File No. 333-108370

As filed on October 29, 2003

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |X|

Pre-Effective Amendment No. 1

Post-Effective Amendment No. |_|

(Check appropriate box or boxes)

American Skandia Advisor Funds

(Exact Name of Registrant as Specified in Charter)

(203) 926-1888

(Area Code and Telephone Number)

One Corporate Drive

Shelton, CT 06484

Address of Principal Executive Offices:

(Number, Street, City, State, Zip Code)

Edward P. Macdonald, Esq.

Assistant Secretary, American Skandia Advisor Funds

One Corporate Drive

Shelton, CT 06484

Name and Address of Agent for Service:

(Number and Street) (City) (State) (Zip Code)

Copies to:

Robert K. Fulton, Esquire

Stradley, Ronon, Stevens & Young, LLP

2600 One Commerce Square

Philadelphia, PA 19103-7098

Approximate Date of Proposed Public Offering: As soon as

practicable after this Registration Statement becomes effective

under the Securities Act of 1933, as amended.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective

date until the registrant shall file a further amendment which specifically states that this Registration Statement shall

thereafter become effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the

Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may

determine.

Title of the securities being registered: Shares of common stock of the ASAF Sanford Bernstein Managed Index 500

Fund of American Skandia Advisor Funds. No filing fee is due because Registrant is relying on Section 24(f) of the

Investment Company Act of 1940, as amended.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF ALLIANCE/BERNSTEIN GROWTH + VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

IMPORTANT PROXY MATERIALS

PLEASE VOTE NOW

Dear Shareholder: October 10, 2003

I am writing to ask you to vote on an important proposal whereby the assets of the ASAF Alliance/Bernstein Growth + Value

Fund (the "Growth + Value Fund") would be acquired by the ASAF Sanford Bernstein Managed Index 500 Fund (the "Managed

Index Fund" and together with the Growth + Value Fund, the "Funds"). The proposed acquisition is referred to as a

merger. The Funds are each a series of American Skandia Advisor Funds, Inc. ("ASAF"). A shareholder meeting for the

Growth + Value Fund is scheduled for November 21, 2003. Only shareholders of the Growth + Value Fund will vote on the

acquisition of the Growth + Value Fund's assets by the Managed Index Fund.

This package contains information about the proposal and includes materials you will need to vote. The Board of Directors

of ASAF has reviewed the proposal and recommended that it be presented to shareholders of the Growth + Value Fund for

their consideration. Although the Directors have determined that the proposal is in the best interests of shareholders,

the final decision is up to you.

If approved, the proposed merger would give you the opportunity to participate in a larger fund with similar investment

policies. In addition, shareholders are expected to realize a reduction in both the net and gross annual operating

expenses paid on their investment in the combined fund. The accompanying proxy statement and prospectus includes a

detailed description of the proposal. Please read the enclosed materials carefully and cast your vote. Remember, your

vote is extremely important, no matter how large or small your holdings. By voting now, you can help avoid additional

costs that would be incurred with follow-up letters and calls.

To vote, you may use any of the following methods:

o By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage paid envelope. Votes

must be received prior to November 21, 2003.

o By Internet. Have your proxy card available. Go to the web site indicated on your proxy card. Enter your 12-digit

control number from your proxy card. Follow the instructions found on the web site. Votes must be entered prior to 4

p.m. on November 20, 2003.

o By Telephone. Have your proxy card available. Call the toll-free number on your proxy card. Enter your 12-digit

control number from your proxy card. Follow the instructions given. Votes must be entered prior to 4 p.m. on November

20, 2003.

If you have any questions before you vote, please call us at 1-800-SKANDIA. We are glad to help you understand the

proposal and assist you in voting. Thank you for your participation.

/s/Judy Rice

Judy A. Rice

President

This page has been intentionally left blank.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF ALLIANCE/BERNSTEIN GROWTH + VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To our Shareholders:

Notice is hereby given that a Special Meeting of Shareholders (the Meeting) of the ASAF Alliance/Bernstein Growth + Value

Fund (the "Growth + Value Fund") will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New

Jersey 07102, on November 21, 2003, at 11:00 a.m. Eastern Standard Time, for the following purposes:

1. For shareholders of the Growth + Value Fund, to approve or disapprove a Plan of Reorganization under which the Growth

+ Value Fund will transfer all of its assets to, and all of its liabilities will be assumed by, the ASAF Sanford

Bernstein Managed Index 500 Fund (the "Managed Index Fund"). In connection with this proposed transfer, each whole and

fractional share of each class of the Growth + Value Fund shall be exchanged for whole and fractional shares of equal net

asset value of the same class of the Managed Index Fund and outstanding shares of the Growth + Value Fund will be

cancelled.

2. To transact such other business as may properly come before the Meeting or any adjournments of the Meeting.

The Board of Directors of American Skandia Advisor Funds, Inc., on behalf of the Growth + Value Fund, has fixed the close

of business on September 19, 2003 as the record date for the determination of the shareholders of the Growth + Value

Fund, as applicable, entitled to notice of, and to vote at, the Meeting and any adjournments of the Meeting.

/s/Edward Macdonald

Edward P. Macdonald

Assistant Secretary

Dated: October 10, 2003

prospectus/proxy statement

TABLE OF CONTENTS

Page

Cover Page................................................................................................. Cover

SUMMARY............................................................................................................................2

The Proposal....................................................................................................................2

Shareholder voting..............................................................................................................2

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS.....................................................................................2

The investment objectives and policies of the Funds.............................................................................2

Diversification.................................................................................................................3

Borrowing, Issuing Senior Securities and Pledging Assets........................................................................3

Lending.........................................................................................................................3

Illiquid Securities.............................................................................................................3

Temporary Defensive Investments.................................................................................................3

Derivative Strategies...........................................................................................................4

Investment Restrictions.........................................................................................................4

Federal Income Tax Considerations...............................................................................................4

Risks of investing in the Funds.................................................................................................4

Management of the Company and the Funds.........................................................................................4

Fee Arrangements................................................................................................................5

Distribution Plan...............................................................................................................6

Valuation.......................................................................................................................6

Purchases, Redemptions, Exchanges and Distributions.............................................................................6

Fees and expenses...............................................................................................................7

Expense Examples...............................................................................................................10

Performance....................................................................................................................12

REASONS FOR THE TRANSACTION.......................................................................................................14

INFORMATION ABOUT THE TRANSACTION.................................................................................................14

Closing of the Transaction.....................................................................................................14

Expenses of the Transaction....................................................................................................15

Tax Consequences of the Transaction............................................................................................15

Characteristics of the Managed Index Fund shares...............................................................................16

Capitalization of the Funds and Capitalization after the Transaction...........................................................16

VOTING INFORMATION................................................................................................................17

How to vote....................................................................................................................18

Solicitation of voting instructions............................................................................................18

ADDITIONAL INFORMATION ABOUT THE COMPANY AND THE FUNDS............................................................................18

PRINCIPAL HOLDERS OF SHARES.......................................................................................................19

EXHIBITS TO PROSPECTUS/PROXY STATEMENT............................................................................................20

EXHIBIT A.......................................................................................................................1

Plan of Reorganization.......................................................................................................1

EXHIBIT B.......................................................................................................................1

Prospectus dated MARCH 1, 2003...............................................................................................1

EXHIBIT C.......................................................................................................................2

ANNUAL REPORT dated OCTOBER 31, 2002.........................................................................................2

EXHIBIT D.......................................................................................................................3

SUPPLEMENTS DATED MAY 16, 2003, AUGUST 1, 2003, SEPTEMBER 16, 2003 AND OCTOBER 2, 2003.......................................3

AMERICAN SKANDIA ADVISOR FUNDS, INC.

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

PROSPECTUS/PROXY STATEMENT

Dated October 10, 2003

Acquisition of the Assets of the ASAF Alliance/Bernstein Growth + Value Fund

By and in exchange for shares of the ASAF Sanford Bernstein Managed Index 500 Fund

This Prospectus/Proxy Statement is furnished in connection with a Special Meeting (the "Meeting") of shareholders

the ASAF Alliance/Bernstein Growth + Value Fund (the "Growth + Value Fund") of American Skandia Advisor Funds, Inc. (the

"Company") called by the Company to approve or disapprove a Plan of Reorganization (the "Plan"). If shareholders of the

Growth + Value Fund vote to approve the Plan, you will receive shares of the ASAF Sanford Bernstein Managed Index 500

Fund (the "Managed Index Fund" and, together with the Growth + Value Fund, the "Funds") of the Company equal in value to

your investment in shares of the Growth + Value Fund as provided in the Plan and described at greater length below. The

Growth + Value Fund will then be liquidated and dissolved.

The Meeting will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New Jersey 07102 on

November 21, 2003 at 11:00 a.m. Eastern Standard Time. The Board of Directors of the Company is soliciting these proxies

on behalf of the Growth + Value Fund. This Prospectus/Proxy Statement will first be sent to shareholders on or about

October 20, 2003.

The investment objective of the Managed Index Fund is to outperform the Standard & Poor's 500 Composite Stock

Price Index while the investment objective of the Growth + Value Fund is to seek capital growth. However, both Funds

invest primarily in large-cap growth and large-cap value equity securities.

This Prospectus/Proxy Statement gives the information about the proposed reorganization and issuance of shares of

the Managed Index Fund that you should know before investing. You should retain it for future reference. Additional

information about the Managed Index Fund and the proposed reorganization has been filed with the Securities and Exchange

Commission ("SEC") and can be found in the following documents:

|_| The Prospectus for the Funds dated March 1, 2003 is enclosed with and considered a part of this Prospectus/Proxy

Statement.

|_| A Statement of Additional Information (SAI) relating to this Prospectus/Proxy Statement dated March 1, 2003 has

been filed with the SEC and is incorporated by reference into this Prospectus/Proxy Statement.

You may request a free copy of the SAI relating to this Prospectus/Proxy Statement or other documents related to

the Company without charge by calling 1-800-752-6342 or by writing to the Company at the above address.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy

Statement. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not

insured by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve

investment risks, including the possible loss of principal.

SUMMARY

This is only a summary of certain information contained in this Prospectus/Proxy Statement. You should read the

more complete information in the rest of this Prospectus/Proxy Statement, including the Plan (attached as Exhibit A) and

the Prospectus for the Funds (enclosed as Exhibit B).

The Proposal

You are being asked to consider and approve a Plan of Reorganization that will have the effect of combining the

Growth + Value Fund and the Managed Index Fund of the Company into a single Fund. If shareholders of the Growth + Value

Fund vote to approve the Plan, the assets of the Growth + Value Fund will be transferred to the Managed Index Fund in

exchange for a then equal value of shares of the Managed Index Fund. Shareholders will have their shares of the Growth +

Value Fund exchanged for the Managed Index Fund shares of equal dollar value based upon the values of the shares at the

time the Growth + Value Fund assets are transferred to the Managed Index Fund. The Growth + Value Fund will be

liquidated and dissolved. The proposed reorganization is referred to in this Prospectus/Proxy Statement as the

"Transaction." As a result of the Transaction, you will cease to be a shareholder of the Growth + Value Fund and will

become a shareholder of the Managed Index Fund.

For the reasons set forth in the "Reasons for the Transaction" section, the Board of Directors of the Company has

determined that the Transaction is in the best interests of the shareholders of the Growth + Value Fund and the Managed

Index Fund, and also concluded that no dilution in value would result to the shareholders of either Fund as a result of

the Transaction.

The Board of Directors of the Company, on behalf of both the Growth + Value Fund and the Managed Index Fund, has approved

the Plan and unanimously recommends that you vote to approve the Plan.

Shareholder voting

Shareholders who own shares of the Growth + Value Fund at the close of business on September 19, 2003 (the

"Record Date") will be entitled to vote at the Meeting, and will be entitled to one vote for each full share and a

fractional vote for each fractional share that they hold. The affirmative vote of the holders of a majority of the total

number of shares of capital stock of the Growth + Value Fund outstanding and entitled to vote is necessary to approve the

Transaction.

Please vote your shares as soon as you receive this Prospectus/Proxy Statement. You may vote by completing and

signing the enclosed ballot (the "proxy card") or over the Internet or by phone. If you vote by any of these methods,

your votes will be officially cast at the Meeting by persons appointed as proxies.

You can revoke or change your voting instructions at any time until the vote is taken at the Meeting. For more

details about shareholder voting, see the "Voting Information" section of this Prospectus/Proxy Statement.

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS

The investment objectives and policies of the Funds

This section describes the investment policies of the Growth + Value Fund and the Managed Index Fund and the

differences between them. For a complete description of the investment policies and risks of the Managed Index Fund, you

should read the Prospectus for the Funds that is enclosed with this Prospectus/Proxy Statement.

The investment objectives of the Funds are comparable. The investment objective of the Growth + Value Fund is

capital growth and the investment objective of the Managed Index Fund is to outperform the S&P 500 Index. Both Funds

invest primarily in equity securities of large-cap growth and large-cap value companies. Both Funds invest primarily in

companies in the financial, health care and information technology sectors.

The Growth + Value Fund will invest primarily in common stocks of large U.S. companies included in the Russell

1000(R)Index (the "Russell 1000"). The Russell 1000 is a market capitalization-weighted index that measures the

performance of the 1,000 largest U.S. companies. As of September 30, 2002, the average market capitalization of the

companies in the Russell 1000 Index was approximately $8.6 billion. Normally, about 60-85 companies will be represented

in the Fund, with 25-35 companies primarily from the Russell 1000 Growth Index (the "Growth Index") constituting

approximately 50% of the Fund's net assets, and 35-50 companies primarily from the Russell 1000(R)Value Index (the "Value

Index") constituting the remainder of the Fund's net assets. Daily cash flows (that is, purchases and reinvested

distributions) and outflows (that is, redemptions and expense items) will be divided between the two portfolio segments

for purposes of maintaining the targeted allocation between growth and value stocks (the "Target Allocation"). Normally,

while it is not expected that the allocation of assets between portfolio segments will deviate more than 10% from the

Target Allocation, it is possible that this deviation may be higher. Factors such as market fluctuation, economic

conditions, corporate transactions and declaration of dividends may result in deviations from the Target Allocation. In

the event the allocation of assets to the portfolio segments differs by more than 10% from the Target Allocation (e.g.,

60% of the Fund's net assets invested in growth stocks and 40% of the Fund's net assets invested in value stocks), the

Fund's sub-advisors will rebalance each portfolio segment's assets in order to maintain the Target Allocation.

The Managed Index Fund will invest, under normal circumstances, at least 80% of its total assets in the

securities included in the Standard & Poor's 500 Composite Stock Price Index (the "S&P 500"). The Fund seeks to

outperform the S&P 500 through stock selection resulting in different weightings of common stocks relative to the index.

The S&P 500 is an index of 500 common stocks, most of which trade on the New York Stock Exchange Inc. (the "NYSE"). In

seeking to outperform the S&P 500, the Fund's sub-advisor starts with a portfolio of stocks representative of the

holdings of the index. It then uses a set of fundamental, quantitative criteria that are designed to indicate whether a

particular stock will predictably perform better or worse than the S&P 500. Based on these criteria, the Fund's

sub-advisor determines whether the Fund should over-weight, under-weight or hold a neutral position in the stock relative

to the proportion of the S&P 500 that the stock represents. In addition, the Sub-advisor may determine based on the

quantitative criteria that (1) certain S&P 500 stocks should not be held by the Fund in any amount, and (2) certain

equity securities that are not included in the S&P 500 should be held by the Fund. The Fund may invest up to 15% of its

total assets in equity securities not included in the S&P 500. While the Fund attempts to outperform the S&P 500, it is

not expected that any out-performance will be substantial. The Fund also may under-perform the S&P 500 over short or

extended periods.

Diversification

Both Funds are diversified funds. This means that, with respect to 75% of the value of each Fund's total assets,

each Fund invests in cash, cash items, obligations of the U.S. Government, its agencies or instrumentalities, securities

of other investment companies and "other securities." The "other securities" are subject to the requirement that not more

than 5% of total assets of the Fund will be invested in the securities of a single issuer and that the Fund will not hold

more than 10% of any single issuer's outstanding voting securities.

The Funds may not purchase the securities of any issuer if, as a result, a Fund would fail to be a diversified

company within the meaning of the Investment Company Act of 1940, as amended ("Investment Company Act") and the rules and

regulations promulgated thereunder.

Borrowing, Issuing Senior Securities and Pledging Assets

Neither Fund may issue senior securities, borrow money or pledge assets except as permitted under the Investment

Company Act, the rules and regulations promulgated thereunder, or under any exemptive order, SEC release, no-action

letter or similar relief or interpretations.

Lending

Both Funds may lend assets to brokers, dealers and financial institutions. Both Funds may make loans, including

through loans of assets of the Fund, repurchase agreements, trade claims, loan participations or similar investments, as

permitted by the Investment Company Act. For purposes of this limitation and consistent with the Fund's investment

objective, the acquisition of bonds, debentures, other debt securities or instruments, or participations or other

interests therein and investments in government obligations, commercial paper, certificates of deposit, bankers'

acceptances or instruments similar to any of the foregoing will not be considered the making of a loan.

Illiquid Securities

Both Funds may invest in illiquid securities, including those without a readily available market and repurchase

agreements with maturities longer than seven days. Each Fund may hold up to 5% of its net assets in illiquid securities.

Temporary Defensive Investments

Although each Fund normally invest assets according to its investment strategy, there are times when a Fund may

temporarily invest up to 100% of its assets in money market instruments in response to adverse market, economic or

political conditions.

For more information about the risks and restrictions associated with these policies, see the Funds' Prospectus,

and for a more detailed discussion of the Funds' investments, see the Statements of Additional Information, all of which

are incorporated into this Proxy Statement by reference.

Derivative Strategies

Both Funds may use derivative strategies to try to improve the Fund's returns or hedging techniques to try to

protect its assets. Derivatives, such as futures, options, foreign currency forward contracts, options on futures and

swaps, involve costs and can be volatile. With derivatives, the Fund's sub-advisor is trying to predict whether the

underlying investment-- a security, market index, currency, interest rate or some other asset, rate or index-- will go up

or down at some future date. Each Fund may use derivatives to try to reduce risk or to increase return, taking into

account the Fund's overall investment objective. The Funds cannot guarantee these derivative strategies will work, that

the instruments necessary to implement these strategies will be available or that the Funds will not lose money.

Investment Restrictions

Each of the Funds has substantially identical fundamental investment restrictions. These fundamental restrictions

limit a Fund's ability to: (i) issue senior securities; (ii) borrow money; (iii) underwrite securities; (iv) purchase or

sell real estate; (v) purchase or sell physical commodities; (vi) make loans (except for certain securities lending

transactions); and (vii) concentrate its investments by investing more than 25% of the value of the Fund's assets in

securities of issuers having their principal business activities in the same industry. A Fund may not change a

fundamental investment restriction without the prior approval of its shareholders.

Federal Income Tax Considerations

Each Fund is treated as a separate entity for federal income tax purposes. Each Fund has qualified and elected

or intends to qualify and elect to be treated as a "regulated investment company" under Subchapter M of the Internal

Revenue Code of 1986, as amended (the "Code"), and intends to continue to so qualify in the future. As a regulated

investment company, a Fund must, among other things, (a) derive at least 90% of its gross income from dividends,

interest, payments with respect to loans of stock and securities, gains from the sale or other disposition of stock,

securities or foreign currency and other income (including but not limited to gains from options, futures, and forward

contracts) derived with respect to its business of investing in such stock, securities or foreign currency; and (b)

diversify its holdings so that, at the end of each quarter of its taxable year, (i) at least 50% of the value of the

Fund's total assets is represented by cash, cash items, U.S. Government securities, securities of other regulated

investment companies, and other securities limited, in respect of any one issuer, to an amount not greater than 5% of the

Fund's total assets, and 10% of the outstanding voting securities of such issuer, and (ii) not more than 25% of the value

of its total assets is invested in the securities of any one issuer (other than U.S. Government securities or securities

of other regulated investment companies). As a regulated investment company, a Fund (as opposed to its shareholders)

will not be subject to federal income taxes on the net investment income and capital gain that it distributes to its

shareholders, provided that at least 90% of its net investment income and realized net short-term capital gain in excess

of net long-term capital loss for the taxable year is distributed in accordance with the Code's timing requirements

The Transaction may entail various tax consequences which are discussed under the caption "Tax Consequences of

the Transaction."

Risks of investing in the Funds

Like all investments, an investment in either Fund involves risk. There is no assurance that either of the Funds

will meet its investment objective. As with any fund investing primarily in equity securities, the value of the

securities held by a Fund may decline. Stocks can decline for many reasons, including reasons related to the particular

company, the industry of which it is a part, or the securities markets generally. These declines may be substantial.

The risk to which a capital growth fund is subject depends in part on the size of the companies in which the

particular fund invests. Securities of smaller companies tend to be subject to more abrupt and erratic price movements

than securities of larger companies, in part because they may have limited product lines, market or financial resources.

Because the Growth + Value Fund and Managed Index Fund invest primarily in large-capitalization companies, the Funds

should be less prone to such abrupt and erratic price movements. Moreover, value stocks are believed to be selling at

prices lower than what they are actually worth, while growth stocks are those of companies that are expected to grow at

above-average rates. A fund investing primarily in growth stocks will tend to be subject to more risk than a value fund,

although this will not always be the case.

Management of the Company and the Funds

American Skandia Investment Services, Inc. ("ASISI"), One Corporate Drive, Shelton, Connecticut, and Prudential

Investments LLC ("PI"), Gateway Center Three, 100 Mulberry Street, Newark, New Jersey, serve as co-managers (each an

"Investment Manager" and together the "Investment Managers") pursuant to an investment management agreement with the

Company on behalf of each Fund (the "Management Agreement"). Under the Management Agreement, PI, as co-manager, will

provide supervision and oversight of ASISI's investment management responsibilities with respect to the Company.

Pursuant to the Management Agreement, the Investment Managers will jointly administer each Fund's business affairs and

supervise each Fund's investments. Subject to approval by the Board of Directors, the Investment Managers may select and

employ one or more sub-advisors for a Fund, who will have primary responsibility for determining what investments the

Fund will purchase, retain and sell. Also subject to the approval of the Board of Directors, the Investment Managers may

reallocate a Fund's assets among sub-advisors including (to the extent legally permissible) affiliated sub-advisors,

consistent with a Fund's investment objectives.

The Company has obtained an exemption from the SEC that permits an Investment Manager to change sub-advisors for

a Fund and to enter into new sub-advisory agreements, without obtaining shareholder approval of the changes. Any such

sub-advisor change would continue to be subject to approval by the Board of Directors of the Company. This exemption

(which is similar to exemptions granted to other investment companies that are operated in a similar manner as the

Company) is intended to facilitate the efficient supervision and management of the sub-advisors by the Investment

Managers and the Directors of the Company.

The Investment Managers currently engage the following sub-advisors to manage the investments of each Fund in

accordance with the Fund's investment objective, policies and limitations and any investment guidelines established by

the Investment Managers. Each sub-advisor is responsible, subject to the supervision and control of the Investment

Managers, for the purchase, retention and sale of securities in the Fund's investment portfolio under its management.

Alliance Capital Management, L.P. ("Alliance"), 1345 Avenue of the Americas, New York, NY 10105, serves as

sub-advisor for the portion of the Growth + Value Fund invested in growth stocks. Alliance is a leading global

investment adviser supervising client accounts with assets as of December 31, 2002 totaling more than $386 billion. Day

to day investment decisions for the growth portion of the ASAF Alliance/Bernstein Growth +Value Fund are made by Syed

Hasnain, Stephanie Simon and Dan Nordby. Ms. Simon and Mr. Nordby have managed the Fund since the Fund commenced

operations, and Mr. Hasnain has been managing the Fund since May 2003. Seth J. Masters, Chief Investment Officer for

Style Blend Services, has overall responsibility for rebalancing and administration of the growth and value components of

the Fund. Mr. Hasnain is Senior Vice President, U. S. Large Cap Portfolio Manager and a member of the Global Large Cap

Growth Equity Team. He has been associated with Alliance since 1995. Ms. Simon is Senior Vice President and Large Cap

Portfolio Manager and joined ACMC in 1998 after serving as Chief Investment Officer for Sargent Management Company from

1996 to 1998. Mr. Norby, Senior Vice President, has been with Alliance since 1996. Mr. Masters has been with Alliance

and, prior to that, Sanford C. Bernstein & Co. LLC, since 1991 and is the chairman of the firm's US and Global Style

Blend Investment Policy Groups and a member of the Bernstein Global, International and Emerging Markets Value Investment

Policy Group.

Sanford C. Bernstein & Co., LLC ("Bernstein"), 767 Fifth Avenue, New York, New York 10153, serves as sub-advisor

for the Managed Index Fund and for the portion of the Growth + Value Fund invested in value stocks as well as the

sub-advisor for the Managed Index Fund. Bernstein is an indirect wholly-owned subsidiary of Alliance Capital Management,

L.P. ("Alliance") and management of the Funds is conducted by Bernstein with the investment management assistance of the

Bernstein Investment Research and Management unit (the "Bernstein Unit") of Alliance. The Bernstein Unit services the

former investment research and management business of Sanford C. Bernstein & Co., Inc., a registered investment advisor

and broker/dealer acquired by Alliance in October 2000 that managed value-oriented investment portfolios since 1967.

Day-to-day investment management decisions for the value portion of the ASAF Alliance/Bernstein Growth + Value

Fund are made by Ranji H. Nagaswami, CFA and Marilyn Goldstein Fedak. Ms. Nagaswami has managed the Funds since May 2003

and is a senior portfolio manager and a member of the U.S. Value Equity Investment Policy Group and the Risk Investment

Policy Group. Ms. Nagaswami has been with Alliance since 1999. From 1986 until 1999, she was at UBS Brinson and its

predecessor organizations, where she progressed from quantitative analyst to managing director to co-head of U.S. fixed

income. Ms. Fedak has managed the Funds since they commenced operations and has been an Executive Vice President and

Chief Investment Officer- U.S. Value Equities of Alliance since October 2000 and prior to that Chief Investment Officer

and Chairman of the U.S. Equity Investment Policy Group at Sanford C. Bernstein & Co, Inc. since 1993.

Day-to-day investment management decisions for the Managed Index Fund are made by Bernstein's Investment Policy

Group for Structured Equities, which is chaired by Steven Pisarkiewicz. Mr. Pisarkiewicz joined Bernstein in 1989 and

assumed his current position as Chief Investment Officer for Structured Equity Services in 1998. Mr. Pisarkiewicz and

the Investment Policy Group for Structured Equities have managed the Fund since Bernstein became the Fund's sub-advisor

in May, 2000.

Fee Arrangements

The Funds have comparable fee arrangements. Under the Management Agreement with respect to the Growth + Value

Fund, the Fund is obligated to pay ASISI an annual investment management fee equal to 1.00% of its average daily net

assets. Similarly, under the Management Agreement with respect to the Managed Index Fund, the Fund is obligated to pay

ASISI an annual investment management fee equal to 0.80% of its average daily net assets. During the calendar year ended

December 31, 2002, the Growth + Value Fund paid $128,852 in investment management fees to ASISI. If the fee rate

applicable to the Managed Index Fund had been in effect during such period, the Growth + Value Fund would have paid

$103,082 in investment management fees to ASISI. Because the Investment Management fee rates currently paid to ASISI by

the Growth + Value Fund are greater than the fee rates paid by the Managed Index Fund, former shareholders of the Growth

+ Value Fund will pay a lesser investment advisory fee rate after becoming shareholders of the Managed Index Fund upon

completion of the Transaction.

The Investment Manager has voluntarily agreed until March 1, 2004 to reimburse each Fund for its respective

operating expenses, exclusive of taxes, interest, brokerage commissions, distribution fees and extraordinary expenses,

but inclusive of the management fee, which in the aggregate exceed specified percentages of a Fund's average net assets

as follows: Growth + Value Fund, 1.35% and Managed Index Fund, 1.00%. The Investment Manager may terminate the above

voluntary agreements at any time after March 1, 2004. Voluntary payments of Fund expenses by the Investment Manager may

be made subject to reimbursement by the Fund, at the Investment Manager's discretion, within the two year period

following such payment to the extent permissible under applicable law and provided that the Fund is able to effect such

reimbursement and remain in compliance with applicable expense limitations.

ASISI pays Alliance and Bernstein a sub-advisory fee for sub-advisory services for the Growth + Value Fund and

the Managed Index Fund, respectively. ASISI pays these sub-advisory fees at no additional costs to the Funds. Under the

current sub-advisory agreement for the Growth + Value Fund, ASISI pays Alliance an annual sub-advisory fee equal to 0.40%

of the growth portion of the Fund's average daily net assets, and pays Bernstein an annual sub-advisory fee equal to

0.40% of the value portion of the Fund's daily net assets. Under the sub-advisory agreement for the Managed Index Fund,

ASISI pays Bernstein an annual sub-advisory fee equal to 0.40% of the average daily net assets of the Managed Index Fund

up to $10 million, 0.30% of the net assets greater than $10 million up to $30 million, 0.20% of the net assets greater

than $30 million up to $100 million, and 0.10% of the net assets greater than $100 million.

Distribution Plan

The Company adopted a Distribution and Service Plan (commonly known as a "12b-1 Plan") for each class of shares

to compensate the Funds' distributor for its services and costs in distributing shares and servicing shareholder

accounts. Under the Distribution and Service Plan for Class A shares, each Fund pays the distributor 0.50% of the Fund's

average daily net assets attributable to Class A shares. Under the Plans for Class B, X and C shares, each Fund pays the

distributor 1.00% of the Fund's average daily net assets attributable to the relevant Class of shares. Because these

fees are paid out of the Funds' assets on an ongoing basis, these fees may, over time, increase the cost of an investment

in the Fund and may be more costly than other types of sales charges. The distributor uses distribution and service fees

received under each 12b-1 Plan to compensate qualified dealers for services provided in connection with the sale of

shares and the maintenance of shareholder accounts. The distributor's rights to distribution and service fees received

under the Class B 12b-1 Plan and the Class X 12b-1 Plan have been assigned to third parties.

Valuation

The net asset value ("NAV") per share is determined for each class of shares for each Fund as of the time of the

close of the NYSE (which is normally 4:00 p.m. Eastern Time) on each business day by dividing the value of the Fund's

total assets attributable to a class, less any liabilities, by the number of total shares of that class outstanding. In

general, the assets of each Fund are valued on the basis of market quotations. However, in certain circumstances where

market quotations are not readily available or where market quotations for a particular security or asset are believed to

be incorrect, securities and other assets are valued by methods that are believed to accurately reflect their fair value.

Purchases, Redemptions, Exchanges and Distributions

The purchase policies for each Fund are identical. The offering price is the NAV plus any initial sales charge

that applies. Class A shares are sold at NAV plus an initial sales charge that varies depending on the amount of your

investment. Class B shares are sold at NAV per share without an initial sales charge. However, if Class B shares are

redeemed within seven years of their purchase, a contingent deferred sales charge ("CDSC") will be deducted from the

redemption proceeds. Class C shares are sold at NAV per share plus an initial sales charge of 1% of the offering price.

If Class C shares are redeemed within 12 months of the first business day of calendar month of their purchase, a CDSC of

1.0% will be deducted from the redemption proceeds. Class X shares are sold at NAV per share without an initial sales

charge. In addition, investors purchasing Class X shares will receive, as a bonus, additional shares having a value

equal to 2.50% of the amount invested. Although Class X shares are sold without an initial sales charge, if Class X

shares are redeemed within 8 years of their purchase, a CDSC will be deducted from the redemption proceeds. Refer to the

Funds' Prospectus for more information regarding how to purchase shares.

The redemption policies for each Fund are identical. Your shares will be sold at the next NAV determined after

your order to sell is received, less any applicable CDSC imposed. Refer to the Funds' Prospectus for more information

regarding how to sell shares.

Shares of each Fund may be exchanged for shares of the same class of other Funds at NAV per share at the time of

exchange. Exchanges of shares involve a redemption of the shares of the Fund you own and a purchase of shares of another

Fund. Shares are normally redeemed and purchased in the exchange transaction on the business day on which the Transfer

Agent receives an exchange request that is in proper form, if the request is received by the close of the NYSE that day.

Each Fund will distribute substantially all of its income and capital gains to shareholder each year. Each Fund

will declare dividends, if any, annually.

Fees and expenses

The following table describes the fees and expenses that shareholders may pay if they hold shares of the Funds,

as well as the projected fees and expenses of the Managed Index Fund after the Transaction.

Class A Shares

Managed Index Fund

Growth + Value Managed Index After Transaction

Fund Class A Fund Class A Class A

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) 5.75% 5.75% 5.75%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) None1 None1 None1

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 1.00% 0.80% 0.80%

Estimated Distribution (12b-1) Fees........ 0.50% 0.50% 0.50%

Other Expenses............................. 2.15% 0.56% 0.61%

Advisory Fee Waivers and Expense Reimbursement (1.80)% (0.36)% (0.41)%

Total Annual Fund Operating Expenses....... 1.85% 1.50% 1.50%

Class B Shares

Managed Index Fund

Growth + Value Managed Index After Transaction

Fund Class B Fund Class B Class B

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) None None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 1.00% 0.80% 0.80%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 2.15% 0.56% 0.61%

Advisory Fee Waivers and Expense Reimbursement (1.80)% (0.36)% (0.41)%

Total Annual Fund Operating Expenses....... 2.35% 2.00% 2.00%

Class C Shares

Managed Index Fund

Growth + Value Managed Index After Transaction

Fund Class C Fund Class C Class C

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) 1.00% 1.00% 1.00%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 1.00%3 1.00%3 1.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 1.00% 0.80% 0.80%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 2.15% 0.56% 0.61%

Advisory Fee Waivers and Expense Reimbursement (1.80)% (0.36)% (0.41)%

Total Annual Fund Operating Expenses....... 2.35% 2.00% 2.00%

Class X Shares

Managed Index Fund

Growth + Value Managed Index After Transaction

Fund Class X Fund Class X Class X

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 1.00% 0.80% 0.80%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 2.15% 0.56% 0.61%

Advisory Fee Waivers and Expense Reimbursement (1.80)% (0.36)% (0.41)%

Total Annual Fund Operating Expenses....... 2.35% 2.00% 2.00%

1. Under certain circumstances, purchases of Class A shares not subject to an initial sales charge (load) will be

subject to a contingent deferred sales charge (load) ("CDSC") if redeemed within 12 months of the calendar month of

purchase. For an additional discussion of the Class A CDSC, see this Prospectus under "How to Buy Shares."

2. A $10 fee may be imposed for wire transfers of redemption proceeds. For an additional discussion of wire

redemptions, see this Prospectus under "How to Redeem Shares."

3. If you purchase Class B or X shares, you do not pay an initial sales charge but you may pay a CDSC if you redeem some

or all of your shares before the end of the seventh (in the case of Class B shares) or eighth (in the case of Class X

shares) year after which you purchased such shares. The CDSC is 6%, 5%, 4%, 3%, 2%, 2% and 1% for redemptions of Class B

shares occurring in years one through seven, respectively. The CDSC is 6%, 5%, 4%, 4%, 3%, 2%, 2% and 1% for redemptions

of Class X shares occurring in years one through eight, respectively. No CDSC is charged after these periods. If you

purchase Class C shares, you may pay an initial sales charge of 1% and you may incur a CDSC if you redeem some or all of

your Class C shares within 12 months of the calendar month of purchase. For a discussion of the Class B, X and C CDSC,

see this Prospectus under "How to Buy Shares."

Expense Examples

Full Redemption - These examples are intended to help you compare the cost of investing in each Fund with the cost of

investing in other mutual funds, and the cost of investing in the Managed Index Fund after the Transaction. They assume

that you invest $10,000, that you receive a 5% return each year, and that the Funds' total operating expenses remain the

same. Although your actual costs may be higher or lower, based on the above assumptions your costs would be:

Class A Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 752 1,471 2,210 4,147

Managed Index 500 Fund 719 1,093 1,491 2,602

Managed Index 500 Fund 719 1,103 1,511 2,648

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 838 1,497 2,171 4,116

Managed Index 500 Fund 803 1,102 1,428 2,544

Managed Index 500 Fund 803 1,112 1,449 2,591

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 436 1,186 2,052 4,280

Managed Index 500 Fund 401 795 1,316 2,742

Managed Index 500 Fund 401 805 1,336 2,788

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 844 1,525 2,321 4,327

Managed Index 500 Fund 808 1,120 1,559 2,735

Managed Index 500 Fund 808 1,130 1,580 2,783

(Projected after the Transaction)

No Redemption - You would pay the following expenses based on the above assumptions except that you do not redeem your

shares at the end of each period:

Class A Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 752 1,471 2,210 4,147

Managed Index 500 Fund 719 1,093 1,491 2,602

Managed Index 500 Fund 719 1,103 1,511 2,648

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 238 1,097 1,971 4,116

Managed Index 500 Fund 203 702 1,228 2,544

Managed Index 500 Fund 203 712 1,249 2,591

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 336 1,186 2,052 4,280

Managed Index 500 Fund 301 795 1,316 2,742

Managed Index 500 Fund 301 805 1,336 2,788

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

Growth + Value Fund 244 1,125 2,021 4,327

Managed Index 500 Fund 208 720 1,259 2,735

Managed Index 500 Fund 208 730 1,280 2,783

(Projected after the Transaction)

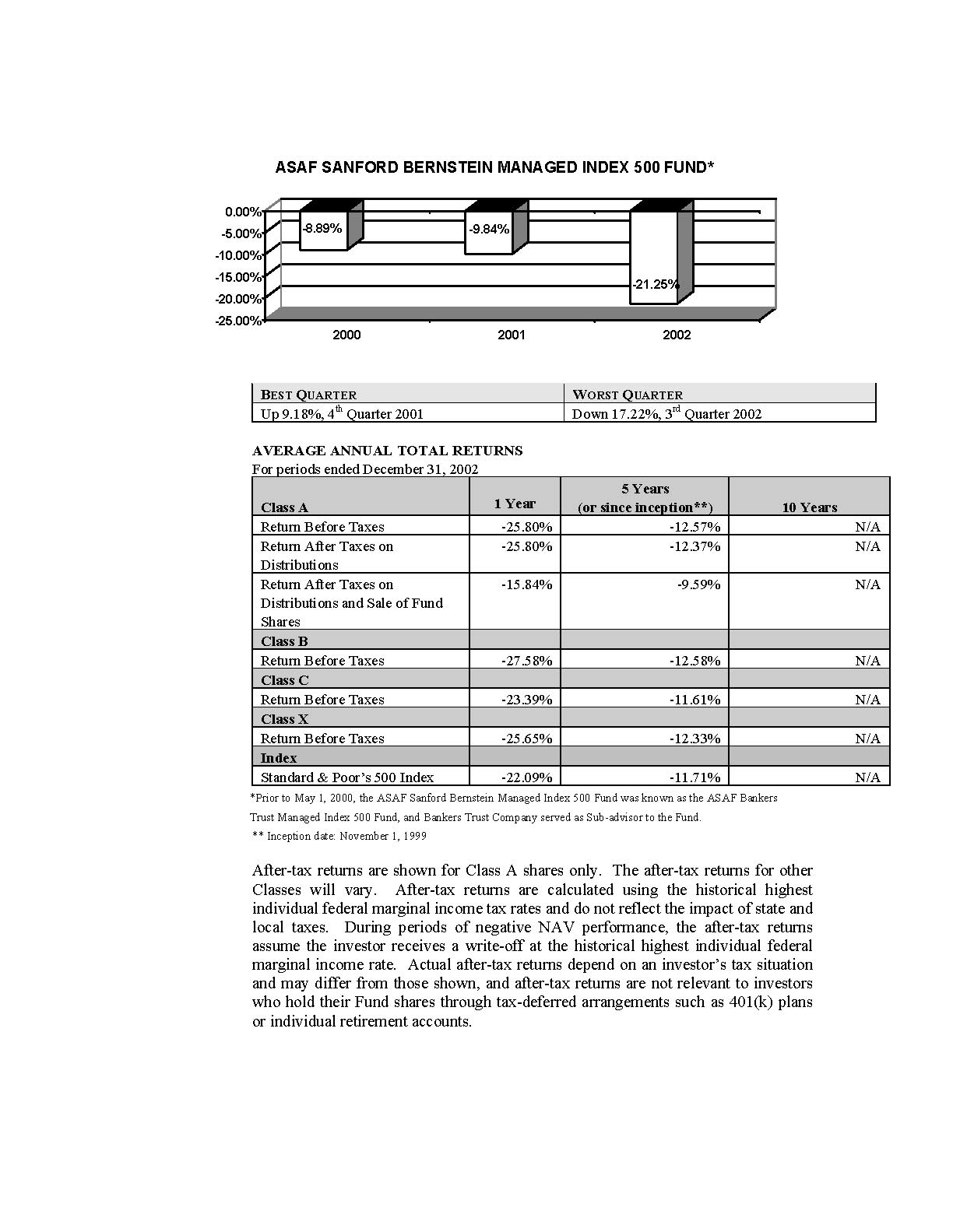

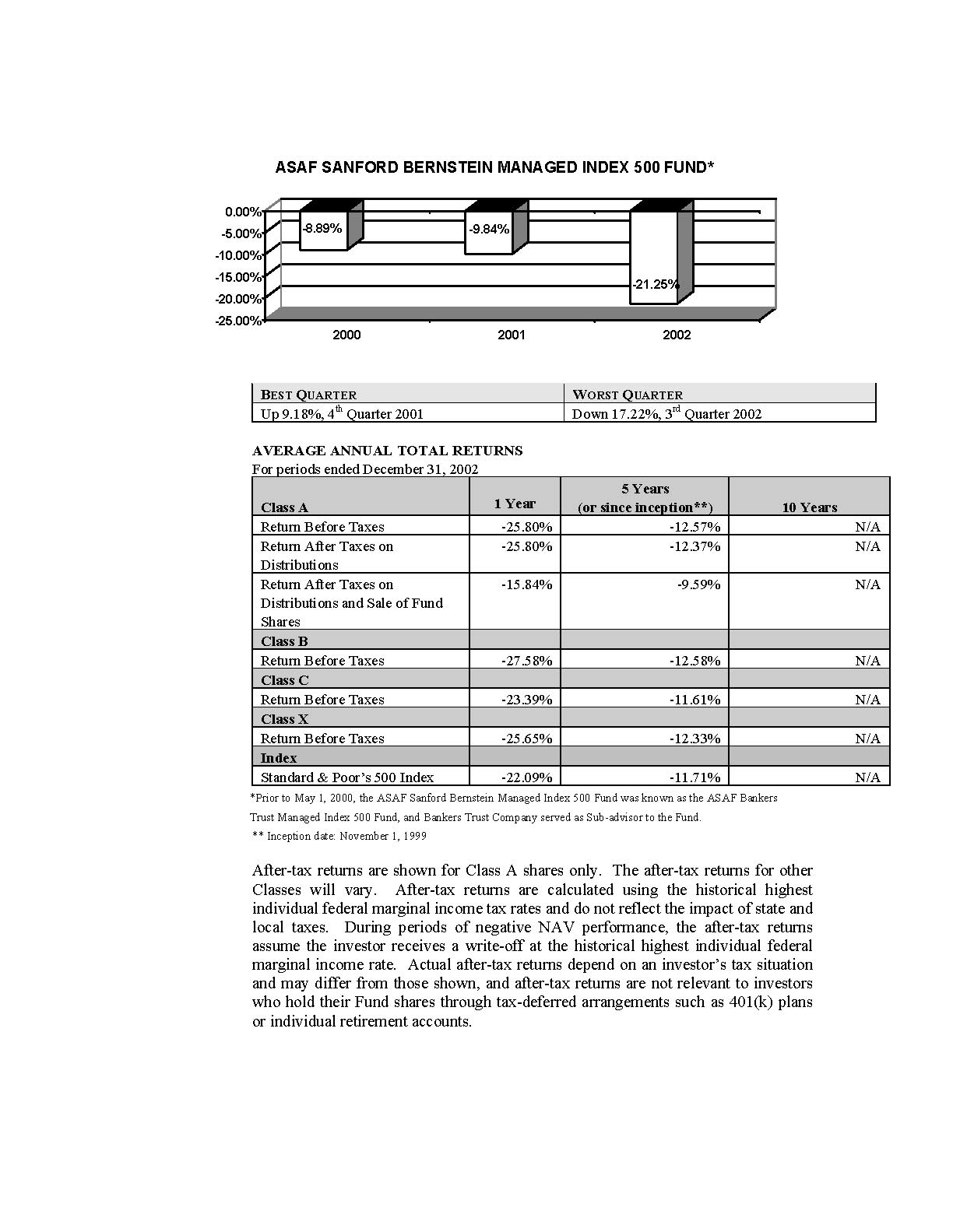

Performance

The bar charts show the performance of the Class A shares of each Fund for each full calendar year the Fund has

been in operation. The first table below each bar chart shows each such Fund's best and worst quarters during the

periods included in the bar chart. The second table shows the average annual total returns before taxes for each Class

of each Fund for 2002 and since inception, as well as the average annual total returns after taxes on distributions and

after taxes on distributions and redemptions for Class A shares of each Fund for 2002 and since inception.

This information may help provide an indication of each Fund's risks by showing changes in performance from year

to year and by comparing the Fund's performance with that of a broad-based securities index. The average annual figures

reflect sales charges; the other figures do not, and would be lower if they did. All figures assume reinvestment of

dividends. Past performance does not necessarily indicate how a Fund will perform in the future.

-------------------------------------------------- ------------------------------------------------

Best Quarter Worst Quarter

-------------------------------------------------- ------------------------------------------------

-------------------------------------------------- ------------------------------------------------

Up 6.98% 4th Quarter 2002 Down 16.65% 3rd Quarter 2002

-------------------------------------------------- ------------------------------------------------

AVERAGE ANNUAL TOTAL RETURNS

For periods ended December 31, 2002

----------------------------------- ------------- -------------------------- ------------------------

5 Years

Class A (or since inception*) 10 Years

1 Year

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -29.49% -15.31% N/A

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -29.49% -15.31% N/A

Distributions

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -18.10% -12.07% N/A

Distributions and Sale of Fund

Shares

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Class B

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -31.48% -16.07% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class C

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -27.26% -13.44% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class X

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -29.69% -14.86% N/A

----------------------------------- ------------- -------------------------- ------------------------

Index

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Standard & Poor's 500 Index -22.09% -15.76% N/A

----------------------------------- ------------- -------------------------- ------------------------

* Inception date: March 1, 2001.

After-tax returns are shown for Class A shares only. The after-tax returns for other Classes will

vary. After-tax returns are calculated using the historical highest individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. During periods of negative NAV

performance, the after-tax returns assume the investor receives a write-off at the historical highest

individual federal marginal income rate. Actual after-tax returns depend on an investor's tax situation

and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund

shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

-------------------------------------------------- ------------------------------------------------

Best Quarter Worst Quarter

-------------------------------------------------- ------------------------------------------------

-------------------------------------------------- ------------------------------------------------

Up 9.18%, 4th Quarter 2001 Down 17.22%, 3rd Quarter 2002

-------------------------------------------------- ------------------------------------------------

AVERAGE ANNUAL TOTAL RETURNS

For periods ended December 31, 2002

----------------------------------- ------------- -------------------------- ------------------------

5 Years

Class A (or since inception**) 10 Years

1 Year

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -25.80% -12.57% N/A

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -25.80% -12.37% N/A

Distributions

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -15.84% -9.59% N/A

Distributions and Sale of Fund

Shares

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Class B

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -27.58% -12.58% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class C

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -23.39% -11.61% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class X

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -25.65% -12.33% N/A

----------------------------------- ------------- -------------------------- ------------------------

Index

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Standard & Poor's 500 Index -22.09% -11.71% N/A

----------------------------------- ------------- -------------------------- ------------------------

*Prior to May 1, 2000, the ASAF Sanford Bernstein Managed Index 500 Fund was known as the ASAF

Bankers Trust Managed Index 500 Fund, and Bankers Trust Company served as Sub-advisor to the Fund.

** Inception date: November 1, 1999

After-tax returns are shown for Class A shares only. The after-tax returns for other Classes will

vary. After-tax returns are calculated using the historical highest individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. During periods of negative NAV

performance, the after-tax returns assume the investor receives a write-off at the historical highest

individual federal marginal income rate. Actual after-tax returns depend on an investor's tax situation

and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund

shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

REASONS FOR THE TRANSACTION

The Directors, including all of the Directors who are not "interested persons" of the Company (the "Independent

Directors") have unanimously determined that the Transaction would be in the best interests of the shareholders of Growth

+ Value and the Managed Index Funds and that the interests of the shareholders of Growth + Value and the Managed Index

Funds would not be diluted as a result of the Transaction. At a meeting held on July 25, 2003, the Board considered a

number of factors that it believes benefits the shareholders of Growth + Value Fund, including the following:

o the compatibility of the Funds' investment objectives, policies and restrictions;

o the relative past and current growth in assets and investment performance of the Funds and future prospects for Managed

Index Fund;

o the relative expense ratios of the Funds and the impact of the proposed Transaction on the expense ratios;

o the anticipated tax consequences of the Transaction with respect to each Fund and its shareholders;

o the relative size of the Growth + Value Fund and the lack of growth in the assets and the number of shareholders of

Growth + Value Fund; and

o the potential benefits of the proposed Transaction to the shareholders of each Fund, including the long-term economies

of scale.

At the July 25 meeting, PI and ASISI recommended the merger to the Board. In recommending the merger, PI and

ASISI advised the Board that the Funds have comparable investment objectives, and similar policies and investment

portfolios. Moreover, the Investment Managers noted that the Funds have similar investment styles and are managed by

affiliated sub-advisory firms. The Investment Managers advised the Board that as of May 31, 2003 the Growth + Value Fund

had assets of approximately $13 million while the Managed Index Fund had assets of approximately $132 million, and the

Growth + Value Fund had a higher cost structure and higher expense ratio compared to the Managed Index Fund.

Accordingly, by merging the Funds, Growth + Value shareholders would enjoy a greater asset base and lower cost

structure. The Board considered that if the merger is approved, shareholders of Growth + Value Fund, regardless of the

class of shares they own, should realize a reduction in both the net annual operating expenses and gross annual operating

expenses (that is, without any waivers or reimbursements) paid on their investment, while the shareholders of the Managed

Index Fund would have identical net annual operating expenses and slightly higher gross annual operating expenses (.05%)

if the merger is approved, although there can be no assurance that operational savings will be realized. In addition,

the Board considered that, even though expenses would not immediately decrease for the Managed Index Fund, the

incremental assets should help to stabilize certain non-distribution related expenses. The Board was advised that the

expenses associated with the Transaction would be borne by the Investment Managers.

The Board, including a majority of the Independent Directors, unanimously concluded that the Transaction is in

the best interests of the shareholders of the Growth + Value Fund and the Managed Index Fund and that no dilution of

value would result to the shareholders of the Growth + Value Fund or the Managed Index Fund from the Transaction.

Consequently, the Board approved the Plan and recommended that shareholders of the Growth + Value Fund vote to approve

the Transaction.

For the reasons discussed above, the Board of Directors unanimously recommends that you vote For the Plan.

If shareholders of the Growth + Value Fund do not approve the Plan, the Board will consider other possible

courses of action for the Growth + Value Fund, including, among others, consolidation of the Growth + Value Fund with one

or more Funds of the Company other than the Managed Index Fund or unaffiliated funds.

INFORMATION ABOUT THE TRANSACTION

This is only a summary of the Plan. You should read the actual Plan attached as Exhibit A.

Closing of the Transaction

If shareholders of the Growth + Value Fund approve the Plan, the Transaction will take place after various

conditions are satisfied by the Company on behalf of the Growth + Value Fund and the Managed Index Fund, including the

preparation of certain documents. The Company will determine a specific date for the actual Transaction to take place.

This is called the "closing date." If the shareholders of the Growth + Value Fund do not approve the Plan, the

Transaction will not take place.

If the shareholders of the Growth + Value Fund approve the Plan, the Growth + Value Fund will deliver to the

Managed Index Fund substantially all of its assets on the closing date. As a result, shareholders of the Growth + Value

Fund will beneficially own shares of the Managed Index Fund that, as of the date of the exchange, have a value equal to

the dollar value of the assets delivered to the Managed Index Fund. The stock transfer books of the Growth + Value Fund

will be permanently closed on the closing date. Requests to transfer or redeem assets allocated to the Growth + Value

Fund may be submitted at any time before 4:00 p.m. Eastern standard time on the closing date; requests that are received

in proper form prior to that time will be effected prior to the closing.

To the extent permitted by law, the Company may amend the Plan without shareholder approval. It may also agree

to terminate and abandon the Transaction at any time before or, to the extent permitted by law, after the approval by

shareholders of the Growth + Value Fund.

Expenses of the Transaction

The expenses resulting from the Transaction will be paid by PI (or its affiliates). The Funds will not incur any

expenses associated with the Transaction. The portfolio securities of the Growth + Value Fund will be transferred

in-kind to the Managed Index Fund prior to the restructuring of the Growth + Value Fund's investment portfolio.

Accordingly, the Transaction will entail little or no expenses in connection with portfolio restructuring.

Tax Consequences of the Transaction

The Transaction is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under

the Code. It is a condition to each Fund's obligation to complete the Transaction that the Funds will have received an

opinion from Stradley Ronon Stevens & Young, LLP, counsel to the Funds, based upon representations made by Growth + Value

Fund and Managed Index Fund, and upon certain assumptions, substantially to the effect that:

1. The acquisition by Managed Index Fund of the assets of Growth + Value Fund in exchange solely for voting shares of

Managed Index Fund and the assumption by Managed Index Fund of the liabilities of Growth + Value Fund, if any, followed

by the distribution of the Managed Index Fund shares acquired by Growth + Value Fund pro rata to their shareholders, will

constitute a reorganization within the meaning of Section 368(a)(1) of the Code, and Managed Index Fund and Growth +

Value Fund each will be "a party to a reorganization" within the meaning of Section 368(b) of the Code;

2. The shareholders of Growth + Value Fund will not recognize gain or loss upon the exchange of all of their shares of

Growth + Value Fund solely for shares of Managed Index Fund, as described above and in the Plan;

3. No gain or loss will be recognized by Growth + Value Fund upon the transfer of its assets to Managed Index Fund in

exchange solely for Class A, Class B, Class C, and Class X shares of Managed Index Fund and the assumption by Managed

Index Fund of the liabilities of Growth + Value Fund, if any. In addition, no gain or loss will be recognized by Managed

Index Fund on the distribution of such shares to the shareholders of Growth + Value Fund in liquidation of Growth + Value

Fund;

4. No gain or loss will be recognized by Managed Index Fund upon the acquisition of the assets of Growth + Value Fund in

exchange solely for shares of Managed Index Fund and the assumption of the liabilities of Growth + Value Fund, if any;

5. Managed Index Fund's basis for the assets acquired from Growth + Value Fund will be the same as the basis of these

assets when held by Growth + Value Fund immediately before the transfer, and the holding period of such assets acquired

by Managed Index Fund will include the holding period of these assets when held by Growth + Value Fund;

6. Growth + Value Fund's shareholders' basis for the shares of Managed Index Fund to be received by them pursuant to the

reorganization will be the same as their basis in Growth + Value Fund shares exchanged; and

7. The holding period of Managed Index Fund shares to be received by the shareholders of Growth + Value Fund will include

the holding period of their Growth + Value Fund shares exchanged provided such Growth + Value Fund shares were held as

capital assets on the date of the exchange.

Shareholders of Growth + Value Fund should consult their tax advisers regarding the tax consequences to them of

the Transaction in light of their individual circumstances. In addition, because the foregoing discussion relates only to

the U.S. federal income tax consequences of the Transaction, shareholders also should consult their tax advisers as to

state, local and foreign tax consequences to them, if any, of the Transaction.

Characteristics of the Managed Index Fund shares

Shares of the Managed Index Fund will be distributed to shareholders of the Growth + Value Fund and will have the

same legal characteristics as the shares of the Managed Index Fund with respect to such matters as voting rights,

assessibility, conversion rights, and transferability.

Capitalization of the Funds and Capitalization after the Transaction

The following table sets forth, as of April 30, 2003 the capitalization of shares of the Growth + Value Fund and

the Managed Index Fund. The table also shows the projected capitalization of the Managed Index Fund shares as adjusted

to give effect to the proposed Transaction. The capitalization of the Managed Index Fund is likely to be different when

the Transaction is consummated.

Class A

Growth + Value Managed Index Managed Index Fund

Projected after

Fund Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets ................................ 2,972,611 27,221,595 30,194,206

Total shares outstanding .................. 359,574 3,752,407 50,441* 4,162,422

Net asset value per share.................. 8.27 7.25 7.25

Class B

Managed Index Fund

Growth + Value Managed Index Projected after

Fund Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets ................................ 5,309,705 64,857,371 70,167,076

Total shares outstanding .................. 649,691 9,093,149 95,008* 9,837,848

Net asset value per share.................. 8.17 7.13 7.13

Class C

Managed Index Fund

Growth + Value Managed Index Projected after

Fund Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets ................................ 2,368,121 32,321,771 34,689,892

Total shares outstanding .................. 289,733 4,531,560 42,402* 4,863,695

Net asset value per share.................. 8.17 7.13 7.13

Class X

Managed Index Fund

Growth + Value Managed Index Projected after

Fund Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets ................................ 1,289,717 7,014,866 8,304,583

Total shares outstanding .................. 157,712 984,955 23,428* 1,166,095

Net asset value per share.................. 8.18 7.12 7.12

*Reflects the change in the Growth + Value Fund upon conversion to the Managed Index Fund.

VOTING INFORMATION

Shareholders of record of the Growth + Value Fund on the Record Date will be entitled to vote at the Meeting. On

the Record Date, there were 1,572,371 shares of the Growth + Value Fund issued and outstanding.

The presence in person or by proxy of the holders of a majority of the outstanding shares of the Fund is required

to constitute a quorum at the Meeting. Shares beneficially held by shareholders present in person or represented by

proxy at the Meeting will be counted for the purpose of calculating the votes cast on the issues before the Meeting. If

a quorum is present, the affirmative vote of the holders of a majority of the total number of shares of capital stock of

the Growth + Value Fund outstanding and entitled to vote is necessary to approve the Plan. Each shareholder will be

entitled to one vote for each full share, and a fractional vote for each fractional share of the Growth + Value Fund held

at the close of business on the Record Date.

Shares held by shareholders present in person or represented by proxy at the Meeting will be counted both for the

purposes of determining the presence of a quorum and for calculating the votes cast on the issues before the Meeting. An

abstention by a shareholder, either by proxy or by vote in person at a Meeting, has the same effect as a negative vote.

Under existing New York Stock Exchange rules, it is not expected that brokers will be permitted to vote Fund shares in

their discretion. In addition, there is only one proposal being presented for a shareholder vote. As a result, the Fund

does not anticipate any broker non-votes.

..........Shareholders having more than one account in the Fund generally will receive a single proxy statement and a

separate proxy card for each account. It is important to mark, sign, date and return all proxy cards received.

..........In the event that sufficient votes to approve the Plan are not received, the persons named as proxies may propose

one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the

affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as

proxies will vote those proxies that they are entitled to vote FOR or AGAINST any such adjournment in their discretion.

..........The Company is not required to hold and will not ordinarily hold annual shareholders' meetings. The Board of

Directors may call special meetings of the shareholders for action by shareholder vote as required by the Investment

Company Act or the Company's Articles of Incorporation.

..........Pursuant to rules adopted by the SEC, a shareholder may include in proxy statements relating to annual and other

meetings of the shareholders of the Company certain proposals for shareholder action which he or she intends to introduce

at such special meetings; provided, among other things, that such proposal is received by the Company a reasonable time

before a solicitation of proxies is made for such meeting. Timely submission of a proposal does not necessarily mean

that the proposal will be included.

The Board of Directors intends to bring before the Meeting the matter set forth in the foregoing Notice. The

Directors do not expect any other business to be brought before the Meeting. If, however, any other matters are properly

presented to the Meeting for action, it is intended that the persons named in the enclosed proxy will vote in accordance

with their judgment. A shareholder executing and returning a proxy may revoke it at any time prior to its exercise by