1

Howard Weil

Energy Conference

Greg King, President

March 30, 2004

Statements contained in this presentation that state

the Company’s or management’s expectations or

predictions of the future are forward-looking

statements intended to be covered by the safe

harbor provisions of the Securities Act of 1933 and

the Securities Exchange Act of 1934. It is important

to note that the Company’s actual results could

differ materially from those projected in such

forward-looking statements. Factors that could

affect those results include those mentioned in the

documents that the Company has filed with the

Securities and Exchange Commission.

Safe Harbor Statement

2

2003 Accomplishments

Record net income -- $622 million

$390 million of operating income from Canadian

operations

Reduced debt-to-cap ratio from 50% to 40%

53.4% at time of UDS acquisition

Acquired St. Charles refinery in July

Commissioned coker at Texas City in October

Great year for retail and wholesale businesses

3

Acquisition of Aruba Refinery

Completed acquisition on March 5 for $465 million plus

162 million for working capital

Financed with $406 million equity and $221 million

cash and debt

315,000 BPD heavy sour crude oil refinery

Replacement cost of $2.4 billion

$640 million invested since 1998

Produces distillates and intermediate feedstocks

Profitable related businesses

Aruba Marine and Bunkering

Marketing assets

Improving reliability and profitability

Proven track record at St. Charles refinery

4

-1.00

1.00

3.00

5.00

7.00

9.00

11.00

13.00

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

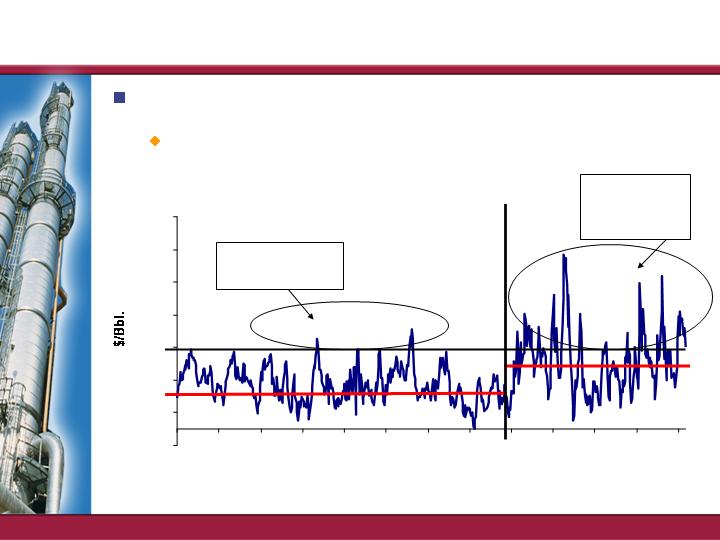

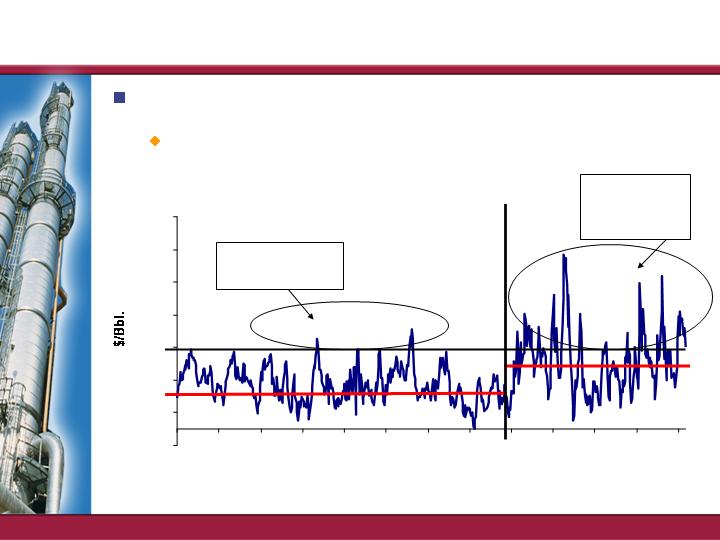

New Era for Refining

Over $5.00/bbl

2% of time

Over

$5.00/bbl

30% of time

Gulf Coast 3-2-1 Refining Margin (1992-2004)

Times have changed since the ’90s

Structural changes in refining industry

Source: Simmons & Company/Valero Research

5

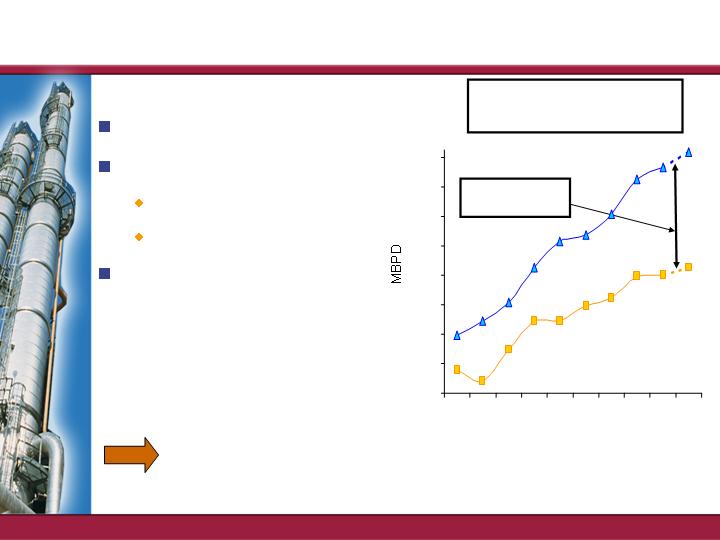

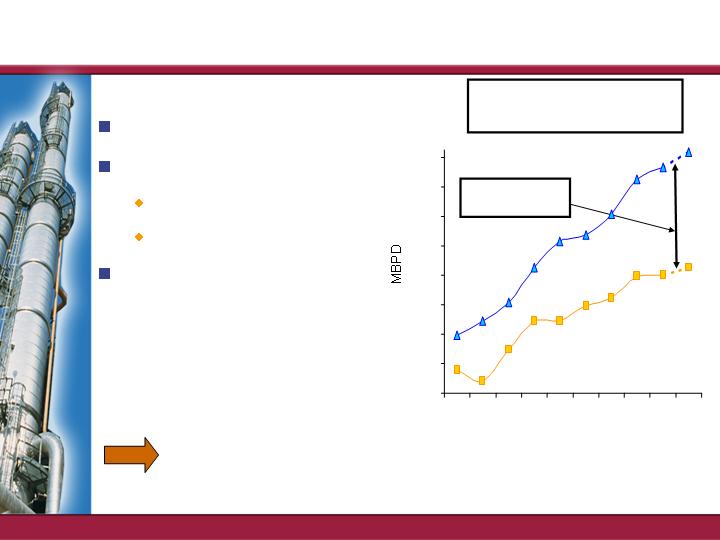

U.S. Gasoline Demand

vs. Production

Gap must be

met by imports

Production

Demand

Gasoline Demand Outpacing Domestic Supply

Demand growing

Supply impacted by

Tier II sulfur specs

MTBE Phase-outs

Gap between U.S.

demand and

production continues

to widen

Higher margins needed to attract

additional supplies to meet U.S. demand

7400

7600

7800

8000

8200

8400

8600

8800

9000

1995

1997

1999

2001

2003

6

U.S./Global Demand Growth

U.S. economy growing

Increasing number of SUVs

on the road

More miles driven

Gasoline demand growing

1-2% per year (up 1.7% YTD)

Nearly all key global regions experiencing strong

economic growth

China economy booming

Economy grew by 9% in ’03; expect 8.2% growth in ’04

China automobile ownership jumped 60% in ’03

7

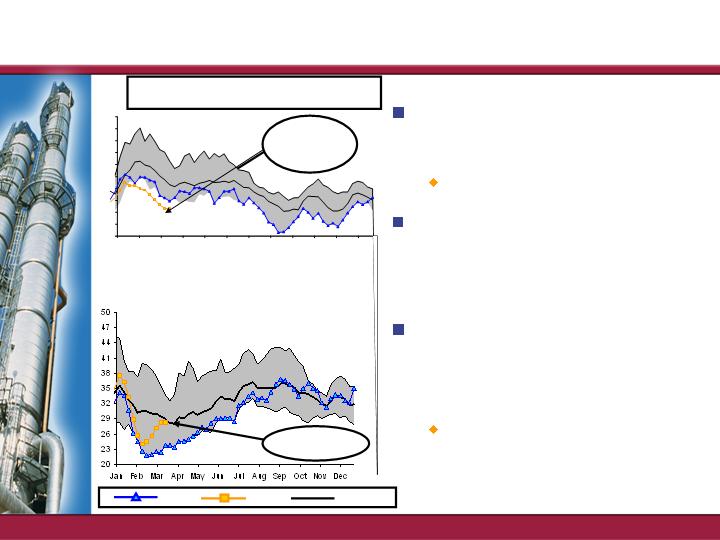

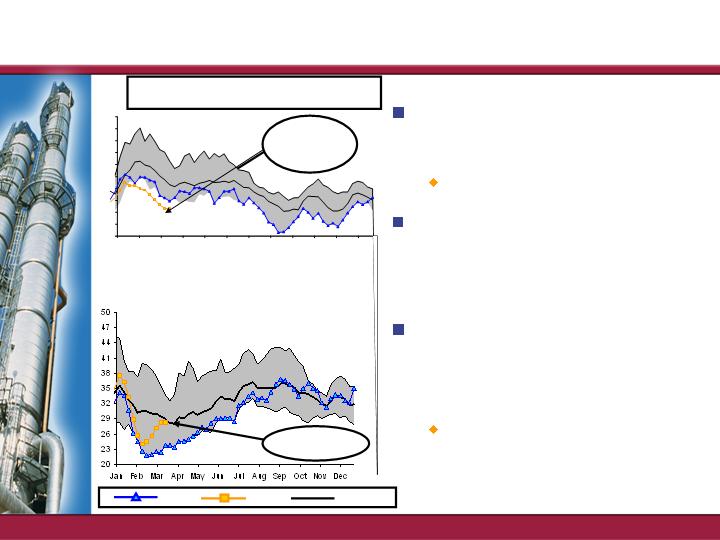

Refined Product Fundamentals

U.S. Gasoline Days of Supply

U.S. Distillate Days of Supply

Record low

Fairly balanced

2003

2004

5 yr avg

U.S.G.C. gasoline margins

$7.75 per bbl QTD

Currently $11.00 per bbl

Full year forward curve

around $7.50 per bbl

40% of 2004 distillate

production hedged at

$4.20 per bbl NYMEX

Full year forward curve

around $3.75 per bbl

NYMEX

20

21

22

23

24

25

26

27

28

29

30

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

8

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Positive Sour Crude Outlook

WTI vs Sour Crude Basket, $/bbl

(50% Arab Medium and 50% Arab Light)

WTI vs GC Maya (FOB), $/bbl

Sour crude discounts

at attractive levels

Expected to continue

Low-sulfur specs

increasing demand for

sweet crude

Residual fuel oils at

depressed price levels

Growing production of

low-quality crude oils

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2003

2004

5 yr avg

9

Product margins

Expected to be around

$1.25 per bbl higher than 2003

Sour crude discounts

Expected to widen

$1.00 per bbl vs. 2003

Throughput volumes

Projected to be 350

MBPD higher than 2003

Off to a great start

Comfortable with 1Q04

First Call Consensus

Full year 2004 First Call

Consensus too low

2004 Looking Better Than 2003

New Texas City Coker

10

$1,640

(Dollars in Millions)

$1,110

$1,620

$1,320

$910

Investing for the Future

Tier II investments expected to be $1.5 billion

Strategic projects to increase leverage to sour

crudes and clean fuels

Significant increase in free cash flow in 2006

11

Well Positioned for the Future

For refiners who have invested, future has

never looked better

Strong margins and wider sour crude discounts a

powerful combination for Valero

Valero already in strong financial position

Solid financial ratios

Conservative capital structure

Valero has all the advantages

Most refining capacity

Highest complexity

Highest leverage to sour crude oil

Best geographic diversity

Best employees in the industry

12