FORM 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _______________ to _______________ |

Commission file number 1-13175

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 74-1828067 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| One Valero Way | 78249 | ||

| San Antonio, Texas | (Zip Code) | ||

| (Address of principal executive offices) | |||

| Registrant’s telephone number, including area code: (210) 345-2000 | |||

Securities registered pursuant to Section 12(b) of the Act: Common stock, $0.01 par value per share listed on the New York Stock Exchange.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes R No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes R No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No o

Indicate by check mark if disclosure of d elinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

Large accelerated filer R | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No R

The aggregate market value of the voting and non-voting common stock held by non-affiliates was approximately $10.2 billion based on the last sales price quoted as of June 30, 2010 on the N ew York Stock Exchange, the last business day of the registrant’s most recently completed second fiscal quarter.

As of January 31, 2011, 568,971,156 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

We intend to file with the Securities and Ex change Commission a definitive Proxy Statement for our Annual Meeting of Stockholders scheduled for April 28, 2011, at which directors will be elected. Portions of the 2011 Proxy Statement are incorporated by reference in Part III of this Form 10-K and are deemed to be a part of this report.

CROSS-REFERENCE SHEET

The following table indicates the headings in the 2011 Proxy Statement where certain information required in Part III of Form 10-K may be found.

| Form 10-K Item No. and Caption | Heading in 2011 Proxy Statement | |

| 10. | Directors, Executive Officers and Corporate Governance | Information Regarding the Board of Directors, Independent D irectors, Audit Committee, Proposal No. 1 Election of Directors, Information Concerning Nominees and Other Directors, Identification of Executive Officers, Section 16(a) Beneficial Ownership Reporting Compliance, and Governance Documents and Codes of Ethics |

| 11. | Executive Compensation | Compensation Committee, Compensation Discussion and Analysis, Director Compensation, Executive Compensation, and Certain Relationships and Related Transactions |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | Beneficial Ownership of Valero Securities and Equity Compensation Plan Information |

| 13. | Certain Relationships and Related Transactions, and Director Independence | Certain Relationships and Related Transactions and Independent Directors |

| 14. | Principal Accountant Fees and Services | KPMG Fees for Fiscal Year 2010, KPMG Fees for Fiscal Year 2009, and Audit Committee Pre-Approval Policy |

Copies of all documents incorpo rated by reference, other than exhibits to such documents, will be provided without charge to each person who receives a copy of this Form 10-K upon written request to Jay D. Browning, Senior Vice President – Corporate Law and Secretary, Valero Energy Corporation, P.O. Box 696000, San Antonio, Texas 78269-6000.

i

CONTENTS

| PAGE | ||

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accountant Fees and Services | |

ii

PART I

The terms “Valero,” “we,” “our,” and “us,” as used in this report, may refer to Valero Energy Corporation, to one or more of our consolidated subsidiaries, or to all of them taken as a whole. In this Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions, and resources, under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You should read our forward-looking statements together with our disclosures beginning on page 23 of this report under the heading: “CAUTIONARY STATEMENT FOR THE PURPOSE OF SAF E HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.”

ITEMS 1., 1A. and 2. BUSINESS, RISK FACTORS AND PROPERTIES

Overview. We are a Fortune 500 company based in San Antonio, Texas. Our corporate offices are at One Valero Way, San Antonio, Texas, 78249, and our telephone number is (210) 345-2000. Our common stock trades on the New York Stock Exchange under the symbol “VLO.” We were incorporated in Delaware in 1981 under the name Valero Refining and Marketing Company. We changed our name to Valero Energy Corporation on August 1, 1997. On January 31, 2011, we had 20,313 employees.

Our 14 petroleum refineries are located in the United States (U.S.), Canada, and Aruba. Our refineries can produce conventional gasolines, distillates, jet fuel, asphalt, petrochemicals, lubricants, and other refined products as well as a slate of premium products including CBOB and RBOB1, gasoline meeting the speci fications of the California Air Resources Board (CARB), CARB diesel fuel, low-sulfur and ultra-low-sulfur diesel fuel, and oxygenates (liquid hydrocarbon compounds containing oxygen).

We market branded and unbranded refined products on a wholesale basis in the U.S. and Canada through an extensive bulk and rack marketing network. We also sell refined products through a network of about 5,800 retail and wholesale branded outlets in the U.S., Canada, and Aruba.

We also own 10 ethanol plants in the Midwest with a combined ethan ol production capacity of about 1.1 billion gallons per year.

Available Information. Our internet website address is www.valero.com. Information contained on our website is not part of this annual report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K filed with (or furnished to) the Securities and Exchange Commission (SEC) are available on our internet website (in the “Investor Relations” section), free of charge, soon after we file or furnish such material. In this same location, we also post our corporate governance guidelines, code of business conduct and ethics, code of ethics for senior financial officers, and the charters of the committees of our board of directors. These documents are available in print to any stockholder that makes a written request to Jay D. Browning, Senior Vice President – Corporate Law and Secretary, Valero Energy Corporation, P.O. Box 696000, San Antonio, Texas 78269-6000.

_____________________________

1 CBOB, or “conventional blendstock for oxygenate blending,” is conventiona l gasoline blendstock intended for blending with oxygenates downstream of the refinery where it was produced. CBOB becomes conventional gasoline after blending with oxygenates. RBOB is a base unfinished reformulated gasoline mixture known as “reformulated gasoline blendstock for oxygenate blending.” It is a specially produced reformulated gasoline blendstock intended for blending with oxygenates downstream of the refinery where it was produced to produce finished gasoline that meets or exceeds U.S. emissions performance requirements for federal reformulated gasoline.

1

SEGMENTS

&n bsp;

Our business is organized into three reportable segments: refining, ethanol, and retail. The financial information about our segments in Note 18 of Notes to Consolidated Financial Statements is incorporated herein by reference.

| • | Our refining segment includes refining operations, wholesale marketing, product supply and distribution, and transportation operations. The refining segment is segregated geographically into the Gulf Coast, Mid-Continent, West Coast, and Northeast regions. |

| • | Our ethanol segment includes sales of internally produced ethanol and distillers grains. Our ethanol operation s are geographically located in the central plains region of the U.S.. |

| • | Our retail segment includes company-operated convenience stores, Canadian dealers/jobbers, truckstop facilities, cardlock facilities, and home heating oil operations. The retail segment is segregated into two geographic regions. Our retail operations in the U.S. are referred to as Retail-U.S. Our retail operations in eastern Canada are referred to as Retai l-Canada. |

2

VALERO’S OPERATIONS

REFINING

On December 31, 2010, our refining operations included 14 refineries in the U.S., Canada, and Aruba with a combined total throughput capacity of approximately 2.6 million barrels per day (BPD). The following table presents the locations of these refineries and their approximate feedstock throughput capacities as of December 31, 2010.

| Refinery | Location | Throughput Capacity (a) (BPD) | |||

Gulf Coast: | |||||

C orpus Christi (b) | Texas | 325,000 | |||

| Port Arthur | Texas | 310,000 | |||

| St. Charles | Louisiana | 270,000 | |||

| Texas City | Texas | 245,000 | |||

Aruba (c) | Aruba | 235,000 | |||

| Houston | Texas | 160,000 | |||

Three Rivers | Texas | 100,000 | |||

| 1,645,000 | |||||

West Coast: | |||||

| Benicia | California | 170,000 | |||

| Wilmington | California | 135,000 | |||

| 305,000 | |||||

Mid-Continent: | |||||

| Memphis | Tennessee | 195,000 | |||

| McKee | Texas | 170,000 | |||

Ardmore | Oklahoma | 90,000 | |||

| 455,000 | |||||

Northeast (d): | |||||

| Quebec City | Quebec, Canada | 235,000 | |||

| Total | & nbsp; | 2,640,000 | |||

&n bsp;

(a) | “Throughput capacity” represents estimated capacity for processing crude oil, intermediates, and other feedstocks. Total estimated crude oil capacity is approximately 2.2 million BPD. |

(b) | Represents the combined capacities of two refineries – the Corpus Christi East and Corpus Christi West Refineries. |

(c) | The Aruba Refinery was idled in July 2009, but resumed operations in January 2011. |

(d) | We sold our Paulsboro, New Jersey Refinery in the fourth quarter of 2010, as described in Note 3 of Notes to Consolidated Financial Statements. Throughput capacity of this refinery was approximately 185,000 BPD. |

3

The following table presents the percentages of principal charges and yields (on a combined basis) for all of our refineries for the year ended December 31, 2010. Our total combined throughput volumes averaged 2.129 million BPD for the year ended December 31, 2010. (The information presented excludes the charges and yields of the Paulsboro Refinery, which we sold in the fourth quart er of 2010, as more fully described in Note 3 of Notes to Consolidated Financial Statements.)

| Combined Refining Charges and Yields | |||

| Charges: | |||

| sour crude oil | 40 | % | |

| acidic sweet crude oil | 3 | % | |

| sweet crude oil | 31 | % | |

| residual fuel oil | 10 | % | |

| other feedstocks | 5 | % | |

| blendstocks | 11 | % | |

| Yields: | |||

| gasolines and blendstocks | 49 | % | |

| distillates | 33 | % | |

| petrochemicals | 3 | % | |

| other products (includes gas oil, No. 6 fuel oil, petroleum coke, and asphalt) | 15 | % | |

Gulf Coast

The following table presents the percentages of principal charges and yields (on a combined basis) for the eight refineries in this region for the year endedDecember 31, 2010. Total throughput volumes for the Gulf Coast refining region averaged 1.28 million BPD for the year ended December 31, 2010.

| Combined Gulf Coast Region Charges and Yields | |||

| Charges: | |||

| sour crude oil | 52 | % | |

| acidic sweet crude oil | 2 | % | |

| sweet crude oil | 11 | % | |

| residual fuel oil | 16 | % | |

| other feedstocks | 6 | % | |

| blendstocks | 13 | % | |

| Yields: | |||

| gasolines and blendstocks | 45 | % | |

| distillates | 33 | % | |

| petrochemicals | 4 | % | |

| other products (includes ga s oil, No. 6 fuel oil, petroleum coke, and asphalt) | 18 | % | |

4

Corpus Christi East and West Refineries. Our Corpus Christi East and West Refineries are located on the Texas Gulf Coast along the Corpus Christi Ship Channel. The West Refinery specializes in processing primarily sour crude oil and residual fuel oil into premium products such as RBOB. The East Refinery processes sour crude oil into conventional gasoline, diesel, jet fuel, asphalt, aromatics, and other light products. The East and West Refineries are substantially integrated allowing for the trans fer of various feedstocks and blending components between the two refineries and the sharing of resources. The refineries typically receive and deliver feedstocks and products by tanker and barge via deepwater docking facilities along the Corpus Christi Ship Channel. Three truck racks with a total of 16 bays service local markets for gasoline, diesel, jet fuels, liquefied petroleum gases, and asphalt. Finished products are distributed across the refinery docks into ships or barges, and are transported via third-party pipelines to the Colonial, Explorer, Valley, and other major pipelines.

Port Arthur Refinery. Our Port Arthur Refinery is located on the Texas Gulf Coast app roximately 90 miles east of Houston. The refinery processes primarily heavy sour crude oils and other feedstocks into gasoline blendstocks, as well as diesel, jet fuel, petrochemicals, petroleum coke, and sulfur. The refinery receives crude oil over marine docks and through crude oil pipelines, and has access to the Sunoco and Oiltanking terminals at Nederland, Texas. Finished products are distributed into the Colonial, Explorer, and TEPPCO pipelines and across the refinery docks into ships or barges.

St. Charles Refinery. Our St. Charles Refinery is located approximately 15 miles from New Orleans along the Mississippi River. The refinery processes sour crude oils and oth er feedstocks into gasoline, distillates, and other light products. The refinery receives crude oil over five marine docks and has access to the Louisiana Offshore Oil Port where it can receive crude oil through a 24-inch pipeline. Finished products can be shipped over these docks or through the Colonial pipeline network for distribution to the eastern U.S.

Texas City Refinery. Our Texas City Refinery is located southeast of Houston on the Texas City Ship Channel. The refinery processes sour crude oils into a wide slate of products. The refinery receives and delivers its feedstocks and products by ship and barge via deepwater docking facilities along the Texas City Ship Channe l and uses the Colonial, Explorer, and TEPPCO pipelines for distribution of its products.

Aruba Refinery. Our Aruba Refinery is located on the island of Aruba in the Caribbean Sea. It processes primarily heavy sour crude oil and produces intermediate feedstocks and finished distillate products. Significant amounts of the refinery's intermediate feedstock production are transported and further processed in our other refineries in the Gulf Coast and West Coast regions. The refinery receives crude oil by ship at its two deepwater marine docks, which can berth ultra-large crude carriers. The refinery's products are delivered by ship primarily into markets in the U.S., the Caribbea n, Europe, and South America.

Houston Refinery. Our Houston Refinery is located on the Houston Ship Channel. It processes a mix of crude oils and low-sulfur residual fuel oil into reformulated gasoline and distillates. The refinery receives its feedstocks via tanker at deepwater docking facilities along the Houston Ship Channel and interconnecting pipelines with the Texas City Refinery. It delivers its products through major refined-product pipelines, including the Colonial, Explorer, Orion, and TEPPCO pipelines.

Three Rivers Refinery. Our Three Rivers Refinery is located in South Texas between Corpus Christi and San Antonio. It processes sweet and medium sour crude oils into gasoline, distillates, and aromatics. The refinery has access to crude oil from foreign sources delivered to the Texas Gulf Coast at Corpus Christi as well as crude oil from domestic sources through third-party pipelines and trucks. A 70-mile pipeline transports crude oil via connections to the Three Rivers Refinery from Corpus Christi. The refinery distributes its refined products primarily through pipelines owned by NuStar Energy L.P.

5

West Coast

The following table presents the percentages of principal charges and yields (on a combined basis) for the two refineries in this region for the year ended December 31, 2010. Total throughput volumes for the West Coast refining region averaged approximately 256,000 BPD for the year ended December 31, 2010.

| Combined West Coast Region Charges and Yields | |||

| Charges: | |||

| sour crude oil | 51 | % | |

| 8 | % | ||

| sweet crude oil | 14 | % | |

| other feedstocks | 12 | % | |

| blendstocks | 15 | % | |

| Yields: | |||

| gasolines and blendstocks | 63 | % | |

| distillates | 22 | % | |

| other products (includes gas oil, No. 6 fuel oil, petroleum coke, and asphalt) | 15 | % | |

Benicia Refinery. Our Benicia Refinery is located northeast of San Francisco on the Carquinez Straits of San Francisco Bay. It processes sour crude oils into premium products, primarily CARBOB gasoline. (CARBOB is a reformulated gasoline mixture that meets the specifications of the CARB when blended with ethanol.) The refinery receives crude oil feedstocks via a marine dock that can berth large crude oil carriers and a 20-inch crude oil pipeline connected to a southern California crude oil delivery system. Most of the refinery's products are distributed via the Kinder Morgan pipeline system in California.

Wilmington Refinery. Our Wilmington Refi nery is located near Los Angeles, California. The refinery processes a blend of lower-cost heavy and high-sulfur crude oils. The refinery can produce all of its gasoline as CARBOB gasoline and produces both ultra-low-sulfur diesel and CARB diesel. The refinery is connected by pipeline to marine terminals and associated dock facilities that can move and store crude oil and other feedstocks. Refined products are distributed via the Kinder Morgan pipeline system and various third-party terminals in southern California, Nevada, and Arizona.

6

Mid-Continent

The following table presents the percentages of principal charges and yields (on a combined basis) for the three refineries in this region for the year ended December 31, 2010. Total throughput volumes for the Mid-Continent refining region averaged approximately 398,000 BPD for the year ended December 31, 2010.

| Combined Mid-Continent Region Charges and Yields | |||

| Charges: | |||

| sour crude oil | 12 | % | |

| sweet crude oil | 79 | % | |

| other feedstocks | 1 | % | |

| blendstocks | 8 | % | |

| Yields: | |||

| gasolines and blendstocks | 55 | % | |

| distillates | 35 | % | |

| petrochemicals | 3 | % | |

| other products (includes gas oil, No. 6 fuel oil, and asphalt) | % | ||

Memphis Refinery. Our Memphis Refinery is located in Tennessee along the Mississippi River's Lake McKellar. It processes primarily sweet crude oils. Most of its production is light products, including regular and premium gasoline, diesel, jet fuels, and petrochemicals. Crude oil is supplied to the refinery via the Capline pipeline and can also be received, along with other feedstocks, via barge. The refinery's products are distributed via truck racks at our three product terminals, barges, and a pipeline network, including one pipeline directly to the Memphis airport.

McKee Refinery. Our McKee Refinery is located in the Texas Panhandle. It processes primarily sweet crude oils into conventional gasoline, RBOB, low-sulfur diesel, jet fuels, and asphalt. The refinery has access to crude oil from Texas, Oklahoma, Kansas, and Colorado through third-party pipelines. The refinery also has access at Wichita Falls, Texas to third-party pipelines that transport crude oil from the Texas Gulf Coast and West Texas to the Mid-Continent region. The refinery distributes its products primarily via NuStar Energy L.P.'s pipelines to markets in Texas, New Mexico, Arizona, Colorado, and Oklahoma.

Ardmore Refinery. Our Ardmore Refinery is located in Ardmore, Oklahoma, approximately 100 miles south of Oklahoma City. It processes medium sour and sweet crude oils into conventional gasoline, ultra-low-sulfur diesel, liquefied petroleum gas products, and asphalt. Local crude oil is gathered by TEPPCO's crude oil gathering/trunkline systems and trucking operations, and then transported to the refinery through third-party crude oil pipelines. Foreign, mid-continent, and other domestic crude oils are received via third-party pipelines. Refined products are transported to market via railcars, trucks, and the Magellan pipeline system.

7

Northeast

The following table presents the percentages of principal charges and yields for the Quebec City Refinery for the year ended December 31, 2010. Total throughput volumes for the Northeast refining region averaged approximately 195,000 BPD for the year ended December 31, 2010.

| Northeast Region Charges and Yields | |||

| Charges: | |||

| acidic sweet crude oil | 10 | % | |

| sweet crude oil | 86 | % | |

| other feedstocks | 2 | % | |

| blendstocks | 2 | % | |

| Yields: | |||

| gasolines and blendstocks | 41 | % | |

| distillates | 44 | % | |

| petrochemicals | 1 | % | |

| other products (includes gas oil, No. 6 fuel oil, petroleum coke, and asphalt) | 14 | % | |

Quebec City Refinery. Our Quebec City Refinery is located in Lévis, Canada (near Quebec City). It processes sweet, high mercaptan crude oils and lower-quality, sweet acidic crude oils into conventional gasoline, low-sulfur diesel, jet fuels, heating oil, and propane. The refinery receives crude oil by ship at its deepwater dock on the St. Lawrence River. We charter large ice-strengthened, double-hulled crude oil tankers that can nav igate the St. Lawrence River year-round. The refinery transports its products to its terminals in Quebec and Ontario primarily by train, and also uses ships and trucks extensively throughout eastern Canada.

Feedstock Supply

Approximately 58 percent of our current crude oil feedstock requirements are purchased through term contracts while the remaining requirements are generally purchased on the spot market. Our term supply agreements include arrangements to purchase feedstoc ks at market-related prices directly or indirectly from various foreign national oil companies (including feedstocks originating in the Middle East, Africa, Asia, Mexico, and South America) as well as international and domestic oil companies. The contracts generally permit the parties to amend the contracts (or terminate them), effective as of the next scheduled renewal date, by giving the other party proper notice within a prescribed period of time (e.g., 60 days, 6 months) before expiration of the current term. The majority of the crude oil purchased under our term contracts is purchased at the producer’s official stated price (i.e., the “market” price established by the seller for all purchasers) and not at a nego tiated price specific to us. About 78 percent of our crude oil feedstocks under term supply agreements are imported from foreign sources and about 22 percent are domestic. If we become unable to purchase crude oil from any one of these sources, we believe that adequate alternative supplies of crude oil would be available.

The U.S. network of crude oil pipelines and terminals allows us to acquire crude oil from producing leases, domestic crude oil trading centers, and ships delivering cargoes of foreign and domestic crude oil. Our Quebec City and Aruba Refineries rely on foreign crude oil that is delivered to the refineries’ dock facilities by ship. We use the futures market to manage a portion of the price risk inherent in purchasing crude oil in adva nce of the delivery date and holding inventories of crude oils and refined products.

8

Refining Segment Sales

Our refining segment includes sales of refined products in both the wholesale rack and bulk markets. These sales include refined products that are manufactured in our refining operations as well as refined products purchased or received on exchange from third parties. Most of our refineries have access to marine transportation facilities and interconnect with common-carrier pipeline systems, allowing us to sell products in most major geographic regions of the U.S. and eastern Canada. No customer accounted for more than 10 percent of our total operating revenues in 2010.

Wholesale Marketing

We market branded and unbranded transportation fuels on a wholesale basis in 44 states through an extensive rack marketing network. The principal purchasers of our transportation fuels from terminal truck racks are wholesalers, distributors, retailers, and truck-delivered end users throughout the U.S..

The majority of our rack volume is sold through unbranded channels. The remainder is sold to distributors and dealers that are members of the Valero-brand family that operate approximately 4,000 branded sites. These sites are indepen dently owned and are supplied by us under multi-year contracts. For wholesale branded sites, we promote our Valero® brand throughout the U.S. In addition, we offer the Beacon® brand in California and the Shamrock® brand elsewhere in the U.S.

Bulk Sales and Trading

We sell a significant portion of our gasoline and distillate production through bulk sales channels in domestic and international markets. Our bulk sales are made to various oil companies and traders as well as certain bulk end-users such as railroads, airlines, and utilities. Our bulk sales are transported primarily by pipeline, barges, and tankers to major tank farms and trading hubs.

We also enter into refined product exchange and purchase agreements. These agreements help to minimize transportation costs, optimize refinery utilization, balance refined product availability , broaden geographic distribution, and provide access to markets not connected to our refined product pipeline systems. Exchange agreements provide for the delivery of refined products by us to unaffiliated companies at our and third parties’ terminals in exchange for delivery of a similar amount of refined products to us by these unaffiliated companies at specified locations. Purchase agreements involve our purchase of refined products from third parties with delivery occurring at specified locations.

Specialty Products

We sell a variety of other pr oducts produced at our refineries, which we refer to collectively as “Specialty Products.” Our Specialty Products include asphalt, lube oils, natural gas liquids (NGLs), petroleum coke, petrochemicals, and sulfur.

| • | We produce asphalt at five of our refineries. Our asphalt products are sold for use in road construction, road repair, and roofing applications through a network of refinery and terminal loading racks. |

| • | We produce napthenic oils at one of our refineries suitable for a wide variety of lubricant and process applications. |

| • | NGLs produced at our refineries include butane, isobutane, and propane. These products can b e used for gasoline blending, home heating, and petrochemical plant feedstocks. |

| • | We are a significant producer of petroleum coke, supplying primarily power generation customers and cement manufacturers. Petroleum coke is used largely as a substitute for coal. |

9

| • | We produce and market a number of commodity petrochemicals including aromatic solvents (benzene, toluene, and xylene) and two grades of propylene. Aromatic solvents and propylenes are sold to customers in the chemical industry for further processing into such products as paints, plastics, and adhesives. |

| • | We are a large producer of sulfur with sales primarily to customers in the agricultural sector. Sulfur is used in manufacturing fertilizer. |

10

ETHANOL

We own 10 ethanol plants with a combined ethanol production capacity of about 1.1 billion gallons per year. Our ethanol plants are dry mill facilities1 that process corn to produce ethanol and distillers grains.2 We source our corn supply from local farmers and commercial elevators. Our facilities receive corn by rail and truck. On our website, we publish a corn bid for local farmers and cooperative dealers to use to facilitate corn supply transactions.

The following table presents the locations of our ethanol plants, their approximate ethanol and DDG production capacit ies, and their approximate corn processing capacities.

| State | City | Ethanol Production (in gallons per year) | Production of DDG (in tons per year) | Corn Processed (in bushels per year) | ||||

| Indiana | Linden | 110 million | 350,000 | 40 million | ||||

| Iowa | Albert City | 110 million | 350,000 | 40 million | ||||

| Charles City | 110 million | 350,000 | 40 million | |||||

| Fort Dodge | 110 million | 350,000 | 40 million | |||||

| Hartley | 110 million | 350,000 | 40 million | |||||

| Minnesota | Welcome | 110 million | 350,000 | 40 million | ||||

| Nebraska | Albion | 110 million | 350,000 | 40 million | ||||

| Ohio | Bloomingburg | 110 million | 350,000 | 40 million | ||||

| South Dakota | Aurora | 120 million | 390,000 | 43 million | ||||

| Wisconsin | Jefferson | 110 million | 350,000 | 40 million | ||||

| Total | 1,110 million | 3,540,000 | 403 million |

Ethanol production from our 10 plants in the fourth quarter of 2010 averaged 3.25 million gallons per day. We acquired our Iowa, Minnesota, Nebraska, and South Dakota plants in the second quarter of 2009. We acquired our Indiana, Ohio, and Wisconsin plants in the first quarter of 2010. For additional information regarding these acquisitions, see Note 2 of Notes to Consolidated Financial Statements.

________________________

1 Ethanol is commercially produced using either the wet mill or dry mill process. Wet milling involves separating the grain kernel into its component parts (germ, fiber, protein, and starch) prior to fermentation. In the dry mill process, the entire grain kernel is ground into flour. The starch in the flour is converted to ethanol during the fermentation process, creating carbon dioxide and distillers grains.

;

2 During fermentation, nearly all of the starch in the grain is converted into ethanol and carbon dioxide, while the remaining nutrients (proteins, fats, minerals, and vitamins) are concentrated to yield modified distillers grains, or, after further drying, dried distillers grains. Distillers grains generally are an economical partial replacement for corn, soybean, and dicalcium phosphate in feeds for livestock, swine, and poultry.

11

RETAIL

Our retail segment operations include the following:

| • | sales of transportation fuels at retail stores and unattended self-service cardlocks, |

| • | sales of convenience store merchandise and services in retail stores, and |

| • | sales of home heating oil to residential customers. |

We are one of the largest independent retailers of refined products in the central and southwest U.S. and eastern Canada. Our retail operations are segregated geographically into two groups: Retail-U.S . and Retail-Canada.

Retail-U.S.

Sales in Retail-U.S. represent sales of transportation fuels and convenience store merchandise and services through our company-operated retail sites. For the year ended December 31, 2010, total sales of refined products through Retail-U.S.’s retail sites averaged approximately 119,900 BPD. In addition to transportation fuels, our company-operated convenience stores sell tobacco products, beer, fast food s and sandwiches, snacks, fountain drinks, bagged ice, and candy. Our stores also offer services such as ATM access, money orders, lottery tickets, car wash facilities, air and water, and video rentals. On December 31, 2010, we had 994 company-operated sites in Retail-U.S. (of which 80 percent were owned and 20 percent were leased). Our company-operated stores are operated primarily under the Corner Store® brand name. Transportation fuels sold in our Retail-U.S. stores are sold primarily under the Valero® brand.

Retail-Canada

Sales in Retail-Canada include the following:

| • | sales of refined products and convenience store merchandise th rough our company-operated retail sites and cardlocks, |

| • | sales of refined products through sites owned by independent dealers and jobbers, and |

| • | sales of home heating oil to residential customers. |

Retail-Canada includes retail operations in eastern Canada where we are a major supplier of refined products serving Quebec, Ontario, and the Atlantic Provinces of Newfoundland, Nova Scotia, New Brunswick, and Prince Edward Island. For the year ended December 31, 2010, total retail sales of refined products through Retail-Canada averaged approximately 75,400 BPD. Transportation fuels are sold under the Ultramar® brand through a network of 812 outlets throughout eastern Canada. On December 31, 2010, we owned or leased 392 retail stores in Retail-Canada and distributed gasoline to 420 dealers and independent jobbers. In addition, Retail-Canada operates 83 cardlocks, which are card- or key-activated, self-service, unattended stations that allow commercial, trucking, and governmental fleets to buy transportation fuel 24 hours a day. Retail-Canada operations also include a large home heating oil business that provides home heating oil to approximately 138,000 households in eastern Canada. Our home heating oil business tends to be seasonal to the extent of increased demand for home heating oil during the winter.

12

RISK FACTORS

Our financial results are affected by volatile refining margins and global economic activity.

Our financial results are primarily affected by the relationship, or margin, between refined product prices and the prices for crude oil and other feedstocks. Our cost to acquire feedstocks and the price at which we can ultimately sell refined products depend upon several factors beyond our control, including regional and global supply of and demand for crude oil, gasoline, diesel, and other feedstocks and refined products. These in turn depend on, among other things, the availability and quantity of imports, the production levels of domestic and foreign sup pliers, levels of refined product inventories, productivity and growth (or the lack thereof) of U.S. and global economies, U.S. relationships with foreign governments, political affairs, and the extent of governmental regulation. Historically, refining margins have been volatile, and we believe they will continue to be volatile in the future.

Continued economic turmoil and hostilities, including the threat of future terrorist attacks, could affect the economies of the U.S. and other countries. Lower levels of economic activity during periods of recession could result in declines in energy consumption, including declines in the demand for and consumption of our refined products, which could cause our revenues and margins to decline and limit our future growth prospect s.

Refining margins are also significantly impacted by additional refinery conversion capacity through the expansion of existing refineries or the construction of new refineries. Worldwide refining capacity expansions may result in refining production capability far exceeding refined product demand, which would have a significant adverse effect on refining margins.

A significant portion of our profitability is derived from the ability to purchase and process crude oil feedstocks that historically have been cheaper than benchm ark crude oils, such as West Texas Intermediate and Louisiana Light Sweet crude oils. These crude oil feedstock differentials vary significantly depending on overall economic conditions and trends and conditions within the markets for crude oil and refined products, and they could decline in the future, which would have a negative impact on our earnings.

Uncertainty and illiquidity in credit and capital markets can impair our ability to obtain credit and financing on acceptable terms, and can adversely affect the financial strength of our business partners.

Our ability to obtain credit and capital depends in large measure on capital markets and liquidity factors that we do not control. Our ability to access credit and capital markets may be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, the cost and availability of debt and equity financing may be adversely impacted by unstable or illiquid market conditions. Protracted uncertainty and illiquidity in these markets also could have an adverse impact on our lenders, commodity hedging counterparties, or our customers, causing them to fail to meet their obligations to us. In addition, decreased returns on pension fund assets may also materially increase our pension funding requirements.

We currently maintain investment-grade ratings by Standard & Poor’s Ratings Services (S&P), Moody’s Investors Service (Moody’s), and Fitch Ratings (Fitch) on our senior unsecured debt. (Ratings from credit agencies are not recommendations to buy, sell, or hold our securities. Each rating should be evaluated independently of any other rating.) We cannot provide assurance that any of our current ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances so warrant. Specifically, if S&P, Moody’s, or Fitch were to downgrade our long-term rating, particularly below investment grade, our borrowing costs would increase,

13

which could adversely affect our ability to attract potential investors and our funding sources could decrease. In addition, we may not be able to obtain favorable credit terms from our suppliers or they may require us to provide collateral, letters of credit, or other forms of security which would increase our operating costs. As a result, a downgrade below investment g rade in our credit ratings could have a material adverse impact on our future operations and financial position.

From time to time, our cash needs may exceed our internally generated cash flow, and our business could be materially and adversely affected if we were unable to obtain necessary funds from financing activities. From time to time, we may need to supplement our cash generated from operations with proceeds from financing activities. We have existing revolving credit facilities, committed letter of credit facilities, and an accounts receivable sales facility to provide us with available financing to meet our ongoing cash needs. Uncertainty and illiquidity in financial markets may materially impact the ability of the participating financial institutions to fun d their commitments to us under our various financing facilities. Accordingly, we may not be able to obtain the full amount of the funds available under our financing facilities to satisfy our cash requirements, and our failure to do so could have a material adverse effect on our operations and financial position.

Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance.

The principal environmental risks associated with our operations are emissions into the air and releases into the soil, surface water, or groundwater.&nb sp; Our operations are subject to extensive federal, state, and local environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention measures, greenhouse gas emissions, and characteristics and composition of gasoline and diesel fuels. If we violate or fail to comply with these laws and regulations, we could be fined or otherwise sanctioned. Because environmental laws and regulations are becoming more stringent and new environmental laws and regulations are continuously being enacted or proposed, such as those relating to greenhouse gas emissions and climate change, the level of expenditures required for environmental matters could increase in the future. In particular, current and future legislative action and regulatory initiatives could result in changes to operating permits, additional remedial actions, material changes in operations, increased capital expenditures and operating costs, increased cost s of the goods we sell, and decreased demand for our products that cannot be assessed with certainty at this time. Our refining processes produce significant amounts of carbon dioxide and the fuels we manufacture are the primary source of carbon dioxide emitted from transportation activities. Federal and state restrictions on greenhouse gas emissions - including so-called “cap-and-trade” programs targeted at reducing carbon dioxide emissions - could result in material increased compliance costs, additional operating restrictions for our business, and an increase in the cost of the products we produce, which could have a material adverse effect on our financial position, results of operations, and liquidity.

Disruption of our ability to obtain crude oil could adversely affect our operations.

A significant portion of our feedstock requirements is satisfied through supplies originating in the Middle East, Africa, Asia, North America, and South America. We are, therefore, subject to the political, geographic, and economic risks attendant to doing business with suppliers located in, and supplies originating from, those areas. If one or more of our supply contracts were terminated, or if political events disrupt our traditional crude oil supply, we believe that adequate alternative supplies of crude oil would be available, but it is possible that we would be unable to find alternative sources of supply. If we are unable to obtain adequate crude oil volumes or are able to obtain such volumes only at unfavorable prices, our results of operations could be materially adversely affected, including reduced sales volumes of refined products or reduced margins as a result of higher crude oil costs.

14

In addition, the U.S. government can prevent or restrict us from doing business in or with foreign countries. These restrictions, and those of foreign governments, could limit our ability to gain access to business opportunities in various countries. Actions by both the U.S. and foreign countries have affected our operations in the past and will continue to do so in the future.

Competitors that produce their own supply of feedstocks, have more extensive retail outlets, or have greater financial resources may have a competitive advantage.

The refining and marketing industry is highly co mpetitive with respect to both feedstock supply and refined product markets. We compete with many companies for available supplies of crude oil and other feedstocks and for outlets for our refined products. We do not produce any of our crude oil feedstocks. Many of our competitors, however, obtain a significant portion of their feedstocks from company-owned production and some have more extensive retail outlets than we have. Competitors that have their own production or extensive retail outlets (and greater brand-name recognition) are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages.

Some of our competitor s also have materially greater financial and other resources than we have. Such competitors have a greater ability to bear the economic risks inherent in all phases of our industry. In addition, we compete with other industries that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial, and individual consumers.

A significant interruption in one or more of our refineries could adversely affect our business.

Our refineries are our principal operating assets. As a result, our operations could be subject to significant interruption if one or more of our refineries w ere to experience a major accident or mechanical failure, encounter work stoppages relating to organized labor issues, be damaged by severe weather or other natural or man-made disaster, such as an act of terrorism, or otherwise be forced to shut down. If any refinery were to experience an interruption in operations, earnings from the refinery could be materially adversely affected (to the extent not recoverable through insurance) because of lost production and repair costs. A significant interruption in one or more of our refineries could also lead to increased volatility in prices for crude oil feedstocks and refined products, and could increase instability in the financial and insurance markets, making it more difficult for us to access capital and to obtain insurance coverage that we consider adequate.

We maintain insurance against many, but not all, potential losses arising from operating hazards. Failure by one or more insurers to honor its coverage commitments for an insured event could materially and adversely affect our future cash flows, operating results, and financial condition.

Our refining and marketing operations are subject to various hazards common to the industry, including explosions, fires, toxic emissions, maritime hazards, and natural catastrophes. As protection against these hazards, we maintain insurance coverage against some, but not all, such potential losses and liabilities. We may not be able to maintain or obtain insurance of the type and amount we desire at reasonable rates. As a result of market conditions, premiums and ded uctibles for certain of our insurance policies have increased substantially, and could escalate further. In some instances, certain insurance could become unavailable or available only for reduced amounts of coverage. For example, coverage for hurricane damage is very limited, and coverage for terrorism risks includes very broad exclusions. If we were to incur a significant liability for which we were not fully insured, it could have a material adverse effect on our financial position.

Our insurance program includes a number of insurance carriers. Significant disruptions in financial markets could lead to a deterioration in the financial condition of many financial institutions, including insurance companies. We are not currently aware of any information that would indicate that any of our insurers is

15

unlikely to perform in the event of a covered incident. However, in light of this uncertainty and the risk of a volatile financial market, we c an make no assurances that we will be able to obtain the full amount of our insurance coverage for insured events.

Compliance with and changes in tax laws could adversely affect our performance.

We are subject to extensive tax liabilities, including U.S., state, and foreign income taxes and transactional taxes such as excise, sales/use, payroll, franchise, withholding, and ad valorem taxes. New tax laws and regulations and changes in existing tax laws and regulations are continuously being enacted or proposed that could result in increased expenditures for tax liabilities in the future. Many of these liabiliti es are subject to periodic audits by the respective taxing authority. Subsequent changes to our tax liabilities as a result of these audits may subject us to interest and penalties.

ENVIRONMENTAL MATTERS

We incorporate by reference into this Item the environmental disclosures contained in the following sections of this report:

| • | Item 1 under the caption “Risk Factors – Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance,” |

| • | I tem 3 “Legal Proceedings” under the caption “Environmental Enforcement Matters,” and |

| • | Item 8 “Financial Statements and Supplementary Data” in Note 10 of Notes to Consolidated Financial Statements under the caption “E nvironmental Liabilities.” |

Capital Expenditures Attributable to Compliance with Environmental Regulations. In 2010, our capital expenditures attributable to compliance with environmental regulations were approximately $730 million, and are currently estimated to be $260 million for 2011 and $80 million for 2012. The estimates for 2011 and 2012 do not include amounts related to capital investments at our facilities that management has deemed to be strategic investments. These amounts could materially change as a result of federal and state legislative and regulatory actions.

PROPERTIES

Our principal properties are described above under the caption “Valero’s Operations,” and that information is incorporated herein by reference. We also own feedstock and refined product storage and transportation facilities in various locations. We believe that our properties and facilities are generally adequate for our operations and that our facilities are maintained in a good state of repair. As of December 31, 2010, we were the lessee under a number of cancelable and noncancelable leases for certain properties. Our leases are discussed more fully in Notes 11 and 12 of Notes to Consolidated Financial Statements.

Our patents relating to our refining operations are not material to us as a whole. The trademarks and tradenames under which we conduct our retail and branded wholesale business – including Valero®, Diamond Shamrock®, Shamrock��, Ultramar®, Beacon®, Corner Store®, and Stop N Go® – and other trademarks employed in the marketing of petroleum products are integral to our wholesale and retail marketing operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

16

ITEM 3. LEGAL PROCEEDINGS

Litigation

For the legal proceedings listed below, we incorporate by reference into this Item our disclosures made in Part II, Item 8 of this report included in Note 12 of Notes to Consolidated Financial Statements under the caption “Litigation Matters.”

| • | Retail Fuel Temperature Litigation |

| • | Other Litigation |

Environmental Enforcement Matters

While it is not possible to predict the outcome of the following environmental proceedings, if any one or more of them were decided against us, we believe that there would be no material effect on our financial position or results of operations. We are reporting these proceedings to comply with SEC regulations, which require us to disclose certain information about proceedings arising under federal, state, or local provisions regulating the discharge of materials into the environment or protecting the environment if we reasonably believe that such proceedings will result in monetary sanctions of $100,000 or more.

United States Environmental Protection Agency (EPA) (mobile source enforcement). In November 201 0, the EPA issued a letter to us formalizing a proposed penalty of $585,000 in connection with eight alleged violations of federal fuels regulations (most of which were self-reported) purportedly occurring from March 2004 to 2006 at various refineries and terminals. We are negotiating with the EPA to resolve this matter.

Bay Area Air Quality Management District (BAAQMD) (Benicia Refinery). In the fourth quarter of 2010, we settled 22 violation notices (VN’s) with the BAAQMD that were issued in 2006 and 2007. We presently have outstanding 78 VN’s issued by the BAAQMD from 2008 to 2010 for various alleged air regulation and air permit violations at our Benicia Refinery and asphalt plant. No penalties have been specified in these VN’s. We are pursuing settlement of all VN’s.

New Jersey Department of Environmental Protection (NJDEP) (Paulsboro Refinery). We previously disclosed certain outstanding proceedings between the NJDEP and the Paulsboro Refinery in our Annual Report on Form 10-K for the year ended December 31, 2009; our Quarterly Report on Form 10-Q for the quarter ended March 31, 2010; and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010. Most of these proceedings were resolved in the first quarter of 2011 through a negotiated settlement with the NJDEP. The other proceedings were resolved with entry of Administrative Compliance Orders in the second quarter and fourth quarter of 2010.

People of the State of Illinois, ex rel. v. The Premcor Refining Group Inc., et al., Third Judicial Circuit Court, Madison County (Case No. 03-CH-00459, filed May 29, 2003) (Hartford Refinery and terminal). The Illinois Environmental Protection Agency has issued several notices of violation alleging violations of air and waste regulations at Premcor’s Hartford, Illinois terminal and closed refinery. We are negotiating the terms of a consent order for corrective action.

Texas Commission on Environmental Quality (TCEQ) (Corpus Christi East Refinery). In October 2010, we received a proposed agreed order from the TCEQ relating to unauthorized air emissions during a flaring event and excess air emissions from three plant boilers at our Corpus Christi East Refinery. The gross penalty demand was stated to be more than $100,000, but following our discussions with the TCEQ to clarify certain issues under question, we reasonably believe that the ultimate penalty amount for this matter will fall below $100,000.

17

TCEQ (Corpus Christi West Refinery and Texas City Refinery). In the second quarter of 2009, the TCEQ issued a notice of enforcement (NOE) to our Corpus Christi West Refinery. The NOE alleged excess air emissions relating to two cooling tower leaks that occurred in 2008. The penalty demanded in t he TCEQ’s Preliminary Report and Petition was $1,100,424. In the fourth quarter of 2010, the TCEQ issued a proposed agreed order with a combined penalty of $591,858 pertaining to alleged cooling tower emissions at our Corpus Christi West Refinery and alleged flaring emissions at our Texas City Refinery. We are negotiating with the TCEQ to resolve this matter.

TCEQ (Three Rivers Refinery). In January 2011, we received a proposed agreed order from the TCEQ relating to our Three Rivers Refinery. In the order, the TCEQ alleges unauthorized discharge of wastewater and oily storm water and the unauthorized storage of industrial solid waste. The gross penalty demand is stated to be $105,9 25, but is subject to reduction to $84,740 under certain circumstances. We are in discussions with the TCEQ to resolve this matter.

ITEM 4. RESERVED

18

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the New York Stock Exchange under the symbol “VLO.”

As of January 31, 2011 there were 7,660 holders of record of our common stock.

The following table shows the high and low sales prices of and dividends declared on our common stock for each quarter of 2010 and 2009.

Sales Prices of the Common Stock | Dividends Per Common Share | |||||||||||

| Quarter Ended | High | Low | ||||||||||

| 2010: | ||||||||||||

| December 31 | $ | 23.35 | $ | 17.25 | $ | 0.05 | ||||||

| September 30 | 18.31 | 15.65 | 0.05 | |||||||||

| June 30 | 21.37 | 16.36 | 0.05 | |||||||||

| March 31 | 20.69 | 17.45 | 0.05 | |||||||||

| 2009: | ||||||||||||

| December 31 | $ | 20.67 | $ | 15.89 | $ | 0.15 | ||||||

| September 30 | 20.50 | 15.57 | 0.15 | |||||||||

| June 30 | 23.30 | 16.03 | 0.15 | |||||||||

| March 31 | 25.85 | 16.24 | &nb sp; | 0.15 | ||||||||

On January 25, 2011, our board of directors declared a quarterly cash dividend of $0.05 per common share payable March 16, 2011 to holders of record at the close o f business on February 16, 2011.

Dividends are considered quarterly by the board of directors and may be paid only when approved by the board.

19

The following table discloses purchases of shares of Valero’s common stock made by us or on our behalf during the fourth quarter of 2010.

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Not Purchased as Part of Publicly Announced Plans or Programs (a) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (b) | |||||

| October 2010 | 160,072 | $ | 18.11 | 160,072 | — | $ 3.46 billion | ||||

| November 2010 | 183,109 | $ | 18.64 | 183,109 | — | $ 3.46 billion | ||||

| December 2010 | 249,985 | $ | 21.11 | 249,985 | — | &n bsp; | $ 3.46 billion | |||

| Total | $ | 19.54 | 593,166 | — | $ 3.46 billion | |||||

(a) The shares reported in this column represent purchases settled in the fourth quarter of 2010 relating to (a) our purchases of shares in open-market transactions to meet our obligations under employee stock compensation plans, and (b) our purchases of shares from our employees and non-employee directors in connection with the exercise of stock options, the vesting of restricted stock, and other stock compensation transactions in accordance with the terms of our incentive compensation plans.

(b) On April 26, 2007, we publicly announced an increase in our common stock purchase program from $2 billion to $6 billion, as authorized by our board of directors on April 25, 2007. The $6 billion common stock purchase program has no expiration date. On February 28, 2008, we announced that our board of directors approved a $3&nbs p;billion common stock purchase program, which is in addition to the $6 billion program. This $3 billion program has no expiration date.

20

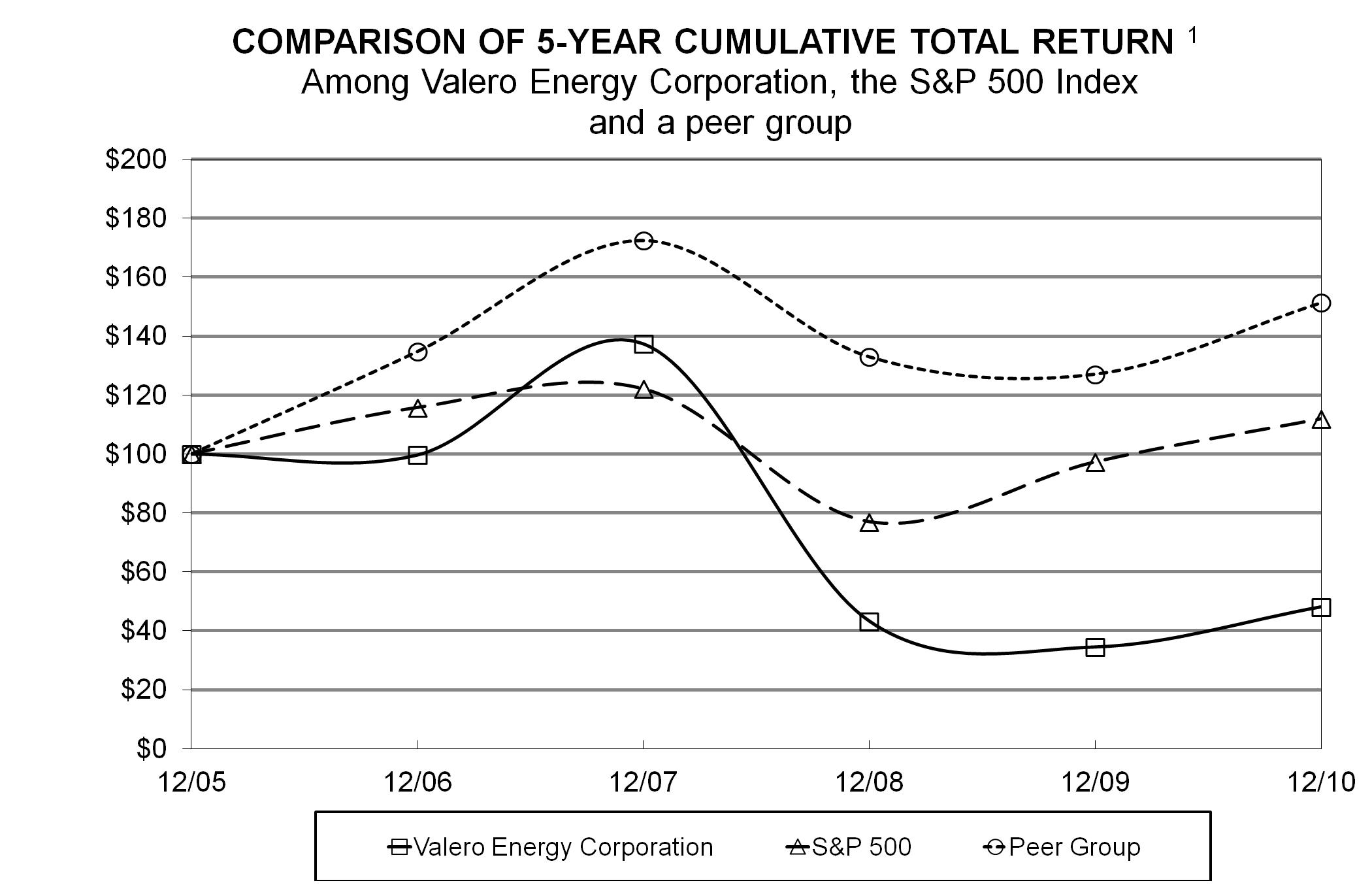

The following p erformance graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of Valero’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

This performance graph and the related textual information are based on historical data and are not indicative of future performance.

The following line graph compares the cumulative total return1 on an investment in our common stock against the cumulative total return of the S&P 500 Composite Index and an index of peer companies (selected by us) for the five-year period commencing December 31, 2005 and ending December 31, 2010. Our peer group consists of the following 13 companies that are engaged in domestic refining operations: Alon USA Energy, Inc., Chevron Corporation, ConocoPhillips, CVR Energy, Inc., Ex xon Mobil Corporation, Frontier Oil Corporation, Hess Corporation, Holly Corporation, Marathon Oil Corporation, Murphy Oil Corporation, Sunoco, Inc., Tesoro Corporation, and Western Refining, Inc.

| 12/2005 | 12/2007 | 12/2008 | 12/2009 | 12/2010 | |||||||||||||||||||

| Valero Common Stock | $ | 100.00 | $ | 99.67 | $ | 137.46 | $ | 43.23 | $ | 34.29 | $ | 48.12 | |||||||||||

| S&P 500 | 100.00 | 115.80 | 122.16 | 76.96 | 97.33 | 111.99 | |||||||||||||||||

| Peer Group | 100.00 | 134.75 | 172.48 | 132.99 | 127.12 | 151.36 | |||||||||||||||||

1 Assumes that an investment in Valero common stock and each index was $100 on December 31, 2005. “Cumulative total return” is based on share price appreciation plus reinvestment of dividends from December 31, 2005 through December 31, 2010.

21

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data for the five-year period ended December 31, 2010 was derived from our audited consolidated financial statements. The following table should be read together with the historical consolidated financial statements and accompanying notes included in Item 8, “Financial Statements and Supplementary Data,” and with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The following summaries are in millions of dollars except for per share amounts:

| Year Ended December 31, | |||||||||||||||||||

2010 (a) (b) | 2009 (a) (b) | 2008 (a) | 2007 (a) | 2006 (a) | |||||||||||||||

| Operating revenues | $ | 82,233 | $ | 64,599 | $ | 106,676 | $ | 85,079 | $ | 78,187 | |||||||||

| Operating income | 1,876 | 83 | 531 | 6,375 | 7,076 | ||||||||||||||

| &nbs p; | |||||||||||||||||||

Income (loss) from continuing operations | 923 | (273 | ) | (1,154 | ) | 4,230 | 4,866 | ||||||||||||

Earnings (loss) per common share from continuing operations - assuming dilution | 1.62 | (0.50 | ) | (2.20 | ) | 7.31 | 7.69 | ||||||||||||

| Dividends per common share | 0.20 | 0.60 | 0.57 | 0.48 | 0.30 | ||||||||||||||

| Property, plant and equipment, net | 22,669 | 21,615 | 20,205 | 18,873 | 17,419 | ||||||||||||||

| Goodwill | — | — | — | 3,943 | 4,019 | ||||||||||||||

| Total assets | 37,621 | 35,572 | 34,417 | 42,722 | 37,753 | ||||||||||||||

Debt and capital lease obligations, less current portion | 7,515 | 7,163 | 6,264 | 6,470 | 4,619 | ||||||||||||||

| Stockholders’ equity | 15,025 | 14,725 | 15,620 | 18,507 | 18,605 | ||||||||||||||

___________________________

| (a) | The information presented in this table excludes the results of operations related to the Paulsboro Refinery, which have been presented as discontinued operations due to the sale of the refinery in December 2010. In addition, the assets related to the Paulsboro Refinery have been presented as asse ts held for sale for all years presented. As a result, the property, plant and equipment and goodwill amounts reflected herein have changed from the amounts presented in our annual report on Form 10-K for the year ended December 31, 2009. |

| (b) | We acquired three ethanol plants in the first quarter of 2010 and seven ethanol plants in the second quarter of 2009. The information presented for 2010 and 2009 includes the results of operations of those plants commencing on their respective acquisition closing dates. |

22

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following review of our results of operations and financial condition should be read in conjunction with Items 1, 1A and 2, “Business, Risk Factors and Properties,” and Item 8, “Financial Statements and Supplementary Data,” included in this report. In the discussions that follow, per-share amounts include the effect of common equivalent shares for periods reflecting income from continuing operations and exclude the effect of common equivalent shares for periods reflecting a loss from continuing operations.

CAUTIONARY STATEMENT FOR THE PURPOSE OF SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report, including without limitation our disclosures below under the heading “OVERVIEW AND OUTLOOK,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify our forward-looking statements by the words “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate,” “project,” “projection,” “predict,” “budget,” “forecast,” “goal,” “guidance,” “target,” “could,” “should,” “may,” and similar expressions.

These forward-looking statements include, among other things, statements regarding:

| • | future refining margins, including gasoline and distillate margins; |

| • | future retail margins, includ ing gasoline, diesel, home heating oil, and convenience store merchandise margins; |

| • | future ethanol margins; |

| • | expectations regarding feedstock costs, including crude oil differentials, and operating expenses; |

| • | anticipated levels of crude oil and refined product inventories; |

| • &nb sp; | our anticipated level of capital investments, including deferred refinery turnaround and catalyst costs and capital expenditures for environmental and other purposes, and the effect of those capital investments on our results of operations; |

| • | anticipated trends in the supply of and demand for crude oil and other feedstocks and refined products in the U.S., Canada, and elsewhere; |

| • | expectations regarding environmental, tax, and other regulatory initiatives; and |

| • | the effect of general economic and other conditions on refining industry fundamentals. |

We based our forward-looking statements on our current expectations, estimates, and projections about ourselves and our industry. We caution that these statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that we cannot predict. In addition, we based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, our actual results may differ materially from the future performance that we have expressed or forecast in the forward-looking statements. Differences between actual results and any future performance suggested in these forward-looking statements could result from a variety of factors, including the following:

| • | acts of terrorism aimed at either our facilities or other facilities that could impair our ability to produce or transport refined products or receive feedstocks; |

| • | political and economic conditions in nations that consume refined products, including the United States, and in crude oil producing regions, including the Middle East and South America; |

| • | domestic and foreign demand for, and supplies of, refined products such as gasoline, diesel fuel, jet fuel, home heating oil, and petrochemicals; |

| • | domestic and foreign demand for, and supplies of, crude oil and other feedstocks; |

23

| • | the ability of the members of the Organization of Petroleum Exporting Countries (OPEC) to agree on and to maintain crude oil price and production controls; |

| • | the level of consumer demand, including seasonal fluctuations; |

| • | refinery overcapacity or undercapacity; |

| • | our ability to successfully integrate any acquired businesses into our operations; |

| • | the actions taken by competitors, including both pricing and adjustments to refining capacity in response to market conditions; |

| • | the level of foreign imports of refined products; |

| • | accidents or other unscheduled shutdowns affecting our refineries, machinery, pipelines, or equi pment, or those of our suppliers or customers; |

| • | changes in the cost or availability of transportation for feedstocks and refined products; |

| • | the price, availability, and acceptance of alternative fuels and alternative-fuel vehicles; |

| • | the levels of government subsidies for ethanol and other alternative fuels; |

| • | delay of, cancellation of, or failure to implement planned capital projects and realize the various assumptions and benefits projected for such projects or cost overruns in constructing such planned capital projects; |

| • | lower than expected ethanol margins; |

| • | earthquakes, hurricanes, tornadoes, and irregular weather, which can unforeseeably affect the price or availability of natural gas, crude oil, grain and other feedstocks, and refined products and ethanol; |

| • | ru lings, judgments, or settlements in litigation or other legal or regulatory matters, including unexpected environmental remediation costs, in excess of any reserves or insurance coverage; |

| • | legislative or regulatory action, including the introduction or enactment of federal, state, municipal, or foreign legislation or rulemakings, including tax and environmental regulations, such as those to be implemented under the California Global Warming Solutions Act (also known as AB32) and the EPA’s regulation of greenhouse gases, which may adverse ly affect our business or operations; |

| • | changes in the credit ratings assigned to our debt securities and trade credit; |

| • | changes in currency exchange rates, including the value of the Canadian dollar relative to the U.S. dollar; |

| • | overall economic conditions, including the stability and liquidity of financial markets; and |

| • | other factors generally described in the “Risk Factors” section included in Items 1, 1A and 2, “Business, Risk Factors and Properties” in this report. |

Any one of these factors, or a combination of these factors, could materially affect our future results of operations and whether any forward-looking statements ultimately prove to be accurate. Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from those suggested in any forward-lookin g statements. We do not intend to update these statements unless we are required by the securities laws to do so.

All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing. We undertake no obligation to publicly release any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

24

OVERVIEW AND OUTLOOK

We reported income from continuing operations of $923 million, or $1.62 per share, for the year ended December 31, 2010, compared to a loss from continuing operations of $273 million, or $0.50 per share, for the year ended December 31, 2009. These results were primarily due to our refining segment operations, which generated operating income of $1.9 billion for the year ended December 31, 2010, compared to operating income of $247 million for the year ended December 31, 2009. The increase in refining operating income was primarily due to improved margins for the distillate products we produce and wider sour crude oil differentials. The sour crude oil differential is the difference between the price of sweet crude oil and the price of sour crude oil. We believe that the improved distillate margins are due to an increase in the demand for refined products resulting from the improving U.S. and worldwide economies. Although improving, refined product demand has not returned to levels experienced prior to the economic slowdown that began in 2008. Excess worldwide refinery capacity and high levels of refined product inventories continue to constrain refined product margins.

In response to the worldwide economic slowdown, and as a result of our assessment of the operating performance and profitability of our refineries, we temporarily shut down our Aruba Refinery in July 2009 and p ermanently shut down our Delaware City Refinery in November 2009. In June 2010, we sold our shutdown Delaware City Refinery assets and associated terminal and pipeline assets for $220 million of cash proceeds, and in December 2010, we sold our Paulsboro Refinery and associated inventory for $547 million of cash proceeds and a $160 million one-year note. Our Aruba Refinery remained idle throughout 2010, but in the third quarter of 2010, we began refinery-wide maintenance to prepare the refinery’s production units for restart due to improved sour crude oil differentials and a general improvement in refining economics. The Aruba Refinery resumed operations in January 2011.

Our retail segment generated operating income of $346 million for the year ended December 31, 2010 compared to operating income of $293 million for the year ended December 31, 2009. The 2010 results benefited from the blending of ethanol into gasoline sold by our retail segment. For most of 2010, ethanol was a lower cost product than gasoline and this lower cost results in an increase in retail fuel margins. During the latter part of 2010, the difference between the cost of gasoline and the cost of et hanol began to narrow and the benefit that our retail segment experienced through most of 2010 from the blending of ethanol into gasoline narrowed. Should this trend continue in 2011, our retail fuel margins may be negatively impacted as compared to 2010.

In the second quarter of 2009, we entered the ethanol business through the acquisition of seven ethanol facilities, and we acquired three additional facilities in the first quarter of 2010. We believe that ethanol is a natural fit for us because we manufacture transportation fuels. During the year ended December 31, 2010, our ethanol segment generated operating in come of $209 million, compared to $165 million for the year ended December 31, 2009. The ethanol business is dependent on margins between ethanol and corn feedstocks and can be impacted by U.S. government subsidies and biofuels (including ethanol) mandates.

To support our financial strength and liquidity, we issued $1.25 b illion in debt during the first quarter of 2010 at interest rates favorable to those on our existing debt. We used a portion of the proceeds to redeem $484 million of debt with a higher interest rate, and the remainder was used for general corporate purposes. In December 2010, we received proceeds of $300 million under a financing agreement associated with the issuance of $300 million of Gulf Opportunity Zone Revenue Bonds (GO Zone Bonds). In February 2011, we paid $300 million to acquire the GO Zone Bonds, which we expect to hold and reissue in future years to help fund the construction costs of a capital project at our St. Charles Refinery.

& nbsp;

25

We expect the U.S. and worldwide economies to continue to recover slowly, and we expect refined product demand to increase. The increase in anticipated refined product demand is expected to result in an increase in crude oil production, which we believe will result in the production of more sour crude oils and continued improvement in sour crude oil differentials. The expected increases in refined product demand and sour crude oil production should favorably impact our refined product margins. However, we expect that the current excess global refining capacity will put pressure on refining margins and could result in ongoing production constraints or refinery shutdowns in the refining industry. We will continue to optimize our refining assets based on market conditions.

26

RESULTS OF OPERATIONS

The following tables highlight our results of operations, our operating performance, and market prices that directly impact our operations. The narrative following these tables provides an analysis of our results of operations.

2010 Compared to 2009

Financial Highlights (a) (b) (c)

(millions of dollars, except per share amounts)

| Year Ended December 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

| Operating revenues | $ | 82,233 | $ | 64,599 | $ | 17,634 | |||||

| Costs and expenses: | |||||||||||

| Cost of sales (d) | 74,458 | 58,686 | 15,772 | ||||||||

| Operating expenses: | |||||||||||

| Refining | 2,944 | 2,880 | 64 | ||||||||

| Retail (d) | 654 | 626 | 28 | ||||||||

| Ethanol | 363 | 169 | 194 | ||||||||

| General and administrative expenses | 531 | 572 | (41 | ) | |||||||

| Depreciation and amortization expense: | |||||||||||

| Refining | 1,210 | 1,194 | 16 | ||||||||

| Retail | 108 | 101 | 7 | ||||||||

| Ethanol | 36 | 18 | 18 | ||||||||

Income (loss) from continuing operations

before income tax expense (benefit)

________________

27

Operating Highlights

(millions of dollars, except per barrel and per gallon amounts)

| Year Ended December 31, | |||||||||||

| 2010 | 2009 | Change | |||||||||

| Refining (a) (b): | |||||||||||

| Operating income (e) | $ | 1,903 | $ | 247 | $ | 1,656 | |||||

| Throughput margin per barrel (f) | $ | 7.80 | $ | 6.00 | $ | 1.80 | |||||

| Operating costs per barrel (e): | |||||||||||

| Operating expenses | $ | 3.79 | $ | 3.71 | $ | 0.08 | |||||

| Depreciation and amortization expense | 1.56 | 1.55 | 0.01 | ||||||||