- VLO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Valero Energy (VLO) 8-KEntry into a Material Definitive Agreement

Filed: 25 Apr 05, 12:00am

Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

Valero to Acquire Premcor

April 25, 2005

[LOGO] |

| [LOGO] |

Safe Harbor Statement |

| [LOGO] |

Statements contained in this presentation that state either company’s or their management’s expectations or predictions of future events are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The words “believe,” “expect,” “should,” “estimates,” and other similar expressions identify forward-looking statements. It is important to note that either company’s actual results could differ materially from those projected in their forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecast, see both companies’ annual reports on Form 10-K and quarterly reports on Form 10- Q, filed with the Securities and Exchange Commission and available on the companies’ respective web sites at http://www.valero.com and

http://www.premcor.com.

2

Prospectus Disclaimer

Investors and security holders are urged to read the proxy statement/prospectus that will be filed with the Securities and Exchange Commission and will be sent to Premcor stockholders regarding the proposed merger, when it becomes available, because it will contain important information. Investors and security holders may obtain a free copy of the proxy statement/prospectus, when it is available, and other documents filed by Valero and Premcor with the SEC at the SEC’s web site at www.sec.gov. The proxy statement/prospectus and these other documents may also be obtained, when available, free of charge from Valero and Premcor.

Premcor and its directors, executive officers and certain other employees, may be deemed to be soliciting proxies from stockholders in favor of the approval of the merger and related matters. Information regarding the persons who may, under SEC rules, be deemed to be participants in the solicitation of Premcor stockholders in connection with the merger is set forth in Premcor’s proxy statement for their 2005 annual meetings, filed with the SEC April 1, 2005. Additional information will be set forth in the proxy statement/prospectus referred to above when it is filed with the SEC.

3

Table of Contents

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

4

Bill Greehey,

Chairman and CEO

Valero Energy

5

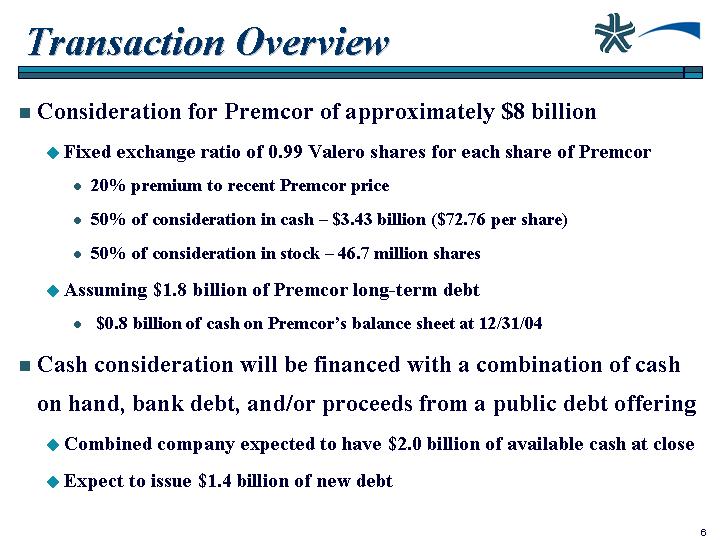

• Consideration for Premcor of approximately $8 billion

• Fixed exchange ratio of 0.99 Valero shares for each share of Premcor

• 20% premium to recent Premcor price

• 50% of consideration in cash – $3.43 billion ($72.76 per share)

• 50% of consideration in stock – 46.7 million shares

• Assuming $1.8 billion of Premcor long-term debt

• $0.8 billion of cash on Premcor’s balance sheet at 12/31/04

• �� Cash consideration will be financed with a combination of cash on hand, bank debt, and/or proceeds from a public debt offering

• Combined company expected to have $2.0 billion of available cash at close

• Expect to issue $1.4 billion of new debt

6

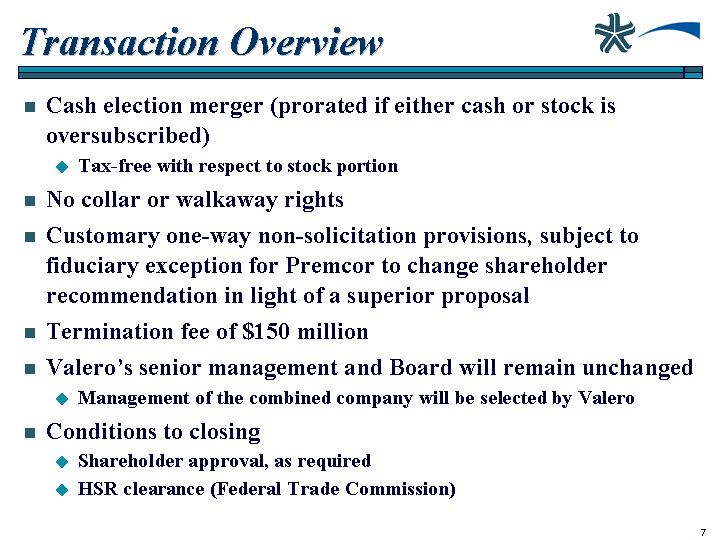

• Cash election merger (prorated if either cash or stock is oversubscribed)

• Tax-free with respect to stock portion

• No collar or walkaway rights

• Customary one-way non-solicitation provisions, subject to fiduciary exception for Premcor to change shareholder recommendation in light of a superior proposal

• Termination fee of $150 million

• Valero’s senior management and Board will remain unchanged

• Management of the combined company will be selected by Valero

• Conditions to closing

• Shareholder approval, as required

• HSR clearance (Federal Trade Commission)

7

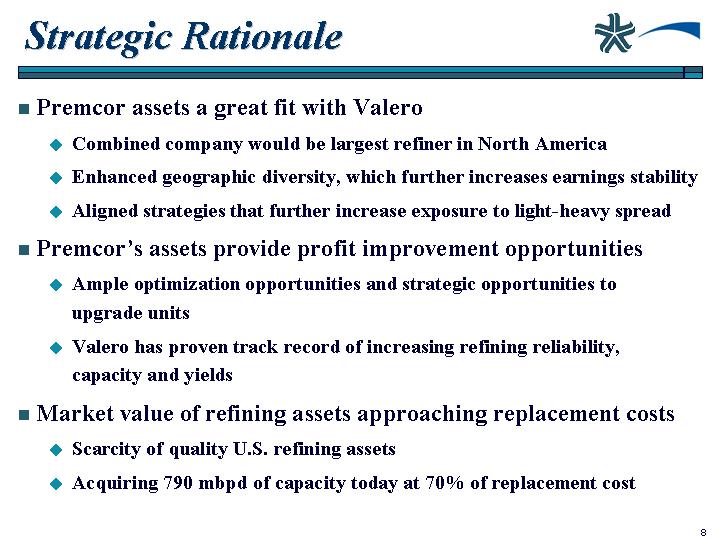

Strategic Rationale

• Premcor assets a great fit with Valero

• Combined company would be largest refiner in North America

• Enhanced geographic diversity, which further increases earnings stability

• Aligned strategies that further increase exposure to light-heavy spread

• Premcor’s assets provide profit improvement opportunities

• Ample optimization opportunities and strategic opportunities to upgrade units

• Valero has proven track record of increasing refining reliability, capacity and yields

• Market value of refining assets approaching replacement costs

• Scarcity of quality U.S. refining assets

• Acquiring 790 mbpd of capacity today at 70% of replacement cost

8

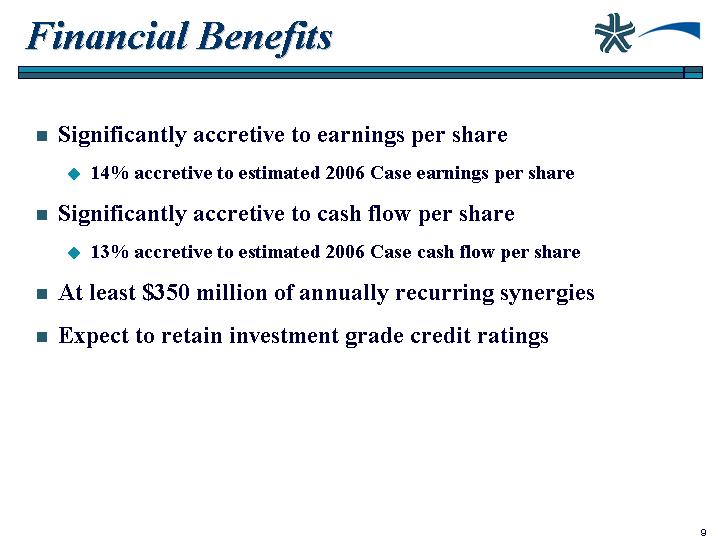

Financial Benefits

• Significantly accretive to earnings per share

• 14% accretive to estimated 2006 Case earnings per share

• Significantly accretive to cash flow per share

• 13% accretive to estimated 2006 Case cash flow per share

• At least $350 million of annually recurring synergies

• Expect to retain investment grade credit ratings

9

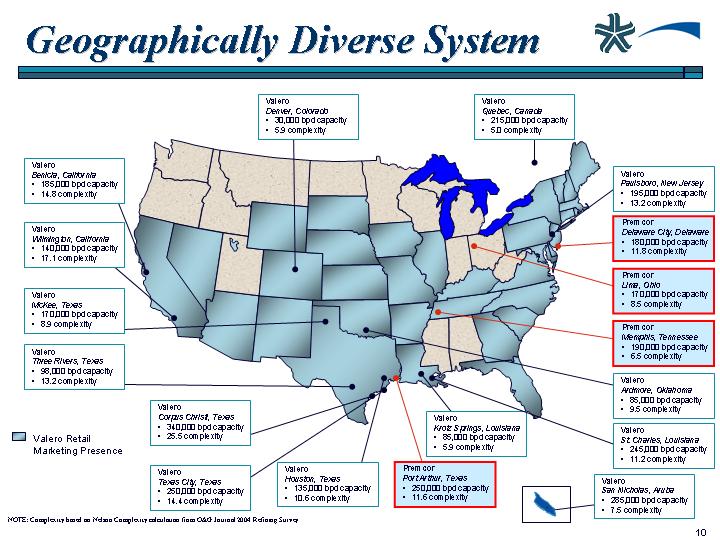

Geographically Diverse System

[GRAPHIC;]

NOTE: Complexity based on Nelson Complexity calculation from O&G Journal 2004 Refining Survey

10

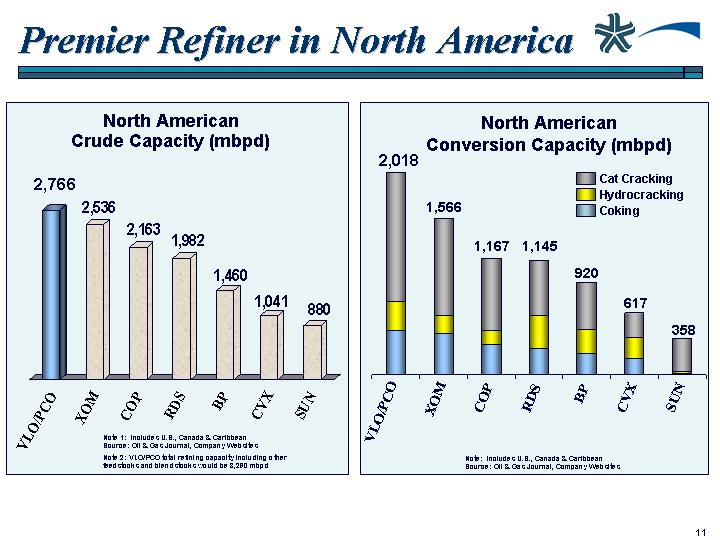

Premier Refiner in North America

North American

Crude Capacity (mbpd)

[CHART]

Note 1: Includes U.S., Canada & Caribbean

Source: Oil & Gas Journal, Company Websites

Note 2: VLO/PCO total refining capacity including other feedstocks and blendstocks would be 3,290 mbpd

North American

Conversion Capacity (mbpd)

[CHART]

Note: Includes U.S., Canada & Caribbean

Source: Oil & Gas Journal, Company Websites

11

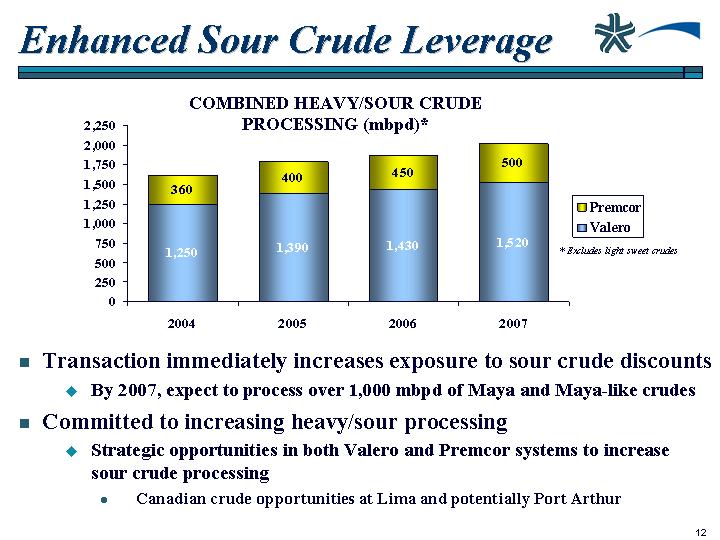

Enhanced Sour Crude Leverage

COMBINED HEAVY/SOUR CRUDE PROCESSING (mbpd)*

[CHART]

* Excludes light sweet crudes

• Transaction immediately increases exposure to sour crude discounts

• By 2007, expect to process over 1,000 mbpd of Maya and Maya-like crudes

• Committed to increasing heavy/sour processing

• Strategic opportunities in both Valero and Premcor systems to increase sour crude processing

• Canadian crude opportunities at Lima and potentially Port Arthur

12

Significant Synergy Opportunities

• Expect at least $350 million of annual recurring synergies

• Expect full realization in year 2

• Administrative synergies

• Reduced sales, general and administrative (SG&A) expenses of $130 million

• Corporate overhead ($55 million)

• Bonus and stock options ($60 million)

• Letter of credit, fees and interest expense of ($15 million)

• Reduced refinery insurance expense of $15 million

* See appendix for further details

13

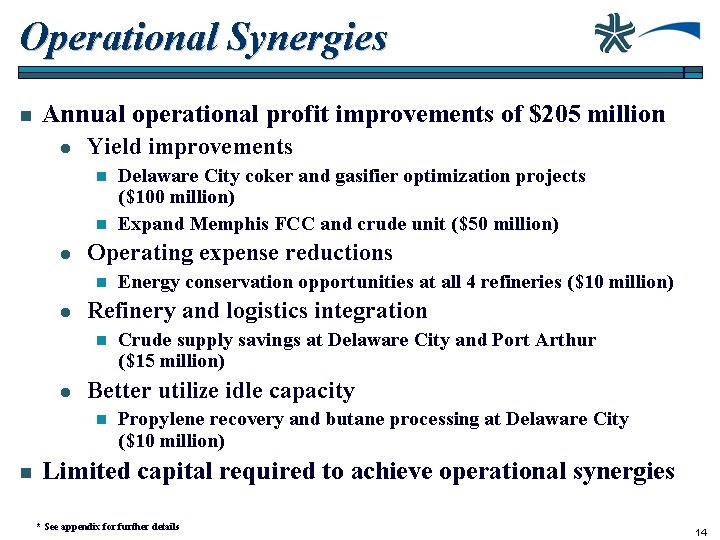

Operational Synergies

• Annual operational profit improvements of $205 million

• Yield improvements

• Delaware City coker and gasifier optimization projects ($100 million)

• Expand Memphis FCC and crude unit ($50 million)

• Operating expense reductions

• Energy conservation opportunities at all 4 refineries ($10 million)

• Refinery and logistics integration

• Crude supply savings at Delaware City and Port Arthur ($15 million)

• Better utilize idle capacity

• Propylene recovery and butane processing at Delaware City ($10 million)

• Limited capital required to achieve operational synergies

* See appendix for further details

14

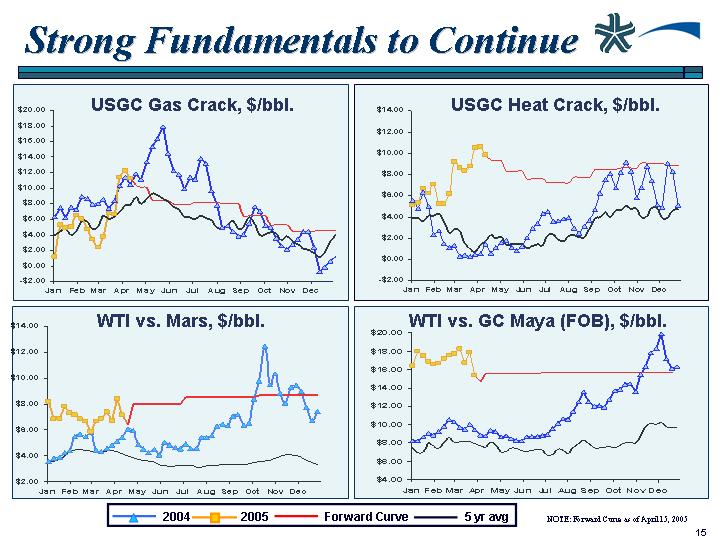

Strong Fundamentals to Continue

USGC Gas Crack, $/bbl.

[CHART]

USGC Heat Crack, $/bbl.

[CHART]

WTI vs. Mars, $/bbl.

[CHART]

WTI vs. GC Maya (FOB), $/bbl.

[CHART]

NOTE: Forward Curve as of April 15, 2005

15

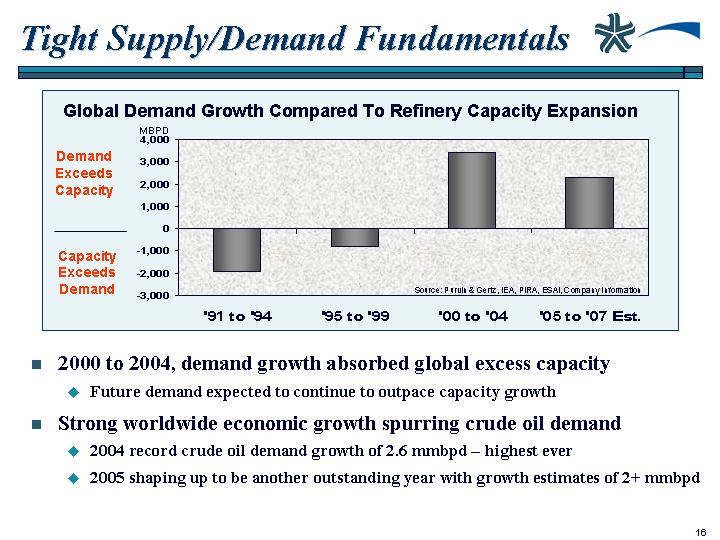

Tight Supply/Demand Fundamentals

Global Demand Growth Compared To Refinery Capacity Expansion

[CHART]

• 2000 to 2004, demand growth absorbed global excess capacity

• Future demand expected to continue to outpace capacity growth

• Strong worldwide economic growth spurring crude oil demand

• 2004 record crude oil demand growth of 2.6 mmbpd – highest ever

• 2005 shaping up to be another outstanding year with growth estimates of 2+ mmbpd

16

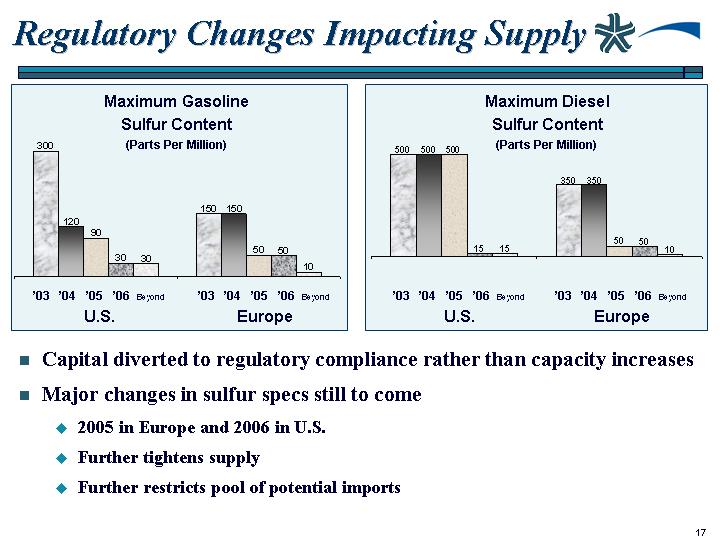

Regulatory Changes Impacting Supply

Maximum Gasoline

Sulfur Content

(Parts Per Million)

[CHART]

Maximum Diesel

Sulfur Content

(Parts Per Million)

[CHART]

• Capital diverted to regulatory compliance rather than capacity increases

• Major changes in sulfur specs still to come

• 2005 in Europe and 2006 in U.S.

• Further tightens supply

• Further restricts pool of potential imports

17

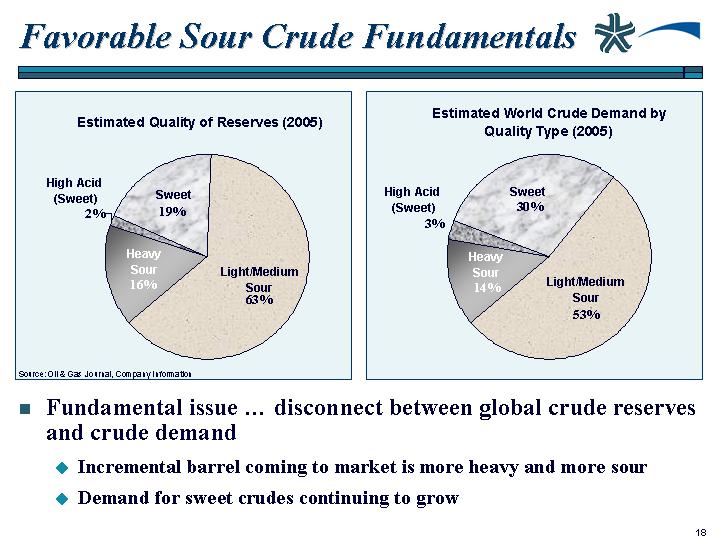

Favorable Sour Crude Fundamentals

Estimated Quality of Reserves (2005)

[CHART]

Estimated World Crude Demand by Quality Type (2005)

[CHART]

Source: Oil & Gas Journal, Company Information

• Fundamental issue … disconnect between global crude reserves and crude demand

• Incremental barrel coming to market is more heavy and more sour

• Demand for sweet crudes continuing to grow

18

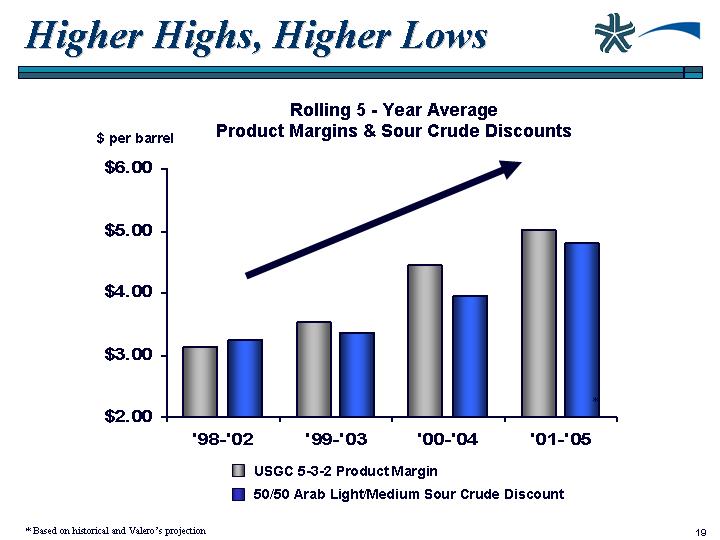

Higher Highs, Higher Lows

Rolling 5 - Year Average

Product Margins & Sour Crude Discounts

[CHART]

* Based on historical and Valero’s projection

19

Jefferson F. Allen,

Chief Executive Officer

Premcor Inc.

20

Great Deal for Premcor Shareholders

• Combined company to become largest refiner in North America

• Well positioned to benefit from positive trends in future

• Valero has investment grade credit rating

• Valero’s financial position increases growth opportunities

• Valero has a proven ability to improve performance

• Deep resource base presents greater opportunities

• Premcor stock has performed very well

• Up 75% in last 12 months

• 20% premium to recent Premcor price

• Valero stock most liquid in the sector

• Stock portion of consideration enables Premcor investors to maintain exposure to refining sector through Valero

• Combined entity becomes the “Must-Own Pure Play Refiner”

21

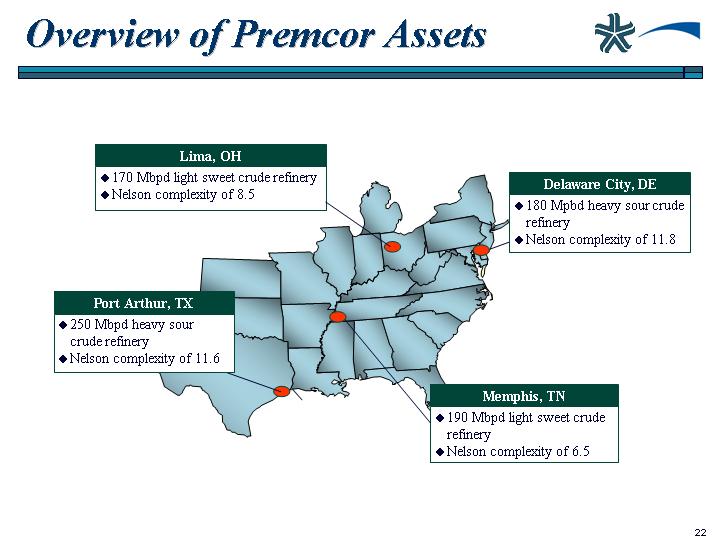

Overview of Premcor Assets

[GRAPHIC]

22

Premcor Assets

• Port Arthur, Texas – 250 mbpd capacity

• Highly complex, heavy sour refinery on Gulf Coast

• Refinery is supported by extensive logistics system

• Expansion of crude and vacuum units underway

• Increases ability to process lower cost, heavy sour crude oil

• Crude unit from 250 to 325 mbpd

• Expected to be completed in June 2006

• Expansion of coker completed

• Coker unit from 80 to 105 mbpd

• Hydrocracker unit from 35 to 45 mbpd

• $220 to $230 million combined capital expenditure for the vacuum, hydrocracker and coker project

• Tier II gasoline investment complete

Valero to capture the benefits of these investments

23

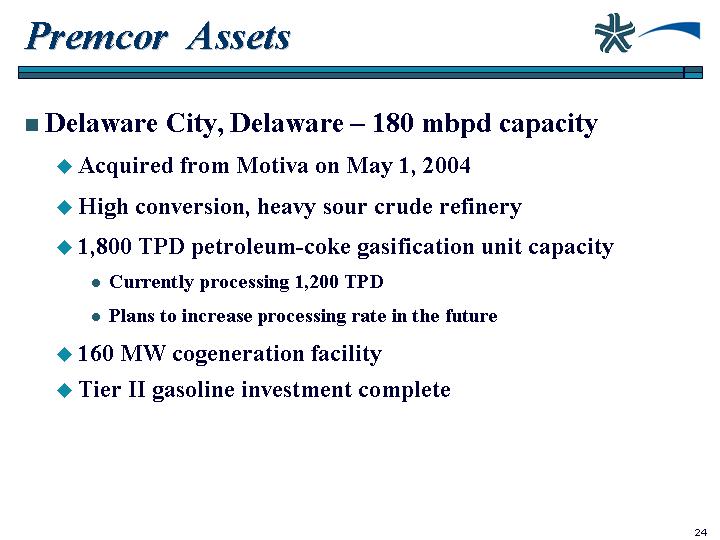

• Delaware City, Delaware – 180 mbpd capacity

• Acquired from Motiva on May 1, 2004

• High conversion, heavy sour crude refinery

• 1,800 TPD petroleum-coke gasification unit capacity

• Currently processing 1,200 TPD

• Plans to increase processing rate in the future

• 160 MW cogeneration facility

• Tier II gasoline investment complete

24

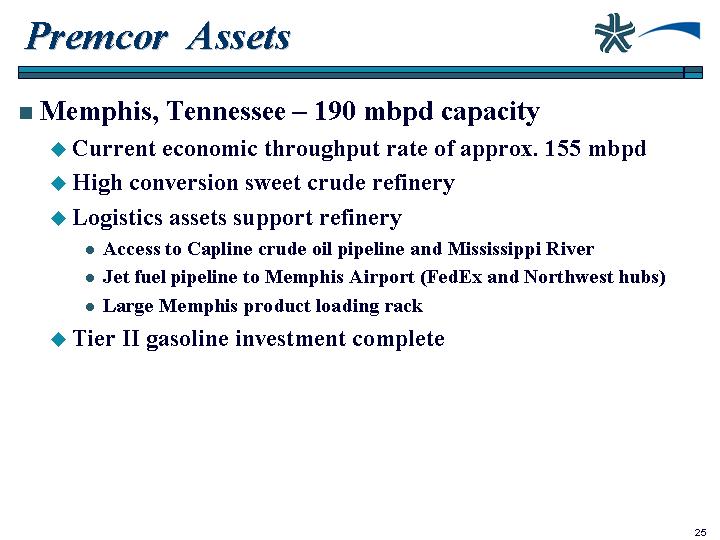

• Memphis, Tennessee – 190 mbpd capacity

• Current economic throughput rate of approx. 155 mbpd

• High conversion sweet crude refinery

• Logistics assets support refinery

• Access to Capline crude oil pipeline and Mississippi River

• Jet fuel pipeline to Memphis Airport (FedEx and Northwest hubs)

• Large Memphis product loading rack

• Tier II gasoline investment complete

25

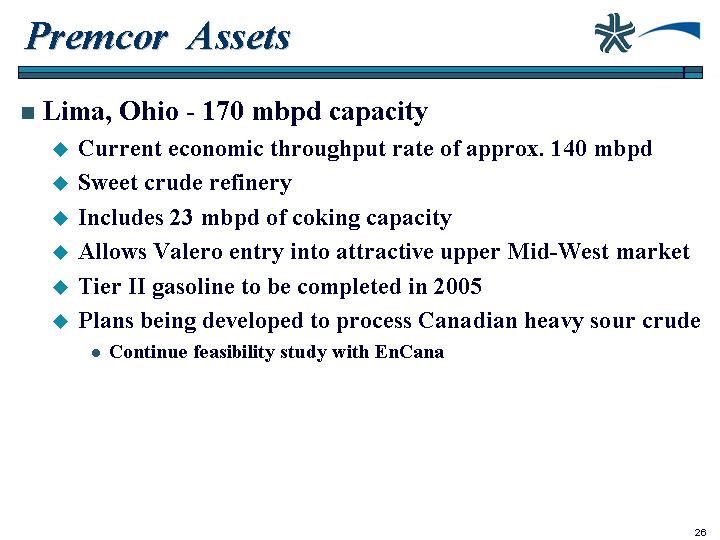

• Lima, Ohio - 170 mbpd capacity

• Current economic throughput rate of approx. 140 mbpd

• Sweet crude refinery

• Includes 23 mbpd of coking capacity

• Allows Valero entry into attractive upper Mid-West market

• Tier II gasoline to be completed in 2005

• Plans being developed to process Canadian heavy sour crude

• Continue feasibility study with EnCana

26

Mike Ciskowski,

Chief Financial Officer

Valero Energy

27

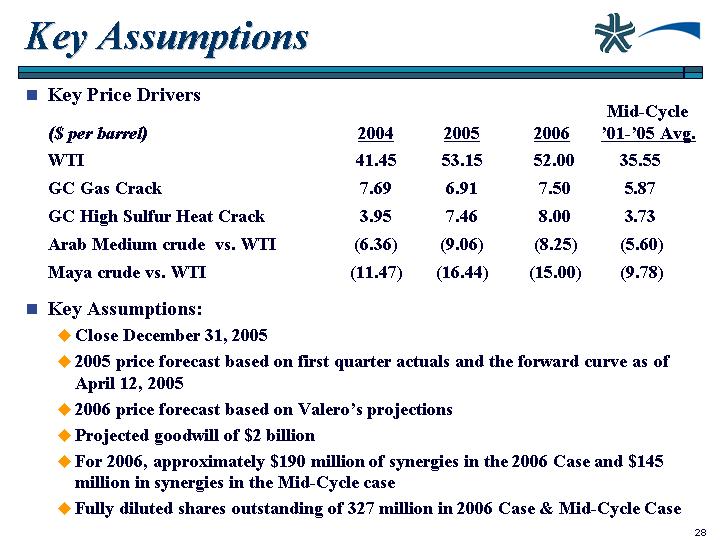

• Key Price Drivers

|

|

|

|

|

|

|

| Mid-Cycle |

|

($per barrel) |

| 2004 |

| 2005 |

| 2006 |

| ’01-’05 Avg. |

|

WTI |

| 41.45 |

| 53.15 |

| 52.00 |

| 35.55 |

|

GC Gas Crack |

| 7.69 |

| 6.91 |

| 7.50 |

| 5.87 |

|

GC High Sulfur Heat Crack |

| 3.95 |

| 7.46 |

| 8.00 |

| 3.73 |

|

Arab Medium crude vs. WTI |

| (6.36 | ) | (9.06 | ) | (8.25 | ) | (5.60 | ) |

Maya crude vs. WTI |

| (11.47 | ) | (16.44 | ) | (15.00 | ) | (9.78 | ) |

• Key Assumptions:

• Close December 31, 2005

• 2005 price forecast based on first quarter actuals and the forward curve as of April 12, 2005

• 2006 price forecast based on Valero’s projections

• Projected goodwill of $2 billion

• For 2006, approximately $190 million of synergies in the 2006 Case and $145 million in synergies in the Mid-Cycle case

• Fully diluted shares outstanding of 327 million in 2006 Case & Mid-Cycle Case

28

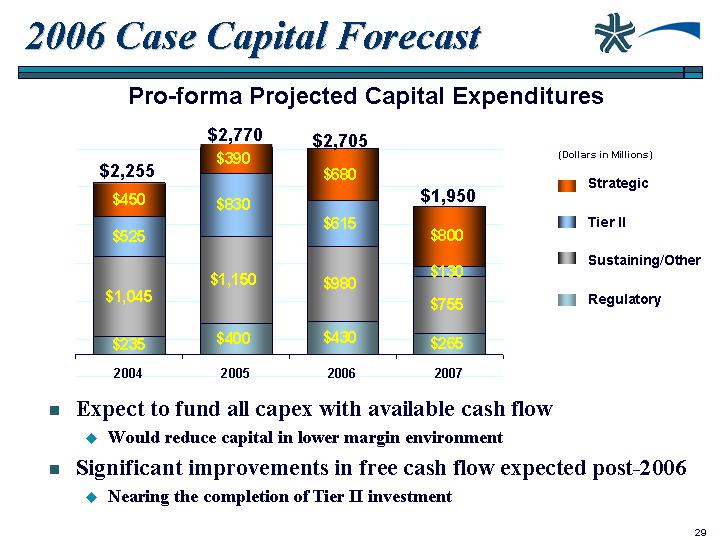

2006 Case Capital Forecast

Pro-forma Projected Capital Expenditures

[CHART]

• Expect to fund all capex with available cash flow

• Would reduce capital in lower margin environment

• Significant improvements in free cash flow expected post-2006

• Nearing the completion of Tier II investment

29

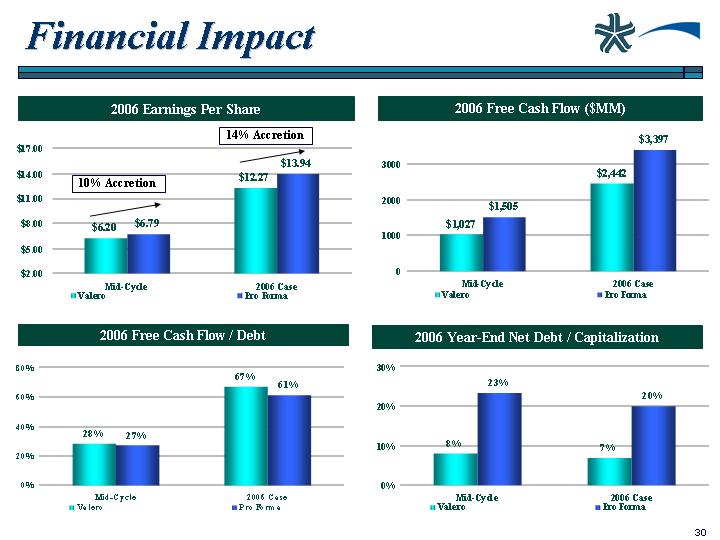

Financial Impact

2006 Earnings Per Share

[CHART]

2006 Free Cash Flow ($MM)

[CHART]

2006 Free Cash Flow / Debt

[CHART]

2006 Year-End Net Debt / Capitalization

[CHART]

30

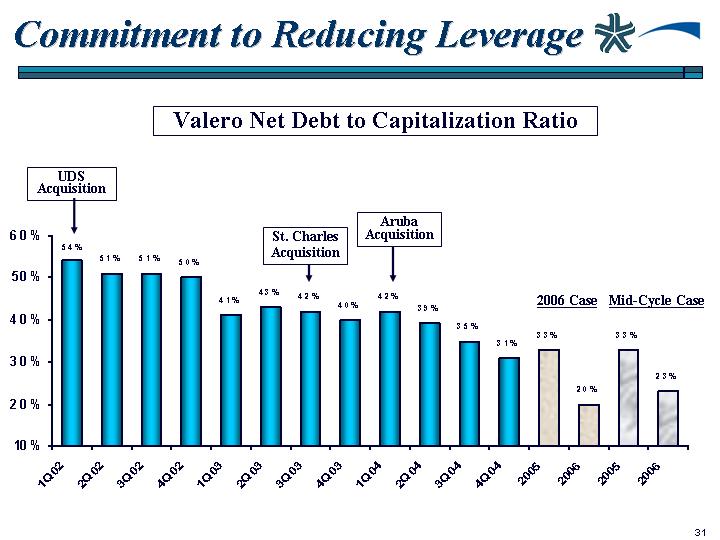

Commitment to Reducing Leverage

Valero Net Debt to Capitalization Ratio

[CHART]

31

Bill Greehey,

Chairman and CEO

Valero Energy

32

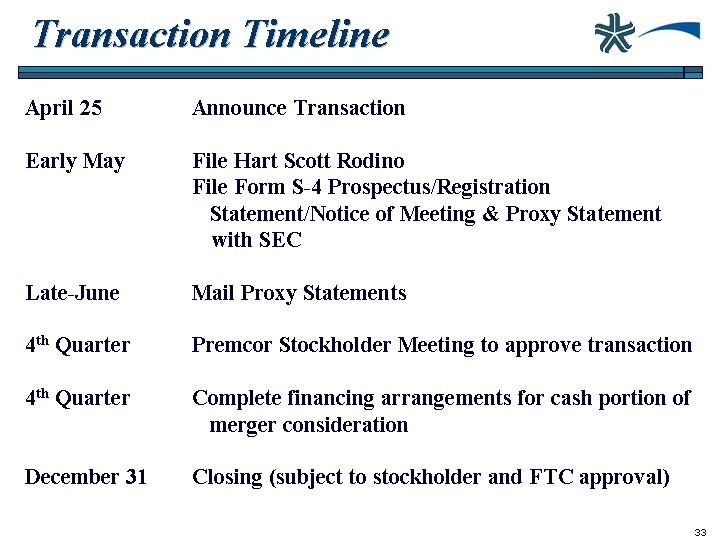

April 25 |

| Announce Transaction |

|

|

|

Early May |

| File Hart Scott Rodino File Form S-4 Prospectus/Registration |

|

|

|

Late-June |

| Mail Proxy Statements |

|

|

|

4th Quarter |

| Premcor Stockholder Meeting to approve transaction |

|

|

|

4th Quarter |

| Complete financing arrangements for cash portion of merger consideration |

|

|

|

December 31 |

| Closing (subject to stockholder and FTC approval) |

33

34

Appendix

35

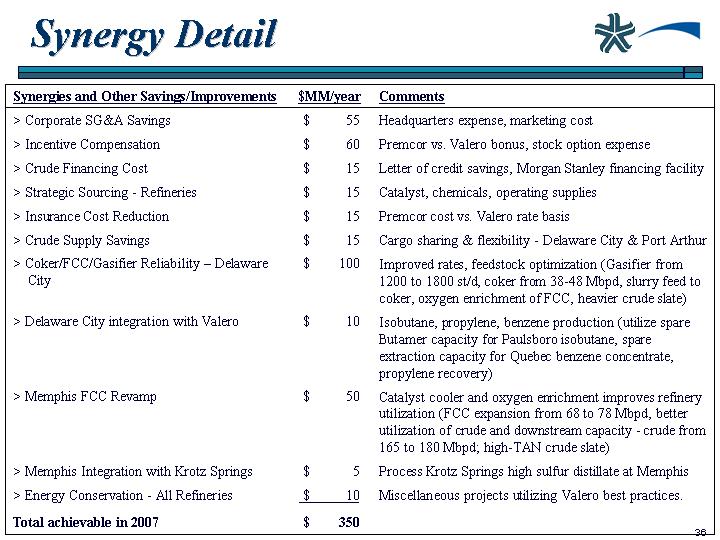

Synergy Detail

Synergies and Other Savings/Improvements |

| $ MM/year |

| Comments |

| |

> Corporate SG&A Savings |

| $ | 55 |

| Headquarters expense, marketing cost |

|

|

|

|

|

|

| |

> Incentive Compensation |

| $ | 60 |

| Premcor vs. Valero bonus, stock option expense |

|

|

|

|

|

|

| |

> Crude Financing Cost |

| $ | 15 |

| Letter of credit savings, Morgan Stanley financing facility |

|

|

|

|

|

|

| |

> Strategic Sourcing - Refineries |

| $ | 15 |

| Catalyst, chemicals, operating supplies |

|

|

|

|

|

|

| |

> Insurance Cost Reduction |

| $ | 15 |

| Premcor cost vs. Valero rate basis |

|

|

|

|

|

|

| |

> Crude Supply Savings |

| $ | 15 |

| Cargo sharing & flexibility -Delaware City & Port Arthur |

|

|

|

|

|

|

| |

> Coker/FCC/Gasifier Reliability - Delaware City |

| $ | 100 |

| Improved rates, feedstock optimization (Gasifier from 1200 to 1800 st/d, coker from 38-48 Mbpd, slurry feed to coker, oxygen enrichment of FCC, heavier crude slate) |

|

|

|

|

|

|

| |

> Delaware City integration with Valero |

| $ | 10 |

| Isobutane, propylene, benzene production (utilize spare Butamer capacity for Paulsboro isobutane, spare extraction capacity for Quebec benzene concentrate, propylene recovery) |

|

|

|

|

|

|

| |

> Memphis FCC Revamp |

| $ | 50 |

| Catalyst cooler and oxygen enrichment improves refinery utilization (FCC expansion from 68 to 78 Mbpd, better utilization of crude and downstream capacity - crude from 165 to 180 Mbpd; high-TAN crude slate) |

|

|

|

|

|

|

| |

> Memphis Integration with Krotz Springs |

| $ | 5 |

| Process Krotz Springs high sulfur distillate at Memphis |

|

|

|

|

|

|

| |

> Energy Conservation - All Refineries |

| $ | 10 |

| Miscellaneous projects utilizing Valero best practices. |

|

|

|

|

|

|

| |

Total achievable in 2007 |

| $ | 350 |

|

|

|

36