File No. 333-108368

As filed on October 29, 2003

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |X|

Pre-Effective Amendment No. 1

Post-Effective Amendment No. |_|

(Check appropriate box or boxes)

American Skandia Advisor Funds, INC.

(Exact Name of Registrant as Specified in Charter)

(203) 926-1888

(Area Code and Telephone Number)

One Corporate Drive

Shelton, CT 06484

Address of Principal Executive Offices:

(Number, Street, City, State, Zip Code)

Edward P. Macdonald, Esq.

Assistant Secretary, American Skandia Advisor Funds

One Corporate Drive

Shelton, CT 06484

Name and Address of Agent for Service:

(Number and Street) (City) (State) (Zip Code)

Copies to:

Robert K. Fulton, Esquire

Stradley, Ronon, Stevens & Young, LLP

2600 One Commerce Square

Philadelphia, PA 19103-7098

Approximate Date of Proposed Public Offering: As soon as

practicable after this Registration Statement becomes effective

under the Securities Act of 1933, as amended.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the Registration Statement

shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Title of the securities being registered: Shares of common stock of the ASAF Alliance Growth and Income Fund of American

Skandia Advisor Funds. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940,

as amended.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF DeAM LARGE-CAP VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

IMPORTANT PROXY MATERIALS

PLEASE VOTE NOW

Dear Shareholder: October 10, 2003

I am writing to ask you to vote on an important proposal whereby the assets of the ASAF DeAM Large Cap Value Fund (the "Large-Cap

Value Fund") would be acquired by the ASAF Alliance Growth and Income Fund (the "Growth and Income Fund" and together with the

Large-Cap Value Fund, the "Funds"). The proposed acquisition is referred to as a merger. The Funds are each a series of American

Skandia Advisor Funds, Inc. ("ASAF"). A shareholder meeting for the Large-Cap Value Fund is scheduled for November 21, 2003.

Only shareholders of the Large-Cap Value Fund will vote on the acquisition of the Large-Cap Value Fund's assets by the Growth and

Income Fund.

This package contains information about the proposal and includes materials you will need to vote. The Board of Directors of ASAF

has reviewed the proposal and recommended that it be presented to shareholders of the Large-Cap Value Fund for their

consideration. Although the Directors have determined that the proposal is in the best interests of shareholders, the final

decision is up to you.

If approved, the proposed merger would give you the opportunity to participate in a larger fund with similar investment policies.

In addition, shareholders are expected to realize a reduction in the gross annual operating expenses paid on their investment in

the combined fund. The accompanying proxy statement and prospectus includes a detailed description of the proposal. Please read

the enclosed materials carefully and cast your vote. Remember, your vote is extremely important, no matter how large or small

your holdings. By voting now, you can help avoid additional costs that would be incurred with follow-up letters and calls.

To vote, you may use any of the following methods:

o By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage paid envelope. Votes must be

received prior to November 21, 2003.

o By Internet. Have your proxy card available. Go to the web site indicated on your proxy card. Enter your 12-digit control

number from your proxy card. Follow the instructions found on the web site. Votes must be entered prior to 4 p.m. on November

20, 2003.

o By Telephone. Have your proxy card available. Call the toll-free number on your proxy card. Enter your 12-digit control

number from your proxy card. Follow the instructions given. Votes must be entered prior to 4 p.m. on November 20, 2003.

If you have any questions before you vote, please call us at 1-800-SKANDIA. We are glad to help you understand the proposal and

assist you in voting. Thank you for your participation.

/s/Judy A. Rice

Judy A. Rice

President

This page has been intentionally left blank.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF DeAM LARGE-CAP VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To our Shareholders:

Notice is hereby given that a Special Meeting of Shareholders (the Meeting) of the ASAF Large-Cap Value Fund (the "Large-Cap Value

Fund") will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New Jersey 07102, on November 21, 2003, at

11:00 a.m. Eastern Standard Time, for the following purposes:

1. For shareholders of the Large-Cap Value Fund, to approve or disapprove a Plan of Reorganization under which the Large-Cap Value

Fund will transfer all of its assets to, and all of its liabilities will be assumed by, the ASAF Alliance Growth and Income Fund

(the "Growth and Income Fund"). In connection with this proposed transfer, each whole and fractional share of each class of the

Large-Cap Value Fund shall be exchanged for whole and fractional shares of equal net asset value of the same class of the Growth

and Income Fund and outstanding shares of the Large-Cap Value Fund will be cancelled.

2. To transact such other business as may properly come before the Meeting or any adjournments of the Meeting.

The Board of Directors of American Skandia Advisor Funds, Inc., on behalf of the Large-Cap Value Fund, has fixed the close of

business on September 19, 2003 as the record date for the determination of the shareholders of the Large-Cap Value Fund, as

applicable, entitled to notice of, and to vote at, the Meeting and any adjournments of the Meeting.

/s/Edward P. Macdonald

Edward P. Macdonald

Assistant Secretary

Dated: October 10, 2003

prospectus/proxy statement

TABLE OF CONTENTS

Page

Cover Page cover

SUMMARY.........................................................................................................................2

The Proposal.......................................................................................................................2

Shareholder voting..............................................................................................................2

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS.....................................................................................2

The investment objectives and policies of the Funds.............................................................................2

Diversification.................................................................................................................3

Borrowing, Issuing Senior Securities and Pledging Assets........................................................................3

Lending.........................................................................................................................3

Illiquid Securities.............................................................................................................3

Temporary Defensive Investments.................................................................................................3

Derivative Strategies...........................................................................................................4

Investment Restrictions.........................................................................................................4

Federal Income Tax Considerations...............................................................................................4

Risks of investing in the Funds.................................................................................................4

Management of the Company and the Funds.........................................................................................5

Fee Arrangements................................................................................................................5

Distribution Plan...............................................................................................................6

Valuation.......................................................................................................................6

Purchases, Redemptions, Exchanges and Distributions.............................................................................6

Fees and expenses...............................................................................................................7

Expense Examples................................................................................................................9

Performance....................................................................................................................10

REASONS FOR THE TRANSACTION.......................................................................................................12

INFORMATION ABOUT THE TRANSACTION.................................................................................................13

Closing of the Transaction.....................................................................................................13

Expenses of the Transaction....................................................................................................13

Tax Consequences of the Transaction............................................................................................13

Characteristics of the Growth and Income Fund shares...........................................................................14

Capitalization of the Funds and Capitalization after the Transaction...........................................................14

VOTING INFORMATION................................................................................................................15

How to vote....................................................................................................................16

Solicitation of voting instructions............................................................................................16

ADDITIONAL INFORMATION ABOUT THE COMPANY AND THE FUNDS............................................................................16

PRINCIPAL HOLDERS OF SHARES.......................................................................................................17

EXHIBITS TO PROSPECTUS/PROXY STATEMENT............................................................................................19

EXHIBIT A.......................................................................................................................1

Plan of Reorganization.......................................................................................................1

EXHIBIT B.......................................................................................................................1

Prospectus dated MARCH 1, 2003...............................................................................................1

EXHIBIT C.......................................................................................................................2

ANNUAL REPORT dated OCTOBER 31, 2002.........................................................................................2

EXHIBIT D.......................................................................................................................3

SUPPLEMENTS DATED MAY 16, 2003, AUGUST 1, 2003, SEPTEMBER 16, 2003 AND OCTOBER 2, 2003.......................................3

AMERICAN SKANDIA ADVISOR FUNDS, INC.

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

PROSPECTUS/PROXY STATEMENT

Dated October 10, 2003

Acquisition of the Assets of the ASAF DeAM Large-Cap Value Fund

By and in exchange for shares of the ASAF Alliance Growth and Income Fund

This Prospectus/Proxy Statement is furnished in connection with a Special Meeting (the "Meeting") of shareholders the

ASAF DeAM Large-Cap Value Fund (the "Large-Cap Value Fund") of American Skandia Advisor Funds, Inc. (the "Company") called by the

Company to approve or disapprove a Plan of Reorganization (the "Plan"). If shareholders of the Large-Cap Value Fund vote to

approve the Plan, you will receive shares of the ASAF Alliance Growth and Income Fund (the "Growth and Income Fund" and, together

with the Large-Cap Value Fund, the "Funds") of the Company equal in value to your investment in shares of the Large-Cap Value Fund

as provided in the Plan and described at greater length below. The Large-Cap Value Fund will then be liquidated and dissolved.

The Meeting will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New Jersey 07102 on November

21, 2003 at 11:00 a.m. Eastern Standard Time. The Board of Directors of the Company is soliciting these proxies on behalf of the

Large-Cap Value Fund. This Prospectus/Proxy Statement will first be sent to shareholders on or about October 20, 2003.

The investment objective of the Growth and Income Fund is to seek long term capital growth and income while the

investment objective of the Large-Cap Value Fund is to seek maximum capital growth. However, both Funds will invest primarily in

large-capitalization value equity securities.

This Prospectus/Proxy Statement gives the information about the proposed reorganization and issuance of shares of the

Growth and Income Fund that you should know before investing. You should retain it for future reference. Additional information

about the Growth and Income Fund and the proposed reorganization has been filed with the Securities and Exchange Commission

("SEC") and can be found in the following documents:

|_| The Prospectus for the Funds dated March 1, 2003 is enclosed with and considered a part of this Prospectus/Proxy

Statement.

|_| A Statement of Additional Information (SAI) relating to this Prospectus/Proxy Statement dated March 1, 2003 has been

filed with the SEC and is incorporated by reference into this Prospectus/Proxy Statement.

You may request a free copy of the SAI relating to this Prospectus/Proxy Statement or other documents related to the

Company without charge by calling 1-800-752-6342 or by writing to the Company at the above address.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy Statement.

Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the

Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including

the possible loss of principal.

SUMMARY

This is only a summary of certain information contained in this Prospectus/Proxy Statement. You should read the more

complete information in the rest of this Prospectus/Proxy Statement, including the Plan (attached as Exhibit A) and the Prospectus

for the Funds (enclosed as Exhibit B).

The Proposal

You are being asked to consider and approve a Plan of Reorganization that will have the effect of combining the Large-Cap

Value Fund and the Growth and Income Fund of the Company into a single Fund. If shareholders of the Large-Cap Value Fund vote to

approve the Plan, the assets of the Large-Cap Value Fund will be transferred to the Growth and Income Fund in exchange for a then

equal value of shares of the Growth and Income Fund. Shareholders will have their shares of the Large-Cap Value Fund exchanged

for the Growth and Income Fund shares of equal dollar value based upon the values of the shares at the time the Large-Cap Value

Fund assets are transferred to the Growth and Income Fund. The Large-Cap Value Fund will be liquidated and dissolved. The

proposed reorganization is referred to in this Prospectus/Proxy Statement as the "Transaction." As a result of the Transaction,

you will cease to be a shareholder of the Large-Cap Value Fund and will become a shareholder of the Growth and Income Fund.

For the reasons set forth in the "Reasons for the Transaction" section, the Board of Directors of the Company has

determined that the Transaction is in the best interests of the shareholders of the Large-Cap Value Fund and the Growth and Income

Fund, and also concluded that no dilution in value would result to the shareholders of either Fund as a result of the

Transaction.

The Board of Directors of the Company, on behalf of both the Large-Cap Value Fund and the Growth and Income Fund, has approved the

Plan and unanimously recommends that you vote to approve the Plan.

Shareholder voting

Shareholders who own shares of the Large-Cap Value Fund at the close of business on September 19, 2003 (the "Record

Date") will be entitled to vote at the Meeting, and will be entitled to one vote for each full share and a fractional vote for each

fractional share that they hold. The affirmative vote of the holders of a majority of the total number of shares of capital stock

of the Large-Cap Value Fund outstanding and entitled to vote is necessary to approve the Transaction.

Please vote your shares as soon as you receive this Prospectus/Proxy Statement. You may vote by completing and signing

the enclosed ballot (the "proxy card") or over the Internet or by phone. If you vote by any of these methods, your votes will be

officially cast at the Meeting by persons appointed as proxies.

You can revoke or change your voting instructions at any time until the vote is taken at the Meeting. For more details

about shareholder voting, see the "Voting Information" section of this Prospectus/Proxy Statement.

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS

The investment objectives and policies of the Funds

This section describes the investment policies of the Large-Cap Value Fund and the Growth and Income Fund and the

differences between them. For a complete description of the investment policies and risks of the Growth and Income Fund, you

should read the Prospectus for the Funds that is enclosed with this Prospectus/Proxy Statement.

The investment objectives of the Funds are comparable. The investment objective of the Large-Cap Value Fund is maximum

capital growth and the investment objective of the Growth and Income Fund is long term capital growth and income. Both Funds will

invest primarily in equity securities of large-capitalization value companies.

The Large-Cap Value Fund will invest, under normal circumstances, at least 80% of the value of its assets in large

capitalization companies. The Fund pursues its investment objective by normally investing primarily in the equity securities of

large sized companies included in the Russell 1000 Value Index. Equity securities include common stocks and securities

convertible into or exchangeable for common stocks, including warrants and rights. The Fund's sub-advisor employs an investment

strategy that seeks to maintain a portfolio of equity securities which approximates the market risk of those stocks included in

the Russell 1000 Value Index, but which outperforms the Russell 1000 Value Index through active stock selection. The Russell 1000

Value Index is a market capitalization index that measures the performance of large, established companies trading at discounts to

their fair value. As of December 31, 2002, the average market capitalization of the companies in the Russell 1000 Value Index was

approximately $7.9 billion and the median market capitalization was approximately $2.6 billion. For purposes of the Fund, the

strategy of attempting to correlate a stock portfolio's market risk with that of a particular index, in this case the Russell 1000

Value Index, while improving upon the return of the same index through active stock selection, is called a "managed alpha"

strategy. The Fund's sub-advisor considers a number of factors in determining whether to invest in a value stock, including

earnings growth rate, analysts' estimates of future earnings and industry-relative price multiples. Other factors are net income

growth versus cash flow growth as well as earnings and price momentum. In the selection of investments, long-term capital

appreciation will take precedence over short range market fluctuations. However, the Fund may occasionally make investments for

short-term capital appreciation.

The Growth and Income Fund normally will invest in common stocks (and securities convertible into common stocks). The

Fund's sub-advisor will take a value-oriented approach, in that it will try to keep the Fund's assets invested in securities that

are selling at reasonable valuations in relation to their fundamental business prospects. In doing so, the Fund may forgo some

opportunities for gains when, in the judgment of the Fund's sub-advisor, they are too risky. In seeking to achieve its objective,

the Fund invests primarily in the equity securities of U.S. companies that the Fund's sub-advisor believes are undervalued. The

Fund's sub-advisor believes that, over time, stock prices (of companies in which the Fund invests) will come to reflect the

companies' intrinsic economic values. The Fund's sub-advisor uses a disciplined investment process to evaluate the companies in

its extensive research universe. Through this process, the Fund's sub-advisor seeks to identify the stocks of companies that

offer the best combination of value and potential for price appreciation.

Diversification

Both Funds are diversified funds. This means that, with respect to 75% of the value of each Fund's total assets, each

Fund invests in cash, cash items, obligations of the U.S. Government, its agencies or instrumentalities, securities of other

investment companies and "other securities." The "other securities" are subject to the requirement that not more than 5% of total

assets of the Fund will be invested in the securities of a single issuer and that the Fund will not hold more than 10% of any

single issuer's outstanding voting securities.

The Funds may not purchase the securities of any issuer if, as a result, a Fund would fail to be a diversified company

within the meaning of the Investment Company Act of 1940, as amended ("Investment Company Act") and the rules and regulations

promulgated thereunder.

Borrowing, Issuing Senior Securities and Pledging Assets

Neither Fund may issue senior securities, borrow money or pledge assets except as permitted under the Investment Company

Act, the rules and regulations promulgated thereunder, or under any exemptive order, SEC release, no-action letter or similar

relief or interpretations.

Lending

Both Funds may lend assets to brokers, dealers and financial institutions. Both Funds may make loans, including through

loans of assets of the Fund, repurchase agreements, trade claims, loan participations or similar investments, as permitted by the

Investment Company Act. For purposes of this limitation and consistent with the Fund's investment objective, the acquisition of

bonds, debentures, other debt securities or instruments, or participations or other interests therein and investments in

government obligations, commercial paper, certificates of deposit, bankers' acceptances or instruments similar to any of the

foregoing will not be considered the making of a loan.

Illiquid Securities

Both Funds may invest in illiquid securities, including those without a readily available market and repurchase

agreements with maturities longer than seven days. Both Funds may hold up to 15% of its net assets in illiquid securities.

Temporary Defensive Investments

Although each Fund normally invest assets according to its investment strategy, there are times when a Fund may

temporarily invest up to 100% of its assets in money market instruments in response to adverse market, economic or political

conditions.

For more information about the risks and restrictions associated with these policies, see the Funds' Prospectus, and for

a more detailed discussion of the Funds' investments, see the Statements of Additional Information, all of which are incorporated

into this Proxy Statement by reference.

Derivative Strategies

Both Funds may use derivative strategies to try to improve the Fund's returns or hedging techniques to try to protect its

assets. Derivatives, such as futures, options, foreign currency forward contracts, options on futures and swaps, involve costs and

can be volatile. With derivatives, the Fund's sub-advisor is trying to predict whether the underlying investment-- a security,

market index, currency, interest rate or some other asset, rate or index-- will go up or down at some future date. Each Fund may

use derivatives to try to reduce risk or to increase return, taking into account the Fund's overall investment objective. The

Funds cannot guarantee these derivative strategies will work, that the instruments necessary to implement these strategies will be

available or that the Funds will not lose money.

Investment Restrictions

Each of the Funds has substantially identical fundamental investment restrictions. These fundamental restrictions limit a

Fund's ability to: (i) issue senior securities; (ii) borrow money; (iii) underwrite securities; (iv) purchase or sell real

estate; (v) purchase or sell physical commodities; (vi) make loans (except for certain securities lending transactions); and (vii)

concentrate its investments by investing more than 25% of the value of the Fund's assets in securities of issuers having their

principal business activities in the same industry. A Fund may not change a fundamental investment restriction without the prior

approval of its shareholders.

Federal Income Tax Considerations

Each Fund is treated as a separate entity for federal income tax purposes. Each Fund has qualified and elected or

intends to qualify and elect to be treated as a "regulated investment company" under Subchapter M of the Internal Revenue Code of

1986, as amended (the "Code"), and intends to continue to so qualify in the future. As a regulated investment company, a Fund

must, among other things, (a) derive at least 90% of its gross income from dividends, interest, payments with respect to loans of

stock and securities, gains from the sale or other disposition of stock, securities or foreign currency and other income

(including but not limited to gains from options, futures, and forward contracts) derived with respect to its business of

investing in such stock, securities or foreign currency; and (b) diversify its holdings so that, at the end of each quarter of its

taxable year, (i) at least 50% of the value of the Fund's total assets is represented by cash, cash items, U.S. Government

securities, securities of other regulated investment companies, and other securities limited, in respect of any one issuer, to an

amount not greater than 5% of the Fund's total assets, and 10% of the outstanding voting securities of such issuer, and (ii) not

more than 25% of the value of its total assets is invested in the securities of any one issuer (other than U.S. Government

securities or securities of other regulated investment companies). As a regulated investment company, a Fund (as opposed to its

shareholders) will not be subject to federal income taxes on the net investment income and capital gain that it distributes to its

shareholders, provided that at least 90% of its net investment income and realized net short-term capital gain in excess of net

long-term capital loss for the taxable year is distributed in accordance with the Code's timing requirements

The Transaction may entail various tax consequences which are discussed under the caption "Tax Consequences of the

Transaction."

Risks of investing in the Funds

Like all investments, an investment in either Fund involves risk. There is no assurance that either of the Funds will

meet its investment objective. As with any fund investing primarily in equity securities, the value of the securities held by a

Fund may decline. Stocks can decline for many reasons, including reasons related to the particular company, the industry of which

it is a part, or the securities markets generally. These declines may be substantial.

The risk to which a capital growth fund is subject depends in part on the size of the companies in which the particular

fund invests. Securities of smaller companies tend to be subject to more abrupt and erratic price movements than securities of

larger companies, in part because they may have limited product lines, market or financial resources. Because the Growth and

Income Fund and the Large-Cap Value Fund will invest primarily in large-capitalization companies, the Funds should be less prone

to such abrupt and erratic price movements. In addition, value stocks are believed to be selling at prices lower than what they

are actually worth, while growth stocks are those of companies that are expected to grow at above-average rates. A fund investing

primarily in growth stocks will tend to be subject to more risk than a value fund, such as the Growth and Income Fund and the

Large-Cap Value Fund, although this will not always be the case.

Management of the Company and the Funds

American Skandia Investment Services, Inc. ("ASISI"), One Corporate Drive, Shelton, Connecticut, and Prudential

Investments LLC ("PI"), Gateway Center Three, 100 Mulberry Street, Newark, New Jersey, serve as co-managers (each an "Investment

Manager" and together the "Investment Managers") pursuant to an investment management agreement with the Company on behalf of each

Fund (the "Management Agreement"). Under the Management Agreement, PI, as co-manager, will provide supervision and oversight of

ASISI's investment management responsibilities with respect to the Company. Pursuant to the Management Agreement, the Investment

Managers will jointly administer each Fund's business affairs and supervise each Fund's investments. Subject to approval by the

Board of Directors, the Investment Managers may select and employ one or more sub-advisors for a Fund, who will have primary

responsibility for determining what investments the Fund will purchase, retain and sell. Also subject to the approval of the

Board of Directors, the Investment Managers may reallocate a Fund's assets among sub-advisors including (to the extent legally

permissible) affiliated sub-advisors, consistent with a Fund's investment objectives.

The Company has obtained an exemption from the SEC that permits an Investment Manager to change sub-advisors for a Fund

and to enter into new sub-advisory agreements, without obtaining shareholder approval of the changes. Any such sub-advisor change

would continue to be subject to approval by the Board of Directors of the Company. This exemption (which is similar to exemptions

granted to other investment companies that are operated in a similar manner as the Company) is intended to facilitate the

efficient supervision and management of the sub-advisors by the Investment Managers and the Directors of the Company.

The Investment Managers currently engage the following sub-advisors to manage the investments of each Fund in accordance

with the Fund's investment objective, policies and limitations and any investment guidelines established by the Investment

Managers. Each sub-advisor is responsible, subject to the supervision and control of the Investment Managers, for the purchase,

retention and sale of securities in the Fund's investment portfolio under its management.

Alliance Capital Management, L.P. ("Alliance"), 1345 Avenue of the Americas, New York, NY 10105, serves as sub-advisor

for the Growth and Income Fund. Alliance is a leading global investment adviser supervising client accounts with assets as of

December 31, 2002 totaling more than $386 billion. Paul Rissman and Frank Caruso have been primarily responsible for the

management of the Growth and Income Fund since Alliance became the Fund's sub-advisor in May 2000. Mr. Rissman has been Senior

Vice President of ACMC since 1994 and has been associated with Alliance since 1989. Mr. Caruso is a Senior Vice President of ACMC

and has been associated with Alliance since 1994.

Deutsche Asset Management, Inc. ("DAMI"), 345 Park Avenue, New York, New York 10154, serves as sub-advisor for the

Large-Cap Value Fund. DAMI was founded in 1838 as Morgan Grenfell Inc. and has provided asset management services since 1953. As

of December 31, 2002, as part of Deutsche Asset Management group ("DeAM"), DAMI managed approximately $90 billion of DeAM's $389.3

billion in assets. David Koziol and Michael Patchen are the co-portfolio managers for the Large-Cap Value Fund. They have been

involved in the management of the Large-Cap Value Fund since the Fund commenced operations. Mr. Koziol, CFA, Director and Head of

Global Quantitative Equities, joined DAMI in 2001 as Head of Global Quantitative Equity Research and International Portfolio

Manager after 6 years of experience as a Principal in the Advanced Strategies and Research Group at Barclays Global Investors,

where he developed quantitative equity fixed income and hedge fund products, and as an investment banker at Salomon Brothers. Mr.

Patchen, Vice President and Head of Global Quantitative Equity Portfolio Management, is responsible for managing a variety of

global mandates covering both traditional accounts and a market-neutral hedge fund. Mr. Patchen joined DAMI in 2000 with four

years of experience managing global quantitative mandates including hedge funds and separate accounts at AQR Capital Management

and Goldman Sachs Asset Management.

Fee Arrangements

The Funds have comparable fee arrangements. Under the Management Agreement with respect to the Large-Cap Value Fund, the

Fund is obligated to pay ASISI an annual investment management fee equal to 0.90% of its average daily net assets. Similarly,

under the Management Agreement with respect to the Growth and Income Fund, the Fund is obligated to pay ASISI an annual investment

management fee equal to 1.00% of its average daily net assets. During the calendar year ended December 31, 2002, the Large-Cap

Value Fund paid $3,692 in investment management fees to ASISI. If the fee rate applicable to the Growth and Income Fund had been

in effect during such period, the Large-Cap Value Fund would have paid $4,102 in investment management fees to ASISI. Because the

Investment Management fee rates currently paid to ASISI by the Large-Cap Value Fund are less than the fee rates paid by the Growth

and Income Fund, former shareholders of the Large-Cap Value Fund would pay a higher investment advisory fee rate after becoming

shareholders of the Growth and Income Fund upon completion of the Transaction. However, the total net annual operating expenses

(after applicable fee waivers and expense reimbursements) for each Fund are identical and would remain the same for the combined

fund if the merger is approved.

The Investment Manager has voluntarily agreed until March 1, 2004 to reimburse each Fund for its respective operating

expenses, exclusive of taxes, interest, brokerage commissions, distribution fees and extraordinary expenses, but inclusive of the

management fee, which in the aggregate exceed specified percentages of a Fund's average net assets as follows: Large-Cap Value

Fund, 1.15% and Growth and Income Fund, 1.15%. The Investment Manager may terminate the above voluntary agreements at any time

after March 1, 2004. Voluntary payments of Fund expenses by the Investment Manager may be made subject to reimbursement by the

Fund, at the Investment Manager's discretion, within the two year period following such payment to the extent permissible under

applicable law and provided that the Fund is able to effect such reimbursement and remain in compliance with applicable expense

limitations.

ASISI pays DAMI and Alliance a sub-advisory fee for sub-advisory services for the Large-Cap Value Fund and the Growth and

Income Fund, respectively. ASISI pays these sub-advisory fees at no additional costs to the Funds. Under the current

sub-advisory agreement for the Large-Cap Value Fund, ASISI pays DAMI an annual sub-advisory fee equal to the following percentages

of the combined average daily net assets of the Fund and the series of American Skandia Trust managed by DAMI and similar to the

Fund: 0.20%of the portion of the combined average daily net assets not in excess of $500 million; plus 0.15% of the portion over

$500 million but not in excess of $1 billion; plus 0.10% of the portion in excess of $1 billion. Under the sub-advisory agreement

for the Growth and Income Fund, ASISI pays Alliance an annual sub-advisory fee equal to the following percentages of the combined

average daily net assets of the Fund and the series of American Skandia Trust managed by Alliance and similar to the Fund: 0.30%

of the portion of the combined average daily net assets not in excess of $1 billion; plus .25% of the portion over $1 billion but

not in excess of $1.5 billion; plus 0.20% of the portion in excess of $1.5 billion.

Distribution Plan

The Company adopted a Distribution and Service Plan (commonly known as a "12b-1 Plan") for each class of shares to

compensate the Funds' distributor for its services and costs in distributing shares and servicing shareholder accounts. Under the

Distribution and Service Plan for Class A shares, each Fund pays the distributor 0.50% of the Fund's average daily net assets

attributable to Class A shares. Under the Plans for Class B, X and C shares, each Fund pays the distributor 1.00% of the Fund's

average daily net assets attributable to the relevant Class of shares. Because these fees are paid out of the Funds' assets on an

ongoing basis, these fees may, over time, increase the cost of an investment in the Fund and may be more costly than other types

of sales charges. The distributor uses distribution and service fees received under each 12b-1 Plan to compensate qualified

dealers for services provided in connection with the sale of shares and the maintenance of shareholder accounts. The

distributor's rights to distribution and service fees received under the Class B 12b-1 Plan and the Class X 12b-1 Plan have been

assigned to third parties.

Valuation

The net asset value ("NAV") per share is determined for each class of shares for each Fund as of the time of the close of

the NYSE (which is normally 4:00 p.m. Eastern Time) on each business day by dividing the value of the Fund's total assets

attributable to a class, less any liabilities, by the number of total shares of that class outstanding. In general, the assets of

each Fund are valued on the basis of market quotations. However, in certain circumstances where market quotations are not readily

available or where market quotations for a particular security or asset are believed to be incorrect, securities and other assets

are valued by methods that are believed to accurately reflect their fair value.

Purchases, Redemptions, Exchanges and Distributions

The purchase policies for each Fund are identical. The offering price is the NAV plus any initial sales charge that

applies. Class A shares are sold at NAV plus an initial sales charge that varies depending on the amount of your investment.

Class B shares are sold at NAV per share without an initial sales charge. However, if Class B shares are redeemed within seven

years of their purchase, a contingent deferred sales charge ("CDSC") will be deducted from the redemption proceeds. Class C

shares are sold at NAV per share plus an initial sales charge of 1% of the offering price. If Class C shares are redeemed within

12 months of the first business day of calendar month of their purchase, a CDSC of 1.0% will be deducted from the redemption

proceeds. Class X shares are sold at NAV per share without an initial sales charge. In addition, investors purchasing Class X

shares will receive, as a bonus, additional shares having a value equal to 2.50% of the amount invested. Although Class X shares

are sold without an initial sales charge, if Class X shares are redeemed within 8 years of their purchase, a CDSC will be deducted

from the redemption proceeds. Refer to the Funds' Prospectus for more information regarding how to purchase shares.

The redemption policies for each Fund are identical. Your shares will be sold at the next NAV determined after your

order to sell is received, less any applicable CDSC imposed. Refer to the Funds' Prospectus for more information regarding how to

sell shares.

Shares of each Fund may be exchanged for shares of the same class of other Funds at NAV per share at the time of

exchange. Exchanges of shares involve a redemption of the shares of the Fund you own and a purchase of shares of another Fund.

Shares are normally redeemed and purchased in the exchange transaction on the business day on which the Transfer Agent receives an

exchange request that is in proper form, if the request is received by the close of the NYSE that day.

Each Fund will distribute substantially all of its income and capital gains to shareholder each year. Each Fund will

declare dividends, if any, annually.

Fees and expenses

The following table describes the fees and expenses that shareholders may pay if they hold shares of the Funds, as well

as the projected fees and expenses of the Growth and Income Fund after the Transaction.

Class A Shares

Growth and Growth and Income Fund

Large-Cap Value Income Fund After Transaction

Fund Class A Class A Class A

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) 5.75% 5.75% 5.75%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) None1 None1 None1

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees................................ 0.90% 1.00% 1.00%

Estimated Distribution (12b-1) Fees............ 0.50% 0.50% 0.50%

Other Expenses................................. 23.85% 0.63% 0.64%

Advisory Fee Waivers and Expense Reimbursement (23.60)% (0.48)% (0.49)%

Total Annual Fund Operating Expenses........... 1.65% 1.65% 1.65%

Class B Shares

Growth and Growth and Income Fund

Large-Cap Value Income Fund After Transaction

Fund Class B Class B Class B

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) None None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.90% 1.00% 1.00%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses................................. 23.85% 0.63% 0.64%

Advisory Fee Waivers and Expense Reimbursement (23.60)% (0.48)% (0.49)%

Total Annual Fund Operating Expenses....... 2.15% 2.15% 2.15%

Class C Shares

Growth and Growth and Income Fund

Large-Cap Value Income Fund After Transaction

Fund Class C Class C Class C

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) 1.00% 1.00% 1.00%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 1.00%3 1.00%3 1.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.90% 1.00% 1.00%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 23.85% 0.63% 0.64%

Advisory Fee Waivers and Expense (23.60)% (0.48)% (0.49)%

Reimbursement

Total Annual Fund Operating Expenses....... 2.15% 2.15% 2.15%

Class X Shares

Growth and Growth and Income Fund

Large-Cap Value Income Fund After Transaction

Fund Class X Class X Class X

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) None None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.90% 1.00% 1.00%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 23.85% 0.63% 0.64%

Advisory Fee Waivers and Expense Reimbursement (23.60)% (0.48)% (0.49)%

Total Annual Fund Operating Expenses....... 2.15% 2.15% 2.15%

1. Under certain circumstances, purchases of Class A shares not subject to an initial sales charge (load) will be subject to a

contingent deferred sales charge (load) ("CDSC") if redeemed within 12 months of the calendar month of purchase. For an

additional discussion of the Class A CDSC, see this Prospectus under "How to Buy Shares."

2. A $10 fee may be imposed for wire transfers of redemption proceeds. For an additional discussion of wire redemptions, see

this Prospectus under "How to Redeem Shares."

3. If you purchase Class B or X shares, you do not pay an initial sales charge but you may pay a CDSC if you redeem some or all

of your shares before the end of the seventh (in the case of Class B shares) or eighth (in the case of Class X shares) year after

which you purchased such shares. The CDSC is 6%, 5%, 4%, 3%, 2%, 2% and 1% for redemptions of Class B shares occurring in years

one through seven, respectively. The CDSC is 6%, 5%, 4%, 4%, 3%, 2%, 2% and 1% for redemptions of Class X shares occurring in

years one through eight, respectively. No CDSC is charged after these periods. If you purchase Class C shares, you may pay an

initial sales charge of 1% and you may incur a CDSC if you redeem some or all of your Class C shares within 12 months of the

calendar month of purchase. For a discussion of the Class B, X and C CDSC, see this Prospectus under "How to Buy Shares."

Expense Examples

Full Redemption - These examples are intended to help you compare the cost of investing in each Fund with the cost of investing in

other mutual funds, and the cost of investing in the Growth and Income Fund after the Transaction. They assume that you invest

$10,000, that you receive a 5% return each year, and that the Funds' total operating expenses remain the same. Although your

actual costs may be higher or lower, based on the above assumptions your costs would be:

Class A Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 733 4,707 7,234 10,225

Growth and Income Fund 733 1,160 1,612 2,860

Growth and Income Fund 733 1,162 1,616 2,869

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 818 4,873 7,345 10,235

Growth and Income Fund 818 1,172 1,552 2,807

Growth and Income Fund 818 1,174 1,556 2,816

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 416 4,528 7,174 10,244

Growth and Income Fund 416 864 1,439 2,999

Growth and Income Fund 416 866 1,443 3,008

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 824 4,985 7,624 10,503

Growth and Income Fund 824 1,191 1,686 3,001

Growth and Income Fund 824 1,193 1,690 3,011

(Projected after the Transaction)

No Redemption - You would pay the following expenses based on the above assumptions except that you do not redeem your shares at

the end of each period:

Class A Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 733 4,707 7,234 10,225

Growth and Income Fund 733 1,160 1,612 2,860

Growth and Income Fund 733 1,162 1,616 2,869

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 218 4,473 7,145 10,235

Growth and Income Fund 218 772 1,352 2,807

Growth and Income Fund 218 774 1,356 2,816

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 316 4,528 7,174 10,244

Growth and Income Fund 316 864 1,439 2,999

Growth and Income Fund 316 866 1,443 3,008

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

Large-Cap Value Fund 224 4,585 7,324 10,503

Growth and Income Fund 224 791 1,386 3,001

Growth and Income Fund 224 793 1,390 3,011

(Projected after the Transaction)

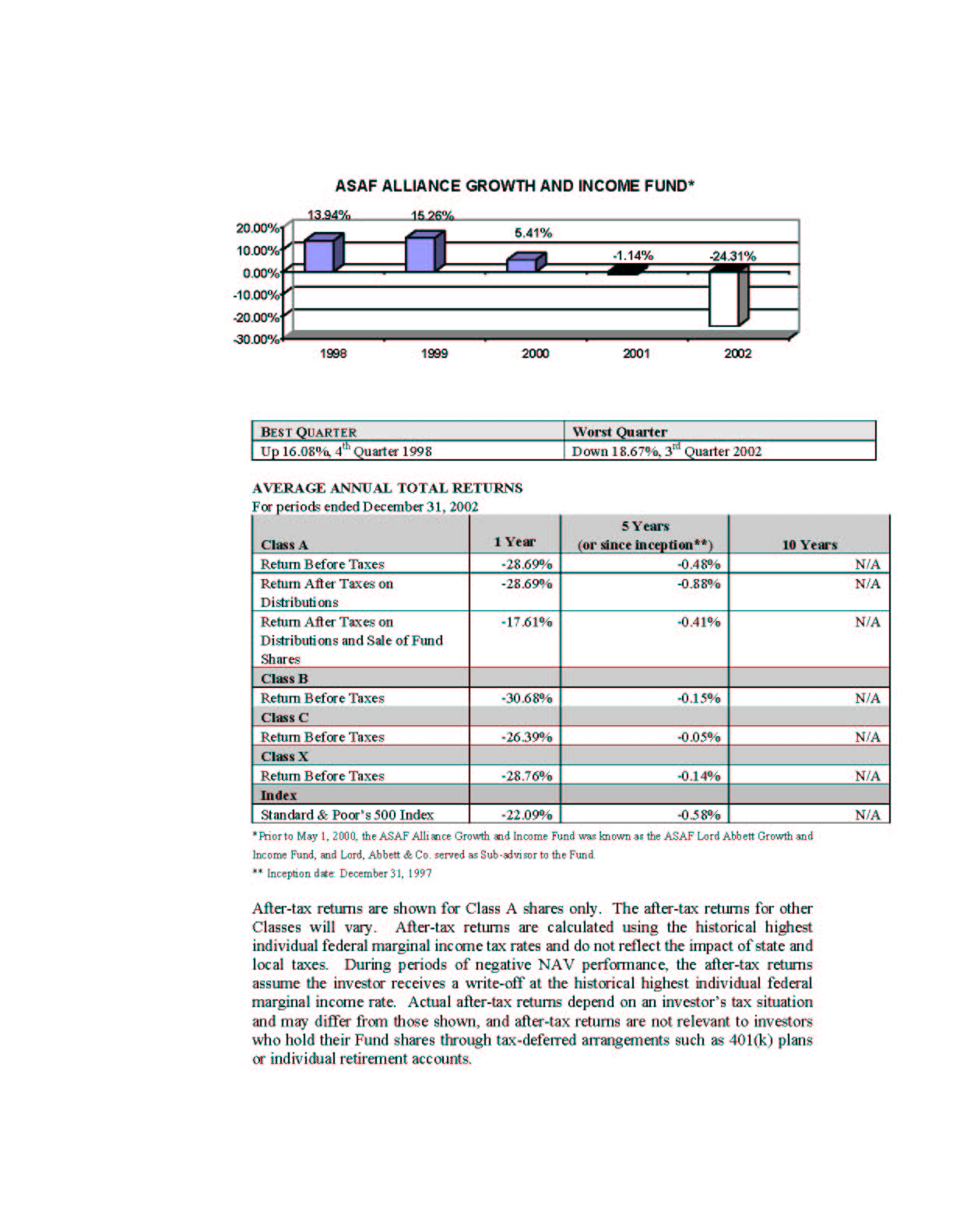

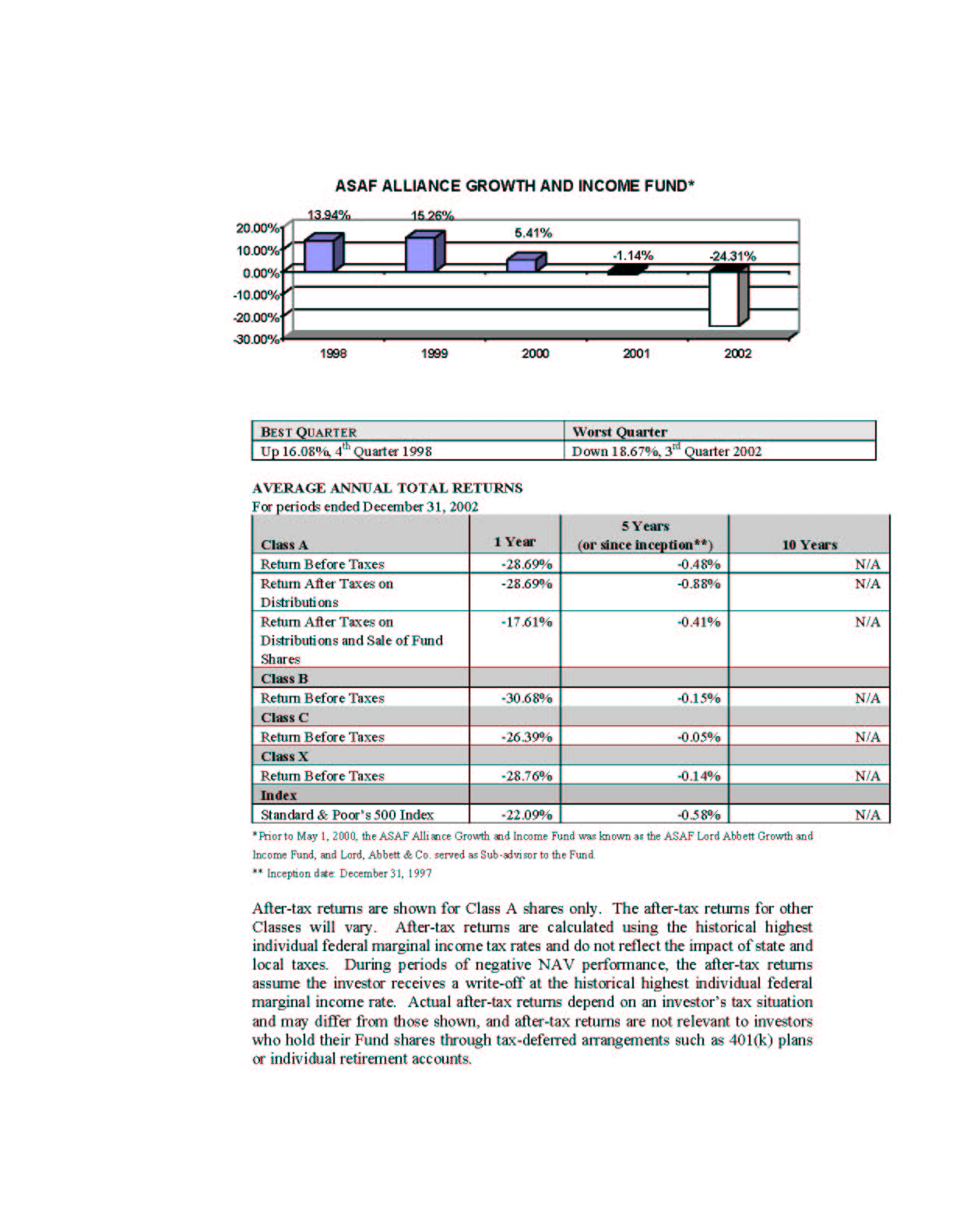

Performance

The bar charts show the performance of the Class A shares of each Fund for each full calendar year the Fund has been in

operation. The first table below each bar chart shows each such Fund's best and worst quarters during the periods included in the

bar chart. The second table shows the average annual total returns before taxes for each Class of each Fund for 2002 and since

inception, as well as the average annual total returns after taxes on distributions and after taxes on distributions and

redemptions for Class A shares of each Fund for 2002 and since inception.

This information may help provide an indication of each Fund's risks by showing changes in performance from year to year

and by comparing the Fund's performance with that of a broad-based securities index. The average annual figures reflect sales

charges; the other figures do not, and would be lower if they did. All figures assume reinvestment of dividends. Past

performance does not necessarily indicate how a Fund will perform in the future.

ASAF DeAM Large-Cap Value Fund

No performance information is included for the Large-Cap Value Fund because it commenced operations after January, 2002.

ASAF ALLIANCE GROWTH AND INCOME FUND

-------------------------------------------------- ------------------------------------------------

Best Quarter Worst Quarter

-------------------------------------------------- ------------------------------------------------

-------------------------------------------------- ------------------------------------------------

Up 16.08%, 4th Quarter 1998 Down 18.67%, 3rd Quarter 2002

-------------------------------------------------- ------------------------------------------------

AVERAGE ANNUAL TOTAL RETURNS

For periods ended December 31, 2002

----------------------------------- ------------- -------------------------- ------------------------

5 Years

Class A (or since inception**) 10 Years

1 Year

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -28.69% -0.48% N/A

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -28.69% -0.88% N/A

Distributions

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -17.61% -0.41% N/A

Distributions and Sale of Fund

Shares

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Class B

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -30.68% -0.15% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class C

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -26.39% -0.05% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class X

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -28.76% -0.14% N/A

----------------------------------- ------------- -------------------------- ------------------------

Index

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Standard & Poor's 500 Index -22.09% -0.58% N/A

----------------------------------- ------------- -------------------------- ------------------------

*Prior to May 1, 2000, the ASAF Alliance Growth and Income Fund was known as the ASAF Lord Abbett Growth and

Income Fund, and Lord, Abbett & Co. served as Sub-advisor to the Fund.

** Inception date: December 31, 1997

After-tax returns are shown for Class A shares only. The after-tax returns for other Classes will vary.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do

not reflect the impact of state and local taxes. During periods of negative NAV performance, the after-tax

returns assume the investor receives a write-off at the historical highest individual federal marginal income

rate. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and

after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such

as 401(k) plans or individual retirement accounts.

REASONS FOR THE TRANSACTION

The Directors, including all of the Directors who are not "interested persons" of the Company (the "Independent

Directors") have unanimously determined that the Transaction would be in the best interests of the shareholders of Large-Cap Value

and the Growth and Income Funds and that the interests of the shareholders of Large-Cap Value and the Growth and Income Funds

would not be diluted as a result of the Transaction. At a meeting held on July 25, 2003, the Board considered a number of factors

that it believes benefits the shareholders of Large-Cap Value Fund, including the following:

o the compatibility of the Funds' investment objectives, policies and restrictions;

o the relative past and current growth in assets and investment performance of the Funds and future prospects for the Growth and

Income Fund;

o the relative expense ratios of the Funds and the impact of the proposed Transaction on the expense ratios;

o the potential benefits of the proposed Transaction to the shareholders of each Fund, including the long-term economies of scale;

o the anticipated tax consequences of the Transaction with respect to each Fund and its shareholders; and

o the relative size of the Large-Cap Value Fund and the lack of growth in the assets and the number of shareholders of Large-Cap

Value Fund.

At the July 25 meeting, PI and ASISI recommended the merger to the Board. In recommending the merger, PI and ASISI

advised the Board that the Funds have comparable investment objectives, and similar styles and investment policies and

restrictions. The Investment Managers advised the Board that the Large-Cap Value Fund had difficulty attracting assets, had never

reached scale and that as of May 31, 2003 had assets of only approximately $1.4 million while the Growth and Income Fund had

assets of approximately $230 million, and that the Large-Cap Value Fund had generally under-performed the Growth and Income Fund

as well as other funds in its peer group. The Investment Managers also advised the Board that by merging the Funds, shareholders

of the combined fund would enjoy a greater asset base over which expenses would be spread. It was also noted that the Large-Cap

Value Fund has a higher total cost structure and higher expense ratio (before any fee waivers or expense reimbursements) as

compared to the Growth and Income Fund, and that the total gross operating expenses of the combined fund would be significantly

lower than the current total gross operating expenses of the Large-Cap Value Fund. The Board considered that if the merger is

approved, shareholders of Large-Cap Value Fund, regardless of the class of shares they own, would have identical total net annual

operating expenses and significantly lower total gross annual operating expenses paid on their investment, while the shareholders

of the Growth and Income Fund would have identical total net annual operating expenses and very slightly increased total gross

annual operating expenses (.01%) if the merger is approved, although there can be no assurance that operational savings will be

realized. In addition, the Board considered that, even though expenses would not immediately decrease for the Growth and Income

Fund, the incremental assets should help to stabilize certain non-distribution related expenses. The Board was also advised that

the expenses associated with the Transaction would be borne by the Investment Managers.

The Board, including a majority of the Independent Directors, unanimously concluded that the Transaction is in the best

interests of the shareholders of the Large-Cap Value Fund and the Growth and Income Fund and that no dilution of value would

result to the shareholders of the Large-Cap Value Fund or the Growth and Income Fund from the Transaction. Consequently, the

Board approved the Plan and recommended that shareholders of the Large-Cap Value Fund vote to approve the Transaction.

For the reasons discussed above, the Board of Directors unanimously recommends that you vote For the Plan.

If shareholders of the Large-Cap Value Fund do not approve the Plan, the Board will consider other possible courses of

action for the Large-Cap Value Fund, including, among others, consolidation of the Large-Cap Value Fund with one or more Funds of

the Company other than the Growth and Income Fund or unaffiliated funds.

INFORMATION ABOUT THE TRANSACTION

This is only a summary of the Plan. You should read the actual Plan attached as Exhibit A.

Closing of the Transaction

If shareholders of the Large-Cap Value Fund approve the Plan, the Transaction will take place after various conditions

are satisfied by the Company on behalf of the Large-Cap Value Fund and the Growth and Income Fund, including the preparation of

certain documents. The Company will determine a specific date for the actual Transaction to take place. This is called the

"closing date." If the shareholders of the Large-Cap Value Fund do not approve the Plan, the Transaction will not take place.

If the shareholders of the Large-Cap Value Fund approve the Plan, the Large-Cap Value Fund will deliver to the Growth and

Income Fund substantially all of its assets on the closing date. As a result, shareholders of the Large-Cap Value Fund will

beneficially own shares of the Growth and Income Fund that, as of the date of the exchange, have a value equal to the dollar value

of the assets delivered to the Growth and Income Fund. The stock transfer books of the Large-Cap Value Fund will be permanently

closed on the closing date. Requests to transfer or redeem assets allocated to the Large-Cap Value Fund may be submitted at any

time before 4:00 p.m. Eastern standard time on the closing date; requests that are received in proper form prior to that time will

be effected prior to the closing.

To the extent permitted by law, the Company may amend the Plan without shareholder approval. It may also agree to

terminate and abandon the Transaction at any time before or, to the extent permitted by law, after the approval by shareholders of

the Large-Cap Value Fund.

Expenses of the Transaction

The expenses resulting from the Transaction will be paid by PI (or its affiliates). The Funds will not incur any

expenses associated with the Transaction. The portfolio securities of the Large-Cap Value Fund will be transferred in-kind to the

Growth and Income Fund prior to the restructuring of the Large-Cap Value Fund's investment portfolio. Accordingly, the

Transaction will entail little or no expenses in connection with portfolio restructuring.

Tax Consequences of the Transaction

The Transaction is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under the Code.

It is a condition to each Fund's obligation to complete the Transaction that the Funds will have received an opinion from Stradley

Ronon Stevens & Young, LLP, counsel to the Funds, based upon representations made by the Large-Cap Value Fund and Growth and

Income Fund, and upon certain assumptions, substantially to the effect that:

1. The acquisition by Growth and Income Fund of the assets of Large-Cap Value Fund in exchange solely for voting shares of Growth

and Income Fund and the assumption by Growth and Income Fund of the liabilities of Large-Cap Value Fund, if any, followed by the

distribution of the Growth and Income Fund shares acquired by Large-Cap Value Fund pro rata to their shareholders, will constitute

a reorganization within the meaning of Section 368(a)(1) of the Code, and Growth and Income Fund and Large-Cap Value Fund each

will be "a party to a reorganization" within the meaning of Section 368(b) of the Code;

2. The shareholders of Large-Cap Value Fund will not recognize gain or loss upon the exchange of all of their shares of Large-Cap

Value Fund solely for shares of Growth and Income Fund, as described above and in the Plan;

3. No gain or loss will be recognized by Large-Cap Value Fund upon the transfer of its assets to Growth and Income Fund in

exchange solely for Class A, Class B, Class C, and Class X shares of Growth and Income Fund and the assumption by Growth and

Income Fund of the liabilities of Large-Cap Value Fund, if any. In addition, no gain or loss will be recognized by Growth and

Income Fund on the distribution of such shares to the shareholders of Large-Cap Value Fund in liquidation of Large-Cap Value Fund;

4. No gain or loss will be recognized by Growth and Income Fund upon the acquisition of the assets of Large-Cap Value Fund in

exchange solely for shares of Growth and Income Fund and the assumption of the liabilities of Large-Cap Value Fund, if any;

5. Growth and Income Fund's basis for the assets acquired from Large-Cap Value Fund will be the same as the basis of these assets

when held by Large-Cap Value Fund immediately before the transfer, and the holding period of such assets acquired by Growth and

Income Fund will include the holding period of these assets when held by Large-Cap Value Fund;

6. Large-Cap Value Fund's shareholders' basis for the shares of Growth and Income Fund to be received by them pursuant to the

reorganization will be the same as their basis in Large-Cap Value Fund shares exchanged; and

7. The holding period of Growth and Income Fund shares to be received by the shareholders of Large-Cap Value Fund will include the

holding period of their Large-Cap Value Fund shares exchanged provided such Large-Cap Value Fund shares were held as capital

assets on the date of the exchange.

Shareholders of Large-Cap Value Fund should consult their tax advisers regarding the tax consequences to them of the

Transaction in light of their individual circumstances. In addition, because the foregoing discussion relates only to the U.S.

federal income tax consequences of the Transaction, shareholders also should consult their tax advisers as to state, local and

foreign tax consequences to them, if any, of the Transaction.

Characteristics of the Growth and Income Fund shares

Shares of the Growth and Income Fund will be distributed to shareholders of the Large-Cap Value Fund and will have the

same legal characteristics as the shares of the Growth and Income Fund with respect to such matters as voting rights,

assessibility, conversion rights, and transferability.

Capitalization of the Funds and Capitalization after the Transaction

The following table sets forth, as of April 30, 2003 the capitalization of shares of the Large-Cap Value Fund and the

Growth and Income Fund. The table also shows the projected capitalization of the Growth and Income Fund shares as adjusted to

give effect to the proposed Transaction. The capitalization of the Growth and Income Fund is likely to be different when the

Transaction is consummated.

Class A

Large-Cap Value Growth and Growth and Income

Fund Projected after

Fund Income Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets................................. 201,860 47,500,447 47,702,307

Total shares outstanding................... 24,205 4,637,560 (4,492)* 4,657,273

Net asset value per share.................. 8.34 10.24 10.24

Class B

Growth and Income

Large-Cap Value Growth and Fund Projected after

Fund Income Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets................................. 594,711 101,549,415 102,144,126

Total shares outstanding................... 71,514 10,098,525 (12,398)* 10,157,641

Net asset value per share.................. 8.32 10.06 10.06

Class C

Growth and Income

Large-Cap Value Growth and Fund Projected after

Fund Income Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets................................. 366,796 47,699,691 48,066,487

Total shares outstanding................... 44,110 4,747,508 (7,613)* 4,784,005

Net asset value per share.................. 8.32 10.05 10.05

Class X

Growth and Income

Large-Cap Value Growth and Fund Projected after

Fund Income Fund Transaction

(unaudited) (unaudited) Adjustments (unaudited)

Net assets................................. 78,970 24,988,764 25,067,734

Total shares outstanding................... 9,511 2,488,805 (1,645)* 2,496,671

Net asset value per share.................. 8.30 10.04 10.04

*Reflects the change in shares of the Large-Cap Value Fund upon conversion to the Growth and Income Fund.

VOTING INFORMATION

Shareholders of record of the Large-Cap Value Fund on the Record Date will be entitled to vote at the Meeting. On the

Record Date, there were 176,643 shares of the Large-Cap Value Fund issued and outstanding.

The presence in person or by proxy of the holders of a majority of the outstanding shares of the Fund is required to

constitute a quorum at the Meeting. Shares beneficially held by shareholders present in person or represented by proxy at the

Meeting will be counted for the purpose of calculating the votes cast on the issues before the Meeting. If a quorum is present,

the affirmative vote of the holders of a majority of the total number of shares of capital stock of the Large-Cap Value Fund

outstanding and entitled to vote is necessary to approve the Plan. Each shareholder will be entitled to one vote for each full

share, and a fractional vote for each fractional share of the Large-Cap Value Fund held at the close of business on the Record

Date.

Shares held by shareholders present in person or represented by proxy at the Meeting will be counted both for the

purposes of determining the presence of a quorum and for calculating the votes cast on the issues before the Meeting. An

abstention by a shareholder, either by proxy or by vote in person at a Meeting, has the same effect as a negative vote. Under

existing New York Stock Exchange rules, it is not expected that brokers will be permitted to vote Fund shares in their

discretion. In addition, there is only one proposal being presented for a shareholder vote. As a result, the Fund does not

anticipate any broker non-votes.

..........Shareholders having more than one account in the Fund generally will receive a single proxy statement and a separate

proxy card for each account. It is important to mark, sign, date and return all proxy cards received.

..........In the event that sufficient votes to approve the Plan are not received, the persons named as proxies may propose one or

more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative

vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as proxies will vote those

proxies that they are entitled to vote FOR or AGAINST any such adjournment in their discretion.

..........The Company is not required to hold and will not ordinarily hold annual shareholders' meetings. The Board of Directors

may call special meetings of the shareholders for action by shareholder vote as required by the Investment Company Act or the

Company's Articles of Incorporation.

..........Pursuant to rules adopted by the SEC, a shareholder may include in proxy statements relating to annual and other meetings

of the shareholders of the Company certain proposals for shareholder action which he or she intends to introduce at such special

meetings; provided, among other things, that such proposal is received by the Company a reasonable time before a solicitation of

proxies is made for such meeting. Timely submission of a proposal does not necessarily mean that the proposal will be included.

The Board of Directors intends to bring before the Meeting the matter set forth in the foregoing Notice. The Directors

do not expect any other business to be brought before the Meeting. If, however, any other matters are properly presented to the

Meeting for action, it is intended that the persons named in the enclosed proxy will vote in accordance with their judgment. A

shareholder executing and returning a proxy may revoke it at any time prior to its exercise by written notice of such revocation

to the Secretary of the Company, by execution of a subsequent proxy, or by voting in person at the Meeting.

How to vote.

You can vote your shares in any one of four ways:

o........By mail, with the enclosed proxy card.

o In person at the Meeting.

o By phone

o Over the Internet

If you simply sign and date the proxy but give no voting instructions, your shares will be voted in favor of the Plan and

in accordance with the views of management upon any unexpected matters that come before the Meeting or adjournment of the Meeting.

Solicitation of voting instructions.

Voting instructions will be solicited principally by mailing this Prospectus/Proxy Statement and its enclosures, but

instructions also may be solicited by telephone, facsimile, through electronic means such as e-mail, or in person by officers or

representatives of the Company. In addition, the Company has engaged Georgeson Shareholder Communications, Inc. ("Georgeson"), a

professional proxy solicitation firm, to assist in the solicitation of proxies. As the Meeting date approaches, you may receive a

phone call from a representative of Georgeson if the Company has not yet received your vote. Georgeson may ask you for authority,

by telephone, to permit Georgeson to execute your voting instructions on your behalf.

ADDITIONAL INFORMATION ABOUT THE COMPANY AND THE FUNDS

The Large-Cap Value Fund and the Growth and Income Fund are separate series of the Company, which is an open-end

management investment company registered with the SEC under the Investment Company Act. Each Fund is, in effect, a separate

mutual fund. Detailed information about the Company and each Fund is contained in the Prospectus for the Funds which is enclosed

with and considered a part of this Prospectus/Proxy Statement. Additional information about the Company and each Fund is included

in the Company's SAI, dated March 1, 2003, which has been filed with the SEC and is incorporated into the SAI relating to this

Prospectus/Proxy Statement.

A copy of the Company's Annual Report to Shareholders for the fiscal year ended October 31, 2002 is part of this

Prospectus/Proxy Statement. You may request a free copy of the Company's Annual Report to Shareholders for the fiscal year ended

October 31, 2002 and the Company's Semi-Annual Report to Shareholders for the period ended April 30, 2003 by calling

1-800-752-6342 or by writing to the Company at One Corporate Drive, P.O. Box 883, Shelton, CT 06484.

The Funds file proxy materials, reports and other information with the SEC in accordance with the informational

requirements of the Securities Exchange Act of 1934 and the Investment Company Act. These materials can be inspected and copied

at: the SEC's Public Reference Room at 450 Fifth Street NW, Washington, DC 20549, and at the Regional Offices of the SEC located

in New York City at 233 Broadway, New York, NY 10279 and in Chicago at 175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604.

Also, copies of such material can be obtained from the SEC's Public Reference Section, Washington, DC 20549-6009, upon payment of

prescribed fees, or from the SEC's Internet address at http://www.sec.gov.

PRINCIPAL HOLDERS OF SHARES

The table below sets forth, as of the Record Date, each shareholder that beneficially owns more than 5% of any class of

the Large-Cap Value Fund.

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

Fund and Share Class Owner Name Address Percent

Ownership

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

ASAF DeAM Large-Cap Value Fund Robert W. Baird & Co. Inc. 777 East Wisconsin Avenue 5.57%

Class A A/C 3563-3322 Milwaukee, WI 53202-5300

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

State Street Bank & Trust Co 1802 Mildred Ave 5.31%

Cust for the Rollover IRA of Marquette, WI 49855-2554

Beverly E. Hill

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

- ----------------------------------------- ------------------------------------ ------------------------------- ---------------

NFSC FEBO # L27-955477 1341 Sharon Lane 6.38%

NFS/FMTC ROLLIRA FBO Jane C. Cheboygan, MI 49721-8910

Bonscour