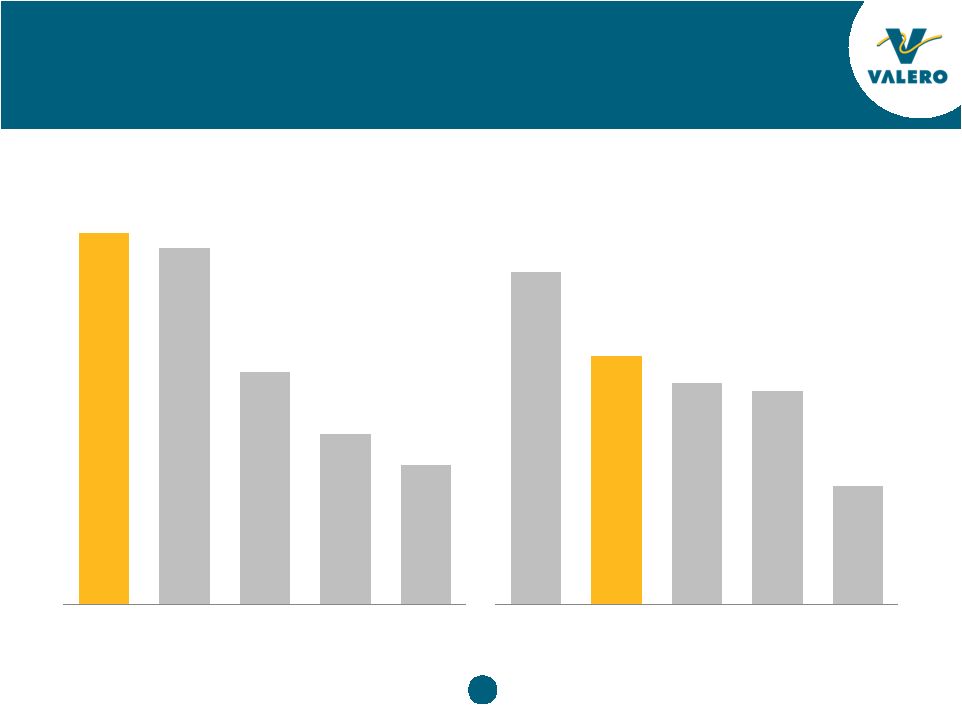

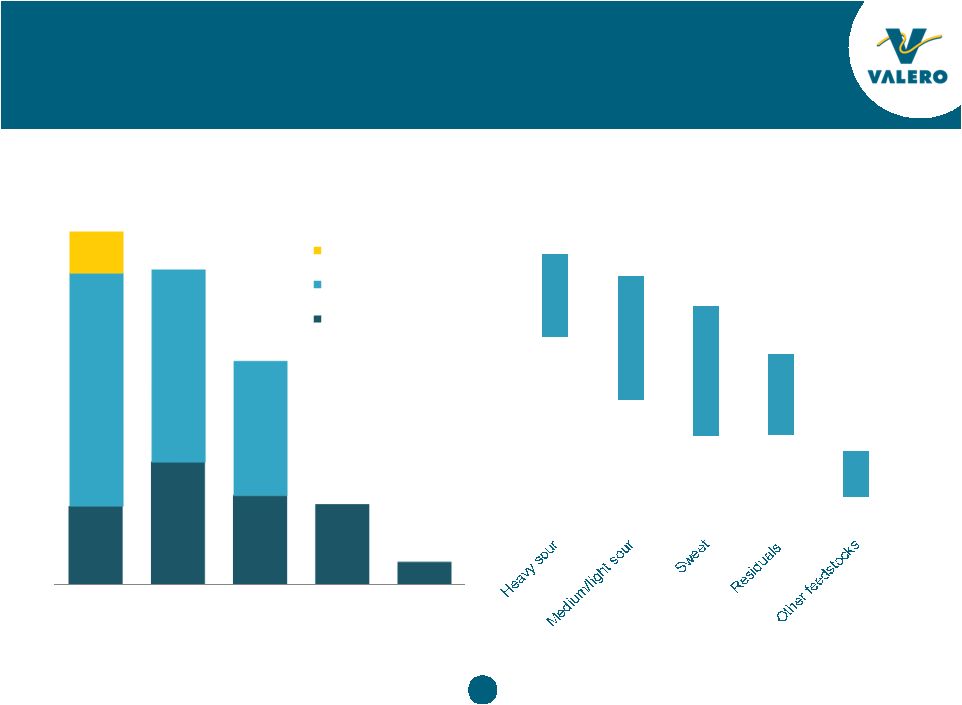

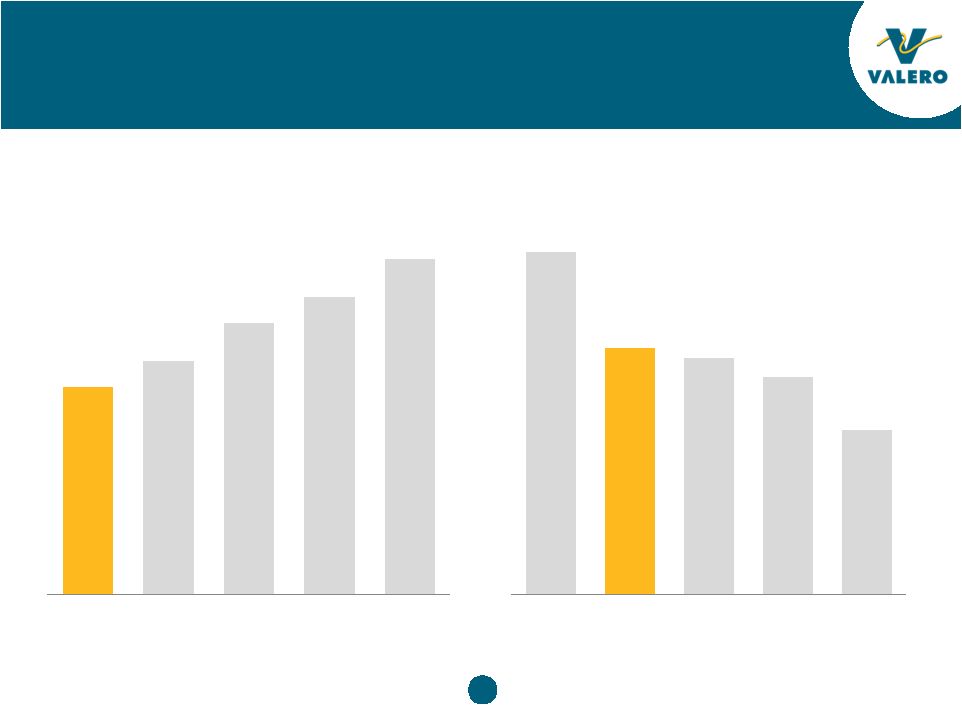

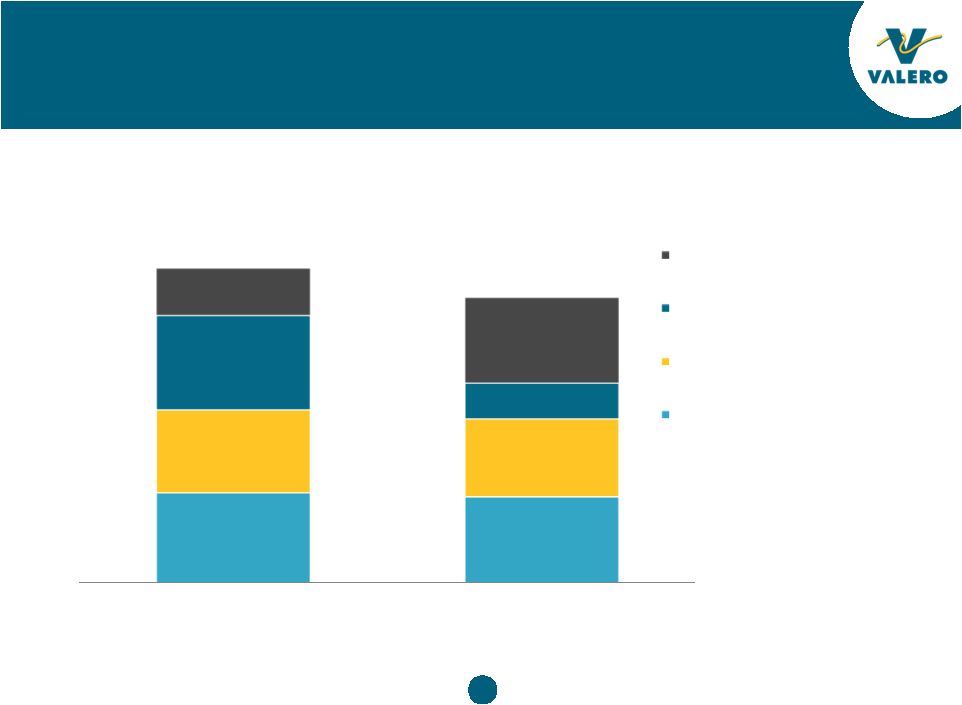

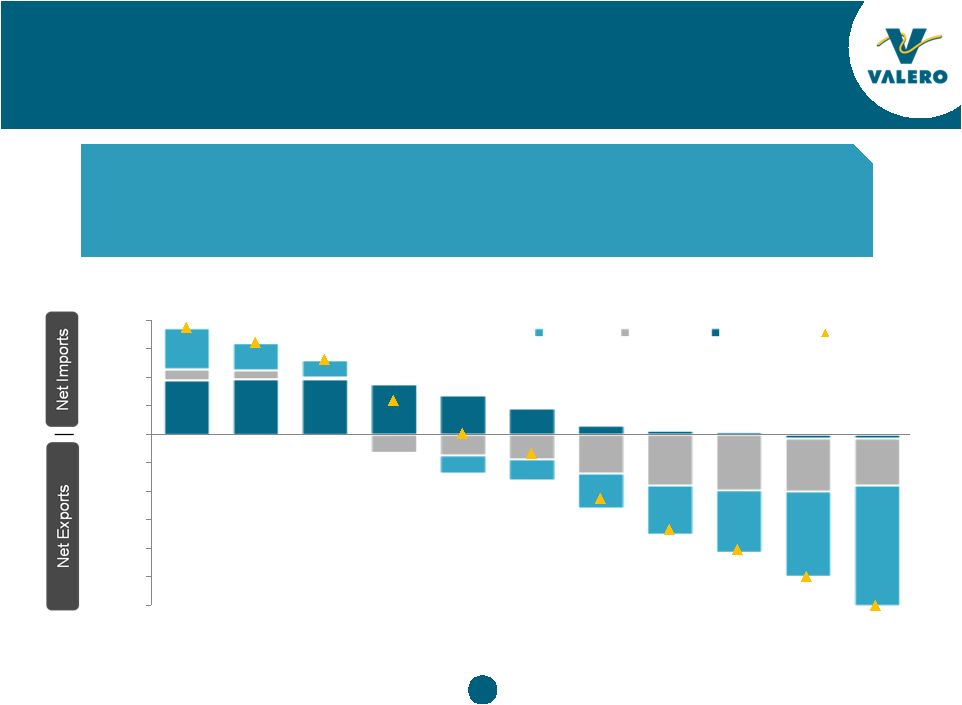

23 Footnotes Slide 5 Macro environment themes represent industry consult views, of which points 1, 2, 5, and 6 are supported by additional slides in the presentation. Slide 7 Contractor recordable incident rate from U.S. Bureau of Labor Statistics. Tier 1 process safety event defined within API Recommended Practice 754. Industry benchmarking and VLO performance statistics from Solomon Associates and Valero. Slide 8 Nelson Complexity Index for HFC, TSO, and MPC from company presentations. PSX’s Nelson Complexity calculated per Oil and Gas Journal NCI formula based on crude capacities in company 10-K report and process unit capacities in Oil and Gas Journal as of January 1, 2015. Total company NCI is weighted average for refineries. Product yields from company 10-Q reports and presentations for six months ended June 30, 2015. Clean products defined as gasoline, jet fuel/kerosene, and distillates. Slide 9 Crude distillation capacities from company 10-K reports and presentations, grouped by geographic location. Valero’s Gulf Coast feedstock ranges are based upon quarterly processing rates between 1Q10 and 2Q15. Slide 10 Valero’s potential future gasoline and distillate export capacities are based upon potential expansion opportunities at the St. Charles and Port Arthur refineries. Slide 11 Refining operating expenses include cash costs and depreciation and amortization from company 10-Q reports for six months ended June 30, 2015. PSX’s refining operating expense per barrel of throughput from analyst reports. Refining operating income and total product yields from company 10-Q reports for six months ended June 30, 2015. PSX’s refining operating income approximated as segment net income from company 10-Q with a 50% allocation of interest and debt expense and an assumed income tax of 35%. Slide 21 Source for price to earnings ratios and returns on average market capital employed (ROMC) is Barclays. 2016 estimated ROMC defined as (tax effected operating and other income) / (average of 2016 and 2015 market capital employed), where market capital employed is calculated as (year-end share price * shares outstanding) + total debt. Prices as of August 28, 2015 market close. |