Exhibit 99.01

| UBS Global Oil and Gas Conference May 2012 |

| Safe Harbor Statement Statements contained in this presentation that state the Company's or management's expectations or predictions of the future are forward- looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The words "believe," "expect," "should," "estimates," and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see Valero's annual reports on Form 10^K and quarterly reports on Form 10^Q, filed with the Securities and Exchange Commission, and available on Valero's website at www.valero.com. 2 |

| Valero Energy Overview World's largest independent refiner 16 refineries including recently acquired Pembroke, U.K. and Meraux, Louisiana refineries, plus recently suspended operations at Aruba 3 million barrels per day (BPD) of throughput capacity, with average capacity of 190,000 BPD (187,000 excluding Aruba) Approximately 6,800 branded marketing sites Nearly 1,300 company operated in U.S. and Canada One of the largest renewable fuels companies 10 efficient corn ethanol plants with total of 1.1 billion gallons/year (72,000 BPD) of nameplate production capacity All plants located in resource-advantaged U.S. corn belt Diamond Green Diesel under construction (renewable diesel from waste cooking oil and animal fat) Approximately 22,000 employees 3 |

| Valero's Geographically Diverse Operations 4 Shutdown in March 2012 235,000 bpd capacity Nelson Index of 8 |

| Valero in the Atlantic Basin 5 5 |

| VLO Well-Positioned to Benefit from Changing Market Trends Competitively exporting into growing markets Atlantic Basin closures reducing excess capacity Increasing Valero's yield of distillates, which have higher margins and growth Expect abundant and growing U.S. shale oil and Canadian production to provide feedstock cost advantage, which increases in the future Low-cost U.S. natural gas provides competitive advantage 6 |

| Valero's Gulf Coast System Taking Advantage of Global Export Opportunities 7 Our large, complex refineries on Gulf Coast are competitive due to low-cost operations and feedstocks flexibility and comprise a significant portion of U.S. exports Strong international demand has been "pulling" products and paying higher values than in the U.S. Exports supporting refinery runs on Gulf Coast 1Based on 1,037 MBPD of average total U.S. gasoline and diesel exports from 1Q09 - February 2012 Remainder of U.S. Valero's Share of U.S. Gasoline and Distillate Exports1 |

| Atlantic Basin Closures Reduce Excess Capacity Capacity closures have been concentrated in the Atlantic Basin: U.S. East Coast, Caribbean, Western Europe (expect more will occur) Combined with poor utilization in Latin American refineries and demand growth in Latin America, creates opportunity for competitive refineries to export quality products 8 Sources: Industry and Consultant reports and Valero estimates; closures do not include Petroplus Coryton or Sunoco Philadelphia |

| Product Margins Responding to Atlantic Basin Closures 9 With recent closures, Atlantic Basin product margins have increased from prior year levels Market focused on gasoline margin improvements, but more significant impact may be strong diesel support due to tightness in diesel balances In addition, expect above-average U.S. turnaround (maintenance) activity throughout the industry to affect production capacity in 1H12 Source: Argus, 2Q11 QTD through May 18, 2011 and 2Q12 QTD through May 18, 2012 /bbl |

| U.S. Refining Capacity Is Globally Competitive 10 U.S. refiners in PADDs 2, 3, and 4 have higher utilization due to structural advantages of increasing access to discounted crude feedstocks and low-cost energy via natural gas PADD 1 and Europe have lower utilization due to structural disadvantages of higher crude oil and operating costs Upcoming capacity expansions in PADD 3 will continue to put pressure on marginal refineries in less-competitive regions, including recent restarts of previously closed capacity Source: EIA and IEA, monthly data through February 2012 Refinery Utilization by PADD, Trailing 12-months These regions have less- competitive capacity |

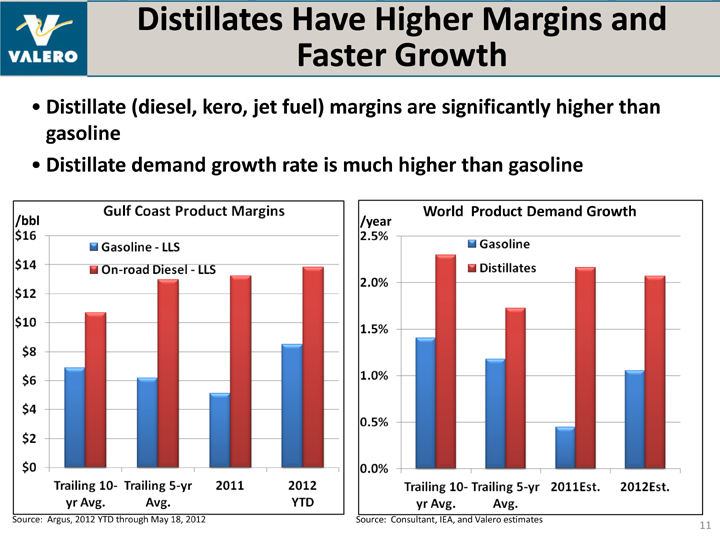

| Distillates Have Higher Margins and Faster Growth World Product Demand Growth Source: Consultant, IEA, and Valero estimates 11 Distillate (diesel, kero, jet fuel) margins are significantly higher than gasoline Distillate demand growth rate is much higher than gasoline Source: Argus, 2012 YTD through May 18, 2012 /bbl /year |

| Valero Increasing Distillate Yields 12 Source: Company Reports and EIA, yield data is for 2010; gasoline and distillate as a percent of total production volumes; distillate includes jet fuel Valero's refining system distillate yields are expected to grow from 33% in 2010 to 39% in 2013 Primary driver for increase is the completion of hydrocracker projects in 2012 Recent acquisitions have also increased distillate yields |

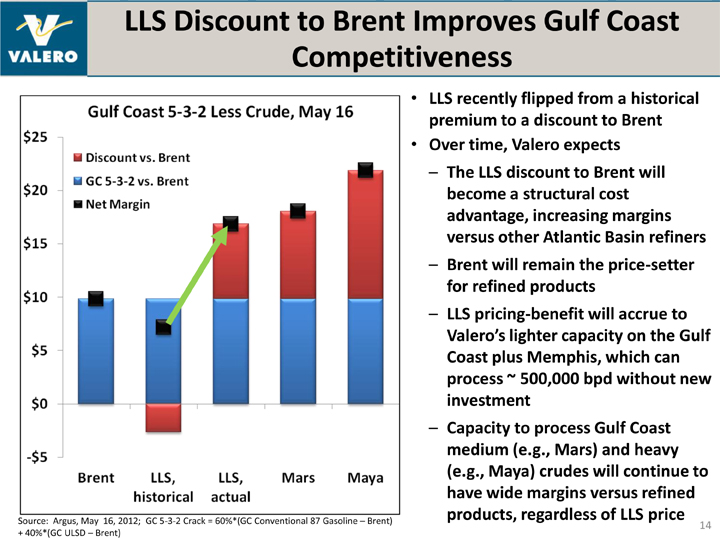

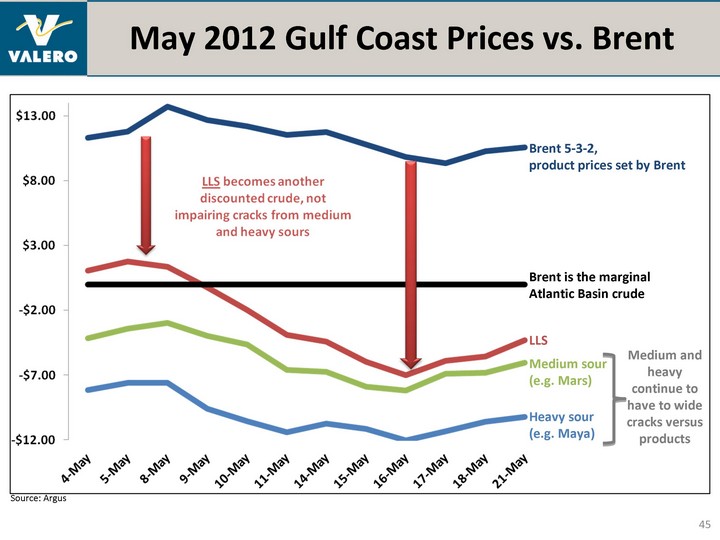

| Expect U.S. and Canadian Crude Supply to Provide Feedstock Cost Advantage 13 Changes in Sweet Crude Balances U.S. GC Light/Medium Sweet Imports in 2011 - 952 MBPD Last 6-months - 763 MBPD Expect significant growth in U.S. shale crude and Canadian production plus heavy-up projects in Mid-Con that free-up light/sweet crude oil Volumes moving via pipeline, rail, and barge from Mid-Con to U.S. Gulf Coast "LLS" Expect all Gulf Coast light/medium sweet imports could be pushed out of PADD III by 2013 to 2014 Expect LLS will go from structural ~$2/bbl premium to parity with, then discount under, Brent Expect Brent will continue to be marginal crude that sets product prices and sets higher feedstock cost for global, coastal (including U.S. East Coast) light/sweet refiners Also, expect growing volumes of Canadian heavy sours to reach U.S. Gulf Coast eventually |

| LLS Discount to Brent Improves Gulf Coast Competitiveness 14 LLS recently flipped from a historical premium to a discount to Brent Over time, Valero expects The LLS discount to Brent will become a structural cost advantage, increasing margins versus other Atlantic Basin refiners Brent will remain the price-setter for refined products LLS pricing-benefit will accrue to Valero's lighter capacity on the Gulf Coast plus Memphis, which can process ~ 500,000 bpd without new investment Capacity to process Gulf Coast medium (e.g., Mars) and heavy (e.g., Maya) crudes will continue to have wide margins versus refined products, regardless of LLS price Source: Argus, May 16, 2012; GC 5-3-2 Crack = 60%*(GC Conventional 87 Gasoline - Brent) + 40%*(GC ULSD - Brent) |

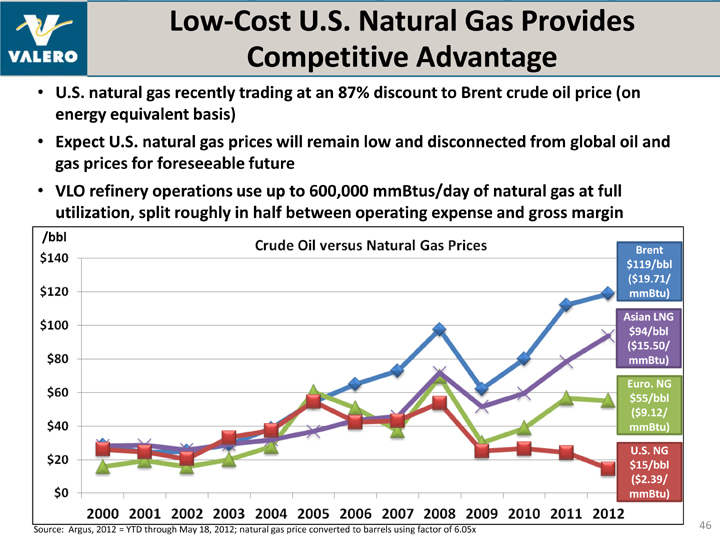

| Lower-Cost Natural Gas Provides Structural Advantage to U.S. Refiners 15 Note: Per barrel cost of 600,000 mmBtus/day of natural gas consumption at 90% utilization (2,529 MBPD) of Valero's capacity $1.5 billion higher annual costs $2.8 billion higher annual costs Expect U.S. natural gas prices will remain low and disconnected from global oil and gas prices for foreseeable future VLO refinery operations consume up to 600,000 mmBtus/day of natural gas at full utilization, split roughly in half between operating expense and gross margin |

| Refinery Project Estimated Completion Date Estimated Annual EBITDA Base Case1 (millions) Estimated IRR2 using Base Case Estimated Annual EBITDA1 using 2011 Prices (millions) LLS-based McKee & Memphis New Hydrogen Plants Operating $105 39% $176 Port Arthur New Hydrocracker 3Q12 $520 23% $634 St. Charles New Hydrocracker 4Q12 $380 17% $487 Valero's Key Economic Projects Capture the Natural Gas to Crude Oil Spread Projects mainly based on high crude, low natural gas prices outlook Estimate Port Arthur HCU mechanical completion early 3Q12 and operating at high rates by late 3Q12 Estimate St. Charles HCU mechanical completion late 4Q12 and operating at high rates by late 1Q13 16 1EBITDA = Pretax operating income + depreciation and amortization, excludes interest expense; 2estimated IRR is unlevered; See appendix for prices |

| 12,000 BPD (20%) volume expansion Hydrocracker Unit Operating Costs Hydrocracker Unit Operating Costs Heat, power, labor, etc. $1.50 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Synergies with Plant Synergies with Plant With existing plant ~$1 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Key Drivers for a 60,000 BPD Hydrocracker 17 Key economic driver is the expected significant liquid-volume expansion of 20%, which primarily comes from the hydrogen saturation via the high- pressure, high-conversion design Designed to maximize distillate yields Hydrocracker Unit Products (BPD) Hydrocracker Unit Products (BPD) Distillates (diesel, jet, kero) 44,000 Gasoline and blendstocks 24,000 LPGs 3,000 Low-sulfur VGO 1,000 Total 72,000 Hydrocracker Unit Feedstocks Hydrocracker Unit Feedstocks High-sulfur VGO 60,000 BPD (Internally produced or purchased) (Internally produced or purchased) Hydrogen 124 MMSCF/day (via 40,000 mmbtu/day of natural gas) (via 40,000 mmbtu/day of natural gas) |

| Valero's Hydrocracker Projects Show Profits Under Various Price Sets 18 Note: EBITDA = Pretax operating income + depreciation and amortization, excludes interest expense; see details in appendix millions |

| Valero's Contribution from Ethanol 19 Large, efficient plants in great location have competitive advantage on costs Acquired competitive, world-class ethanol plants at an average of 35% of replacement cost In 3 years, cumulative EBITDA was $882 million, versus $760 million total purchase price for plants 2Q12 ethanol margins remain challenged, but we are profitable Ethanol EBITDA millions |

| Valero's Retail Performance 20 Retail achieved record results in 2011 Improvement in retail earnings with smaller asset base = better returns Retail business has yielded strong free cash flow 2Q12 U.S. retail margins much better than 1Q12 Valero Retail EBITDA Number of Valero Retail Sites Note: includes all Canadian motorist sites reported in Canadian results |

| Better Better Our goal is to be a 1st-quartile refiner Refining industry benchmark studies show our portfolio continues to improve Seven refineries currently operating in 1st quartile for mechanical availability, the most important Solomon metric Saw results from improvement initiatives in 2011 First full-year with 1st quartile portfolio performance in mechanical availability Lowest-ever unplanned downtime Best-ever energy efficiency for refining portfolio Working diligently on weaker performers to improve entire portfolio Improving Refinery Operations 21 1st Quartile 2nd Quartile 1st Quartile 2nd Quartile 3rd Quartile 3rd Quartile Source: Solomon Associates and Valero Energy; excludes Aruba, Pembroke, and Meraux |

| Expect Large Decline in Capital Spending After Completion of Key Economic Growth Projects 22 "Stay- in- business" spending 2012 capital high due to estimated completion of economic growth projects, mainly the hydrocrackers Expect a significant decline in capital spending after 2012 $1,740 $1,735 $1,645 $1,565 Total $2,000 to $2,500 Decline $435 to $935 |

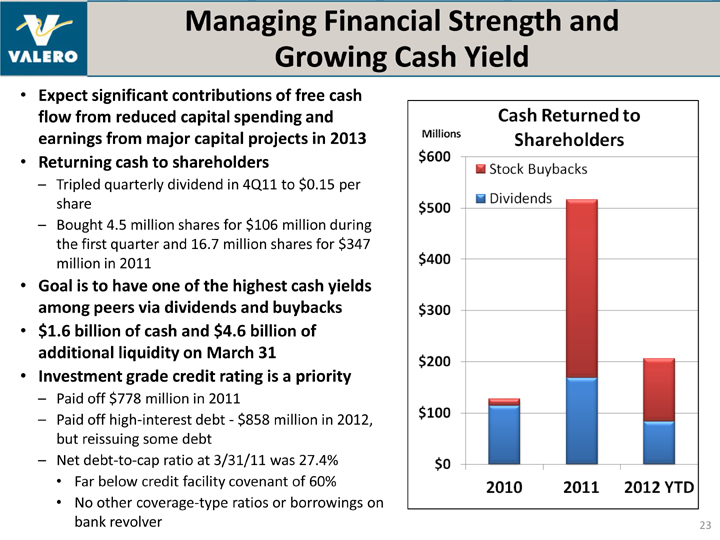

| Managing Financial Strength and Growing Cash Yield Expect significant contributions of free cash flow from reduced capital spending and earnings from major capital projects in 2013 Returning cash to shareholders Tripled quarterly dividend in 4Q11 to $0.15 per share Bought 4.5 million shares for $106 million during the first quarter and 16.7 million shares for $347 million in 2011 Goal is to have one of the highest cash yields among peers via dividends and buybacks $1.6 billion of cash and $4.6 billion of additional liquidity on March 31 Investment grade credit rating is a priority Paid off $778 million in 2011 Paid off high-interest debt - $858 million in 2012, but reissuing some debt Net debt-to-cap ratio at 3/31/11 was 27.4% Far below credit facility covenant of 60% No other coverage-type ratios or borrowings on bank revolver 23 |

| Valero's Strategic Priorities 24 Constant focus on safety, environmental, and regulatory compliance Maintain investment grade credit rating Continue improvement in refining performance to 1st quartile levels Continue cost reduction efforts Complete major, value-added capital projects Optimize portfolio - continue "high-grading" strategy Evaluate dispositions of poor performing assets Evaluate attractively priced, strategic, and accretive acquisitions that improve competitiveness Expand access to Atlantic Basin export markets Add selective investments in retail, logistics, and alternative fuels Goal: Increase long-term shareholder value |

| Why We Believe Valero Is an Excellent Buy Today Well-positioned to benefit from changing market trends Benefiting from strong export market Atlantic Basin capacity closures have improved refining fundamentals Expect abundant U.S. shale and Canadian crude oil production to provide a cost advantage to U.S. Gulf Coast refiners versus global, coastal (including U.S. East Coast) light/sweet refiners Projects focus on taking advantage of low-cost natural gas, high oil prices, and higher distillate demand and margins Solid performance and free cash flow from ethanol and retail Improving performance and competitiveness of refining portfolio Key growth projects and falling capital expenditures should contribute significant free cash flow in late 2012 and 2013 Returning more cash to shareholders Goal to have one of the highest cash yields among peers 25 |

| Appendix 26 |

| Made Excellent Ethanol Acquisitions Built position for average of only 35% of estimated replacement cost 2Q09: Acquired 7 plants with 780 million gallons per year of world-scale capacity in advantaged locations 1Q10: Added 3 plants with 330 million gallons per year of capacity 27 Expect margins to improve Recently narrow margins should rationalize less competitive capacity High crude oil prices support ethanol prices International demand supporting margins 2012 corn ethanol mandate grows 4.6% over 2011 Valero's low-cost acquisitions of high-quality plants imply a competitive advantage in any margin environment Provides platform for future production of advanced biofuels |

| Attractive Acquisition Prices for Meraux and Pembroke 28 @ $22 per share |

| Valero Has Competitive, Low-Cost Refining Operations 29 Refining Cash Operating Expenses less Natural Gas Usage ($/bbl) Source: Macquarie Capital |

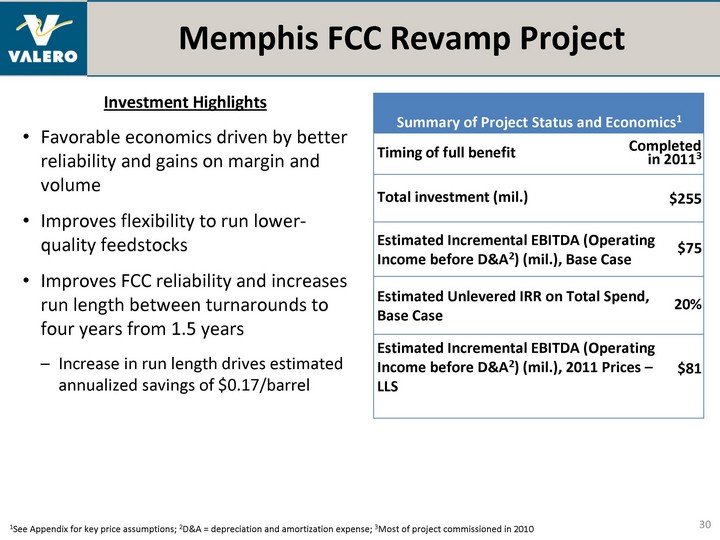

| Memphis FCC Revamp Project Investment Highlights Favorable economics driven by better reliability and gains on margin and volume Improves flexibility to run lower- quality feedstocks Improves FCC reliability and increases run length between turnarounds to four years from 1.5 years Increase in run length drives estimated annualized savings of $0.17/barrel 30 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Timing of full benefit Completed in 20113 Completed in 20113 Total investment (mil.) $255 $255 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $75 Estimated Unlevered IRR on Total Spend, Base Case Estimated Unlevered IRR on Total Spend, Base Case 20% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS $81 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense; 3Most of project commissioned in 2010 |

| St. Charles MSCC to FCC Conversion Project Investment Highlights Favorable economics driven by better reliability and gains on margin and volume Improves FCC reliability and increases run length between turnarounds to four years from 1.5 years Adds 5%+ volume expansion through FCC Improves energy efficiency via new power recovery turbine Doubles flexibility of FCC to process lower-priced resid feedstocks, backing out higher-priced VGO 31 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Completion date 2Q11 2Q11 Total investment (mil.) $330 $330 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $140 Estimated Unlevered IRR on Total Spend, Base Case Estimated Unlevered IRR on Total Spend, Base Case 28% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS $172 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Hydrogen Plant Projects 32 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Completion/start-up date 4Q11/ 1Q12 4Q11/ 1Q12 Total investment (mil.) $183 $183 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $105 Unlevered IRR on Total Spend, average, Base Case Unlevered IRR on Total Spend, average, Base Case 39% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - WTI Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - WTI $156 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS $176 Investment Highlights Favorable economics driven by cost savings and gains on margin and volume Reduces cost of hydrogen by using cheaper natural gas instead of more expensive crude oil Natural gas price per mmBtu (energy unit) is significantly lower than the price per mmBtu as WTI crude oil Projects were completed at the McKee and Memphis refineries Memphis project also includes conversion of a distillate hydrotreater to a mild hydrocracker 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Port Arthur Hydrocracker Project Investment Highlights Favorable economics driven by margin and volume gains Main unit is 57,000 barrels/day (rolling 12- month average per permit) hydrocracker plus facilities to process over 150,000 barrels/day of high-acid, heavy sour crudes (e.g. Canadian and Latin American) Creates high-value products from low-value feedstocks plus hydrogen sourced from relatively inexpensive natural gas Unit has volume expansion up to 30%, but plan to optimize at 20%: 1 barrel of feedstocks yields up to 1.2 barrels of products Main products are high-quality diesel and jet fuel for growing global demand for middle distillates Located at large, Gulf Coast refinery to leverage existing operations and export logistics 33 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Estimated mechanical completion date Estimated operation date Early 3Q12 Late 3Q12 Early 3Q12 Late 3Q12 Estimated total investment (mil.) (Reduced by $94 mil. from prior estimate) $1,510 $1,510 Cumulative spend thru 1Q 2012 (mil.) $1,160 $1,160 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $520 Estimated Unlevered IRR on Total Spend, Base Case Estimated Unlevered IRR on Total Spend, Base Case 23% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS $634 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| St. Charles Hydrocracker Project Investment Highlights Favorable economics driven by margin and volume gains Main unit is 60,000 barrels/day hydrocracker Creates high-value products from low- value feedstocks plus hydrogen sourced from relatively inexpensive natural gas Unit has volume expansion up to 30%, but plan to optimize at 20%: 1 barrel of feedstocks yields up to 1.2 barrels of products Main products are high-quality diesel and jet fuel for growing global demand for middle distillates Located at large, Gulf Coast refinery to leverage existing operations 34 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Estimated mechanical completion date Estimated operation date Late 4Q12 Late 1Q13 Late 4Q12 Late 1Q13 Estimated total investment (mil.) (Increased by $165 mil. from prior estimate) $1,525 $1,525 Cumulative spend thru 1Q 2012 (mil.) $924 $924 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $380 Estimated Unlevered IRR on Total Spend, Base Case Estimated Unlevered IRR on Total Spend, Base Case 17% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2011 Prices - LLS $487 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Montreal Pipeline Project Investment Highlights Favorable economics driven by reducing transportation costs and growing volumes New pipeline with 100,000 barrels/day of throughput capacity Planned closure of Shell Montreal refinery allows Valero to place additional products into Montreal and Ontario markets Quebec refinery is largest refinery in the region with 1st-quartile performance and has a cost advantage 35 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Summary of Project Status and Economics1 Estimated completion date 4Q12 4Q12 Estimated total investment (mil.) $370 $370 Cumulative spend thru 1Q 2012 (mil.) $246 $246 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $55 Estimated Unlevered IRR on Total Spend Estimated Unlevered IRR on Total Spend 12% 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Diamond Green Diesel Joint Venture Investment Highlights Building a 9,300 BPD renewable diesel plant adjacent to Valero's St. Charles refinery 50/50 JV project with Darling Int'l, a leading gatherer of used cooking oils and animal fat Uses refinery technology to produce high- quality diesel from low-quality, low-cost cooking oils and fats Diesel production qualifies as biomass- based diesel, a difficult specification under the Renewable Fuels Standard Total estimated project cost of $368 million Valero to provide 14-year term loan for up to $221 million to JV at attractive rates Favorable economics assume conservative $1.25/gal RIN value, when current market is $1.40/gal to $1.70/gal 36 Summary of JV Status and Economics1 Summary of JV Status and Economics1 Summary of JV Status and Economics1 Estimated mechanical completion date Estimated operation date Late 4Q12 Late 1Q13 Late 4Q12 Late 1Q13 Estimated Partner Equity (mil.) $106 $106 Cumulative Valero project spend thru 1Q2012 (mil.) $89 $89 Estimated Valero EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Valero EBITDA (Operating Income before D&A2) (mil.), Base Case $55 Estimated Unlevered IRR on Partner Equity and Loan, Base Case Estimated Unlevered IRR on Partner Equity and Loan, Base Case 21% 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Project Price Set Assumptions 37 Commodity Base Case ($/barrel) 2008 ($/barrel) 2009 ($/barrel) 2010 ($/barrel) 2011 ($/barrel) LLS Crude oil1 85.00 102.07 62.75 81.64 111.09 LLS - USGC HS Gas Oil -3.45 2.03 -2.86 -2.72 -5.75 USGC Gas Crack 6.00 2.47 6.91 5.32 5.11 USGC ULSD Crack 11.00 20.5 7.26 8.94 13.24 Natural Gas, $/MMBTU (NYMEX) 5.00 8.90 4.16 4.38 4.03 Prices shown below are for illustrating a potential estimate for Valero's economic projects Price assumptions are based on a blend of recent market prices and Valero's price forecast 1LLS prices are roll adjusted |

| Project Price Sensitivities 38 EBITDA1 Sensitivities (Delta $ millions/year) Port Arthur HCU St. Charles HCU Memphis & McKee Hydrogen Plants Memphis FCC St. Charles FCC Montreal Products Pipeline Crude oil, + $1/BBL 4 3.6 2.5 0.4 1.4 N/A Crude oil - USGC HS Gas Oil, + $1/BBL 16.7 17.8 N/A N/A N/A N/A USGC Gas Crack, + $1/BBL 12.9 13.3 0.9 3.6 1.7 N/A USGC ULSD Crack, + $1/BBL 18.4 20.8 0.3 (0.7) (1.2) N/A Natural Gas, - $1/MMBTU 18.3 19.7 6.5 N/A N/A N/A Total Investment IRR to 10% cost 1.3% 1.5% 6.3% 1.9% 2.7% 0.9% 1Operating income before depreciation and amortization expense Price sensitivities shown below are for illustrating a potential estimate for Valero's economic projects Price assumptions are based on a blend of recent market prices and Valero's price forecast |

| 60,000 BPD Hydrocracker Model Estimates Under Various Price Sets 39 Key Drivers and Prices 2008 Prices 2008 Prices 2009 Prices 2009 Prices 2010 Prices 2010 Prices 2011 Prices 2011 Prices Jan. 2012 Prices Jan. 2012 Prices LLS /bbl $102.07 $62.75 $81.64 $111.09 $110.43 LLS - HSVGO /bbl $2.03 -$2.86 -$2.72 -$5.75 -$11.34 GC Gasoline - LLS /bbl $2.47 $6.91 $5.32 $5.11 $5.86 GC Diesel - LLS /bbl $20.50 $7.26 $8.94 $13.24 $16.64 Natural Gas (NYMEX) /mmBtu $8.90 $4.16 $4.38 $4.03 $2.67 Natural Gas to H2 cost factor $/mmBtu 1.5x 1.5x 1.5x 1.5x 1.5x H2 Consumption SCF /bbl 2,050 2,050 2,050 2,050 2,0GC 50 GC LSVGO - HSVGO /bbl $4.28 $2.85 $3.21 $3.87 $1.96 GC LPGs - LLS /bbl -$40.02 -$20.11 -$23.97 -$38.30 -$35.06 Feedstocks (Barrels per day) Bbl/day Bbl/day Bbl/day Bbl/day Bbl/day HSVGO 60,000 60,000 60,000 60,000 60,000 Hydrogen 6,709 6,709 6,709 6,709 6,709 Product Yields Distillates (diesel, jet, kero) 61% 43,902 61% 43,902 61% 43,902 61% 43,902 61% 43,902 Gasoline and blendstocks 33% 23,940 33% 23,940 33% 23,940 33% 23,940 33% 23,940 LPGs 4% 3,042 4% 3,042 4% 3,042 4% 3,042 4% 3,042 LSVGO 2% 1,338 2% 1,338 2% 1,338 2% 1,338 2% 1,338 Total Product Yields 100% 72,222 100% 72,222 100% 72,222 100% 72,222 100% 72,222 Volume Expansion on HSVGO 20% 20% 20% 20% 20% Estimated Profit Model Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Revenues $136.87 $8.2 $82.71 $5.0 $105.85 $6.4 $143.72 $8.6 $145.96 $8.8 Less: Feedstock cost -$109.07 -$6.5 -$69.83 -$4.2 -$88.80 -$5.3 -$120.93 -$7.3 -$124.48 -$7.5 = Gross Margin $27.80 $1.7 $12.88 $0.8 $17.05 $1.0 $22.79 $1.4 $21.48 $1.3 Less: Cash Operating Costs -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 Add: Synergies $1.70 $0.1 $0.55 $0.0 $0.03 $0.0 $0.95 $0.1 $0.95 $0.1 = EBITDA $28.00 $1.7 $11.93 $0.7 $15.57 $0.9 $22.24 $1.3 $20.93 $1.3 Estimated Annual EBITDA ($MM/year) $613 $261 $341 $487 $458 |

| Hydrocracking Enhances Refinery Competitiveness Benefits of hydrocrackers Volume gain provides significant margin advantage More economic home for VGO than FCCs Creates feedstock flexibility 40 Source: EIA Refinery Capacity Report as of January 1, 2011; Valero More-profitable hydrocrackers... Make mostly distillates, not gasoline Are severe/high pressure, not mild/low pressure Get hydrogen from cheap natural gas, not expensive foreign natural gas or oil ... like Valero's new hydrocrackers |

| Continued Global Demand Growth Important to Refining Margins 41 Source: Consultant and Valero estimates World Petroleum Demand Growth Emerging markets are taking the lead in terms of global petroleum demand growth - but refining is a global business and world growth impacts refiners in every market MMBPD |

| World Refinery Capacity Growth Significant new global refining additions seen in the next several years Mainly new plants in Asia and the Middle East Some investment in Latin America Global Refinery Additions 42 MMBPD Source: Consultant and Valero estimates Net 1,054 MBPD Net 1,162 MBPD |

| *Partial closure of refinery captured in capacity Note: This data represents refineries currently closed, ownership may choose to restart or sell listed refinery Sources: Industry and Consultant reports and Valero estimates 1The Petit Couronne refinery remains closed at this time with plans for Shell to supply crude via a processing agreement at 100 MBPD starting in mid-June 2The Trainer refinery remains closed, but Delta Airlines has announced its intent to purchase the refinery, which would likely result in a restart of this facility 3The Cressier refinery remians closed, but Varo Holding SA has agreed to purchase the plant and has indicated that it may restart Global Refining Capacity Rationalization 43 Location Owner CDU Capacity Closed (MBPD) Year Closed Perth Amboy, NJ Chevron 80 2008 Bakersfield,CA Big West 65 2008 Westville, NJ Sunoco 145 2009 Bloomfield, NM Western 17 2009 Teesside, UK Petroplus 117 2009 Gonfreville, France* Total 100 2009 Dunkirk, France Total 140 2009 Japan* Nippon Oil 205 2009 Toyama, Japan Nihonkai Oil 57 2009 Arpechim, Romania * Petrom 70 2009 Cartagena* REPSOL 100 2009 Bilboa* REPSOL 100 2009 Arpechim, Romania OMV 70 2010 Japan* Cosmo 94 2010 Nadvornaja, Ukraine Privat Group 50 2010 Montreal, Canada1 Shell 130 2010 Yorktown, Virginia Western 65 2010 Reichstett, France Petroplus 85 2010 Wilhemshaven, Germany Phillips 66 260 2010 Ingolstadt, Germany Bayernoil 90 2010 Cremona, Italy Tamoil 94 2011 Location Owner CDU Capacity Closed (MBPD) Year Closed St. Croix, U.S.V.I,* Hovensa 150 2011 Funshun, China PetroChina 70 2011 Keihin Ohgimachi, Japan Showa Shell 120 2011 Clyde, Australia Shell 75 2011 Trainer, PA2 Phillips 66 185 2011 Porto Marghera, Italy ENI 70 2011 Marcus Hook, PA Sunoco 175 2011 Harburg, Germany Shell 107 2012 Berre, France LyondellBassel 105 2012 Petit Couronne, France1 Petroplus 162 2012 Cressier, Switzerland3 Petroplus 68 2012 Ingolstadt, Germany Petroplus 110 2012 St. Croix, U.S.V.I Hovensa 350 2012 Aruba Valero 235 2012 Gela, Italy* ENI 50 2012 Japan Indemitsu Kosan 100 2014 Japan Nippon 200 2014 |

| Global Refining Capacity For Sale or Under Strategic Review 44 Location Owner CDU Capacity (MBPD) Gothenburg, Sweden Shell 80 Kapolei, HI Chevron 54 Milford Haven, UK Murphy 108 Whitegate, Ireland Phillips 66 70 Belle Chase, LA Phillips 66 247 Mazeikai, Lithuania PKN 190 Various Japanese Locations JX Energy 400 Incheon, South Korea SK Group 275 Texas City, Texas BP 475 Carson, California BP 265 Kapolei, HI Tesoro 94 Philadelphia, PA Sunoco 330 Coryton, UK Petroplus 220 Okinawa, Japan Petrobras/Nansei Sekiyu 100 Sydney, Australia (Kurnell) Caltex 135 Brisbane, Australia (Lytton) Caltex 109 Mongstad, Norway Statoil 220 Dartmouth, Canada Imperial Oil 88 Sources: Industry and Consultant reports and Valero estimates |

| May 2012 Gulf Coast Prices vs. Brent 45 Source: Argus Brent 5-3-2, product prices set by Brent Brent is the marginal Atlantic Basin crude LLS Medium sour (e.g. Mars) Heavy sour (e.g. Maya) Medium and heavy continue to have to wide cracks versus products |

| Low-Cost U.S. Natural Gas Provides Competitive Advantage 46 U.S. natural gas recently trading at an 87% discount to Brent crude oil price (on energy equivalent basis) Expect U.S. natural gas prices will remain low and disconnected from global oil and gas prices for foreseeable future VLO refinery operations use up to 600,000 mmBtus/day of natural gas at full utilization, split roughly in half between operating expense and gross margin Source: Argus, 2012 = YTD through May 18, 2012; natural gas price converted to barrels using factor of 6.05x Brent $119/bbl ($19.71/ mmBtu) U.S. NG $15/bbl ($2.39/ mmBtu) Asian LNG $94/bbl ($15.50/ mmBtu) Euro. NG $55/bbl ($9.12/ mmBtu) /bbl |

| Gasoline Fundamentals 47 USGC LLS Gasoline Crack (per bbl) U.S. Gasoline Demand (mmbpd) Source: Argus; 2012 data through May 18 Source: DOE weekly data; 2012 data through week ending May 11 Source: DOE weekly data; 2012 data through week ending May 11 U.S. Gasoline Days of Supply U.S. Net Imports of Gasoline and Blendstocks (mbpd) Source: DOE monthly data; 2011 data through February 2012 |

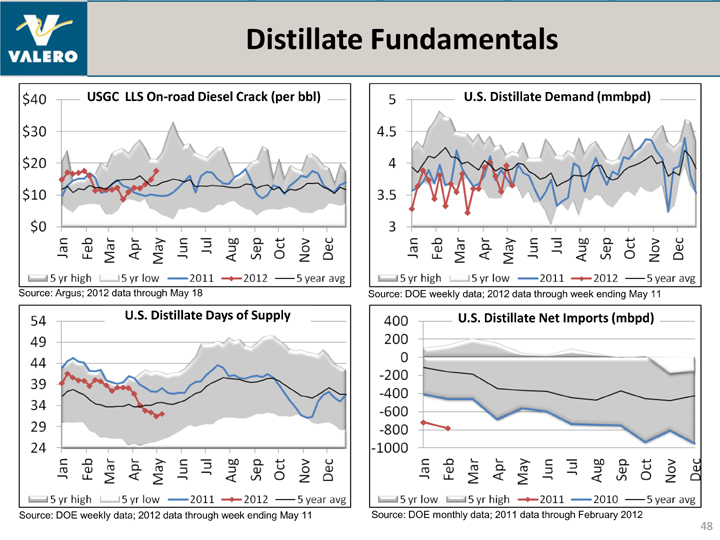

| Distillate Fundamentals 48 USGC LLS On-road Diesel Crack (per bbl) U.S. Distillate Demand (mmbpd) Source: Argus; 2012 data through May 18 Source: DOE weekly data; 2012 data through week ending May 11 Source: DOE weekly data; 2012 data through week ending May 11 Source: DOE monthly data; 2011 data through February 2012 U.S. Distillate Days of Supply U.S. Distillate Net Imports (mbpd) |

| U.S. Transport Indicators: Trucking Indicators 49 |

| U.S. Transport Indicators 50 Latest data Week 16, 2012 |

| Mexico Statistics Diesel Gross Imports (MBPD) Source: PEMEX, latest data Mar-12 Gasoline Gross Imports (MBPD) Source: PEMEX, latest data Mar-12 Crude Unit Throughput (MBPD) Crude Unit Utilization 51 Source: Mexico Secretary of Energy, latest data Mar-12 Source: Mexico Secretary of Energy, latest data Mar-12 |

| Venezuelan Exports to the U.S. 52 Source: EIA, February 2012 |

| Competitively Exporting into Growing Markets Source: DOE Petroleum Supply Monthly with data as of February 2012, Latin America includes South and Central America plus Mexico U.S. has become a net exporter of refined products due to growth in developing countries, Atlantic Basin capacity closures, Western European diesel demand, and Latin American refining operating issues U.S. Gulf Coast (PADD III) is largest source of exported products Latin America continues to be the largest U.S. export market, followed by Western Europe Latin American petroleum demand has been increasing 2.5% per year over the past 5 years versus U.S. decreasing 1.8% per year 53 U. S. Product Exports By Destination U. S. Product Exports By Source MMBPD 12 Month Moving Average |

| U.S. Shifted to Net Exporter Net Imports Net Exports Note: Gasoline includes ethanol, MTBE, and other oxygenates; Source: DOE Petroleum Supply Monthly with data as of February 2012 MBPD Diesel net exports continue to rise significantly, with U.S. refiners sending a net of 690 MBPD to other countries in 2012 YTD Gasoline net imports have fallen from almost 1 MMBPD in 2006 to only 170 MBPD in 2012 Still, gasoline and blendstocks are the only product category where the U.S. remains a net importer As a result of the continued shift towards exports, U.S. net exports of petroleum products have increased from 340 MBPD in 2010 to 1270 MBPD in 2012 YTD 54 |

| U.S. Gasoline Exports by Destination Most of the gasoline export growth this year has been to Latin America, including Mexico Latin American requirements are growing due to increased demand and poor performance of refineries in Venezuela and Mexico Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly with data as of February 2012. 4 Week Average estimate from Weekly Petroleum Statistics Report and VLO estimates MBPD 55 12 Month Moving Average |

| U.S. Gasoline Imports by Source Gasoline imports have declined steadily since 2007 Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly with data as of February 2012. 4 Week Average estimate from Weekly Petroleum Statistics Report and VLO estimates Shutdown of the Atlantic Basin refineries will keep pressure on this trend in 2012 Although the shutdown of U.S. East coast refineries will require more gasoline to balance 56 MBPD 12 Month Moving Average |

| U.S. Diesel Exports by Destination Diesel exports to Latin America continue to exceed exports to Europe, but over two- thirds of diesel export growth in 2011 was to Europe Source: DOE Petroleum Supply Monthly with data as of February 2012. 4 Week Average estimate from Weekly Petroleum Statistics Report Lower European refinery runs on challenging economics forced the region to import more diesel Expect Petroplus' refinery shutdowns will add to European diesel deficit Latin America needs remain high on good demand growth and continued challenges running refineries in key countries 57 MBPD 12 Month Moving Average |

| U.S. Diesel Imports by Source Diesel imports have fallen slightly in 2012 due to less volume from Latin America Source: DOE Petroleum Supply Monthly with data as of February 2012. 4 Week Average estimate from Weekly Petroleum Statistics Report Expect the St. Croix shutdown will reduce 2012 imports 58 MBPD 12 Month Moving Average |

| 59 U.S. Crude and Natural Gas Production - Tight Oil Supply Growth The furthest along in development are in North Dakota (Bakken) and South Texas (Eagle Ford) Each could see 500+ MBPD of growth in the next few years and potentially more thereafter Utica (Ohio) is potentially a large play, but is not as far along in development and is 3 to 5 years away Source: Map from CERA Shale Oil Plays in North America Expect supply growth will exceed regional demand, and excess will clear toward the Gulf Coast, pushing out imports The new U.S. shale plays are located in places that should provide additional barrels into the Rockies and Gulf Coast - pressuring crude imports and lowering natural gas prices |

| Ethanol and Retail Reconciliation of Operating Income to EBITDA Ethanol (millions) 2Q09 - 4Q09 2010 2011 1Q12 Operating Income $165 $209 $396 $9 + Depreciation and amortization expense $18 $36 $39 $10 = EBITDA $183 $245 $435 $19 60 Retail (millions) 2005 2006 2007 2008 2009 2010 2011 1Q12 U.S. Operating Income $81 $113 $154 $260 $170 $200 $213 $11 + U.S. depreciation and amortization expense $60 $60 $59 $70 $70 $73 $77 $18 = U.S. EBITDA $141 $173 $214 $330 $240 $273 $290 $29 Canada Operating Income $73 $69 $95 $109 $123 $146 $168 $29 + Canada depreciation and amortization expense $23 $27 $31 $35 $31 $35 $38 $9 = Canada EBITDA $96 $96 $126 $144 $154 $181 $206 $38 |

| Crude Discounts Narrowed since 3Q11 61 $/barrel Source: Argus; 2012 year-to-date through May 18; LLS prices are roll adjusted |

| Regional Refinery Indicator Margins 62 Source: Argus; 2012 year-to-date through May 18; see Appendix for details on refinery configuration assumptions |

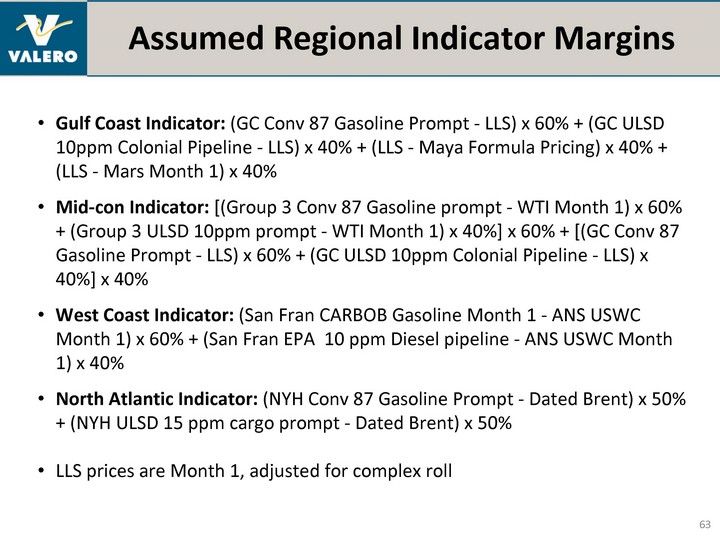

| Assumed Regional Indicator Margins Gulf Coast Indicator: (GC Conv 87 Gasoline Prompt - LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline - LLS) x 40% + (LLS - Maya Formula Pricing) x 40% + (LLS - Mars Month 1) x 40% Mid-con Indicator: [(Group 3 Conv 87 Gasoline prompt - WTI Month 1) x 60% + (Group 3 ULSD 10ppm prompt - WTI Month 1) x 40%] x 60% + [(GC Conv 87 Gasoline Prompt - LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline - LLS) x 40%] x 40% West Coast Indicator: (San Fran CARBOB Gasoline Month 1 - ANS USWC Month 1) x 60% + (San Fran EPA 10 ppm Diesel pipeline - ANS USWC Month 1) x 40% North Atlantic Indicator: (NYH Conv 87 Gasoline Prompt - Dated Brent) x 50% + (NYH ULSD 15 ppm cargo prompt - Dated Brent) x 50% LLS prices are Month 1, adjusted for complex roll 63 |

| Investor Relations Contacts For more information, please contact: Ashley Smith, CFA, CPA Vice President, Investor Relations 210.345.2744 ashley.smith@valero.com Matthew Jackson Investor Relations Specialist 210.345.2564 matthew.jackson@valero.com 64 |