COVID-19 pandemic related business update

The COVID-19 pandemic has upended the automotive industry and customer projects for 2020. Autoliv is navigating the same challenges as other companies are facing in managing and forecasting the overall impact the pandemic will have on the automotive industry this year. In this environment, on April 2, 2020, the Company withdrew its previously issued 2020 guidance until the effects of the pandemic can be better assessed.

First quarter 2020

The COVID-19 pandemic in the first quarter had a substantial impact on our operations, particularly China, where our customer’s plants were closed for several weeks in February and operated at low levels in March. In Europe and North America, sales declined substantially in the second half of March as the pandemic led to customer plant closures. Global light vehicle production (LVP) declined by 24% in the first quarter 2020 compared to Q1 2019 according to IHS, with LVP declining by almost 50% in China, by around 20% in Europe, and by 11% in North America. Although our organic sales* outperformed the LVP decline by 11pp, the 24% decline in global LVP had a significant impact on our sales and profitability in Q1 2020.

Liquidity and management actions to manage the challenging months ahead

| • | Cancelling the dividend scheduled for June 4, 2020 and suspending future dividends, although the Board of Directors will review such suspension on a quarterly basis. |

| • | Drawing down $1.1 billion of cash on our existing Revolving Credit Facility, creating a cash balance of approximately $1.5 billion on April 2, 2020, which gives a healthy liquidity position as debt maturities are $318m in 2020 and $275m in 2021. |

| • | Executives voluntarily reducing their base salaries by 20% for Q2 2020 and non-employee board members reducing their cash compensation by 20% for Q2 2020. |

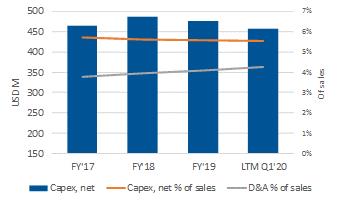

| • | Reducing or suspending capital expenditures with the ambition to reduce spending as is needed and possible depending on market volumes and our customers’ launch activities. |

| • | Strict inventory control, close monitoring of receivables and close collaboration with suppliers. |

| • | Adjusting production and work week hours to a lower demand, reducing or suspending discretionary spending that is not critical for daily operations and accelerated cost saving initiatives and furloughed personnel, many in government supported programs. |

Second quarter 2020

The situation is currently more challenging than it was in Q1, as customer closures are now affecting the majority of our operations, for an uncertain period of time, compared to a more limited scope in the first quarter. With a higher safety content per vehicle in North America and Europe, the regional mix will have a negative impact on sales in Q2. It is currently not possible to estimate the market in Q2 with a reasonable degree of certainty. However, IHS outlook dated April 16, indicates a Q2 global LVP decline of 45%. A decline of such magnitude, should it come true, would have a significant impact on our sales and we do not expect to be able to fully offset the lower sales with cost reduction activities while also planning for production restarts. We therefore expect the LVP decline in Q2 to have a more substantial impact on our profitability and cash flow than the decline in Q1.

Next step

While we continue to focus on further cost reduction actions, we are planning and preparing to restart and ramp up production in close coordination with our customers and suppliers. Although the situation remains fluid and visibility is limited, below is a summary of our current view of our three most important regions.

China: OEMs are gradually returning to previous production levels, and the China Passenger Car Association reported that retail sales were 14% above last year’s level in the second week of April. However, the situation remains fluid, and we expect OEMs will be adjusting production according to inventory levels and demand. Additionally, production disruptions in other regions, which supply components to automakers in China, may slow down the recovery in China.

Europe: A number of European automotive plants have recently restarted or are preparing to restart production after more than a month of coronavirus-related shutdowns. The production rate will likely be volatile, with reduced shifts to adapt to uncertain demand development and component availability.

North America: In the US and Canada, most OEMs plan to resume production by early May. There is significant uncertainty around the return dates for their plants in Mexico, due to the stay-at-home measures in Mexico.

We are deeply focused on the safety of our employees, customers and suppliers when re-starting. We have therefore developed a Smart Start Playbook that outlines processes to raise awareness of new health protocols and to support execution in a challenging situation. This includes recommendations based on guidelines from the World Health Organization and lessons-learned from our recent ramp-up in China. We will provide personal protection equipment, such as masks and visors, and redesign some production environments, such as setting up protective screens.

Comments from Mikael Bratt, President & CEO

Comments from Mikael Bratt, President & CEO