- VLO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Valero Energy (VLO) 8-KRegulation FD Disclosure

Filed: 21 May 13, 12:00am

| UBS Global Oil and Gas Conference May 21-22, 2013 |

| Safe Harbor Statement Statements contained in this presentation that state the Company's or management's expectations or predictions of the future are forward- looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The words "believe," "expect," "should," "estimates," "intend," and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see Valero's annual reports on Form 10^K and quarterly reports on Form 10^Q, filed with the Securities and Exchange Commission, and available on Valero's website at www.valero.com. 2 |

| Valero Energy Overview World's largest independent refiner 16 refineries 2.8 million barrels per day (BPD) of throughput capacity, with average capacity of 187,000 BPD, excluding Aruba More than 7,300 branded marketing sites Nearly 1,900 sites belong to CST Brands, our former retail business that we spun off (80%) May 1, 2013 Brands include: Valero, Ultramar, Texaco, Shamrock, Diamond Shamrock, and Beacon One of the largest renewable fuels companies 10 efficient corn ethanol plants with total of 1.1 billion gallons/year (72,000 BPD) of nameplate production capacity All plants located in resource-advantaged U.S. corn belt Diamond Green Diesel JV plant nearly complete Renewable diesel from waste cooking oil and animal fat Approximately 10,000 BPD capacity, 50% to Valero Approximately 10,500 employees 3 |

| Refinery Capacities (000 bpd) Capacities (000 bpd) Nelson Index Refinery Total Through-put Crude Oil Nelson Index Corpus Christi 325 205 20.6 Houston 160 90 15.1 Meraux 135 135 10.2 Port Arthur 310 290 12.7 St. Charles 270 190 15.2 Texas City 245 225 11.1 Three Rivers 100 95 12.4 Gulf Coast 1,545 1,230 14.0 Ardmore 90 86 12.0 McKee 170 168 9.5 Memphis 195 180 7.5 Mid-Con 455 434 9.2 Pembroke 270 220 11.8 Quebec City 235 230 7.7 North Atlantic 505 450 9.7 Benicia 170 145 15.0 Wilmington 135 85 15.8 West Coast 305 230 15.3 Total or Avg. 2,810 2,344 12.4 Valero's Geographically Diverse Operations 4 Shutdown in March 2012 235,000 bpd capacity, Nelson Index of 8 |

| Valero's Strategy to Enhance Returns and Increase Long-term Shareholder Value Increase Long-term Shareholder Value Increase Long-term Shareholder Value 5 |

| Key Market Trends 6 Expect dramatic growth in U.S. shale oil and Canadian oil production to provide North American crude oil cost advantage Industry installing significant infrastructure to move crude oil to refining markets, mainly to U.S. Gulf Coast Lower-cost North American natural gas provides competitive advantage Global distillates demand growth yields higher margins U.S. Gulf Coast competitively advantaged to export into growing and undersupplied markets, taking market share from Western Europe and replacing shutdown and underperforming refining capacity in the Atlantic Basin |

| U.S. and Canadian Production Growth Provides Resource Advantage to North American Refiners Resource Advantage to North American Refiners Resource Advantage to North American Refiners 7 Source: EIA, Consultants, company announcements and Valero estimates; 2013 U.S. Crude imports are YTD as of February 2013 Crude production growth reduces similar quality imports Largest growth coming from U.S. shale crude and heavy Canadian crude |

| Logistics Constraints Create Regional Crude Discounts in U.S. and Canada 8 (CHART) Source: Argus; data as of May 17, 2013 E A B C D F G H I Crude Pricing by Location A B C D E F G H I Premium Discount |

| U.S. Gulf Coast: Main Destination for Most Cost-Efficient Crude Oil Logistics Rapid increase in pipeline capacities to move inland North American light and heavy crude oils to the Gulf Coast Light crudes have been pricing below LLS in western (Houston, Corpus) parts of Gulf Coast Expect rail to play a smaller part in Gulf Coast crude supply vs. East and West Coasts because of pipelines Expect Valero to benefit with over 50% of it's refining capacity on the Gulf Coast (CHART) Source: Consultants, company announcements and Valero estimates Note: Import volumes include light and medium crudes between 28 and 50 API with less than 0.7% sulfur; 2013 data is year-to-date through February U.S. GC Light/Medium Sweet Imports 9 |

| Valero's Strategy to Supply Incremental Volumes of Cost-Advantaged Crude Oil Volumes of Cost-Advantaged Crude Oil Volumes of Cost-Advantaged Crude Oil 10 Insert photos Expect Quebec refinery to benefit and become supplied by U.S. and Canadian crude in three ways: rail, ship, pipeline Rail up to 30 MBPD of light crude starting in 3Q13, increasing to 50 MBPD in 3Q14 Ship Eagle Ford crude from Texas via lower-cost foreign-flagged vessel in 2H13 Committed to receive substantial volume of light crude via Enbridge pipeline 9B and shuttled from Montreal by Valero-owned ships in 2H14 |

| Valero's Estimate of Marginal Light Crude Oil Costs per Barrel in 12 to 24 Months 11 to USEC Rail $14 to $17/bbl to St. James Rail $12/bbl to Cushing Rail $9/bbl Cushing ICE Brent -$5 to -$8 to Houston Pipe $4/bbl Midland ICE Brent -$5 to -$8 to Houston Pipe $4/bbl CC to Houston $1 to $2/bbl Houston to St. James $1 to $2 /bbl to West Coast Rail $13 to $15/bbl USGC to USEC U.S. Ship $5 to $6/bbl USGC to Canada Foreign Ship $2/bbl Alberta to Bakken $1 to $2/bbl USEC ICE Brent +$2 ICE Brent -$0 to -$3 ICE Brent +$1 to -$3 ICE Brent -$1 to -$5 Expect Gulf Coast will have cost advantage versus East Coast, West Coast, and foreign markets Bakken ICE Brent -$12 to -$15 Rail $9/bbl U.S. Ship $4 to $5/bbl Alberta ICE Brent -$13 to -$16 to Eastern Canada Rail $9 to $12/bbl Brent-priced crude |

| Lower-Cost Natural Gas Provides Structural Advantage to U.S. and Canadian Refiners 12 Note: Per barrel cost of 700,000 MCF/day of natural gas consumption at 90% utilization (2,529 MBPD) of Valero's capacity $1.5 billion higher pre- tax annual costs $3.1 billion higher pre-tax annual costs Expect U.S. natural gas prices will remain low and disconnected from global oil and LNG prices for foreseeable future Natural gas is a cost-advantaged feedstock, not just an operating expense advantage Conversion to hydrogen provides desulfurization and volume expansion VLO refinery operations consume up to 700 MMCF/day of natural gas at full utilization, split roughly in half between operating expense and cost of goods sold |

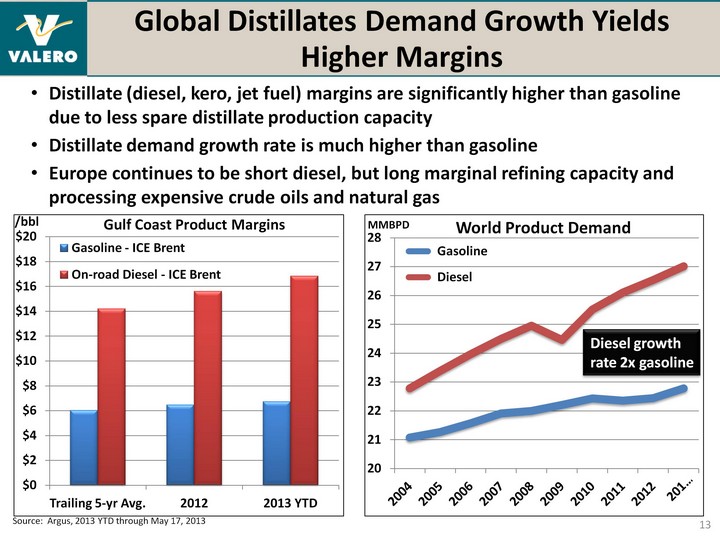

| Global Distillates Demand Growth Yields Higher Margins 13 Distillate (diesel, kero, jet fuel) margins are significantly higher than gasoline due to less spare distillate production capacity Distillate demand growth rate is much higher than gasoline Europe continues to be short diesel, but long marginal refining capacity and processing expensive crude oils and natural gas (CHART) Source: Argus, 2013 YTD through May 17, 2013 /bbl (CHART) Diesel growth rate 2x gasoline |

| Valero Increasing Distillate Yields 14 (CHART) Source: Company Reports and EIA, yield data is for 2012; gasoline and distillate as a percent of total production volumes; distillate includes jet fuel; gasoline excludes naphtha Valero's refining system distillate yields are estimated to grow from 33% in 2010 to 39% in 4Q13 and 41% in 2015, yielding a gasoline/diesel ratio of nearly 1:1 Primary driver for increase is the construction of two new hydrocrackers at Port Arthur and St. Charles, plus planned expansions on those and Meraux (CHART) Nearly a 1:1 ratio |

| U.S. Refining Capacity Is Globally Competitive and Taking Market Share 15 U.S. flipped from importer to exporter on lower local demand and competitive advantages U.S. refiners in PADDs 2, 3, and 4 have higher utilization due to structural advantages of cost-advantaged crude oil and natural gas U.S. Gulf Coast refineries have taken market share in the Atlantic Basin via growing exports Source: EIA and IEA, data as of February 2013 (CHART) Refinery Utilization by PADD, Trailing 12-months These regions have less-competitive capacity "Mid- con" "Gulf Coast" "West Coast" "Rockies" "East Coast" (CHART) U.S. Net Product Imports Source: EIA, data annual through 2012 |

| Valero in the Atlantic Basin 16 16 Aruba Terminal |

| (CHART) Continued Global Demand Growth Important to Refining Margins 17 Source: Consultant and Valero estimates World Petroleum Demand Growth Emerging markets lead in terms of global petroleum demand growth Refining is a global business - world growth impacts refiners in every market because products are generally very storable, transportable, and fungible commodities MMBPD |

| (CHART) World Refinery Capacity Growth Expect significant new global refining additions in the next several years Mainly new plants in Asia and the Middle East , where demand growth is strong New capacity announcements from Brazil, Mexico, and Colombia will likely be much smaller and much later than originally announced Others unlikely to happen because of costs: Ecuador, Peru, Algeria, Egypt Offsets include shutdowns of marginal refineries, mainly in Europe, Australia, and Japan - expect more to continue Net Global Refinery Additions 18 MMBPD Source: Consultant and Valero estimates; Net Global Refinery Additions = New Capacity + Restarts- Closures |

| Valero's 2013 Capital Spending Focuses on Growth Projects, Mainly Logistics 19 "Stay- in- business" spending 2012 spending was higher mainly due to the two new hydrocrackers 2013 spending includes approximate $60 million for retail (CST Brands) through April Total $2,850 Total $3,410 Decline (CHART) Total $1,335 2013 Growth Investments (millions) |

| Logistics Growth Investments Strategy Increase access to cost-advantaged crudes Increase capability to export more products and crude Assets qualify for value-creating MLP Investments Pipelines, rail cars, rail unloading, barges, ships, docks, tanks Purchased 5,320 rail cars for delivery 4Q12 through 2Q15 Crude rail unloading terminals at Quebec (2013), St. Charles (2013), and West Coast refineries (2013/2015) Quebec crude oil logistics to deliver crude oil from Enbridge Line 9 reversal, includes tankage and ships Facilities for increased exports of products and export of crude oil from Gulf Coast to Canada and/or Canada to Pembroke 20 |

| Expect to Unlock Value via New MLP Evaluating formation of a publicly traded MLP for Valero's logistics assets Valero completely divested its first MLP in 2006, now called NuStar Energy Since that separation, Valero has built a portfolio of logistics assets Seeking value creation through higher valuation of logistics earnings Logistics MLPs trade at 10x to 15x EBITDA versus refiners and VLO at 3x to 5x EBITDA Focusing on logistics assets with steady EBITDA Pipelines, docks, terminal tankage, marketing racks, rail cars, rail unloading facilities, ships, and barges Logistics assets in 2012 had annual EBITDA in the range of $50 million to $100 million Expect significant increase in EBITDA from in- progress and planned logistics investments 21 |

| Strategy Produce diesel and jet fuel partially using hydrogen from natural gas (gas-to-liquids process) Designed to benefit from our price outlook of high crude and low natural gas Growth Investments Recently completed 57 MBPD hydrocracker at Port Arthur refinery performing well Distillates Hydrocracking Growth Investments 22 New St. Charles Hydrocracker New 60 MBPD hydrocracker at St. Charles refinery estimated to begin startup at end of 2Q13 50 MBPD in lower-cost hydrocracker expansion projects Estimated cost of $10,000/BPD versus $27,000/BPD for the new units Expand Meraux hydrocracker by 20 MBPD and increase distillate yield by end of 2014 Expand new Port Arthur and St. Charles hydrocrackers each by 15 MBPD in late 2015 In addition, new ~10 MBPD Diamond Green Diesel JV plant to start up late 2Q13 Relies on hydroprocessing technology |

| Valero's Hydrocracker Projects Show Profits Under Various Price Sets Under Various Price Sets Under Various Price Sets 23 Note: EBITDA = Pretax operating income + depreciation and amortization, excludes interest expense; see details in appendix; Port Arthur excludes benefit from high-acid crude project expected to complete in 2015 millions |

| Investments to Process More Domestic Light Crude Oil Strategy Increase processing of North American cost- advantaged crude oil Growth Investments Two new crude oil topping units expected to come online in second-half of 2015 90 MBPD at Houston refinery for $290 million 70 MBPD at Corpus Christi refinery for $240 million Relatively low cost at $3,300 per barrel of daily throughput capacity Economics mainly driven by spread between Gulf Coast light crudes and imported intermediate feedstocks (foreign sweet-resids) Topping units displace more-expensive imported intermediate feedstocks Expect approximately 2 to 3-year payback Refineries selected for configuration with oversized conversion capacity relative to crude capacity 24 (CHART) McKee crude unit expansion of 25 MBPD expected in mid-2014 Evaluating low-cost projects to unlock light crude capacity at Port Arthur and Meraux |

| Valero's Growth in Processing Volumes of Cost-Advantaged U.S. and Canadian Crude 25 (CHART) |

| (CHART) Returning More Cash to Shareholders and Managing Financial Strength Spun off 80% of company operated retail, equivalent to $3.25 to $3.50 per share of VLO Returning cash to shareholders Increased quarterly dividend from $0.05 per share in 2Q11 to $0.20 per share in 1Q13 Bought 9.7 million shares so far in 2013, and 27.3 million shares in 2011 and 2012 combined Goal is to have one of the highest cash yields among peers via dividends and buybacks Maintaining investment grade credit rating is a priority Paid off $180 million of debt in January 2013 and plan to pay off an additional $300 million in 2Q13 Reduced debt by $558 million in 2012 Net debt-to-cap ratio at 3/31/13 was 21.4% 26 Cash Per Share Returned to Shareholders (CHART) Source: 2013 EPS estimates from First Call as of 5-9-13 |

| Better Better Our goal is to be a 1st-quartile refiner Refining industry benchmark studies show our portfolio continues to improve Seven refineries currently operating in 1st quartile for mechanical availability, the most important Solomon metric Meantime between pump repair approaching 60 months Saw results from improvement initiatives in 2011 and 2012 2011 was first full-year with 1st quartile portfolio performance in mechanical availability 2012 is best-ever energy efficiency for refining portfolio Working diligently on weaker performers to improve entire portfolio Constant focus on safety, environmental, and regulatory compliance Valero Focused on Improving Refinery Operations 27 1st Quartile 2nd Quartile 1st Quartile 2nd Quartile 3rd Quartile 3rd Quartile Source: Solomon Associates and Valero Energy; excludes Aruba |

| We Believe Valero Is an Excellent Buy Today Expect dramatic growth in U.S. shale oil and Canadian oil production to provide North American crude oil cost advantage Industry installing significant infrastructure to move crude oil to refining markets, mainly to U.S. Gulf Coast Lower-cost U.S. and Canadian natural gas provides competitive advantage Global distillate demand growth yielding higher margins U.S. competitively exporting into growing and undersupplied markets, replacing shutdown and underperforming capacity and taking market share Invest in growth projects that exploit North American resource advantages and key market trends Logistics, distillates hydrocracking, processing more domestic light crude oil, and evaluating NGLs upgrading projects (petrochemicals, alkylation) Unlock potential value of existing assets Spun off retail assets into publicly traded CST Brands Evaluating MLP for our growing portfolio of logistics assets Return cash to shareholders Grow regular dividend at sustainable rate Concentrate value per share via stock buybacks 28 Key Market Trends Valero's Strategy |

| Appendix 29 |

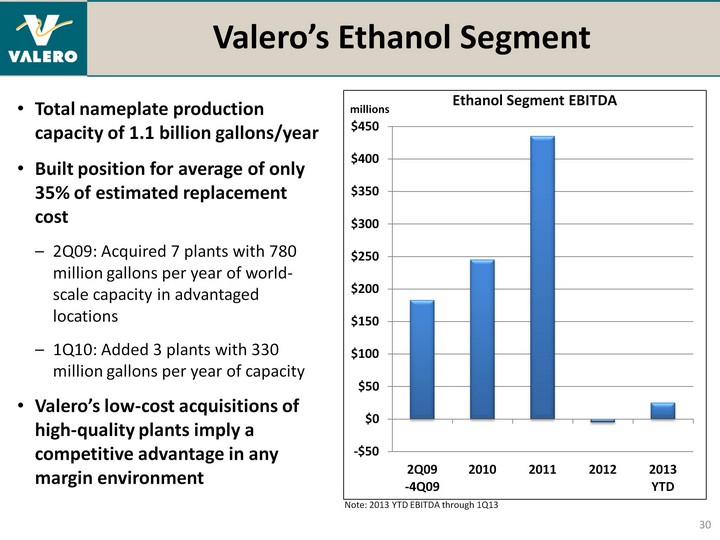

| Valero's Ethanol Segment Total nameplate production capacity of 1.1 billion gallons/year Built position for average of only 35% of estimated replacement cost 2Q09: Acquired 7 plants with 780 million gallons per year of world- scale capacity in advantaged locations 1Q10: Added 3 plants with 330 million gallons per year of capacity Valero's low-cost acquisitions of high-quality plants imply a competitive advantage in any margin environment 30 (CHART) Note: 2013 YTD EBITDA through 1Q13 |

| Refinery Project Estimated Total Investment (millions) Estimated 2013 Spend (millions) Estimated Completion Date Estimated Key Economic Benefit Key Drivers/Additional Comments McKee 25 MBPD Crude Unit Project $130 $40 2Q14 $9 mm per year of EBITDA for every $1/bbl of Brent - WTI Brent - WTI differential; permitting in progress Houston/ Corpus Christi Crude Topping Facilities $220-$280 per site $60 Early 2015 Enables substitution of cheaper North American crude oil versus more expensive imports Port Arthur 15 MBPD HCU Expansion $160 $5 2015 Similar margins to base HCU project Natural gas to diesel spread, volume expansion with high crude price St. Charles 15 MBPD HCU Expansion $160 $5 2015 Similar margins to base HCU project Natural gas to diesel spread, volume expansion with high crude price Port Arthur/St. Charles HCUs and Crude Projects $295 $285 2013 for HCUs 2014 for crude projects Spending to complete HCUs and associated projects Natural gas to diesel spread, volume expansion with high crude price Meraux 20 MBPD HCU Expansion $160 $55 2014 $75 - $100 mm per year EBITDA Natural gas to diesel spread, volume expansion with high crude price 2013 Strategic/Economic Growth Spending Details 31 Note: EBITDA = Pretax operating income + depreciation and amortization, excludes interest expense |

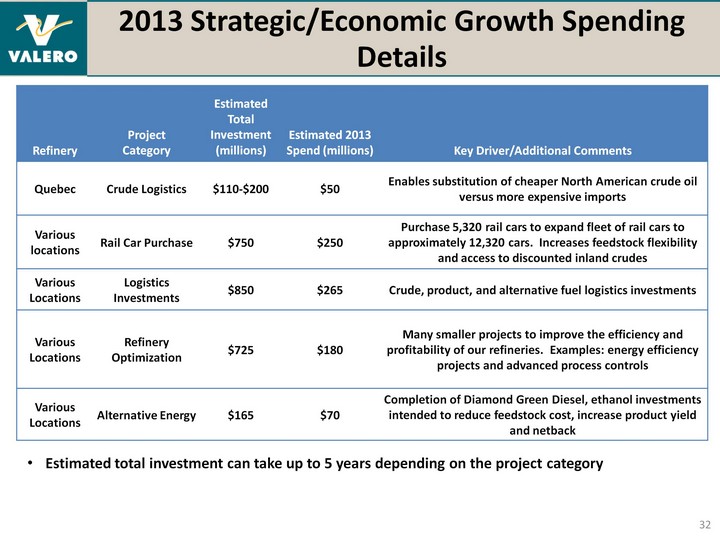

| Refinery Project Category Estimated Total Investment (millions) Estimated 2013 Spend (millions) Key Driver/Additional Comments Quebec Crude Logistics $110-$200 $50 Enables substitution of cheaper North American crude oil versus more expensive imports Various locations Rail Car Purchase $750 $250 Purchase 5,320 rail cars to expand fleet of rail cars to approximately 12,320 cars. Increases feedstock flexibility and access to discounted inland crudes Various Locations Logistics Investments $850 $265 Crude, product, and alternative fuel logistics investments Various Locations Refinery Optimization $725 $180 Many smaller projects to improve the efficiency and profitability of our refineries. Examples: energy efficiency projects and advanced process controls Various Locations Alternative Energy $165 $70 Completion of Diamond Green Diesel, ethanol investments intended to reduce feedstock cost, increase product yield and netback 2013 Strategic/Economic Growth Spending Details 32 Estimated total investment can take up to 5 years depending on the project category |

| Port Arthur and St. Charles Hydrocracker Projects Investment Highlights Favorable economics driven by margin and volume gains Main unit is 57,000 barrels/day hydrocracker (rolling 12-month average per permit) at Port Arthur and 60,000 barrels/day hydrocracker at St. Charles Creates high-value products from low-value feedstocks plus hydrogen sourced from relatively inexpensive natural gas Unit has volume expansion up to 30%, but plan to optimize at 20%: 1 barrel of feedstocks yields up to 1.2 barrels of products Main products are high-quality diesel and jet fuel for growing global demand for middle distillates Located at large, Gulf Coast refinery to leverage existing operations and export logistics At Port Arthur, adding facilities to process over 150,000 barrels/day of high-acid, heavy sour crudes (e.g. Canadian and Latin American). This benefit is delayed until late-2014. 33 Summary of Project Status and Economics1 Port Arthur St. Charles Estimated mechanical completion date Estimated operation date Complete Complete 2Q13 2Q13 Estimated total investment (mil.) $1,620 $1,650 Cumulative spend thru 1Q 2013 (mil.) $1,590 $1,550 Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), Base Case $520 $380 Estimated Unlevered IRR on Total Spend, Base Case 22% 17% Estimated Incremental EBITDA (Operating Income before D&A2) (mil.), 2012 Prices - LLS $634 $487 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Diamond Green Diesel Joint Venture Investment Highlights Building a 9,300 BPD renewable diesel plant adjacent to Valero's St. Charles refinery 50/50 JV project with Darling Int'l, a leading gatherer of used cooking oils and animal fat Uses refinery technology to produce high-quality diesel from low-quality, low-cost cooking oils and fats Diesel production qualifies as biomass-based diesel, a difficult specification under the Renewable Fuels Standard Total estimated project cost of $368 million Valero to provide 14-year term loan for up to $221 million to JV at attractive rates Base case economics assume $1.25/gal RIN value, when current market is $0.65/gal to $0.90/gal 34 Summary of JV Status and Economics1 Summary of JV Status and Economics1 Summary of JV Status and Economics1 Estimated mechanical completion date Estimated operation date 2Q13 2Q13 2Q13 2Q13 Estimated Partner Equity (mil.) $106 $106 Cumulative Valero project spend thru 1Q 2013 (mil.) $331 $331 Estimated Valero EBITDA (Operating Income before D&A2) (mil.), Base Case Estimated Valero EBITDA (Operating Income before D&A2) (mil.), Base Case $55 Estimated Unlevered IRR on Partner Equity and Loan, Base Case Estimated Unlevered IRR on Partner Equity and Loan, Base Case 21% 1See Appendix for key price assumptions; 2D&A = depreciation and amortization expense |

| Project Price Set Assumptions 35 Commodity Base Case ($/bbl) 2008 ($/bbl) 2009 ($/bbl) 2010 ($/bbl) 2011 ($/bbl) 2012 ($/bbl) LLS Crude oil1 85.00 102.07 62.75 81.64 111.09 112.20 LLS - USGC HS Gas Oil -3.45 2.03 -2.86 -2.72 -5.75 -7.59 USGC Gas Crack 6.00 2.47 6.91 5.32 5.11 4.66 USGC ULSD Crack 11.00 20.5 7.26 8.94 13.24 15.99 Natural Gas, $/MMBTU (NYMEX) 5.00 8.90 4.16 4.38 4.03 2.71 Prices shown below are for illustrating a potential estimate for Valero's economic projects 1LLS prices are roll adjusted EBITDA2 Sensitivities (Delta $ millions/year) Port Arthur HCU St. Charles HCU Crude oil, + $1/BBL 4 3.6 Crude oil - USGC HS Gas Oil, + $1/BBL 16.7 17.8 USGC Gas Crack, + $1/BBL 12.9 13.3 USGC ULSD Crack, + $1/BBL 18.4 20.8 Natural Gas, - $1/MMBTU 18.3 19.7 Total Investment IRR to 10% cost 1.3% 1.5% Price sensitivities shown below are for illustrating a potential estimate for Valero's economic projects 2Operating income before depreciation and amortization expense |

| 12,000 BPD (20%) volume expansion Hydrocracker Unit Operating Costs Hydrocracker Unit Operating Costs Heat, power, labor, etc. $1.50 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Synergies with Plant Synergies with Plant With existing plant ~$1 per barrel (per barrel amount based on hydrocracker unit volumes) (per barrel amount based on hydrocracker unit volumes) Key Drivers for a 60,000 BPD Hydrocracker 36 Key economic driver is the expected significant liquid-volume expansion of 20%, which primarily comes from the hydrogen saturation via the high- pressure, high-conversion design Designed to maximize distillate yields Hydrocracker Unit Products (BPD) Hydrocracker Unit Products (BPD) Distillates (diesel, jet, kero) 44,000 Gasoline and blendstocks 24,000 LPGs 3,000 Low-sulfur VGO 1,000 Total 72,000 Hydrocracker Unit Feedstocks Hydrocracker Unit Feedstocks High-sulfur VGO 60,000 BPD (Internally produced or purchased) (Internally produced or purchased) Hydrogen 124 MMSCF/day (via 40,000 mmbtu/day of natural gas) (via 40,000 mmbtu/day of natural gas) |

| 60,000 BPD Hydrocracker Model Estimates Under Various Price Sets 37 Key Drivers and Prices 2008 Prices 2008 Prices 2009 Prices 2009 Prices 2010 Prices 2010 Prices 2011 Prices 2011 Prices 2012 Prices 2012 Prices LLS /bbl $102.07 $62.75 $81.64 $111.09 $112.20 LLS - HSVGO /bbl $2.03 -$2.86 -$2.72 -$5.75 -$7.59 GC Gasoline - LLS /bbl $2.47 $6.91 $5.32 $5.11 $4.66 GC Diesel - LLS /bbl $20.50 $7.26 $8.94 $13.24 $15.99 Natural Gas (NYMEX) /mmBtu $8.90 $4.16 $4.38 $4.03 $2.71 Natural Gas to H2 cost factor $/mmBtu 1.5x 1.5x 1.5x 1.5x 1.5 H2 Consumption SCF /bbl 2,050 2,050 2,050 2,050 2,050 GC LSVGO - HSVGO /bbl $4.28 $2.85 $3.21 $3.87 $3.14 GC LPGs - LLS /bbl -$40.02 -$20.11 -$23.97 -$38.30 -$49.70 Feedstocks (Barrels per day) Bbl/day Bbl/day Bbl/day Bbl/day Bbl/day HSVGO 60,000 60,000 60,000 60,000 60,000 Hydrogen 6,709 6,709 6,709 6,709 6,709 Product Yields Distillates (diesel, jet, kero) 61% 43,902 61% 43,902 61% 43,902 61% 43,902 61% 43,902 Gasoline and blendstocks 33% 23,940 33% 23,940 33% 23,940 33% 23,940 33% 23,940 LPGs 4% 3,042 4% 3,042 4% 3,042 4% 3,042 4% 3,042 LSVGO 2% 1,338 2% 1,338 2% 1,338 2% 1,338 2% 1,338 Total Product Yields 100% 72,222 100% 72,222 100% 72,222 100% 72,222 100% 72,222 Volume Expansion on HSVGO 20% 20% 20% 20% 20% Estimated Profit Model Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Per Bbl $Mil./day Revenues $136.87 $8.2 $82.71 $5.0 $105.85 $6.4 $143.72 $8.6 $146.33 $8.8 Less: Feedstock cost -$109.07 -$6.5 -$69.83 -$4.2 -$88.80 -$5.3 -$120.93 -$7.3 -$122.54 -$7.4 = Gross Margin $27.80 $1.7 $12.88 $0.8 $17.05 $1.0 $22.79 $1.4 $23.79 $1.4 Less: Cash Operating Costs -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 -$1.50 -$0.1 Add: Synergies $1.70 $0.1 $0.55 $0.0 $0.03 $0.0 $0.95 $0.1 $0.95 $0.1 = EBITDA $28.00 $1.7 $11.93 $0.7 $15.57 $0.9 $22.24 $1.3 $23.24 $1.4 Estimated Annual EBITDA ($MM/year) $613 $261 $341 $487 $509 Note: 2012 YTD prices as December 31, 2012 |

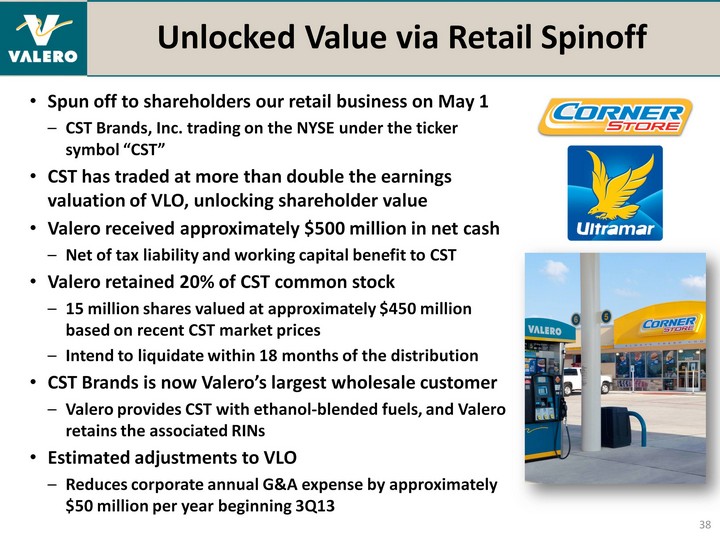

| Unlocked Value via Retail Spinoff Spun off to shareholders our retail business on May 1 CST Brands, Inc. trading on the NYSE under the ticker symbol "CST" CST has traded at more than double the earnings valuation of VLO, unlocking shareholder value Valero received approximately $500 million in net cash Net of tax liability and working capital benefit to CST Valero retained 20% of CST common stock 15 million shares valued at approximately $450 million based on recent CST market prices Intend to liquidate within 18 months of the distribution CST Brands is now Valero's largest wholesale customer Valero provides CST with ethanol-blended fuels, and Valero retains the associated RINs Estimated adjustments to VLO Reduces corporate annual G&A expense by approximately $50 million per year beginning 3Q13 38 |

| Valero's Wholesale Segment VLO markets branded and unbranded refined products on a wholesale basis through an extensive rack marketing network The Valero-branded family operates in the U.S., Canada, and U.K with approximately 1,000 branded sites in the U.K. and Ireland These sites are independently owned and are supplied by Valero under multi-year contracts The principal buyers of our refined products from terminal truck racks are wholesalers, distributors, retailers, and truck-delivered-end users For wholesale branded sites, we promote our Valero (r), Beacon(r), and Shamrock(r) brands in the U.S., Ultramar in Canada, and the Texaco(r) brand in the U.K. and Ireland 39 (CHART) |

| (CHART) Refining Crude & Feedstock Supply 40 Valero crude and feedstock runs were approximately 2.3 million bpd in 2012 Valero ran 94 unique crudes in 2012 Crude inventory typically ranges from 44 to 52 million barrels throughout the year Intermediate inventory ranges from 12 to 15 million barrels and heavy oil inventory ranges from 2 to 3 million barrels We hedge all crude against LIFO inventory levels to protect against volatile swings in crude price between date of purchase and date of delivery/ consumption at the refineries About 60% to 65% of Valero's crude purchases are under term contracts, and nearly all purchases have market-based pricing Valero receives crude and feedstocks by many modes of transport including tanker ship, barge, pipeline, rail, and truck MBPD |

| Issues with Processing Light Crudes 41 Refineries are designed for a specific range of crude oil properties, otherwise build costs would be very high Lighter crudes contain significantly more light components, e.g., propane, butane, straight run gasoline, naphtha Be careful about generalizing crude oil properties and their impact on product yields Some light crudes are inherently diesel rich or gasoline rich despite having a similar API gravity As we have shifted our diet to higher API domestic shale crudes (Eagle Ford, Bakken, etc.), we have seen distillate yields stay about the same, while gasoline yields have increased Many constraints can limit a refinery's ability to process light components, and constraints are refinery specific Examples include: Distillation tower has insufficient capacity for light components Hydraulic capacity of overhead distillation hardware Heater or heat exchanger design has insufficient capacity, flexibility or limited ability to cool and condense higher volume of light ends Saturated gas plant has insufficient capacity to process additional volume Downstream processing capacity limits ability to convert intermediates into finished products Depending on the constraint, solutions can range from $10 million to hundreds of millions |

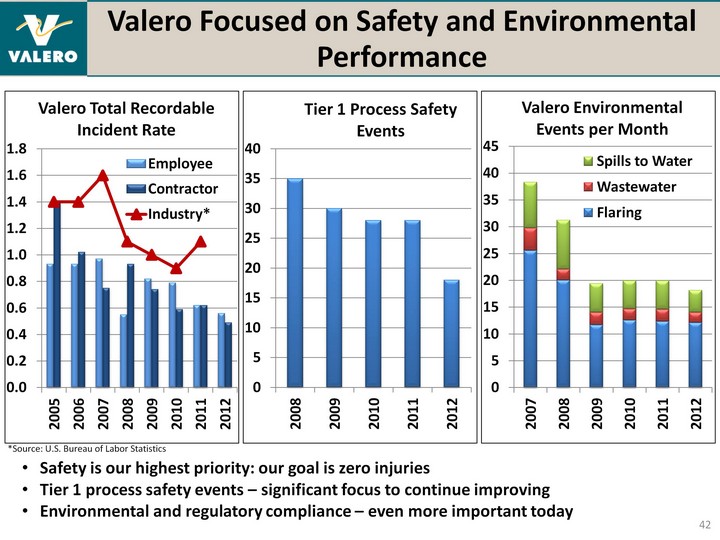

| Safety is our highest priority: our goal is zero injuries Tier 1 process safety events - significant focus to continue improving Environmental and regulatory compliance - even more important today (CHART) (CHART) *Source: U.S. Bureau of Labor Statistics (CHART) Valero Focused on Safety and Environmental Performance 42 |

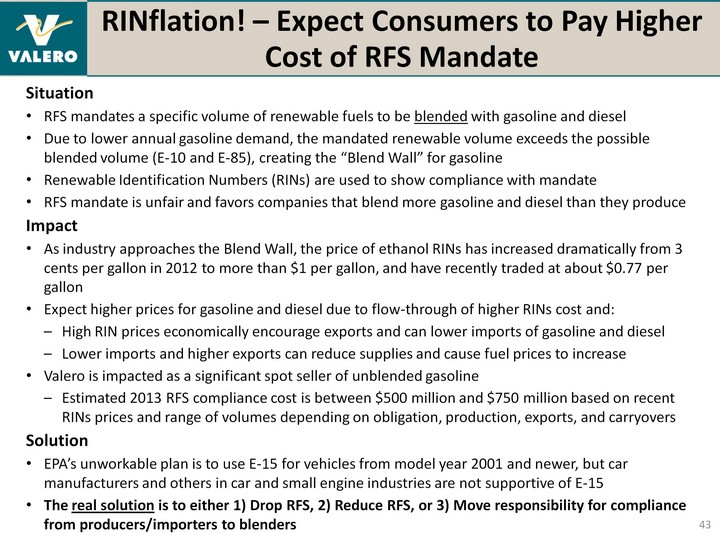

| RINflation! - Expect Consumers to Pay Higher Cost of RFS Mandate 43 Situation RFS mandates a specific volume of renewable fuels to be blended with gasoline and diesel Due to lower annual gasoline demand, the mandated renewable volume exceeds the possible blended volume (E-10 and E-85), creating the "Blend Wall" for gasoline Renewable Identification Numbers (RINs) are used to show compliance with mandate RFS mandate is unfair and favors companies that blend more gasoline and diesel than they produce Impact As industry approaches the Blend Wall, the price of ethanol RINs has increased dramatically from 3 cents per gallon in 2012 to more than $1 per gallon, and have recently traded at about $0.77 per gallon Expect higher prices for gasoline and diesel due to flow-through of higher RINs cost and: High RIN prices economically encourage exports and can lower imports of gasoline and diesel Lower imports and higher exports can reduce supplies and cause fuel prices to increase Valero is impacted as a significant spot seller of unblended gasoline Estimated 2013 RFS compliance cost is between $500 million and $750 million based on recent RINs prices and range of volumes depending on obligation, production, exports, and carryovers Solution EPA's unworkable plan is to use E-15 for vehicles from model year 2001 and newer, but car manufacturers and others in car and small engine industries are not supportive of E-15 The real solution is to either 1) Drop RFS, 2) Reduce RFS, or 3) Move responsibility for compliance from producers/importers to blenders |

| U.S. Oil and Natural Gas Production Increasing While Crude Oil Imports Decreasing While Crude Oil Imports Decreasing While Crude Oil Imports Decreasing 44 Source: DOE (CHART) Local resource provides cost-advantage of refiners |

| 45 Source: Company Reports Canadian Heavy Crudes Have Several Options to the Gulf Coast Pipeline - industry has several options in various stages to move crude oil from Alberta, Canada to the U.S. Gulf Coast Seaway Currently shipping light and heavy sour from Cushing to Gulf Coast Expansion expected to complete in 2014 Enbridge Mainline to Flanagan South via Cushing to Seaway Completion expected mid-2014 TransCanada Keystone and Keystone XL Completion expected second half 2015 ETP/Enbridge Trunkline project Completion expected first half 2015 Rail - in process by industry and VLO Bitumen and WCS movements from Alberta Barge - occurring now by industry and VLO Via pipeline and rail movements to hubs on Mississippi River, then ETP/Enbridge Trunkline Enbridge System Flanagan South Seaway TransCanada Keystone XL Valero Gulf Coast medium/heavy refineries |

| Growth of Pipeline Crude Logistics to U.S. Gulf Coast 46 Year-End Throughput Capacities, '000 bpd 2011 2012 2013E 2014E 2015E Announced Start-up Cushing Seaway 150 400 850 850 2Q12, 1Q13, 1Q14 Keystone - - 550 550 830 4Q13, 2015 Total - 150 950 1,400 1,680 Permian Longhorn 225 225 225 2Q at 75; 225 by mid-13 BridgeTex 300 300 Mid-2014 SXL Permian Express 150 350 350 2Q at 90; 150 by late-13 SXL WTG - - 80 80 80 2Q13 Total - - 455 955 955 Eagleford Harvest 150 150 150 150 Enterprise 350 350 350 350 KinderMorgan 300 300 300 300 Plains 185 185 185 185 NuStar 130 200 200 200 200 Total 130 1,185 1,185 1,185 1,185 Patoka ETP/Enbridge Trunkline - - - - 660 2015 Total - - - - 660 Other Blueknight Silverado 70 70 2Q14 SXL Eaglebine Express - - - 60 60 Mid-2014 Total - - - 130 130 Source: Consultants, company announcements and Valero estimates |

| (CHART) Atlantic Basin Closures Reduce Excess Capacity Capacity closures have been concentrated in the Atlantic Basin: U.S. East Coast, Caribbean, Western Europe; expect more will occur Combined with poor reliability and low utilization in Latin American refineries and demand growth in Latin America, creates opportunity for competitive refineries to export quality products 47 (CHART) Sources: Industry and Consultant reports and Valero estimates |

| *Partial closure of refinery captured in capacity Note: This data represents refineries currently closed, ownership may choose to restart or sell listed refinery Sources: Industry and Consultant reports and Valero estimates 1The Petit Couronne refinery has shut completely when processing deal with Shell ended in December 2012 2Alon announced the closure of these refineries for economic reasons, may restart Global Refining Capacity Rationalization 48 Location Owner CDU Capacity Closed (MBPD) Year Closed Perth Amboy, NJ Chevron 80 2008 Bakersfield,CA Big West 65 2008 Westville, NJ Sunoco 145 2009 Bloomfield, NM Western 17 2009 Teesside, UK Petroplus 117 2009 Gonfreville, France* Total 100 2009 Dunkirk, France Total 140 2009 Japan* Nippon Oil 205 2009 Toyama, Japan Nihonkai Oil 57 2009 Arpechim, Romania * Petrom 70 2009 Cartagena* REPSOL 100 2009 Bilboa* REPSOL 100 2009 Arpechim, Romania OMV 70 2010 Japan* Cosmo 94 2010 Nadvornaja, Ukraine Privat Group 50 2010 Montreal, Canada1 Shell 130 2010 Yorktown, Virginia Western 65 2010 Reichstett, France Petroplus 85 2010 Wilhemshaven, Germany Phillips 66 260 2010 Ingolstadt, Germany Bayernoil 90 2010 Cremona, Italy Tamoil 94 2011 St. Croix, U.S.V.I,* Hovensa 150 2011 Funshun, China PetroChina 70 2011 Location Owner CDU Capacity Closed (MBPD) Year Closed Keihin Ohgimachi, Japan Showa Shell 120 2011 Clyde, Australia Shell 75 2011 Porto Marghera, Italy ENI 70 2011 Marcus Hook, PA Sunoco 175 2011 Harburg, Germany Shell 107 2012 Berre, France LyondellBassel 105 2012 Coryton, U.K. Petroplus 220 2012 Petit Couronne, France1 Petroplus 160 2012 St. Croix, U.S.V.I Hovensa 350 2012 Aruba Valero 235 2012 Rome, Italy TotalErg 82 2012 Fawley, U.K.* ExxonMobil 80 2012 Trecate, Italy* ExxonMobil 70 2012 Paramo, Czech Republic Unipetrol 20 2012 Lisichansk, Ukraine TNK-BP 175 2012 Bakersfield/Paramount, CA Alon 90 2012 Ewa Beach, Hawaii Tesoro 94 2013 Port Reading, NJ Hess N/A 2013 Venice, Italy ENI 80 2013 Sakaide, Japan Cosmo Oil 140 2013 Japan Indemitsu Kosan 100 2014 Japan Nippon 200 2014 Kurnell, Australia Caltex 135 2014 Kawasaki, Japan Tonen- General 105 2014 |

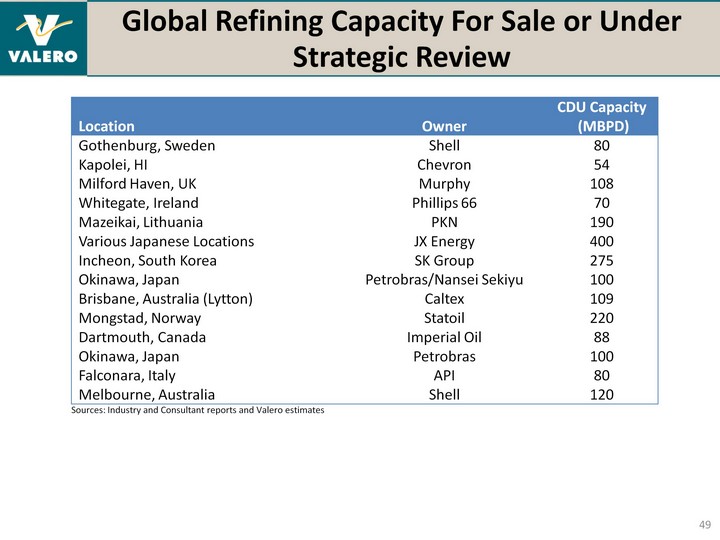

| Global Refining Capacity For Sale or Under Strategic Review 49 Location Owner CDU Capacity (MBPD) Gothenburg, Sweden Shell 80 Kapolei, HI Chevron 54 Milford Haven, UK Murphy 108 Whitegate, Ireland Phillips 66 70 Mazeikai, Lithuania PKN 190 Various Japanese Locations JX Energy 400 Incheon, South Korea SK Group 275 Okinawa, Japan Petrobras/Nansei Sekiyu 100 Brisbane, Australia (Lytton) Caltex 109 Mongstad, Norway Statoil 220 Dartmouth, Canada Imperial Oil 88 Okinawa, Japan Petrobras 100 Falconara, Italy API 80 Melbourne, Australia Shell 120 Sources: Industry and Consultant reports and Valero estimates |

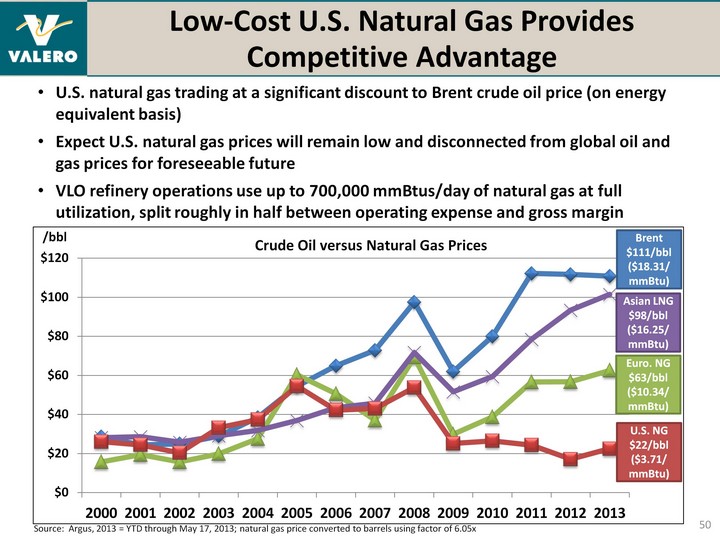

| Low-Cost U.S. Natural Gas Provides Competitive Advantage 50 U.S. natural gas trading at a significant discount to Brent crude oil price (on energy equivalent basis) Expect U.S. natural gas prices will remain low and disconnected from global oil and gas prices for foreseeable future VLO refinery operations use up to 700,000 mmBtus/day of natural gas at full utilization, split roughly in half between operating expense and gross margin (CHART) Source: Argus, 2013 = YTD through May 17, 2013; natural gas price converted to barrels using factor of 6.05x Brent $111/bbl ($18.31/ mmBtu) U.S. NG $22/bbl ($3.71/ mmBtu) Asian LNG $98/bbl ($16.25/ mmBtu) Euro. NG $63/bbl ($10.34/ mmBtu) /bbl |

| (CHART) Gasoline Fundamentals 51 (CHART) USGC LLS Gasoline Crack (per bbl) U.S. Gasoline Demand (mmbpd) (CHART) Source: Argus; 2013 data through May 17 Source: DOE weekly data; 2012 data through week ending May 10 Source: DOE weekly data; 2012 data through week ending May 10 U.S. Gasoline Days of Supply U.S. Net Imports of Gasoline and Blendstocks (mbpd) Source: DOE monthly data; 2013 data through February 2013 |

| Distillate Fundamentals 52 52 (CHART) USGC LLS On-road Diesel Crack (per bbl) U.S. Distillate Demand (mmbpd) (CHART) (CHART) Source: Argus; 2013 data through May 17 Source: DOE weekly data; 2012 data through week ending May 10 Source: DOE weekly data; 2012 data through week ending May 10 Source: DOE monthly data; 2013 data through February 2013 U.S. Distillate Days of Supply U.S. Distillate Net Imports (mbpd) |

| U.S. Transport Indicators 53 Latest data Week 16, 2013 (CHART) (CHART) |

| U.S. Transport Indicators: Trucking Indicators 54 (CHART) (CHART) (CHART) (CHART) ATA data through Feb-13, TSI data through Feb-13 |

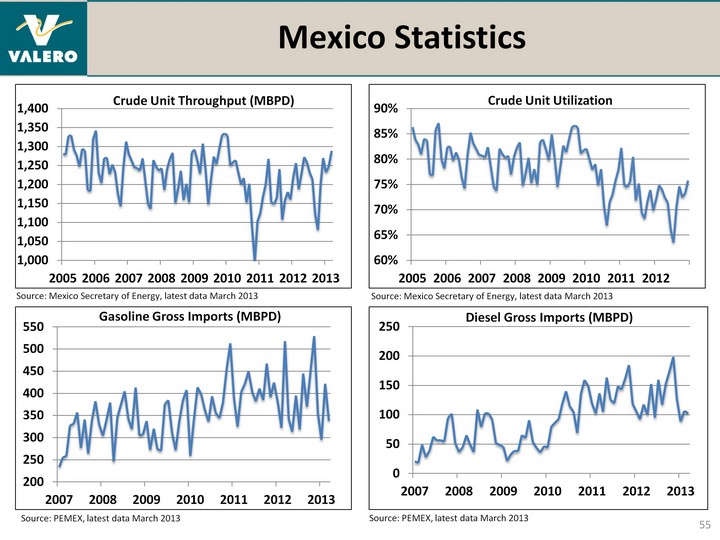

| (CHART) (CHART) Mexico Statistics Diesel Gross Imports (MBPD) Source: PEMEX, latest data March 2013 Gasoline Gross Imports (MBPD) Source: PEMEX, latest data March 2013 (CHART) Crude Unit Throughput (MBPD) Crude Unit Utilization (CHART) 55 Source: Mexico Secretary of Energy, latest data March 2013 Source: Mexico Secretary of Energy, latest data March 2013 |

| Venezuelan Exports to the U.S. 56 (CHART) Source: EIA, February 2013 |

| (CHART) U.S. Gasoline Exports by Destination Gasoline exports remain at elevated levels due to the strong demand from Latin America, including Mexico Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly with data as of February 2013. 4 Week Average estimate from Weekly Petroleum Statistics Report and VLO estimates MBPD 57 12 Month Moving Average |

| U.S. Gasoline Imports by Source Gasoline imports have declined steadily since 2007 Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly with data as of February 2013. 4 Week Average estimate from Weekly Petroleum Statistics Report and VLO estimates Shutdown of the Atlantic Basin refineries will keep pressure on this trend 58 (CHART) MBPD 12 Month Moving Average |

| U.S. Diesel Exports by Destination Diesel exports to Latin America continue to exceed exports to Europe, but over two- thirds of diesel export growth in 2011 was to Europe Source: DOE Petroleum Supply Monthly with data as of February 2013. 4 Week Average estimate from Weekly Petroleum Statistics Report Latin America needs remain high on good demand growth and continued challenges running refineries in key countries 59 (CHART) MBPD 12 Month Moving Average |

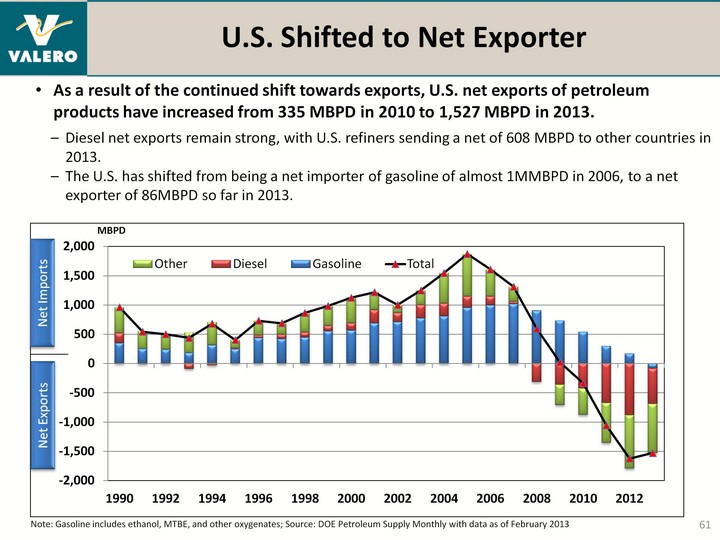

| The transition of the U.S. refining system to being a net exporter to the world market has mitigated the impact of declining domestic demand Large quantities of U.S. diesel and gasoline exports to Latin America and diesel exports to Europe Strong international demand has been "pulling" products and paying higher values than in the U.S Valero's share of U.S. exports has averaged 20% to 25% over the past few years U.S. Shifted to Net Exporter 60 (CHART) U.S. Demand for Refined Products and Net Trade MMBPD U.S. Petroleum Demand Excluding Ethanol and Non-Refinery NGL's (Refined Product Demand) Net Imports Net Exports Implied Total Production of U.S. Refined Products Note: Implied production = Petroleum demand excluding ethanol and non-refinery NGLs minus product net imports; Source: EIA, Consultant and Valero estimates Implied Production of U.S. Refined Products for Domestic Use |

| (CHART) U.S. Shifted to Net Exporter Net Imports Net Exports Note: Gasoline includes ethanol, MTBE, and other oxygenates; Source: DOE Petroleum Supply Monthly with data as of February 2013 MBPD Diesel net exports remain strong, with U.S. refiners sending a net of 608 MBPD to other countries in 2013. The U.S. has shifted from being a net importer of gasoline of almost 1MMBPD in 2006, to a net exporter of 86MBPD so far in 2013. As a result of the continued shift towards exports, U.S. net exports of petroleum products have increased from 335 MBPD in 2010 to 1,527 MBPD in 2013. 61 |

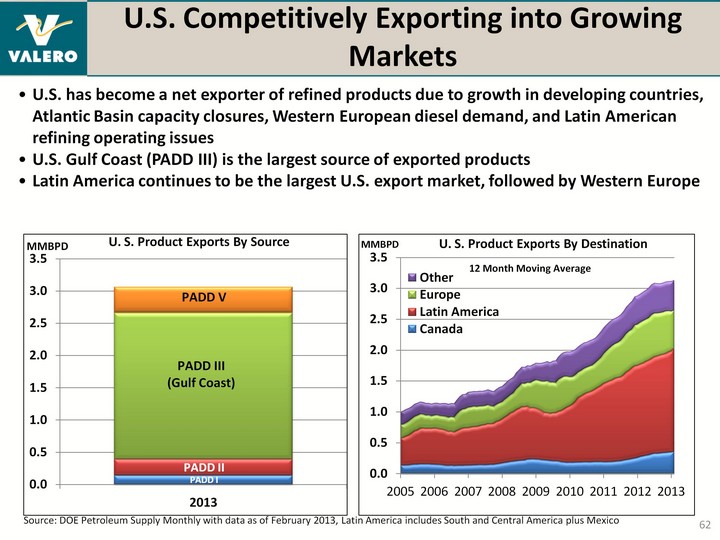

| (CHART) U.S. Competitively Exporting into Growing Markets Source: DOE Petroleum Supply Monthly with data as of February 2013, Latin America includes South and Central America plus Mexico U.S. has become a net exporter of refined products due to growth in developing countries, Atlantic Basin capacity closures, Western European diesel demand, and Latin American refining operating issues U.S. Gulf Coast (PADD III) is the largest source of exported products Latin America continues to be the largest U.S. export market, followed by Western Europe (CHART) U. S. Product Exports By Destination U. S. Product Exports By Source MMBPD 12 Month Moving Average 62 |

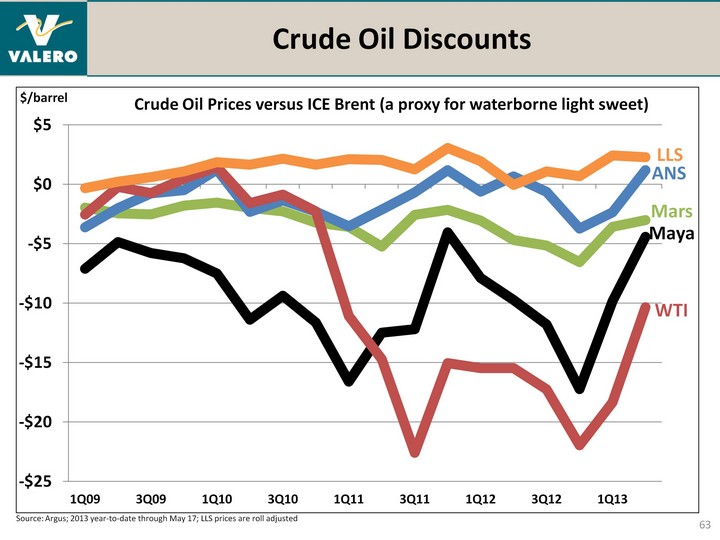

| (CHART) Crude Oil Discounts 63 $/barrel Source: Argus; 2013 year-to-date through May 17; LLS prices are roll adjusted |

| Regional Refinery Indicator Margins 64 Source: Argus; 2013 year-to-date through May 17; see Appendix for details on refinery configuration assumptions |

| Assumed Regional Indicator Margins Gulf Coast Indicator: (GC Colonial 85 CBOB A grade- LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline prompt - LLS) x 40% + (LLS - Maya Formula Pricing) x 40% + (LLS - Mars Month 1) x 40% Mid-con Indicator: [(Group 3 Conv 87 Gasoline prompt - WTI Month 1) x 60% + (Group 3 ULSD 10ppm prompt - WTI Month 1) x 40%] x 60% + [(GC Colonial 85 CBOB A grade prompt - LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline - LLS) x 40%] x 40% West Coast Indicator: (San Fran CARBOB Gasoline Month 1 - ANS USWC Month 1) x 60% + (San Fran EPA 10 ppm Diesel pipeline - ANS USWC Month 1) x 40% + 10% (ANS - West Coast High Sulfur Vacuum Gasoil cargo prompt) North Atlantic Indicator: (NYH Conv 87 Gasoline Prompt - ICE Brent) x 50% + (NYH ULSD 15 ppm cargo prompt - ICE Brent) x 50% LLS prices are Month 1, adjusted for complex roll Prior to 2010, GC Colonial 85 CBOB is substituted for GC 87 Conventional 65 |

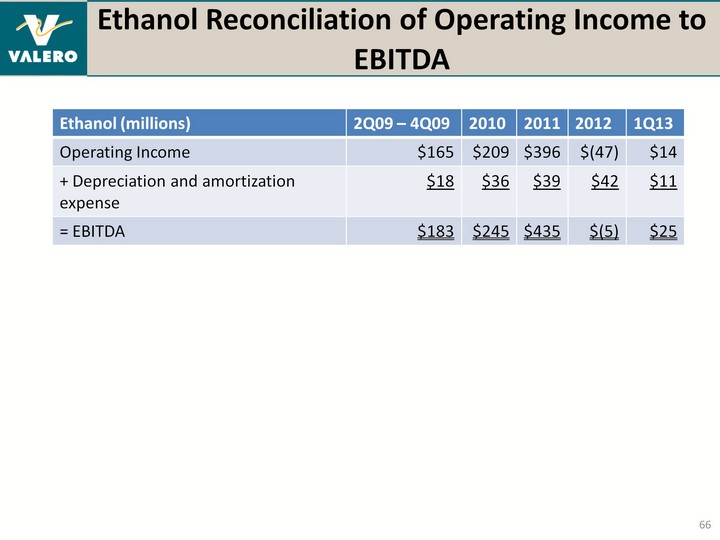

| Ethanol Reconciliation of Operating Income to EBITDA EBITDA EBITDA 66 |

| Investor Relations Contacts For more information, please contact: Ashley Smith, CFA, CPA Vice President, Investor Relations 210.345.2744 ashley.smith@valero.com Matthew Jackson Investor Relations Specialist 210.345.2564 matthew.jackson@valero.com 67 |