Uses of capital

Summary of capital expenditures

One of our primary uses of capital relates to the development, redevelopment, pre-construction, and construction of properties.

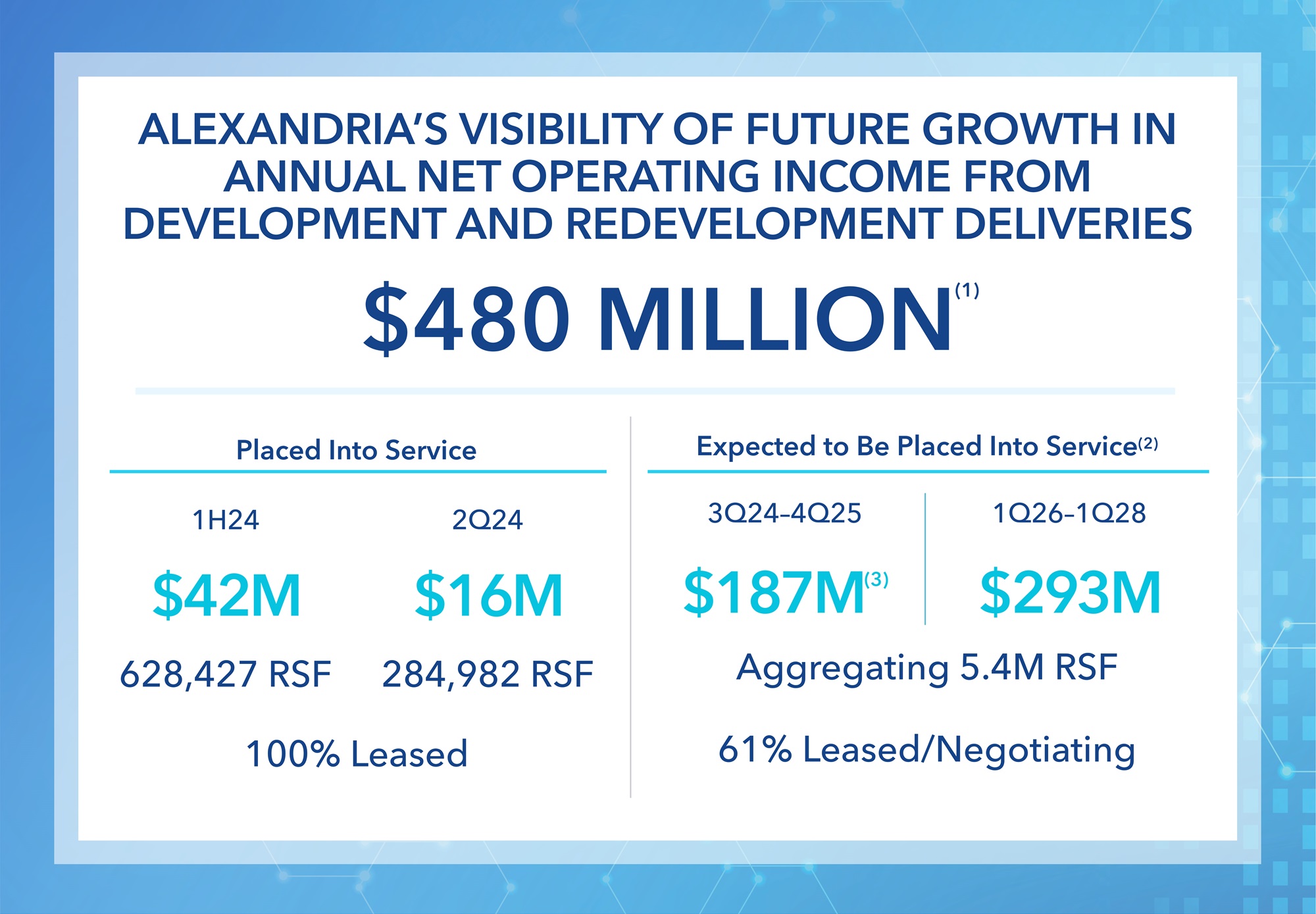

We currently have projects in our value-creation pipeline aggregating 5.3 million RSF of Class A/A+ properties undergoing construction

and one committed near-term project expected to commence construction in the next two years, and 2.4 million RSF of priority

anticipated development and redevelopment projects. We incur capitalized construction costs related to development, redevelopment,

pre-construction, and other construction activities. We also incur additional capitalized project costs, including interest, property taxes,

insurance, and other costs directly related and essential to the development, redevelopment, pre-construction, or construction of a

project, during periods when activities necessary to prepare an asset for its intended use are in progress. Refer to “New Class A/A+

development and redevelopment properties: current projects” and “Summary of capital expenditures” in Item 2 for more information on

our capital expenditures.

We capitalize interest cost as a cost of the project only during the period in which activities necessary to prepare an asset for

its intended use are ongoing, provided that expenditures for the asset have been made and interest cost has been incurred. Capitalized

interest for the six months ended June 30, 2024 and 2023 of $162.9 million and $178.7 million, respectively, was classified in

investments in real estate in our consolidated balance sheets. The decrease in capitalized interest was related to a lower weighted-

average capitalized cost basis of $8.0 billion for the six months ended June 30, 2024, as compared to $9.4 billion for the six months

ended June 30, 2023, partially offset by an increase in weighted-average interest rate used to capitalize interest to 3.94% for the six

months ended June 30, 2024 from 3.73% for the six months ended June 30, 2023.

Property taxes, insurance on real estate, and indirect project costs, such as construction, administration, legal fees, and office

costs that clearly relate to projects under development or construction, are capitalized as incurred during the period an asset is

undergoing activities to prepare it for its intended use. We capitalized payroll and other indirect costs related to development,

redevelopment, pre-construction, and construction projects, aggregating $52.1 million and $50.3 million, and property taxes, insurance

on real estate, and indirect project costs aggregating $63.0 million and $63.0 million during the six months ended June 30, 2024 and

2023, respectively.

Our capitalized costs for the six months ended June 30, 2024, compared to the same period in 2023, were consistent primarily

due to relative consistency in the size of our value-creation pipeline during these periods. Pre-construction activities include

entitlements, permitting, design, site work, and other activities preceding commencement of construction of aboveground building

improvements. The advancement of pre-construction efforts is focused on reducing the time required to deliver projects to prospective

tenants. These critical activities add significant value for future ground-up development and are required for the vertical construction of

buildings. Should we cease activities necessary to prepare an asset for its intended use, the interest, taxes, insurance, and certain

other direct and indirect project costs related to the asset would be expensed as incurred. Expenditures for repairs and maintenance

are expensed as incurred.

Fluctuations in our development, redevelopment, and construction activities could result in significant changes to total

expenses and net income. For example, had we experienced a 10% reduction in development, redevelopment, and construction

activities without a corresponding decrease in indirect project costs, including interest and payroll, total expenses would have increased

by approximately $27.8 million for the six months ended June 30, 2024.

We use third-party brokers to assist in our leasing activity, who are paid on a contingent basis upon successful leasing. We are

required to capitalize initial direct costs related to successful leasing transactions that result directly from and are essential to the lease

transaction and would not have been incurred had that lease transaction not been successfully executed. During the six months ended

June 30, 2024, we capitalized total initial direct leasing costs of $47.0 million. Costs that we incur to negotiate or arrange a lease

regardless of its outcome, such as fixed employee compensation, tax, or legal advice to negotiate lease terms, and other costs, are

expensed as incurred.

Acquisitions

During the six months ended June 30, 2024, the purchase price of our completed acquisitions aggregated $201.8 million. As of

June 30, 2024, the total purchase price of our pending acquisitions under executed letters of intent or purchase and sale agreements

that are expected to be completed in 2024 aggregated $47.6 million. For the year ending December 31, 2024, we expect real estate

acquisitions to range from $250 million to $750 million.

Refer to “Acquisitions” in Note 3 – “Investments in real estate” and to Note 4 – “Consolidated and unconsolidated real estate

joint ventures” to our unaudited consolidated financial statements in Item 1, and “Acquisitions” in Item 2 for information on our

acquisitions.