactly when, the seatbelt pretensioners should be triggered and each airbag system should be deployed. The ECU contains crash sensors and a microprocessor, as well as back-up electricity in the event the connection to the car battery is cut off in the crash. The ECU is located in the middle of the vehicle where it is well protected during a crash. Autoliv’s latest ECU also contains sensors for the Electronic Stability Control System (see “Brake Control/ESC” on the previous page).

Satellite sensors are mounted in the door beam, the pillar between the doors, the rocker panel, and/or in various locations at the front of the vehicle, to quickly provide the ECU with acceleration data to enable appropriate deployment of the airbags and seatbelt pretensioners.

PEDESTRIAN PROTECTION

To protect the head, the hood needs to be able to act as a cushion. This can be achieved usingpyrotechnic hood-lifters that raise the rear end of the hood to create clearance above the rigid engine structure beneath. However, in many smaller vehicles, the hood is too short, and the head of a pedestrian will most likely hit the hard area between the hood and the windscreen or one of the windshield pillars. In this case an outsidepedestrian protection airbag can be used to create a cushion effect.

Pedestrian protection systems are deployed either by contact sensors in the bumper or by an active safety system. The latter systems have the advantage of being able to brake the car, thereby reducing the speed and the severity of impact.

ANTI WHIPLASH

Anti-whiplash systems are based on a yieldable backrest that tilts in a controlled way in a rear-end collision, thereby reducing the risk for neck injuries.

BATTERY DISCONNECT SAFETY SWITCH

ThePyrotechnic Safety Switch utilizes a pyrotechnic initiator to cut the electrical power to a designated portion of the vehicle in a crash. This minimizes the potential for a fire in a crash. It is especially important in electrical vehicles to automatically and safely cut-off the connection to the electrical power.

Innovations for the Future

Autoliv has 4,700 people, or almost 10% of all associates, in research, product development and application engineering.

SAFETY is one of the strongest sales drivers for new cars. In virtually all inquiries about what consumers want in their next vehicle, new safety products rank very high or at the top of their priorities.

Autoliv assists vehicle manufacturers in meeting these evolving safety trends by staying at the forefront of technology, crash-testing more vehicles than any other safety company and working as a development partner for new vehicles.

We have 4,700 people in Research, Product Development and Application Engineering (R,D&E).

Research (R) is conducted by some 30 dedicated specialists at our Swedish Safety Center. We also provide funding for another 30 scientists at universities and independent research institutes to work on special projects. We use accident databases (such as NASS-CDS in the U.S., as well as GIDAS in Europe and CIDAS in China both of which Autoliv is a member) to identify the types of traffic injuries to which we might apply Autoliv’s safety expertise. We also draw on our crash tests and trials, as well as on the vast expertise our specialists have gathered over many years.

Corporate development projects (D) are assigned to our leading tech centers in China, France, Germany, Japan, South Korea, Sweden and the United States. Our tech center in India has been assigned some corporate projects for the safety of small cars. Application engineering projects are completed in our tech centers in close cooperation with the manufacturing units.

Our R,D&E focuses both on inventing completely new technologies and on implementing further improvements and cost savings to existing products.

In total, Autoliv currently has thousands of R,D&E projects with the vast majority of the projects (and the associated costs) in application engineering to support the development of new vehicle models. No single project accounts for more than 3% of Autoliv’s total R,D&E spending.

INVESTMENTS

During 2012, we increased Research, Development and Application Engineering (R,D&E) expenses, net by $14 million, mainly to increase our engineering capability in Asia and to accelerate our efforts even further in active safety, thereby reinforcing our long-term commitment to innovation and technology.

Gross expenditures for R,D&E amounted to $598 million compared to $568 million in 2011, which corresponded to 7.2% of sales in 2012 and to 6.9% of sales in 2011 (see graph).

Of these amounts, $143 million in 2012 and $127 million in 2011 related to engineering projects and crash tests were paid by vehicle manufacturers, safety authorities, auto magazines and other external customers.

Net of this income, R,D&E expenditures amounted to $455 million in 2012 and $441 million in 2011 or to 5.5% and 5.4% of sales.

Of the gross R,D&E expense in 2012, 75% was for projects and programs for which we have customer orders, typically related to vehicle models in development. The remaining 25% was not only for completely new innovations but also for improvements of existing products, standardization and cost reduction projects.

PATENTS

Our commitment to technological leadership is evidenced by our strong patent position. In 2010, (the latest year with official statistics), Autoliv accounted for 5% of all new patent filings in passive automotive safety filed in more than one country.

Autoliv holds more than 6,500 patents covering a wide range of innovations and products in automotive safety and key supporting technologies, an increase from 6,300 in 2011.

DYNAMIC SPOT LIGHT

Autoliv’s new Dynamic Spot Light, which was developed in collaboration with BMW, can selectively illuminate pedestrians and animals without blinding on-coming drivers. It uses the heat-emission sensor in Autoliv’s infrared-based Night Vision system to detect a pedestrian or animal and two LED spot lights that act independent of each other.

DRIVER DISTRACTION

Autoliv’s Eyes-On-the-Road (EOR) camera can warn the driver and/or brake the vehicle if the driver is distracted or about to fall asleep. The EOR can also identify the driver to make sure the vehicle is not stolen, as well as adjust the seat automatically to the right position to the driver’s height and weight. The bars on the photos show three degrees of distraction.

Empty bar with driver’s eyes on the road. Driver busy texting. Distracted driver.

ADAPTABLE SEATBELTS

Heavier and taller vehicle occupants need—and can take—higher restraining forces in a crash than, for instance, a child. Therefore, adaptive load-limiters were developed a decade ago. One drawback with these features is their need for sensors, which are expensive. Existing adaptive load limiters could also be difficult to tune in real life to the occupant’s size and the severity of the crash.

Autoliv has now invented a new seatbelt retractor that can tune its restraining force individually to each vehicle occupant – without any sensor. This purely mechanical solution offers adaptability to the occupant size and the severity of a crash at a low cost.

Unique Testing Capabilities

With our technical centers in nine countries, we have one of the best global footprints in the industry to support our customers’ new vehicle development.

CRASH TESTING We are the only safety supplier with dedicated resources for crash testing of complete vehicles rather than just vehicle bodies in sled tests. Autoliv has six crash-test facilities with tracks for full-scale tests (one in China, France, Sweden, the U.S. and two in Germany). At these tracks, vehicles weighing up to five tons can be crash-tested at speeds up to 64 Km/h (40 mph).

The experience our experts gather from these full scale tests gives us a unique capability to work as a “safety consultant” to help support safety systems development with the vehicle manufacturers.

FIELD TESTS Autoliv’s engineers perform hundreds of thousands of kilometers of on-road testing and data gathering all over the world since active safety systems must work in all types of driving conditions and road sign layouts, lane markings etc. vary between countries and regions.

WINTER TESTING The region near the Arctic Circle provides ideal conditions for developing and testing brake control systems such as stability control and traction control.

ROLL-OVERS are dangerous accidents that have a higher fatality rate than other types of crashes.

Our roll-over tests use special rigs, ditches, sand beds and ramps to simulate various roll-over accidents. The in-door roll-over tests require huge open buildings with large high-intensity light ramps.

SIMULATION is a cost-efficient re-creation of a destructive crash test to examine the level of safety. To model real crash tests, today’s crash simulations include virtual models of the anatomy of the human body.

CARSON CITY is a unique outdoor test facility for pre-crash and active safety systems located in Vårgårda, Sweden. The facility can be used for advanced development of pedestrian protection systems, including autonomous braking systems.

SLED TESTING in a High-G Sled is a non-destructive cost-efficient test method. It uses a hydraulically powered piston that “strikes” the sled for repeatable comparisons of occupant motions and loadings in different crash situations.

Investing in Social Responsibility and Integrity

Helping to save more lives and preventing injuries is the most important contribution Autoliv can make to social responsibility. Therefore, corporate social responsibility is not new to us. It has been our core business for 60 years.

MORE THAN 1.2 MILLION PEOPLE perish every year on the world’s roads, and between 20 and 50 million suffer serious injuries, according to the World Health Organization (WHO).

In addition to the human suffering, these tragedies cost societies billions of dollars every year. The situation is aggravated by the fact that traffic accidents affect especially younger generations (they are a top-three cause of death for people aged 5 to 44) and often lead to life-long disabilities.

Consequently, saving more lives and preventing injuries is the most important contribution Autoliv can make to social responsibility. We therefore use our expertise to support and cooperate with government agencies, hospitals, insurance companies, non-governmental organizations and others who share our vision of zero traffic fatalities.

We also assume our social responsibility in several other ways.

INVESTING IN INTEGRITY

Our investment in integrity is demonstrated through our commitment to upholding our values, to adhering to the law, and fostering a culture that all employees act with the highest ethics and integrity.

We live our values every day, because how we do business is very important for a company that is in the business of saving lives. We have in place the elements of an effective compliance program, including executive sponsorship, Board of Directors’ oversight, a system for reporting potential or actual criminal conduct, and the Autoliv Standards of Business Conduct and Ethics.

Autoliv’s Standard of Business Conduct and Ethics draws on universal standards such as the “Global Sullivan Principles of Social Responsibilities”; the “U.N. Global Compact”; ILO’s Declaration on Fundamental Principles and Rights at Work; and OECD’s Guidelines for Multinational Enterprises. These standards apply to all operations and all employees worldwide and are available to view and download from www.autoliv.com.

We invest in our compliance and awareness program “Raise your hand for Integrity” to educate every employee of Autoliv’s expectations for acting with integrity and promoting ethical conduct and communicating that ethical breaches will not be tolerated. Our compliance education and awareness program empowers employees and conveys our expectations that employees are required to report any suspected, potential, or known violations of law, Autoliv policies and procedures, or concerns through one of the available channels. The awareness program educates employees that they can report concerns by speaking confidentially with a representative in Human Resources, the Legal department, a Corporate Compliance Officer, or by using the Autoliv Helpline.

The Autoliv Helpline is a multilingual third-party operated service where reports can be made confidentially, without fear of retaliation, 24 hours a day, 7 days a week, by phone or online athttp://helpline.Autoliv.com.

CONTRIBUTION TO PROTECTING THE ENVIRONMENT

The environmental impact from our operations is generally modest, since most of our manufacturing consists of the assembly of components. For instance, Life Cycle Assessments (LCA) show that CO2 emissions from Autoliv account for 1% of the 31.4 kg emitted during the life of a driver airbag and that the driving of the vehicle and the raw material production for the airbag generate almost 100 times more carbon dioxide.

As a consequence, the most important contribution we can make to the environment is to design and develop low-weight and environmentally-friendly safety systems. Even a small reduction in weight can result in substantial improvements through lower fuel use and emissions throughout the car’s entire life. Helping our customers in their efforts to meet the stringent CO2 and CAFE (Corporate Average Fuel Economy) requirements is important for them, and a competitive tool for us.

Although Autoliv’s CO2 emissions are low, we have launched several energy saving programs, ranging from automatic lighting systems to heat recovery of cooling water. The total energy consumption (incl. electricity and heating) by all Autoliv facilities was 715 GWh during 2012, which corresponds to 246,000 metric tons of CO2 (using the Greenhouse Gas Protocol), which was an increase from 2011 of 7% and in line with our unit sales increase.

With our strong global presence we can minimize the environmental impact imposed by logistics when procuring parts and supplying finished products to our customers. By improving the efficiency of our logistic systems we also benefit financially.

It is our policy that every Autoliv facility be certified according to ISO 14001. The few remaining non-certified plants are essentially new manufacturing facilities that have not yet been certified. All Autoliv facilities measure and work to continuously improve all of their relevant environmental measurables, such as energy and water consumption, emissions to air, transportation and the use of packaging materials.

ASSISTING CUSTOMERS

Since 2006, the European directive End of Life of Vehicle (ELV) requires that 85% of all material in new vehicle models must be recoverable. The level will be raised to 95% by 2015.

Although the directive on ELV only specifies recovery levels for the whole vehicle and not for individual components, we make sure that our products meet or exceed the legal requirements.

SUPPORTING SUPPLIERS

We also work closely with our suppliers to encourage them to implement an environmental management system, according to ISO 14001. We require them to adhere to our environmental policy (see www.autoliv.com).

Our leading suppliers are monitored as part of our regular quality audit process to ensure they are compliant with – or preferably exceed – the minimum basic working conditions as established in universal standards. This includes preventing child labor and forced labor, ensuring safe and healthy work environment for employees and fair work conditions, a commitment to adhere to laws and regulations, specifically those related to bribery and corruption, competition and money-laundering.

Supporting Governments

During 2012, Autoliv has supported the Dutch Ministry of Transportation in its efforts to reduce traffic injuries among bicyclists and other Vulnerable Road Users (VRU). We were a partner in a special government project along with the Dutch Cyclists’ Union, an insurance company and the R&D institute TNO. Our experts have contributed by providing analysis of cyclist accident data, helping draft the specifications of a pre-crash sensor and developing a prototype VRU-airbag that we have tested in our crash labs in vehicle-to-cyclist impacts for the government project.

Other examples of our support of governmental agencies and the public sector is cooperation with universities, authorities, traffic rescue organizations and insurance companies.

CO2-Emission from an airbag

Only 1% of the CO2-emissions from an airbag comes from Autoliv, according to Life Cycle Assessments.

Of the emissions, 73% are generated during the life of the vehicle and 25% are produced in steel mills and other parts of our supply chain.

Therefore, weight and material reductions are the most important contributions we can make to reduce CO2 (and other) emissions.

Investing in People

Our people are the foundation of our success. To find, develop and retain people with the right skills and talents for the right positions is therefore a top priority.

WE ARE ALWAYS SEARCHING for talented men and women who share our passion for saving lives and wish to build their careers and broaden their capabilities. This is paramount for a sustainable development of our company, particularly in our growth markets. In this pursuit of dedicated and motivated people we are helped by the fact that Autoliv, as the world leading automotive safety company, can offer challenging, rewarding careers in a dynamic, global industry that saves lives and social costs. Another attraction for many job seekers from other industries is our close relationship with all of the important vehicle manufacturers in the world. For potential employees in our tech centers, Autoliv’s close relationship with universities and colleges is another attraction factor.

We are committed to maintaining this environment that attracts high performers and keeps them motivated.

TALENT MANAGEMENT

To further strengthen our ability to be an attractive employer and continuously develop our people, we have an advanced talent management program. It is a solid process to identify and develop high potential individuals in order to meet our long-term business targets.

The talent management program is an annual activity among our 13,500 indirect employees in R&D, sales & administration and production overhead. Our talent management program begins with an employee performance and development dialog that supports our succession planning and future need of various competencies.

LEARNING AND DEVELOPMENT

To make sure we have enough skilled and talented people we are also focusing on the development of our employees. This leads, as well, to more engaged and motivated people.

Our global and regional training programs focus on building key leadership and management skills and knowledge where participants have the opportunity to network and collaborate with people from all over the world.

Our local training programs focus on developing functional skills and knowledge as well as basic leadership and management skills. The managers take the responsibility, along with the employee, for growth and development through one-on-one training, mentoring, coaching and support.

Additionally, we have effectiveness workshops to ensure that all leaders are role modeling the expected behaviors to drive a common culture throughout Autoliv.

All of our plants have on-the-job and skills development trainings, starting with job orientation for newly employees. In these trainings, work safety is an important element, in addition to understanding the manufacturing process and the product technologies. We also encourage job rotation and mobility across functions, plants and national boundaries.

We are committed to connecting talent management and succession planning processes to employee development activities to ensure that we focus on the right people in the right places. This connection not only reinforces Autoliv’s competitiveness as an employer but strengthens our ability to maximize customer and shareholder value, helping us grow our business and have continued success.

EMPLOYEE SAFETY

Our first important key performance indicator is employee safety. The target for each plant is of course zero injuries. In 2012, 13 plants managed to meet this target, an improvement from 8 plants five years ago.

From an already low level, our overall injury level globally continues to decline as seen in the graph on the next page. Since we are dedicated to the business of protecting people and saving lives, we feel a unique responsibility to ensure the safety, health and well-being of our associates. For instance, we have introduced a “first alert” system which uses our network of safety representatives to share information readily among all plants should a machine or process require any type of corrective process as a result of a safety concern.

With this timely notification, plants using similar equipment or processes can promptly analyze their own resources and work to minimize future risk.

EMPOWERING EMPLOYEES

Autoliv has a long track record of encouraging all employees to be creative and put forward their improvement ideas. This is a key element in our lean manufacturing philosophy and culture of continuous improvement.

We have asked ourselves: Who are better to propose improvements in, for instance, manufacturing, than the line operators themselves? We have therefore made the number of improvement suggestions per associate one of our operational key performance indicators (KPI) by which our approximately 80 facilities globally are benchmarked every quarter.

During 2012, this KPI continued to improve as seen by the index chart on the next page. Globally, more than half a million employee suggestions were received, helping us reduce waste and continue to improve labor efficiency by 6% and exceed our annual target of at least 5%. This trust in our employees not only improves our business performance, but it is highly motivating.

EMPLOYEE WELL-BEING

A third indicator of the well-being of Autoliv’s most valuable asset is labor absenteeism, although this indicator also often reflects the welfare systems and levels of sick leave compensation in the various countries in which we operate. We measure labor absenteeism as labor hours lost due to sickness in relation to total possible labor time.

This ratio has been declining for several years thanks to the dedicated efforts we have made. These efforts include various activities such as providing health care and programs to improve workplace ergonomics. As a result, labor absenteeism shows a favorable declining trend, despite a minor increase during 2012.

EMPLOYEE DIVERSITY

Due to Autoliv’s global presence, our workforce reflects the diversity of the 29 countries in which we operate. However, simply having diversity in our workforce is not enough. We work hard to create an inclusive environment where all people can contribute their best work regardless of age, gender, ethnicity or other differentiating factors, and we promote equal opportunities for all employees at all levels irrespective of color, race, gender, age, sexual orientation, ethnicity or religious beliefs.

We place special priorities on diversity in selection of professionals for our training program and succession planning to achieve balance and competence in our workforce and management.

The average age of our personnel is 34 years and nearly 50% are women. Around 71% of our 51,000 associates are direct workers and 16% other personnel in manufacturing, 9% are involved in R,D&E and 4% in sales and administration.

“At Autoliv we emphasize teamwork”

Good teamwork is essential for Rocio when she describes her role as Production Control Manager in Mexico.

WHAT IS MOST ATTRACTIVE AND/OR DIFFICULT PART OF YOUR JOB?

When you manufacture products designed to save lives, you feel an added weight of responsibility to make sure your products are built right the first time and every time. To ensure the highest quality, we utilize tools that drive our culture of continuous improvement and empower me and my fellow team members to find the right solutions to meet our customers’ needs.

DESCRIBE A NORMAL WORKING DAY.

Arriving at my office at 7 am, I quickly browse my e-mails and grab a quick cup of coffee. Then it’s down to the warehouse floor to “go and see” how teams are doing as they build and prepare orders for shipment. I handle the calls from suppliers or customers before stepping into planning meetings or workshops. I typically keep these activities up until the end of the day.

WHY DO YOU ENJOY WORKING FOR AUTOLIV?

I enjoy working at Autoliv because we truly care about people. I have worked at other companies, but I’ve never come across this same sense of belonging. At Autoliv, you don’t just build a professional career. You build friendships. Autoliv places a priority on building teams that work. Pressure exists, yes, but with our emphasis on teamwork principles such as respect and accountability, pressure really becomes a tool to help us reach our desired results.

Superior Global Presence

With operations in 29 countries and one of the broadest customer bases of any automotive supplier, Autoliv has the best global footprint in its industry.

| | | | |

| AMERICAS | | JAPAN | | REST OF ASIA |

| Sales1) +14% | | Sales1) +10% | | Sales1) +3% |

| | |

| EUROPE | | CHINA | | |

| Sales1) –7% | | Sales1) +9% | | |

LOCATIONS AND CAPABILITIES

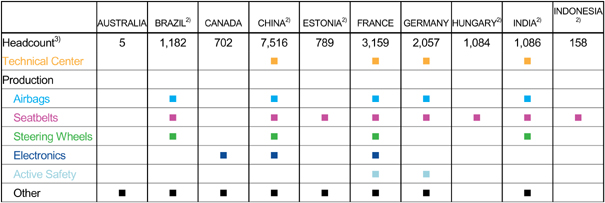

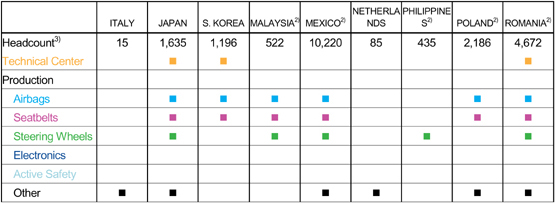

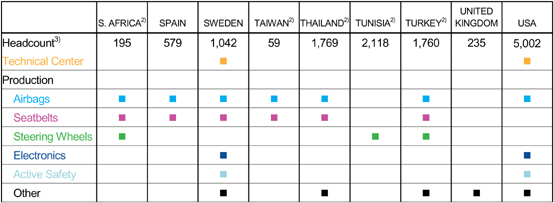

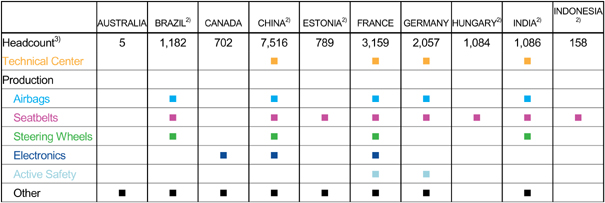

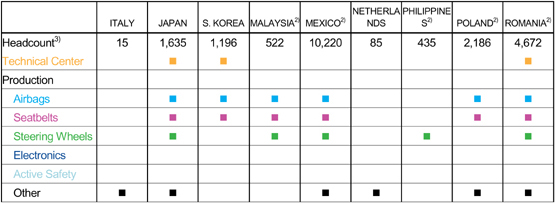

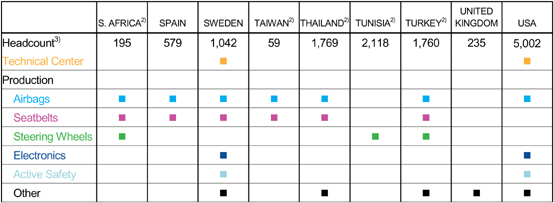

| 1) | Autoliv’s organic sales change in 2012 i.e. excluding currency effects and acquisitions/divestitures. 2) Defined as Low Cost Country. 3) Includes headcount in joint ventures. |

Our Market and Competitors

Autoliv’s market is expected to continue to grow at an average annual rate of approximately 5% over the next three years.

OUR MARKET is driven by two primary factors; light vehicle production (LVP) and content per vehicle (CPV). (CPV includes Seatbelts, Airbags, Steering Wheels, Electronic Control Unit, Crash sensors, Night Vision, Radar and Vision Systems).

The first growth driver, LVP, has risen at an average annual rate of 4% over the past ten years despite the cyclical nature of the automotive industry. Over the next five years, LVP is expected to continue to grow to almost 100 million light vehicles (LV) by 2017 from nearly 80 million in 2012, according to IHS. Virtually all of this expansion will be in the “Growth Markets”, predominately China, India, Thailand, Indonesia as well as Eastern Europe and Brazil.

Unlike LVP, which Autoliv cannot influence, we can affect the other growth driver of our market, CPV, by continuously developing new higher value-added products. This increases the long-term average safety content per vehicle and has caused the automotive safety market to grow faster than LVP. A steady flow of new technologies to the market has also enabled Autoliv to outpace the market and increase its market share. For instance, since the start of Autoliv Inc. in 1997, the Company’s sales have increased at a Compounded Annual Average Growth Rate (CAGR) of 6% compared to 5% for our market and 3% for LVP.

Historically, CPV has been driven by passive safety (mainly seatbelts and airbag products) in the developed markets of Western Europe, North America and Japan (Triad). Looking ahead, the CPV in the Triad will primarily be driven by active safety systems while new passive safety systems such as pedestrian protection, knee airbags and far-side side-impact airbags are expected to have a modest effect. However, in the Growth Markets, passive safety systems will still be the dominant growth driver for CPV for the next several years.

Several mega trends will continue to positively influence the overall safety content per vehicle. These include;

| 1) | Evolution of collision avoidance to reduce the society cost of accidents and fatalities on the roads, |

| 2) | Traffic fatalities as a cause of death will almost double to 2.4 million people by 2030, according to the World Health Organization (WHO), |

| 3) | Demographic trends of increased safety conscious consumers, aging driver population and higher LVP in the Growth Markets, |

| 4) | Government regulations and test rating systems to improve the safety of vehicles in the various markets, and |

| 5) | Trends toward lighter and alternative fuel vehicles. |

MARKET GROWTH BY REGION

In 2012, the global passive and active safety market, including steering wheels, grew by 7% to a new record of $23 billion. This was entirely due to record-high LVP, while the global average CPV stood unchanged at roughly $300. This flattish CPV was due to an 8% LVP decline in Western Europe, where the average CPV is around $400, while more than one third of the increase in global LVP occurred in the Growth Markets, where the average CPV is only around $200.

This CPV trend is likely to continue, at least for the next few years, since virtually all of the LPV growth is expected to be in the Growth Markets and as it takes two vehicles in the Growth Markets to equal the sales resulting from one vehicle in the Triad.

Despite this negative CPV mix effect, our market is expected to grow at a CAGR of approximately 5% during the next three years to about $27 billion, based on the current macro-economic outlook and business awarded Autoliv or other companies in our industry.

Most of the increase from $23 billion to $27 billion will be in the Growth Markets, which are expected to increase at a rate of 12% per year to $11 billion. This strong growth will be mitigated by an expected decline of the Japanese market of 4% per year. This geographical mix will result in a favorable effect for Autoliv since our market share in the Growth Markets is 34% and in the process of increasing, while our market share in Japan is approximately 20%. However, this favorable mix effect will be mitigated by the fact that the important Western European market is expected to expand at a rate that will be 3 percentage points less than the global average growth rate.

MARKET GROWTH BY PRODUCT

Our passive safety market is expected to grow at a CAGR of 4% with the highest growth rate expected for seatbelts.

This product line is expected to grow at a CAGR of 5% or by $1 billion to $7.5 billion. In seatbelts, Autoliv has reached a global market share of approximately 40%, primarily due to being the technology leader with several important innovations such as pretensioners and load limiters. Our strong market position is also a reflection of our superior global footprint. Seatbelts are the primary safety product and also an important requirement in low-end vehicles for the Growth Markets. This provides an excellent opportunity to benefit from the expected growth of this segment of the market.

The markets for frontal and side-impact airbags are expected to increase at an annual rate of 3% to $5.6 billion and $5.3 billion, respectively. Since Autoliv has relatively high dependence on the side-impact market (where we have a market share exceeding 40%) this relatively low growth rate will result in a relatively unfavorable product mix, while the 3% growth rate for frontal airbags (where we have a 30% market share) should have less of an impact.

The passive safety electronics and the steering wheel markets are both expected to grow by 4% annually, i.e. close to the expected average growth rate of our market. Our market share in passive safety electronics has doubled since 2001 to more than 20% and is expected to continue to increase. Our latest electronic control unit (ECU) for airbags is very competitive as it integrates active and passive safety (see page 12 in the Annual Report).

Our most recent market, active safety market, is expected to grow at a rate of 27% and to double in size to $2.2 billion by 2015. Through acquisitions and technology partnerships with our customers, Autoliv holds a strong number two market position with around 20% market share.

In summary, the winners in the automotive safety market during the next few years are likely to be companies that have built a strong position in active safety and a strong position in the Growth Markets, in line with Autoliv’s strategy.

OUR COMPETITORS

In passive safety, Autoliv’s major competitors are Takata and TRW, where we estimate that they account for roughly one fifth and one sixth of the market, respectively, while Autoliv leads the market with an approximate share of 36%.

TRW is a U.S. listed company on the New York Stock Exchange, with strong market positions in Europe and North America.

Takata is a family-controlled Japanese company with its shares listed on the Tokyo Stock Exchange. Takata has its strongest market position in Japan and North America.

In Japan, South Korea and China there are a number of local manufacturers that have close ties with the domestic vehicle manufacturers. For instance, Toyota has the “keiretsu” (in-house) suppliers Tokai Rika for seatbelts, Denso for electronics and Toyoda Gosei for airbags and steering wheels. These suppliers generally receive the majority of the Toyota business in Japan for these products, as does Mobis, a major supplier to Hyundai-Kia, in South Korea.

Other passive safety system competitors include US Private Equity owned KSS; Nihon Plast and Ashimori of Japan; Jinheng of China and Samsong of South Korea. Collectively, these competitors account for the majority of the remaining 25% global market share in passive safety.

The active safety market is relatively fragmented with more and bigger competitors than in the passive safety market and include Continental, Bosch, Delphi, Valeo, Gentex, Magna, Hella and Denso, of which we believe Continental has the leading market position today.

Continental, Bosch and Denso are also major competitors of Autoliv in passive safety electronics.

Our Customers

Our diversified customer base includes virtually every vehicle manufacturer in the world, due to our technological leadership and superior global footprint.

OURTOPFIVECUSTOMERS represented 54% of sales in 2012 and the ten largest customers 83%. This may seem to be a high concentration.

However, it is merely a reflection of the concentration in the vehicle industry. The five largest vehicle manufacturers (“OEMs”) in 2012 accounted for 52% of global light vehicle production (“LVP”) and the ten largest OEMs for 77%.

GM, RENAULT/NISSAN, FORD

General Motors is our largest customer, accounting for 15% of sales in 2012, while Ford and Renault/Nissan each account for 11%.

This is partly due to historical reasons since we have cooperated with these OEMs for many years and have developed a number of new safety innovations together with them. Autoliv’s strong global presence also fits these global OEMs very well, as well as our broad product offering. We have also acquired assets from Delphi and Visteon, which are spin-offs from GM and Ford, respectively.

VOLKSWAGEN, TOYOTA

In relation to their share of the global LVP, Autoliv is “under represented” with Volkswagen and Toyota. In 2012, Volkswagen and Toyota each accounted for roughly 12% of global LVP, while they accounted for slightly more than 8% and around 6% of our sales, respectively.

The larger the OEM, the more suppliers the OEM generally has to leverage prices with volumes. In addition, one of our major competitors, TRW has historically had close relations with Volkswagen and acquired companies that have been close to Volkswagen. Similarly, Toyota has in-house (“keiretsu”) suppliers that are awarded more than half of Toyota’s safety business.

BMW, DAIMLER, VOLVO

BMW and Daimler account for 5% each of our sales, despite the fact that they only account for 2% of global LVP. Volvo, another premium brand OEM, accounts for more than 2% of our sales compared to half a percentage of global LVP.

Our relatively high dependence on premium brand OEMs reflects higher safety content in their vehicles. It is also due to their strong pursuit of new safety innovations to advertise their new vehicle models along with Autoliv’s well-established position of being the technology leader in the automotive safety industry.

HYUNDAI/KIA, HONDA

Hyundai/Kia has been our fastest growing customer. Only five years ago, Hyundai/Kia accounted for 4% of our sales compared to 9% in 2012. Honda has grown during the last ten years and account now for more than 6% of our sales.

The reasons for this growth are both the success of these customers in the global LVP market and our long-term investments in their home markets, South Korea and Japan. These investments include the acquisition in 2009-2010 of Delphi’s assets in passive safety in South Korea.

FIAT/CHRYSLER, PEUGEOT/CITROËN

We have always had a relatively strong position with Chrysler and PSA, which is the owner of Peugeot and Citroën. Chrysler is an important customer for both our active and passive safety systems.

Our dependence on PSA has declined; both as a reflection of our lower market share with them and their lower share of the global LVP market.

For historical reasons, Fiat has not been a strong Autoliv customer within Italy. However, we are making inroads with Fiat, as we already are an important supplier to them in Turkey and have good possibilities to support them in Latin America.

CUSTOMER SALES TRENDS

Asian vehicle producers (including the Japanese)have steadily increased their importance to Autoliv. They now account for 35% of Autoliv’s global sales compared to less than 20% ten years ago. This reflects both their increasing share of the global LVP and our increasing share with them.

General Motors, Ford and Chrysler now account for 32% of our global sales, approximately the same as in 2002, after a decline to 23% in 2008. This swing primarily reflects their “come back” after the crisis in 2008-09 and our acquisition of Delphi’s passive safety assets.

Our high dependence on European and other customers has decreased significantly; from around 45% of sales in 2002 to 33% in 2012.

Therefore, our sales have become much more balanced than ten years ago.

Customer World’s Firsts with Autoliv

By being at the forefront of technology, by crash-testing more vehicles than any other safety company and by working as a development partner for new vehicles, Autoliv assists vehicle manufacturers not only to meet the evolving safety trends but also exploit the trends and become trend leaders. Over the years, we have contributed to:

Volvo becoming the first company in the world to introduce side airbags (1994),

Kia becoming the first company to offer knee airbags (1995),

BMW becoming the first company with side airbags for head protection (1997),

Volvo and Mercedes becoming the first companies, with side curtain airbags (1998),

Fordbecoming the first company to integrate the gyro-rollover sensor into the airbag ECU (2002),

Renault becoming the first company to receive the highest safety rating (i.e. five stars) in the EuroNCAP’s crash tests (the Laguna 2002),

BMW becoming the first company with seatbelts with adaptive load limiters (2002),

Jaguar becoming the first company with a pedestrian protection pop-up hood (2005),

Chryslerbecoming the first company with a Safety-Vent airbag (2006),

Renaultbecoming the first company with an Adaptive Multi-Volume Cushion airbag (2007),

Ford becoming the first company to integrate the inertia motion control ECU into the airbag Electronic Control Unit (ECU) (2008),

BMW becoming the first company with pedestrian warning (2009),

Volvo becoming the first company to introduce an external pedestrian protection airbag (2012).

Major Launches 2012

Illustrated below are the most significant model launches for us by our customers in 2012. A delivery contract is typically for the lifetime of a vehicle model, which is normally between 3 and 7 years.

None of our customer contracts account for more than 5% of our global sales.

Focus on Cost Control

Through our effective total cost management in manufacturing and purchasing we create customer and shareholder value.

OUR MAIN TARGETS for cost efficiency are to:

Reduce direct material costs at the same rate as our market prices decline, i.e. by at least 3% annually.

Consolidate the supply base by reducing the number of suppliers to optimize it in size, geography, service and knowledge.

Focus 90% of purchasing value to preferred suppliers.

Improve labor productivity by at least 5% per year.

REDUCE IMPACT OF RAW MATERIAL PRICES

Approximately half of our revenues are spent on direct materials (DM) from external suppliers. The raw material content in these components costs currently represents 51% of the direct material cost, while the other 49% represents the value added by our supply base (for more details on dependence on raw materials and component costs, see page 51 in the Annual Report).

The raw material value portion of our sales has increased from 22% in 2008 to 27% in 2012, primarily due to increasing raw material prices. Our strategy to mitigate higher commodity prices is to develop new more cost-efficient designs and components than the existing ones, for instance, by replacing steel with reinforced plastics. This often reduces weight which is an important added advantage in the permanent pursuit for more fuel-efficient vehicles.

REDUCING OTHER COMPONENT COSTS

We also mitigate the effect of higher commodity prices by reducing – in cooperation with our suppliers – the value added portion of our component costs.

During the five-year period 2008-2012, these costs added in our supply chain have been cut from 30% of sales to 26%, thereby offsetting most of the above-mentioned negative effect from higher raw materials. This has been achieved by several actions and programs.

For instance, we have actively increased our level of component sourcing in low-cost countries (LCC) from 39% in 2008 to 48% in 2012 (and from 15% in 2004 when the program was initiated).

We have increased the level of components sourced from our long-term strategic suppliers from 70% in 2008 to 75% in 2012.

We are continuously consolidating purchase volumes to fewer suppliers to help them reduce their prices to us. For instance, in 2012, we managed to reduce the number of suppliers by nearly 7% after a steady increase in prior years. This increase was due to acquisitions and the need to add new suppliers in Asia and other LCC. We are now on track to reach our target of reducing the number of supplier groups to 1,000 by 2016 from a peak of 1,600 in 2011.

We also standardize products and components, and phase out older, more complex products with low volumes to help suppliers reduce their costs and, consequently, our prices.

Through the above-mentioned strategies we have met our direct material cost reduction target of at least 3% every year, except in 2008 and 2011 when, in particular, steel prices sky-rocketed. In 2012, the estimated net savings for direct materials was 3.9% and 2.1% in 2011.

LABOR PRODUCTIVITY IMPROVEMENTS

The second most important type of cost is wages, salaries and other labor costs. In 2012, these costs corresponded to 22.0% of sales, which was a reduction from 26.0% in 2008.

This reduction has been achieved by continuous productivity improvements, restructuring of operations and by expansion as well as movement of production to LCC.

We measure productivity improvements in manufacturing in LMPU (labor minutes per produced unit). This measure is often affected by shifts of production to LCC where typically more labor-intensive manufacturing processes are used and less automation than in HCC (although the productivity in individual LCC may improve rapidly). Despite this, we have achieved LMPU reductions of approximately 6% every year during the last five-year period. Consequently, we managed to reach our productivity improvement target of at least 5% per year, both when LVP dropped sharply during the crisis, and in 2012 when LVP was erratic and depressed in Western Europe.

Manufacturing in LCC could offer significant cost saving opportunities, since our average headcount cost in LCC is only 20% of the same cost in HCC for direct personnel. However, we already have 78% of our direct workers in LCC, and the offsetting costs required for producing in one country and selling in another (such as freight and duty costs) should also be considered in addition to the labor cost difference. Consequently, most of this savings potential has now been achieved. In spite of this, we expect our headcount to continue to increase more in LCC than in HCC as a reflection of the mix in the expected LVP growth. This mix trend should continue to have a favorable impact on our cost structure in the future.

In addition, through automation and introduction of new higher value-added products (for instance in active safety) we should continue to be competitive in HCC and thereby continue to support our customers with manufacturing close to their assembly plants in North America, Western Europe and Japan. Going forward we also foresee a higher degree of automation in LCC to compensate for increasing labor and component costs.

Quality Excellence

We can never lose sight of our primary goal to save lives, and our products never get a second chance. This is why we can never compromise on quality.

IN ADDITION TO OUR PRIMARY GOAL of saving lives, quality is a key to our financial performance, since quality excellence is critical for winning new orders, preventing recalls and maintaining low scrap rates. For all of these reasons, we are fully committed to providing quality products and services to all our customers.

This pursuit of excellence is a continuous improvement process, driven by our ability to anticipate and respond to the challenges of a rapidly changing automotive industry.

OUR QUALITY CULTURE

Although quality has always been paramount in the automotive industry, especially for safety products, vehicle manufacturers have become even more quality-focused with no tolerance for deviations.

This trend is likely to continue as more and more vehicle manufacturers apply these stricter quality requirements.

In response to this trend and to improve our own quality, we are driving a program called “Q5” for shaping a proactive quality culture of zero defects. It is called “Q5” because it addresses quality in five dimensions: customers, products, growth, behavior and suppliers.

The goal of Q5 is to firmly tie together quality with value within all our processes, for all our employees, thereby leading to the best value for all our customers.

We believe this will advance our leadership position even further in automotive safety. When we get our customers’ acknowledgement and confirmation that our products and services are superior to anything else on the market, we know we are well on our way to reaching our goal.

FLAWLESS PRODUCTS AND DELIVERIES

In our pursuit of excellence we have developed a chain of four “defense lines” against quality issues that consist of 1) robust product designs, 2) flawless components from suppliers and our own in-house component companies, 3) manufacturing of flawless products and 4) implementing systems for verifying that our products conform with specifications and an advanced traceability system in the event of a recall. These “defense lines”, in combination with our Q5 behaviors, should ensure deliveries of flawless products on-time to our customers.

When quality deviations occur, they very rarely affect the protection provided by our products. Virtually all deviations are, instead, due to other requirements, such as flawless labeling, precise delivery of the right parts at the right moment, as well as correct color nuance and surface texture on steering wheels and other products where the look and feel is important to the car buyer.

OUR QUALITY PERFORMANCE

In our product conformity verifications, we register all deviations and include them in our quality measure, which is “parts per million” (ppm). Our target used to be less than 10 ppm. We have successfully reduced our actual ppm levels over the last several years. In 2011, we therefore tightened our goal to “not more than three products rejected by customers for every million parts delivered” (3 ppm). To illustrate how rigorous this new target is, it could be compared to not having a single rainy day in 912 years, i.e. since the year 1100.