EXHIBIT 99.2

Alexandria Real Estate Equities, Inc., an S&P 500® REIT, is the first, preeminent, and longest-tenured owner, operator, and developer uniquely focused on collaborative life science campuses in AAA innovation cluster locations. Our mission — to create and grow life science ecosystems and clusters that ignite and accelerate the world’s leading innovators in their noble pursuit to advance human health by curing disease and improving nutrition — drives what we do and has shaped our pioneering business.

Renowned author and business strategist Jim Collins has said of the company’s track record, “Alexandria has achieved the three outputs that define a great company: Superior Results, Distinctive Impact, and Lasting Endurance.”

Alexandria’s irreplaceable life science real estate platform dominates the asset class we pioneered. Further, we continue to strengthen our balance sheet and enhance our significant liquidity, which provides us with important flexibility to drive forward this dominant platform and the critically important life science industry by delivering the highly complex infrastructure and fostering the holistic ecosystems needed to enable innovation to advance life-changing treatments and cures.

Following the successful and timely expansion of our unsecured senior line of credit to $5 billion at the end of June 2023, and in recognition and support of our world-class brand and differentiated business model, members of the company’s longstanding banking syndicate said:

•“The outcome of the trade exemplified where banks in today’s market want to allocate their capital. It’s clear that Alexandria’s credit quality and growth prospects far exceed most REITs, and that has translated into a positive impact on its access to bank capital and the structural/economic elements of the bank facility.”

•“Once again, Alexandria stands out as the best in class and proves able to accomplish what very few have been able to do. That truly is remarkable and a testament to the strength of your management team, amazing business strategy, and rock solid balance sheet.”

In 1994, we saw the remarkable potential of the life science industry, and today we are honored to be at the vanguard and heart of the broad and diverse life science ecosystem. As Steve Jobs said, “I think the biggest innovations of the 21st century will be at the intersection of biology and technology.” With over 10,000 diseases known to humankind and less than 10% currently addressable with therapies, the incredible innovation taking place within our Labspace® facilities is and will remain a national imperative.

Catalyzed by groundbreaking technologies, massive unmet medical need, and strong fundamentals, the life science industry remains uniquely positioned to tackle and solve our most persistent and major healthcare challenges. The emergence of a new golden age of biology only bolsters the strength and growth potential of this vital industry. It also reaffirms the fundamental truth Alexandria recognized nearly three decades ago: our integrated 24/7 scientific laboratory and supporting infrastructure is essential for advancing innovation that improves human health.

To learn more about our one-of-a-kind, once-in-a-generation company, please view our 2022 Annual Report and 2022 ESG Report on the company’s website at https://investor.are.com. A statement regarding certain aspects of our business and prospects can be found below.

1

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

ALEXANDRIA’S HIGH-QUALITY, DIFFERENTIATED, AND ESSENTIAL LABSPACE® ASSET BASE,

SUPPORTED BY STRONG LIFE SCIENCE INDUSTRY FUNDAMENTALS, IS WELL POSITIONED

•Utilization and demand for Alexandria’s essential 24/7, fully integrated, workflow-optimized infrastructure is driven by its tenants’ mission-critical need to house, operate, advance, and help safeguard billions of dollars of scientific research, development, and commercial assets, and not by a desire for high foot traffic as is applicable in a retail context.

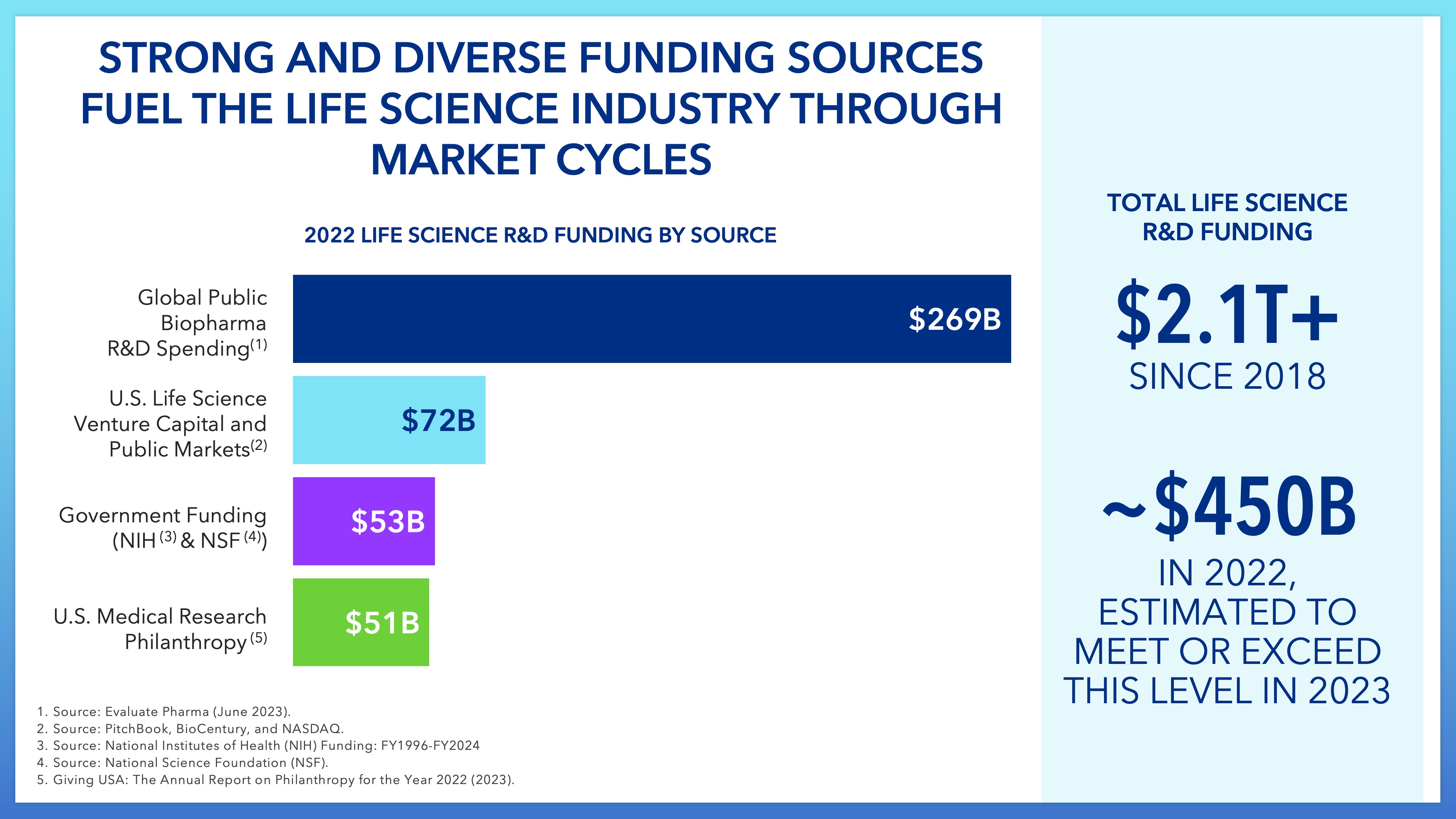

•The secular growth life science industry, which has an estimated market value of over $5 trillion1 and approximately $450 billion in estimated 2023 R&D funding, fuels continuing demand for Alexandria’s Labspace assets across its cluster markets.

•Alexandria has created a robust moat through its strategic focus on aggregating its high-quality Labspace assets into highly sought-after mega campuses primarily concentrated in high-barrier-to-entry markets, which affords the company a competitive advantage against new supply.

•Alexandria’s operating and financial performance, fueled by fundamentals returning to historical pre-COVID-19 levels, drives continued growth.

1.Alexandria’s tenants rely on essential Labspace infrastructure for its intended purpose of providing 24/7 compliant, fully integrated, and workflow-optimized facilities to house, operate, advance, and help safeguard scientific research, pipeline programs, and commercial assets

•Alexandria’s Labspace infrastructure generally runs 24/7 and in aggregate houses and helps safeguard billions of dollars of high-intensity infrastructure, specialized equipment, and irreplaceable tenant research, clinical pipeline programs, and commercial assets.

•It is the advancement of this science and related intellectual property in Alexandria’s Labspace buildings, and NOT employee foot traffic that drives the utilization of and demand for space.

•Much like a data center, where the core infrastructure is required for data usage, throughput, and storage, Alexandria’s Labspace assets are needed to house, operate, advance, and help safeguard scientific throughput.

•Within Alexandria’s Labspace assets, the laboratories and adjacent nontechnical space cannot be decoupled. Each tenant space, floor, and building plan is fully integrated and intentionally designed to enable seamless workflows between the laboratory and nontechnical spaces within a leased premises. The representative image below highlights this critical integration.

1 Source: YCharts. Based on aggregate market capitalization for the life science industry, encompassing biotechnology companies, drug manufacturers, and diagnostics and research companies as of June 16, 2023.

2

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•Based on its nearly 30 years of experience and expertise in life science real estate, Alexandria understands that the majority of tenant employees in its Labspace assets interact with the science in the laboratory in some form, including to conduct experiments, analyze and interpret data, plan new experiments, make business decisions about the data, or engage in other related activities. This is the nature of life science companies’ research workflows — critical aspects of which cannot be performed from home.

•Furthermore, laboratory work must be conducted in dedicated spaces in compliance with stringent safety requirements governed by city, state, and/or federal regulatory agencies. In addition, each tenant has its own protocols to protect the propriety of the intellectual property transpiring within Alexandria’s buildings, further necessitating on-site activity.

•Selling, general, and administrative (SG&A) functions, such as sales, marketing, legal, and accounting, do not comprise a significant portion of space within Alexandria’s Labspace asset base given tenants’ primary focus on research and development within its buildings.

•Large pharmaceutical, biotechnology, academic institutions, and life science product companies that do have more sizeable SG&A groups tend to prioritize Labspace infrastructure requirements with Alexandria and typically place these non-lab-related administrative functions in more traditional corporate office space.

•For example, one of Alexandria’s multinational pharmaceutical tenants in San Diego operates an over 150,000 RSF laboratory facility where 87% of the employees are focused on research (i.e. non-SG&A).

•Smaller pre-commercial public or private biotech companies by definition have minimal SG&A requirements (given the absence of products), and instead, the R&D and associated intellectual property, held and conducted in Alexandria spaces are the core assets for these companies.

•Lastly, Alexandria has observed key trends contributing to new specialized infrastructure requirements.

•The COVID-19 pandemic reaffirmed the essential nature of the life science industry, and the infrastructure that supports it, while also exposing supply chain pressures. As a result, it encouraged life science companies in the United States to repatriate novel research, development, and production as well as shift more chemistry and other basic R&D processes on shore.

•Concurrently, the complexity of new modalities that are enabling some of today’s most promising medicines, such as mRNA and cell and gene therapies, requires highly integrated research, development, and manufacturing infrastructure, resulting in more specialized technical space requirements.

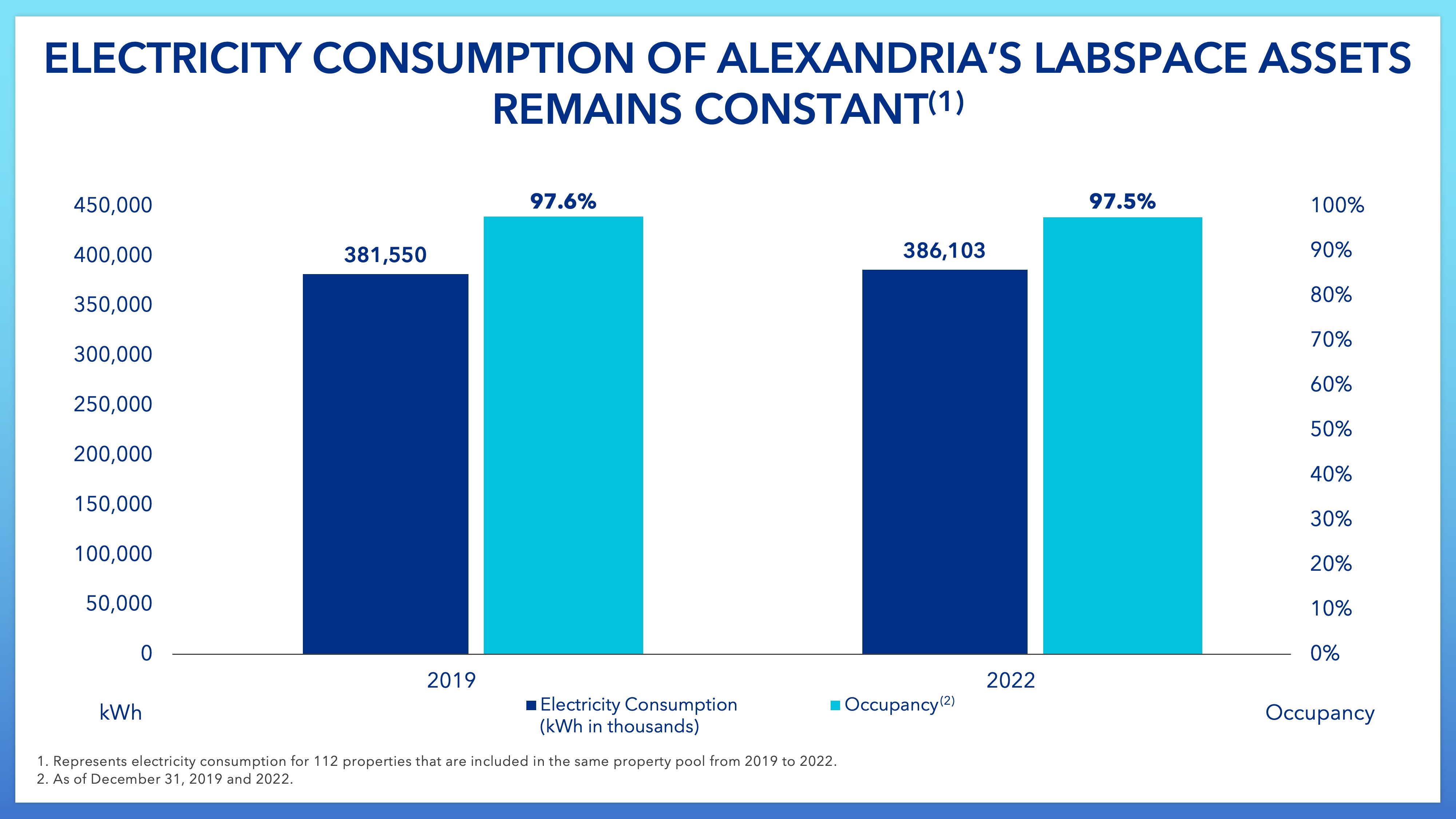

Consistent electricity consumption demonstrates continued strong utilization and value of Alexandria’s Labspace asset base for which geospatial data analysis is not relevant

•Alexandria analyzed electricity consumption in a population of 112 properties, which represents a subset of its same property pool of 161 properties2 that it owned and operated for the entirety of the period from 2019 to 2022 and where complete electricity consumption data is available. Alexandria excluded 49 properties from its same property pool from 2019 to 2022 mainly because the properties’ electricity meters are held by tenants and Alexandria has either no data or only partial data on their electricity consumption.

•Electricity consumption in this subset of 112 properties increased approximately 1% between 2019 and 2022, indicating no significant change in the utilization of Alexandria’s life science assets. In other commercial real estate settings, a significant decline in electricity usage was observed such as in New York City during the COVID-19 pandemic.3

•Occupancy for this subset of 112 properties also remained consistent, with 97.6% as of 4Q19 and 97.5% as of 4Q22.

2 This same property pool is related to this analysis of electricity consumption and is different from our same property results disclosed in our quarterly earnings results.

3 Source: MDPI, “Analysis of Energy Consumption in Commercial and Residential Buildings in New York City before and during the COVID-19 Pandemic,” October 20, 2021.

3

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•Given the essential usage of laboratory space and Alexandria’s tenants’ need for laboratories to generally run 24/7, metrics such as electricity consumption are appropriate proxies for scientific throughput and laboratory space utilization (which is analogous to the high-intensity data processing through a data center). Moreover, there are limitations associated with using geospatial data collected from cell phones as a tool to measure life science real estate asset utilization. Limitations of geospatial data include, but are not limited to, the following:

•Most geospatial data companies partner with mobile phone applications to track cell phone locations. The coverage of these applications varies widely, with one prominent geospatial company’s “partner apps” typically covering less than 10% of the U.S. population. As this sample size is not randomly selected, it is limited to regular users of one or more of the partner apps, which means that data in cell phone studies is inferred and is not a representative average of the population, and also most likely not of the life science employee base.

•Significant changes in data privacy that Apple and Google put into effect between 2019 and 2022 drove tremendous declines in the amount of data collected: data collection dropped by 70% for apps when not in use and by 24% when in use.4

▪Additionally, Apple’s release of iOS 14 in September 2020 further encumbered geolocation tracking by allowing users to only share an approximate location (within a few miles) instead of a precise one (which would be required for an accurate per property analysis).5

•Originally developed to track retail foot traffic, where validating data is possible due to built-in attributes such as turnstiles, ticket sales, and credit card receipts, geospatial data appears to be ill-suited for occupancy analysis in other settings if not carefully and consistently physically validated. Without this physical validation, material errors can occur based on location, timing of the data, analyzed area, and the inability to validate foot traffic.

4 Sources: The Wall Street Journal and FastCompany.

5 Source: Forbes.

4

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

2.Sustained strength of life science fundamentals and the need for essential infrastructure continue to serve as the foundation for demand for Alexandria’s Labspace assets

•Utilization of and demand for Alexandria’s Labspace infrastructure is fueled by the over $5 trillion6 life science industry, which is in the early innings of growth and dependent on laboratory space to conduct mission-critical research and to house, operate, advance, and help safeguard R&D and commercial assets.

•This secular growth industry is not significantly impacted by cyclicality, but by the achievement of scientific milestones and other resilient demand drivers that are generally less correlated with macro trends currently impacting commodity REIT product types.

•The broad and diverse sources of annual R&D funding fuel the continued secular growth of the industry with nearly $450 billion7 flowing into the industry in 2022, and 2023 expected to meet or exceed this level.

•Biopharma continues to invest heavily in R&D with a 57% increase in total spend on R&D over the past 10 years, driving new sources of demand that are associated with the advent of new platforms and modalities (e.g., mRNA, cell and gene therapies, single cell analytics, artificial intelligence) and the desire for life science companies to control their own research, development, and to a certain extent, manufacturing, of novel, complex medicines within specialized, fully integrated facilities8.

•The U.S. Food and Drug Administration (“FDA”) has approved over 450 new drugs over the past decade and is on track for a near-record high year of new drug approvals with up to 60 new approvals expected in 2023,9 collectively reflecting the productivity and impact of the life science industry in bringing new medicines to patients.

•Following a historic bull run, public market IPO issuances have stagnated, with a potential slight reopening on the horizon in 2H23, yet public markets continue to reward clinical progress for companies with strong, positive data, as demonstrated through their ability to raise follow-on financings in the hundreds of millions.10

•Life science employment continues to rise, up 87% from 2002 to 2022, compared to only a 14% increase for all U.S. occupations over the same time period.11

6 Source: YCharts. Based on aggregate market capitalization for the life science industry, encompassing biotechnology companies, drug manufacturers, and diagnostics and research companies as of June 16, 2023.

7 Source: Evaluate Pharma, PitchBook, BioCentury, NASDAQ, National Institutes of Health, National Science Foundation, and Giving USA.

8 Source: Evaluate Pharma.

9 Up to 60 new approvals based on scheduled Prescription Drug User Fee Act (PDUFA) dates in 2023. BioPharma Catalyst and FDATracker.com

10 Source: BioCentury and NASDAQ.

11 Source: CBRE Research.

5

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

3.Alexandria has strategically created a high quality Labspace® asset base primarily concentrated in high-barrier-to-entry markets where it has a competitive advantage against new supply

•Alexandria’s mega campus strategy and world-class brand provide the company a competitive advantage against new market supply across most of its operating asset base of 41 million RSF (as of June 30, 2023). To delve into the potential impact of new supply on the company’s operating assets, it is imperative to look at the company’s following four differentiators, as further described below:

1.Unique, highly complex Labspace assets concentrated in high-barrier-to-entry submarkets

2.Longstanding strategic relationships across its ecosystems

3.Differentiated mega campus offerings that drive value

4.Operational excellence to help safeguard leading-edge science

Alexandria’s unique, highly complex Labspace assets are primarily concentrated in high-barrier-to-entry submarkets

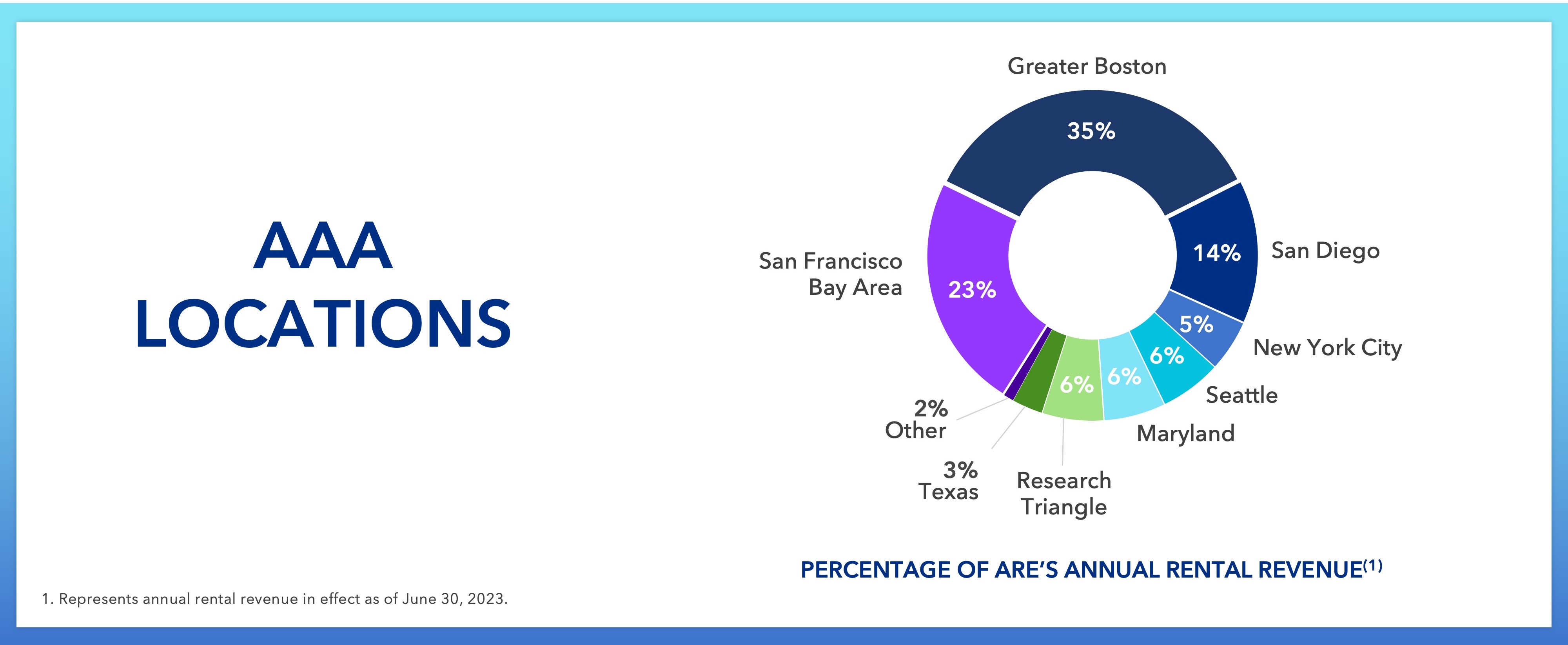

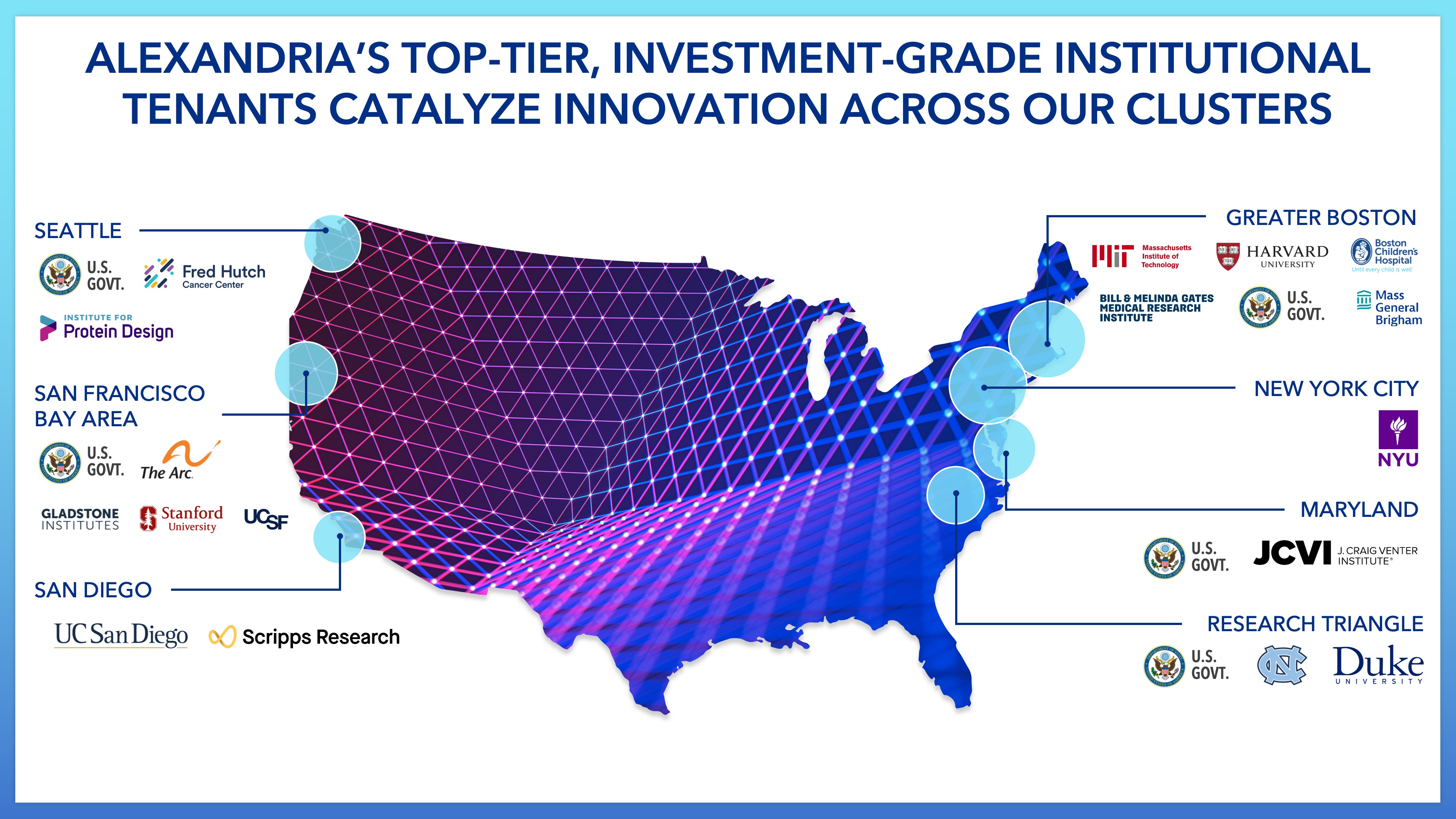

•Alexandria was founded on the belief that life science companies are most successful when positioned in the epicenter of the world’s top innovation ecosystems in close proximity to world-renowned academic medical institutions, deep specialized talent, and ample risk capital.

•Over the past three decades, Alexandria has strategically and methodically amassed a dominant market presence primarily in these AAA innovation locations where the adjacency to these top institutions is a key driver of tenant demand.

6

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

Alexandria’s longstanding strategic relationships across its ecosystems

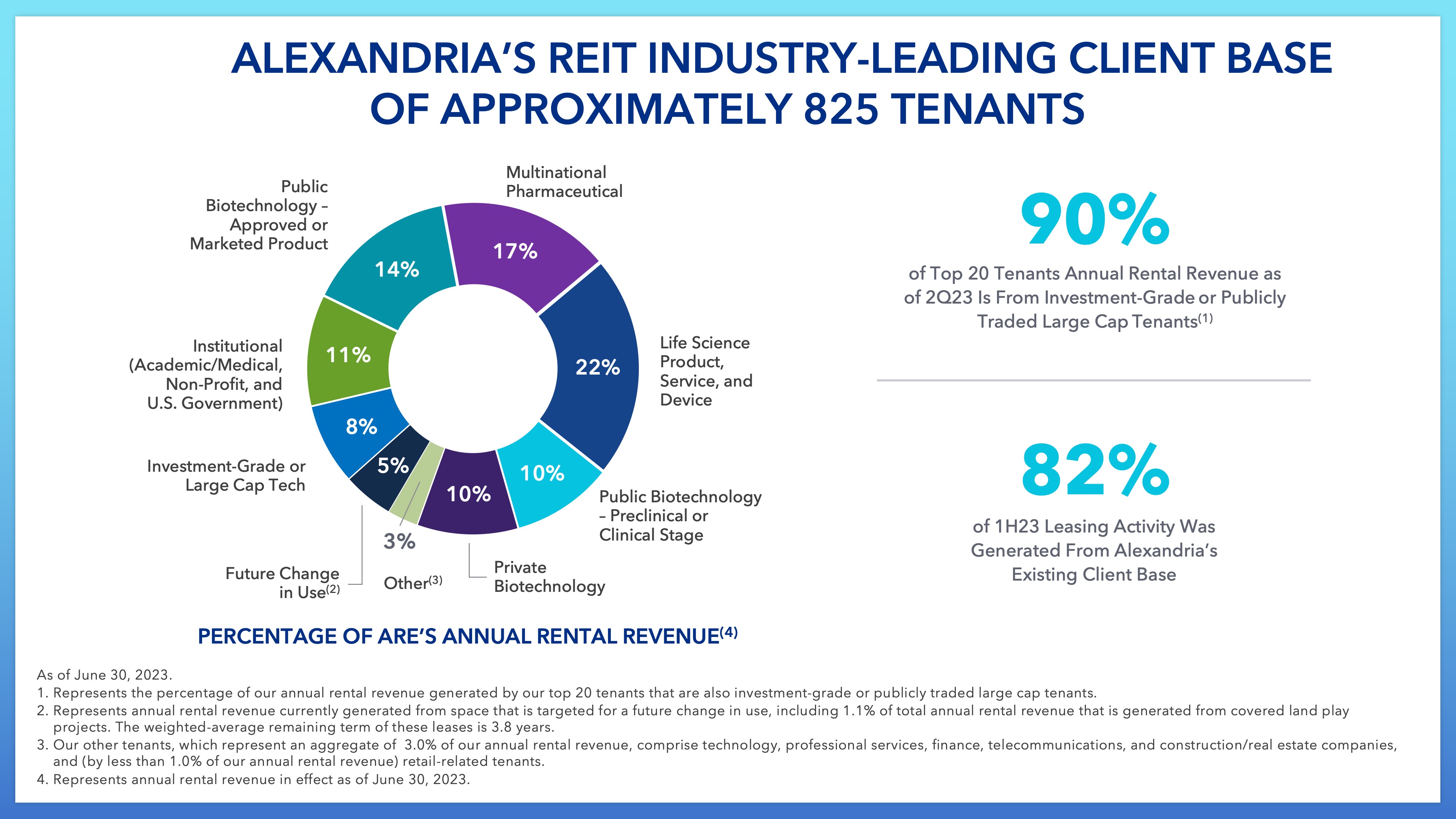

•Alexandria, known for its longstanding relationships within the life science and real estate communities, has diligently cultivated a high-quality and diverse client base of approximately 825 tenants as of June 30, 2023.

•As a testament to its ability to strategically partner and form long-term strategic relationships with its tenants, Alexandria leased 2.55 million RSF during the six months ended June 30, 2023, 82% of which was generated from existing tenants.

Alexandria’s differentiated mega campus offerings drive value

•Alexandria’s pioneering mega campus strategy was borne out of its vision to provide engaging workplace environments that drive productivity, collaboration, and innovation for its life science tenants as scientific research cannot be performed from home.

•Alexandria’s highly amenitized, vibrant mega campuses, which are defined as cluster campuses that consist of approximately 1 million RSF or more, including operating, active development/redevelopment, and land RSF,12 encompass 73% of Alexandria’s annual rental revenue as of March 31, 2023.

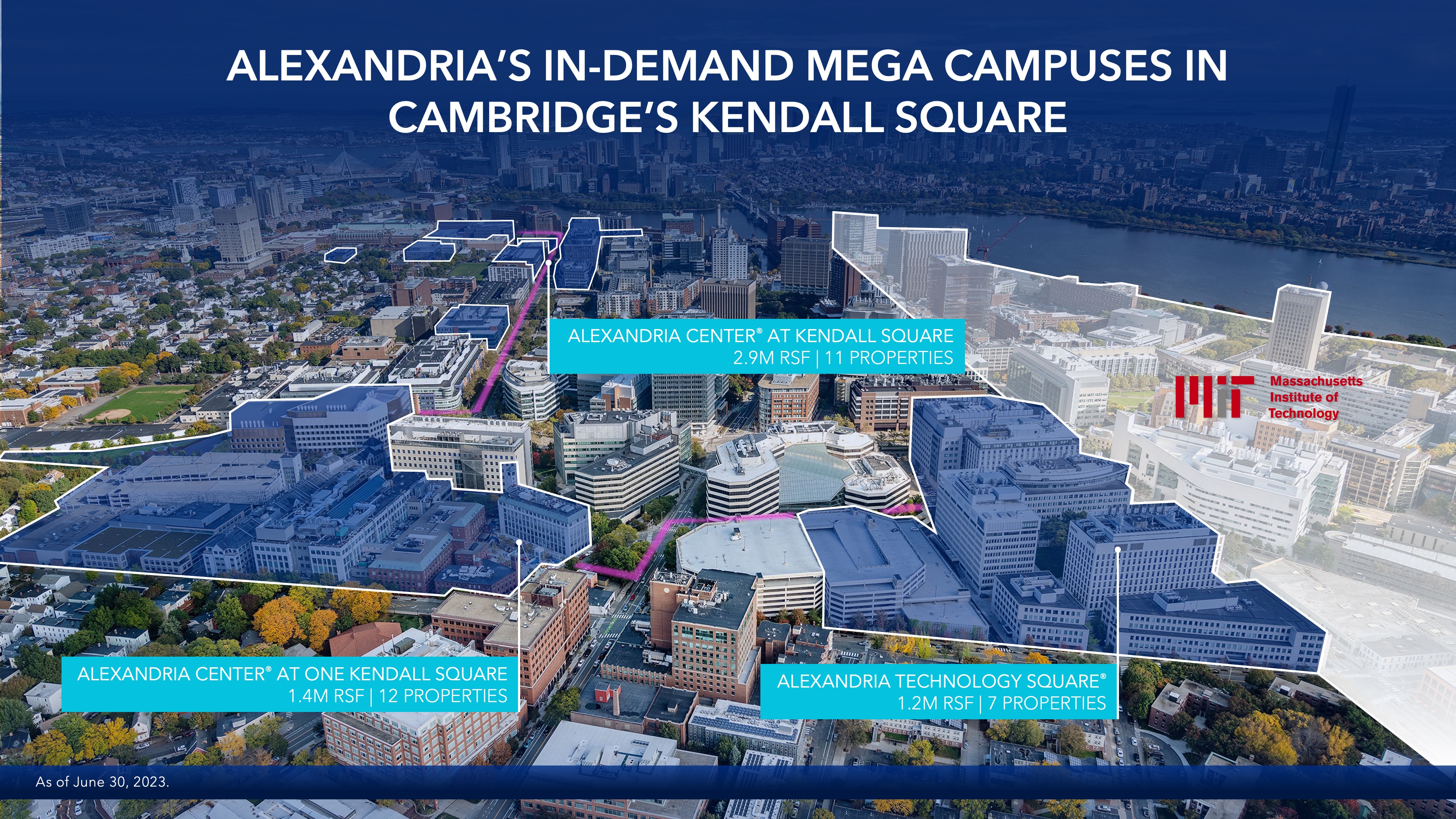

◦Three of the country’s foremost, in-demand Alexandria mega campuses, which aggregate over 5 million RSF in operation or under construction, are in Cambridge’s Kendall Square, which has been called the most innovative square mile on the planet.13

12 Excludes RSF that is currently operating, but is expected to be demolished for future development opportunities upon expiration of the existing in-place lease.

13 Source: Massachusetts Institute of Technology, "Kendall Square Initiative.”

7

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

8

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•Two notable examples that demonstrate the continued demand for Alexandria’s unrivaled mega campuses are large-scale development projects with long-term leases to Moderna, Inc. and Bristol-Myers Squibb Company, which were executed in September 2021 and February 2022, respectively:

•A 462,100 RSF headquarters and core R&D center for Moderna at 325 Binney Street on the Alexandria Center® at One Kendall Square mega campus in the Cambridge/Inner Suburbs submarket of Greater Boston. The Class A+ active development project is expected to deliver in late 2023, when Moderna anticipates beginning its move-in process.

•A 426,927 RSF R&D facility for Bristol Myers Squibb at 4135 Campus Point Court on the Campus Point by Alexandria mega campus in the University Town Center submarket of San Diego. The Class A+ near-term development project is expected to commence construction in the next three quarters.

9

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

Alexandria’s operational excellence helps safeguard leading-edge science

•Alexandria provides direct asset management and operations of its Labspace asset base. Its operational excellence helps safeguard billions of dollars of high-intensity infrastructure, specialized equipment, and irreplaceable tenant research and clinical pipeline assets.

•Importantly, this laboratory-based scientific research cannot be performed from home and must be conducted in dedicated spaces in compliance with stringent laboratory safety requirements governed by city, state, and/or federal regulatory agencies.

•Alexandria’s team includes well-educated and credentialed in-house facilities specialists who drive operational and technical capabilities commensurate with other similarly rigorous industries as part of the United States’ critical infrastructure.

10

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

4. Not all new supply is competitive with Alexandria’s asset base

•Alexandria designs, develops, owns, and operates an asset base consisting of predominantly Class A/A+ facilities in AAA innovation cluster locations in close proximity to world-renowned research institutions, deeply specialized talent, and ample risk capital — which it coalesces to enable life science companies to accelerate discovery and commercialization. Alexandria segments the life science laboratory market into the following categories:

| | | | | |

| Class A+ | Class A |

•High-quality, new expertly designed

and purpose-built laboratory facilities integrated into highly curated mega campuses •Proximate to the nation’s leading academic and medical research institutions •Operated by a fully integrated, deeply skilled technical team •Strong capitalization | •New high-quality development and redevelopment laboratory facilities that meet general specifications for basic research and development work •Operated by competent technical teams •Generally adjacent to other similar assets or integrated into a campus/mega campus •Reasonably or well capitalized |

| Class B | Class C |

•New one-off construction generally in line with office design and construction characteristics •Limited and/or minimal to no operational expertise and challenging capital structure | •New one-off redevelopment of poor base building infrastructure •No operational expertise and thinly capitalized |

11

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

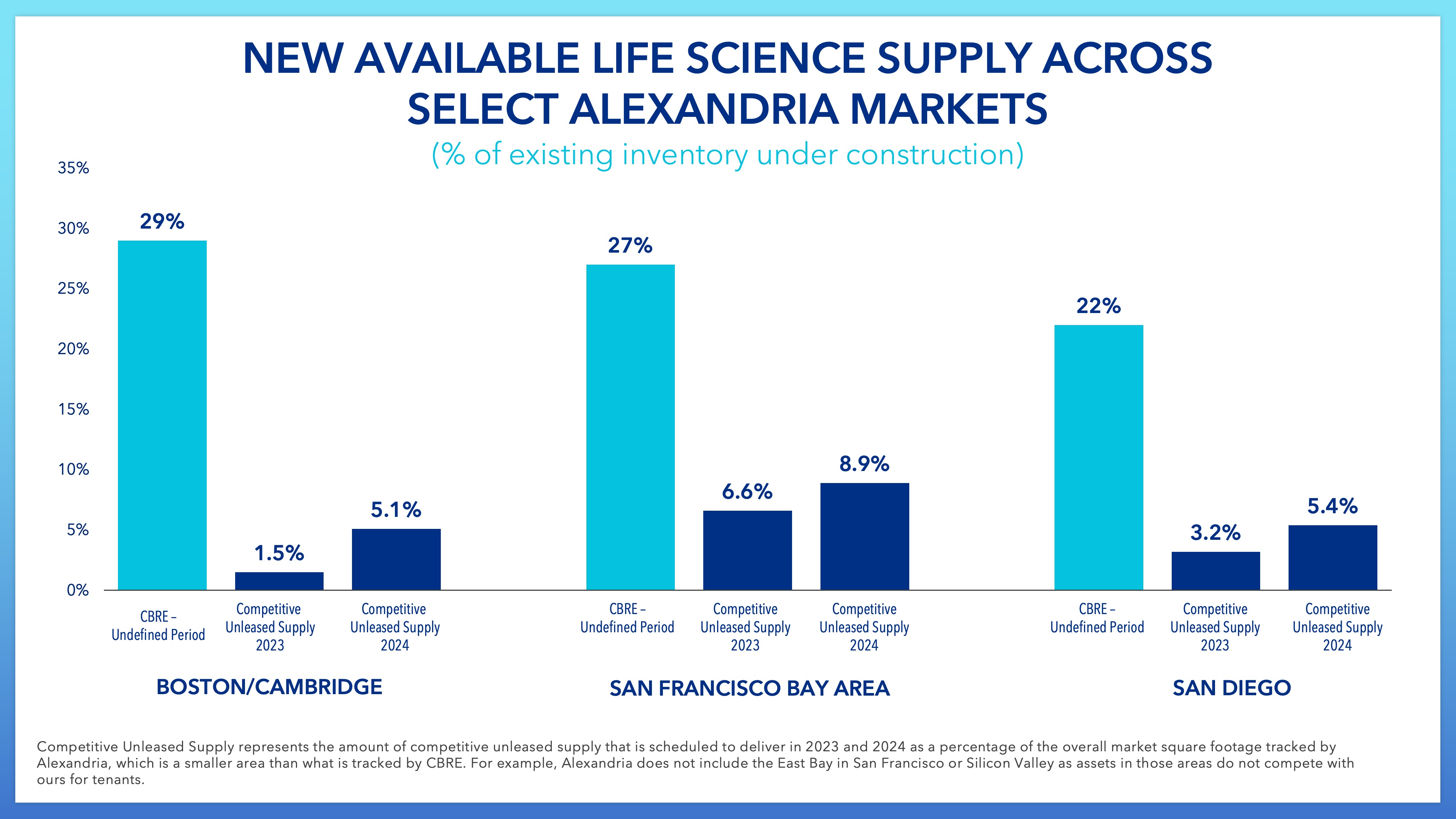

•Such differentiated infrastructure offerings and operational excellence by Alexandria afford the company a competitive advantage against most new market supply. Although the company does consider some Class B projects competitive, the majority of the projects it competes with are classified as Class A/A+. A summary of available competitive supply is shown below, gleaned from Alexandria’s rigorous building-by-building tracking of supply in each of its markets:

12

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

5. Operating and financial performance, fueled by fundamentals returning to historical pre-COVID-19 levels, drives continued growth

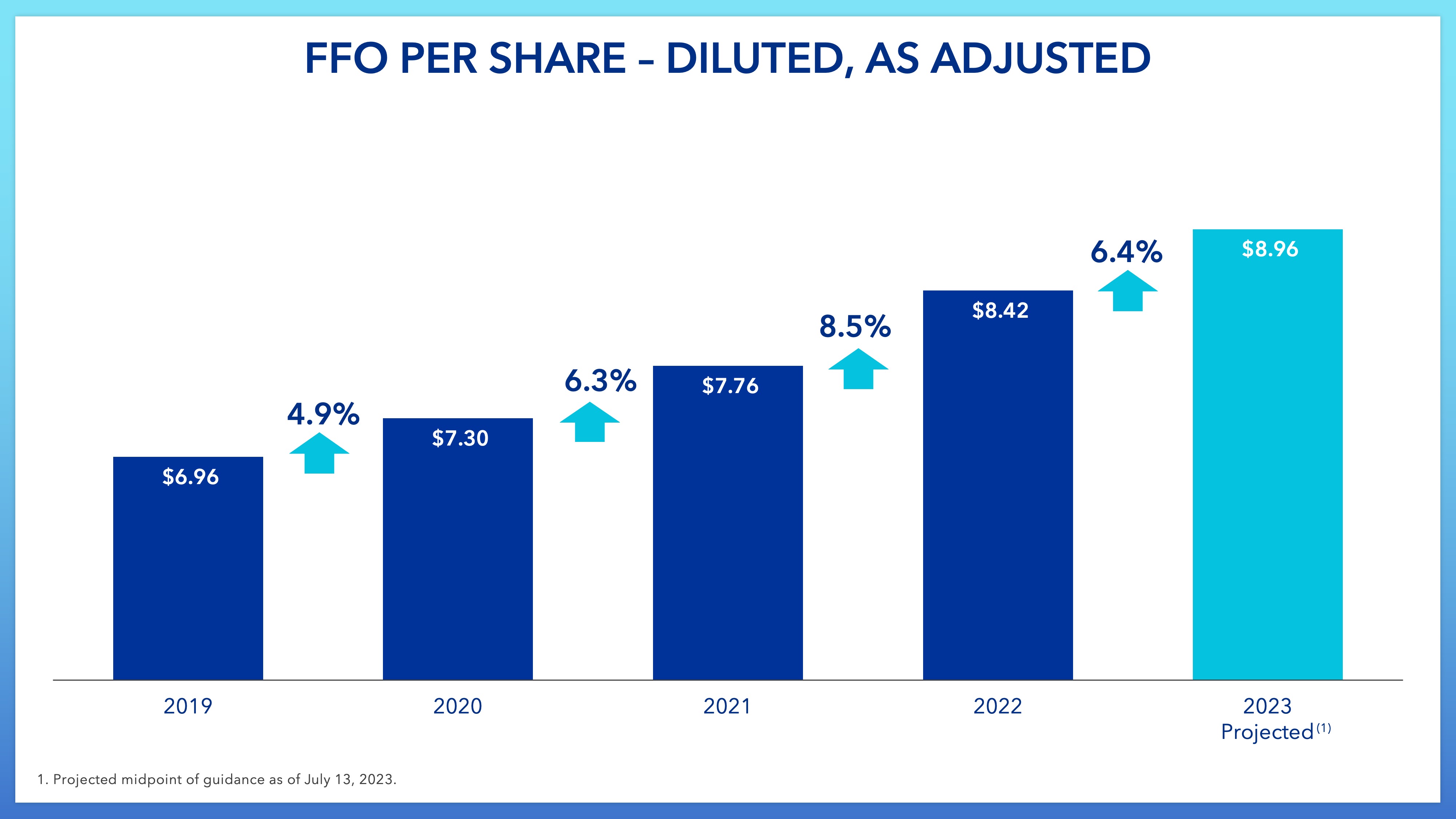

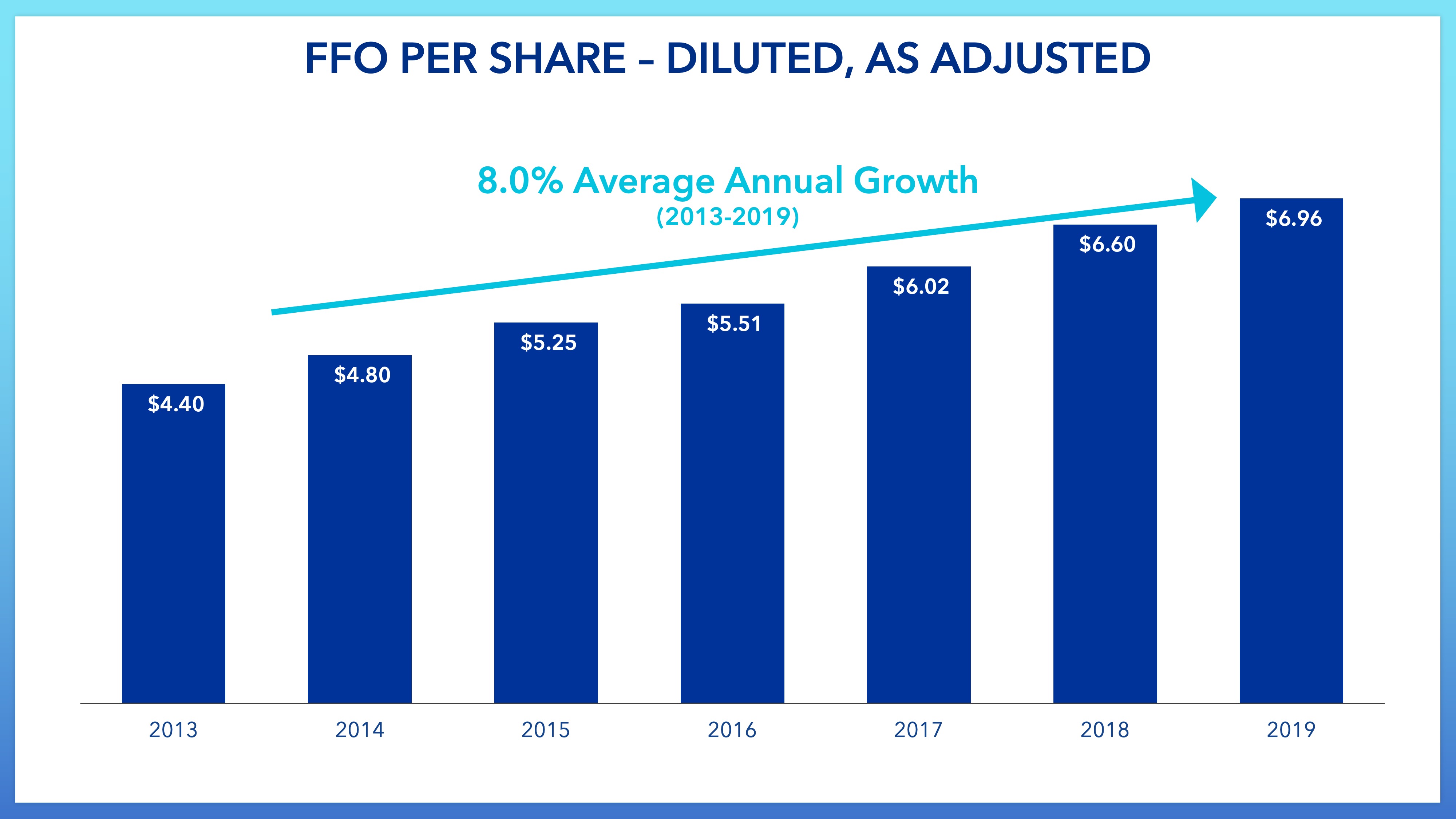

The company projects growth in funds from operations per share attributable to Alexandria’s common stockholders – diluted, as adjusted (“FFO per share – diluted, as adjusted”) of 6.4% in 2023, at the midpoint of its 2023 guidance affirmed on July 13, 2023, compared to 2022, as Alexandria continues to benefit from its differentiated business platform uniquely focused on providing the complex laboratory infrastructure needed to support the life science industry’s pursuit of desperately needed treatments and cures. The consistent increase of FFO per share – diluted, as adjusted is the result of continued strength in the leasing volume, rental rates, and occupancy.

•Alexandria’s FFO per share – diluted, as adjusted continues to grow as follows:

13

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•Alexandria’s 2023 FFO per share – diluted, as adjusted growth (based on the midpoint of its 2023 guidance affirmed on July 13, 2023) of 6.4% extends the solid historical growth that the company achieved prior to the COVID-19 pandemic.

14

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

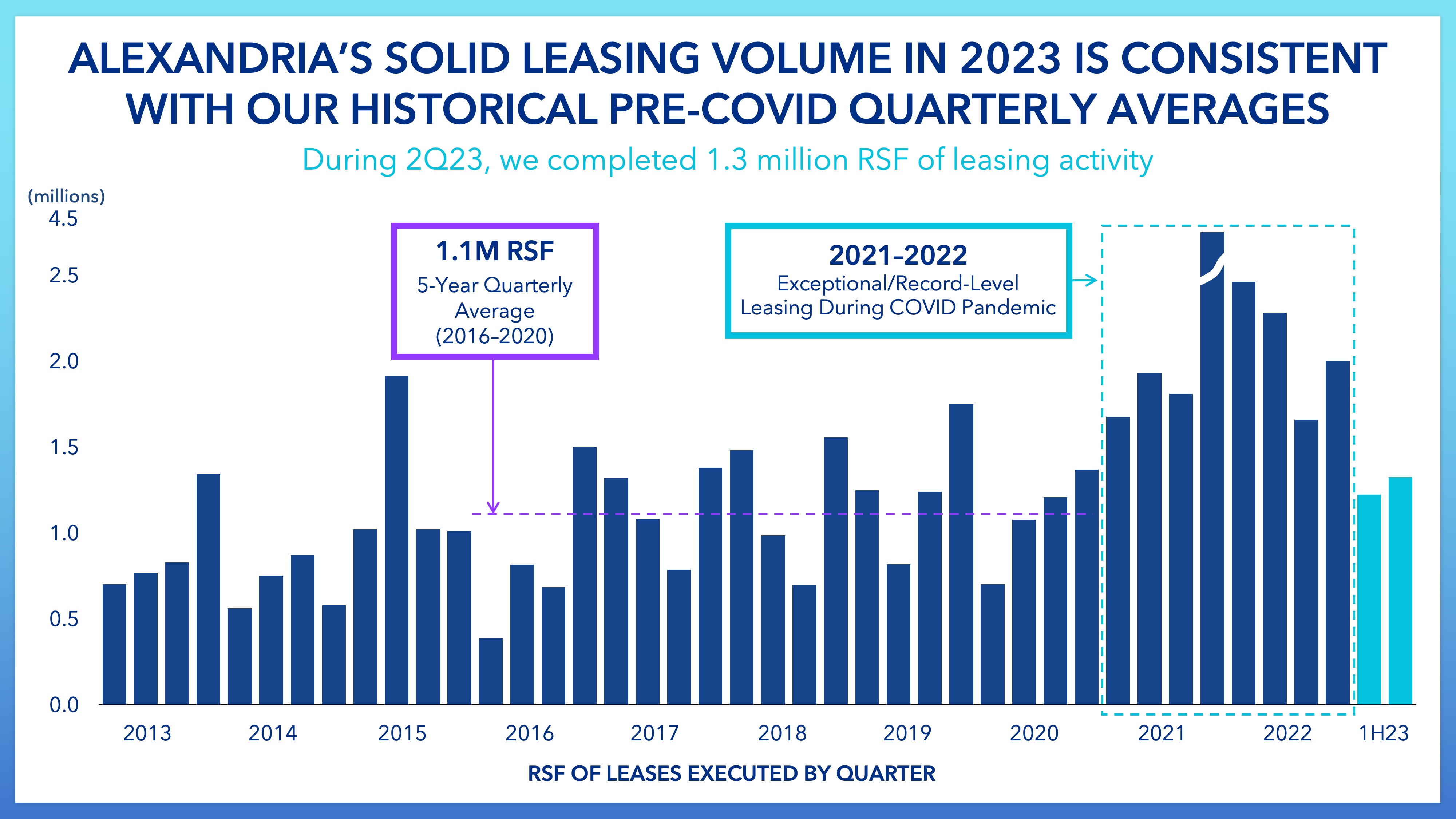

Alexandria’s leasing volume in 4Q21 and 1Q22 were the highest in company history, driven by the exceptional record-level tenant demand over historical norms due to, among other drivers, extraordinary additional funding and resources to address the COVID-19 pandemic.

•Alexandria’s leasing volume for the six months ended June 30, 2023 of 2.55 million RSF, or 5.1 million RSF on an annualized basis, has normalized to historical pre-COVID-19 levels of 4.2 million RSF on an annual basis from 2013 to 2020 and 1.1 million RSF on a quarterly basis from 2016 to 2020.

15

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

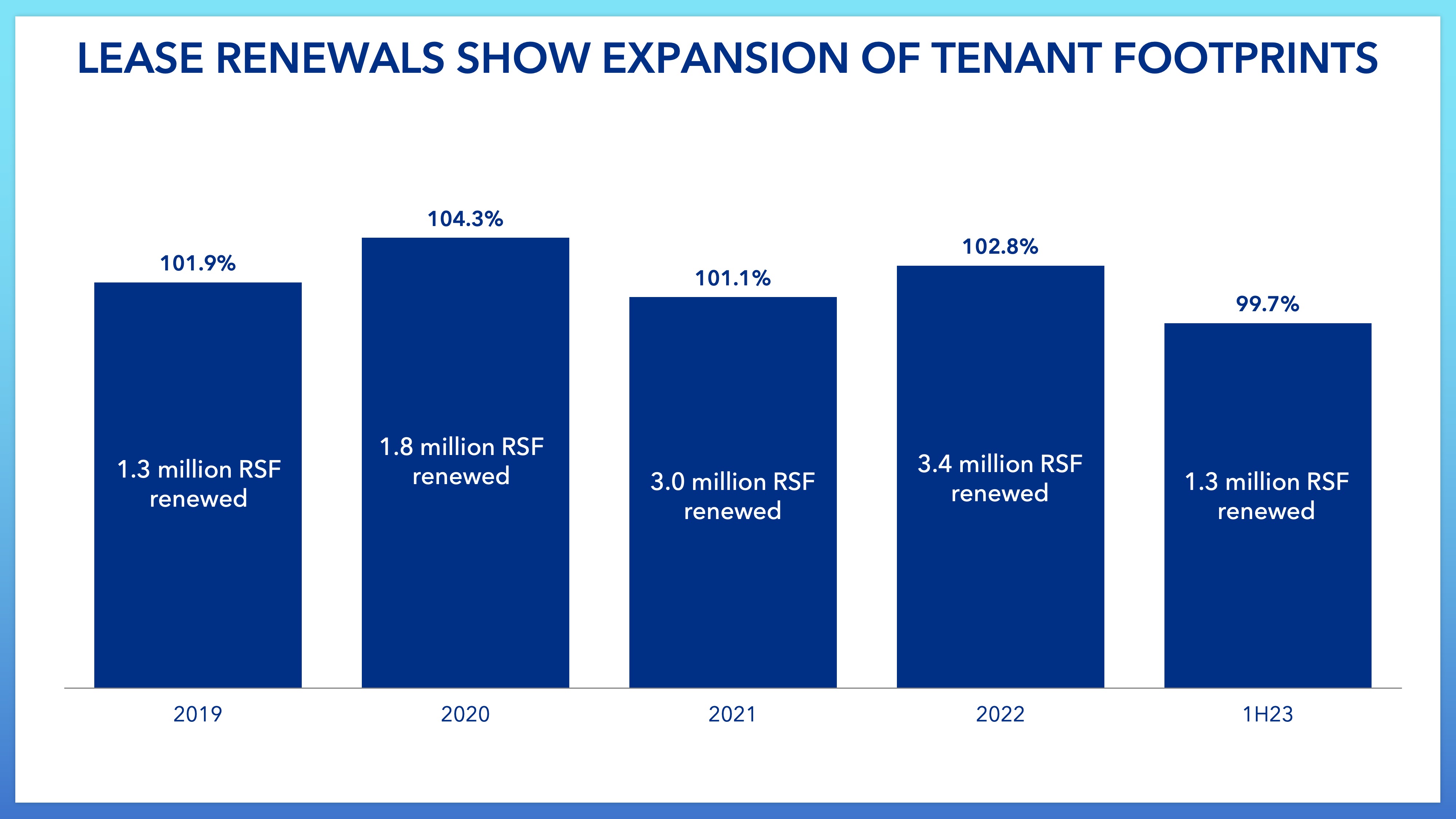

During the COVID-19 pandemic and into 2023, the majority of Alexandria’s tenants who have renewed their leases, have in aggregate retained or expanded their original footprints, which is generally consistent with the trend prior to COVID-19. Alexandria has seen no evidence indicating a trend of its tenants significantly reducing their square footage upon renewal. In fact, there was positive expansion during each year, except for the six months ended June 30, 2023, in which one tenant slightly reduced their RSF footprint as a result of the wind down in the COVID-19 testing portion of their business.

16

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

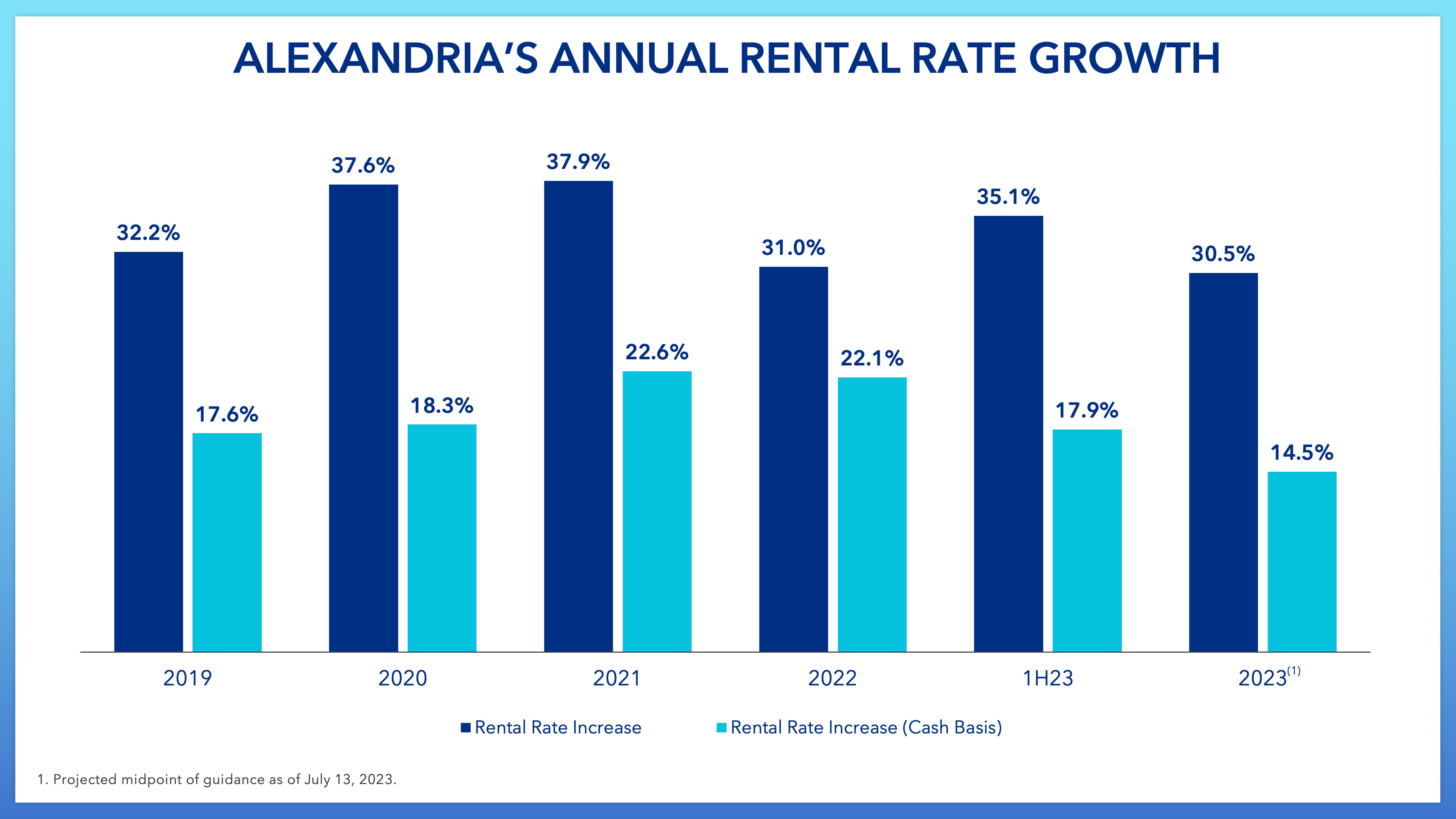

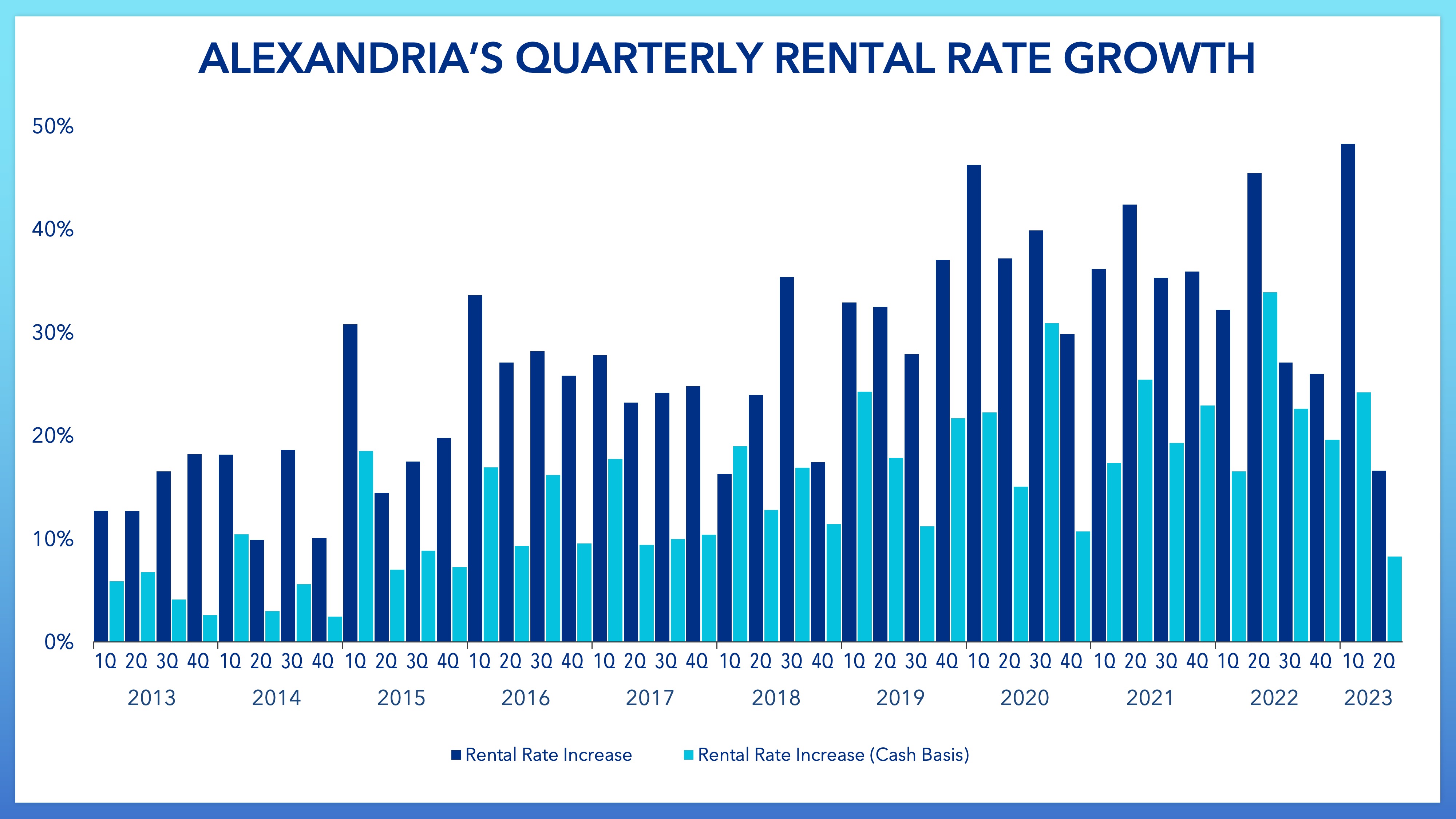

•Strong rental rate increases continue to be a driver of Alexandria’s internal growth.

17

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•During 1Q23, Alexandria’s rental rate growth was driven by lease renewals in the Greater Boston, San Francisco Bay Area, and Seattle markets. Alexandria’s 2Q23 rental rate growth of 16.6% and 8.3% (cash basis) was driven by renewals in the Seattle, Maryland, and Research Triangle markets. It is important to keep in mind that quarterly rental rate growth for lease renewals and re-leasing of space can be significantly skewed by a small number of leases or mix of leases (by submarket or property) executed. Alexandria’s outlook for rental rate growth related to lease renewals and re-leasing of space remains solid with guidance ranges for 2023 rental rate increases of 28% to 33% and 12% to 17% (cash basis) noted in the chart above.

18

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

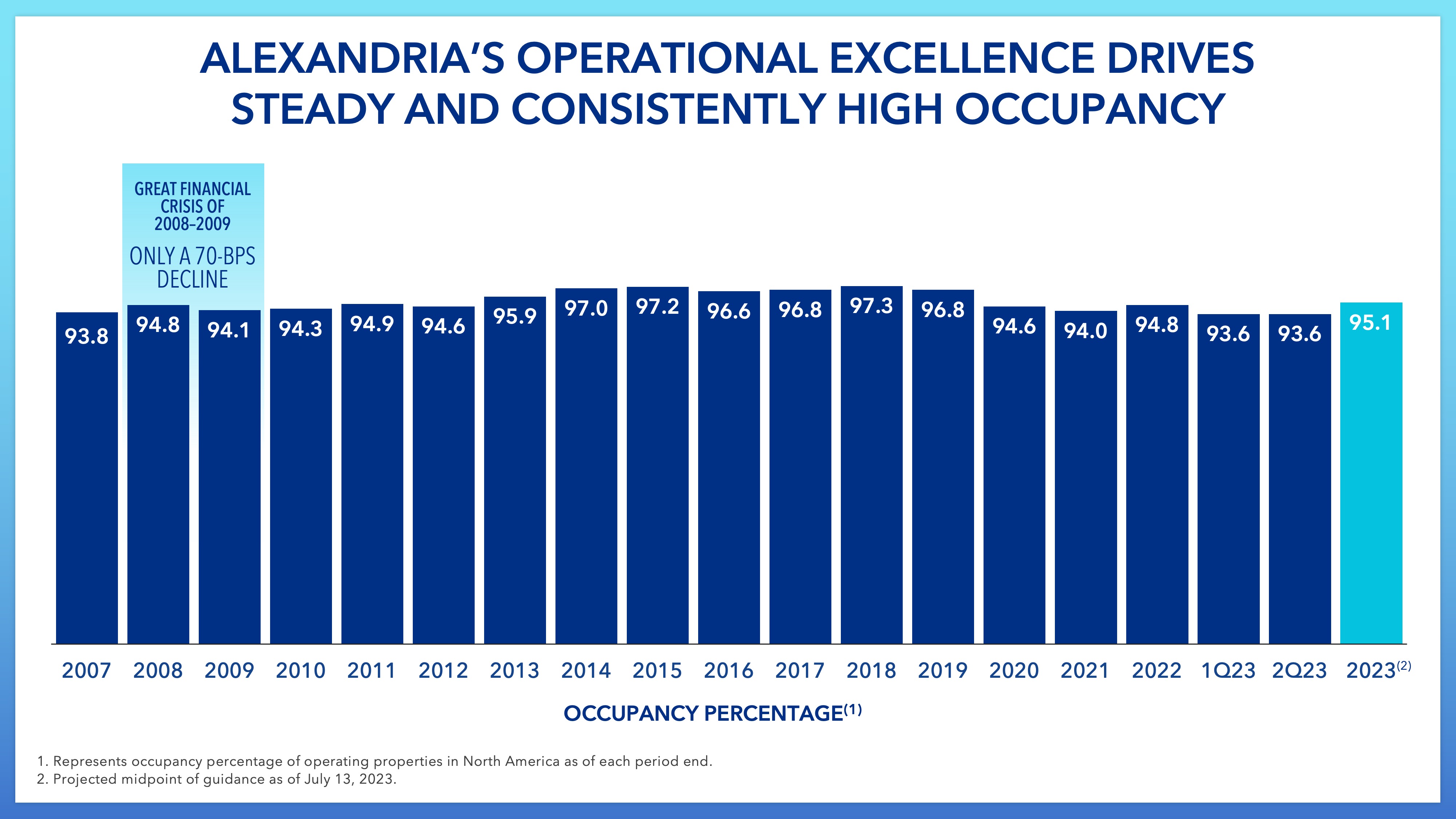

Alexandria’s occupancy has proven resilient through various real estate cycles, including during the Great Financial Crisis of 2008–2009 with only a 70-basis point decline in occupancy percentage. As of June 30, 2023, its value-creation pipeline projects include spaces aggregating 4.2 million RSF under construction that are 94% leased and expected to reach stabilized occupancy by December 31, 2024.

•Alexandria’s occupancy as of June 30, 2023 remained strong at 93.6%, which includes vacancy of 2.2% from properties recently acquired in 2021 or 2022 primarily from lease-up opportunities. Occupancy is expected to increase by the end of 2023 to a range between 94.6% and 95.6%. Over the last 15 years, tenant demand for Alexandria’s properties has resulted in consistently high occupancy through various macro environments.

19

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

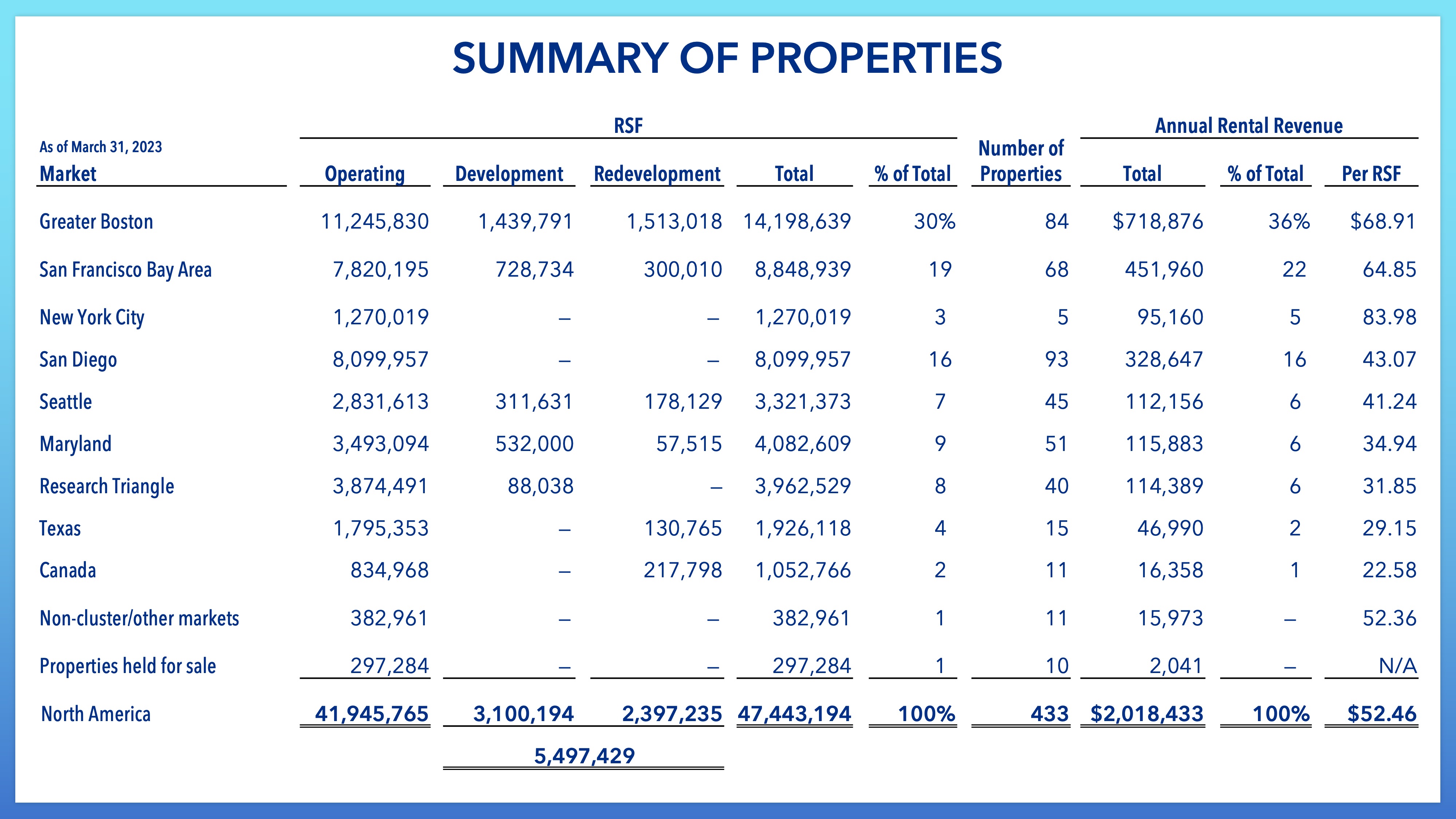

With 93% of Alexandria’s leases structured as triple-net leases, which allow for the recovery of operating expenses and capital expenditures, Alexandria believes it is inaccurate to compare its in-place triple-net rental rates to that of traditional Class A office space which is typically leased and reported on a gross basis, without the full recovery of operating expenses from tenants.

•Alexandria’s reported annual rental revenue per RSF in the table below excludes expenses recovered from its tenants. In its coastal markets,14 expenses recovered from Alexandria’s tenants ranged from approximately $22 per RSF in San Diego to $34 per RSF in New York City for the twelve months ended March 31, 2023.

14 Includes our Greater Boston, San Francisco Bay Area, New York City, and San Diego markets.

20

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

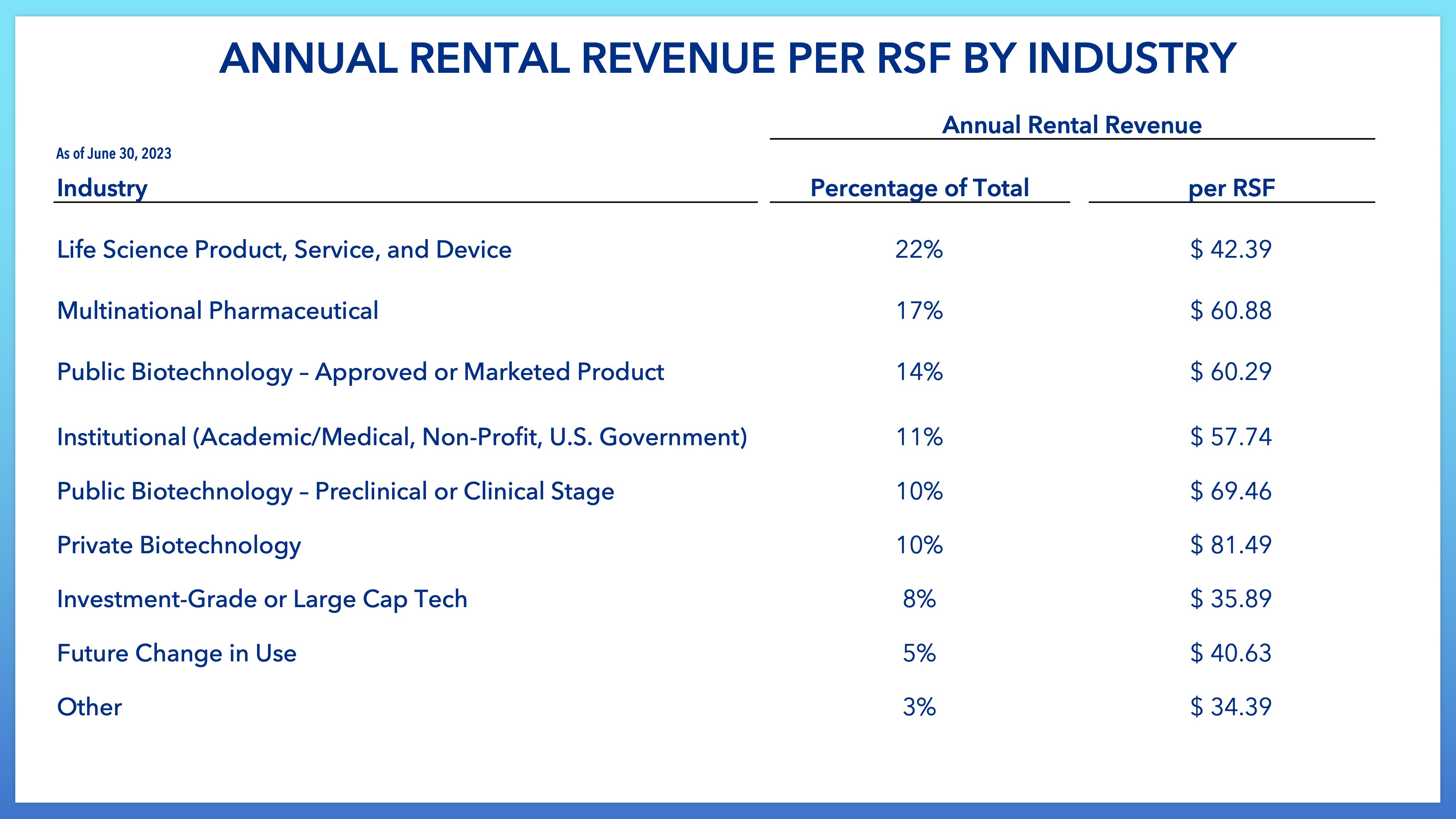

•In addition, the following table provides annual rental revenue per RSF for the industry mix of Alexandria’s diverse tenant base, excluding tenant recoveries.

21

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

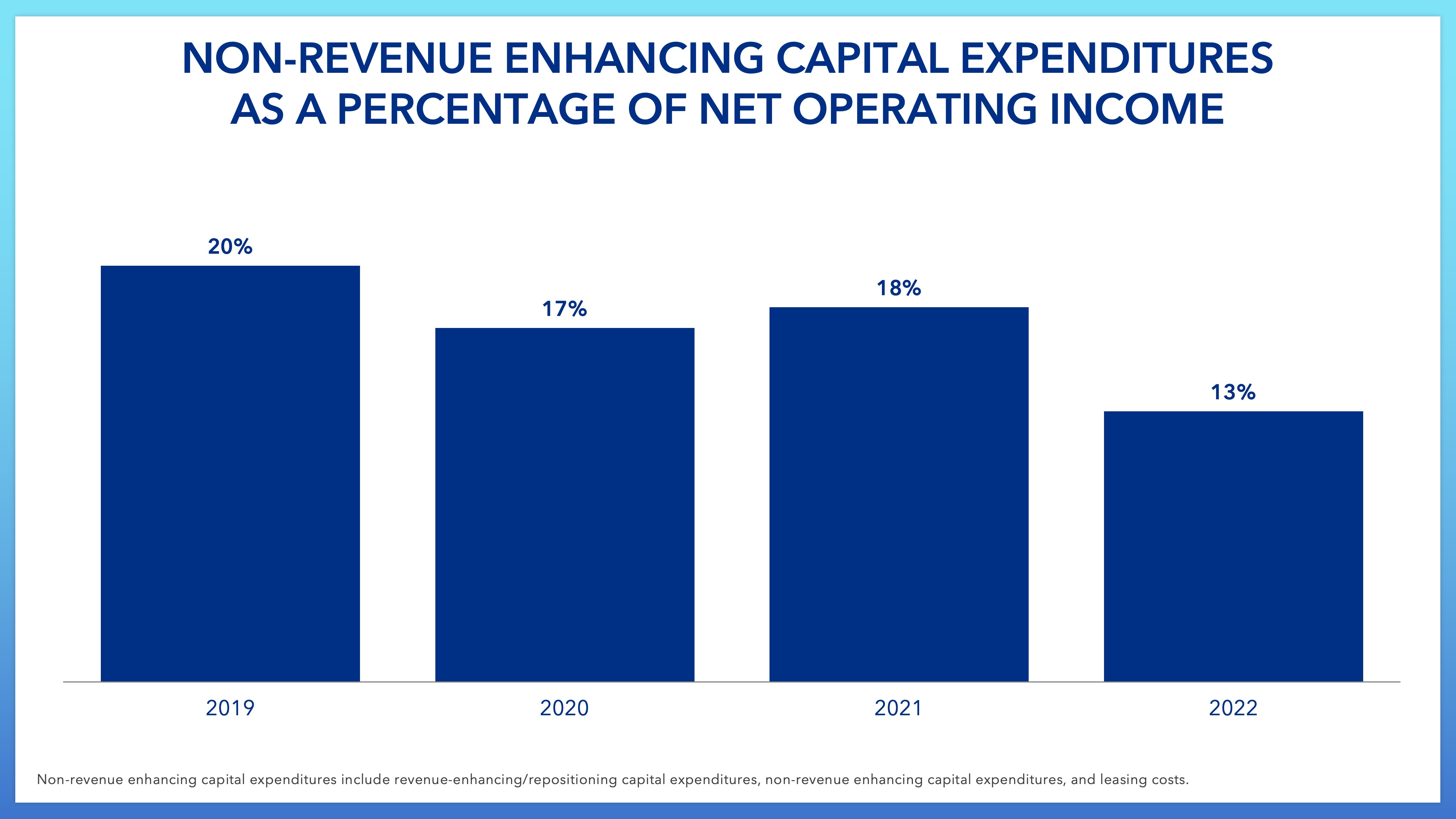

•Alexandria’s asset base continues to require only a modest level of overall non-revenue-enhancing capital expenditures as a percentage of net operating income. Non-revenue-enhancing capital expenditures include all additions to real estate except for costs related to ground-up development or first-time conversion of non-laboratory space to laboratory space through redevelopment. Historical non-revenue-enhancing capital expenditures have averaged 15% of net operating income and are trending lower for both 2022 and 2023. This low level of non-revenue-enhancing capital expenditure demonstrates the high durability and reusability of Alexandria’s infrastructure space through multiple lease terms.

22

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

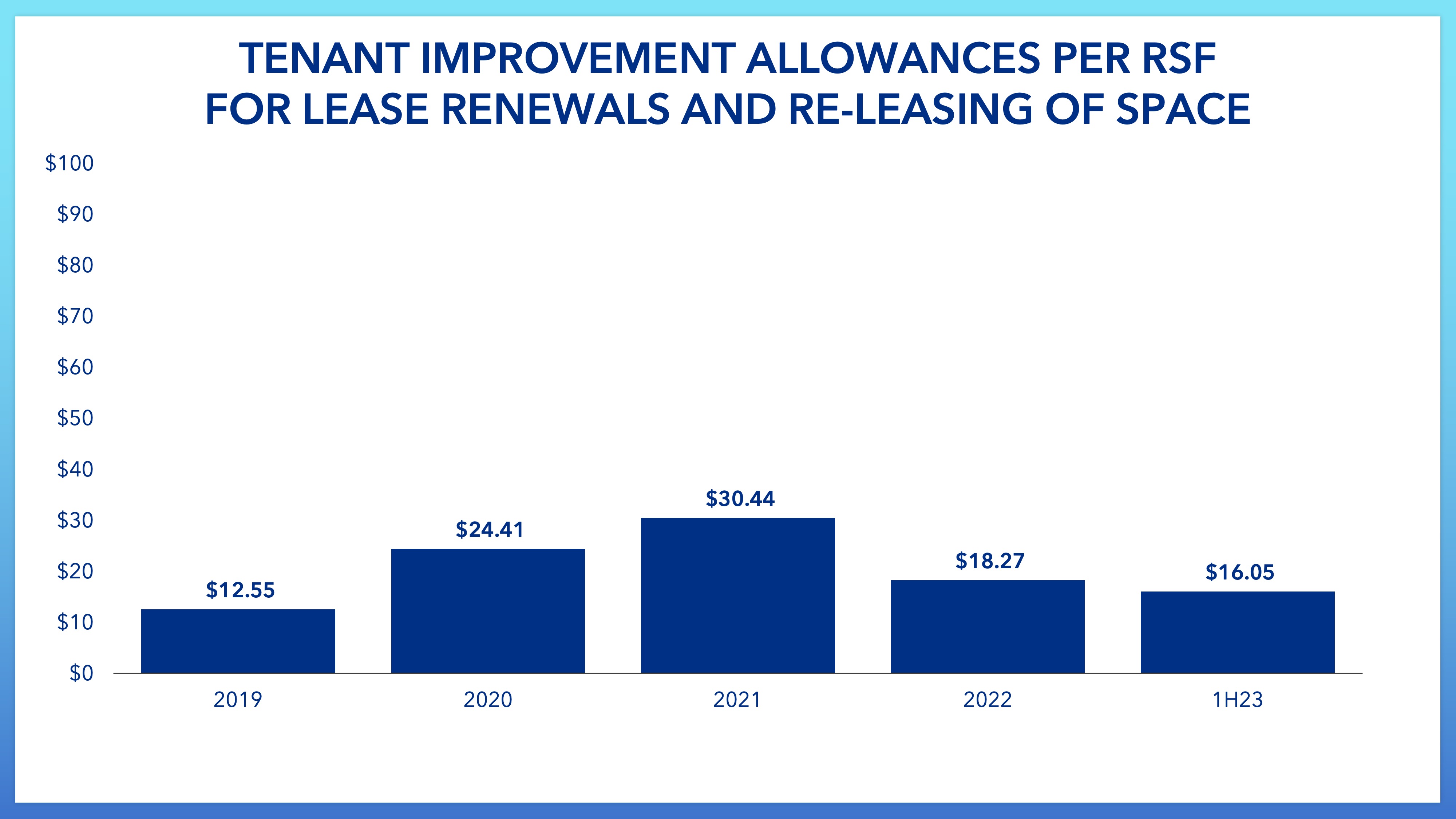

•Alexandria’s tenant improvement allowances for the re-lease/renewal of space, included in the chart immediately above, remain low, again evidencing the high durability and reusability of Alexandria’s infrastructure space.

23

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

6. Alexandria continues its market leadership with a strong and flexible balance sheet, increasing dividends, and continued execution of its capital recycling program through partial interest sales and enhancement of its asset base with dispositions of non-core properties

•Alexandria’s strong and flexible balance sheet underpins not only robust financial performance for Alexandria’s shareholders, but also supports Alexandria’s value proposition to its tenants. Tenants value a landlord with a strong and flexible balance sheet and a partner they know will be there to service their complex needs for years to come. Key metrics from the company’s REIT industry-leading balance sheet as of March 31, 2023, include the following:

•Investment-grade credit ratings that rank in the top 10% among all publicly traded U.S. REITs.

•$5.3 billion of liquidity.

•No debt maturities prior to 2025.

•13.4 years weighted-average remaining term of debt.

•96.1% of debt has a fixed interest rate.

•In June 2023, Alexandria increased commitments available under its unsecured senior line of credit from $4 billion to $5 billion, further bolstering its already significant liquidity.

•Additionally, the company’s premier financial and operational reporting practices have earned it eight NAREIT Investor CARE (Communications and Reporting Excellence) awards, including seven Gold Awards since 2015 — the most Gold Awards by any equity REIT.

24

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

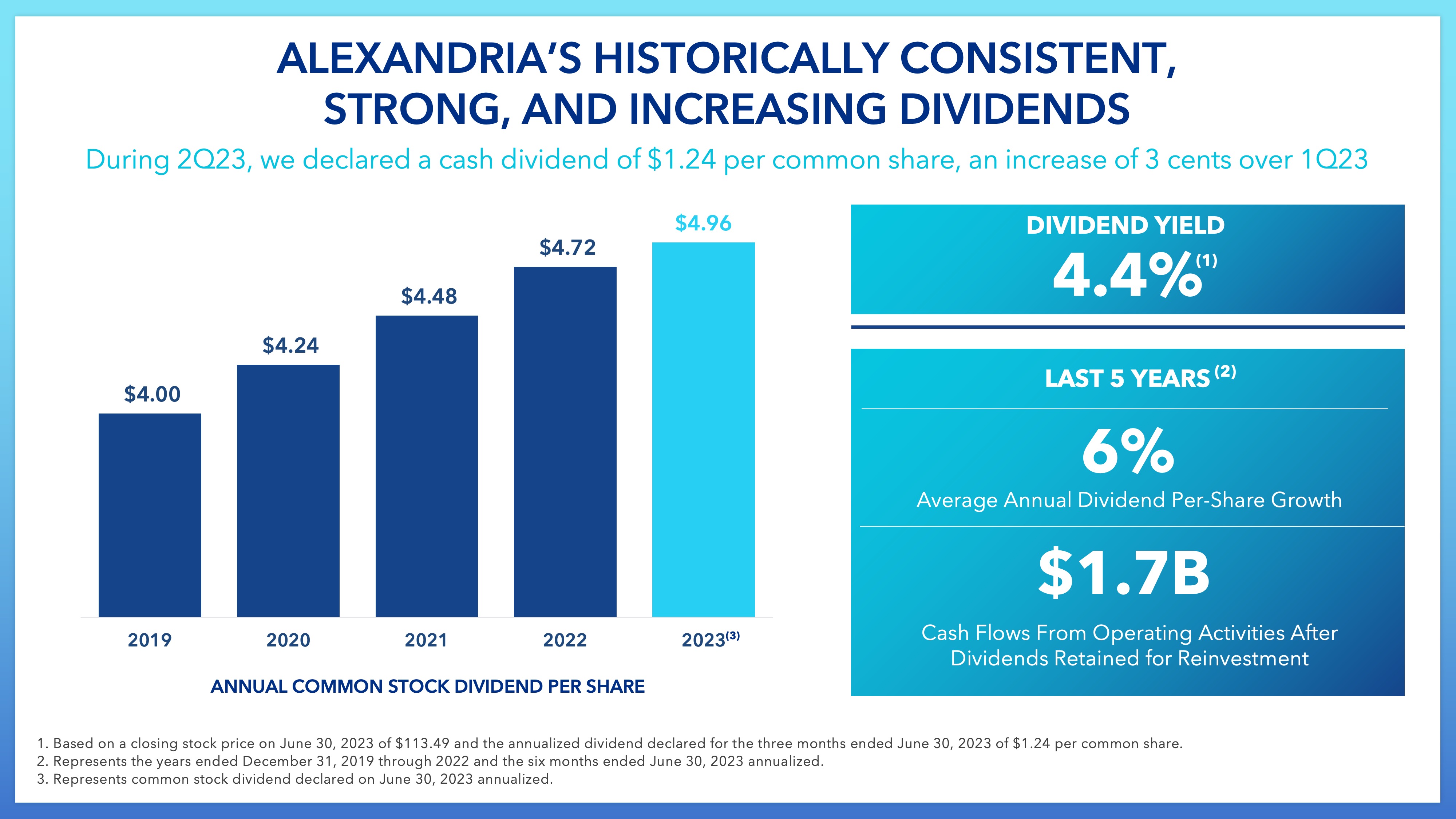

•Alexandria’s continued strong and increasing dividends yield of 4.4% as of June 30, 2023 also supports the reinvestment of significant net cash flows from operating activities after dividends.

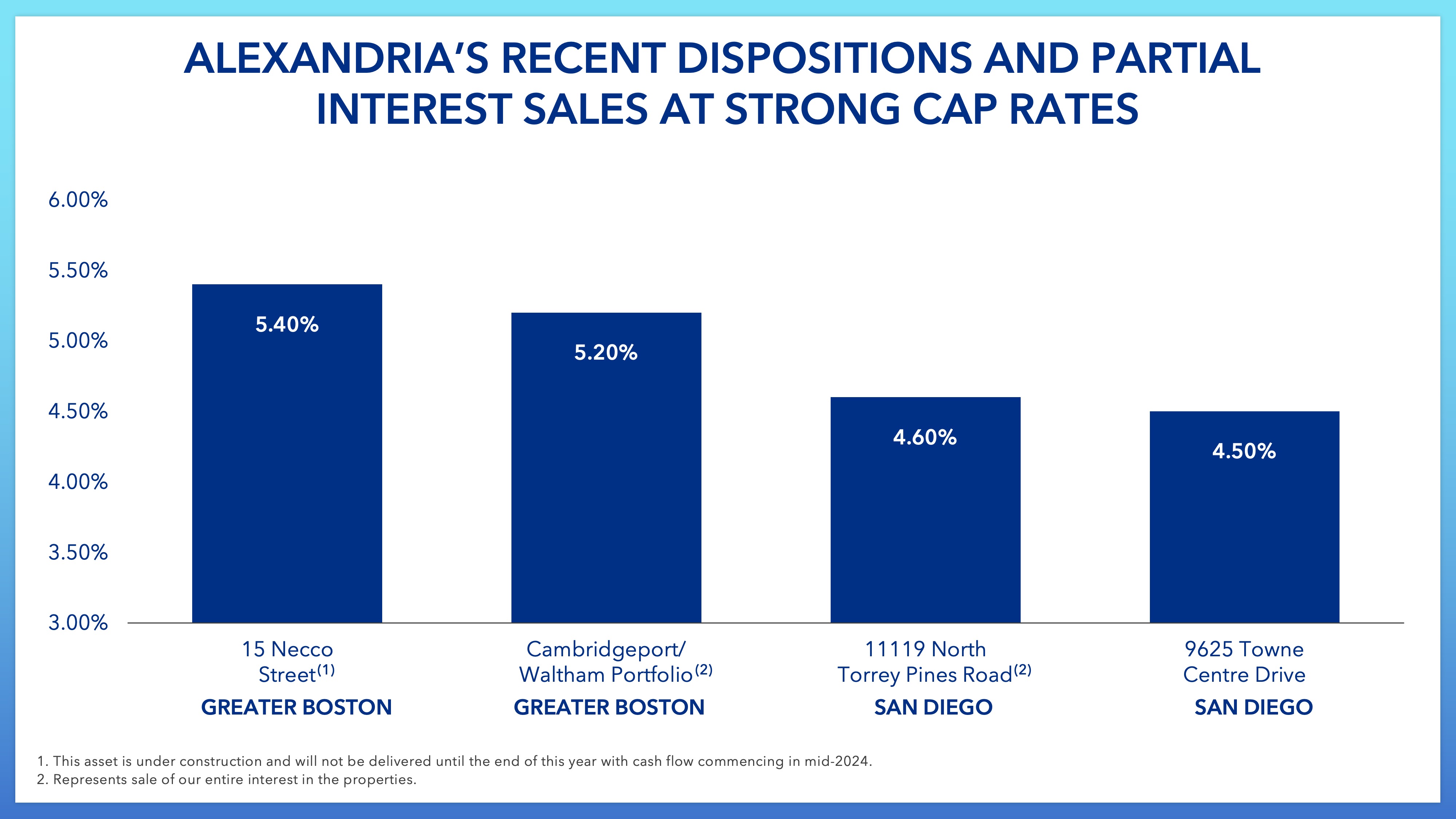

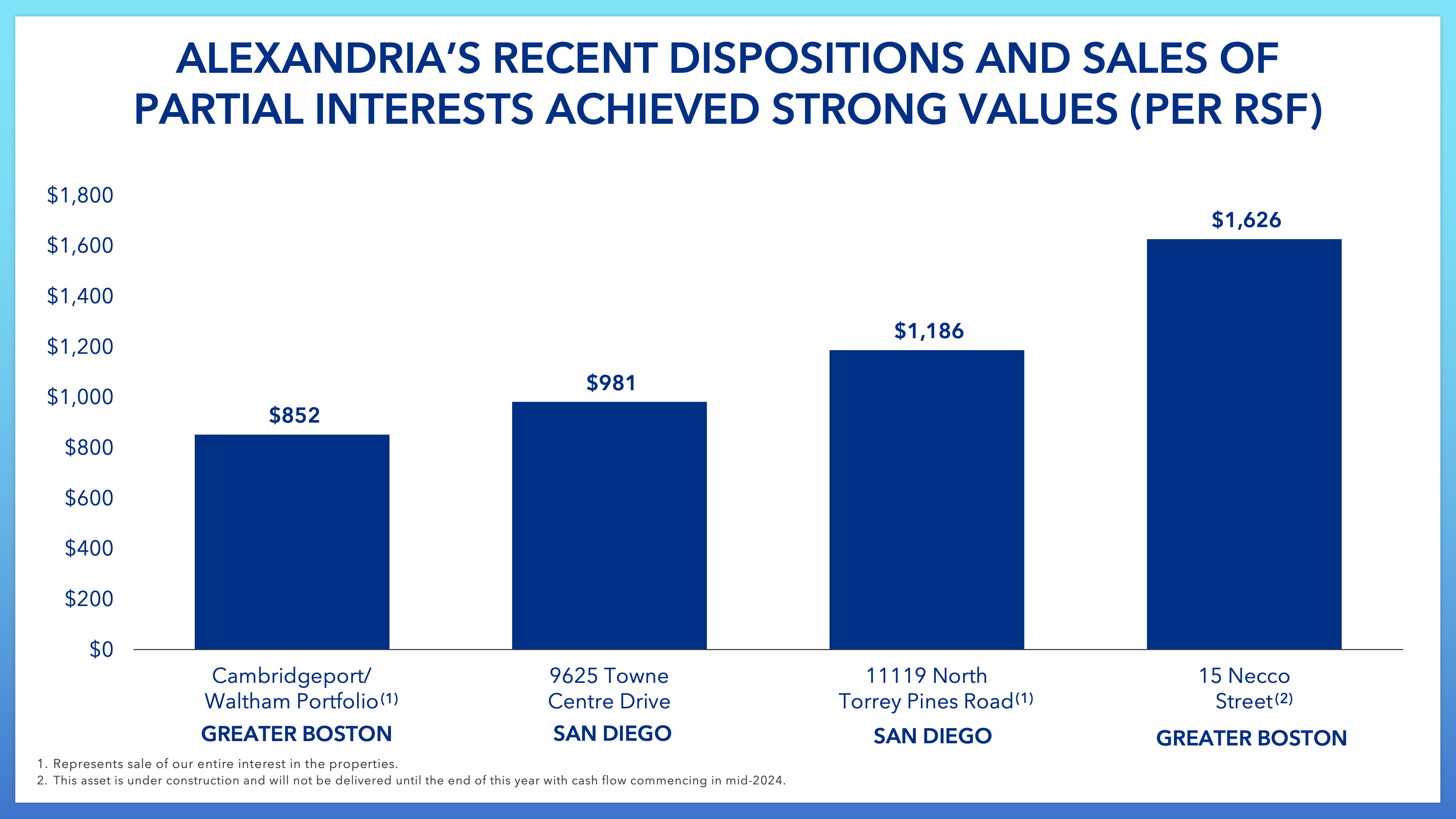

•Alexandria’s strong and timely execution of its strategic value harvesting and asset recycling program to raise accretive capital has demonstrated continuing solid demand for its scarce, high-quality life science assets.

•On April 12, 2023, Alexandria announced the completion of its sale of a 20% partial interest in its 15 Necco Street property in the Seaport Innovation District submarket of Greater Boston, which consists of an 18% interest sold by Alexandria and a 2% interest sold by an existing partner. The sales price of the 18% interest sold by Alexandria was $66.1 million, and Alexandria expects the new joint venture partner to contribute capital approximating $130 million to fund construction of the project over time and to accrete its ownership interest in the joint venture from 20% to 37%.

•On May 24, 2023, Alexandria announced the completion of the sale of 11119 North Torrey Pines Road in San Diego. The fully leased 72,506 RSF single-tenant property sold for $86 million at a strong capitalization rate of 4.6% (based upon cash net operating income for 1Q23 annualized).

•On June 20, 2023, Alexandria announced that an affiliate of the company completed the sale of five non-core, non-mega campus properties aggregating 428,663 RSF in Greater Boston. Alexandria sold the portfolio for $365 million, or an average sales price of $852 per RSF, and at a weighted-average capitalization rate of 5.2% (based upon cash net operating income for 2Q23 annualized) which includes vacancy available for redevelopment, resulting in a gain on sale of $187.2 million and a value-creation margin of 80%.

•On June 22, 2023, Alexandria announced the recapitalization of an existing joint venture for 9625 Towne Centre Drive in its University Town Center submarket in San Diego. The 70% partial interest sale in this consolidated real estate joint venture comprised a 20.1% interest sold by Alexandria and a 49.9% interest sold by the previous joint venture partner and was completed at a total property valuation of $160.5 million, or $981 per RSF, and at a strong cash capitalization rate of 4.5% (based upon cash net operating income for 2Q23 annualized). Upon completion of the sale, Alexandria’s ownership in the joint venture is 30%.

•In June 2023, Alexandria signed a purchase and sale agreement for the disposition of 268,000 RSF of a 660,034 RSF Class A near-term development at 421 Park Drive, in its Fenway submarket of Greater Boston, to an affiliate of Boston Children’s Hospital. Initial proceeds at closing are estimated to be $155 million and will help fund Alexandria’s remaining approximately 392,000 RSF of the project.

•The project is expected to commence vertical construction later this year and be substantially complete in 2026.

•Boston Children’s Hospital will fund the project costs related to its 268,000 RSF and these costs are not included in Alexandria’s projected construction spending as they will be the obligation of Boston’s Children’s Hospital.

25

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

•Alexandria will develop and operate the completed project and will earn development fees over the next three years.

•Inclusive of the above transactions, $976.0 million, or 53%, of Alexandria’s $1.85 billion capital plan is completed or subject to executed letters of intent or purchase and sales agreements, including $701.0 million from completed dispositions and partial interest sales, $175.0 million from dispositions under executed letters of intent or purchase and sales agreements, and approximately $100 million from forward equity sales agreements that were outstanding as of December 31, 2022.

•Proceeds from these strategic dispositions and sales of partial interests will be reinvested into the company’s highly leased value-creation pipeline, which consists of large-scale research and development facilities for some of the world’s leading life science companies, including Eli Lilly, Bristol Myers Squibb, and Moderna.

•Alexandria expects to continue its positive momentum into 2H23, executing the remainder of its dispositions and partial interest sales at attractive values and capitalization rates. Importantly, its 2023 capital plan assumes that Alexandria does not issue any additional common equity.

26

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023

Forward-Looking Statements

This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our expectations for future funds from operations (FFO) per share, property occupancy, leasing volumes, rental rate growth, and dividend payments and other statements regarding Alexandria’s future operating or financial performance, including our outlook for future growth, the expected pace of FDA drug approvals and expected life science research and development funding levels. These forward-looking statements are based on Alexandria’s present intent, beliefs, or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by Alexandria’s forward-looking statements as a result of a variety of factors, including, without limitation, the risks and uncertainties detailed in its filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this document, and Alexandria assumes no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in Alexandria’s forward-looking statements, and risks and uncertainties to Alexandria’s business in general, please refer to Alexandria’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q.

27

Exhibit 99.2 to Form 8-K Filed on July 13, 2023 Alexandria Real Estate Equities, Inc. All Rights Reserved. © 2023