Exhibit 99.1

FIG Partners 11 th Annual CEO Forum September 29, 2015

Safe Harbor Regarding Forward - Looking Statements This presentation may contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Shore Bancshares, Inc. (the “Company”). Forward - looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or s imi lar expressions or future or conditional verbs such as “may,” “will,” “should,” “would” and “could.” These forward - looking statements are subjec t to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the fo rwa rd - looking statements, including, without limitation, the following: the strength of the United States economy in general and the streng th of the local economies in which the Company conducts operations; fluctuations in interest rates and in real estate values; monetary and fiscal policies of the Board of Governors of the Federal Reserve System and the U.S. Government and other governmental initiatives a ffe cting the financial services industry; the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write - offs and changes in estimates of the adequacy of the allowance for loan losses; the Company’s ability to access cost - effective funding; the timely development of and acceptance of the Bank’s new products and services and the perceived overa ll value of these products and services by users, including the features, pricing and quality compared to competitors’ products and services; expected cost savings, synergies and other benefits from the Company’s merger and acquisition activities might not be realize d w ithin the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to cu sto mer and employee retention, might be greater than expected; fluctuations in real estate values and both residential and commercial re al estate market conditions; demand for loans and deposits in the Company’s market areas; legislative or regulatory changes that advers ely affect the Company’s business; results of examinations of the Company and its subsidiaries by their regulators, including the possib ili ty that such regulators may, among other things, take regulatory enforcement action or require the Company’s bank subsidiaries to inc rea se their reserves for loan losses or to write - down assets; the impact of technological changes; and the Company’s success at managing the risks involved in the foregoing. Any forward - looking statements are based upon management’s beliefs and assumptions at the time they a re made. The Company undertakes no obligation to publicly update or revise any forward - looking statements or to update the reasons why ac tual results could differ from those contained in such statements, whether as a result of new information, future events or otherw ise . In light of these risks, uncertainties and assumptions, the forward - looking statements discussed might not occur, and you should not put undue reliance on any forward - looking statements. Important Statements 2

Management Team Name Title/Function Entity Years in Banking Years with Company L . Lloyd “Scott” Beatty, Jr. President and Chief Executive Officer SHBI 23 10 George S. Rapp Chief Financial Officer SHBI 38 2 Donna J. Stevens SVP and Chief Operating Officer SHBI 35 17 Patrick M. Bilbrough President and Chief Executive Officer Talbot Bank 19 4 Edward C. Allen President and Chief Executive Officer CNB 38 4 Kathleen A. Kurtz SVP and Senior Credit Officer Talbot Bank 30 2 Charles E. Ruch, Jr. SVP and Senior Credit Officer CNB 26 8 TOTAL 209 47 Significant depth of executive management talent as well as across our employee base. 3

Financial Summary As of June 30, 2015 4 Total Assets: $ 1,084.4 million Gross Loans: $ 741.0 million Total Deposits: $ 928.9 million Total Shareholder’s Equity: $ 143.4 million Tangible Common Equity: $ 130.2 million Tangible Book value per Share: $ 10.31 Branches: Depository 18 Insurance and Wealth Management 6 Shares Outstanding (June 30, 2015): 12,630,428 Closing Stock Price (June 30, 2015 ) $9.43 Market capitalization (June 30, 2015 ) $ 119.1 million Price/Tangible Book value per Share: 91.5% Headquarters: Easton, Maryland

Strategic Direction 5 Focus on Driving Profitability Diversity of Revenues o Banking, Insurance, Service Charges, Wealth Management Improving Asset Quality Emphasis on Core Deposits/Funding Leverage Size and Existing Platform to Take Advantage of Market Dislocation Expand Footprint into New Markets Acquire Community Banks Within and Attached to our Existing Markets

Strategic Direction ● Shore Bancshares has the opportunity to dominate the Delmarva ● Currently dominant independent locally headquartered company in our footprint ● SHBI is striving to be the bank and employer of choice on the Delmarva 6

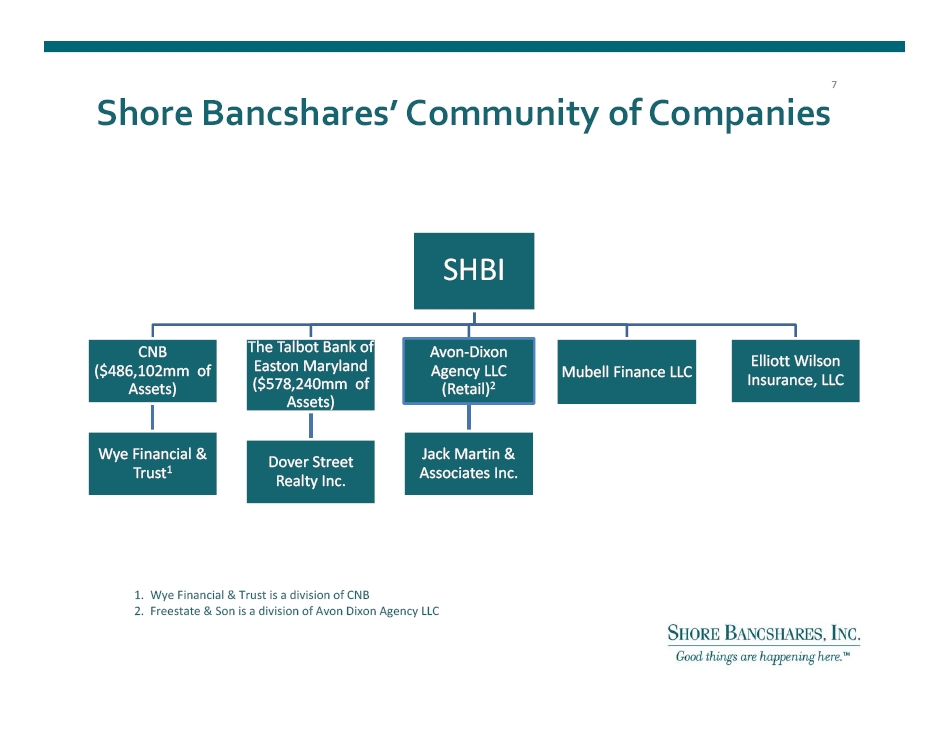

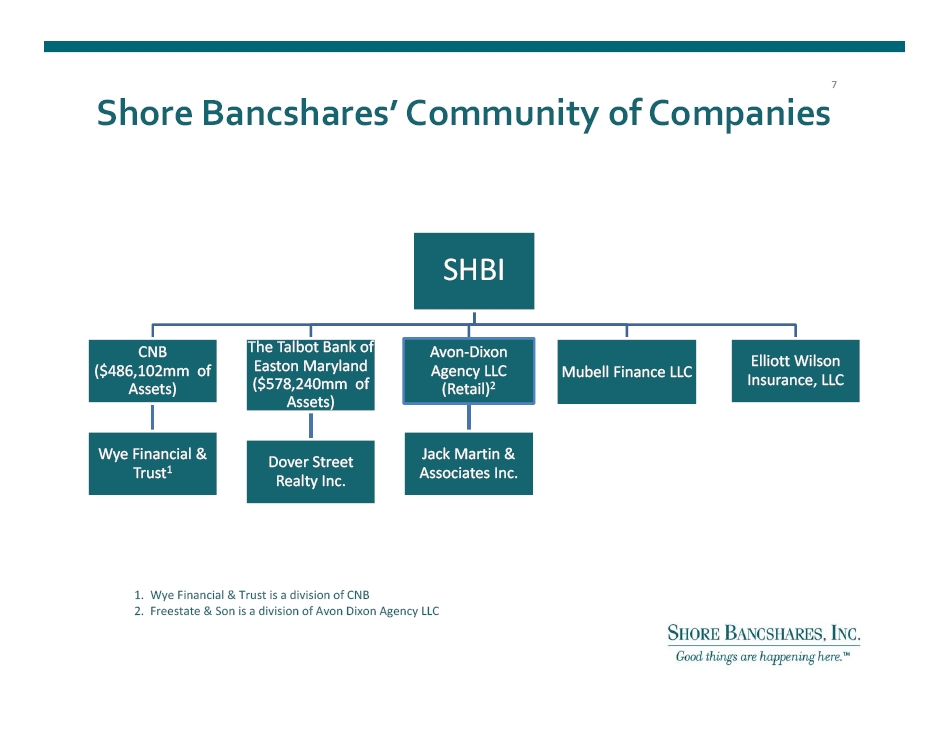

Shore Bancshares’ Community of Companies SHBI CNB ($486,102mm of Assets) Wye Financial & Trust 1 The Talbot Bank of Easton Maryland ($578,240mm of Assets) Dover Street Realty Inc. Avon - Dixon Agency LLC (Retail) 2 Jack Martin & Associates Inc. Mubell Finance LLC Elliott Wilson Insurance, LLC 1. Wye Financial & Trust is a division of CNB 2. Freestate & Son is a division of Avon Dixon Agency LLC 7

Shore Bancshares’ Community of Companies 8

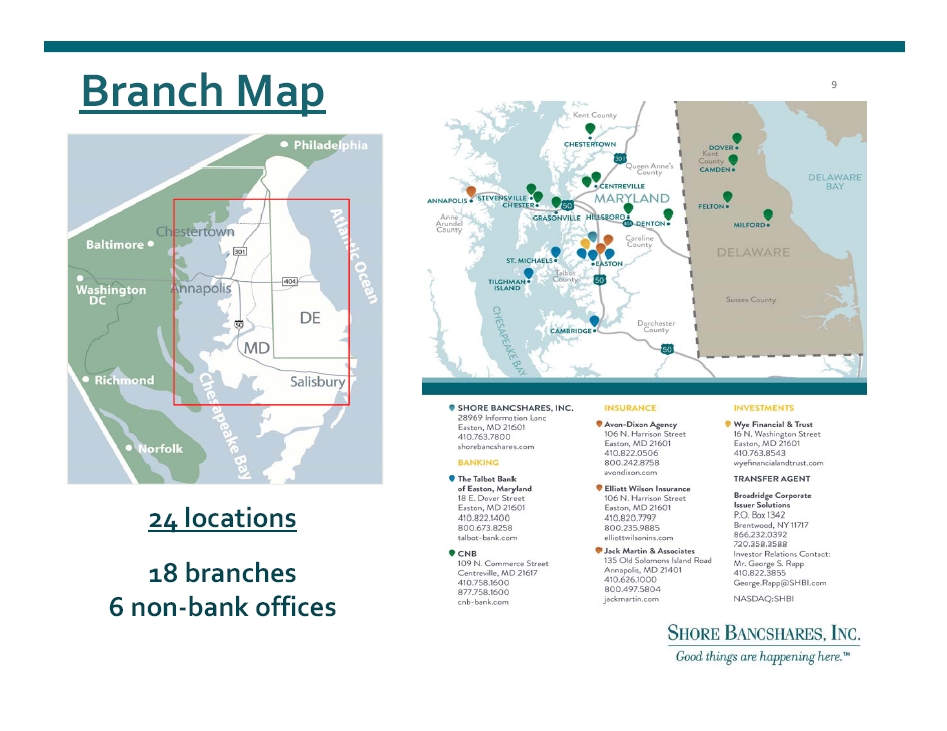

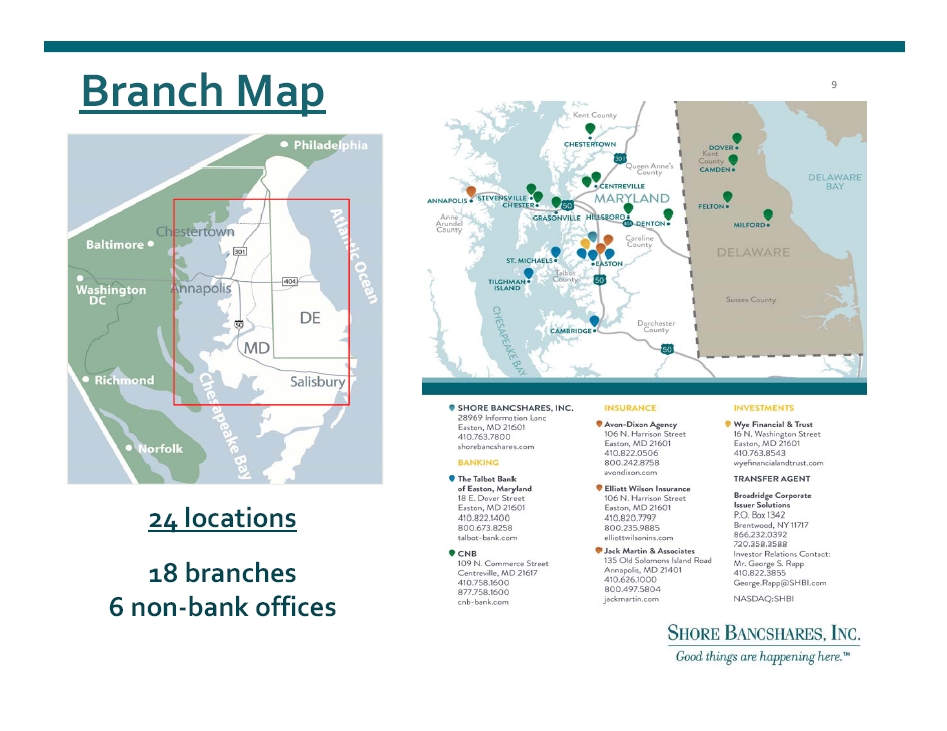

24 locations 18 branches 6 non - bank offices 9 Branch Map

Selected SHBI Market Highlights ▪ Household income for entire franchise is $74,567 in MD and $61,587 in DE vs. $ 53,706 for the US. ▪ Projected HH income growth rate (2015 - 2020) is 9.98% for MD, and 7.31% for DE ▪ Projected 5 - year population growth rate (2015 - 2020) in overall market = 3.93% for MD and 4.67% for DE ▪ SHBI deposit market rank/share by county (2015): * Source:SNL Maryland Rank Share # Branches Talbot #1 40.93% 5 Queen Anne’s #2 26.70% 5 Caroline #3 16.42% 2 Kent #5 8.43% 1 Dorchester #6 6.55% 1 Delaware Rank Share #Branches Kent #6 3.86% 4 10

Deposit Market Share: SHBI Market Market Rank Ticker Company Name City (HQ) HQ State Branches Total Deposits as of June 30, 2014 ($000) ’14 Market Share(%) 1 PNC PNC Financial Services Group Inc. Pittsburgh PA 43 1,984,150 19.25 2 MTB M&T Bank Corp. Buffalo NY 30 1,676,287 16.27 3 SHBI Shore Bancshares Inc. Easton MD 18 925,455 8.98 4 WSFS WSFS Financial Corp. Wilmington DE 15 542,760 5.27 5 BBT BB&T Corp. Winston - Salem NC 14 492,662 4.78 6 BAC Bank of America Corp. Charlotte NC 7 471,050 4.57 7 - HSB Bancorp Inc. Hebron MD 12 441,590 4.28 8 WFC Wells Fargo & Co. San Francisco CA 4 409,988 3.98 9 - Queenstown Bancorp of Maryland Inc. Queenstown MD 8 391,314 3.80 10 TYCB Calvin B. Taylor Bankshares Inc. Berlin MD 10 367,122 3.56 11 DBCP Delmar Bancorp Salisbury MD 12 362,933 3.52 12 RBS Royal Bank of Scotland Group Plc Edinburgh - 8 361,455 3.51 13 - CB Financial Corp. Rehoboth Beach DE 7 295,014 2.86 14 FULT Fulton Financial Corp. Lancaster PA 6 267,348 2.59 15 PSBP PSB Holding Corp. Preston MD 7 242,241 2.35 16 - First Shore Federal Savings and Loan Association Salisbury MD 9 241,335 2.34 17 - Farmers Bank of Willards Willards MD 8 240,068 2.33 18 - Bank of Ocean City Ocean City MD 6 213,642 1.07 19 PEBC Peoples Bancorp Inc. Chestertown MD 6 190,882 1.85 20 STI SunTrust Banks Inc. Atlanta GA 6 188,641 1.83 Total 236 10,305,937 100.00 NOTE: SHBI Market defined as Maryland Counties of Kent, Queen Anne's, Talbot, Caroline, Dorchester, Wicomico, Somerset, and Worcester ; Delaware counties of Kent , Sussex; Deposit market share excludes Discover Financial Services Data and adjusted for all M&A transactions. SOURCE: SNL 7/30/15 11

Competitors ’ Branch Proximity Report Within 1 Mile Within 5 Miles Competing Branches Deposits in Competing Branches Competing Branches Deposits in Competing Branches Shore Bancshares, Inc . 18 930,670 Money Centers/Regionals 27 1,475,712 40 2,148,723 Community Banks 23 1,010,462 34 1,4417,12 TOTALS 50 2,486,174 74 3,590,435 SOURCE : SNL, regulatory filings. Pro - forma ownership as of 7/30/15. 12

Loan Portfolio (Dollar Value in Thousands) As of June 30, 2015 Loan Type Balance % of Total Construction $ 80,715 10.9% Residential Real Estate 278,598 37.6% Commercial Real Estate 317,131 42.8% Commercial 57,300 7.7% Consumer 7,286 1.0% Total $ 741,030 100.0% 13 Residential Real Estate 37.6% Commercial 7.7% Consumer 1.0% Construction 10.9% Commercial Real Estate 42.8% 13

Improving Credit Quality 6/30/2015 12/31/2014 12/31/2013 12/31/12 NON - PERFORMING ASSETS Nonaccrual Loans $14,009 $13,467 $18,147 $36,474 90+ or More Days Past Due 35 87 270 460 Other Real Estate Owned 2,498 3,691 3,779 7,659 Total Non - Performing Assets 16,542 17,245 22,196 44,593 Performing TDRs 18,353 16,674 26,088 52,353 Total NPAs + TDRs 34,895 33,919 $48,284 $96,946 NPAs / Assets (%) 1.53 1.57 2.11 3.76 NPAs + TDRS / Assets (%) 3.22 3.08 4.58 8.18 RESERVES Loan Loss Reserve 7,917 7,695 $10,725 $15,991 Reserves / Gross Loans (%) 1.07 1.09 1.51 2.04 Reserves / NPLs (%) 56.51 57.14 58.23 43.30 Reserves / NPLs+TDRs (%) 22.69 25.53 24.10 17.91 NET CHARGE - OFFS Net Charge - Offs (Annualized) $1,952 $6,380 $33,050 $26,042 NCOs / Avg Loans (Annualized ) (%) 0.27 0.90 4.32 3.20 14

Credit Trends: NPAs & TDRs 6/30/15 12/31/2014 12/31/2013 12/31/2012 Construction $12,400 $10,068 $5,569 $37,029 Residential Real Estate 10,761 10,486 19,768 18,839 Commercial Real Estate 8,896 9,358 14,462 32,612 Commercial 217 188 1,137 715 Consumer 123 127 48 92 Total 32,397 30,227 40,984 89,287 OREO 2,498 3,691 3,779 7,659 Nonaccrual Loans Held for Sale --- --- 3,521 --- Total NPAs & TDRs 34,895 33,918 $48,284 $96,946 15

Attractive Deposit Base 16 (Dollar Value in Thousands) June 30, 2015 Deposit Type Quarterly Average Balance % of Total Cost Noninterest Bearing Demand $ 203,435 21.8% 0.00% Interest Bearing Demand 171,274 18.4% 0.12% Money Market & Savings 238,173 25.6% 0.14% CDs $100,000 or more 152,478 16.4% 0.97% Other Time 166,277 17.8% 0.85% Total Deposits $ 931,637 100.0% 0.37% Noninterest Bearing Demand 21.8% Interest Bearing Demand 18.4% Money Market & Savings 25.6% CDs $100k or more 16.4% Other Time 17.8% Deposit Type

Transaction Deposit Growth* 66% 65% 60% 59% 56% 34% 35% 40% 41% 44% 6/30/2015 12/31/2014 12/31/2013 12/31/2012* 12/31/2011* Transaction Deposits Time Deposits *Excludes IND Program 17

S ecurities Portfolio (Dollars in thousands) Amortized Cost G Gross Unrealized Gains G Gross Unrealized Losses E Estimated Fair Value Available - for - sale securities: June 30, 2015 U.S. Treasury $ 5,144 $11 $ --- $5,155 U.S. Government Agencies 70,449 175 250 70,374 Mortgage - backed 151,952 730 638 152,044 Equity 631 5 --- 636 Total $ 228,176 $921 $888 $228,209 Held - to - maturity securities: June 30, 2015 U.S Government Agencies $2,676 $921 $888 $2,595 States and Political Subdivisions 1,837 123 --- 1,960 Total $4,513 $123 $81 $4,555 Available for Sale Held to Maturity Amortized Estimated Cost Fair Value Amortized Estimated Cost Fair Value Due in one year or less $2,001 $2,003 $220 $220 Due after one year through five years 70,545 70,579 711 757 Due after five years through ten years 12,939 12,881 403 452 Due after ten years 142,060 142,110 3,179 3.126 227,545 227,573 4,513 4,555 Equity Securities 631 636 --- --- Total $228,176 $228,209 $4,513 $4,555 18

Income Statement (Quarterly) (Dollars in thousands, except per share amounts) 2Q15 1Q15 4Q14 3Q14 2Q14 Interest income $9,542 $9,445 $9,625 $9,686 $9,523 Interest expense 859 906 989 1,050 1,076 Net interest income 8,683 8,539 8,636 8,636 8,447 Provision for credit losses 540 650 650 775 950 Noninterest income 3,788 4,085 3,471 3,994 4,528 Noninterest expense 9,300 9,704 9,510 9,819 9,917 Income (loss) before income taxes 2,631 2,270 1,947 2,036 2,108 Net (loss) income 1,627 1,409 1,226 1,262 $1,305 EPS diluted $0.13 $0.11 $0.10 $0.10 $0.13 19

Pre Tax Pre Provision ROA 1.17% 1.09% 0.93% 1.02%* 1.17% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2Q15 1Q15 4Q14 3Q14 2Q14 *Includes severance cost and equates to 10 BPs. 20

SHBI Net Interest Margin 21 3.43% 3.43% 3.48% 3.23% 3.10% 3.15% 3.20% 3.25% 3.30% 3.35% 3.40% 3.45% 3.50% 6 months 2015 2Q14 2Q13 2012

Interest Rate Sensitivity 22 6/30/2015 - 200 +200 % in Net Interest Income (13.0)% 0.9% % in Value of Capital 1.2% 13.3% 2014 - 200 +200 +200 % in Net Interest Income (13.3)% 1.9% % in Value of Capital 3.6% 14.8%

Continued Focus on Fee Revenue Total Revenue Breakdown Noninterest Income 1) Q2 2015 is annualized 2) Excludes wholesale insurance operation Dollars in thousands 24% 25% 26% 34% 32% 31% 69% 72% 72% 74% 73% 31% 28% 28% 26% 27% $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2Q15 2014 2013 2012 2011 30% 30% 31% ٿ Noninterest Income % ٿ Net Interest Income % Trust and Investment Fee Income 12% Other Non - interest Income 16% Retail Insurance Agency Commission 56% Service Charges on Deposits 16% 24

SHBI Return on Average Assets 0.56% Return on Average Equity 4.29% Net Interest Margin 3.43% Non - interest Income/Operating Revenue 31.37% Non - interest Income/Average Assets 1.40% Non - interest Expense/Average Assets 3.44% Efficiency Ratio Bank Only (Non - GAAP) (1) 70.15% Nonperforming Assets/Assets (Excluding TDRs) (2) 1.53% Nonperforming Assets/Assets (Including TDRs) (2) 3.22% Key Ratios At or for the quarter ended June 30, 2015 (Annualized) (1) Noninterest expense (excluding amortization of intangible assets) as a percentage of fully taxable net interest income and noninterest income. (2) Nonperforming assets (NPAs) include nonaccrual and 90 days past due and still accruing loans , accruing troubled debt restructurings and net other real estate and other assets owned . 24

Capital Ratios 25 12.20% 11.70% 8.41% 8.36% 15.64% 15.27% 10.09% 12.05% 16.71% 16.36% 11.34% 13.32% 15.64% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 2015 2014 2013 2012 Tangible Common equity / Tangible Assets Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio Common Equity Tier 1

Company Ownership as of 3/31/15 Major Holders % of Ownership Wellington Management Company 9.47% Maltese Capital Management LLC 5.04% FJ Capital Management LLC 4.74% Banc Funds Company LLC 4.16% Manufacturers Life Insurance Company 3.17% Elizabeth Park Capital Advisors LTD Brown Advisory Inc. Mendon Capital Advisors Corporation Basswood Capital Management LLC 1.99% 1.67% 1.57% 1.56% Insider Holdings 2.02% 26

What Makes SHBI Unique? ● Diversity of Revenue Sources - - without Mortgage ● Strong Capital Position ● Stable Net Interest Margin ● Strong Control of Operating Expenses ● Dominant I ndependent F inancial S ervices C ompany in all Markets within Footprint 27

28 ● We are a very different Company now x Improved credit process x Continuing to build organizational depth x Revamped strategic plan positions for growth x Focused on creating sustainable competitive advantages x Strengthened noninterest revenue sources x Forging a sales culture with new branding approach ● Current valuation is attractive 6/30/15 (trade at 91.5% of TBV)* Compelling Investment Considerations *Market data as of June 30, 2015.

SHBI – LTM Price Change (%) 29

ADDENDUM 30

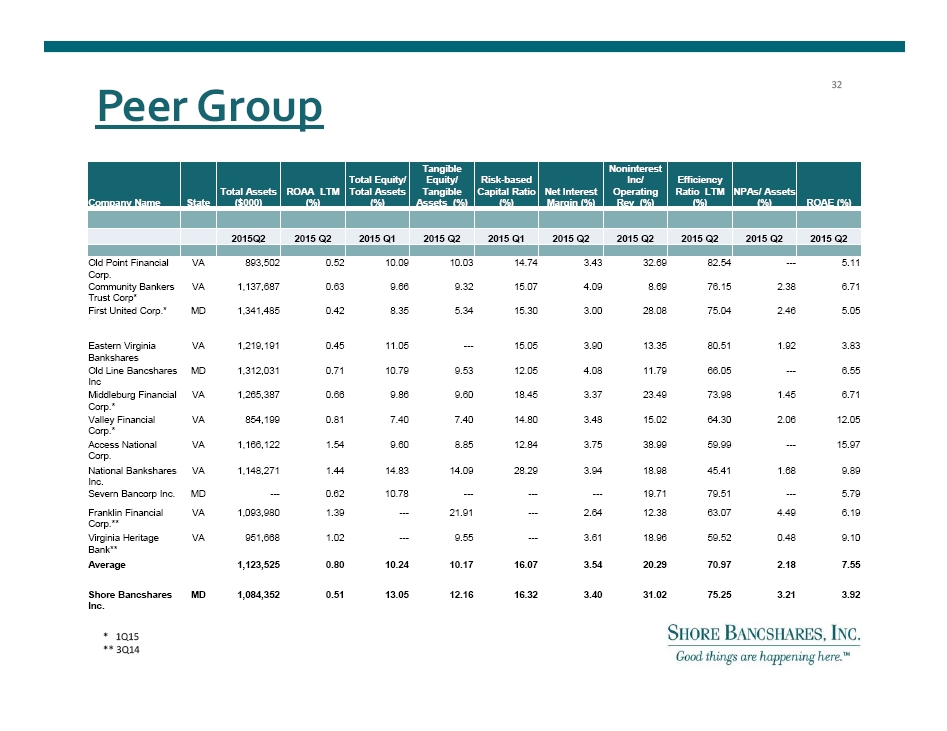

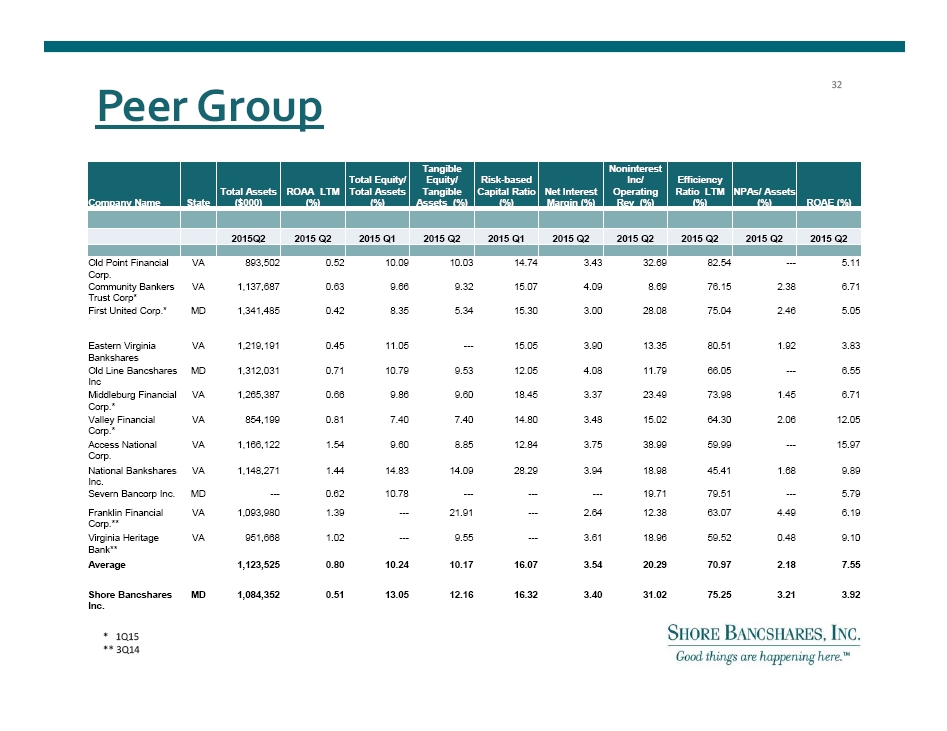

Peer Group Definition 31 Publically traded banking c ompanies in MD, DC, VA, DE w ith total a ssets between $750M - $2B.

Peer Group 32 Company Name State Total Assets ($000) ROAA LTM (%) Total Equity/ Total Assets (%) Tangible Equity/ Tangible Assets (%) Risk - based Capital Ratio (%) Net Interest Margin (%) Noninterest Inc/ Operating Rev (%) Efficiency Ratio LTM (%) NPAs/ Assets (%) ROAE (%) 2015Q2 2015 Q2 2015 Q1 2015 Q2 2015 Q1 2015 Q2 2015 Q2 2015 Q2 2015 Q2 2015 Q2 Old Point Financial Corp. VA 893,502 0.52 10.09 10.03 14.74 3.43 32.69 82.54 --- 5.11 Community Bankers Trust Corp* VA 1,137,687 0.63 9.66 9.32 15.07 4.09 8.69 76.15 2.38 6.71 First United Corp .* MD 1,341,485 0.42 8.35 5.34 15.30 3.00 28.08 75.04 2.46 5.05 Eastern Virginia Bankshares VA 1,219,191 0.45 11.05 --- 15.05 3.90 13.35 80.51 1.92 3.83 Old Line Bancshares Inc MD 1,312,031 0.71 10.79 9.53 12.05 4.08 11.79 66.05 --- 6.55 Middleburg Financial Corp .* VA 1,265,387 0.66 9.86 9.60 18.45 3.37 23.49 73.98 1.45 6.71 Valley Financial Corp .* VA 854,199 0.81 7.40 7.40 14.80 3.48 15.02 64.30 2.06 12.05 Access National Corp. VA 1,166,122 1.54 9.60 8.85 12.84 3.75 38.99 59.99 --- 15.97 National Bankshares Inc. VA 1,148,271 1.44 14.83 14.09 28.29 3.94 18.98 45.41 1.68 9.89 Severn Bancorp Inc. MD --- 0.62 10.78 --- --- --- 19.71 79.51 --- 5.79 Franklin Financial Corp .** VA 1,093,980 1.39 --- 21.91 --- 2.64 12.38 63.07 4.49 6.19 Virginia Heritage Bank** VA 951,668 1.02 --- 9.55 --- 3.61 18.96 59.52 0.48 9.10 Average 1,123,525 0.80 10.24 10.17 16.07 3.54 20.29 70.97 2.18 7.55 Shore Bancshares Inc. MD 1,084,352 0.51 13.05 12.16 16.32 3.40 31.02 75.25 3 .21 3.92 * 1Q15 ** 3Q14

33 Talent, depth, unique skills • Lloyd L. “Scott” Beatty, Jr ., 62, CPA, President & CEO of SHBI since June 2013, Director of SHBI since December 2000, Director of Talbot Bank since 1992. COO from 2006 until 2012 and named President and COO in 2012. Formerly COO, private equity firm Darby Overseas Investments. Formerly Managing Partner of public accounting firm. • George S. Rapp , 62, CPA, Vice President and Chief Financial Officer of SHBI since February 2013. From 2010 to 2012 , Chief Financial Officer and one of th e f our executive founders of World Currency USA. From 2005 to 2010, Chief Financial Officer of Harleysville National Corporation . Prior to 2005, held various financial positions including CFO, SVP & Chief Accounting Officer, COO and Controller . • Donna J. Stevens , 52, was appointed Senior Vice President and Chief Operating Officer of the Company in July 2015. She served as the Company’s Chief Operations Officer from July 2013 to July 2015. She has been employed by the Company in various officer capacities since 199 7, including Senior Vice President, Senior Operations and Compliance Officer and Corporate Secretary for CNB, the Company’s wholly - owned commercial bank subsidiary from February 2010 to June 2013. • Patrick M. Bilbrough , 50, President and CEO of the Talbot Bank since December 2012. He joined Talbot Bank in May of 2011 as an Executive Vice President . Prior to his employment with Talbot Bank and since 2007, Mr. Bilbrough served as the Market Executive of PNC Bank, N.A . From 1995 to 2004, Mr. Bilbrough was with the Peoples Bank of Maryland, of Denton, where he had most recently been President and CEO after beginning as its Chief F inancial O fficer and comptroller. He was a small business owner from 1985 to 1995 . • Edward C. Allen , 67, President & CEO of CNB since September 2014. Prior to that he served as CNB’s Chief Financial Officer since October 2011. Mr. Allen is a career banker with 40 years experience in community banks. He has extensive experience in budgeting and investment portfolio ma nagement. • Kathleen A. Kurtz , 63, SVP and Senior Credit Officer of Talbot Bank. Began career as assistant national bank examiner with Comptroller of the Cur rency. Held positions as Commercial Mortgage Loan Officer, Credit & Loan Department Manager, Senior Credit Officer and Credit Policy mana ger at Girard Bank in Philadelphia. Later joined New Jersey National Bank as Commercial Mortgage/Construction Lender. • Charles E. Ruch Jr. , 56, Senior Credit Officer of CNB since 2010 and joined CNB in 2006. Entered banking in 1977, holding various retail positio ns from teller to core m anager through the 1980s with Equitable Bank. Joined AB&T as a commercial lender in 1987 and was AB&T’s Senior Commercial Len der for 10 years. Graduated from the University of Maryland in 1983. SHBI Management Team

Non - GAAP Financial Measures June 30, 2015 December 31, 2014 2013 2012 2011 2010 Total Assets $1,084,352 $1,100,402 $1,054,124 $1,185,807 $1,158,193 $1,130,311 Less: Intangible Assets 13,195 13,262 15,974 16,270 16,662 18,518 Tangible Assets $1,071,157 $1,087,140 $1,038,150 $1,169,537 $1,141,531 $1,111,793 Total Stockholders’ Equity $143,402 $140,469 $103,299 $114,026 $121,249 $122,513 Less: Preferred Stock 0 0 0 0 0 0 Common Stockholders’ Equity $143,402 $140,469 $103,299 $114,026 $121,249 $122,513 Less: Intangible Assets 13,195 13,262 15,974 16,270 16,662 18,518 Tangible Common Equity $130,207 $127,207 $87,325 $97,756 $104,587 $103,995 Tangible Common Equity/Tangible Assets 12.16% 11.70% 8.41% 8.36% 9.16% 9.35% Book Value per Share $11.35 $11.13 $12.19 $13.48 $14.34 $14.51 Less: Intangible Assets per Share 1.04 1.05 1.88 1.92 1.97 2.19 Tangible Book Value per Share $10.31 $10.08 $10.31 $11.56 $12.37 $12.32 Share Information: Common Shares Outstanding (actual) 12,630,428 12,618,513 8,471,289 8,457,359 8,457,359 8,443,436 We calculate tangible common equity by excluding the balance of intangible assets from common stockholders’ equity. We calcul ate tangible book value per share by dividing tangible common equity by adjusted common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholder’s equity by adjusted common shares outstanding. We calculate tangible common equity to tangible assets by dividing tangible common equity by tangible assets. We believe that t his is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk - based ca pital ratios. Accordingly, we believe that these non - GAAP financial measures provide information that is important to investors and th at is useful in understanding our capital position and ratios. A reconciliation of the non - GAAP measures of tangible assets, tangible common equity and tangible book value per share to the GAAP measures of common stockholder’s equity and book value per share is set forth below. NOTE: Pro forma data assumes 3,000,000 shares are issued at $9.31 per share (the closing price on May 12, 2014), including all fees and expenses. 34

General Impact of Consolidation 35 Unified policies and procedures; eliminate differences and streamline approval process Streamlined decisioning and meetings Specialist versus generalist

Departments Currently Consolidated 36 Deposit Operations Finance IT Marketing Human Resources Loan Operations

Departments to be Consolidated 37 Retail Sales/Branch Administration Administrative Sales Manager Branch Operations and Security 18 branch locations

Departments to be Consolidated 38 Loan Administration Credit Administration (policy and procedure) Underwriting / Credit Analysis Business Bankers / Lenders Collections / Workout Documentation / Processing

Departments to be Consolidated 39 Compliance Impact as a result of increased asset size o Bank Secrecy Act (BSA) o Community Reinvestment Act (CRA) o Home Mortgage Disclosure Act o Flood / Escrow o Additional scrutiny of compliance management system Depth and continuity with combined strengths of Compliance Officers Decrease number and frequency of reviews, audits, examinations

Consent Order Termination and Bank Consolidation Benefits 40 Reduced FDIC Assessment Reduced Professional Expenses Personnel Reduction IT/Systems Directors & Officers Insurance Director Fees Total $2 Million Annual Savings Current Reduced Expense Annualized – $1.2 Million