Net operating income, net operating income (cash basis), and operating margin (continued)

Net operating income is a non-GAAP financial measure calculated as net income (loss), the

most directly comparable financial measure calculated and presented in accordance with GAAP,

excluding equity in the earnings of our unconsolidated real estate joint ventures, general and

administrative expenses, interest expense, depreciation and amortization, impairments of real estate,

gains or losses on early extinguishment of debt, gains or losses on sales of real estate, and investment

income or loss. We believe net operating income provides useful information to investors regarding our

financial condition and results of operations because it primarily reflects those income and expense

items that are incurred at the property level. Therefore, we believe net operating income is a useful

measure for investors to evaluate the operating performance of our consolidated real estate assets. Net

operating income on a cash basis is net operating income adjusted to exclude the effect of straight-line

rent, amortization of acquired above- and below-market lease revenue, amortization of deferred revenue

related to tenant-funded and tenant-built landlord improvements, and provision for expected credit

losses on financial instruments adjustments required by GAAP. We believe that net operating income on

a cash basis is helpful to investors as an additional measure of operating performance because it

eliminates straight-line rent revenue and the amortization of acquired above- and below-market leases

and tenant-funded and tenant-built landlord improvements.

Furthermore, we believe net operating income is useful to investors as a performance

measure of our consolidated properties because, when compared across periods, net operating income

reflects trends in occupancy rates, rental rates, and operating costs, which provide a perspective not

immediately apparent from net income or loss. Net operating income can be used to measure the initial

stabilized yields of our properties by calculating net operating income generated by a property divided by

our investment in the property. Net operating income excludes certain components from net income in

order to provide results that are more closely related to the results of operations of our properties. For

example, interest expense is not necessarily linked to the operating performance of a real estate asset

and is often incurred at the corporate level rather than at the property level. In addition, depreciation and

amortization, because of historical cost accounting and useful life estimates, may distort comparability of

operating performance at the property level. Impairments of real estate have been excluded in deriving

net operating income because we do not consider impairments of real estate to be property-level

operating expenses. Impairments of real estate relate to changes in the values of our assets and do not

reflect the current operating performance with respect to related revenues or expenses. Our

impairments of real estate represent the write-down in the value of the assets to the estimated fair value

less cost to sell. These impairments result from investing decisions or a deterioration in market

conditions. We also exclude realized and unrealized investment gain or loss, which results from

investment decisions that occur at the corporate level related to non-real estate investments in publicly

traded companies and certain privately held entities. Therefore, we do not consider these activities to be

an indication of operating performance of our real estate assets at the property level. Our calculation of

net operating income also excludes charges incurred from changes in certain financing decisions, such

as losses on early extinguishment of debt and provision for expected credit losses on financial

instruments, as these charges often relate to corporate strategy. Property operating expenses included

in determining net operating income primarily consist of costs that are related to our operating

properties, such as utilities, repairs, and maintenance; rental expense related to ground leases;

contracted services, such as janitorial, engineering, and landscaping; property taxes and insurance; and

property-level salaries. General and administrative expenses consist primarily of accounting and

corporate compensation, corporate insurance, professional fees, rent, and supplies that are incurred as

part of corporate office management. We calculate operating margin as net operating income divided by

total revenues.

We believe that in order to facilitate for investors a clear understanding of our operating

results, net operating income should be examined in conjunction with net income or loss as presented in

our consolidated statements of operations. Net operating income should not be considered as an

alternative to net income or loss as an indication of our performance, nor as an alternative to cash flows

as a measure of our liquidity or our ability to make distributions.

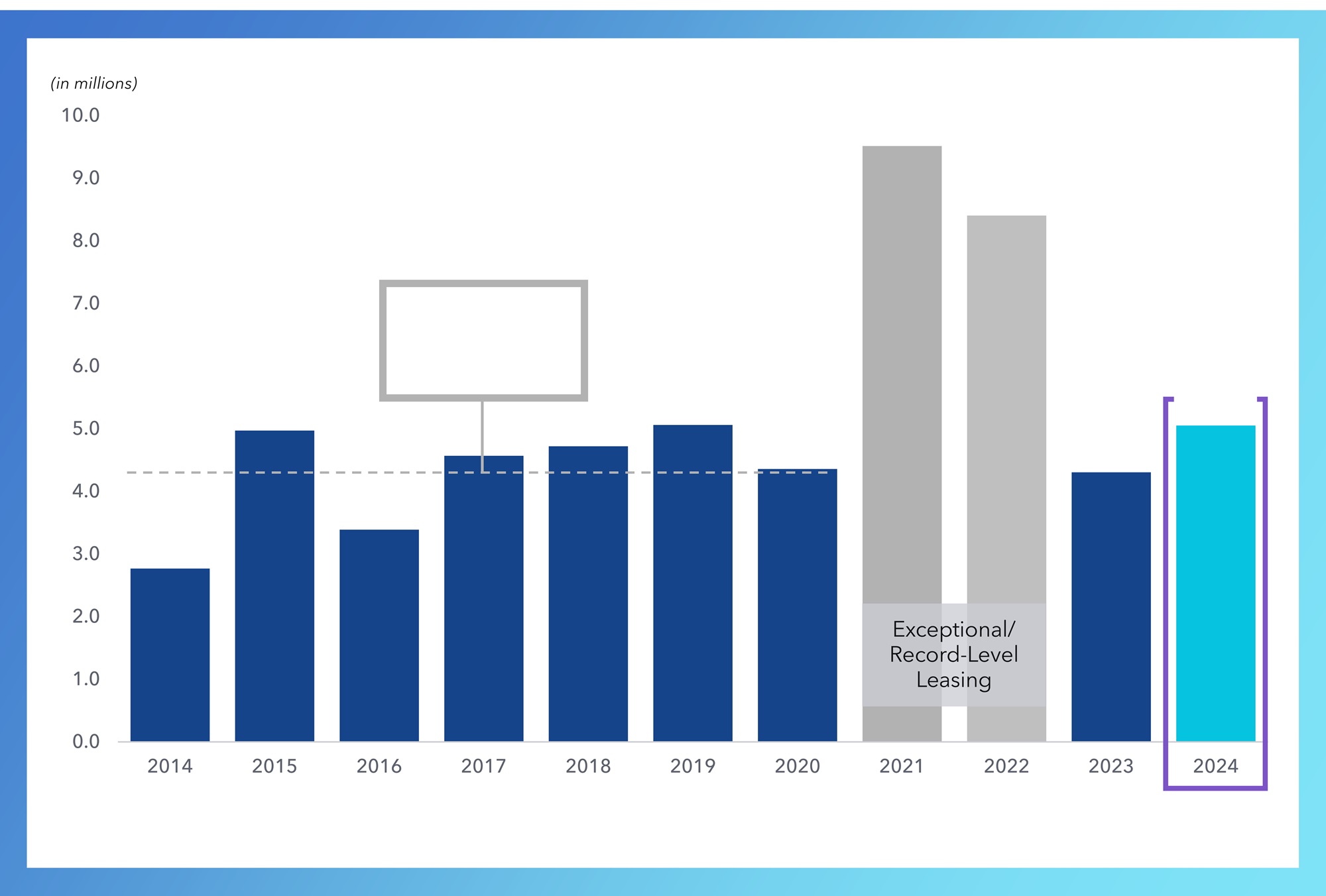

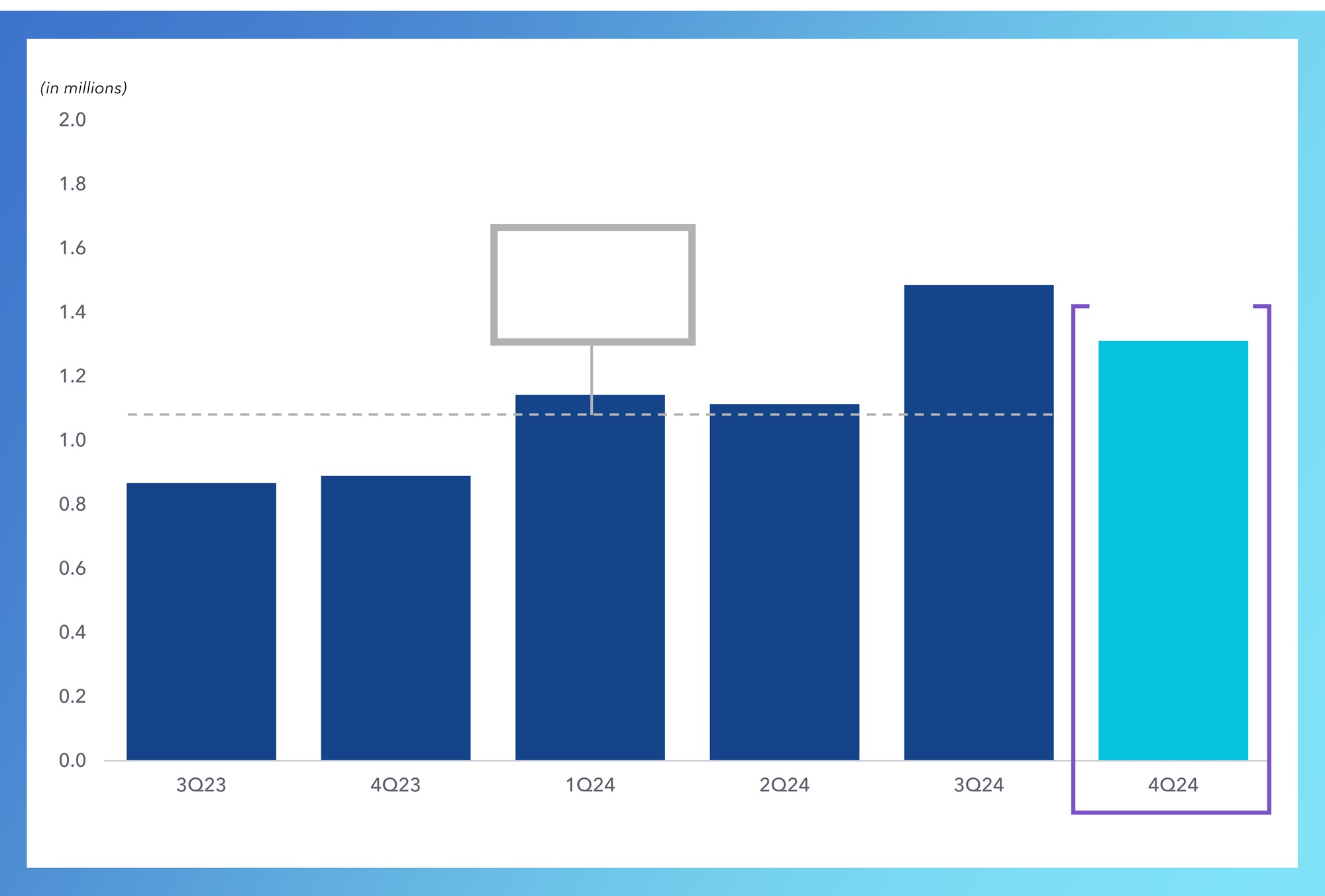

Operating statistics

We present certain operating statistics related to our properties, including number of

properties, RSF, occupancy percentage, leasing activity, and contractual lease expirations as of the end

of the period. We believe these measures are useful to investors because they facilitate an

understanding of certain trends for our properties. We compute the number of properties, RSF,

occupancy percentage, leasing activity, and contractual lease expirations at 100%, excluding RSF at

properties classified as held for sale, for all properties in which we have an investment, including

properties owned by our consolidated and unconsolidated real estate joint ventures. For operating

metrics based on annual rental revenue, refer to the definition of annual rental revenue herein.

Same property comparisons

As a result of changes within our total property portfolio during the comparative periods

presented, including changes from assets acquired or sold, properties placed into development or

redevelopment, and development or redevelopment properties recently placed into service, the

consolidated total income from rentals, as well as rental operating expenses in our operating results, can

show significant changes from period to period. In order to supplement an evaluation of our results of

operations over a given quarterly or annual period, we analyze the operating performance for all

consolidated properties that were fully operating for the entirety of the comparative periods presented,

referred to as same properties. We separately present quarterly and year-to-date same property results

to align with the interim financial information required by the SEC in our management’s discussion and

analysis of our financial condition and results of operations. These same properties are analyzed

separately from properties acquired subsequent to the first day in the earliest comparable quarterly or

year-to-date period presented, properties that underwent development or redevelopment at any time

during the comparative periods, unconsolidated real estate joint ventures, properties classified as held

for sale, and corporate entities (legal entities performing general and administrative functions), which are

excluded from same property results. Additionally, termination fees, if any, are excluded from the results

of same properties.

| |

Space Intentionally Blank |

|