#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 September 30, 2024 Investor Presentation

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Forward-Looking Statements This presentation contains future oral and written statements of Shore Bancshares, Inc. (the “Company” or “SHBI”) and its wholly-owned banking subsidiary, Shore United Bank, N.A. (the “Bank”), and its management, which may contain statements about future events that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by references to a future period or periods or by the use of the words "believe," "expect," "anticipate," "intend," "estimate," "assume," "will," should," "plan," and other similar terms or expressions. Forward-looking statements include but are not limited to: (i) projections and estimates of revenues, expenses, income or loss, earnings or loss per share, and other financial items, including our financial results for the third quarter of 2024, (ii) statements of plans, objectives and expectations of the Company or its management, (iii) statements of future economic performance, and (iv) statements of assumptions underlying such statements. Forward-looking statements should not be relied on because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Company and the Bank. These risks, uncertainties and other factors may cause the actual results, performance, and achievements of the Company and the Bank to be materially different from the anticipated future results, performance or achievements expressed in, or implied by, the forward- looking statements. Factors that could cause such differences include, but are not limited to, the effect of acquisitions we have made or may make, including, without limitation, general economic conditions, (including the interest rate environment, government economic and monetary policies, the strength of global financial markets and inflation/deflation and supply chain issues), whether national or regional, and conditions in the lending markets in which we participate that may have an adverse effect on the demand for our loans and other products, our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that we own or that is the collateral for our loans;; recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; changes in general economic, political, or industry conditions; the Company's ability to remediate the existing material weakness identified in its internal control over financial reporting; the effectiveness of the Company's internal control over financial reporting and disclosure controls and procedures; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national, or global level; results of examinations of us by our regulators, including the possibility that our regulators may, among other things, require us to increase our reserve for loan losses or to write-down assets; changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, which could lead to restrictions on activities of banks generally, or our subsidiary bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; changes in market rates and prices may adversely impact the value of securities, loans, deposits and other financial instruments and the interest rate sensitivity of our balance sheet; our liquidity requirements could be adversely affected by changes in our assets and liabilities; our ability to prudently manage our growth and execute our strategy; impairment of our goodwill and intangible assets; competitive factors among financial services organizations, including product and pricing pressures and our ability to attract, develop and retain qualified banking professionals; the expected cost savings, synergies and other financial benefits from the acquisition of The Community Financial Corporation or any other acquisition the Company has made or may make might not be realized within the expected time frames or at all; the growth and profitability of noninterest or fee income being less than expected; the effect of legislative or regulatory developments, including changes in laws concerning taxes, banking, securities, insurance and other aspects of the financial services industry; the effect of any change in federal government enforcement of federal laws affecting the cannabis industry; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board (the “FASB”), the Securities and Exchange Commission (the “SEC”), the Public Company Accounting Oversight Board and other regulatory agencies; potential changes in federal policy and at regulatory agencies as a result of the 2024 presidential election; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the debt ceiling and the federal budget; the impact of recent or future changes in Federal Deposit Insurance Corporation (the “FDIC”) insurance assessment rate or the rules and regulations related to the calculation of the FDIC insurance assessment amount, including any special assessments; the effect of fiscal and governmental policies of the U.S. federal government; climate change, including the enhanced regulatory, compliance, credit and reputational risks and costs; geopolitical concerns, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts of terrorism, and/or military conflicts, including the war between Russian and Ukraine and the conflict in the Middle East, which could impact business and economic conditions in the United States and abroad; and other factors that may affect our future results. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. For more information about these factors, please see our reports filed with or furnished to the SEC and available at the SEC’s Internet site (http://www.sec.gov), including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. Any forward-looking statements contained in this presentation are made as of the date hereof, and the Company undertakes no duty, and specifically disclaims any duty, to update or revise any such statements, whether as a result of new information, future events or otherwise, except as required by applicable law. This presentation has been prepared by the Company solely for informational purposes based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information. This presentation has been prepared to assist interested parties in making their own evaluation of the Company and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in the presentation and other information provided by or on behalf of the Company. This presentation is not an offer to sell securities and it is not soliciting an offer to buy securities in any state where the offer or sale is not permitted. Neither the SEC nor any other regulatory body has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Non-GAAP Financials This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures and the Company’s reported results prepared in accordance with GAAP. Numbers in this presentation may not sum due to rounding. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within this presentation, as necessary, of the non-GAAP financial measures to the most directly comparable GAAP financial measures. For more details on the Company's non-GAAP measures, refer to the Appendix in this presentation. 2

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Shore Bancshares, Inc. (NASDAQ: SHBI) (1) Allowance for Credit Losses ("ACL"), Nonperforming Assets (“NPAs”) includes Other Real Estate Owned ("OREO"), Loan Modifications to Borrowers Experiencing Financial Difficulty ("BEFDs") (2) Return on Average Assets ("ROAA"), Tangible Common Equity (“TCE”), Tangible Assets, Return on Average TCE (“ROATCE”), Efficiency Ratio, and Tangible Book Value (“TBV”) are non-GAAP measures - see reconciliations in Appendix 3 Balance Sheet ($ in billions, except per share data) 2020 2021 2022 2023 2023 Q3 2024 Q3 Assets $ 1.93 $ 3.46 $ 3.48 $ 6.01 $ 5.71 $ 5.92 Gross Portfolio Loans 1.45 2.12 2.56 4.64 4.62 4.73 Deposits 1.70 3.03 3.01 5.39 5.11 5.23 NPAs(1) / Assets 0.32 % 0.09 % 0.11 % 0.23 % 0.20 % 0.27 % ACL / NPAs + BEFDs(1) 104.77 % 160.07 % 199.29 % 418.59 % 504.43 % 371.72 % TCE / Tangible Assets (Non-GAAP)(2) 9.18 % 8.25 % 8.67 % 6.78 % 6.93 % 7.39 % Risk-Based Capital Ratio 14.25 % 15.36 % 13.91 % 11.48 % 11.26 % 12.04 % 2020 2021 2022 2023 2023 YTD Q3 2024 YTD Q3 ROAA 0.92 % 0.66 % 0.90 % 0.24 % 0.02 % 0.70 % ROAA (Non-GAAP)(2) 0.94 % 0.95 % 0.99 % 0.58 % 0.49 % 0.91 % ROATCE (Non-GAAP)(2) 9.04 % 11.34 % 11.96 % 7.74 % 6.27 % 12.83 % Cost of Deposits 0.43 % 0.22 % 0.33 % 1.71 % 1.49 % 2.23 % Net Interest Margin ("NIM") 3.27 % 2.94 % 3.15 % 3.11 % 3.12 % 3.12 % Efficiency Ratio (Non-GAAP)(2) 59.56 % 61.15 % 61.18 % 61.62 % 61.46 % 61.83 % Diluted Earnings Per Share $ 1.27 $ 1.17 $ 1.57 $ 0.42 $ 0.03 $ 0.92 TBV Per Share (Non-GAAP)(2) $ 14.92 $ 14.12 $ 14.87 $ 12.06 $ 11.70 $ 12.88 2024 Insurance, Trust & Wealth Management offered Shore United / Community Financial merger Centreville National Bank of MD founded Shore United Bank rebranding Shore Bancshares acquires Talbot Bank 202320212016200420022000199618851876 Shore Bancshares, Inc. formed Shore United / Severn merger Talbot Bank of Easton founded Expansion into Delaware $5.8 billion community bank with operations in MD, DE and VA Financial Performance

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Suburban and Rural Branches Support Dominant Maryland Franchise and Growing Presence in Virginia and Delaware 4 Branch locations (40 branches) Commercial Lending Centers (4 locations) Mortgage Loan Offices (3 locations) Pennsylvania West Virginia Virginia Delaware New Jersey Maryland I-60 I-60 I-83 I-95 I-695 I-70 I-495 I-66 I-95 I-64 Fredericksburg Charlottesville Waldorf Easton Investment Services Offices (5 locations) Maryland

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Investment Opportunity 2024 Q3 ▪ EPS and ROATCE of $0.34 per diluted share and 8.41%, respectively ▪ ROAA of 0.77% and 0.90% (Non-GAAP) 2023 Q3 ▪ EPS and ROATCE of $(0.29) per diluted share and (7.25)%, respectively ▪ ROAA of (0.67)% and 0.13% (Non-GAAP) Improving Profitability Dominant Deposit Market Shares Support Dynamic Growth Markets Continued Strong Credit Performance Expense Management and Technology Will Enhance Operating Leverage ▪ 25.78% deposit market share in Maryland (1) ▪ Non-interest deposits at 30.07% of total deposits at Q3 2024 ▪ 2024 Median Household income is $97,364 in MD, $76,379 in DE, $89,172 in VA, vs. $75,874 for the US ▪ Government spending provides economic stability ▪ 0.27% Q3 2024 NPAs / Assets ▪ 0.14% 2020 to Q3 2024 Average NPAs / Assets ▪ 371.72% Q3 2024 Reserves / Nonperforming Assets ▪ 1.24% Q3 2024 Reserves / Gross Loans ▪ $3.0 million 2024 YTD Net Charge Offs ▪ $4.3 million 2020 to Q3 2024 Cumulative Net Charge-Offs ▪ Multiple initiatives are intended to improve operating leverage over time but are currently inflating expenses ▪ Total FTEs have been reduced by 72 (11%) since merger with TCFC closed on July 1, 2023 ▪ Announced closure of two branches and consolidation of two offices by Q3 2024 5 $6 billion community bank with dominant market share in Central and Southern Maryland and established presence in Delaware and Virginia (1) Per FDIC Annual Market Share Data published in July 2023 for the Maryland counties of Calvert, Charles, St. Mary's, Talbot, Queen Anne's, Caroline, Worcester and Dorchester

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Federal Agency Presence Insulates Economy in Operating Markets 6 Naval Surface Warfare – Naval Support Facility at Dahlgren Defense Intelligence Agency & Defense Intelligence Analysis Center – Joint Base Anacostia-Bolling Naval Air Station Patuxent River Air Force One – Joint Base Andrews US Marines – Quantico Additional major Federal Agency presence: ▪ Federal Aviation Administration (FAA) Unmanned Aerial Vehicle (UAV) Drones Program ▪ Homeland Security ▪ FBI & DEA – Quantico (Prince William County) Naval Support Facility at Indian Head National Security Agency Fort Meade Dover AFB

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Construction 7.12% Residential real estate 33.19% Commercial real estate 48.09% Commercial 4.75% Consumer 6.85% Loan Portfolio Loan Composition (September 30, 2024 - MRQ) 7 $4.73 billion Concentrations as a percentage of total capital as of September 30, 2024: ▪ CRE Concentration Ratio = 368.70% ▪ Construction Concentration Ratio = 58.60% ($ in thousands) As of September 30, 2024 Loan Type Balance % of Total Construction $ 337,113 7.12 % 1-4 family residential 115,452 CRE Lot Loans 27,001 Land Development 44,180 Commercial Const Non 1-4 Family 131,952 Consumer RE Lot Loans 18,528 Residential real estate 1,570,998 33.19 % Secured by 1-4 family-revolving 111,550 Secured by 1-4 family-closed end 1,185,698 Secured by multifamily 258,623 Mortgage division 15,127 Commercial real estate 2,276,381 48.09 % Secured by farmland 57,495 Secured by owner-occupied 746,499 Secured by other 1,472,387 Commercial 225,083 4.75 % Commercial and industrial loans 225,038 Consumer 317,149 6.70 % Classic Auto 124,017 Boats 193,132 Credit Cards 7,185 0.15 % Gross loans $ 4,733,909 100.00 % MRQ Average Loan Yield: 5.76%

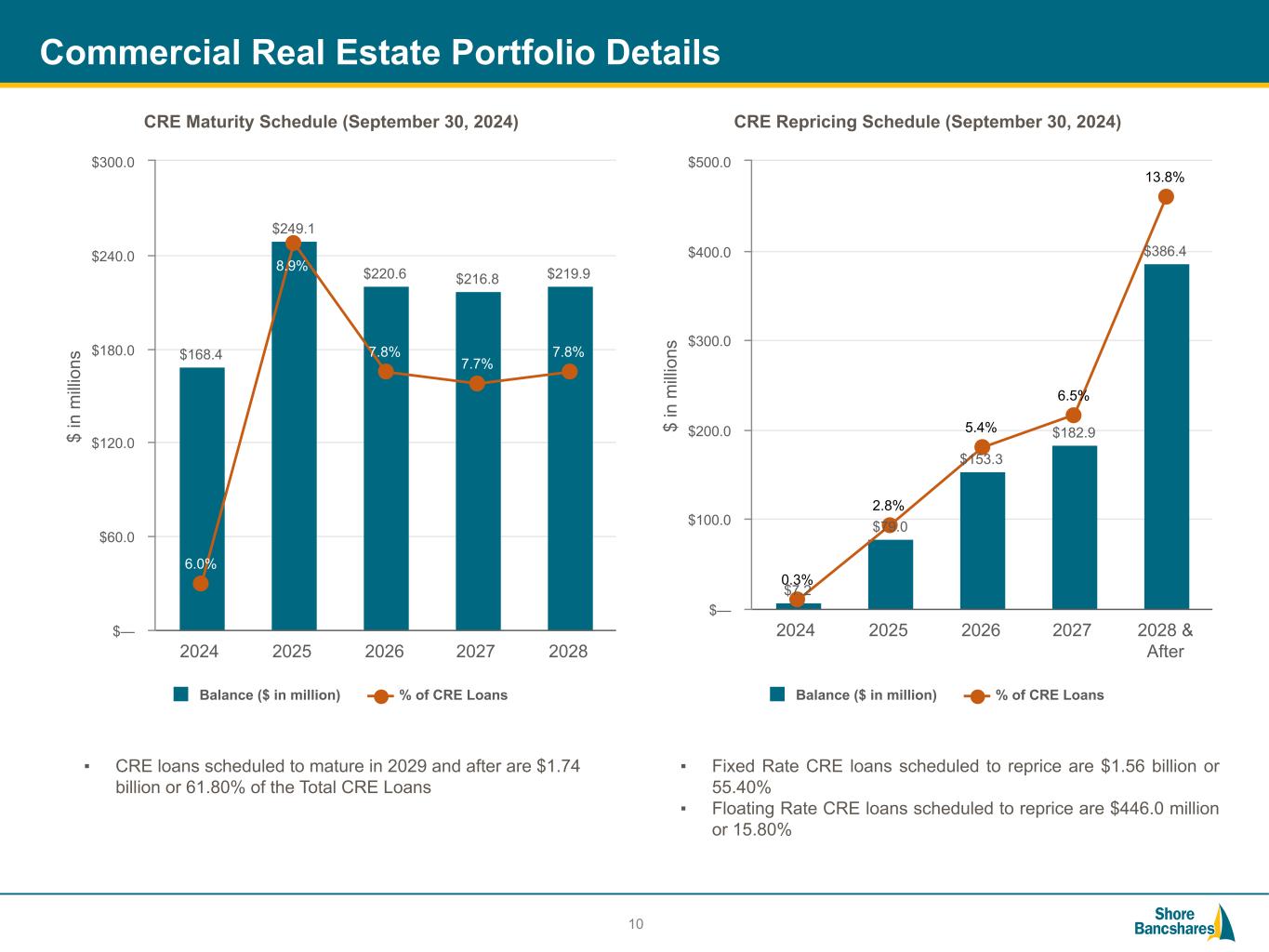

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details Average loan size $1.09mm Average LTV* 49.8% DSC (non-owner occupied) 1.16x % with guaranty (by $ / by #) 81% / 90% Past due 30-89 days $7.1mm / 0.03% of total CRE Nonaccrual $6.0mm / 0.21% of total CRE Special mention $17.0mm / 0.60% of total CRE Classified $10.6mm / 0.38% of total CRE *Loan to Value ("LTV") collateral values are based on the most recent appraisal, which varies from the initial loan boarding to interim credit reviews CRE Portfolio Metrics at September 30, 2024 Number of Loans by Balance 1,913 566 67 35 3 <$1mm $1-5mm $5-10mm $10-20mm >$20mm 0 500 1,000 1,500 2,000 2,500 ▪ Loans secured by office properties represented 10.76% of our total loan portfolio. ▪ CRE portfolio is 26.52% owner occupied, 52.31% non-owner occupied, 11.98% construction, and 9.19% multifamily. ▪ 74.00% of CRE loans are below $1 million dollars. ▪ Office CRE loans compose 18.10% of total CRE loans and 10.76% of total loans. ▪ 0.30% and 2.80% of total CRE Loans are repricing in the years 2024 and 2025, respectively. 8

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details Multifamily, 9.5% Industrial, 11.8% Office, 18.1% Retail, 17.5% Other, 35.5% Hotel/Motel, 7.6% 9 MD, 54.0% VA, 24.3% DE, 8.3% Other, 13.4% CRE Portfolio Composition(1) Amount ($000) % of CRE Loans Multifamily $ 266,804 9.5 % Industrial 331,452 11.8 % Retail 493,680 17.5 % Other 1,000,420 35.5 % Hotel/Motel 212,890 7.6 % Office 509,376 18.1 % Grand Total $ 2,814,622 100.0 % Location Loan Count Amount ($000) % of Total Office Metropolitian(2) 13 $ 13,574 2.7 % Suburban 337 388,565 76.3 % Rural 153 107,237 21.1 % Grand Total 503 $ 509,376 100.0 % (1) CRE portfolio composition by Call Report Code (2) Metropolitan includes major cities of Baltimore, Alexandria and Washington DC Office CRE Portfolio Composition (September 30, 2024) Geography (September 30, 2024)

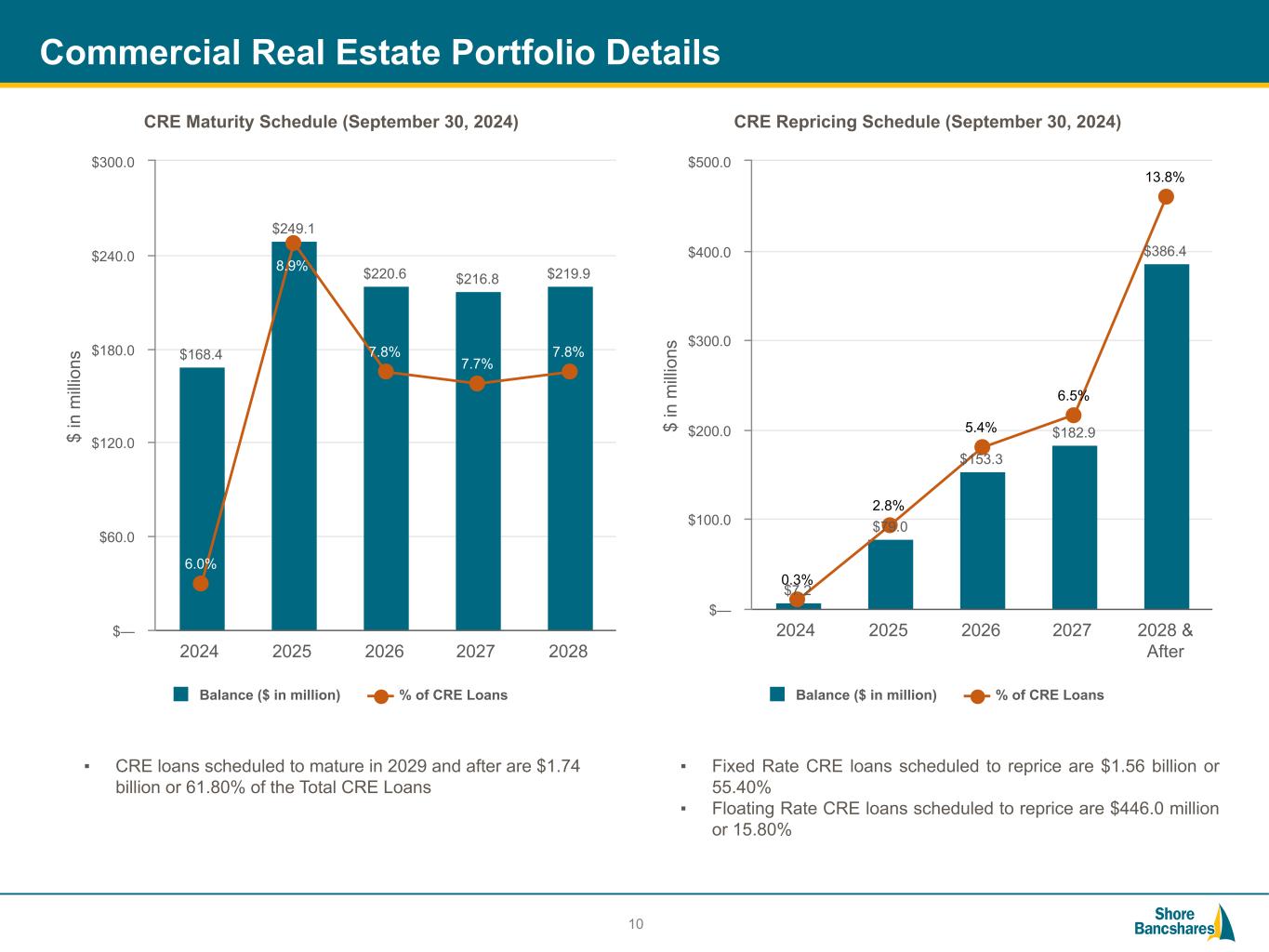

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details 10 $ in m ill io ns $168.4 $249.1 $220.6 $216.8 $219.9 6.0% 8.9% 7.8% 7.7% 7.8% Balance ($ in million) % of CRE Loans 2024 2025 2026 2027 2028 $— $60.0 $120.0 $180.0 $240.0 $300.0 $ in m ill io ns $7.2 $79.0 $153.3 $182.9 $386.4 0.3% 2.8% 5.4% 6.5% 13.8% Balance ($ in million) % of CRE Loans 2024 2025 2026 2027 2028 & After $— $100.0 $200.0 $300.0 $400.0 $500.0 ▪ CRE loans scheduled to mature in 2029 and after are $1.74 billion or 61.80% of the Total CRE Loans ▪ Fixed Rate CRE loans scheduled to reprice are $1.56 billion or 55.40% ▪ Floating Rate CRE loans scheduled to reprice are $446.0 million or 15.80% CRE Maturity Schedule (September 30, 2024) CRE Repricing Schedule (September 30, 2024)

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Interest Bearing, 45.65% Non-Interest Bearing, 30.07% Time Deposits, 24.28% Deposit Portfolio Deposit Composition (September 30, 2024 - MRQ) ▪ Deposit franchise positions Bank to succeed in a variety of rate environments ▪ Non-interest bearing deposits have increased to 30.07% of total deposits at Q3 2024 from 23.70% in Q3 2023 ▪ 17.14% of deposits are uninsured (Net of pledged securities 14.71%) ▪ $623.2 million of the deposits were indexed to Fed Funds at September 30, 2024 MRQ Cost of Deposits: 2.26% 11 $5.23 billion ($ in thousands) As of September 30, 2024 Deposit Type Balance % of Total Average Rate (%) Non-interest Bearing Demand $ 1,571,393 30.07 % 0.00 % Interest Bearing Demand 751,533 14.38 % 2.90 % Money Market & Savings 1,634,140 31.27 % 2.46 % CDs $100,000 or more 832,024 15.92 % 4.09 % Other Time 436,633 8.36 % 3.93 % Total Deposits $ 5,225,723 100.00 % 3.07 % Total Cost of Interest Bearing Deposits 3.07 % Total Cost of Funds (Including Borrowings)(1) 2.35 % (1) Includes Non-interest bearing deposits

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 3.27% 2.94% 3.15% 3.11% 3.12%3.24% 2.91% 3.09% 2.89% 2.83% 3.27% 3.10% 3.37% 3.19% 3.07% 3.33% 3.21% 3.46% 3.41% 3.26% NIM Core-NIM Regional Peer National Peer 2020 2021 2022 2023 2024YTD 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% NIM and Core NIM(1) 12 (1) Core NIM excludes net accretion income - see Non-GAAP reconciliations in Appendix. Q3 2024 Vs Q3 2023 ▪ Net Interest margin decreased from 3.35% in Q3 2023 to 3.17% in Q3 2024 ▪ Average Loan Yields increased from 5.65% in Q3 2023 to 5.82% in Q3 2024 ▪ Cost of Deposits increased from 1.84% in Q3 2023 to 2.26% in Q3 2024

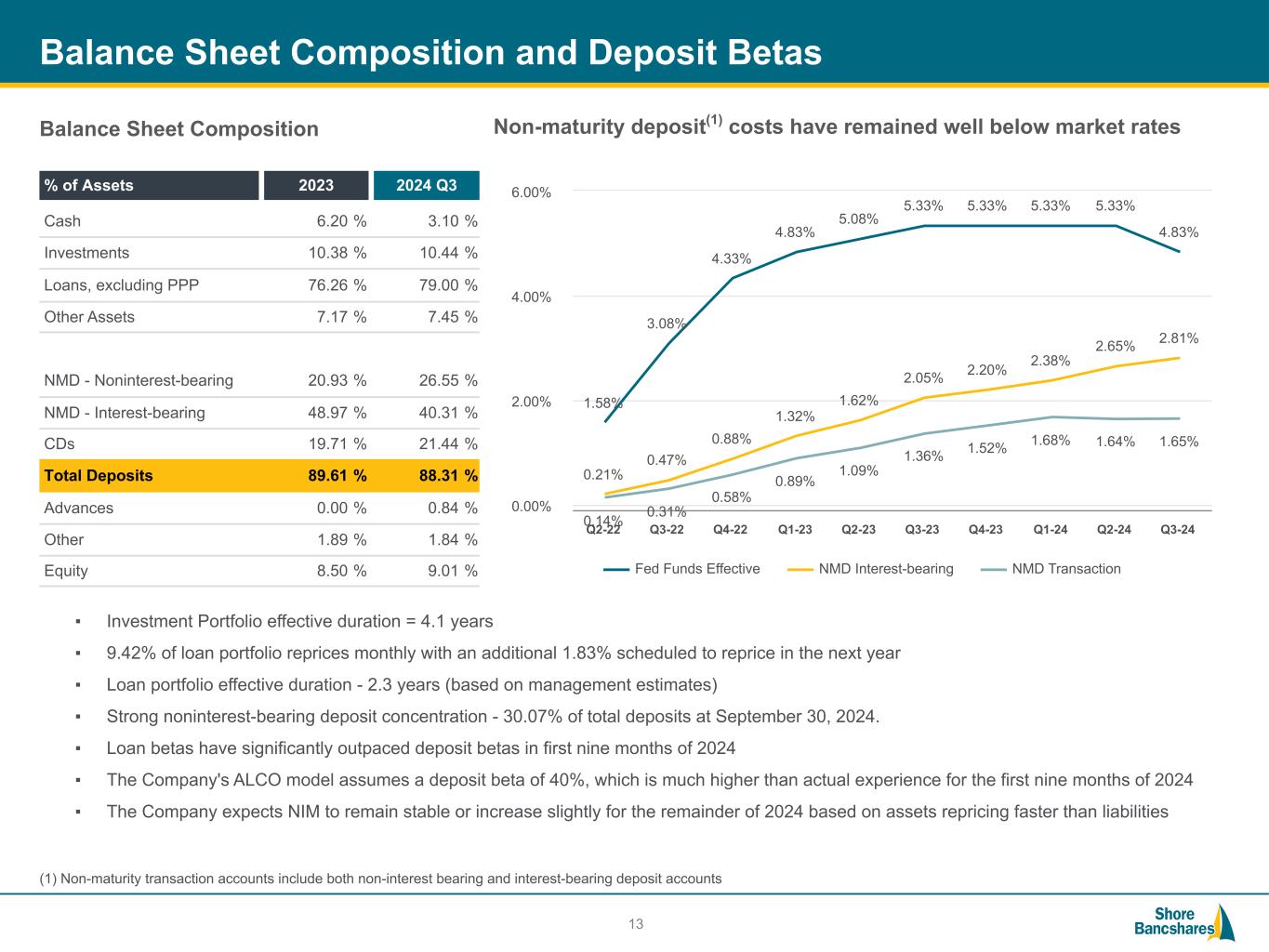

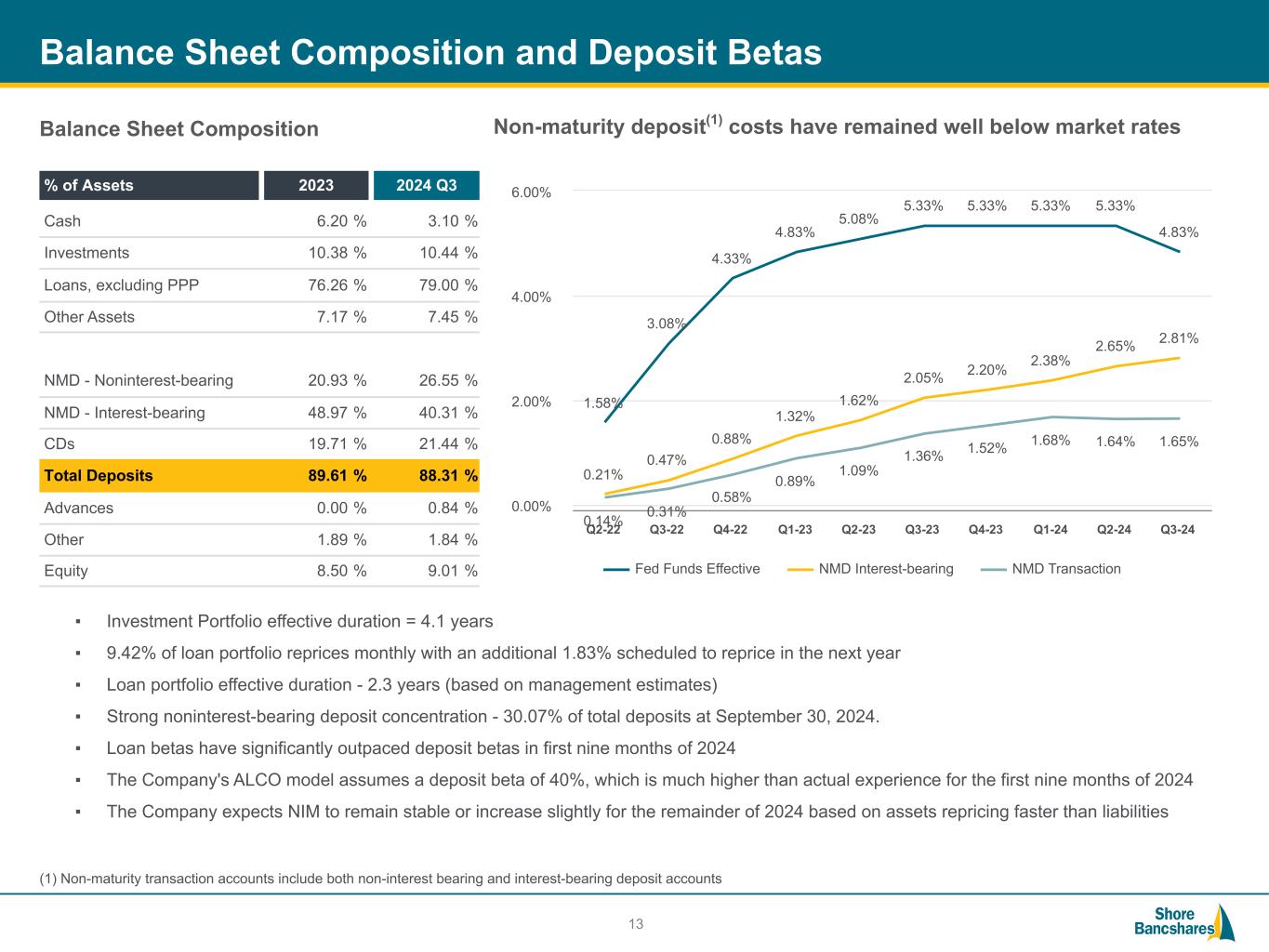

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Balance Sheet Composition and Deposit Betas 13 (1) Non-maturity transaction accounts include both non-interest bearing and interest-bearing deposit accounts Non-maturity deposit(1) costs have remained well below market ratesBalance Sheet Composition % of Assets 2023 2024 Q3 Cash 6.20 % 3.10 % Investments 10.38 % 10.44 % Loans, excluding PPP 76.26 % 79.00 % Other Assets 7.17 % 7.45 % NMD - Noninterest-bearing 20.93 % 26.55 % NMD - Interest-bearing 48.97 % 40.31 % CDs 19.71 % 21.44 % Total Deposits 89.61 % 88.31 % Advances 0.00 % 0.84 % Other 1.89 % 1.84 % Equity 8.50 % 9.01 % 1.58% 3.08% 4.33% 4.83% 5.08% 5.33% 5.33% 5.33% 5.33% 4.83% 0.21% 0.47% 0.88% 1.32% 1.62% 2.05% 2.20% 2.38% 2.65% 2.81% 0.14% 0.31% 0.58% 0.89% 1.09% 1.36% 1.52% 1.68% 1.64% 1.65% Fed Funds Effective NMD Interest-bearing NMD Transaction Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 0.00% 2.00% 4.00% 6.00% ▪ Investment Portfolio effective duration = 4.1 years ▪ 9.42% of loan portfolio reprices monthly with an additional 1.83% scheduled to reprice in the next year ▪ Loan portfolio effective duration - 2.3 years (based on management estimates) ▪ Strong noninterest-bearing deposit concentration - 30.07% of total deposits at September 30, 2024. ▪ Loan betas have significantly outpaced deposit betas in first nine months of 2024 ▪ The Company's ALCO model assumes a deposit beta of 40%, which is much higher than actual experience for the first nine months of 2024 ▪ The Company expects NIM to remain stable or increase slightly for the remainder of 2024 based on assets repricing faster than liabilities

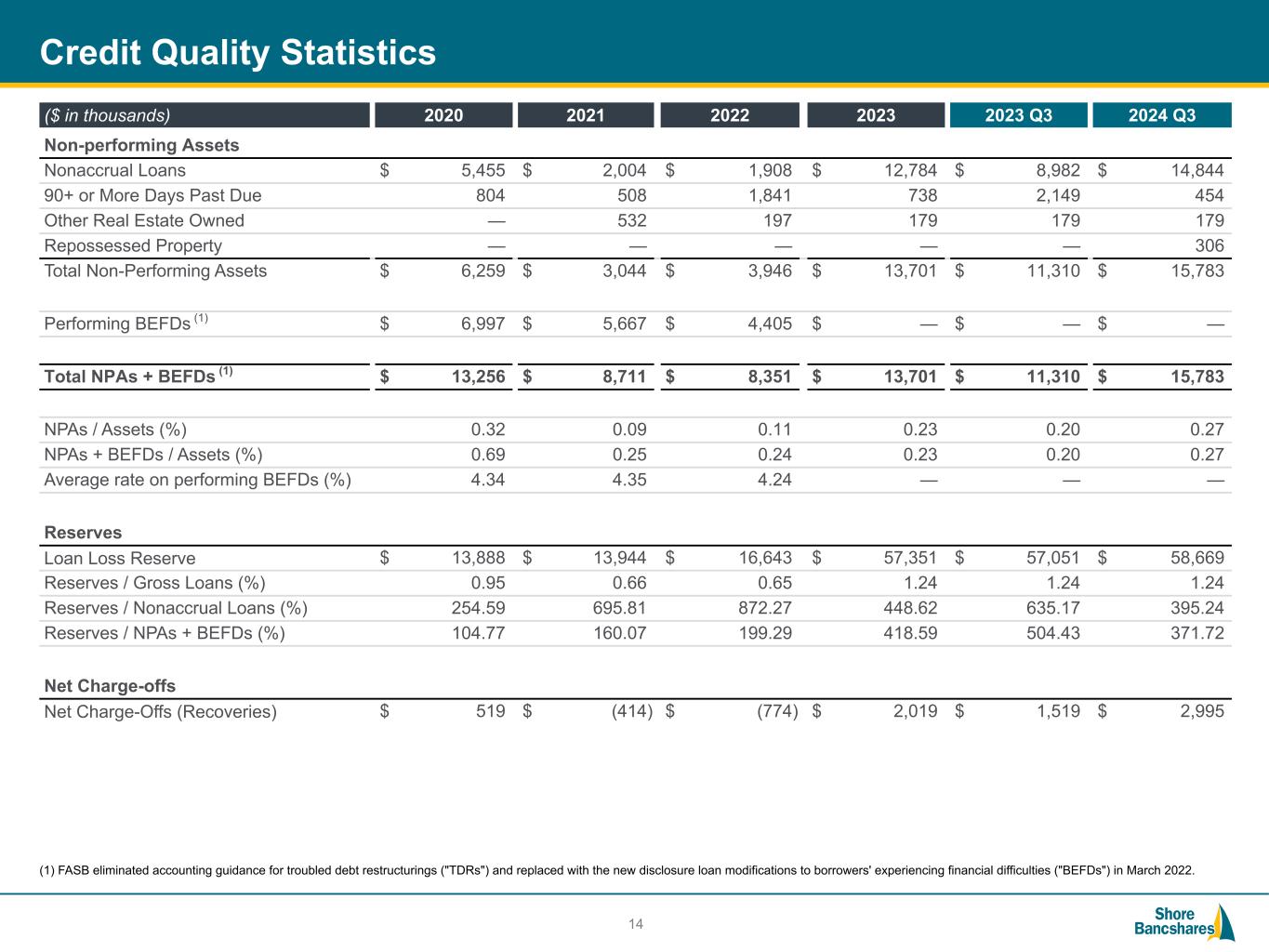

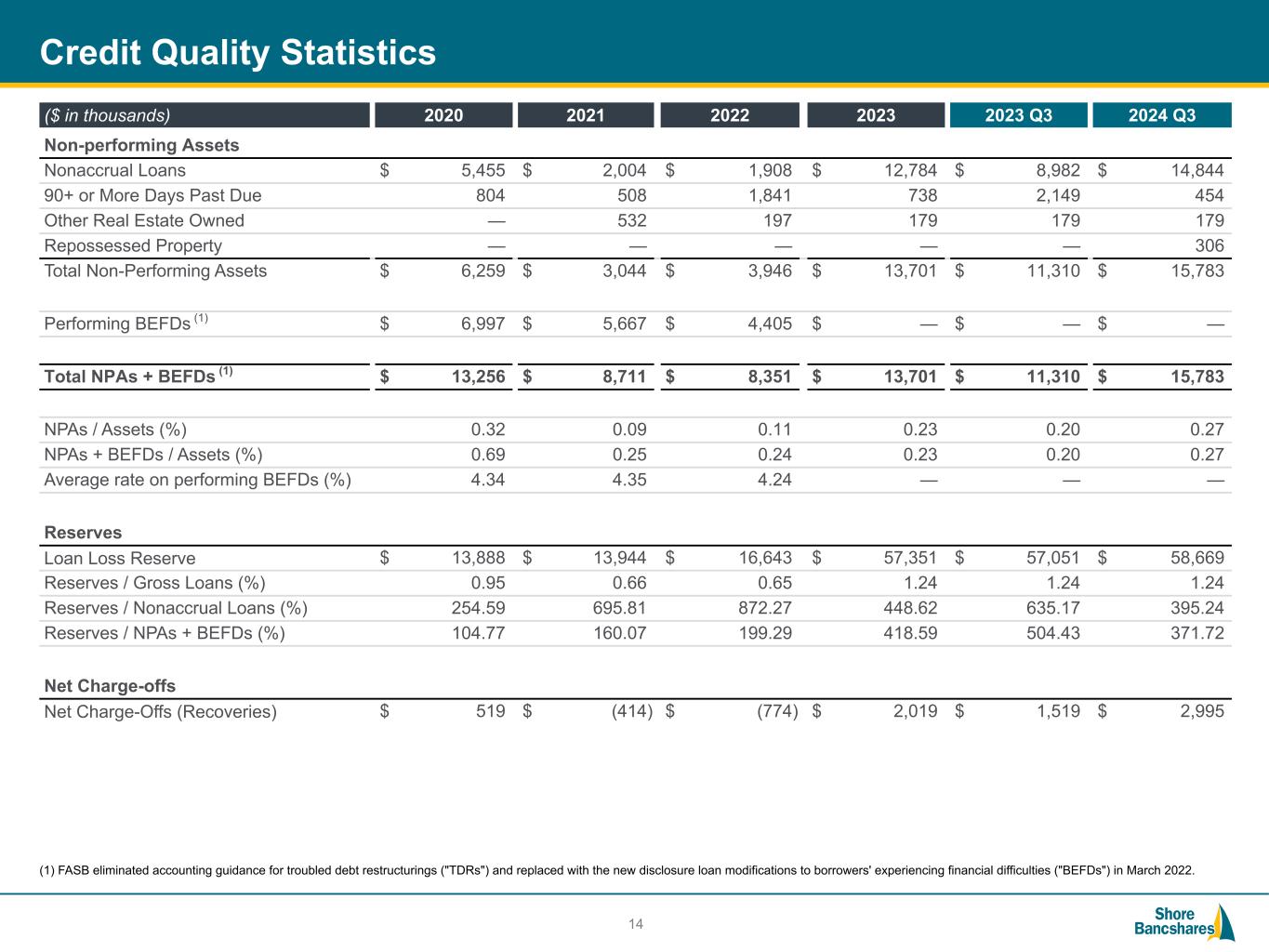

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Credit Quality Statistics 14 (1) FASB eliminated accounting guidance for troubled debt restructurings ("TDRs") and replaced with the new disclosure loan modifications to borrowers' experiencing financial difficulties ("BEFDs") in March 2022. ($ in thousands) 2020 2021 2022 2023 2023 Q3 2024 Q3 Non-performing Assets Nonaccrual Loans $ 5,455 $ 2,004 $ 1,908 $ 12,784 $ 8,982 $ 14,844 90+ or More Days Past Due 804 508 1,841 738 2,149 454 Other Real Estate Owned — 532 197 179 179 179 Repossessed Property — — — — — 306 Total Non-Performing Assets $ 6,259 $ 3,044 $ 3,946 $ 13,701 $ 11,310 $ 15,783 Performing BEFDs (1) $ 6,997 $ 5,667 $ 4,405 $ — $ — $ — Total NPAs + BEFDs (1) $ 13,256 $ 8,711 $ 8,351 $ 13,701 $ 11,310 $ 15,783 NPAs / Assets (%) 0.32 0.09 0.11 0.23 0.20 0.27 NPAs + BEFDs / Assets (%) 0.69 0.25 0.24 0.23 0.20 0.27 Average rate on performing BEFDs (%) 4.34 4.35 4.24 — — — Reserves Loan Loss Reserve $ 13,888 $ 13,944 $ 16,643 $ 57,351 $ 57,051 $ 58,669 Reserves / Gross Loans (%) 0.95 0.66 0.65 1.24 1.24 1.24 Reserves / Nonaccrual Loans (%) 254.59 695.81 872.27 448.62 635.17 395.24 Reserves / NPAs + BEFDs (%) 104.77 160.07 199.29 418.59 504.43 371.72 Net Charge-offs Net Charge-Offs (Recoveries) $ 519 $ (414) $ (774) $ 2,019 $ 1,519 $ 2,995

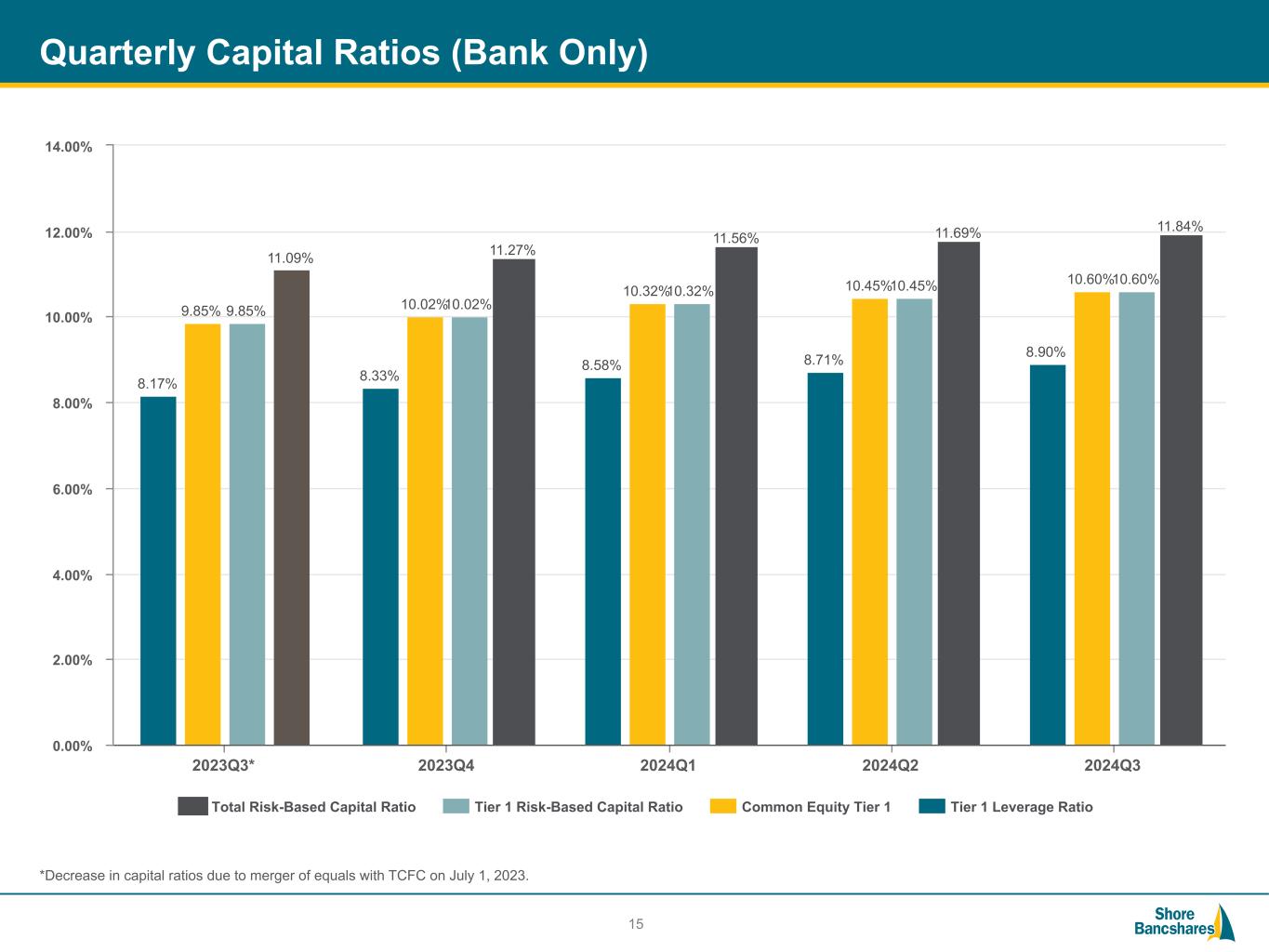

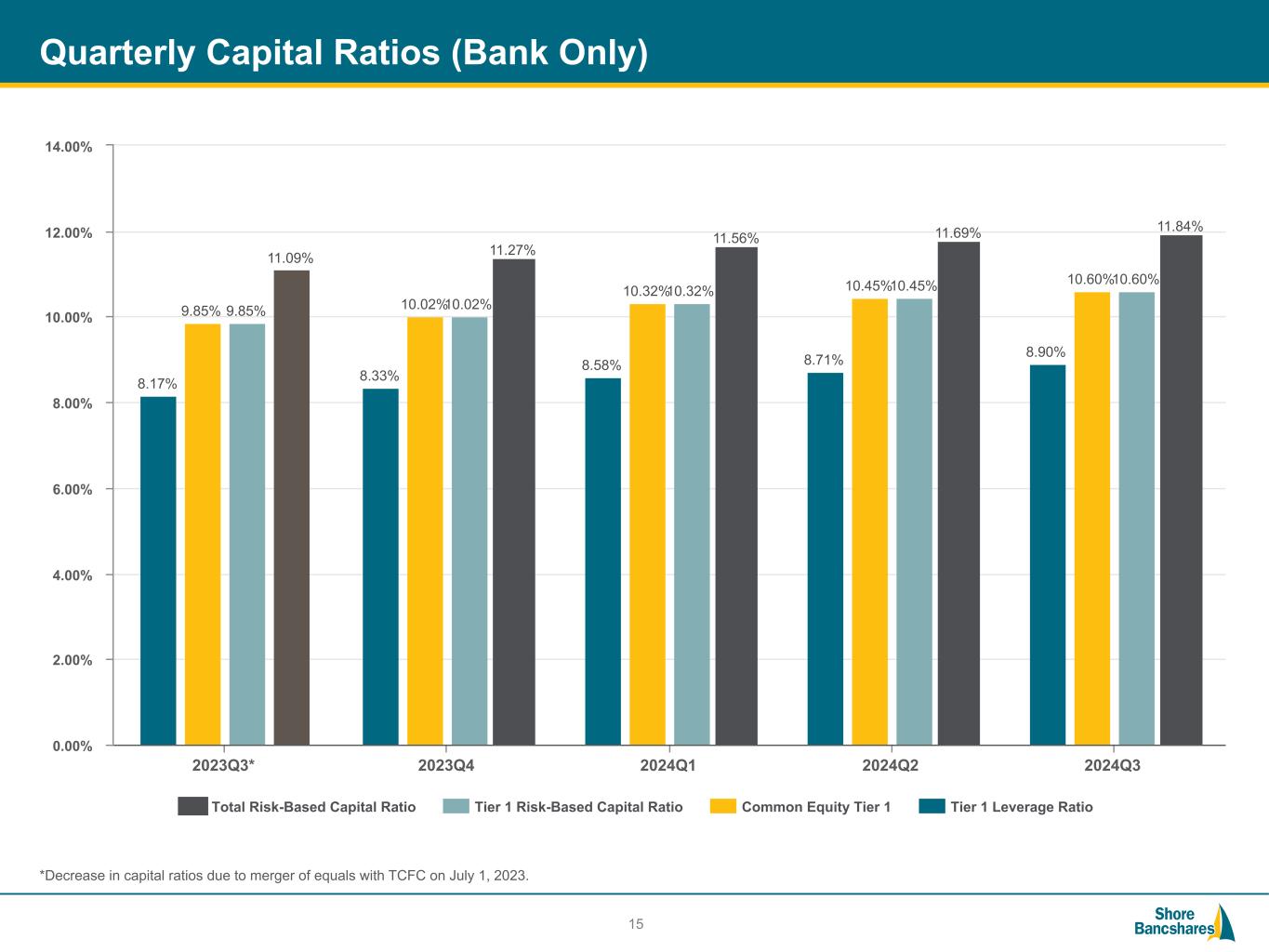

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Quarterly Capital Ratios (Bank Only) 15 8.17% 8.33% 8.58% 8.71% 8.90% 9.85% 10.02% 10.32% 10.45% 10.60% 9.85% 10.02% 10.32% 10.45% 10.60% 11.09% 11.27% 11.56% 11.69% 11.84% Total Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio Common Equity Tier 1 Tier 1 Leverage Ratio 2023Q3* 2023Q4 2024Q1 2024Q2 2024Q3 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% *Decrease in capital ratios due to merger of equals with TCFC on July 1, 2023.

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Quarterly Capital Ratios (Holding Company) 16 *Decrease in capital ratios due to merger of equals with TCFC on July 1, 2023. 7.55% 7.74% 7.93% 8.07% 8.31%8.49% 8.69% 8.91% 9.06% 9.27%9.10% 9.31% 9.53% 9.67% 9.89% 11.26% 11.48% 11.68% 11.82% 12.04% Total Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio Common Equity Tier 1 Tier 1 Leverage Ratio 2023Q3* 2023Q4 2024Q1 2024Q2 2024Q3 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00%

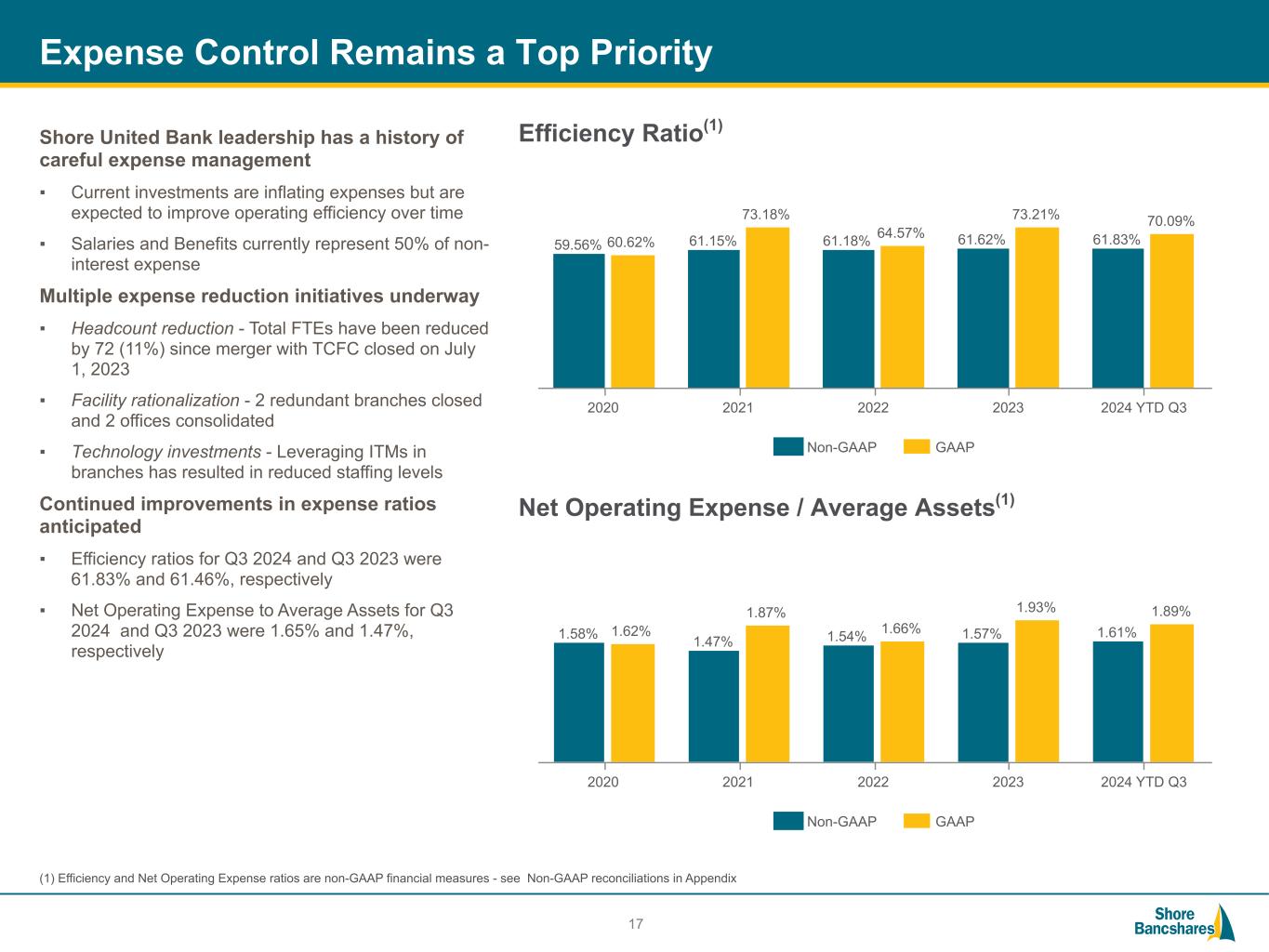

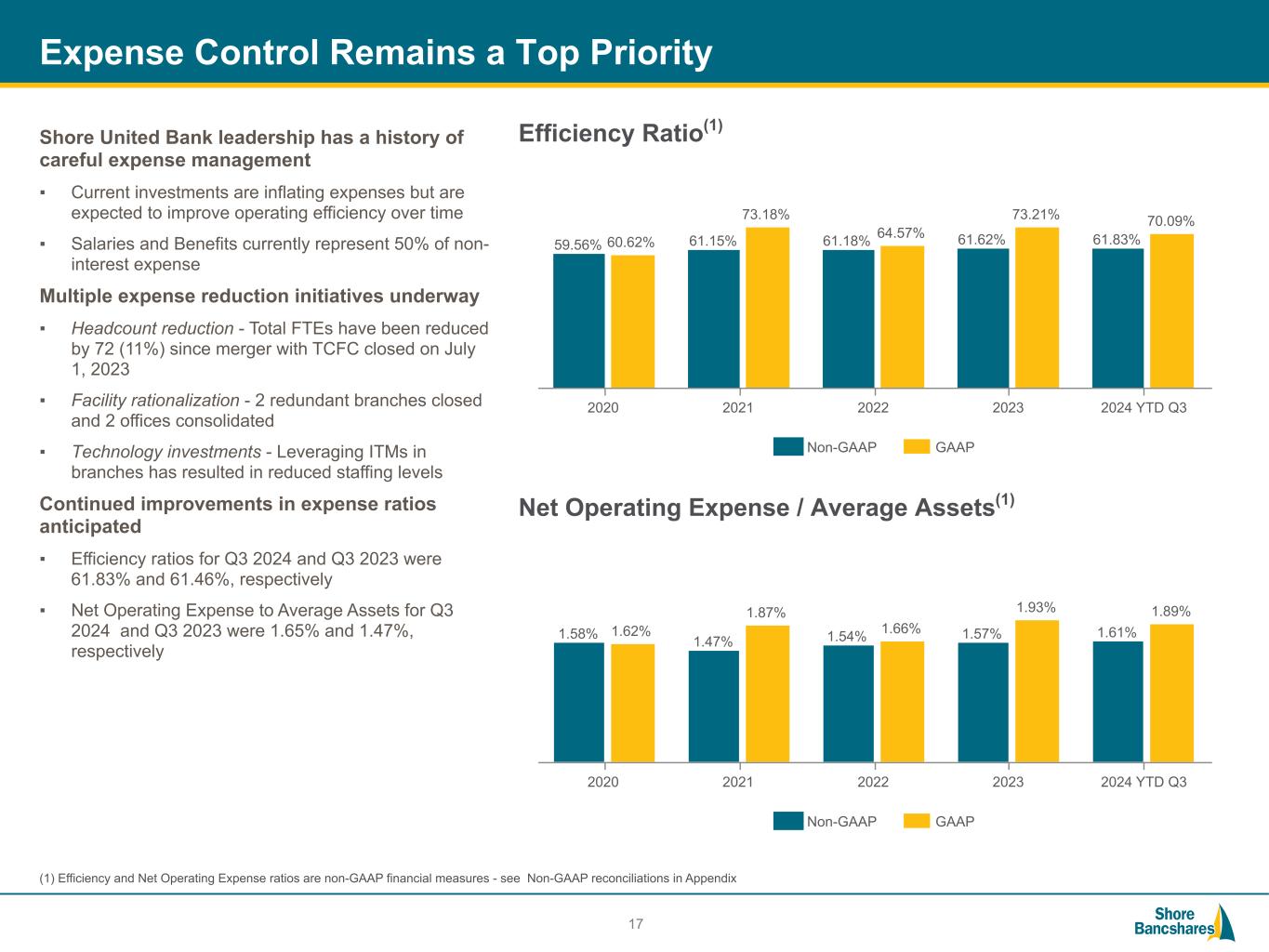

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Expense Control Remains a Top Priority Shore United Bank leadership has a history of careful expense management ▪ Current investments are inflating expenses but are expected to improve operating efficiency over time ▪ Salaries and Benefits currently represent 50% of non- interest expense Multiple expense reduction initiatives underway ▪ Headcount reduction - Total FTEs have been reduced by 72 (11%) since merger with TCFC closed on July 1, 2023 ▪ Facility rationalization - 2 redundant branches closed and 2 offices consolidated ▪ Technology investments - Leveraging ITMs in branches has resulted in reduced staffing levels Continued improvements in expense ratios anticipated ▪ Efficiency ratios for Q3 2024 and Q3 2023 were 61.83% and 61.46%, respectively ▪ Net Operating Expense to Average Assets for Q3 2024 and Q3 2023 were 1.65% and 1.47%, respectively (1) Efficiency and Net Operating Expense ratios are non-GAAP financial measures - see Non-GAAP reconciliations in Appendix 17 Efficiency Ratio(1) Net Operating Expense / Average Assets(1) 59.56% 61.15% 61.18% 61.62% 61.83%60.62% 73.18% 64.57% 73.21% 70.09% Non-GAAP GAAP 2020 2021 2022 2023 2024 YTD Q3 1.58% 1.47% 1.54% 1.57% 1.61%1.62% 1.87% 1.66% 1.93% 1.89% Non-GAAP GAAP 2020 2021 2022 2023 2024 YTD Q3

Appendix

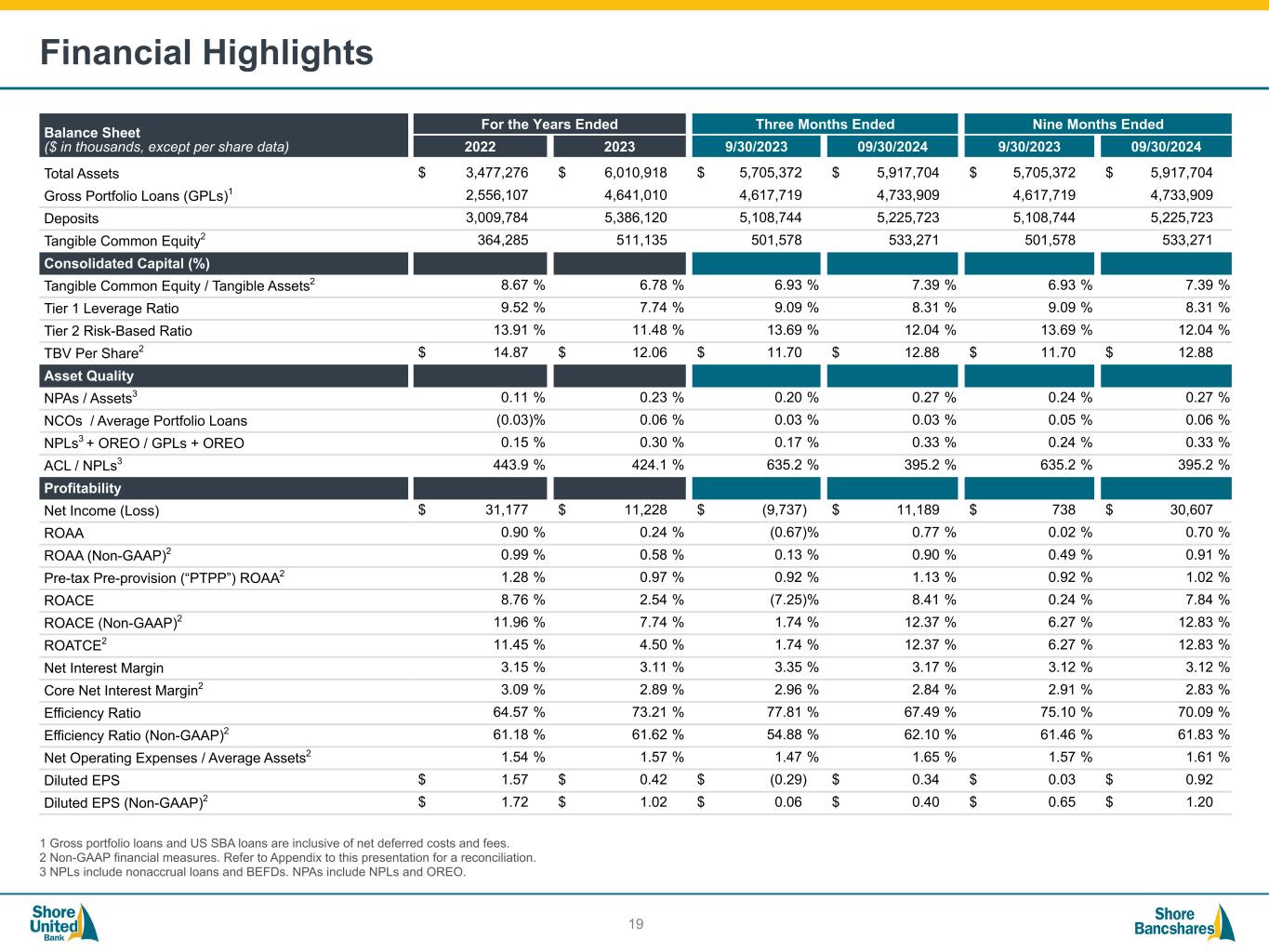

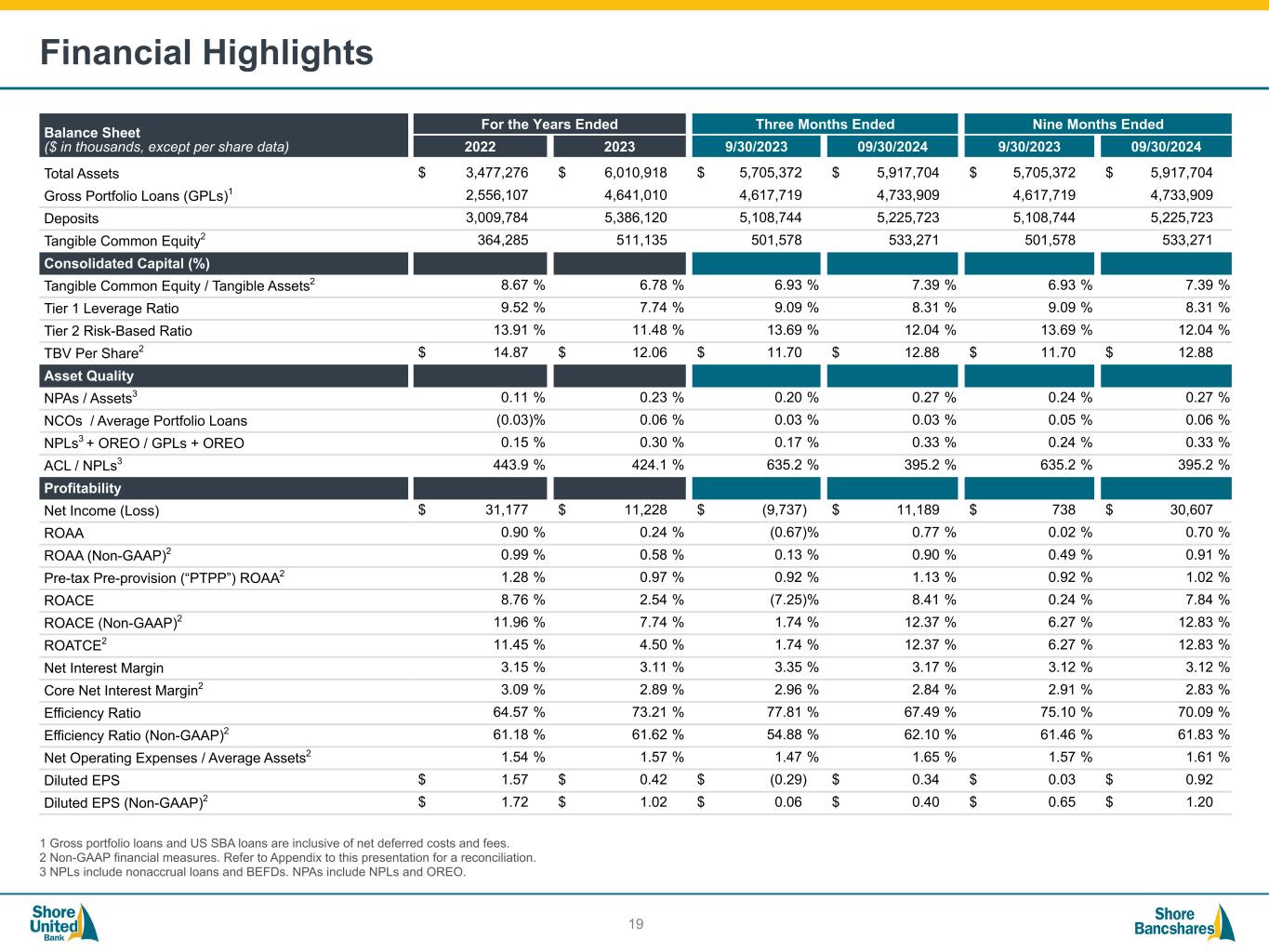

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Financial Highlights 19 1 Gross portfolio loans and US SBA loans are inclusive of net deferred costs and fees. 2 Non-GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. 3 NPLs include nonaccrual loans and BEFDs. NPAs include NPLs and OREO. Balance Sheet ($ in thousands, except per share data) For the Years Ended Three Months Ended Nine Months Ended 2022 2023 9/30/2023 09/30/2024 9/30/2023 09/30/2024 Total Assets $ 3,477,276 $ 6,010,918 $ 5,705,372 $ 5,917,704 $ 5,705,372 $ 5,917,704 Gross Portfolio Loans (GPLs)1 2,556,107 4,641,010 4,617,719 4,733,909 4,617,719 4,733,909 Deposits 3,009,784 5,386,120 5,108,744 5,225,723 5,108,744 5,225,723 Tangible Common Equity2 364,285 511,135 501,578 533,271 501,578 533,271 Consolidated Capital (%) Tangible Common Equity / Tangible Assets2 8.67 % 6.78 % 6.93 % 7.39 % 6.93 % 7.39 % Tier 1 Leverage Ratio 9.52 % 7.74 % 9.09 % 8.31 % 9.09 % 8.31 % Tier 2 Risk-Based Ratio 13.91 % 11.48 % 13.69 % 12.04 % 13.69 % 12.04 % TBV Per Share2 $ 14.87 $ 12.06 $ 11.70 $ 12.88 $ 11.70 $ 12.88 Asset Quality NPAs / Assets3 0.11 % 0.23 % 0.20 % 0.27 % 0.24 % 0.27 % NCOs / Average Portfolio Loans (0.03) % 0.06 % 0.03 % 0.03 % 0.05 % 0.06 % NPLs3 + OREO / GPLs + OREO 0.15 % 0.30 % 0.17 % 0.33 % 0.24 % 0.33 % ACL / NPLs3 443.9 % 424.1 % 635.2 % 395.2 % 635.2 % 395.2 % Profitability Net Income (Loss) $ 31,177 $ 11,228 $ (9,737) $ 11,189 $ 738 $ 30,607 ROAA 0.90 % 0.24 % (0.67) % 0.77 % 0.02 % 0.70 % ROAA (Non-GAAP)2 0.99 % 0.58 % 0.13 % 0.90 % 0.49 % 0.91 % Pre-tax Pre-provision (“PTPP”) ROAA2 1.28 % 0.97 % 0.92 % 1.13 % 0.92 % 1.02 % ROACE 8.76 % 2.54 % (7.25) % 8.41 % 0.24 % 7.84 % ROACE (Non-GAAP)2 11.96 % 7.74 % 1.74 % 12.37 % 6.27 % 12.83 % ROATCE2 11.45 % 4.50 % 1.74 % 12.37 % 6.27 % 12.83 % Net Interest Margin 3.15 % 3.11 % 3.35 % 3.17 % 3.12 % 3.12 % Core Net Interest Margin2 3.09 % 2.89 % 2.96 % 2.84 % 2.91 % 2.83 % Efficiency Ratio 64.57 % 73.21 % 77.81 % 67.49 % 75.10 % 70.09 % Efficiency Ratio (Non-GAAP)2 61.18 % 61.62 % 54.88 % 62.10 % 61.46 % 61.83 % Net Operating Expenses / Average Assets2 1.54 % 1.57 % 1.47 % 1.65 % 1.57 % 1.61 % Diluted EPS $ 1.57 $ 0.42 $ (0.29) $ 0.34 $ 0.03 $ 0.92 Diluted EPS (Non-GAAP)2 $ 1.72 $ 1.02 $ 0.06 $ 0.40 $ 0.65 $ 1.20

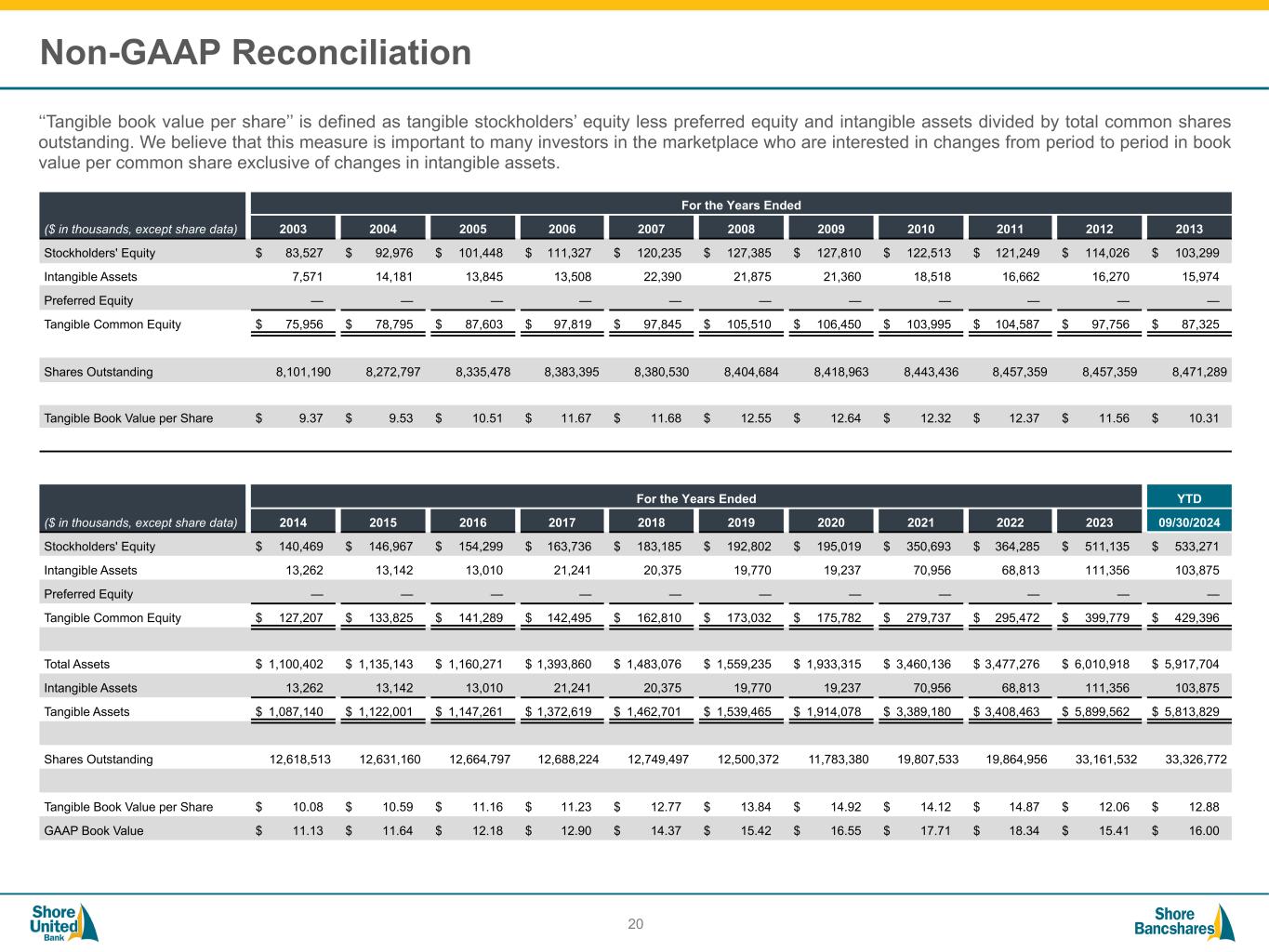

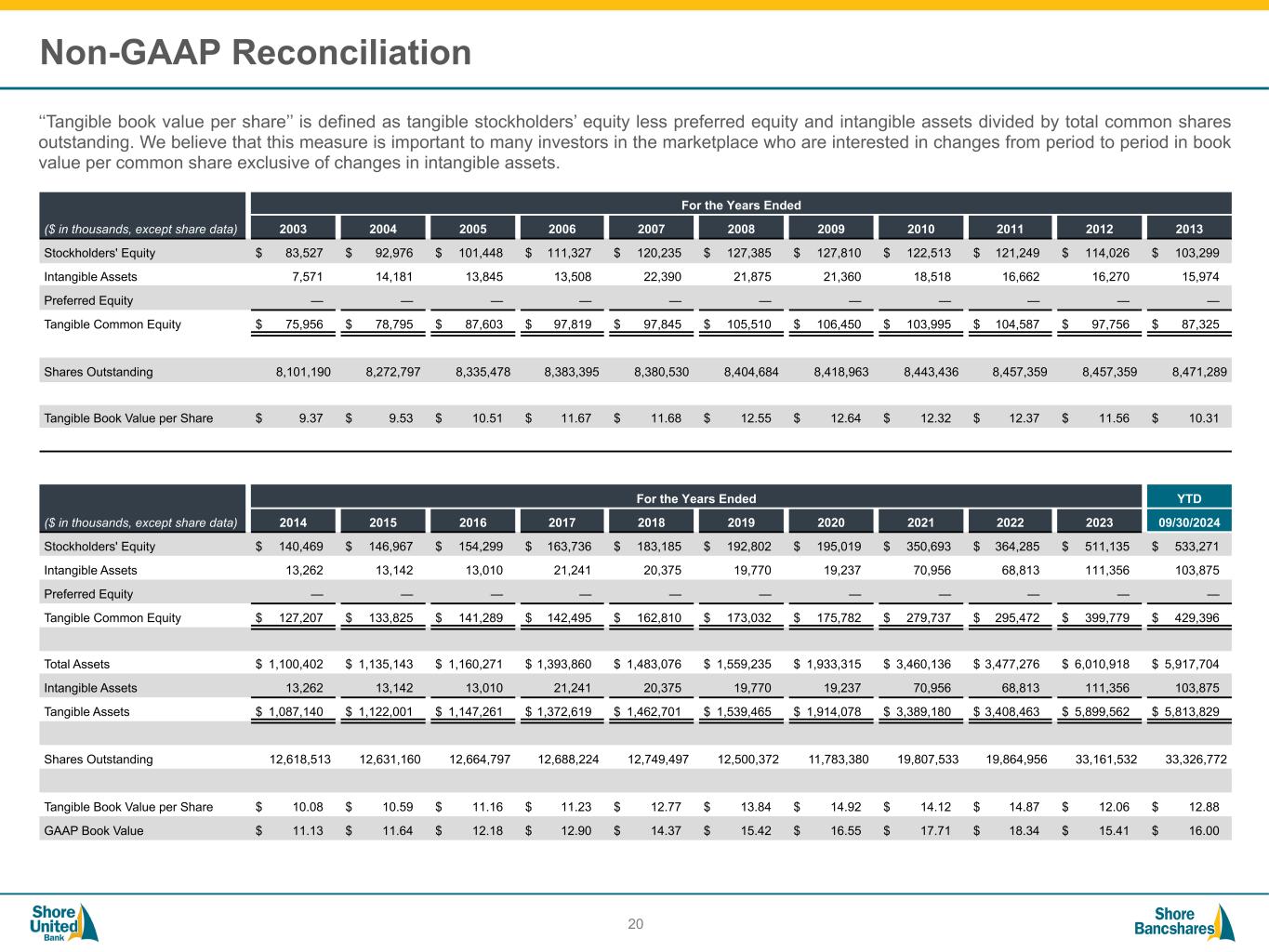

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Tangible book value per share’’ is defined as tangible stockholders’ equity less preferred equity and intangible assets divided by total common shares outstanding. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets. 20 ($ in thousands, except share data) For the Years Ended 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Stockholders' Equity $ 83,527 $ 92,976 $ 101,448 $ 111,327 $ 120,235 $ 127,385 $ 127,810 $ 122,513 $ 121,249 $ 114,026 $ 103,299 Intangible Assets 7,571 14,181 13,845 13,508 22,390 21,875 21,360 18,518 16,662 16,270 15,974 Preferred Equity — — — — — — — — — — — Tangible Common Equity $ 75,956 $ 78,795 $ 87,603 $ 97,819 $ 97,845 $ 105,510 $ 106,450 $ 103,995 $ 104,587 $ 97,756 $ 87,325 Shares Outstanding 8,101,190 8,272,797 8,335,478 8,383,395 8,380,530 8,404,684 8,418,963 8,443,436 8,457,359 8,457,359 8,471,289 Tangible Book Value per Share $ 9.37 $ 9.53 $ 10.51 $ 11.67 $ 11.68 $ 12.55 $ 12.64 $ 12.32 $ 12.37 $ 11.56 $ 10.31 ($ in thousands, except share data) For the Years Ended YTD 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 09/30/2024 Stockholders' Equity $ 140,469 $ 146,967 $ 154,299 $ 163,736 $ 183,185 $ 192,802 $ 195,019 $ 350,693 $ 364,285 $ 511,135 $ 533,271 Intangible Assets 13,262 13,142 13,010 21,241 20,375 19,770 19,237 70,956 68,813 111,356 103,875 Preferred Equity — — — — — — — — — — — Tangible Common Equity $ 127,207 $ 133,825 $ 141,289 $ 142,495 $ 162,810 $ 173,032 $ 175,782 $ 279,737 $ 295,472 $ 399,779 $ 429,396 Total Assets $ 1,100,402 $ 1,135,143 $ 1,160,271 $ 1,393,860 $ 1,483,076 $ 1,559,235 $ 1,933,315 $ 3,460,136 $ 3,477,276 $ 6,010,918 $ 5,917,704 Intangible Assets 13,262 13,142 13,010 21,241 20,375 19,770 19,237 70,956 68,813 111,356 103,875 Tangible Assets $ 1,087,140 $ 1,122,001 $ 1,147,261 $ 1,372,619 $ 1,462,701 $ 1,539,465 $ 1,914,078 $ 3,389,180 $ 3,408,463 $ 5,899,562 $ 5,813,829 Shares Outstanding 12,618,513 12,631,160 12,664,797 12,688,224 12,749,497 12,500,372 11,783,380 19,807,533 19,864,956 33,161,532 33,326,772 Tangible Book Value per Share $ 10.08 $ 10.59 $ 11.16 $ 11.23 $ 12.77 $ 13.84 $ 14.92 $ 14.12 $ 14.87 $ 12.06 $ 12.88 GAAP Book Value $ 11.13 $ 11.64 $ 12.18 $ 12.90 $ 14.37 $ 15.42 $ 16.55 $ 17.71 $ 18.34 $ 15.41 $ 16.00

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Efficiency ratio” is defined as recurring non-interest expense less foreclosed real estate (OREO) expenses and valuation allowances, less merger and acquisition costs, less amortization of intangible assets divided by operating revenue. Operating revenue is equal to net interest income plus non-interest income excluding gains and losses on securities, foreclosed real estate and sales of impaired loans. In our judgment, the adjustments made to non- interest expense and operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items that are unrelated to our core business. “Efficiency ratio as reported” is defined as non-interest expense divided by operating revenue. This is the ratio that appears in the Company’s SEC filings. 21 ($ in thousands, except share data) For the Years Ended Three Months Ended Nine Months Ended 2020 2021 2022 2023 9/30/2023 09/30/2024 9/30/2023 09/30/2024 Non-Interest Expense $ 38,399 $ 56,806 $ 80,322 $ 123,329 $ 47,158 $ 34,114 $ 89,661 $ 104,311 OREO Valuation Allowance & Expenses (56) (2) (44) 2 (2) — — — Amortization of Intangible Assets (533) (734) (1,988) (6,105) (2,634) (2,336) (3,510) (7,482) Merger Expenses — (8,530) (2,098) (17,356) (14,866) — (16,754) — Credit Card Fraud Losses1 — — — — — (337) — (4,660) Adjusted Non-Interest Expense (Numerator) $ 37,810 $ 47,540 $ 76,192 $ 99,870 $ 29,656 $ 31,441 $ 69,397 $ 92,169 Net Interest Income $ 52,597 $ 64,130 $ 101,302 $ 135,307 $ 45,622 $ 43,263 $ 93,782 $ 126,538 Taxable-equivalent adjustment 141 121 155 253 80 82 172 242 Taxable-equivalent net interest income $ 52,738 $ 64,251 $ 101,457 $ 135,560 $ 45,702 $ 43,345 $ 93,954 $ 126,780 Non-Interest Income $ 10,749 $ 13,498 $ 23,086 $ 33,159 $ 14,984 $ 7,287 $ 25,613 $ 22,294 Investment securities losses (gains) — — — 2,166 2,166 — 2,166 — Bargain purchase gain — — — (8,816) (8,816) — (8,816) — Adjusted noninterest income $ 10,749 $ 13,498 $ 23,086 $ 26,509 $ 8,334 $ 7,287 $ 18,963 $ 22,294 Operating Revenue (Denominator) $ 63,487 $ 77,749 $ 124,543 $ 162,069 $ 54,036 $ 50,632 $ 112,917 $ 149,074 Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 5,769,312 $ 5,810,492 $ 4,298,943 $ 5,808,153 Reported Efficiency Ratio 60.62 % 73.18 % 64.57 % 73.21 % 77.81 % 67.49 % 75.10 % 70.09 % Efficiency Ratio 59.56 % 61.15 % 61.18 % 61.62 % 54.88 % 62.10 % 61.46 % 61.83 % Reported Non-interest Expense/Average Assets 2.25 % 2.45 % 2.33 % 2.64 % 3.24 % 2.34 % 2.79 % 2.40 % Operating Non-interest Expense/Average Assets 2.21 % 2.05 % 2.21 % 2.14 % 2.04 % 2.15 % 2.16 % 2.12 % Reported Net Operating Expense/Average Assets2 1.62 % 1.87 % 1.66 % 1.93 % 2.21 % 1.84 % 1.99 % 1.89 % Operating Net Operating Expense/Average Assets2 1.58 % 1.47 % 1.54 % 1.57 % 1.47 % 1.65 % 1.57 % 1.61 % 1 Noninterest expense in the first six months of 2024 included a $4.3 million related to an isolated credit card fraud incident. Our investigation determined that no information systems of the Bank were compromised, and no employee fraud was involved. 2 Net operating expense is non-interest expense offset by non-interest income.

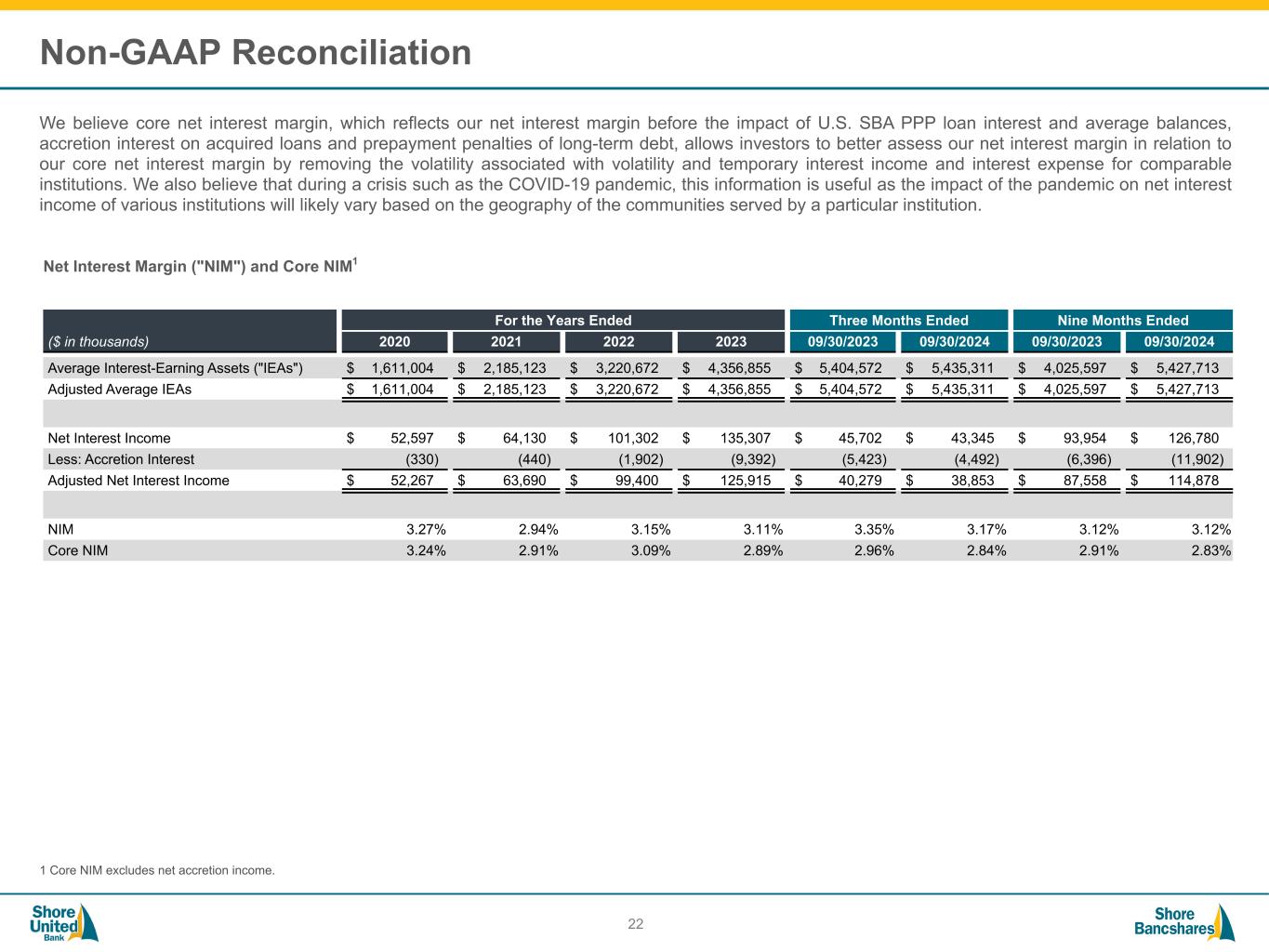

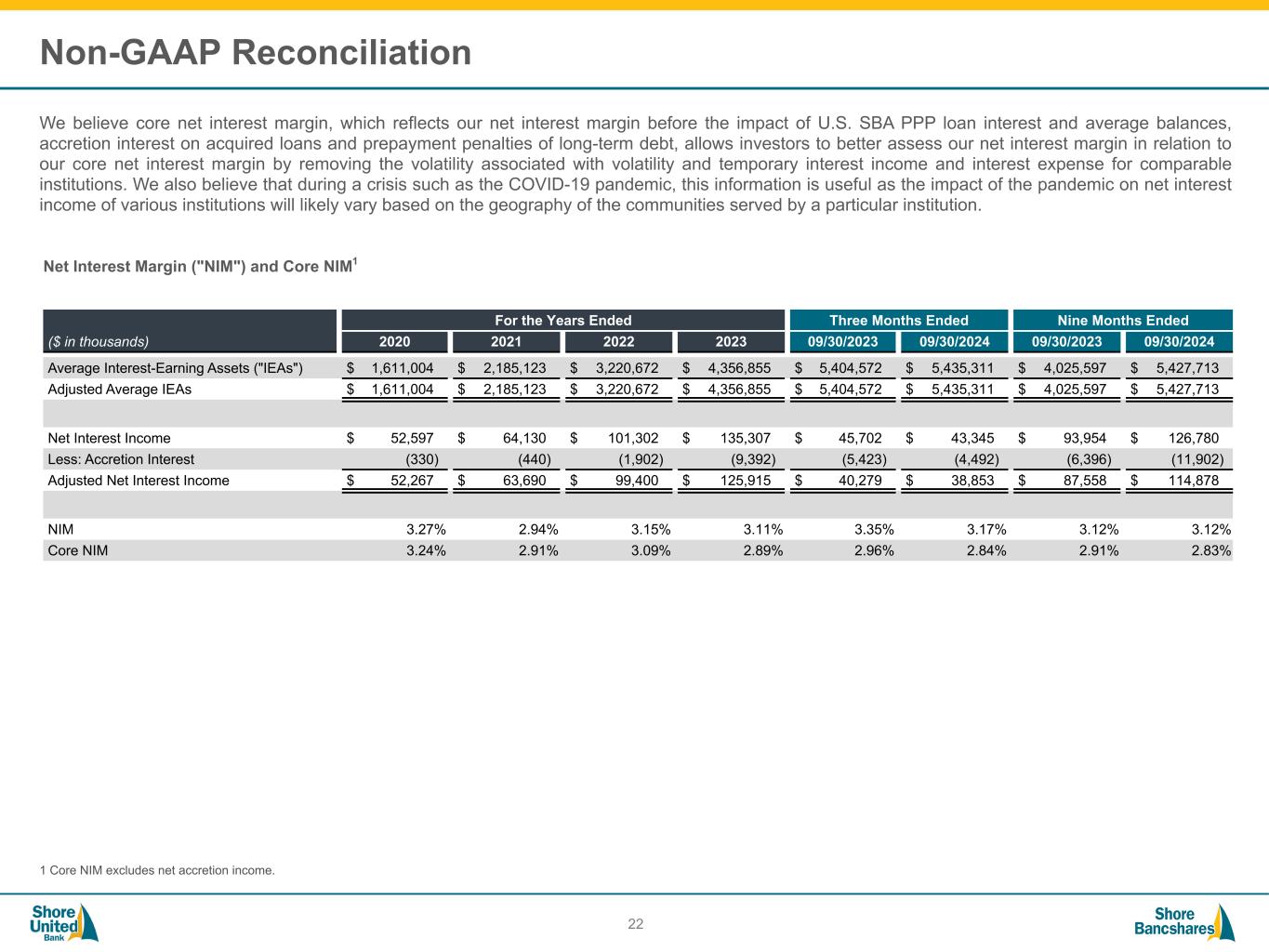

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe core net interest margin, which reflects our net interest margin before the impact of U.S. SBA PPP loan interest and average balances, accretion interest on acquired loans and prepayment penalties of long-term debt, allows investors to better assess our net interest margin in relation to our core net interest margin by removing the volatility associated with volatility and temporary interest income and interest expense for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on net interest income of various institutions will likely vary based on the geography of the communities served by a particular institution. 22 Net Interest Margin ("NIM") and Core NIM1 ($ in thousands) For the Years Ended Three Months Ended Nine Months Ended 2020 2021 2022 2023 09/30/2023 09/30/2024 09/30/2023 09/30/2024 Average Interest-Earning Assets ("IEAs") $ 1,611,004 $ 2,185,123 $ 3,220,672 $ 4,356,855 $ 5,404,572 $ 5,435,311 $ 4,025,597 $ 5,427,713 Adjusted Average IEAs $ 1,611,004 $ 2,185,123 $ 3,220,672 $ 4,356,855 $ 5,404,572 $ 5,435,311 $ 4,025,597 $ 5,427,713 Net Interest Income $ 52,597 $ 64,130 $ 101,302 $ 135,307 $ 45,702 $ 43,345 $ 93,954 $ 126,780 Less: Accretion Interest (330) (440) (1,902) (9,392) (5,423) (4,492) (6,396) (11,902) Adjusted Net Interest Income $ 52,267 $ 63,690 $ 99,400 $ 125,915 $ 40,279 $ 38,853 $ 87,558 $ 114,878 NIM 3.27 % 2.94 % 3.15 % 3.11 % 3.35 % 3.17 % 3.12 % 3.12 % Core NIM 3.24 % 2.91 % 3.09 % 2.89 % 2.96 % 2.84 % 2.91 % 2.83 % 1 Core NIM excludes net accretion income.

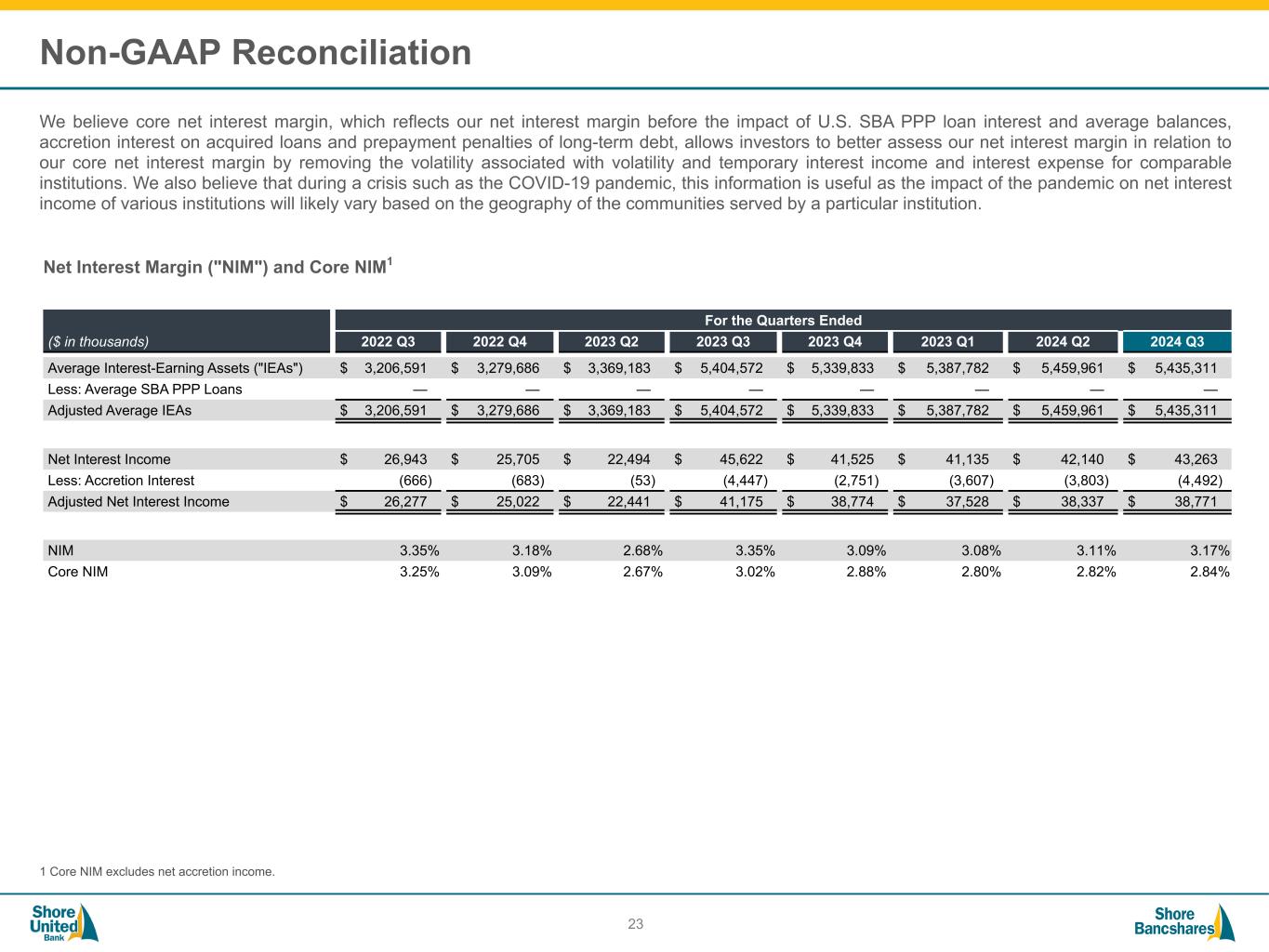

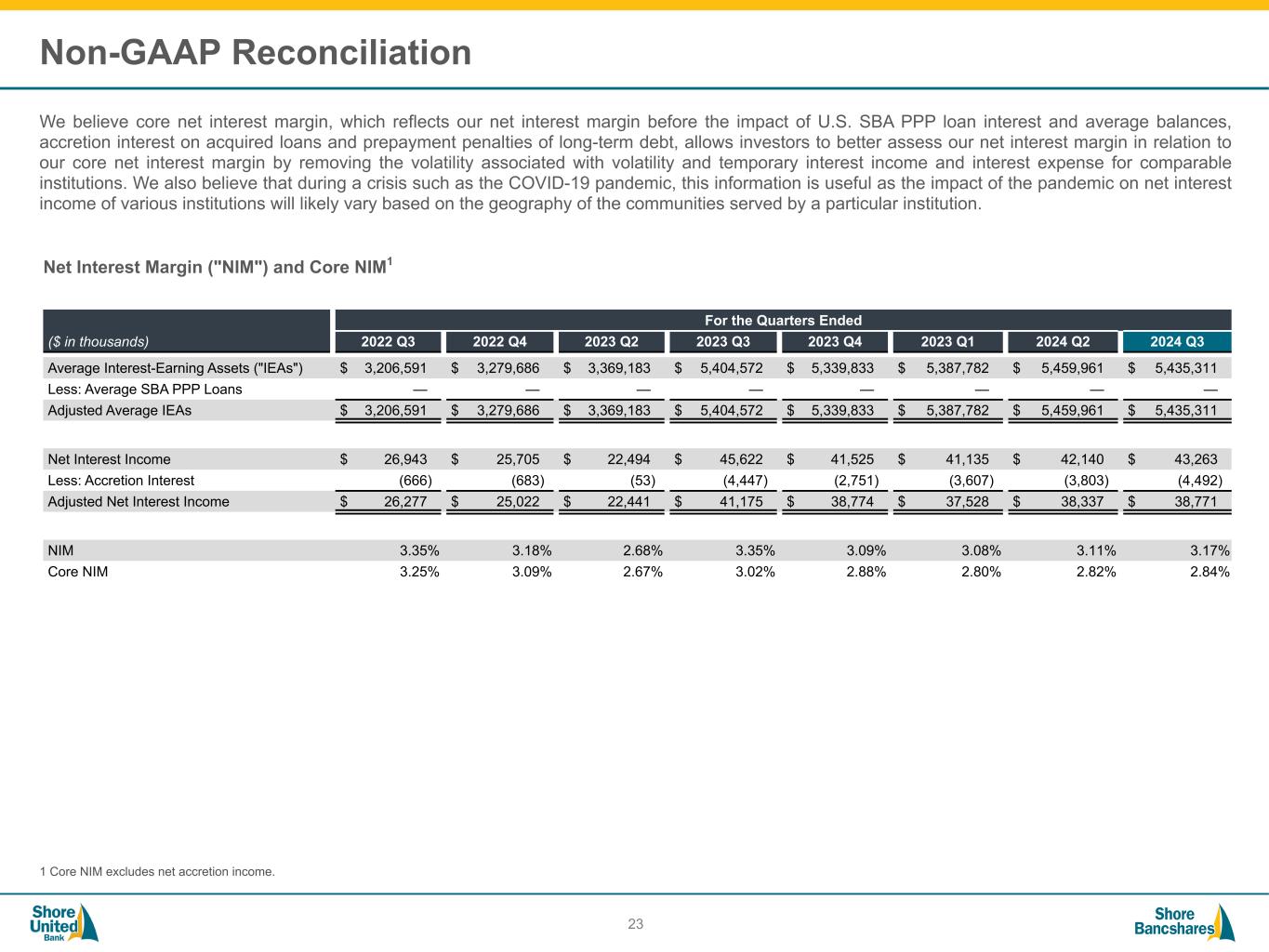

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe core net interest margin, which reflects our net interest margin before the impact of U.S. SBA PPP loan interest and average balances, accretion interest on acquired loans and prepayment penalties of long-term debt, allows investors to better assess our net interest margin in relation to our core net interest margin by removing the volatility associated with volatility and temporary interest income and interest expense for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on net interest income of various institutions will likely vary based on the geography of the communities served by a particular institution. 23 Net Interest Margin ("NIM") and Core NIM1 ($ in thousands) For the Quarters Ended 2022 Q3 2022 Q4 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 Average Interest-Earning Assets ("IEAs") $ 3,206,591 $ 3,279,686 $ 3,369,183 $ 5,404,572 $ 5,339,833 $ 5,387,782 $ 5,459,961 $ 5,435,311 Less: Average SBA PPP Loans — — — — — — — — Adjusted Average IEAs $ 3,206,591 $ 3,279,686 $ 3,369,183 $ 5,404,572 $ 5,339,833 $ 5,387,782 $ 5,459,961 $ 5,435,311 Net Interest Income $ 26,943 $ 25,705 $ 22,494 $ 45,622 $ 41,525 $ 41,135 $ 42,140 $ 43,263 Less: Accretion Interest (666) (683) (53) (4,447) (2,751) (3,607) (3,803) (4,492) Adjusted Net Interest Income $ 26,277 $ 25,022 $ 22,441 $ 41,175 $ 38,774 $ 37,528 $ 38,337 $ 38,771 NIM 3.35 % 3.18 % 2.68 % 3.35 % 3.09 % 3.08 % 3.11 % 3.17 % Core NIM 3.25 % 3.09 % 2.67 % 3.02 % 2.88 % 2.80 % 2.82 % 2.84 % 1 Core NIM excludes net accretion income.

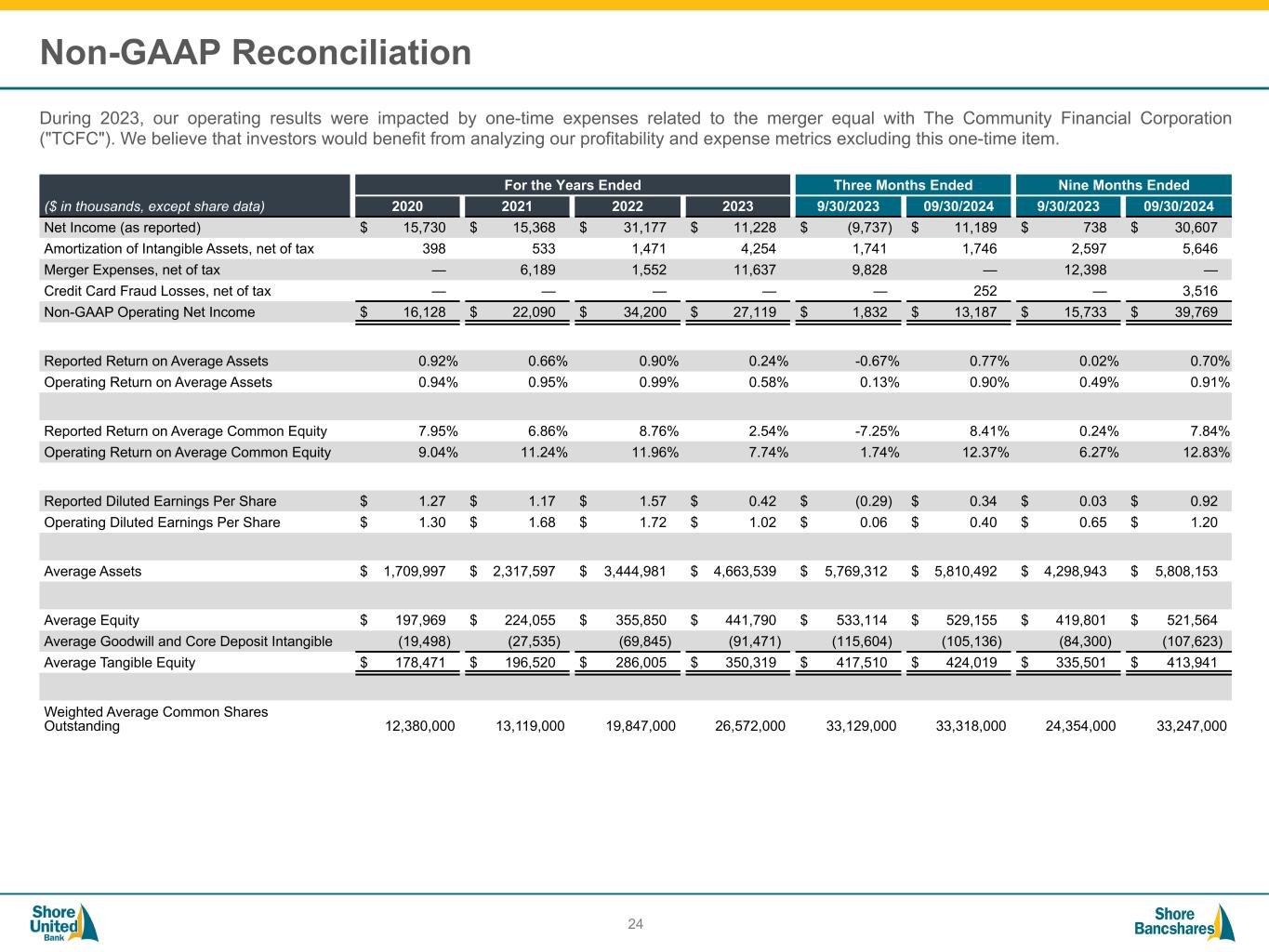

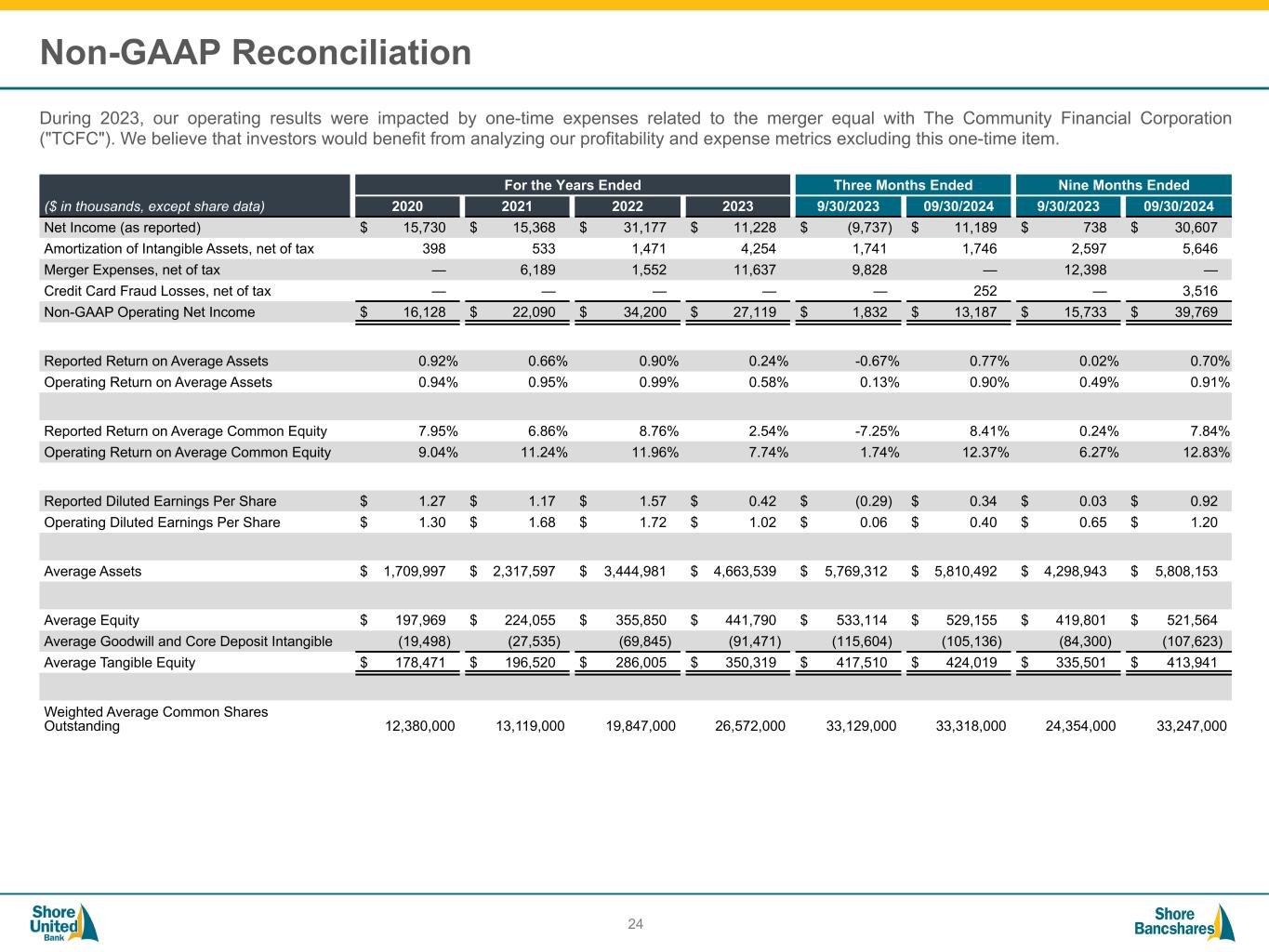

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation During 2023, our operating results were impacted by one-time expenses related to the merger equal with The Community Financial Corporation ("TCFC"). We believe that investors would benefit from analyzing our profitability and expense metrics excluding this one-time item. 24 ($ in thousands, except share data) For the Years Ended Three Months Ended Nine Months Ended 2020 2021 2022 2023 9/30/2023 09/30/2024 9/30/2023 09/30/2024 Net Income (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ (9,737) $ 11,189 $ 738 $ 30,607 Amortization of Intangible Assets, net of tax 398 533 1,471 4,254 1,741 1,746 2,597 5,646 Merger Expenses, net of tax — 6,189 1,552 11,637 9,828 — 12,398 — Credit Card Fraud Losses, net of tax — — — — — 252 — 3,516 Non-GAAP Operating Net Income $ 16,128 $ 22,090 $ 34,200 $ 27,119 $ 1,832 $ 13,187 $ 15,733 $ 39,769 Reported Return on Average Assets 0.92 % 0.66 % 0.90 % 0.24 % -0.67 % 0.77 % 0.02 % 0.70 % Operating Return on Average Assets 0.94 % 0.95 % 0.99 % 0.58 % 0.13 % 0.90 % 0.49 % 0.91 % Reported Return on Average Common Equity 7.95 % 6.86 % 8.76 % 2.54 % -7.25 % 8.41 % 0.24 % 7.84 % Operating Return on Average Common Equity 9.04 % 11.24 % 11.96 % 7.74 % 1.74 % 12.37 % 6.27 % 12.83 % Reported Diluted Earnings Per Share $ 1.27 $ 1.17 $ 1.57 $ 0.42 $ (0.29) $ 0.34 $ 0.03 $ 0.92 Operating Diluted Earnings Per Share $ 1.30 $ 1.68 $ 1.72 $ 1.02 $ 0.06 $ 0.40 $ 0.65 $ 1.20 Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 5,769,312 $ 5,810,492 $ 4,298,943 $ 5,808,153 Average Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 533,114 $ 529,155 $ 419,801 $ 521,564 Average Goodwill and Core Deposit Intangible (19,498) (27,535) (69,845) (91,471) (115,604) (105,136) (84,300) (107,623) Average Tangible Equity $ 178,471 $ 196,520 $ 286,005 $ 350,319 $ 417,510 $ 424,019 $ 335,501 $ 413,941 Weighted Average Common Shares Outstanding 12,380,000 13,119,000 19,847,000 26,572,000 33,129,000 33,318,000 24,354,000 33,247,000

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Tangible common equity (or “TCE”)” is defined as stockholders’ equity less preferred equity and intangible assets. “Tangible assets (or “TA”)” are defined as total assets less intangible assets. We believe that the TCE/TA and the Return on Average Tangible Equity (“ROATCE”) ratios are important to many investors in the marketplace who are interested in changes from period to period exclusive of changes in preferred equity and intangible assets. Our calculation of ROATCE excludes the amortization of core deposits and merger costs. 25 Common Equity to Assets and TCE to TA Return on Average Common Equity ("ROACE") and Return on Average Tangible Common Equity ("ROATCE") ($ in thousands, except share data) For the Years Ended Nine Months Ended 2020 2021 2022 2023 9/30/2023 09/30/2024 Stockholders' Equity $ 195,019 $ 350,693 $ 364,285 $ 511,135 $ 501,578 $ 533,271 Intangible Assets (19,237) (70,956) (68,813) (111,356) (113,951) (103,875) Tangible Common Equity $ 175,782 $ 279,737 $ 295,472 $ 399,779 $ 387,627 $ 429,396 Total Assets $ 1,933,315 $ 3,460,136 $ 3,477,276 $ 6,010,918 $ 5,705,372 $ 5,917,704 Intangible Assets (19,237) (70,956) (68,813) (111,356) (113,951) (103,875) Tangible Assets $ 1,914,078 $ 3,389,180 $ 3,408,463 $ 5,899,562 $ 5,591,421 $ 5,813,829 Shares Outstanding 11,783,380 19,807,533 19,864,956 33,161,532 33,136,182 33,326,772 Common Equity to Assets 10.09 % 10.14 % 10.48 % 8.50 % 8.79 % 9.01 % Tangible Common Equity/Tangible Assets 9.18 % 8.25 % 8.67 % 6.78 % 6.93 % 7.39 % ($ in thousands, except share data) For the Years Ended Three Months Ended Nine Months Ended 2020 2021 2022 2023 9/30/2023 09/30/2024 9/30/2023 09/30/2024 Net Income (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ (9,737) $ 11,189 $ 738 $ 30,607 Amortization of Intangible Assets, net of tax 398 548 1,471 4,254 1,741 1,746 2,597 5,646 Merger Expenses, net of tax — 6,363 1,552 11,637 9,828 — 12,398 — Credit Card Fraud Losses, net of tax — — — — — 252 — 3,516 Non-GAAP Operating Net Income $ 16,128 $ 22,279 $ 34,200 $ 27,119 $ 1,832 $ 13,187 $ 15,733 $ 39,769 ROACE 7.95 % 6.86 % 8.76 % 2.54 % -7.25 % 8.41 % 0.24 % 7.84 % ROATCE 9.04 % 11.34 % 11.96 % 7.74 % 1.74 % 12.37 % 6.27 % 12.83 % Average Common Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 533,114 $ 529,155 $ 419,801 $ 521,564 Average Tangible Common Equity $ 178,474 $ 196,520 $ 286,005 $ 350,319 $ 417,510 $ 424,019 $ 335,501 $ 413,941

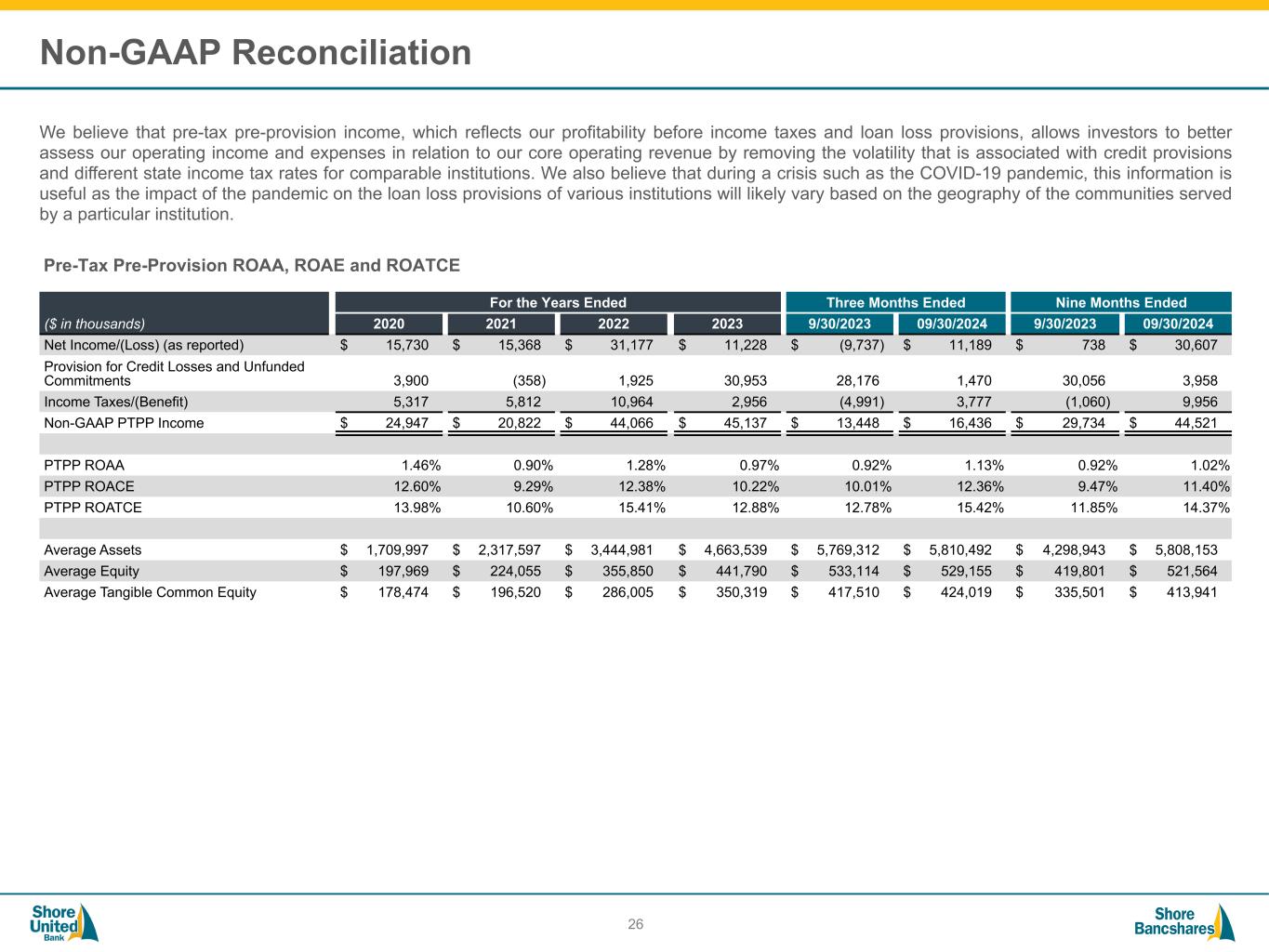

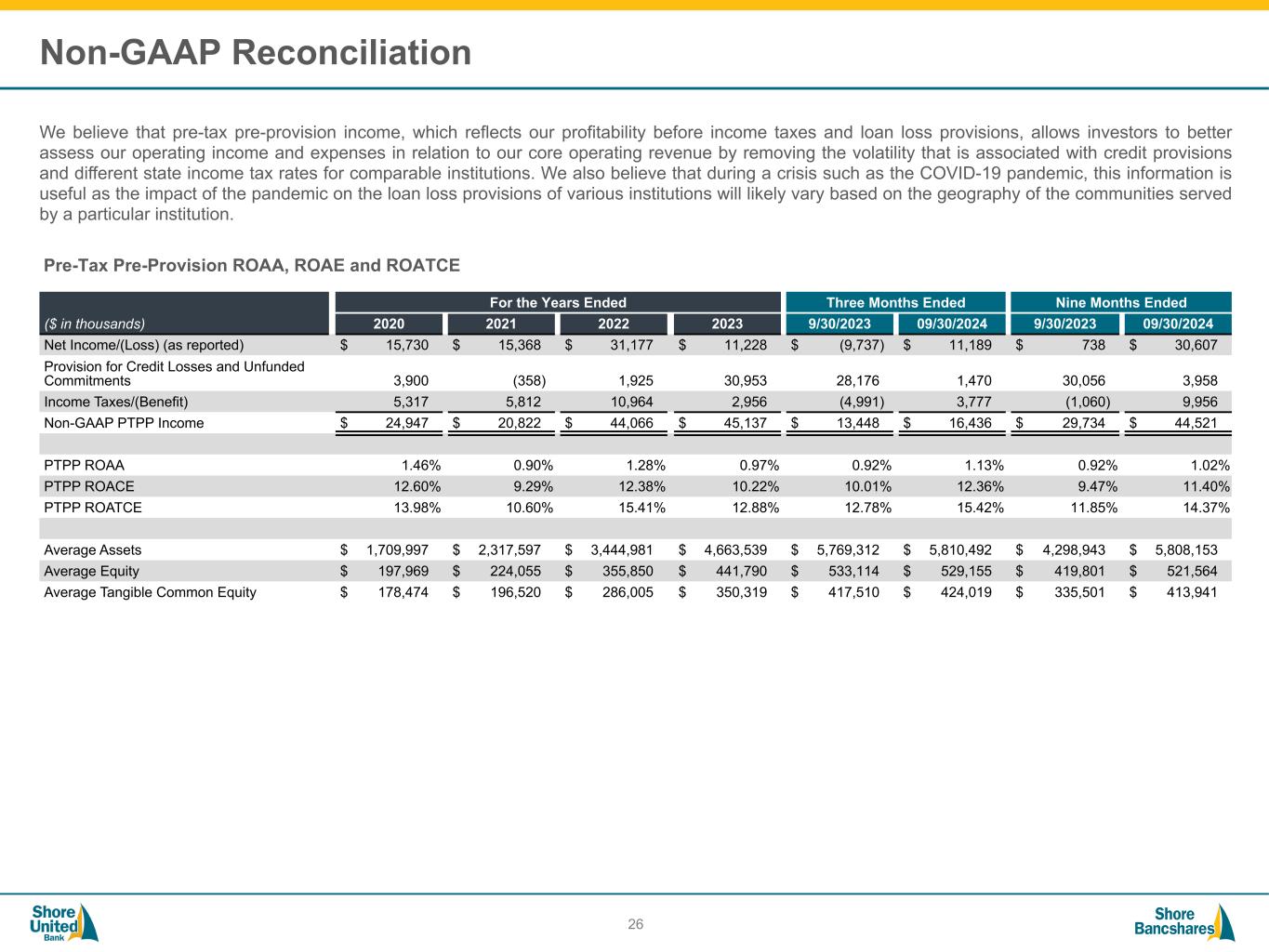

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe that pre-tax pre-provision income, which reflects our profitability before income taxes and loan loss provisions, allows investors to better assess our operating income and expenses in relation to our core operating revenue by removing the volatility that is associated with credit provisions and different state income tax rates for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on the loan loss provisions of various institutions will likely vary based on the geography of the communities served by a particular institution. 26 Pre-Tax Pre-Provision ROAA, ROAE and ROATCE ($ in thousands) For the Years Ended Three Months Ended Nine Months Ended 2020 2021 2022 2023 9/30/2023 09/30/2024 9/30/2023 09/30/2024 Net Income/(Loss) (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ (9,737) $ 11,189 $ 738 $ 30,607 Provision for Credit Losses and Unfunded Commitments 3,900 (358) 1,925 30,953 28,176 1,470 30,056 3,958 Income Taxes/(Benefit) 5,317 5,812 10,964 2,956 (4,991) 3,777 (1,060) 9,956 Non-GAAP PTPP Income $ 24,947 $ 20,822 $ 44,066 $ 45,137 $ 13,448 $ 16,436 $ 29,734 $ 44,521 PTPP ROAA 1.46 % 0.90 % 1.28 % 0.97 % 0.92 % 1.13 % 0.92 % 1.02 % PTPP ROACE 12.60 % 9.29 % 12.38 % 10.22 % 10.01 % 12.36 % 9.47 % 11.40 % PTPP ROATCE 13.98 % 10.60 % 15.41 % 12.88 % 12.78 % 15.42 % 11.85 % 14.37 % Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 5,769,312 $ 5,810,492 $ 4,298,943 $ 5,808,153 Average Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 533,114 $ 529,155 $ 419,801 $ 521,564 Average Tangible Common Equity $ 178,474 $ 196,520 $ 286,005 $ 350,319 $ 417,510 $ 424,019 $ 335,501 $ 413,941

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Investor Presentation Third Quarter 2024 NASDAQ: SHBI Parent of: Shore Bancshares, Inc. is the largest independent financial holding company headquartered on the Eastern Shore of Maryland. It is the parent company of Shore United Bank, N.A. The Bank operates 30 full-service branches in Baltimore County, Howard County, Kent County, Queen Anne’s County, Caroline County, Talbot County, Dorchester County, Anne Arundel County and Worcester County in Maryland, Kent County and Sussex County in Delaware and in Accomack County, Virginia. The Company engages in trust and wealth management services through Wye Financial Partners, a division of Shore United Bank, N.A. The Company also engages in title work for real estate transactions through Mid-Maryland Title Company, Inc. (“Title Company”). As a result of the acquisition of TCFC, which was effective July 1, 2023, the Bank now operates 40 full-service branches in the above locations as well as Calvert County, St Mary’s County, and Charles County in Maryland and Fredericksburg City and Spotsylvania County in Virginia. © 2024 Shore Bancshares, Inc.