Investor Presentation January 2018 Exhibit 99.01

Disclaimers This presentation contains forward-looking statements made by Valero Energy Corporation (“VLO” or “Valero”) and Valero Energy Partners LP (“VLP” or the “Partnership”) within the meaning of federal securities laws. These statements discuss future expectations, contain projections of results of operations or of financial condition or state other forward-looking information. You can identify forward-looking statements by words such as “believe,” “estimate,” “expect,” “forecast,” “could,” “may,” “will,” “targeting,” “illustrative” or other similar expressions that convey the uncertainty of future events or outcomes. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of Valero or VLP, as applicable, and are difficult to predict. These statements are often based upon various assumptions, many of which are based, in turn, upon further assumptions, including examination of historical operating trends made by the management of Valero or VLP, as applicable. Although Valero and VLP believe that the assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies, which are difficult or impossible to predict and are beyond their respective control, neither Valero nor VLP can give assurance that either will achieve or accomplish their respective expectations, beliefs or intentions. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements contained in Valero’s and VLP’s filings with the Securities and Exchange Commission, including Valero’s annual reports on Form 10-K, quarterly reports on Form 10-Q, and other reports available on Valero’s website at www.valero.com, and VLP’s annual reports on Form 10-K, quarterly reports on Form 10-Q, and other reports available on VLP’s website at www.valeroenergypartners.com. These risks could cause the actual results of Valero or VLP to differ materially from those contained in any forward-looking statement. This presentation includes non-GAAP financial measures. Our reconciliations of non-GAAP financial measures to GAAP financial measures are located at the end of this presentation. These non-GAAP financial measures should not be considered as an alternative to GAAP financial measures.

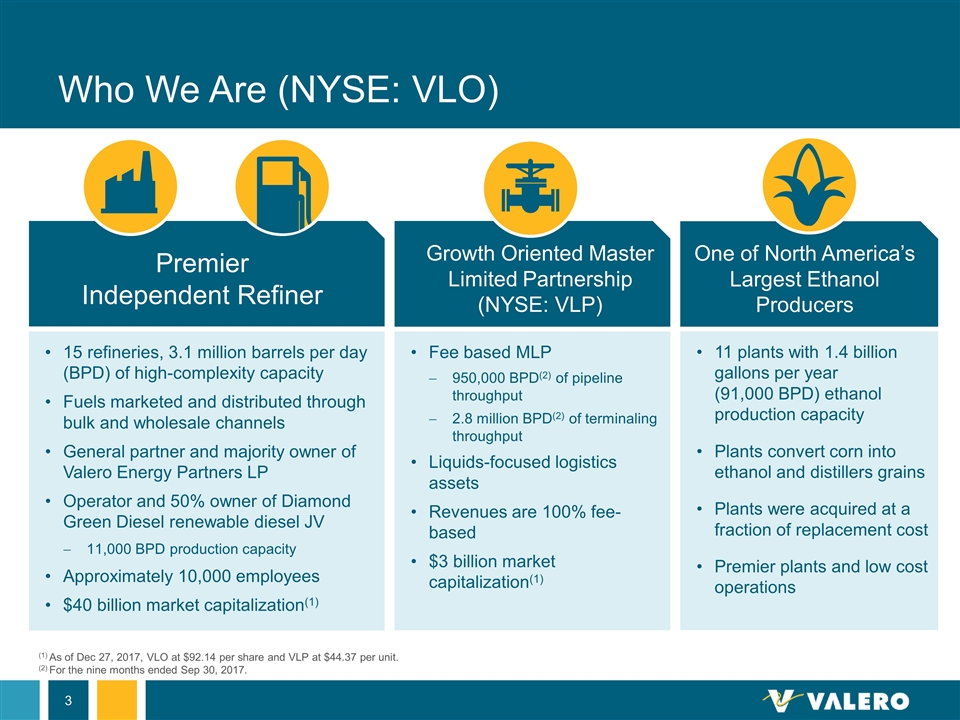

Who We Are (NYSE: VLO) Premier Independent Refiner 15 refineries, 3.1 million barrels per day (BPD) of high-complexity capacity Fuels marketed and distributed through bulk and wholesale channels General partner and majority owner of Valero Energy Partners LP Operator and 50% owner of Diamond Green Diesel renewable diesel JV 11,000 BPD production capacity Approximately 10,000 employees $40 billion market capitalization(1) One of North America’s Largest Ethanol Producers 11 plants with 1.4 billion gallons per year (91,000 BPD) ethanol production capacity Plants convert corn into ethanol and distillers grains Plants were acquired at a fraction of replacement cost Premier plants and low cost operations (1) As of Dec 27, 2017, VLO at $92.14 per share and VLP at $44.37 per unit. (2) For the nine months ended Sep 30, 2017. Growth Oriented Master Limited Partnership (NYSE: VLP) Fee based MLP 950,000 BPD(2) of pipeline throughput 2.8 million BPD(2) of terminaling throughput Liquids-focused logistics assets Revenues are 100% fee-based $3 billion market capitalization(1)

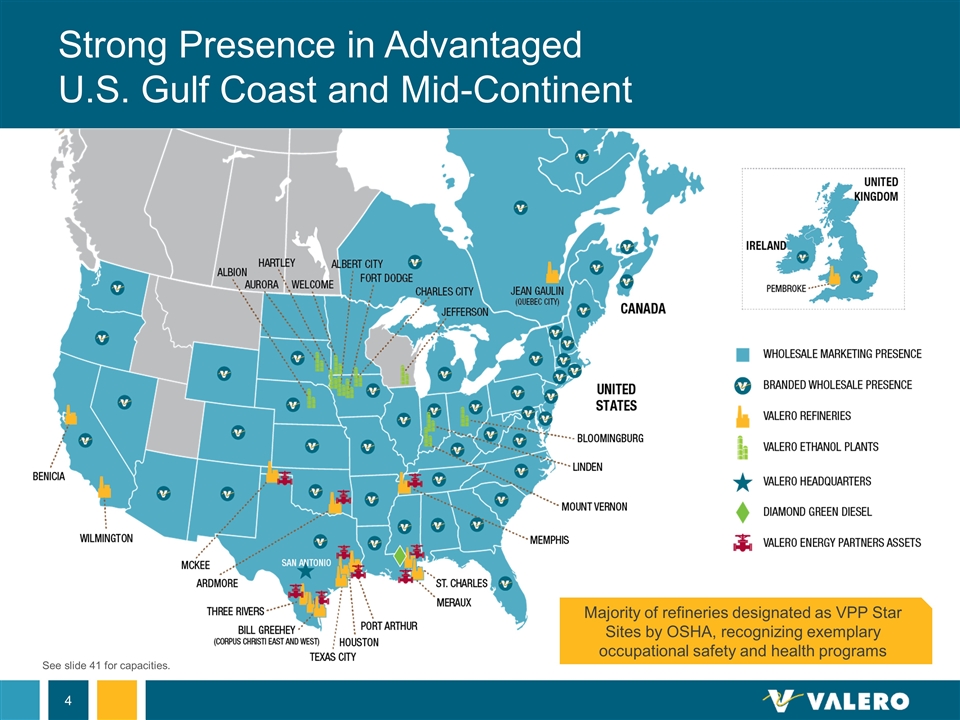

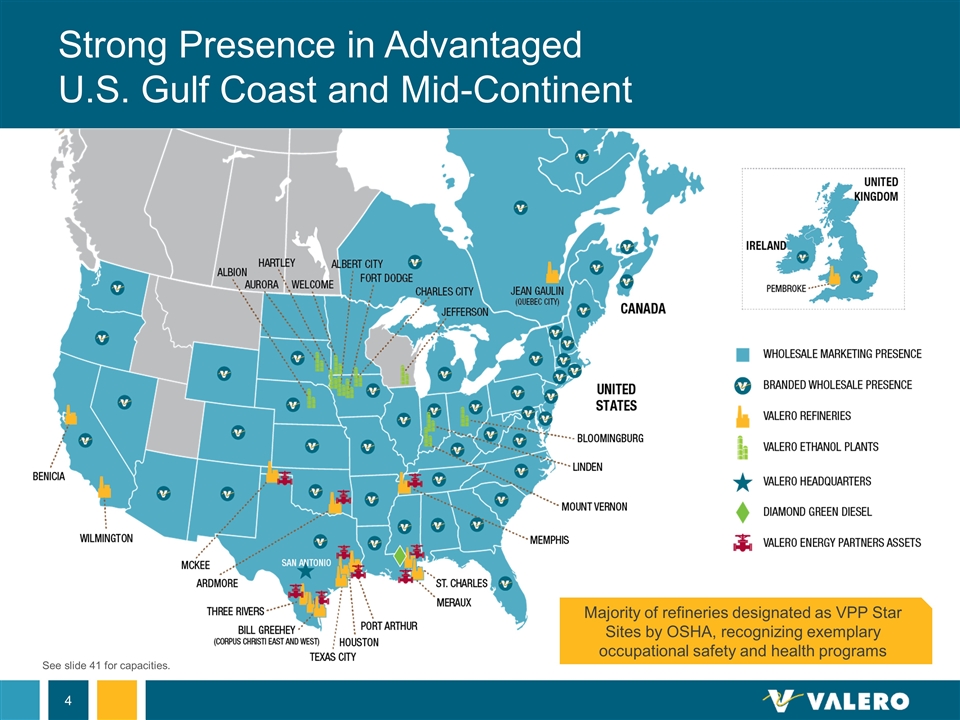

Strong Presence in Advantaged U.S. Gulf Coast and Mid-Continent Majority of refineries designated as VPP Star Sites by OSHA, recognizing exemplary occupational safety and health programs See slide 41 for capacities.

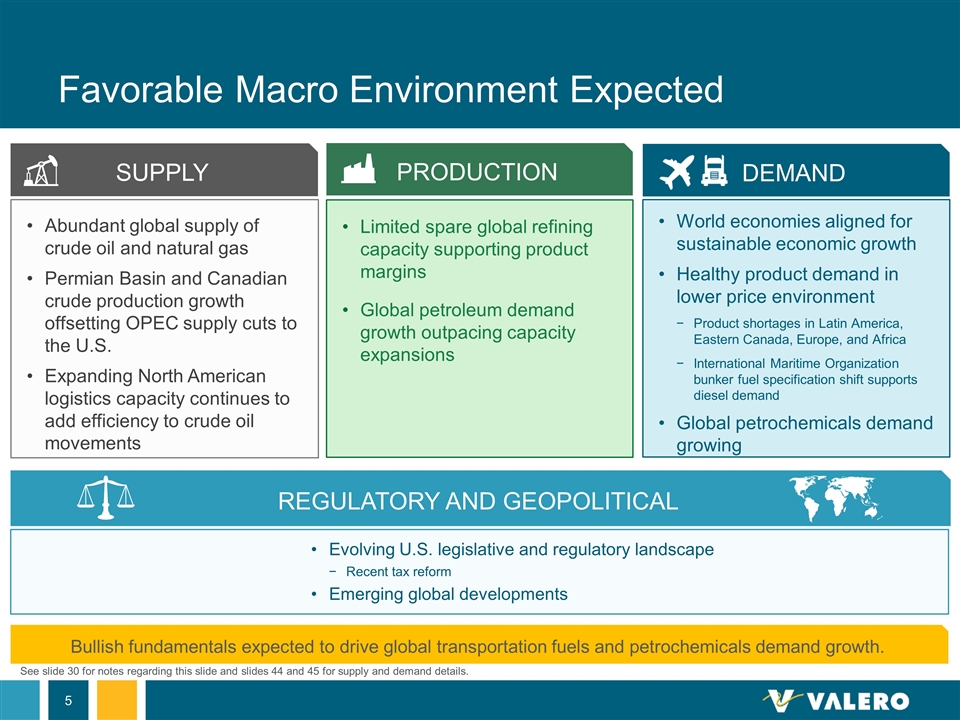

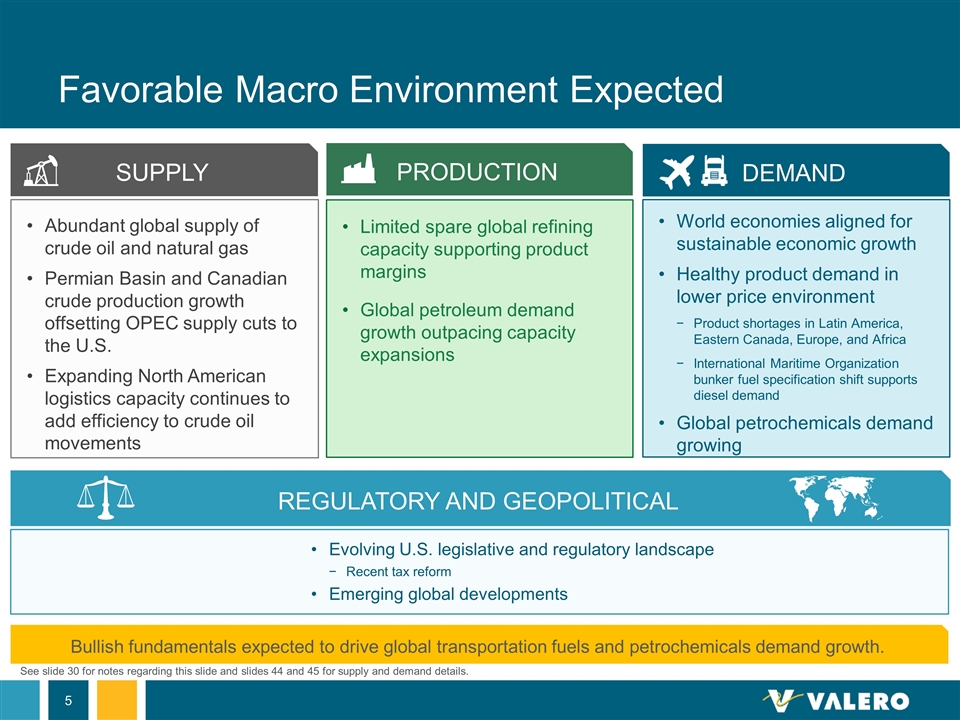

Favorable Macro Environment Expected SUPPLY DEMAND See slide 30 for notes regarding this slide and slides 44 and 45 for supply and demand details. REGULATORY AND GEOPOLITICAL Evolving U.S. legislative and regulatory landscape Recent tax reform Emerging global developments Bullish fundamentals expected to drive global transportation fuels and petrochemicals demand growth. PRODUCTION Abundant global supply of crude oil and natural gas Permian Basin and Canadian crude production growth offsetting OPEC supply cuts to the U.S. Expanding North American logistics capacity continues to add efficiency to crude oil movements World economies aligned for sustainable economic growth Healthy product demand in lower price environment Product shortages in Latin America, Eastern Canada, Europe, and Africa International Maritime Organization bunker fuel specification shift supports diesel demand Global petrochemicals demand growing Limited spare global refining capacity supporting product margins Global petroleum demand growth outpacing capacity expansions

Our Strategy for Value Creation Maintain manufacturing excellence: safe, reliable, environmentally responsible operations Focus on earnings growth: Market expansion, margin improvement, operating cost control Disciplined capital allocation: deliver distinctive financial results and peer-leading returns to stockholders

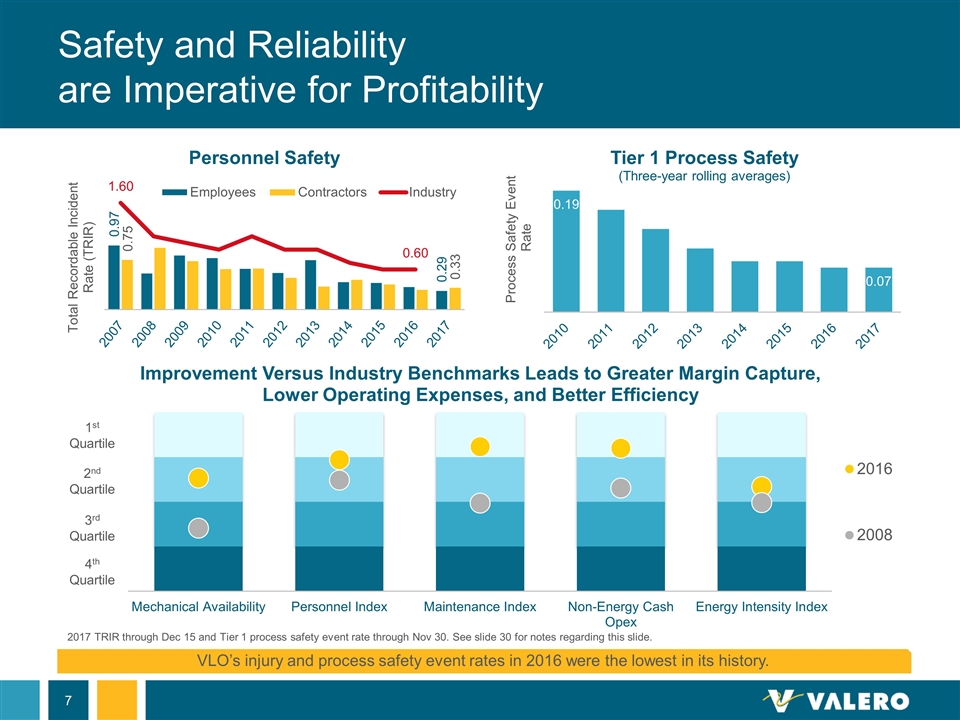

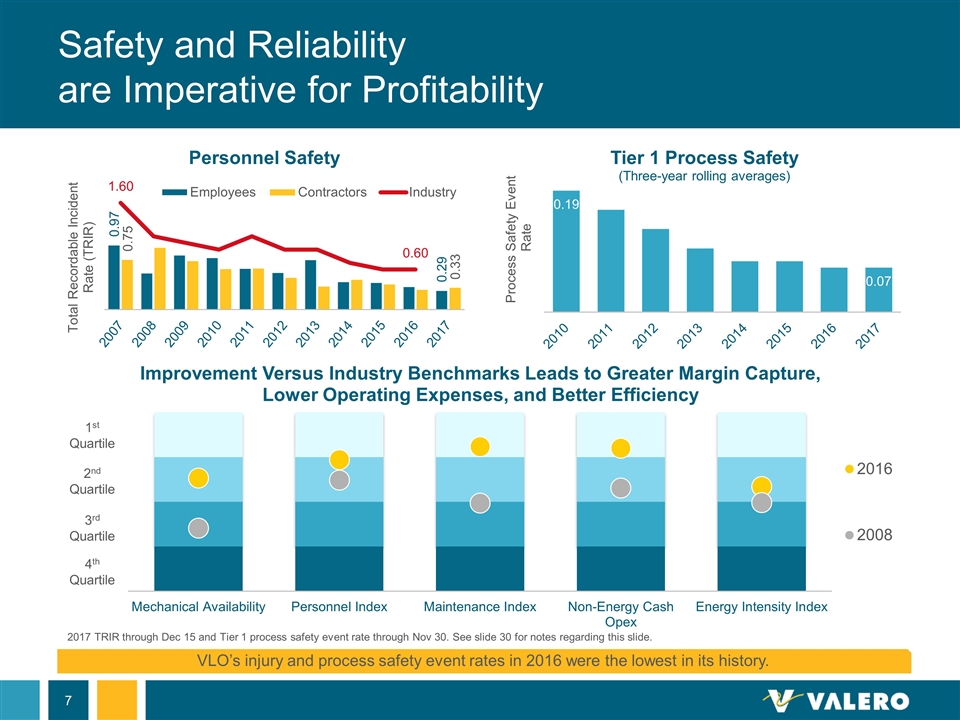

Safety and Reliability are Imperative for Profitability 2017 TRIR through Dec 15 and Tier 1 process safety event rate through Nov 30. See slide 30 for notes regarding this slide. VLO’s injury and process safety event rates in 2016 were the lowest in its history.

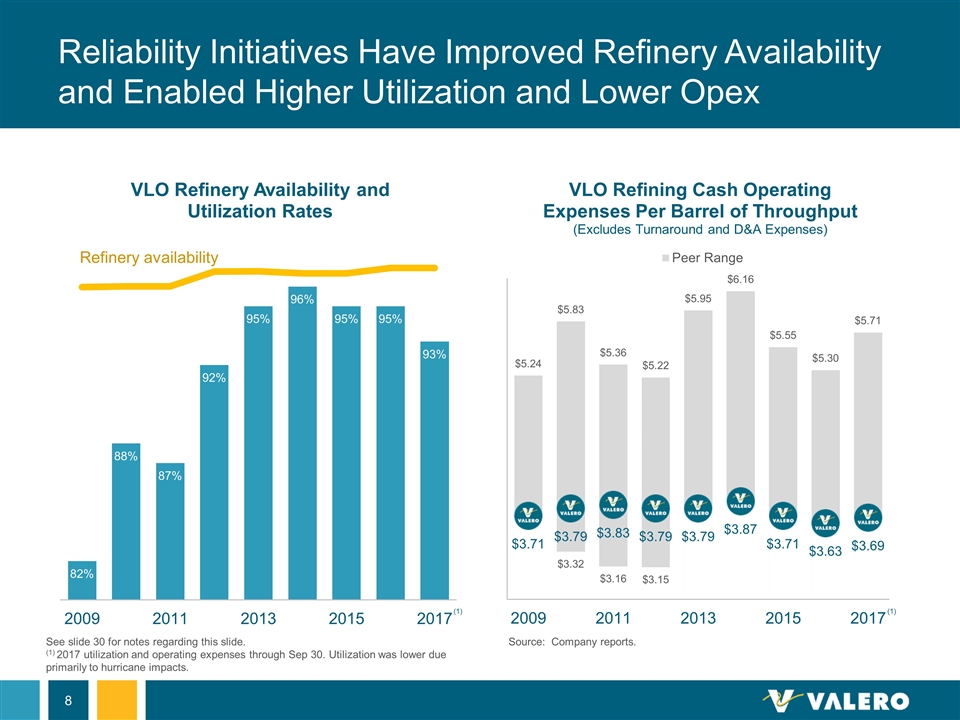

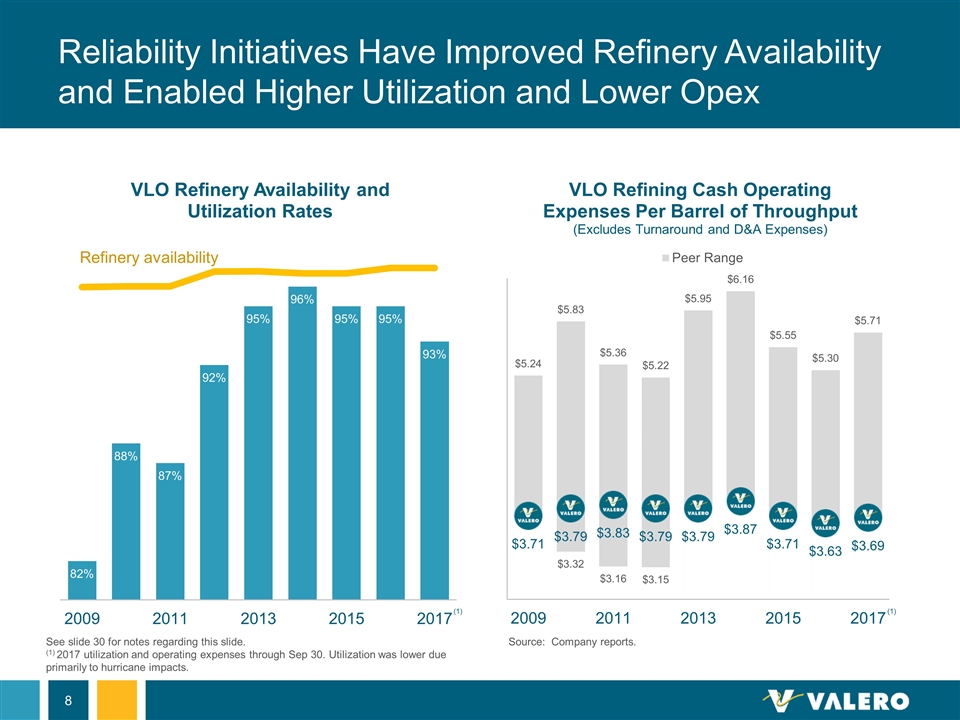

Reliability Initiatives Have Improved Refinery Availability and Enabled Higher Utilization and Lower Opex See slide 30 for notes regarding this slide. (1) 2017 utilization and operating expenses through Sep 30. Utilization was lower due primarily to hurricane impacts. Source: Company reports. (1) (1)

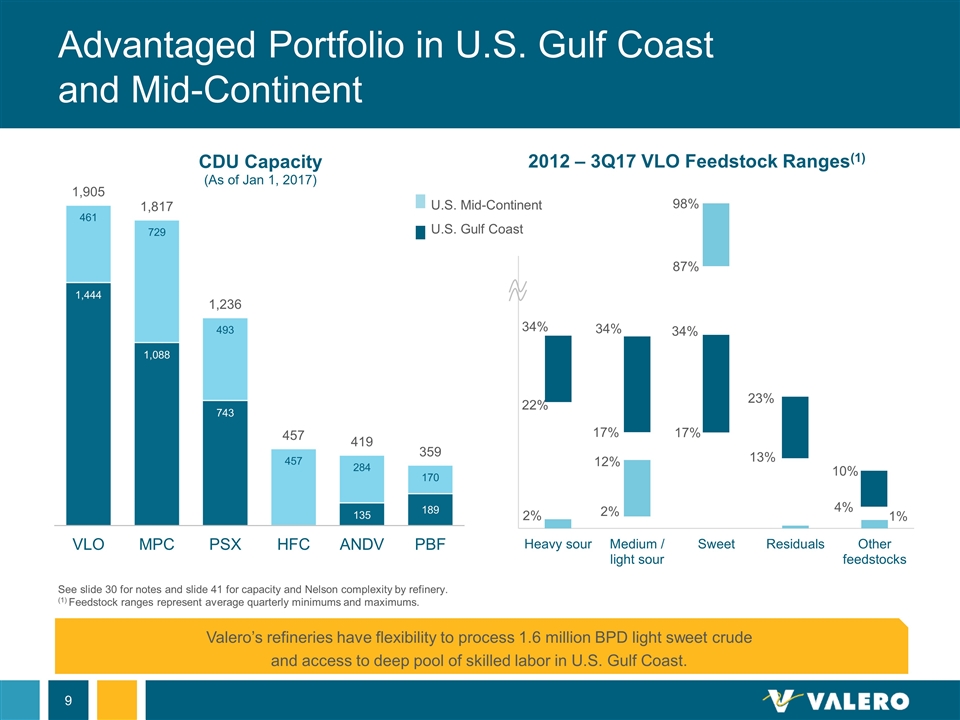

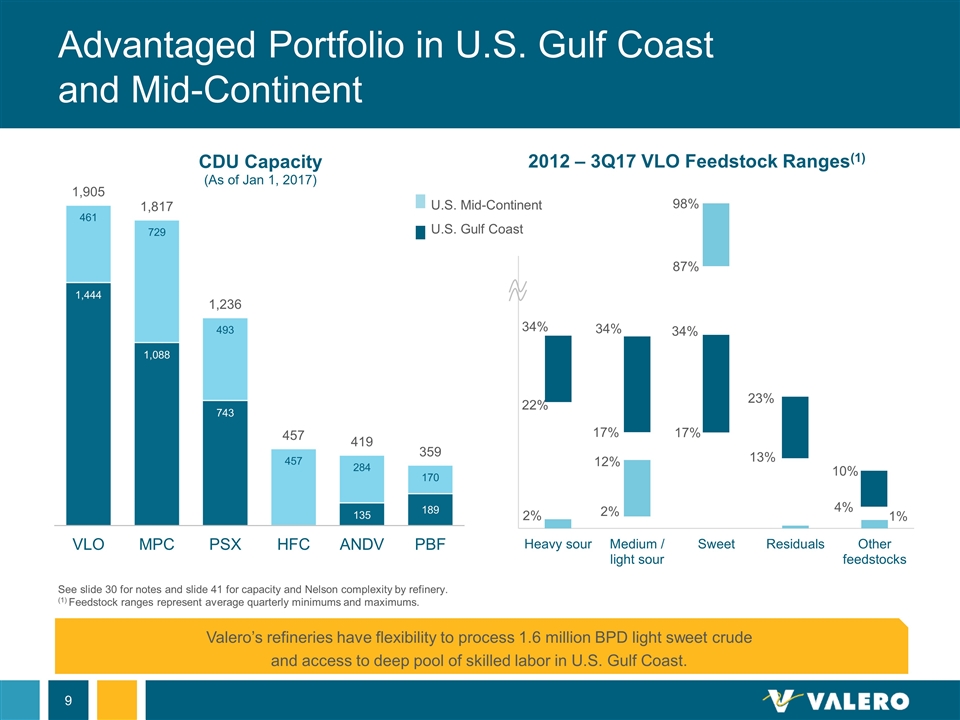

Advantaged Portfolio in U.S. Gulf Coast and Mid-Continent See slide 30 for notes and slide 41 for capacity and Nelson complexity by refinery. (1) Feedstock ranges represent average quarterly minimums and maximums. Valero’s refineries have flexibility to process 1.6 million BPD light sweet crude and access to deep pool of skilled labor in U.S. Gulf Coast. U.S. Mid-Continent U.S. Gulf Coast

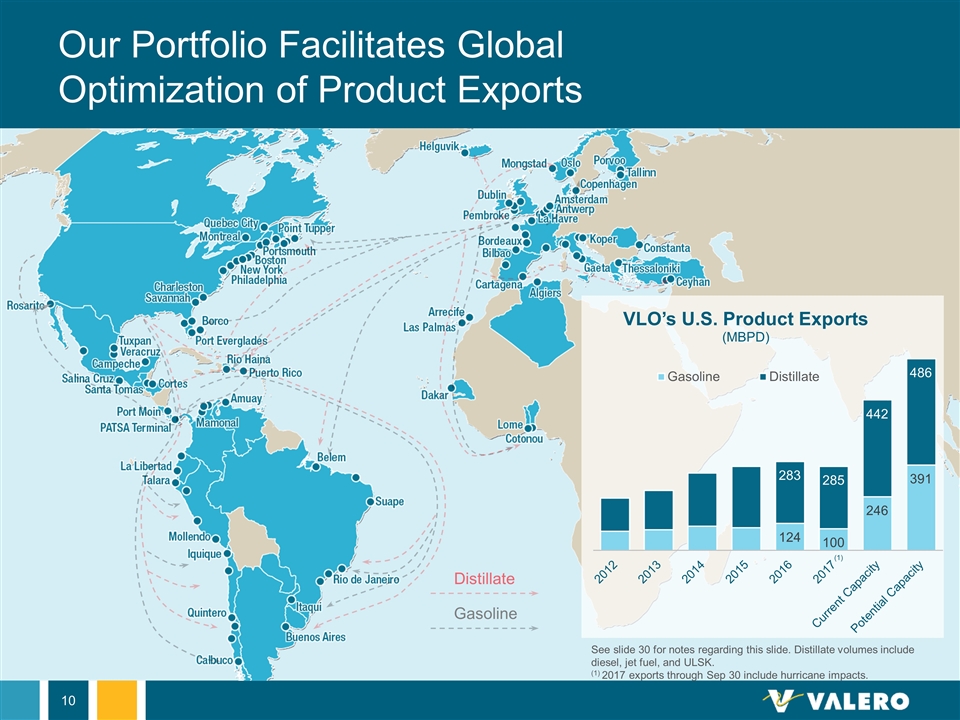

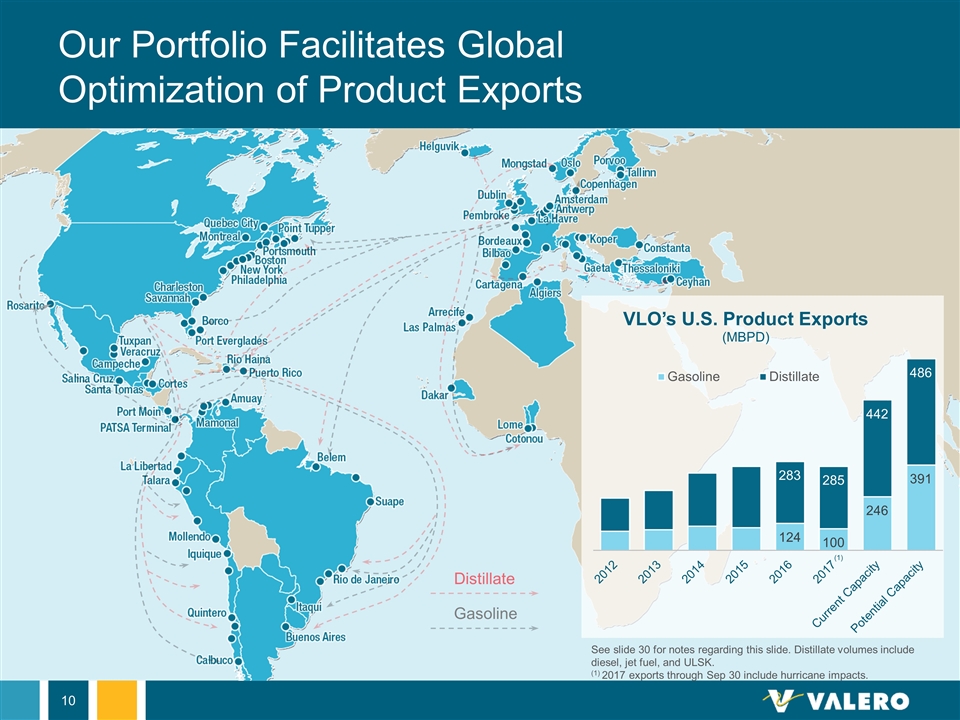

Our Portfolio Facilitates Global Optimization of Product Exports See slide 30 for notes regarding this slide. Distillate volumes include diesel, jet fuel, and ULSK. (1) 2017 exports through Sep 30 include hurricane impacts. Distillate Gasoline (1)

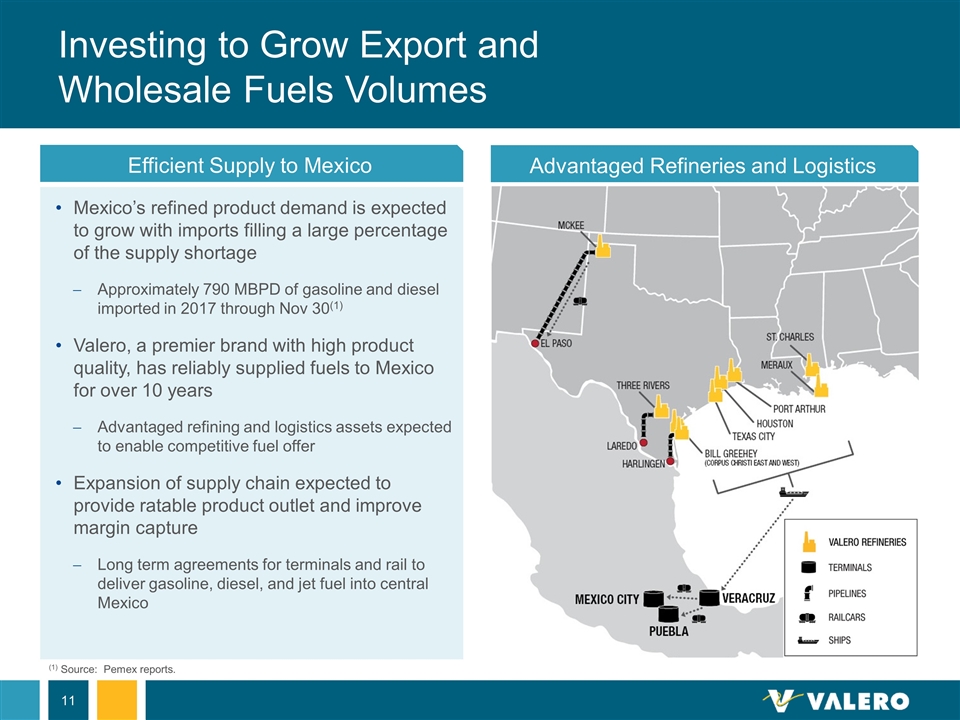

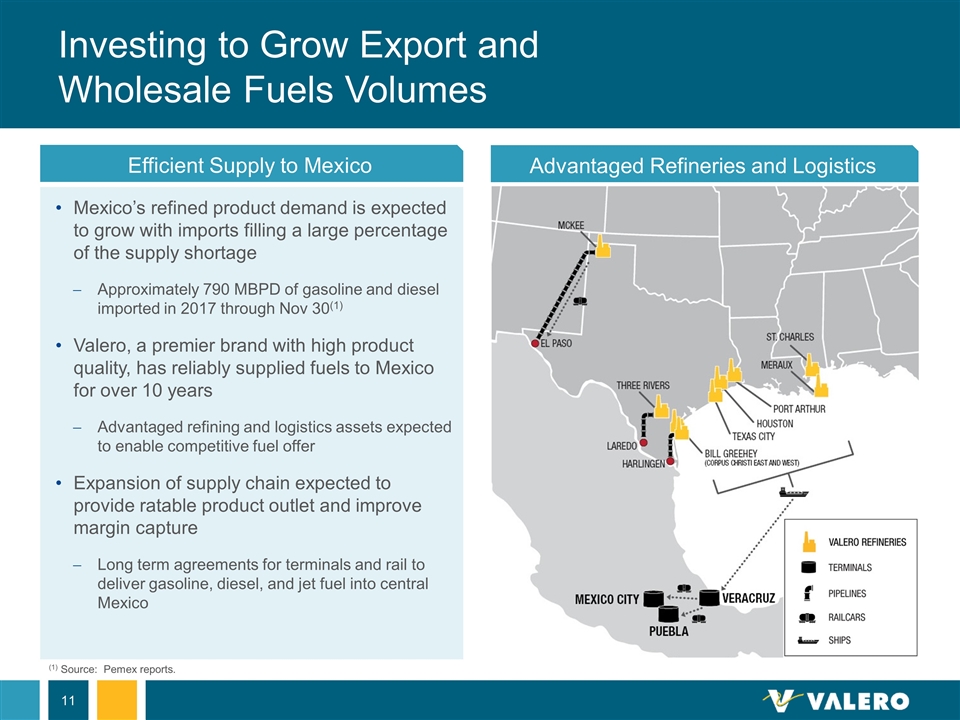

Investing to Grow Export and Wholesale Fuels Volumes Mexico’s refined product demand is expected to grow with imports filling a large percentage of the supply shortage Approximately 790 MBPD of gasoline and diesel imported in 2017 through Nov 30(1) Valero, a premier brand with high product quality, has reliably supplied fuels to Mexico for over 10 years Advantaged refining and logistics assets expected to enable competitive fuel offer Expansion of supply chain expected to provide ratable product outlet and improve margin capture Long term agreements for terminals and rail to deliver gasoline, diesel, and jet fuel into central Mexico (1) Source: Pemex reports. Advantaged Refineries and Logistics Efficient Supply to Mexico

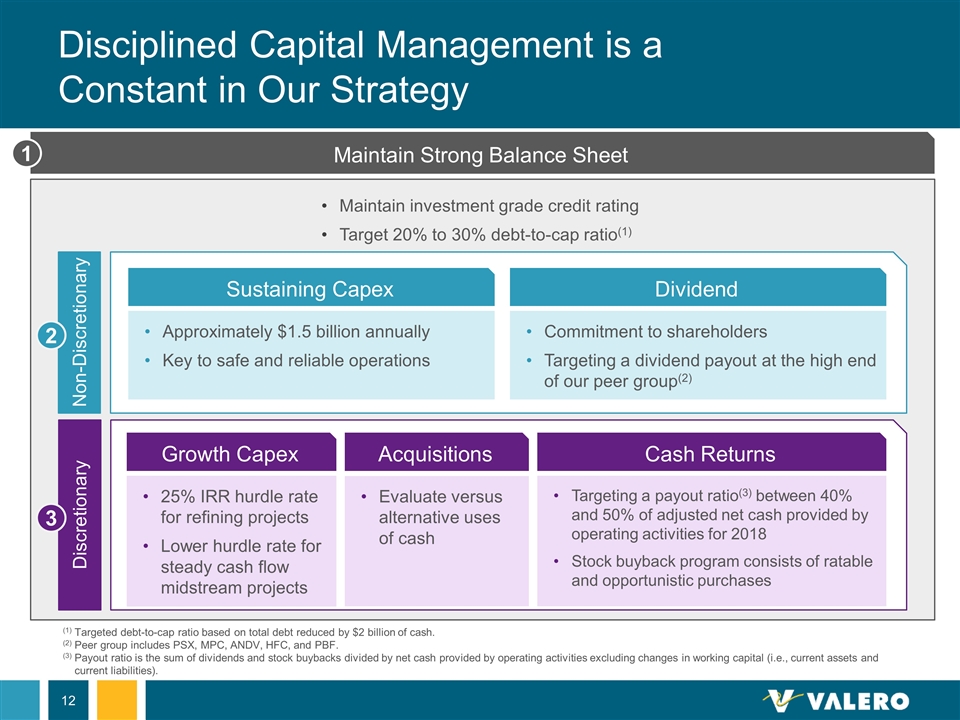

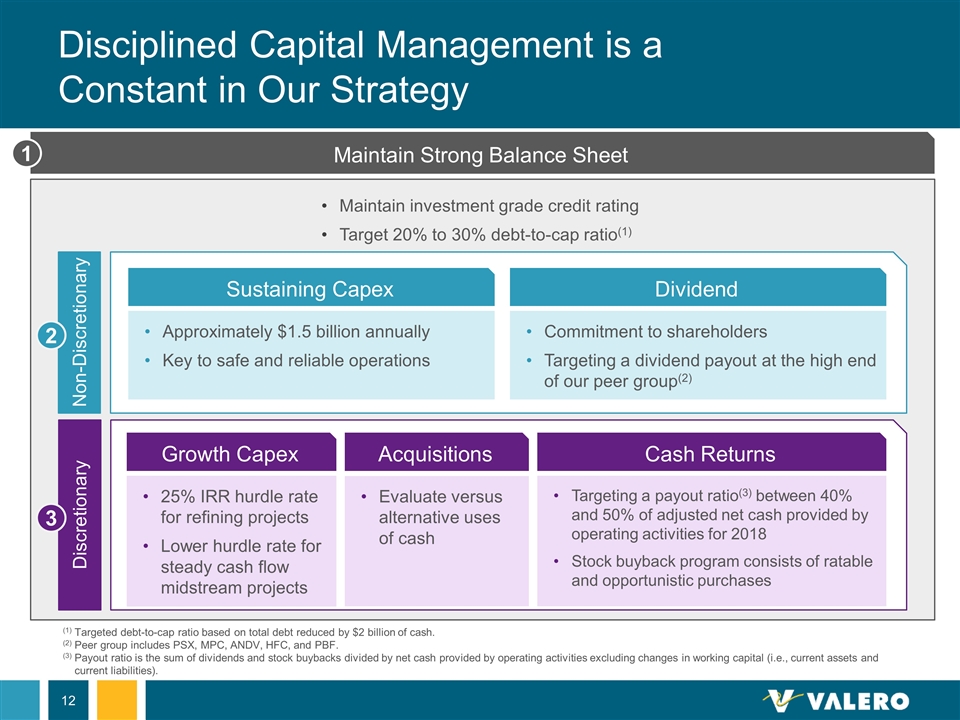

Disciplined Capital Management is a Constant in Our Strategy Maintain Strong Balance Sheet (1)Targeted debt-to-cap ratio based on total debt reduced by $2 billion of cash. (2)Peer group includes PSX, MPC, ANDV, HFC, and PBF. (3)Payout ratio is the sum of dividends and stock buybacks divided by net cash provided by operating activities excluding changes in working capital (i.e., current assets and current liabilities). Sustaining Capex Approximately $1.5 billion annually Key to safe and reliable operations Dividend Commitment to shareholders Targeting a dividend payout at the high end of our peer group(2) Non-Discretionary Growth Capex 25% IRR hurdle rate for refining projects Lower hurdle rate for steady cash flow midstream projects Cash Returns Targeting a payout ratio(3) between 40% and 50% of adjusted net cash provided by operating activities for 2018 Stock buyback program consists of ratable and opportunistic purchases Acquisitions Evaluate versus alternative uses of cash Discretionary Maintain investment grade credit rating Target 20% to 30% debt-to-cap ratio(1) 1 2 3

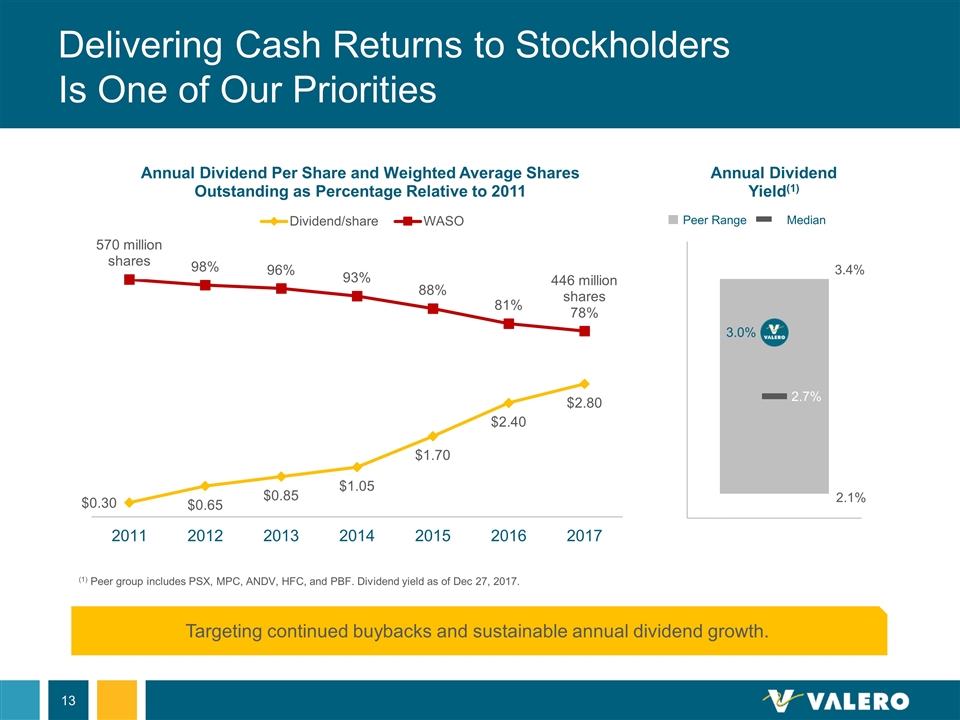

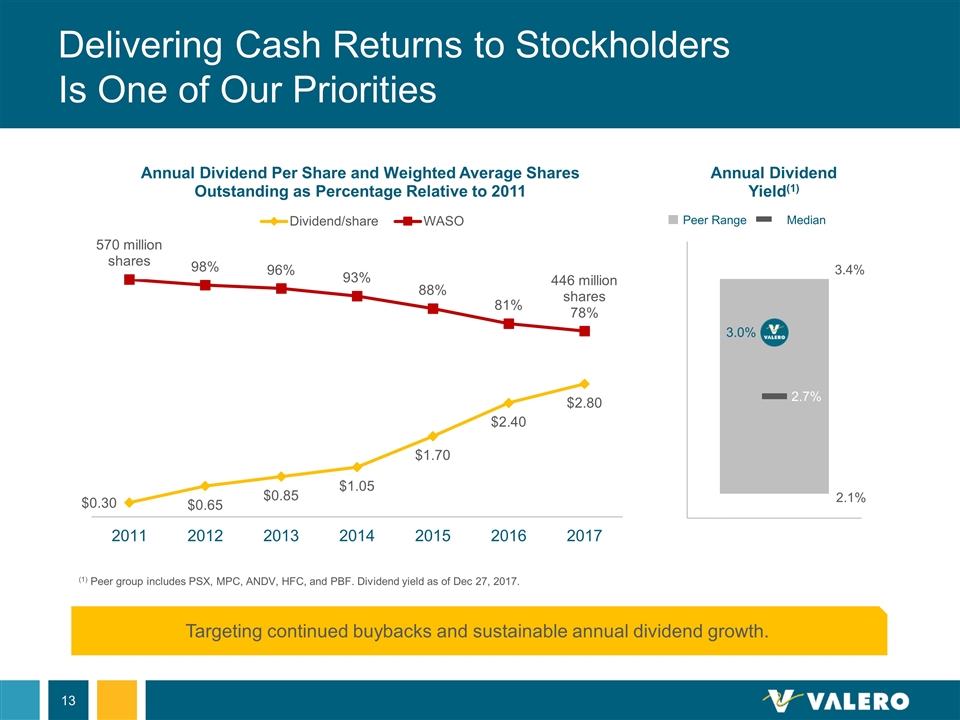

Delivering Cash Returns to Stockholders Is One of Our Priorities Targeting continued buybacks and sustainable annual dividend growth. (1) Peer group includes PSX, MPC, ANDV, HFC, and PBF. Dividend yield as of Dec 27, 2017. Peer Range Median

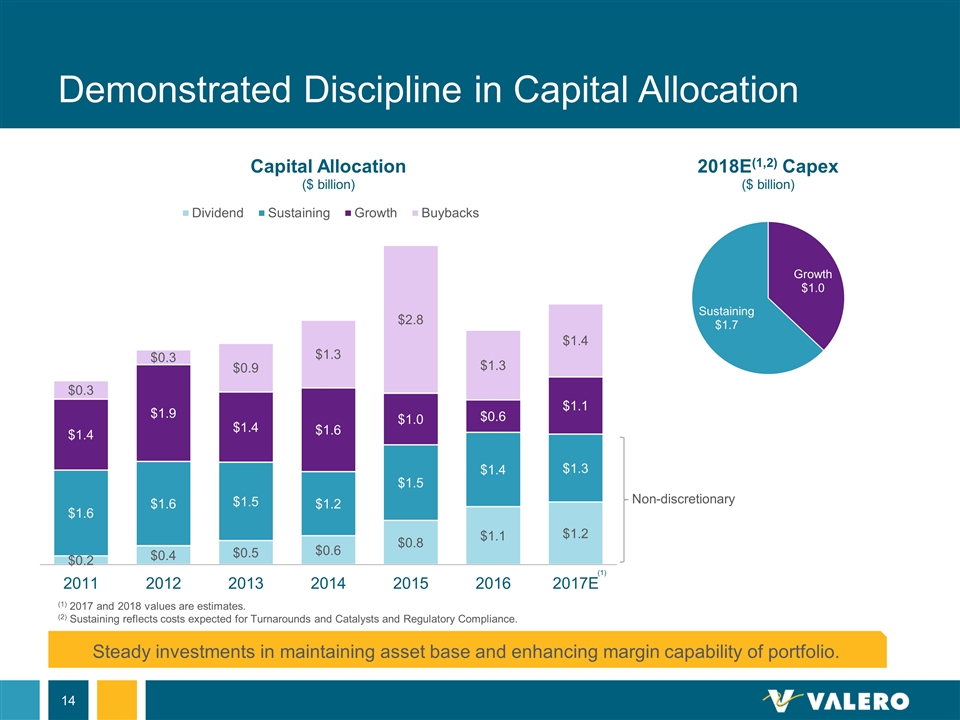

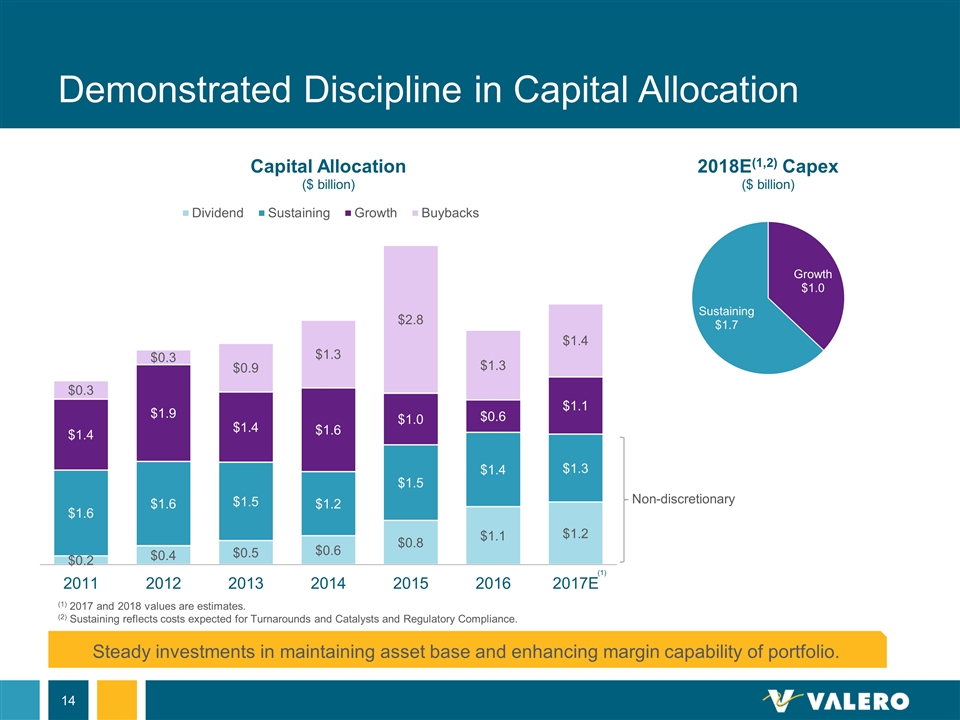

Demonstrated Discipline in Capital Allocation Steady investments in maintaining asset base and enhancing margin capability of portfolio. Non-discretionary (1) (1) 2017 and 2018 values are estimates. (2) Sustaining reflects costs expected for Turnarounds and Catalysts and Regulatory Compliance.

Steady Pipeline of High Return Projects Texas City Refinery photo Expect to spend $1 billion annually on growth investments from 2017 through 2021 Approximately 50 / 50 allocation between refining and logistics projects Diamond Pipeline and Wilmington cogeneration unit completed in Nov 2017 Projects in execution phase (by expected completion date) Diamond Green Diesel expansion (3Q18) Houston alkylation unit (1H19) Central Texas pipelines and terminals (mid-2019) Pasadena terminal (early 2020) Other projects in development phases Expanding product supply chain into Mexico and Latin America Increasing light products yield and octane enhancement in U.S. Gulf Coast Cogeneration in North Atlantic Logistics for feedstock and product flexibility High grading secondary products into petrochemicals See slide 30 for notes regarding this slide. EBITDA estimates are illustrative and based on average actual prices for 2015 and 2016. Excludes potential M&A.

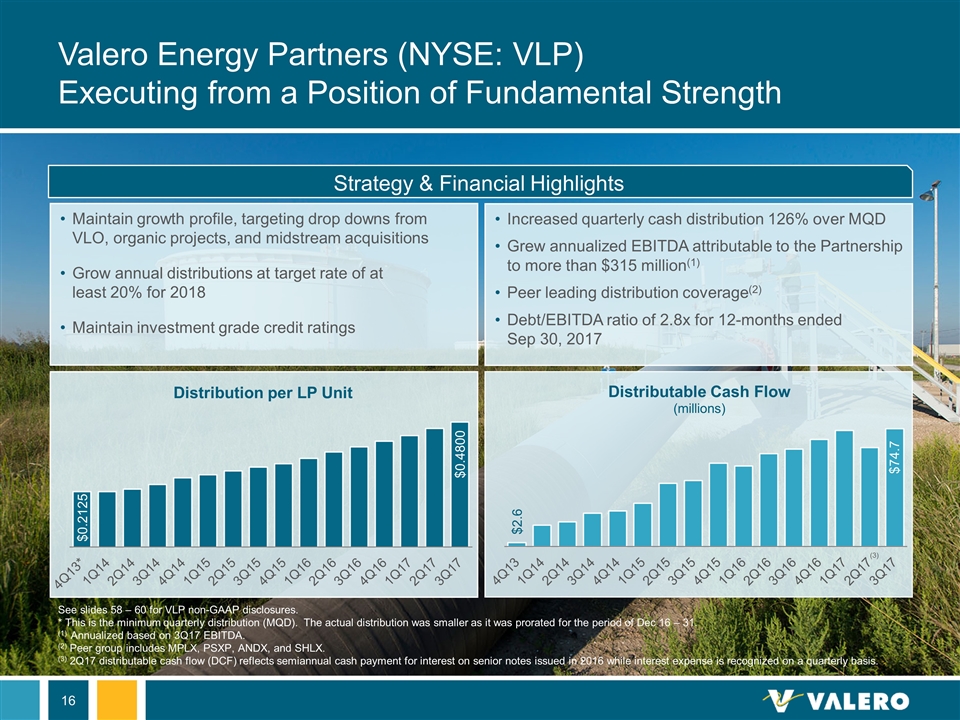

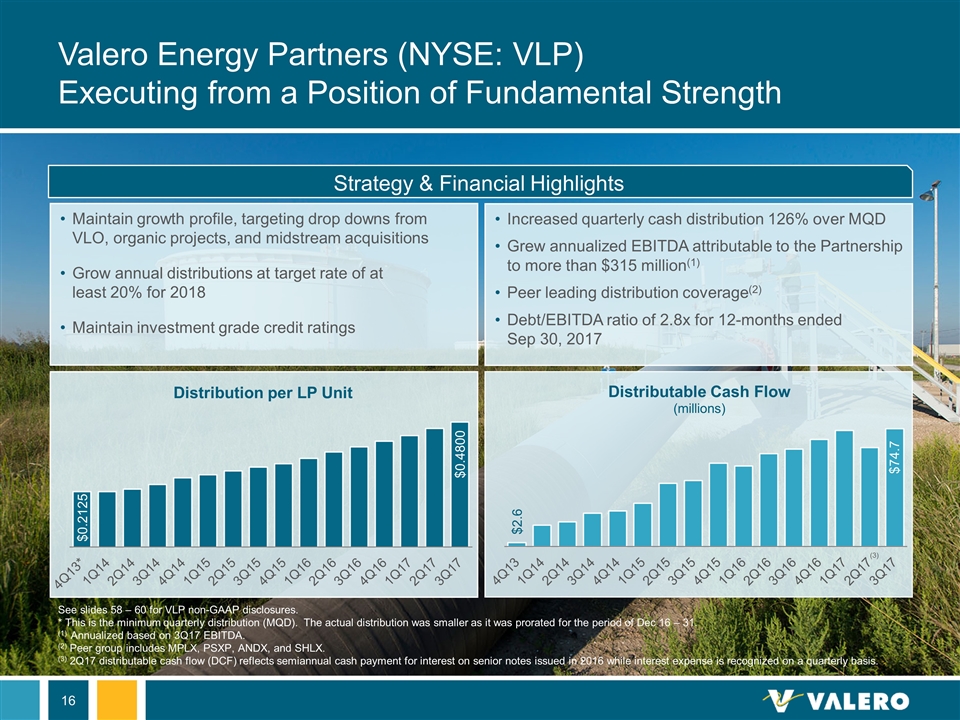

Maintain growth profile, targeting drop downs from VLO, organic projects, and midstream acquisitions Grow annual distributions at target rate of at least 20% for 2018 Maintain investment grade credit ratings Valero Energy Partners (NYSE: VLP) Executing from a Position of Fundamental Strength Strategy & Financial Highlights Increased quarterly cash distribution 126% over MQD Grew annualized EBITDA attributable to the Partnership to more than $315 million(1) Peer leading distribution coverage(2) Debt/EBITDA ratio of 2.8x for 12-months ended Sep 30, 2017 See slides 58 – 60 for VLP non-GAAP disclosures. * This is the minimum quarterly distribution (MQD). The actual distribution was smaller as it was prorated for the period of Dec 16 – 31. (1) Annualized based on 3Q17 EBITDA. (2) Peer group includes MPLX, PSXP, ANDX, and SHLX. (3) 2Q17 distributable cash flow (DCF) reflects semiannual cash payment for interest on senior notes issued in 2016 while interest expense is recognized on a quarterly basis. (3)

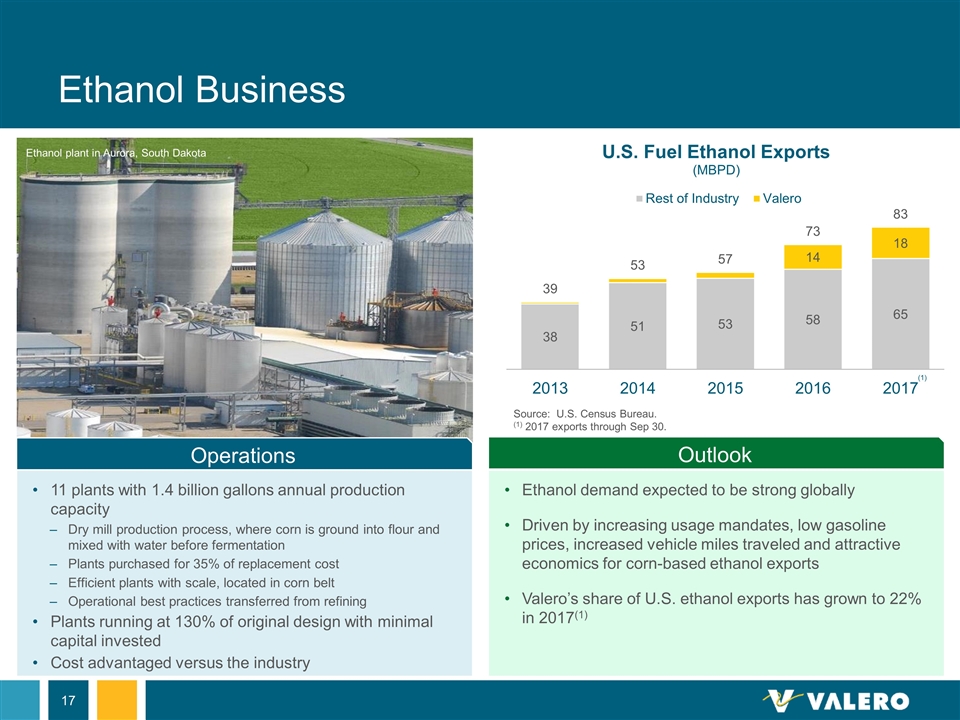

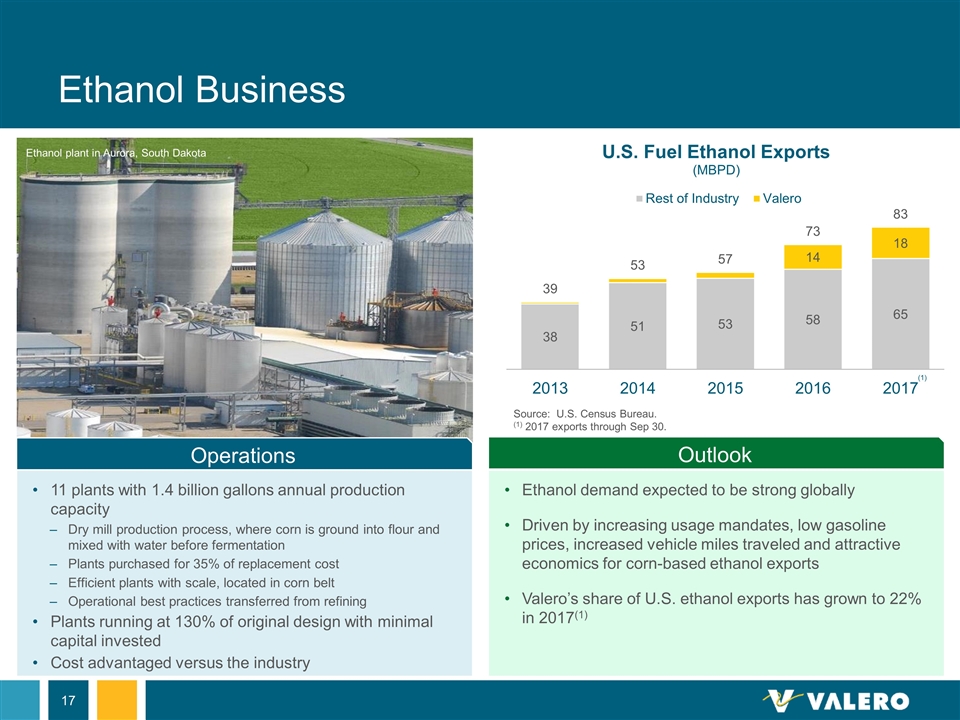

Ethanol Business Operations 11 plants with 1.4 billion gallons annual production capacity Dry mill production process, where corn is ground into flour and mixed with water before fermentation Plants purchased for 35% of replacement cost Efficient plants with scale, located in corn belt Operational best practices transferred from refining Plants running at 130% of original design with minimal capital invested Cost advantaged versus the industry Outlook Ethanol demand expected to be strong globally Driven by increasing usage mandates, low gasoline prices, increased vehicle miles traveled and attractive economics for corn-based ethanol exports Valero’s share of U.S. ethanol exports has grown to 22% in 2017(1) Ethanol plant in Aurora, South Dakota Source: U.S. Census Bureau. (1) 2017 exports through Sep 30.

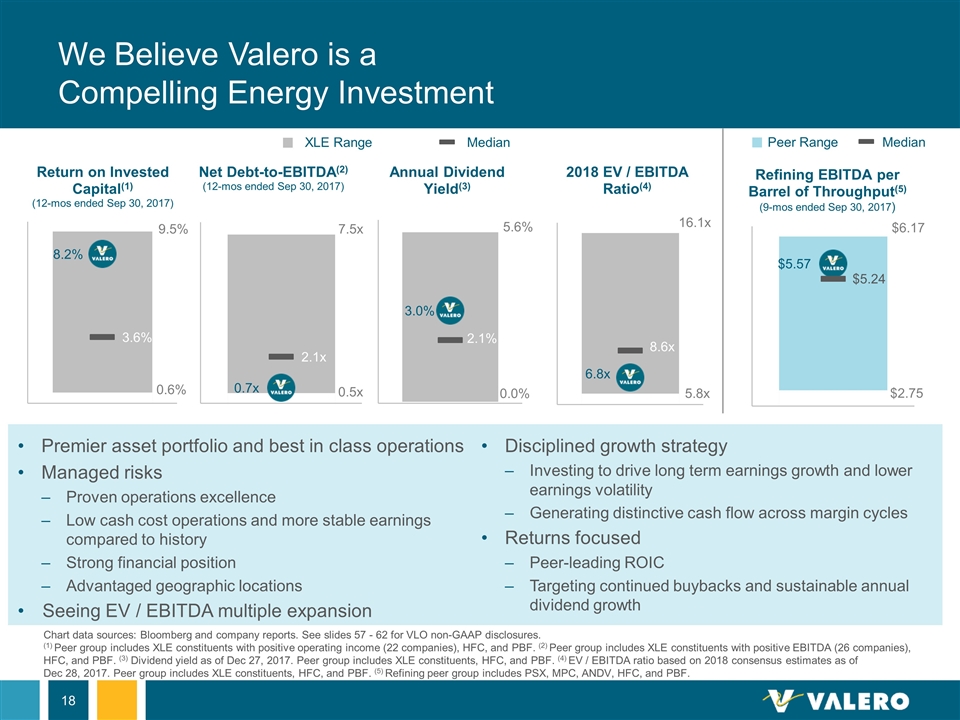

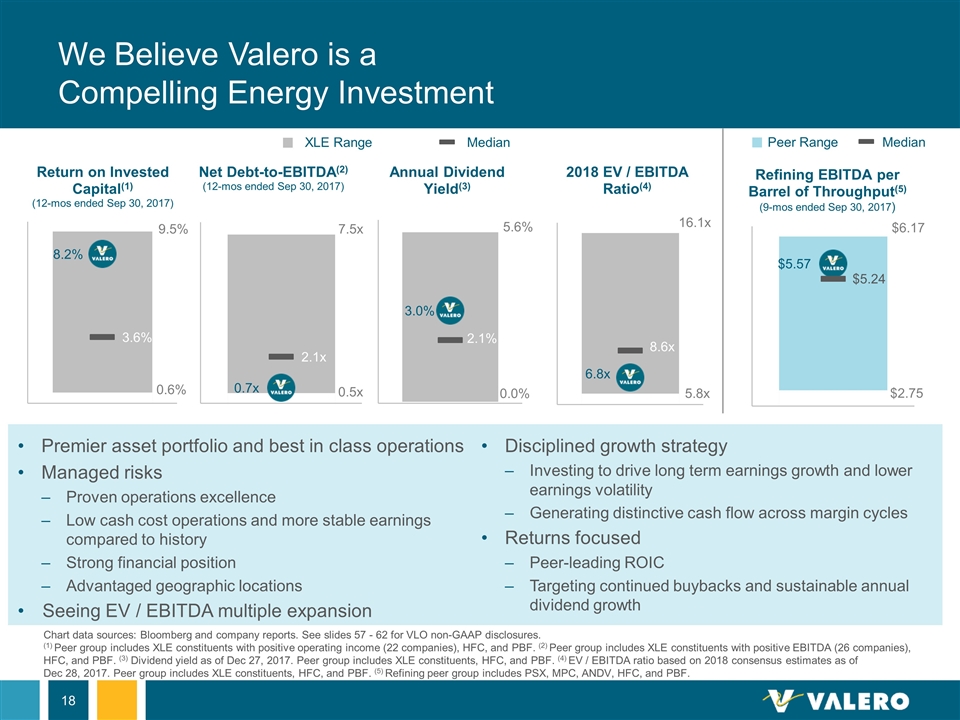

We Believe Valero is a Compelling Energy Investment Chart data sources: Bloomberg and company reports. See slides 57 - 62 for VLO non-GAAP disclosures. (1) Peer group includes XLE constituents with positive operating income (22 companies), HFC, and PBF. (2) Peer group includes XLE constituents with positive EBITDA (26 companies), HFC, and PBF. (3) Dividend yield as of Dec 27, 2017. Peer group includes XLE constituents, HFC, and PBF. (4) EV / EBITDA ratio based on 2018 consensus estimates as of Dec 28, 2017. Peer group includes XLE constituents, HFC, and PBF. (5) Refining peer group includes PSX, MPC, ANDV, HFC, and PBF. XLE Range Median Premier asset portfolio and best in class operations Managed risks Proven operations excellence Low cash cost operations and more stable earnings compared to history Strong financial position Advantaged geographic locations Seeing EV / EBITDA multiple expansion Disciplined growth strategy Investing to drive long term earnings growth and lower earnings volatility Generating distinctive cash flow across margin cycles Returns focused Peer-leading ROIC Targeting continued buybacks and sustainable annual dividend growth Peer Range Median

Investor Update January 2018

Who We Are (NYSE: VLP) Sponsored by Premier Independent Refiner, Valero Valero (NYSE:VLO) is our general partner and majority owner $40 billion market capitalization(2) VLP’s assets are integrated with VLO’s refining system Growth Oriented Master Limited Partnership Liquids focused logistics assets 950,000 BPD(1) of pipeline throughput 2.8 million BPD(1) of terminaling throughput 100% fee-based revenues Vehicle to fund logistics growth at VLO $3 billion market capitalization(2) (1) For the nine months ended Sep 30, 2017. (2) As of Dec 27, 2017, VLP at $44.37 per unit and VLO at $92.14 per share.

Our Strategic Vision Maintain safe and environmentally responsible operations ` Generate stable, predictable cash flows, avoiding commodity price risks and protecting revenues with minimum volume commitments (MVCs) and long-term agreements… Demonstrate financial discipline by maintaining a strong balance sheet, healthy distribution coverage and investment grade credit ratings Maintain growth profile, targeting drop downs from VLO, organic projects, and logistics acquisitions

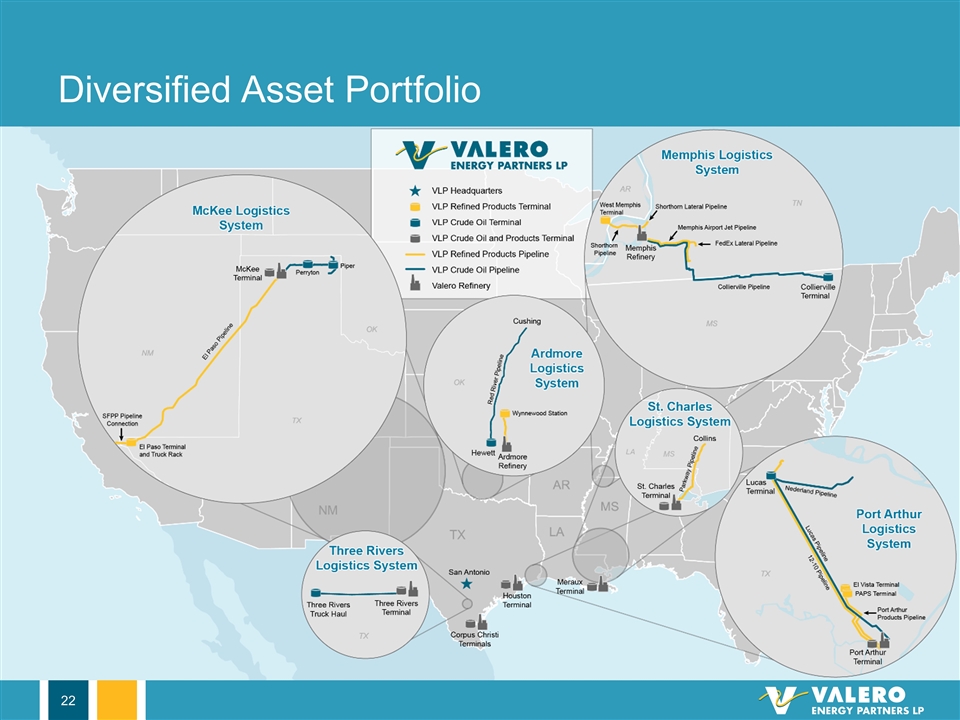

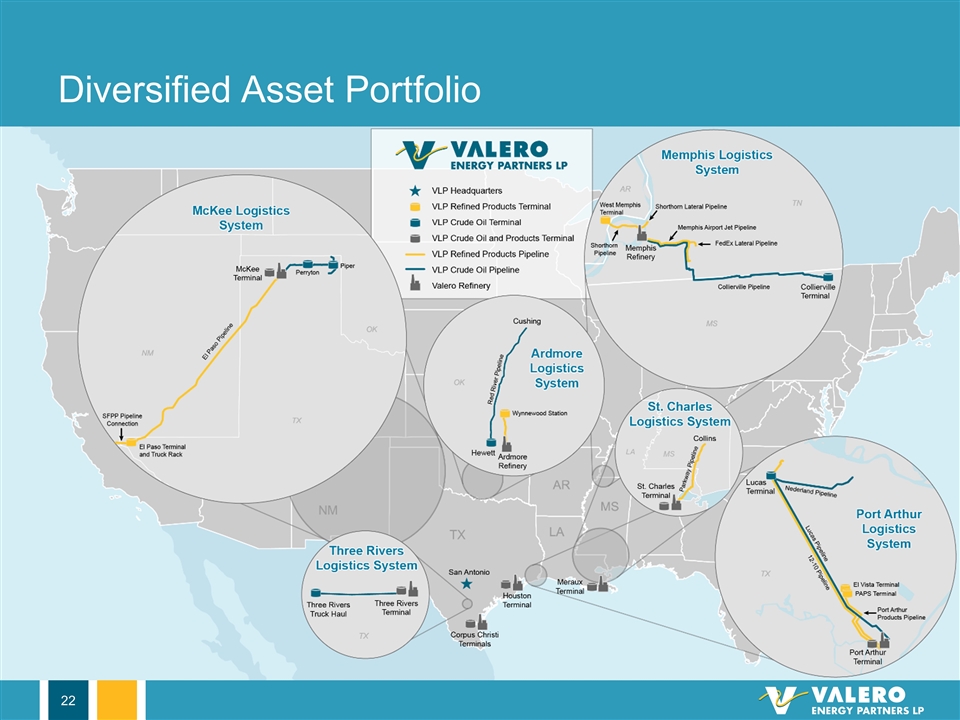

Diversified Asset Portfolio

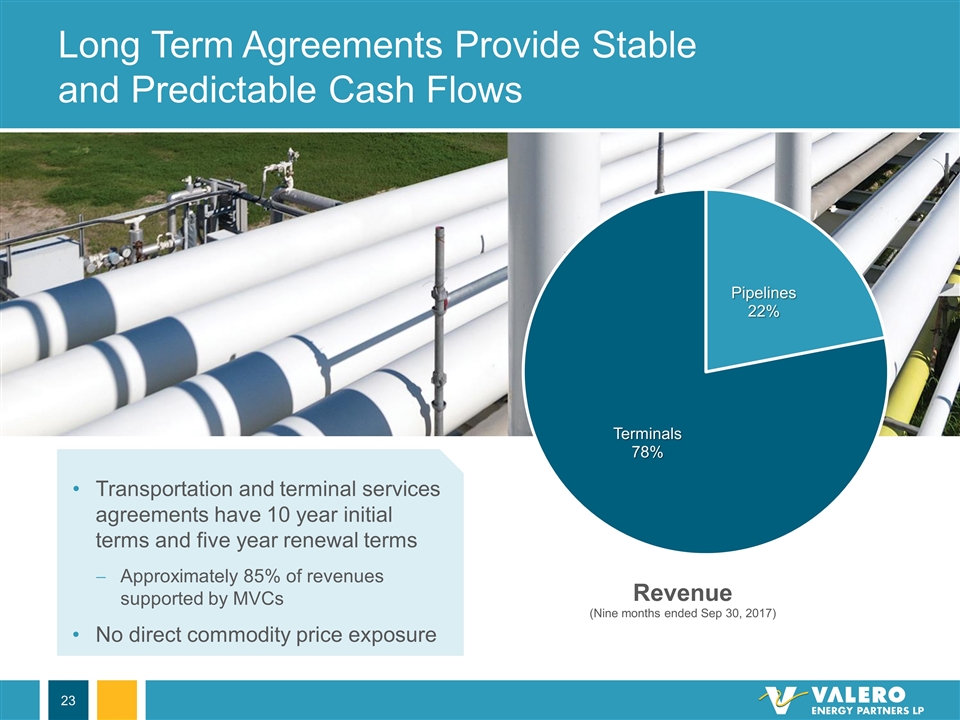

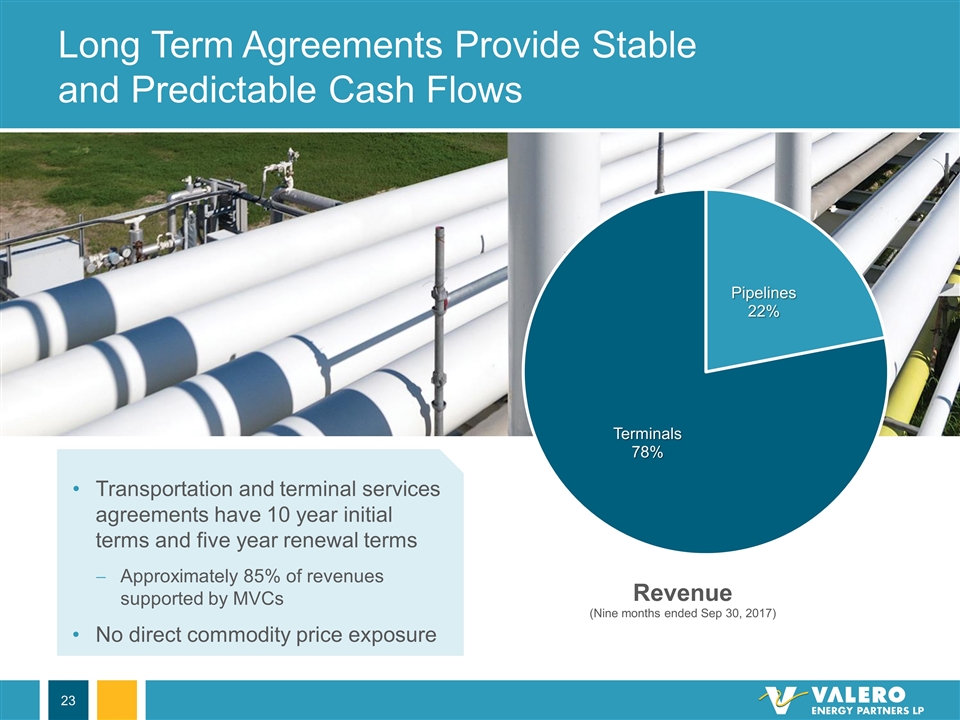

Long Term Agreements Provide Stable and Predictable Cash Flows Transportation and terminal services agreements have 10 year initial terms and five year renewal terms Approximately 85% of revenues supported by MVCs No direct commodity price exposure

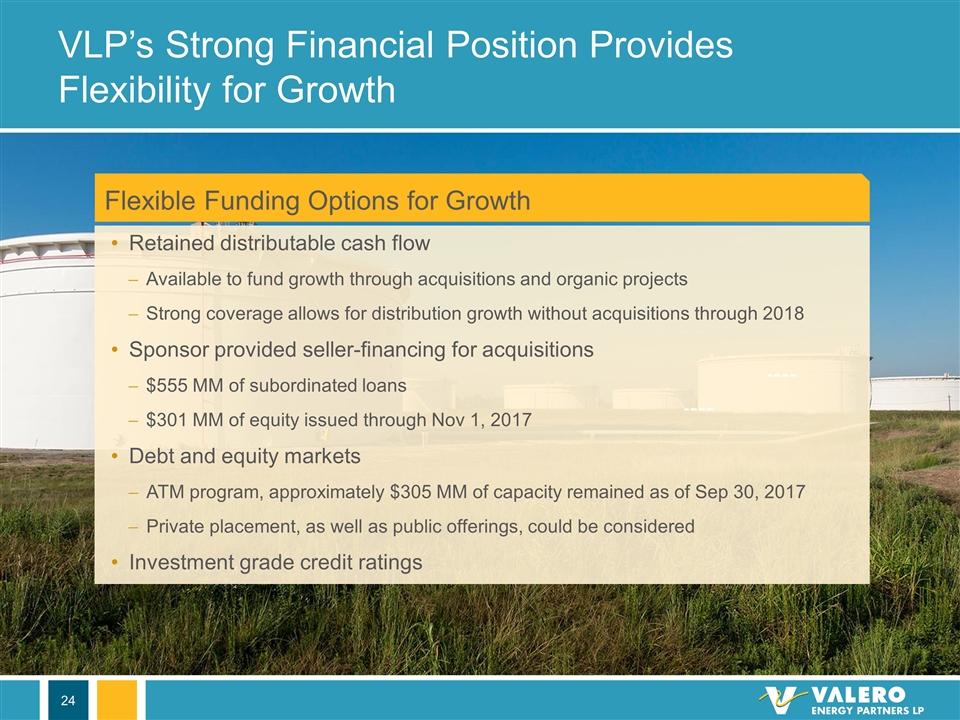

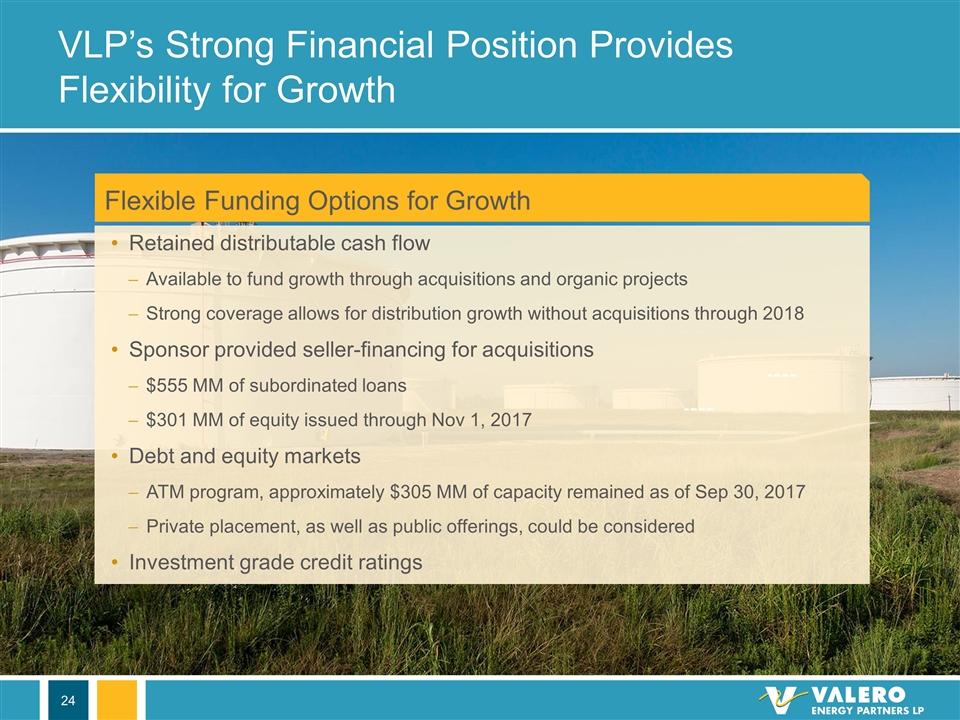

Retained distributable cash flow Available to fund growth through acquisitions and organic projects Strong coverage allows for distribution growth without acquisitions through 2018 Sponsor provided seller-financing for acquisitions $555 MM of subordinated loans $301 MM of equity issued through Nov 1, 2017 Debt and equity markets ATM program, approximately $305 MM of capacity remained as of Sep 30, 2017 Private placement, as well as public offerings, could be considered Investment grade credit ratings VLP’s Strong Financial Position Provides Flexibility for Growth Flexible Funding Options for Growth

Delivering Organic Growth Diamond Green Diesel logistics assets at the St. Charles Terminal Rail loading facility completed in 2Q17 180,000 barrel storage tank expected to be complete in 1Q18 Supported by a long-term, fee based contract through June 2033 Approximately $20 MM total project cost Port Arthur Products System 320,000 barrel storage tank completed in Dec 2017 Approximately $13 MM project cost Corpus Christi terminals Improvements aimed at increasing gasoline segregation and blending capabilities Started up in Dec 2017 Approximately $4 MM project cost Projects in Execution Phase

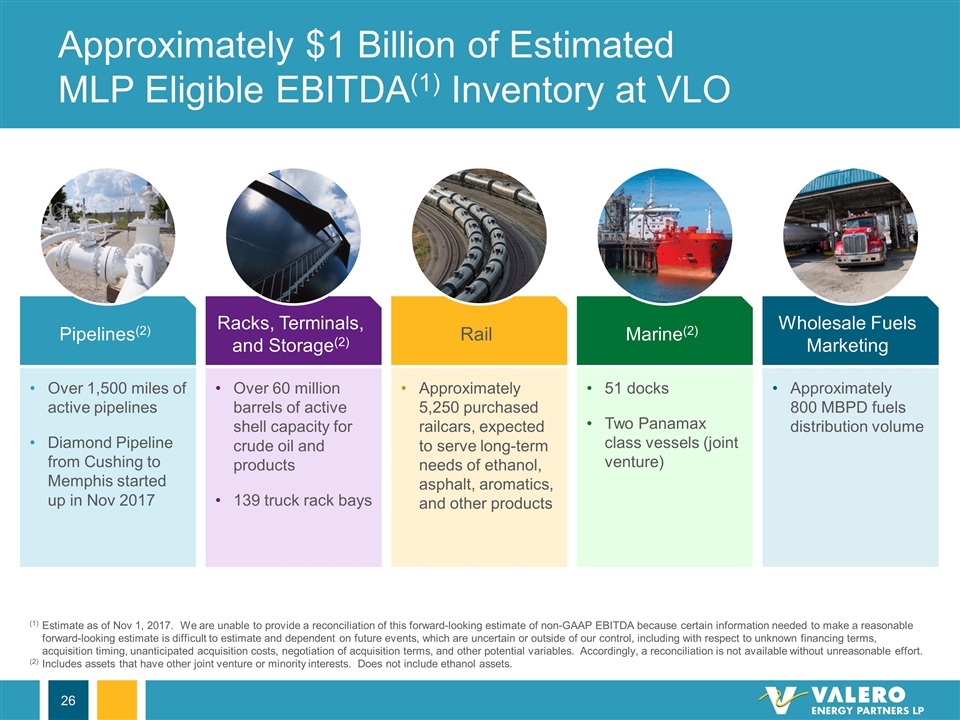

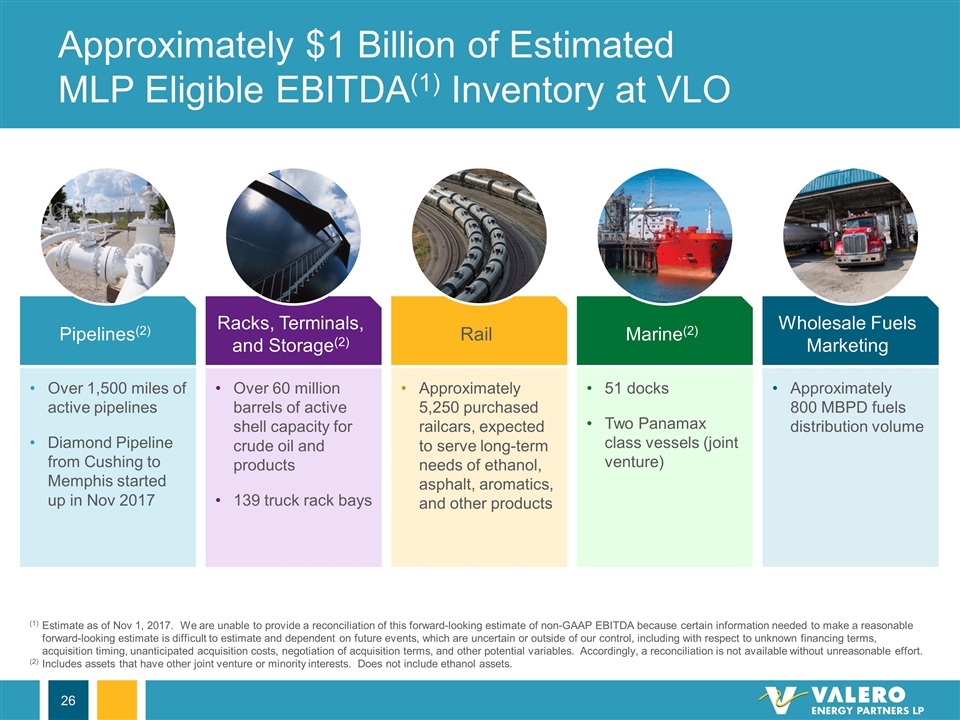

Approximately $1 Billion of Estimated MLP Eligible EBITDA(1) Inventory at VLO Racks, Terminals, and Storage(2) Over 60 million barrels of active shell capacity for crude oil and products 139 truck rack bays Rail Approximately 5,250 purchased railcars, expected to serve long-term needs of ethanol, asphalt, aromatics, and other products Pipelines(2) Over 1,500 miles of active pipelines Diamond Pipeline from Cushing to Memphis started up in Nov 2017 Marine(2) 51 docks Two Panamax class vessels (joint venture) Wholesale Fuels Marketing Approximately 800 MBPD fuels distribution volume (1)Estimate as of Nov 1, 2017. We are unable to provide a reconciliation of this forward-looking estimate of non-GAAP EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown financing terms, acquisition timing, unanticipated acquisition costs, negotiation of acquisition terms, and other potential variables. Accordingly, a reconciliation is not available without unreasonable effort. (2)Includes assets that have other joint venture or minority interests. Does not include ethanol assets.

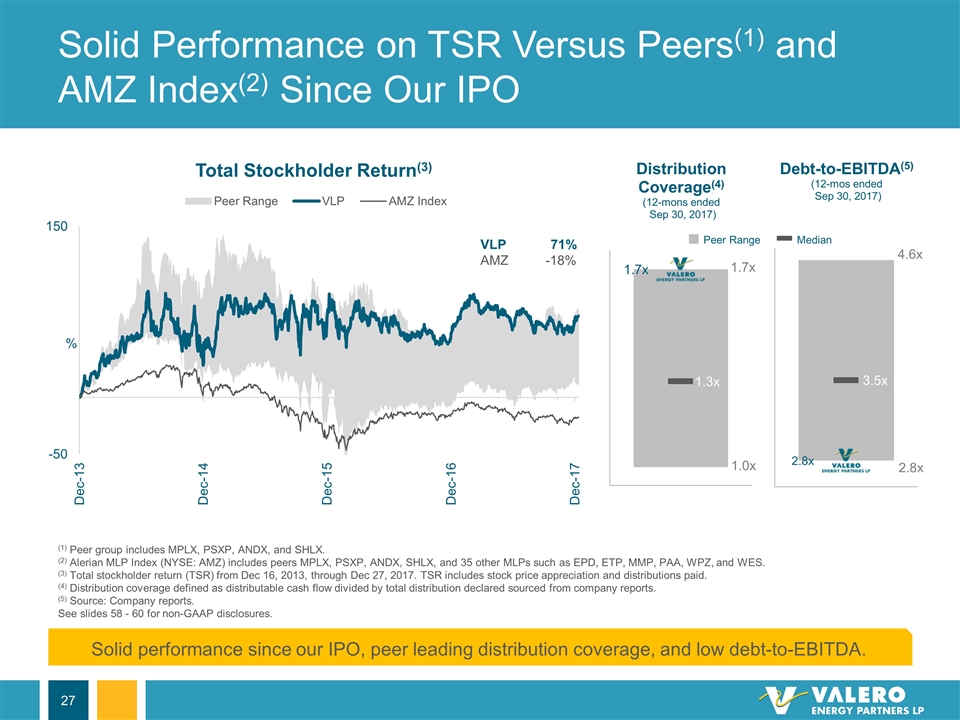

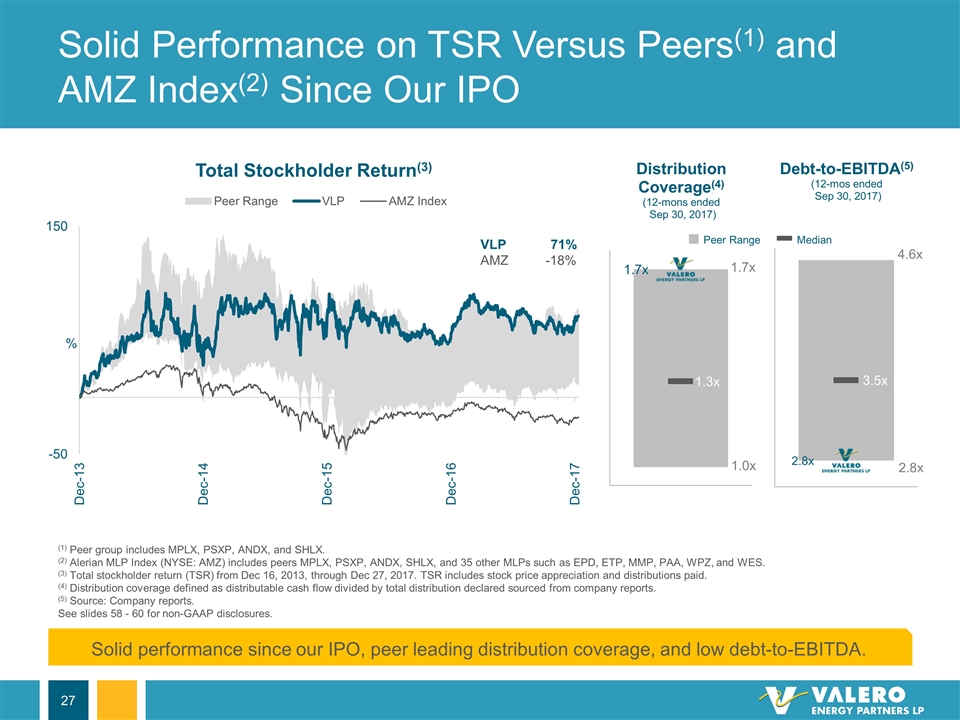

Solid Performance on TSR Versus Peers(1) and AMZ Index(2) Since Our IPO VLP71% AMZ-18% (1) Peer group includes MPLX, PSXP, ANDX, and SHLX. (2) Alerian MLP Index (NYSE: AMZ) includes peers MPLX, PSXP, ANDX, SHLX, and 35 other MLPs such as EPD, ETP, MMP, PAA, WPZ, and WES. (3) Total stockholder return (TSR) from Dec 16, 2013, through Dec 27, 2017. TSR includes stock price appreciation and distributions paid. (4) Distribution coverage defined as distributable cash flow divided by total distribution declared sourced from company reports. (5) Source: Company reports. See slides 58 - 60 for non-GAAP disclosures. Solid performance since our IPO, peer leading distribution coverage, and low debt-to-EBITDA. Peer Range Median

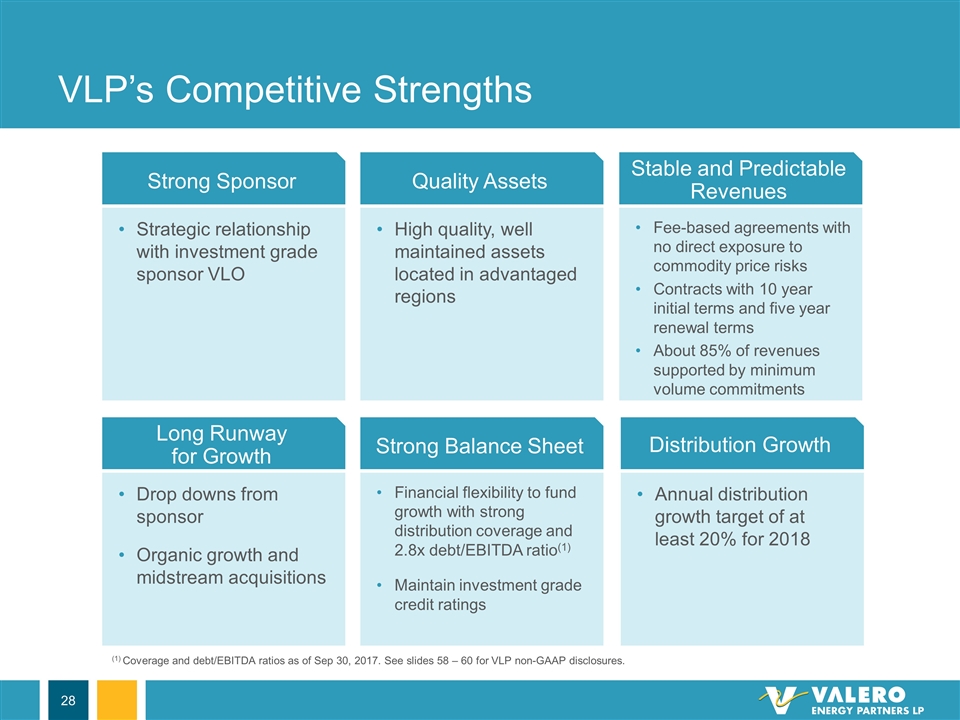

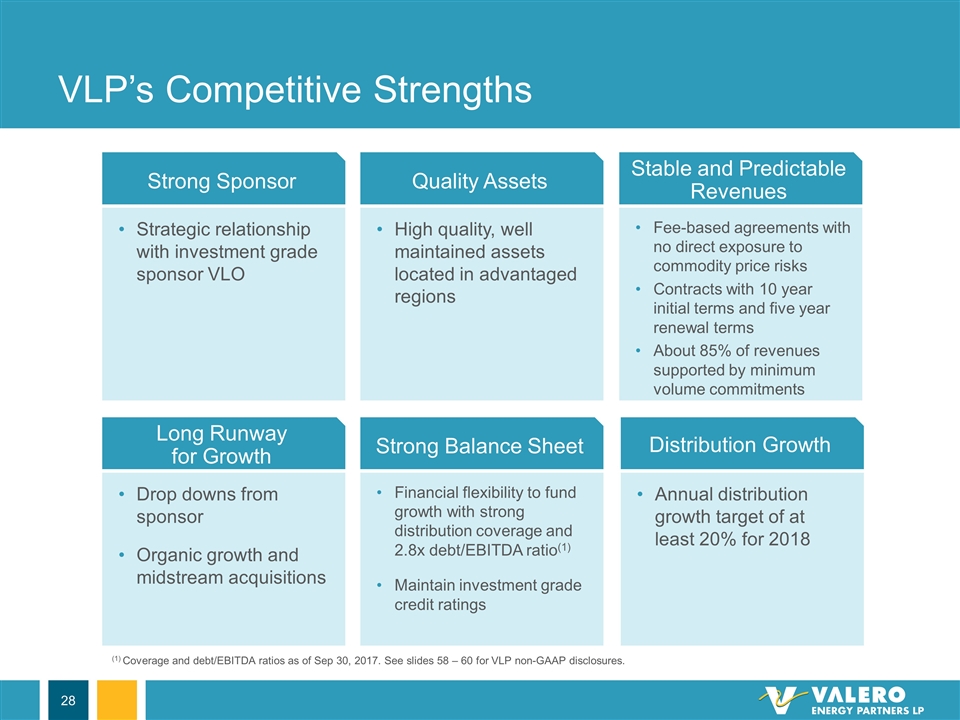

VLP’s Competitive Strengths Strong Sponsor Strategic relationship with investment grade sponsor VLO Quality Assets High quality, well maintained assets located in advantaged regions Stable and Predictable Revenues Fee-based agreements with no direct exposure to commodity price risks Contracts with 10 year initial terms and five year renewal terms About 85% of revenues supported by minimum volume commitments Strong Balance Sheet Financial flexibility to fund growth with strong distribution coverage and 2.8x debt/EBITDA ratio(1) Maintain investment grade credit ratings Long Runway for Growth Drop downs from sponsor Organic growth and midstream acquisitions Distribution Growth Annual distribution growth target of at least 20% for 2018 (1) Coverage and debt/EBITDA ratios as of Sep 30, 2017. See slides 58 – 60 for VLP non-GAAP disclosures.

Appendix Contents Topic Pages Notes 30 Guidance 31 Projects in Execution Phase or Recently Completed 32 – 35 Prior Investments in Light Crude Processing 36 Historical Market Price Drivers 37 Shift in Refining Evaluation 38 Equity Performance, Stockholder Returns, Financial Results 39 – 40 Refining Capacity and Nelson Complexity 41 Natural Gas Cost Sensitivity 42 Crude Oil Pipeline Transportation 43 Fundamentals 44 – 45 VLP Organizational Structure 46 VLP Acquisitions 47 – 51 VLO Non-GAAP Disclosures 52 – 57 VLP Non-GAAP Disclosures 58 – 60 Investor Relations Contacts 61

Notes Slide 5 Macro environment themes represent industry consultant views. Slide 7 Contractor total recordable incident rate from U.S. Bureau of Labor Statistics. Tier 1 three-year rolling averages of process safety events per 20,000 work hours. Tier 1 defined within API Recommended Practice 754. Industry benchmarking and Valero’s performance statistics from Solomon Associates and Valero. Slide 8 Refining cash operating expenses per barrel of throughput, excluding turnaround and D&A, from company reports. Peer group includes PSX, MPC, ANDV, HFC, and PBF. Slide 9 Crude distillation capacities by geographic location from company reports and 10-K filings. Gulf Coast region is consistent with EIA’s PADD 3; Mid-Continent region represents PADDs 2 and 4. Slide 10 Valero’s actual U.S. gasoline and distillate export volumes and current and potential future gasoline and distillate export capacities are shown in the chart. Potential future gasoline and distillate export capacities are based upon expansion opportunities identified at the St. Charles (gasoline and distillate), Port Arthur (gasoline and distillate), Corpus Christi (gasoline), and Texas City (distillate) refineries. Map shows destinations for products exported from VLO refineries in the U.S., Canada, and the U.K. Slide 15 Amounts shown represent targeted EBITDA growth. We are unable to provide a reconciliation of such forward-looking targets because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events are uncertain or outside of our control, including with respect to unknown financing terms, project timing and costs, and other potential variables. Accordingly, a reconciliation is not available without unreasonable effort.

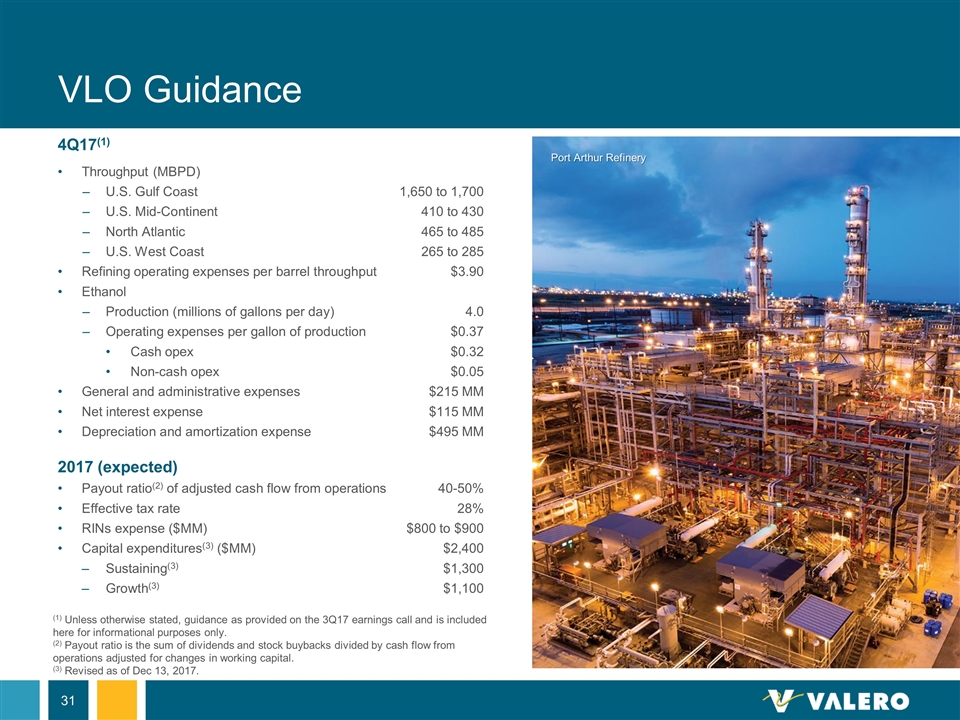

VLO Guidance 4Q17(1) Throughput (MBPD) U.S. Gulf Coast1,650 to 1,700 U.S. Mid-Continent 410 to 430 North Atlantic465 to 485 U.S. West Coast265 to 285 Refining operating expenses per barrel throughput$3.90 Ethanol Production (millions of gallons per day)4.0 Operating expenses per gallon of production$0.37 Cash opex$0.32 Non-cash opex$0.05 General and administrative expenses$215 MM Net interest expense$115 MM Depreciation and amortization expense$495 MM 2017 (expected) Payout ratio(2) of adjusted cash flow from operations40-50% Effective tax rate28% RINs expense ($MM)$800 to $900 Capital expenditures(3) ($MM) $2,400 Sustaining(3)$1,300 Growth(3)$1,100 Port Arthur Refinery (1) Unless otherwise stated, guidance as provided on the 3Q17 earnings call and is included here for informational purposes only. (2) Payout ratio is the sum of dividends and stock buybacks divided by cash flow from operations adjusted for changes in working capital. (3) Revised as of Dec 13, 2017.

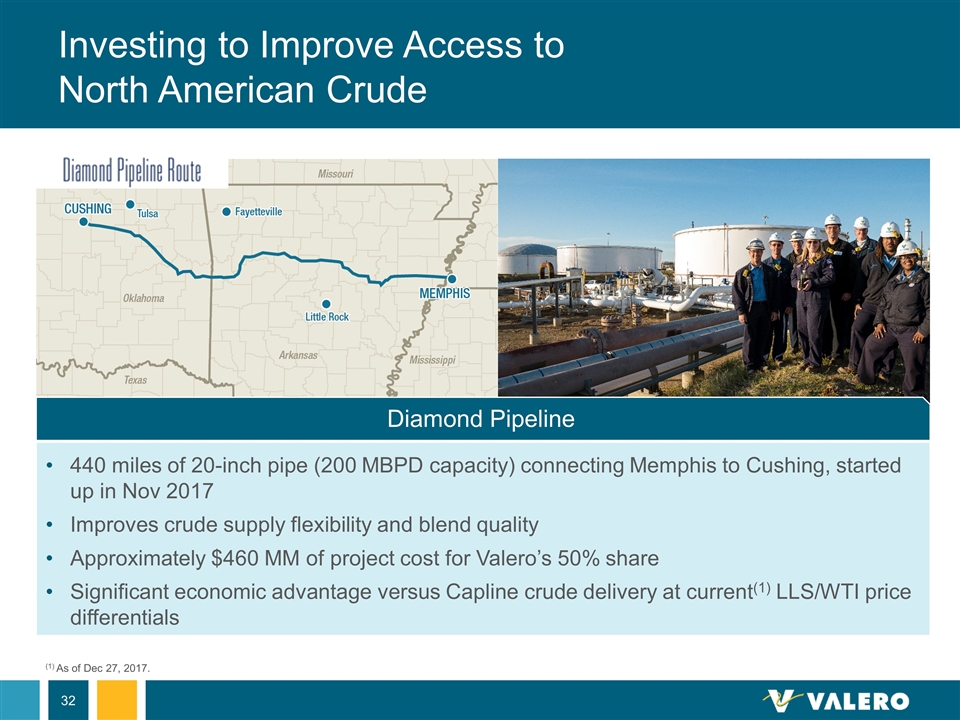

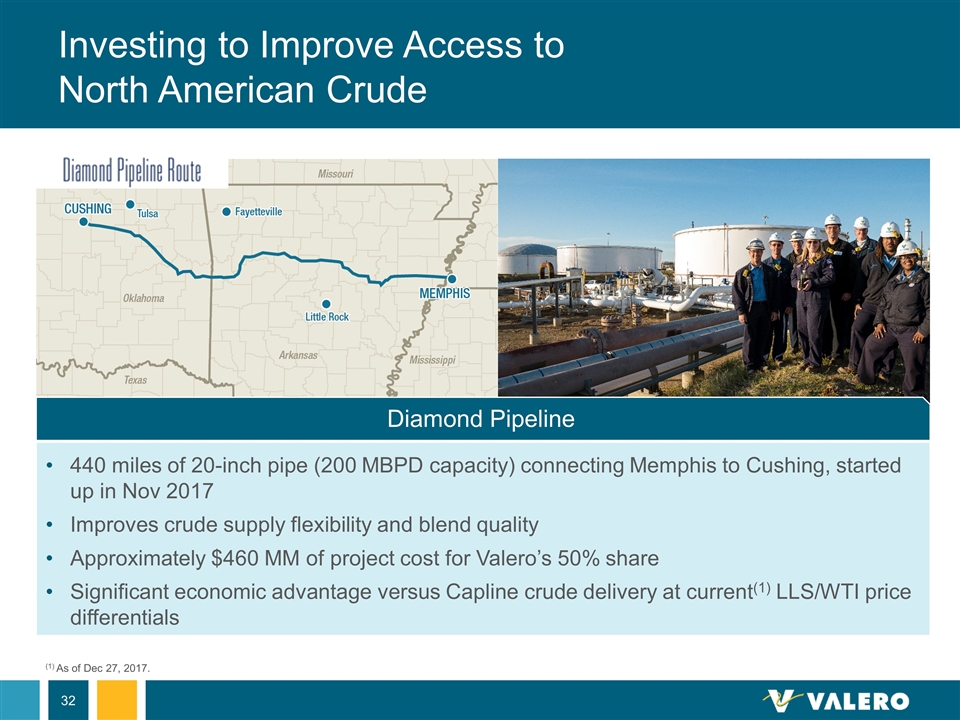

Investing to Improve Access to North American Crude Diamond Pipeline 440 miles of 20-inch pipe (200 MBPD capacity) connecting Memphis to Cushing, started up in Nov 2017 Improves crude supply flexibility and blend quality Approximately $460 MM of project cost for Valero’s 50% share Significant economic advantage versus Capline crude delivery at current(1) LLS/WTI price differentials (1) As of Dec 27, 2017.

Investing to Improve Operating Cost Structure and Margins Started up in Nov 2017 and is running well Expect to reduce costs and improve supply reliability for power and steam $110 MM project cost Wilmington Cogeneration Plant Expect octane demand growth (Tier 3 regulations) Completion expected in 1H19 13 MBPD unit upgrades low value isobutane and amylenes into high value alkylate High octane, low vapor pressure component enables the blending of incremental butane and low octane naphtha Cost-advantaged North American NGL supply $300 MM project cost Houston Alkylation Unit

Investing to Increase Premium Renewable Fuels Production Expect renewable diesel margins to be supported by increased usage mandates and carbon pricing 6 MBPD of additional production capacity expected to be completed in 3Q18 $200 MM project cost, 50% of which is Valero’s portion Evaluating an additional project to expand production capacity to 36 MBPD, or 550 million gallons annually, with final investment decision expected in 2018 Diamond Green Diesel Capacity Expansion

Investing to Improve Margins, Expand Product Export Capability, and Increase Biofuels Blending (1) Valero to own ~70 mile pipeline from Hearne to Williamson County and 40% undivided interest in 135 mile pipeline from Houston to Hearne. Central Texas pipelines and terminals to supply high-growth refined products market Approximately 205 miles of pipe(1), 960 MB of total storage capacity, and a truck rack Pasadena refined products terminal joint venture with Magellan Midstream Partners (NYSE: MMP) Initially includes 5 MM barrels of storage capacity, two ship docks, and a three-bay truck rack Projects expected to improve product margins, reduce secondary costs, provide opportunity for third-party revenues, and increase capability for biofuels blending Valero costs of $380 MM for central Texas logistics and $410 MM for Pasadena terminal, with completion expected in mid-2019 and early 2020, respectively Extending Product Supply Chain in Central Texas and the U.S. Gulf Coast

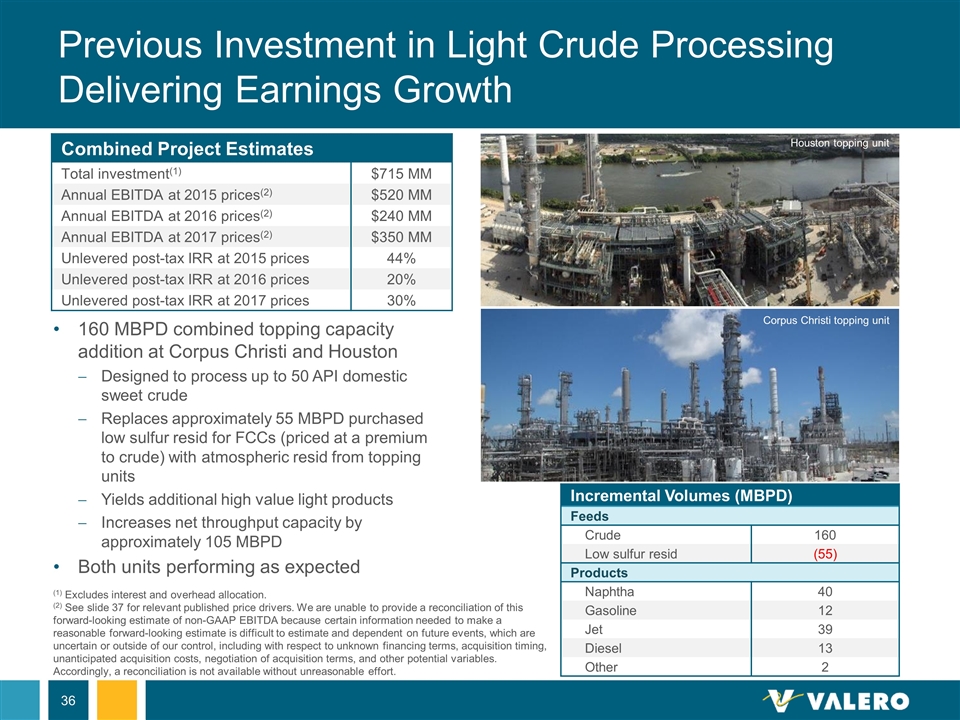

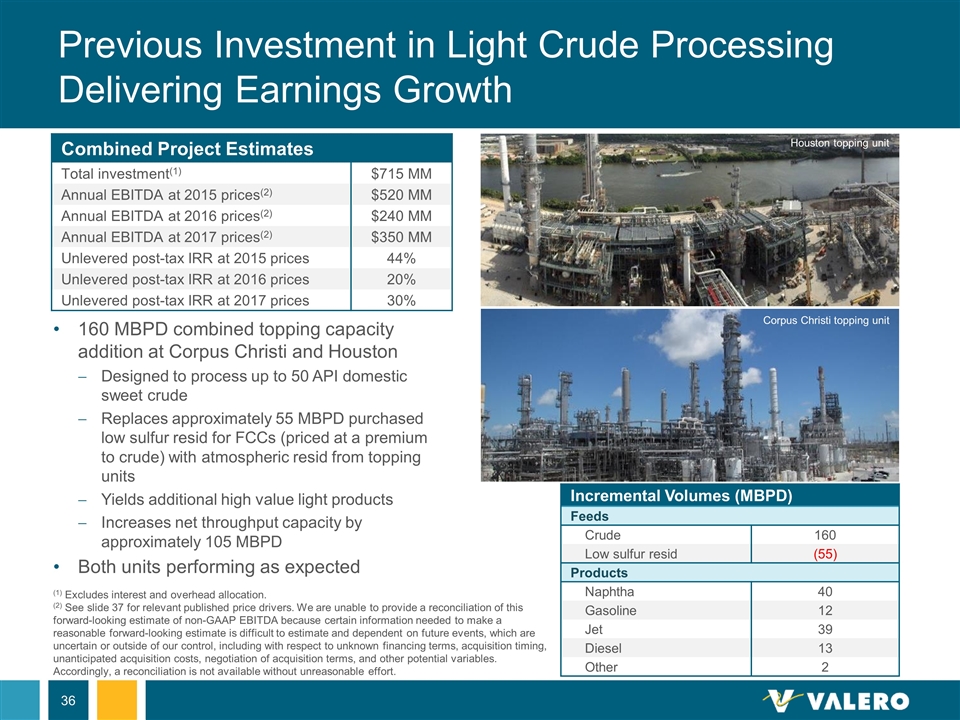

Previous Investment in Light Crude Processing Delivering Earnings Growth 160 MBPD combined topping capacity addition at Corpus Christi and Houston Designed to process up to 50 API domestic sweet crude Replaces approximately 55 MBPD purchased low sulfur resid for FCCs (priced at a premium to crude) with atmospheric resid from topping units Yields additional high value light products Increases net throughput capacity by approximately 105 MBPD Both units performing as expected Combined Project Estimates Total investment(1) $715 MM Annual EBITDA at 2015 prices(2) $520 MM Annual EBITDA at 2016 prices(2) $240 MM Annual EBITDA at 2017 prices(2) $350 MM Unlevered post-tax IRR at 2015 prices 44% Unlevered post-tax IRR at 2016 prices 20% Unlevered post-tax IRR at 2017 prices 30% (1) Excludes interest and overhead allocation. (2) See slide 37 for relevant published price drivers. We are unable to provide a reconciliation of this forward-looking estimate of non-GAAP EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown financing terms, acquisition timing, unanticipated acquisition costs, negotiation of acquisition terms, and other potential variables. Accordingly, a reconciliation is not available without unreasonable effort. Incremental Volumes (MBPD) Feeds Crude 160 Low sulfur resid (55) Products Naphtha 40 Gasoline 12 Jet 39 Diesel 13 Other 2 Houston topping unit Corpus Christi topping unit

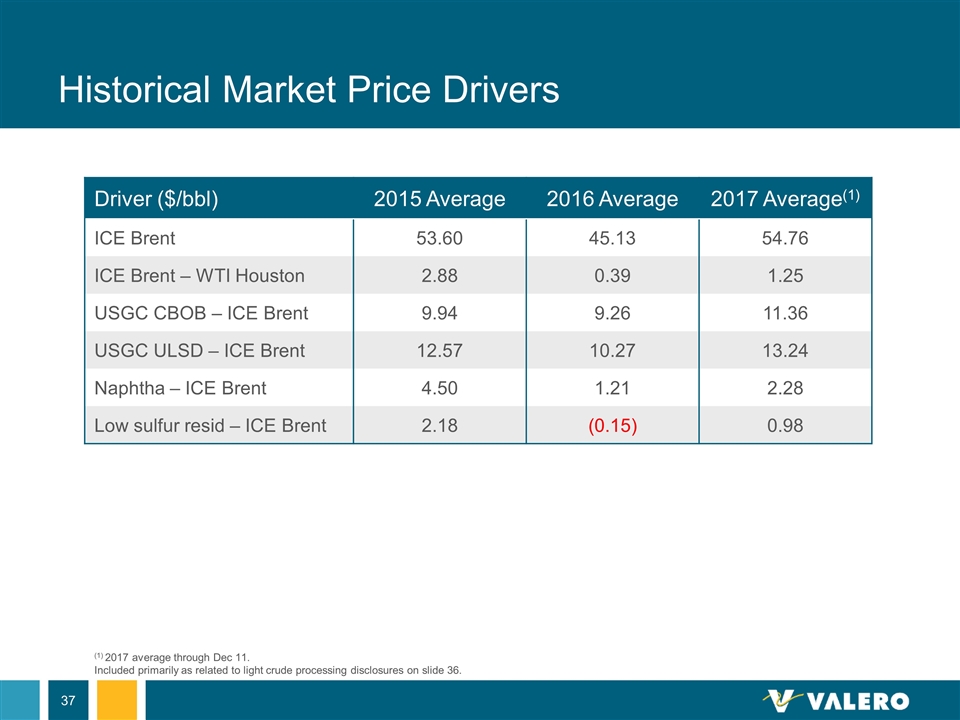

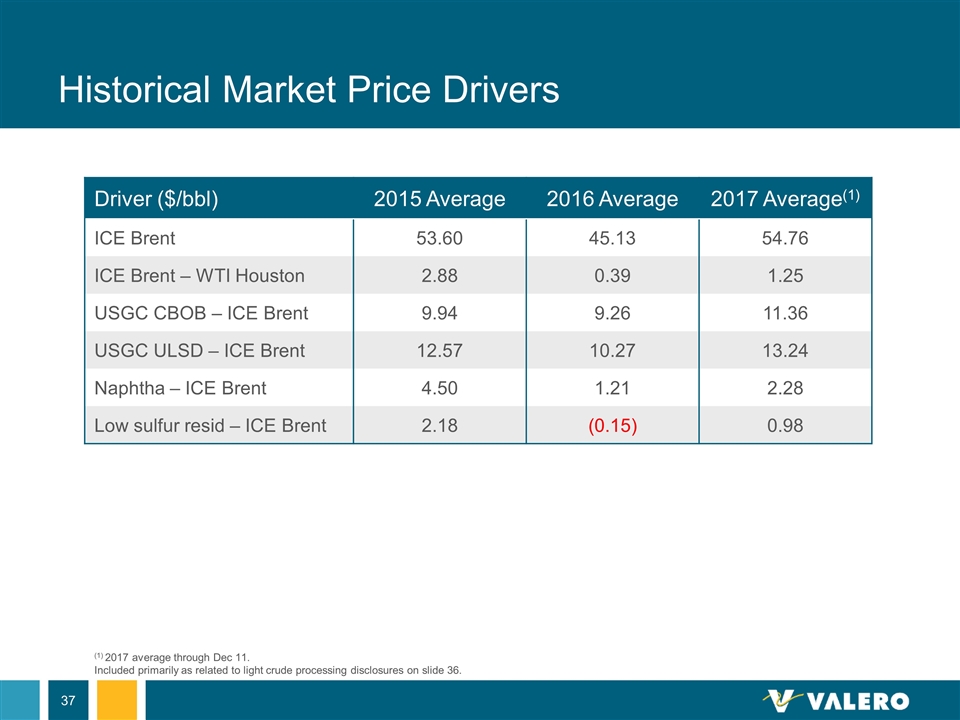

Historical Market Price Drivers Driver ($/bbl) 2015 Average 2016 Average 2017 Average(1) ICE Brent 53.60 45.13 54.76 ICE Brent – WTI Houston 2.88 0.39 1.25 USGC CBOB – ICE Brent 9.94 9.26 11.36 USGC ULSD – ICE Brent 12.57 10.27 13.24 Naphtha – ICE Brent 4.50 1.21 2.28 Low sulfur resid – ICE Brent 2.18 (0.15) 0.98 (1) 2017 average through Dec 11. Included primarily as related to light crude processing disclosures on slide 36.

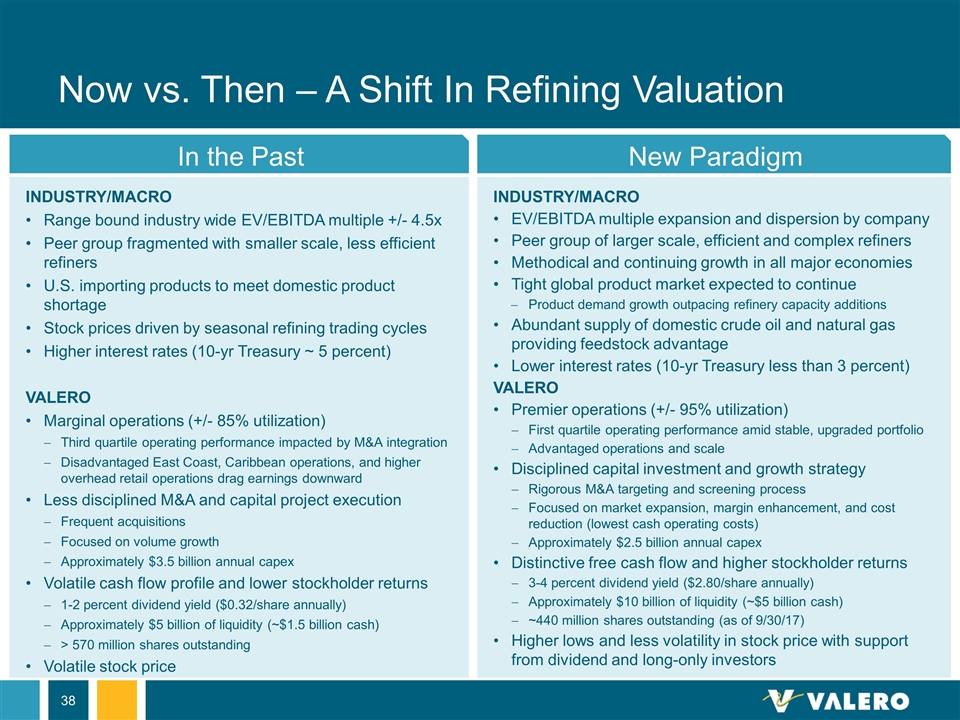

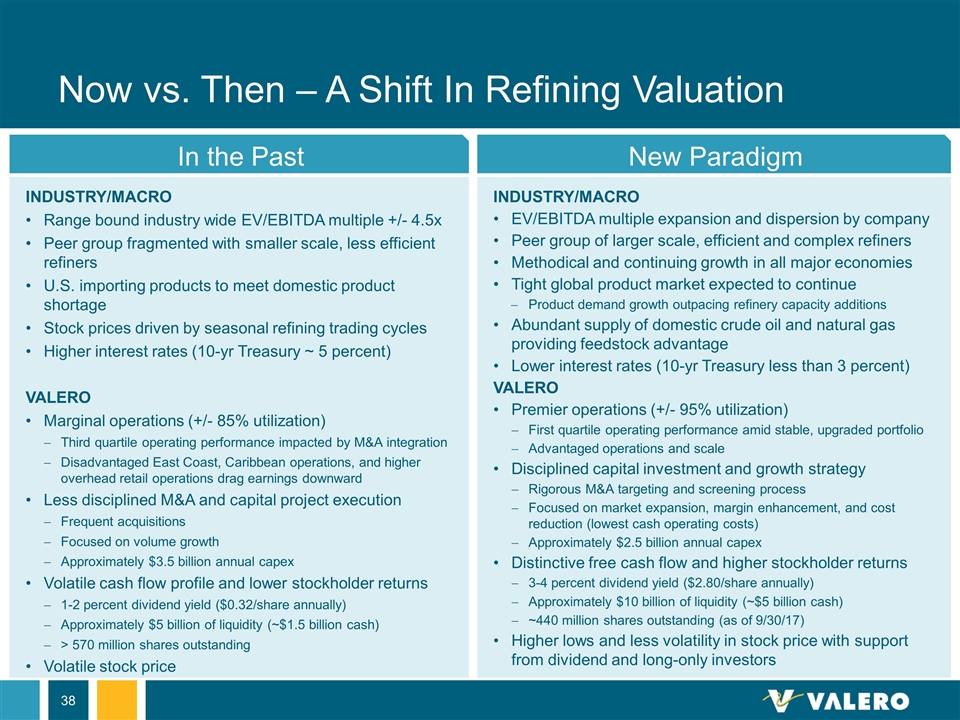

Now vs. Then – A Shift In Refining Valuation New Paradigm INDUSTRY/MACRO EV/EBITDA multiple expansion and dispersion by company Peer group of larger scale, efficient and complex refiners Methodical and continuing growth in all major economies Tight global product market expected to continue Product demand growth outpacing refinery capacity additions Abundant supply of domestic crude oil and natural gas providing feedstock advantage Lower interest rates (10-yr Treasury less than 3 percent) VALERO Premier operations (+/- 95% utilization) First quartile operating performance amid stable, upgraded portfolio Advantaged operations and scale Disciplined capital investment and growth strategy Rigorous M&A targeting and screening process Focused on market expansion, margin enhancement, and cost reduction (lowest cash operating costs) Approximately $2.5 billion annual capex Distinctive free cash flow and higher stockholder returns 3-4 percent dividend yield ($2.80/share annually) Approximately $10 billion of liquidity (~$5 billion cash) ~440 million shares outstanding (as of 9/30/17) Higher lows and less volatility in stock price with support from dividend and long-only investors In the Past INDUSTRY/MACRO Range bound industry wide EV/EBITDA multiple +/- 4.5x Peer group fragmented with smaller scale, less efficient refiners U.S. importing products to meet domestic product shortage Stock prices driven by seasonal refining trading cycles Higher interest rates (10-yr Treasury ~ 5 percent) VALERO Marginal operations (+/- 85% utilization) Third quartile operating performance impacted by M&A integration Disadvantaged East Coast, Caribbean operations, and higher overhead retail operations drag earnings downward Less disciplined M&A and capital project execution Frequent acquisitions Focused on volume growth Approximately $3.5 billion annual capex Volatile cash flow profile and lower stockholder returns 1-2 percent dividend yield ($0.32/share annually) Approximately $5 billion of liquidity (~$1.5 billion cash) > 570 million shares outstanding Volatile stock price

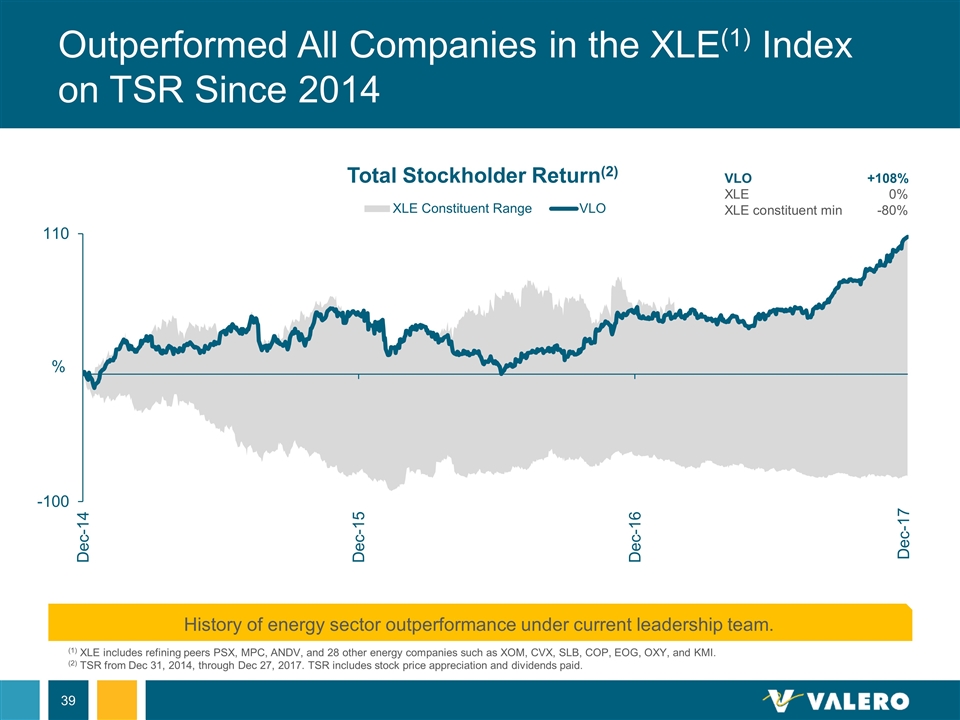

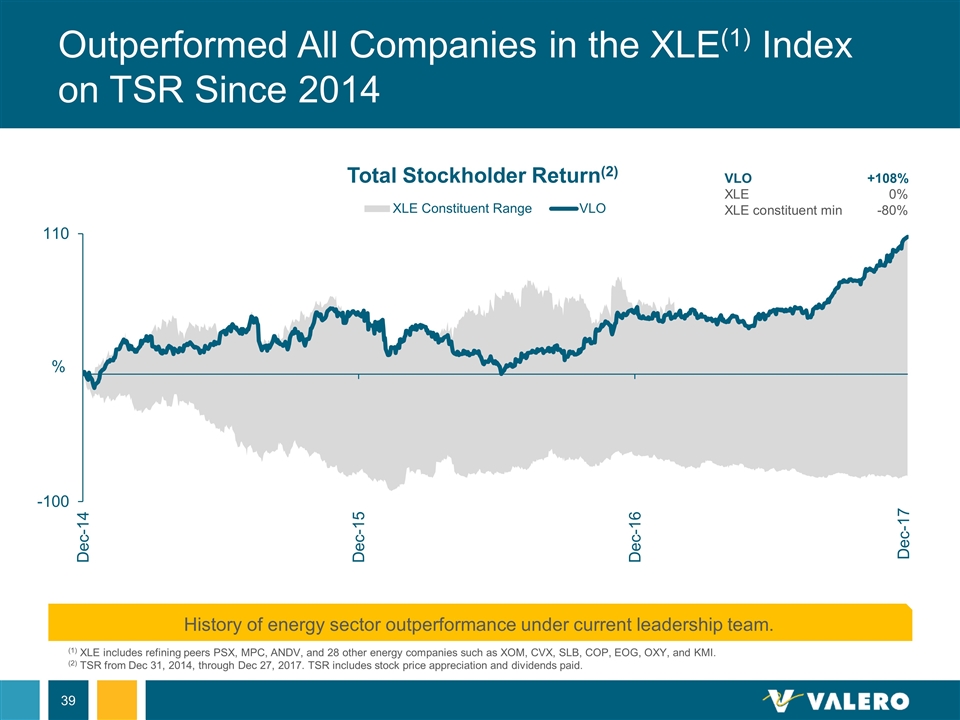

Outperformed All Companies in the XLE(1) Index on TSR Since 2014 (1) XLE includes refining peers PSX, MPC, ANDV, and 28 other energy companies such as XOM, CVX, SLB, COP, EOG, OXY, and KMI. (2) TSR from Dec 31, 2014, through Dec 27, 2017. TSR includes stock price appreciation and dividends paid. VLO +108% XLE0% XLE constituent min -80% History of energy sector outperformance under current leadership team. Dec-17

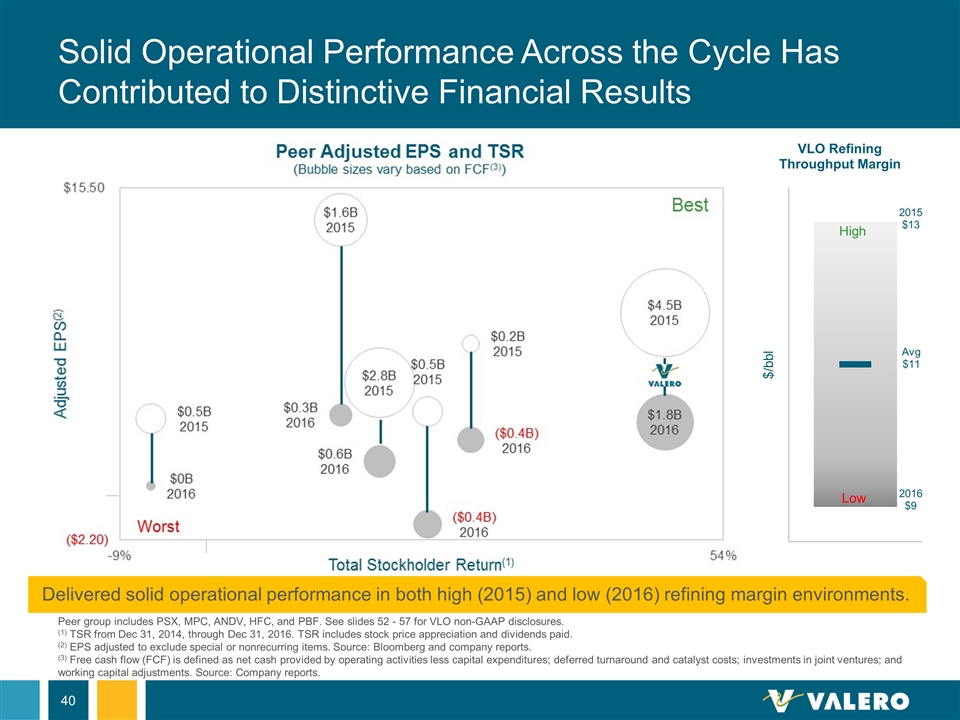

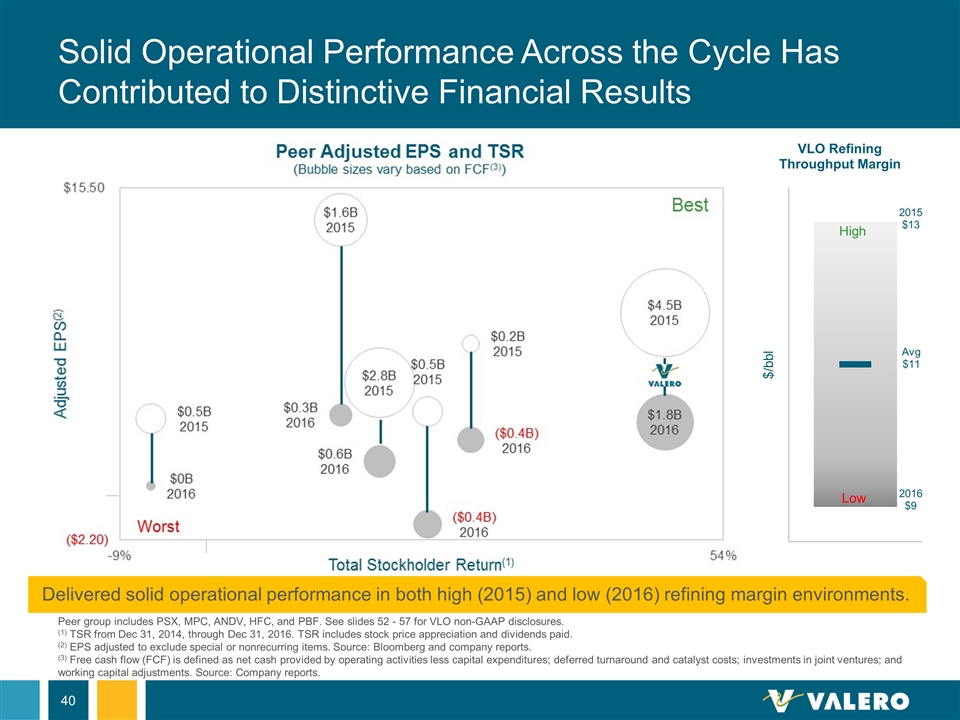

Solid Operational Performance Across the Cycle Has Contributed to Distinctive Financial Results Peer group includes PSX, MPC, ANDV, HFC, and PBF. See slides 52 - 57 for VLO non-GAAP disclosures. (1) TSR from Dec 31, 2014, through Dec 31, 2016. TSR includes stock price appreciation and dividends paid. (2) EPS adjusted to exclude special or nonrecurring items. Source: Bloomberg and company reports. (3) Free cash flow (FCF) is defined as net cash provided by operating activities less capital expenditures; deferred turnaround and catalyst costs; investments in joint ventures; and working capital adjustments. Source: Company reports. Delivered solid operational performance in both high (2015) and low (2016) refining margin environments. Low High

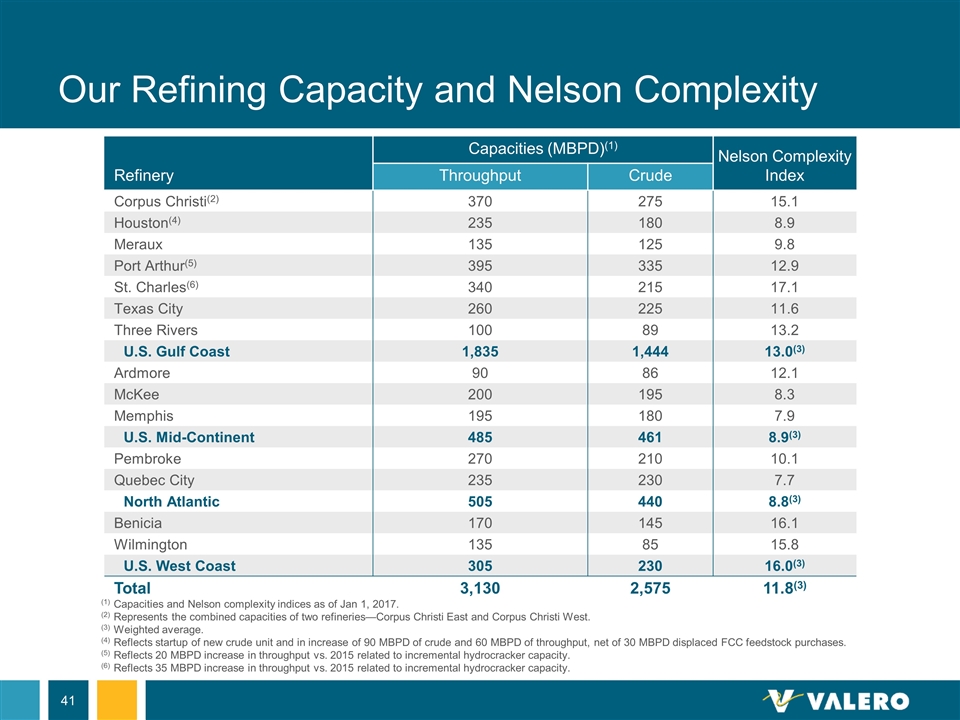

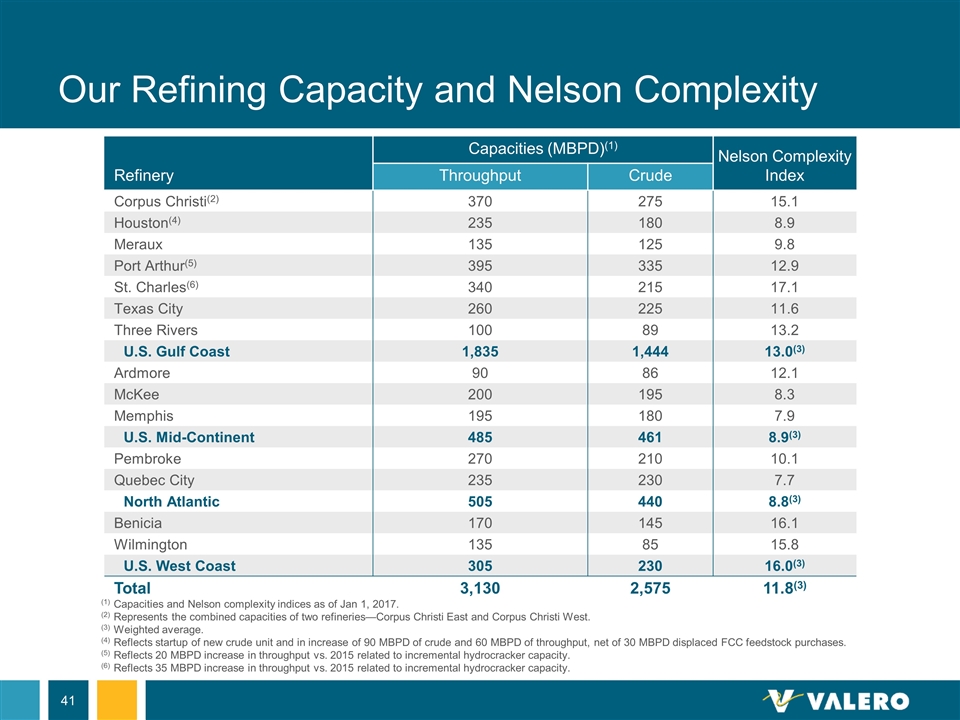

Our Refining Capacity and Nelson Complexity Refinery Capacities (MBPD)(1) Nelson Complexity Index Throughput Crude Corpus Christi(2) 370 275 15.1 Houston(4) 235 180 8.9 Meraux 135 125 9.8 Port Arthur(5) 395 335 12.9 St. Charles(6) 340 215 17.1 Texas City 260 225 11.6 Three Rivers 100 89 13.2 U.S. Gulf Coast 1,835 1,444 13.0(3) Ardmore 90 86 12.1 McKee 200 195 8.3 Memphis 195 180 7.9 U.S. Mid-Continent 485 461 8.9(3) Pembroke 270 210 10.1 Quebec City 235 230 7.7 North Atlantic 505 440 8.8(3) Benicia 170 145 16.1 Wilmington 135 85 15.8 U.S. West Coast 305 230 16.0(3) Total 3,130 2,575 11.8(3) (1)Capacities and Nelson complexity indices as of Jan 1, 2017. (2)Represents the combined capacities of two refineries—Corpus Christi East and Corpus Christi West. (3)Weighted average. (4)Reflects startup of new crude unit and in increase of 90 MBPD of crude and 60 MBPD of throughput, net of 30 MBPD displaced FCC feedstock purchases. (5)Reflects 20 MBPD increase in throughput vs. 2015 related to incremental hydrocracker capacity. (6)Reflects 35 MBPD increase in throughput vs. 2015 related to incremental hydrocracker capacity.

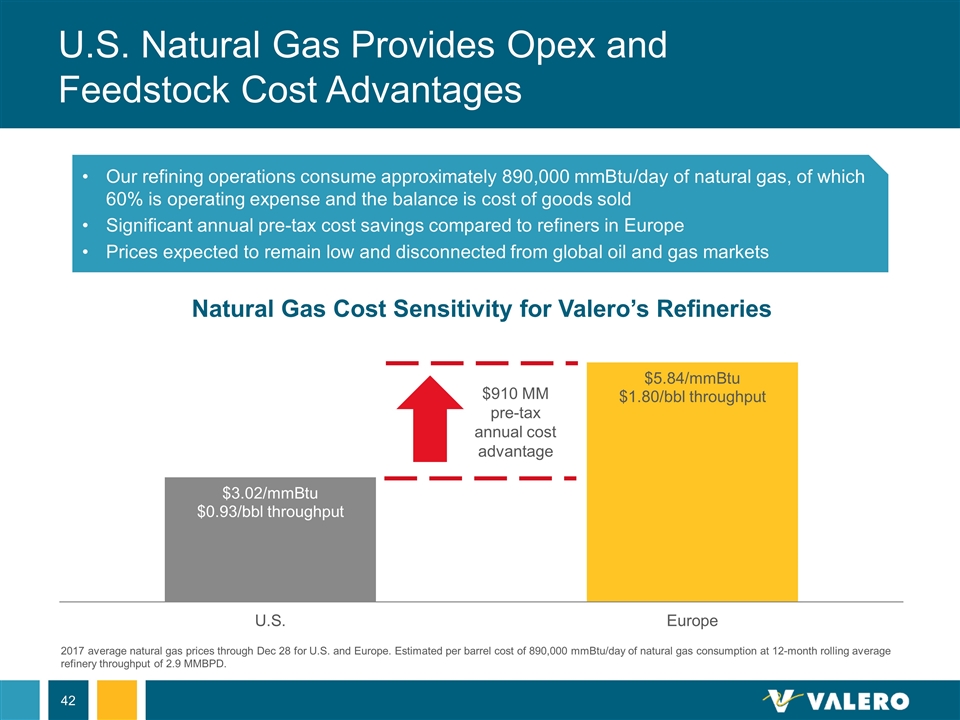

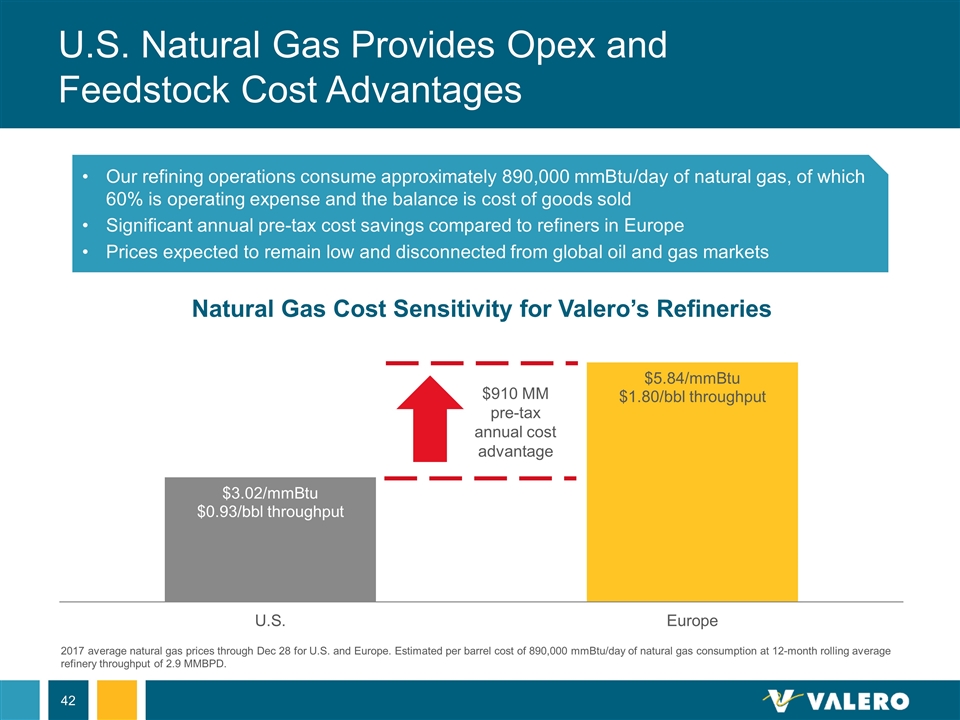

U.S. Natural Gas Provides Opex and Feedstock Cost Advantages 2017 average natural gas prices through Dec 28 for U.S. and Europe. Estimated per barrel cost of 890,000 mmBtu/day of natural gas consumption at 12-month rolling average refinery throughput of 2.9 MMBPD. $910 MM pre-tax annual cost advantage Our refining operations consume approximately 890,000 mmBtu/day of natural gas, of which 60% is operating expense and the balance is cost of goods sold Significant annual pre-tax cost savings compared to refiners in Europe Prices expected to remain low and disconnected from global oil and gas markets

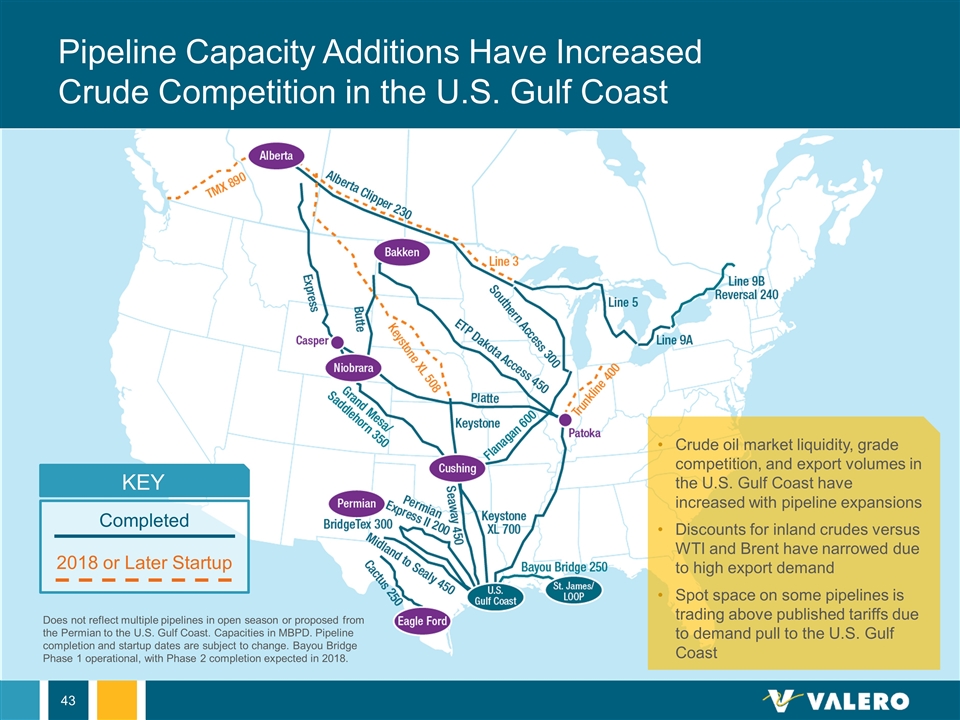

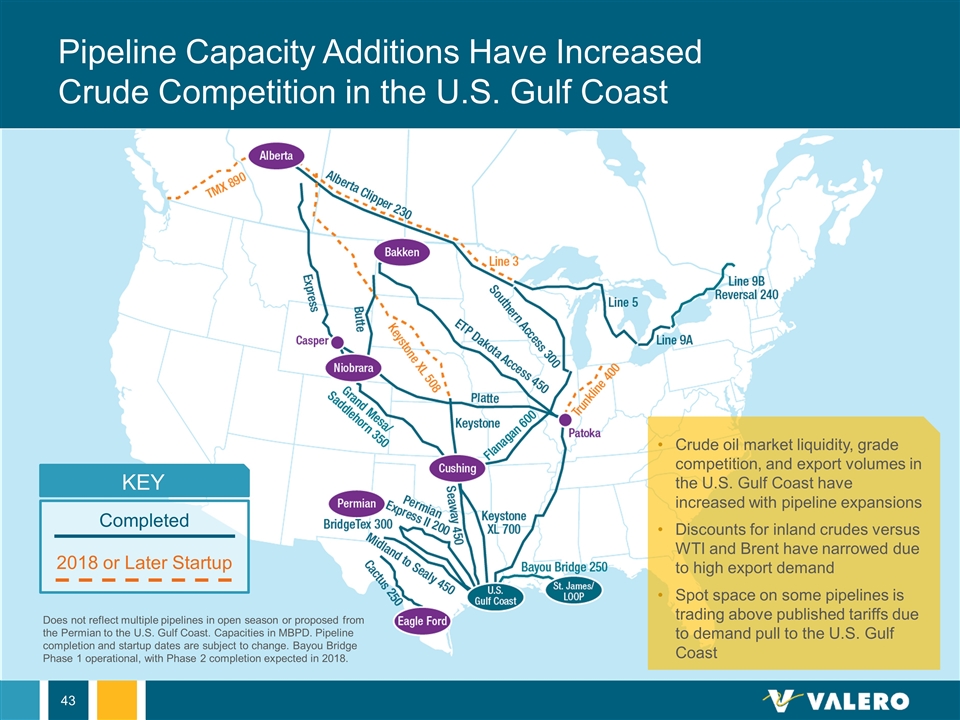

Pipeline Capacity Additions Have Increased Crude Competition in the U.S. Gulf Coast KEY Does not reflect multiple pipelines in open season or proposed from the Permian to the U.S. Gulf Coast. Capacities in MBPD. Pipeline completion and startup dates are subject to change. Bayou Bridge Phase 1 operational, with Phase 2 completion expected in 2018. Completed 2018 or Later Startup Crude oil market liquidity, grade competition, and export volumes in the U.S. Gulf Coast have increased with pipeline expansions Discounts for inland crudes versus WTI and Brent have narrowed due to high export demand Spot space on some pipelines is trading above published tariffs due to demand pull to the U.S. Gulf Coast

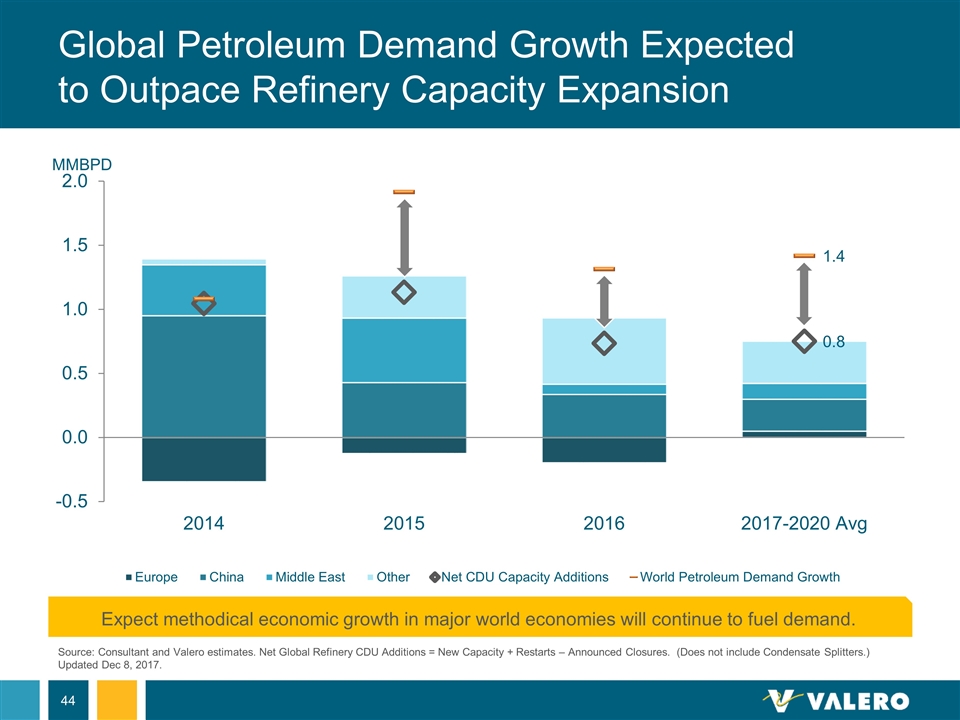

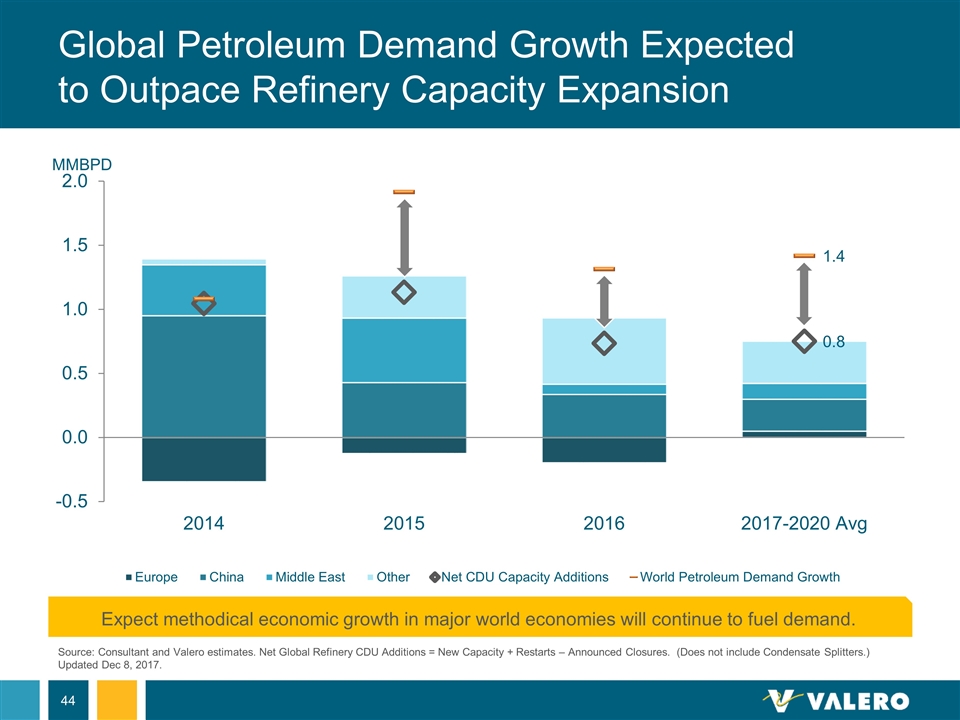

Source: Consultant and Valero estimates. Net Global Refinery CDU Additions = New Capacity + Restarts – Announced Closures. (Does not include Condensate Splitters.) Updated Dec 8, 2017. Global Petroleum Demand Growth Expected to Outpace Refinery Capacity Expansion Expect methodical economic growth in major world economies will continue to fuel demand.

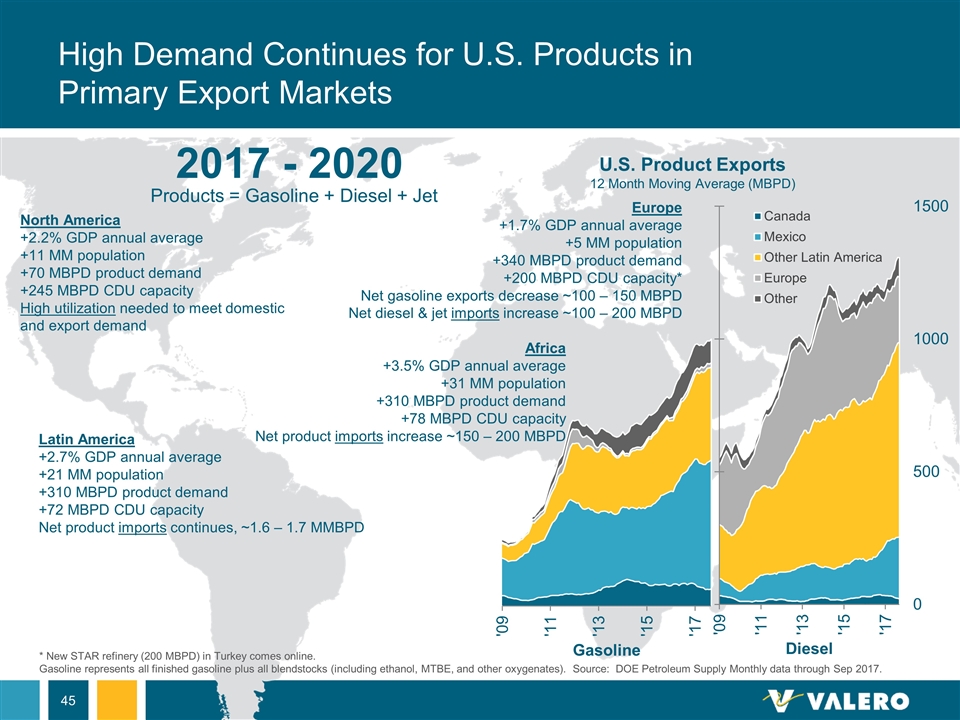

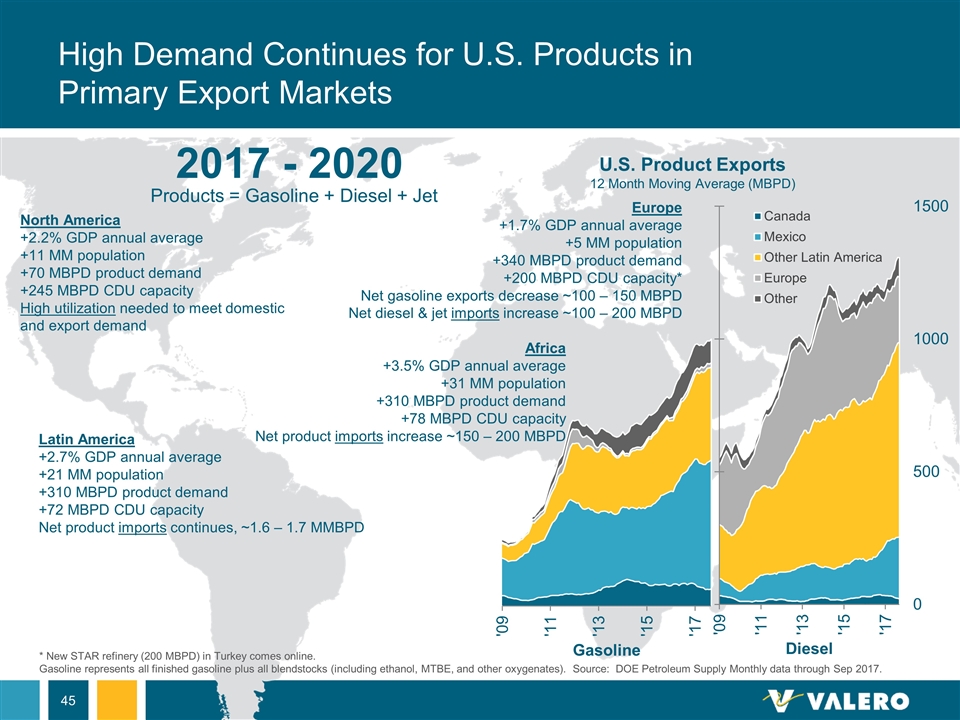

High Demand Continues for U.S. Products in Primary Export Markets North America +2.2% GDP annual average +11 MM population +70 MBPD product demand +245 MBPD CDU capacity High utilization needed to meet domestic and export demand Latin America +2.7% GDP annual average +21 MM population +310 MBPD product demand +72 MBPD CDU capacity Net product imports continues, ~1.6 – 1.7 MMBPD Europe +1.7% GDP annual average +5 MM population +340 MBPD product demand +200 MBPD CDU capacity* Net gasoline exports decrease ~100 – 150 MBPD Net diesel & jet imports increase ~100 – 200 MBPD Africa +3.5% GDP annual average +31 MM population +310 MBPD product demand +78 MBPD CDU capacity Net product imports increase ~150 – 200 MBPD 2017 - 2020 Products = Gasoline + Diesel + Jet * New STAR refinery (200 MBPD) in Turkey comes online. Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates). Source: DOE Petroleum Supply Monthly data through Sep 2017. U.S. Product Exports 12 Month Moving Average (MBPD)

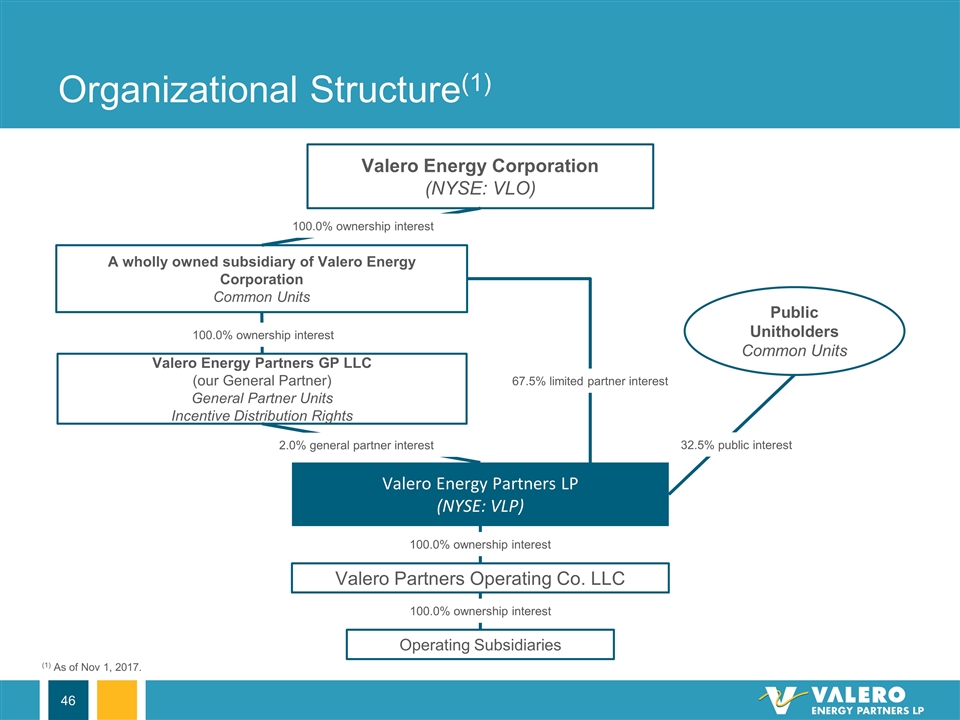

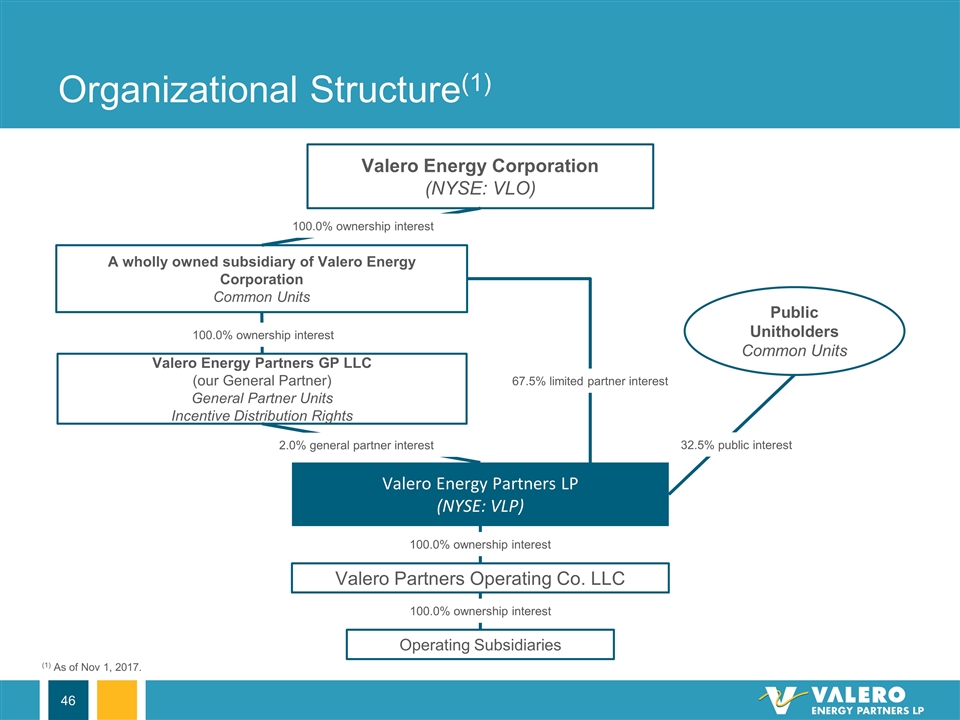

Organizational Structure(1) Valero Energy Corporation (NYSE: VLO) A wholly owned subsidiary of Valero Energy Corporation Common Units Valero Energy Partners GP LLC (our General Partner) General Partner Units Incentive Distribution Rights Valero Energy Partners LP (NYSE: VLP) Valero Partners Operating Co. LLC 67.5% limited partner interest 100.0% ownership interest 100.0% ownership interest 2.0% general partner interest Public Unitholders Common Units 100.0% ownership interest Operating Subsidiaries 32.5% public interest 100.0% ownership interest (1) As of Nov 1, 2017.

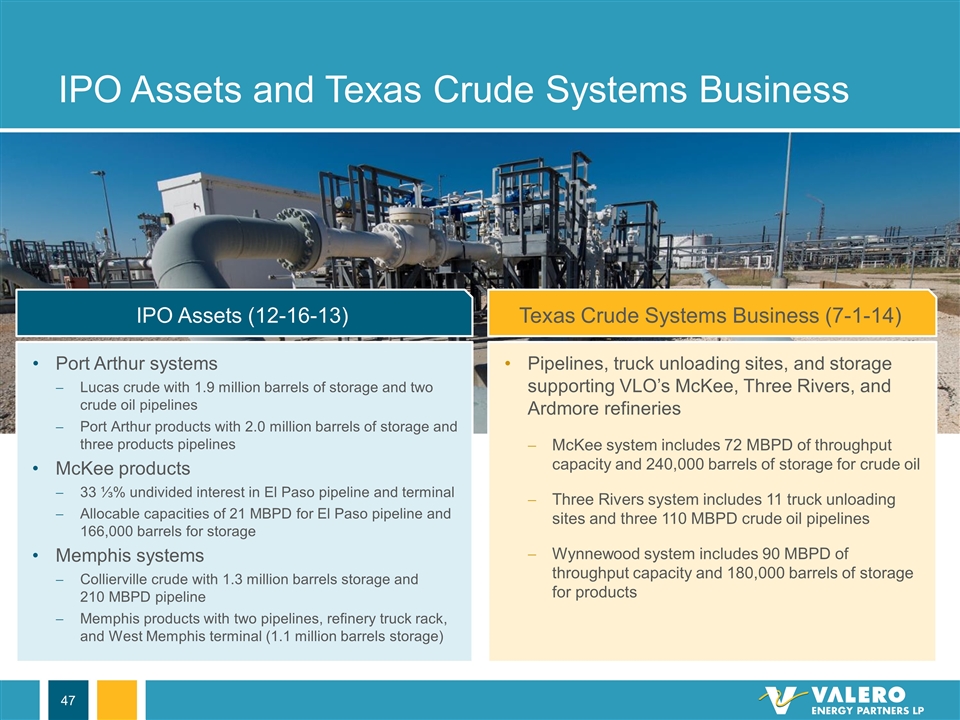

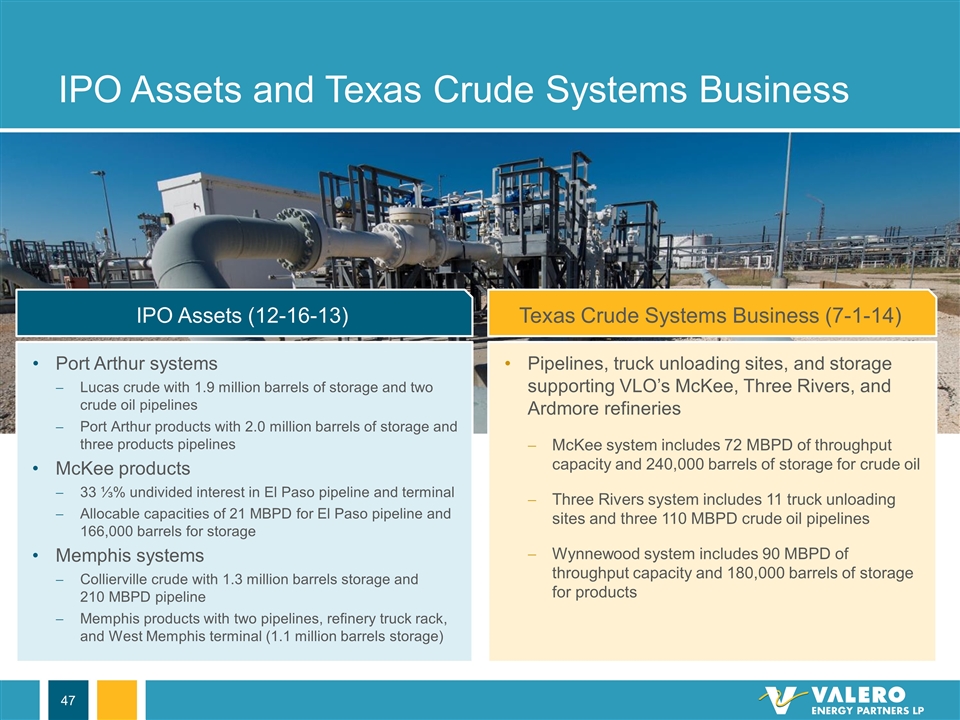

IPO Assets and Texas Crude Systems Business Texas Crude Systems Business (7-1-14) Pipelines, truck unloading sites, and storage supporting VLO’s McKee, Three Rivers, and Ardmore refineries McKee system includes 72 MBPD of throughput capacity and 240,000 barrels of storage for crude oil Three Rivers system includes 11 truck unloading sites and three 110 MBPD crude oil pipelines Wynnewood system includes 90 MBPD of throughput capacity and 180,000 barrels of storage for products IPO Assets (12-16-13) Port Arthur systems Lucas crude with 1.9 million barrels of storage and two crude oil pipelines Port Arthur products with 2.0 million barrels of storage and three products pipelines McKee products 33 ⅓% undivided interest in El Paso pipeline and terminal Allocable capacities of 21 MBPD for El Paso pipeline and 166,000 barrels for storage Memphis systems Collierville crude with 1.3 million barrels storage and 210 MBPD pipeline Memphis products with two pipelines, refinery truck rack, and West Memphis terminal (1.1 million barrels storage)

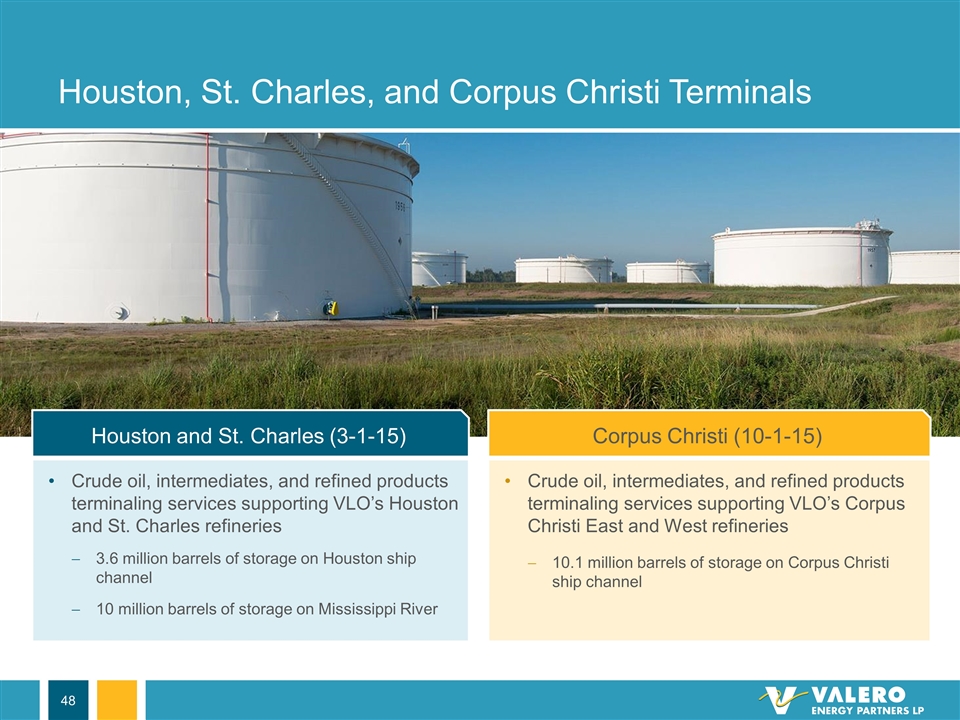

Houston, St. Charles, and Corpus Christi Terminals Corpus Christi (10-1-15) Crude oil, intermediates, and refined products terminaling services supporting VLO’s Corpus Christi East and West refineries 10.1 million barrels of storage on Corpus Christi ship channel Houston and St. Charles (3-1-15) Crude oil, intermediates, and refined products terminaling services supporting VLO’s Houston and St. Charles refineries 3.6 million barrels of storage on Houston ship channel 10 million barrels of storage on Mississippi River

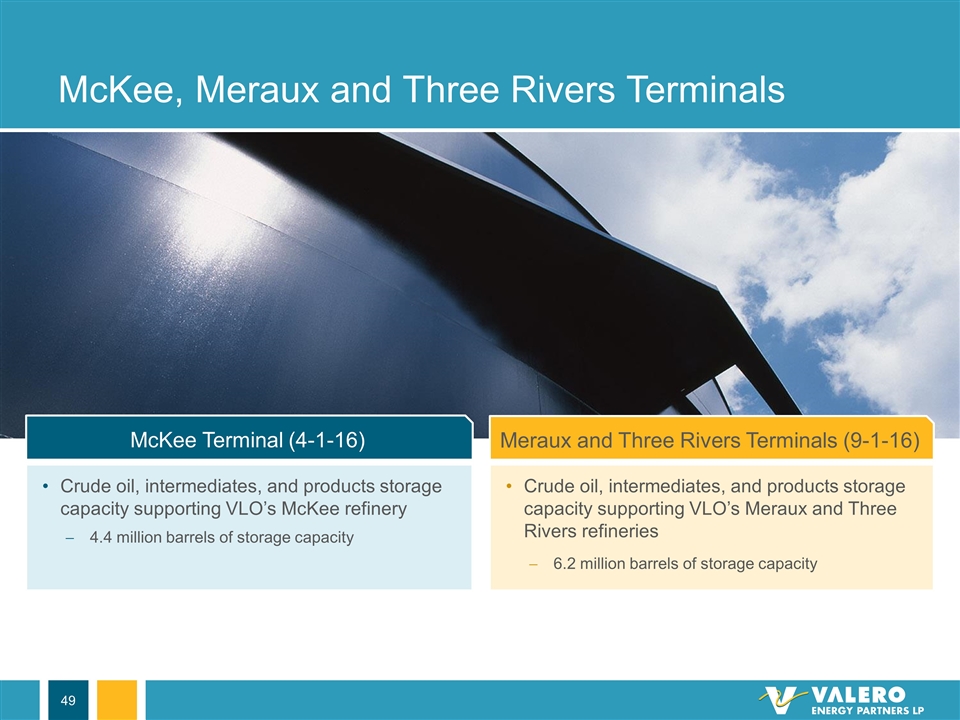

McKee, Meraux and Three Rivers Terminals Meraux and Three Rivers Terminals (9-1-16) Crude oil, intermediates, and products storage capacity supporting VLO’s Meraux and Three Rivers refineries 6.2 million barrels of storage capacity McKee Terminal (4-1-16) Crude oil, intermediates, and products storage capacity supporting VLO’s McKee refinery 4.4 million barrels of storage capacity

Red River Pipeline Red River Pipeline (1-18-17) 40% undivided interest in Hewitt segment of Red River Pipeline supporting VLO’s Ardmore refinery with a connection from Hewitt to Wasson 138 miles of newly constructed 16-inch crude oil pipeline with 150,000 barrels per day of capacity Two 150,000 barrel capacity storage tanks at Hewitt Station that are 100% dedicated to VLP Long term contract with MVC that protects over 90% of forecasted revenue

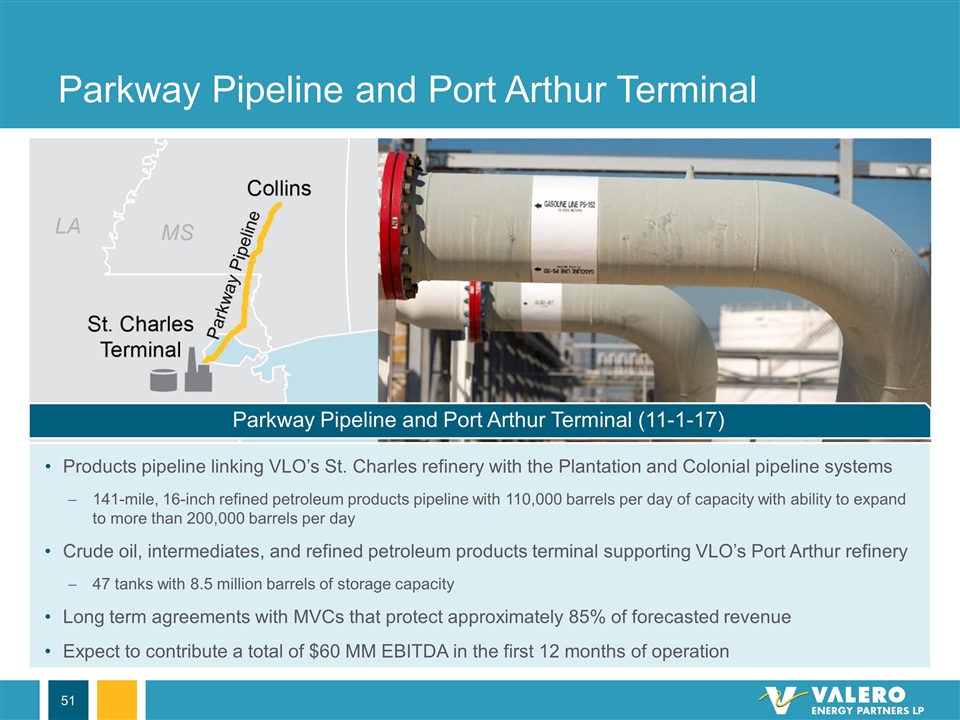

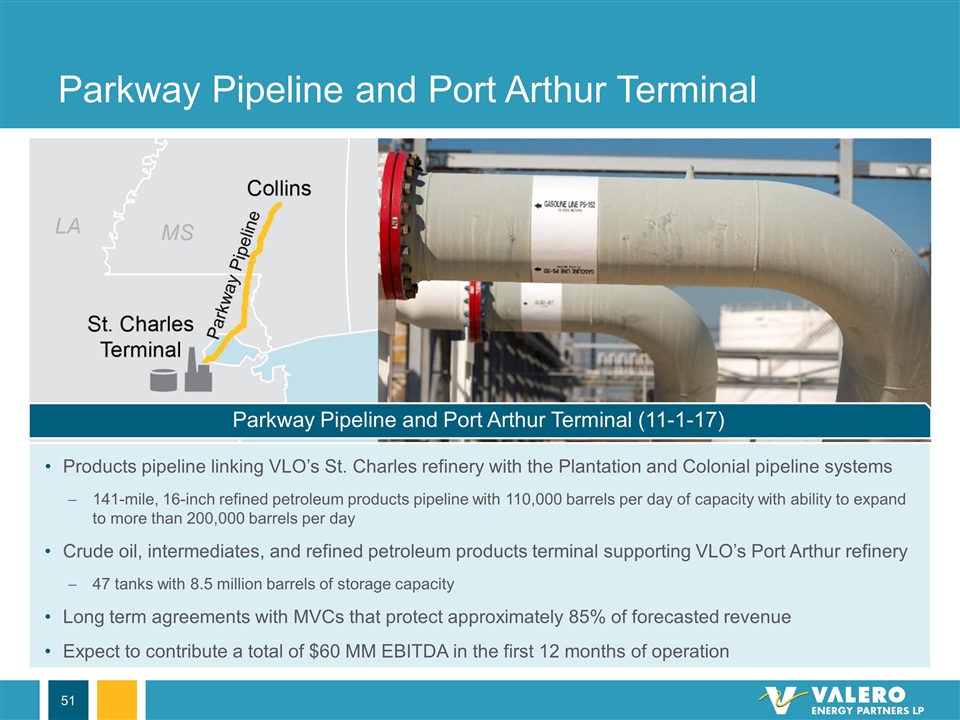

Parkway Pipeline and Port Arthur Terminal Parkway Pipeline and Port Arthur Terminal (11-1-17) Products pipeline linking VLO’s St. Charles refinery with the Plantation and Colonial pipeline systems 141-mile, 16-inch refined petroleum products pipeline with 110,000 barrels per day of capacity with ability to expand to more than 200,000 barrels per day Crude oil, intermediates, and refined petroleum products terminal supporting VLO’s Port Arthur refinery 47 tanks with 8.5 million barrels of storage capacity Long term agreements with MVCs that protect approximately 85% of forecasted revenue Expect to contribute a total of $60 MM EBITDA in the first 12 months of operation

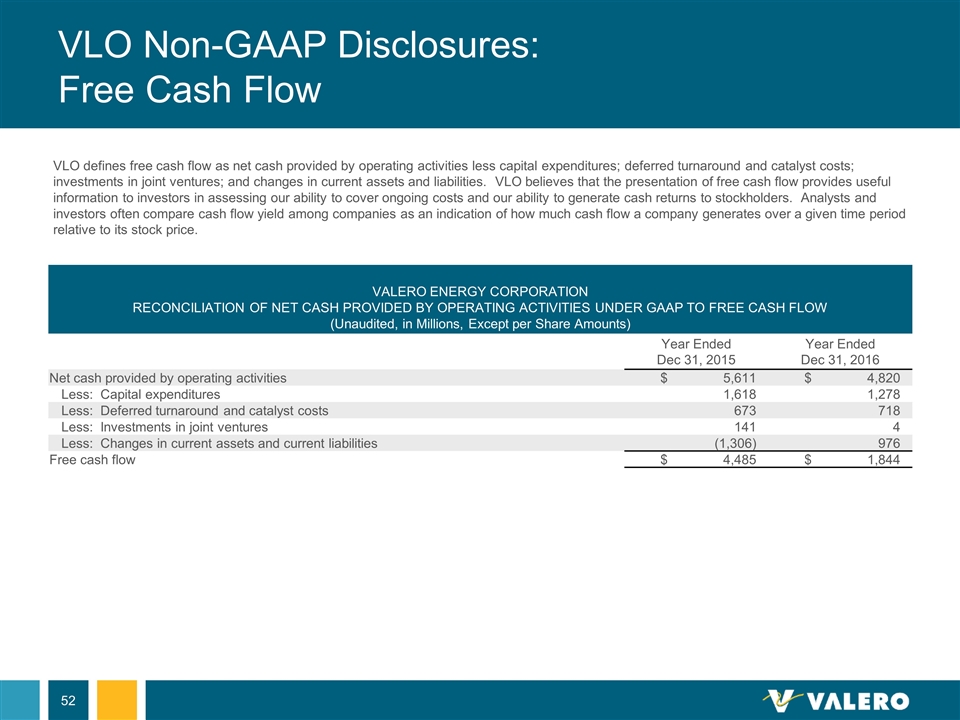

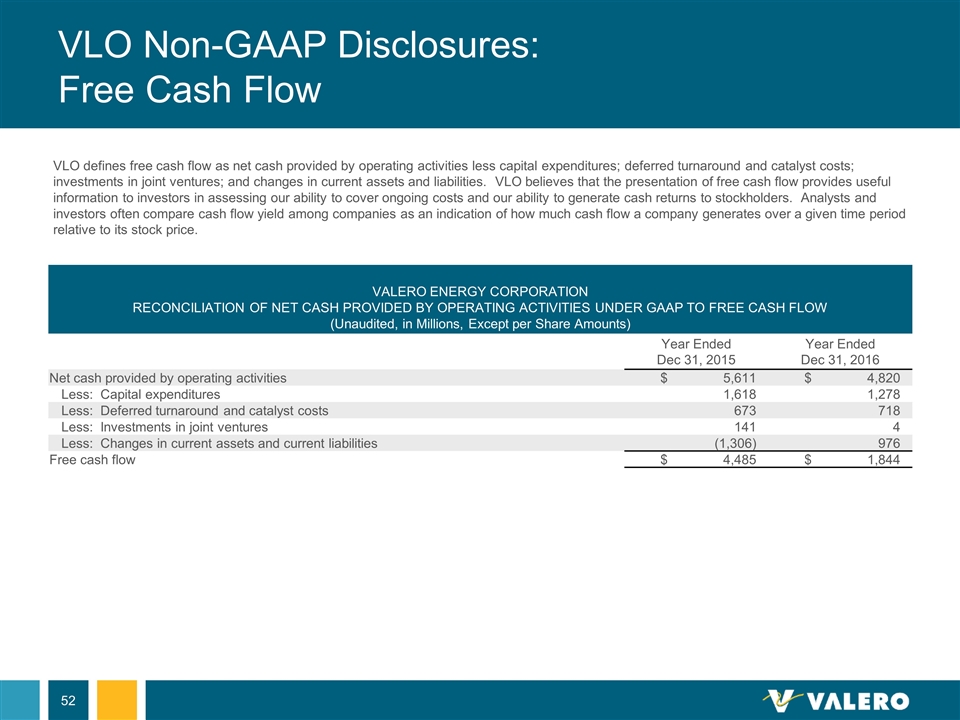

VLO Non-GAAP Disclosures: Free Cash Flow VLO defines free cash flow as net cash provided by operating activities less capital expenditures; deferred turnaround and catalyst costs; investments in joint ventures; and changes in current assets and liabilities. VLO believes that the presentation of free cash flow provides useful information to investors in assessing our ability to cover ongoing costs and our ability to generate cash returns to stockholders. Analysts and investors often compare cash flow yield among companies as an indication of how much cash flow a company generates over a given time period relative to its stock price. VALERO ENERGY CORPORATION RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES UNDER GAAP TO FREE CASH FLOW (Unaudited, in Millions, Except per Share Amounts) Year Ended Dec 31, 2015 Year Ended Dec 31, 2016 Net cash provided by operating activities $5,611 $4,820 Less: Capital expenditures 1,618 1,278 Less: Deferred turnaround and catalyst costs 673 718 Less: Investments in joint ventures 141 4 Less: Changes in current assets and current liabilities (1,306) 976 Free cash flow $4,485 $1,844

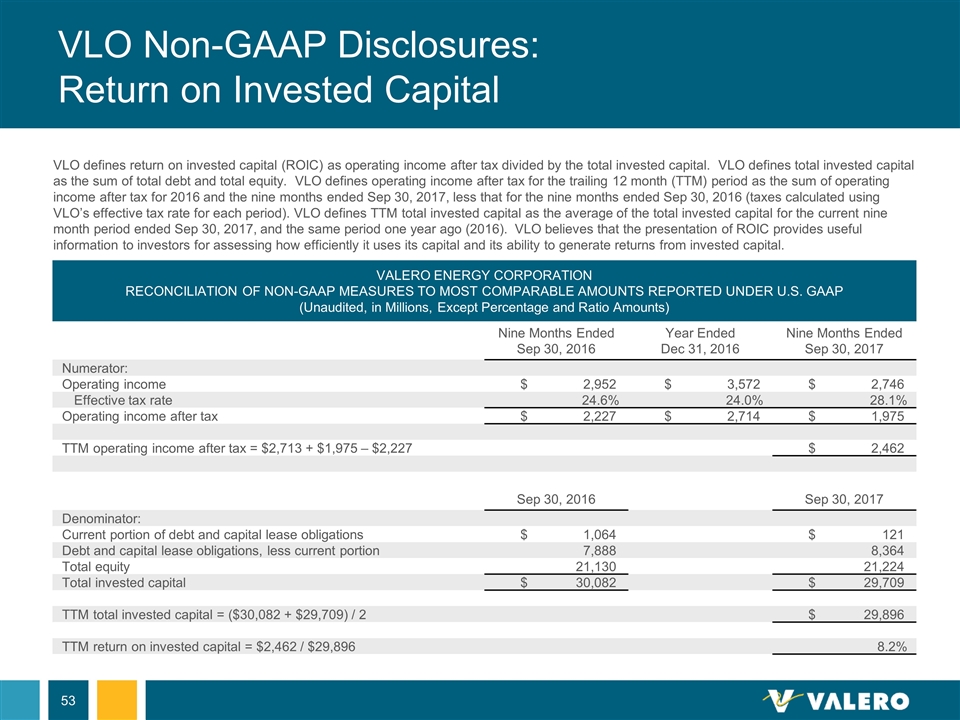

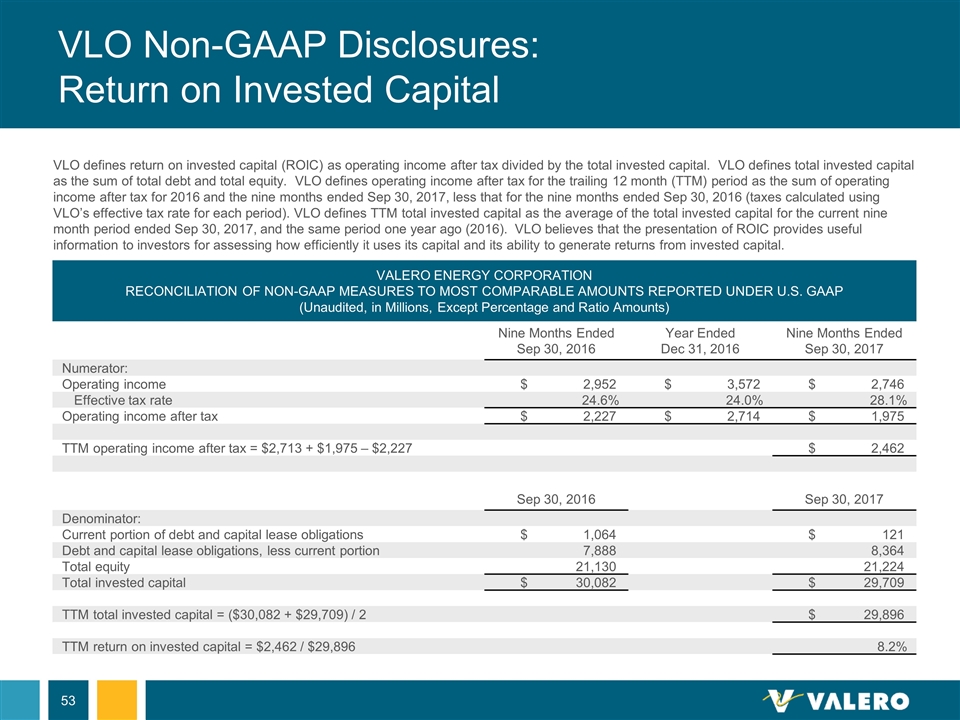

VLO Non-GAAP Disclosures: Return on Invested Capital VALERO ENERGY CORPORATION RECONCILIATION OF NON-GAAP MEASURES TO MOST COMPARABLE AMOUNTS REPORTED UNDER U.S. GAAP (Unaudited, in Millions, Except Percentage and Ratio Amounts) Nine Months Ended Sep 30, 2016 Year Ended Dec 31, 2016 Nine Months Ended Sep 30, 2017 Numerator: Operating income $2,952 $3,572 $2,746 Effective tax rate 24.6% 24.0% 28.1% Operating income after tax $2,227 $2,714 $1,975 TTM operating income after tax = $2,713 + $1,975 – $2,227 $2,462 Sep 30, 2016 Sep 30, 2017 Denominator: Current portion of debt and capital lease obligations $1,064 $121 Debt and capital lease obligations, less current portion 7,888 8,364 Total equity 21,130 21,224 Total invested capital $30,082 $29,709 TTM total invested capital = ($30,082 + $29,709) / 2 $29,896 TTM return on invested capital = $2,462 / $29,896 8.2% VLO defines return on invested capital (ROIC) as operating income after tax divided by the total invested capital. VLO defines total invested capital as the sum of total debt and total equity. VLO defines operating income after tax for the trailing 12 month (TTM) period as the sum of operating income after tax for 2016 and the nine months ended Sep 30, 2017, less that for the nine months ended Sep 30, 2016 (taxes calculated using VLO’s effective tax rate for each period). VLO defines TTM total invested capital as the average of the total invested capital for the current nine month period ended Sep 30, 2017, and the same period one year ago (2016). VLO believes that the presentation of ROIC provides useful information to investors for assessing how efficiently it uses its capital and its ability to generate returns from invested capital.

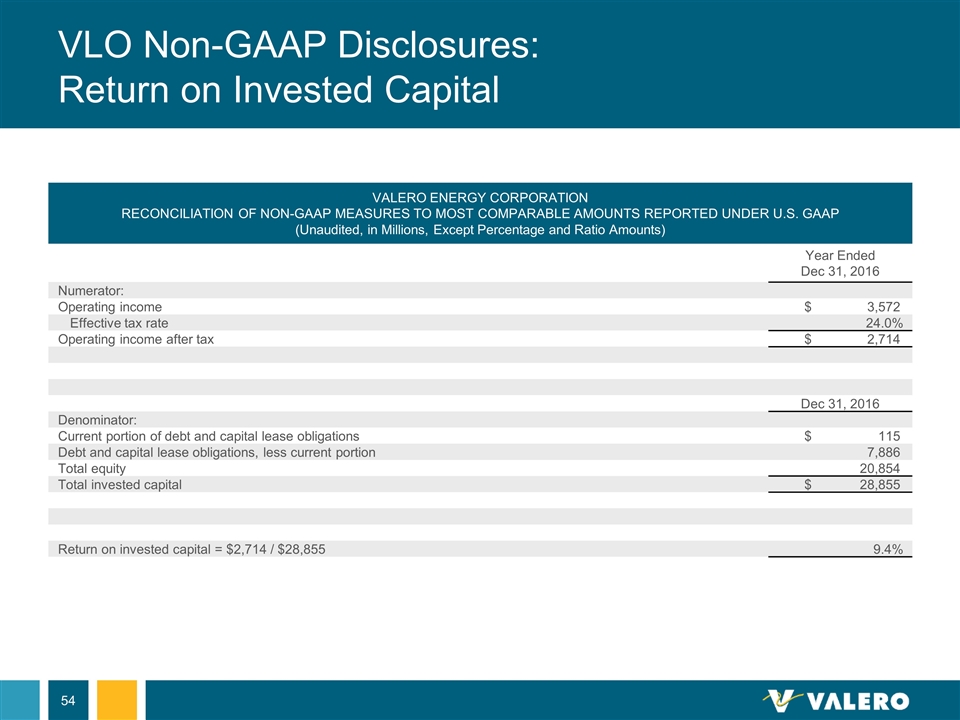

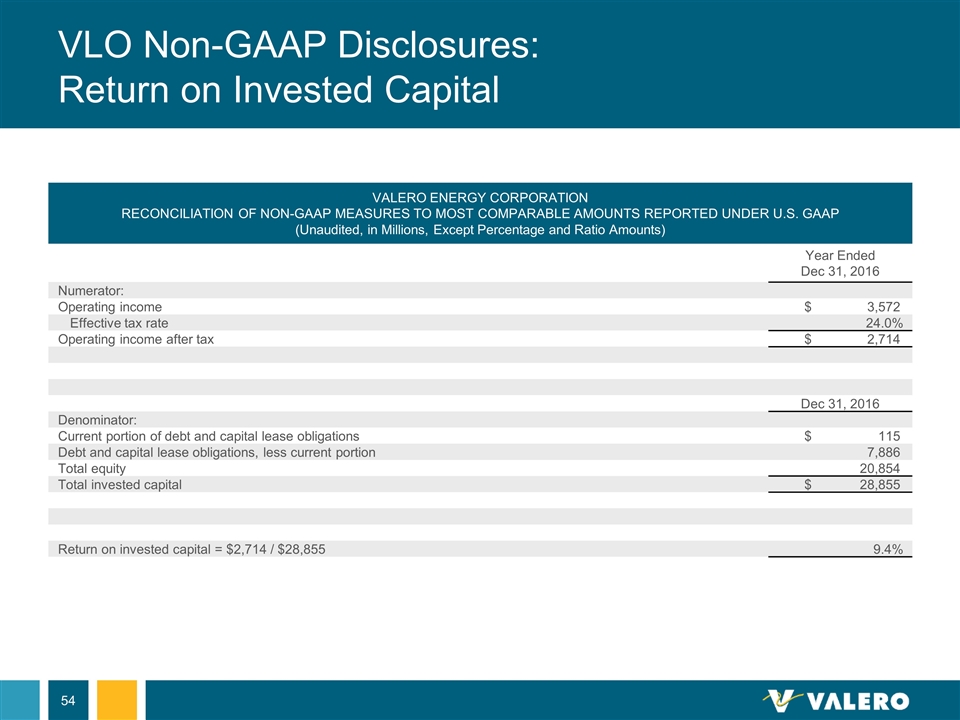

VLO Non-GAAP Disclosures: Return on Invested Capital VALERO ENERGY CORPORATION RECONCILIATION OF NON-GAAP MEASURES TO MOST COMPARABLE AMOUNTS REPORTED UNDER U.S. GAAP (Unaudited, in Millions, Except Percentage and Ratio Amounts) Year Ended Dec 31, 2016 Numerator: Operating income $3,572 Effective tax rate 24.0% Operating income after tax $2,714 Dec 31, 2016 Denominator: Current portion of debt and capital lease obligations $115 Debt and capital lease obligations, less current portion 7,886 Total equity 20,854 Total invested capital $28,855 Return on invested capital = $2,714 / $28,855 9.4%

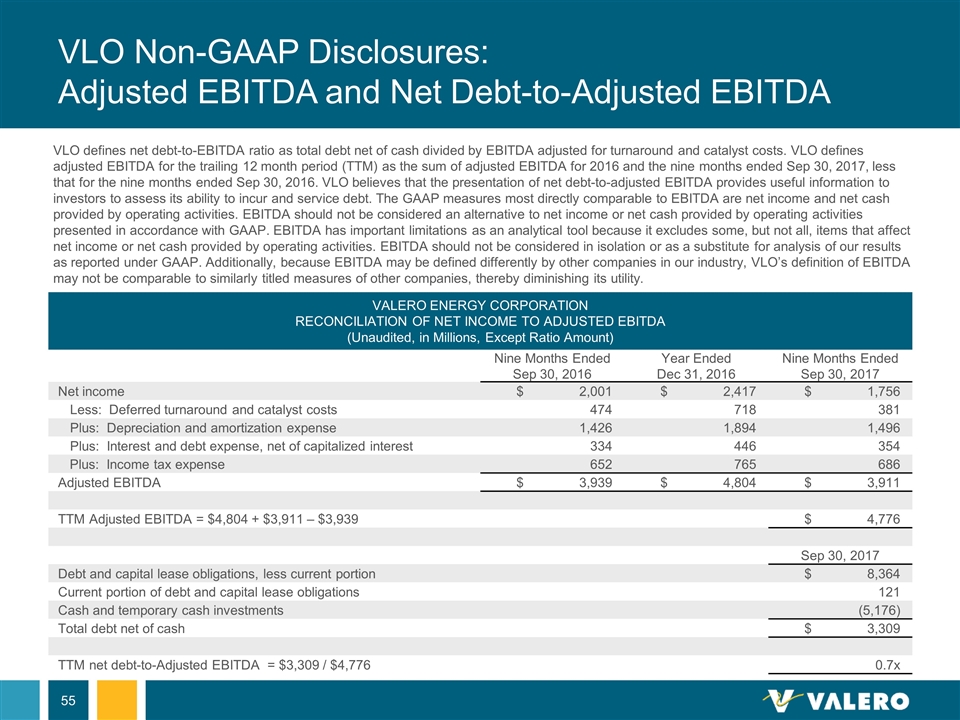

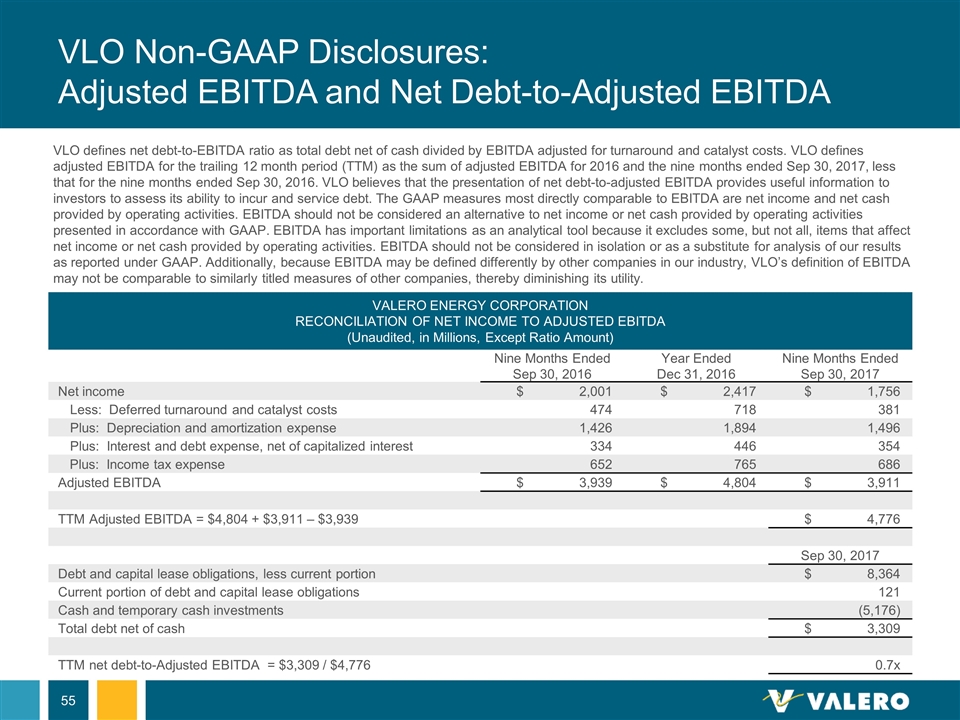

VLO Non-GAAP Disclosures: Adjusted EBITDA and Net Debt-to-Adjusted EBITDA VALERO ENERGY CORPORATION RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited, in Millions, Except Ratio Amount) Nine Months Ended Sep 30, 2016 Year Ended Dec 31, 2016 Nine Months Ended Sep 30, 2017 Net income $2,001 $2,417 $1,756 Less: Deferred turnaround and catalyst costs 474 718 381 Plus: Depreciation and amortization expense 1,426 1,894 1,496 Plus: Interest and debt expense, net of capitalized interest 334 446 354 Plus: Income tax expense 652 765 686 Adjusted EBITDA $3,939 $4,804 $3,911 TTM Adjusted EBITDA = $4,804 + $3,911 – $3,939 $4,776 Sep 30, 2017 Debt and capital lease obligations, less current portion $8,364 Current portion of debt and capital lease obligations 121 Cash and temporary cash investments (5,176) Total debt net of cash $3,309 TTM net debt-to-Adjusted EBITDA = $3,309 / $4,776 0.7x VLO defines net debt-to-EBITDA ratio as total debt net of cash divided by EBITDA adjusted for turnaround and catalyst costs. VLO defines adjusted EBITDA for the trailing 12 month period (TTM) as the sum of adjusted EBITDA for 2016 and the nine months ended Sep 30, 2017, less that for the nine months ended Sep 30, 2016. VLO believes that the presentation of net debt-to-adjusted EBITDA provides useful information to investors to assess its ability to incur and service debt. The GAAP measures most directly comparable to EBITDA are net income and net cash provided by operating activities. EBITDA should not be considered an alternative to net income or net cash provided by operating activities presented in accordance with GAAP. EBITDA has important limitations as an analytical tool because it excludes some, but not all, items that affect net income or net cash provided by operating activities. EBITDA should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because EBITDA may be defined differently by other companies in our industry, VLO’s definition of EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

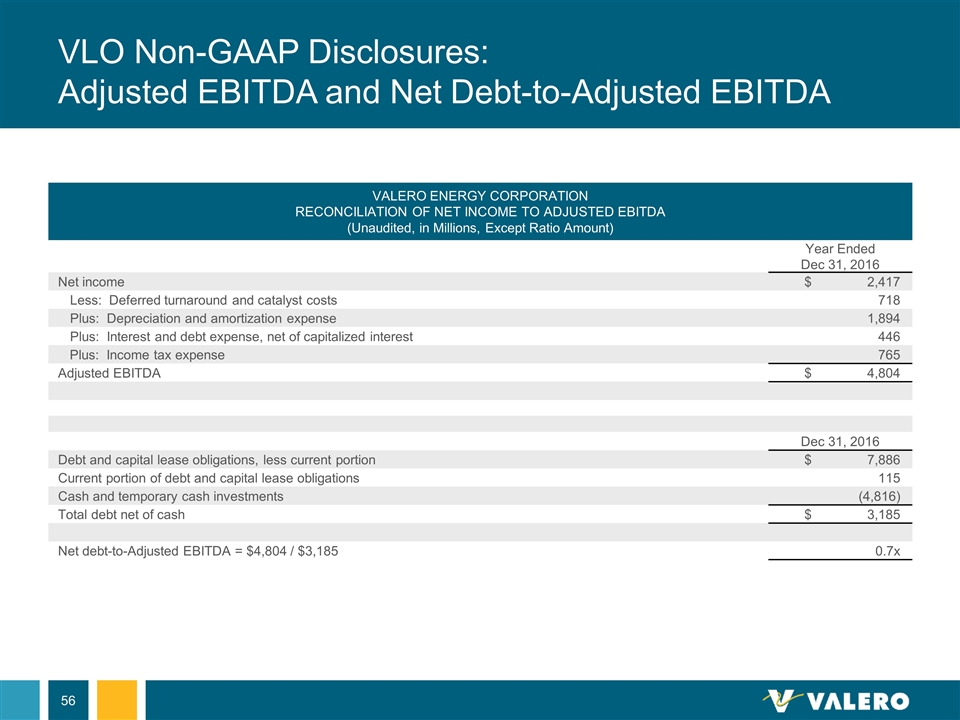

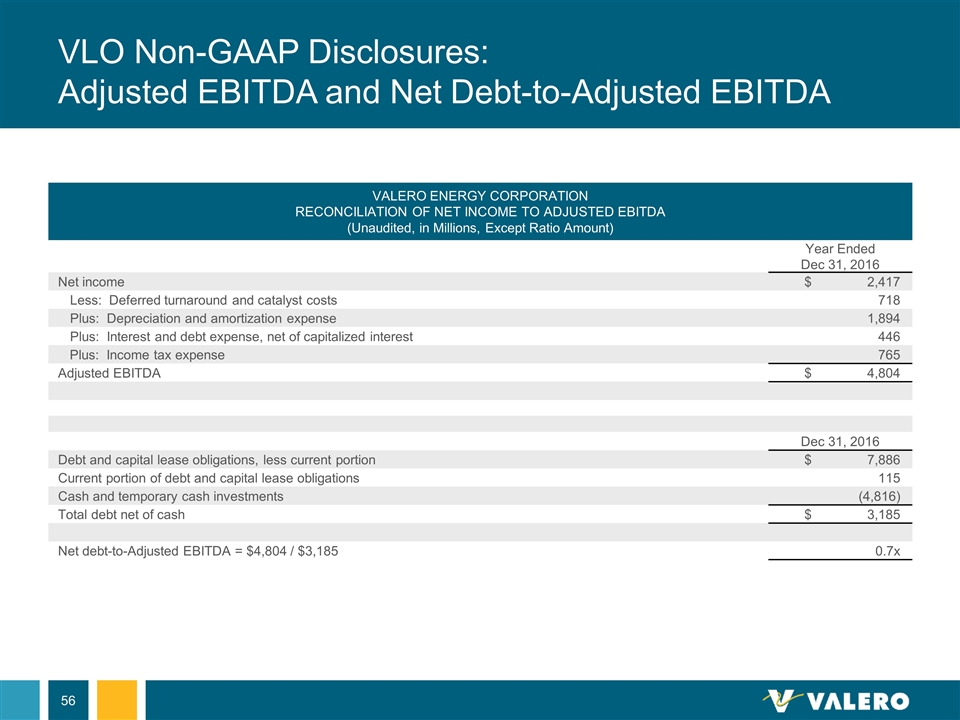

VLO Non-GAAP Disclosures: Adjusted EBITDA and Net Debt-to-Adjusted EBITDA VALERO ENERGY CORPORATION RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited, in Millions, Except Ratio Amount) Year Ended Dec 31, 2016 Net income $2,417 Less: Deferred turnaround and catalyst costs 718 Plus: Depreciation and amortization expense 1,894 Plus: Interest and debt expense, net of capitalized interest 446 Plus: Income tax expense 765 Adjusted EBITDA $4,804 Dec 31, 2016 Debt and capital lease obligations, less current portion $7,886 Current portion of debt and capital lease obligations 115 Cash and temporary cash investments (4,816) Total debt net of cash $3,185 Net debt-to-Adjusted EBITDA = $4,804 / $3,185 0.7x

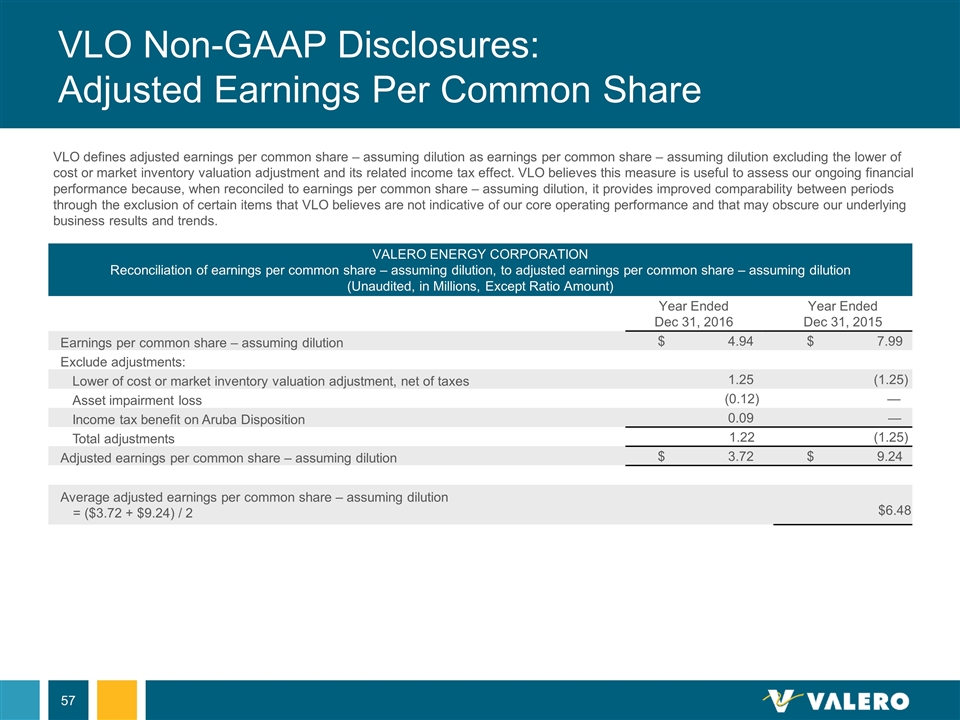

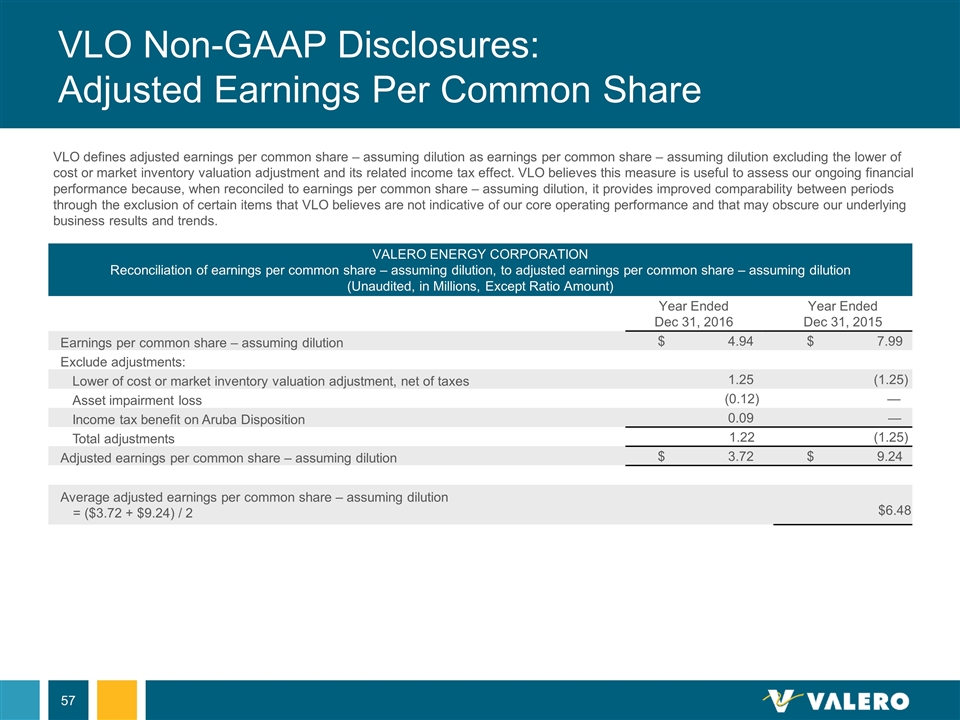

VLO Non-GAAP Disclosures: Adjusted Earnings Per Common Share VALERO ENERGY CORPORATION Reconciliation of earnings per common share – assuming dilution, to adjusted earnings per common share – assuming dilution (Unaudited, in Millions, Except Ratio Amount) Year Ended Dec 31, 2016 Year Ended Dec 31, 2015 Earnings per common share – assuming dilution $4.94 $7.99 Exclude adjustments: Lower of cost or market inventory valuation adjustment, net of taxes 1.25 (1.25) Asset impairment loss (0.12) — Income tax benefit on Aruba Disposition 0.09 — Total adjustments 1.22 (1.25) Adjusted earnings per common share – assuming dilution $3.72 $9.24 Average adjusted earnings per common share – assuming dilution = ($3.72 + $9.24) / 2 $6.48 VLO defines adjusted earnings per common share – assuming dilution as earnings per common share – assuming dilution excluding the lower of cost or market inventory valuation adjustment and its related income tax effect. VLO believes this measure is useful to assess our ongoing financial performance because, when reconciled to earnings per common share – assuming dilution, it provides improved comparability between periods through the exclusion of certain items that VLO believes are not indicative of our core operating performance and that may obscure our underlying business results and trends.

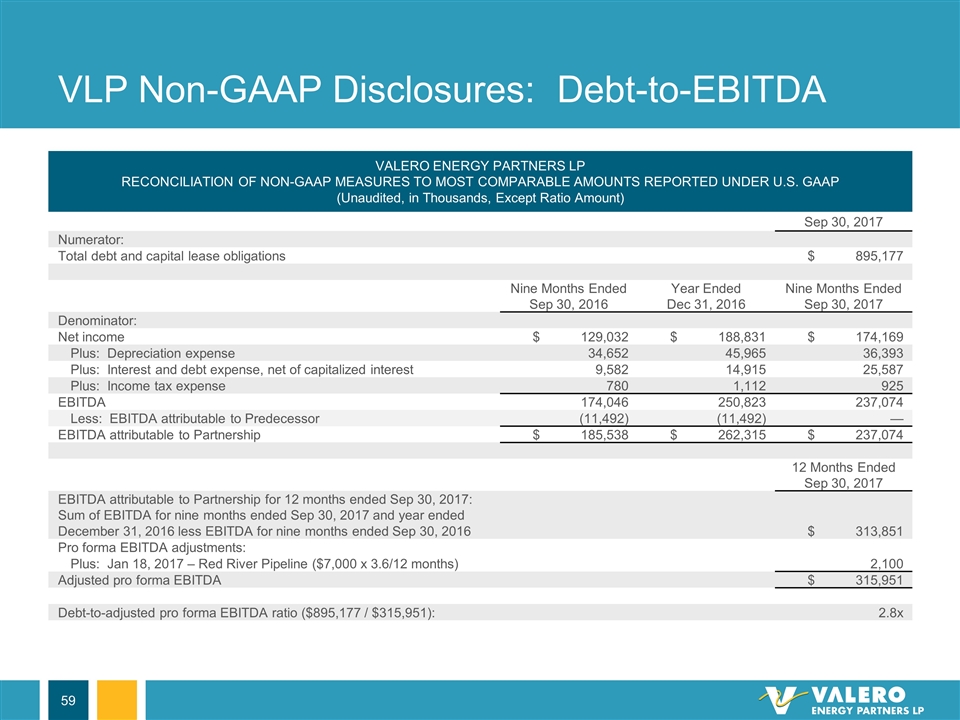

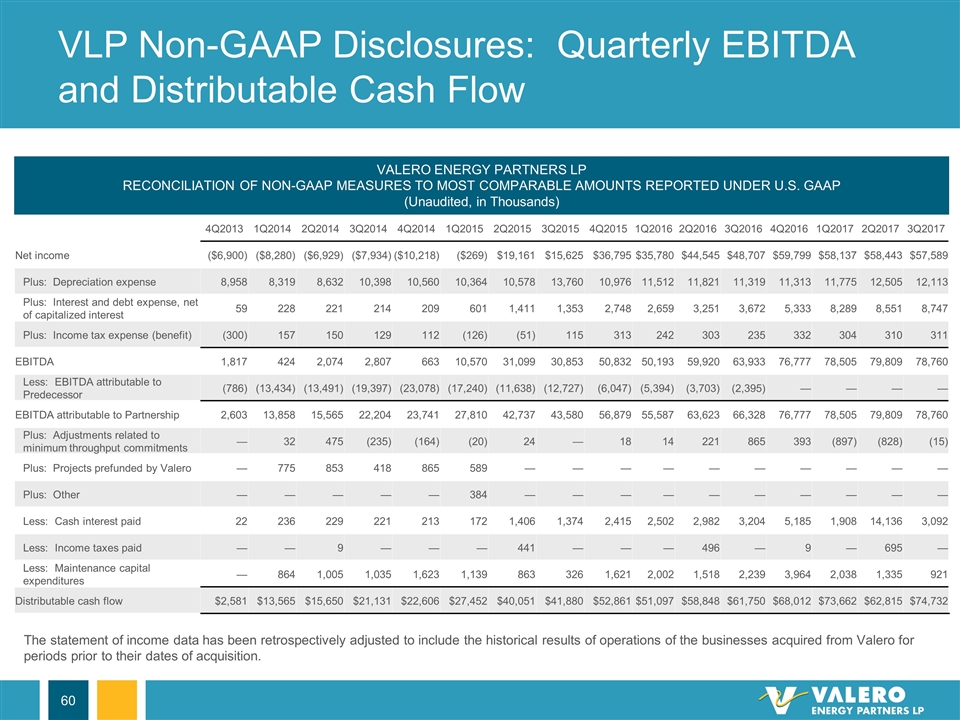

VLP Non-GAAP Disclosures: EBITDA, Distributable Cash Flow, and Debt-to-Adjusted Pro Forma EBITDA VLP defines EBITDA as net income before income tax expense, interest and debt expense, net of capitalized interest, and depreciation expense. VLP defines distributable cash flow as EBITDA less (i) EBITDA attributable to its Predecessor and cash payments during the period for interest, income taxes, and maintenance capital expenditures; plus (ii) adjustments related to minimum throughput commitments, capital projects prefunded by Valero, and certain other items. VLP defines coverage ratio as the ratio of distributable cash flow to the total distribution declared. EBITDA, distributable cash flow, debt-to-adjusted pro forma EBITDA, and coverage ratio are supplemental financial measures that are not defined under GAAP. They may be used by management and external users of our financial statements, such as industry analysts, investors, lenders, and rating agencies, to: describe VLP’s expectation of forecasted earnings; assess VLP’s operating performance as compared to other publicly traded limited partnerships in the transportation and logistics industry, without regard to historical cost basis or, in the case of EBITDA, financing methods; assess the ability of VLP’s business to generate sufficient cash to support its decision to make distributions to its unitholders; assess VLP’s ability to incur and service debt and fund capital expenditures; and assess the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. VLP believes that the presentation of EBITDA provides useful information to investors in assessing its financial condition and results of operations. The GAAP measures most directly comparable to EBITDA are net income and net cash provided by operating activities. EBITDA should not be considered an alternative to net income or net cash provided by operating activities presented in accordance with GAAP. EBITDA has important limitations as an analytical tool because it excludes some, but not all, items that affect net income or net cash provided by operating activities. EBITDA should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because EBITDA may be defined differently by other companies in our industry, VLP’s definition of EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. VLP uses distributable cash flow to measure whether it has generated from its operations, or “earned,” an amount of cash sufficient to support the payment of the minimum quarterly distributions. VLP’s partnership agreement contains the concept of “operating surplus” to determine whether VLP’s operations are generating sufficient cash to support the distributions that it is paying, as opposed to returning capital to VLP’s partners. Because operating surplus is a cumulative concept (measured from VLP’s IPO date and compared to cumulative distributions from the IPO date), VLP uses the term distributable cash flow to approximate operating surplus on a quarterly or annual, rather than a cumulative, basis. As a result, distributable cash flow is not necessarily indicative of the actual cash VLP has on hand to distribute or that it is required to distribute. VLP uses the distribution coverage ratio to reflect the relationship between its distributable cash flow and the total distribution declared. The debt-to-EBITDA ratio as defined in accordance with VLP’s debt covenants is the total debt and capital lease obligations divided by adjusted pro forma EBITDA for the trailing 12 month period. VLP believes that the presentation of debt-to-EBITDA provides useful information to investors to assess its ability to incur and service debt.

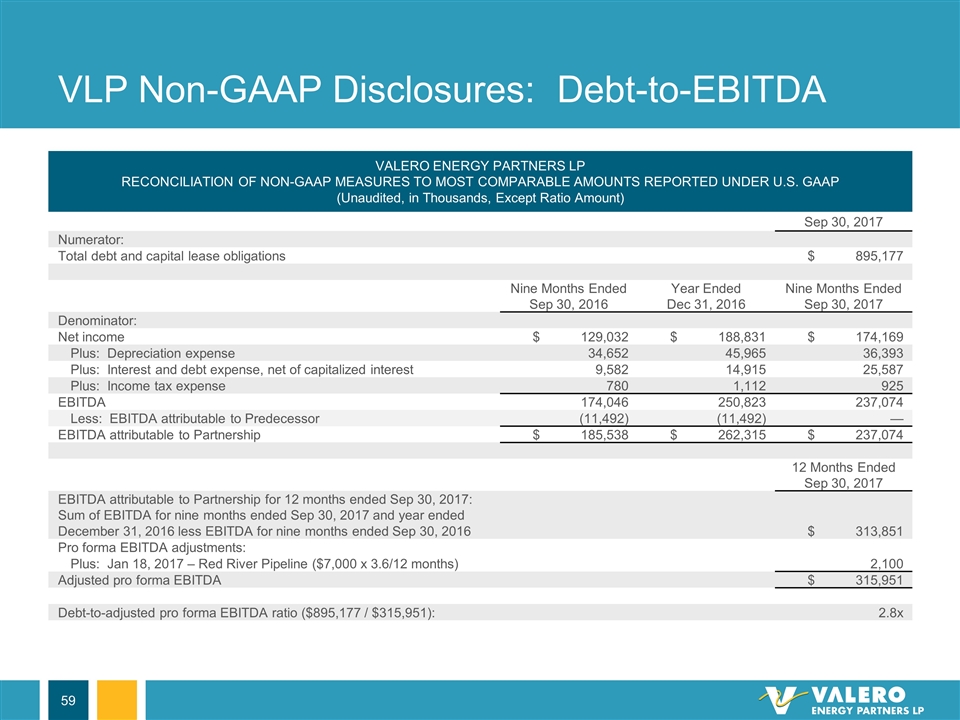

VLP Non-GAAP Disclosures: Debt-to-EBITDA VALERO ENERGY PARTNERS LP RECONCILIATION OF NON-GAAP MEASURES TO MOST COMPARABLE AMOUNTS REPORTED UNDER U.S. GAAP (Unaudited, in Thousands, Except Ratio Amount) Sep 30, 2017 Numerator: Total debt and capital lease obligations $895,177 Nine Months Ended Sep 30, 2016 Year Ended Dec 31, 2016 Nine Months Ended Sep 30, 2017 Denominator: Net income $129,032 $188,831 $174,169 Plus: Depreciation expense 34,652 45,965 36,393 Plus: Interest and debt expense, net of capitalized interest 9,582 14,915 25,587 Plus: Income tax expense 780 1,112 925 EBITDA 174,046 250,823 237,074 Less: EBITDA attributable to Predecessor (11,492) (11,492) — EBITDA attributable to Partnership $185,538 $262,315 $237,074 12 Months Ended Sep 30, 2017 EBITDA attributable to Partnership for 12 months ended Sep 30, 2017: Sum of EBITDA for nine months ended Sep 30, 2017 and year ended December 31, 2016 less EBITDA for nine months ended Sep 30, 2016 $313,851 Pro forma EBITDA adjustments: Plus: Jan 18, 2017 – Red River Pipeline ($7,000 x 3.6/12 months) 2,100 Adjusted pro forma EBITDA $315,951 Debt-to-adjusted pro forma EBITDA ratio ($895,177 / $315,951): 2.8x

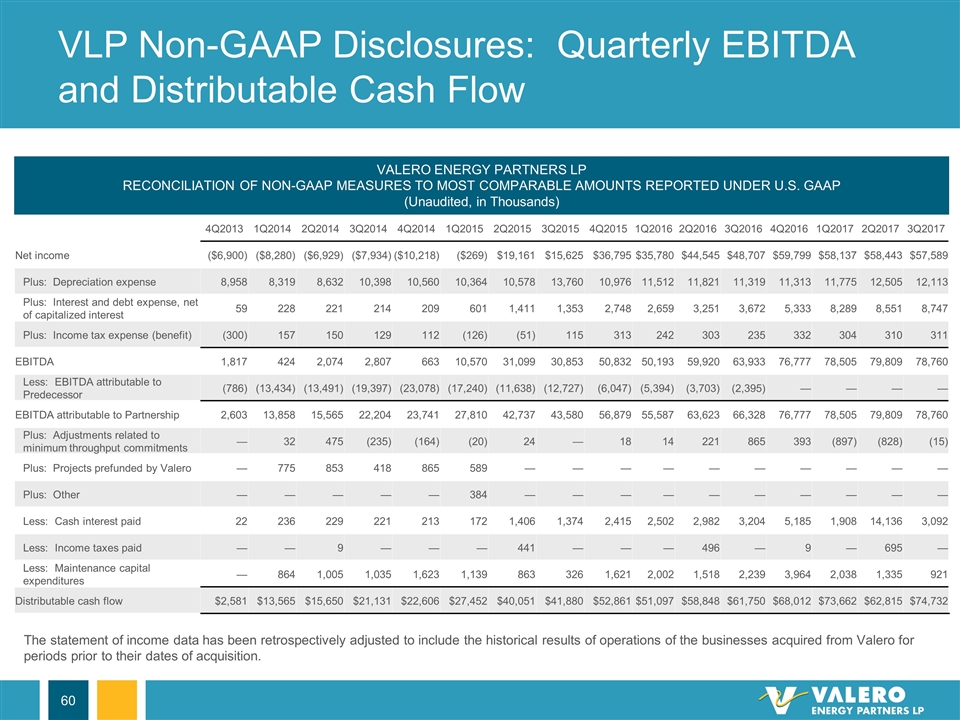

4Q2013 1Q2014 2Q2014 3Q2014 4Q2014 1Q2015 2Q2015 3Q2015 4Q2015 1Q2016 2Q2016 3Q2016 4Q2016 1Q2017 2Q2017 3Q2017 Net income ($6,900) ($8,280) ($6,929) ($7,934) ($10,218) ($269) $19,161 $15,625 $36,795 $35,780 $44,545 $48,707 $59,799 $58,137 $58,443 $57,589 Plus: Depreciation expense 8,958 8,319 8,632 10,398 10,560 10,364 10,578 13,760 10,976 11,512 11,821 11,319 11,313 11,775 12,505 12,113 Plus: Interest and debt expense, net of capitalized interest 59 228 221 214 209 601 1,411 1,353 2,748 2,659 3,251 3,672 5,333 8,289 8,551 8,747 Plus: Income tax expense (benefit) (300) 157 150 129 112 (126) (51) 115 313 242 303 235 332 304 310 311 EBITDA 1,817 424 2,074 2,807 663 10,570 31,099 30,853 50,832 50,193 59,920 63,933 76,777 78,505 79,809 78,760 Less: EBITDA attributable to Predecessor (786) (13,434) (13,491) (19,397) (23,078) (17,240) (11,638) (12,727) (6,047) (5,394) (3,703) (2,395) — — — — EBITDA attributable to Partnership 2,603 13,858 15,565 22,204 23,741 27,810 42,737 43,580 56,879 55,587 63,623 66,328 76,777 78,505 79,809 78,760 Plus: Adjustments related to minimum throughput commitments — 32 475 (235) (164) (20) 24 — 18 14 221 865 393 (897) (828) (15) Plus: Projects prefunded by Valero — 775 853 418 865 589 — — — — — — — — — — Plus: Other — — — — — 384 — — — — — — — — — — Less: Cash interest paid 22 236 229 221 213 172 1,406 1,374 2,415 2,502 2,982 3,204 5,185 1,908 14,136 3,092 Less: Income taxes paid — — 9 — — — 441 — — — 496 — 9 — 695 — Less: Maintenance capital expenditures — 864 1,005 1,035 1,623 1,139 863 326 1,621 2,002 1,518 2,239 3,964 2,038 1,335 921 Distributable cash flow $2,581 $13,565 $15,650 $21,131 $22,606 $27,452 $40,051 $41,880 $52,861 $51,097 $58,848 $61,750 $68,012 $73,662 $62,815 $74,732 VLP Non-GAAP Disclosures: Quarterly EBITDA and Distributable Cash Flow VALERO ENERGY PARTNERS LP RECONCILIATION OF NON-GAAP MEASURES TO MOST COMPARABLE AMOUNTS REPORTED UNDER U.S. GAAP (Unaudited, in Thousands) The statement of income data has been retrospectively adjusted to include the historical results of operations of the businesses acquired from Valero for periods prior to their dates of acquisition.

Investor Relations Contacts For more information, please contact: John Locke Vice President, Investor Relations 210.345.3077 john.locke@valero.com Karen Ngo Senior Manager, Investor Relations 210.345.4574 karen.ngo@valero.com Tom Mahrer Manager, Investor Relations 210.345.1953 tom.mahrer@valero.com