1ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA REAL ESTATE EQUITIES, INC. ALEXANDRIA INVESTOR DAY 2024 STRATEGIC POSITIONING for FUTURE GROWTH ONE ALEXANDRIA SQUARE MEGACAMPUS™ | SAN DIEGO December 4, 2024 | Alexandria Center® for Life Science — NYC

2ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria®, Lighthouse Design® logo, Building the Future of Life-Changing Innovation®, That’s What’s in Our DNA®, Megacampus™, Alexandria Center®, Alexandria Technology Square®, Labspace®, Alexandria Summit®, and Alexandria Technology Center® are copyrights and trademarks of Alexandria Real Estate Equities, Inc. All other company names, trademarks, and logos referenced herein are the property of their respective owners. Safe Harbor This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our projected earnings per share attributable to Alexandria’s common stockholders – diluted, funds from operations per share attributable to Alexandria’s common stockholders – diluted, net operating income, sources and uses of capital, and targets and timing for rental revenues and development and value-creation projects, expenses, capital plan strategy, risk management strategy and related actions, and environmental, social, and governance goals. You can identify the forward-looking statements by their use of forward-looking words, such as “forecast,” “guidance,” “goals,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” “targets,” or “will,” or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, lower than expected yields, increased interest rates and construction and operating costs, adverse economic or real estate developments in our markets, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired or existing properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, adverse general and local economic conditions, an unfavorable capital market environment, unfavorable or uncertain social and political conditions (including the effects of new laws, regulations and policies), decreased leasing activity or lease renewals, failure to obtain LEED and other healthy building certifications and efficiencies, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). Accordingly, you are cautioned not to place undue reliance on such forward-looking statements. Other than as may be required by law, we assume no obligation to update this information and expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

3ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 TABLE OF CONTENTS Alexandria: Jim Collins’ Definition of a Great Company 4 The Next Generation of Life Science Real Estate Demand 29 Alexandria’s Megacampus™ Strategy: Strategic Positioning for Future Growth 49 Life Science Real Estate Supply: Aftermath of COVID 78 Alexandria’s Capital Recycling Strategy: Funding Self-Sufficiency 92 Alexandria’s Balance Sheet and 2025 Guidance 106 Appendix 154 ALEXANDRIA CENTER® FOR ADVANCED TECHNOLOGIES AND AGTECH – RESEARCH TRIANGLE MEGACAMPUS™

4ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 ALEXANDRIA: JIM COLLINS’ DEFINITION OF A GREAT COMPANY

5ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria Pioneered the Life Science Real Estate Niche Based on the Principle of “Clustering” That Is Rooted in the DNA of the Life Science Industry Alexandria’s Cluster Model: OUR NORTH STAR 1994 ONE ALEXANDRIA SQUARE MEGACAMPUS™ | SAN DIEGO Life science clusters fuel scientific translation and collaboration, accelerating the commercialization of novel medicines to advance human health

6ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. Alexandria’s initial public offering was priced at $20.00 per share on May 27, 1997. NYSE:ARE Alexandria Completed Our Initial Public Offering, Igniting Our Strong Growth Trajectory Catalyzed by the Rapid Acceleration of Life Science Innovation The First and Only Publicly Traded PURE-PLAY LIFE SCIENCE REIT $155M Gross Proceeds Raised1 1997

7ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 WE ARE MISSION DRIVEN To create and grow life science ecosystems and clusters that ignite and accelerate the world’s leading innovators in their noble pursuit to advance human health by curing disease and improving nutrition S

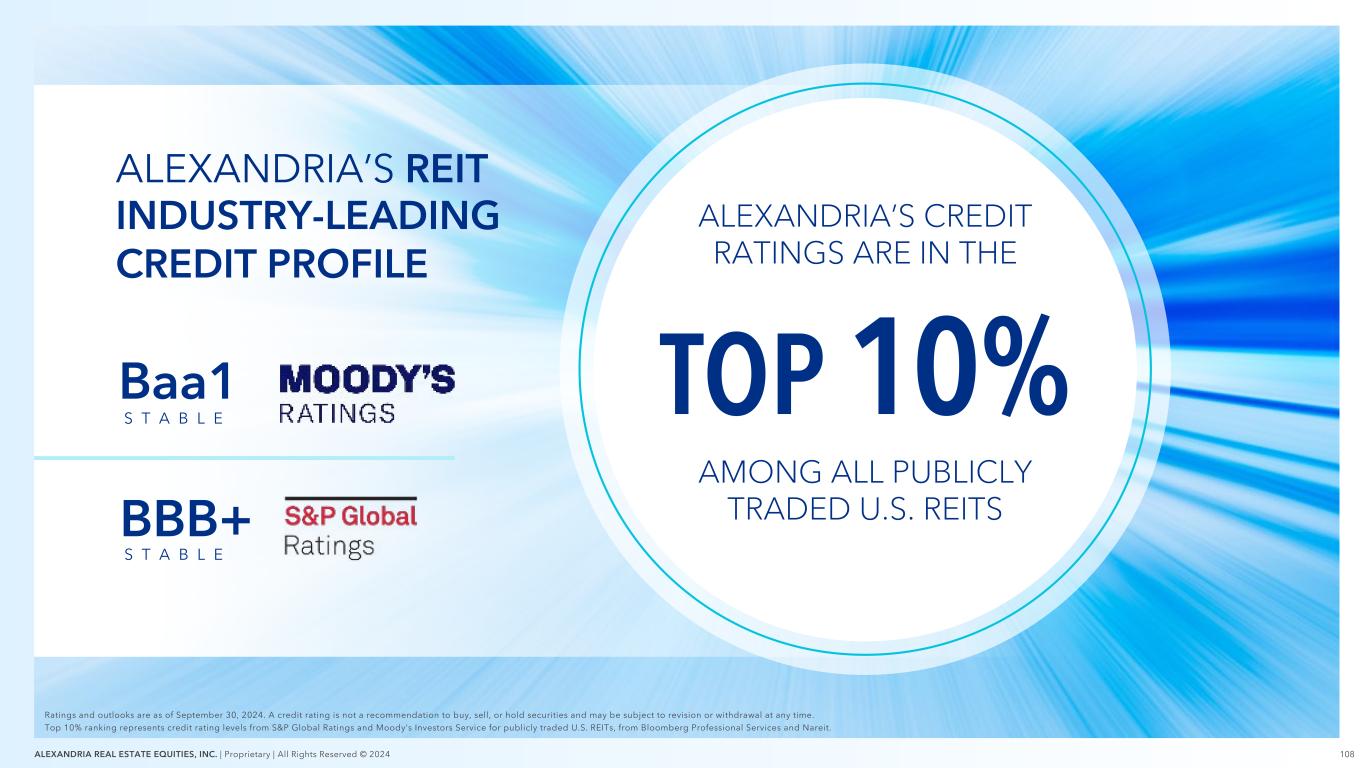

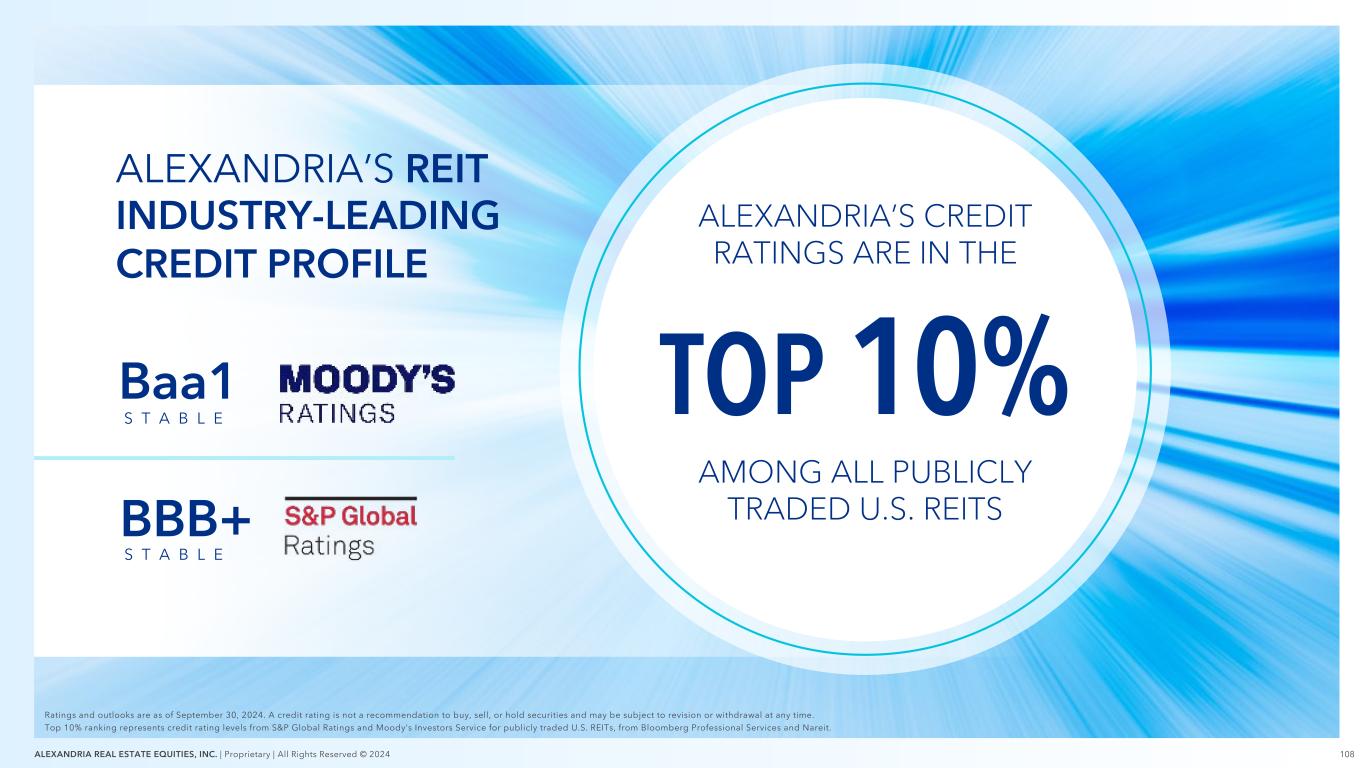

8ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 LIFE SCIENCE REAL ESTATE WE INVENTED IT. WE OWN IT. WE DOMINATE IT. As of September 30, 2024, unless otherwise indicated. Refer to ‘Megacampus” in the appendix. 1. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. Top 10% ranking represents credit rating levels from Moody’s Ratings and S&P Global Ratings for publicly traded U.S. REITs, from Bloomberg Professional Services and Nareit. 2. Source: CBRE, “U.S. Life Sciences Real Estate Investment Trends,” June 2024. A Sector- Leading Client Base ~800 Tenants Alexandria has one of the strongest balance sheets in the REIT industry Fortress Balance Sheet Unmatched Operational Excellence TOP 10% Credit Rating Ranking Among All Publicly Traded U.S. REITs1 30+ YEARS Experience in Life Science Building Operations Alexandria’s longstanding strategic relationships provide unparalleled insights into life science industry trends Alexandria controls more square footage than the next two largest owners of life science real estate combined2 Alexandria’s tenants require our essential infrastructure and unmatched operations to help safeguard billions of dollars of their mission-critical science Irreplaceable Clustered Asset Base 41.8M Operating RSF 25+ Megacampus™ Ecosystems

9ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S COMPETITIVE ADVANTAGES 1. As of September 30, 2024. 2. Source: Evaluate Pharma. Represents aggregate total market capitalization for the life science industry, including global major, regional major, and specialty pharmaceutical companies and excluding specialty pharmaceutical consumer companies, as of November 22, 2024. CLUSTERED IN THE BEST LOCATIONS LARGEST, HIGHEST-QUALITY LABORATORY PLATFORM ~800 TENANTS¹ HIGH-QUALITY CASH FLOWS FORTRESS BALANCE SHEET HIGHLY EXPERIENCED MANAGEMENT TEAM PROVEN UNDERWRITING Widen the moat, build enduring competitive advantage, delight your customers, and relentlessly fight costs. WARREN BUFFETT At the Vanguard and Heart of the $5.5 Trillion² Secularly Growing Life Science Industry YEARS

10ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria’s long-term successful track record flows from its disciplined focus on what it can be the best in the world at, disciplined insight into what drives its economic engine, and disciplined people passionate about the company’s purpose. JIM COLLINS Renowned Author & Business Strategist

11ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA HAS INTEGRATED JIM COLLINS’ GOOD TO GREAT® CONCEPTS ON OUR PATH TO ACHIEVING ENDURING GREATNESS Superior Results Distinctive Impact Lasting Endurance Disciplined Focus OUTPUTSINPUTS Disciplined People Disciplined Insight

12ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Disciplined Focus ALEXANDRIA HAS MAINTAINED OUR DISCIPLINED FOCUS AS THE ONLY PURE-PLAY LIFE SCIENCE REIT, CULTIVATING AND GROWING THRIVING LIFE SCIENCE CLUSTERS THAT CATALYZE INNOVATION As of September 30, 2024. RSF presented in the map represents operating RSF for each market shown. Refer to “Annual rental revenue” and “Megacampus” in the appendix. GREATER BOSTON SAN FRANCISCO BAY AREA SEATTLE NEW YORK CITY RESEARCH TRIANGLE MARYLAND ENTERED 1996 | 3.1M RSF ENTERED 1997 | 10.4M RSF ENTERED 1997 | 7.8M RSF ENTERED 2005 | 922K RSF ENTERED 1996 | 3.8M RSF ENTERED 1997 | 3.8M RSFENTERED 1994 | 7.7M RSF SAN DIEGO 41.8M OPERATING RSF THE ALEXANDRIA MEGACAMPUS™ PLATFORM ENCOMPASSES 76% OF OUR ANNUAL RENTAL REVENUE

13ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S LONG-TENURED, HIGHLY EXPERIENCED MANAGEMENT TEAM HAS A PROVEN TRACK RECORD LEADING AND GROWING THE COMPANY THROUGH MULTIPLE ECONOMIC CYCLES STARTUP IN THE BASEMENT OF JACOBS ENGINEERING GROUP Alexandria forms the first-ever private REIT uniquely focused on the critically important life science industry DOTCOM BUBBLE BURST Alexandria prioritizes cultivation of long-term strategic relationships with life science industry leaders GREAT FINANCIAL CRISIS Alexandria navigates a worldwide crisis and seeks investment-grade credit ratings while continuing to own key land parcels on balance sheet for future growth (Cambridge and Mission Bay) PEAK COVID-19 PANDEMIC Alexandria capitalizes on historic demand INFLATION AND INTEREST RATES IMPACT THE LIFE SCIENCE AND COMMERCIAL REAL ESTATE INDUSTRIES Alexandria further enhances our focus on our Megacampus™ platform to position the company for future growth OUR EXECUTIVE MANAGEMENT TEAM AVERAGES 19 YEARS WITH ALEXANDRIA1 Disciplined Insight 1994 2000– 2002 2008– 2009 2020– 2021 2021– 2024 Refer to “Megacampus” in the appendix. 1. As of September 30, 2024.

14ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Disciplined Insight ALEXANDRIA DOUBLES DOWN ON CULTIVATING LONG-TERM STRATEGIC TENANT RELATIONSHIPS WITH LIFE SCIENCE INDUSTRY LEADERS UNITED STATES GOVERNMENT — 1996 — — 1999 — — 2000 — — 2002 —— 1996 — — 2004 — — 2005 — — 2005 — — 2006 — — 2009 — — 2005 — — 2009 —— 2007 — — 2008 — — 2011 — — 2012 — — 2013 — — 2015 —— 2010 — — 2010 — Represents the year Alexandria’s relationship with each tenant began through (i) executed lease agreement with the tenant, (ii) Alexandria’s acquisition of property where the tenant was located, (iii) the tenant’s acquisition of an existing Alexandria tenant, or (iv) the sale-leaseback of the tenant’s property. Navigating Long-Term Growth Through THE DOTCOM BUBBLE

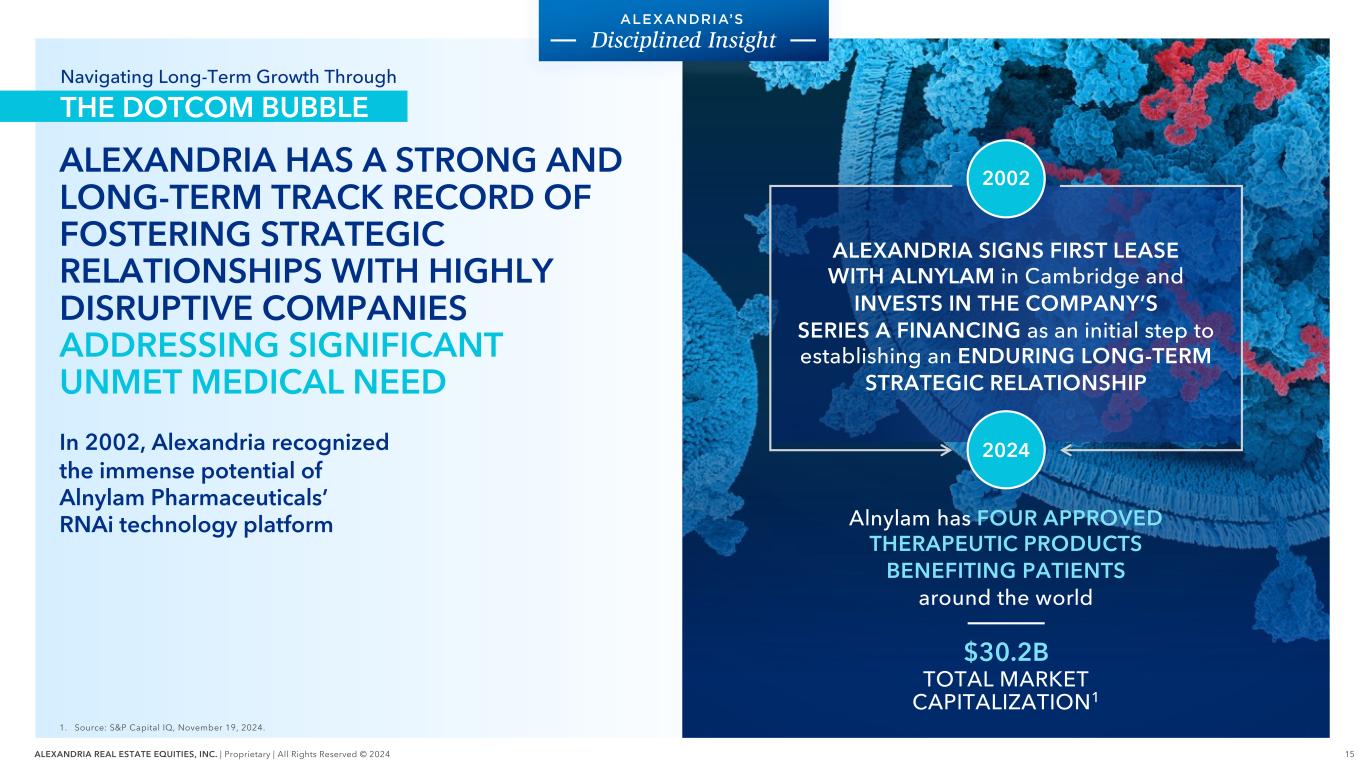

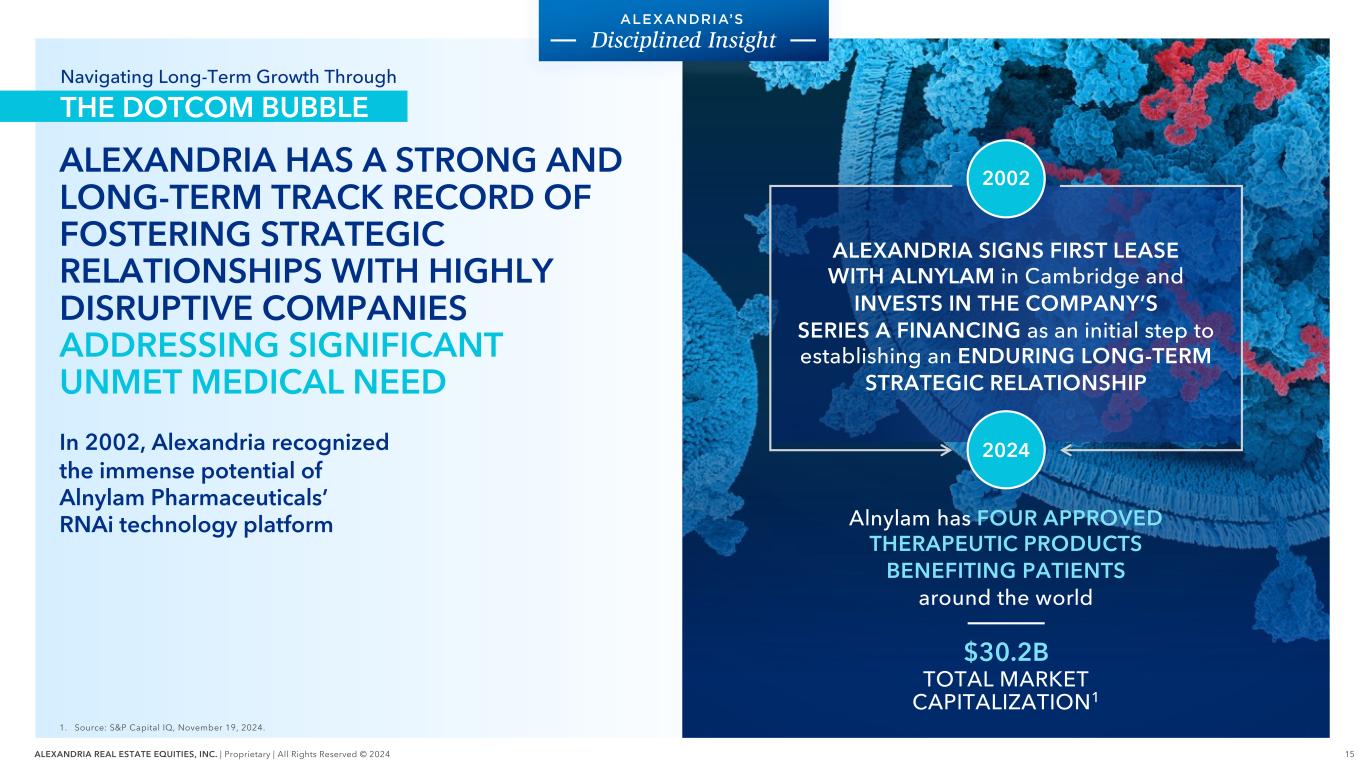

15ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA HAS A STRONG AND LONG-TERM TRACK RECORD OF FOSTERING STRATEGIC RELATIONSHIPS WITH HIGHLY DISRUPTIVE COMPANIES ADDRESSING SIGNIFICANT UNMET MEDICAL NEED 1. Source: S&P Capital IQ, November 19, 2024. In 2002, Alexandria recognized the immense potential of Alnylam Pharmaceuticals’ RNAi technology platform Disciplined Insight ALEXANDRIA SIGNS FIRST LEASE WITH ALNYLAM in Cambridge and INVESTS IN THE COMPANY’S SERIES A FINANCING as an initial step to establishing an ENDURING LONG-TERM STRATEGIC RELATIONSHIP Alnylam has FOUR APPROVED THERAPEUTIC PRODUCTS BENEFITING PATIENTS around the world 2002 2024 $30.2B TOTAL MARKET CAPITALIZATION1 Navigating Long-Term Growth Through THE DOTCOM BUBBLE

16ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA STRATEGICALLY IMPROVED OUR CREDIT PROFILE TO ACHIEVE OUR INVESTMENT-GRADE CREDIT RATINGS IN 2011 1. Ratings and outlooks are as of September 30, 2024. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. Top 10% ranking represents credit rating levels from S&P Global Ratings and Moody’s Investors Service for publicly traded U.S. REITs, from Bloomberg Professional Services and Nareit. 2011 Baa2 Today Baa1 Stable Stable1 2008–2009 Unrated Today 2011 BBB- BBB+ Stable1Stable 2008–2009 Unrated Disciplined Insight TOP 10% CREDIT RATING RANKING AMONG ALL PUBLICLY TRADED U.S. REITS1 Navigating Long-Term Growth Through THE GREAT FINANCIAL CRISIS

17ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 As of September 30, 2024. Refer to “Megacampus” in the appendix. Disciplined Insight MEGACAMPUS™ ALEXANDRIA CENTER® AT KENDALL SQUARE 3.0M RSF ALEXANDRIA CONTINUES TO CREATE VALUE ON STRATEGIC FUTURE DEVELOPMENT PARCELS IN CAMBRIDGE BEFORE ALEXANDRIA CENTER® AT KENDALL SQUARE MEGACAMPUS™ ALEXANDRIA TECHNOLOGY SQUARE® 1.3M RSF MEGACAMPUS™ ALEXANDRIA CENTER® AT ONE KENDALL SQUARE 1.4M RSF Navigating Long-Term Growth Through THE GREAT FINANCIAL CRISIS

18ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 RESIDENTIAL CHASE CENTER MEGACAMPUS™ ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY – MISSION BAY 2.2M RSF ALEXANDRIA CONTINUES TO CREATE VALUE ON STRATEGIC FUTURE DEVELOPMENT PARCELS IN MISSION BAY Disciplined Insight As of September 30, 2024. Refer to “Megacampus” in the appendix. BEFORE MISSION BAY Navigating Long-Term Growth Through THE GREAT FINANCIAL CRISIS

19ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Disciplined Insight ALEXANDRIA’S STRATEGY POSITIONED US TO ENABLE OUR TENANTS’ GROWTH DURING THE UNPRECEDENTED 9-YEAR LIFE SCIENCE BULL RUN FROM 2013 TO 2021 Refer to “Net operating income and net operating income (cash basis)” in the appendix. 1. Represents growth from the year ended December 31, 2009 compared to the year ended December 31, 2021. 2. Assumes reinvestment of dividends. 396% TOTAL SHAREHOLDER RETURN2 2009–20211 335% NET OPERATING INCOME Navigating Long-Term Growth Through THE GREAT FINANCIAL CRISIS 142% COMMON STOCK DIVIDENDS PER SHARE

20ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA EXECUTES ON STRATEGIC DISPOSITIONS OF NON-CORE ASSETS TO FUND THE FUTURE GROWTH OF OUR BUSINESS CONCENTRATED ON OUR MEGACAMPUS™ PLATFORM As of September 30, 2024. Refer to “Megacampus” in the appendix. 1. Represents dispositions and partial interest sales completed during the year ended December 31, 2023 and completed dispositions and pending dispositions subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 2. Represents the average percentage of total funding during the year ended December 31, 2023 and the projected amounts for the year ending December 31, 2024 based on the midpoints of our guidance ranges for key sources of capital disclosed on October 21, 2024. Includes forward equity sales agreements that were completed in 2024 and are expected to be settled during the three months ending December 31, 2024. Disciplined Insight $2.8B OF DISPOSITIONS AND SALES OF PARTIAL INTERESTS1 Navigating Long-Term Growth Following THE BULL RUN AND PEAK COVID YEARS ONLY 2% OF NEW ISSUANCES OF COMMON STOCK2 2023–2024 Self-Funding Execution 14225 NEWBROOK DRIVE NORTHERN VIRGINIA Alexandria successfully operated this property from acquisition in 1997 (prior to our IPO) through sale in 4Q24

21ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S CORE VALUES EXEMPLIFY THE BEHAVIORS OF A DISCIPLINED COMPANY WITH DISCIPLINED PEOPLE INTEGRITY MUTUAL RESPECT EGOLESS LEADERSHIP HUMILITY TRANSPARENCY TEAMWORK TRUST Disciplined People 1 of only 3 S&P 500 REITs recognized by Newsweek in the Real Estate & Housing category NAMED ONE OF THE WORLD’S MOST TRUSTWORTHY COMPANIES 2024 BY NEWSWEEK

22ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria has achieved the three outputs that define a great company: Superior Results, Distinctive Impact, and Lasting Endurance. JIM COLLINS Renowned Author & Business Strategist

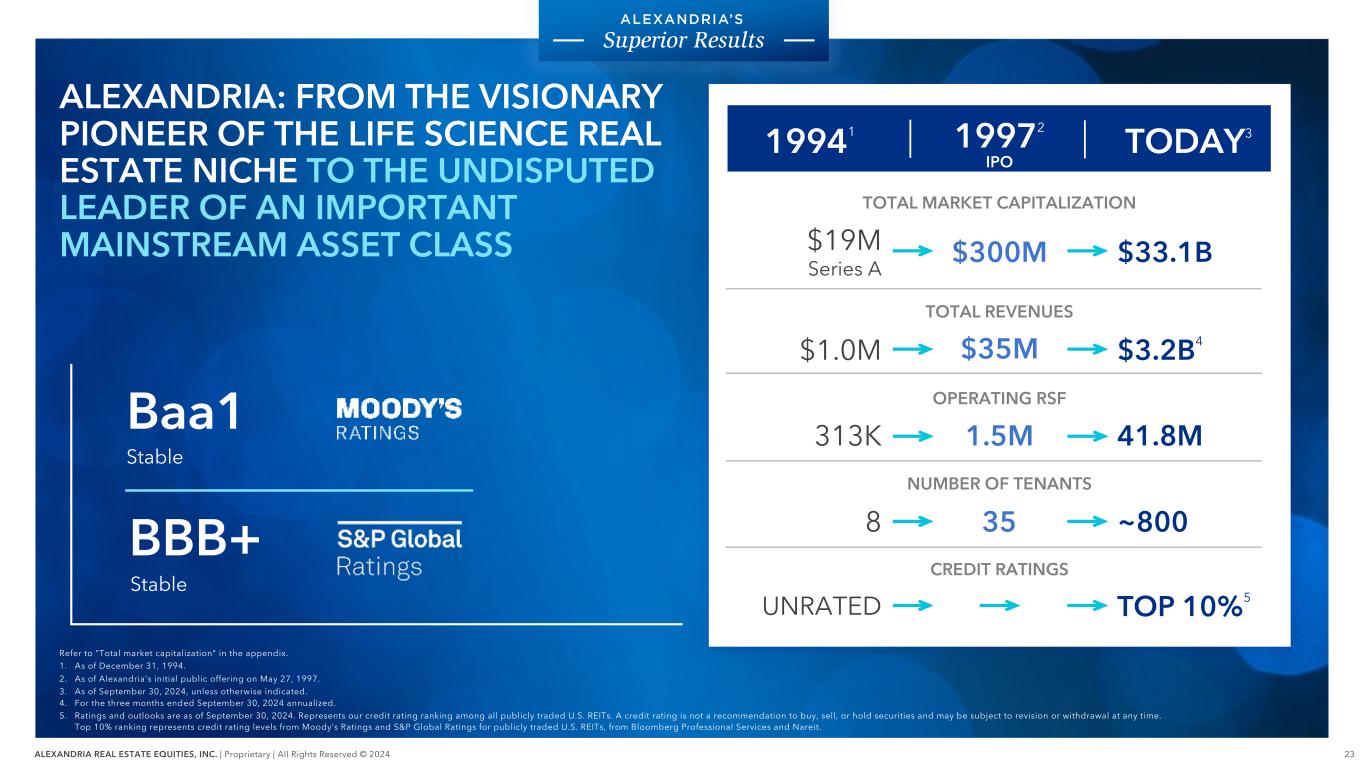

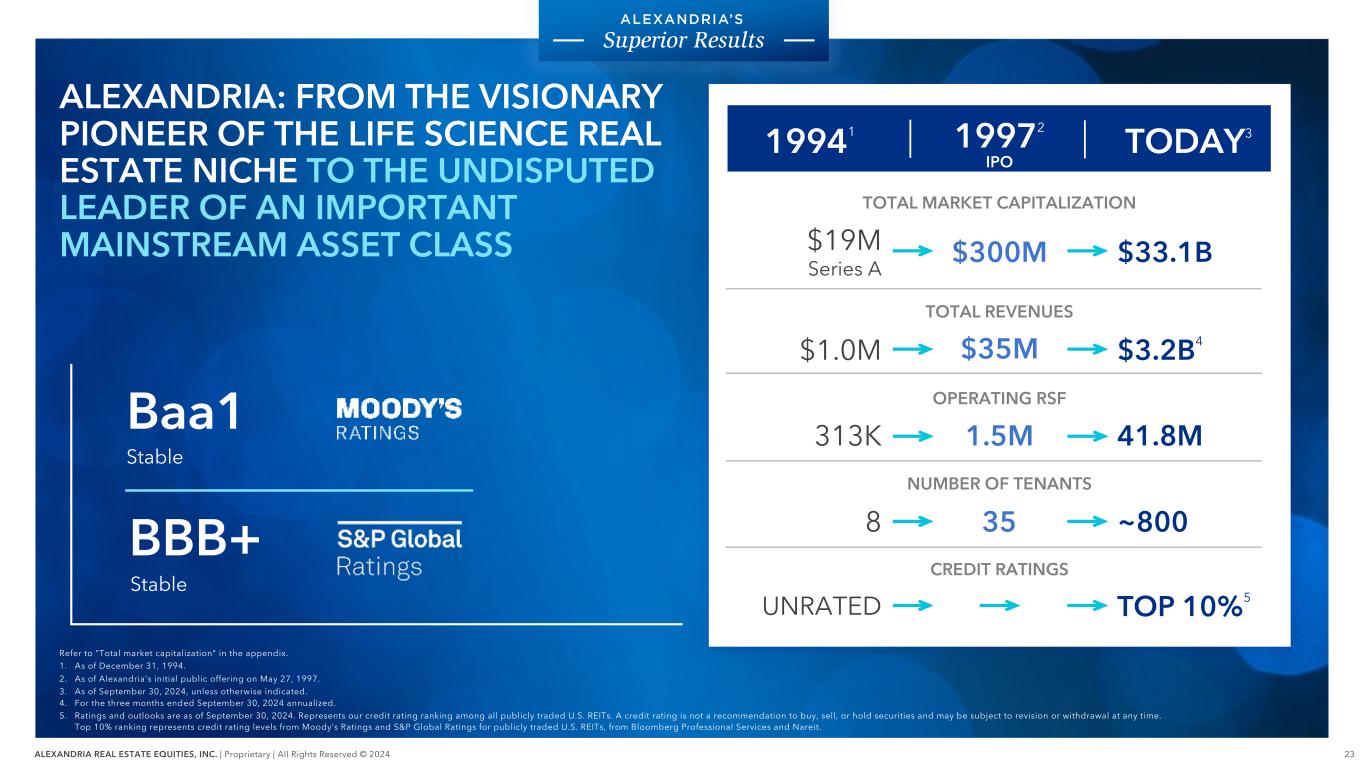

23ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA: FROM THE VISIONARY PIONEER OF THE LIFE SCIENCE REAL ESTATE NICHE TO THE UNDISPUTED LEADER OF AN IMPORTANT MAINSTREAM ASSET CLASS Refer to ”Total market capitalization” in the appendix. 1. As of December 31, 1994. 2. As of Alexandria’s initial public offering on May 27, 1997. 3. As of September 30, 2024, unless otherwise indicated. 4. For the three months ended September 30, 2024 annualized. 5. Ratings and outlooks are as of September 30, 2024. Represents our credit rating ranking among all publicly traded U.S. REITs. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. Top 10% ranking represents credit rating levels from Moody’s Ratings and S&P Global Ratings for publicly traded U.S. REITs, from Bloomberg Professional Services and Nareit. Superior Results BBB+ Stable Baa1 Stable 19941 19972 IPO TODAY3 TOTAL MARKET CAPITALIZATION $19M Series A $300M $33.1B TOTAL REVENUES $1.0M $35M $3.2B4 OPERATING RSF 313K 1.5M 41.8M NUMBER OF TENANTS 8 35 ~800 CREDIT RATINGS UNRATED TOP 10%5

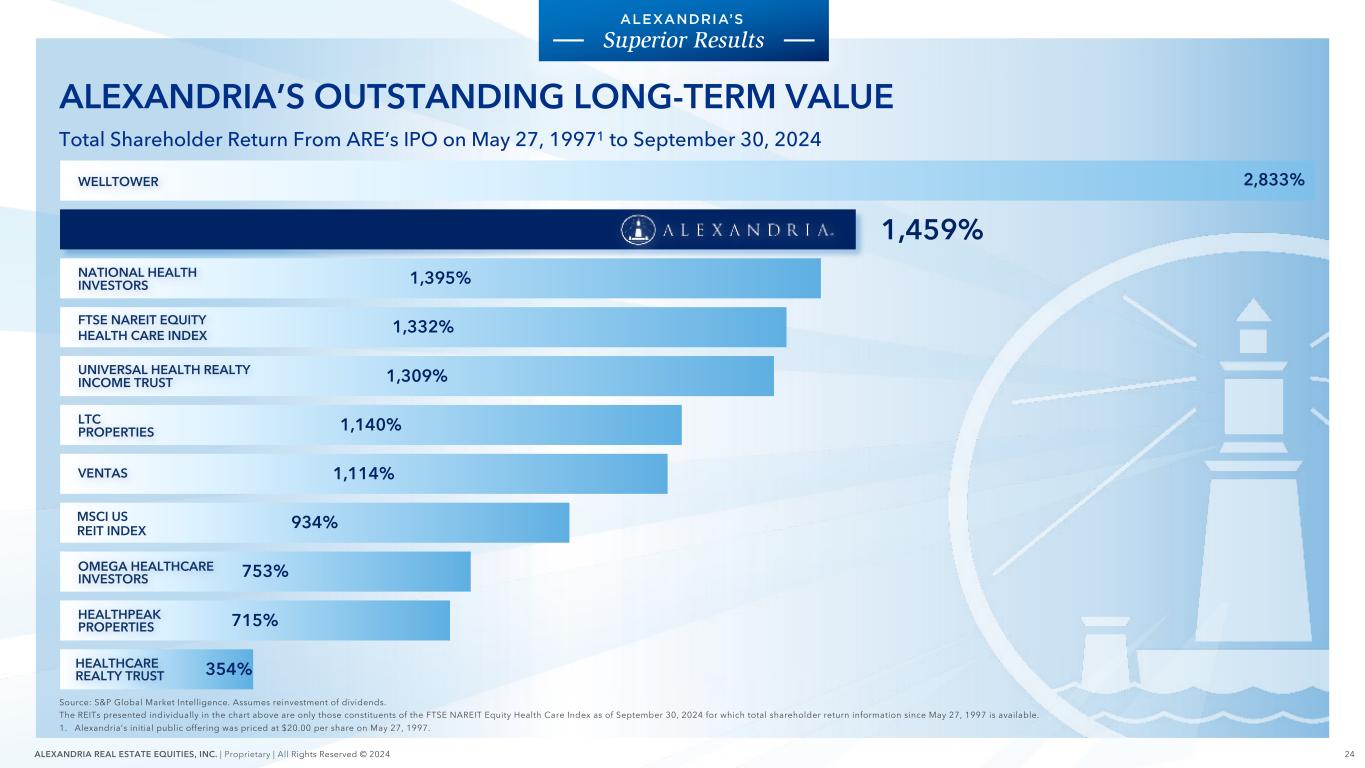

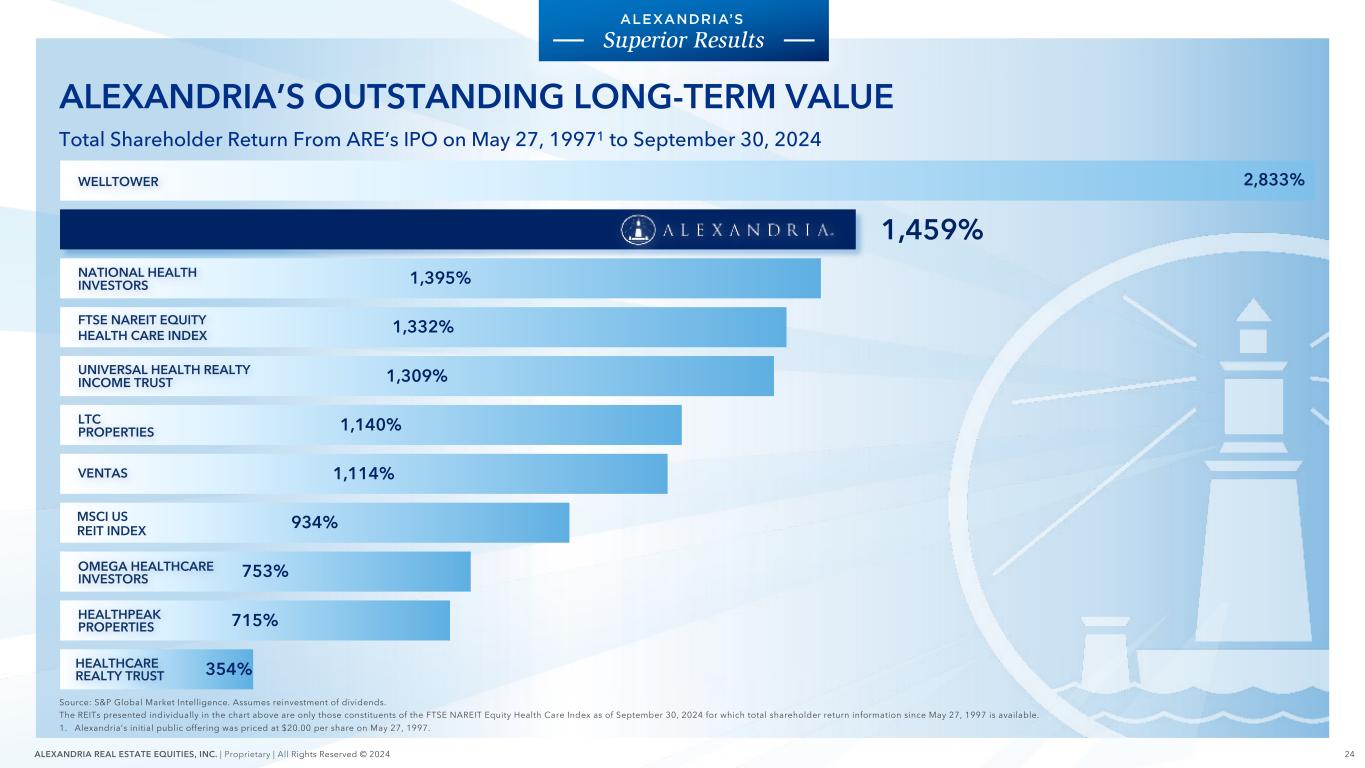

24ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S OUTSTANDING LONG-TERM VALUE Source: S&P Global Market Intelligence. Assumes reinvestment of dividends. The REITs presented individually in the chart above are only those constituents of the FTSE NAREIT Equity Health Care Index as of September 30, 2024 for which total shareholder return information since May 27, 1997 is available. 1. Alexandria’s initial public offering was priced at $20.00 per share on May 27, 1997. 354% 715% 753% 934% 1,114% 1,140% 1,309% 1,332% 1,395% 1,459% 2,833% HEALTHCARE REALTY TRUST WELLTOWER UNIVERSAL HEALTH REALTY INCOME TRUST LTC PROPERTIES NATIONAL HEALTH INVESTORS HEALTHPEAK PROPERTIES OMEGA HEALTHCARE INVESTORS VENTAS FTSE NAREIT EQUITY HEALTH CARE INDEX MSCI US REIT INDEX Superior Results Total Shareholder Return From ARE’s IPO on May 27, 19971 to September 30, 2024

25ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S ESSENTIAL LABSPACE® INFRASTRUCTURE HELPS POSITION OUR TENANTS TO MEET THEIR SUSTAINABILITY GOALS Distinctive Impact ENERGY DISTRICT SEATTLE ELECTRIFICATION AND ALTERNATIVE ENERGY POWER PURCHASE AGREEMENT GREATER BOSTON RENEWABLE ELECTRICITY 325 BINNEY STREET GREATER BOSTON ENERGY EFFICIENCY Alexandria was honored for implementing sustainable practices that demonstrate leadership, ingenuity, and environmental impact in the commercial real estate industry 2024 NAREIT INAUGURAL SUSTAINABILITY DESIGN IMPACT AWARD INNOVATIVE STRATEGY FOR REDUCING OPERATIONAL EMISSIONS

26ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Accelerating medical innovation to save lives Harnessing agtech to combat hunger and improve nutrition Prioritizing the mental health crisis Building principled leaders through education Revolutionizing addiction treatment Inspiring future generations with the stories and values of our nation’s heroes Approaching homelessness as a healthcare problem, not a housing issue Supporting our military, our veterans, and their families OneFifteen campus in Dayton, OH The Honor Foundation headquarters in San Diego, CA Future National Medal of Honor Museum in Arlington, TX Former Congressman Patrick Kennedy at the Alexandria Summit® on Mental Health Graduates of the Emily K Center in Durham, NC Developing and implementing collaborative and innovative solutions to some of the nation’s most pressing challenges Distinctive Impact ALEXANDRIA’S HIGHLY IMPACTFUL SOCIAL RESPONSIBILITY PILLARS

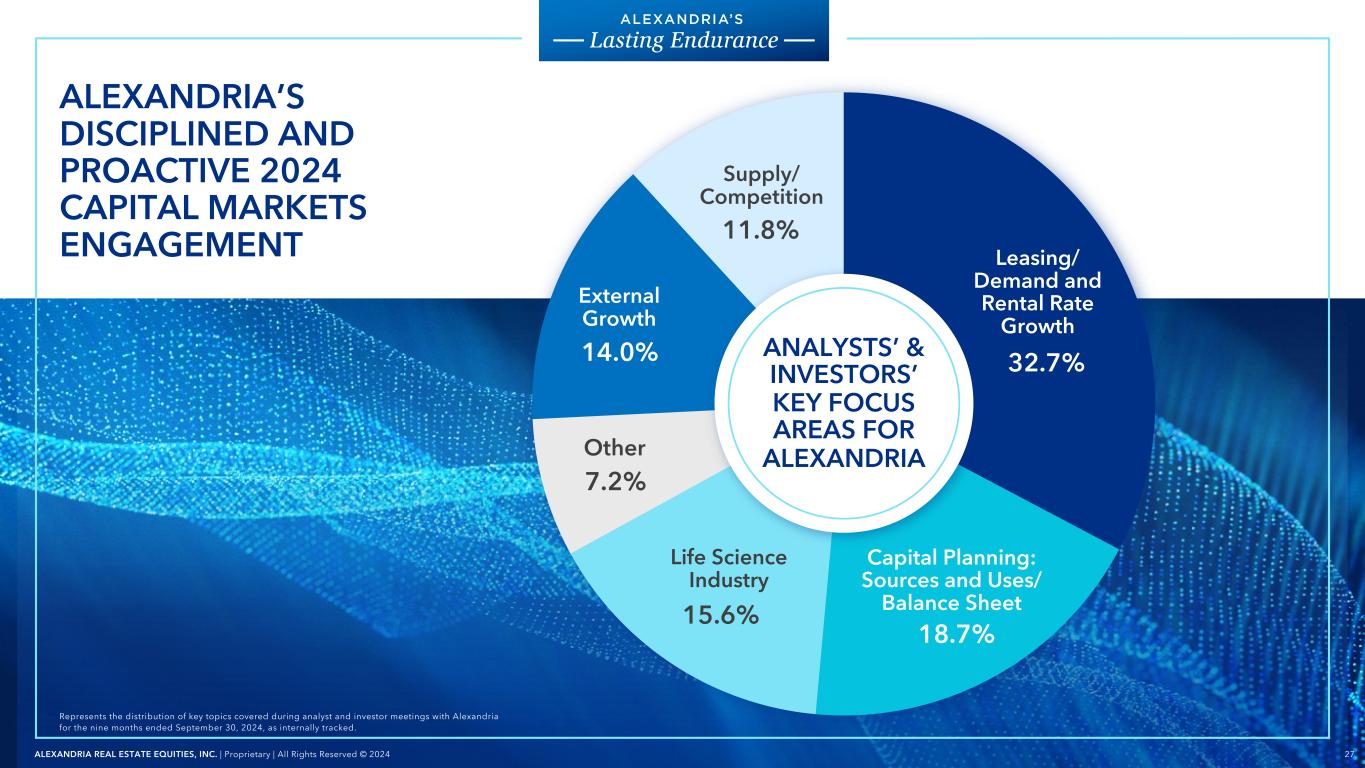

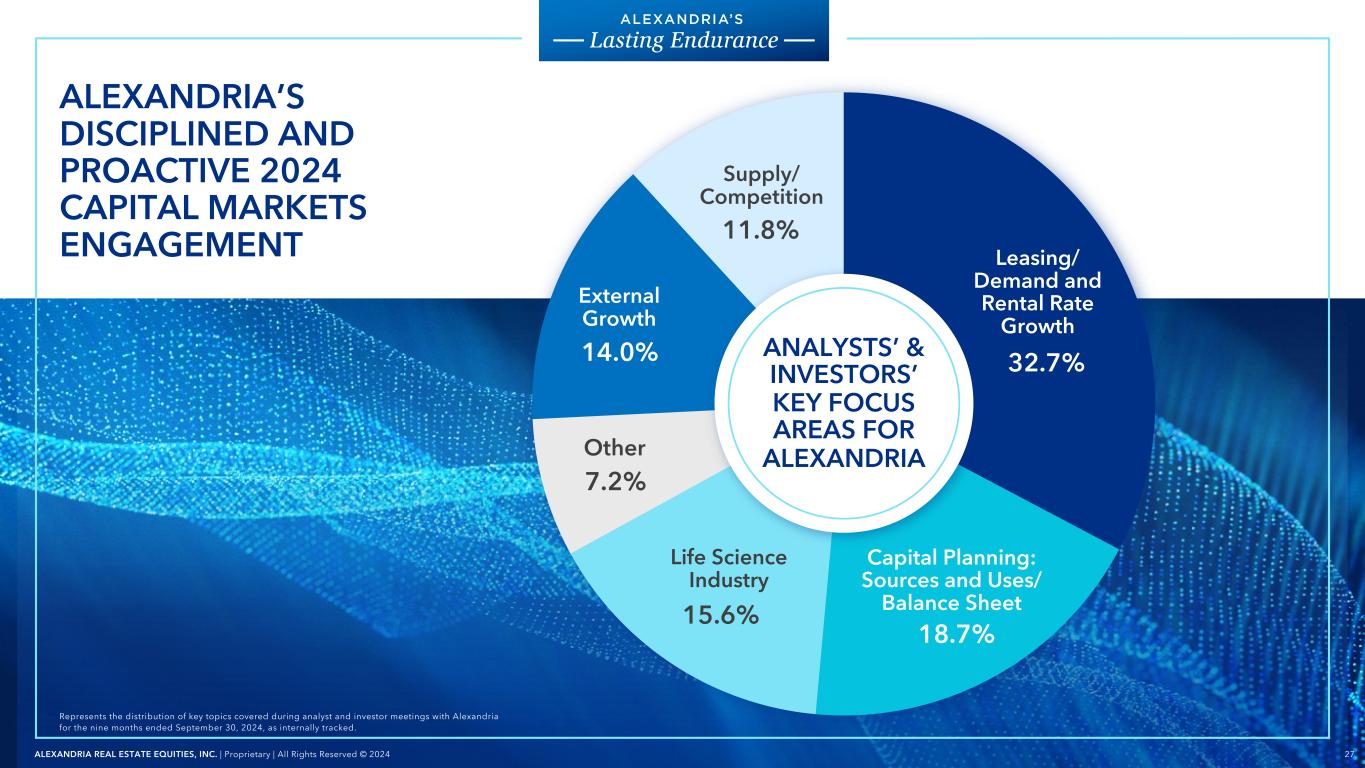

27ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S DISCIPLINED AND PROACTIVE 2024 CAPITAL MARKETS ENGAGEMENT 32.7% 18.7% 15.6% 7.2% 14.0% 11.8% Leasing/ Demand and Rental Rate Growth Capital Planning: Sources and Uses/ Balance Sheet Life Science Industry External Growth Supply/ Competition Other Lasting Endurance ANALYSTS’ & INVESTORS’ KEY FOCUS AREAS FOR ALEXANDRIA Represents the distribution of key topics covered during analyst and investor meetings with Alexandria for the nine months ended September 30, 2024, as internally tracked.

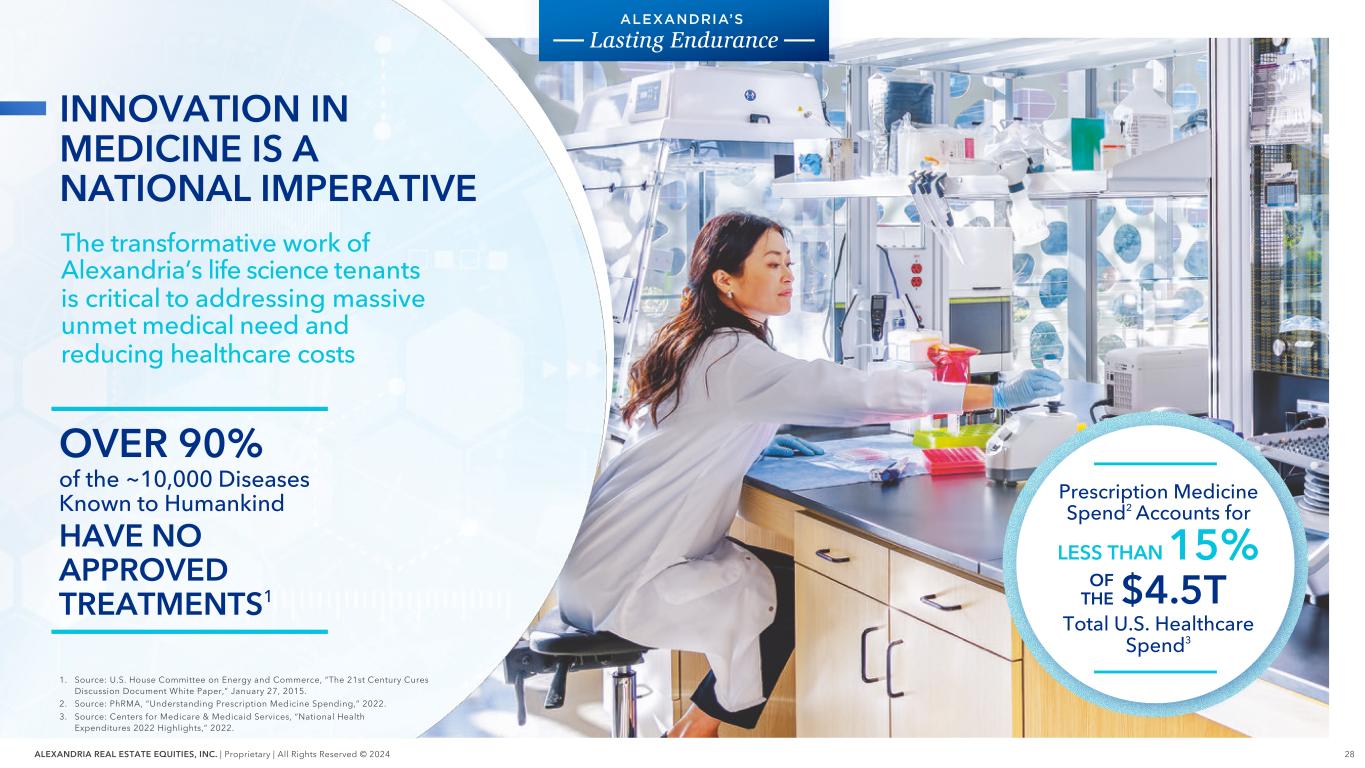

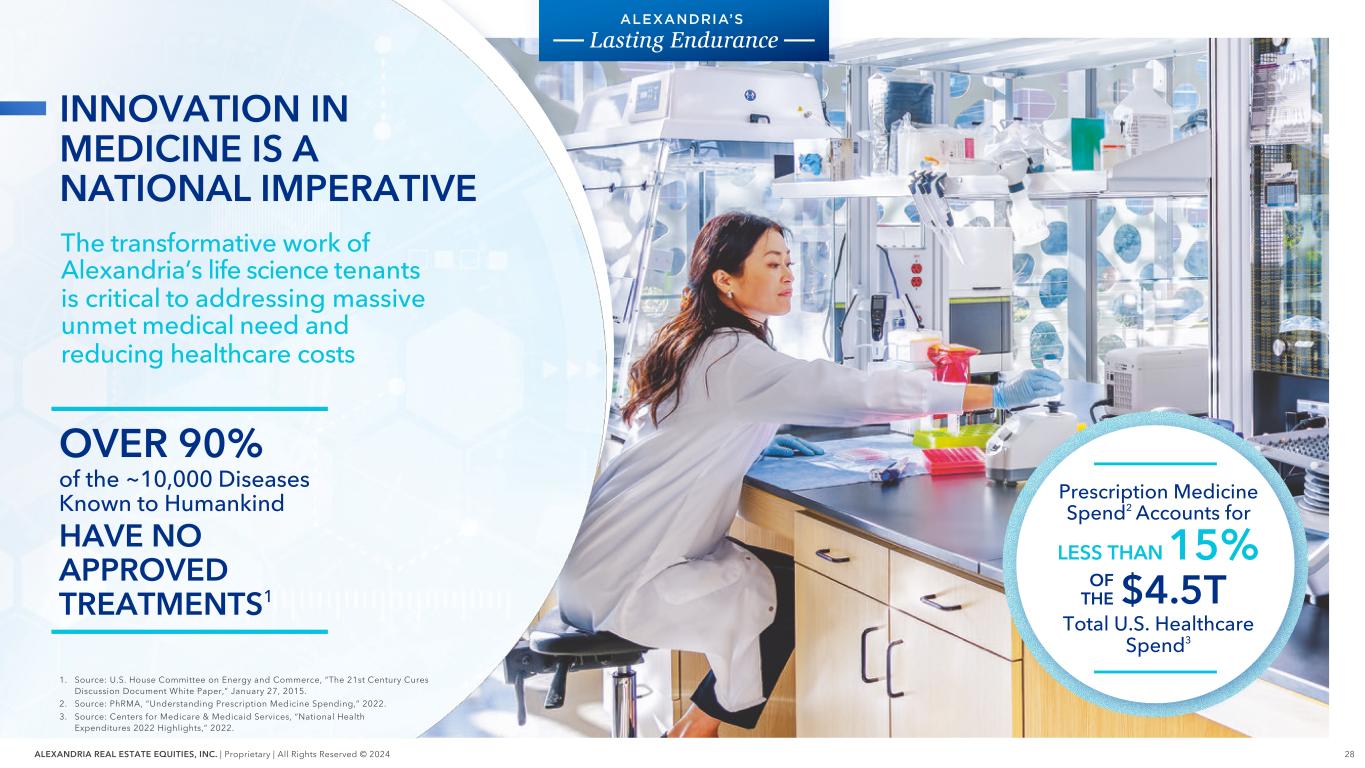

28ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Lasting Endurance INNOVATION IN MEDICINE IS A NATIONAL IMPERATIVE 1. Source: U.S. House Committee on Energy and Commerce, “The 21st Century Cures Discussion Document White Paper,” January 27, 2015. 2. Source: PhRMA, “Understanding Prescription Medicine Spending,” 2022. 3. Source: Centers for Medicare & Medicaid Services, “National Health Expenditures 2022 Highlights,” 2022. The transformative work of Alexandria’s life science tenants is critical to addressing massive unmet medical need and reducing healthcare costs OVER 90% of the ~10,000 Diseases Known to Humankind HAVE NO APPROVED TREATMENTS1 Prescription Medicine Spend2 Accounts for LESS THAN 15% $4.5T Total U.S. Healthcare Spend3 OF THE

29ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 THE NEXT GENERATION OF LIFE SCIENCE REAL ESTATE DEMAND

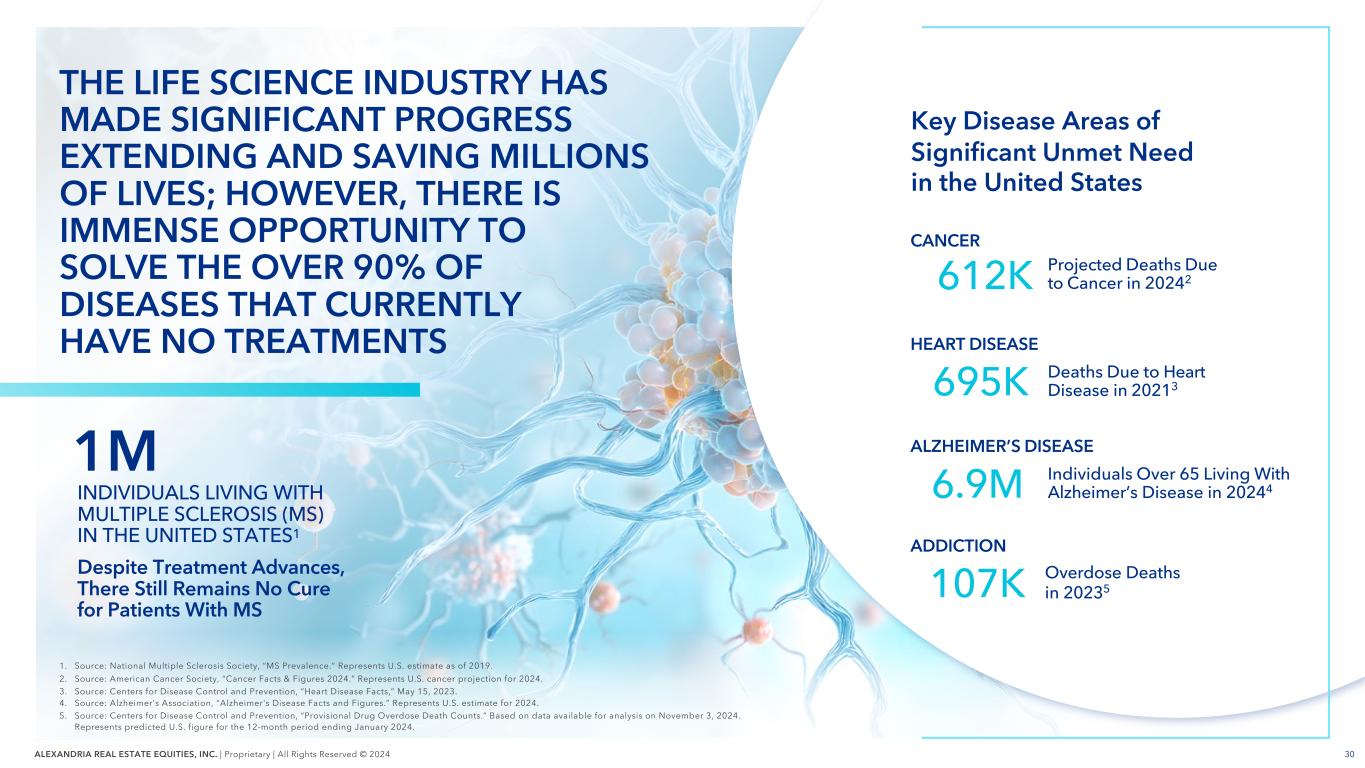

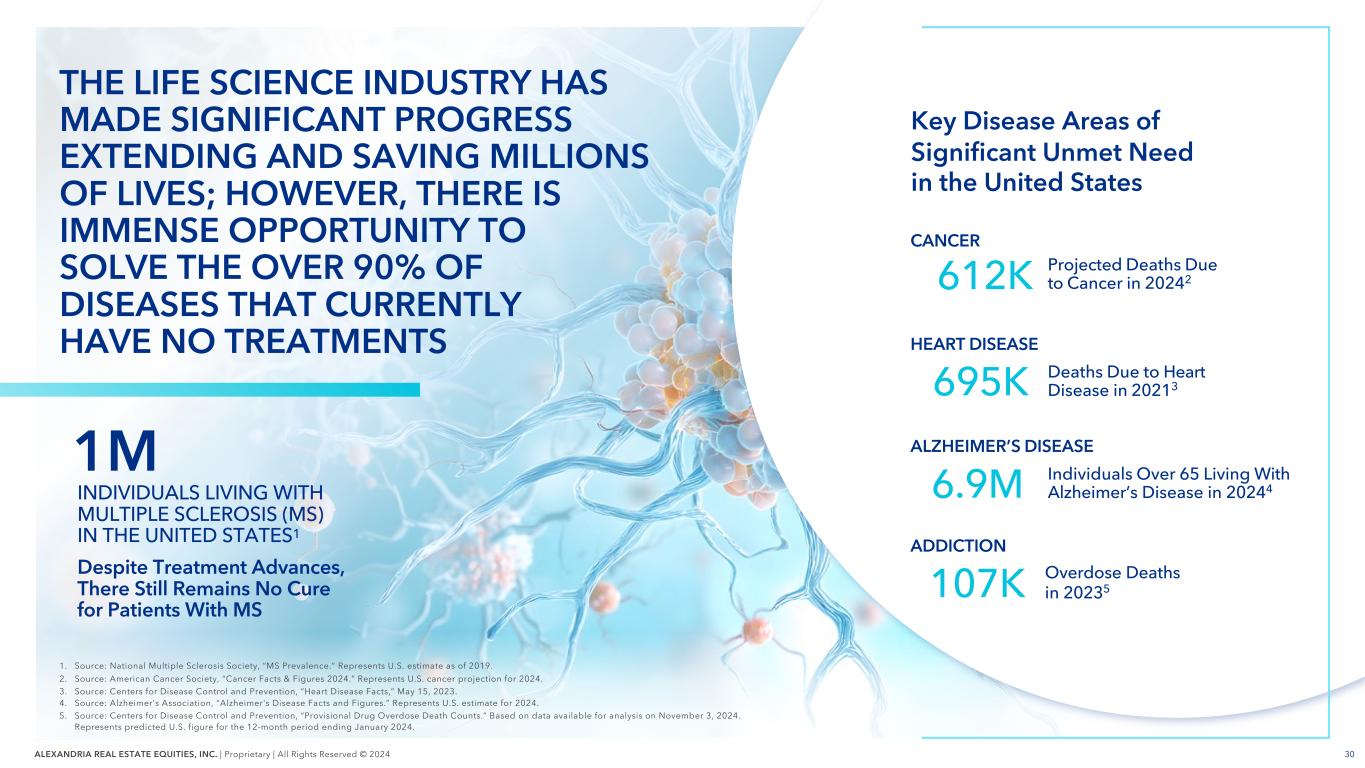

30ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Projected Deaths Due to Cancer in 20242 CANCER 612K Deaths Due to Heart Disease in 20213 HEART DISEASE 695K 6.9M Individuals Over 65 Living With Alzheimer’s Disease in 20244 ALZHEIMER’S DISEASE Overdose Deaths in 20235 ADDICTION 107K THE LIFE SCIENCE INDUSTRY HAS MADE SIGNIFICANT PROGRESS EXTENDING AND SAVING MILLIONS OF LIVES; HOWEVER, THERE IS IMMENSE OPPORTUNITY TO SOLVE THE OVER 90% OF DISEASES THAT CURRENTLY HAVE NO TREATMENTS 1. Source: National Multiple Sclerosis Society, “MS Prevalence.” Represents U.S. estimate as of 2019. 2. Source: American Cancer Society, “Cancer Facts & Figures 2024.” Represents U.S. cancer projection for 2024. 3. Source: Centers for Disease Control and Prevention, “Heart Disease Facts,” May 15, 2023. 4. Source: Alzheimer’s Association, “Alzheimer's Disease Facts and Figures.” Represents U.S. estimate for 2024. 5. Source: Centers for Disease Control and Prevention, “Provisional Drug Overdose Death Counts.” Based on data available for analysis on November 3, 2024. Represents predicted U.S. figure for the 12-month period ending January 2024. INDIVIDUALS LIVING WITH MULTIPLE SCLEROSIS (MS) IN THE UNITED STATES1 1M Despite Treatment Advances, There Still Remains No Cure for Patients With MS Key Disease Areas of Significant Unmet Need in the United States

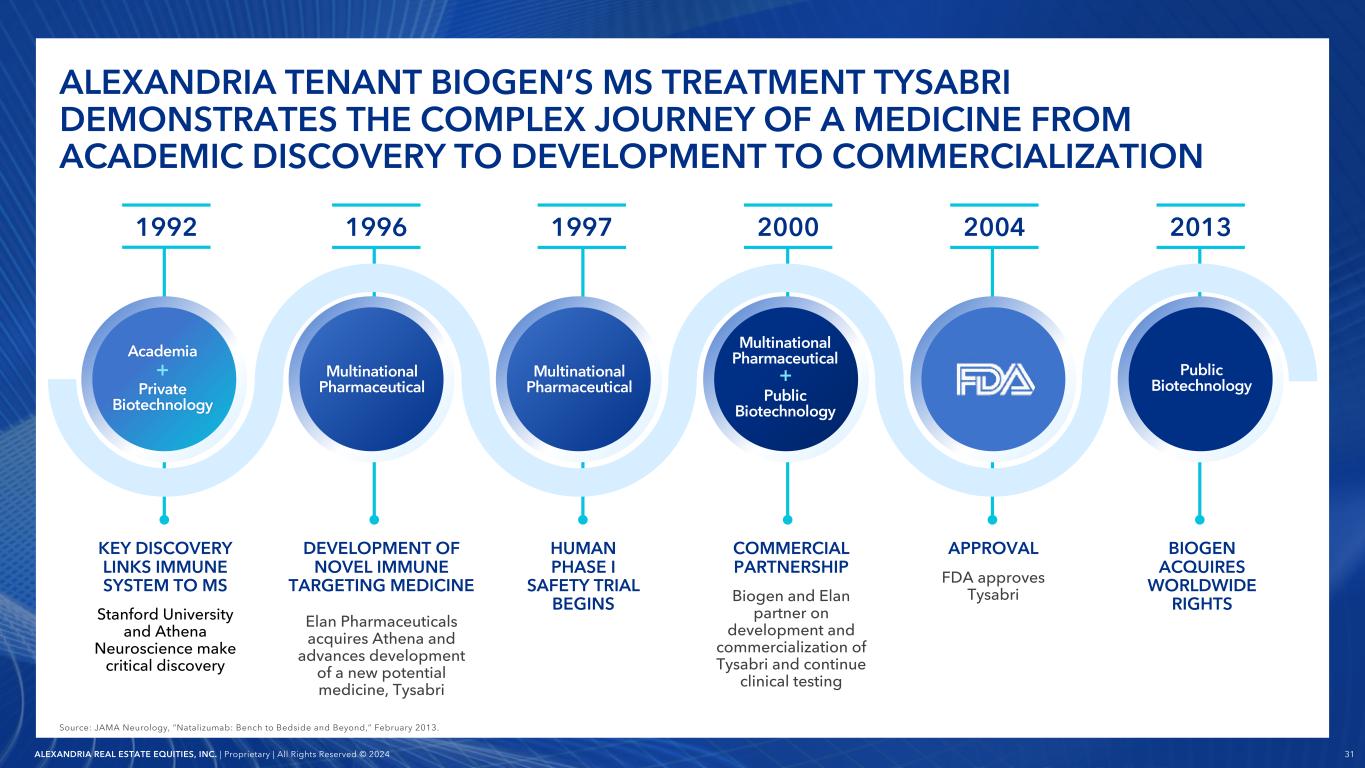

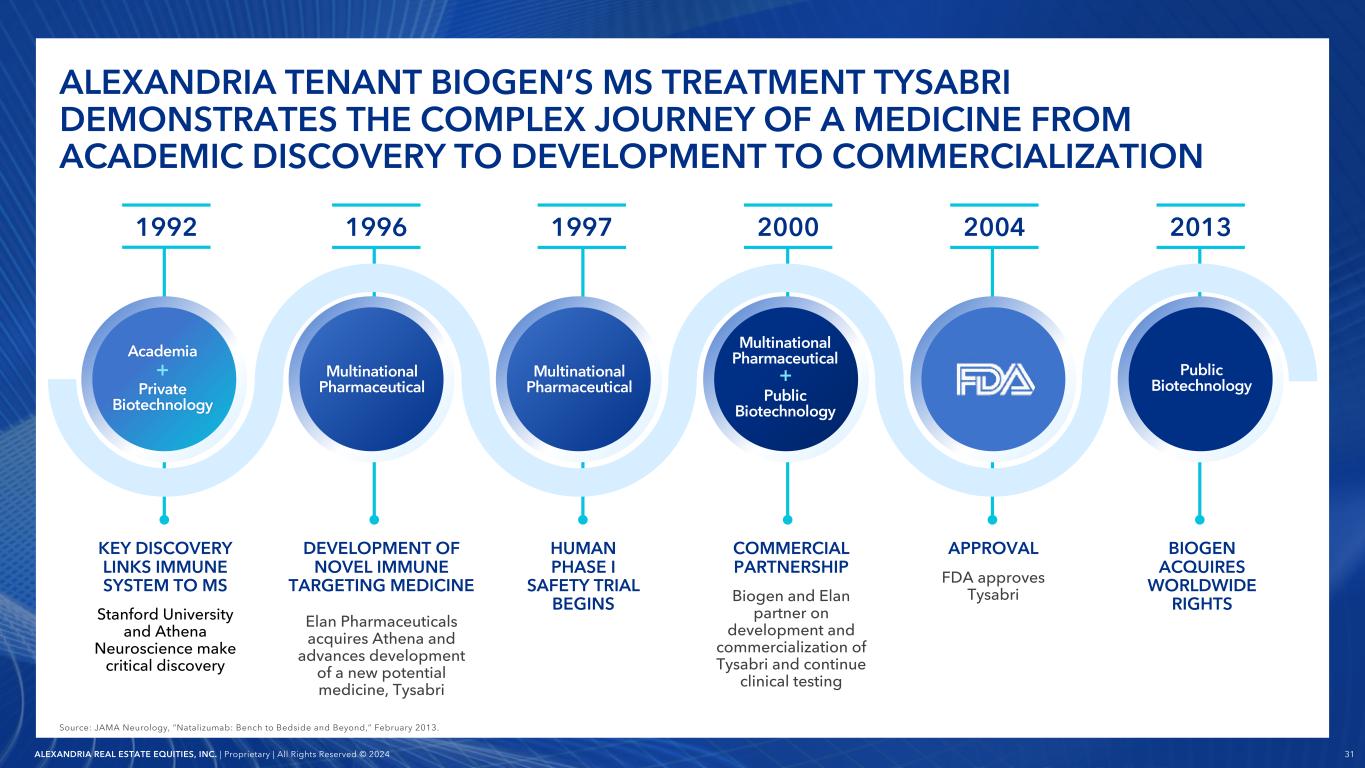

31ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA TENANT BIOGEN’S MS TREATMENT TYSABRI DEMONSTRATES THE COMPLEX JOURNEY OF A MEDICINE FROM ACADEMIC DISCOVERY TO DEVELOPMENT TO COMMERCIALIZATION Source: JAMA Neurology, “Natalizumab: Bench to Bedside and Beyond,” February 2013. 1992 KEY DISCOVERY LINKS IMMUNE SYSTEM TO MS Stanford University and Athena Neuroscience make critical discovery 1996 DEVELOPMENT OF NOVEL IMMUNE TARGETING MEDICINE Elan Pharmaceuticals acquires Athena and advances development of a new potential medicine, Tysabri 1997 HUMAN PHASE I SAFETY TRIAL BEGINS 2000 COMMERCIAL PARTNERSHIP Biogen and Elan partner on development and commercialization of Tysabri and continue clinical testing 2004 APPROVAL FDA approves Tysabri 2013 BIOGEN ACQUIRES WORLDWIDE RIGHTS Private Biotechnology Academia Multinational Pharmaceutical Public Biotechnology Public Biotechnology Multinational Pharmaceutical Multinational Pharmaceutical ++

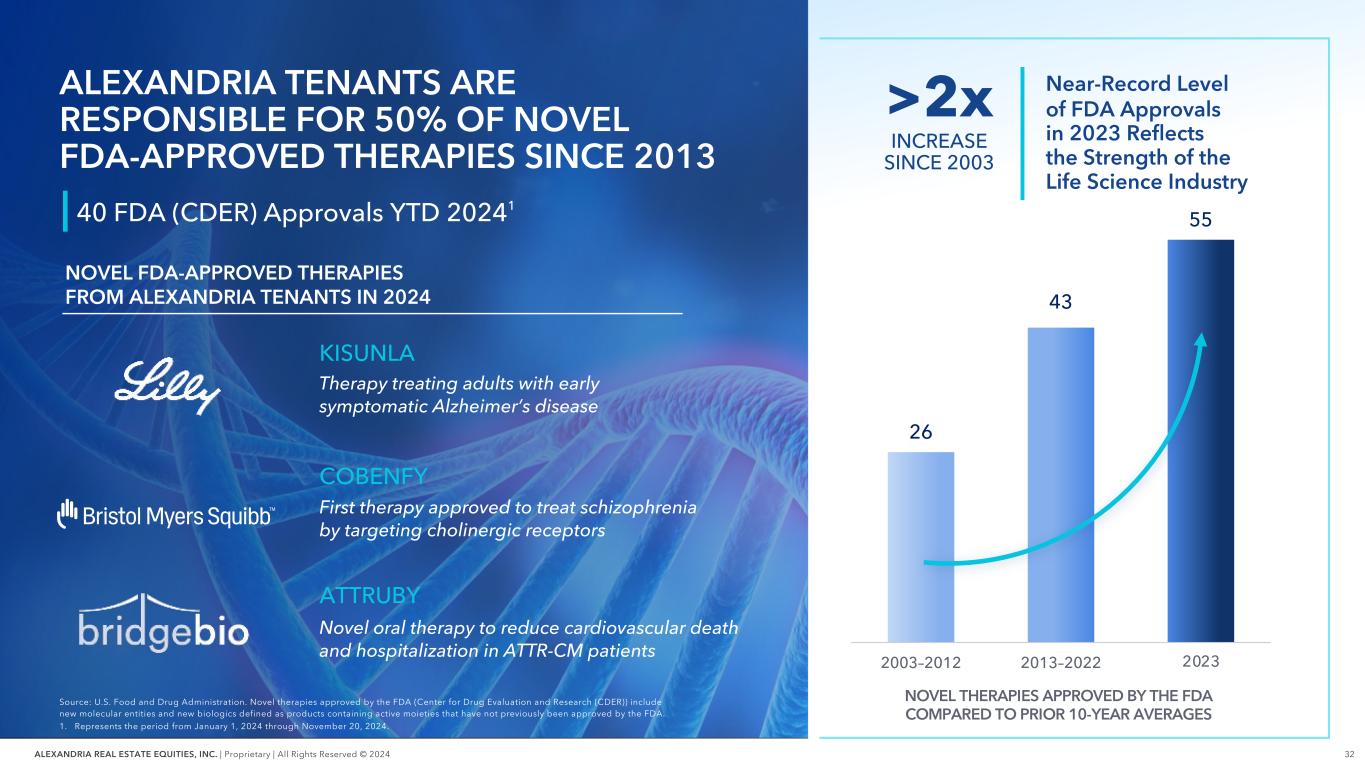

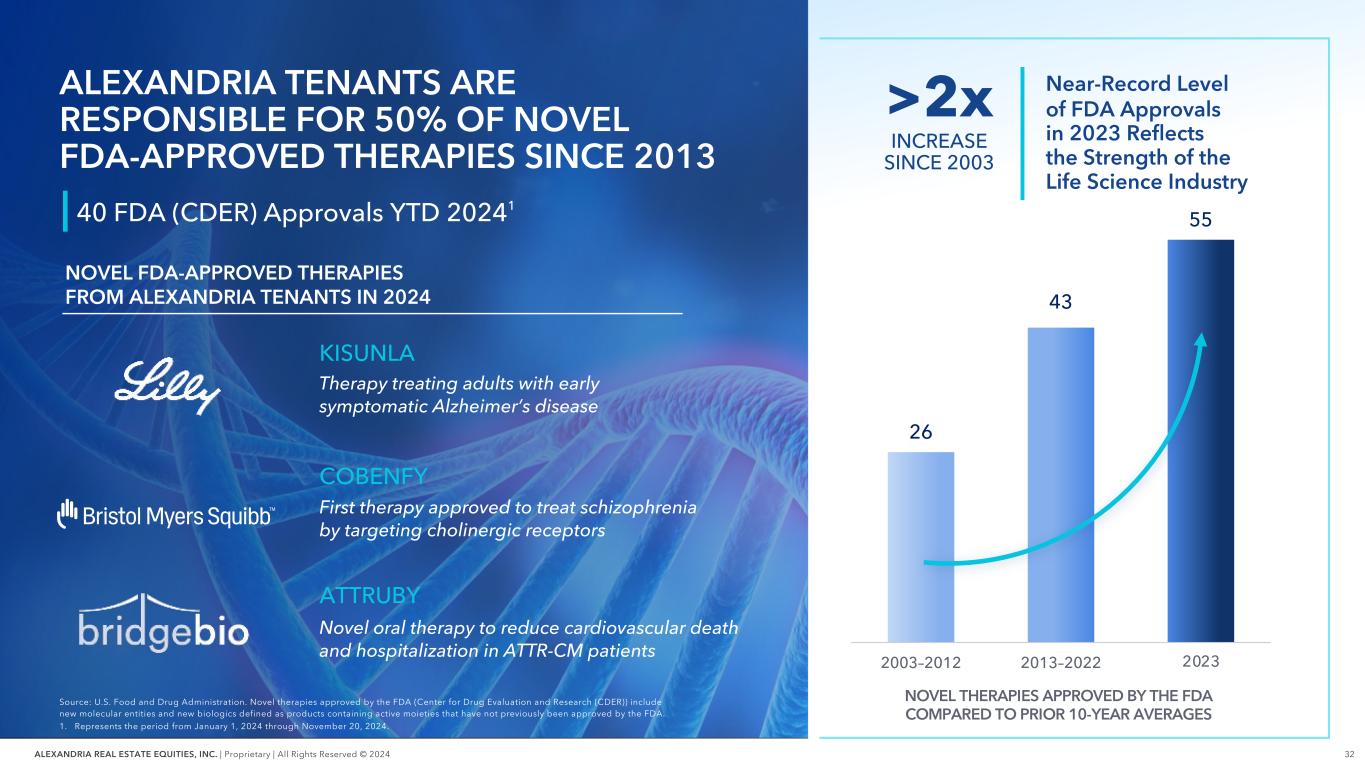

32ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 26 43 55 2003–2012 2013–2022 2023 NOVEL FDA-APPROVED THERAPIES FROM ALEXANDRIA TENANTS IN 2024 >2x INCREASE SINCE 2003 KISUNLA Therapy treating adults with early symptomatic Alzheimer’s disease COBENFY First therapy approved to treat schizophrenia by targeting cholinergic receptors Near-Record Level of FDA Approvals in 2023 Reflects the Strength of the Life Science Industry ATTRUBY Novel oral therapy to reduce cardiovascular death and hospitalization in ATTR-CM patients 40 FDA (CDER) Approvals YTD 20241 ALEXANDRIA TENANTS ARE RESPONSIBLE FOR 50% OF NOVEL FDA-APPROVED THERAPIES SINCE 2013 Source: U.S. Food and Drug Administration. Novel therapies approved by the FDA (Center for Drug Evaluation and Research (CDER)) include new molecular entities and new biologics defined as products containing active moieties that have not previously been approved by the FDA. 1. Represents the period from January 1, 2024 through November 20, 2024. NOVEL THERAPIES APPROVED BY THE FDA COMPARED TO PRIOR 10-YEAR AVERAGES

33ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 — 1998 — SYNAGIS, developed by MedImmune, is approved for prevention of respiratory syncytial virus infection INNOVATION IS THE DRIVING FORCE BEHIND THE LIFE SCIENCE INDUSTRY’S GROWTH AND DEMAND FOR ALEXANDRIA’S CRITICAL INFRASTRUCTURE AND OPERATIONS IN OUR KEY CLUSTERS 2010s RNAi 2000s ANTIBODY DRUG CONJUGATE 1990s MONOCLONAL ANTIBODY 2020s CRISPR GENE THERAPY — 2001 — Novartis receives approval for GLEEVEC, a treatment for leukemia that was one of the first cancer therapies targeting the molecular cause of the disease — 2018 — Alnylam’s ONPATTRO is approved for treatment of polyneuropathy caused by hereditary ATTR amyloidosis — 2023 — The first approved CRISPR-based medicine, Vertex’s CASGEVY, is approved for treatment of sickle cell disease NOTABLE FDA APPROVALS OF NOVEL MODALITIES BY ALEXANDRIA TENANTS OVER THREE DECADES

34ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 OVER THE THREE DECADES SINCE ALEXANDRIA’S FOUNDING, THE HIGHLY RESILIENT LIFE SCIENCE INDUSTRY HAS INNOVATED THROUGH MULTIPLE MACROECONOMIC CYCLES AND GROWN TO A TOTAL MARKET CAPITALIZATION OF $5.5T1 1. Source: Evaluate Pharma. Represents aggregate total market capitalization for the life science industry, including global major, regional major, and specialty pharmaceutical companies and excluding specialty pharmaceutical consumer companies, as of November 22, 2024. 2. Represents the date of Alexandria’s initial public offering (IPO). Alexandria’s IPO was priced at $20.00 per share on May 27, 1997. 3. Source: S&P Global Market Intelligence. Alexandria’s total shareholder return assumes reinvestment of dividends. 4. Source: S&P Capital IQ. NBI 1,406%4 1,459%3 ARE 2000–2002 2008–2009 2015–2016 COVID CORRECTION & RISING INTEREST RATES GREAT FINANCIAL CRISIS POLITICAL DRUG PRICING SCRUTINY DOTCOM BUBBLE ARE TOTAL SHAREHOLDER RETURN & NASDAQ BIOTECH INDEX (NBI) PERFORMANCE May 27, 19972 to September 30, 2024 IPO 1997 ARE 2021–2024

35ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 FUNDING IS ONLY ONE OF THE MULTIFACETED DRIVERS OF DEMAND FOR ALEXANDRIA’S LIFE SCIENCE REAL ESTATE Demand Drivers Across Key Tenant Segments of Leasing Activity in 2024 New Biological Discoveries Employee Recruitment and Retention Mergers and Acquisitions R&D and Clinical Milestones Business Development and Partnership DealsRecycling of Executive Management Teams PRIVATE BIOTECHNOLOGY PUBLIC BIOTECHNOLOGY LARGE CAP BIOPHARMA/ MULTINATIONAL PHARMACEUTICAL D E M A N D D R IV E R S

36ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 TENANT CASE STUDY PRIVATE BIOTECH 1. Represents RSF leased by City Therapeutics during the nine months ended September 30, 2024. CITY THERAPEUTICS Co-founded by former Alnylam CEO John Maraganore, City Therapeutics is developing next-generation engineering of small interfering RNAs to improve and expand the reach of RNAi-based medicines Alexandria’s relationship with COMPANY FOUNDER STARTED IN 2002 399 BINNEY STREET ALEXANDRIA CENTER® AT ONE KENDALL SQUARE MEGACAMPUS™ | CAMBRIDGE 31K RSF LEASED1 New Biological Discoveries Recycling of Executive Management DEMAND DRIVERS

37ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 TENANT CASE STUDY PUBLIC BIOTECH VAXCYTE Vaxcyte is a clinical-stage biopharmaceutical company developing novel medicines to protect individuals from the consequences of severe bacterial diseases ALEXANDRIA TENANT SINCE 2021 825 INDUSTRIAL ROAD ALEXANDRIA CENTER® FOR LIFE SCIENCE – SAN CARLOS MEGACAMPUS™ | GREATER STANFORD 259K RSF LEASED1 1. Represents RSF leased by Vaxcyte in November 2024. Positive Clinical Milestones Business Development and Partnership Deals DEMAND DRIVERS

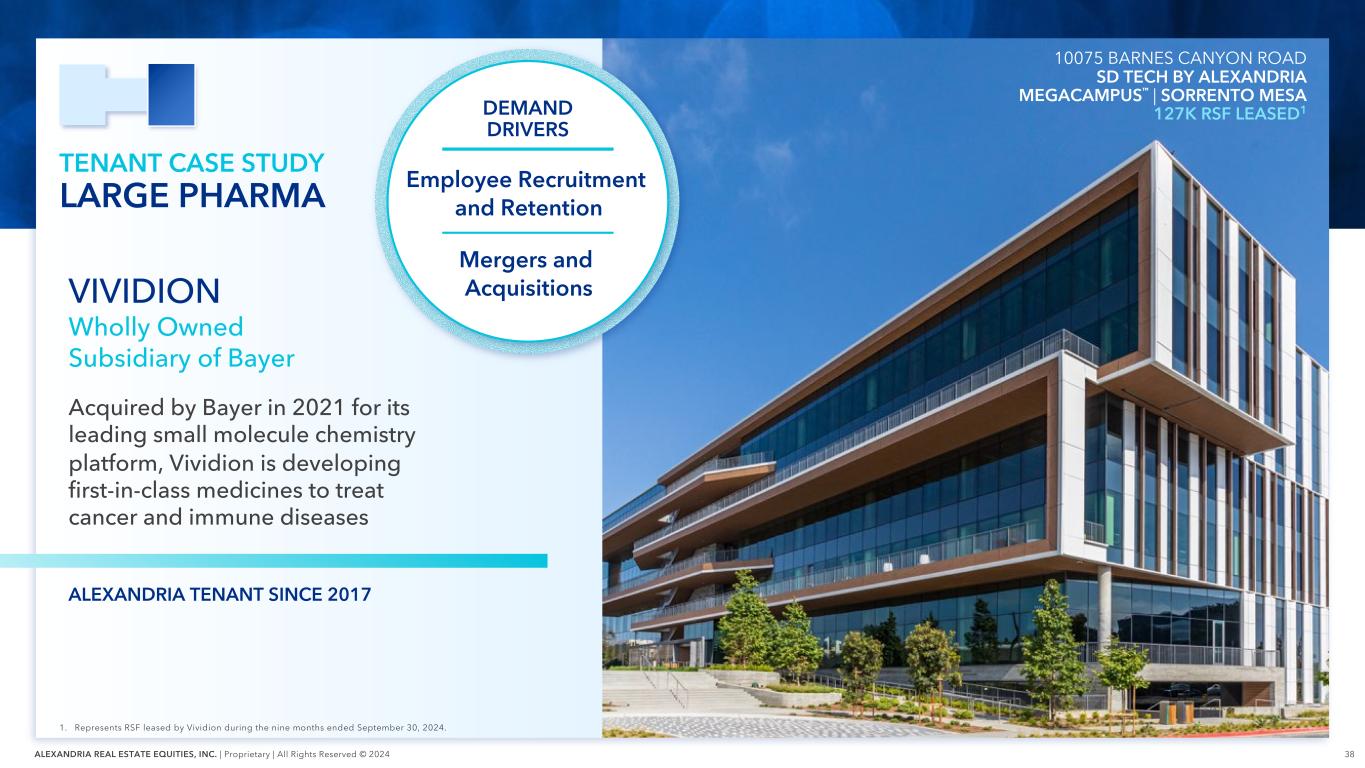

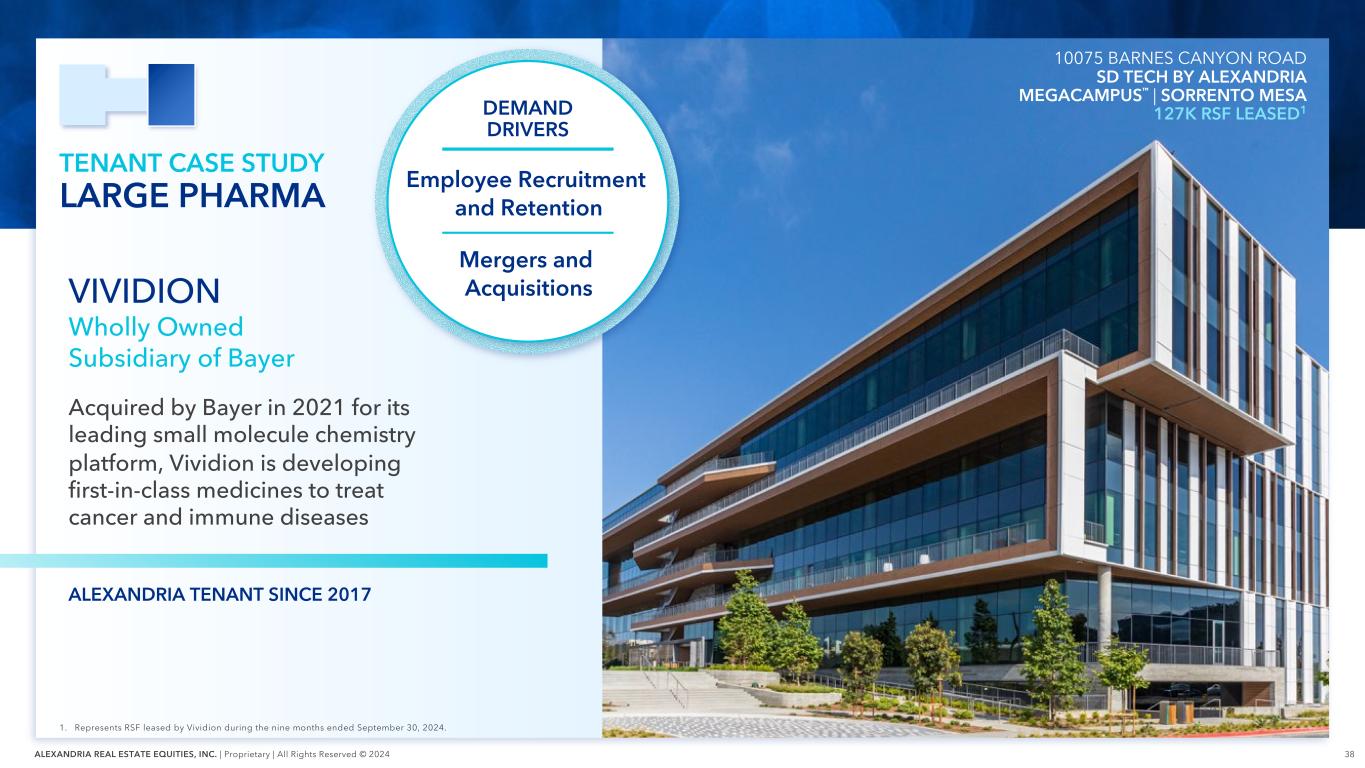

38ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 TENANT CASE STUDY LARGE PHARMA VIVIDION Wholly Owned Subsidiary of Bayer Acquired by Bayer in 2021 for its leading small molecule chemistry platform, Vividion is developing first-in-class medicines to treat cancer and immune diseases ALEXANDRIA TENANT SINCE 2017 10075 BARNES CANYON ROAD SD TECH BY ALEXANDRIA MEGACAMPUS™ | SORRENTO MESA 127K RSF LEASED1 1. Represents RSF leased by Vividion during the nine months ended September 30, 2024. Employee Recruitment and Retention Mergers and Acquisitions DEMAND DRIVERS

39ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S LEASING ACTIVITY IS UNIQUELY FUELED BY A SECTOR-LEADING CLIENT BASE OF ~800 TENANTS CULTIVATED OVER 30+ YEARS 1. As of September 30, 2024. 8 213 440 1994 2004 2014 3Q24 NUMBER OF ALEXANDRIA TENANTS 80% OF LEASING ACTIVITY DURING THE PAST 12 MONTHS IS FROM OUR EXISTING TENANT BASE1 ~800 TENANTS

40ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S STRONG, BROAD, AND DIVERSE LIFE SCIENCE TENANT BASE BOLSTERED OUR SOLID 2024 LEASING ACTIVITY PERCENTAGE OF LIFE SCIENCE LEASING ACTIVITY BY RSF (1Q–3Q24) MULTINATIONAL PHARMACEUTICAL 37% PRIVATE BIOTECHNOLOGY 23% PUBLIC BIOTECHNOLOGY 7% BIOMEDICAL and GOVERNMENT INSTITUTIONS 10% LIFE SCIENCE SERVICE, PRODUCT, and DEVICE 23%

41ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S LONG-TERM RELATIONSHIPS WITH CLINICAL AND COMMERCIAL PUBLIC BIOTECH COMPANIES PROVIDE A PATH FOR GROWTH AS THEY ACHIEVE CLINICAL MILESTONES AND SEEK TO EXPAND R&D CAPABILITIES 7% OF LIFE SCIENCE LEASING ACTIVITY2 82% OF ABOVE LEASING ACTIVITY WAS FROM EXISTING TENANT RELATIONSHIPS2 PUBLIC BIOTECHNOLOGY 1. Source: Evaluate Pharma, November 2024. Includes Phase 1–4 trials that are active, recruiting, enrolling by invitation, or will start recruiting in the near term. Excludes trials with no disclosed phase and trials with no National Clinical Trial number. 2. Represents the nine months ended September 30, 2024. 1,500+ Ongoing Clinical Trials by Alexandria’s Public Biotech Tenants Form the Foundation for Future Growth1

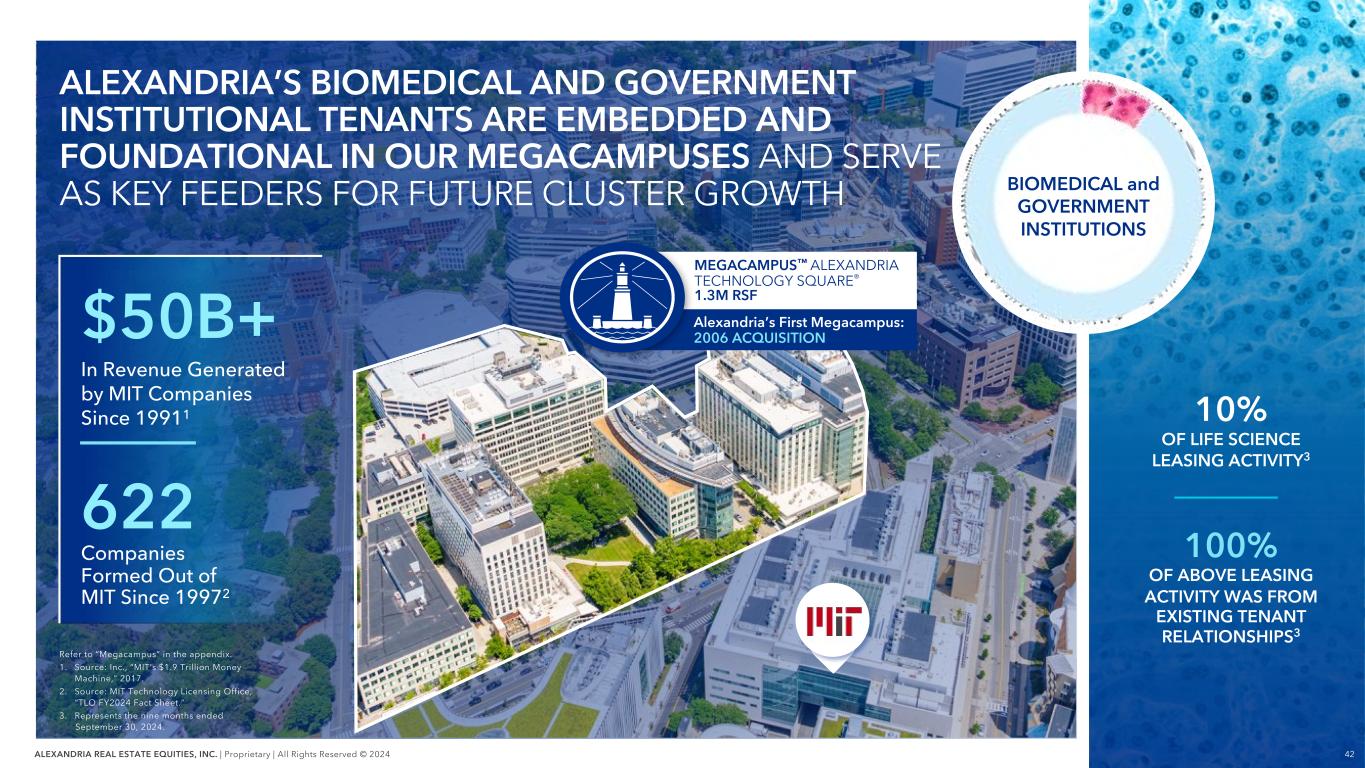

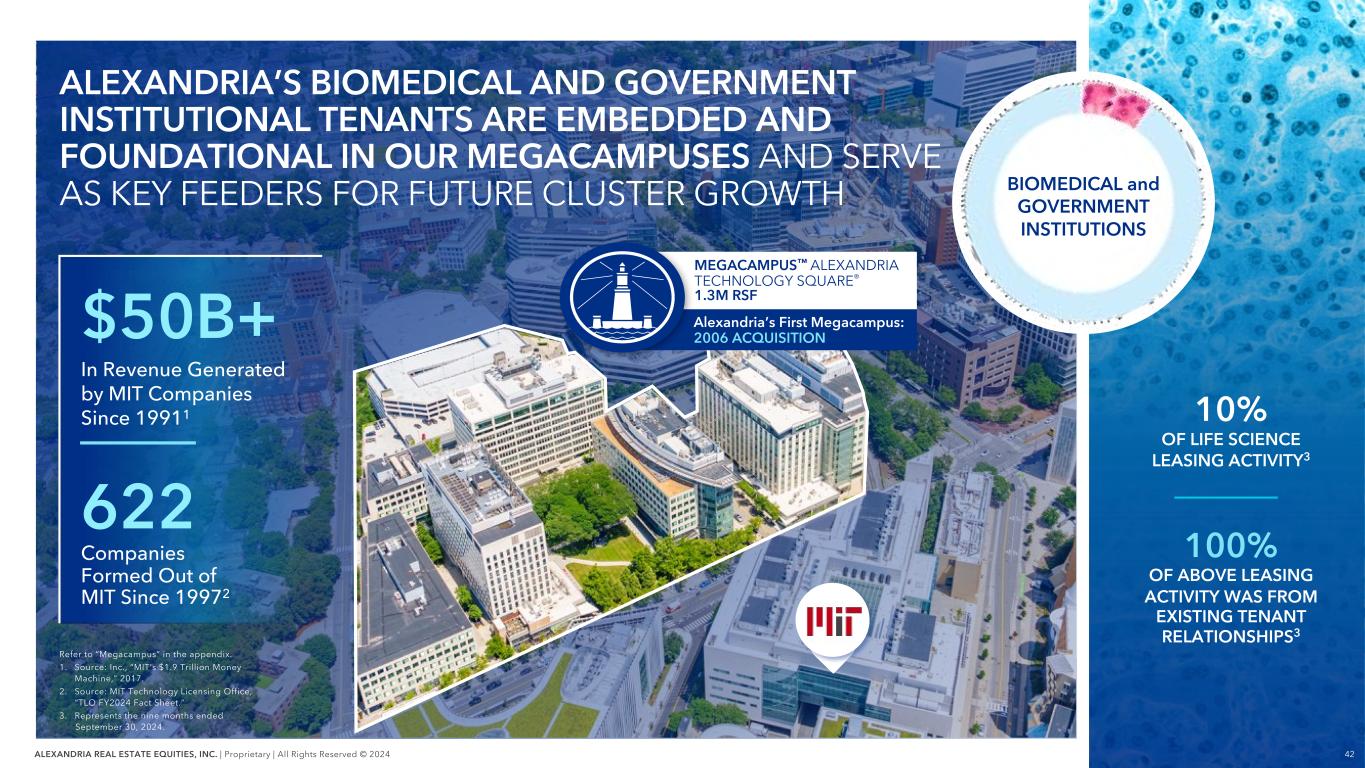

42ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S BIOMEDICAL AND GOVERNMENT INSTITUTIONAL TENANTS ARE EMBEDDED AND FOUNDATIONAL IN OUR MEGACAMPUSES AND SERVE AS KEY FEEDERS FOR FUTURE CLUSTER GROWTH Refer to “Megacampus” in the appendix. 1. Source: Inc., “MIT’s $1.9 Trillion Money Machine,” 2017. 2. Source: MIT Technology Licensing Office, “TLO FY2024 Fact Sheet.” 3. Represents the nine months ended September 30, 2024. 10% OF LIFE SCIENCE LEASING ACTIVITY3 100% OF ABOVE LEASING ACTIVITY WAS FROM EXISTING TENANT RELATIONSHIPS3 MEGACAMPUS™ ALEXANDRIA TECHNOLOGY SQUARE® 1.3M RSF Alexandria’s First Megacampus: 2006 ACQUISITION 622 Companies Formed Out of MIT Since 19972 $50B+ In Revenue Generated by MIT Companies Since 19911 BIOMEDICAL and GOVERNMENT INSTITUTIONS

43ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S INNOVATIVE LIFE SCIENCE PRODUCT, SERVICE, AND DEVICE TENANTS DEVELOP CUTTING- EDGE TOOLS AND SERVICES TO ACCELERATE THE DISCOVERY AND ADVANCEMENT OF NEW MEDICINES 23% OF LIFE SCIENCE LEASING ACTIVITY2 90% OF ABOVE LEASING ACTIVITY WAS FROM EXISTING TENANT RELATIONSHIPS2 1. Source: Charles River Laboratories 2023 J.P. Morgan Healthcare Conference presentation. The last three years represent 2020 through 2022. 2. Represents the nine months ended September 30, 2024. 80% Over the Last Three Years¹ Alexandria Tenants in This Cohort Helped Support OF FDA- APPROVED DRUGS LIFE SCIENCE SERVICE, PRODUCT, and DEVICE

44ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S BENCH OF HIGHLY INNOVATIVE PRIVATE BIOTECH TENANTS DRIVES DEVELOPMENT OF SCIENTIFIC PLATFORMS THAT REPRESENT THE FUTURE WAVE OF INNOVATIVE MEDICINES 1. Source: PitchBook, November 2024. Includes pharmaceutical and biotechnology mega-financings (>$100 million) from January 1, 2024 to October 31, 2024. 2. Represents the nine months ended September 30, 2024. 23% OF LIFE SCIENCE LEASING ACTIVITY2 69% OF ABOVE LEASING ACTIVITY WAS FROM EXISTING TENANT RELATIONSHIPS2 88% Proportion of $100M+ Life Science Venture Financings Raised in Alexandria Clusters Through YTD 20241 PRIVATE BIOTECHNOLOGY

45ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA IS PHARMA’S REAL ESTATE PARTNER OF CHOICE, WITH 17 OF THE TOP 20 LARGE PHARMA COMPANIES AS OUR EXISTING TENANTS 37% OF LIFE SCIENCE LEASING ACTIVITY2 100% OF ABOVE LEASING ACTIVITY WAS FROM EXISTING TENANT RELATIONSHIPS2 64% of Revenue Is Driven by External Partnerships and M&A With Private and Public Biotech Companies1 MULTINATIONAL PHARMACEUTICAL 1. Source: Evaluate Pharma. Represents percentage of top 20 biopharmaceutical product sales generated from partnerships and mergers and acquisitions (M&A) in 2023. Partnerships include products sourced by a company through in-licensing deals. M&A includes company and product acquisitions. 2. Represents the nine months ended September 30, 2024.

46ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. Source: National Library of Medicine SRA Database Growth October 5, 1981 “DESIGNING DRUGS BY COMPUTER” AI HAS BEEN A CRITICAL TOOL FOR THE LIFE SCIENCE INDUSTRY FOR DECADES November 15, 2024 “AI LEARNS THE LANGUAGE OF LIFE”

47ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Generating large volumes of high-quality biological and chemical data within the laboratory Integrating vast amounts of data generated in the research lab with the aid of AI tools, which then inform the next set of laboratory experiments LIFE SCIENCE RESEARCH LAB COMPUTATIONAL LAB AI IS A CRITICAL TOOL FOR ANALYZING THE VAST AMOUNT OF LIFE SCIENCE DATA GENERATED IN THE LAB AI Tools to Uncover Patterns Within Complex Life Science Data Sets High-Performance Computing Novel Deep Learning and AI Modes Machine Learning

48ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Refer to “Megacampus” in the appendix. CLUSTERING is the DNA of the LIFE SCIENCE INDUSTRY Alexandria’s Megacampus™ platform strategically located in core R&D clusters uniquely meets the infrastructure and critical operational needs of the collaborative life science industry

49ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 ALEXANDRIA’S MEGACAMPUS™ STRATEGY STRATEGIC POSITIONING FOR FUTURE GROWTH

50ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 CO-LOCATED with RESEARCH INSTITUTIONS, VENTURE CAPITAL, BIOTECH, and PHARMA STRATEGIC OPTIONALITY and FUTURE GROWTH OPPORTUNITIES BESPOKE AMENITIES to RECRUIT and RETAIN TOP TALENT ENGAGING WORKPLACES that DRIVE PRODUCTIVITY CLUSTERING is the DNA of the LIFE SCIENCE INDUSTRY MISSION-CRITICAL INFRASTRUCTURE and OPERATIONS to CONDUCT CUTTING-EDGE SCIENCE

51ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 CLUSTERING is the DNA of the ALEXANDRIA MEGACAMPUS™ Refer to ”Megacampus” in the appendix. Co-Location Strategic Optionality Talent Attraction Mission-Critical Infrastructure Productivity HIGH-QUALITY ASSETS CLUSTERED in COLLABORATIVE LIFE SCIENCE ECOSYSTEMS SCALE and FLEXIBILITY to PROVIDE PATH FOR GROWTH BESPOKE AMENITIES and ACTIVATED ENVIRONMENTS TALENT-CENTERED DESIGN The Alexandria Megacampus platform was intentionally designed to align and integrate with the DNA of the life science industry UNMATCHED LABORATORY OPERATIONS EXPERTISE

52ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 M A IN STR E E T FOR OVER 30 YEARS ALEXANDRIA HAS CURATED AND DOMINATED THE CREATION AND GROWTH OF VIBRANT LIFE SCIENCE CLUSTERS MEGACAMPUS™ ALEXANDRIA CENTER® AT ONE KENDALL SQUARE 1.4M RSF MEGACAMPUS™ ALEXANDRIA TECHNOLOGY SQUARE® 1.3M RSF As of September 30, 2024. Refer to ”Megacampus” in the appendix. CAMBRIDGE GREATER BOSTON MEGACAMPUS™ ALEXANDRIA CENTER® AT KENDALL SQUARE 3.0M RSF ALEXANDRIA ENTERED CAMBRIDGE IN 1999

53ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 FOR OVER 30 YEARS ALEXANDRIA HAS CURATED AND DOMINATED THE CREATION AND GROWTH OF VIBRANT LIFE SCIENCE CLUSTERS MISSION BAY SAN FRANCISCO BAY AREA As of September 30, 2024. Refer to “Megacampus” in the appendix. RESIDENTIAL CHASE CENTER MEGACAMPUS™ ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY – MISSION BAY 2.2M RSF ALEXANDRIA ENTERED MISSION BAY IN 2004

54ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 FOR OVER 30 YEARS ALEXANDRIA HAS CURATED AND DOMINATED THE CREATION AND GROWTH OF VIBRANT LIFE SCIENCE CLUSTERS As of September 30, 2024. Refer to “Megacampus” in the appendix. TORREY PINES SAN DIEGO WITH THE ACQUISITION OF OUR FIRST ASSET ALEXANDRIA ENTERED TORREY PINES IN 1994 Genesee Ave MEGACAMPUS™ ONE ALEXANDRIA SQUARE 1.2M RSF MEGACAMPUS™ CAMPUS POINT BY ALEXANDRIA 2.9M RSF

55ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 FOR OVER 30 YEARS ALEXANDRIA HAS CURATED AND DOMINATED THE CREATION AND GROWTH OF VIBRANT LIFE SCIENCE CLUSTERS As of September 30, 2024. Refer to ”Megacampus” in the appendix. LAKE UNION SEATTLE ALEXANDRIA ENTERED LAKE UNION IN 2002 MEGACAMPUS™ ALEXANDRIA CENTER® FOR LIFE SCIENCE – SOUTH LAKE UNION 1.6M RSF MEGACAMPUS™ ALEXANDRIA CENTER® FOR LIFE SCIENCE – EASTLAKE 1.2M RSF

56ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA HAS BEEN CURATING AND GROWING HIGHLY DESIRABLE AND WELL-AMENITIZED MEGACAMPUS™ ECOSYSTEMS IN THE TOP LIFE SCIENCE CLUSTERS FOR NEARLY TWO DECADES Refer to “Megacampus” in the appendix. Represents the year in which each campus had at least one operating property and aggregated over 1 million RSF, including operating, active development/redevelopment, and land RSF less operating RSF expected to be demolished. First Megacampus: Alexandria Technology Square® | Cambridge — 2006 — Alexandria Center® for Life Science – NYC — 2010 — Alexandria Center® for Science and Technology – Mission Bay — 2007 — Campus Point by Alexandria | University Town Center — 2015 — Alexandria Center® at Kendall Square | Cambridge — 2007 — Alexandria Center® at One Kendall Square | Cambridge — 2017 — One Alexandria Square | Torrey Pines — 2014 — Alexandria Center® for Advanced Technologies and Agtech – Research Triangle — 2012 — 2006 Alexandria Center® for Life Science – Eastlake | Lake Union — 2015 —

57ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA HAS BEEN CURATING AND GROWING HIGHLY DESIRABLE AND WELL-AMENITIZED MEGACAMPUS™ ECOSYSTEMS IN THE TOP LIFE SCIENCE CLUSTERS FOR NEARLY TWO DECADES Refer to “Annual rental revenue” and “Megacampus” in the appendix. Represents the year in which each campus had at least one operating property and aggregated over 1 million RSF, including operating, active development/redevelopment, and land RSF less operating RSF expected to be demolished. 1. Represents the percentage of our annual rental revenue as of September 30, 2024 from our megacampuses. The Arsenal on the Charles | Watertown — 2019 — Alexandria Center® for Life Science – San Carlos — 2021— Alexandria Center® for Life Science – Durham | Research Triangle — 2020 — SD Tech by Alexandria | Sorrento Mesa — 2019 — Alexandria Center® for Life Science – Fenway — 2021 — Alexandria Center® for Life Science – Waltham — 2020 — 76% OF OUR ANNUAL RENTAL REVENUE1 AND GROWING 2025–2029 Alexandria Center® for Life Science – South Lake Union — 2022— 3Q24 Alexandria Center® for Life Science – Shady Grove | Maryland — 2018 —

58ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA HAS BEEN STRATEGICALLY AGGREGATING OUR CAMPUS POINT MEGACAMPUS™ FOR NEARLY 15 YEARS As of September 30, 2024. Refer to "Megacampus” in the appendix. RSF amounts represent the actual or anticipated total square footage in operation or under active construction at the end of each respective year. 0.5M RSF 0.8M RSF 1.0M RSF 1.3M RSF 1.4M RSF 1.7M RSF 1.8M RSF 2.3M RSF 2.9M RSF 2010 2015 2018 2019 2020 2022 2024 2026 Future 480% GROWTH

59ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S WORLD-CLASS DESIGN AND DEVELOPMENT OF MISSION-CRITICAL INFRASTRUCTURE SOLUTIONS 1. For the period from January 1, 2010 through September 30, 2024. The top life science companies in the world continue to select Alexandria as their development and operational partner of choice 14.7M RSF DEVELOPMENT PROJECTS COMMENCED ACROSS 19 MEGACAMPUSES SINCE 20101

60ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S HIGHLY CURATED AMENITIES ARE SPECIFICALLY DESIGNED TO ENABLE TENANTS TO RECRUIT, RETAIN, AND ENGAGE TOP TALENT AMENITIES AND ACTIVATION

61ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S DIRECT MANAGEMENT AND OPERATION OF MISSION- CRITICAL INFRASTRUCTURE DRIVE TENANT RETENTION 1. Represents average years of applicable experience of our asset services team leadership as of December 4, 2024. Our new building has been the perfect place for us to move our science forward and provide an exceptional employee experience due to the brilliant design of the facility and the outstanding service provided by the ARE team. The management, facilities, and engineering teams at ARE take great pride in providing top-notch customer service. SCOTT DAVIS, LEED AP Director, Operations and Facilities Sail Biomedicines (Tenant at 140 First Street, Cambridge) 25+ YEARS AVERAGE EXPERIENCE IN BUILDING OPERATIONS1

62ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Refer to "Megacampus” in the appendix. Driving Superior Operating and Financial Results EXCEPTIONAL ANNUAL RENTAL REVENUE GROWTH LEASING OUTPERFORMANCE RENTAL RATE PREMIUMS OCCUPANCY OUTPERFORMANCE SUPERIOR RETURN ON INVESTMENT THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM

63ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM EXCEPTIONAL ARR GROWTH Refer to ”Annual rental revenue” and “Megacampus” in the appendix. 1. Represents growth in annual rental revenue in effect as of December 31, 2016 compared to that in effect as of September 30, 2024. 4Q16 3Q24 $42.3M $144.6M ANNUAL RENTAL REVENUE (ARR) ALEXANDRIA CENTER® AT ONE KENDALL SQUARE MEGACAMPUS™ | CAMBRIDGE 3x Since Our Acquisition of One Kendall Square in November 20161 MORE THAN

64ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM LEASING OUTPERFORMANCE: OPERATING Refer to “Megacampus” in the appendix. 1. Represents our lease signed with Vaxcyte in November 2024. 2. As of September 30, 2024 and represents information for the Alexandria Center for Life Science – San Carlos. 3. Represents total square footage upon completion of development or redevelopment of one or more new Class A/A+ properties. Square footage presented includes the RSF of buildings currently in operation at properties that also have future development or redevelopment opportunities. Upon expiration of existing in-place leases, we have the intent to demolish or redevelop the existing property subject to market conditions and leasing. ALEXANDRIA CENTER® FOR LIFE SCIENCE – SAN CARLOS MEGACAMPUS™ | GREATER STANFORD ◎ Flagship destination for life science innovation in the Bay Area’s Mid-Peninsula 97.4% OCCUPIED2 ◎ Significant options for tenant growth 1.5M RSF OF FUTURE DEVELOPMENT OPPORTUNITIES2,3 258,581 RSF 10-YEAR LEASE1 EXPANSION AND EXTENSION AT 825 INDUSTRIAL ROAD

65ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM LEASING OUTPERFORMANCE: DEVELOPMENT As of September 30, 2024, unless otherwise indicated. Refer to “Competitive supply” and “Megacampus” in the appendix. 1. Represents our lease signed with Vividion during the nine months ended September 30, 2024. 2. Source: Alexandria’s proprietary competitive supply database. SD TECH BY ALEXANDRIA MEGACAMPUS™ 10075 BARNES CANYON ROAD | SORRENTO MESA 70% PRE-LEASED AT ALEXANDRIA’S 10075 BARNES CANYON ROAD AHEAD OF ANTICIPATED INITIAL DELIVERY IN 2025 vs 8% Pre-Leased at Competitive New Developments in Sorrento Mesa2 127,382 RSF 10-YEAR LEASE1

66ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM Refer to “Megacampus” in the appendix. 1. Sources: Internal records for One Alexandria Square; Cushman & Wakefield for competitor building. Represents the peak rental rates achieved for life science space within the Torrey Pines and University Town Center submarkets in 2023. ONE ALEXANDRIA SQUARE 10935 AND 10945 ALEXANDRIA WAY | TORREY PINES $87 ONE ALEXANDRIA SQUARE MEGACAMPUS vs $78 STAND-ALONE COMPETITOR BUILDING RENTAL RATE PREMIUMS 11.5% RENTAL RATE PREMIUM NNN RENTAL RATES PER RSF1

67ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE POWER OF ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM OCCUPANCY OUTPERFORMANCE Refer to “Competitive supply” and “Megacampus” in the appendix. 1. Represents average occupancy of operating properties for the Alexandria Center® for Life Science – Eastlake Megacampus in our Lake Union submarket as of each December 31 from 2020 through 2023 and as of September 30, 2024. 2. Source: Newmark. Represents average operating occupancy of competitive supply in our Lake Union submarket as of each September 30 for 2020 through 2024. ALEXANDRIA CENTER® FOR LIFE SCIENCE – EASTLAKE MEGACAMPUS™ | LAKE UNION AVERAGE OCCUPANCY SINCE 2020 97% ALEXANDRIA EASTLAKE MEGACAMPUS OCCUPANCY1 58% LAKE UNION MARKET OCCUPANCY2 39% ALEXANDRIA’S OCCUPANCY OUTPERFORMANCE vs =

68ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE ALEXANDRIA MEGACAMPUS™ PLATFORM DRIVES SUPERIOR FINANCIAL PERFORMANCE Refer to “Annual rental revenue” and “Megacampus” in the appendix. Percentages represent the compounded annual growth rate (CAGR) in annual rental revenue in effect as of September 30, 2024 compared to that in effect as of each date indicated. The starting dates represent the year in which each Megacampus was established. 17.3%16.6% ALEXANDRIA CENTER® AT ONE KENDALL SQUARE ARR CAGR Since 4Q16 GREATER BOSTON ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY – MISSION BAY ARR CAGR Since 4Q08 SAN FRANCISCO BAY AREA 18.1% CAMPUS POINT BY ALEXANDRIA ARR CAGR Since 4Q15 SAN DIEGO

69ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 ALEXANDRIA’S MEGACAMPUS™ STRATEGY FUTURE DEVELOPMENT AND REDEVELOPMENT WITHIN THE ALEXANDRIA MEGACAMPUS™ PLATFORM PROVIDE SIGNIFICANT NOI GROWTH

70ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 18+ YEARS EXECUTING ON OUR VISION As of September 30, 2024. Refer to “Megacampus” in the appendix. ALEXANDRIA’S DISCIPLINED AND PROVEN APPROACH TO CREATING A COLLABORATIVE MEGACAMPUS™ IN CAMBRIDGE GUIDES OUR DISCIPLINED FUTURE DEVELOPMENT STRATEGY SPOTLIGHT ON CAMBRIDGE ALEXANDRIA CENTER® AT KENDALL SQUARE 3.0M RSF

71ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 20+ YEARS EXECUTING ON OUR VISION As of September 30, 2024. Refer to “Megacampus” in the appendix. SPOTLIGHT ON MISSION BAY ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY 2.2M RSF ALEXANDRIA’S DISCIPLINED AND PROVEN APPROACH TO CREATING A COLLABORATIVE MEGACAMPUS™ IN MISSION BAY GUIDES OUR DISCIPLINED FUTURE DEVELOPMENT STRATEGY

72ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S VISIBILITY OF FUTURE GROWTH IN ANNUAL NET OPERATING INCOME FROM DELIVERIES OF DEVELOPMENT AND REDEVELOPMENT PROJECTS As of September, 30, 2024. Refer to “Megacampus” and “Net operating income and net operating income (cash basis)” in the appendix. 1. Our share of incremental annual net operating income from development and redevelopment projects expected to be placed into service primarily commencing from 4Q24 through 1Q28 is projected to be $407 million. 2. Represents expected RSF and incremental annual net operating income to be placed into service from deliveries of projects undergoing construction and one committed near-term project expected to commence construction in the next two years. Primarily driven by disciplined development and redevelopment within our Megacampus™ platform $510M1 EXPECTED TO BE PLACED INTO SERVICE 4Q24–1Q282 5.5M RSF ONE ALEXANDRIA SQUARE MEGACAMPUS™ | SAN DIEGO FUTURE GROWTH IN INCREMENTAL ANNUAL NOI

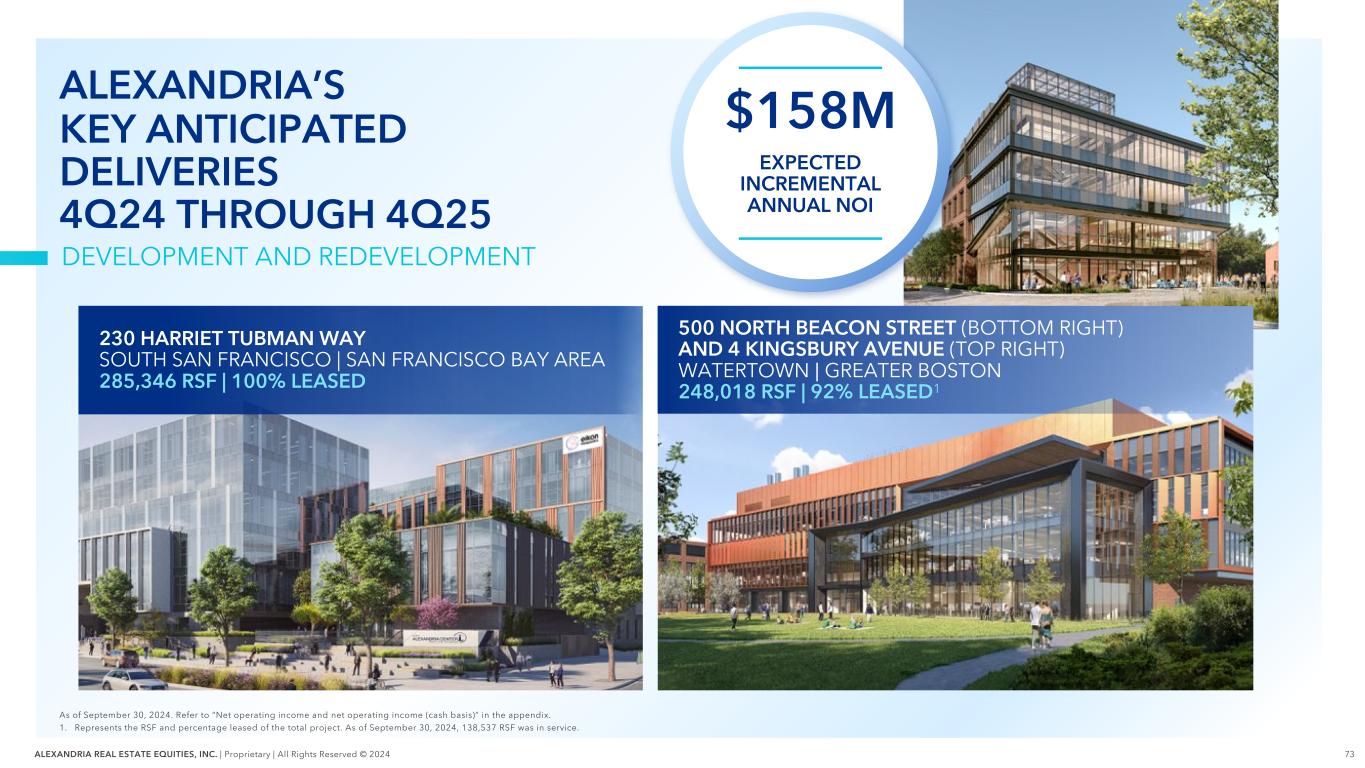

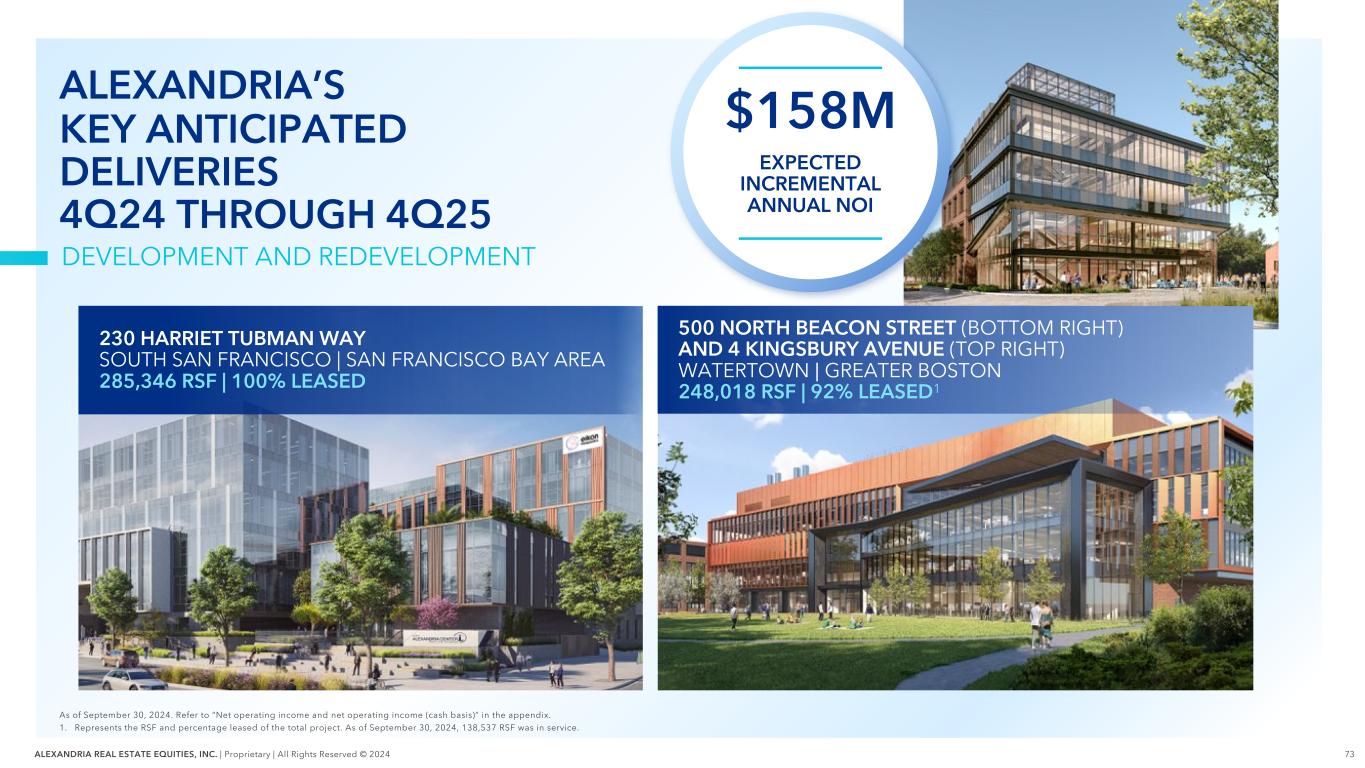

73ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 230 HARRIET TUBMAN WAY SOUTH SAN FRANCISCO | SAN FRANCISCO BAY AREA 285,346 RSF | 100% LEASED ALEXANDRIA’S KEY ANTICIPATED DELIVERIES 4Q24 THROUGH 4Q25 As of September 30, 2024. Refer to “Net operating income and net operating income (cash basis)” in the appendix. 1. Represents the RSF and percentage leased of the total project. As of September 30, 2024, 138,537 RSF was in service. DEVELOPMENT AND REDEVELOPMENT 500 NORTH BEACON STREET (BOTTOM RIGHT) AND 4 KINGSBURY AVENUE (TOP RIGHT) WATERTOWN | GREATER BOSTON 248,018 RSF | 92% LEASED1 EXPECTED INCREMENTAL ANNUAL NOI $158M

74ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S KEY ANTICIPATED DELIVERIES 1Q26 THROUGH 1Q28 As of September 30, 2024. Refer to “Net operating income and net operating income (cash basis)” in the appendix. 1. 60 Sylvan Road is included in the 596,064 RSF redevelopment project at 40, 50, and 60 Sylvan Road in our Route 128 submarket. 60 SYLVAN ROAD1 ROUTE 128 | GREATER BOSTON 185,080 RSF | 100% LEASED 4135 CAMPUS POINT COURT UNIVERSITY TOWN CENTER | SAN DIEGO 426,927 RSF | 100% LEASED 10935, 10945, AND 10955 ALEXANDRIA WAY TORREY PINES | SAN DIEGO 334,996 RSF | 100% LEASED EXPECTED INCREMENTAL ANNUAL NOI $352M DEVELOPMENT AND REDEVELOPMENT

75ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 99 COOLIDGE STREET GREATER BOSTON (TOP) ◎ Leased/negotiating increased to 62%1 (from 40%2 as of 3Q24) ALEXANDRIA’S STRATEGIC RESOLUTION OF DEVELOPMENT PROJECTS FUTURE GROWTH OPPORTUNITIES FOR 2026 AND BEYOND 1. As of December 4, 2024. 2. Leased/negotiating percentage disclosed on October 21, 2024. 1450 OWENS STREET SAN FRANCISCO BAY AREA (BOTTOM) ◎ Executed a signed LOI to sell a condo interest for 103,361 RSF, or ~49% of the project • Expected to close in 2025

76ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 THE NEXT GENERATION OF ALEXANDRIA’S LONG-TERM MEGACAMPUS™ DEVELOPMENTS ALEXANDRIA CENTER® FOR ADVANCED TECHNOLOGIES – TANFORAN SOUTH SAN FRANCISCO 1.9M FUTURE SF 1.5M FUTURE SF ALEXANDRIA CENTER® FOR LIFE SCIENCE – SAN CARLOS GREATER STANFORD ALEXANDRIA CENTER® FOR LIFE SCIENCE – SOUTH LAKE UNION LAKE UNION 1.3M ACTIVE AND FUTURE SF As of September 30, 2024. Refer to “Megacampus” in the appendix. Represents total square footage upon completion of development or redevelopment of one or more new Class A/A+ properties. Square footage presented includes the RSF of buildings currently in operation at properties that also have future development or redevelopment opportunities. Upon expiration of existing in-place leases, we have the intent to demolish or redevelop the existing property subject to market conditions and leasing.

77ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S PROVEN DEVELOPMENT EXECUTION OVER THE LONG TERM 1. Represents the percentage of RSF leased at development projects initially delivered during 2015 through 3Q24. 100% 100% 97% 100% 94% 93% 98% 86% 95% 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 3Q24 89% 94% AVERAGE LEASED PERCENTAGE AT INITIAL DELIVERY OVER THE PAST 10 YEARS1 PERCENTAGE OF RSF LEASED AT INITIAL DELIVERY

78ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 LIFE SCIENCE REAL ESTATE SUPPLY: AFTERMATH OF COVID

79ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Refer to "Megacampus" in the appendix. 1. As of September 30, 2024. 2. Source: ARE company update from Deutsche Bank AG. ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM AND WORLD-CLASS BRAND PROVIDE THE COMPANY A COMPETITIVE ADVANTAGE VS. NEW SUPPLY DELIVERIES SCALE Largest and highest-quality laboratory infrastructure platform with ~800 tenants1 SPONSORSHIP Most experienced and well-capitalized life science real estate owner, operator, and developer LOCATION Best assets in the best locations, primarily in high-barrier-to-entry submarkets … the market is quickly evolving into one where only those companies with good assets, in good locations, with strong balance sheets and deep industry relationships win. DEUTSCHE BANK AG October 21, 20242

80ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 As of September 30, 2024. 1. Represents average occupancy of operating properties in North America as of each December 31 from 2015 through 2023 and as of September 30, 2024. Alexandria’s Consistently HIGH OCCUPANCY STRONG HISTORICAL OCCUPANCY 96% OVER PAST 10 YEARS1 3Q24 OPERATING OCCUPANCY ACROSS KEY LOCATIONS 94.7% 94.6% 94.1% 96.0% North America Greater Boston San Francisco Bay Area San Diego ALEXANDRIA REMAINS THE MOST TRUSTED BRAND IN LIFE SCIENCE REAL ESTATE

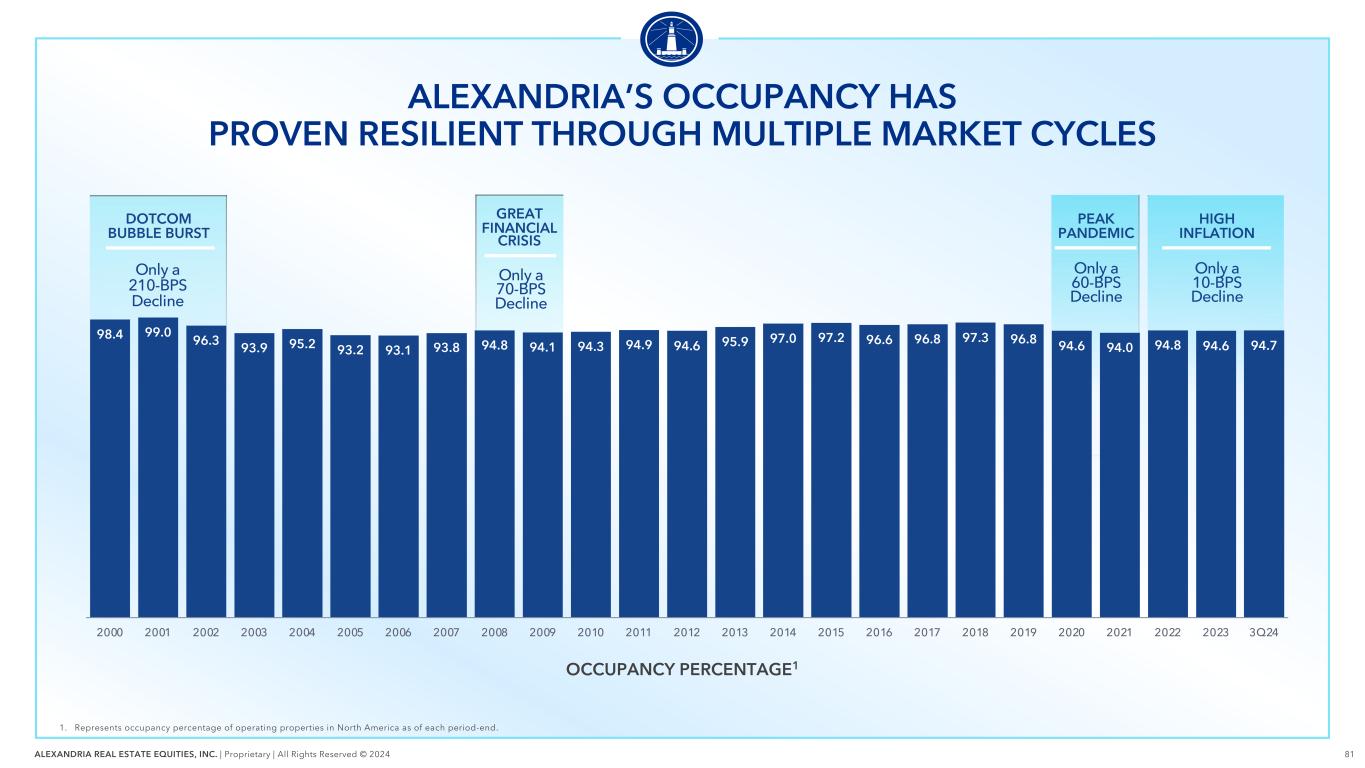

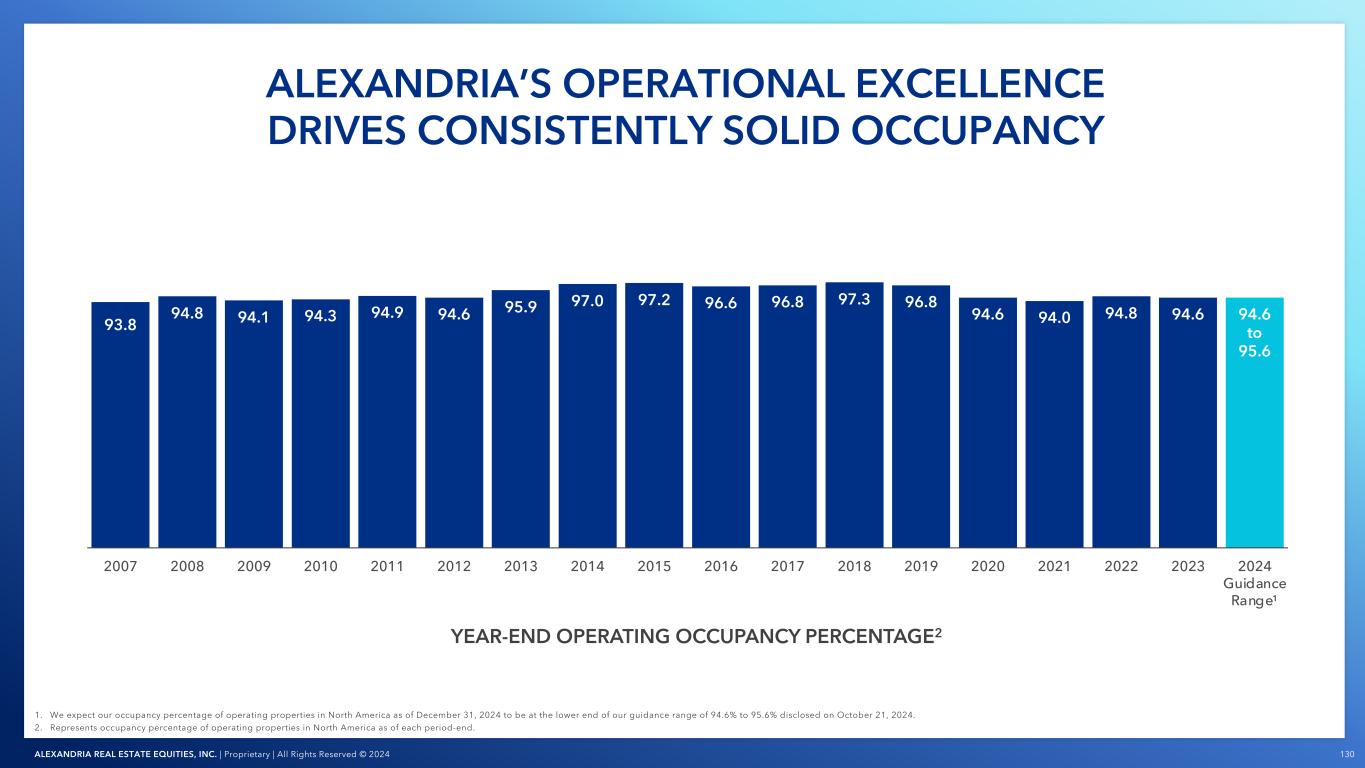

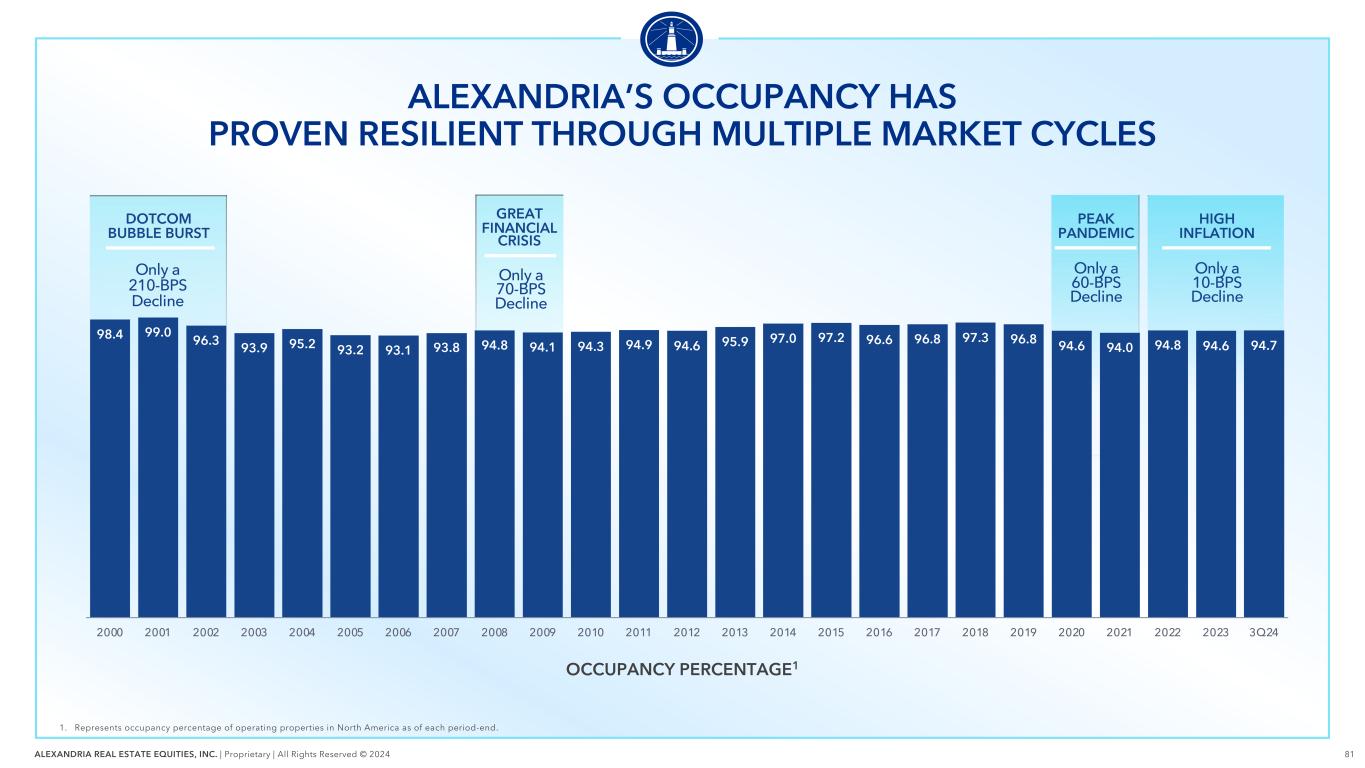

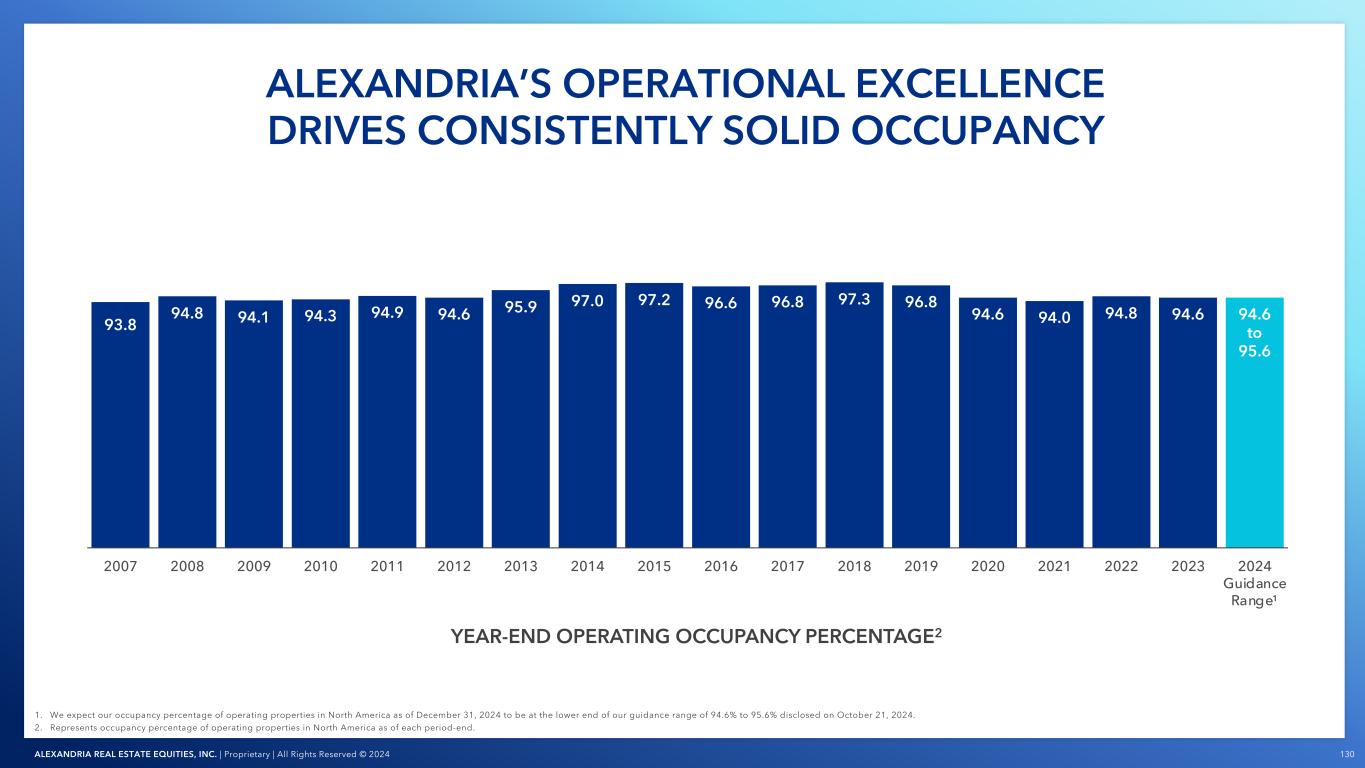

81ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 GREAT FINANCIAL CRISIS Only a 70-BPS Decline OCCUPANCY PERCENTAGE1 DOTCOM BUBBLE BURST Only a 210-BPS Decline PEAK PANDEMIC Only a 60-BPS Decline HIGH INFLATION Only a 10-BPS Decline 98.4 99.0 96.3 93.9 95.2 93.2 93.1 93.8 94.8 94.1 94.3 94.9 94.6 95.9 97.0 97.2 96.6 96.8 97.3 96.8 94.6 94.0 94.8 94.6 94.7 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 3Q24 ALEXANDRIA’S OCCUPANCY HAS PROVEN RESILIENT THROUGH MULTIPLE MARKET CYCLES 1. Represents occupancy percentage of operating properties in North America as of each period-end.

82ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria’s 2024/2025 Development and Redevelopment LEASING OUTPERFORMANCE 99% ALEXANDRIA DELIVERIES LEASED1 vs 39% COMPETITIVE SUPPLY LEASED2 ALEXANDRIA REMAINS THE MOST TRUSTED BRAND IN LIFE SCIENCE REAL ESTATE 1. As of September 30, 2024. 2. Represents the percentage of RSF leased as of September 30, 2024 at active development and redevelopment projects in the Greater Boston, San Francisco Bay Area, and San Diego markets that are expected to stabilize in 4Q24 through 4Q25. 3. Source: Alexandria’s proprietary competitive supply database. Represents the percentage of RSF leased as of September 30, 2024 for competitive supply projects in the Greater Boston, San Francisco Bay Area, and San Diego markets expected to deliver in 4Q24 through 4Q25. Refer to “Competitive supply” in the appendix. GREATER BOSTON | SAN FRANCISCO BAY AREA | SAN DIEGO

83ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 Alexandria’s Leading Labspace® Platform CONTINUES TO CAPTURE OUTSIZED SHARE OF DEMAND 1. Source: Alexandria’s proprietary competitive supply database. Represents Alexandria’s total leasing executed during the year ended December 31, 2023 and the nine months ended September 30, 2024 in the Greater Boston, San Francisco Bay Area, and San Diego markets compared to the sum of total leasing executed by the next five largest life science real estate owners within the respective markets. Refer to “Competitive supply” in the appendix. ALEXANDRIA LEASED 1.5x MORE THAN THE NEXT FIVE LIFE SCIENCE REAL ESTATE OWNERS COMBINED1 2023–3Q24 ALEXANDRIA REMAINS THE MOST TRUSTED BRAND IN LIFE SCIENCE REAL ESTATE

84ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 WHAT SUPPLY IS COMPETITIVE? Projects are considered competitive if included as options in market tours for life science companies with space requirements Refer to “Competitive supply” in the appendix. KEY ATTRIBUTES OF A COMPETITIVE PROJECT Factors Considered Not All Need to Be Met GEOGRAPHIC DESIRABILITY PROJECT QUALITY LIFE SCIENCE READINESS SPONSORSHIP EXPERIENCE FINANCIAL CAPABILITIES

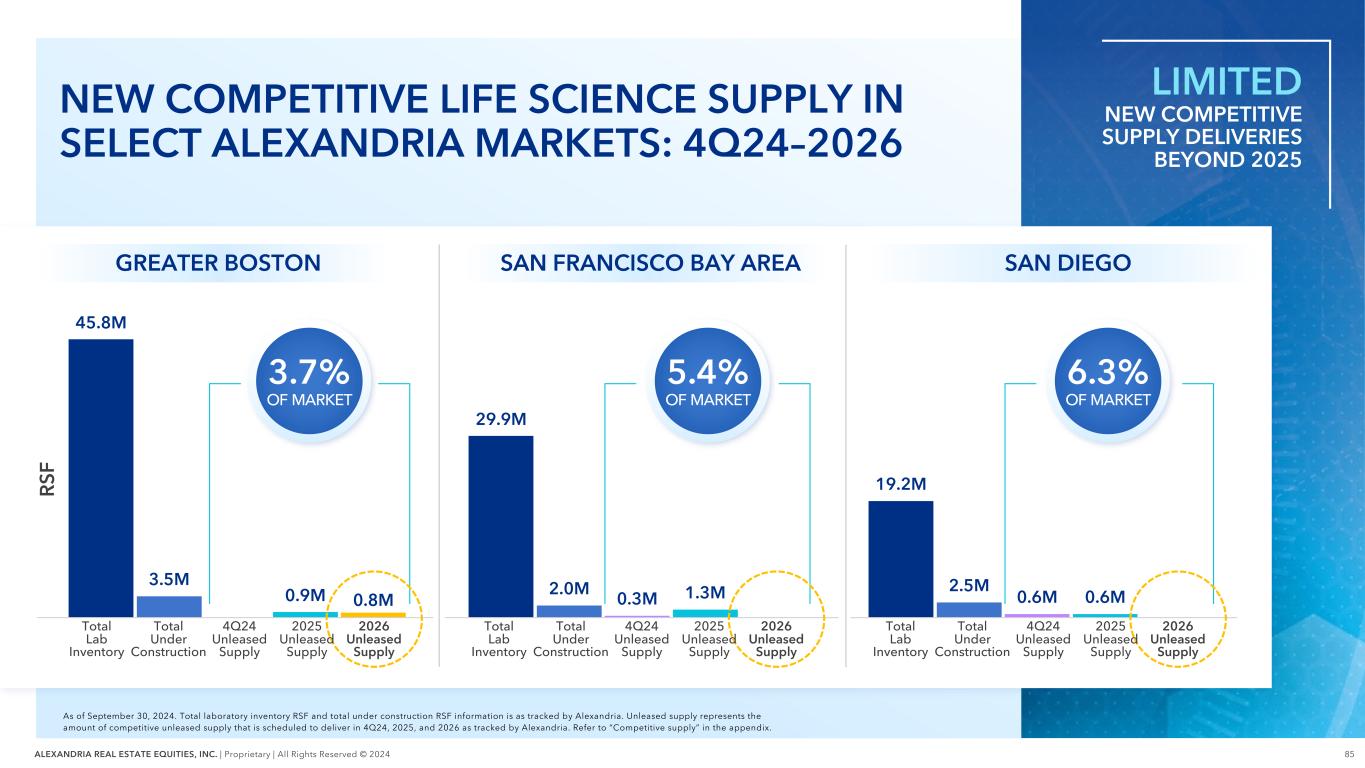

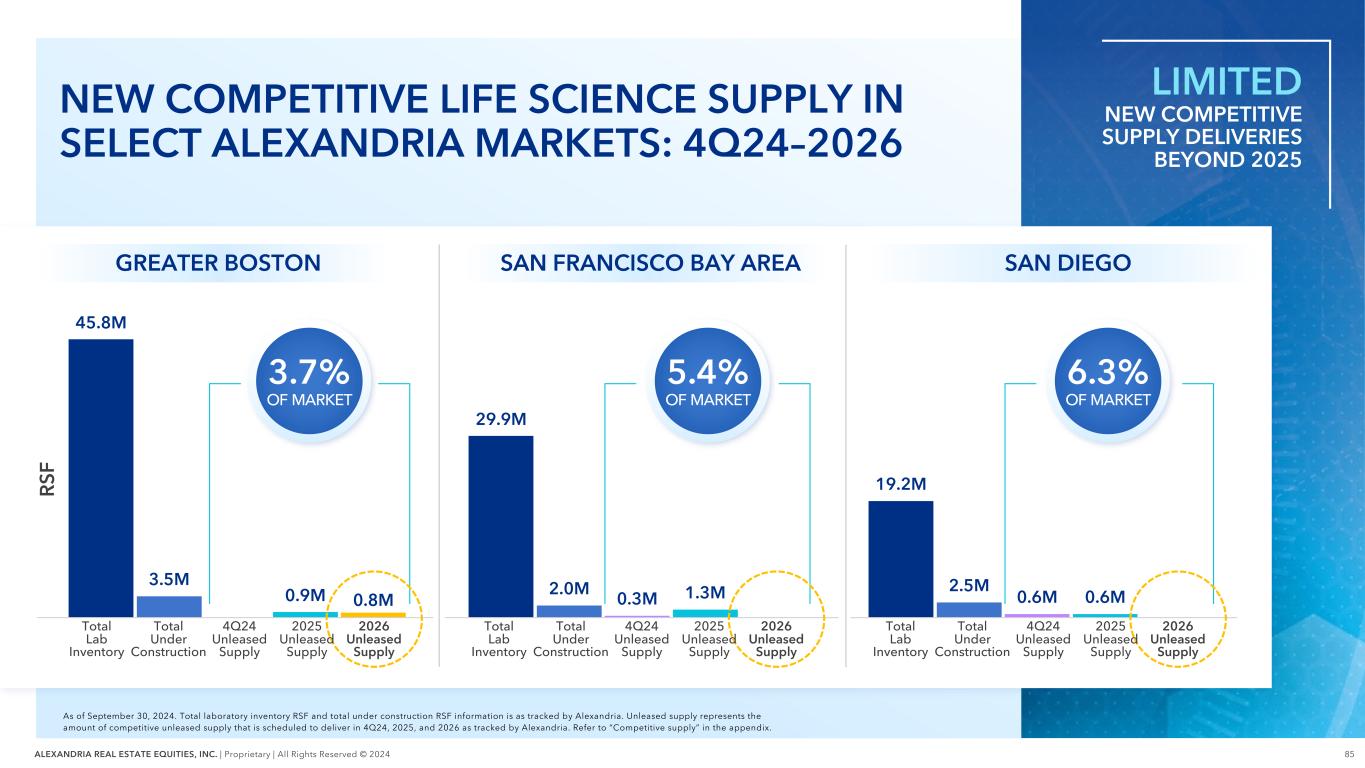

85ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 45.8M 29.9M 19.2M 3.5M 2.0M 2.5M 0.3M 0.6M0.9M 1.3M 0.6M0.8M NEW COMPETITIVE LIFE SCIENCE SUPPLY IN SELECT ALEXANDRIA MARKETS: 4Q24–2026 As of September 30, 2024. Total laboratory inventory RSF and total under construction RSF information is as tracked by Alexandria. Unleased supply represents the amount of competitive unleased supply that is scheduled to deliver in 4Q24, 2025, and 2026 as tracked by Alexandria. Refer to “Competitive supply” in the appendix. Total Under Construction Total Lab Inventory 4Q24 Unleased Supply 2026 Unleased Supply 3.7% OF MARKET LIMITED NEW COMPETITIVE SUPPLY DELIVERIES BEYOND 2025 2025 Unleased Supply Total Under Construction Total Lab Inventory 4Q24 Unleased Supply 2026 Unleased Supply 5.4% OF MARKET 2025 Unleased Supply Total Under Construction Total Lab Inventory 4Q24 Unleased Supply 2026 Unleased Supply 6.3% OF MARKET 2025 Unleased Supply GREATER BOSTON SAN FRANCISCO BAY AREA SAN DIEGO R SF

86ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 LIMITED NEW SUPPLY DELIVERING IN HIGH-BARRIER-TO-ENTRY SUBMARKETS As of September 30, 2024. Refer to ”Annual rental revenue” and “Competitive supply” in the appendix. RSF reflects deliveries by Alexandria and other competitive supply as tracked by Alexandria. 0.3M RSF DELIVERIES TORREY PINES, SAN DIEGO 79% PRE-LEASED WEIGHTED AVERAGE 1.4M RSF DELIVERIES CAMBRIDGE, GREATER BOSTON 100% PRE-LEASED 0.2M RSF DELIVERIES MISSION BAY, SAN FRANCISCO BAY AREA 0% PRE-LEASED 4Q24–2026 ALEXANDRIA AND COMPETITIVE SUPPLY DELIVERIES THESE SUBMARKETS ACCOUNT FOR NEARLY ONE-THIRD OF OUR ANNUAL RENTAL REVENUE

87ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S SUPERIOR PROJECTS OUTPERFORM COMPETITIVE SUPPLY As of September 30, 2024. Refer to “Competitive supply” in the appendix. WATERTOWN GREATER BOSTON 63% ALEXANDRIA LEASED vs 38% COMPETITIVE SUPPLY LEASED 2023–2026 DEVELOPMENT AND REDEVELOPMENT DELIVERIES IN WATERTOWN THE ARSENAL ON THE CHARLES MEGACAMPUS™

88ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA TECHNOLOGY CENTER® – GATEWAY MEGACAMPUS™ALEXANDRIA’S SUPERIOR PROJECTS OUTPERFORM COMPETITIVE SUPPLY As of September 30, 2024. Refer to “Competitive supply” in the appendix. SOUTH SAN FRANCISCO SAN FRANCISCO BAY AREA 69% ALEXANDRIA LEASED vs 21% COMPETITIVE SUPPLY LEASED 2023–2026 DEVELOPMENT AND REDEVELOPMENT DELIVERIES IN SOUTH SAN FRANCISCO

89ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S SUPERIOR PROJECTS OUTPERFORM COMPETITIVE SUPPLY As of September 30, 2024. Refer to “Competitive supply” in the appendix. 70% ALEXANDRIA LEASED vs 8% COMPETITIVE SUPPLY LEASED 2023–2026 DEVELOPMENT AND REDEVELOPMENT DELIVERIES IN SORRENTO MESA SD TECH BY ALEXANDRIA MEGACAMPUS™ SORRENTO MESA SAN DIEGO

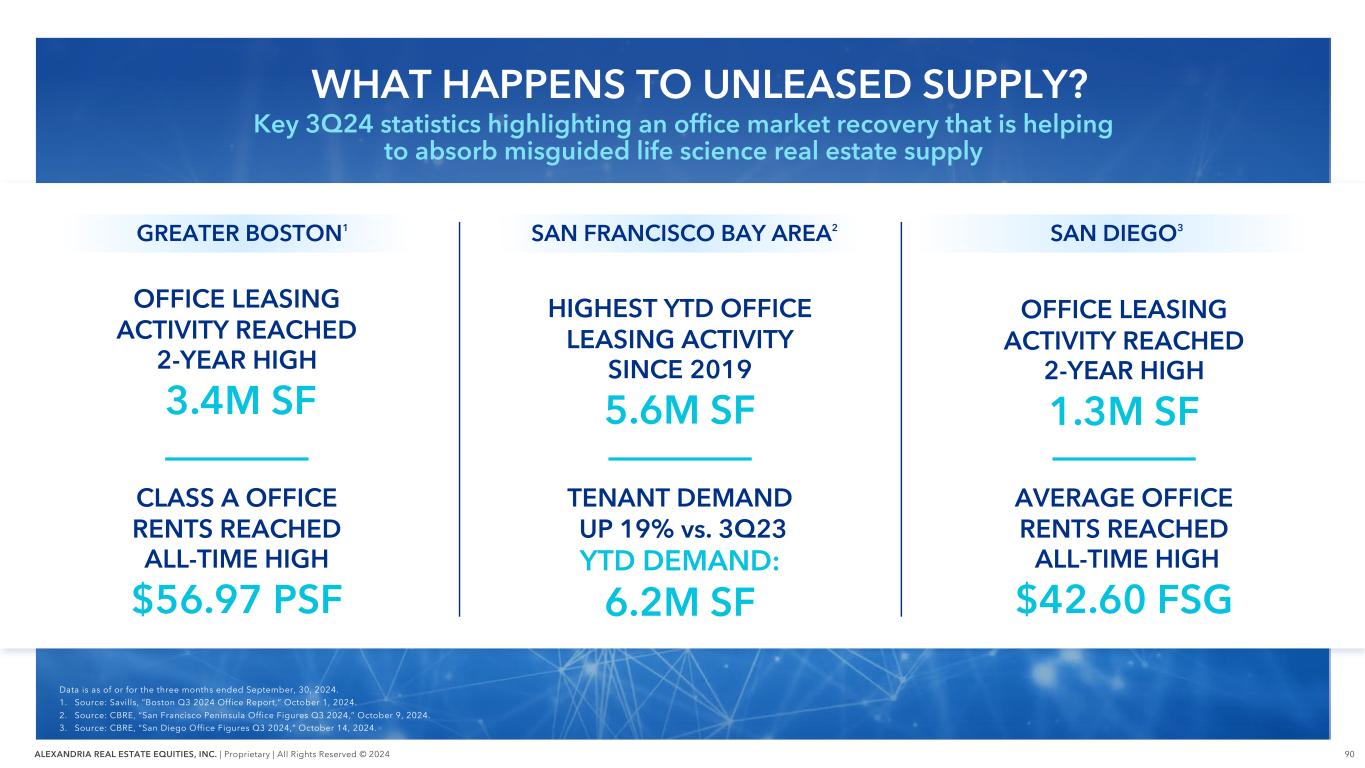

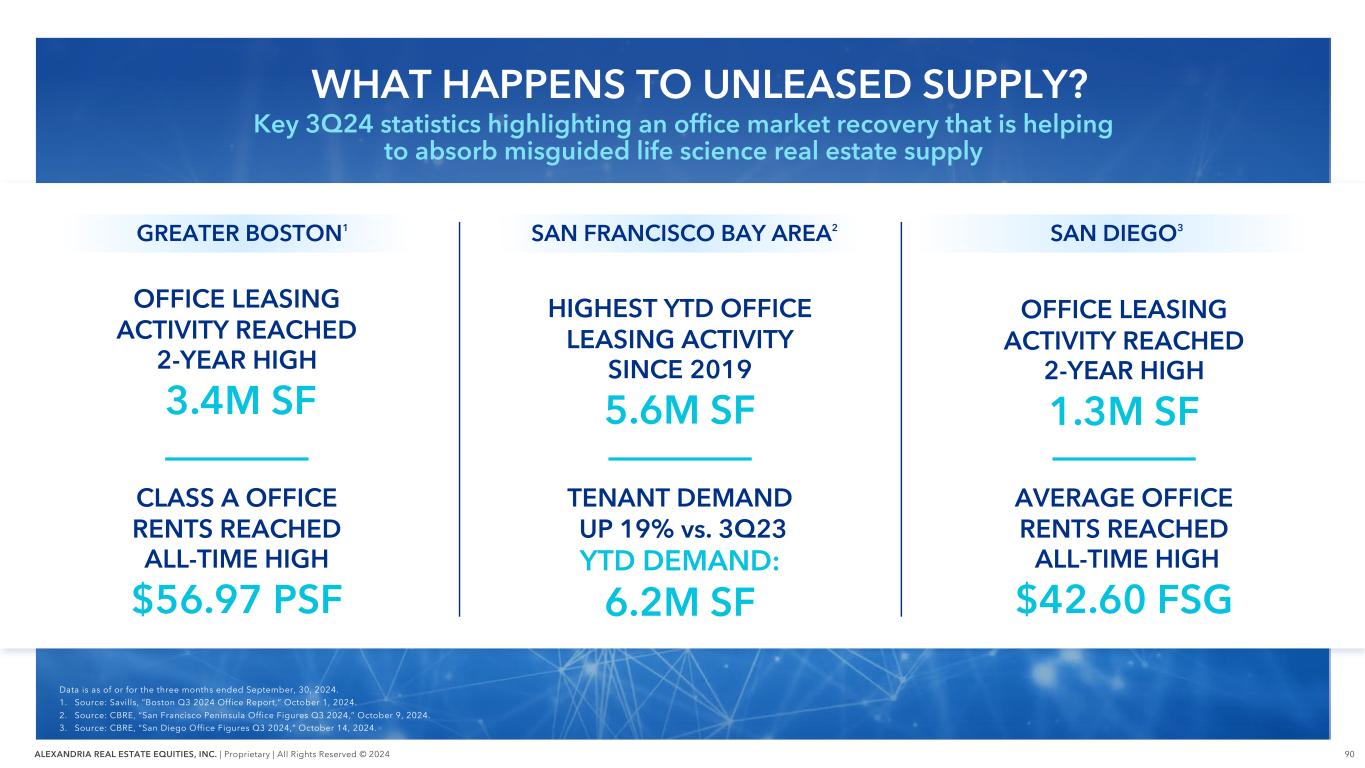

90ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 WHAT HAPPENS TO UNLEASED SUPPLY? Data is as of or for the three months ended September, 30, 2024. 1. Source: Savills, “Boston Q3 2024 Office Report,” October 1, 2024. 2. Source: CBRE, “San Francisco Peninsula Office Figures Q3 2024,” October 9, 2024. 3. Source: CBRE, “San Diego Office Figures Q3 2024,” October 14, 2024. OFFICE LEASING ACTIVITY REACHED 2-YEAR HIGH 3.4M SF CLASS A OFFICE RENTS REACHED ALL-TIME HIGH $56.97 PSF OFFICE LEASING ACTIVITY REACHED 2-YEAR HIGH 1.3M SF AVERAGE OFFICE RENTS REACHED ALL-TIME HIGH $42.60 FSG HIGHEST YTD OFFICE LEASING ACTIVITY SINCE 2019 5.6M SF TENANT DEMAND UP 19% vs. 3Q23 YTD DEMAND: 6.2M SF Key 3Q24 statistics highlighting an office market recovery that is helping to absorb misguided life science real estate supply GREATER BOSTON1 SAN FRANCISCO BAY AREA2 SAN DIEGO3

91ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM AND WORLD-CLASS BRAND PROVIDE THE COMPANY A SIGNIFICANT COMPETITIVE ADVANTAGE VS. NEW SUPPLY DELIVERIES ALEXANDRIA’S MEGACAMPUS PLATFORM Main & Main Locations Unmatched Scale Operational Excellence Consistently High Occupancy Strong Relative Leasing Performance Strong Tenant Retention Loyal Tenant Base COMPETITIVE SUPPLY Tertiary Locations One-Off Buildings Largely Inexperienced Operators High Vacancy No Path for Growth Operating Risk No Embedded Tenant Base 99% 39% LEASED 2024/2025 DELIVERIES1 LEASED 2024/2025 DELIVERIES2 As of September 30, 2024. Refer to “Competitive supply” and “Megacampus” in the appendix. 1. Represents the percentage of RSF leased as of September 30, 2024 at active development and redevelopment projects in the Greater Boston, San Francisco Bay Area, and San Diego markets that are expected to stabilize in 4Q24 through 4Q25. 2. Source: Alexandria’s proprietary competitive supply database. Represents the percentage of RSF leased as of September 30, 2024 for competitive supply projects in the Greater Boston, San Francisco Bay Area, and San Diego markets expected to deliver in 4Q24 through 4Q25.

92ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 ALEXANDRIA’S CAPITAL RECYCLING STRATEGY: FUNDING SELF-SUFFICIENCY

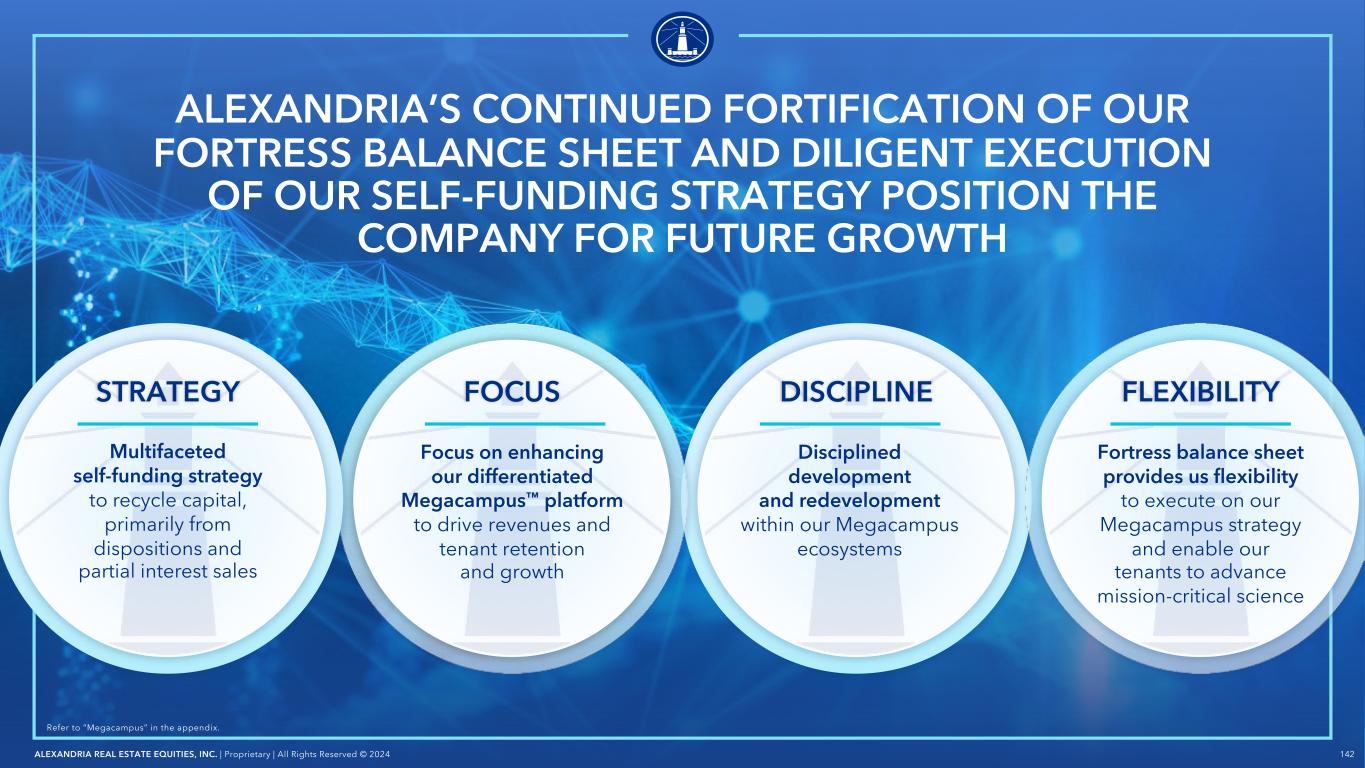

93ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 LEVERAGE- NEUTRAL DEBT CASH FLOWS FROM OPERATING ACTIVITIES¹ OUTRIGHT DISPOSITIONS PARTIAL INTEREST SALES 1. Represents net cash provided by operating activities after dividends and distributions to noncontrolling interests. Refer to “Net cash provided by operating activities after dividends” in the appendix. ALEXANDRIA’S MULTIFACETED STRATEGIC SELF-FUNDING TOOLS

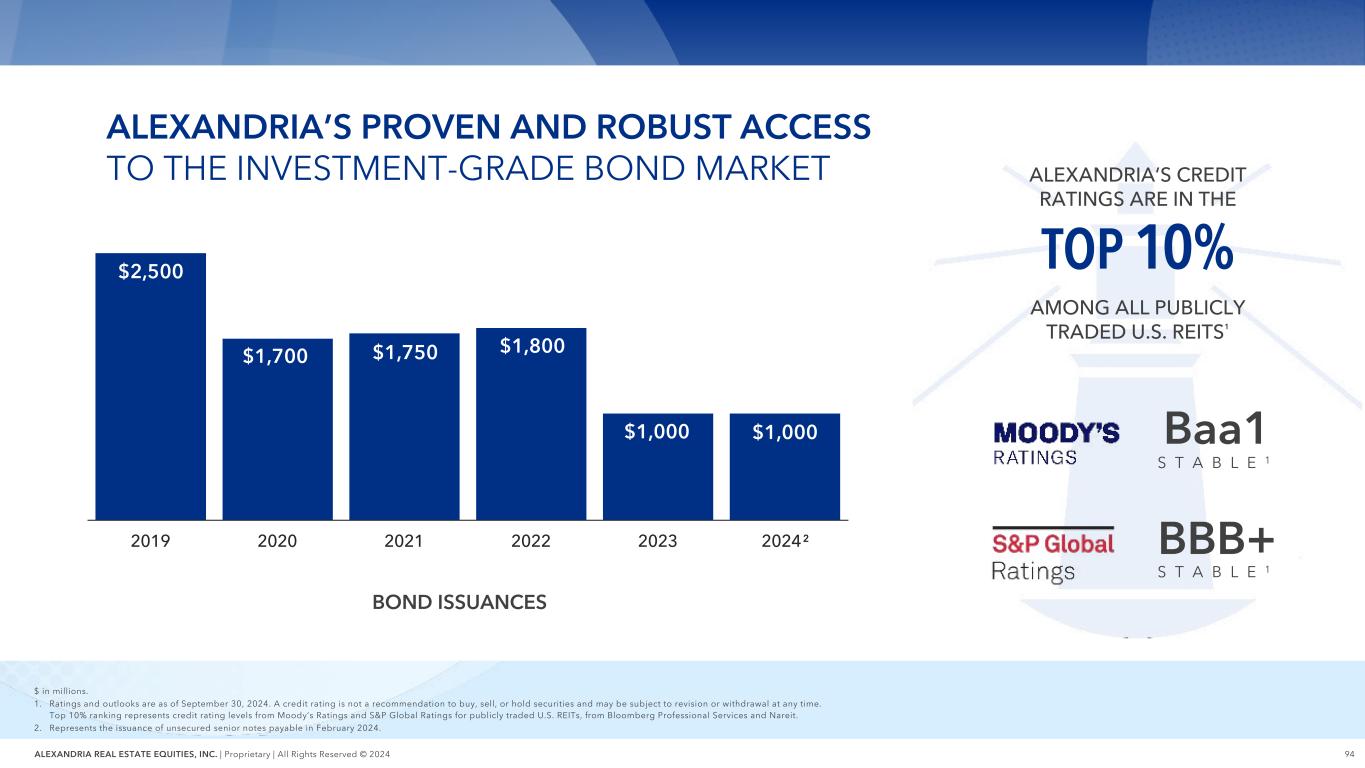

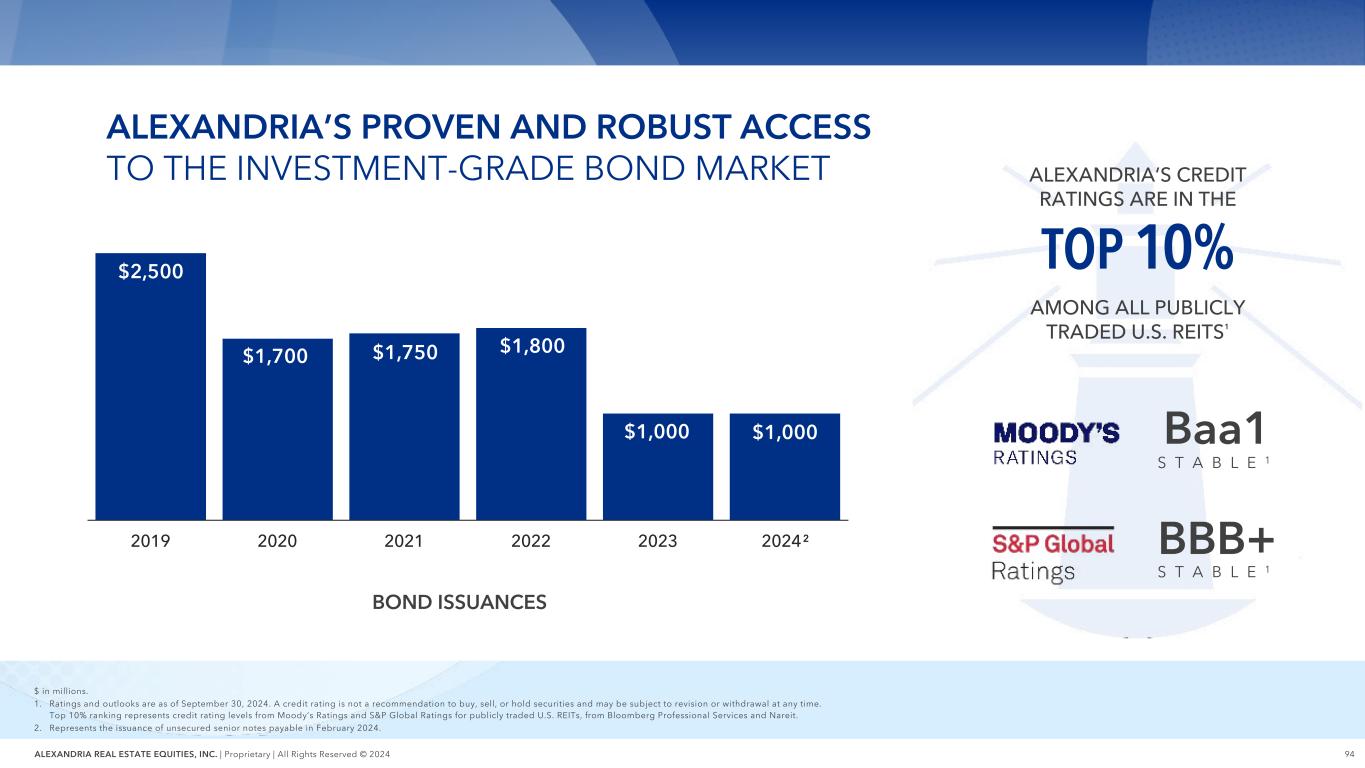

94ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 $ in millions. 1. Ratings and outlooks are as of September 30, 2024. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. Top 10% ranking represents credit rating levels from Moody’s Ratings and S&P Global Ratings for publicly traded U.S. REITs, from Bloomberg Professional Services and Nareit. 2. Represents the issuance of unsecured senior notes payable in February 2024. $2,500 $1,700 $1,750 $1,800 $1,000 $1,000 2019 2020 2021 2022 2023 2024² BOND ISSUANCES S T A B L E 1 BBB+ S T A B L E 1 Baa1 TOP 10% AMONG ALL PUBLICLY TRADED U.S. REITS¹ ALEXANDRIA’S CREDIT RATINGS ARE IN THE ALEXANDRIA’S PROVEN AND ROBUST ACCESS TO THE INVESTMENT-GRADE BOND MARKET

95ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 $222M $450M 2019 2024 Projected² NET CASH PROVIDED BY OPERATING ACTIVITIES AFTER DIVIDENDS Refer to “Net cash provided by operating activities after dividends” in the appendix. 1. Represents net cash provided by operating activities after dividends for the years ended December 31, 2019 through 2023 and the midpoint of our 2024 guidance range disclosed on October 21, 2024. 2. Represents the midpoint of our guidance range for 2024 net cash provided by operating activities after dividends disclosed on October 21, 2024. ALEXANDRIA’S CONSISTENT INCREASE IN ANNUAL CASH FLOWS PROVIDES SIGNIFICANT CAPITAL FOR REINVESTMENT 103% INCREASE $2.3B TOTAL SINCE 2019¹

96ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. Represents dispositions and partial interest sales from January 1, 2019 through December 31, 2024. Amounts for the year ending December 31, 2024 include completed dispositions and pending dispositions subject to non- refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 2. Represents the weighted-average capitalization rate and capitalization rate (cash basis) for dispositions and partial interest sales (excluding land) completed during the years ended December 31, 2019 through 2023 and completed dispositions and pending dispositions (excluding land) subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. Refer to “Capitalization rates” in the appendix. 3. Represents the net gain and loss for outright sales as well as consideration in excess of book value for partial interest sales. $9.7B TOTAL SALES 74 TOTAL TRANSACTIONS 5.2% CAPITALIZATION RATE (CASH BASIS)² 5.5% CAPITALIZATION RATE² DISPOSITIONS 2019–2024¹ $2.8B NET GAIN³ ALEXANDRIA’S LONGSTANDING TRACK RECORD OF MONETIZING EMBEDDED ASSET VALUE

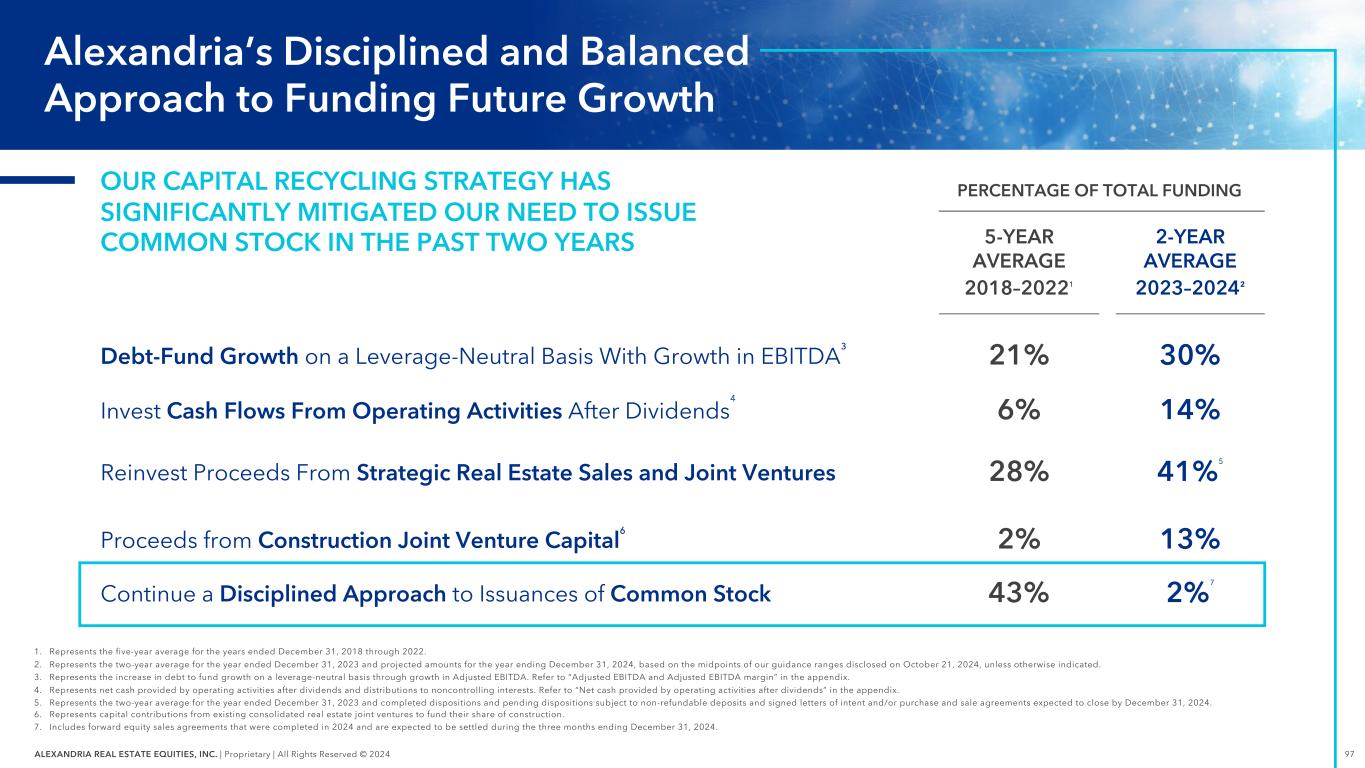

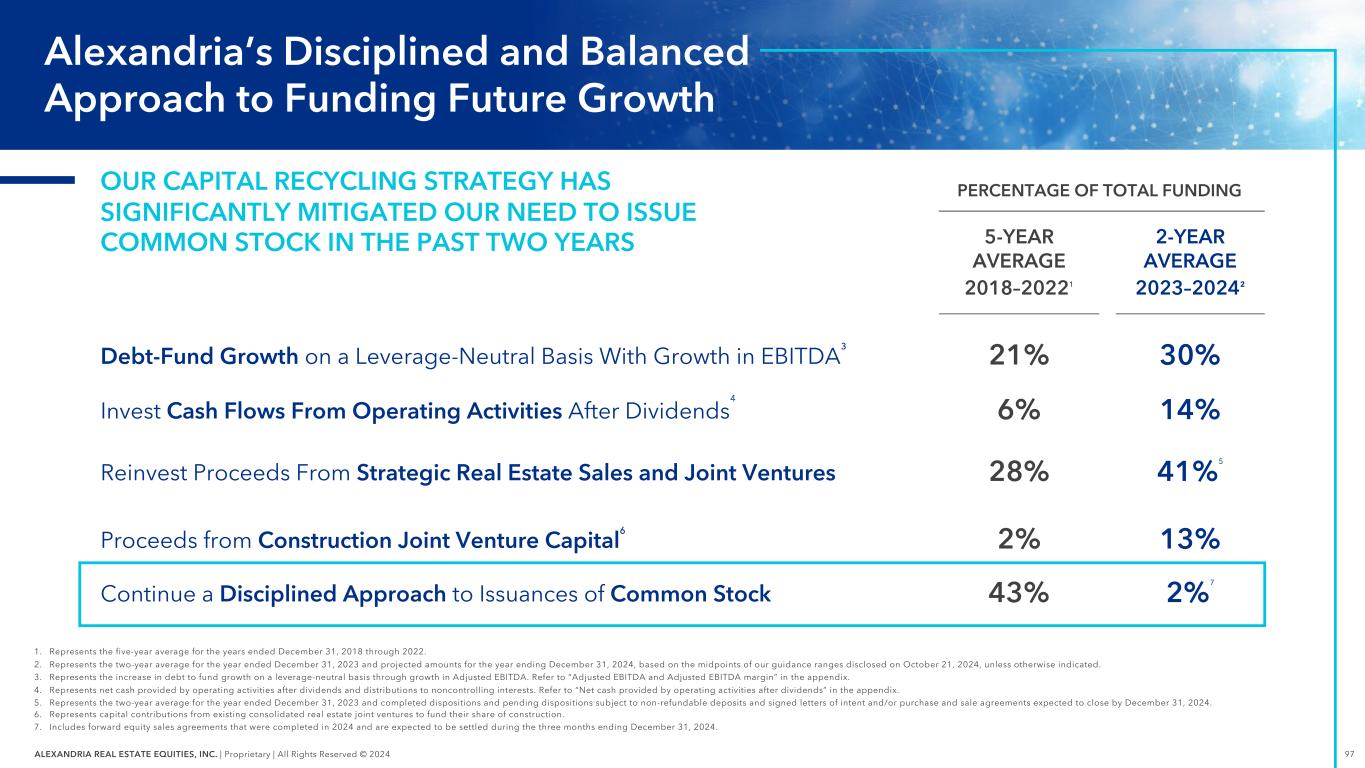

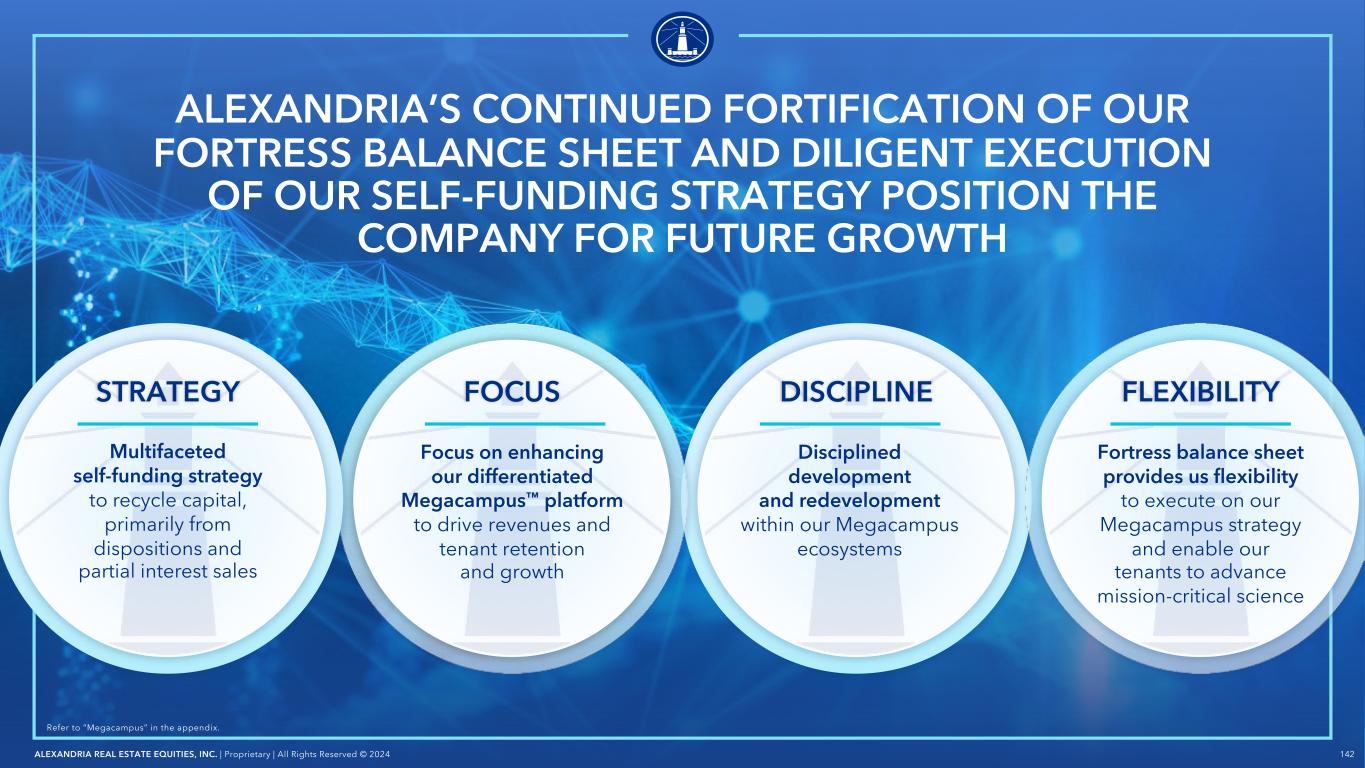

97ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. Represents the five-year average for the years ended December 31, 2018 through 2022. 2. Represents the two-year average for the year ended December 31, 2023 and projected amounts for the year ending December 31, 2024, based on the midpoints of our guidance ranges disclosed on October 21, 2024, unless otherwise indicated. 3. Represents the increase in debt to fund growth on a leverage-neutral basis through growth in Adjusted EBITDA. Refer to “Adjusted EBITDA and Adjusted EBITDA margin” in the appendix. 4. Represents net cash provided by operating activities after dividends and distributions to noncontrolling interests. Refer to “Net cash provided by operating activities after dividends” in the appendix. 5. Represents the two-year average for the year ended December 31, 2023 and completed dispositions and pending dispositions subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 6. Represents capital contributions from existing consolidated real estate joint ventures to fund their share of construction. 7. Includes forward equity sales agreements that were completed in 2024 and are expected to be settled during the three months ending December 31, 2024. 5-YEAR AVERAGE 2-YEAR AVERAGE 2018–2022¹ 2023–2024² Debt-Fund Growth on a Leverage-Neutral Basis With Growth in EBITDA³ 21% 30% Invest Cash Flows From Operating Activities After Dividends⁴ 6% 14% Reinvest Proceeds From Strategic Real Estate Sales and Joint Ventures 28% 41%⁵ Proceeds from Construction Joint Venture Capital⁶ 2% 13% Continue a Disciplined Approach to Issuances of Common Stock 43% 2%⁷ Alexandria’s Disciplined and Balanced Approach to Funding Future Growth OUR CAPITAL RECYCLING STRATEGY HAS SIGNIFICANTLY MITIGATED OUR NEED TO ISSUE COMMON STOCK IN THE PAST TWO YEARS PERCENTAGE OF TOTAL FUNDING

98ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. Represents cost at completion and weighted-average initial stabilized yields for all development and redevelopment deliveries, partial deliveries, and projected deliveries from January 1, 2019 through December 31, 2024. Refer to ”Initial stabilized yield (unlevered)” in the appendix. 2019–2024¹ 6.9% YIELD 6.3% YIELD (CASH BASIS) $10.5B COST AT COMPLETION ALEXANDRIA’S DEVELOPMENT AND REDEVELOPMENT DELIVERIES

99ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S ACCRETIVE REINVESTMENT STRATEGY Refer to ”Capitalization rates” and ”Initial stabilized yield (unlevered)” in the appendix. 1. Represents the margin between disposition capitalization rates and delivery yields for the period between January 1, 2019 and December 31, 2024. 2. Represents the weighted-average capitalization rate for dispositions and partial interest sales (excluding land) completed during the years ended December 2019 through 2023 and completed dispositions and pending dispositions (excluding land) subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 3. Represents weighted-average initial stabilized yield for all development and redevelopment deliveries, partial deliveries, and projected deliveries from January 1, 2019 through December 31, 2024. 5.5% 6.9% Cap Rate² Yield³ DISPOSITION CAPITALIZATION RATES vs. DELIVERY YIELDS (2019–2024) 25.6% Alexandria’s Value-Creation Margin From 2019 to 2024¹

100ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 1. For the years ended December 31, 2019 through 2023 and the midpoint of our guidance ranges for the year ending December 31, 2024 disclosed on October 21, 2024, unless otherwise indicated. 2. Represents net cash provided by operating activities after dividends and distributions to noncontrolling interests. Refer to “Net cash provided by operating activities after dividends” in the appendix. 3. Represents dispositions and partial interest sales from January 1, 2019 through December 31, 2024. Amounts for the year ending December 31, 2024 include completed dispositions and pending dispositions subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 4. Represents capital contributions from existing consolidated real estate joint ventures to fund their share of construction. $2.3B Cash Flows From Operating Activities² $9.7B Total Sales Across 74 Transactions³ $9.8B Bonds Issued SUCCESSFUL TRACK RECORD OF EXECUTION IN EVER-CHANGING MARKET CONDITIONS 2019–2024¹ $1.4B Funding From JVs for Construction⁴ ALEXANDRIA’S MULTIFACETED STRATEGIC SELF-FUNDING TOOLS LEVERAGE-NEUTRAL DEBT CASH FLOWS FROM OPERATING ACTIVITIES² OUTRIGHT DISPOSITIONS PARTIAL INTEREST SALES FUNDING FROM JVs FOR CONSTRUCTION

101ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 $1.05B TO $2.05B ALEXANDRIA’S STRATEGIC DISPOSITIONS FOR 2024 $370M 24%³ PENDING Subject to Signed LOI/PSA $724M 48%³ NON-REFUNDABLE $433M 28%³ COMPLETED² $1.1B REMAINING⁴ 1. Represents our guidance range for 2024 dispositions and common equity disclosed on October 21, 2024. 2. Represents dispositions completed from January 1, 2024 through December 4, 2024. 3. Percentages based upon total completed and pending dispositions expected to close by December 31, 2024. 4. Represents aggregate pending dispositions expected to be completed by December 31, 2024. GUIDANCE RANGE FOR 2024 DISPOSITIONS AND COMMON EQUITY¹

102ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S KEY 2024 STRATEGIC DISPOSITIONS As of December 4, 2024. Percentages represent estimated breakout of the types of dispositions that were completed or are pending subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. LIQUID PORTFOLIO OF DIVERSIFIED ASSETS PROVIDE DISPOSITION OPTIONALITY 42% USER SALE 22% LAND SALE (Stabilized and Non-Stabilized) 36% INVESTOR SALE (Stabilized and Non-Stabilized) RESIDENTIAL LAND SAN DIEGO 1165 EASTLAKE AVENUE EAST SEATTLE 14225 NEWBROOK DRIVE NORTHERN VIRGINIA

103ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 15 NECCO STREET | GREATER BOSTON 230 HARRIET TUBMAN WAY | SAN FRANCISCO BAY AREA ALEXANDRIA’S ASSET BASE TODAY 24% 76% MEGACAMPUS CORE AND NON-CORE CAMPUS POINT BY ALEXANDRIA | SAN DIEGO As of September 30, 2024. Refer to “Annual rental revenue” and “Megacampus” in the appendix. PERCENTAGE OF OUR ANNUAL RENTAL REVENUE ALEXANDRIA CENTER® FOR LIFE SCIENCE – SHADY GROVE | MARYLAND

104ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA IS INVESTING PRECIOUS CAPITAL INTO ASSETS WITH THE HIGHEST NET ASSET VALUE POTENTIAL Refer to “Megacampus” in the appendix. Gross margin for each Megacampus is calculated as gain divided by gross book value as of September 30, 2024. The gain for each Megacampus is calculated as follows: (a) our share of net operating income (cash basis) for the three months ended September 30, 2024 annualized divided by the submarket capitalization rate estimated by Green Street Advisors as of September 30, 2024, less (b) our share of net book value as of September 30, 2024, plus (c) to the extent we previously monetized a portion of a Megacampus through a partial interest sale, the consideration in excess of book value related to the partial interest sold at the time of joint venture. Refer to “Net operating income and net operating income (cash basis)” in the appendix. MEGACAMPUS™ ALEXANDRIA TECHNOLOGY SQUARE® Greater Boston 110% GROSS MARGIN MEGACAMPUS™ ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY – MISSION BAY San Francisco Bay Area 35% GROSS MARGIN MEGACAMPUS™ ALEXANDRIA CENTER® FOR LIFE SCIENCE – EASTLAKE Seattle 32% GROSS MARGIN

105ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S FUTURE STRATEGIC ASSET BASE PERCENTAGE OF ANNUAL RENTAL REVENUE Refer to “Annual rental revenue” and “Megacampus” in the appendix. 1. As of September 30, 2024. TODAY¹ STRATEGIC TARGET (2029) 24% 76% MEGACAMPUS CORE AND NON-CORE 10% 90% MEGACAMPUS CORE AND NON-CORE

106ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 STRATEGIC POSITIONING for FUTURE GROWTH ALEXANDRIA INVESTOR DAY 2024 ALEXANDRIA’S BALANCE SHEET AND 2025 GUIDANCE

107ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2024 ALEXANDRIA’S IMPRESSIVE FORTRESS BALANCE SHEET OFFERS FUTURE CAPITAL ALLOCATION OPPORTUNITIES ALEXANDRIA CENTER® FOR LIFE SCIENCE – SAN CARLOS MEGACAMPUS™ | GREATER STANFORD OUR INVESTMENT-GRADE CREDIT RATINGS AND LOW LEVERAGE will provide us with the ability to be opportunistic and take advantage of capital allocation strategies that drive future earnings growth

108ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S REIT INDUSTRY-LEADING CREDIT PROFILE Ratings and outlooks are as of September 30, 2024. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. Top 10% ranking represents credit rating levels from S&P Global Ratings and Moody’s Investors Service for publicly traded U.S. REITs, from Bloomberg Professional Services and Nareit. S T A B L E Baa1 S T A B L E BBB+ TOP 10% AMONG ALL PUBLICLY TRADED U.S. REITS ALEXANDRIA’S CREDIT RATINGS ARE IN THE

109ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024 ALEXANDRIA’S IMPRESSIVE KEY 2024 BALANCE SHEET ACCOMPLISHMENTS As of or for the nine months ended September 30, 2024, unless otherwise indicated. 1. Represents completed dispositions and pending dispositions subject to non-refundable deposits and signed letters of intent and/or purchase and sale agreements expected to close by December 31, 2024. 2. Represents projected capital contributions from existing consolidated real estate joint ventures to fund their share of construction from 4Q24 through 2027. 3. Debt rate and term are based on weighted averages. 4. Represents our guidance for net debt and preferred stock to Adjusted EBITDA for the three months ending December 31, 2024 annualized, disclosed on October 21, 2024. Refer to “Net debt and preferred stock to Adjusted EBITDA“ in the appendix. 5. Represents the midpoint of our guidance range for cash expected to be held at December 31, 2024, disclosed on October 21, 2024. SELF-FUNDED with $1.5B of dispositions¹ $1.0B of JV COMMITMENTS to fund future construction² $150M OF EXCESS CASH at 4Q24 that can be deployed in 2025⁵ LOW LEVERAGE at ≤5.1x⁴ for 4Q24 $1.0B BOND ISSUANCE at 5.48% with a 23-year term³ EXTENDED $5.0B LINE OF CREDIT

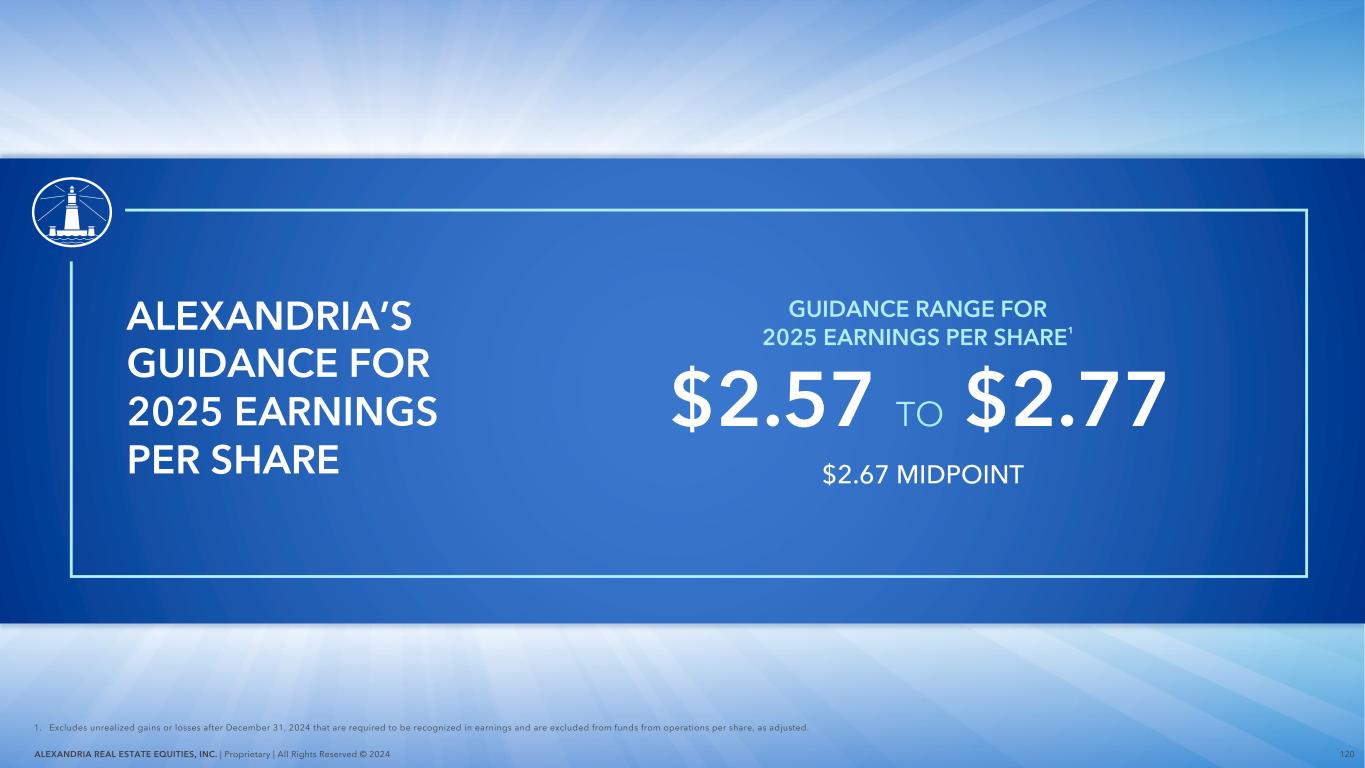

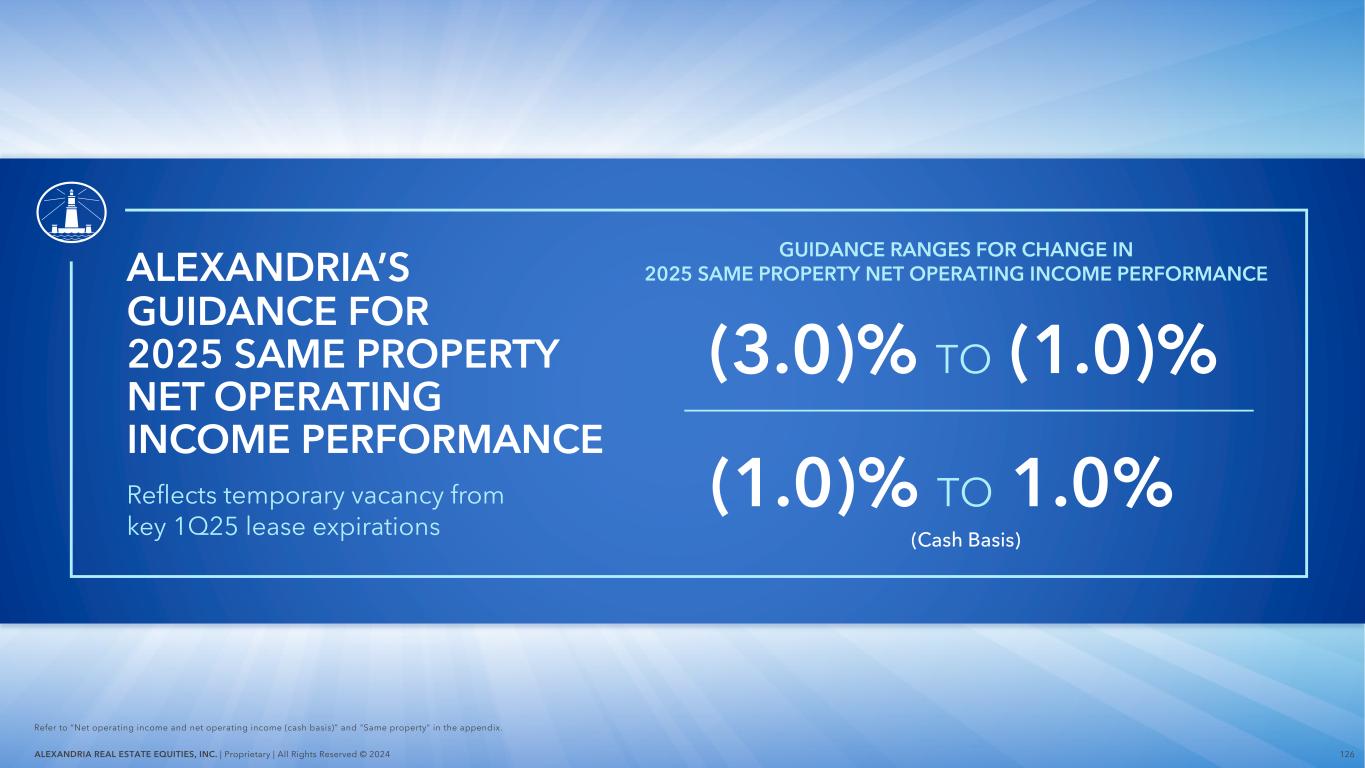

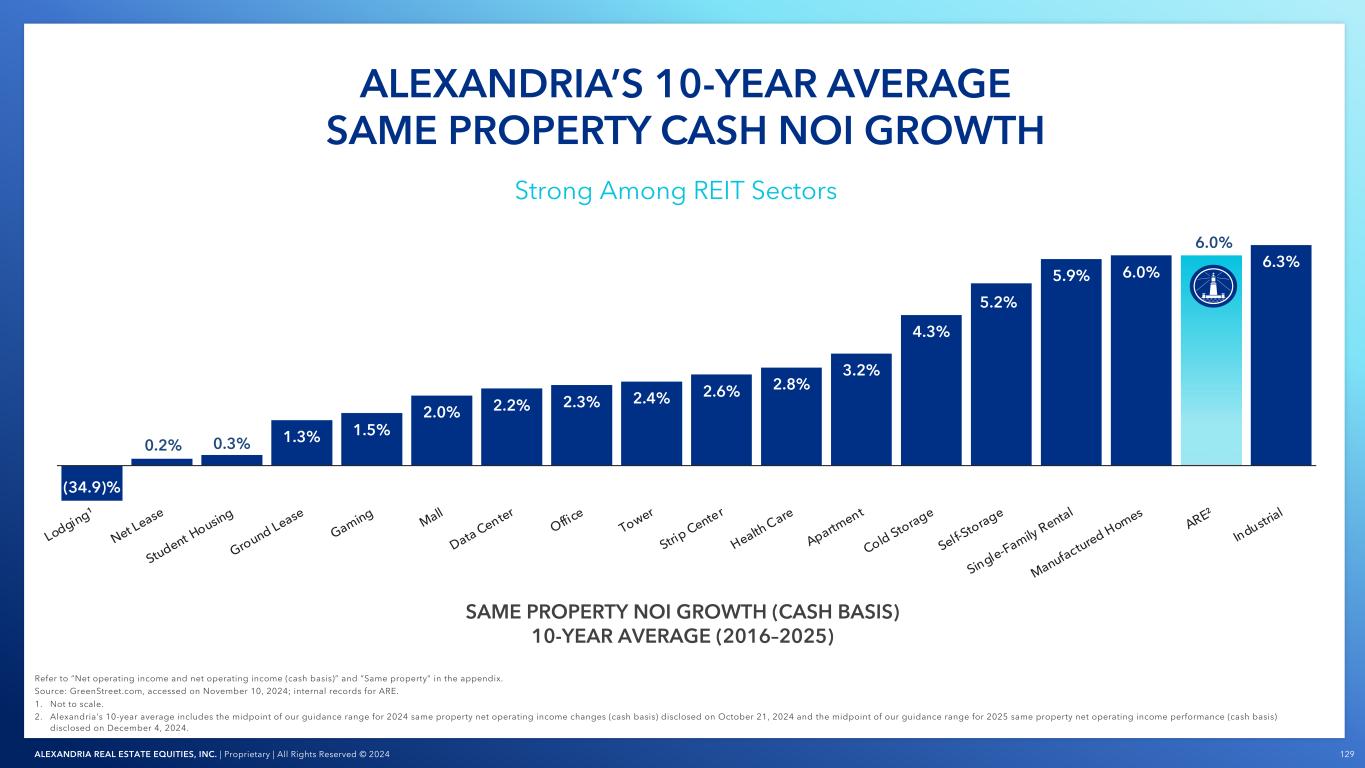

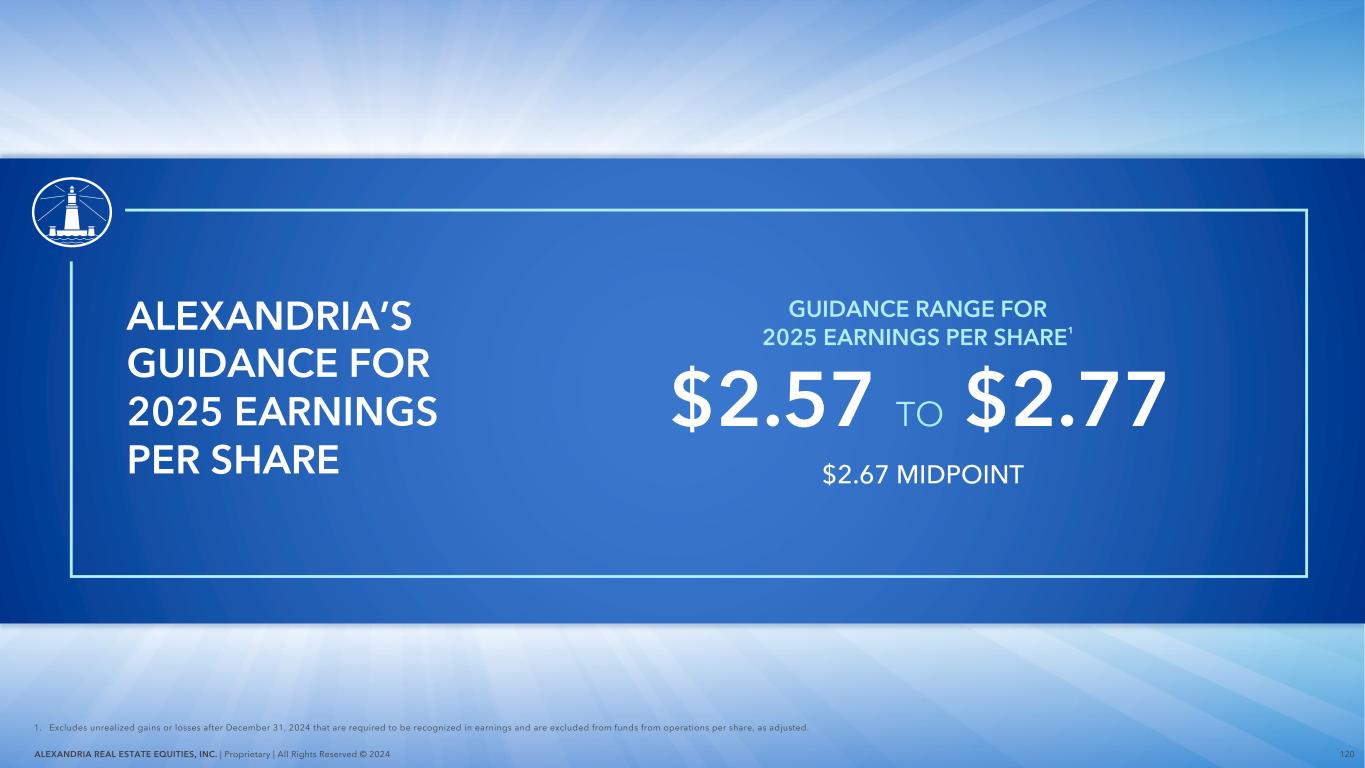

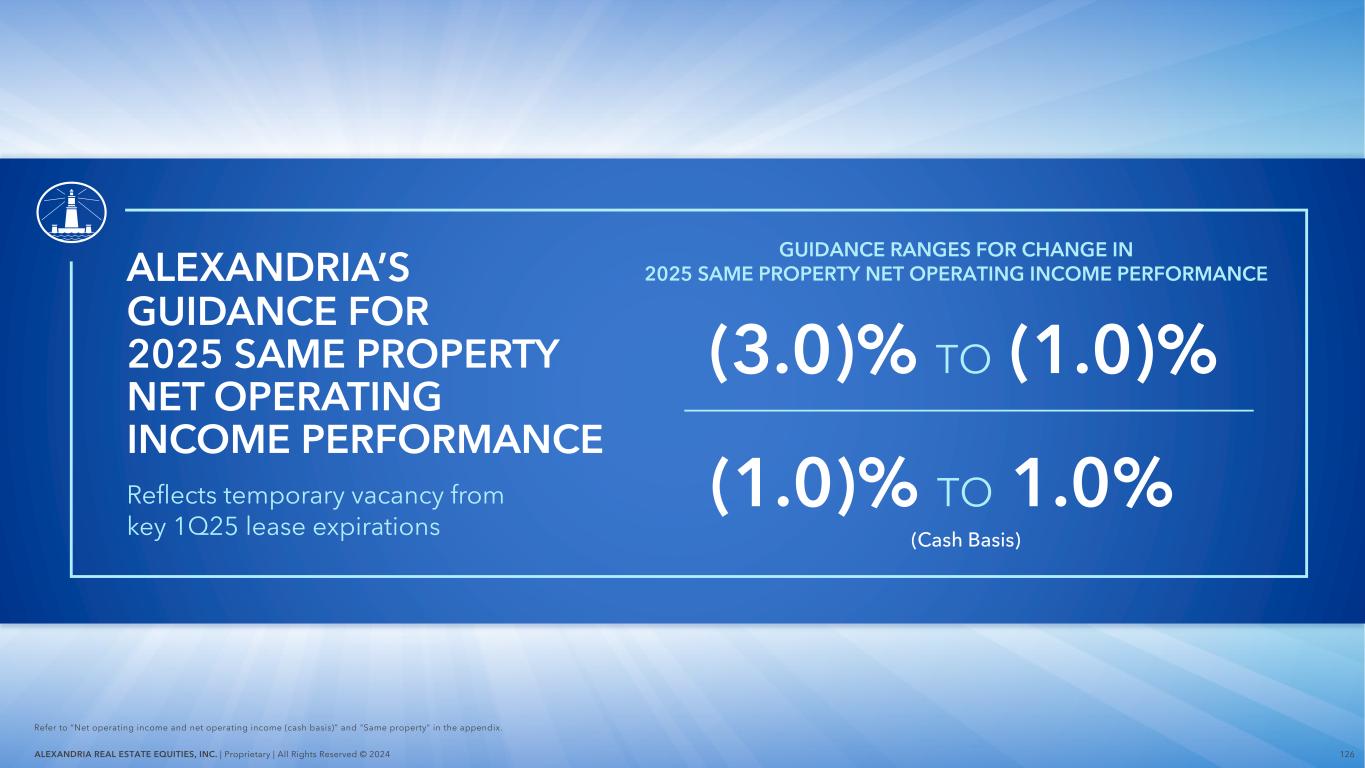

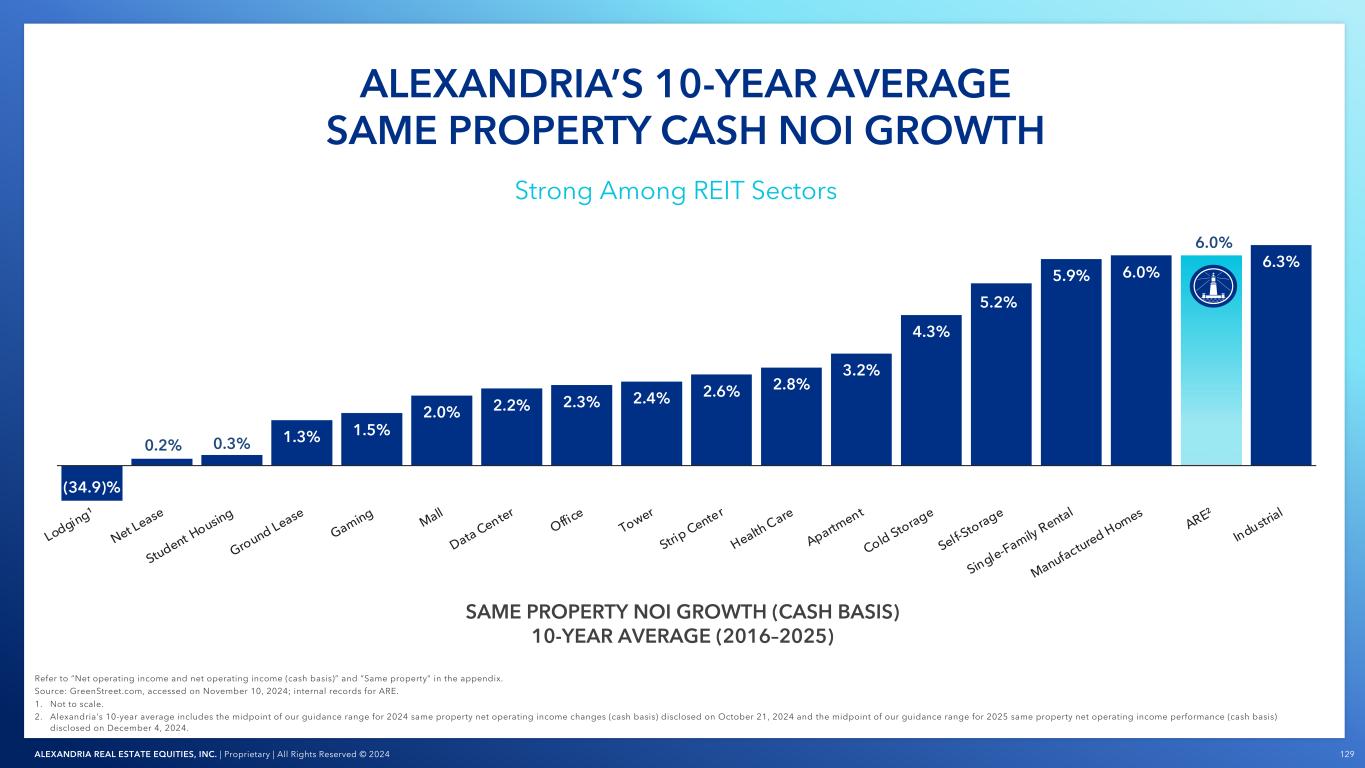

110ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2024Confidential and Proprietary | Do Not Copy or Distribute | All Rights Reserved © 2024 ALEXANDRIA’S SIGNIFICANT LIQUIDITY 1. Represents availability under our unsecured senior line of credit, net of amounts outstanding under our commercial paper program; outstanding forward equity sales agreements; cash, cash equivalents, and restricted cash; availability under our secured construction loan; and investments in publicly traded companies as of each period-end. $0.9B $2.0B $4.1B $5.4B 2010 2015 2020 3Q24 LIQUIDITY1 6x GREATER THAN IN 2010 Impressive Growth in Liquidity Since 2010