0001035002 srt:ConsolidationEliminationsMember vlo:VariableInterestEntityPrimaryBeneficiaryDiamondGreenDieselHoldingsLLCMember 2019-01-01 2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from _______________ to _______________ |

Commission file number 001-13175

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 74-1828067 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

One Valero Way

San Antonio, Texas 78249

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (210) 345-2000

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock | | VLO | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | | | | | |

| | Large accelerated filer | ☑ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | |

| | | Smaller reporting company | ☐ | | Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common stock held by non-affiliates was approximately $35.5 billion based on the last sales price quoted as of June 28, 2019 on the New York Stock Exchange, the last business day of the registrant’s most recently completed second fiscal quarter.

As of January 31, 2020, 409,337,126 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

We intend to file with the Securities and Exchange Commission a definitive Proxy Statement for our Annual Meeting of Stockholders scheduled for April 30, 2020, at which directors will be elected. Portions of the 2020 Proxy Statement are incorporated by reference in Part III of this Form 10-K and are deemed to be a part of this report.

CROSS-REFERENCE SHEET

The following table indicates the headings in the 2020 Proxy Statement where certain information required in Part III of this Form 10-K may be found.

|

| | | |

| Form 10-K Item No. and Caption | | Heading in 2020 Proxy Statement |

| | | | |

| 10. | Directors, Executive Officers and Corporate Governance | | Information Regarding the Board of Directors, Independent Directors, Audit Committee, Proposal No. 1 Election of Directors, Information Concerning Nominees and Other Directors, Identification of Executive Officers, and Governance Documents and Codes of Ethics |

| | | | |

| 11. | Executive Compensation | | Compensation Committee, Compensation Discussion and Analysis, Executive Compensation, Director Compensation, Pay Ratio Disclosure, and Certain Relationships and Related Transactions |

| | | | |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | Beneficial Ownership of Valero Securities and Equity Compensation Plan Information |

| | | | |

| 13. | Certain Relationships and Related Transactions, and Director Independence | | Certain Relationships and Related Transactions and Independent Directors |

| | | | |

| 14. | Principal Accountant Fees and Services | | KPMG LLP Fees and Audit Committee Pre-Approval Policy |

Copies of all documents incorporated by reference, other than exhibits to such documents, will be provided without charge to each person who receives a copy of this Form 10-K upon written request to Valero Energy Corporation, Attn: Secretary, P.O. Box 696000, San Antonio, Texas 78269-6000.

CONTENTS

The terms “Valero,” “we,” “our,” and “us,” as used in this report, may refer to Valero Energy Corporation, to one or more of its consolidated subsidiaries, or to all of them taken as a whole. In this Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions, and resources under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You should read our forward-looking statements together with our disclosures beginning on page 23 of this report under the heading: “CAUTIONARY STATEMENT FOR THE PURPOSE OF SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.”

PART I

ITEMS 1. and 2. BUSINESS AND PROPERTIES

OVERVIEW

We are a Fortune 500 company based in San Antonio, Texas. Our corporate offices are at One Valero Way, San Antonio, Texas, 78249, and our telephone number is (210) 345-2000. We were incorporated in Delaware in 1981 under the name Valero Refining and Marketing Company. We changed our name to Valero Energy Corporation on August 1, 1997. Our common stock trades on the New York Stock Exchange (NYSE) under the trading symbol “VLO.” On January 31, 2020, we had 10,222 employees.

We own 15 petroleum refineries located in the United States (U.S.), Canada, and the United Kingdom (U.K.) with a combined throughput capacity of approximately 3.15 million barrels per day (BPD). Our refineries produce conventional gasolines, premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), diesel, low-sulfur diesel, ultra-low-sulfur diesel, CARB diesel, other distillates, jet fuel, asphalt, petrochemicals, lubricants, and other refined petroleum products. We also own 14 ethanol plants located in the Mid-Continent region of the U.S. with a combined production capacity of approximately 1.73 billion gallons per year. We are also a joint venture partner in Diamond Green Diesel Holdings LLC (DGD), which owns and operates a renewable diesel plant in Norco, Louisiana. We sell our products in the wholesale rack or bulk markets in the U.S., Canada, the U.K., Ireland, and Latin America. Approximately 7,000 outlets carry our brand names.

On January 10, 2019, we completed our acquisition of all of the outstanding publicly held common units of Valero Energy Partners LP (VLP) as described in Note 2 of Notes to Consolidated Financial Statements, which is incorporated herein by reference.

AVAILABLE INFORMATION

Our website address is www.valero.com. Information on our website is not part of this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other reports, as well as any amendments to those reports, filed with (or furnished to) the U.S. Securities and Exchange Commission (SEC) are available on our website (under About Valero > Investor Relations > Financial Information > SEC Filings) free of charge, soon after we file or furnish such material. In this same location, we also post our corporate governance guidelines and other governance policies, codes of ethics, and the charters of the committees of our board of directors. These documents are available in print to any stockholder that makes a written request to Valero Energy Corporation, Attn: Secretary, P.O. Box 696000, San Antonio, Texas 78269-6000.

VALERO’S OPERATIONS

Effective January 1, 2019, we revised our reportable segments to align with certain changes in how our chief operating decision maker manages and allocates resources to our business. Accordingly, we created a new reportable segment — renewable diesel — because of the growing importance of renewable fuels in the market and the growth of our investments in renewable fuels production. The renewable diesel segment includes the operations of DGD, which were transferred from the refining segment on January 1, 2019. Also effective January 1, 2019, we no longer have a VLP segment, and we include the operations of VLP in our refining segment. This change was made because of the Merger Transaction with VLP, as defined and discussed in Note 2 of Notes to Consolidated Financial Statements, which is incorporated herein by reference, and the resulting change in how we manage VLP’s operations. We no longer manage VLP as a business but as logistics assets that support the operations of our refining segment.

As a result, as of December 31, 2019, we had three reportable segments as follows:

| |

| • | Refining segment includes our refining operations, the associated marketing activities, and logistics assets that support our refining operations; |

| |

| • | Ethanol segment includes our ethanol operations, the associated marketing activities, and logistics assets that support our ethanol operations; and |

| |

| • | Renewable diesel segment includes the operations of DGD, our consolidated joint venture, as discussed in Note 12 of Notes to Consolidated Financial Statements, which is incorporated herein by reference. |

Financial information about these segments is presented in Note 17 of Notes to Consolidated Financial Statements, which is incorporated herein by reference.

REFINING

Refining Operations

As of December 31, 2019, our refining operations included 15 petroleum refineries in the U.S., Canada, and the U.K., with a combined total throughput capacity of approximately 3.15 million BPD. The following table presents the locations of these refineries and their approximate feedstock throughput capacities as of December 31, 2019.

|

| | | | | |

| Refinery | | Location | | Throughput Capacity (a) (BPD) |

| U.S. | | | | |

| Benicia | | California | | 170,000 |

|

| Wilmington | | California | | 135,000 |

|

| Meraux | | Louisiana | | 135,000 |

|

| St. Charles | | Louisiana | | 340,000 |

|

| Ardmore | | Oklahoma | | 90,000 |

|

| Memphis | | Tennessee | | 195,000 |

|

| Corpus Christi (b) | | Texas | | 370,000 |

|

| Houston | | Texas | | 255,000 |

|

| McKee | | Texas | | 200,000 |

|

| Port Arthur | | Texas | | 395,000 |

|

| Texas City | | Texas | | 260,000 |

|

| Three Rivers | | Texas | | 100,000 |

|

| Canada | | | | |

| Quebec City | | Quebec, Canada | | 235,000 |

|

| U.K. | | | | |

| Pembroke | | Wales, U.K. | | 270,000 |

|

| Total | | | | 3,150,000 |

|

________________________

| |

| (a) | “Throughput capacity” represents estimated capacity for processing crude oil, inter-mediates, and other feedstocks. Total estimated crude oil capacity is approximately 2.6 million BPD. |

| |

| (b) | Represents the combined capacities of two refineries – the Corpus Christi East and Corpus Christi West Refineries. |

The following table presents the percentages of principal charges and yields (on a combined basis) for all of our refineries for 2019, during which period our total combined throughput volumes averaged approximately 3.0 million BPD.

|

| | | |

| Combined Total Refining System Charges and Yields |

| Charges | | |

| | sour crude oil | 23 | % |

| | sweet crude oil | 54 | % |

| | residual fuel oil | 7 | % |

| | other feedstocks | 5 | % |

| | blendstocks | 11 | % |

| Yields | | |

| | gasolines and blendstocks | 48 | % |

| | distillates | 38 | % |

| | other products (primarily includes petrochemicals, gas oils, No. 6 fuel oil, petroleum coke, sulfur and asphalt) | 14 | % |

California

Benicia Refinery. Our Benicia Refinery is located northeast of San Francisco on the Carquinez Straits of San Francisco Bay. It processes sour crude oils into gasoline, diesel, jet fuel, and asphalt. Gasoline production is primarily California Reformulated Blendstock Gasoline for Oxygenate Blending (CARBOB), which meets CARB specifications when blended with ethanol. The refinery receives crude oil feedstocks via a marine dock and crude oil pipelines connected to a southern California crude oil delivery system. Most of the refinery’s products are distributed via pipeline and truck rack into northern California markets.

Wilmington Refinery. Our Wilmington Refinery is located near Los Angeles. The refinery processes a blend of heavy and high-sulfur crude oils. The refinery produces CARBOB gasoline, diesel, CARB diesel, jet fuel, and asphalt. The refinery is connected by pipeline to marine terminals and associated dock facilities that move and store crude oil and other feedstocks. Refined petroleum products are distributed via pipeline systems to various third-party terminals in southern California, Nevada, and Arizona.

Louisiana

Meraux Refinery. Our Meraux Refinery is located approximately 15 miles southeast of New Orleans along the Mississippi River. The refinery processes sour and sweet crude oils into gasoline, diesel, jet fuel, and high sulfur fuel oil. The refinery receives crude oil at its dock and has access to the Louisiana Offshore Oil Port. Finished products are shipped from the refinery’s dock and through the Colonial pipeline. The refinery is located about 40 miles from our St. Charles Refinery, allowing for integration of feedstocks and refined petroleum product blending.

St. Charles Refinery. Our St. Charles Refinery is located approximately 25 miles west of New Orleans along the Mississippi River. The refinery processes sour crude oils and other feedstocks into gasoline and diesel. The refinery receives crude oil over docks and has access to the Louisiana Offshore Oil Port. Finished products are shipped over these docks and through our Parkway pipeline and the Bengal pipeline, which ultimately provide access to the Plantation and Colonial pipeline networks.

Oklahoma

Ardmore Refinery. Our Ardmore Refinery is located in Oklahoma, approximately 100 miles south of Oklahoma City. It processes sweet and sour crude oils into gasoline, diesel, and asphalt. The refinery predominantly receives Permian Basin and Cushing-sourced crude oil via third-party pipelines. Refined petroleum products are transported via rail, trucks, and the Magellan pipeline system.

Tennessee

Memphis Refinery. Our Memphis Refinery is located in Tennessee along the Mississippi River. It processes primarily sweet crude oils. Most of its production is gasoline, diesel, and jet fuels. Crude oil supply is primarily from Cushing, Oklahoma over the Diamond Pipeline. Crude oil can also be received, along with other feedstocks, via barge. Most of the refinery’s products are distributed via truck rack and barges.

Texas

Corpus Christi East and West Refineries. Our Corpus Christi East and West Refineries are located on the Texas Gulf Coast along the Corpus Christi Ship Channel. The East Refinery processes sour crude oil, and the West Refinery processes sweet crude oil, sour crude oil, and residual fuel oil. The feedstocks are delivered by tanker and barge via deepwater docking facilities along the Corpus Christi Ship Channel, and West Texas or South Texas crude oil is delivered via pipelines. The refineries’ physical locations allow for the transfer of various feedstocks and blending components between them. The refineries produce gasoline, aromatics, jet fuel, diesel, and asphalt. Truck racks service local markets for gasoline, diesel, jet fuels, liquefied petroleum gases, and asphalt. These and other finished products are also distributed by ship and barge across docks and third-party pipelines.

Houston Refinery. Our Houston Refinery is located on the Houston Ship Channel. It processes sweet crude and intermediate oils into gasoline, jet fuel, and diesel. The refinery successfully commissioned a new alkylation unit in 2019. The refinery receives its feedstocks primarily by various interconnecting pipelines and also has waterborne-receiving capability at deepwater docking facilities along the Houston Ship Channel. The majority of its finished products are delivered to local, mid-continent U.S., and northeastern U.S. markets through various pipelines, including the Colonial and Explorer pipelines.

McKee Refinery. Our McKee Refinery is located in the Texas Panhandle. It processes primarily sweet crude oils into gasoline, diesel, jet fuels, and asphalt. The refinery has access to local and Permian Basin crude oil sources via third-party pipelines. Refined petroleum products are transported primarily via third-party pipelines and rail to markets in Texas, New Mexico, Arizona, Colorado, Oklahoma, and Mexico.

Port Arthur Refinery. Our Port Arthur Refinery is located on the Texas Gulf Coast approximately 90 miles east of Houston. The refinery processes heavy sour crude oils and other feedstocks into gasoline, diesel, and jet fuel. The refinery receives crude oil by rail, marine docks, and pipelines. Finished products are distributed into the Colonial, Explorer, and other pipelines, and across the refinery docks into ships and barges.

Texas City Refinery. Our Texas City Refinery is located southeast of Houston on the Houston Ship Channel. The refinery processes crude oils into gasoline, diesel, and jet fuel. The refinery receives its feedstocks by pipeline and by ship or barge via deepwater docking facilities along the Houston Ship Channel. The refinery uses ships and barges, as well as the Colonial, Explorer, and other pipelines for distribution of its products.

Three Rivers Refinery. Our Three Rivers Refinery is located in South Texas between Corpus Christi and San Antonio. It primarily processes sweet crude oils into gasoline, distillates, and aromatics. The refinery has access to crude oil from West Texas and South Texas through third-party pipelines and trucks. The refinery distributes its refined petroleum products primarily through third-party pipelines.

Canada

Quebec City Refinery. Our Quebec City Refinery is located in Lévis, Canada (near Quebec City). It processes sweet crude oils into gasoline, diesel, jet fuel, heating oil, and low-sulfur fuel oil. The refinery receives crude oil by ship at its deepwater dock on the St. Lawrence River and by pipeline and ship from western Canada. The refinery transports its products through our pipeline from Quebec City to our terminal in Montreal and to various other terminals throughout eastern Canada by rail, ships, trucks, and third-party pipelines.

U.K.

Pembroke Refinery. Our Pembroke Refinery is located in the County of Pembrokeshire in southwest Wales, U.K. The refinery processes primarily sweet crude oils into gasoline, diesel, jet fuel, heating oil, and low-sulfur fuel oil. The refinery receives all of its feedstocks and delivers some of its products by ship and barge via deepwater docking facilities along the Milford Haven Waterway, with its remaining products being delivered through our Mainline pipeline system and by trucks.

Feedstock Supply

Our crude oil feedstocks are purchased through a combination of term and spot contracts. Our term supply agreements are at market-related prices and are purchased directly or indirectly from various national oil companies as well as international and U.S. oil companies. The contracts generally permit the parties to amend the contracts (or terminate them), effective as of the next scheduled renewal date, by giving the other party proper notice within a prescribed period of time (e.g., 60 days, 6 months) before expiration of the current term. The majority of the crude oil purchased under our term contracts is purchased at the producer’s official stated price (i.e., the “market” price established by the seller for all purchasers) and not at a negotiated price specific to us.

Marketing

Overview

We sell refined petroleum products in both the wholesale rack and bulk markets. These sales include refined petroleum products that are manufactured in our refining operations, as well as refined petroleum products purchased or received on exchange from third parties. Most of our refineries have access to marine transportation facilities and interconnect with common-carrier pipeline systems, allowing us to sell products in the U.S., Canada, the U.K., and other countries.

Wholesale Rack Sales

We sell our gasoline and distillate products, as well as other products, such as asphalt, lube oils, and natural gas liquids (NGLs), on a wholesale basis through an extensive rack marketing network. The principal purchasers of our refined petroleum products from terminal truck racks are wholesalers, distributors, retailers, and truck-delivered end users throughout the U.S., Canada, the U.K., Ireland, and Latin America.

The majority of our rack volume is sold through unbranded channels. The remainder is sold to distributors and dealers that are members of the Valero-brand family that operate 5,158 branded sites in the U.S., 874 branded sites in the U.K. and Ireland, and 795 branded sites in Canada as of December 31, 2019. These sites are independently owned and are supplied by us under multi-year contracts. For branded sites, products are sold under the Valero®, Beacon®, Diamond Shamrock®, and Shamrock® brands in the U.S., the Texaco® brand in the U.K. and Ireland, and the Ultramar® brand in Canada.

Bulk Sales

We also sell our gasoline and distillate products, as well as other products, such as asphalt, petrochemicals, and NGLs, through bulk sales channels in the U.S. and international markets. Our bulk sales are made to

various oil companies, traders, and bulk end-users, such as railroads, airlines, and utilities. Our bulk sales are transported primarily by pipeline, barges, and tankers to major tank farms and trading hubs.

We also enter into refined petroleum product exchange and purchase agreements. These agreements help minimize transportation costs, optimize refinery utilization, balance refined petroleum product availability, broaden geographic distribution, and provide access to markets not connected to our refined product pipeline systems. Exchange agreements provide for the delivery of refined petroleum products by us to unaffiliated companies at our and third-parties’ terminals in exchange for delivery of a similar amount of refined petroleum products to us by these unaffiliated companies at specified locations. Purchase agreements involve our purchase of refined petroleum products from third parties with delivery occurring at specified locations.

Logistics

We own logistics assets (crude oil pipelines, refined petroleum product pipelines, terminals, tanks, marine docks, truck rack bays, and other assets) that support our refining operations.

ETHANOL

We own 14 ethanol plants with a combined ethanol production capacity of 1.73 billion gallons per year. Our ethanol plants are dry mill facilities that process corn to produce ethanol, distillers grains, and corn oil. We source our corn supply from local farmers and commercial elevators. Our facilities receive corn primarily by rail and truck. We publish on our website a corn bid for local farmers and cooperative dealers to facilitate corn supply transactions.

We sell our ethanol primarily to refiners and gasoline blenders under term and spot contracts in bulk markets such as New York, Chicago, the U.S. Gulf Coast, Florida, and the U.S. West Coast. We also export our ethanol into the global markets. We ship our dry distillers grains (DDGs) by truck or rail primarily to animal feed customers in the U.S. and Mexico. We also sell modified distillers grains locally at our plant sites, and corn oil by truck and rail. We distribute our ethanol through logistics assets, which include railcars owned by us.

The following table presents the locations of our ethanol plants, their approximate annual production capacities for ethanol (in millions of gallons) and DDGs (in tons), and their approximate annual corn processing capacities (in millions of bushels).

|

| | | | | | | | |

| State | | City | | Ethanol Production Capacity | | Production of DDGs | | Corn Processed |

| Indiana | | Bluffton | | 115 | | 302,000 | | 40 |

| | | Linden | | 135 | | 355,000 | | 47 |

| | | Mount Vernon | | 100 | | 263,000 | | 35 |

| Iowa | | Albert City | | 135 | | 355,000 | | 47 |

| | | Charles City | | 140 | | 368,000 | | 49 |

| | | Fort Dodge | | 140 | | 368,000 | | 49 |

| | | Hartley | | 140 | | 368,000 | | 49 |

| | | Lakota | | 110 | | 289,000 | | 38 |

| Michigan | | Riga | | 55 | | 145,000 | | 19 |

| Minnesota | | Welcome | | 140 | | 368,000 | | 49 |

| Nebraska | | Albion | | 135 | | 355,000 | | 47 |

| Ohio | | Bloomingburg | | 135 | | 355,000 | | 47 |

| South Dakota | | Aurora | | 140 | | 368,000 | | 49 |

| Wisconsin | | Jefferson | | 110 | | 352,000 | | 41 |

| Total | | | | 1,730 | | 4,611,000 | | 606 |

The combined production of ethanol from our plants averaged 4.3 million gallons per day for 2019.

RENEWABLE DIESEL

Our renewable segment includes the operations of DGD, which owns and operates a biomass-based diesel plant (the DGD Plant) that processes animal fats, used cooking oils, and other vegetable oils into renewable diesel. The DGD Plant is located next to our St. Charles Refinery in Norco, Louisiana. During 2019, the DGD Plant’s capacity was approximately 18,000 BPD. The DGD Plant is capable of annually converting approximately 2.3 billion pounds of rendered and recycled material into more than 275 million gallons of renewable diesel. In 2019, we began an expansion of the DGD Plant that is expected to increase production up to 675 million gallons of renewable diesel annually. DGD is in the advanced engineering review phase for a potential new renewable diesel plant to be located in Port Arthur, Texas.

ENVIRONMENTAL MATTERS

We incorporate by reference into this Item the environmental disclosures contained in the following sections of this report:

| |

| • | Item 1A, “RISK FACTORS”—Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance; |

| |

| • | Item 1A, “RISK FACTORS”—Compliance with the U.S. Environmental Protection Agency (EPA) Renewable Fuel Standard (RFS) could adversely affect our performance; |

| |

| • | Item 1A, “RISK FACTORS”—We may incur additional costs as a result of our use of rail cars for the transportation of crude oil and the products that we manufacture; |

| |

| • | Item 3, “LEGAL PROCEEDINGS” under the caption “ENVIRONMENTAL ENFORCEMENT MATTERS,” and; |

| |

| • | Item 8, “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” in Note 8 of Notes to Consolidated Financial Statements. |

Capital Expenditures Attributable to Compliance with Environmental Regulations. In 2019, our capital expenditures attributable to compliance with environmental regulations were $235 million, and they are currently estimated to be $14 million for 2020 and $20 million for 2021. The estimates for 2020 and 2021 do not include amounts related to capital investments at our facilities that management has deemed to be strategic investments. These amounts could materially change as a result of governmental and regulatory actions.

PROPERTIES

Our principal properties are described above under the caption “VALERO’S OPERATIONS,” and that information is incorporated herein by reference. We believe that our properties and facilities are generally adequate for our operations and that our facilities are maintained in a good state of repair. As of December 31, 2019, we were the lessee under a number of cancelable and noncancelable leases for certain properties. Our leases are discussed in Note 5 of Notes to Consolidated Financial Statements, which is incorporated herein by reference. Financial information about our properties is presented in Note 6 of Notes to Consolidated Financial Statements, which is incorporated herein by reference.

Our patents relating to our refining operations are not material to us as a whole. The trademarks and tradenames under which we conduct our branded wholesale business — Valero®, Diamond Shamrock®, Shamrock®, Ultramar®, Beacon®, and Texaco®— and other trademarks employed in the marketing of refined petroleum products are integral to our wholesale rack marketing operations.

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors in addition to the other information included in this report. Each of these risk factors could adversely affect our business, operating results, and/or financial condition, as well as adversely affect the value of an investment in our common stock.

Our financial results are affected by volatile refining margins, which are dependent upon factors beyond our control, including the price of crude oil and the market price at which we can sell refined petroleum products.

Our financial results are primarily affected by the relationship, or margin, between refined petroleum product prices and the prices for crude oil and other feedstocks. Historically, refining margins have been volatile, and we believe they will continue to be volatile in the future. Our cost to acquire feedstocks and the price at which we can ultimately sell refined petroleum products depend upon several factors beyond our control, including regional and global supply of and demand for crude oil, gasoline, diesel, and other feedstocks and refined petroleum products. These in turn depend on, among other things, the availability and quantity of imports, the production levels of U.S. and international suppliers, levels of refined petroleum product inventories, productivity and growth (or the lack thereof) of U.S. and global economies, U.S. relationships with foreign governments, political affairs, and the extent of governmental regulation.

Some of these factors can vary by region and may change quickly, adding to market volatility, while others may have longer-term effects. The longer-term effects of these and other factors on refining and marketing margins are uncertain. We do not produce crude oil and must purchase all of the crude oil we refine. We may purchase our crude oil and other refinery feedstocks long before we refine them and sell the refined petroleum products. Price level changes during the period between purchasing feedstocks and selling the refined petroleum products from these feedstocks could have a significant effect on our financial results. A decline in market prices may negatively impact the carrying value of our inventories.

Economic turmoil and political unrest or hostilities, including the threat of future terrorist attacks, could affect the economies of the U.S. and other countries. Lower levels of economic activity could result in declines in energy consumption, including declines in the demand for and consumption of our refined petroleum products, which could cause our revenues and margins to decline and limit our future growth prospects.

Refining margins are also significantly impacted by additional refinery conversion capacity through the expansion of existing refineries or the construction of new refineries. Worldwide refining capacity expansions may result in refining production capability exceeding refined petroleum product demand, which would have an adverse effect on refining margins.

A significant portion of our profitability is derived from the ability to purchase and process crude oil feedstocks that historically have been cheaper than benchmark crude oils, such as Louisiana Light Sweet (LLS) and Brent crude oils. These crude oil feedstock differentials vary significantly depending on overall economic conditions and trends and conditions within the markets for crude oil and refined petroleum products, and they could decline in the future, which would have a negative impact on our results of operations.

Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance.

The principal environmental risks associated with our operations are emissions into the air and releases into the soil, surface water, or groundwater. Our operations are subject to extensive environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention measures, greenhouse gas (GHG) emissions, and characteristics and composition of fuels, including gasoline and diesel. Certain of these laws and regulations could impose obligations to conduct assessment or remediation efforts at our facilities as well as at formerly owned properties or third-party sites where we have taken wastes for disposal or where our wastes have migrated. Environmental laws and regulations also may impose liability on us for the conduct of third parties, or for actions that complied with applicable requirements when taken, regardless of negligence or fault. If we violate or fail to comply with these laws and regulations, we could be fined or otherwise sanctioned.

Because environmental laws and regulations are becoming more stringent and new environmental laws and regulations are continuously being enacted or proposed, such as those relating to GHG emissions and climate change, the level of expenditures required for environmental matters could increase in the future. Current and future legislative action and regulatory initiatives could result in changes to operating permits, material changes in operations, increased capital expenditures and operating costs, increased costs of the goods we sell, and decreased demand for our products that cannot be assessed with certainty at this time. We may be required to make expenditures to modify operations, discontinue use of certain process units, or install pollution control equipment that could materially and adversely affect our business, financial condition, results of operations, and liquidity.

For example, in 2015, the U.S., Canada, and the U.K. participated in the United Nations Conference on Climate Change, which led to the creation of the Paris Agreement. The Paris Agreement, which was signed by the U.S. in April 2016, requires countries to review and “represent a progression” in their intended nationally determined contributions (which set GHG emission reduction goals) every five years beginning in 2020. In November 2019, the current U.S. administration served notice on the United Nations that the U.S. would withdraw from the Paris Agreement in 2020. There are no guarantees that the Paris Agreement will not be re-implemented in the U.S. or re-implemented in part by specific U.S. states or local governments. Regardless, the Paris Agreement could still affect our operations in Canada, the U.K., Ireland, and Latin America. Restrictions on emissions of methane or carbon dioxide that have been or may be imposed in various U.S. states, at the U.S. federal level, or in other countries could adversely affect the oil and gas industry.

Investor sentiment towards climate change, fossil fuels, and sustainability could adversely affect our business and our stock price.

There have been efforts in recent years aimed at the investment community, including investment advisors, sovereign wealth funds, public pension funds, universities and other groups, to promote the divestment of shares of energy companies, as well as to pressure lenders and other financial services companies to limit or curtail activities with energy companies. If these efforts are successful, our stock price and our ability to access capital markets may be negatively impacted.

Members of the investment community are also increasing their focus on sustainability practices, including practices related to GHGs and climate change, in the energy industry. As a result, we may face increasing pressure regarding our sustainability disclosures and practices. Additionally, members of the investment community may screen companies such as ours for sustainability performance before investing in our stock.

If we are unable to meet the sustainability standards set by these investors, we may lose investors, our stock price may be negatively impacted and our reputation may be negatively affected.

Severe weather events may have an adverse effect on our assets and operations.

Severe weather events, such as storms, droughts, or floods, could have an adverse effect on our operations. Members within the scientific community believe that an increasing concentration of GHG emissions in the Earth’s atmosphere may contribute to climate changes that can have significant physical effects, including an increased frequency and severity of these types of events.

Compliance with the U.S. Environmental Protection Agency (EPA) Renewable Fuel Standard (RFS) could adversely affect our performance.

The U.S. EPA has implemented the RFS pursuant to the Energy Policy Act of 2005 and the Energy Independence and Security Act of 2007. The RFS program sets annual quotas for the quantity of renewable fuels (such as ethanol and diesel) that must be blended into transportation fuels consumed in the U.S. A Renewable Identification Number (RIN) is assigned to each gallon of renewable fuel produced in or imported into the U.S. As a producer of petroleum-based transportation fuels, we are obligated to blend renewable fuels into the products we produce at a rate that is at least commensurate to the U.S. EPA’s quota and, to the extent we do not, we must purchase RINs in the open market to satisfy our obligation under the RFS program.

We are exposed to the volatility in the market price of RINs. We cannot predict the future prices of RINs. RINs prices are dependent upon a variety of factors, including U.S. EPA regulations, the availability of RINs for purchase, and levels of transportation fuels produced, which can vary significantly from quarter to quarter. If sufficient RINs are unavailable for purchase, if we have to pay a significantly higher price for RINs, or if we are otherwise unable to meet the U.S. EPA’s RFS mandates, our results of operations and cash flows could be adversely affected.

Disruption of our ability to obtain crude oil could adversely affect our operations.

A significant portion of our feedstock requirements is satisfied through supplies originating in the Middle East, Africa, Asia, North America, and South America. We are, therefore, subject to the political, geographic, and economic risks attendant to doing business with suppliers located in, and supplies originating from, these areas. If one or more of our supply contracts were terminated, or if political events disrupt our traditional crude oil supply, we believe that adequate alternative supplies of crude oil would be available, but it is possible that we would be unable to find alternative sources of supply. If we are unable to obtain adequate crude oil volumes or are able to obtain such volumes only at unfavorable prices, our results of operations could be materially adversely affected, including reduced sales volumes of refined petroleum products or reduced margins as a result of higher crude oil costs.

In addition, the U.S. government can prevent or restrict us from doing business in or with other countries. These restrictions, and those of other governments, could limit our ability to gain access to business opportunities in various countries. Actions by both the U.S. and other countries have affected our operations in the past and will continue to do so in the future.

Any attempt by the U.S. government to withdraw from or materially modify existing international trade agreements could adversely affect our business, financial condition, and results of operations.

The current U.S. administration has questioned certain existing and proposed trade agreements. For example, the administration withdrew the U.S. from the Trans-Pacific Partnership. In addition, the administration has

implemented and proposed various trade tariffs, which have resulted in foreign governments responding with tariffs on U.S. goods.

Changes in U.S. social, political, regulatory, and economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment could adversely affect our business. For example, the imposition of tariffs or other trade barriers with other countries could affect our ability to obtain feedstocks from international sources, increase our costs and reduce the competitiveness of our products.

While there is currently a lack of certainty around the likelihood, timing, and details of any such policies and reforms, if the current U.S. administration takes action to withdraw from, or materially modify, existing international trade agreements, our business, financial condition, and results of operations could be adversely affected.

We are subject to interruptions and increased costs as a result of our reliance on third-party transportation of crude oil and the products that we manufacture.

We use the services of third parties to transport feedstocks to our facilities and to transport the products we manufacture to market. If we experience prolonged interruptions of supply or increases in costs to deliver our products to market, or if the ability of the pipelines, vessels, or railroads to transport feedstocks or products is disrupted because of weather events, accidents, derailment, collision, fire, explosion, governmental regulations, or third-party actions, it could have a material adverse effect on our financial position, results of operations, and liquidity.

We may incur additional costs as a result of our use of rail cars for the transportation of crude oil and the products that we manufacture.

We currently use rail cars for the transportation of some feedstocks to certain of our facilities and for the transportation of some of the products we manufacture to their markets. We own and lease rail cars for our operations. Rail transportation is subject to a variety of federal, state, and local regulations, as well as industry practices and customs. New laws and regulations, and changes in existing laws and regulations, are frequently enacted or proposed, and could result in increased expenditures for compliance, either directly through costs for our owned and leased rail assets, or as passed along to us by rail carriers and operators. For example, in the past several years, the Department of Transportation and various agencies within the Department of Transportation, including the Surface Transportation Board, the Pipeline and Hazardous Materials Safety Administration, and the Federal Railroad Administration, have issued orders and rules pursuant to the Federal Railroad Safety Act of 1970, the Interstate Commerce Commission Termination Act of 1995, the Rail Safety Improvement Act of 2008, Fixing America’s Surface Transportation Act of 2015 and other statutory authorities concerning such matters as enhanced tank car standards, positive train control and other operational controls, safety training programs, and notification requirements. The general trend has been toward greater regulation of rail transportation over recent years. We do not believe these orders and rules will have a material impact on our financial position, results of operations, and liquidity, although further changes in law, regulations, or industry practices could require us to incur additional costs to the extent they are applicable to us.

Competitors that produce their own supply of feedstocks, own their own retail sites, have greater financial resources, or provide alternative energy sources may have a competitive advantage.

The refining and marketing industry is highly competitive with respect to both feedstock supply and refined petroleum product markets. We compete with many companies for available supplies of crude oil and other feedstocks and for sites for our refined petroleum products. We do not produce any of our crude oil feedstocks and, following the separation of our retail business in 2013, we do not have a company-owned retail network.

Many of our competitors, however, obtain a significant portion of their feedstocks from company-owned production and some have extensive retail sites. Such competitors are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages.

Some of our competitors also have materially greater financial and other resources than we have. Such competitors have a greater ability to bear the economic risks inherent in all phases of our industry. In addition, we compete with other industries that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial, and individual consumers.

Uncertainty and illiquidity in credit and capital markets can impair our ability to obtain credit and financing on acceptable terms, and can adversely affect the financial strength of our business partners.

Our ability to obtain credit and capital depends in large measure on capital markets and liquidity factors that we do not control. Our ability to access credit and capital markets may be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, the cost and availability of debt and equity financing may be adversely impacted by unstable or illiquid market conditions. Protracted uncertainty and illiquidity in these markets also could have an adverse impact on our lenders, commodity hedging counterparties, or our customers, causing them to fail to meet their obligations to us. In addition, decreased returns on pension fund assets may also materially increase our pension funding requirements.

Our access to credit and capital markets also depends on the credit ratings assigned to our debt by independent credit rating agencies. We currently maintain investment-grade ratings by Standard & Poor’s Ratings Services, Moody’s Investors Service, and Fitch Ratings on our senior unsecured debt. Ratings from credit agencies are not recommendations to buy, sell, or hold our securities. Each rating should be evaluated independently of any other rating. We cannot provide assurance that any of our current ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances so warrant. Specifically, if ratings agencies were to downgrade our long-term rating, particularly below investment grade, our borrowing costs may increase, which could adversely affect our ability to attract potential investors and our funding sources could decrease. In addition, we may not be able to obtain favorable credit terms from our suppliers or they may require us to provide collateral, letters of credit, or other forms of security, which would increase our operating costs. As a result, a downgrade below investment grade in our credit ratings could have a material adverse impact on our financial position, results of operations, and liquidity.

From time to time, our cash needs may exceed our internally generated cash flow, and our business could be materially and adversely affected if we were unable to obtain necessary funds from financing activities. From time to time, we may need to supplement our cash generated from operations with proceeds from financing activities. We have existing revolving credit facilities, committed letter of credit facilities, and an accounts receivable sales facility to provide us with available financing to meet our ongoing cash needs. In addition, we rely on the counterparties to our derivative instruments to fund their obligations under such arrangements. Uncertainty and illiquidity in financial markets may materially impact the ability of the participating financial institutions and other counterparties to fund their commitments to us under our various financing facilities or our derivative instruments, which could have a material adverse effect on our financial position, results of operations, and liquidity.

A significant interruption in one or more of our refineries could adversely affect our business.

Our refineries are our principal operating assets. As a result, our operations could be subject to significant interruption if one or more of our refineries were to experience a major accident or mechanical failure, be damaged by severe weather or other natural or man-made disaster, such as an act of terrorism, or otherwise be forced to shut down. If any refinery were to experience an interruption in operations, earnings from the refinery could be materially adversely affected (to the extent not recoverable through insurance) because of lost production and repair costs. Significant interruptions in our refining system could also lead to increased volatility in prices for crude oil feedstocks and refined petroleum products, and could increase instability in the financial and insurance markets, making it more difficult for us to access capital and to obtain insurance coverage that we consider adequate.

A significant interruption related to our information technology systems could adversely affect our business.

Our information technology systems and network infrastructure may be subject to unauthorized access or attack, which could result in (i) a loss of intellectual property, proprietary information, or employee, customer or vendor data; (ii) public disclosure of sensitive information; (iii) increased costs to prevent, respond to, or mitigate cybersecurity events, such as deploying additional personnel and protection technologies, training employees, and engaging third-party experts and consultants; (iv) systems interruption; (v) disruption of our business operations; (vi) remediation costs for repairs of system damage; (vii) reputational damage that adversely affects customer or investor confidence; and (viii) damage to our competitiveness, stock price, and long-term stockholder value. A breach could also originate from, or compromise, our customers’ and vendors’ or other third-party networks outside of our control. A breach may also result in legal claims or proceedings against us by our shareholders, employees, customers, vendors, and governmental authorities (U.S. and non-U.S.). There can be no assurance that our infrastructure protection technologies and disaster recovery plans can prevent a technology systems breach or systems failure, which could have a material adverse effect on our financial position or results of operations. Furthermore, the continuing and evolving threat of cyberattacks has resulted in increased regulatory focus on prevention. To the extent we face increased regulatory requirements, we may be required to expend significant additional resources to meet such requirements.

Increasing regulatory focus on privacy and security issues and expanding laws could expose us to increased liability, subject us to lawsuits, investigations and other liabilities and restrictions on our operations that could significantly and adversely affect our business.

Along with our own data and information in the normal course of our business, we and our partners collect and retain certain data that is subject to specific laws and regulations. The transfer and use of this data both domestically and across international borders is becoming increasingly complex. This data is subject to governmental regulation at the federal, state, international, national, provincial and local levels in many areas of our business, including data privacy and security laws such as the European Union (EU) General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

The GDPR applies to activities regarding personal data that may be conducted by us, directly or indirectly through vendors and subcontractors, from an establishment in the EU. As interpretation and enforcement of the GDPR evolves, it creates a range of new compliance obligations, which could cause us to incur additional costs. Failure to comply could result in significant penalties of up to a maximum of 4 percent of our global turnover that may materially adversely affect our business, reputation, results of operations, and cash flows.

The CCPA, which came into effect on January 1, 2020, gives California residents specific rights in relation to their personal information, requires that companies take certain actions, including notifications for security

incidents and may apply to activities regarding personal information that is collected by us, directly or indirectly, from California residents. As interpretation and enforcement of the CCPA evolves, it creates a range of new compliance obligations, with the possibility for significant financial penalties for noncompliance that may materially adversely affect our business, reputation, results of operations, and cash flows.

The GDPR and CCPA, as well as other data privacy laws that may become applicable to our business, pose increasingly complex compliance challenges and potentially elevate our costs. Any failure by us to comply with these laws and regulations, including as a result of a security or privacy breach, could result in significant penalties and liabilities for us. Additionally, if we acquire a company that has violated or is not in compliance with applicable data protection laws, we may incur significant liabilities and penalties as a result.

Our business may be negatively affected by work stoppages, slowdowns or strikes by our employees, as well as new labor legislation issued by regulators.

Workers at some of our refineries are covered by collective bargaining or similar agreements. To the extent we are in negotiations for labor agreements expiring in the future, there is no assurance an agreement will be reached without a strike, work stoppage, or other labor action. Any prolonged strike, work stoppage, or other labor action could have an adverse effect on our financial condition or results of operations. In addition, future federal, state, or foreign labor legislation could result in labor shortages and higher costs, especially during critical maintenance periods.

We are subject to operational risks and our insurance may not be sufficient to cover all potential losses arising from operating hazards. Failure by one or more insurers to honor its coverage commitments for an insured event could materially and adversely affect our financial position, results of operations, and liquidity.

Our operations are subject to various hazards common to the industry, including explosions, fires, toxic emissions, maritime hazards, and natural catastrophes. As protection against these hazards, we maintain insurance coverage against some, but not all, potential losses and liabilities. We may not be able to maintain or obtain insurance of the type and amount we desire at reasonable rates. As a result of market conditions, premiums and deductibles for certain of our insurance policies could increase substantially. In some instances, certain insurance could become unavailable or available only for reduced amounts of coverage. For example, coverage for hurricane damage is very limited, and coverage for terrorism risks includes very broad exclusions. If we were to incur a significant liability for which we were not fully insured, it could have a material adverse effect on our financial position, results of operations, and liquidity.

Our insurance program includes a number of insurance carriers. Significant disruptions in financial markets could lead to a deterioration in the financial condition of many financial institutions, including insurance companies. We can make no assurances that we will be able to obtain the full amount of our insurance coverage for insured events.

Large capital projects can take many years to complete, and market conditions could deteriorate over time, negatively impacting project returns.

We may engage in capital projects based on the forecasted project economics and level of return on the capital to be employed in the project. Large-scale projects take many years to complete, and market conditions can change from our forecast. As a result, we may be unable to fully realize our expected returns, which could negatively impact our financial condition, results of operations, and cash flows.

Compliance with and changes in tax laws could adversely affect our performance.

We are subject to extensive tax liabilities imposed by multiple jurisdictions, including income taxes, indirect taxes (excise/duty, sales/use, gross receipts, and value-added taxes), payroll taxes, franchise taxes, withholding taxes, and ad valorem taxes. New tax laws and regulations and changes in existing tax laws and regulations are continuously being enacted or proposed that could result in increased expenditures for tax liabilities in the future. Many of these liabilities are subject to periodic audits by the respective taxing authority. Subsequent changes to our tax liabilities as a result of these audits may subject us to interest and penalties.

On December 22, 2017, tax legislation commonly known as the Tax Cuts and Jobs Act of 2017 (Tax Reform) was enacted. Among other things, Tax Reform reduced the U.S. corporate income tax rate from 35 percent to 21 percent and implemented a new system of taxation for non-U.S. earnings, including by imposing a one-time tax on the deemed repatriation of undistributed earnings of non-U.S. subsidiaries. Tax Reform also generally (i) repealed the manufacturing deduction we previously were able to claim, (ii) resulted in a shift from a worldwide system of taxation to a territorial system of taxation, resulting in a minimum tax on the income of international subsidiaries (the GILTI tax) rather than a tax deferral on such earnings in certain circumstances, (iii) limits our annual deductions for interest expense to no more than 30 percent of our “adjusted taxable income” (plus 100 percent of our business interest income) for the year and (iv) permits us to offset only 80 percent (rather than 100 percent) of our taxable income with any net operating losses we generate after 2017. We have evaluated the effects of Tax Reform, including the one-time deemed repatriation tax and the re-measurement of our deferred tax assets and liabilities, and the provisions of Tax Reform, taken as a whole, did not have an adverse impact on our cash tax liabilities, results of operations, or financial condition. We have used reasonable interpretations and assumptions in applying Tax Reform, but it is possible that the Internal Revenue Service (IRS) could issue subsequent guidance or take positions on audit that differ from our prior interpretations and assumptions, which could adversely impact our cash tax liabilities, results of operations, and financial condition.

Our investments in joint ventures and other entities decrease our ability to manage risk.

We conduct some of our operations through joint ventures in which we may share control over certain economic and business interests with our joint venture partners and in some entities in which we have no ownership or control. Our joint venture partners may have economic, business or legal interests or goals that are inconsistent with our goals and interests or may be unable to meet their obligations. Failure by us, or an entity in which we have a joint-venture interest, to adequately manage the risks associated with any acquisitions or joint ventures could have a material adverse effect on our, or our joint ventures’, financial position, results of operations, and liquidity.

We may incur losses and additional costs as a result of our forward-contract activities and derivative transactions.

We currently use commodity derivative instruments, and we expect to continue their use in the future. If the instruments we use to hedge our exposure to various types of risk are not effective, we may incur losses. In addition, we may be required to incur additional costs in connection with future regulation of derivative instruments to the extent it is applicable to us.

Changes in the method of determining the London Interbank Offered Rate (LIBOR), or the replacement of LIBOR with an alternative reference rate, may adversely affect interest rates.

On July 27, 2017, the Financial Conduct Authority in the U.K. announced that it would phase out LIBOR as a benchmark by the end of 2021. It is unclear whether new methods of calculating LIBOR will be established such that it continues to exist after 2021, or whether different benchmark rates used to price indebtedness

will develop. In the future, we may need to renegotiate our financial agreements, including, but not limited to, our revolving credit facility (the Valero Revolver), or incur other indebtedness, and the phase-out of LIBOR may negatively impact the terms of such indebtedness. In addition, the overall financial market may be disrupted as a result of the phase-out or replacement of LIBOR. Disruption in the financial market could have a material adverse effect on our financial position, results of operations, and liquidity.

Changes in the U.K.’s economic and other relationships with the EU could adversely affect us.

In June 2016, the U.K. elected to withdraw from the EU in a national referendum (Brexit). The U.K. withdrew from the EU on January 31, 2020, consistent with the terms of the EU-U.K. Withdrawal Agreement. The terms of that agreement provide for a transition period, from January 31, 2020 to December 31, 2020, during which the trading relationship between the U.K. and the EU will remain the same while the U.K. and the EU try to negotiate an agreement regarding their future trading relationship. The ultimate effects of Brexit will depend on whether an agreement is reached, or on the specific terms of any such agreement that is reached, either of which outcomes could adversely impact the ability to trade freely between the U.K. and the EU at the end of the transition period and could negatively impact our competitive position, supplier and customer relationships, and financial performance.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 3. LEGAL PROCEEDINGS

LITIGATION

We incorporate by reference into this Item our disclosures made in Part II, Item 8 of this report included in Note 1 of Notes to Consolidated Financial Statements under the caption “Legal Contingencies.”

ENVIRONMENTAL ENFORCEMENT MATTERS

While it is not possible to predict the outcome of the following environmental proceedings, if any one or more of them were decided against us, we believe that there would be no material effect on our financial position, results of operations, or liquidity. We are reporting these proceedings to comply with SEC regulations, which require us to disclose certain information about proceedings arising under federal, state, or local provisions regulating the discharge of materials into the environment or protecting the environment if we reasonably believe that such proceedings will result in monetary sanctions of $100,000 or more.

U.S. EPA (Fuels). In our annual report on Form 10-K for the year ended December 31, 2018, we reported that we had an outstanding Notice of Violation (NOV) from the U.S. EPA related to violations from a 2015 Mobile Source Inspection. In the fourth quarter of 2019, we received a draft Consent Order from the U.S. EPA proposing penalties of $3.4 million. We are working with the U.S. EPA to resolve this matter.

Attorney General of the State of Texas (Texas AG) (Corpus Christi Asphalt Plant). In our quarterly report on Form 10-Q for the quarter ended March 31, 2019, we reported that we had received a letter and draft Agreed Final Judgment from the Texas AG related to a contaminated water backflow incident that occurred at the Valero Corpus Christi Asphalt Plant. The draft Agreed Final Judgment assesses proposed penalties in the amount of $1.3 million. We are working with the Texas AG to resolve this matter.

Texas AG (Port Arthur Refinery). In our quarterly report on Form 10-Q for the quarter ended June 30, 2019, we reported that the Texas AG had filed suit against our Port Arthur Refinery in the 419th Judicial District Court of Travis County, Texas, Cause No. D-1-GN-19-004121, for alleged violations of the Clean Air Act seeking injunctive relief and penalties. We are working with the Texas AG to resolve this matter.

Texas AG (Houston Terminal). In our annual report on Form 10-K for the year ended December 31, 2018, we reported that we had an outstanding Notice of Enforcement (NOE) from the Texas Commission on Environmental Quality (TCEQ), and an outstanding Violation Notice (VN) from the Harris County Pollution Control Services Department, both alleging excess emissions from Tank 003 that occurred during Hurricane Harvey. On January 27, 2020, the Texas AG filed suit related to this incident against our Houston Terminal in the 419th Judicial District Court of Travis County, Texas, Cause No. D-1-GN-20-000516 seeking injunctive relief and penalties. We are working with the Texas AG to resolve this matter.

Bay Area Air Quality Management District (BAAQMD) and Solano County Department of Resource Management Certified Unified Program Agency (Solano County) (Benicia Refinery). In our quarterly report on Form 10-Q for the quarter ended March 31, 2019, we reported that we had received multiple VNs issued by the BAAQMD related to an upset of the Flue Gas Scrubber (FGS) at our Benicia Refinery, and a draft Consent from Solano County related to the FGS incident proposing penalties of $242,840. In our quarterly report on Form 10-Q for the quarter ended September 30, 2019, we reported that we had resolved the matter with Solano County. We continue to work with the BAAQMD on a final resolution of the remaining VNs.

BAAQMD (Benicia Refinery). In our annual report on Form 10-K for the year ended December 31, 2018, we reported that we had multiple outstanding VNs issued by the BAAQMD. These VNs are for various alleged air regulation and air permit violations at our Benicia Refinery and asphalt plant. We continue to work with the BAAQMD to resolve these VNs.

South Coast Air Quality Management District (SCAQMD) (Wilmington Refinery). In our annual report on Form 10-K for the year ended December 31, 2018, we reported that we had outstanding Notices of Violation (NOVs) issued by the SCAQMD. These NOVs are for alleged reporting violations and excess emissions at our Wilmington Refinery. We are working with the SCAQMD to resolve these NOVs.

TCEQ (Port Arthur). In our annual report on Form 10-K for the year ended December 31, 2018, we reported that we had an outstanding NOE from the TCEQ alleging unauthorized emissions associated with a November 18, 2017 release of crude oil from the 24-inch fill pipe of Tank T-285. We are working with the TCEQ to resolve this matter.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NYSE under the trading symbol “VLO.”

As of January 31, 2020, there were 5,082 holders of record of our common stock.

Dividends are considered quarterly by the board of directors, may be paid only when approved by the board, and will depend on our financial condition, results of operations, cash flows, prospects, industry conditions, capital requirements, and other factors and restrictions our board deems relevant. There can be no assurance that we will pay a dividend at the rates we have paid historically, or at all, in the future.

The following table discloses purchases of shares of our common stock made by us or on our behalf during the fourth quarter of 2019.

|

| | | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Not Purchased as Part of Publicly Announced Plans or Programs (a) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (b) |

| October 2019 | | 332,704 |

| | $ | 88.06 |

| | 98,396 |

| | 234,308 |

| | $1.6 billion |

| November 2019 | | 1,565,500 |

| | $ | 99.21 |

| | 107,914 |

| | 1,457,586 |

| | $1.5 billion |

| December 2019 | | 393,694 |

| | $ | 94.61 |

| | 6,984 |

| | 386,710 |

| | $1.5 billion |

| Total | | 2,291,898 |

| | $ | 96.80 |

| | 213,294 |

| | 2,078,604 |

| | $1.5 billion |

____________________________________

| |

| (a) | The shares reported in this column represent purchases settled in the fourth quarter of 2019 relating to (i) our purchases of shares in open-market transactions to meet our obligations under stock-based compensation plans and (ii) our purchases of shares from our employees and non-employee directors in connection with the exercise of stock options, the vesting of restricted stock, and other stock compensation transactions in accordance with the terms of our stock-based compensation plans. |

| |

| (b) | On January 23, 2018, we announced that our board of directors authorized our purchase of up to $2.5 billion of our outstanding common stock (the 2018 Program), with no expiration date. As of December 31, 2019, we had $1.5 billion remaining available for purchase under the 2018 Program. |

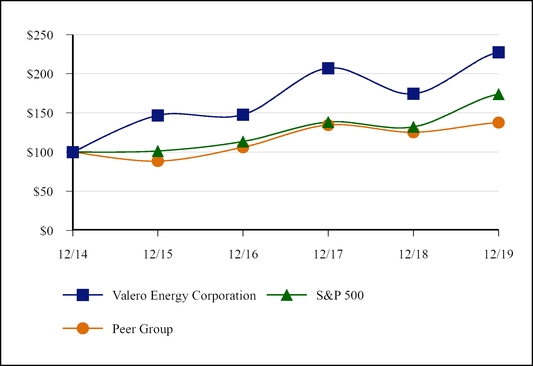

The following performance graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of Valero’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

This performance graph and the related textual information are based on historical data and are not indicative of future performance. The following line graph compares the cumulative total return(a) on an investment in our common stock against the cumulative total return of the S&P 500 Composite Index and an index of peer companies (that we selected) for the five-year period commencing December 31, 2014 and ending December 31, 2019. Our peer group comprises the following eight companies: BP plc; CVR Energy, Inc.; Delek US Holdings, Inc.; HollyFrontier Corporation; Marathon Petroleum Corporation; PBF Energy Inc.; Phillips 66; and Royal Dutch Shell plc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN(a)

Among Valero Energy Corporation, the S&P 500 Index,

and Peer Group

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, |

| | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 |

| Valero Common Stock | $ | 100.00 |

| | $ | 146.79 |

| | $ | 147.94 |

| | $ | 207.10 |

| | $ | 174.54 |

| | $ | 227.53 |

|

| S&P 500 | 100.00 |

| | 101.38 |

| | 113.51 |

| | 138.29 |

| | 132.23 |

| | 173.86 |

|

| Peer Group | 100.00 |

| | 88.46 |

| | 106.16 |

| | 134.53 |

| | 125.35 |

| | 137.49 |

|

____________________________________

| |

| (a) | Assumes that an investment in Valero common stock and each index was $100 on December 31, 2014. “Cumulative total return” is based on share price appreciation plus reinvestment of dividends from December 31, 2014 through December 31, 2019. |

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data for the five-year period ended December 31, 2019 was derived from our audited financial statements. The following table should be read together with Item 7, “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” and with the historical financial statements and accompanying notes included in Item 8, “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.”

The following summaries are in millions of dollars, except for per share amounts:

|

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 (a) | | 2016 (b) | | 2015 (c) |

| Revenues | $ | 108,324 |

| | $ | 117,033 |

| | $ | 93,980 |

| | $ | 75,659 |

| | $ | 87,804 |

|

| Net income | 2,784 |

| | 3,353 |

| | 4,156 |

| | 2,417 |

| | 4,101 |

|

Earnings per common share – assuming dilution | 5.84 |

| | 7.29 |

| | 9.16 |

| | 4.94 |

| | 7.99 |

|

| Dividends per common share | 3.60 |

| | 3.20 |

| | 2.80 |

| | 2.40 |

| | 1.70 |

|

| Total assets | 53,864 |

| | 50,155 |

| | 50,158 |

| | 46,173 |

| | 44,227 |

|

Debt and finance lease obligations, less current portion | 9,178 |

| | 8,871 |

| | 8,750 |

| | 7,886 |

| | 7,208 |

|

_________________________________________________

| |

| (a) | Includes the impact of Tax Reform that was enacted on December 22, 2017 and resulted in a net income tax benefit of $1.9 billion as described in Note 15 of Notes to Consolidated Financial Statements. |

| |

| (b) | Includes a noncash lower of cost or market inventory valuation reserve adjustment that resulted in a net benefit to our results of operations of $747 million. |

| |

| (c) | Includes a noncash lower of cost or market inventory valuation reserve adjustment that resulted in a net charge to our results of operations of $790 million. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following review of our results of operations and financial condition should be read in conjunction with Item 1A, “RISK FACTORS,” and Item 8, “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA,” included in this report.

CAUTIONARY STATEMENT FOR THE PURPOSE OF SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report, including without limitation our disclosures below under the heading “OVERVIEW AND OUTLOOK,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify our forward-looking statements by the words “anticipate,” “believe,” “expect,” “plan,” “intend,” “scheduled,” “estimate,” “project,” “projection,” “predict,” “budget,” “forecast,” “goal,” “guidance,” “target,” “could,” “would,” “should,” “will,” “may,” and similar expressions.

These forward-looking statements include, among other things, statements regarding:

| |

| • | future refining segment margins, including gasoline and distillate margins; |

| |

| • | future ethanol segment margins; |

| |

| • | future renewable diesel segment margins; |

| |

| • | expectations regarding feedstock costs, including crude oil differentials, and operating expenses; |

| |

| • | anticipated levels of crude oil and refined petroleum product inventories; |

| |

| • | our anticipated level of capital investments, including deferred turnaround and catalyst cost expenditures, capital expenditures for environmental and other purposes, and joint venture investments, and the effect of those capital investments on our results of operations; |

| |

| • | anticipated trends in the supply of and demand for crude oil and other feedstocks and refined petroleum products in the regions where we operate, as well as globally; |

| |

| • | expectations regarding environmental, tax, and other regulatory initiatives; and |

| |

| • | the effect of general economic and other conditions on refining, ethanol, and renewable diesel industry fundamentals. |

We based our forward-looking statements on our current expectations, estimates, and projections about ourselves and our industry. We caution that these statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that we cannot predict. In addition, we based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, our actual results may differ materially from the future performance that we have expressed or forecast in the forward-looking statements. Differences between actual results and any future performance suggested in these forward-looking statements could result from a variety of factors, including the following:

| |

| • | acts of terrorism aimed at either our facilities or other facilities that could impair our ability to produce or transport refined petroleum products or receive feedstocks; |

| |

| • | political and economic conditions in nations that produce crude oil or consume refined petroleum products; |

| |