INDUSTRIAL MINERALS INC

346 WAVERLEY ST

OTTAWA ONTARIO, CANADA

K2P 0W5

Tel: 604-970-0901

e-mail: robertdinning@gmail.com

September 22, 2008

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington D.C. 20549 - 7010

Attention Mark A. Wojciechowski

Staff Accountant

We will respond to your correspondence dated July 21, 2008 in point form as outlined in your memo to Industrial Minerals Inc.

| 1. | The exploration expenses amounted to $418,599. This will be corrected. |

| 2. | Our intent here was to indicate that work on the property was accelerated during 2007 because of the implementation of a drilling, additional staking, and general engineering work done on the graphite property in conjunction with the preparation of a technical report referred to as a 43101. This report was completed and released in late December 2007 and is public information. Our purpose was to advise the public that with the additional drilling etc, we have advanced the specific knowledge of the graphite deposit. |

| 3. | Correct. We omitted the other long term liabilities. This will be added to the table under Contractual Obligations And Other Long-Term Liabilities. This will include the items Asset retirement obligations of $230,000 (07), Accrued interest payable 13,282 (06), and Loans payable of 567,607 (07) and 599,495 (06). |

| 4. | We will include the following: |

| | Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, conducted an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Annual Report (December 31, 2007 ), as defined in Rule 13a-15(e) promulgated under the Securities and Exchange Act of 1934, as amended. Our disclosure controls and procedures are intended to ensure that the information we are required to disclose in the reports that we file or submit under the Securities Exchange Act of 1934 is (i) recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and (ii) accumulated and communicated to our management, including the Chief Executive Officer and Chief Financial Officer, as the principal executive and financial Officers, respectively, to allow timely decisions regarding required disclosure. |

| | Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of the end of the period covered by this Annual Report, our disclosure controls and procedures were effective. |

| | Our management has concluded that the financial statements included in this Form 10-K present fairly, in all material respects our financial position, results of operations and cash flows for the periods presented in conformity with generally accepted accounting principles. |

| | It should be noted that any system of controls, however well designed and operated, can provide only reasonable, and not absolute, assurance that the objectives of the system will be met. In addition, the design of any control system is based in part upon certain assumptions about the likelihood of future events. |

| | Management’s Annual Report on Internal Control over Financial Reporting |

| | Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Exchange Rule 13a-15(f). Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles. |

| | Under supervision and with the participation of our management, including the Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework established by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) as set forth in Internal Control – Integrated Framework. Based on our evaluation under the framework in Internal Control – Integrated Framework, our management concluded that our internal control over financial reporting was effective as of December 31, 2007. |

| | This Annual Report does not include an audit or attestation report of our registered public accounting firm regarding our internal control over financial reporting. Our management’s report was not subject to an audit or attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management’s report in this Annual Report. |

| | Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Also, projections of any evaluation of effectiveness to future periods are subject to risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. |

| 5. | We will remove the line item “Stock Compensation Expense” and include in general and administrative expense. |

| 6. | This recording was in error. The December 31, 2007 figure was correct but there was none in 2006. This will be corrected. |

| 7. | They were not meant to be blank. Item $446,853 will be inserted in proper column. |

| 8. | Regarding the Statement of Stockholders’ Equity we advise as follows: |

| | — | The number of shares issued have been restated back to inception to reflect the splits that have occurred over the years. |

| | — | Our auditors advised us to review SFAS 154 and based on the restated shares issued to reflect the forward and reverse splits, we feel we have adhered to this policy. |

| | — | The Company prepared the Stockholders’ Equity Schedule and consulted with its auditors to ensure that the calculations were correct. The auditors advised us that in their view it was prepared correctly. |

| | — | Our independent public auditor did complete an audit of the calculation of shares issued on the Stockholders’ Equity statement and they concurred with our calculation. |

| 9. | We acknowledge that the March 31, 2008 quarterly filings were not competed on the proper Form – 10Q. Unfortunately we did not receive this comment letter before the June 30, 2008 quarterly was filed. We will ensure that the September 30, 2008 filing is completed on the proper form. |

| 10. | “Income earned during exploration stage” is the line item that will be referred to in the future and this line will be shown in “Other Income” on the Operating Statement. |

| 11. | The Company confirms that it did adopt the provisions of SFAS 123(R) beginning with the first annual reporting period beginning after December 31, 2005. |

| 12. | The March 31, 2008 Form 10Q under Controls and Procedures should reflect the following statement: |

| | “There have been no changes in internal control over financial reporting.” “It is confirmed that the word “material” and “materially” is to be removed. |

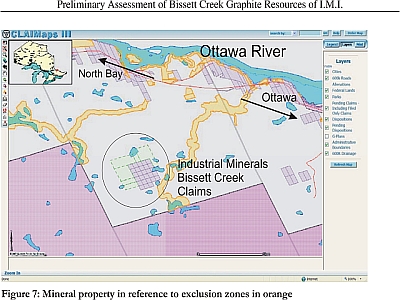

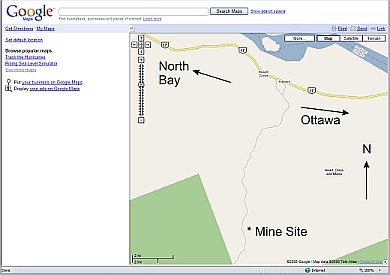

| 13. | The Company is an exploration stage mining company that holds exclusive rights to explore and, if feasible, develop graphite mineral claims at a site located in the Maria Township in Southern Ontario, approximately 180 miles north-northeast of Toronto, Ontario. We refer to our claims in this prospectus as the “Bissett Property” because of their proximity to the town of Bissett Creek. The rights in the Bissett Property are held through our wholly-owned subsidiary Industrial Minerals Canada Inc., an Ontario corporation through which we conduct our operations. |

| | Transportation into and around the property is by four wheel vehicle and the road off of Hwy 17 is hard gravel and extends about 6 miles to the claims owned by the Company. On January 31, 2002, the Company acquired its interest in the Bissett Property pursuant to an assignment of the Bissett Lease from Westland Capital Inc. |

| | The site is also close enough to all major highways, rail and power lines to permit the substantial infrastructure that will be required for a large scale open pit mining operation, if feasible. The core claims are not subject to any alienation for parks or special management zones according to information from the Ministry on Northern Development and Mines. The area comes under the administration of the Southern Ontario Mining District, and does not include any rural cottage properties. |

| | Our rights in the Bissett Creek Property are based upon a Lease granted by the Province of Ontario on September 22, 1993 to Consolidated North Coast Industries Ltd. (“North Coast”). We refer to this as the “Bissett Creek Lease.” The Bissett Creek Lease has a twenty-one year term and an annual rental payment payable to Ministry of Northern Development and Mines in an amount prescribed by the Mining Act. Under the terms of the Bissett Creek Lease, the tenant is obligated to pay all taxes on the Bissett Property and remain in compliance with the Mining Act, the Mining Tax Act, the Forest Fires Prevention Act, the Ontario Water Resources Act and any amendments to the foregoing legislation. |

| | On December 29, 1997, North Coast amalgamated with Pacific Sentinal Gold Gold Corp. and the surviving corporation changed its name to Great Basin Gold Ltd. (“Great Basin”). On December 21, 2001, Great Basin assigned its rights in the Bissett Creek Lease to Paul C. McLean, Pierre G. Lacombe and Frank P. Tagliamonte (collectively referred to as the “McLean Group”). In connection with that assignment, the McLean Group entered into an option agreement with Great Basin that was subsequently terminated by a court order on May 15, 2001. The court order granted to the McLean Group all of the rights of Great Basin in the Bissett Creek Lease. |

| | The McLean Group assigned the Bissett Creek Lease to Westland Capital Inc. (“Westland”) in January of 2002. In connection with that assignment, Westland entered into an option agreement with the McLean Group (the “Option Agreement”) pursuant to which, among other things, Westland agreed to pay to the McLean Group an advance royalty payment of CDN$27,000 annually in two equal installments of CDN$13,500. The Option Agreement further provides that in the event that graphite carbon concentrate is produced at the Bissett Property, a royalty CDN$20.00 per ton must be paid to the McLean Group. Further, pursuant to the Option Agreement a 2.5% net smelter return royalty is payable to the McLean Group in the event that any other minerals are derived from the Bissett Property. |

| | Westland assigned the Bissett Creek Lease to the Company as of January 31, 2002. As a condition of the assignment the Company assumed all of Westland’s obligations under the Option Agreement. On August 15, 2003, the Company assigned its rights in the Bissett Creek Lease to its wholly owned subsidiary, Industrial Minerals Canada Inc. As of the date of this prospectus, the Bissett Creek Lease is in full force and effect and all payments owed to Westland in connection with the Option Agreement are current. The remaining term of the Bissett Creek Lease is approximately 7 years. |

| | The property is predominantly underlain by Middle Precambrian age meta-sedimentary rocks. These are divided into graphite gneiss, transitional graphitic gneiss, and barren gneiss for mapping purposes.The graphitic gneiss is a distinctive recessive weathering unit, commonly exposed along rock cuts, hill tops and occasional cliff faces. It is calcareous, biotite-amphibole-quartzofelspathic gneiss (generally red-brown to pale yellow-brown weathering). Graphite, pyrite and pyrrhotite occur throughout. Graphite occurs in concentrations visually estimated to be from 1 to 10 % C. Sulphides occur in concentrations from 1 to 5 %. In its unweathered state, the rock unit is pale to medium grey in color. |

| | This graphite gneiss has a moderate 5 to 20 degree dips to the east and the high grade layer dips 20 to 30 degrees south of the property. This unit is sandwiched between the upper barren noncalcareous gneiss, which forms the hanging wall of the deposit and similar lower barren gneiss which forms the footwall. A total thickness of 75 m of graphitic gneiss was intersected by drilling. The barren gneiss is a pale to dark grey-green non-calcareous unit. Black biotite, dark green amphiboles and red garnets distinguish the units from the graphite bearing varieties. |

| | Industrial Minerals Inc — exploration, phase 1 and independent validation drilling |

| | The Company signed a contract with Geostat International Inc (“Geostat”) on May 22, 2007 regarding the preparation of a technical report on the Bissett Property in compliance with the requirements of Canadian National Instrument 43-101. The Geostat work program included a site visit, an independent certification of resources, an estimation of resources and classification of resources, certification and validation of the database, verification and validation of the interpretation of ore zones, and an assessment of the mill and processing procedures, the market, the capital expenditures for the project and related operating costs. The process included the drilling of an additional 6 holes for just under 300 meters in order to assist in verification of previously obtained data. The specific drill targets were determined by Geostat following their review of the original drill target data prepared by Kilborn Engineering. In the summer of 2007, following Geostat’s recommendation, IMI undertook an independent validation drilling program. The program permitted the development of independent assay results and has also provided material to carry out metallurgical testing and validation. Six (6) vertical NQ size diamond drill holes were drilled in the eastern part of the deposit for a total of 246.43 meters (808.5 ft) around the location of Pit # 1. The last drill hole (DDH-07-06) was drilled in an area of the property previously named “Pencil zone”. Drilling was done by George Downing Estate Drilling Ltd., from August 1 to August 9, 2007. |

| | Moreover the phase 1, independent drilling campaign, was done and supervised by Geostat’s personnel from the beginning to the end. |

| | The Property consists of a building and several pieces of equipment. Additional equipment will be acquired once the final mine plan is completed. |

| | The power on site is by generator only and there is ample water on the property. |

| | To December 31, 2007, the Company had incurred general exploration costs on the Bissett Creek claims of $418,599. |

| 15. | The Bissett Creek Lease |

| | The Company’s rights in the Bissett Creek Property are based upon a Lease granted by the Province of Ontario on September 22, 1993 to Consolidated North Coast Industries Ltd. (“North Coast”). We refer to this as the “Bissett Creek Lease.” The Bissett Creek Lease has a twenty-one year term and an annual rental payment payable to Ministry of Northern Development and Mines in an amount prescribed by the Mining Act. Under the terms of the Bissett Creek Lease, the tenant is obligated to pay all taxes on the Bissett Property and remain in compliance with the Mining Act, the Mining Tax Act, the Forest Fires Prevention Act, the Ontario Water Resources Act and any amendments to the foregoing legislation. |

| | On December 29, 1997, North Coast amalgamated with Pacific Sentinal Gold Gold Corp. and the surviving corporation changed its name to Great Basin Gold Ltd. (“Great Basin”). On December 21, 2001, Great Basin assigned its rights in the Bissett Creek Lease to Paul C. McLean, Pierre G. Lacombe and Frank P. Tagliamonte (collectively referred to as the “McLean Group”). In connection with that assignment, the McLean Group entered into an option agreement with Great Basin that was subsequently terminated by a court order on May 15, 2001. The court order granted to the McLean Group all of the rights of Great Basin in the Bissett Creek Lease. |

| | The McLean Group assigned the Bissett Creek Lease to Westland Capital Inc. (“Westland”) in January of 2002. In connection with that assignment, Westland entered into an option agreement with the McLean Group (the “Option Agreement”) pursuant to which, among other things, Westland agreed to pay to the McLean Group an advance royalty payment of CDN$27,000 annually in two equal installments of CDN$13,500. The Option Agreement further provides that in the event that graphite carbon concentrate is produced at the Bissett Property, a royalty CDN$20.00 per ton must be paid to the McLean Group. Further, pursuant to the Option Agreement a 2.5% net smelter return royalty is payable to the McLean Group in the event that any other minerals are derived from the Bissett Property. |

| | Westland assigned the Bissett Creek Lease to the Company as of January 31, 2002. As a condition of the assignment the Company assumed all of Westland’s obligations under the Option Agreement. On August 15, 2003, the Company assigned its rights in the Bissett Creek Lease to its wholly owned subsidiary, Industrial Minerals Canada Inc. As of the date of this prospectus, the Bissett Creek Lease is in full force and effect and all payments owed to Westland in connection with the Option Agreement are current. The remaining term of the Bissett Creek Lease is approximately 7 years. |

| | During the summer of 2007 six (6) diamond drill holes were carried out for a total of 246.43 meters (808.5 ft). The drilling was carried out by George Downing Estate Drilling Ltd from August 1, 2007 to August 9, 2007. The consulting engineers on site, Geostat International Inc, supervised the six hole diamond drill program to verify the model and interpretation of the deposit. Geostat photographed in detail the core boxes before the splitting of the core. The core samples were sent to the ORTECH Laboratory in Ontario for preparation and sieve analysis. ACTLABS Laboratory also in Ontario did the carbon assays on all the samples. The rejects were kept by the laboratories for validation purposes. |

| | This drilling program confirmed data previously obtained from former operators of the project. The Company intends to continue with additional drilling once financing is secured with the intention of confirming and possibly enhancing the grade of the graphite. This program is budgeted for $800,000 of which $250,000 will be spent in the coming year. |

| | It is estimated that additional geophysics, geochemistry, and surface sampling will cost about $100,000 while the next phase of drilling is budgeted at $150,000. |

| | The next phase – to occur over a 12 to 18 month period, will cover the balance of the budget and be under the supervision of a qualified geologist and drilling company. |

| | The Company intends to complete a private placement to fund the foregoing program. There is no assurance that said funding will be available. |

| 17. | All core derived from the drilling program was split. The carbon content determination was done using two methods, the double loss of ignition, (double LOI) and by LECO. The double LOI method, being the accepted industry standard, is the method used in the ore reserve analysis. The majority of samples were prepared and analyzed at a site facility with regular checks being conducted at SGS Lakefield Research in Lakefield, Ontario, and KHD’s facilities in West Germany. |

| | The possibility of tampering is almost nil since the core was split bagged and sealed. The sample bags were under control of Geostat staff until being shipped to the laboratory for preparation and analysis. |

| | Worldwide production of natural graphite now exceeds 1 million tonnes/year with China accounting for approximately 70% followed by India, Brazil, Canada, North Korea, the Czech Republic, Mexico, and Turkey. This production is as flake and amorphous grades each serving specific and often separate markets. Flake graphite is the most versatile form. Given the relatively limited geographic distribution of graphite production and the common practice of blending grades from multiple locations, most of the major graphite producers are exporters. The leading exporters are China, Canada, Brazil, Zimbabwe, and Madagascar and the leading importers are South Korea, the United States, Germany, Malaysia, and the UK. |

| | Refractories used in iron and steel manufacture have been a traditional market for natural graphite. Worldwide steel production has increased by about 450 million tonnes since 2000 exceeding 1 billion tonnes each year since 2004 with an average annual growth rate (AARG) of 9%. Output in 2007 reached 1.3 billion tonnes (5 — 6% up on 2006) and the prospects are good for continued growth at similar rates. |

| | The increased use of graphite in friction materials and packings and gaskets was driven initially by asbestos-related legislation combined with increased vehicle production. Asbestos replacement continues in developing countries and the overall increase in vehicle production should further boost graphite demand in this sector. |

| | The increased popularity of batteries for portable electronics and the changeover to alkaline and more recently Li-ion batteries has boosted natural and synthetic graphite demand. Various treatment techniques have encouraged a gradual move towards natural graphite. |

| | A large-flake graphite feed may be treated to yield expanded graphite or graphite foil used in a variety of high-tech applications such as a heat sink for high-tech computer and communication products. |

| | A summary of demand for flake graphite is outlined in the table below. |

| | Refractories — Considerable growth in Asia (particularly China) and Latin America in line with steel production using the OBC process (85%of China’s output); |

| | Batteries — Increased demand in the current version of alkaline batteries including increased use of purified natural and expanded graphite as alternatives to synthetic graphite. Similarly, increased use in the popular Li-ion battery for electronics and tremendous potential for future growth in Li-ion batteries for vehicles where they reduce HEV battery cost and increase performance. Actual demand depends on the adoption in vehicles after 2010. |

| | Fuel cells — Tremendous potential for increased graphite consumption but with a 10 —15 year time horizon and requiring considerable R&D. |

| | Friction materials — Increased use in brake lining, gaskets etc. replacing asbestos. Main growth driven by vehicle and auto parts production which will be concentrated in Asia/Latin America. |

| | Lubricants — Declining in certain areas due to changing technology and lubricant needs. |

| | Foundries — Declining use as facing and coating agents as natural graphite is challenged by synthetic graphite and other carbon products. |

| | Powder metals — Growing use of natural graphite. |

| | Treated graphite — Expanding from a small base, but critical for the success of many new applications such as heat sinks in computers. |

| | Exports of graphite from China have decreased in recent years due to the need to service the growing domestic market and government discouragement of exports through decreased subsidies and increased taxes. At the same time, high grading has reduced the availability of certain grades and increased production costs which, combined with record high freight rates, has rendered Chinese graphite less competitive. |

| | At the same time, demand for high-quality flake graphite has increased significantly in refractories and friction products and this is expected to continue in parallel with increased production of crude steel and automobiles. |

| | The increased popularity of batteries for electronics has provided a significant boost to the flake graphite market and is expected to increase by 50% or even double over the next 5 – 10 years as natural replaces synthetic graphite, lithium replaces alkaline batteries, and more products become portable. |

| | Starting in 2010, it is likely that Li-ion batteries will be used in vehicles. The high price of |

| | petroleum, the emphasis on the environment, and the battery research by the major automakers will boost the production of electric and/or hybrid vehicles and the technical advantages of lithium should displace the current NiMH batteries. After this, possibly in the 2017 — 2020 period, the development of fuel cells may be the next boost for graphite demand. |

| | Overall, the combination of reduced supply and growing demand has tightened the supply/demand balance which, combined with rising commodity prices in general, has forced graphite prices upwards. Increased demand in the future will require additional sources in order to redress the balance and an emphasis on treated grades for high-purity applications (such as batteries) commanding a significant premium over traditional application prices. |

| | The opportunity to develop new supply sources of natural graphite – particularly large flake, high-carbon grades – is the opposite of the 1980s when China was flooding an oversupplied market and driving out the competition. Many large consumers are requesting non-Chinese sources due to the lengthy supply line, tax increases, and the increased attention of large multinational corporations to its vendor’s social responsibilities. |

| | Graphite prices are far from transparent being based on negotiations between the buyer and seller. Prices are complex depending on carbon content, flake size, size distribution, and ash content. As a general rule, larger flake sizes sell at a premium price, prices increase with carbon content and particle size so that the combination of large flake size, high carbon content, and large particle size generates the highest price. |

| | Following a period of flat to declining prices throughout most of the 1980s and 1990s, recent prices have seen a sharp rise. The expectation is that as supply remains tight and demand increases, prices should continue to increase at an AAGR of 5 — 10%. |

| |

|---|

| Very truly yours,

INDUSTRIAL MINERALS, INC.

By:/s/ Robert Dinning

Robert Dinning

Chief Financial Officer |