File No. 333-108375

As filed on October 29, 2003

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |X|

Pre-Effective Amendment No. 1

Post-Effective Amendment No. |_|

(Check appropriate box or boxes)

American Skandia Advisor Funds, INC.

(Exact Name of Registrant as Specified in Charter)

(203) 926-1888

(Area Code and Telephone Number)

One Corporate Drive

Shelton, CT 06484

Address of Principal Executive Offices:

(Number, Street, City, State, Zip Code)

Edward P. Macdonald, Esq.

Assistant Secretary, American Skandia Advisor Funds

One Corporate Drive

Shelton, CT 06484

Name and Address of Agent for Service:

(Number and Street) (City) (State) (Zip Code)

Copies to:

Robert K. Fulton, Esquire

Stradley, Ronon, Stevens & Young, LLP

2600 One Commerce Square

Philadelphia, PA 19103-7098

Approximate Date of Proposed Public Offering: As soon as

practicable after this Registration Statement becomes effective

under the Securities Act of 1933, as amended.

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the Registration Statement

shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Title of the securities being registered: Shares of common stock of the ASAF Neuberger Berman Mid-Cap Value Fund of

American Skandia Advisor Funds. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act

of 1940, as amended.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF GABELLI ALL-CAP VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

IMPORTANT PROXY MATERIALS

PLEASE VOTE NOW

Dear Shareholder: October 10, 2003

I am writing to ask you to vote on an important proposal whereby the assets of the ASAF Gabelli All-Cap Value Fund (the "All-Cap

Value Fund") would be acquired by the ASAF Neuberger Berman Mid-Cap Value Fund (the "Mid-Cap Value Fund" and together with the

All-Cap Value Fund, the "Funds"). The proposed acquisition is referred to as a merger. The Funds are each a series of American

Skandia Advisor Funds, Inc. ("ASAF"). A shareholder meeting for the All-Cap Value Fund is scheduled for November 21, 2003. Only

shareholders of the All-Cap Value Fund will vote on the acquisition of the All-Cap Value Fund's assets by the Mid-Cap Value Fund.

This package contains information about the proposal and includes materials you will need to vote. The Board of Directors of ASAF

has reviewed the proposal and recommended that it be presented to shareholders of the All-Cap Value Fund for their consideration.

Although the Directors have determined that the proposal is in the best interests of shareholders, the final decision is up to

you.

If approved, the proposed merger would give you the opportunity to participate in a larger fund with similar investment policies.

In addition, shareholders are expected to realize a reduction in both the net and gross annual operating expenses paid on their

investment in the combined fund. The accompanying proxy statement and prospectus includes a detailed description of the proposal.

Please read the enclosed materials carefully and cast your vote. Remember, your vote is extremely important, no matter how large

or small your holdings. By voting now, you can help avoid additional costs that would be incurred with follow-up letters and

calls.

To vote, you may use any of the following methods:

o By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage paid envelope. Votes must be

received prior to November 21, 2003.

o By Internet. Have your proxy card available. Go to the web site indicated on your proxy card. Enter your 12-digit control

number from your proxy card. Follow the instructions found on the web site. Votes must be entered prior to 4 p.m. on November 20,

2003.

o By Telephone. Have your proxy card available. Call the toll-free number on your proxy card. Enter your 12-digit control

number from your proxy card. Follow the instructions given. Votes must be entered prior to 4 p.m. on November 20, 2003.

If you have any questions before you vote, please call us at 1-800-SKANDIA. We are glad to help you understand the proposal and

assist you in voting. Thank you for your participation.

/s/Judy Rice

Judy Rice

President

This page intentionally left blank.

AMERICAN SKANDIA ADVISOR FUNDS, INC.

ASAF GABELLI ALL-CAP VALUE FUND

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To our Shareholders:

Notice is hereby given that a Special Meeting of Shareholders (the "Meeting") of the ASAF Gabelli All-Cap Value Fund (the "All-Cap

Value Fund") will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New Jersey 07102, on November 21,

2003, at 11:00 a.m. Eastern Standard Time, for the following purposes:

1. For shareholders of the All-Cap Value Fund, to approve or disapprove a Plan of Reorganization under which the All-Cap Value

Fund will transfer all of its assets to, and all of its liabilities will be assumed by, the ASAF Neuberger Berman Mid-Cap Value

Fund (the "Mid-Cap Value Fund"). In connection with this proposed transfer, each whole and fractional share of each class of the

All-Cap Value Fund shall be exchanged for whole and fractional shares of equal net asset value of the same class of the Mid-Cap

Value Fund and outstanding shares of the All-Cap Value Fund will be cancelled.

2. To transact such other business as may properly come before the Meeting or any adjournments of the Meeting.

The Board of Directors of American Skandia Advisor Funds, Inc., on behalf of the All-Cap Value Fund, has fixed the close of

business on September 19, 2003 as the record date for the determination of the shareholders of the All-Cap Value Fund, as

applicable, entitled to notice of, and to vote at, the Meeting and any adjournments of the Meeting.

/s/Edward P. Macdonald

Edward P. Macdonald

Assistant Secretary

Dated: October 10, 2003

prospectus/proxy statement

TABLE OF CONTENTS

Page

Cover Page.....................................................................................................................Cover

SUMMARY............................................................................................................................2

The Proposal....................................................................................................................2

Shareholder voting..............................................................................................................2

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS.....................................................................................2

The investment objectives and policies of the Funds.............................................................................2

Diversification.................................................................................................................3

Borrowing, Issuing Senior Securities and Pledging Assets........................................................................3

Lending.........................................................................................................................3

Illiquid Securities.............................................................................................................3

Temporary Defensive Investments.................................................................................................3

Derivative Strategies...........................................................................................................3

Foreign Securities..............................................................................................................4

Investment Restrictions.........................................................................................................4

Federal Income Tax Considerations...............................................................................................4

Risks of investing in the Funds.................................................................................................5

Management of the Company and the Funds.........................................................................................5

Distribution Plan...............................................................................................................6

Valuation.......................................................................................................................6

Purchases, Redemptions, Exchanges and Distributions.............................................................................6

Fees and expenses...............................................................................................................7

Expense Examples................................................................................................................9

Performance....................................................................................................................11

REASONS FOR THE TRANSACTION.......................................................................................................13

INFORMATION ABOUT THE TRANSACTION.................................................................................................13

Closing of the Transaction.....................................................................................................13

Expenses of the Transaction....................................................................................................14

Tax Consequences of the Transaction............................................................................................14

Characteristics of the Mid-Cap Value Fund shares..................................................................................14

Capitalizations of the Funds and Capitalization after the Transaction..........................................................15

VOTING INFORMATION................................................................................................................16

How to vote....................................................................................................................17

Solicitation of voting instructions............................................................................................17

ADDITIONAL INFORMATION ABOUT THE COMPANY AND THE FUNDS............................................................................17

PRINCIPAL HOLDERS OF SHARES.......................................................................................................18

EXHIBITS TO PROSPECTUS/PROXY STATEMENT............................................................................................19

EXHIBIT A.......................................................................................................................1

Plan of Reorganization.......................................................................................................1

EXHIBIT B.......................................................................................................................1

Prospectus dated March 1, 2003...............................................................................................1

EXHIBIT C.......................................................................................................................2

ANNUAL REPORT dated OCTOBER 31, 2002.........................................................................................2

EXHIBIT D.......................................................................................................................3

SUPPLEMENTS DATED MAY 16, 2003, AUGUST 1, 2003, SEPTEMBER 16, 2003 AND OCTOBER 2, 2003.......................................3

2

AMERICAN SKANDIA ADVISOR FUNDS, INC.

One Corporate Drive

P.O. Box 883

Shelton, Connecticut 06484

PROSPECTUS/PROXY STATEMENT

Dated October 10, 2003

Acquisition of the Assets of the ASAF Gabelli All-Cap Value Fund

By and in exchange for shares of the ASAF Neuberger Berman Mid-Cap Value Fund

This Prospectus/Proxy Statement is furnished in connection with a Special Meeting (the "Meeting") of shareholders the

ASAF Gabelli All-Cap Value Fund (the "All-Cap Value Fund") of American Skandia Advisor Funds, Inc. (the "Company") called by the

Company to approve or disapprove a Plan of Reorganization (the "Plan"). If shareholders of the All-Cap Value Fund vote to approve

the Plan, you will receive shares of the ASAF Neuberger Berman Mid-Cap Value Fund (the "Mid-Cap Value Fund" and, together with the

All-Cap Value Fund, the "Funds") of the Company equal in value to your investment in shares of the All-Cap Value Fund as provided

in the Plan and described at greater length below. The All-Cap Value Fund will then be liquidated and dissolved.

The Meeting will be held at 100 Mulberry Street, Gateway Center Three, 14th Floor, Newark, New Jersey 07102 on November

21, 2003 at 11:00 a.m. Eastern standard time. The Board of Directors of the Company is soliciting these proxies on behalf of the

All-Cap Value Fund. This Prospectus/Proxy Statement will first be sent to shareholders on or about October 20, 2003.

The investment objective of both the Mid-Cap Value Fund and the All-Cap Value Fund is to seek capital growth.

This Prospectus/Proxy Statement gives the information about the proposed reorganization and issuance of shares of the

Mid-Cap Value Fund that you should know before investing. You should retain it for future reference. Additional information

about the Mid-Cap Value Fund and the proposed reorganization has been filed with the Securities and Exchange Commission ("SEC")

and can be found in the following documents:

|_| The Prospectus for the Funds dated March 1, 2003 is enclosed with and considered a part of this Prospectus/Proxy

Statement.

|_| A Statement of Additional Information (SAI) relating to this Prospectus/Proxy Statement dated March 1, 2003 has been

filed with the SEC and is incorporated by reference into this Prospectus/Proxy Statement.

You may request a free copy of the SAI relating to this Prospectus/Proxy Statement or other documents related to the

Company without charge by calling 1-800-752-6342 or by writing to the Company at the above address.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy Statement.

Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the

Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including

the possible loss of principal.

SUMMARY

This is only a summary of certain information contained in this Prospectus/Proxy Statement. You should read the more

complete information in the rest of this Prospectus/Proxy Statement, including the Plan (attached as Exhibit A) and the Prospectus

for the Funds (enclosed as Exhibit B).

The Proposal

You are being asked to consider and approve a Plan of Reorganization that will have the effect of combining the All-Cap

Value Fund and the Mid-Cap Value Fund of the Company into a single Fund. If shareholders of the All-Cap Value Fund vote to

approve the Plan, the assets of the All-Cap Value Fund will be transferred to the Mid-Cap Value Fund in exchange for a then equal

value of shares of the Mid-Cap Value Fund. Shareholders will have their shares of the All-Cap Value Fund exchanged for the

Mid-Cap Value Fund shares of equal dollar value based upon the values of the shares at the time the All-Cap Value Fund assets are

transferred to the Mid-Cap Value Fund. The All-Cap Value Fund will be liquidated and dissolved. The proposed reorganization is

referred to in this Prospectus/Proxy Statement as the "Transaction." As a result of the Transaction, you will cease to be a

shareholder of the All-Cap Value Fund and will become a shareholder of the Mid-Cap Value Fund.

For the reasons set forth in the "Reasons for the Transaction" section, the Board of Directors of the Company has

determined that the Transaction is in the best interests of the shareholders of the All-Cap Value Fund and the Mid-Cap Value Fund,

and also concluded that no dilution in value would result to the shareholders of either Fund as a result of the Transaction.

The Board of Directors of the Company, on behalf of both the All-Cap Value Fund and the Mid-Cap Value Fund, has approved the Plan

and unanimously recommends that you vote to approve the Plan.

Shareholder voting

Shareholders who own shares of the All-Cap Value Fund at the close of business on September 19, 2003 (the "Record Date")

will be entitled to vote at the Meeting, and will be entitled to one vote for each full share and a fractional vote for each

fractional share that they hold. The affirmative vote of the holders of a majority of the total number of shares of the All-Cap

Value Fund outstanding and entitled to vote is necessary to approve the Transaction.

Please vote your shares as soon as you receive this Prospectus/Proxy Statement. You may vote by completing and signing

the enclosed ballot (the "proxy card") or over the Internet or by phone. If you vote by any of these methods, your votes will be

officially cast at the Meeting by persons appointed as proxies.

You can revoke or change your voting instructions at any time until the vote is taken at the Meeting. For more details

about shareholder voting, see the "Voting Information" section of this Prospectus/Proxy Statement.

COMPARISONS OF IMPORTANT FEATURES OF THE FUNDS

The investment objectives and policies of the Funds

This section describes the investment objectives and policies of the All-Cap Value Fund and the Mid-Cap Value Fund and

the differences between them. For a complete description of the investment policies and risks of the Mid-Cap Value Fund, you

should read the Prospectus for the Funds that is enclosed with this Prospectus/Proxy Statement.

The investment objectives of the Funds are identical - to seek capital growth. The Mid-Cap Value Fund invests primarily

in equity securities of mid-cap value companies, while the All-Cap Value Fund invests in equity securities of companies of all

sizes. Both Funds take a value approach to investing and primarily invest in securities that are believed to be selling at prices

lower than what they are actually worth.

The All-Cap Value Fund will primarily invest in readily marketable equity securities including common stocks, preferred

stocks and securities that may be converted at a later time into common stock. The Fund may invest in the securities of companies

of all sizes, and may emphasize either larger or smaller companies at a given time based on the Fund's sub-advisor's assessment of

particular companies and market conditions. In making stock selections, the Fund strives to earn a 10% real rate of return. The

Fund focuses on companies that appear under-priced relative to the value that the Fund's sub-advisor believes informed investors

would be willing to pay for the company. The Fund's sub-advisor considers factors such as price, earnings expectations, earnings

and price histories, balance sheet characteristics and perceived management skills. The Fund's sub-advisor also considers changes

in economic and political outlooks as well as individual corporate developments. The Fund's sub-advisor will sell any Fund

investments that lose their perceived value relative to other investments.

The Mid-Cap Value Fund will invest, under normal circumstances, at least 80% of the value of its assets in medium

capitalization companies. Companies with equity market capitalizations that fall within the range of the Russell Midcap(R)Index at

the time of investment are considered mid-cap companies for purposes of the Fund. Some of the Fund's assets may be invested in the

securities of large-cap companies as well as in small-cap companies. The Fund seeks to reduce risk by diversifying among many

companies and industries. Under the Fund's value-oriented investment approach, the Fund's sub-advisor looks for well-managed

companies whose stock prices are undervalued and that may rise in price when other investors realize their worth. Factors that

the Fund's sub-advisor may use to identify these companies include strong fundamentals, such as a low price-to-earnings ratio,

consistent cash flow, and a sound track record through all phases of the market cycle. The Fund's sub-advisor may also look for

other characteristics in a company, such as a strong position relative to competitors, a high level of stock ownership among

management, or a recent sharp decline in stock price that appears to be the result of a short-term market overreaction to negative

news. The Fund's sub-advisor generally considers selling a stock when it reaches a target price, when it fails to perform as

expected, or when other opportunities appear more attractive.

Diversification

Both Funds are diversified funds. This means that, with respect to 75% of the value of each Fund's total assets, each

Fund invests in cash, cash items, obligations of the U.S. Government, its agencies or instrumentalities, securities of other

investment companies and "other securities." The "other securities" are subject to the requirement that not more than 5% of total

assets of the Fund will be invested in the securities of a single issuer and that the Fund will not hold more than 10% of any

single issuer's outstanding voting securities.

The Funds may not purchase the securities of any issuer if, as a result, a Fund would fail to be a diversified company

within the meaning of the Investment Company Act of 1940, as amended ("Investment Company Act") and the rules and regulations

promulgated thereunder.

Borrowing, Issuing Senior Securities and Pledging Assets

Neither Fund may issue senior securities, borrow money or pledge assets except as permitted under the Investment Company

Act, the rules and regulations promulgated thereunder, or under any exemptive order, SEC release, no-action letter or similar

relief or interpretations.

Lending

Both Funds may lend assets to brokers, dealers and financial institutions. Both Funds may make loans, including through

loans of assets of the Fund, repurchase agreements, trade claims, loan participations or similar investments, as permitted by the

Investment Company Act. For purposes of this limitation and consistent with the Fund's investment objective, the acquisition of

bonds, debentures, other debt securities or instruments, or participations or other interests therein and investments in

government obligations, commercial paper, certificates of deposit, bankers' acceptances or instruments similar to any of the

foregoing will not be considered the making of a loan.

Illiquid Securities

Both Funds may invest in illiquid securities, including those without a readily available market and repurchase

agreements with maturities longer than seven days. Both Funds may hold up to 15% of its net assets in illiquid securities.

Temporary Defensive Investments

Although each Fund normally invest assets according to its investment strategy, there are times when a Fund may

temporarily invest up to 100% of its assets in money market instruments in response to adverse market, economic or political

conditions.

For more information about the risks and restrictions associated with these policies, see the Funds' Prospectus, and for

a more detailed discussion of the Funds' investments, see the Statements of Additional Information, all of which are incorporated

into this Proxy Statement by reference.

Derivative Strategies

Both Funds may use certain derivative strategies to try to improve the Fund's returns or hedging techniques to try to

protect its assets. Derivatives, such as futures, options, foreign currency forward contracts, options on futures and swaps,

involve costs and can be volatile. With derivatives, the Fund's sub-advisor is trying to predict whether the underlying

investment-- a security, market index, currency, interest rate or some other asset, rate or index-- will go up or down at some

future date. Each Fund may use derivatives to try to reduce risk or to increase return, taking into account the Fund's overall

investment objective. The Funds cannot guarantee these derivative strategies will work, that the instruments necessary to

implement these strategies will be available or that the Funds will not lose money. While the Mid-Cap Value Fund will not enter

into futures contracts or related options, it may utilize other derivative strategies such as other types of option transactions

and foreign currency forward contracts.

Foreign Securities

Both Funds may invest in foreign securities. The All-Cap Value Fund may invest up to 25% of its total assets in

securities of non-U.S. issuers. The Mid-Cap Value Fund may invest up to 10% of its total assets in securities denominated in

foreign currencies, but may invest without limitation in securities of foreign companies that are denominated in U.S. dollars.

Investments in securities of foreign issuers may involve risks that are not present with domestic investments. While investments

in foreign securities can reduce risk by providing further diversification, such investments involve "sovereign risks" in addition

to the credit and market risks to which securities generally are subject. Sovereign risks includes local political or economic

developments, potential nationalization, withholding taxes on dividend or interest payments, and currency blockage (which would

prevent cash from being brought back to the United States). Compared to United States issuers, there is generally less publicly

available information about foreign issuers and there may be less governmental regulation and supervision of foreign stock

exchanges, brokers and listed companies. Foreign issuers are not generally subject to uniform accounting, auditing and financial

reporting standards, practices and requirements comparable to those applicable to domestic issuers. In some countries, there may

also be the possibility of expropriation or confiscatory taxation, difficulty in enforcing contractual and other obligations,

political or social instability or revolution, or diplomatic developments that could affect investments in those countries.

Securities of some foreign issuers are less liquid and their prices are more volatile than securities of comparable domestic

issuers. Further, it may be more difficult for the Company's agents to keep currently informed about corporate actions and

decisions that may affect the price of portfolio securities. Brokerage commissions on foreign securities exchanges, which may be

fixed, may be higher than in the United States. Settlement of transactions in some foreign markets may be less frequent or less

reliable than in the United States, which could affect the liquidity of investments.

Investment Restrictions

Each of the Funds has substantially identical fundamental investment restrictions.

Federal Income Tax Considerations

Each Fund is treated as a separate entity for federal income tax purposes. Each Fund has qualified and elected or

intends to qualify and elect to be treated as a "regulated investment company" under Subchapter M of the Internal Revenue Code of

1986, as amended (the "Code"), and intends to continue to so qualify in the future. As a regulated investment company, a Fund

must, among other things, (a) derive at least 90% of its gross income from dividends, interest, payments with respect to loans of

stock and securities, gains from the sale or other disposition of stock, securities or foreign currency and other income

(including but not limited to gains from options, futures, and forward contracts) derived with respect to its business of

investing in such stock, securities or foreign currency; and (b) diversify its holdings so that, at the end of each quarter of its

taxable year, (i) at least 50% of the value of the Fund's total assets is represented by cash, cash items, U.S. Government

securities, securities of other regulated investment companies, and other securities limited, in respect of any one issuer, to an

amount not greater than 5% of the Fund's total assets, and 10% of the outstanding voting securities of such issuer, and (ii) not

more than 25% of the value of its total assets is invested in the securities of any one issuer (other than U.S. Government

securities or securities of other regulated investment companies). As a regulated investment company, a Fund (as opposed to its

shareholders) will not be subject to federal income taxes on the net investment income and capital gain that it distributes to its

shareholders, provided that at least 90% of its net investment income and realized net short-term capital gain in excess of net

long-term capital loss for the taxable year is distributed in accordance with the Code's timing requirements

The Transaction may entail various tax consequences which are discussed under the caption "Tax Consequences of the

Transaction."

Risks of investing in the Funds

Like all investments, an investment in either Fund involves risk. There is no assurance that either of the Funds will

meet its investment objective. As with any fund investing primarily in equity securities, the value of the securities held by a

Fund may decline. Stocks can decline for many reasons, including reasons related to the particular company, the industry of which

it is a part, or the securities markets generally. These declines may be substantial.

The risk to which a capital growth fund is subject depends in part on the size of the companies in which the particular

fund invests. Securities of smaller companies tend to be subject to more abrupt and erratic price movements than securities of

larger companies, in part because they may have limited product lines, market or financial resources. Overall, the Funds are

exposed to similar risks in that the Mid-Cap Value Fund invests primarily in medium-capitalization companies and the All-Cap Value

Fund invests in equity securities without regard to capitalization, and may include large, medium and small companies at the same

time. However, because the investment policies of the All-Cap Value Fund offer the ability to invest in companies of all sizes,

the All-Cap Value Fund could be subject to somewhat less risk than the Mid-Cap Value Fund when emphasizing investments in

large-cap equity securities and subject to a greater level of risk than the Mid-Cap Value Fund when emphasizing investments in

securities of small companies. Further, value stocks are believed to be selling at prices lower than what they are actually

worth, while growth stocks are those of companies that are expected to grow at above-average rates. Value investing historically

has involved less risk than investing in growth companies, although this will not always be the case. The stocks purchased by a

value fund may remain undervalued during a short or extended period of time. This may happen because value stocks as a category

lose favor with investors compared to growth stocks, or because of a failure to anticipate which stocks or industries would

benefit from changing market or economic conditions. Both the All-Cap Value Fund and the Mid-Cap Value Fund take a value approach

to investing.

Management of the Company and the Funds

American Skandia Investment Services, Inc. ("ASISI"), One Corporate Drive, Shelton, Connecticut, and Prudential

Investments LLC ("PI"), Gateway Center Three, 100 Mulberry Street, Newark, New Jersey, serve as co-managers (each an "Investment

Manager" and together the "Investment Managers") pursuant to an investment management agreement with the Company on behalf of each

Fund (the "Management Agreement"). Under the Management Agreement, PI, as co-manager, will provide supervision and oversight of

ASISI's investment management responsibilities with respect to the Company. Pursuant to the Management Agreement, the Investment

Managers will jointly administer each Fund's business affairs and supervise each Fund's investments. Subject to approval by the

Board of Directors, the Investment Managers may select and employ one or more sub-advisors for a Fund, who will have primary

responsibility for determining what investments the Fund will purchase, retain and sell. Also subject to the approval of the

Board of Directors, the Investment Managers may reallocate a Fund's assets among sub-advisors including (to the extent legally

permissible) affiliated sub-advisors, consistent with a Fund's investment objectives.

The Company has obtained an exemption from the SEC that permits an Investment Manager to change sub-advisors for a Fund

and to enter into new sub-advisory agreements, without obtaining shareholder approval of the changes. Any such sub-advisor change

would continue to be subject to approval by the Board of Directors of the Company. This exemption (which is similar to exemptions

granted to other investment companies that are operated in a similar manner as the Company) is intended to facilitate the

efficient supervision and management of the sub-advisors by the Investment Managers and the Directors of the Company.

The Investment Managers currently engage the following sub-advisors to manage the investments of each Fund in accordance

with the Fund's investment objective, policies and limitations and any investment guidelines established by the Investment

Managers. Each sub-advisor is responsible, subject to the supervision and control of the Investment Managers, for the purchase,

retention and sale of securities in the Fund's investment portfolio under its management.

GAMCO Investors, Inc. ("GAMCO"), with principal offices located at One Corporate Center, Rye, New York 10580-1434, serves

as Sub-advisor to the All-Cap Value Fund. GAMCO managed approximately $9.97 billion in assets as of December 31, 2002 and is a

wholly-owned subsidiary of Gabelli Asset Management Inc. Mario J. Gabelli, CFA, is primarily responsible for the day-to-day

management of the All-Cap Value Fund. Mr. Gabelli has managed the All-Cap Value Fund since its inception in September, 2000. Mr.

Gabelli has been Chief Executive Officer and Chief Investment Officer of GAMCO and its predecessor since the predecessor's

inception in 1978.

Neuberger Berman Management Inc. ("NB Management"), 605 Third Avenue, New York, NY 10158, serves as sub-advisor for the

Mid-Cap Value Fund. NB Management and its predecessor firms have specialized in the management of mutual funds since 1950.

Neuberger Berman, LLC ("Neuberger Berman"), an affiliate of NB Management, acts as a principal broker in the purchase and sale of

portfolio securities for the Funds for which it serves as Sub-advisor, and provides NB Management with certain assistance in the

management of the Funds without added cost to the Funds or ASISI. Neuberger Berman and its affiliates manage securities accounts,

including mutual funds, that had approximately $56.1 billion of assets as of December 31, 2002. The portfolio manager responsible

for the day-to-day management of the Mid-Cap Value Fund is Andrew Wellington. Mr. Wellington has been managing the Fund since May

2003. Mr. Wellington has been with NB Management since 2001, where he is currently a Managing Director and a Portfolio Manager.

From 2000 until 2001, Mr. Wellington served as a Portfolio Manager at Pzena Investment Management ("Pzena"). From 1996 until

1999, he served as a Senior Research Analyst at Pzena.

Fee Arrangements

The Funds have comparable fee arrangements. Under the Management Agreement with respect to the All-Cap Value Fund, the

Fund is obligated to pay ASISI an annual investment management fee equal to .95% of its average daily net assets. Similarly,

under the Management Agreement with respect to the Mid-Cap Value Fund, the Fund is obligated to pay ASISI an annual investment

management fee equal to 0.90% of its average daily net assets. ASISI pays GAMCO and NB Management a sub-advisory fee for

sub-advisory services for the All-Cap Value Fund and the Mid-Cap Value Fund, respectively. ASISI pays these sub-advisory fees at

no additional costs to the Funds. Under the current sub-advisory agreement for the All-Cap Value Fund, ASISI pays GAMCO an annual

sub-advisory fee equal to the following percentages of the combined average daily net assets of the All-Cap Value Fund and the

series of American Skandia Trust that is managed by the sub-advisor and identified by the sub-advisor and the Investment Managers

as being similar to the All-Cap Value Fund: 0.50% of the portion of the combined average daily net assets not in excess of $500

million; plus 0.40% of the portion in excess of $500 million. GAMCO has voluntarily agreed to waive a portion of its fee so that

the following fee schedule based on combined assets is in effect: 0.40% of the portion of combined average daily net assets not in

excess of $500 million; plus 0.35% of the portion of combined assets over $500 million but not in excess of $1 billion; plus 0.30%

of the portion of combined assets over $1 billion. Under the current sub-advisory agreement for the Mid-Cap Value Fund, ASISI

pays NB Management an annual sub-advisory fee equal to 0.40% of the Fund's average daily net assets. NB Management has

voluntarily agreed to waive a portion of its fee so that the following fee schedule based on the combined average daily net assets

of the Mid-Cap Value Fund, the ASAF Neuberger Berman Mid-Cap Growth Fund and the series of American Skandia Trust that are managed

by the sub-advisor and identified by the sub-advisor and Investment Managers as being similar to the Fund and ASAF Neuberger

Berman Mid-Cap Growth Fund is in effect: 0.40% of the portion of the combined average daily net assets not in excess of $1

billion; plus 0.35% of the portion over $1 billion. Voluntary fee waivers may be revoked by the sub-advisor at any time.

During the calendar year ended December 31, 2002, the All-Cap Value Fund paid $743,861 in investment management fees to

ASISI. If the fee rate applicable to the Mid-Cap Value Fund had been in effect during such period, the Mid-Cap Value Fund would

have paid $704,710 in investment management fees to ASISI. Because the Investment Management fee rates currently paid to ASISI by

the All-Cap Value Fund are greater than the fee rates paid by the Mid-Cap Value Fund, former shareholders of the All-Cap Value

Fund will pay a lesser investment advisory fee rate after becoming shareholders of the Mid-Cap Value Fund upon completion of the

Transaction.

Distribution Plan

The Company adopted a Distribution and Service Plan (commonly known as a "12b-1 Plan") for each class of shares to

compensate the Funds' distributor for its services and costs in distributing shares and servicing shareholder accounts. Under the

Distribution and Service Plan for Class A shares, each Fund pays the distributor 0.50% of the Fund's average daily net assets

attributable to Class A shares. Under the Plans for Class B, X and C shares, each Fund pays the distributor 1.00% of the Fund's

average daily net assets attributable to the relevant Class of shares. Because these fees are paid out of the Funds' assets on an

ongoing basis, these fees may, over time, increase the cost of an investment in the Fund and may be more costly than other types

of sales charges. The distributor uses distribution and service fees received under each 12b-1 Plan to compensate qualified

dealers for services provided in connection with the sale of shares and the maintenance of shareholder accounts. The distributor

has assigned its right to receive distribution and service fees under the Class B and X 12b-1 Plans to a third party.

Valuation

The net asset value ("NAV") per share is determined for each class of shares for each Fund as of the time of the close of

the NYSE (which is normally 4:00 p.m. Eastern Time) on each business day by dividing the value of the Fund's total assets

attributable to a class, less any liabilities, by the number of total shares of that class outstanding. In general, the assets of

each Fund are valued on the basis of market quotations. However, in certain circumstances where market quotations are not readily

available or where market quotations for a particular security or asset are believed to be incorrect, securities and other assets

are valued by methods that are believed to accurately reflect their fair value.

Purchases, Redemptions, Exchanges and Distributions

The purchase policies for each Fund are identical. The offering price is the NAV plus any initial sales charge that

applies. Class A shares are sold at NAV plus an initial sales charge that varies depending on the amount of your investment.

Class B shares are sold at NAV per share without an initial sales charge. However, if Class B shares are redeemed within seven

years of their purchase, a contingent deferred sales charge ("CDSC") will be deducted from the redemption proceeds. Class C

shares are sold at NAV per share plus an initial sales charge of 1% of the offering price. If Class C shares are redeemed within

12 months of the first business day of calendar month of their purchase, a CDSC of 1.0% will be deducted from the redemption

proceeds. Class X shares are sold at NAV per share without an initial sales charge. In addition, investors purchasing Class X

shares will receive, as a bonus, additional shares having a value equal to 2.50% of the amount invested. Although Class X shares

are sold without an initial sales charge, if Class X shares are redeemed within 8 years of their purchase, a CDSC will be deducted

from the redemption proceeds.

The redemption policies for each Fund are identical. Your shares will be sold at the next NAV determined after your

order to sell is received, less any applicable CDSC imposed. Refer to the Funds' Prospectus for more information regarding how to

sell shares.

Shares of each Fund may be exchanged for shares of the same class of other Funds at NAV per share at the time of

exchange. Exchanges of shares involve a redemption of the shares of the Fund you own and a purchase of shares of another Fund.

Shares are normally redeemed and purchased in the exchange transaction on the business day on which the Transfer Agent receives an

exchange request that is in proper form, if the request is received by the close of the NYSE that day.

Each Fund will distribute substantially all of its income and capital gains to shareholder each year. Each Fund will

declare dividends, if any, annually.

Fees and expenses

The following table describes the fees and expenses that shareholders may pay if they hold shares of the Funds, as well

as the projected fees and expenses of the Mid-Cap Value Fund after the Transaction.

Class A Shares

Mid-Cap Value Fund

All-Cap Value Mid-Cap Value After Transaction

Fund Class A Fund Class A Class A

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) 5.75% 5.75% 5.75%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) None1 None1 None1

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.95% 0.90% 0.90%

Estimated Distribution (12b-1) Fees........ 0.50% 0.50% 0.50%

Other Expenses............................. 0.86% 0.65% 0.66%

Advisory Fee Waivers and Expense Reimbursement (0.46)% (0.20)% (0.21)%

Total Annual Fund Operating Expenses....... 1.85% 1.85% 1.85%

Class B Shares

Mid-Cap Value Fund

All-Cap Value Mid-Cap Value After Transaction

Fund Class B Fund Class B Class B

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

On Purchases (as % of offering price) None None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.95% 0.90% 0.90%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 0.86% 0.65% 0.66%

Advisory Fee Waivers and Expense Reimbursement (0.46)% (0.20)% (0.21)%

Total Annual Fund Operating Expenses....... 2.35% 2.35% 2.35%

Class C Shares

Mid-Cap Value Fund

All-Cap Value Mid-Cap Value After Transaction

Fund Class C Fund Class C Class C

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

On Purchases (as % of offering price) 1.00% 1.00% 1.00%

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 1.00%3 1.00%3 1.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.95% 0.90% 0.90%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 0.86% 0.65% 0.66%

Advisory Fee Waivers and Expense Reimbursement (0.46)% (0.20)% (0.21)%

Total Annual Fund Operating Expenses....... 2.35% 2.35% 2.35%

Class X Shares

Mid-Cap Value Fund

All-Cap Value Mid-Cap Value After Transaction

Fund Class X Fund Class X Class X

Shareholder Fees

(fees paid directly from your investment)

Maximum Sales Charge (Load)

on Purchases (as % of offering price) None None None

Maximum Contingent Deferred Sales Charge (Load)

(as % of original purchase price) 6.00%3 6.00%3 6.00%3

Redemption Fee................................. None2 None2 None2

Exchange Fee................................... None None None

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets)

Management Fees............................ 0.95% 0.90% 0.90%

Estimated Distribution (12b-1) Fees........ 1.00% 1.00% 1.00%

Other Expenses............................. 0.86% 0.65% 0.66%

Advisory Fee Waivers and Expense Reimbursement (0.46)% (0.20)% (0.21)%

Total Annual Fund Operating Expenses....... 2.35% 2.35% 2.35%

1. Under certain circumstances, purchases of Class A shares not subject to an initial sales charge (load) will be subject to a

contingent deferred sales charge (load) ("CDSC") if redeemed within 12 months of the calendar month of purchase. For an

additional discussion of the Class A CDSC, see this Prospectus under "How to Buy Shares."

2. A $10 fee may be imposed for wire transfers of redemption proceeds. For an additional discussion of wire redemptions, see

this Prospectus under "How to Redeem Shares."

3. If you purchase Class B or X shares, you do not pay an initial sales charge but you may pay a CDSC if you redeem some or all

of your shares before the end of the seventh (in the case of Class B shares) or eighth (in the case of Class X shares) year after

which you purchased such shares. The CDSC is 6%, 5%, 4%, 3%, 2%, 2% and 1% for redemptions of Class B shares occurring in years

one through seven, respectively. The CDSC is 6%, 5%, 4%, 4%, 3%, 2%, 2% and 1% for redemptions of Class X shares occurring in

years one through eight, respectively. No CDSC is charged after these periods. If you purchase Class C shares, you may pay an

initial sales charge of 1% and you may incur a CDSC if you redeem some or all of your Class C shares within 12 months of the

calendar month of purchase. For a discussion of the Class B, X and C CDSC, see this Prospectus under "How to Buy Shares."

Expense Examples

Full Redemption - These examples are intended to help you compare the cost of investing in each Fund with the cost of investing in

other mutual funds, and the cost of investing in the Mid-Cap Value Fund after the Transaction. They assume that you invest

$10,000, that you receive a 5% return each year, and that the Funds' total operating expenses remain the same. Although your

actual costs may be higher or lower, based on the above assumptions your costs would be:

Class A Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 752 1,213 1,700 3,035

Mid-Cap Value Fund 752 1,163 1,598 2,802

Mid-Cap Value Fund 752 1,165 1,602 2,812

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 838 1,228 1,643 2,985

Mid-Cap Value Fund 838 1,175 1,538 2,748

Mid-Cap Value Fund 838 1,177 1,542 2,758

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 436 919 1,529 3,174

Mid-Cap Value Fund 436 867 1,424 2,942

Mid-Cap Value Fund 436 869 1,428 2,951

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 844 1,248 1,780 3,182

Mid-Cap Value Fund 844 1,194 1,671 2,942

Mid-Cap Value Fund 844 1,196 1,675 2,951

(Projected after the Transaction)

No Redemption - You would pay the following expenses based on the above assumptions except that you do not redeem your shares at

the end of each period:

Class A Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 752 1,213 1,700 3,035

Mid-Cap Value Fund 752 1,163 1,598 2,802

Mid-Cap Value Fund 752 1,165 1,602 2,812

(Projected after the Transaction)

Class B Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 238 828 1,443 2,985

Mid-Cap Value Fund 238 775 1,338 2,748

Mid-Cap Value Fund 238 777 1,342 2,758

(Projected after the Transaction)

Class C Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 336 919 1,529 3,174

Mid-Cap Value Fund 336 867 1,424 2,942

Mid-Cap Value Fund 336 869 1,428 2,951

(Projected after the Transaction)

Class X Shares

1 Year 3 Years 5 Years 10 Years

All-Cap Value Fund 244 848 1,480 3,182

Mid-Cap Value Fund 244 794 1,371 2,942

Mid-Cap Value Fund 244 796 1,375 2,951

(Projected after the Transaction)

Performance

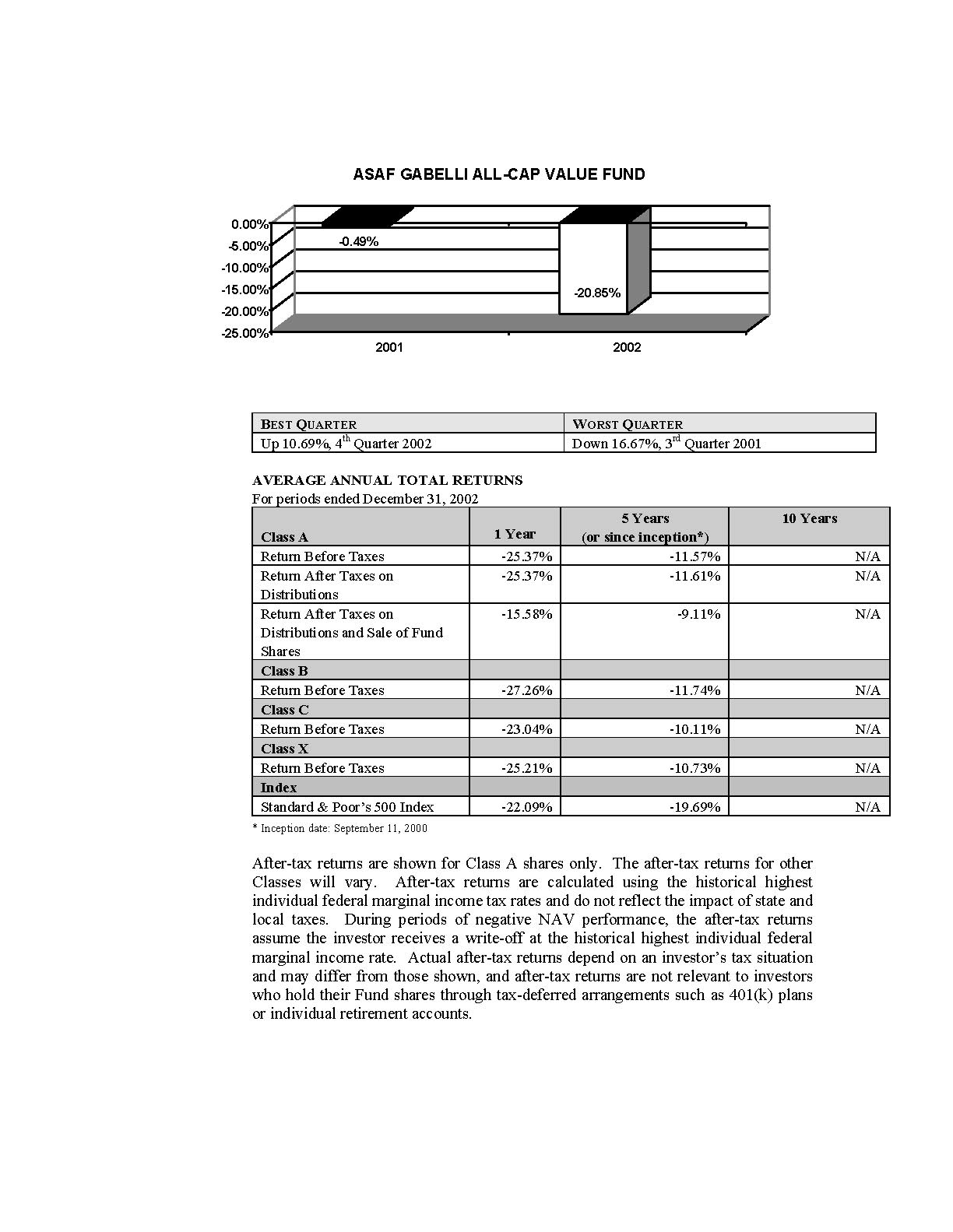

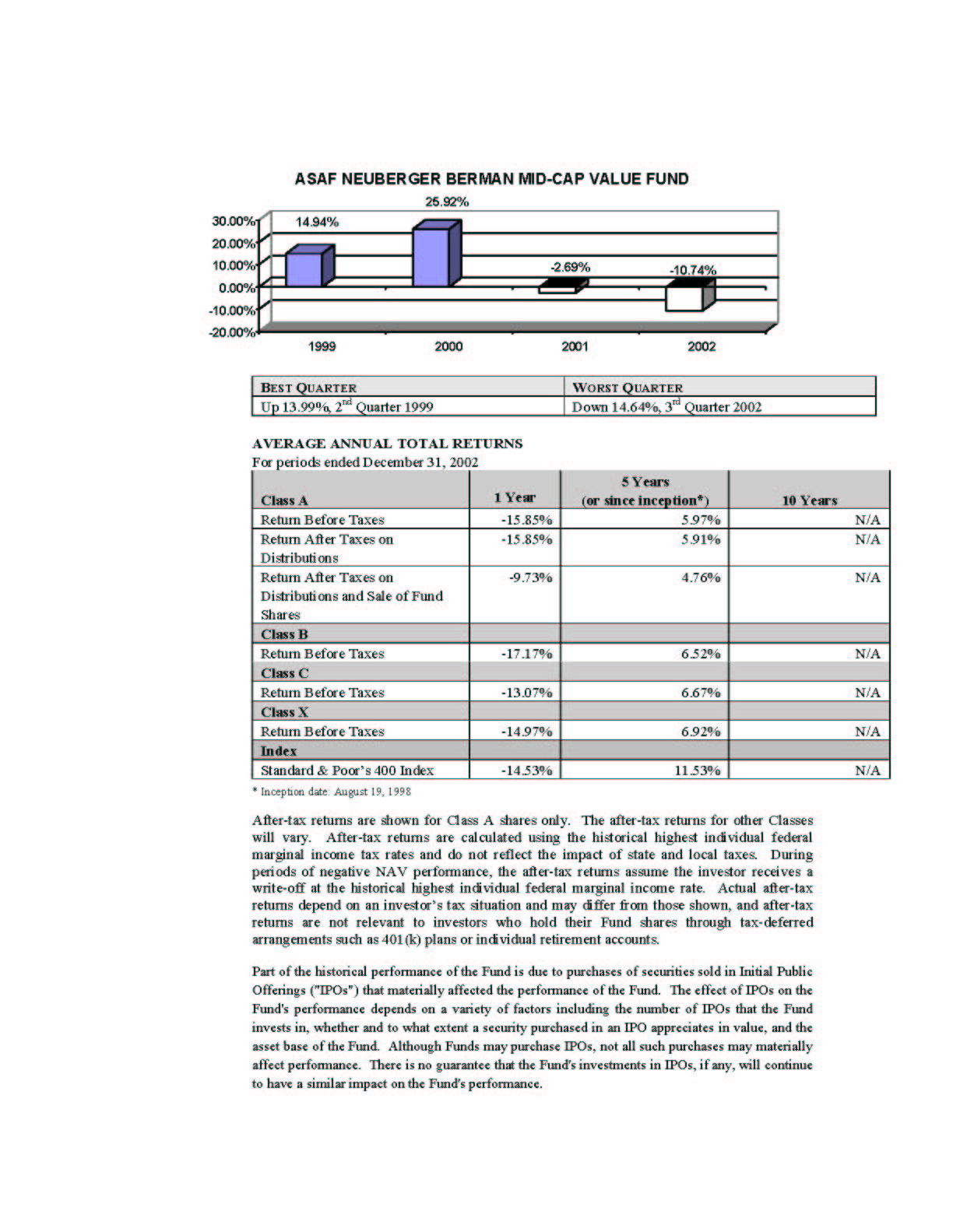

The bar charts show the performance of the Class A shares of each Fund for each full calendar year the Fund has been in

operation. The first table below each bar chart shows each such Fund's best and worst quarters during the periods included in the

bar chart. The second table shows the average annual total returns before taxes for each Class of each Fund for 2002 and since

inception, as well as the average annual total returns after taxes on distributions and after taxes on distributions and

redemptions for Class A shares of each Fund for 2002 and since inception.

This information may help provide an indication of each Fund's risks by showing changes in performance from year to year

and by comparing the Fund's performance with that of a broad-based securities index. The average annual figures reflect sales

charges; the other figures do not, and would be lower if they did. All figures assume reinvestment of dividends. Past

performance does not necessarily indicate how a Fund will perform in the future.

-------------------------------------------------- ------------------------------------------------

Best Quarter WORST QUARTER

-------------------------------------------------- ------------------------------------------------

-------------------------------------------------- ------------------------------------------------

Up 10.69%, 4th Quarter 2002 Down 16.67%, 3rd Quarter 2001

-------------------------------------------------- ------------------------------------------------

AVERAGE ANNUAL TOTAL RETURNS

For periods ended December 31, 2002

----------------------------------- ------------- -------------------------- ------------------------

5 Years 10 Years

Class A (or since inception*)

1 Year

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -25.37% -11.57% N/A

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -25.37% -11.61% N/A

Distributions

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -15.58% -9.11% N/A

Distributions and Sale of Fund

Shares

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Class B

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -27.26% -11.74% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class C

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -23.04% -10.11% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class X

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -25.21% -10.73% N/A

----------------------------------- ------------- -------------------------- ------------------------

Index

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Standard & Poor's 500 Index -22.09% -19.69% N/A

----------------------------------- ------------- -------------------------- ------------------------

* Inception date: September 11, 2000

After-tax returns are shown for Class A shares only. The after-tax returns for other Classes will vary.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do

not reflect the impact of state and local taxes. During periods of negative NAV performance, the after-tax

returns assume the investor receives a write-off at the historical highest individual federal marginal income

rate. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and

after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such

as 401(k) plans or individual retirement accounts.

-------------------------------------------------- ------------------------------------------------

Best Quarter WORST QUARTER

-------------------------------------------------- ------------------------------------------------

-------------------------------------------------- ------------------------------------------------

Up 13.99%, 2nd Quarter 1999 Down 14.64%, 3rd Quarter 2002

-------------------------------------------------- ------------------------------------------------

AVERAGE ANNUAL TOTAL RETURNS

For periods ended December 31, 2002

----------------------------------- ------------- -------------------------- ------------------------

5 Years

Class A (or since inception*) 10 Years

1 Year

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -15.85% 5.97% N/A

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -15.85% 5.91% N/A

Distributions

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return After Taxes on -9.73% 4.76% N/A

Distributions and Sale of Fund

Shares

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Class B

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -17.17% 6.52% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class C

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -13.07% 6.67% N/A

----------------------------------- ------------- -------------------------- ------------------------

Class X

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Return Before Taxes -14.97% 6.92% N/A

----------------------------------- ------------- -------------------------- ------------------------

INDEX

----------------------------------- ------------- -------------------------- ------------------------

----------------------------------- ------------- -------------------------- ------------------------

Standard & Poor's 400 Index -14.53% 11.53% N/A

----------------------------------- ------------- -------------------------- ------------------------

* Inception date: August 19, 1998

After-tax returns are shown for Class A shares only. The after-tax returns for other Classes will vary.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do

not reflect the impact of state and local taxes. During periods of negative NAV performance, the after-tax

returns assume the investor receives a write-off at the historical highest individual federal marginal income

rate. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and

after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such

as 401(k) plans or individual retirement accounts.

Part of the historical performance of the Fund is due to purchases of securities sold in Initial Public Offerings

("IPOs") that materially affected the performance of the Fund. The effect of IPOs on the Fund's performance

depends on a variety of factors including the number of IPOs that the Fund invests in, whether and to what extent

a security purchased in an IPO appreciates in value, and the asset base of the Fund. Although Funds may purchase

IPOs, not all such purchases may materially affect performance. There is no guarantee that the Fund's

investments in IPOs, if any, will continue to have a similar impact on the Fund's performance.

REASONS FOR THE TRANSACTION

The Directors, including all of the Directors who are not "interested persons" of the Company (the "Independent

Directors") have unanimously determined that the Transaction would be in the best interests of the shareholders of All-Cap Value

and the Mid-Cap Value Funds and that the interests of the shareholders of All-Cap Value and the Mid-Cap Value Funds would not be

diluted as a result of the Transaction. At a meeting held on July 25, 2003, the Board considered a number of factors that it

believes benefits the shareholders of All-Cap Value Fund, including the following:

o the compatibility of the Funds' investment objectives, policies and restrictions;

o the relative past and current growth in assets and investment performance of the Funds and future prospects for Mid-Cap Value

Fund;

o the relative expense ratios of the Funds;

o the tax consequences of the merger; and

o the relative size of the All-Cap Value Fund and the lack of growth in the assets and the number of shareholders of All-Cap Value

Fund.

At the July 25 meeting, PI and ASISI recommended the merger to the Board. In recommending the merger, the Investment

Manager advised the Board that the Funds have identical investment objectives, and similar policies and investment portfolios.

Further, PI advised that while the strategy of the All-Cap Value Fund allows for investments in equity securities of companies of

all sizes, since its inception is September, 2000 the All-Cap Value Fund has settled into the mid/large-cap value fund category.

Thus, the risk exposure to each of the Funds is also substantially similar. The Investment Managers advised the Board that as of

March 31, 2003, the All-Cap Value Fund had assets of approximately $71 million while the Mid-Cap Value Fund had assets of

approximately $192.5 million, and the All-Cap Value Fund had a higher cost structure and higher gross annual operating expenses

compared to the Mid-Cap Value Fund. Accordingly, by merging the Funds, All-Cap Value shareholders would enjoy a greater asset

base and lower cost structure. The Board considered that if the merger is approved, shareholders of All-Cap Value Fund,

regardless of the class of shares they own, should realize a reduction in the gross annual operating expenses (that is, without

any waivers or reimbursements) paid on their investment.

The Board, including a majority of the Independent Directors, unanimously concluded that the Transaction is in the best

interests of the shareholders of the All-Cap Value Fund and the Mid-Cap Value Fund and that no dilution of value would result to

the shareholders of the All-Cap Value Fund or the Mid-Cap Value Fund from the Transaction. Consequently, the Board approved the

Plan and recommended that shareholders of the All-Cap Value Fund vote to approve the Transaction.

For the reasons discussed above, the Board of Directors unanimously recommends that you vote For the Plan.

If shareholders of the All-Cap Value Fund do not approve the Plan, the Board will consider other possible courses of

action for the All-Cap Value Fund, including, among others, consolidation of the All-Cap Value Fund with one or more Funds of the

Company other than the Mid-Cap Value Fund or unaffiliated funds.

INFORMATION ABOUT THE TRANSACTION

This is only a summary of the Plan. You should read the actual Plan attached as Exhibit A.

Closing of the Transaction

If shareholders of the All-Cap Value Fund approve the Plan, the Transaction will take place after various conditions are

satisfied by the Company on behalf of the All-Cap Value Fund and the Mid-Cap Value Fund, including the preparation of certain

documents. The Company will determine a specific date for the actual Transaction to take place. This is called the "closing

date." If the shareholders of the All-Cap Value Fund do not approve the Plan, the Transaction will not take place.

If the shareholders of the All-Cap Value Fund approve the Plan, the All-Cap Value Fund will deliver to the Mid-Cap Value

Fund substantially all of its assets on the closing date. As a result, shareholders of the All-Cap Value Fund will beneficially

own shares of the Mid-Cap Value Fund that, as of the date of the exchange, have a value equal to the dollar value of the assets

delivered to the Mid-Cap Value Fund. The stock transfer books of the All-Cap Value Fund will be permanently closed on the closing

date. Requests to transfer or redeem assets allocated to the All-Cap Value Fund may be submitted at any time before 4:00 p.m.

Eastern standard time on the closing date; requests that are received in proper form prior to that time will be effected prior to

the closing.

To the extent permitted by law, the Company may amend the Plan without shareholder approval. It may also agree to

terminate and abandon the Transaction at any time before or, to the extent permitted by law, after the approval by shareholders of

the All-Cap Value Fund.

Expenses of the Transaction

The expenses resulting from the Transaction will be paid by PI (or its affiliates). The portfolio securities of the

All-Cap Value Fund will be transferred in-kind to the Mid-Cap Value Fund prior to the restructuring of the All-Cap Value Fund's

investment portfolio. Accordingly, the Transaction will entail little or no expenses in connection with portfolio restructuring.

Tax Consequences of the Transaction

The Transaction is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under the Code.

It is a condition to each Fund's obligation to complete the Transaction that the Funds will have received an opinion from Stradley

Ronon Stevens & Young, LLP, counsel to the Funds, based upon representations made by the All-Cap Value Fund and the Mid-Cap Value

Fund, and upon certain assumptions, substantially to the effect that:

1. The acquisition by the Mid-Cap Value Fund of the assets of the All-Cap Value Fund in exchange solely for voting shares of the

Mid-Cap Value Fund and the assumption by the Mid-Cap Value Fund of the liabilities of the All-Cap Value Fund, if any, followed by

the distribution of Mid-Cap Value Fund shares acquired by the All-Cap Value Fund pro rata to their shareholders, will constitute a

reorganization within the meaning of Section 368(a)(1) of the Code, and the Mid-Cap Value Fund and the All-Cap Value Fund each

will be "a party to a reorganization" within the meaning of Section 368(b) of the Code;

2. The shareholders of the All-Cap Value Fund will not recognize gain or loss upon the exchange of all of their shares of the

All-Cap Value Fund solely for shares of the Mid-Cap Value Fund, as described above and in the Plan;

3. No gain or loss will be recognized by the All-Cap Value Fund upon the transfer of its assets to the Mid-Cap Value Fund in

exchange solely for Class A, Class B, Class C, and Class X shares of the Mid-Cap Value Fund and the assumption by the Mid-Cap

Value Fund of the liabilities of the All-Cap Value Fund, if any. In addition, no gain or loss will be recognized by the Mid-Cap

Value Fund on the distribution of such shares to the shareholders of the All-Cap Value Fund in liquidation of the All-Cap Value

Fund;

4. No gain or loss will be recognized by the Mid-Cap Value Fund upon the acquisition of the assets of the All-Cap Value Fund in

exchange solely for shares of the Mid-Cap Value Fund and the assumption of the liabilities of the All-Cap Value Fund, if any;

5. Mid-Cap Value Fund's basis for the assets acquired from the All-Cap Value Fund will be the same as the basis of these assets

when held by the All-Cap Value Fund immediately before the transfer, and the holding period of such assets acquired by the Mid-Cap

Value Fund will include the holding period of these assets when held by the All-Cap Value Fund;

6. All-Cap Value Fund's shareholders' basis for the shares of the Mid-Cap Value Fund to be received by them pursuant to the

reorganization will be the same as their basis in the All-Cap Value Fund shares exchanged; and

7. The holding period of the Mid-Cap Value Fund shares to be received by the shareholders of the All-Cap Value Fund will include

the holding period of their All-Cap Value Fund shares exchanged provided such All-Cap Value Fund shares were held as capital

assets on the date of the exchange.

Shareholders of the All-Cap Value Fund should consult their tax advisers regarding the tax consequences to them of the

Transaction in light of their individual circumstances. In addition, because the foregoing discussion relates only to the U.S.

federal income tax consequences of the Transaction, shareholders also should consult their tax advisers as to state, local and

foreign tax consequences to them, if any, of the Transaction.

Characteristics of the Mid-Cap Value Fund shares.

Shares of the Mid-Cap Value Fund will be distributed to shareholders of the All-Cap Value Fund and will have the same

legal characteristics as the shares of the Mid-Cap Value Fund with respect to such matters as voting rights, assessibility,

conversion rights, and transferability.

Capitalizations of the Funds and Capitalization after the Transaction.

The following table sets forth, as of April 30, 2003 the capitalization of shares of the All-Cap Value Fund and the

Mid-Cap Value Fund. The table also shows the projected capitalization of the Mid-Cap Value Fund shares as adjusted to give effect

to the proposed Transaction. The capitalization of the Mid-Cap Value Fund is likely to be different when the Transaction is

consummated.

Class A

All-Cap Value Mid-Cap Value Mid-Cap Value

Fund Projected

Fund Fund Adjustments after Transaction

(unaudited) (unaudited) (unaudited)

Net assets................................. 19,451,138 44,410,445 63,861,583

Total shares outstanding................... 2,318,314 3,263,535 (889,134)* 4,692,715

Net asset value per share.................. 8.39 13.61 13.61

Class B

Mid-Cap Value

All-Cap Value Mid-Cap Value Fund Projected

Fund Fund Adjustments after Transaction

(unaudited) (unaudited) (unaudited)

Net assets................................. 27,519,711 87,030,737 114,550,448

Total shares outstanding................... 3,320,416 6,531,330 (1,255,922)* 8,595,824

Net asset value per share.................. 8.29 13.33 13.33

Class C

Mid-Cap Value

All-Cap Value Mid-Cap Value Fund Projected

Fund Fund Adjustments after Transaction

(unaudited) (unaudited) (unaudited)

Net assets................................. 15,313,925 34,961,172 50,275,097

Total shares outstanding................... 1,848,097 2,623,202 (699,265)* 3,772,034

Net asset value per share.................. 8.29 13.33 13.33

Class X

Mid-Cap Value

All-Cap Value Mid-Cap Value Fund Projected

Fund Fund Adjustments after Transaction

(unaudited) (unaudited) (unaudited)

Net assets................................. 3,894,742 16,582,979 20,477,721

Total shares outstanding................... 470,087 1,247,034 (177,249)* 1,539,872

Net asset value per share.................. 8.29 13.30 13.30

*Reflects the change in shares of Gabelli All-Cap Value upon conversion to Neuberger Berman Mid-Cap Growth.

VOTING INFORMATION

Shareholders of record of the All-Cap Value Fund on the Record Date will be entitled to vote at the Meeting. On the

Record Date, there were 8,222,248 shares of the All-Cap Value Fund issued and outstanding.

The presence in person or by proxy of the holders of a majority of the outstanding shares of the Fund is required to

constitute a quorum at the Meeting. Shares beneficially held by shareholders present in person or represented by proxy at the

Meeting will be counted for the purpose of calculating the votes cast on the issues before the Meeting. If a quorum is present,

the affirmative vote of the holders of a majority of the total number of shares of capital stock of the All-Cap Value Fund

outstanding and entitled to vote is necessary to approve the Plan. Each shareholder will be entitled to one vote for each full

share, and a fractional vote for each fractional share of the All-Cap Value Fund held at the close of business on the Record Date.

Shares held by shareholders present in person or represented by proxy at the Meeting will be counted both for the

purposes of determining the presence of a quorum and for calculating the votes cast on the issues before the Meeting. An

abstention by a shareholder, either by proxy or by vote in person at a Meeting, has the same effect as a negative vote. Under

existing New York Stock Exchange rules, it is not expected that brokers will be permitted to vote Fund shares in their

discretion. In addition, there is only one proposal being presented for a shareholder vote. As a result, the Fund does not

anticipate any broker non-votes.

..........Shareholders having more than one account in the Fund generally will receive a single proxy statement and a separate

proxy card for each account. It is important to mark, sign, date and return all proxy cards received.

..........In the event that sufficient votes to approve the Plan are not received, the persons named as proxies may propose one or

more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative

vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as proxies will vote those

proxies that they are entitled to vote FOR or AGAINST any such adjournment in their discretion.

..........The Company is not required to hold and will not ordinarily hold annual shareholders' meetings. The Board of Directors

may call special meetings of the shareholders for action by shareholder vote as required by the Investment Company Act or the

Company's Articles of Incorporation.

..........Pursuant to rules adopted by the SEC, a shareholder may include in proxy statements relating to annual and other meetings

of the shareholders of the Company certain proposals for shareholder action which he or she intends to introduce at such special

meetings; provided, among other things, that such proposal is received by the Company a reasonable time before a solicitation of

proxies is made for such meeting. Timely submission of a proposal does not necessarily mean that the proposal will be included.

The Board of Directors intends to bring before the Meeting the matter set forth in the foregoing Notice. The Directors

do not expect any other business to be brought before the Meeting. If, however, any other matters are properly presented to the

Meeting for action, it is intended that the persons named in the enclosed proxy will vote in accordance with their judgment. A

shareholder executing and returning a proxy may revoke it at any time prior to its exercise by written notice of such revocation

to the Secretary of the Company, by execution of a subsequent proxy, or by voting in person at the Meeting.

How to vote.

You can vote your shares in any one of four ways:

o........By mail, with the enclosed proxy card.

o In person at the Meeting.

o By phone

o Over the Internet

If you simply sign and date the proxy but give no voting instructions, your shares will be voted in favor of the Plan and