| Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2020 | i | |

| (1) | Refer to “Annual Rental Revenue,” “Class A Properties and AAA Locations,” and “Investment-Grade or Publicly Traded Large Cap Tenants” in the “Definitions and Reconciliations” of our Supplemental Information for additional details. |

| (2) | Refer to “Summary of Debt” in the “Key Credit Metrics” of our Supplemental Information for additional details. |

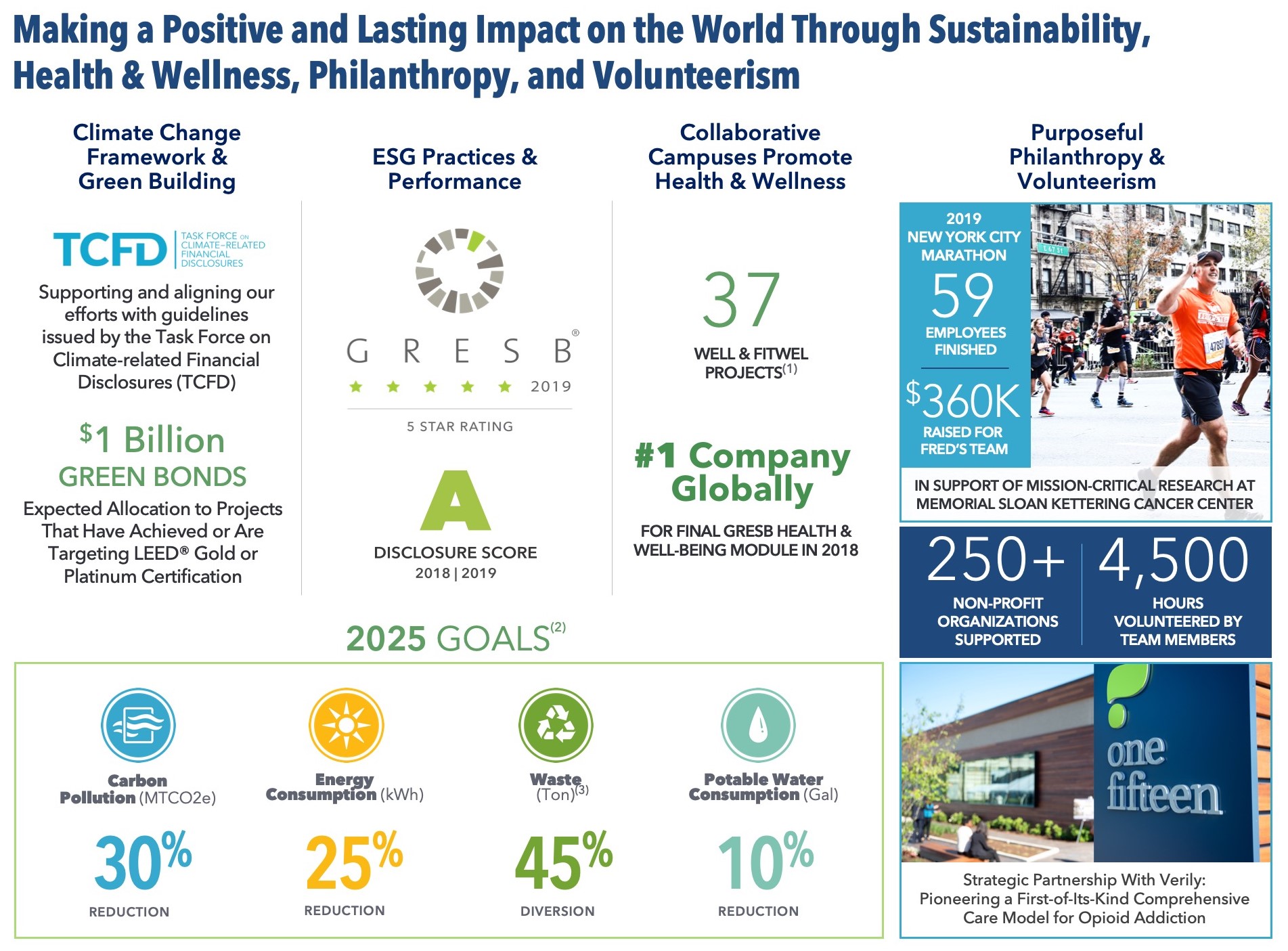

| (1) | Upon completion of 26 projects in process targeting either WELL or Fitwel certification. |

| (2) | Relative to a 2015 baseline. Carbon pollution, energy consumption, and water consumption values are for our directly managed buildings. |

| (3) | Waste values are for our total portfolio, which includes both indirectly and directly managed buildings. |

| Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2020 | iii | |

| |

| Table of Contents | |

| December 31, 2019 | |

| EARNINGS PRESS RELEASE | Page | Page | ||

| SUPPLEMENTAL INFORMATION | Page | Page | ||

| External Growth / Investments in Real Estate | ||||

| New Class A Development and Redevelopment Properties: | ||||

| Internal Growth | ||||

| Balance Sheet Management | ||||

| Definitions and Reconciliations | ||||

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Please refer to page 8 of this Earnings Press Release and our Supplemental Information for further information. |

| This document is not an offer to sell or a solicitation to buy securities of Alexandria Real Estate Equities, Inc. Any offers to sell or solicitations to buy our securities shall be made only by means of a prospectus approved for that purpose. Unless otherwise indicated, the “Company,” “Alexandria,” “ARE,” “we,” “us,” and “our” refer to Alexandria Real Estate Equities, Inc. and our consolidated subsidiaries. |

| Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2020 | iv | |

Alexandria Real Estate Equities, Inc.

Reports:

2019 Revenues of $1.5 billion, Up 15.4% Over 2018;

4Q19 and 2019 Net Income per Share – Diluted of $1.74 and $3.12;

4Q19 and 2019 FFO per Share – Diluted, As Adjusted, of $1.77 and $6.96; and

Continued Operational Excellence and Growing Dividends

PASADENA, Calif. – February 3, 2020 – Alexandria Real Estate Equities, Inc. (NYSE:ARE)

announced financial and operating results for the fourth quarter and year ended December 31, 2019.

| Key highlights | |||||||||||||||

| Operating results | 4Q19 | 4Q18 | 2019 | 2018 | |||||||||||

| Total revenues: | |||||||||||||||

| In millions | $ | 408.1 | $ | 340.5 | $ | 1,531.3 | $ | 1,327.5 | |||||||

| Growth | 19.9% | 15.4% | |||||||||||||

| Net income (loss) attributable to Alexandria’s common stockholders – diluted: | |||||||||||||||

| In millions | $ | 199.6 | $ | (31.7 | ) | $ | 351.0 | $ | 364.0 | ||||||

| Per share | $ | 1.74 | $ | (0.30 | ) | $ | 3.12 | $ | 3.52 | ||||||

| Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted: | |||||||||||||||

| In millions | $ | 203.4 | $ | 178.0 | $ | 783.0 | $ | 682.0 | |||||||

| Per share | $ | 1.77 | $ | 1.68 | $ | 6.96 | $ | 6.60 | |||||||

Celebrating our 25th Anniversary; an important milestone in company history

Since our initial launch in January 1994 as a garage startup with a strategic business plan, $19 million in Series A capital, and a unique vision to create a new kind of real estate company focused on serving the life science industry, we have grown into an investment-grade rated S&P 500® company, a recognized leader in life science cluster development, and a trusted partner to innovative companies, highly respected cities, and renowned institutions. From our initial public offering in May 1997 through December 31, 2019, we have generated a total shareholder return of 1,714% and a total market capitalization of $26.3 billion as of December 31, 2019.

A REIT industry-leading, high-quality tenant roster

| • | 50% of annual rental revenue from investment-grade or publicly traded large cap tenants. |

| • | Weighted-average remaining lease term of 8.1 years. |

Continued growth in common stock dividend

Common stock dividend declared for 4Q19 of $1.03 per common share, aggregating $4.00 per common share for the year ended December 31, 2019, up 27 cents, or 7%, over the year ended December 31, 2018; continuation of our strategy to share growth in cash flows from operating activities with our stockholders while also retaining a significant portion for reinvestment.

Strong internal growth; highest leasing activity in our history and highest annual rental rate increases during the past 10 years

| • | Continued strong internal growth; acquired vacancy from recent acquisitions provides opportunity to increase income from rentals and net operating income. |

| • | Net operating income (cash basis) of $1.0 billion for 4Q19 annualized, up $134.1 million, or 15.3%, compared to 4Q18 annualized. |

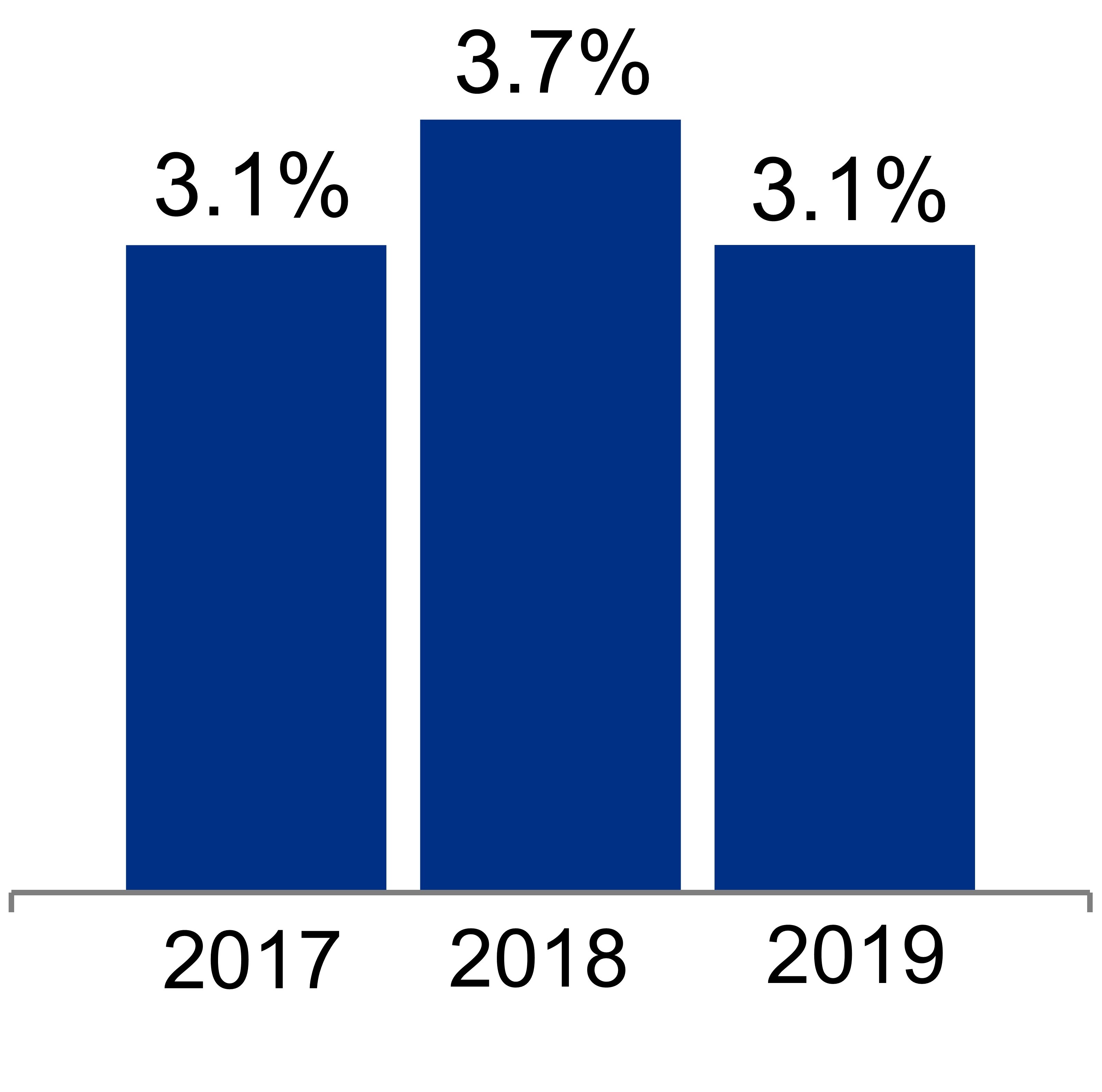

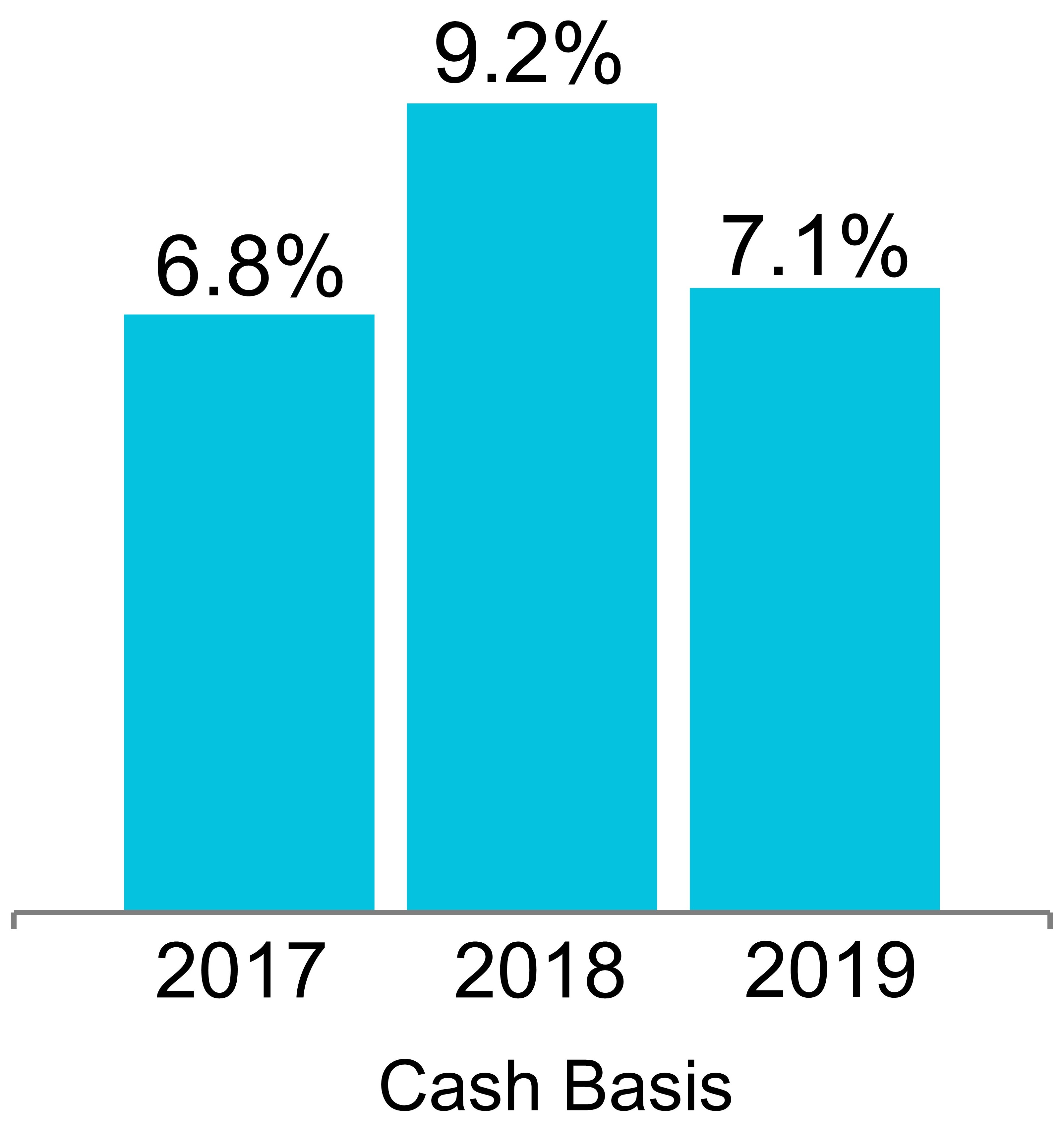

| • | Same property net operating income growth: |

| • | 2.0% and 4.0% (cash basis) for 4Q19, compared to 4Q18 |

| • | 3.1% and 7.1% (cash basis) for 2019, compared to 2018 |

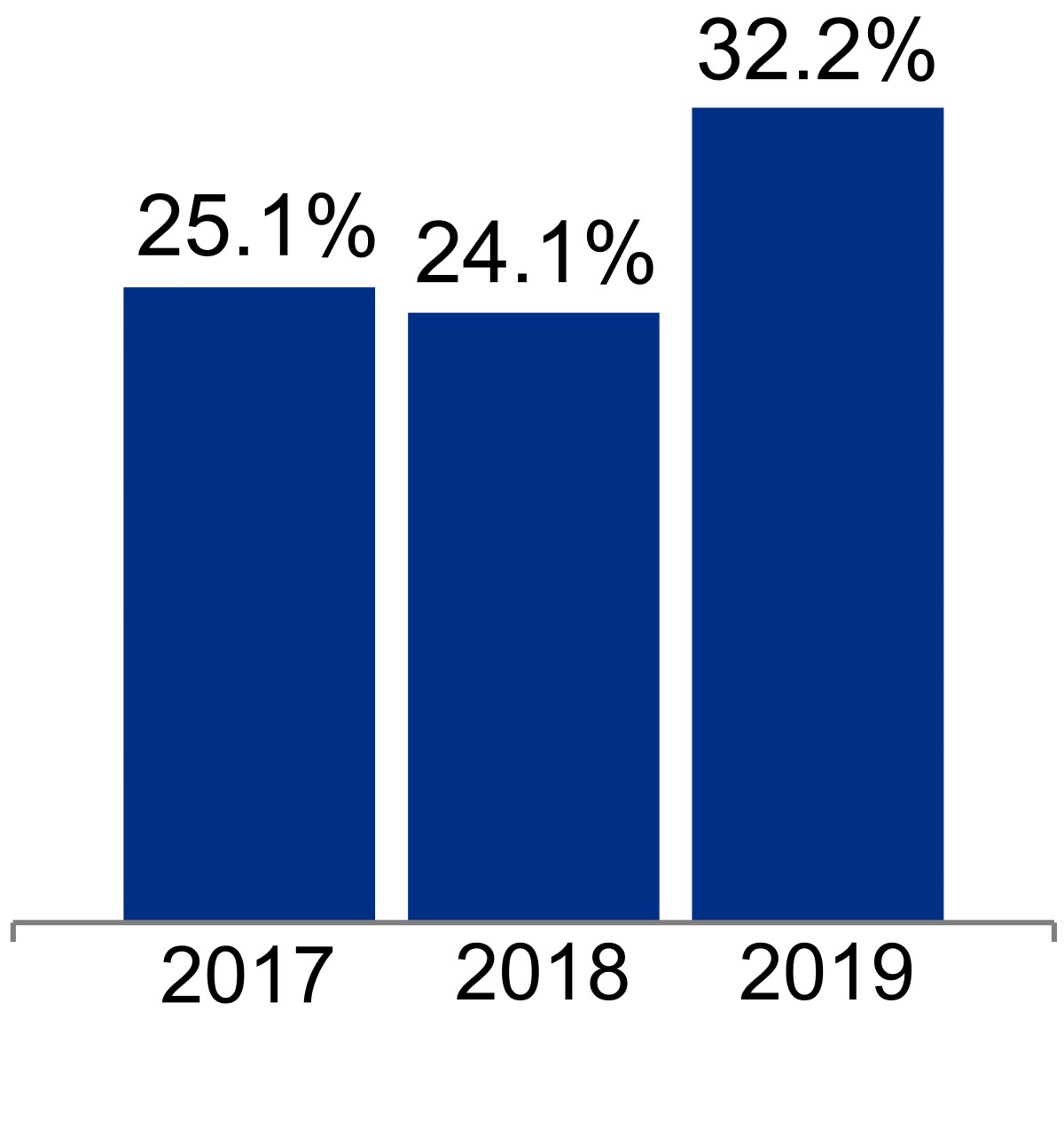

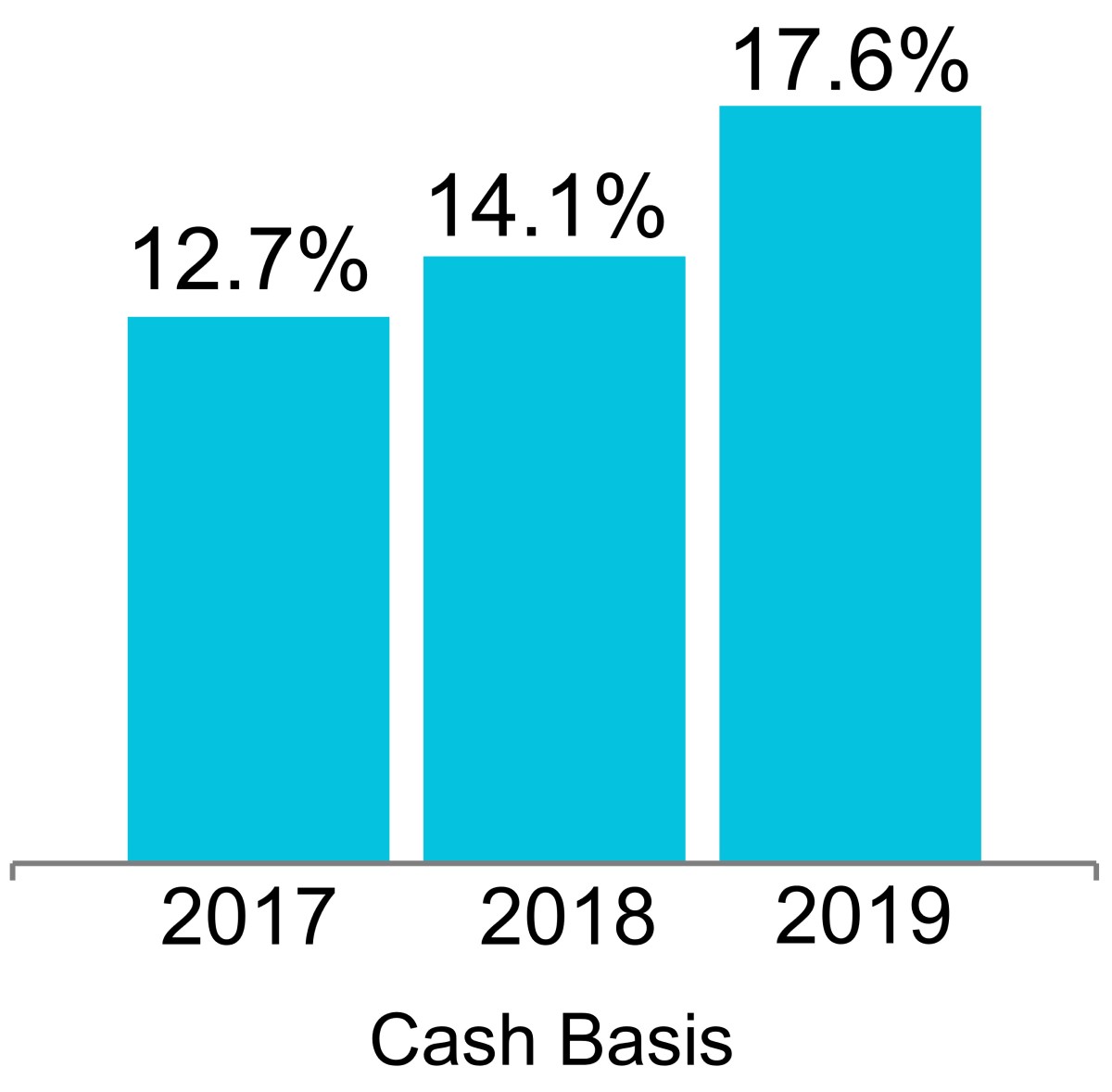

| • | Continued strong leasing activity during 2019, representing the highest leasing activity in our history and rental rate growth over expiring rates on renewed and re-leased space during 2019, representing our highest annual rental rate increases during the past 10 years: |

| 4Q19 | 2019 | |||||

| Total leasing activity – RSF | 1,752,124 | 5,062,722 | ||||

| Lease renewals and re-leasing of space: | ||||||

| RSF (included in total leasing activity above) | 571,650 | 2,427,108 | ||||

| Rental rate increases | 37.0% | 32.2% | ||||

| Rental rate increases (cash basis) | 21.7% | 17.6% | ||||

Strong external growth; disciplined allocation of capital to visible, highly leased

value-creation pipeline

| • | Since the beginning of 2019, we have placed into service 2.1 million RSF of development and redevelopment projects, with weighted-average initial stabilized yields of 7.4% and 6.9% (cash basis). |

| • | Significant near-term growth of annual net operating income (cash basis), including our share of unconsolidated real estate joint ventures, of $55 million upon the burn-off of initial free rent on recently delivered projects. |

| • | We commenced development and redevelopment projects aggregating 1.9 million RSF during 2019. |

| • | During 2019, we leased 1.4 million RSF of development and redevelopment space. |

Completion of acquisitions with significant value-creation opportunities in key submarkets

During 4Q19, we completed the acquisition of 23 properties for an aggregate purchase price of $956.5 million, comprising 3.3 million RSF, including 2.1 million RSF of current and future value-creation opportunities.

| |

| Fourth Quarter Ended December 31, 2019, Financial and Operating Results (continued) | |

| December 31, 2019 | |

Key items included in operating results

| Key items included in net income (loss) attributable to Alexandria’s common stockholders: | |||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | Amount | Per Share – Diluted | Amount | Per Share – Diluted | |||||||||||||||||||||||||||

| 4Q19 | 4Q18 | 4Q19 | 4Q18 | 2019 | 2018 | 2019 | 2018 | ||||||||||||||||||||||||

Gains (losses) on non-real estate investments(1): | |||||||||||||||||||||||||||||||

| Unrealized | $ | 148.3 | $ | (94.9 | ) | $ | 1.29 | $ | (0.89 | ) | $ | 161.5 | $ | 99.6 | $ | 1.44 | $ | 0.96 | |||||||||||||

| Realized | — | 6.4 | — | 0.06 | — | 14.7 | — | 0.14 | |||||||||||||||||||||||

| Gain on sales of real estate | 0.5 | 8.7 | — | 0.08 | 0.5 | 44.4 | — | 0.43 | |||||||||||||||||||||||

| Impairment of: | |||||||||||||||||||||||||||||||

| Real estate | (12.3 | ) | (2) | — | (0.11 | ) | — | (12.3 | ) | (6.3 | ) | (0.11 | ) | (0.06 | ) | ||||||||||||||||

Non-real estate investments(1) | (10.0 | ) | (5.5 | ) | (0.09 | ) | (0.05 | ) | (17.1 | ) | (5.5 | ) | (0.15 | ) | (0.05 | ) | |||||||||||||||

| Early extinguishment of debt: | |||||||||||||||||||||||||||||||

| Loss | — | — | — | — | (47.6 | ) | (1.1 | ) | (0.42 | ) | (0.01 | ) | |||||||||||||||||||

| Our share of gain | — | — | — | — | — | 0.8 | — | 0.01 | |||||||||||||||||||||||

| Loss on early termination of interest rate hedge agreements | — | — | — | — | (1.7 | ) | — | (0.02 | ) | — | |||||||||||||||||||||

| Preferred stock redemption charge | — | (4.2 | ) | — | (0.04 | ) | (2.6 | ) | (4.2 | ) | (0.02 | ) | (0.04 | ) | |||||||||||||||||

| Allocation to unvested restricted stock awards | — | — | — | — | — | (2.2 | ) | — | (0.02 | ) | |||||||||||||||||||||

| Total | $ | 126.5 | $ | (89.5 | ) | $ | 1.09 | $ | (0.84 | ) | $ | 80.7 | $ | 140.2 | $ | 0.72 | $ | 1.36 | |||||||||||||

Weighted-average shares of common stock outstanding for calculation of earnings per share – diluted | 115.0 | 106.0 | 112.5 | 103.3 | |||||||||||||||||||||||||||

(1) Refer to “Investments” on page 44 of our Supplemental Information for additional details. (2) Refer to “Consolidated Statements of Operations” in this Earnings Press Release for additional details. | |||||||||||||||||||||||||||||||

Core operating metrics as of or for the quarter ended December 31, 2019

High-quality revenues and cash flows, significant improvement in Adjusted EBITDA margin, and operational excellence

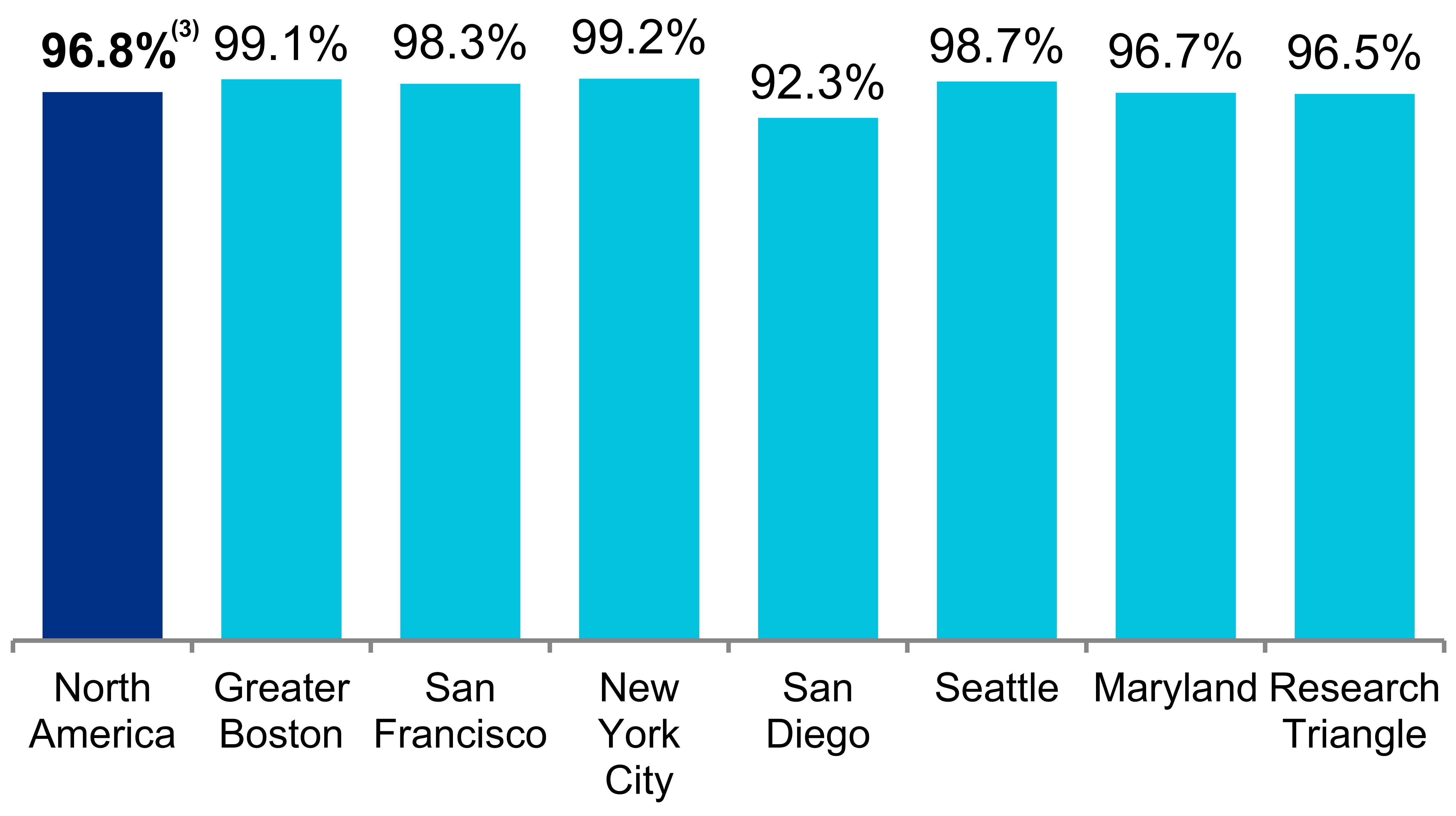

| Percentage of annual rental revenue in effect from: | |||||

| Investment-grade or publicly traded large cap tenants | 50 | % | |||

| Class A properties in AAA locations | 76 | % | |||

| Occupancy of operating properties in North America | 96.8 | % | (1) | ||

| Operating margin | 70 | % | |||

| Adjusted EBITDA margin | 68 | % | (2) | ||

| Weighted-average remaining lease term: | |||||

| All tenants | 8.1 | years | |||

| Top 20 tenants | 11.6 | years | |||

| (1) | Includes 259,616 RSF, or 1.0%, of vacancy representing lease-up opportunities at properties recently acquired during 2H19, primarily related to our SD Tech by Alexandria campus. Excluding these vacancies, occupancy of operating properties in North America would have been 97.8% as of December 31, 2019. Refer to “Occupancy” on page 20 of our Supplemental Information for additional details. |

| (2) | Represents an increase of 400 bps since the beginning of 2013. |

Balance sheet management

Key metrics as of December 31, 2019

| • | $26.3 billion of total market capitalization |

| • | $19.5 billion of total equity capitalization |

| • | $2.4 billion of liquidity(1) |

| (1) | In January 2020, we entered into $1.0 billion of forward equity sales agreements. Including the outstanding forward equity agreements, we had proforma liquidity of $3.4 billion. |

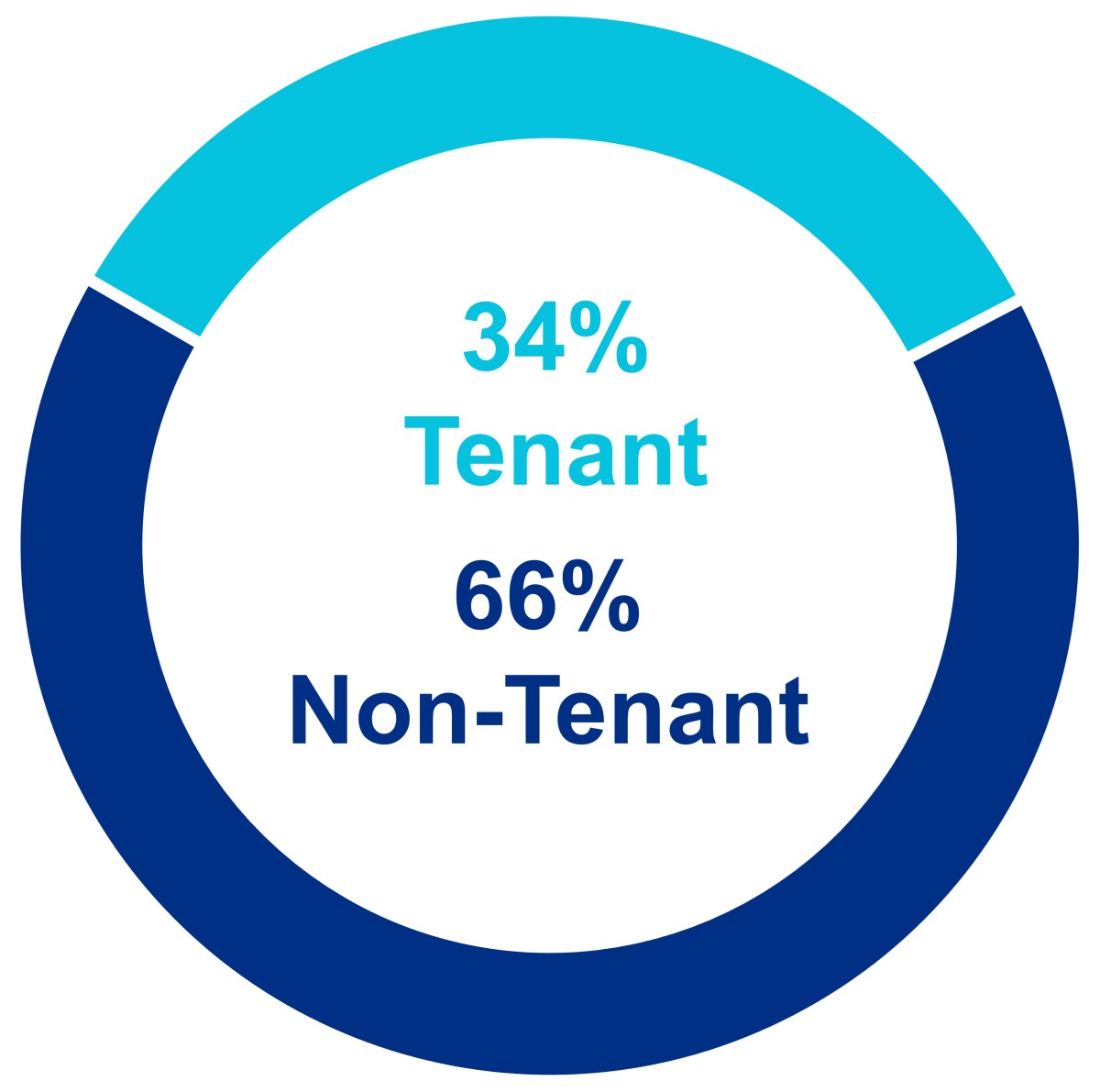

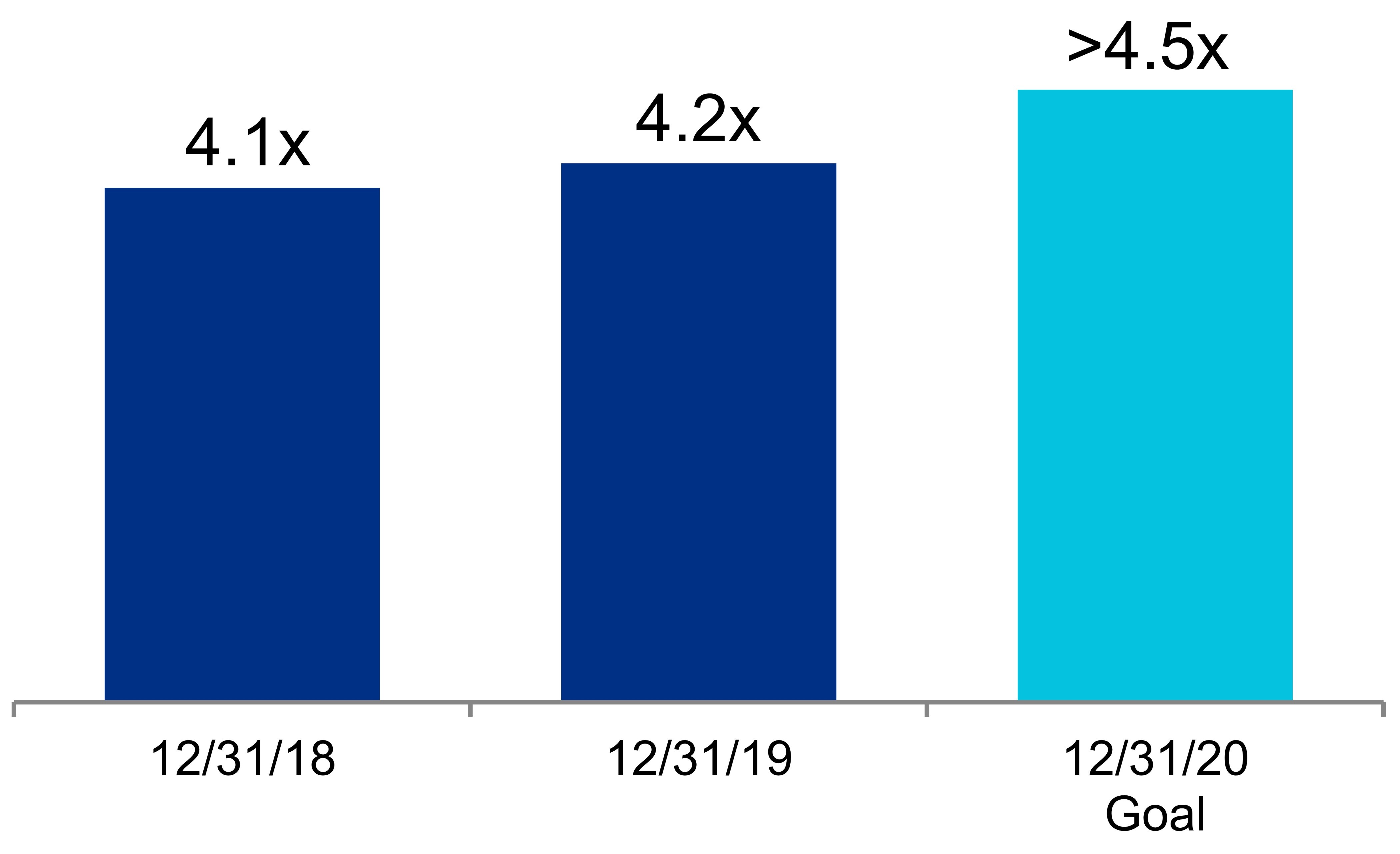

| 4Q19 | Goal | ||||||

| Quarter | Trailing 12 | 4Q20 | |||||

| Annualized | Months | Annualized | |||||

| Net debt and preferred stock to Adjusted EBITDA | 5.7x | (1) | 6.1x | Less than or equal to 5.2x | |||

| Fixed-charge coverage ratio | 4.2x | 4.2x | Greater than 4.5x | ||||

| (1) | Due to the timing of two acquisitions that closed in December 2019, we had a temporary 0.4x increase above our projected net debt and preferred stock to Adjusted EBITDA – fourth quarter of 2019, annualized, for December 31, 2019. We remain committed to our guidance for net debt and preferred stock to Adjusted EBITDA – fourth quarter of 2020, annualized, of less than or equal to 5.2x. |

| Value-creation pipeline of new Class A development and redevelopment projects as a percentage of gross investments in real estate | 4Q19 | ||

| Under construction and 63% leased/negotiating | 6% | ||

Income-producing/potential cash flows/covered land play(1) | 5% | ||

| Land | 2% | ||

| (1) | Includes projects that have existing buildings which are generating or can generate operating cash flows. Also includes development rights associated with existing operating campuses. |

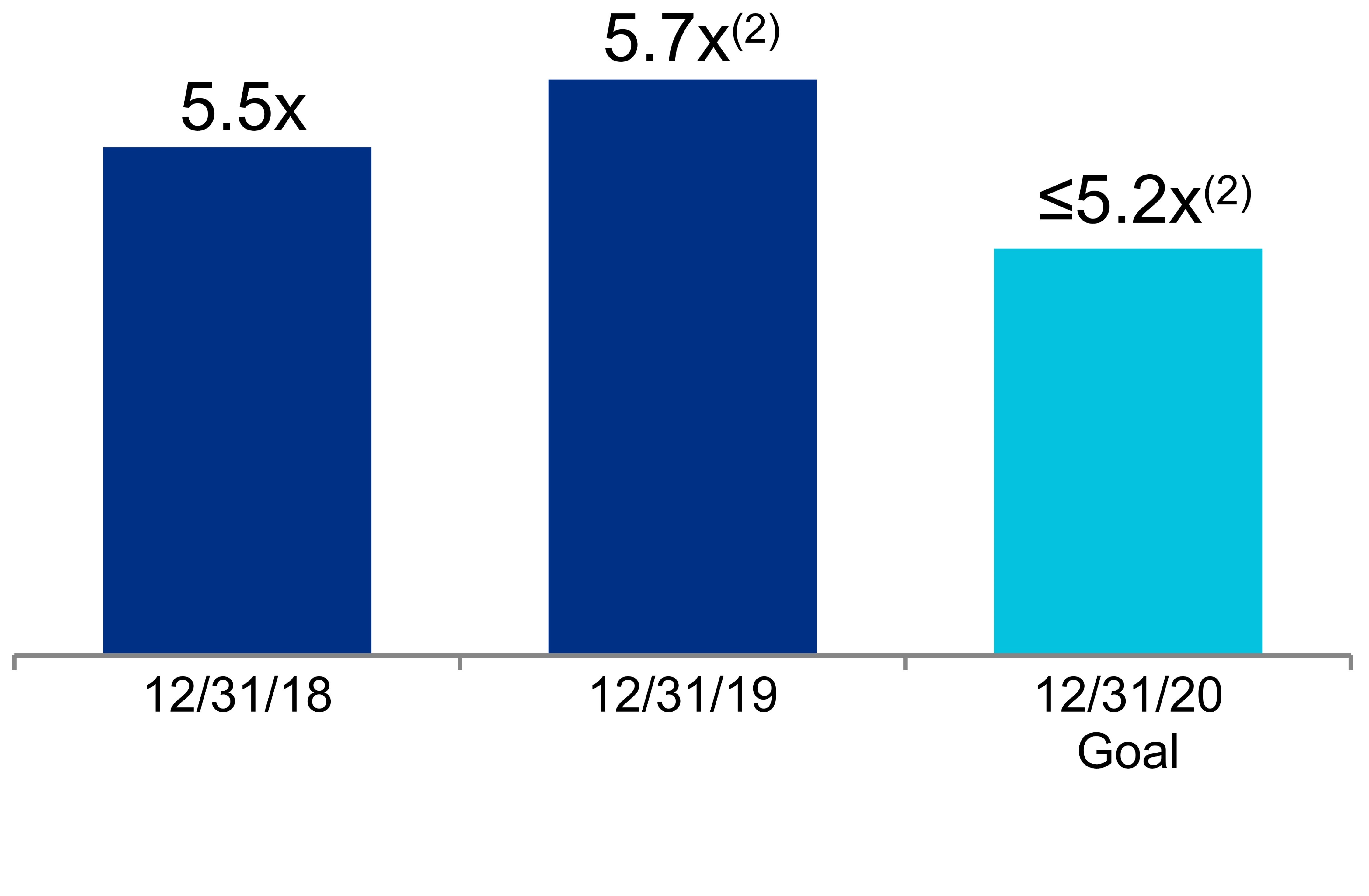

Key capital events

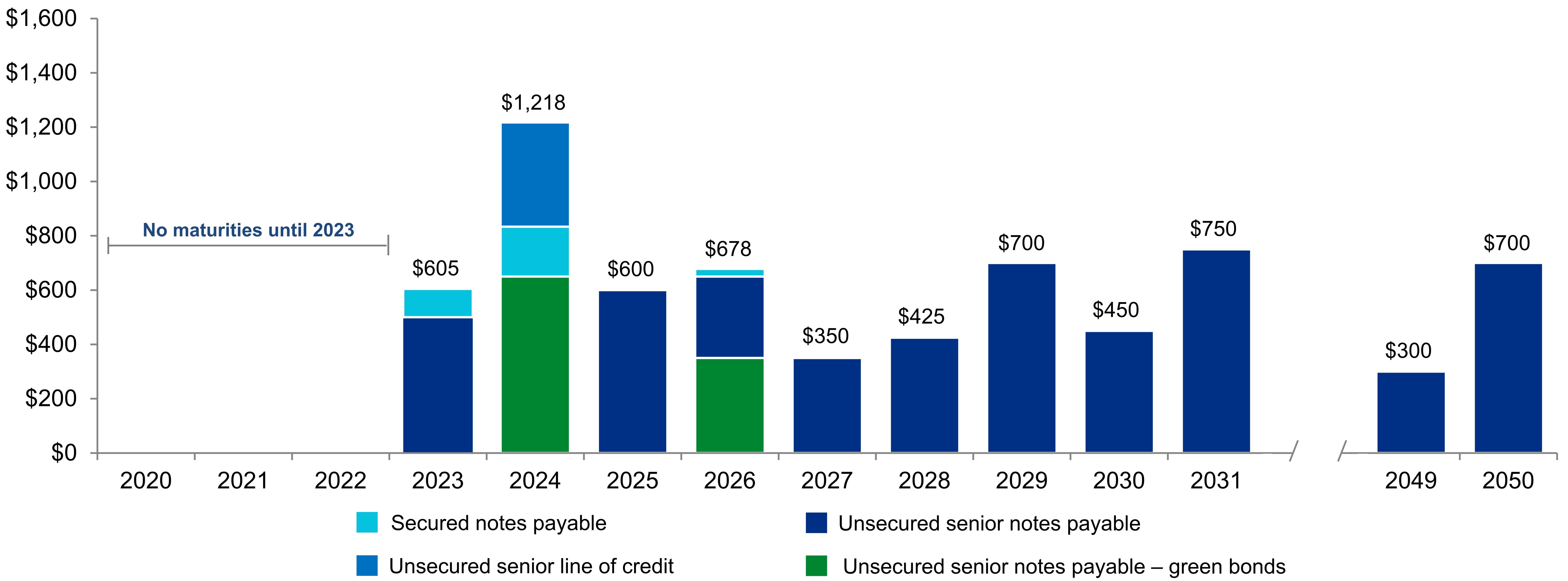

| • | During 2019, we opportunistically issued $2.7 billion of unsecured senior notes payable, with a weighted average interest rate of 3.77% and maturity of 16.9 years. Proceeds were primarily used to refinance and repay $1.6 billion of secured notes and unsecured senior debt. As of December 31, 2019, our weighted average remaining term on outstanding debt is 10.4 years, with no debt maturing until 2023. |

| • | During 2019, we completed dispositions and sales of partial interests for an aggregate sales price of $906.9 million and consideration in excess of book value of $382.5 million, including $900.2 million of dispositions and sales of partial interests completed during the first nine months of 2019. Proceeds were reinvested into our highly leased value-creation pipeline. |

| • | In January 2020, we entered into forward equity sales agreements to sell an aggregate of 6.9 million shares of our common stock (including the exercise of an underwriters’ option) at a public offering price of $155.00 per share, before underwriting discounts. We expect to settle these forward equity sales agreements in 2020, and receive proceeds of approximately $1.0 billion, to be further adjusted as provided in the sales agreements, which will fund pending and recently completed acquisitions and the construction of our highly leased development projects. Refer to “Subsequent Events” on next page. |

| |

| Fourth Quarter Ended December 31, 2019, Financial and Operating Results (continued) | |

| December 31, 2019 | |

Key capital events (continued)

| • | During 4Q19, we issued 7.0 million shares of common stock to settle our remaining outstanding forward equity sales agreements that were entered into during 2Q19, and received net proceeds of $981.3 million. The proceeds were used to fund construction projects and to fund 2019 acquisitions completed prior to December 2019. |

| • | In October 2019, we elected to convert the remaining 2.3 million outstanding shares of our 7.00% Series D cumulative convertible preferred stock (“Series D Convertible Preferred Stock”) into shares of our common stock. The Series D Convertible Preferred Stock became eligible for mandatory conversion at our discretion upon our common stock price exceeding $149.46 per share for the specified period of time required to cause the mandatory conversion. We converted the Series D Convertible Preferred Stock into 578 thousand shares of common stock. This conversion was accounted for as an equity transaction, and we did not recognize a gain or loss. |

Investments

We carry our investments in publicly traded companies and certain privately held entities at fair value. Investment income included the following:

| • | $152.7 million during 4Q19, comprising $14.4 million in realized gains, $10.0 million in impairments related to privately held non-real estate investments, and $148.3 million in unrealized gains. |

| • | $194.6 million during 2019, comprising $50.3 million in realized gains, $17.1 million in impairments related to privately held non-real estate investments, and $161.5 million in unrealized gains. |

Industry leadership, strategic initiatives, and corporate responsibility

| • | In October 2019, we accepted the 2019 Developer of the Year Award from NAIOP, the Commercial Real Estate Development Association. This award annually honors the development company that best exemplifies leadership and innovation as demonstrated by the outstanding quality of projects and services, financial consistency and stability, ability to adapt to market conditions, and support for the local community. |

| • | In November 2019, Alexandria, in collaboration with academic institutions, research hospitals, and life science industry partners, including Harvard University, the Massachusetts Institute of Technology, FUJIFILM Diosynth Biotechnologies, and GE Healthcare Life Sciences, announced the launch of a first-of-its-kind consortium to catalyze advanced biological innovation and manufacturing in Greater Boston with an aim to treat, prevent, and cure diseases. |

| • | In January 2020, we announced our first national $100,000 AgTech Innovation Prize competition to recognize startup and early-stage agtech and foodtech companies that demonstrate novel approaches to addressing agriculture-, food-, and nutrition-related challenges. |

| • | In January 2020, Alexandria Venture Investments, the company’s venture capital arm, was recognized for a third consecutive year as the most active biopharma investor by new deal volume by Silicon Valley Bank in its “2020 Annual Report: Healthcare Investments and Exits.” Alexandria’s venture activity provides us with, among other things, mission-critical data and knowledge on innovations and trends. |

| • | Our philanthropy and volunteerism efforts provide mission-critical support to non-profit organizations doing meaningful work in areas of medical research, STEM education, military support services, and serving local communities. During 2019, our team members volunteered more than 4,500 hours to support over 250 non-profit organizations across the country. |

Industry leadership, strategic initiatives, and corporate responsibility (continued)

| • | We value both the health and wellness of our team members as well as supporting organizations on the leading edge of medical innovation. In November 2019, we were honored to support 59 of our team members who completed the New York City Marathon on behalf of Fred’s Team and raised over $360 thousand to support mission-critical research at Memorial Sloan Kettering Cancer Center. |

Subsequent events

| • | As of February 3, 2020, we completed acquisitions of four properties in 2020 for an aggregate purchase price of $341.2 million, comprising 800,346 RSF of operating and redevelopment opportunities strategically located across multiple markets. |

| • | In January 2020, we formed a real estate joint venture with Boston Properties, Inc., in which we are targeting a 51% ownership interest over time. We are the managing member and will consolidate this joint venture pursuant to accounting literature since we have the power to direct the activities that most significantly affect the economic performance of the joint venture. Our partner contributed three office buildings and land supporting 260,000 square feet of future development, and we contributed one office building, one office/laboratory building, one amenity building, at 701, 681, and 685 Gateway Boulevard, respectively, and land supporting 377,000 square feet of future development. This future mega campus in our South San Francisco submarket will aggregate 1.7 million RSF, approximately 50% of which represents future development and redevelopment opportunities. |

| • | In January 2020, we entered into forward equity sales agreements to sell an aggregate of 6.9 million shares of our common stock. Refer to the previous page for additional details. |

| • | We expect to file a new ATM program in the first quarter of 2020. |

| Select 2019 Highlights |  | |

| December 31, 2019 | ||

| (1) | Leasing activity aggregating 5.1 million RSF for 2019 represents the highest annual leasing activity in our history. |

| (2) | Rental rate increases of 32.2% and 17.6% (cash basis) represent our highest annual increase during the past 10 years. |

| 2019 Acquisitions |  |

| December 31, 2019 | |

| (Dollars in thousands) | |

| Property | Submarket/Market | Date of Purchase | Number of Properties | Operating Occupancy | Square Footage | Unlevered Yields | Purchase Price | |||||||||||||||||||||||||||||

| Future Development | Active Redevelopment | Operating With Future Development/ Redevelopment | Operating | Initial Stabilized | Initial Stabilized (Cash) | |||||||||||||||||||||||||||||||

| Completed YTD 3Q19 | Various | 24 | 87 | % | 995,338 | 347,912 | 246,578 | 822,508 | $ | 1,203,680 | (1) | |||||||||||||||||||||||||

| Completed 4Q19: | ||||||||||||||||||||||||||||||||||||

| The Arsenal on the Charles | Cambridge/Inner Suburbs/Greater Boston | 12/17/19 | 11 | 100 | % | 200,000 | 153,157 | 154,855 | (2) | 528,276 | (3) | (3) | 525,500 | |||||||||||||||||||||||

| 3825 and 3875 Fabian Way | Greater Stanford/ San Francisco | 12/10/19 | 2 | 100 | % | — | — | 478,000 | — | 8.2 | % | (4) | 6.9 | % | (4) | 291,000 | ||||||||||||||||||||

| SD Tech by Alexandria (50% interest in consolidated JV) | Sorrento Mesa/ San Diego | 10/30/19 | 10 | 71 | % | 720,000 | — | — | 598,316 | (5) | 6.6 | % | (5) | 6.5 | % | (5) | 114,964 | |||||||||||||||||||

| 14200 Shady Grove Road | Rockville/Maryland | 10/31/19 | — | N/A | 435,000 | — | — | — | (3) | (3) | 25,000 | |||||||||||||||||||||||||

| 23 | 81 | % | 1,355,000 | 153,157 | 632,855 | 1,126,592 | 956,464 | |||||||||||||||||||||||||||||

| 2019 acquisitions | 47 | 83 | % | 2,350,338 | 501,069 | 879,433 | 1,949,100 | $ | 2,160,144 | |||||||||||||||||||||||||||

| (1) | Refer to our Form 10-Q for the quarterly period ended September 30, 2019 filed on October 29, 2019, for transactions and related yield information. |

| (2) | Represents leased square footage with contractual lease expirations in 3Q20 and 1Q21. Upon expiration of the existing leases, we anticipate this RSF will be redeveloped to office/laboratory space. |

| (3) | We expect to provide total estimated costs and related yields in the future, subsequent to the commencement of development or redevelopment. |

| (4) | Represents the initial stabilized yields related to the fully occupied operating properties upon closing. |

| (5) | The campus includes 10 operating buildings, of which we expect to renovate several vacant suites aggregating 182,056 RSF. We expect to achieve unlevered initial stabilized yields of 6.6% and 6.5% (cash basis) for the operating buildings and yields for future development will be disclosed subsequent to the commencement of development. |

| 2020 Acquisitions |  |

| December 31, 2019 | |

| (Dollars in thousands) | |

| Property | Submarket/Market | Date of Purchase | Number of Properties | Operating Occupancy | Square Footage | Unlevered Yields | Purchase Price | ||||||||||||||||||||||||

| Future Development | Operating With Future Development/ Redevelopment | Operating | Initial Stabilized | Initial Stabilized (Cash) | |||||||||||||||||||||||||||

| 2020 acquisitions: | |||||||||||||||||||||||||||||||

| Completed | |||||||||||||||||||||||||||||||

| 275 Grove Street | Route 128/ Greater Boston | 1/10/20 | 1 | 99 | % | — | — | 509,702 | 8.0% | 6.7% | $ | 226,100 | |||||||||||||||||||

601, 611, and 651 Gateway Boulevard(1) | South San Francisco/ San Francisco | 1/28/20 | 3 | 73 | % | (2) | 260,000 | 300,010 | 475,607 | (3) | (3) | (1) | |||||||||||||||||||

| 9808 and 9868 Scranton Road | Sorrento Mesa/ San Diego | 1/10/20 | 2 | 88 | % | — | — | 219,628 | 7.3% | 6.8% | 102,250 | ||||||||||||||||||||

| Other | 1/14/20 | 1 | — | % | — | 71,016 | — | N/A | N/A | 12,800 | |||||||||||||||||||||

| 7 | 80 | % | 260,000 | 371,026 | 1,204,937 | 341,150 | |||||||||||||||||||||||||

| Pending | |||||||||||||||||||||||||||||||

| Mercer Mega Block | Lake Union/Seattle | TBD | — | N/A | 800,000 | — | — | (3) | (3) | 143,500 | |||||||||||||||||||||

| Pending | San Francisco | TBD | — | N/A | 700,000 | — | — | (3) | (3) | 120,000 | |||||||||||||||||||||

| Pending | Various | TBD | 5 | N/A | 500,000 | — | 423,000 | N/A | N/A | 345,350 | |||||||||||||||||||||

| 2020 acquisitions | 12 | 2,260,000 | 371,026 | 1,627,937 | $ | 950,000 | |||||||||||||||||||||||||

| 2020 guidance range | $900,000 - $1,000,000 | ||||||||||||||||||||||||||||||

| (1) | In January 2020, we formed a real estate joint venture with Boston Properties, Inc., through a non-cash contribution, and are targeting a 51% ownership interest over time. Our initial ownership interest in the real estate joint venture was 44%, and we anticipate contributing additional capital over time to accrete to our target ownership interest of 51%. We are the managing member and will consolidate this joint venture pursuant to accounting literature since we have the power to direct the activities that most significantly affect the economic performance of the joint venture. Our partner contributed three office buildings and land supporting 260,000 square feet of future development, and we contributed one office building, one office/laboratory building, one amenity building, at 701, 681, and 685 Gateway Boulevard, respectively, and land supporting 377,000 square feet of future development. This future mega campus in our South San Francisco submarket will aggregate 1.7 million RSF, approximately 50% of which represents future development and redevelopment opportunities. We anticipate providing additional details within our Earnings Press Release and Supplemental Package for the first quarter ending March 31, 2020. |

| (2) | Includes 211,454 RSF of expected vacancy as of 1Q20. We expect this vacant RSF to result in a decline in our operating occupancy of 0.7% as of 1Q20. Refer to “Occupancy” on page 20 in our Supplemental Information for additional details. |

| (3) | We expect to provide total estimated costs and related yields for development and redevelopment projects in the future, subsequent to the commencement of construction. |

| Guidance |  | |

| December 31, 2019 | ||

| (Dollars in millions, except per share amounts) | ||

The following updated guidance is based on our current view of existing market conditions and assumptions for the year ending December 31, 2020. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. Refer to our discussion of “forward-looking statements” on page 8 of this Earnings Press Release for additional details.

| Summary of Key Changes in Guidance | Guidance | ||||||||||||||

| As of 2/3/20 | As of 1/6/20 | ||||||||||||||

Occupancy percentage in North America as of December 31, 2020(1) | 95.4% to 96.0% | 95.7% to 96.3% | |||||||||||||

| Projected 2020 Earnings per Share and Funds From Operations per Share Attributable to Alexandria’s Common Stockholders – Diluted | |||||

Earnings per share(2) | $2.17 to $2.37 | ||||

| Depreciation and amortization of real estate assets | 5.15 | ||||

| Allocation to unvested restricted stock awards | (0.04) | ||||

Funds from operations per share(3) | $7.28 to $7.48 | ||||

| Midpoint | $7.38 | ||||

| Key Assumptions | Low | High | |||||||

Occupancy percentage in North America as of December 31, 2020(1) | 95.4% | 96.0% | |||||||

| Lease renewals and re-leasing of space: | |||||||||

| Rental rate increases | 28.0% | 31.0% | |||||||

| Rental rate increases (cash basis) | 14.0% | 17.0% | |||||||

| Same property performance: | |||||||||

| Net operating income increase | 1.5% | 3.5% | |||||||

| Net operating income increase (cash basis) | 5.0% | 7.0% | |||||||

| Straight-line rent revenue | $ | 113 | $ | 123 | |||||

| General and administrative expenses | $ | 121 | $ | 126 | |||||

| Capitalization of interest | $ | 108 | $ | 118 | |||||

| Interest expense | $ | 169 | $ | 179 | |||||

| Key Credit Metrics | 2020 Guidance | ||

| Net debt and preferred stock to Adjusted EBITDA – 4Q20 annualized | Less than or equal to 5.2x | ||

| Fixed-charge coverage ratio – 4Q20 annualized | Greater than 4.5x | ||

Key Sources and Uses of Capital (in millions) | Range | Midpoint | Certain Completed Items | ||||||||||||||

| Sources of capital: | |||||||||||||||||

| Net cash provided by operating activities after dividends | $ | 200 | $ | 240 | $ | 220 | |||||||||||

| Incremental debt | 400 | 360 | 380 | ||||||||||||||

Real estate dispositions, partial interest sales, and common equity(4) | 1,850 | 2,050 | 1,950 | $ | 1,025 | (5) | |||||||||||

| Total sources of capital | $ | 2,450 | $ | 2,650 | $ | 2,550 | |||||||||||

| Uses of capital: | |||||||||||||||||

| Construction | $ | 1,550 | $ | 1,650 | $ | 1,600 | |||||||||||

Acquisitions(4) | 900 | 1,000 | 950 | $ | 341 | ||||||||||||

| Total uses of capital | $ | 2,450 | $ | 2,650 | $ | 2,550 | |||||||||||

| Incremental debt (included above): | |||||||||||||||||

| Issuance of unsecured senior notes payable | $ | 550 | $ | 650 | $ | 600 | |||||||||||

| $2.2 billion unsecured senior line of credit and commercial paper program/other | (150 | ) | (290 | ) | (220 | ) | |||||||||||

| Incremental debt | $ | 400 | $ | 360 | $ | 380 | |||||||||||

| (1) | The 0.3% reduction in occupancy guidance is attributable to vacancy aggregating 71,016 RSF representing lease-up opportunities at one acquisition completed in January 2020. Refer to “Occupancy” on page 20 in our Supplemental Information for additional details. |

| (2) | Excludes unrealized gains or losses after December 31, 2019, that are required to be recognized in earnings and are excluded from funds from operations per share, as adjusted. |

| (3) | Refer to “Funds From Operations and Funds From Operations, As Adjusted, Attributable to Alexandria’s Common Stockholders” in “Definitions and Reconciliations” of our Supplemental Information for additional details. |

| (4) | Excludes the formation of a consolidated joint venture with Boston Properties, Inc. through non-cash contributions of real estate. Refer to “2020 Acquisitions” in this Earnings Press Release for additional details. |

| (5) | In January 2020, we entered into forward equity sales agreements to sell an aggregate of 6.9 million shares of our common stock (including the exercise of underwriters’ option) at a public offering price of $155.00 per share, before underwriting discounts. We expect to settle these forward equity sales agreements in 2020 and receive proceeds of approximately $1.0 billion, to be further adjusted as provided in the sales agreements. |

| |

| Earnings Call Information and About the Company | |

| December 31, 2019 | |

We will host a conference call on Tuesday, February 4, 2020, at 3:00 p.m. Eastern Time (“ET”)/noon Pacific Time (“PT”), which is open to the general public, to discuss our financial and operating results for the fourth quarter and year ended December 31, 2019. To participate in this conference call, dial (833) 366-1125 or (412) 902-6738 shortly before 3:00 p.m. ET/noon PT and ask the operator to join the call for Alexandria Real Estate Equities, Inc. The audio webcast can be accessed at www.are.com in the “For Investors” section. A replay of the call will be available for a limited time from 5:00 p.m. ET/2:00 p.m. PT on Tuesday, February 4, 2020. The replay number is (877) 344-7529 or (412) 317-0088, and the access code is 10136680.

Additionally, a copy of this Earnings Press Release and Supplemental Information for the fourth quarter and year ended December 31, 2019, is available in the “For Investors” section of our website at www.are.com or by following this link: http://www.are.com/fs/2019q4.pdf.

For any questions, please contact Joel S. Marcus, executive chairman and founder; Stephen A. Richardson, co-chief executive officer; Peter M. Moglia, co-chief executive officer and co-chief investment officer; Dean A. Shigenaga, co-president and chief financial officer; or Sara M. Kabakoff, vice president – corporate communications, at (626) 578-0777; or Paula Schwartz, managing director – Rx Communications Group, at (917) 322-2216.

About the Company

Alexandria Real Estate Equities, Inc. (NYSE:ARE), an S&P 500® urban office real estate investment trust (“REIT”), is the first and longest-tenured owner, operator, and developer uniquely focused on collaborative life science, technology, and agtech campuses in AAA innovation cluster locations, with a total market capitalization of $26.3 billion as of December 31, 2019, and an asset base in North America of 39.2 million square feet (“SF”). The asset base in North America includes 27.0 million RSF of operating properties and 2.1 million RSF of Class A properties undergoing construction, 6.3 million RSF of near-term and intermediate-term development and redevelopment projects, and 3.8 million SF of future development projects. Founded in 1994, Alexandria pioneered this niche and has since established a significant market presence in key locations, including Greater Boston, San Francisco, New York City, San Diego, Seattle, Maryland, and Research Triangle. Alexandria has a longstanding and proven track record of developing Class A properties clustered in urban life science, technology, and agtech campuses that provide our innovative tenants with highly dynamic and collaborative environments that enhance their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. Alexandria also provides strategic capital to transformative life science, technology, and agtech companies through our venture capital arm. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value. For additional information on Alexandria, please visit www.are.com.

***********

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our 2020 earnings per share attributable to Alexandria’s common stockholders – diluted, 2020 funds from operations per share attributable to Alexandria’s common stockholders – diluted, net operating income, and our projected sources and uses of capital. You can identify the forward-looking statements by their use of forward-looking words, such as “forecast,” “guidance,” “goals,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” or “will,” or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). Accordingly, you are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are made as of the date of this Earnings Press Release, and unless otherwise stated, we assume no obligation to update this information and expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

Alexandria®, Lighthouse Design® logo, Building the Future of Life-Changing Innovation™, LaunchLabs®, Alexandria Center®, Alexandria Technology Square®, Alexandria Summit®, Alexandria Technology Center®, Alexandria Innovation Center®, and GradLabs™ are trademarks of Alexandria Real Estate Equities, Inc. All other company names, trademarks, and logos referenced herein are the property of their respective owners.

| Consolidated Statements of Operations |  |

| December 31, 2019 | |

| (Dollars in thousands, except per share amounts) | |

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | 12/31/19 | 12/31/18 | ||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||

| Income from rentals | $ | 404,721 | $ | 385,776 | $ | 371,618 | $ | 354,749 | $ | 337,785 | $ | 1,516,864 | $ | 1,314,781 | ||||||||||||||

| Other income | 3,393 | 4,708 | 2,238 | 4,093 | 2,678 | 14,432 | 12,678 | |||||||||||||||||||||

| Total revenues | 408,114 | 390,484 | 373,856 | 358,842 | 340,463 | 1,531,296 | 1,327,459 | |||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||

| Rental operations | 121,852 | 116,450 | 105,689 | 101,501 | 97,682 | 445,492 | 381,120 | |||||||||||||||||||||

| General and administrative | 29,782 | 27,930 | 26,434 | 24,677 | 22,385 | 108,823 | 90,405 | |||||||||||||||||||||

| Interest | 45,493 | 46,203 | 42,879 | 39,100 | 40,239 | 173,675 | 157,495 | |||||||||||||||||||||

| Depreciation and amortization | 140,518 | 135,570 | 134,437 | 134,087 | 124,990 | 544,612 | 477,661 | |||||||||||||||||||||

| Impairment of real estate | 12,334 | (1) | — | — | — | — | 12,334 | (1) | 6,311 | |||||||||||||||||||

| Loss on early extinguishment of debt | — | 40,209 | — | 7,361 | — | 47,570 | 1,122 | |||||||||||||||||||||

| Total expenses | 349,979 | 366,362 | 309,439 | 306,726 | 285,296 | 1,332,506 | 1,114,114 | |||||||||||||||||||||

| Equity in earnings of unconsolidated real estate joint ventures | 4,777 | 2,951 | 1,262 | 1,146 | 1,029 | 10,136 | 43,981 | |||||||||||||||||||||

| Investment income (loss) | 152,667 | (2) | (63,076 | ) | 21,500 | 83,556 | (83,531 | ) | 194,647 | 136,763 | ||||||||||||||||||

| Gain on sales of real estate | 474 | — | — | — | 8,704 | 474 | 8,704 | |||||||||||||||||||||

| Net income (loss) | 216,053 | (36,003 | ) | 87,179 | 136,818 | (18,631 | ) | 404,047 | 402,793 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (13,612 | ) | (11,199 | ) | (8,412 | ) | (7,659 | ) | (6,053 | ) | (40,882 | ) | (23,481 | ) | ||||||||||||||

| Net income (loss) attributable to Alexandria Real Estate Equities, Inc.’s stockholders | 202,441 | (47,202 | ) | 78,767 | 129,159 | (24,684 | ) | 363,165 | 379,312 | |||||||||||||||||||

| Dividends on preferred stock | — | (1,173 | ) | (1,005 | ) | (1,026 | ) | (1,155 | ) | (3,204 | ) | (5,060 | ) | |||||||||||||||

| Preferred stock redemption charge | — | — | — | (2,580 | ) | (4,240 | ) | (2,580 | ) | (4,240 | ) | |||||||||||||||||

| Net income attributable to unvested restricted stock awards | (2,823 | ) | (1,398 | ) | (1,432 | ) | (1,955 | ) | (1,661 | ) | (6,386 | ) | (6,029 | ) | ||||||||||||||

| Net income (loss) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | $ | 199,618 | $ | (49,773 | ) | $ | 76,330 | $ | 123,598 | $ | (31,740 | ) | $ | 350,995 | $ | 363,983 | ||||||||||||

| Net income (loss) per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders: | ||||||||||||||||||||||||||||

| Basic | $ | 1.75 | $ | (0.44 | ) | $ | 0.68 | $ | 1.11 | $ | (0.30 | ) | $ | 3.13 | $ | 3.53 | ||||||||||||

| Diluted | $ | 1.74 | $ | (0.44 | ) | $ | 0.68 | $ | 1.11 | $ | (0.30 | ) | $ | 3.12 | $ | 3.52 | ||||||||||||

| Weighted-average shares of common stock outstanding: | ||||||||||||||||||||||||||||

| Basic | 114,175 | 112,120 | 111,433 | 111,054 | 106,033 | 112,204 | 103,010 | |||||||||||||||||||||

| Diluted | 114,974 | 112,120 | 111,501 | 111,054 | 106,033 | 112,524 | 103,321 | |||||||||||||||||||||

| Dividends declared per share of common stock | $ | 1.03 | $ | 1.00 | $ | 1.00 | $ | 0.97 | $ | 0.97 | $ | 4.00 | $ | 3.73 | ||||||||||||||

| (1) | Represents charges to lower the carrying amount of two investments in real estate that were classified as held for sale during the three months ended December 31, 2019, to their estimated fair value. |

| (2) | Refer to “Investments” of our Supplemental Information for additional details. |

| Consolidated Balance Sheets |  |

| December 31, 2019 | |

| (In thousands) | |

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Investments in real estate | $ | 14,844,038 | $ | 13,618,280 | $ | 12,872,824 | $ | 12,410,350 | $ | 11,913,693 | ||||||||||

| Investments in unconsolidated real estate joint ventures | 346,890 | 340,190 | 334,162 | 290,405 | 237,507 | |||||||||||||||

| Cash and cash equivalents | 189,681 | 410,675 | 198,909 | 261,372 | 234,181 | |||||||||||||||

| Restricted cash | 53,008 | 42,295 | 39,316 | 54,433 | 37,949 | |||||||||||||||

| Tenant receivables | 10,691 | 10,668 | 9,228 | 9,645 | 9,798 | |||||||||||||||

| Deferred rent | 641,844 | 615,817 | 585,082 | 558,103 | 530,237 | |||||||||||||||

| Deferred leasing costs | 270,043 | 252,772 | 247,468 | 241,268 | 239,070 | |||||||||||||||

| Investments | 1,140,594 | 990,454 | 1,057,854 | 1,000,904 | 892,264 | |||||||||||||||

| Other assets | 893,714 | 777,003 | 694,627 | 653,726 | 370,257 | |||||||||||||||

| Total assets | $ | 18,390,503 | $ | 17,058,154 | $ | 16,039,470 | $ | 15,480,206 | $ | 14,464,956 | ||||||||||

| Liabilities, Noncontrolling Interests, and Equity | ||||||||||||||||||||

| Secured notes payable | $ | 349,352 | $ | 351,852 | $ | 354,186 | $ | 356,461 | $ | 630,547 | ||||||||||

| Unsecured senior notes payable | 6,044,127 | 6,042,831 | 5,140,914 | 5,139,500 | 4,292,293 | |||||||||||||||

| Unsecured senior line of credit | 384,000 | 343,000 | 514,000 | — | 208,000 | |||||||||||||||

| Unsecured senior bank term loan | — | — | 347,105 | 347,542 | 347,415 | |||||||||||||||

| Accounts payable, accrued expenses, and other liabilities | 1,320,268 | 1,241,276 | 1,157,417 | 1,171,377 | 981,707 | |||||||||||||||

| Dividends payable | 126,278 | 115,575 | 114,379 | 110,412 | 110,280 | |||||||||||||||

| Total liabilities | 8,224,025 | 8,094,534 | 7,628,001 | 7,125,292 | 6,570,242 | |||||||||||||||

| Commitments and contingencies | ||||||||||||||||||||

| Redeemable noncontrolling interests | 12,300 | 12,099 | 10,994 | 10,889 | 10,786 | |||||||||||||||

| Alexandria Real Estate Equities, Inc.’s stockholders’ equity: | ||||||||||||||||||||

| 7.00% Series D cumulative convertible preferred stock | — | 57,461 | 57,461 | 57,461 | 64,336 | |||||||||||||||

| Common stock | 1,208 | 1,132 | 1,120 | 1,112 | 1,110 | |||||||||||||||

| Additional paid-in capital | 8,874,367 | 7,743,188 | 7,581,573 | 7,518,716 | 7,286,954 | |||||||||||||||

| Accumulated other comprehensive loss | (9,749 | ) | (11,549 | ) | (11,134 | ) | (10,712 | ) | (10,435 | ) | ||||||||||

| Alexandria Real Estate Equities, Inc.’s stockholders’ equity | 8,865,826 | 7,790,232 | 7,629,020 | 7,566,577 | 7,341,965 | |||||||||||||||

| Noncontrolling interests | 1,288,352 | 1,161,289 | 771,455 | 777,448 | 541,963 | |||||||||||||||

| Total equity | 10,154,178 | 8,951,521 | 8,400,475 | 8,344,025 | 7,883,928 | |||||||||||||||

| Total liabilities, noncontrolling interests, and equity | $ | 18,390,503 | $ | 17,058,154 | $ | 16,039,470 | $ | 15,480,206 | $ | 14,464,956 | ||||||||||

| Funds From Operations and Funds From Operations per Share |  |

| December 31, 2019 | |

| (In thousands) | |

The following table presents a reconciliation of net income (loss) attributable to Alexandria’s common stockholders, the most directly comparable financial measure presented in accordance with generally accepted accounting principles (“GAAP”), including our share of amounts from consolidated and unconsolidated real estate joint ventures, to funds from operations attributable to Alexandria’s common stockholders – diluted, and funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted, for the periods below:

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | 12/31/19 | 12/31/18 | ||||||||||||||||||||||

| Net income (loss) attributable to Alexandria’s common stockholders | $ | 199,618 | $ | (49,773 | ) | $ | 76,330 | $ | 123,598 | $ | (31,740 | ) | $ | 350,995 | $ | 363,983 | ||||||||||||

Depreciation and amortization of real estate assets(1) | 137,761 | 135,570 | 134,437 | 134,087 | 124,990 | 541,855 | 477,661 | |||||||||||||||||||||

| Noncontrolling share of depreciation and amortization from consolidated real estate JVs | (10,176 | ) | (8,621 | ) | (6,744 | ) | (5,419 | ) | (4,252 | ) | (30,960 | ) | (16,077 | ) | ||||||||||||||

| Our share of depreciation and amortization from unconsolidated real estate JVs | 2,702 | 1,845 | 973 | 846 | 719 | 6,366 | 3,181 | |||||||||||||||||||||

| Gain on sales of real estate | (474 | ) | — | — | — | (8,704 | ) | (474 | ) | (8,704 | ) | |||||||||||||||||

| Our share of gain on sales of real estate from unconsolidated real estate JVs | — | — | — | — | — | — | (35,678 | ) | ||||||||||||||||||||

| Impairment of real estate – rental properties | 12,334 | — | — | — | — | 12,334 | — | |||||||||||||||||||||

| Assumed conversion of 7.00% Series D cumulative convertible preferred stock | — | — | 1,005 | 1,026 | — | 3,204 | 5,060 | |||||||||||||||||||||

| Allocation to unvested restricted stock awards | (1,809 | ) | — | (1,445 | ) | (2,054 | ) | — | (5,904 | ) | (5,961 | ) | ||||||||||||||||

Funds from operations attributable to Alexandria’s common stockholders – diluted(1) | 339,956 | 79,021 | 204,556 | 252,084 | 81,013 | 877,416 | 783,465 | |||||||||||||||||||||

| Unrealized (gains) losses on non-real estate investments | (148,268 | ) | 70,043 | (11,058 | ) | (72,206 | ) | 94,850 | (161,489 | ) | (99,634 | ) | ||||||||||||||||

| Realized gains on non-real estate investments | — | — | — | — | (6,428 | ) | — | (14,680 | ) | |||||||||||||||||||

| Impairment of real estate – land parcels | — | — | — | — | — | — | 6,311 | |||||||||||||||||||||

| Impairment of non-real estate investments | 9,991 | (2) | 7,133 | — | — | 5,483 | 17,124 | 5,483 | ||||||||||||||||||||

| Loss on early extinguishment of debt | — | 40,209 | — | 7,361 | — | 47,570 | 1,122 | |||||||||||||||||||||

| Loss on early termination of interest rate hedge agreements | — | 1,702 | — | — | — | 1,702 | — | |||||||||||||||||||||

| Our share of gain on early extinguishment of debt from unconsolidated real estate JVs | — | — | — | — | — | — | (761 | ) | ||||||||||||||||||||

| Preferred stock redemption charge | — | — | — | 2,580 | 4,240 | 2,580 | 4,240 | |||||||||||||||||||||

| Removal of assumed conversion of 7.00% Series D cumulative convertible preferred stock | — | — | (1,005 | ) | (1,026 | ) | — | (3,204 | ) | (5,060 | ) | |||||||||||||||||

| Allocation to unvested restricted stock awards | 1,760 | (1,002 | ) | 179 | 990 | (1,138 | ) | 1,307 | 1,517 | |||||||||||||||||||

| Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted | $ | 203,439 | $ | 197,106 | $ | 192,672 | $ | 189,783 | $ | 178,020 | $ | 783,006 | $ | 682,003 | ||||||||||||||

| (1) | Calculated in accordance with standards established by the Nareit Board of Governors. Refer to “Funds From Operations and Funds From Operations, As Adjusted, Attributable to Alexandria’s Common Stockholders” in the “Definitions and Reconciliations” of our Supplemental Information for additional details. |

| (2) | Relates to two privately held non-real estate investments. |

| Funds From Operations and Funds From Operations per Share (continued) |  |

| December 31, 2019 | |

| (In thousands, except per share amounts) | |

The following table presents a reconciliation of net income (loss) per share attributable to Alexandria’s common stockholders, the most directly comparable financial measure presented in accordance with GAAP, including our share of amounts from consolidated and unconsolidated real estate joint ventures, to funds from operations per share attributable to Alexandria’s common stockholders – diluted, and funds from operations per share attributable to Alexandria’s common stockholders – diluted, as adjusted, for the periods below. Per share amounts may not add due to rounding.

| Three Months Ended | Year Ended | |||||||||||||||||||||||||||

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | 12/31/19 | 12/31/18 | ||||||||||||||||||||||

| Net income (loss) per share attributable to Alexandria’s common stockholders – diluted | $ | 1.74 | $ | (0.44 | ) | $ | 0.68 | $ | 1.11 | $ | (0.30 | ) | $ | 3.12 | $ | 3.52 | ||||||||||||

| Depreciation and amortization of real estate assets | 1.13 | 1.14 | 1.15 | 1.17 | 1.14 | 4.60 | 4.50 | |||||||||||||||||||||

| Gain on sales of real estate | — | — | — | — | (0.08 | ) | — | (0.08 | ) | |||||||||||||||||||

| Our share of gain on sales of real estate from unconsolidated real estate JVs | — | — | — | — | — | — | (0.35 | ) | ||||||||||||||||||||

| Impairment of real estate – rental properties | 0.11 | — | — | — | — | 0.11 | — | |||||||||||||||||||||

| Allocation to unvested restricted stock awards | (0.02 | ) | — | — | (0.02 | ) | — | (0.06 | ) | (0.06 | ) | |||||||||||||||||

Funds from operations per share attributable to Alexandria’s common stockholders – diluted(1) | 2.96 | 0.70 | 1.83 | 2.26 | 0.76 | 7.77 | 7.53 | |||||||||||||||||||||

| Unrealized (gains) losses on non-real estate investments | (1.29 | ) | 0.62 | (0.10 | ) | (0.65 | ) | 0.89 | (1.44 | ) | (0.96 | ) | ||||||||||||||||

| Realized gains on non-real estate investments | — | — | — | — | (0.06 | ) | — | (0.14 | ) | |||||||||||||||||||

| Impairment of real estate – land parcels | — | — | — | — | — | — | 0.06 | |||||||||||||||||||||

| Impairment of non-real estate investments | 0.09 | 0.06 | — | — | 0.05 | 0.15 | 0.05 | |||||||||||||||||||||

| Loss on early extinguishment of debt | — | 0.36 | — | 0.07 | — | 0.42 | 0.01 | |||||||||||||||||||||

| Loss on early termination of interest rate hedge agreements | — | 0.02 | — | — | — | 0.02 | — | |||||||||||||||||||||

| Our share of gain on early extinguishment of debt from unconsolidated real estate JVs | — | — | — | — | — | — | (0.01 | ) | ||||||||||||||||||||

| Preferred stock redemption charge | — | — | — | 0.02 | 0.04 | 0.02 | 0.04 | |||||||||||||||||||||

| Allocation to unvested restricted stock awards | 0.01 | (0.01 | ) | — | 0.01 | — | 0.02 | 0.02 | ||||||||||||||||||||

| Funds from operations per share attributable to Alexandria’s common stockholders – diluted, as adjusted | $ | 1.77 | $ | 1.75 | $ | 1.73 | $ | 1.71 | $ | 1.68 | $ | 6.96 | $ | 6.60 | ||||||||||||||

Weighted-average shares of common stock outstanding(2) for calculations of: | ||||||||||||||||||||||||||||

| Earnings per share – diluted | 114,974 | 112,120 | 111,501 | 111,054 | 106,033 | 112,524 | 103,321 | |||||||||||||||||||||

| Funds from operations – diluted, per share | 114,974 | 112,562 | 112,077 | 111,635 | 106,244 | 112,966 | 104,048 | |||||||||||||||||||||

| Funds from operations – diluted, as adjusted, per share | 114,974 | 112,562 | 111,501 | 111,054 | 106,244 | 112,524 | 103,321 | |||||||||||||||||||||

| (1) | Refer to footnotes on previous page for additional details. |

| (2) | Refer to “Weighted-Average Shares of Common Stock Outstanding – Diluted” in the “Definitions and Reconciliations” of our Supplemental Information for additional details. |

SUPPLEMENTAL

INFORMATION

| |

| Company Profile | |

| December 31, 2019 | |

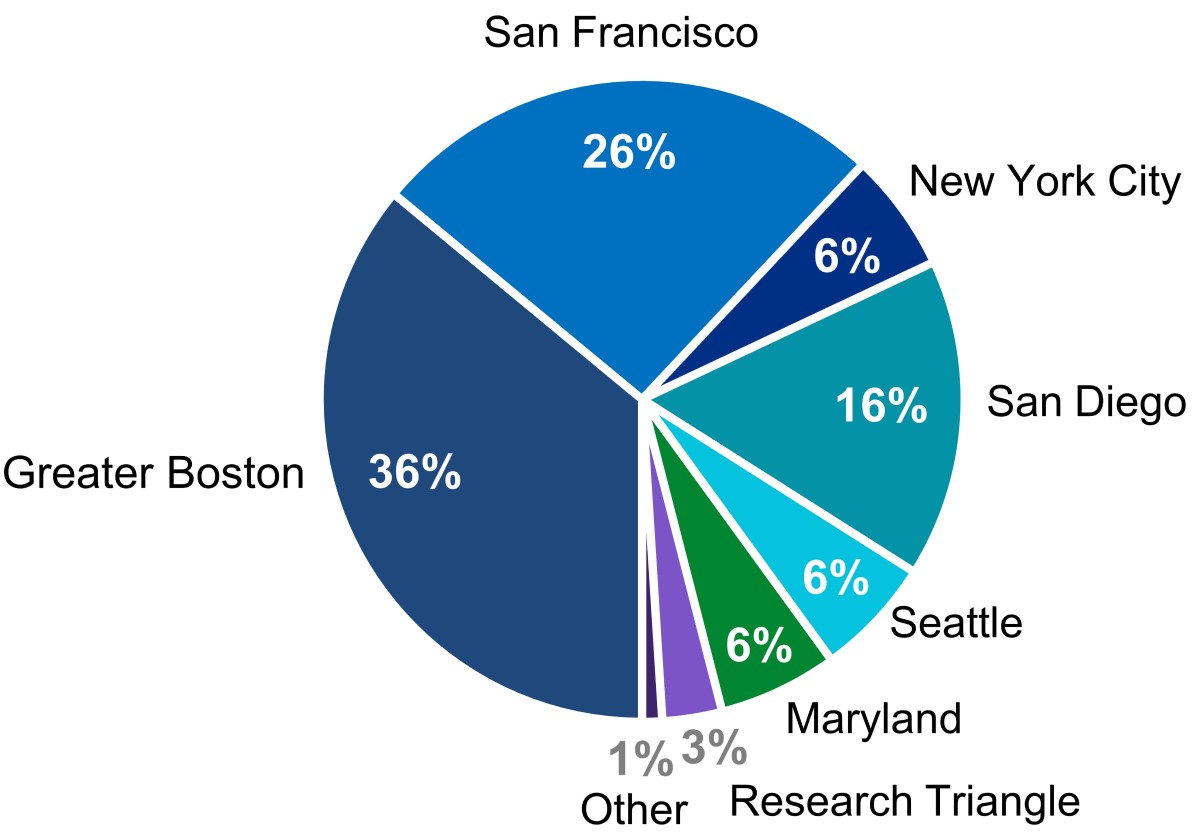

Alexandria Real Estate Equities, Inc. (NYSE:ARE), an S&P 500® urban office REIT, is the first and longest-tenured owner, operator, and developer uniquely focused on collaborative life science, technology, and agtech campuses in AAA innovation cluster locations, with a total market capitalization of $26.3 billion as of December 31, 2019, and an asset base in North America of 39.2 million SF. The asset base in North America includes 27.0 million RSF of operating properties and 2.1 million RSF of Class A properties undergoing construction, 6.3 million RSF of near-term and intermediate-term development and redevelopment projects, and 3.8 million SF of future development projects. Founded in 1994, Alexandria pioneered this niche and has since established a significant market presence in key locations, including Greater Boston, San Francisco, New York City, San Diego, Seattle, Maryland, and Research Triangle. Alexandria has a longstanding and proven track record of developing Class A properties clustered in urban life science, technology, and agtech campuses that provide our innovative tenants with highly dynamic and collaborative environments that enhance their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. Alexandria also provides strategic capital to transformative life science, technology, and agtech companies through our venture capital arm. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value. For additional information on Alexandria, please visit www.are.com.

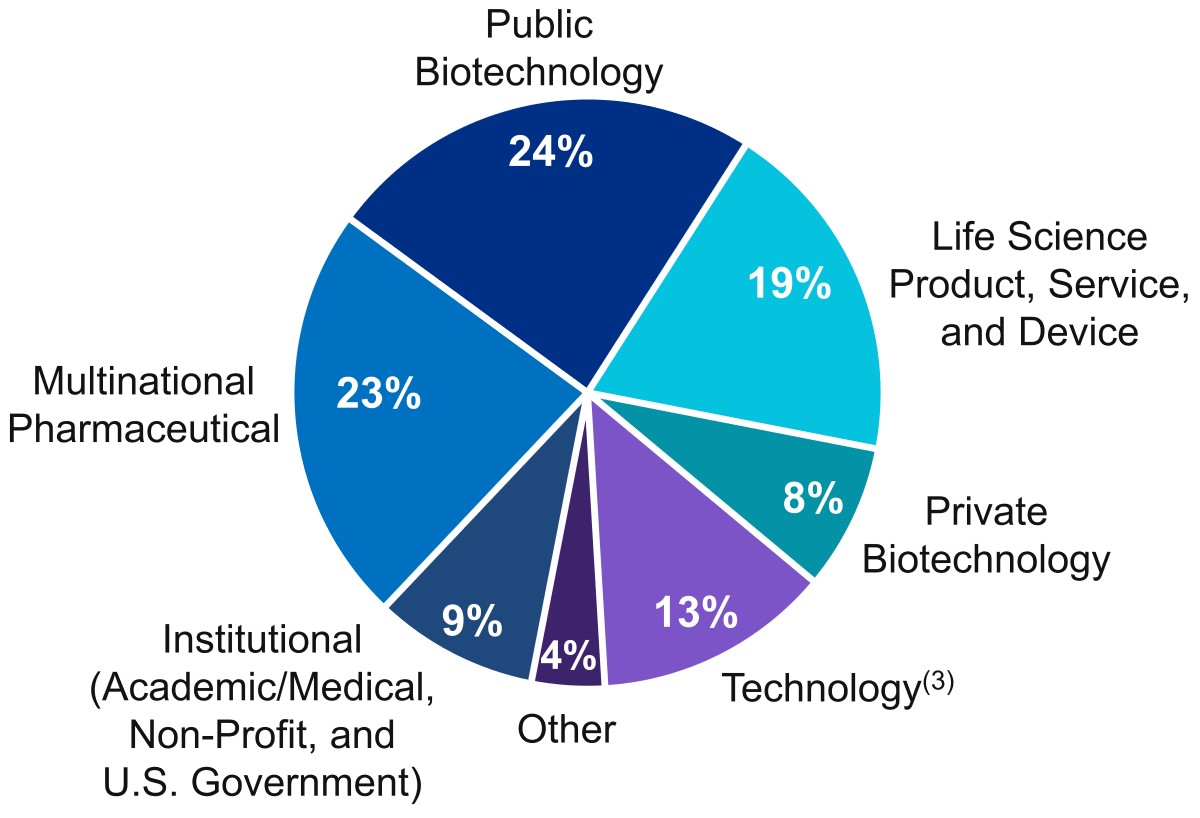

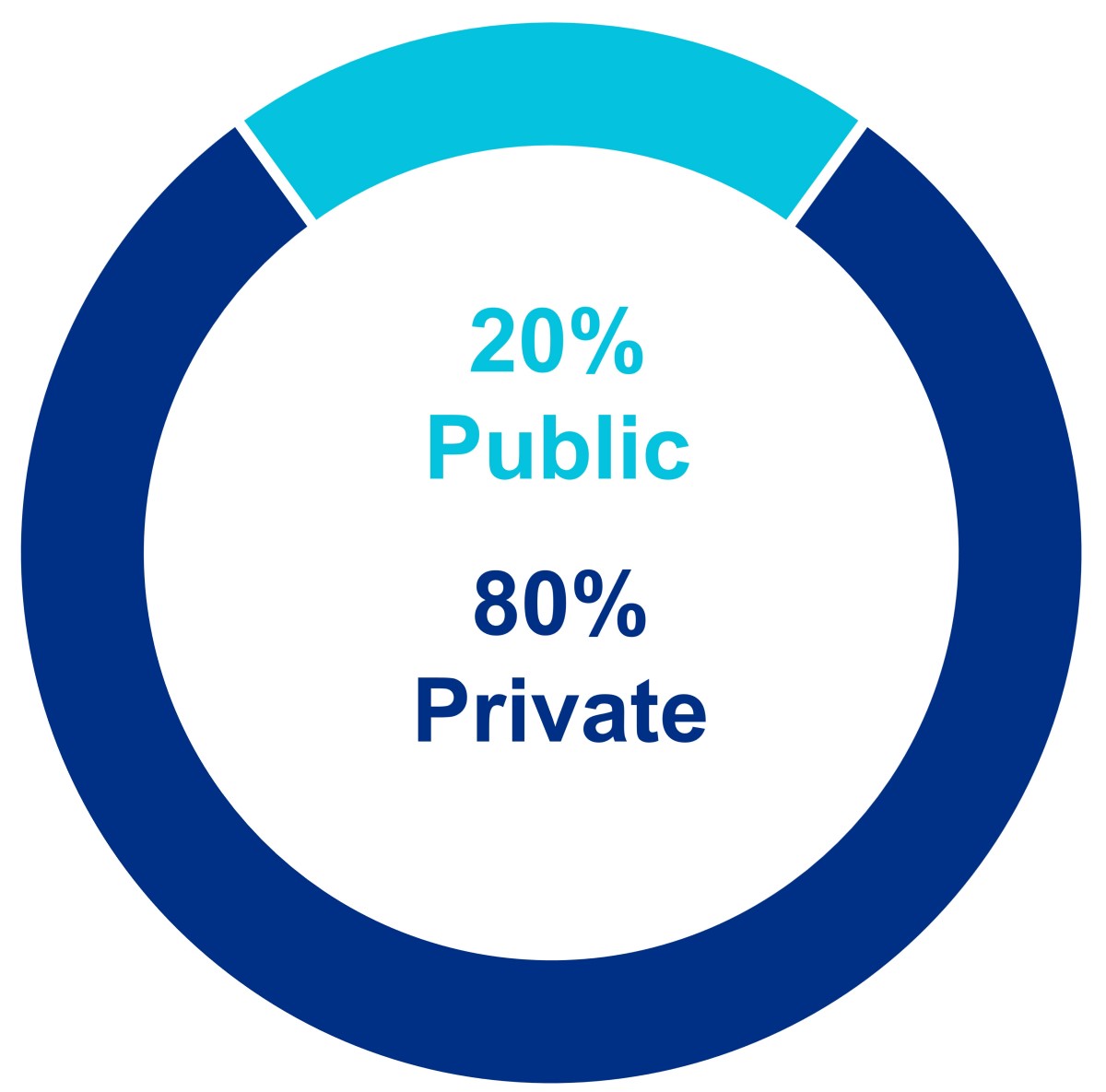

Tenant base

Alexandria is known for our high-quality and diverse tenant base, with 50% of our annual rental revenue generated from tenants that are investment-grade rated or publicly traded large cap companies. The quality, diversity, breadth, and depth of our significant relationships with our tenants provide Alexandria with high-quality and stable cash flows. Alexandria’s underwriting team and long-term industry relationships positively distinguish us from all other publicly traded REITs and real estate companies.

Executive and senior management team

Alexandria’s executive and senior management team has unique experience and expertise in creating, owning, and operating highly dynamic and collaborative campuses in key urban life science, technology, and agtech cluster locations that inspire innovation. From the development of high-quality, sustainable real estate, to the ongoing cultivation of collaborative environments with unique amenities and events, the Alexandria team has a first-in-class reputation of excellence in our niche. Alexandria’s highly experienced management team also includes regional market directors with leading reputations and longstanding relationships within the life science, technology, and agtech communities in their respective urban innovation clusters. We believe that our expertise, experience, reputation, and key relationships in the real estate, life science, technology, and agtech industries provide Alexandria significant competitive advantages in attracting new business opportunities.

Alexandria’s executive and senior management team consists of 44 individuals, averaging 25 years of real estate experience, including 13 years with Alexandria. Our executive management team alone averages 19 years of experience with Alexandria.

| EXECUTIVE MANAGEMENT TEAM |

| Joel S. Marcus |

| Executive Chairman & Founder |

| Stephen A. Richardson |

| Co-Chief Executive Officer |

| Peter M. Moglia |

| Co-Chief Executive Officer & Co-Chief Investment Officer |

| Dean A. Shigenaga |

| Co-President & Chief Financial Officer |

| Thomas J. Andrews |

| Co-President & Regional Market Director – Greater Boston |

| Daniel J. Ryan |

| Co-Chief Investment Officer & Regional Market Director – San Diego |

| Jennifer J. Banks |

| Co-Chief Operating Officer, General Counsel & Corporate Secretary |

| Lawrence J. Diamond |

| Co-Chief Operating Officer & Regional Market Director – Maryland |

| Vincent R. Ciruzzi |

| Chief Development Officer |

| John H. Cunningham |

| Executive Vice President – Regional Market Director – New York City |

| Marc E. Binda |

| Executive Vice President – Finance & Treasurer |

| Joseph Hakman |

| Chief Strategic Transactions Officer |

| |

| Investor Information | |

| December 31, 2019 | |

| Corporate Headquarters | New York Stock Exchange Trading Symbol | Information Requests | |||

| 26 North Euclid Avenue | Common stock: ARE | Phone: | (626) 578-0777 | ||

| Pasadena, California 91101 | Email: | corporateinformation@are.com | |||

| Web: | www.are.com | ||||

| Equity Research Coverage |

| Alexandria is currently covered by the following research analysts. This list may be incomplete and is subject to change as firms initiate or discontinue coverage of our company. Please note that any opinions, estimates, or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, or forecasts of Alexandria or our management. Alexandria does not by our reference or distribution of the information below imply our endorsement of or concurrence with any opinions, estimates, or forecasts of these analysts. Interested persons may obtain copies of analysts’ reports on their own as we do not distribute these reports. Several of these firms may, from time to time, own our stock and/or hold other long or short positions in our stock and may provide compensated services to us. |

| Bank of America Merrill Lynch | CFRA | Green Street Advisors, Inc. | RBC Capital Markets | |||

| Jamie Feldman / Elvis Rodriguez | Kenneth Leon | Daniel Ismail / Chris Darling | Michael Carroll / Jason Idoine | |||

| (646) 855-5808 / (646) 855-1589 | (646) 517-2552 | (949) 640-8780 / (949) 640-8780 | (440) 715-2649 / (440) 715-2651 | |||

| Barclays Capital Inc. | Citigroup Global Markets Inc. | J.P. Morgan Securities LLC | Robert W. Baird & Co. Incorporated | |||

| Ross Smotrich / Upal Rana | Michael Bilerman / Emmanuel Korchman | Anthony Paolone | David Rodgers | |||

| (212) 526-2306 / (212) 526-4887 | (212) 816-1383 / (212) 816-1382 | (212) 622-6682 | (216) 737-7341 | |||

| BTIG, LLC | Evercore ISI | Mizuho Securities USA Inc. | SMBC Nikko Securities America, Inc. | |||

| Tom Catherwood / James Sullivan | Sheila McGrath / Wendy Ma | Haendel St. Juste / Zachary Silverberg | Richard Anderson / Jay Kornreich | |||

| (212) 738-6140 / (212) 738-6139 | (212) 497-0882 / (212) 497-0870 | (212) 209-9300 / (212) 205-7855 | (646) 521-2351 / (646) 424-3202 | |||

| Fixed Income Coverage | Rating Agencies | |||||

| Barclays Capital Inc. | Wells Fargo & Company | Moody’s Investors Service | S&P Global Ratings | |||

| Srinjoy Banerjee / Devon Zhou | Thierry Perrein / Kevin McClure | (212) 553-0376 | Fernanda Hernandez / Michael Souers | |||

| (212) 526-3521 / (212) 526-6961 | (704) 410-3262 / (704) 410-3252 | (212) 438-1347 / (212) 438-2508 | ||||

| J.P. Morgan Securities LLC | ||||||

| Mark Streeter / Ian Snyder | ||||||

| (212) 834-5086 / (212) 834-3798 | ||||||

| Financial and Asset Base Highlights |  |

| December 31, 2019 | |

| (Dollars in thousands, except per share amounts) | |

| Three Months Ended (unless stated otherwise) | ||||||||||||||||||||

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | ||||||||||||||||

| Selected financial data from consolidated financial statements and related information | ||||||||||||||||||||

| Rental revenues | $ | 308,418 | $ | 293,182 | $ | 289,625 | $ | 274,563 | $ | 260,102 | ||||||||||

| Tenant recoveries | $ | 96,303 | $ | 92,594 | $ | 81,993 | $ | 80,186 | $ | 77,683 | ||||||||||

| General and administrative expenses | $ | 29,782 | $ | 27,930 | $ | 26,434 | $ | 24,677 | $ | 22,385 | ||||||||||

| General and administrative expenses as a percentage of net operating income – trailing 12 months | 10.0% | 9.7% | 9.5% | 9.5% | 9.6% | |||||||||||||||

| Operating margin | 70% | 70% | 72% | 72% | 71% | |||||||||||||||

| Adjusted EBITDA margin | 68% | 68% | 69% | 70% | 69% | |||||||||||||||

| Adjusted EBITDA – quarter annualized | $ | 1,148,620 | $ | 1,099,908 | $ | 1,063,056 | $ | 1,029,944 | $ | 968,888 | ||||||||||

| Adjusted EBITDA – trailing 12 months | $ | 1,085,382 | $ | 1,040,449 | $ | 1,004,724 | $ | 966,781 | $ | 937,906 | ||||||||||

| Net debt at end of period | $ | 6,582,089 | $ | 6,333,459 | $ | 6,154,885 | $ | 5,565,623 | $ | 5,237,538 | ||||||||||

| Net debt to Adjusted EBITDA – quarter annualized | 5.7x | (1) | 5.8x | 5.8x | 5.4x | 5.4x | ||||||||||||||

| Net debt to Adjusted EBITDA – trailing 12 months | 6.1x | 6.1x | 6.1x | 5.8x | 5.6x | |||||||||||||||

| Net debt and preferred stock to Adjusted EBITDA – quarter annualized | 5.7x | 5.8x | 5.8x | 5.5x | 5.5x | |||||||||||||||

| Net debt and preferred stock to Adjusted EBITDA – trailing 12 months | 6.1x | 6.1x | 6.2x | 5.8x | 5.7x | |||||||||||||||

| Fixed-charge coverage ratio – quarter annualized | 4.2x | 3.9x | 4.2x | 4.5x | 4.1x | |||||||||||||||

| Fixed-charge coverage ratio – trailing 12 months | 4.2x | 4.1x | 4.2x | 4.2x | 4.2x | |||||||||||||||

| Unencumbered net operating income as a percentage of total net operating income | 95% | 95% | 94% | 95% | 88% | |||||||||||||||

| Closing stock price at end of period | $ | 161.58 | $ | 154.04 | $ | 141.09 | $ | 142.56 | $ | 115.24 | ||||||||||

| Common shares outstanding (in thousands) at end of period | 120,800 | 113,173 | 111,986 | 111,181 | 111,012 | |||||||||||||||

| Total equity capitalization at end of period | $ | 19,518,915 | $ | 17,522,382 | $ | 15,887,660 | $ | 15,936,979 | $ | 12,879,366 | ||||||||||

| Total market capitalization at end of period | $ | 26,296,394 | $ | 24,260,065 | $ | 22,243,865 | $ | 21,780,482 | $ | 18,357,621 | ||||||||||

| Dividend per share – quarter/annualized | $1.03/$4.12 | $1.00/$4.00 | $1.00/$4.00 | $0.97/$3.88 | $0.97/$3.88 | |||||||||||||||

| Dividend payout ratio for the quarter | 61% | 57% | 58% | 57% | 60% | |||||||||||||||

| Dividend yield – annualized | 2.5% | 2.6% | 2.8% | 2.7% | 3.4% | |||||||||||||||

| Amounts related to operating leases: | ||||||||||||||||||||

| Operating lease liabilities | $ | 271,809 | $ | 270,614 | $ | 243,585 | $ | 244,601 | $ | — | ||||||||||

| Rent expense | $ | 4,609 | $ | 4,705 | $ | 4,482 | $ | 4,492 | $ | 4,164 | ||||||||||

| Capitalized interest | $ | 23,822 | $ | 24,558 | $ | 21,674 | $ | 18,509 | $ | 19,902 | ||||||||||

| Weighted-average interest rate for capitalization of interest during the period | 3.88% | 4.00% | 4.14% | 3.96% | 4.01% | |||||||||||||||

| (1) Due to the timing of two acquisitions that closed in December 2019, we had a temporary 0.4x increase above our projected net debt and preferred stock to Adjusted EBITDA – fourth quarter of 2019, annualized. We remain committed to our guidance for net debt and preferred stock to Adjusted EBITDA – fourth quarter of 2020, annualized, of less than or equal to 5.2x. | ||||||||||||||||||||

| Financial and Asset Base Highlights (continued) |  |

| December 31, 2019 | |

| (Dollars in thousands, except annual rental revenue per occupied RSF amounts) | |

| Three Months Ended (unless stated otherwise) | ||||||||||||||||||||

| 12/31/19 | 9/30/19 | 6/30/19 | 3/31/19 | 12/31/18 | ||||||||||||||||

| Amounts included in funds from operations and non-revenue-enhancing capital expenditures | ||||||||||||||||||||

| Straight-line rent revenue | $ | 24,400 | $ | 27,394 | $ | 25,476 | $ | 26,965 | $ | 17,923 | ||||||||||

| Amortization of acquired below-market leases | $ | 8,837 | $ | 5,774 | $ | 8,054 | $ | 7,148 | $ | 5,350 | ||||||||||

| Straight-line rent expense on ground leases | $ | 219 | $ | 320 | $ | 226 | $ | 246 | $ | 272 | ||||||||||

| Stock compensation expense | $ | 10,239 | $ | 10,935 | $ | 11,437 | $ | 11,029 | $ | 9,810 | ||||||||||

| Amortization of loan fees | $ | 2,241 | $ | 2,251 | $ | 2,380 | $ | 2,233 | $ | 2,401 | ||||||||||

| Amortization of debt premiums | $ | 907 | $ | 1,287 | $ | 782 | $ | 801 | $ | 611 | ||||||||||

| Non-revenue-enhancing capital expenditures: | ||||||||||||||||||||

| Building improvements | $ | 3,295 | $ | 2,901 | $ | 2,876 | $ | 2,381 | $ | 3,256 | ||||||||||

| Tenant improvements and leasing commissions | $ | 14,648 | $ | 11,964 | $ | 13,901 | $ | 8,709 | $ | 11,758 | ||||||||||

| Operating statistics and related information (at end of period) | ||||||||||||||||||||

| Number of properties – North America | 291 | 269 | 257 | 250 | 237 | |||||||||||||||

| RSF – North America (including development and redevelopment projects under construction) | 29,098,433 | 27,288,263 | 26,321,122 | 25,323,299 | 24,587,438 | |||||||||||||||

| Total square feet – North America | 39,170,786 | 38,496,276 | 37,120,560 | 33,688,294 | 33,097,210 | |||||||||||||||

| Annual rental revenue per occupied RSF – North America | $ | 51.04 | $ | 51.00 | $ | 50.27 | $ | 49.56 | $ | 48.42 | ||||||||||

| Occupancy of operating properties – North America | 96.8% | (1) | 96.6% | 97.4% | 97.2% | 97.3% | ||||||||||||||

| Occupancy of operating and redevelopment properties – North America | 94.4% | 94.5% | 96.4% | 95.5% | 95.1% | |||||||||||||||

| Weighted-average remaining lease term (in years) | 8.1 | 8.3 | 8.4 | 8.4 | 8.6 | |||||||||||||||

| Total leasing activity – RSF | 1,752,124 | 1,241,677 | 819,949 | 1,248,972 | 1,558,064 | |||||||||||||||

| Lease renewals and re-leasing of space – change in average new rental rates over expiring rates: | ||||||||||||||||||||

| Rental rate increases | 37.0% | 27.9% | 32.5% | 32.9% | 17.4% | |||||||||||||||

| Rental rate increases (cash basis) | 21.7% | 11.2% | 17.8% | 24.3% | 11.4% | |||||||||||||||

| RSF (included in total leasing activity above) | 571,650 | 758,113 | 587,930 | 509,415 | 650,540 | |||||||||||||||

| Same property – percentage change over comparable quarter from prior year: | ||||||||||||||||||||

| Net operating income increase | 2.0% | 2.5% | 4.3% | 2.3% | 3.8% | |||||||||||||||

| Net operating income increase (cash basis) | 4.0% | 5.7% | 9.5% | 10.2% | 7.6% | |||||||||||||||

| (1) | Includes 259,616 RSF, or 1.0%, of vacancy representing lease-up opportunities at properties recently acquired during 2H19, primarily related to our SD Tech by Alexandria campus. Excluding these vacancies, occupancy of operating properties in North America would have been 97.8% as of December 31, 2019. Refer to “Occupancy” in this Supplemental Information for additional details. |

| |

| High-Quality, Diverse, and Innovative Tenants | |

| December 31, 2019 | |

Long-Duration Cash Flows From High-Quality, Diverse, and

Innovative Tenants

Investment-Grade or Publicly Traded Large Cap Tenants | Tenant Mix | ||||

| |||||

| 50% | |||||

of ARE’s Annual Rental Revenue(1) | |||||

| Long-Duration Lease Terms | |||||

| 8.1 Years | |||||

Weighted-Average Remaining Term(2) | |||||

Percentage of ARE’s Annual Rental Revenue(1) | |||||

| (1) | Represents annual rental revenue in effect as of December 31, 2019. |

| (2) | Based on aggregate annual rental revenue in effect as of December 31, 2019. Refer to “Annual Rental Revenue” in the “Definitions and Reconciliations” of this Supplemental Information for additional details on our methodology on annual rental revenue from unconsolidated real estate joint ventures. |

| (3) | 67% of our annual rental revenue for technology tenants is from investment-grade or publicly traded large cap tenants. |

| |

| Class A Properties in AAA Locations | |

| December 31, 2019 | |

High-Quality Cash Flows From Class A Properties in AAA Locations

Class A Properties in AAA Locations | AAA Locations | |||

| ||||

| 76% | ||||

| of ARE’s | ||||

Annual Rental Revenue(1) | ||||

Percentage of ARE’s Annual Rental Revenue(1) | ||||

| (1) | Represents annual rental revenue in effect as of December 31, 2019. |

| |

| Occupancy | |

| December 31, 2019 | |

Solid Demand for Class A Properties in AAA Locations

Drives Solid Occupancy

Solid Historical Occupancy(1) | Occupancy Across Key Locations(2) | |||

| ||||

| 96% | ||||

| Over 10 Years | ||||

| (1) | Represents average occupancy of operating properties in North America as of each December 31 for the last 10 years. |

| (2) | As of December 31, 2019. |

| (3) | Includes 259,616 RSF, or 1.0%, of vacancy representing lease-up opportunities at properties recently acquired during 2H19, primarily related to our SD Tech by Alexandria campus. Excluding these vacancies, occupancy of operating properties in North America would have been 97.8% as of December 31, 2019. Expected occupancy for 1Q20 includes 689,103 RSF, or 2.4%, of vacancy primarily from three buildings contributed by our partner in a recently formed consolidated real estate joint venture and our acquisition of SD Tech by Alexandria campus. Refer to “Acquisitions” in this Earnings Press Release for additional details. |

| 4Q19 | 1Q20 (projected) | |||||||||||||||||||

| Property | Submarket/Market | Occupancy Impact | Occupancy Impact | |||||||||||||||||

| RSF | Region | Consolidated | RSF | Region | Consolidated | |||||||||||||||

| SD Tech by Alexandria | Sorrento Mesa/San Diego | 182,056 | 3.2 | % | 0.7 | % | 225,865 | 3.8 | % | 0.8 | % | |||||||||

| 601, 611, and 651 Gateway Boulevard | South San Francisco/San Francisco | N/A | N/A | N/A | 211,454 | 2.7 | % | 0.7 | % | |||||||||||

| Other acquisitions | Various | 77,560 | N/A | 0.3 | 251,784 | N/A | 0.9 | % | ||||||||||||

| 259,616 | 1.0 | % | 689,103 | 2.4 | % | |||||||||||||||

| |

| Key Operating Metrics | |

| December 31, 2019 | |

| Same Property Net Operating Income Growth | Favorable Lease Structure(1) | |||||||||

|  | Strategic Lease Structure by Owner and Operator of Collaborative Life Science, Technology, and AgTech Campuses | ||||||||

| Increasing cash flows | ||||||||||

Percentage of leases containing annual rent escalations | 95% | |||||||||

| Stable cash flows | ||||||||||

Percentage of triple net leases | 97% | |||||||||

| Lower capex burden | ||||||||||

Percentage of leases providing for the recapture of capital expenditures | 96% | |||||||||

| Rental Rate Growth: Renewed/Re-Leased Space | Margins(2) | |||||||||

|  | |||||||||

| Operating | Adjusted EBITDA | |||||||||

| 70% | 68% | |||||||||

| (1) | Percentages calculated based on RSF as of December 31, 2019. |

| (2) | Represents percentages for the three months ended December 31, 2019. |

| Same Property Performance |  |

| December 31, 2019 | |

| (Dollars in thousands) | |

| December 31, 2019 | December 31, 2019 | ||||||||||

| Same Property Financial Data | Three Months Ended | Year Ended | Same Property Statistical Data | Three Months Ended | Year Ended | ||||||

| Percentage change over comparable period from prior year: | Number of same properties | 209 | 192 | ||||||||

| Net operating income increase | 2.0% | 3.1% | Rentable square feet | 20,477,995 | 18,519,783 | ||||||

| Net operating income increase (cash basis) | 4.0% | 7.1% | Occupancy – current-period average | 96.9% | 96.6% | ||||||

| Operating margin | 71% | 71% | Occupancy – same-period prior-year average | 97.1% | 96.3% | ||||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||

| 2019 | 2018 | $ Change | % Change | 2019 | 2018 | $ Change | % Change | |||||||||||||||||||||||

| Income from rentals: | ||||||||||||||||||||||||||||||

| Same properties | $ | 257,762 | $ | 251,375 | $ | 6,387 | 2.5 | % | $ | 927,077 | $ | 897,522 | $ | 29,555 | 3.3 | % | ||||||||||||||

| Non-same properties | 50,656 | 8,727 | 41,929 | 480.5 | 238,711 | 113,196 | 125,515 | 110.9 | ||||||||||||||||||||||

| Rental revenues | 308,418 | 260,102 | 48,316 | 18.6 | 1,165,788 | 1,010,718 | 155,070 | 15.3 | ||||||||||||||||||||||

| Same properties | 82,558 | 76,031 | 6,527 | 8.6 | 299,325 | 281,092 | 18,233 | 6.5 | ||||||||||||||||||||||

| Non-same properties | 13,745 | 1,652 | 12,093 | 732.0 | 51,751 | 22,971 | 28,780 | 125.3 | ||||||||||||||||||||||

| Tenant recoveries | 96,303 | 77,683 | 18,620 | 24.0 | 351,076 | 304,063 | 47,013 | 15.5 | ||||||||||||||||||||||

| Income from rentals | 404,721 | 337,785 | 66,936 | 19.8 | 1,516,864 | 1,314,781 | 202,083 | 15.4 | ||||||||||||||||||||||

| Same properties | 107 | 95 | 12 | 12.6 | 448 | 298 | 150 | 50.3 | ||||||||||||||||||||||

| Non-same properties | 3,286 | 2,583 | 703 | 27.2 | 13,984 | 12,380 | 1,604 | 13.0 | ||||||||||||||||||||||

| Other income | 3,393 | 2,678 | 715 | 26.7 | 14,432 | 12,678 | 1,754 | 13.8 | ||||||||||||||||||||||

| Same properties | 340,427 | 327,501 | 12,926 | 3.9 | 1,226,850 | 1,178,912 | 47,938 | 4.1 | ||||||||||||||||||||||

| Non-same properties | 67,687 | 12,962 | 54,725 | 422.2 | 304,446 | 148,547 | 155,899 | 104.9 | ||||||||||||||||||||||

| Total revenues | 408,114 | 340,463 | 67,651 | 19.9 | 1,531,296 | 1,327,459 | 203,837 | 15.4 | ||||||||||||||||||||||

| Same properties | 98,396 | 90,152 | 8,244 | 9.1 | 353,431 | 332,051 | 21,380 | 6.4 | ||||||||||||||||||||||

| Non-same properties | 23,456 | 7,530 | 15,926 | 211.5 | 92,061 | 49,069 | 42,992 | 87.6 | ||||||||||||||||||||||

| Rental operations | 121,852 | 97,682 | 24,170 | 24.7 | 445,492 | 381,120 | 64,372 | 16.9 | ||||||||||||||||||||||

| Same properties | 242,031 | 237,349 | 4,682 | 2.0 | 873,419 | 846,861 | 26,558 | 3.1 | ||||||||||||||||||||||

| Non-same properties | 44,231 | 5,432 | 38,799 | 714.3 | 212,385 | 99,478 | 112,907 | 113.5 | ||||||||||||||||||||||

| Net operating income | $ | 286,262 | $ | 242,781 | $ | 43,481 | 17.9 | % | $ | 1,085,804 | $ | 946,339 | $ | 139,465 | 14.7 | % | ||||||||||||||

| Net operating income – same properties | $ | 242,031 | $ | 237,349 | $ | 4,682 | 2.0 | % | $ | 873,419 | $ | 846,861 | $ | 26,558 | 3.1 | % | ||||||||||||||

| Straight-line rent revenue | (13,578 | ) | (16,809 | ) | 3,231 | (19.2 | ) | (55,393 | ) | (79,475 | ) | 24,082 | (30.3 | ) | ||||||||||||||||

| Amortization of acquired below-market leases | (3,092 | ) | (3,934 | ) | 842 | (21.4 | ) | (7,249 | ) | (10,196 | ) | 2,947 | (28.9 | ) | ||||||||||||||||

| Net operating income – same properties (cash basis) | $ | 225,361 | $ | 216,606 | $ | 8,755 | 4.0 | % | $ | 810,777 | $ | 757,190 | $ | 53,587 | 7.1 | % | ||||||||||||||

Refer to “Same Property Comparisons” in the “Definitions and Reconciliations” of this Supplemental Information for a reconciliation of same properties to total properties. “Definitions and Reconciliations” also contains definitions of “Tenant Recoveries” and “Net Operating Income” and their respective reconciliations from the most directly comparable financial measures presented in accordance with GAAP.

| Leasing Activity |  |

| December 31, 2019 | |

| (Dollars per RSF) | |

| Three Months Ended | Year Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| December 31, 2019 | December 31, 2019 | December 31, 2018 | ||||||||||||||||||||||||||||||||||

Including Straight-Line Rent | Cash Basis | Including Straight-Line Rent | Cash Basis | Including Straight-Line Rent | Cash Basis | |||||||||||||||||||||||||||||||

| Leasing activity: | ||||||||||||||||||||||||||||||||||||

Renewed/re-leased space(1) | ||||||||||||||||||||||||||||||||||||

| Rental rate changes | 37.0% | 21.7% | 32.2% | 17.6% | 24.1% | 14.1% | ||||||||||||||||||||||||||||||

| New rates | $66.26 | $63.30 | $58.65 | $56.19 | $55.05 | $52.79 | ||||||||||||||||||||||||||||||

| Expiring rates | $48.35 | $52.02 | $44.35 | $47.79 | $44.35 | $46.25 | ||||||||||||||||||||||||||||||

| RSF | 571,650 | 2,427,108 | 2,088,216 | |||||||||||||||||||||||||||||||||

| Tenant improvements/leasing commissions | $24.20 | $20.28 | $20.61 | |||||||||||||||||||||||||||||||||

| Weighted-average lease term | 5.9 years | 5.7 years | 6.1 years | |||||||||||||||||||||||||||||||||

| Developed/redeveloped/previously vacant space leased | ||||||||||||||||||||||||||||||||||||

| New rates | $47.76 | $41.71 | $55.95 | $52.19 | $58.45 | $48.73 | ||||||||||||||||||||||||||||||

| RSF | 1,180,474 | 2,635,614 | 2,633,476 | |||||||||||||||||||||||||||||||||

| Tenant improvements/leasing commissions | $6.23 | $13.74 | $12.57 | |||||||||||||||||||||||||||||||||

| Weighted-average lease term | 8.8 years | 9.8 years | 11.5 years | |||||||||||||||||||||||||||||||||