NYSE:ARE Investor Day | November 30, 2016 | New York City 2017 and Beyond: Continuing Demand and Growth Unique Collaborative Science & Technology Campuses in Urban Innovation Clusters

2ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Safe Harbor This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our 2016 and 2017 earnings per share attributable to Alexandria’s common stockholders – diluted, 2016 and 2017 funds from operations per share attributable to Alexandria’s common stockholders – diluted, net operating income, and our projected sources and uses of capital. You can identify the forward-looking statements by their use of forward-looking words, such as “forecast,” “guidance,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” or “will,” or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, general and local economic conditions, a favorable capital market environment, leasing activity, lease renewals, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). Accordingly, you are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are made as of the date of this presentation, and unless otherwise stated, we assume no obligation to update this information and expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

4ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria Investor Day | November 2016: Presenters Steve Richardson Joel Marcus Chairman, Chief Executive Officer & Founder Dean Shigenaga Executive Vice President, Chief Financial Officer & Treasurer Monica Beam, PhD Senior Principal – Science & Technology Steve Richardson Chief Operating Officer & Regional Market Director – San Francisco Peter Moglia Chief Investment Officer Tom Andrews Executive Vice President, Regional Market Director – Greater Boston Dan Ryan Executive Vice President, Regional Market Director – San Diego & Strategic Operations Hart Cole Vice President – Strategic OperationsTom Andrews Dan Ryan Joel Marcus Peter Moglia Hart Cole Dean Shigenaga Monica Beam, PhD

5ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. For the three months ended September 30, 2016. Best-in-Class, Unique Office REIT of ARE’s Annual Rental Revenue1 is from Investment-Grade Tenants54% 78% of ARE’s Annual Rental Revenue1is from Top 20 Tenants from Investment-Grade Entities Unique Collaborative Science and Technology Campuses in Key Urban Innovation Clusters Class A Properties in AAA Locations Investment-Grade REIT with Significant Liquidity $1.9 billion in liquidity1; 87% Unencumbered Net Operating Income2 Moody’s: Baa2 / Stable; Standard & Poor’s: BBB- / Positive Internal Growth – Same Property Net Operating Income Growth Favorable triple net lease structure with annual rent escalations Strong demand from innovative entities Limited supply of Class A space Significant rental rate growth on leasing activity and early renewals External Growth – New Class A Properties through Development/Redevelopment Visible, multiyear, highly leased value-creation pipeline with deliveries in 2016-2019 expected to generate incremental annual net operating income in a range from $203 million to $227 million, including YTD 3Q16 deliveries; will increase net operating income by 37% over 2015 Disciplined Allocation of Capital and Management of Balance Sheet Unique Underwriting Expertise and Experience Enable Alexandria to prudently underwrite tenants and strategically capitalize on industry trends High-Quality Growth in Cash Flows, Funds from Operations Per Share, and Net Asset Value Per Share and Increasing Common Stock Dividends 77% of ARE’s Annual Rental Revenue1 is from Class A Properties in AAA Locations

6ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Key Takeaways: Alexandria Investor Day November 2016 Alexandria is the only publicly traded pure-play laboratory/office REIT Alexandria is a safe, long-term investment Alexandria’s tenant quality and health continue to remain strong Alexandria continues to benefit from strong market fundamentals, and internal and external growth Alexandria is committed to a strong and flexible balance sheet Alexandria expects strong 2017 growth Every detail on Alexandria’s urban innovation campuses is intentionally designed to foster innovation, drive productivity, and enhance collaboration – that’s what we at Alexandria care about, that’s what is in our DNA. Joel Marcus Chairman, Chief Executive Officer & Founder

7ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Table of Contents 2016: Alexandria’s Performance Scorecard 2017: Alexandria’s Investment Thesis Market Fundamentals and Tenant Demand for Alexandria’s Campuses and Class A Properties Institutional Investor Demand for Life Science Real Estate Internal Growth: Strong Same Property Net Operating Income Growth External Growth: Strong and Highly Leased New Class A Properties Future Pipeline of New Class A Properties: 2018-2021 Balance Sheet 2017 Guidance Appendix 8 24 29 77 85 96 122 134 147 158

8ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 2016: Alexandria’s Performance Scorecard

9ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Disciplined Allocation of Capital✓ ✓ Solid Internal Growth ✓ Solid External Growth ✓ Disciplined Management of Balance Sheet Alexandria’s 2016 Scorecard ✓ Solid Per Share Growth in Net Asset Value, Funds from Operations, and Common Stock Dividends

10ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ✓ 1. See detailed reconciliation in Appendix. Alexandria’s Per Share Results: 2016 vs. 2013 $(1.54) to $(1.52) $5.50 to $5.52 2016P120131 $1.60 $4.40 Net income (loss) per share Funds from operations per share, as adjusted +25% Growth in Funds from Operations Per Share, as Adjusted ATTRIBUTABLE TO ALEXANDRIA’S COMMON STOCKHOLDERS – DILUTED

11ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents December 2013 average net asset value estimates from Bank of America Merrill Lynch, Barclays Capital Inc., Citigroup Global Markets Inc., Evercore ISI, Green Street Advisors, Inc., J.P. Morgan Securities LLC, and UBS Securities LLC. 2016 net asset value represents November 2016 consensus from S&P Global Market Intelligence. 2. 2016 projected funds from operations per share, as adjusted, represents the midpoint of our guidance range provided on October 31, 2016. 3. 2016 common stock dividend per share represents the nine months ended September 30, 2016 annualized. Alexandria’s Solid Per Share Growth $70 $113 2013 2016 Consensus Net Asset Value1 $2.61 $3.20 2013 2016 Common Stock Dividend3 $4.40 $5.51 2013 2016 Funds from Operations2 +23%+25%+61%

12ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents the change in average net asset values reported by Bank of America Merrill Lynch, Barclays Capital Inc., Citigroup Global Markets Inc., Evercore ISI, Green Street Advisors, Inc., J.P. Morgan Securities LLC, and UBS Securities LLC in December 2013 and consensus net asset values in November 2016 from S&P Global Market Intelligence. 2. Represents the change in funds from operations per share for the year ended December 31, 2013 compared to the year ended December 31, 2016. Source: SEC filing (2013) and Bloomberg (consensus 2016). 3. Represents the change in common stock dividends per share declared for the year ended December 31, 2013 compared to the nine months ended September 30, 2016 annualized. Source: SEC filings and S&P Global Market Intelligence. 4. Excludes special dividends. Alexandria’s Strong Three-Year Per Share Growth 57% 30% 25% 22% 21% 20% 16% -21% SLG KRC ARE BXP DEI DLR HIW HCP Funds from Operations Growth2 Common Stock Dividend Growth3 93% 23% 19% 13% 10% 5% 0% 0% SLG ARE DEI DLR HCP KRC BXP HIW Net Asset Value Growth1 73% 61% 55% 50% 37% 33% 30% -5% DLR ARE DEI KRC SLG HIW BXP HCP 4 A AR AR

13ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents period from December 31, 2013 through October 31, 2016. Total stockholder return assumes reinvestment of dividends. 2. Data from S&P Global Market Intelligence. Alexandria’s Three-Year Total Shareholder Return1 Companies2 Indices2 118% 86% 69% 53% 52% 33% 13% 10% Digital Realty Trust, Inc. Alexandria Real Estate Equities, Inc. Douglas Emmett, Inc. Highwoods Properties, Inc. Kilroy Realty Corporation Boston Properties, Inc. SL Green Realty Corp. HCP, Inc. 86% 35% 32% 22% 6% Alexandria Real Estate Equities, Inc. FTSE NAREIT Equity Office Index SNL US REIT Office Index S&P 500 Equity Index Russell 2000 Index

14ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 EXTERNALINTERNAL New Class A properties through developments and redevelopments Same property net operating income and rental rate growth GROWTH GROWTH

15ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Initial 2016 Guidance provided at Investor Day on December 2, 2015. 2016: Alexandria’s Unique Business Strategy Driving Solid Internal Growth 2016 Guidance Range1 Rental Rate Growth 14.0%–17.0% 28.4% Rental Rate Growth (Cash Basis) 6.0%–9.0% 13.2% YTD September 30, 2016 Same Property Net Operating Income Growth 2.0%–4.0% 5.0% Same Property Net Operating Income Growth (Cash Basis) 3.5%–5.5% 6.1% Occupancy—North America 96.5%–97.1% 97.1% Solid Internal Growth is on Track to Exceed/Meet Initial Guidance✓

16ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 For the nine months ended September 30, 2016. See prior slide for initial range of 2016 guidance. 2016: Alexandria’s Significant Rental Rate Increases on Renewed/Re-Leased Space 1.5M RSF Renewed or Re-Leased +13% (CASH) +28% RENTAL RATE INCREASE Solid Internal Growth is on Track to Exceed/Meet Initial Guidance✓

17ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ✓ 1. Represents incremental annual net operating income upon stabilization of our development and redevelopment projects, including our share of real estate joint venture projects. Includes properties delivered in the nine months ended September 30, 2016 and properties expected to be delivered in 4Q16. 2016: Solid External Growth as Alexandria Delivers 10 New Highly Leased Class A Properties vs. PREVIOUS GUIDANCE OF $69M INCREMENTAL ANNUAL NET OPERATING INCOME1 FROM 2016 DELIVERIES 7.1% vs. Previous Guidance of 6.9% Initial Cash Yield Solid Final Cash Yield of Exceeded External Growth Forecast— Delivering $90M in Incremental Net Operating Income $90M 92% Leased

18ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 See external growth section for additional details. Alexandria Inspires Real Estate Solutions to Drive Collaboration and Innovation Completed 3Q 97% Leased 274,734 RSF Sanofi Genzyme 50 BINNEY STREET Greater Boston/Cambridge Completed 3Q 99% Leased 255,743 RSF bluebird bio, Inc. 60 BINNEY STREET Greater Boston/Cambridge Completed 2Q 92% Leased 418,639 RSF Roche Nestlé S.A. New York University 430 EAST 29TH STREET New York City/Manhattan Completed 3Q 100% Leased 59,783 RSF Editas Medicine, Inc 11 HURLEY STREET Greater Boston/Cambridge Dec 2016 76% Leased 413,799 RSF Dana-Farber Cancer Institute, Inc. The Children’s Hospital Corporation 360 LONGWOOD AVENUE Greater Boston/Longwood Medical Area Completed 2Q 100% Leased 295,609 RSF Illumina, Inc. 5200 ILLUMINA WAY, BUILDING 6 San Diego/University Town Center Dec 2016 100% Leased 61,755 RSF Otonomy, Inc. 4796 EXECUTIVE DRIVE San Diego/University Town Center Completed 4Q 100% Leased 422,980 RSF Uber Technologies, Inc. 1455/1515 THIRD STREET1 San Francisco/Mission Bay/SoMa Dec 2016 100% Leased 304,326 RSF Eli Lilly and Company 10290 CAMPUS POINT DRIVE San Diego/University Town Center 10 New Class A Properties in Urban Innovation Clusters Delivered in 2016

19ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Reflects projected construction and acquisitions for the year ending December 31, 2016, including the acquisition of One Kendall Square located in our Cambridge submarket. 97% 2016: Alexandria Allocated Capital to Urban Innovation Submarkets1 Cambridge GREATER BOSTON Mission Bay/SoMa SAN FRANCISCO Manhattan NEW YORK CITY Torrey Pines | University Town Center SAN DIEGO Lake Union SEATTLE LOCATION | INNOVATION | TALENT | CAPITAL

20ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Includes completed and pending dispositions, including sales of partial interests for the year ending December 31, 2016. 2. Includes $106 million of construction funding related to 10290 Campus Point Drive. 3. The cash capitalization rate reflects the near-term contractual lease expiration by Eli Lily and Company of 125,409 RSF at 10300 Campus Point Drive as it expands into 304,326 RSF at 10290 Campus Point Drive. 4. Includes projected dispositions of $53.6 million representing 634,328 RSF of operating properties located in China plus land parcels aggregating 59 acres located in India. Sales are expected to be completed in multiple transactions over several quarters. 2016: Alexandria’s Dispositions Provided Important Capital for Investment into New Class A Properties at Solid Returns $360M DISPOSITIONS AT CASH CAP RATE OF 4.7%1 KEY DISPOSITIONS 10290 & 10300 CAMPUS POINT DRIVE UNIVERSITY TOWN CENTER | SAN DIEGO $256M2 Sales Price 45% Partial Interest Sale 5.7%3 Cash Capitalization Rate OPERATING PROPERTIES AND LAND PARCELS IN ASIA $106M4 Sales Price 1.4% Cash Capitalization Rate

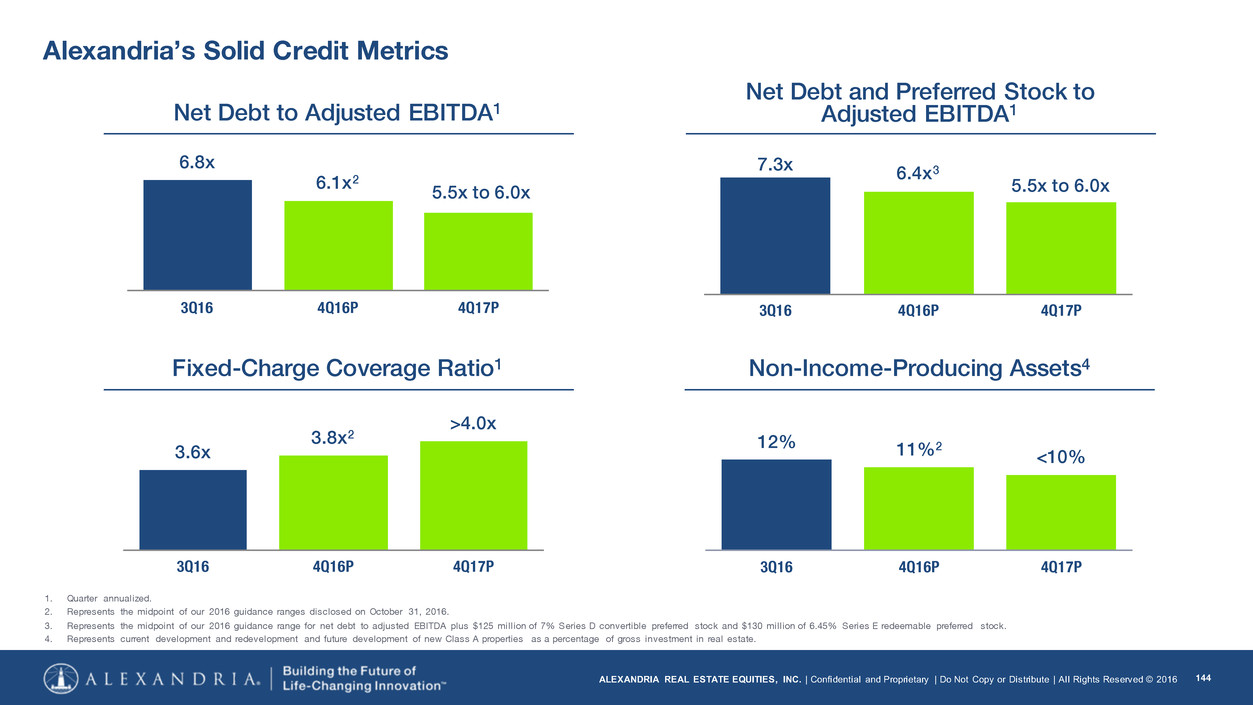

21ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Other REITs represents an average of the following companies based upon their SEC filings: Boston Properties, Inc., HCP, Inc., Kilroy Realty Corporation, Digital Realty Trust, Inc., Douglas Emmett, Inc., Highwoods Properties, Inc., and SL Green Realty Corp. 2. Represents the three months ended December 31, 2015 annualized. 3. Represents the midpoint of our 2016 guidance range as disclosed on October 31, 2016. 2016: Alexandria’s Accelerated Timing of Leverage and Fixed-Charge Coverage Ratio Goals 6.5x 6.5x 6.1x <6.0x Average Other REITs 12/31/15 ARE 12/31/15 ARE 12/31/16 ARE Goal Solid Net Debt to Adjusted EBITDA Solid Fixed-Charge Coverage Ratio 3.4x 3.6x 3.8x >4.0x Average Other REITs 12/31/15 ARE 12/31/15 ARE 12/31/16 ARE Goal11 22 3 3

22ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria is honored to be recognized by NAREIT again this year for its efforts to provide transparent, quality, and efficient communications to the investment community. Clear and consistent communications are key to investor relations, and we strive to deliver high-quality and relevant content to all of our stakeholders. in Communications and Reporting Excellence

23ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s 2016 Awards ▷Alexandria Real Estate Equities, Inc. ▷75/125 Binney Street ▷100 Binney Street ▷50 Binney Street ▷60 Binney Street ▷100 Binney Street ▷Alexandria Real Estate Equities, Inc. ▷10996 Torreyana Road▷Alexandria Real Estate Equities, Inc. ▷400 Technology Square ▷499 Illinois Street ▷430 East 29th Street ▷450 East 29th Street ▷10300 Campus Point Drive

24ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 2017: Alexandria’s Investment Thesis

25ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. For the three months ended September 30, 2016. Best-in-Class, Unique Office REIT of ARE’s Annual Rental Revenue1 is from Investment-Grade Tenants54% 78% of ARE’s Annual Rental Revenue1is from Top 20 Tenants from Investment-Grade Entities Unique Collaborative Science and Technology Campuses in Key Urban Innovation Clusters Class A Properties in AAA Locations Investment-Grade REIT with Significant Liquidity $1.9 billion in liquidity1; 87% Unencumbered Net Operating Income2 Moody’s: Baa2 / Stable; Standard & Poor’s: BBB- / Positive Internal Growth – Same Property Net Operating Income Growth Favorable triple net lease structure with annual rent escalations Strong demand from innovative entities Limited supply of Class A space Significant rental rate growth on leasing activity and early renewals External Growth – New Class A Properties through Development/Redevelopment Visible, multiyear, highly leased value-creation pipeline with deliveries in 2016-2019 expected to generate incremental annual net operating income in a range from $203 million to $227 million, including YTD 3Q16 deliveries; will increase net operating income by 37% over 2015 Disciplined Allocation of Capital and Management of Balance Sheet Unique Underwriting Expertise and Experience Enable Alexandria to prudently underwrite tenants and strategically capitalize on industry trends High-Quality Growth in Cash Flows, Funds from Operations Per Share, and Net Asset Value Per Share and Increasing Common Stock Dividends 77% of ARE’s Annual Rental Revenue1 is from Class A Properties in AAA Locations

26ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Long-Term Business Goals Growth in Net Asset Value and Funds from Operations Per Share1 Beat and Raise Guidance2 A Clean Operating Story3 Disciplined Allocation of Capital4 Disciplined Management of Balance Sheet5

27ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Investment Thesis Continuing strong demand for Alexandria’s Class A properties in AAA urban innovation clusters Unique underwriting expertise that enables the selection and diversification of high-quality tenants Continuing solid internal growth: same property net operating income and rental rate growth Solid external growth through the development and redevelopment of new Class A properties Disciplined allocation of capital to the best urban innovation cluster submarkets Disciplined management of balance sheet to lower long-term cost of capital

28ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 2017: Solid Macro Fundamentals Limited supply of existing and future Class A space Strong demand from highly innovative entities Favorable rental rate trends Very strong occupancy Strong asset valuations

29ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Market Fundamentals and Tenant Demand for Alexandria’s Campuses and Class A Properties

31ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Unique Collaborative Urban Innovation Clusters: Kendall Square and East Cambridge WHITEHEAD INSTITUTE FOR BIOMEDICAL RESEARCH HARVARD UNIVERSITY 225 BINNEY STREET MASSACHUSETTS INSTITUTE OF TECHNOLOGY n Operating property n Operating campus with development property n Development property 300 THIRD STREET ALEXANDRIA TECHNOLOGY SQUARE® 161 FIRST STREET 150 SECOND STREET 75/125 BINNEY STREET ONE KENDALL SQUARE (OKS) 215 FIRST STREET BROAD INSTITUTE OF MIT AND HARVARD 11 HURLEY STREET 50/60 BINNEY STREET100 BINNEY STREET

32ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Greater Boston’s Major Urban Innovation Cluster Drivers NOVEMBER 2016 IBM Watson Health and the Broad Institute of MIT and Harvard will sequence 10,000 drug-resistant cancer tumor samples and analyze the genomic data using Watson’s computing capabilities. Committed to advancing and accelerating cancer research by sharing data with the scientific community. $50M 5-Year Cancer Drug Resistance Project Location Top biopharma cluster in the world Proximate to top academic research institutes, including MIT, Harvard, Whitehead Institute, Broad Institute, Koch Institute, and Wyss Institute Innovation Presence of nearly all big pharma companies and most blue-chip technology companies Talent Broad talent pool across 16 teaching hospitals, 110 universities, and 500+ biopharma companies in Greater Boston Capital Abundant and diverse sources of capital to fund biomedical innovation

33ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. Institutional represents: Academic/Medical, Non-Profit & U.S. Government. Alexandria’s Diverse and High-Quality Tenant Base in Greater Boston Institutional2 Multinational Pharmaceutical Public Biotechnology Tech & Other Private Biotechnology Life Science Product, Service & Device 44% Annual Rental Revenue1 is from Investment-Grade Tenants TENANT MIX BY ANNUAL RENTAL REVENUE of Cluster’s

34ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: CBRE & Newmark Grubb Knight Frank. Cambridge’s Strong Urban Cluster Fundamentals for Both Laboratory/Office and Office 7.7% AVAILABLE 11.7M RSF OFFICE MARKET 4.1% AVAILABLE 11.8M RSF LABORATORY/OFFICE MARKET Rental Rate Growth: 2013–3Q16 32.6% INCREASE $55.80 | 2013 $56.43 | 2013 $74.00 | 3Q16 $75.00 | 3Q16 32.9% INCREASE 1.3% VACANCY 3.8% VACANCY CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) CLASS A OFFICE (FULL-SERVICE GROSS)

35ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Limited Pipeline of Announced New Laboratory/Office and Office in Kendall Square 2 New additions to supply in 2017 and 2018; both are Alexandria projects 2018/2019 399 Binney Street One Kendall Square 172,500 RSF 2017 100 Binney Street 431,483 RSF 79% Leased/Negotiated Future Laboratory/Office Deliveries Future Office Deliveries MIT – South of Main Phase 1 300,000 RSF Estimated Delivery 2020 Boston Properties 250 Binney Street 300,000 RSF Estimated Delivery 2021 MIT – South of Main Phase 2 400,000 RSF Estimated Delivery 2022

36ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Cambridge’s Robust Life Science Demand 2.4M RSFLife Science Demand 300,000 RSF Large-Cap Biotech 200,000 RSF Multinational Pharma 200,000 RSF Multinational Pharma 27 Requirements 100 BINNEY STREET Alexandria Center® at Kendall Square 431,483 RSF 79% Leased/Negotiating 399 BINNEY STREET One Kendall Square Future Development 172,500 RSF Top 5 Requirements 200,000 RSF Public Biotech 150,000 RSF Public Biotech

37ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 $115,752 $145,671 $163,029 $221,245 $276,788 $318,462 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 4Q12 4Q13 4Q14 4Q15 3Q16 3Q16 ($ in t ho us an d s) pro-forma annual rental revenue from in-progress development and redevelopment projects INCREASE IN ANNUAL RENTAL REVENUE Growth and Continuing Increase in Alexandria’s Annual Rental Revenue from Class A Properties in Greater Boston +

38ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 14.0% CASH 98.3% OCCUPANCY1 30.2% GAAP 1. As of September 30, 2016. Robust Demand and Limited Availability Driving Alexandria’s Core Rental Rate Growth in Greater Boston PRICING POWER YTD 3Q16 Rental Rate Growth Renewal/Re-Lease

39ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. Demand for Alexandria’s Cambridge Properties Drives Rental Rate Growth 62.2% Cambridge 16,135 RSF $60.00 NNN/SF Previous Rent: $37.00 NNN/SF 36.0% Cambridge 36,309 RSF $65.00 NNN/SF Previous Rent: $47.80 NNN/SF 23.0% Cambridge 16,188 RSF $73.80 NNN/SF Previous Rent: $60.00 NNN/SF

41ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Unique Collaborative Urban Innovation Clusters: Mission Bay/SoMa SOMA RESIDENTIAL MISSION BAY AT&T PARK GOLDEN STATE WARRIORS UCSF MEDICAL CENTER UCSF RESEARCH CAMPUS 88 BLUXOME STREET GLADSTONE INSTITUTES n Operating property n Development property n Pending acquisition 505 BRANNAN STREET 1455/1515 THIRD STREET 455 MISSION BAY BOULEVARD SOUTH 409/499 ILLINOIS STREET 1500 OWENS STREET 1700 OWENS STREET 510 TOWNSEND STREET

42ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Source: http://business.nasdaq.com /nasda q25 /10; Bay Area Council Economic Institute as of August 7, 2015. 2. Source: CBRE Scoring Tech Talent Report, 2016. 3. Source: National Science Foundation, all data from 2014. San Francisco’s Major Urban Innovation Cluster Drivers Location Proximate to premier research institutions, including Stanford, UCSF, and UC Berkeley Innovation Birthplace of the biotech industry and the silicon transistor chip Global epicenter of innovation for over 60 years U.S. leader in patent generation with 16% of all issued patents in the country1 Talent 30+ Nobel laureates in the Bay Area High density of STEM talent, including repeat entrepreneurs and senior management U.S. leader in total “brain gain” over the last 5 years2 No. 1 region for earned doctorate degrees3 Capital Abundant and diverse sources of capital to fund biomedical innovation OCTOBER 2016: Chan and Zuckerberg pledged $600M NOVEMBER 2016: LinkedIn Co-Founder Reid Hoffman donated $20M Brings together leading scientists and engineers from UCSF, Stanford, and UC Berkeley “The Biohub will be the sinew that ties together three institutions in the Bay Area like never before.” –Stephen Quake, PhD, Biohub Co-President biomedical research investment to Biohub, located at 499 Illinois Street, Mission Bay$620M

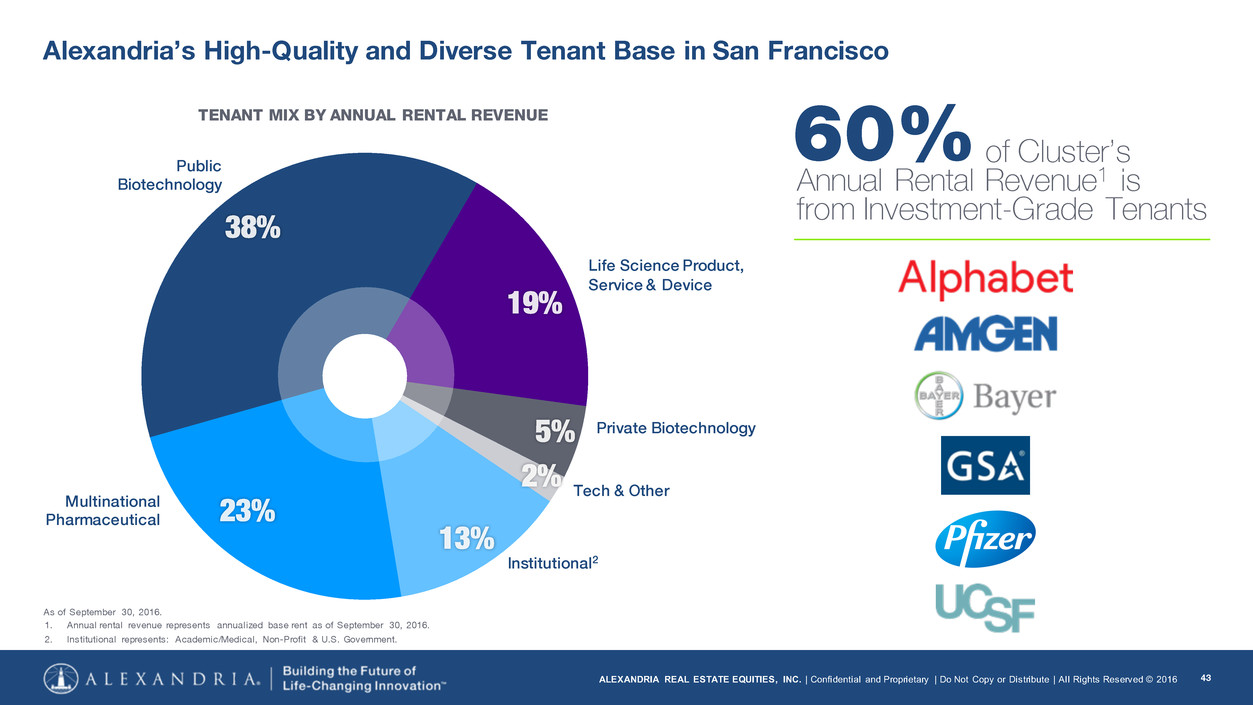

43ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. Institutional represents: Academic/Medical, Non-Profit & U.S. Government. Alexandria’s High-Quality and Diverse Tenant Base in San Francisco Institutional2 Multinational Pharmaceutical Public Biotechnology Tech & Other Private Biotechnology Life Science Product, Service & Device TENANT MIX BY ANNUAL RENTAL REVENUE 60% Annual Rental Revenue1 is from Investment-Grade Tenants of Cluster’s

44ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. Source: Jones Lange LaSalle. 1. Represents a midpoint between new build-to-suit and second generation product. San Francisco’s Strong Urban Cluster Fundamentals for Laboratory/Office 4.6% AVAILABLE 1.3% VACANCY 20.0M RSF LABORATORY/OFFICE MARKET 41.5% INCREASE $45.80 | 2013 $64.80 | 3Q16 Mission Bay/SoMa CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) 38.7% INCREASE Palo Alto/ Stanford Research Park $37.50 | 2013 $52.00 | 3Q16 CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) 53.2% INCREASE South San Francisco1 $33.30 | 2013 $51.00 | 3Q16 CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) Rental Rate Growth: 2013–3Q16

45ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. Source: Jones Lange LaSalle. San Francisco’s Strong Urban Cluster Fundamentals for Tech Office Rental Rate Growth: 2013–3Q16 50% INCREASE $40.00 | 2013 $60.00 | 3Q16 Mission Bay/SoMa CLASS A OFFICE (TRIPLE NET LEASE) 56.8% INCREASE Palo Alto/Stanford Research Park $44.33 | 2013 $69.50 | 3Q16 CLASS A OFFICE (TRIPLE NET LEASE) 8.8% AVAILABLE 134.2M RSF TECH OFFICE MARKET

46ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 San Francisco’s Robust Life Science and Technology Demand 2.2M RSFLife Science Demand 750,000 RSF Multinational Pharma 400,000 RSF Multinational Pharma 300,000 RSF Institutional 65 Requirements Top 5 Requirements 115,000 RSF Public Biotech 75,000 RSF Medical Device 8.6M RSFTechnology Demand 197 Requirements Top 5 Requirements 250,000 RSF Large-Cap Tech 200,000 RSF Private Tech 750,000 RSF Large-Cap Tech 300,000 RSF Large-Cap Tech 250,000 RSF Large-Cap Tech LIFE SCIENCE DEMAND TECHNOLOGY DEMAND

47ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 $96,952 $99,723 $115,013 $121,705 $126,424 $195,952 $85,000 $105,000 $125,000 $145,000 $165,000 $185,000 2012 2013 2014 2015 3Q16 3Q16 ($ in t ho us an d s) INCREASE IN ANNUAL RENTAL REVENUE Growth and Continuing Increase in Alexandria’s Annual Rental Revenue from Class A Properties in San Francisco pro-forma annual rental revenue from in-progress development and redevelopment projects +

48ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 15.7% CASH 99.8% OCCUPANCY1 35.9% GAAP 1. As of September 30, 2016. Robust Demand and Limited Availability Driving Alexandria’s Core Rental Rate Growth in San Francisco PRICING POWER YTD 3Q16 Rental Rate Growth Renewal/Re-Lease

49ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Demand for Alexandria’s San Francisco Properties Drives Rental Rate Growth 43.0% South San Francisco 16,234 RSF $52.80 NNN/SF Previous Rent: $36.92 NNN/SF 40.1% South San Francisco 50,400 RSF $40.80 NNN/SF Previous Rent: $29.13 NNN/SF 22.8% South San Francisco 53,980 RSF $42.00 NNN/SF Previous Rent: $34.20 NNN/SF

51ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 SUNY DOWNSTATE MEDICAL CENTER HOSPITAL FOR SPECIAL SURGERY THE ROCKEFELLER UNIVERSITY FUTURE HOME OF CORNELL- TECHNION NYC TECH CAMPUS NEW YORK UNIVERSITY SCHOOL OF MEDICINE ICAHN SCHOOL OF MEDICINE AT MOUNT SINAI COLUMBIA UNIVERSITY COLLEGE OF PHYSICIANS AND SURGEONS CUNY SOPHIE DAVIS SCHOOL OF BIOMEDICAL EDUCATION WEST TOWER EAST TOWER NORTH TOWER n Operating property n Future development property

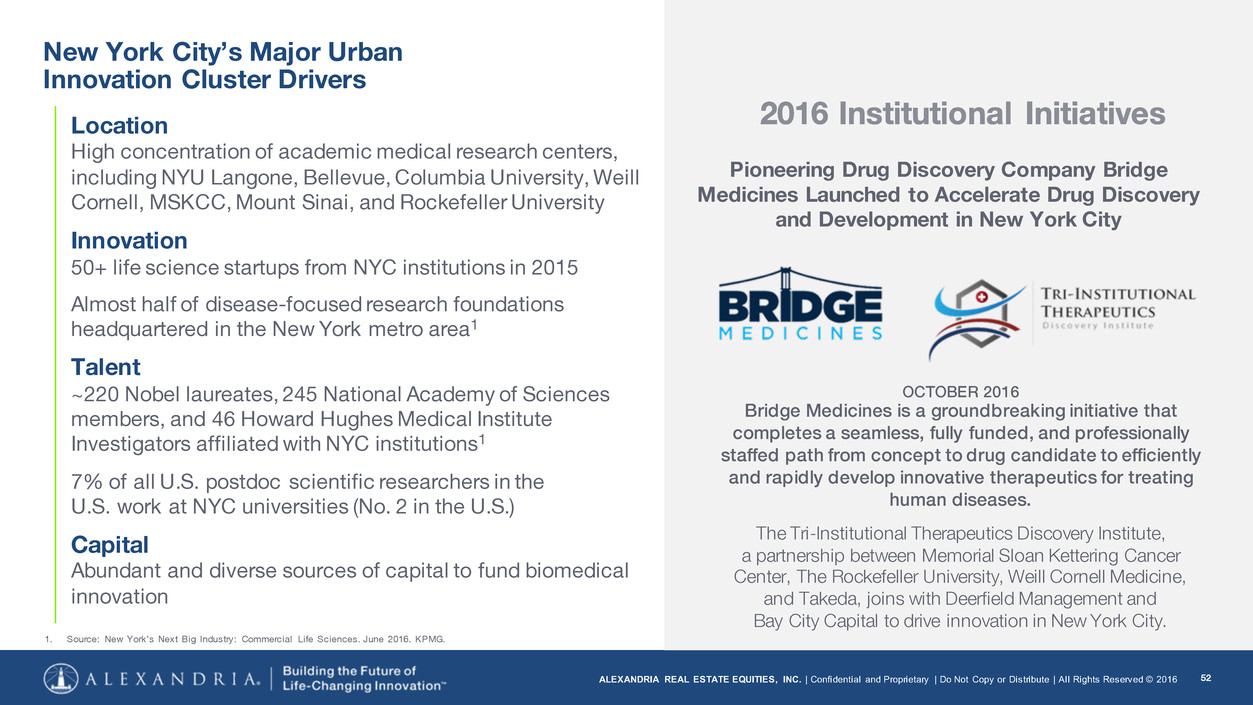

52ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Source: New York’s Next Big Industry: Commercial Life Sciences. June 2016. KPMG. New York City’s Major Urban Innovation Cluster Drivers OCTOBER 2016 Bridge Medicines is a groundbreaking initiative that completes a seamless, fully funded, and professionally staffed path from concept to drug candidate to efficiently and rapidly develop innovative therapeutics for treating human diseases. The Tri-Institutional Therapeutics Discovery Institute, a partnership between Memorial Sloan Kettering Cancer Center, The Rockefeller University, Weill Cornell Medicine, and Takeda, joins with Deerfield Management and Bay City Capital to drive innovation in New York City. Location High concentration of academic medical research centers, including NYU Langone, Bellevue, Columbia University, Weill Cornell, MSKCC, Mount Sinai, and Rockefeller University Innovation 50+ life science startups from NYC institutions in 2015 Almost half of disease-focused research foundations headquartered in the New York metro area1 Talent ~220 Nobel laureates, 245 National Academy of Sciences members, and 46 Howard Hughes Medical Institute Investigators affiliated with NYC institutions1 7% of all U.S. postdoc scientific researchers in the U.S. work at NYC universities (No. 2 in the U.S.) Capital Abundant and diverse sources of capital to fund biomedical innovation Pioneering Drug Discovery Company Bridge Medicines Launched to Accelerate Drug Discovery and Development in New York City

53ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. Institutional represents: Academic/Medical, Non-Profit & U.S. Government. Alexandria’s Diverse and High-Quality Tenant Base in New York City Institutional2 Multinational Pharmaceutical Public Biotechnology Tech & Other Private Biotechnology Life Science Product, Service & Device TENANT MIX BY ANNUAL RENTAL REVENUE 74% Annual Rental Revenue1 is from Investment-Grade Tenants of Cluster’s

54ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Cushman & Wakefield. 1. Pending. New York City’s Strong Urban Cluster Fundamentals for Laboratory/Office 3.9% AVAILABLE 728K RSF LABORATORY/OFFICE MARKET Rental Rate Growth: 2013–3Q16 18.6% INCREASE $70.00 | 2013 $83.00 | 3Q161 CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) (Alexandria Center® for Life Science – New York City)

55ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Cushman & Wakefield. New York City’s Robust Life Science Demand 1.3M RSFLife Science Demand 600,000 RSF Multinational Pharma 400,000 RSF Institutional 125,000 RSF Institutional 7 Requirements Top 5 Requirements 60,000 RSF Public Biotech 30,000 RSF Life Science Lab NORTH TOWER Alexandria Center® for Life Science – NYC Future Development Project 420,000+ RSF

56ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 $32,115 $47,100 $50,098 $56,135 $59,641 $30,000 $35,000 $40,000 $45,000 $50,000 $55,000 $60,000 4Q12 4Q13 4Q14 4Q15 3Q16 ($ in t ho us an d s) 95% OCCUPANCY1 INCREASE IN ANNUAL RENTAL REVENUE 1. As of September 30, 2016. Growth and Continuing Increase in Alexandria’s Annual Rental Revenue from Class A Properties in New York City

58ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 z SANFORD BURNHAM PREBYS MEDICAL DISCOVERY INSTITUTE THE SCRIPPS RESEARCH INSTITUTE SANFORD CONSORTIUM FOR REGENERATIVE MEDICINE SALK INSTITUTE FOR BIOLOGICAL STUDIES J. CRAIG VENTER INSTITUTE WEST HEALTH INSTITUTE GENOMICS INSTITUTE OF THE NOVARTIS RESEARCH FOUNDATION THE SCRIPPS RESEARCH INSTITUTE n Operating campus n Operating campus with development property n Operating campus with redevelopment property UNIVERSITY OF CALIFORNIA, SAN DIEGO ARE TOWNE CENTRE ALEXANDRIA CENTER® FOR LIFE SCIENCE AT CAMPUS POINTE ARE ESPLANADE ARE ILLUMINA CAMPUS ARE SPECTRUM ARE SUNRISE ARE NAUTILUS TORREY RIDGE SCIENCE CENTER CALIFORNIA INSTITUTE FOR BIOMEDICAL RESEARCH Alexandria’s Unique Collaborative Urban Innovation Clusters: Torrey Pines and University Town Center

59ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Source: The San Diego Regional Development Corporation and JLL San Diego Life Science Outlook Report 2016. San Diego’s Major Urban Innovation Cluster Drivers OCTOBER 2016 TSRI and Calibr – two leading non-profit research organizations – form a first-of-its-kind strategic affiliation combining the two organizations into an entity with the tools and know-how to rapidly translate its scientific discoveries into life-saving medicines. Location Close proximity of academic and industry R&D World-renowned academic research institutes known for their entrepreneurial and highly collaborative spirit, including UCSD, TSRI, Sanford Burnham Prebys Medical Discovery Institute, and Salk Institute for Biological Studies Innovation Committed large pharma and biotech presence Genomics hub led by Illumina, the world leader in DNA sequencing Talent More than 64,000 life science employees; second-highest concentration of scientists and engineers compared to other U.S. metro regions1 Capital Abundant and diverse sources of capital to fund biomedical innovation New Model for Non-Profit Basic and Translational Research

60ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. Institutional represents: Academic/Medical, Non-Profit & U.S. Government. Alexandria’s High-Quality and Diverse Tenant Base in San Diego Institutional2 Multinational Pharmaceutical Public Biotechnology Tech & Other Private Biotechnology Life Science Product, Service & Device TENANT MIX BY ANNUAL RENTAL REVENUE 70% Annual Rental Revenue1 is from Investment-Grade Tenants of Cluster’s

61ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Cushman & Wakefield. 1. Lab market size includes core submarkets of Torrey Pines, University Town Center, Sorrento Mesa, and Sorrento Valley. San Diego’s Strong Urban Cluster Fundamentals for Laboratory/Office 7.7% AVAILABLE 6.0% VACANCY 14.1M RSF LABORATORY/OFFICE MARKET1 Rental Rate Growth: 2013–3Q16 39.1% INCREASE $30.96 | 2013 $43.08 | 3Q16 CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE)

62ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Cushman & Wakefield. San Diego’s Robust Life Science Demand 2.1M RSFLife Science Demand 250,000 RSF Medical Device 180,000 RSF Medical Device 150,000 RSF Multinational Pharma 38 Requirements ARE SPECTRUM Torrey Pines 336,461 RSF 327,529 RSF Leased/Negotiating 9625 TOWNE CENTRE DRIVE University Town Center 162,156 RSF 100% Negotiating Top 5 Requirements 140,000 RSF Public Biotech 125,000 RSF Private Biotech

63ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 $86,942 88,778 $103,048 $100,379 $100,733 $145,126 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 4Q12 4Q13 4Q14 4Q15 3Q16 3Q16 ($ in t ho us an d s) 93% OCCUPANCY1 INCREASE IN ANNUAL RENTAL REVENUE 1. As of September 30, 2016. Growth and Continuing Increase in Alexandria’s Annual Rental Revenue from Class A Properties in San Diego pro-forma annual rental revenue from in-progress development and redevelopment projects +

64ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Demand for Alexandria’s San Diego Properties Increasing Rental Rates 79.1% Torrey Pines 24,240 RSF $46.20 NNN/SF Previous Rent: $25.79 NNN/SF 17.0% Torrey Pines 25,457 RSF $46.80 NNN/SF Previous Rent: $39.99 NNN/SF

66ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1150/1165/1166 EASTLAKE AVE EAST 1201/1208 EASTLAKE AVE EAST 1551 EASTLAKE AVE EAST 199 EAST BLAINE STREET1616 EASTLAKE AVE EAST 219 TERRY AVE NORTH 400 DEXTER AVE NORTH1600 FAIRVIEW AVE EAST INFECTIOUS DISEASE RESEARCH INSTITUTE LIFE SCIENCE WASHINGTON FRED HUTCHINSON CANCER RESEARCH CENTER THE BILL & MELINDA GATES FOUNDATION ALLEN INSTITUTE FOR BRAIN SCIENCE UNIVERSITY OF WASHINGTON SCHOOL OF MEDICINE 1818 FAIRVIEW AVE EAST Alexandria’s Unique Collaborative Urban Innovation Cluster: Lake Union n Operating property n Development property n Future development property

67ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Source: Bloomberg Business, 2015 and Washington Life Sciences Economic Report, 2015. Seattle’s Major Urban Innovation Cluster Drivers OCTOBER 2016 Fred Hutch will collaborate with clinical care partners Seattle Cancer Care Alliance and UW Medicine. The initiative will put the patient at the center of every treatment decision and will advance the Pancreatic Cancer Action Network’s goal to double survival by 2020. Location Proximate to world-renowned translational academic research, includes Fred Hutchinson Cancer Research Center, Seattle Children’s Hospital, and University of Washington Innovation Global leader in immuno-oncology Strong home grown tech companies, Amazon, Impinj, and Expedia, and important engineering hub for leading tech innovators, including Facebook and Google Global health epicenter, including major disease research centers, such as IDRI, as well as grant funding organizations, such as the Gates Foundation Talent Roughly 200K STEM jobs, including more than 24K life science employees and 90K software engineers1 Capital Abundant and diverse sources of capital to fund biomedical innovation Fred Hutchinson Cancer Research Center selected to join Precision Promise, a national platform creating an unprecedented model of collaboration among renowned researchers, clinicians, and diagnostic and drug developers

68ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Annual rental revenue represents annualized base rent as of September 30, 2016. 2. Institutional represents: Academic/Medical, Non-Profit & U.S. Government. Alexandria’s High-Quality and Diverse Tenant Base in Seattle Institutional2 Multinational Pharmaceutical Public Biotechnology Tech & Other Private Biotechnology Life Science Product, Service & Device TENANT MIX BY ANNUAL RENTAL REVENUE 61% Annual Rental Revenue1 is from Investment-Grade Tenants of Cluster’s

69ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. Source: CBRE. Seattle’s Strong Urban Cluster Fundamentals for Both Laboratory/Office and Office 7.9% AVAILABLE 8.7M RSF OFFICE MARKET 2.2% AVAILABLE 4.6M RSF LABORATORY/OFFICE MARKET Rental Rate Growth: 2013–3Q16 20.0% INCREASE $45.00 | 2013 $28.00 | 2013 $54.00 | 3Q16 $36.00 | 3Q16 28.6% INCREASE CLASS A LABORATORY/OFFICE (TRIPLE NET LEASE) CLASS A OFFICE (TRIPLE NET LEASE)

70ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Seattle’s Life Science Demand 217K RSFLife Science Demand 75,000 RSF Institutional 25,000 RSF Public Biotech 25,000 RSF Private Biotech 9 Requirements 1150/1165/1166 EASTLAKE AVENUE EAST Lake Union Future Development Project 366,000 RSF 1818 FAIRVIEW AVENUE EAST Lake Union Future Development Project 188,490 RSF Top 5 Requirements 25,000 RSF Private Biotech 20,000 RSF Large-Cap Biotech

71ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 $26,001 $29,438 $29,881 $33,113 $33,930 $50,634 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 $55,000 4Q12 4Q13 4Q14 4Q15 3Q16 3Q16 ($ in t ho us an d s) INCREASE IN ANNUAL RENTAL REVENUE Growth and Continuing Increase in Alexandria’s Annual Rental Revenue from Class A Properties in Seattle pro-forma annual rental revenue from in-progress development and redevelopment projects +

72ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 13.6% CASH 98.4% OCCUPANCY1 29.3% GAAP 1. As of September 30, 2016. Continued Demand and Limited Availability Driving Alexandria’s Core Rental Rate Growth in Seattle PRICING POWER YTD 3Q16 Rental Rate Growth Renewal/Re-Lease

73ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Demand for Alexandria’s Seattle Properties Increasing Rental Rates 23.9% South Lake Union 20,133 RSF $54.00 NNN/SF Previous Rent: $43.60 NNN/SF 21.3% South Lake Union 6,272 RSF $54.00 NNN/SF Previous Rent: $44.50 NNN/SF

74ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 2017/2018 Contractual Lease Expirations

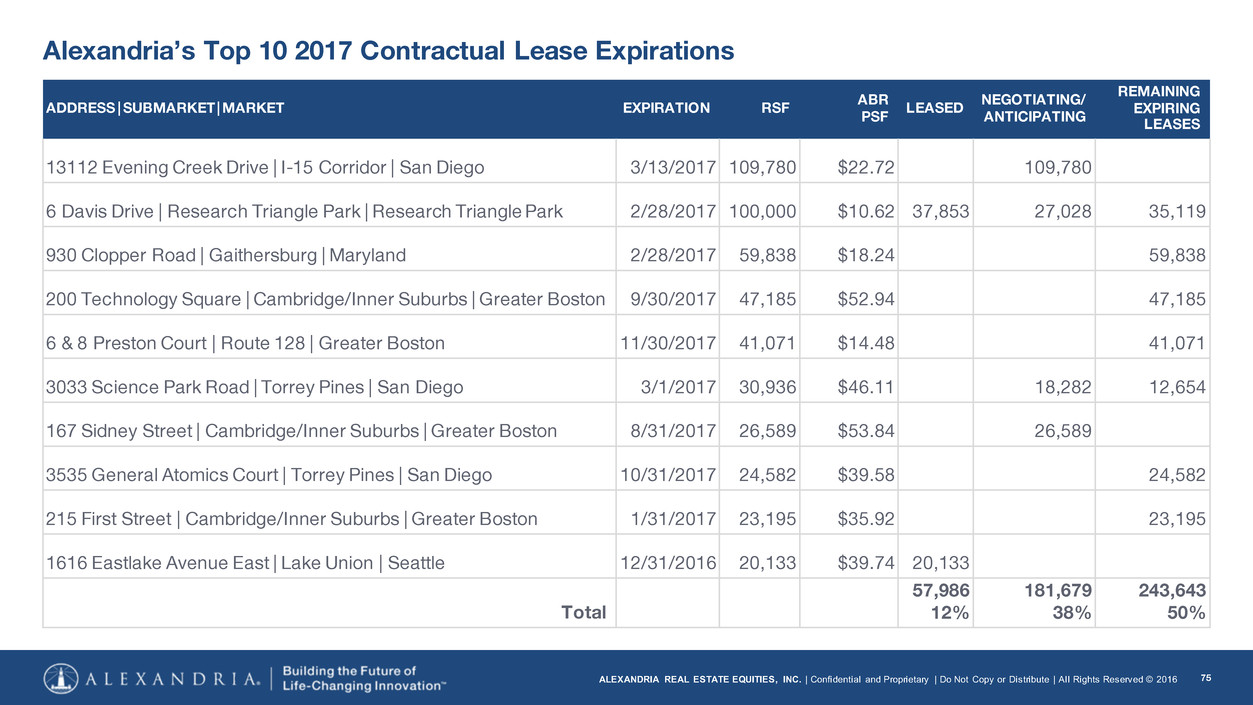

75ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Top 10 2017 Contractual Lease Expirations ADDRESS | SUBMARKET | MARKET EXPIRATION RSF ABRPSF LEASED NEGOTIATING/ ANTICIPATING REMAINING EXPIRING LEASES 13112 Evening Creek Drive | I-15 Corridor | San Diego 3/13/2017 109,780 $22.72 109,780 6 Davis Drive | Research Triangle Park | Research Triangle Park 2/28/2017 100,000 $10.62 37,853 27,028 35,119 930 Clopper Road | Gaithersburg | Maryland 2/28/2017 59,838 $18.24 59,838 200 Technology Square | Cambridge/Inner Suburbs | Greater Boston 9/30/2017 47,185 $52.94 47,185 6 & 8 Preston Court | Route 128 | Greater Boston 11/30/2017 41,071 $14.48 41,071 3033 Science Park Road | Torrey Pines | San Diego 3/1/2017 30,936 $46.11 18,282 12,654 167 Sidney Street | Cambridge/Inner Suburbs | Greater Boston 8/31/2017 26,589 $53.84 26,589 3535 General Atomics Court | Torrey Pines | San Diego 10/31/2017 24,582 $39.58 24,582 215 First Street | Cambridge/Inner Suburbs | Greater Boston 1/31/2017 23,195 $35.92 23,195 1616 Eastlake Avenue East | Lake Union | Seattle 12/31/2016 20,133 $39.74 20,133 Total 57,986 12% 181,679 38% 243,643 50%

76ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s 2018 Contractual Lease Expirations MARKET EXPIRING RSF RENTAL RATE Greater Boston 1,052,429 $50.69 San Francisco 314,958 $41.96 New York City 2,942 N/A San Diego 293,354 $27.88 Seattle 28,183 $44.31 Maryland 181,069 $14.84 Research Triangle Park 59,817 $27.74 Canada 80,689 $20.81 Non-Cluster Markets 10,604 $26.58 Total 2,024,045 12.7% $40.82 of contractual lease expirations in Greater Boston are located in Cambridge 68%

77ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Institutional Investor Demand for Life Science Real Estate

78ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Institutional Investor Interest in Life Science Real Estate Strong Demographic Story An aging population and lengthening life span both point to longer required periods of care. High Barrier to Entry The specialized nature of space limits the number of players and creates a natural barrier to entry. The small number of players reinforces performance in the space as operators develop very strong relationships with tenants. Diversification Gain exposure to tenants and industries that are not represented in traditional office stock. Correlation The life science space is not directly correlated to regular office space. Strong reputation Best-in-class operator First-mover advantage Landlord of choice to the life science industry Strong relationships with the tenant community Focused and astute real estate and development expertise Exceptional leadership throughout organization Why Life Science? Why Alexandria?

79ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. 10290 Campus Point Drive closed June 2016 and 10300 Campus Point Drive is expected to close by December 31, 2016. Represents the combined partial interest sales of 10290 and 10300 Campus Point Drive. Strategic Relationships with High-Quality Institutional Investors at an Average Cap Rate of 4.5%-5.7% Key joint venture deals allow Alexandria to recycle capital into high-value Class A developments in key urban innovation clusters at strong returns of 7% 10290 & 10300 CAMPUS POINT DRIVE UNIVERSITY TOWN CENTER1 225 BINNEY STREET CAMBRIDGE 1500 OWENS STREET MISSION BAY 409/499 ILLINOIS STREET MISSION BAY

80ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents the sale of partial interests. 225 BINNEY STREET DATE CLOSED December 2015 SALE OF PARTIAL INTERESTS 70.0% SALE PRICE1 $190M CASH CAP RATE 4.5%

81ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents the sale of partial interests. 409/499 ILLINOIS STREET DATE CLOSED December 2015 SALE OF PARTIAL INTERESTS 40.0% SALE PRICE1 $190M CASH CAP RATE 4.5%

82ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents the sale of partial interests. 1500 OWENS STREET DATE CLOSED December 2015 SALE OF PARTIAL INTERESTS 49.9% SALE PRICE1 $73M CASH CAP RATE 4.8%

83ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. 10290 Campus Point Drive closed June 2016 and 10300 Campus Point Drive is expected to close by December 31, 2016. Represents the combined partial interest sales of 10290 and 10300 Campus Point Drive. 2. Represents the sale of partial interests. 3. The cash capitalization rate reflects the near- term contractual lease expiration by Eli Lilly and Company of 125,409 RSF at 10300 Campus Point Drive as it expands into 304,326 RSF at 10290 Campus Point Drive. 10290 & 10300 CAMPUS POINT DRIVE DATE CLOSED1 June 2016 SALE OF PARTIAL INTERESTS 45.0% SALE PRICE2 $256M CASH CAP RATE3 5.7%

84ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Life Science Real Estate Attracts Institutional Investors AFIAA (Swiss Fund) American Healthcare Investors American Realty Capital Angelo, Gordon & Co. The Blackstone Group Capital Square Holdings Carter Validus Clarion Partners Deutsche Bank DivcoWest Equis Capital Partners Evergrande Group GI Partners Goldman Sachs Greenland Holdings Griffin Capital Grubb-Rubenstein Harrison Street Real Estate Harvard Investment Group HCP Hines Invesco Jamestown The JBG Companies J.P. Morgan KanAm Grund KBS Keystone Property Group Kilroy Realty King Street Properties Korea Post LaSalle Investment Management Legacy Partners Mirae Asset Management National Development Norges Bank Oak Street Real Estate Capital Principal Financial Group Prudential PS Business Parks REIT Management & Research The Related Companies Rockefeller Group Safanad Samsung SRA Asset Management Senior Housing Properties Trust SunTrust Equity Funding TIAA Global Asset Management Tritower Financial Group Urban Renaissance Group Walton Street Capital W. P. Carey ENTITIES INVOLVED IN RECENT LABORATORY/OFFICE TRANSACTIONS

85ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Internal Growth: Strong Same Property Net Operating Income Growth

86ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 2017: Solid Macro Fundamentals Limited supply of existing and future Class A space Strong demand from highly innovative entities Favorable rental rate trends Very strong occupancy Strong asset valuations

87ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ✓ As of September 30, 2016. 1. Annual Rental revenue represents annualized base rent in effect as of September 30, 2016. Alexandria’s High-Quality Cash Flows 54% of ARE’s Annual Rental Revenue1is from Investment-Grade Tenants 77% of ARE’s Annual Rental Revenue1is from Class A Properties in AAA Locations 97% of ARE’s Leases Require Tenants to Pay for Operating Expenses under Triple Net Leases 95% of ARE’s Leases Require Tenants to Pay for Major Capital Expenditures Industry Leading Tenant Roster ✓ ✓ Solid Demand for Class A Properties Favorable Lease Structure

88ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Leasing activity includes renewals, re-leasing, and early renewals, and excludes leasing activity related to development and redevelopment projects. Alexandria’s Steady Same Property Cash Net Operating Income Growth Illustration 3% 5% Contractual Annual Rent Escalation Rental Rate Growth from Leasing Activity Steady Occupancy Same Property Cash Net Operating Income Growth 5% 10-Year Average Same Property Cash Net Operating Income Growth 3% 1%-3% +/-% 1 5%

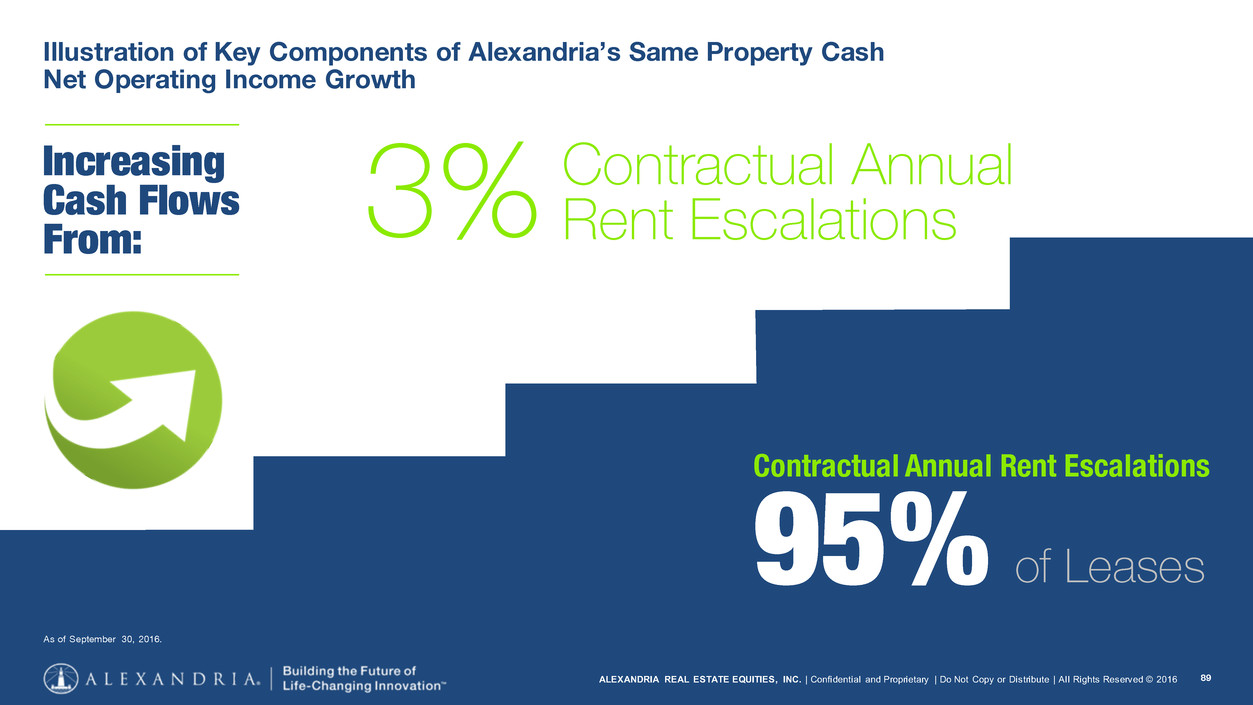

89ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Increasing Cash Flows From: As of September 30, 2016. Illustration of Key Components of Alexandria’s Same Property Cash Net Operating Income Growth Contractual Annual Rent Escalations 95% of Leases 3% Contractual Annual Rent Escalations

90ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Represents lease renewals, re-leasing, and early renewals, and excludes leasing activity related to development and redevelopment projects and vacant spaces. Strong Demand with Limited Supply Generating Strong Volume of Early Lease Renewals/Re-Leasing of Alexandria’s Space Early lease renewals are approximately 2x leasing activity related to current year contractual expirations 37%Current-Year Contractual Lease Expirations 31% 10-Year Average1YTD 3Q161Annual Leasing Activity 63%Early Lease Renewals 69%

91ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1%-3% Annual Same Property Cash Net Operating Income Growth 10% Rental Rate Growth x Illustration of Key Components of Alexandria’s Same Property Cash Net Operating Income Growth: Leasing Activity Drives Same Property Net Operating Income Growth of Total RSF 10% Current-Year Expirations Early Lease Renewals 0%-20% of Total RSF Increasing Cash Flows From:

92ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 For the nine months ended September 30, 2016. 2016: Significant Rental Rate Increases on Alexandria’s Lease Renewals and Re-Leasing of Space 1.5M RSF Renewed or Re-Leased +13% (CASH) +28% RENTAL RATE INCREASES

93ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Office REIT Average composition per UBS Investment Research and data from S&P Global Market Intelligence. 1. Represents average occupancy of operating properties in North America as of December 31 for the last 10 years, and as of September 30, 2016. 2. Represents the average retention for 2011 through 2015 and the nine months ended September 30, 2016. Alexandria Consistently Outperforms Office REITs in Key Operating Metrics: Occupancy OCCUPANCY OF OPERATING PROPERTIES 94% 95% 94% 94% 95% 95% 96% 97% 97% 97% 2007 2008 2009 2010 2011 2012 2013 2014 2015 3Q16 Alexandria Office REIT Average 95% 10-Year Historical Average Occupancy1 >80% Retention Rate2 ALEXANDRIA

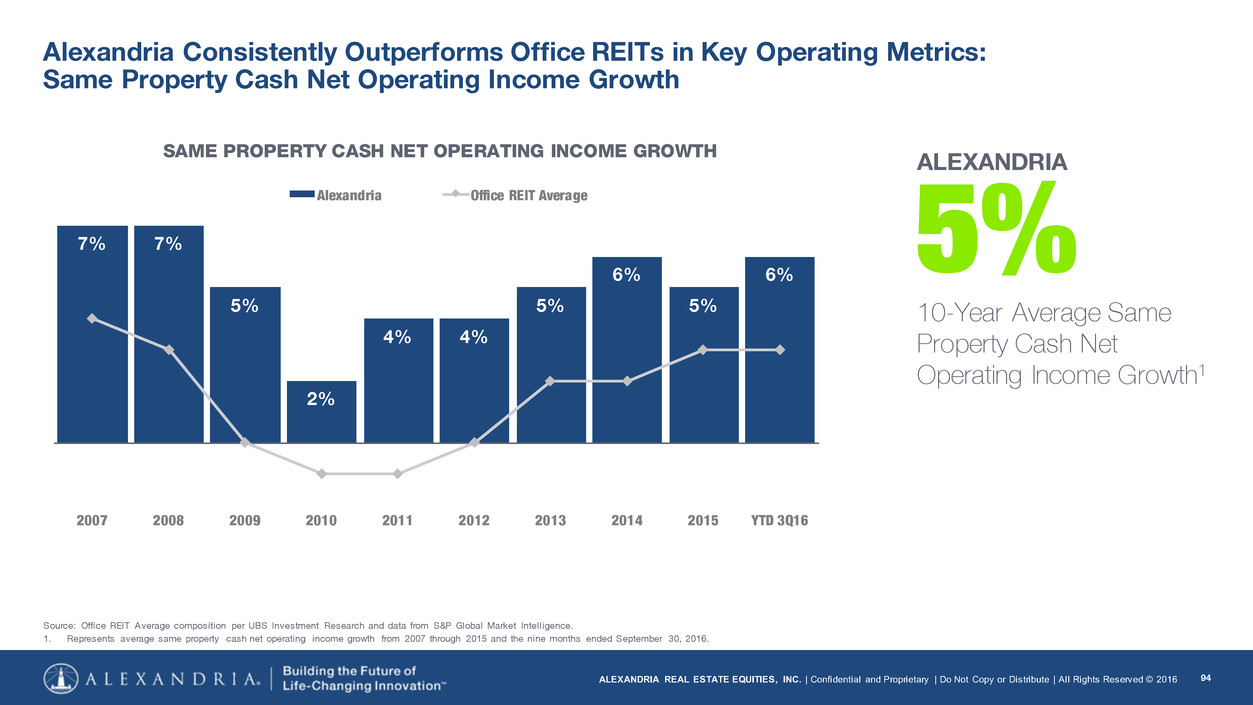

94ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 7% 7% 5% 2% 4% 4% 5% 6% 5% 6% 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD 3Q16 Alexandria Office REIT Average Source: Office REIT Average composition per UBS Investment Research and data from S&P Global Market Intelligence. 1. Represents average same property cash net operating income growth from 2007 through 2015 and the nine months ended September 30, 2016. Alexandria Consistently Outperforms Office REITs in Key Operating Metrics: Same Property Cash Net Operating Income Growth 5% 10-Year Average Same Property Cash Net Operating Income Growth1 SAME PROPERTY CASH NET OPERATING INCOME GROWTH ALEXANDRIA

95ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Source: Office REIT Average composition per UBS Investment Research and data from S&P Global Market Intelligence. Alexandria Consistently Outperforms Office REITs in Key Operating Metrics: EBITDA Margin 67% Adjusted EBITDA Margin for 3Q16 65% 64% 65% 64% 65% 67% 2011 2012 2013 2014 2015 3Q16 Alexandria Office REIT Average ADJUSTED EBITDA MARGIN ALEXANDRIA

96ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 External Growth: Strong and Highly Leased New Class A Properties

97ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 DEVELOPMENTS REDEVELOPMENTS ACQUISITIONS Development/redevelopment opportunities Near-term lease-up Below-market rental rates New, highly leased, creative, and innovative Class A properties External Growth: Strategically Creating Value VALUE ADDED

98ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Reflects projected construction and acquisitions for the year ending December 31, 2016, including the acquisition of One Kendall Square located in our Cambridge submarket. 97% 2016: Alexandria Allocated Capital to Urban Innovation Submarkets1 Cambridge GREATER BOSTON Mission Bay/SoMa SAN FRANCISCO Manhattan NEW YORK CITY Torrey Pines | University Town Center SAN DIEGO Lake Union SEATTLE LOCATION | INNOVATION | TALENT | CAPITAL

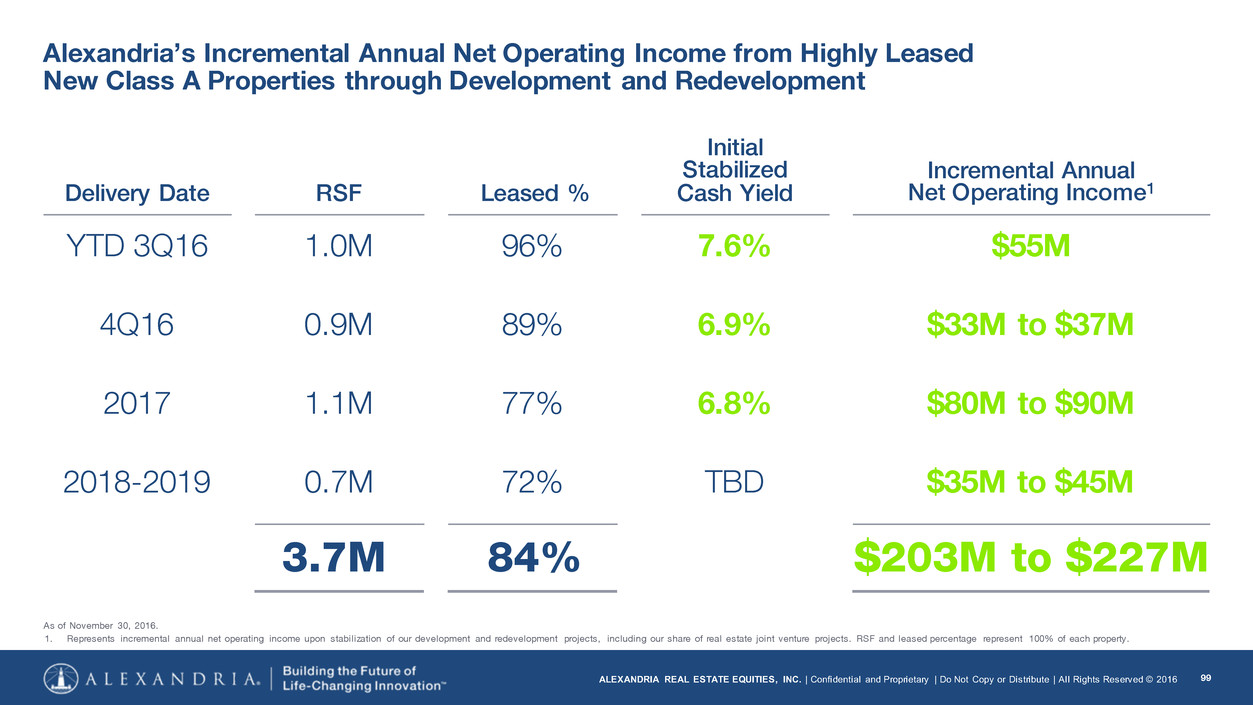

99ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of November 30, 2016. 1. Represents incremental annual net operating income upon stabilization of our development and redevelopment projects, including our share of real estate joint venture projects. RSF and leased percentage represent 100% of each property. Alexandria’s Incremental Annual Net Operating Income from Highly Leased New Class A Properties through Development and Redevelopment $203M to $227M84% Leased % 96% 89% 72% 77% Incremental Annual Net Operating Income1 $55M $33M to $37M $35M to $45M $80M to $90M 3.7M RSF 1.0M 0.9M 0.7M 1.1M Delivery Date YTD 3Q16 4Q16 2018-2019 2017 7.6% Initial Stabilized Cash Yield 6.9% TBD 6.8%

100ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of November 30, 2016. 1. Represents average pre-leased percentage at the commencement of vertical aboveground construction. Alexandria’s Disciplined Pre-Leasing Approach to Ground-Up Development of New Class A Properties Since January 1, 20091 100% SIGNIFICANT PRE-LEASING ON 5.2 MILLION RSF 38% 2.7M RSF 16 New Class A Properties Single-Tenant Multi-Tenant Pre-Leased Pre-Leased 2.5M RSF 8 New Class A Properties

101ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Represents ground-up developments commenced and delivered from January 1, 2009 through November 30, 2016. Alexandria’s Solid Returns on Ground-Up Development of 17 New Class A Properties Since January 1, 2009 8.3% Average Initial Stabilized Yield 7.6% Average Initial Stabilized Yield (Cash) 1.2% Cost Savings from Highly Experienced Team 0.3% Yield Improved by 0.2% Yield Improved by (Cash) Cost Below Budget Returns Above Budget

102ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016. 1. Represents annualized base rent from investment-grade rated tenants and/or tenants with market capitalization equal to or greater than $5 billion from ground-up developments commenced since January 1, 2009. Alexandria’s Highly Successful Ground-Up Development of New Class A Properties 73% of Annual Rental Revenue is from Investment-Grade or Large-Cap Tenants1

103ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 RSF in Service % of Project in Service Unlevered Yields Placed into Service 2016 Total Project Average Cash Initial Stabilized Cash Basis Initial StabilizedProperty/Market/Submarket Our Interest Date Delivered Prior to 1/1/16 1H16 Third Quarter Fourth Quarter Total Leased Negotiating Investment Consolidated development projects 50/60 Binney Street/ Greater Boston/Cambridge 100% 9/30/16 — — 530,477 — 530,477 100% 98% —% $ 474,000 8.6% 7.7% 7.9% 430 East 29th Street/ New York City/Manhattan 100% Various 354,261 64,378 — — 418,639 100% 92% 4% $ 471,000 7.6% 7.0% 7.1% 5200 Illumina Way, Building 6/San Diego/University Town Center 100% 6/20/16 — 295,609 — — 295,609 100% 100% —% $ 68,000 8.8% 7.2% 8.6% 4796 Executive Drive/ San Diego/University Town Center 100% 12/16 — — — 61,755 61,755 100% 100% —% $ 42,200 7.7% 6.8% 7.1% 1455/1515 Third Street/ San Francisco/Mission Bay/SoMa1 100% 11/10/16 — — — 422,980 422,980 100% 100% —% $ 184,000 14.5% 7.0% 12.0% Consolidated redevelopment projects 11 Hurley Street/ Greater Boston/Cambridge 100% 9/29/16 — — 59,783 — 59,783 100% 100% —% $ 36,500 9.8% 8.8% 9.7% 10290 Campus Point Drive/ San Diego/University Town Center 55% 12/16 — — — 304,326 304,326 100% 100% —% $ 222,000 7.6% 6.8% 7.0% Unconsolidated joint venture projects 360 Longwood Avenue/ Greater Boston/Longwood Medical Area 27.5% Various 259,859 53,548 — 100,392 413,799 100% 76% —% $ 108,965 8.2% 7.3% 7.8% 614,120 413,535 590,260 889,453 2,567,368 1. Reflects delivery of 1455/1515 Third Street, located in Mission Bay, to Uber Technologies, Inc. on November 10, 2016. 2. Development and management fees earned from this project has been excluded from our estimate of unlevered yields. Total project investment represents 100% of the project, including cost incurred directly by us outside of the real estate joint venture. Our unlevered yields are based upon our share of the investment in real estate, including costs incurred directly by us outside of the real estate joint venture. The RSF related to the project in the table above represents 100% of the project RSF. 3. Total project investment and unlevered yields are based upon our share of the investment in real estate, including costs incurred directly by us outside of the real estate joint venture. Alexandria’s Visible-Growth Pipeline: Highly Leased Projects Expected to Be Placed into Service by 4Q16 2 2 22 3 3 33 ($ in thousands)

104ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Development and Redevelopment Projects Placed into Service during YTD 3Q16 50 BINNEY STREET Greater Boston | Cambridge 97% Leased | 274,734 RSF Sanofi Genzyme 360 LONGWOOD AVENUE Greater Boston | Longwood Medical Area 76% Leased | 313,407 RSF Dana-Farber Cancer Institute, Inc. The Children’s Hospital Corporation 60 BINNEY STREET Greater Boston | Cambridge 99% Leased | 255,734 RSF bluebird bio, Inc. 11 HURLEY STREET Greater Boston | Cambridge 100% Leased | 59,783 RSF Editas Medicine, Inc. 430 EAST 29TH STREET New York City | Manhattan 92% Leased | 418,639 RSF Roche | Nestlé S.A. | New York University 5200 Illumina Way, Building 6 San Diego | University Town Center 100% Leased | 295, 609 RSF Illumina, Inc.

105ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Development and Redevelopment Projects Expected to Be Placed into Service in 4Q16 360 LONGWOOD AVENUE Greater Boston | Longwood Medical Area 76% Leased | 100,392 RSF Dana-Farber Cancer Institute, Inc. The Children’s Hospital Corporation 1455/1515 THIRD STREET San Francisco | Mission Bay/SoMa 100% Leased | 422,980 RSF Uber Technologies,Inc. 10290 CAMPUS POINT DRIVE San Diego | University Town Center 100% Leased | 304,326 RSF Eli Lilly and Company 4796 EXECUTIVE DRIVE San Diego | University Town Center 100% Leased | 61,755 RSF Otonomy, Inc.

106ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1455/1515 THIRD STREET San Francisco | Mission Bay/SoMa 422,980 RSF TRANSACTION COMPLETED NOVEMBER 2016 75-year lease of land and parking garage with Uber Technologies, Inc. PRIOR TO NOVEMBER 2016 Joint venture (51% share) with 15-year lease to Uber Technologies, Inc. of two office buildings 2018 delivery ECONOMICS REMAIN THE SAME/IMPROVED $154M cash investment1 7.0% initial stabilized cash yield 12.0% initial stabilized yield 1. Includes $56.8 million expected to be paid in 2017.

107ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Property/Market/Submarket ARE’s Ownership Interest Unlevered Yields Cost to Complete Funded By Total at Completion Average Cash Initial Stabilized Cash Basis Initial StabilizedIn Service CIP ARE JV Partner 100 Binney Street/Greater Boston/Cambridge 100% $ 9,958 $ 232,795 $ 292,247 $ — $ 535,000 7.9% 7.0% 7.7% 510 Townsend Street/San Francisco/Mission Bay/SoMa 100% — 107,682 130,318 — 238,000 7.9% 7.0% 7.2% 505 Brannan Street, Phase I/San Francisco/Mission Bay/SoMa 99.4% — 52,621 88,379 — 141,000 8.6% 7.0% 8.2% 213 East Grand Avenue/San Francisco/South San Francisco 100% — 32,433 TBD — TBD 1 1 1 ARE Spectrum/San Diego/Torrey Pines 100% 64,915 95,105 117,980 — 278,000 6.9% 6.1% 6.4% 9625 Towne Centre Drive/San Diego/University Town Center 100% — 24,857 TBD — TBD 1 1 1 5200 Illumina Way, Parking Structure/San Diego/Univ Town Center 100% — 12,473 57,527 — 70,000 7.0% 7.0% 7.0% 400 Dexter Avenue North/Seattle/Lake Union 100% — 112,670 119,330 — 232,000 7.3% 6.9% 7.2% $ 74,873 670,636 TBD $ — TBD As of November 30, 2016 except for in service and CIP information, which are as of September 30, 2016. 1. The design and budget of these projects are in process, and the estimated project costs with related yields will be disclosed in the future. Alexandria’s Visible-Growth Highly Leased Pipeline: Projects Expected to Be Placed into Service in 2017, 2018, and 2019 Property/Market/Submarket Dev/ Redev Project RSF Percentage Total Leased/Negotiating Project Start Occupancy In Service CIP Total Leased Negotiating RSF % Initial Stabilized 100 Binney Street/Greater Boston/Cambridge Dev — 431,483 431,483 48% 31% 341,556 79% 3Q15 4Q17 2017 510 Townsend Street/San Francisco/Mission Bay/SoMa Dev — 300,000 300,000 100% —% 300,000 100% 3Q15 3Q17 2017 505 Brannan Street, Phase I/San Francisco/Mission Bay/SoMa Dev — 150,000 150,000 100% —% 150,000 100% 1Q16 2H17 2017 213 East Grand Avenue/San Francisco/South San Francisco Dev — 293,855 293,855 100% —% 293,855 100% 2017 2019 2019 ARE Spectrum/San Diego/Torrey Pines Dev 102,938 233,523 336,461 90% 7% 327,529 97% 2Q16 2H17 2017 5200 Illumina Way, Parking Structure/San Diego/Univ Town Center Dev N/A N/A N/A 100% —% N/A 100% 2Q16 2H17 2017 9625 Towne Centre Drive/San Diego/University Town Center Redev — 162,156 162,156 —% 100% 162,156 100% 3Q15 2H18 2018 400 Dexter Avenue North/Seattle/Lake Union Dev — 287,806 287,806 83% 12% 272,675 95% 2Q15 1Q17 2018 102,938 1,858,823 1,961,761 75% 19% 1,847,771 94% ($ in thousands)

108ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ▷ BRISTOL-MYERS SQUIBB COMPANY 100 BINNEY STREET GREATER BOSTON | CAMBRIDGE | 431,483 RSF

109ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 510 TOWNSEND STREET ▷ STRIPE, INC. SAN FRANCISCO | MISSION BAY/SOMA | 300,000 RSF

110ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 505 BRANNAN STREET, PHASE I ▷ PINTEREST, INC. SAN FRANCISCO | MISSION BAY/SOMA | 150,000 RSF

111ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 213 EAST GRAND AVENUE ▷ MERCK & CO., INC. SAN FRANCISCO | SOUTH SAN FRANCISCO | 293,855 RSF

112ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ARE SPECTRUM ▷ CELGENE CORPORATION ▷ THE MEDICINES COMPANY ▷ VERTEX PHARMACEUTICALS INCORPORATED SAN DIEGO | TORREY PINES | 336,461 RSF

113ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 9625 TOWNE CENTRE DRIVE ▷ NEGOTIATING SAN DIEGO | UNIVERSITY TOWN CENTER | 162,156 RSF

114ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 400 DEXTER AVENUE NORTH ▷ JUNO THERAPEUTICS, INC. SEATTLE | LAKE UNION | 287,806 RSF

115ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Opportunistic Value-Added Acquisition Strategy GROUND-UP DEVELOPMENT REDEVELOPMENT OF OFFICE TO LAB BELOW-MARKET LEASES $How WeIncrease Cash Flows At acquisition

116ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ONE KENDALL SQUARE Greater Boston | Cambridge 817,271 RSF CLOSED NOVEMBER 8, 2016 $725 million purchase price, including $203 million assumption of secured loan Seven buildings aggregating 644,771 RSF (36% office, 48% office/laboratory, and 16% retail/other) Significant opportunity to increase cash flows from operating activities in the near term $47/RSF average in-place below-market rents 55% contractual lease expirations through 2019 Conversion opportunities from office space to lab Initial unlevered stabilized yield upon completion of near-term lease renewals/re-leasing of space 6.4% 6.2% (Cash) Entitled land parcel for ground-up development of new Class A building aggregating 172,500 RSF

117ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 TORREY RIDGE SCIENCE CENTER San Diego | Torrey Pines 294,993 RSF CLOSED OCTOBER 3, 2016 $182.5 million purchase price Three buildings aggregating 294,993 RSF 87.1% occupied Conversion of 75,953 RSF of shell and office space to laboratory/office Near-term below-market lease renewals and re-leasing of space Initial unlevered stabilized yield in 1H18 7.1% 6.8% (Cash)

118ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Conservative Underwriting and Construction Practices Lead to Yield Enhancement

119ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Alexandria’s Conservative Underwriting Principles ACQUISITIONS/REDEVELOPMENTS Define clear value-add profile Highly vetted pre-construction hold Sensitivity analysis on hold periods, rent, costs, and absorption Emphasis on cash flow vs. cap rate arbitrage for internal rate of return Analysis completed on unlevered basis (debt enhancement not included) DEVELOPMENT YIELD-ON-COST DISCLOSURES Use of Gross Basis Fully loaded carry costs assumptions through stabilization Highly vetted construction period Annual construction cost escalations Conservative contingency amounts Multi-tenancy projects • Untrended rent assumptions for space remaining to be leased • Typical 12 to 36 month absorption period from completion

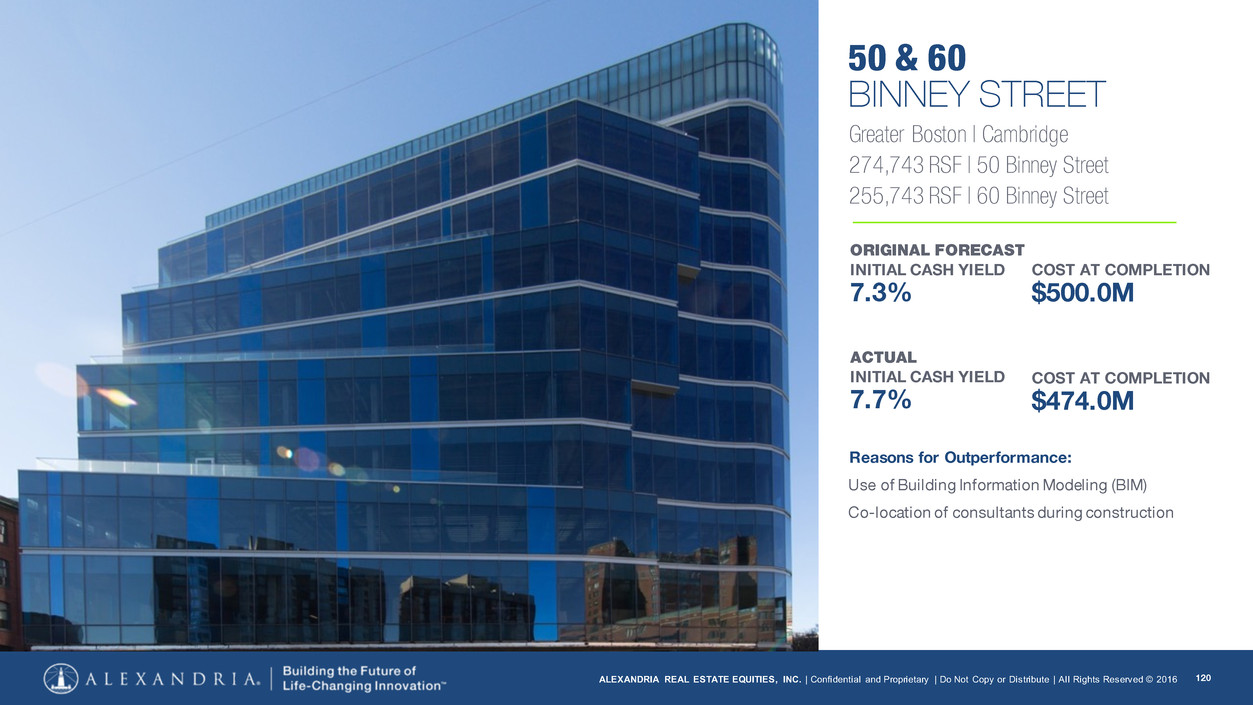

120ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 1. Source: Greater Boston | Cambridge 274,743 RSF | 50 Binney Street 50 & 60 BINNEY STREET ORIGINAL FORECAST INITIAL CASH YIELD 7.3% ACTUAL INITIAL CASH YIELD 7.7% 255,743 RSF | 60 Binney Street Reasons for Outperformance: Use of Building Information Modeling (BIM) Co-location of consultants during construction COST AT COMPLETION $500.0M COST AT COMPLETION $474.0M

121ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Greater Boston | Cambridge 59,783 RSF Reasons for Outperformance: Avoided use of owner’s contingency Consultants brought in early Co-location of consultants during construction Adaptive re-use of special permit 11 HURLEY STREET ORIGINAL FORECAST INITIAL CASH YIELD 7.9% ACTUAL INITIAL CASH YIELD 8.8% COST AT COMPLETION $41.0M COST AT COMPLETION $36.5M

122ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 Future Pipeline of New Class A Properties: 2018-2021

123ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 As of September 30, 2016 unless otherwise stated. 1. Excludes acquisition of 88 Bluxome Street which is currently under contract. 2. Information for 399 Binney Street is updated as of November 30, 2016. 3. Reflects the commencement of 213 East Grand Avenue aggregating 293,855 RSF, which is expected to be placed into service in 2019. Alexandria’s Key Future Projects ($ in thousands, except per SF amounts) Square Feet Property/Submarket Our Interest Book Value Owned Pending Per SF1 Greater Boston 399 Binney Street (One Kendall Square)/Cambridge2 100% $ 56,000 172,500 — $ 325 Alexandria Technology Square®/Cambridge 100% 7,787 100,000 — 78 San Francisco 88 Bluxome Street/Mission Bay/SoMa 100% — — 1,070,925 — 505 Brannan Street, Phase II/Mission Bay/SoMa 99.4% 13,430 165,000 — 81 Grand Avenue/South San Francisco3 100% 14,807 227,936 — 65 560 Eccles Avenue/South San Francisco 100% 17,655 144,000 — 123 New York East 29th Street/Manhattan 100% — 420,000 — — San Diego 5200 Illumina Way/University Town Center 100% 10,831 386,044 — 28 Campus Point Drive/University Town Center 100% 10,063 315,000 — 32 Seattle 1150/1165/1166 Eastlake Avenue East/Lake Union 100% 35,388 366,000 — 97 1818 Fairview Avenue East/Lake Union 100% 10,036 188,490 — 53 Research Triangle Park 6 Davis Drive/Research Triangle Park 100% 16,429 1,000,000 — 16 Key future projects 192,426 3,484,970 1,070,925 55 Other future projects 100% 69,869 2,072,382 — 34 $ 262,295 5,557,352 1,070,925 $ 47 Total future value-creation projects 6,628,277

124ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 399 BINNEY STREET GREATER BOSTON | CAMBRIDGE | 172,500 RSF

125ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 ALEXANDRIA TECHNOLOGY SQUARE® GREATER BOSTON | CAMBRIDGE | 100,000 RSF

126ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 88 BLUXOME STREET SAN FRANCISCO | MISSION BAY/SOMA | 1,070,925 RSF

127ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 505 BRANNAN STREET, PHASE II SAN FRANCISCO | MISSION BAY/SOMA | 165,000 RSF

128ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 EAST 29TH STREET (NORTH TOWER) NEW YORK CITY | MANHATTAN | 420,000 RSF

129ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 5200 ILLUMINA WAY SAN DIEGO | UNIVERSITY TOWN CENTER | 386,044 RSF

130ALEXANDRIA REAL ESTATE EQUITIES, INC. | Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2016 CAMPUS POINT DRIVE SAN DIEGO | UNIVERSITY TOWN CENTER | 315,000 RSF