Exhibit 99.2

| |

SUPPLEMENTAL FINANCIAL, OPERATING,

& PROPERTY INFORMATION QUARTER ENDED MARCH 31, 2010 Conference Call Information: Thursday, April 29, 2010 3:00PM Eastern Time/12:00PM Noon Pacific Time Number: (719) 457-2668 Confirmation Code: 1945679 385 EAST COLORADO BOULEVARD, SUITE 299 PASADENA, CALIFORNIA 91101 (626) 578-9693 www.labspace.com |

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Table of Contents

March 31, 2010

(Unaudited)

| Page |

Company Profile | | 3 |

Investor Information | | 4 |

Equity Research Coverage | | 5 |

First Quarter Ended March 31, 2010 Operating and Financial Results | | 6 |

Condensed Consolidated Income Statements | | 10 |

Condensed Consolidated Balance Sheets | | 11 |

Earnings per Share | | 12 |

Funds from Operations | | 13 |

Adjusted Funds from Operations | | 14 |

Financial and Asset Base Highlights | | 15 |

Debt Information | | 18 |

Summary of Occupancy Percentage and Properties | | 22 |

Same Property Comparisons | | 23 |

Summary of Leasing Activity | | 24 |

Summary of Lease Expirations | | 26 |

20 Largest Client Tenants | | 27 |

Client Tenant Mix | | 28 |

Summary of Additions and Dispositions of Properties | | 29 |

Real Estate and Value Added Activities | | 30 |

Summary of Capital Expenditures | | 35 |

Definitions and Other Information | | 36 |

This Supplemental Financial, Operating, & Property Information package includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify the forward-looking statements by their use of forward-looking words, such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative of those words or similar words. Our actual results may differ materially from those projected in such forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully complete and lease our existing space held for redevelopment and new properties acquired for that purpose and any properties undergoing development, our failure to successfully operate or lease acquired properties, decreased rental rates or increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, general and local economic conditions, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). All forward-looking statements are made as of April 29, 2010, the date this Supplemental Financial, Operating, & Property Information package is first made available on our website, and we assume no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

This Supplemental Financial, Operating, & Property Information package is not an offer to sell or solicitation to buy securities of Alexandria Real Estate Equities, Inc. Any offers to sell or solicitations to buy securities of Alexandria Real Estate Equities, Inc. shall be made only by means of a prospectus approved for that purpose. Unless otherwise indicated, the “Company,” “we,” “us,” and “our” refer to Alexandria Real Estate Equities, Inc. and its consolidated subsidiaries.

2

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Company Profile

March 31, 2010

The Company

Alexandria Real Estate Equities, Inc. (the “Company” or “Alexandria”), a self-administered and self-managed real estate investment trust (“REIT”), is the largest owner and preeminent REIT focused principally on science-driven cluster formation. Our operating platform is based on the principle of “clustering” with assets and operations located in key life science markets. The Company has significant real estate assets adjacent to key life science entities which we believe results in higher occupancy levels, longer lease terms, and higher rental income and returns. These locations are in the best submarkets in each of the top life science cluster destinations, including San Francisco and San Diego, California, Eastern Massachusetts, New Jersey and Suburban Philadelphia, New York City, Southeast, Suburban Washington, D.C., Seattle, Washington, and international locations. Client tenants include institutional (universities and independent not-for-profit institutions), pharmaceutical, biotechnology, medical device, product, service, and translational entities, as well as government agencies. The Company was founded in 1994 by Jerry M. Sudarsky and Joel S. Marcus and the Company executed its initial public offering in 1997. Alexandria is well-known for its very well located high-quality environmentally sustainable real estate, technical infrastructure, and unique expertise it provides to its broad and diverse life science industry client tenant base.

Management

Alexandria’s executive and senior management team is highly experienced in the REIT industry (with both real estate and life science experience and expertise) and is the most accomplished team focused on providing high-quality environmentally sustainable real estate, technical infrastructure, and unique expertise to the broad and diverse life science industry. Our deep and talented team has decades of real estate and life science industry experience. We believe that our expertise, experience, reputation, and key life science relationships provide Alexandria significant competitive advantages in attracting new business opportunities. Our management team also includes highly experienced regional market directors each averaging over 20 years of real estate experience and over 10 years with Alexandria. Our regional market directors have tremendous experience and valuable relationships that enable Alexandria to develop long-term relationships with preeminent life science entities.

Strategy

Alexandria’s primary business objective is to maximize shareholder value by providing its shareholders and employees with the greatest possible total return. The key elements to our strategy include our consistent focus on the top life science cluster destinations with our properties located adjacent to life science entities driving growth and technological advances within each cluster. These adjacency locations are characterized by high barriers to entry, limited supply of available space, and represent highly desirable locations for tenancy by life science entities. Alexandria’s strategy also includes leveraging on its deep and broad life science and real estate relationships in order to attract new and leading life science client tenants and value added real estate opportunities through acquisitions, redevelopment, and development.

Summary (as of March 31, 2010)

Corporate headquarters | Pasadena, California | |

Markets | San Diego, San Francisco Bay, Eastern Massachusetts, New Jersey/Suburban Philadelphia,

New York City, Southeast, Suburban Washington, D.C., Seattle, and International | |

Fiscal year-end | December 31 | |

Total properties | 161 | |

Total rentable square feet | 12.7 million | |

Common shares outstanding | 43.9 million | |

Dividend – quarter/annualized | $0.35/$1.40 | |

Dividend yield | 2.1% | |

Total market capitalization | $6.1 billion | |

3

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Investor Information

March 31, 2010

Executive/Senior Management |

| | | |

Joel S. Marcus | Chairman & Chief Executive Officer | Thomas J. Andrews | SVP-Regional Market Director-Massachusetts |

Dean A. Shigenaga | Chief Financial Officer & Treasurer | Vincent R. Ciruzzi | SVP-Construction and Development |

James H. Richardson | Director and Senior Management Consultant | John J. Cox | SVP-Regional Market Director-Seattle |

Peter J. Nelson | Corporate Secretary/Senior Management Consultant | John H. Cunningham | SVP-Regional Market Director-NY/Strategic Operations |

Jennifer J. Pappas | SVP-General Counsel/Assistant Secretary | Larry J. Diamond | SVP-Regional Market Director-Mid Atlantic |

Peter M. Moglia | Chief Investment Officer | Stephen A. Richardson | SVP-Regional Market Director-San Francisco Bay |

| | Jeff J. Ryan | SVP-Regional Market Director-San Diego |

Company Information |

| | | | |

Corporate Headquarters | | Trading Symbol | | Information Requests |

385 East Colorado Boulevard, Suite 299 | | ARE | | Phone: (626) 396-4828 |

Pasadena, California 91101 | | New York Stock Exchange | | E-mail: corporateinformation@labspace.com |

| | | | Web: www.labspace.com |

Common Stock Data (NYSE: ARE) |

| | | | | | | | | | |

| | 1Q 2010 | | 4Q 2009 | | 3Q 2009 | | 2Q 2009 | | 1Q 2009 |

High trading price | | $ | 69.03 | | $ | 68.24 | | $ | 62.49 | | $ | 43.76 | | $ | 66.69 |

Low trading price | | $ | 55.54 | | $ | 51.35 | | $ | 30.33 | | $ | 30.48 | | $ | 31.19 |

Average closing price | | $ | 62.97 | | $ | 57.67 | | $ | 46.57 | | $ | 36.31 | | $ | 48.64 |

Closing stock price, at the end of the quarter | | $ | 67.60 | | $ | 64.29 | | $ | 54.35 | | $ | 35.79 | | $ | 36.40 |

Dividends per share – annualized | | $ | 1.40 | | $ | 1.40 | | $ | 1.40 | | $ | 1.40 | | $ | 3.20 |

Dividend yield – annualized | | 2.1% | | 2.2% | | 2.6% | | 3.9% | | 8.8% |

Common shares outstanding at the end of the quarter | | 43,919,968 | | 43,846,050 | | 43,715,900 | | 39,040,518 | | 38,974,166 |

Market value of outstanding common shares (in thousands) | | $ | 2,968,990 | | $ | 2,818,863 | | $ | 2,375,959 | | $ | 1,397,260 | | $ | 1,418,660 |

Timing |

|

Quarterly results for 2010 are expected to be announced according to the following schedule: |

Second quarter | Late July 2010 | |

Third quarter | Early November 2010 | |

Fourth quarter | Early February 2011 | |

4

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Equity Research Coverage

March 31, 2010

Argus Research | Green Street Advisors | Morningstar |

William L. Eddleman, Jr. | (212) 425-7500 | John Stewart | (949) 640-8780 | David Rodziewicz | (312) 244-7037 |

| | Michael Knott | (949) 640-8780 | | |

| | | | | |

Banc of America Securities-Merrill Lynch | International Strategy & Investment Group Inc | RW Baird |

James Feldman | (212) 449-6339 | Steve Sakwa | (212) 446-9462 | David AuBuchon | (314) 863-4235 |

Jana Galan | (212) 449-5151 | George Auerbach | (212) 446-9459 | Justin Pelham-Webb | (314) 863-6413 |

| | | | | |

Barclays Capital | JMP Securities | Standard & Poor’s |

Ross L. Smotrich | (212) 526-2306 | William C. Marks | (415) 835-8944 | Robert McMillan | (212) 438-9522 |

Jeffrey S. Langbaum | (212) 526-0971 | Susan Gutierrez | (415) 835-3909 | | |

| | | | | |

Citigroup Global Markets | JP Morgan Securities | UBS |

Michael Bilerman | (212) 816-1383 | Anthony Paolone | (212) 622-6682 | Ross Nussbaum | (212) 713-2484 |

Quentin Velleley | (212) 816-6981 | Joseph Dazio | (212) 622-6416 | Robert Salisbury | (212) 713-4760 |

| | | | | |

| | Keefe, Bruyette & Woods | | |

| | Sheila McGrath | (212) 887-7793 | | |

| | Kristin Brown | (212) 887-3810 | | |

Alexandria Real Estate Equities, Inc. is currently covered by the equity research analysts listed above. This list may not be complete and is subject to change as firms initiate or discontinue coverage of our company. Please note that any opinions, estimates or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, forecasts, or predictions of Alexandria Real Estate Equities, Inc. or its management. Alexandria Real Estate Equities, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions, or recommendations. Interested persons may obtain copies of analysts’ reports on their own as we do not distribute these reports. Several of these firms may from time-to-time own our stock and/or hold other long or short positions in our stock, and may provide compensated services to us.

5

ALEXANDRIA REAL ESTATE EQUITIES, INC.

First Quarter Ended March 31, 2010 Operating and Financial Results

Highlights

First Quarter 2010:

· First Quarter 2010 Funds from Operations Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $1.09

· First Quarter 2010 Earnings Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $0.47

· First Quarter 2010 GAAP Same Property Revenues Less Operating Expenses Up Approximately 1%

· Executed 42 Leases for 564,000 Rentable Square Feet, Including 137,000 Rentable Square Feet of Redevelopment and Development Space

· First Quarter 2010 GAAP Rental Rate Increase of 1.8% on Renewed/Released Space

· First Quarter 2010 Occupancy Remains Steady at 94.0%

· Completed Ground-Up Development of One Property in Seattle, Washington Aggregating 115,000 Rentable Square Feet Pursuant to a 10-Year Lease with Gilead Sciences, Inc.

· Completed Redevelopment of Space Aggregating 56,000 Rentable Square Feet; 100% Leased

· Repaid Two Secured Loans Aggregating $11 Million

· Sold One Property Aggregating 71,000 Rentable Square Feet Previously Classified as “Held For Sale”

· One Land Parcel for Future Ground-Up Development of an 80,000 Square Foot Building Classified as “Held for Sale” as of March 31, 2010

· Received LEED® Silver Certifications for Two Buildings in San Francisco Bay Market

Other:

· In April 2010, Executed a 10-Year Lease with Large Cap Life Science Company for 49,000 Rentable Square Feet at The Alexandria Center for Science and Technology at Mission Bay

Financial Results

For the first quarter of 2010, we reported funds from operations (“FFO”) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $53,980,000, or $1.09 per share (diluted), compared to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $61,329,000, or $1.89 per share (diluted), for the first quarter of 2009. Comparing the first quarter of 2010 to the first quarter of 2009, FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders decreased 12% and FFO per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders decreased 42%. In the first quarter of 2009, we recognized additional rental income of approximately $18,509,000 related to a modification of a lease for a property in South San Francisco, California. Excluding the property in South San Francisco, California, FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders was $43,424,000, or $1.34 per share (diluted), for the first quarter of 2009. The weighted average number of common stock outstanding for calculating FFO per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders totaled 49,654,614 and 32,498,107 for the first quarter of 2010 and 2009, respectively.

6

ALEXANDRIA REAL ESTATE EQUITIES, INC.

First Quarter Ended March 31, 2010 Operating and Financial Results

Financial Results (continued)

FFO is a non-GAAP measure widely used by publicly traded real estate investment trusts. We compute FFO in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”) in its April 2002 White Paper and related implementation guidance. A reconciliation of net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders in accordance with United States generally accepted accounting principles (“GAAP”) to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders is included in the financial information accompanying this press release. The primary reconciling item between GAAP net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders and FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders is depreciation and amortization expense. Depreciation and amortization expense for the three months ended March 31, 2010 and 2009 was $29,738,000 and $31,446,000, respectively. Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the first quarter of 2010 was $20,542,000, or $0.47 per share (diluted), compared to net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $32,769,000, or $1.01 per share (diluted), for the first quarter of 2009. The weighted average number of common stock outstanding for calculating earnings per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders totaled 43,857,513 and 32,498,107 for the first quarter of 2010 and 2009, respectively.

Leasing Activity

For the first quarter of 2010, we executed a total of 42 leases for approximately 564,000 rentable square feet of space at 28 different properties (excluding month-to-month leases). Of this total, approximately 348,000 rentable square feet related to new or renewal leases of previously leased space (renewed/released space) and approximately 216,000 rentable square feet related to developed, redeveloped or previously vacant space. Of the 216,000 rentable square feet, approximately 137,000 rentable square feet were related to our development or redevelopment programs, with the remaining approximately 79,000 rentable square feet related to previously vacant space. Rental rates for these new or renewal leases (renewed/released space) were on average approximately 1.8% higher (on a GAAP basis) than rental rates for expiring leases.

As of March 31, 2010, approximately 88% of our leases (on a rentable square footage basis) were triple net leases, requiring tenants to pay substantially all real estate taxes and insurance, common area and other operating expenses, including increases thereto. In addition, approximately 8% of our leases (on a rentable square footage basis) required the tenants to pay a majority of operating expenses. Additionally, approximately 92% of our leases (on a rentable square footage basis) provided for the recapture of certain capital expenditures, and approximately 94% of our leases (on a rentable square footage basis) contained effective annual rent escalations that were either fixed or indexed based on the consumer price index or another index.

Dispositions and Properties “Held for Sale”

In the first quarter of 2010, we sold one property located in the Seattle, Washington market aggregating 70,647 rentable square feet for approximately $11.8 million at a gain. This property was located outside of our primary submarket location in Seattle. The buyer of this building intends to invest a significant amount of capital prior to occupancy of it for their own use. As of March 31, 2010, one land parcel for future ground-up development of an 80,000 square foot building was classified as “held for sale.”

Other Recent Events

In April 2010, we executed a 10-year lease with a large cap life science company for approximately 49,000 rentable square feet at The Alexandria Center for Science and Technology at Mission Bay.

7

ALEXANDRIA REAL ESTATE EQUITIES, INC.

First Quarter Ended March 31, 2010 Operating and Financial Results

Earnings Outlook

Based on our current view of existing market conditions and certain current assumptions, our updated guidance for FFO per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders and earnings per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders is as follows:

| | 2010 |

FFO per share (diluted) | | $4.43 |

Earnings per share (diluted) | | $1.80 |

Client Tenant Base

The quality, diversity, breadth, and depth of our significant relationships with our life science client tenants provide Alexandria Real Estate Equities, Inc. (“Alexandria”) with consistent and solid cash flows. As of March 31, 2010, Alexandria’s multinational pharmaceutical client tenants represented approximately 28% of our annualized base rent, led by Novartis AG, Roche Holding Ltd, GlaxoSmithKline plc, Pfizer Inc., Johnson & Johnson, and Merck & Co., Inc.; revenue-producing life science product and service companies represented approximately 19%, led by Quest Diagnostics Incorporated, Qiagen N.V., Laboratory Corporation of America Holdings, and Monsanto Company; public biotechnology companies represented approximately 18% and included the three largest in the sector, Amgen Inc., Gilead Sciences, Inc., and Celgene Corporation; government agencies and renowned medical and research institutions represented approximately 15% and included The Scripps Research Institute, Massachusetts Institute of Technology, Fred Hutchinson Cancer Research Center, University of Washington, Sanford-Burnham Medical Research Institute, and the United States Government; private biotechnology companies represented approximately 13% and included high-quality, leading-edge companies with blue-chip venture and institutional investors, including Ambrx, Inc., Intellikine, Inc., MacroGenics, Inc., and Tolerx, Inc.; and the remaining approximately 7% consisted of traditional office tenants. Two of the fastest-growing client tenant sectors by revenue currently include leading institutional and multinational pharmaceutical entities. Alexandria’s strong life science underwriting skills, long-term life science industry relationships, and sophisticated management with both real estate and life science operating expertise set the Company apart from all other publicly traded REITs and real estate companies.

Earnings Call Information

We will host a conference call on Thursday, April 29, 2010 at 3:00 p.m. Eastern Time (“ET”)/12:00 p.m. noon Pacific Time (“PT”) that is open to the general public to discuss our financial and operating results for the first quarter ended March 31, 2010. To participate in this conference call, dial (719) 457-2668 and confirmation code 1945679, shortly before 3:00 p.m ET/12:00 p.m. noon PT. The audio web cast can be accessed at: www.labspace.com, in the Corporate Information section. A replay of the call will be available for a limited time from 6:00 p.m. ET/3:00 p.m. PT on Thursday, April 29, 2010. The replay number is (719) 457-0820 and the confirmation code is 1945679.

Additionally, a copy of Alexandria Real Estate Equities, Inc.’s Supplemental Financial, Operating, & Property Information for the quarter ended March 31, 2010 and this press release are available in the Corporate Information section of our website at www.labspace.com.

8

ALEXANDRIA REAL ESTATE EQUITIES, INC.

First Quarter Ended March 31, 2010 Operating and Financial Results

About the Company

Alexandria Real Estate Equities, Inc., Landlord of Choice to the Life Science Industry®, is the largest owner and preeminent REIT focused principally on cluster development through the ownership, operation, management, selective redevelopment, development, and acquisition of properties containing life science laboratory space. Alexandria is the leading provider of high-quality, environmentally sustainable real estate, technical infrastructure, and services to the broad and diverse life science industry. Client tenants include institutional (universities and independent not-for-profit institutions), pharmaceutical, biotechnology, medical device, product, service, and translational entities, as well as government agencies. Alexandria’s operating platform is based on the principle of “clustering,” with assets and operations located in key life science markets. Our asset base contains 161 properties approximating 12.7 million rentable square feet consisting of 156 properties approximating 11.8 million rentable square feet (including spaces undergoing active redevelopment) and five properties undergoing ground-up development approximating an additional 865,000 rentable square feet. In addition, our asset base will enable us to grow to approximately 24.0 million rentable square feet through additional ground-up development of approximately 11.3 million rentable square feet.

9

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Condensed Consolidated Income Statements

(Dollars in thousands, except per share data)

(Unaudited)

| | | Three Months Ended (1) | |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (2) | | 3/31/2009 (3) |

Revenues | | | | | | | | | | |

Rental | | $ | 88,858 | | $ | 88,702 | | $ | 88,419 | | $ | 87,461 | | $ | 104,011 |

Tenant recoveries | | 26,558 | | 25,414 | | 26,230 | | 24,668 | | 26,796 |

Other income | | 1,071 | | 1,009 | | 1,177 | | 8,910 | | 752 |

Total revenues | | 116,487 | | 115,125 | | 115,826 | | 121,039 | | 131,559 |

| | | | | | | | | | |

Expenses | | | | | | | | | | |

Rental operations | | 31,651 | | 29,451 | | 31,218 | | 29,224 | | 32,434 |

General and administrative | | 9,481 | | 8,468 | | 9,611 | | 8,804 | | 9,418 |

Interest | | 17,562 | | 19,452 | | 21,225 | | 21,373 | | 20,199 |

Depreciation and amortization | | 29,735 | | 29,007 | | 28,112 | | 29,500 | | 31,242 |

Total expenses | | 88,429 | | 86,378 | | 90,166 | | 88,901 | | 93,293 |

| | | | | | | | | | |

Gain on early extinguishment of debt | | – | | – | | – | | 11,254 | | – |

Income from continuing operations | | 28,058 | | 28,747 | | 25,660 | | 43,392 | | 38,266 |

Income from discontinued operations, net | | 727 | | 1,158 | | 718 | | 724 | | 2,983 |

Net income | | 28,785 | | 29,905 | | 26,378 | | 44,116 | | 41,249 |

| | | | | | | | | | |

Net income attributable to noncontrolling interests | | 935 | | 924 | | 886 | | 4,362 | | 875 |

Dividends on preferred stock | | 7,089 | | 7,089 | | 7,090 | | 7,089 | | 7,089 |

Net income attributable to unvested restricted stock awards | | 219 | | 242 | | 199 | | 367 | | 517 |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 20,542 | | $ | 21,650 | | $ | 18,203 | | $ | 32,298 | | $ | 32,768 |

| | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – basic | | | | | | | | | | |

Continuing operations | | $ | 0.45 | | $ | 0.47 | | $ | 0.45 | | $ | 0.81 | | $ | 0.92 |

Discontinued operations, net | | 0.02 | | 0.03 | | 0.02 | | 0.02 | | 0.09 |

Earnings per share – basic | | $ | 0.47 | | $ | 0.50 | | $ | 0.47 | | $ | 0.83 | | $ | 1.01 |

| | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – diluted | | | | | | | | | | |

Continuing operations | | $ | 0.45 | | $ | 0.46 | | $ | 0.45 | | $ | 0.80 | | $ | 0.92 |

Discontinued operations, net | | 0.02 | | 0.03 | | 0.02 | | 0.02 | | 0.09 |

Earnings per share – diluted | | $ | 0.47 | | $ | 0.49 | | $ | 0.47 | | $ | 0.82 | | $ | 1.01 |

(1) Certain prior year amounts have been reclassified to conform to current year presentation related to discontinued operations.

(2) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(3) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

10

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | |

| | 2010 | | 2009 | | 2009 | | 2009 | | 2009 | |

Assets | | | | | | | | | | | |

Investments in real estate: | | | | | | | | | | | |

Rental properties | | $ | 3,937,876 | | $ | 3,903,955 | | $ | 3,867,725 | | $ | 3,720,238 | | $ | 3,683,249 | |

Less: accumulated depreciation | | (538,570 | ) | (520,647 | ) | (500,765 | ) | (476,970 | ) | (452,539 | ) |

Rental properties, net | | 3,399,306 | | 3,383,308 | | 3,366,960 | | 3,243,268 | | 3,230,710 | |

Land held for future development | | 294,631 | | 255,025 | | 254,549 | | 240,411 | | 109,561 | |

Construction in progress | | 1,326,865 | | 1,400,795 | | 1,349,656 | | 1,406,451 | | 1,452,434 | |

Investment in unconsolidated real estate entity (1) | | 34,421 | | – | | – | | – | | – | |

Investments in real estate, net | | 5,055,223 | | 5,039,128 | | 4,971,165 | | 4,890,130 | | 4,792,705 | |

Cash and cash equivalents | | 70,980 | | 70,628 | | 68,280 | | 70,313 | | 125,281 | |

Restricted cash | | 35,832 | | 47,291 | | 60,002 | | 51,683 | | 54,770 | |

Tenant receivables | | 2,710 | | 3,902 | | 3,789 | | 4,665 | | 5,992 | |

Deferred rent | | 99,248 | | 96,700 | | 92,022 | | 87,697 | | 85,970 | |

Investments | | 76,918 | | 72,882 | | 71,080 | | 66,068 | | 64,788 | |

Other assets | | 127,623 | | 126,696 | | 126,999 | | 116,097 | | 112,669 | |

| | | | | | | | | | | |

Total assets | | $ | 5,468,534 | | $ | 5,457,227 | | $ | 5,393,337 | | $ | 5,286,653 | | $ | 5,242,175 | |

| | | | | | | | | | | |

Liabilities and Equity | | | | | | | | | | | |

Secured notes payable | | $ | 884,839 | | $ | 937,017 | | $ | 837,177 | | $ | 941,600 | | $ | 1,041,854 | |

Unsecured line of credit and unsecured term loan | | 1,291,000 | | 1,226,000 | | 1,248,000 | | 1,307,000 | | 1,355,000 | |

Unsecured convertible notes | | 586,975 | | 583,929 | | 580,919 | | 577,984 | | 433,408 | |

Accounts payable, accrued expenses, and tenant security deposits | | 284,830 | | 282,516 | | 325,720 | | 312,313 | | 331,715 | |

Dividends payable | | 21,709 | | 21,686 | | 21,665 | | 20,005 | | 37,701 | |

Total liabilities | | 3,069,353 | | 3,051,148 | | 3,013,481 | | 3,158,902 | | 3,199,678 | |

| | | | | | | | | | | |

Redeemable noncontrolling interests | | 17,490 | | 41,441 | | 41,232 | | 41,012 | | 32,887 | |

| | | | | | | | | | | |

Alexandria Real Estate Equities, Inc. stockholders’ equity: | | | | | | | | | | | |

Series C preferred stock | | 129,638 | | 129,638 | | 129,638 | | 129,638 | | 129,638 | |

Series D cumulative convertible preferred stock | | 250,000 | | 250,000 | | 250,000 | | 250,000 | | 250,000 | |

Common stock | | 439 | | 438 | | 437 | | 390 | | 390 | |

Additional paid-in capital | | 1,987,512 | | 1,977,062 | | 1,961,421 | | 1,718,737 | | 1,668,546 | |

Accumulated other comprehensive loss | | (26,990 | ) | (33,730 | ) | (44,162 | ) | (53,013 | ) | (79,868 | ) |

Total Alexandria Real Estate Equities, Inc. stockholders’ equity | | 2,340,599 | | 2,323,408 | | 2,297,334 | | 2,045,752 | | 1,968,706 | |

Noncontrolling interests | | 41,092 | | 41,230 | | 41,290 | | 40,987 | | 40,904 | |

Total equity | | 2,381,691 | | 2,364,638 | | 2,338,624 | | 2,086,739 | | 2,009,610 | |

Total | | $ | 5,468,534 | | $ | 5,457,227 | | $ | 5,393,337 | | $ | 5,286,653 | | $ | 5,242,175 | |

(1) See page 40 for additional information.

11

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Earnings per Share

(Dollars in thousands, except per share data)

(Unaudited)

Earnings per Share

| | Three Months Ended | |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (1) | | 3/31/2009 (2) | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for basic earnings per share | | $ | 20,542 | | $ | 21,650 | | $ | 18,203 | | $ | 32,298 | | $ | 32,768 | |

Assumed conversion of 8% unsecured convertible notes | | – | | – | | – | | 3,197 | | – | |

Effect of dilutive securities and assumed conversion attributable to unvested restricted stock awards | | – | | – | | – | | 3 | | 1 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders assuming effect of dilutive securities and assumed conversion – numerator for diluted earnings per share | | $ | 20,542 | | $ | 21,650 | | $ | 18,203 | | $ | 35,498 | | $ | 32,769 | |

| | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for basic earnings per share | | 43,821,765 | | 43,715,462 | | 39,094,018 | | 38,929,971 | | 32,478,671 | |

Effect of dilutive securities and assumed conversion: | | | | | | | | | | | |

Dilutive effect of stock options | | 35,748 | | 34,839 | | 11,932 | | 1,167 | | 19,436 | |

Assumed conversion of 8% unsecured convertible notes | | – | | – | | – | | 4,140,787 | | – | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders assuming effect of dilutive securities and assumed conversion – denominator for diluted earnings per share | | 43,857,513 | | 43,750,301 | | 39,105,950 | | 43,071,925 | | 32,498,107 | |

| | | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | | | | | | | | | | |

Basic | | $ | 0.47 | | $ | 0.50 | | $ | 0.47 | | $ | 0.83 | | $ | 1.01 | |

Diluted | | $ | 0.47 | | $ | 0.49 | | $ | 0.47 | | $ | 0.82 | | $ | 1.01 | |

(1) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(2) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

See “Definitions and Other Information” section of this report starting on page 36.

12

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Funds from Operations

(Dollars in thousands, except per share data)

(Unaudited)

Funds from Operations (“FFO”)

The following table presents a reconciliation of net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders, the most directly comparable financial measure calculated and presented in accordance with United States generally accepted accounting principles (“GAAP”), to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the three month periods below:

| | Three Months Ended | |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (1) | | 3/31/2009 (2) | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 20,542 | | $ | 21,650 | | $ | 18,203 | | $ | 32,298 | | $ | 32,768 | |

Add: Depreciation and amortization (3) | | 29,738 | | 29,004 | | 28,336 | | 29,722 | | 31,446 | |

Add: Net income attributable to noncontrolling interests | | 935 | | 924 | | 886 | | 4,362 | | 875 | |

Add: Net income attributable to unvested restricted stock awards | | 219 | | 242 | | 199 | | 367 | | 517 | |

Subtract: Gain on sales of property | | (24 | ) | (393 | ) | – | | – | | (2,234 | ) |

Subtract: FFO attributable to noncontrolling interests | | (1,098 | ) | (1,006 | ) | (918 | ) | (842 | ) | (1,077 | ) |

Subtract: FFO attributable to unvested restricted stock awards | | (530 | ) | (558 | ) | (505 | ) | (740 | ) | (966 | ) |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for basic FFO per share | | 49,782 | | 49,863 | | 46,201 | | 65,167 | | 61,329 | |

Add: Assumed conversion of 8% unsecured convertible notes | | 4,194 | | 4,362 | | 4,384 | | 3,197 | | – | |

Add: Effect of dilutive securities and assumed conversion attributable to unvested restricted stock awards | | 4 | | 22 | | 24 | | 37 | | – | |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders assuming effect of dilutive securities and assumed conversion – numerator for diluted FFO per share | | $ | 53,980 | | $ | 54,247 | | $ | 50,609 | | $ | 68,401 | | $ | 61,329 | |

| | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for basic FFO per share | | 43,821,765 | | 43,715,462 | | 39,094,018 | | 38,929,971 | | 32,478,671 | |

Effect of dilutive securities and assumed conversion: | | | | | | | | | | | |

Dilutive effect of stock options | | 35,748 | | 34,839 | | 11,932 | | 1,167 | | 19,436 | |

Assumed conversion of 8% unsecured convertible notes | | 5,797,101 | | 5,797,101 | | 5,797,101 | | 4,140,787 | | – | |

Weighted average shares of common stock outstanding for calculating FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders assuming effect of dilutive securities and assumed conversion – denominator for diluted FFO per share | | 49,654,614 | | 49,547,402 | | 44,903,051 | | 43,071,925 | | 32,498,107 | |

| | | | | | | | | | | |

FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | | | | | | | | | | |

Basic | | $ | 1.14 | | $ | 1.14 | | $ | 1.18 | | $ | 1.67 | | $ | 1.89 | |

| | | | | | | | | | | |

Diluted | | $ | 1.09 | | $ | 1.09 | | $ | 1.13 | | $ | 1.59 | | $ | 1.89 | |

(1) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(2) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

(3) Includes depreciation and amortization for assets “held for sale” classified as discontinued operations for the periods prior to when such assets were designated as “held for sale.”

See “Definitions and Other Information” section of this report starting on page 36.

13

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Adjusted Funds from Operations

(Dollars in thousands)

(Unaudited)

Adjusted Funds from Operations

The following table presents a reconciliation of FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders to adjusted funds from operations (“AFFO”) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders:

| | Three Months Ended | |

| | | |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (1) | | 3/31/2009 (2) | |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 49,782 | | $ | 49,863 | | $ | 46,201 | | $ | 65,167 | | $ | 61,329 | |

Add/(deduct): | | | | | | | | | | | |

Capital expenditures | | (303 | ) | (607 | ) | (565 | ) | (270 | ) | (492 | ) |

Second generation tenant improvements and leasing costs | | (1,485 | ) | (2,334 | ) | (819 | ) | (894 | ) | (691 | ) |

Amortization of loan fees | | 2,072 | | 2,081 | | 2,061 | | 2,023 | | 1,793 | |

Amortization of debt premiums/discounts | | 3,026 | | 2,998 | | 2,923 | | 2,605 | | 2,262 | |

Amortization of acquired above and below market leases | | (2,247 | ) | (1,457 | ) | (1,510 | ) | (1,736 | ) | (4,745 | ) |

Deferred rent | | (4,135 | ) | (7,064 | ) | (3,106 | ) | (2,700 | ) | (1,509 | ) |

Net stock compensation | | 2,731 | | 3,194 | | 4,141 | | 3,694 | | 3,022 | |

Capitalized income from development projects | | 1,356 | | 1,660 | | 1,545 | | 1,631 | | 1,662 | |

Deferred rent on ground leases | | 1,432 | | 1,400 | | 1,564 | | 1,478 | | 1,124 | |

Gain on early extinguishment of debt | | – | | – | | – | | (11,254 | ) | – | |

Allocation to unvested restricted stock awards | | (25 | ) | 1 | | (67 | ) | 61 | | (38 | ) |

AFFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 52,204 | | $ | 49,735 | | $ | 52,368 | | $ | 59,805 | | $ | 63,717 | |

| | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders assuming effect of dilutive securities and assumed conversion – denominator for diluted earnings per share | | 43,857,513 | | 43,750,301 | | 39,105,950 | | 43,071,925 | | 32,498,107 | |

Less: Assumed conversion of 8% unsecured convertible notes | | – | | – | | – | | 4,140,787 | | – | |

| | 43,857,513 | | 43,750,301 | | 39,105,950 | | 38,931,138 | | 32,498,107 | |

(1) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(2) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

See “Definitions and Other Information” section of this report starting on page 36.

14

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights

(Dollars in thousands, except per share amounts)

(Unaudited)

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 | | 3/31/2009 | |

Balance Sheet Data | | | | | | | | | | | |

Rental properties, net | | $ | 3,399,306 | | $ | 3,383,308 | | $ | 3,366,960 | | $ | 3,243,268 | | $ | 3,230,710 | |

Land held for future development | | $ | 294,631 | | $ | 255,025 | | $ | 254,549 | | $ | 240,411 | | $ | 109,561 | |

Construction in progress | | $ | 1,326,865 | | $ | 1,400,795 | | $ | 1,349,656 | | $ | 1,406,451 | | $ | 1,452,434 | |

Investment in unconsolidated real estate entity | | $ | 34,421 | | $ | – | | $ | – | | $ | – | | $ | – | |

Gross book value of real estate | | $ | 5,593,793 | | $ | 5,559,775 | | $ | 5,471,930 | | $ | 5,367,100 | | $ | 5,245,244 | |

Tangible non-real estate assets | | $ | 222,248 | | $ | 227,440 | | $ | 239,076 | | $ | 224,016 | | $ | 283,306 | |

Total assets | | $ | 5,468,534 | | $ | 5,457,227 | | $ | 5,393,337 | | $ | 5,286,653 | | $ | 5,242,175 | |

Secured notes payable | | $ | 884,839 | | $ | 937,017 | | $ | 837,177 | | $ | 941,600 | | $ | 1,041,854 | |

Outstanding balance on unsecured line of credit | | $ | 541,000 | | $ | 476,000 | | $ | 498,000 | | $ | 557,000 | | $ | 605,000 | |

Outstanding balance on unsecured term loan | | $ | 750,000 | | $ | 750,000 | | $ | 750,000 | | $ | 750,000 | | $ | 750,000 | |

3.7% unsecured convertible notes | | $ | 369,961 | | $ | 368,027 | | $ | 366,120 | | $ | 364,242 | | $ | 433,408 | |

8.0% unsecured convertible notes | | $ | 217,014 | | $ | 215,902 | | $ | 214,799 | | $ | 213,742 | | $ | – | |

Total debt | | $ | 2,762,814 | | $ | 2,746,946 | | $ | 2,666,096 | | $ | 2,826,584 | | $ | 2,830,262 | |

Total liabilities | | $ | 3,069,353 | | $ | 3,051,148 | | $ | 3,013,481 | | $ | 3,158,902 | | $ | 3,199,678 | |

Common shares outstanding | | 43,919,968 | | 43,846,050 | | 43,715,900 | | 39,040,518 | | 38,974,166 | |

Total market capitalization | | $ | 6,112,219 | | $ | 5,946,639 | | $ | 5,417,648 | | $ | 4,580,406 | | $ | 4,600,039 | |

| | Three Months Ended | |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (1) | | 3/31/2009 (2) | |

Operating Data | | | | | | | | | | | |

Total revenue | | $ | 116,487 | | $ | 115,125 | | $ | 115,826 | | $ | 121,039 | | $ | 131,559 | |

Deferred rent | | $ | 4,135 | | $ | 7,064 | | $ | 3,106 | | $ | 2,700 | | $ | 1,509 | |

Amortization of acquired above and below market leases | | $ | 2,247 | | $ | 1,457 | | $ | 1,510 | | $ | 1,736 | | $ | 4,745 | |

Non-cash amortization of discount on unsecured convertible notes | | $ | 3,046 | | $ | 3,009 | | $ | 2,935 | | $ | 2,612 | | $ | 2,263 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 20,542 | | $ | 21,650 | | $ | 18,203 | | $ | 32,298 | | $ | 32,768 | |

Earnings per share – diluted | | $ | 0.47 | | $ | 0.49 | | $ | 0.47 | | $ | 0.82 | | $ | 1.01 | |

FFO attributable to Alexandria Real Estate, Inc.’s common stockholders – diluted | | $ | 53,980 | | $ | 54,247 | | $ | 50,609 | | $ | 68,401 | | $ | 61,329 | |

FFO per share – diluted | | $ | 1.09 | | $ | 1.09 | | $ | 1.13 | | $ | 1.59 | | $ | 1.89 | |

Weighted average common shares outstanding – EPS – diluted | | 43,857,513 | | 43,750,301 | | 39,105,950 | | 43,071,925 | | 32,498,107 | |

Weighted average common shares outstanding – FFO – diluted | | 49,654,614 | | 49,547,402 | | 44,903,051 | | 43,071,925 | | 32,498,107 | |

(1) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(2) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

See “Definitions and Other Information” section of this report starting on page 36.

15

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights (continued)

(Dollars in thousands, except per share amounts)

(Unaudited)

| | Three Months Ended |

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 (1) | | 3/31/2009 (2) |

Financial, Debt, and Other Ratios | | | | | | | | | | |

Unencumbered net operating income as a percentage of total net operating income | | 57% | | 55% | | 60% | | 61% | | 64% |

Unencumbered assets gross book value | | $ | 4,250,976 | | $ | 4,166,066 | | $ | 4,092,300 | | $ | 3,971,718 | | $ | 3,912,462 |

Unencumbered assets gross book value as a percentage of gross assets | | 71% | | 70% | | 69% | | 69% | | 69% |

Percentage outstanding on unsecured line of credit at end of period | | 47% | | 41% | | 43% | | 48% | | 53% |

Operating margin | | 73% | | 74% | | 73% | | 74% | | 75% |

Adjusted EBITDA margin | | 68% | | 70% | | 69% | | 72% | | 71% |

General and administrative expense as a percentage of total revenues | | 8.1% | | 7.4% | | 8.3% | | 7.3% | | 7.2% |

EBITDA – trailing 12 months (1)(2) | | $ | 325,596 | | $ | 342,428 | | $ | 341,639 | | $ | 342,624 | | $ | 321,518 |

Adjusted EBITDA – trailing 12 months (1)(2) | | $ | 327,685 | | $ | 342,598 | | $ | 353,831 | | $ | 354,198 | | $ | 343,525 |

Capitalized interest | | $ | 19,509 | | $ | 18,976 | | $ | 17,933 | | $ | 18,240 | | $ | 16,919 |

Weighted average interest rate used for capitalization during period | | 5.20% | | 5.42% | | 5.16% | | 5.23% | | 4.89% |

Net debt to gross assets (3) | | 45.0% | | 44.9% | | 44.0% | | 47.9% | | 48.1% |

Secured debt as a percentage of gross assets (3) | | 15% | | 16% | | 14% | | 16% | | 18% |

Net debt to Adjusted EBITDA – trailing 12 months (1)(2) | | 8.1 | | 7.7 | | 7.2 | | 7.6 | | 7.7 |

Dividends per share on common stock | | $ | 0.35 | | $ | 0.35 | | $ | 0.35 | | $ | 0.35 | | $ | 0.80 |

Dividend payout ratio (common stock) | | 29% | | 29% | | 31% | | 20% | | 51% |

| | | | | | | | | | |

| | 1Q 2010 | | 4Q 2009 | | 3Q 2009 | | 2Q 2009 | | 1Q 2009 |

Asset Base Statistics | | | | | | | | | | |

Number of properties (3) | | 161 | | 162 | | 163 | | 163 | | 163 |

Rentable square feet (3) | | 12,675,439 | | 12,746,086 | | 12,793,644 | | 12,793,644 | | 12,793,644 |

Occupancy of operating properties (3) | | 94.0% | | 94.1% | | 94.4% | | 94.5% | | 94.3% |

Occupancy including redevelopment properties (3) | | 88.9% | | 89.4% | | 89.1% | | 89.4% | | 89.6% |

Leasing activity – YTD rentable square feet | | 563,901 | | 1,864,347 | | 1,349,098 | | 935,580 | | 464,603 |

Leasing activity – Qtr rentable square feet | | 563,901 | | 489,079 | | 449,515 | | 472,822 | | 464,603 |

Leasing activity – YTD GAAP rental rate increase | | 1.8% | | 3.5% | | 4.9% | | 4.0% | | 5.4% |

Leasing activity – Qtr GAAP rental rate increase | | 1.8% | | 1.5% | | 5.6% | | 3.3% | | 5.4% |

Leasing activity – YTD Cash rental rate increase | | 0.7% | | 0.1% | | 2.8% | | 2.5% | | 3.1% |

Leasing activity – Qtr Cash rental rate increase | | 0.7% | | (8.0% | ) | 1.6% | | 2.1% | | 3.1% |

Same property YTD revenue less operating expenses – GAAP basis | | 0.8% | | 2.8% | | 3.7% | | 4.0% | | 3.6% |

Same property Qtr revenue less operating expenses – GAAP basis | | 0.8% | | 1.1% | | 0.8% | | 2.2% | | 3.6% |

Same property YTD revenue less operating expenses – Cash basis | | 0.4% | | 4.7% | | 7.1% | | 7.1% | | 5.3% |

Same property Qtr revenue less operating expenses – Cash basis | | 0.4% | | 1.3% | | 4.3% | | 5.8% | | 5.3% |

(1) During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes.

(2) During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco.

(3) At end of period.

See “Definitions and Other Information” section of this report starting on page 36.

16

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights (continued)

(Unaudited)

Summary of Occupancy Percentage

| | December 31, | | | | | |

| | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 1Q10 | | Average | |

Occupancy of operating properties –

end of period | | 96.2% | | 95.7% | | 98.4% | | 99.0% | | 96.3% | | 93.9% | | 95.2% | | 93.2% | | 93.1% | | 93.8% | | 94.8% | | 94.1% | | 94.0% | | 95.2% | |

Occupancy including redevelopment properties – end of period | | 92.9% | | 91.5% | | 90.8% | | 88.6% | | 89.2% | | 88.4% | | 87.0% | | 87.7% | | 88.0% | | 87.8% | | 90.0% | | 89.4% | | 88.9% | | 89.2% | |

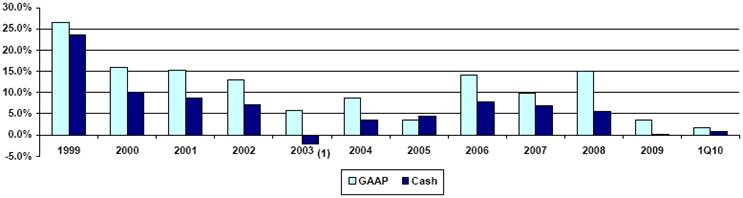

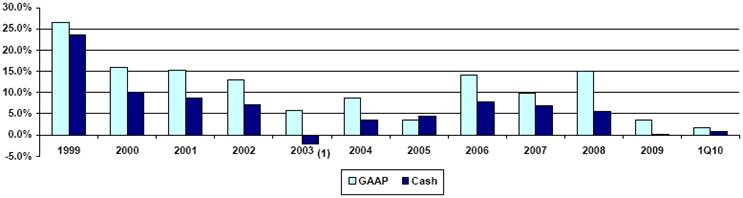

Quarterly Percentage Change in GAAP and Cash Same Property Revenues Less Operating Expenses

Summary of GAAP and Cash Rental Rate Increases on Renewed/Released Space

(1) Excluding a lease for 21,310 rentable square feet in the San Francisco Bay market, rental rates for renewed or released space in 2003 were on average 2.5% higher than expiring rates on a cash basis and 9.7% higher than expiring rates on a GAAP basis,

17

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Debt

March 31, 2010

(Dollars in thousands)

(Unaudited)

Debt Maturities

| | Secured Debt | | Unsecured Debt | |

Year | | Our Share | | Noncontrolling

Interests’

Share | | Total

Consolidated

Secured Debt | | Credit Facility | | Unsecured

Convertible Notes | |

2010 | | $ | 22,045 | | $ | 203 | | $ | 22,248 | | $ | – | | $ | – | |

2011 | | 134,790 | | 284 | | 135,074 | | 541,000 | (1) | – | |

2012 | | 40,817 | | 300 | | 41,117 | | 750,000 | (1) | 369,961 | |

2013 | | 52,382 | | 318 | | 52,700 | | – | | – | |

2014 | | 196,106 | | 20,846 | | 216,952 | | – | | 217,014 | |

Thereafter | | 416,748 | | – | | 416,748 | | – | | – | |

Total | | $ | 862,888 | | $ | 21,951 | | $ | 884,839 | (2) | $ | 1,291,000 | | $ | 586,975 | (3) |

Secured and Unsecured Debt Analysis

| | Balance | | Percentage

of

Balance | | Weighted Average

Interest Rate at

End of Period (4) | | Weighted Average

Remaining Term | |

Secured Notes Payable | | $ | 884,839 | (2) | 32.0 | % | | 5.93 | % | | 6.4 Years | |

Unsecured Line of Credit | | 541,000 | | 19.6 | | | 1.25 | | | 1.6 Years | (5) |

Unsecured Term Loan | | 750,000 | | 27.1 | | | 5.43 | | | 2.6 Years | (5) |

Unsecured Convertible Notes | | 369,961 | (3) | 13.4 | | | 3.70 | | | 1.8 Years | |

Unsecured Convertible Notes | | 217,014 | (3) | 7.9 | | | 8.00 | | | 4.0 Years | |

Total Debt | | $ | 2,762,814 | | 100.0 | % | | 4.74 | % | | 3.6 Years | |

(1) Assumes we exercise our sole right to extend the maturity date of our unsecured line of credit from October 2010 to October 2011 and our unsecured term loan from October 2011 to October 2012. Our multi-year capital plan assumes that we will successfully amend and renegotiate our $1.9 billion unsecured credit facility to a significant availability level that will take into account our business needs, including a portion of the total commitment allocated to an unsecured line of credit and an unsecured term loan. See our Annual Report on Form 10-K for the year ended December 31, 2009 for additional disclosures on our unsecured line of credit and unsecured term loan.

(2) Includes unamortized discount of approximately $2.2 million as of March 31, 2010.

(3) Includes unamortized discount of approximately $37.7 million as of March 31, 2010.

(4) Represents the weighted average contractual interest rate as of the end of the period plus the impact of debt premiums/discounts and our interest rate hedge agreements on our secured notes payable, unsecured line of credit and unsecured term loan and the contractual rates of 3.7% and 8% on our unsecured convertible notes. The weighted average interest rate excludes bank fees and amortization of loan fees. See also the “Summary of Interest Rate Hedge Agreements” section of this report.

(5) Assumes we exercise our sole right to extend the maturity date of our unsecured line of credit and unsecured term loan by twelve months to October 2011 and October 2012, respectively. The interest rate related to outstanding borrowings for our unhedged floating rate debt is based upon one-month LIBOR. The interest rate resets periodically and will vary in future periods.

18

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Secured Debt Principal Maturities Through 2014

March 31, 2010

(Dollars in thousands)

(Unaudited)

Description | | Maturity Date | | Type | | Stated Rate | | Effective Rate (1) | | Amount | |

| | | | | | | | | | | |

California – San Diego #1 | | 10/1/2010 | | CMBS | | 8.23 | % | | 5.71 | % | | $ | 13,540 | |

Other scheduled principal repayments/amortization | | | | | | | | | | | | 8,708 | |

2010 Total | | | | | | | | | | | | $ | 22,248 | |

| | | | | | | | | | | | | |

California – San Francisco Bay #1 | | 1/3/2011 | | Bank | | 1.55 | % | | 1.55 | % | | $ | 29,558 | (2) |

Eastern Massachusetts #1 | | 2/1/2011 | | Bank | | 7.52 | | | 5.82 | | | 5,050 | |

California – San Diego #2 | | 8/2/2011 | | Not-for-Profit | | 7.50 | | | 7.50 | | | 8,500 | |

Eastern Massachusetts #2 | | 10/1/2011 | | Bank | | 8.10 | | | 5.69 | | | 2,237 | |

Suburban Washington, D.C. #1 | | 11/1/2011 | | CMBS | | 7.25 | | | 5.82 | | | 2,978 | |

Suburban Washington, D.C. #2 | | 12/22/2011 | | Bank | | 3.57 | | | 3.57 | | | 76,000 | (3) |

Other scheduled principal repayments/amortization | | | | | | | | | | | | 10,751 | |

2011 Total | | | | | | | | | | | | $ | 135,074 | |

| | | | | | | | | | | | | |

Washington – Seattle #1 | | 1/1/2012 | | Bank | | 6.15 | % (4) | | 6.15 | % | | $ | 28,500 | (2)(5) |

Eastern Massachusetts #3 | | 3/1/2012 | | Insurance Co. | | 7.14 | | | 5.83 | | | 1,358 | |

Other scheduled principal repayments/amortization | | | | | | | | | | | | 11,259 | |

2012 Total | | | | | | | | | | | | $ | 41,117 | |

| | | | | | | | | | | | | |

California – San Diego #3 | | 3/1/2013 | | Insurance Co. | | 6.21 | % | | 6.21 | % | | $ | 7,940 | |

Suburban Washington, D.C. #3 | | 9/1/2013 | | CMBS | | 6.36 | | | 6.36 | | | 26,093 | |

California – San Francisco Bay #2 | | 11/16/2013 | | Other | | 6.14 | | | 6.14 | | | 7,527 | |

Other scheduled principal repayments/amortization | | | | | | | | | | | | 11,140 | |

2013 Total | | | | | | | | | | | | $ | 52,700 | |

| | | | | | | | | | | | | |

Eastern Massachusetts #4 | | 4/1/2014 | | Insurance Co. | | 5.26 | % | | 5.59 | % | | $ | 208,457 | |

Washington – Seattle #2 | | 11/18/2014 | | Other | | 6.37 | | | 6.37 | | | 240 | |

Other scheduled principal repayments/amortization | | | | | | | | | | | | 8,255 | |

2014 Total | | | | | | | | | | | | $ | 216,952 | |

(1) Represents the contractual interest rate as of the end of the period plus the impact of debt premiums/discounts and interest rate hedge agreements. The effective rate excludes bank fees and amortization of loan fees.

(2) Variable rate loan based on one month LIBOR plus an applicable spread. The interest rate resets periodically and will vary in future periods.

(3) We have ongoing discussions with lenders to extend or refinance the debt secured by this property.

(4) Represents the stated rate of 1.38% as of March 31, 2010 and the impact of an interest rate hedge agreement.

(5) Assumes we exercise our sole right to extend the maturity date of this secured debt from January 1, 2011 to January 1, 2012.

19

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Fixed/Floating Rate Debt and Leverage

(Dollars in thousands, except per share data)

(Unaudited)

Fixed/Floating Rate Debt Analysis

| | March 31, 2010 | | Percentage

of

Balance | | Weighted Average Interest Rate at

End of Period (1) | | Weighted

Average

Maturity | |

Fixed Rate Debt | | $ | 1,412,145 | | 51.1 | % | | 5.75 | % | | 5.0 Years | |

Floating Rate Debt – Hedged | | 728,500 | | 26.4 | | | 5.75 | | | 2.6 Years | (2) |

Floating Rate Debt – Unhedged | | 622,169 | | 22.5 | | | 1.27 | | | 1.6 Years | (2) |

Total Debt | | $ | 2,762,814 | | 100.0 | % | | 4.74 | % | | 3.6 Years | (2) |

Leverage

| | 3/31/2010 | | 12/31/2009 | | 9/30/2009 | | 6/30/2009 | | 3/31/2009 | |

Total debt | | $ | 2,762,814 | | $ | 2,746,946 | | $ | 2,666,096 | | $ | 2,826,584 | | $ | 2,830,262 | |

Less: cash, cash equivalents, and restricted cash | | (106,812 | ) | (117,919 | ) | (128,282 | ) | (121,996 | ) | (180,051 | ) |

Net debt | | $ | 2,656,002 | | $ | 2,629,027 | | $ | 2,537,814 | | $ | 2,704,588 | | $ | 2,650,211 | |

| | | | | | | | | | | |

Adjusted EBITDA – trailing 12 months (3)(4) | | $ | 327,685 | | $ | 342,598 | | $ | 353,831 | | $ | 354,198 | | $ | 343,525 | |

Gross Assets (excluding cash and restricted cash) | | $ | 5,900,292 | | $ | 5,859,955 | | $ | 5,765,820 | | $ | 5,641,627 | | $ | 5,514,663 | |

Net debt to Adjusted EBITDA – trailing 12 months (3)(4) | | 8.1 | | 7.7 | | 7.2 | | 7.6 | | 7.7 | |

Net debt to Gross Assets (excluding cash and restricted cash) | | 45.0% | | 44.9% | | 44.0% | | 47.9% | | 48.1% | |

Unencumbered net operating income as a percentage of total net operating income – trailing 12 months | | 57% | | 55% | | 60% | | 61% | | 64% | |

Unencumbered assets gross book value as a percentage of gross assets | | 71% | | 70% | | 69% | | 69% | | 69% | |

(1) | Represents the contractual interest rate as of the end of the period plus the impact of debt premiums/discounts and our interest rate hedge agreements on our secured notes payable, unsecured line of credit, and unsecured term loan and the contractual rates of 3.7% and 8% on our unsecured convertible notes. The weighted average interest rate excludes bank fees and amortization of loan fees. See also the “Summary of Interest Rate Hedge Agreements” section of this report. |

(2) | Assumes we exercise our sole right to extend the maturity date of our unsecured line of credit and unsecured term loan by twelve months to October 2011 and October 2012, respectively. The interest rate related to outstanding borrowings for our unhedged floating rate debt is based upon one-month LIBOR. The interest rate resets periodically and will vary in future periods. |

(3) | During the second quarter of 2009, we recognized additional income approximating $7.2 million for a cash receipt related to real estate acquired in November 2007. Additionally during the second quarter of 2009, we recognized a gain on early extinguishment of debt of approximately $11.3 million related to the repurchase, in privately negotiated transactions, of approximately $75 million (par value) of our 3.7% unsecured convertible notes. |

(4) | During the first quarter of 2009, we recognized approximately $18.5 million of additional rental income related to the modification of a lease in South San Francisco. |

See “Definitions and Other Information” section of this report starting on page 36.

20

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Interest Rate Hedge Agreements

March 31, 2010

(Dollars in thousands)

(Unaudited)

Transaction

Date | | Effective

Date | | Termination

Date | | Interest Pay

Rate | | Notional

Amount | | Effective at

March 31, 2010 | |

| | | | | | | | | | | |

December 2006 | | December 29, 2006 | | March 31, 2014 | | 4.990 | % | | $ | 50,000 | | $ | 50,000 | |

December 2006 | | January 2, 2007 | | January 3, 2011 | | 5.003 | | | 28,500 | | 28,500 | |

October 2007 | | October 31, 2007 | | September 30, 2012 | | 4.546 | | | 50,000 | | 50,000 | |

October 2007 | | October 31, 2007 | | September 30, 2013 | | 4.642 | | | 50,000 | | 50,000 | |

December 2005 | | January 2, 2008 | | December 31, 2010 | | 4.768 | | | 50,000 | | 50,000 | |

June 2006 | | June 30, 2008 | | June 30, 2010 | | 5.325 | | | 50,000 | | 50,000 | |

June 2006 | | June 30, 2008 | | June 30, 2010 | | 5.325 | | | 50,000 | | 50,000 | |

October 2007 | | July 1, 2008 | | March 31, 2013 | | 4.622 | | | 25,000 | | 25,000 | |

October 2007 | | July 1, 2008 | | March 31, 2013 | | 4.625 | | | 25,000 | | 25,000 | |

June 2006 | | October 31, 2008 | | December 31, 2010 | | 5.340 | | | 50,000 | | 50,000 | |

June 2006 | | October 31, 2008 | | December 31, 2010 | | 5.347 | | | 50,000 | | 50,000 | |

October 2008 | | September 30, 2009 | | January 31, 2011 | | 3.119 | | | 100,000 | | 100,000 | |

December 2006 | | November 30, 2009 | | March 31, 2014 | | 5.015 | | | 75,000 | | 75,000 | |

December 2006 | | November 30, 2009 | | March 31, 2014 | | 5.023 | | | 75,000 | | 75,000 | |

December 2006 | | December 31, 2010 | | October 31, 2012 | | 5.015 | | | 100,000 | | – | |

Total | | | | | | | | | | | $ | 728,500 | |

| | | | | | | | | | | | | | |

Interest pay rate represents the interest rate we will pay for one month LIBOR under the applicable interest rate swap agreement. This rate does not include any spread in addition to one month LIBOR that is due monthly as interest expense.

21

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Occupancy Percentage and Properties

(Dollars in thousands)

(Unaudited)

Summary of Occupancy Percentage

| | December 31, | | | | | |

| | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 1Q10 | | Average | |

Occupancy of operating properties –

end of period | | 96.2% | | 95.7% | | 98.4% | | 99.0% | | 96.3% | | 93.9% | | 95.2% | | 93.2% | | 93.1% | | 93.8% | | 94.8% | | 94.1% | | 94.0% | | 95.2% | |

Occupancy including redevelopment properties – end of period | | 92.9% | | 91.5% | | 90.8% | | 88.6% | | 89.2% | | 88.4% | | 87.0% | | 87.7% | | 88.0% | | 87.8% | | 90.0% | | 89.4% | | 88.9% | | 89.2% | |

Summary of Properties

| | March 31, 2010 | | December 31, 2009 | |

| | Rentable Square Feet | | Number of | | Annualized | | Occupancy | | Occupancy | |

Markets | | Operating | | Redevelopment | | Development | | Total | | Properties | | Base Rent (1) | | Percentage (1) (2) | | Percentage (3) | |

California – San Diego | | 1,467,228 | | 198,247 | | – | | 1,665,475 | | 32 | | $ | 40,281 | | 87.4 | % | | 89.2 | % | |

California – San Francisco Bay | | 1,580,943 | | – | | 555,000 | | 2,135,943 | | 22 | | 53,854 | | 95.8 | | | 95.4 | | |

Eastern Massachusetts | | 3,168,242 | | 292,750 | | – | | 3,460,992 | | 38 | | 113,643 | | 94.9 | | | 94.3 | | |

New Jersey/Suburban Philadelphia | | 459,904 | | – | | – | | 459,904 | | 8 | | 9,302 | | 83.5 | | | 88.0 | | |

New York City | | – | | – | | 310,000 | | 310,000 | | 1 | | – | | – | | | – | | |

Southeast | | 741,732 | | 21,191 | | – | | 762,923 | | 13 | | 16,144 | | 93.5 | | | 93.7 | | |

Suburban Washington, D.C. | | 2,311,760 | | 135,843 | | – | | 2,447,603 | | 30 | | 48,863 | | 95.4 | | | 94.3 | | |

Washington – Seattle | | 1,090,205 | | – | | – | | 1,090,205 | | 13 | | 35,609 | | 98.1 | | | 99.1 | | |

International – Canada | | 342,394 | | – | | – | | 342,394 | | 4 | | 8,907 | | 100.0 | | | 100.0 | | |

Total Properties (Continuing Operations) | | 11,162,408 | | 648,031 | | 865,000 | | 12,675,439 | | 161 | | $ | 326,603 | | 94.0 | % | | 94.1 | % | |

(1) | Represents annualized base rent and occupancy percentages related to our operating properties aggregating 11,162,408 rentable square feet. |

(2) | Including spaces undergoing a permanent change in use to life science laboratory space through redevelopment, including the conversion of single-tenancy space to multi-tenancy space or multi-tenancy space to single-tenancy space, occupancy as of March 31, 2010 was 88.9%. See also the “Value Added Activities” section of this report for additional information on our redevelopment program. |

(3) | Represents annualized base rent and occupancy percentages related to our operating properties aggregating 10,962,853 rentable square feet. Including spaces undergoing a permanent change in use to life science laboratory space through redevelopment, including the conversion of single-tenancy space to multi-tenancy space or multi-tenancy space to single-tenancy space, occupancy as of December 31, 2009 was 89.4%. See also the “Value Added Activities” section of this report for additional information on our redevelopment program. |

22

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Same Property Comparisons

(Dollars in thousands)

(Unaudited)

| | GAAP Basis | | Cash Basis | |

| | Three Months Ended | | Three Months Ended | |

| | 3/31/2010 | | 3/31/2009 | | % Change | | 3/31/2010 | | 3/31/2009 | | % Change | |

Revenues | | $ | 95,758 | | $ | 96,192 | | (0.5 | )% | | $ | 93,797 | | $ | 94,502 | | (0.7 | )% | |

Operating expenses | | 25,580 | | 26,553 | | (3.7 | ) | | 25,580 | | 26,553 | | (3.7 | ) | |

Revenues less operating expenses | | $ | 70,178 | | $ | 69,639 | | 0.8 | % | | $ | 68,217 | | $ | 67,949 | | 0.4 | % | |

Quarterly Percentage Change in GAAP and Cash Same Property Revenues Less Operating Expenses

See “Definitions and Other Information” section of this report starting on page 36.

23

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Leasing Activity

Three Months Ended March 31, 2010

(Unaudited)

| | | | | | | | | | | | TI’s/Lease | | |

| | | | Rentable | | | | | | Rental | | Commissions | | Average |

| | Number | | Square | | Expiring | | New | | Rate | | Per | | Lease |

| | of Leases | | Footage | | Rates | | Rates | | Changes | | Square Foot | | Terms |

Leasing Activity | | | | | | | | | | | | | | |

Lease Expirations | | | | | | | | | | | | | | |

Cash Basis | | 48 | | 594,955 | | $28.83 | | – | | – | | – | | – |

GAAP Basis | | 48 | | 594,955 | | $29.62 | | – | | – | | – | | – |

| | | | | | | | | | | | | | |

Renewed/Released Space Leased | | | | | | | | | | | | | | |

Cash Basis | | 27 | | 348,388 | | $30.30 | | $30.51 | | 0.7% | | $4.26 | | 4.2 years |

GAAP Basis | | 27 | | 348,388 | | $29.82 | | $30.37 | | 1.8% | | $4.26 | | 4.2 years |

| | | | | | | | | | | | | | |

Developed/Redeveloped/Vacant Space Leased | | | | | | | | | | | | | | |

Cash Basis | | 15 | | 215,513 | | – | | $26.83 | | – | | $11.52 | | 8.1 years |

GAAP Basis | | 15 | | 215,513 | | – | | $29.01 | | – | | $11.52 | | 8.1 years |

| | | | | | | | | | | | | | |

Month-to-Month Leases in Effect | | | | | | | | | | | | | | |

Cash Basis | | 7 | | 21,076 | | $31.81 | | $21.09 | | – | | – | | – |

GAAP Basis | | 7 | | 21,076 | | $30.49 | | $21.09 | | – | | – | | – |

| | | | | | | | | | | | | | |

Leasing Activity Summary | | | | | | | | | | | | | | |

Excluding Month-to-Month Leases | | | | | | | | | | | | | | |

Cash Basis | | 42 | | 563,901 | | – | | $29.11 | | – | | $7.04 | | 5.7 years |

GAAP Basis | | 42 | | 563,901 | | – | | $29.85 | | – | | $7.04 | | 5.7 years |

| | | | | | | | | | | | | | |

Including Month-to-Month Leases | | | | | | | | | | | | | | |

Cash Basis | | 49 | | 584,977 | | – | | $28.82 | | – | | – | | – |

GAAP Basis | | 49 | | 584,977 | | – | | $29.53 | | – | | – | | – |

24

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Leasing Activity

(Unaudited)

| | Three Months Ended | | Year Ended |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2010 | | | December 31, 2009 | | | December 31, 2008 | | | December 31, 2007 | | | December 31, 2006 |

| | GAAP | | Cash | | | GAAP | | Cash | | | GAAP | | Cash | | | GAAP | | Cash | | | GAAP | | Cash |

| | | | | | | | | | | | | | | | | | | | | | | | |

Lease Expirations | | | | | | | | | | | | | | | | | | | | | | | | |

Rentable Square Footage | | 594,955 | | 594,955 | | | 1,842,597 | | 1,842,597 | | | 1,664,944 | | 1,664,944 | | | 1,626,033 | | 1,626,033 | | | 1,224,143 | | 1,224,143 |

Expiring Rates | | $29.62 | | $28.83 | | | $30.70 | | $30.61 | | | $25.52 | | $26.88 | | | $26.97 | | $25.98 | | | $22.42 | | $24.62 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Renewed/Released Space | | | | | | | | | | | | | | | | | | | | | | | | |

Leased Rentable Square Footage | | 348,388 | | 348,388 | | | 1,188,184 | | 1,188,184 | | | 1,254,285 | | 1,254,285 | | | 895,894 | | 895,894 | | | 704,826 | | 704,826 |

New Rates | | $30.37 | | $30.51 | | | $27.72 | | $28.11 | | | $29.34 | | $28.60 | | | $31.48 | | $31.41 | | | $23.67 | | $23.64 |

Expiring Rates | | $29.82 | | $30.30 | | | $26.78 | | $28.07 | | | $25.51 | | $27.08 | | | $28.66 | | $29.38 | | | $20.74 | | $21.94 |

Rental Rate Changes | | 1.8% | | 0.7% | | | 3.5% | | 0.1% | | | 15.0% | | 5.6% | | | 9.8% | | 6.9% | | | 14.1% | | 7.7% |

| | | | | | | | | | | | | | | | | | | | | | | | |

Developed/Redeveloped/Vacant Space Leased | | | | | | | | | | | | | | | | | | | | | | | | |

Rentable Square Footage | | 215,513 | | 215,513 | | | 676,163 | | 676,163 | | | 906,859 | | 906,859 | | | 686,856 | | 686,856 | | | 883,503 | | 883,503 |

New Rates | | $29.01 | | $26.83 | | | $36.00 | | $33.57 | | | $37.64 | | $35.04 | | | $33.68 | | $31.59 | | | $32.89 | | $31.02 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | | | | | | | | | | | | | | | | | | | | | | |

Rentable Square Footage | | 563,901 | | 563,901 | | | 1,864,347 | | 1,864,347 | | | 2,161,144 | | 2,161,144 | | | 1,582,750 | | 1,582,750 | | | 1,588,329 | | 1,588,329 |

New Rates | | $29.85 | | $29.11 | | | $30.73 | | $30.09 | | | $32.82 | | $31.30 | | | $32.44 | | $31.49 | | | $28.80 | | $27.74 |

TI’s/Lease Commissions per Square Foot | | $7.04 | | $7.04 | | | $5.49 | | $5.49 | | | $7.23 | | $7.23 | | | $6.95 | | $6.95 | | | $5.13 | | $5.13 |

Average Lease Terms | | 5.7 years | | 5.7 years | | | 4.5 years | | 4.5 years | | | 5.5 years | | 5.5 years | | | 5.1 years | | 5.1 years | | | 6.3 years | | 6.3 years |

25

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Lease Expirations

March 31, 2010

(Unaudited)

Year of Lease

Expiration | | Number of

Leases Expiring | | Rentable Square

Footage (“RSF”) of

Expiring Leases | | Percentage of

Aggregate

Total RSF | | Annualized Base Rent

of Expiring Leases

(per RSF) |

2010 | | 51 | (1) | | 685,496 | (1) | | 5.8 | % | | $25.93 | |

2011 | | 80 | | | 1,753,855 | | | 14.9 | | | 27.51 | |

2012 | | 70 | | | 1,421,922 | | | 12.0 | | | 32.88 | |

2013 | | 63 | | | 1,133,913 | | | 9.6 | | | 29.02 | |

2014 | | 48 | | | 1,102,628 | | | 9.3 | | | 28.33 | |

2015 | | 35 | | | 699,122 | | | 5.9 | | | 26.55 | |

2016 | | 20 | | | 1,033,893 | | | 8.8 | | | 31.53 | |

2017 | | 13 | | | 684,973 | | | 5.8 | | | 34.63 | |

2018 | | 11 | | | 737,172 | | | 6.2 | | | 44.29 | |

2019 | | 6 | | | 254,703 | | | 2.2 | | | 34.64 | |

| | 2010 RSF of Expiring Leases | | Annualized Base Rent |

Markets | | Leased (2) | | Targeted for Redevelopment (3) | | Negotiating/

Anticipating | | Remaining

Expiring Leases | | Total | | of Expiring Leases

(per RSF) |

California – San Diego | | 7,941 | | 34,723 | (4) | 8,504 | | 40,746 | | 91,914 | | $26.62 | |

California – San Francisco Bay | | 114,433 | | – | | 25,644 | | 67,876 | | 207,953 | | 28.84 | |

Eastern Massachusetts | | 63,828 | | – | | 21,282 | | 56,123 | | 141,233 | | 28.58 | |

New Jersey/Suburban Philadelphia | | – | | – | | – | | 27,588 | | 27,588 | | 14.98 | |

Southeast | | 45,403 | | – | | 19,546 | | 8,934 | | 73,883 | | 23.06 | |

Suburban Washington, D.C. | | 2,952 | | – | | 4,457 | | 14,446 | | 21,855 | | 15.40 | |

Washington – Seattle | | 14,187 | | 93,000 | (5) | 1,989 | | 11,894 | | 121,070 | | 23.47 | |

International – Canada | | – | | – | | – | | – | | – | | – | |

Total | | 248,744 | | 127,723 | | 81,422 | | 227,607 | | 685,496 | (1) | $25.93 |

Percentage of expiring leases | | 36% | | 19% | | 12% | | 33% | | 100% | | |

| | 2011 RSF of Expiring Leases | | Annualized Base Rent |

Markets | | Leased (2) | | Targeted for Redevelopment (3) | | Negotiating/

Anticipating | | Remaining

Expiring Leases | | Total | | of Expiring Leases

(per RSF) |

California – San Diego | | 56,489 | | – | | 30,487 | | 114,996 | | 201,972 | | $25.88 | |

California – San Francisco Bay | | 25,508 | | 32,074 | (6) | 45,608 | | 161,364 | | 264,554 | | 35.05 | |

Eastern Massachusetts | | 83,561 | | 222,662 | (7) | 263,357 | | 187,004 | | 756,584 | | 29.96 | |

New Jersey/Suburban Philadelphia | | – | | – | | 14,872 | | 19,149 | | 34,021 | | 15.82 | |

Southeast | | – | | – | | 25,373 | | 15,302 | | 40,675 | | 18.87 | |

Suburban Washington, D.C. | | – | | – | | 151,601 | | 48,207 | | 199,808 | | 22.14 | |

Washington – Seattle | | – | | 181,790 | (8) | 39,427 | | 35,024 | | 256,241 | | 20.91 | |

International – Canada | | – | | – | | – | | – | | – | | – | |

Total | | 165,558 | | 436,526 | | 570,725 | | 581,046 | | 1,753,855 | | $27.51 | |

Percentage of expiring leases | | 9% | | 25% | | 33% | | 33% | | 100% | | | |

(1) Excludes seven month-to-month leases for approximately 21,000 rentable square feet.

(2) Represents leases that have been either (a) executed subsequent to March 31, 2010 as a renewal/extension, or (b) leased to another tenant.

(3) We selectively redevelop existing office/warehouse/shell space or newly acquired properties into generic laboratory space that can be leased at higher rental rates to our target life science cluster markets.

(4) Represents a 34,723 rentable square foot core and shell building with no interior improvements targeted for redevelopment into laboratory space.

(5) Represents a 93,000 rentable square foot industrial building targeted for redevelopment into single or multi-tenancy laboratory space.

(6) Represents a 32,074 rentable square foot single-tenancy space targeted for redevelopment into multi-tenancy laboratory space.

(7) Represents a 177,662 rentable square foot office building targeted for redevelopment into single or multi-tenancy laboratory space and a 45,000 rentable square foot single-tenancy space targeted for redevelopment into multi-tenancy laboratory space.

(8) Represents a 60,000 rentable square foot industrial building targeted for redevelopment into single or multi-tenancy laboratory space and a 121,790 rentable square foot office building targeted for redevelopment into single or multi-tenancy laboratory space.

26

ALEXANDRIA REAL ESTATE EQUITIES, INC.