Annual rental revenue

Annual rental revenue represents the annualized fixed base rental obligations, calculated in

accordance with GAAP, including the amortization of deferred revenue related to tenant-funded and -

built landlord improvements, for leases in effect as of the end of the period, related to our operating

RSF. Annual rental revenue is presented using 100% of the annual rental revenue from our consolidated

properties and our share of annual rental revenue for our unconsolidated real estate joint ventures.

Annual rental revenue per RSF is computed by dividing annual rental revenue by the sum of 100% of

the RSF of our consolidated properties and our share of the RSF of properties held in unconsolidated

real estate joint ventures. As of September 30, 2024, approximately 93% of our leases (on an annual

rental revenue basis) were triple net leases, which require tenants to pay substantially all real estate

taxes, insurance, utilities, repairs and maintenance, common area expenses, and other operating

expenses (including increases thereto) in addition to base rent. Annual rental revenue excludes these

operating expenses recovered from our tenants. Amounts recovered from our tenants related to these

operating expenses, along with base rent, are classified in income from rentals in our consolidated

statements of operations.

Capitalization rates

Capitalization rates are calculated based on net operating income and net operating income

(cash basis) annualized, excluding lease termination fees, on stabilized operating assets for the quarter

preceding the date on which the property is sold, or near-term prospective net operating income.

Capitalized interest

We capitalize interest cost as a cost of a project during periods for which activities necessary

to develop, redevelop, or reposition a project for its intended use are ongoing, provided that

expenditures for the asset have been made and interest cost has been incurred. Activities necessary to

develop, redevelop, or reposition a project include pre-construction activities such as entitlements,

permitting, design, site work, and other activities preceding commencement of construction of

aboveground building improvements. The advancement of pre-construction efforts is focused on

reducing the time required to deliver projects to prospective tenants. These critical activities add

significant value for future ground-up development and are required for the vertical construction of

buildings. If we cease activities necessary to prepare a project for its intended use, interest costs related

to such project are expensed as incurred.

Cash interest

Cash interest is equal to interest expense calculated in accordance with GAAP plus

capitalized interest, less amortization of loan fees and debt premiums (discounts). Refer to the definition

of fixed-charge coverage ratio for a reconciliation of interest expense, the most directly comparable

financial measure calculated and presented in accordance with GAAP, to cash interest.

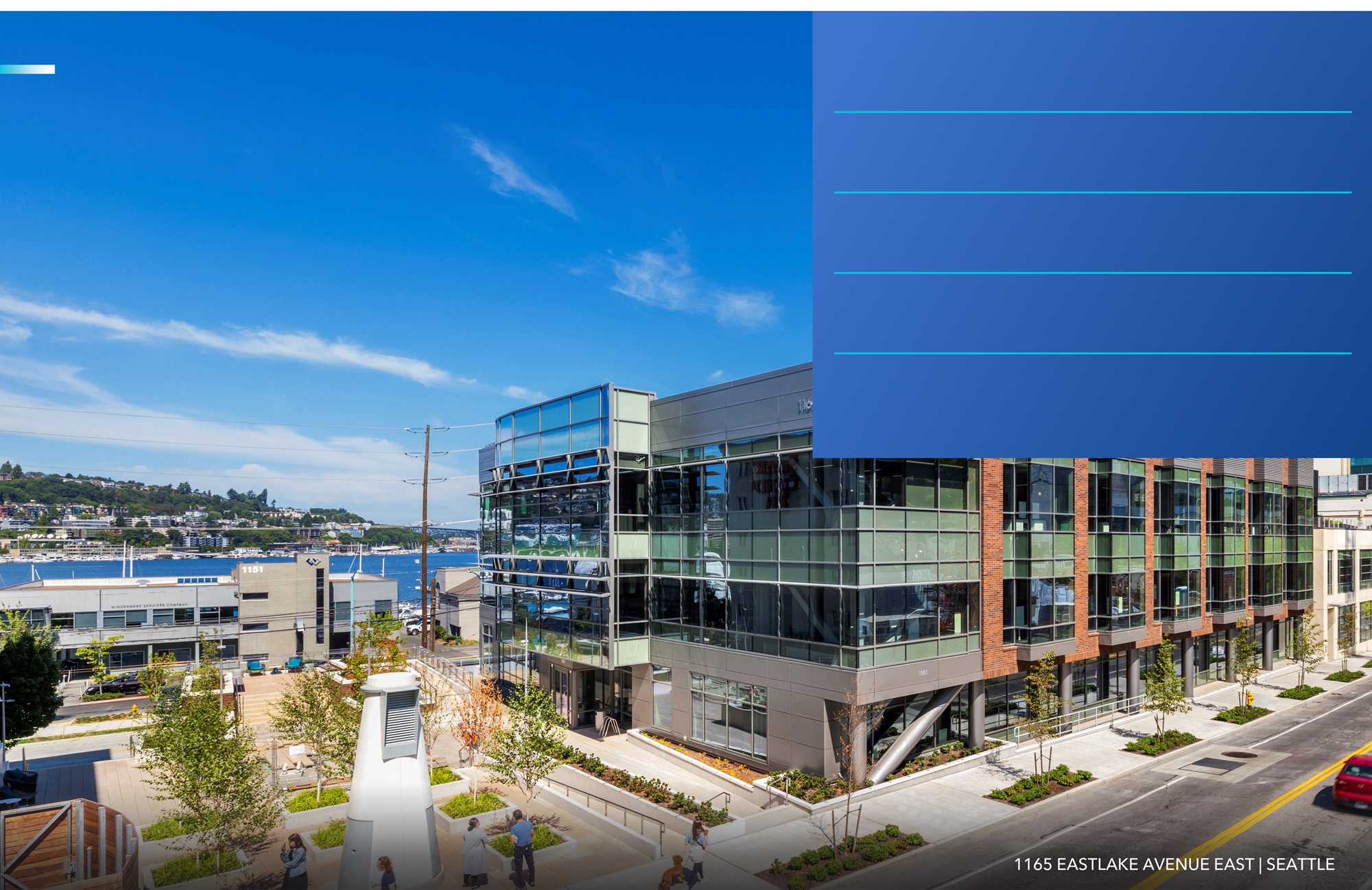

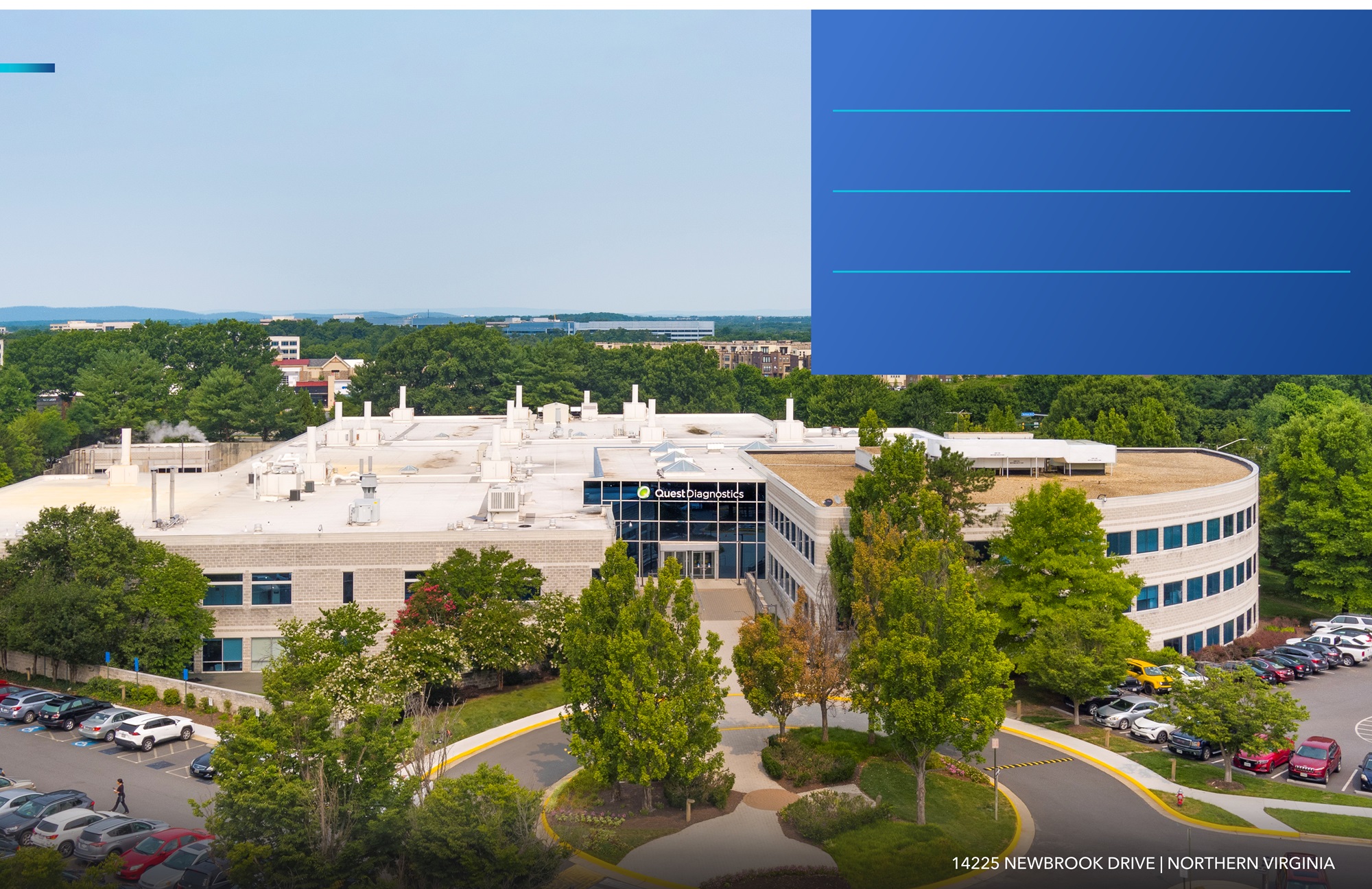

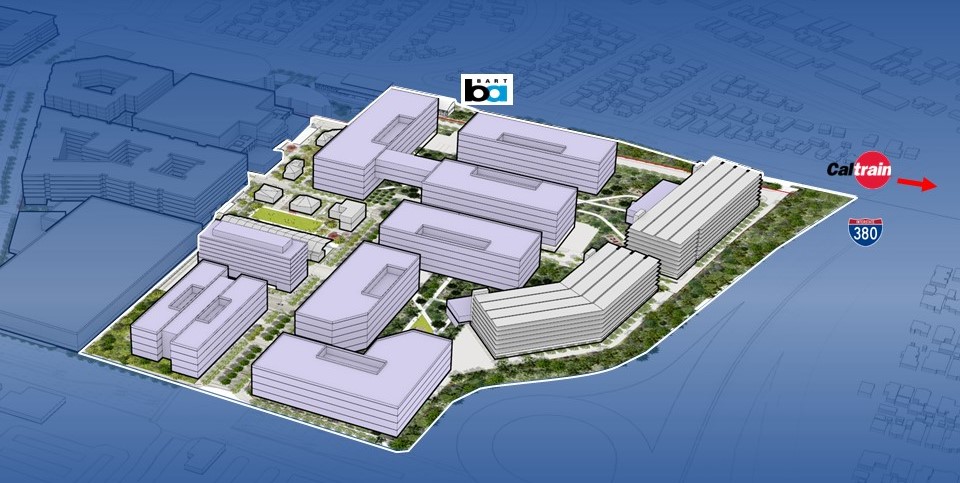

Class A/A+ properties and AAA locations

Class A/A+ properties are properties clustered in AAA locations that provide innovative

tenants with highly dynamic and collaborative environments that enhance their ability to successfully

recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success. Class A/

A+ properties generally command higher annual rental rates than other classes of similar properties.

AAA locations are in close proximity to concentrations of specialized skills, knowledge, institutions, and

related businesses.

Development, redevelopment, and pre-construction

A key component of our business model is our disciplined allocation of capital to the

development and redevelopment of new Class A/A+ properties, and property enhancements identified

during the underwriting of certain acquired properties, located in collaborative mega campuses in AAA

life science innovation clusters. These projects are generally focused on providing high-quality, generic,

and reusable spaces that meet the real estate requirements of a wide range of tenants. Upon

completion, each development and redevelopment project is expected to generate increases in rental

income, net operating income, and cash flows. Our development and redevelopment projects are

generally in locations that are highly desirable to high-quality entities, which we believe results in higher

occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset

value.

Development projects generally consist of the ground-up development of generic and

reusable laboratory facilities. Redevelopment projects consist of the permanent change in use of

acquired office, warehouse, or shell space into laboratory space. We generally will not commence new

development projects for aboveground construction of new Class A/A+ laboratory space without first

securing significant pre-leasing for such space, except when there is solid market demand for high-

quality Class A/A+ properties.

Priority anticipated projects are those most likely to commence future ground-up development

or first-time conversion from non-laboratory space to laboratory space prior to our other future projects,

pending market conditions and leasing negotiations.

Pre-construction activities include entitlements, permitting, design, site work, and other

activities preceding commencement of construction of aboveground building improvements. The

advancement of pre-construction efforts is focused on reducing the time required to deliver projects to

prospective tenants. These critical activities add significant value for future ground-up development and

are required for the vertical construction of buildings. Ultimately, these projects will provide high-quality

facilities and are expected to generate significant revenue and cash flows.

Development, redevelopment, and pre-construction spending also includes the following

costs: (i) amounts to bring certain acquired properties up to market standard and/or other costs identified

during the acquisition process (generally within two years of acquisition) and (ii) permanent conversion

of space for highly flexible, move-in-ready laboratory space to foster the growth of promising early- and

growth-stage life science companies.

Revenue-enhancing and repositioning capital expenditures represent spending to reposition

or significantly change the use of a property, including through improvement in the asset quality from

Class B to Class A/A+.

Non-revenue-enhancing capital expenditures represent costs required to maintain the current

revenues of a stabilized property, including the associated costs for renewed and re-leased space.

Dividend payout ratio (common stock)

Dividend payout ratio (common stock) is the ratio of the absolute dollar amount of dividends

on our common stock (shares of common stock outstanding on the respective record dates multiplied by

the related dividend per share) to funds from operations attributable to Alexandria’s common

stockholders – diluted, as adjusted.