Exhibit 99.2

| |

SUPPLEMENTAL FINANCIAL, OPERATING, &

PROPERTY INFORMATION Third Quarter Ended September 30, 2011 Conference Call Information: Wednesday, October 26, 2011 3:00PM Eastern Time/12:00PM Noon Pacific Time Number: (719) 457-2668 Confirmation Code: 7211433 385 EAST COLORADO BOULEVARD, SUITE 299 PASADENA, CALIFORNIA 91101 (626) 578-9693 www.are.com |

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Table of Contents

September 30, 2011

(Unaudited)

| | Page |

Company Profile | | 3 |

Investor Information | | 4 |

Equity Research Coverage and Rating Agencies | | 5 |

Third Quarter Ended September 30, 2011 Financial and Operating Results | | 6 |

Condensed Consolidated Statements of Income | | 15 |

Condensed Consolidated Balance Sheets | | 16 |

Earnings per Share | | 17 |

Funds from Operations | | 18 |

Adjusted Funds from Operations | | 19 |

Financial and Asset Base Highlights | | 20 |

Summary of Properties | | 23 |

Summary of Occupancy Percentage | | 24 |

Property Listing | | 25 |

Debt Information | | 31 |

Summary of Same Property Comparisons | | 35 |

Summary of Leasing Activity | | 36 |

Summary of Lease Expirations | | 39 |

20 Largest Client Tenants | | 40 |

Client Tenant Mix | | 41 |

Summary of Additions and Dispositions of Properties | | 42 |

Real Estate and Value-Added Projects | | 43 |

Summary of Capital Expenditures | | 52 |

Definitions and Other Information | | 53 |

This Supplemental Financial, Operating, & Property Information package includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify the forward-looking statements by their use of forward-looking words, such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative of those words or similar words. Our actual results may differ materially from those projected in such forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, increased interest rates and operating costs, adverse economic or real estate developments in our markets, our failure to successfully complete and lease our existing space held for redevelopment and new properties acquired for that purpose and any properties undergoing development, our failure to successfully operate or lease acquired properties, lower rental rates or higher vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, general and local economic conditions, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). All forward-looking statements are made as of October 25, 2011, the date this Supplemental Financial, Operating, & Property Information package was first made available on our website, and we assume no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

This Supplemental Financial, Operating, & Property Information package is not an offer to sell or solicitation to buy securities of Alexandria Real Estate Equities, Inc. Any offers to sell or solicitations to buy securities of Alexandria Real Estate Equities, Inc. shall be made only by means of a prospectus approved for that purpose. Unless otherwise indicated, the “Company,” “we,” “us,” and “our” refer to Alexandria Real Estate Equities, Inc. and its consolidated subsidiaries.

2

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Company Profile

September 30, 2011

The Company

Alexandria Real Estate Equities, Inc. (the “Company” or “Alexandria”), a self-administered and self-managed real estate investment trust (“REIT”), is the largest owner and preeminent REIT focused principally on science-driven cluster formation. Our operating platform is based on the principle of “clustering” with high-quality assets and operations located adjacent to life science research and innovation entities driving growth and technological advances. The Company has significant real estate assets adjacent to these key life science entities which we believe results in higher occupancy levels, longer lease terms, higher rental income, and higher returns. Our targeted locations are in the best submarkets within each of the top life science cluster destinations, including San Francisco and San Diego, California; Greater Boston; New York City, New Jersey, and Suburban Philadelphia; Research Triangle Park, North Carolina; Suburban Washington, D.C.; Seattle, Washington; and international locations. Client tenants include institutional (universities and independent non-profit institutions), pharmaceutical, biotechnology, medical device, product, and service entities, and government agencies. The Company was founded in 1994 by Jerry M. Sudarsky and Joel S. Marcus and the Company executed its initial public offering in 1997. Alexandria is the leading life science real estate company and is known for its very well located high-quality environmentally sustainable real estate, technical infrastructure, and its long term experience, and the unique expertise it provides to its broad and diverse high-quality life science industry client tenant base.

Management

Alexandria’s executive and senior management team is highly experienced in the REIT industry (uniquely with both real estate and life science experience and expertise) and is the most accomplished team focused on providing high-quality environmentally sustainable real estate, technical infrastructure, and unique expertise to the broad and diverse life science industry. Our deep and talented team has decades of real estate and life science industry experience. We believe that our expertise, experience, reputation, and key life science relationships provide Alexandria significant competitive advantages in attracting new business opportunities. Our management team also includes highly experienced regional market directors averaging over 20 years of real estate experience and almost 10 years with Alexandria. Our regional market directors have significant experience, expertise, as well as highly valuable relationships and networks that enable Alexandria to develop long-term relationships with preeminent life science entities.

Strategy

Alexandria’s primary business objective is to maximize stockholder value by providing its stockholders with the greatest possible total return based on a multifaceted platform of internal and external growth. The key elements to our strategy include our consistent focus on high-quality assets and operations in the top life science cluster destinations with our properties located adjacent to life science entities driving growth and technological advances within each cluster. These adjacency locations are characterized by high barriers to entry and exit, limited supply of available space, and represent highly desirable locations for tenancy by life science entities. Alexandria’s strategy also includes leveraging on its deep and broad life science and real estate relationships in order to attract new and leading life science client tenants and value-added real estate opportunities through acquisitions, redevelopment, and development.

Summary as of September 30, 2011

Corporate headquarters | Pasadena, California |

Markets | San Francisco, San Diego, Greater Boston, NYC/New Jersey/Suburban Philadelphia, Research Triangle Park, Suburban Washington, D.C., Seattle, and International |

Fiscal year-end | December 31 |

Total properties | 171 |

Total rentable square feet | 14.9 million |

Common shares outstanding | 61.5 million |

Dividend – quarter/annualized | $0.47/$1.88 |

Closing dividend yield – annualized | 3.1% |

Total market capitalization | $6.8 billion |

3

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Investor Information

September 30, 2011

Executive/Senior Management |

| | | | | | |

Joel S. Marcus | | Chairman, Chief Executive Officer, & Founder | | Thomas J. Andrews | | EVP-Regional Market Director-Greater Boston |

Dean A. Shigenaga | | SVP, Chief Financial Officer, & Treasurer | | John J. Cox | | SVP-Regional Market Director-Seattle |

Jennifer J. Pappas | | SVP, General Counsel, & Corporate Secretary | | John H. Cunningham | | SVP-Regional Market Director-NY & Strategic Operations |

Peter M. Moglia | | Chief Investment Officer | | Larry J. Diamond | | SVP-Regional Market Director-Mid Atlantic |

Vincent R. Ciruzzi | | SVP-Construction and Development | | Stephen A. Richardson | | EVP-Regional Market Director-San Francisco |

| | | | Daniel J. Ryan | | SVP-Regional Market Director-San Diego & Strategic Operations |

Company Information |

| | | | |

Corporate Headquarters | | Trading Symbols | | Information Requests |

385 East Colorado Boulevard, Suite 299 | | New York Stock Exchange (“NYSE”) | | Phone: (626) 396-4828 |

Pasadena, California 91101 | | Common stock: ARE | | E-mail: corporateinformation@are.com |

| | Series C preferred stock: ARE-C | | Web: www.are.com |

Common Stock Data (NYSE: ARE) |

| | | | | | | | | | |

| | 3Q11 | | 2Q11 | | 1Q11 | | 4Q10 | | 3Q10 |

High trading price | | $ | 85.33 | | $ | 83.08 | | $ | 80.72 | | $ | 76.19 | | $ | 73.89 |

Low trading price | | $ | 59.33 | | $ | 75.09 | | $ | 72.99 | | $ | 65.60 | | $ | 60.11 |

Closing stock price, average for period | | $ | 72.68 | | $ | 78.31 | | $ | 76.79 | | $ | 71.25 | | $ | 69.28 |

Closing stock price, at the end of the quarter | | $ | 61.39 | | $ | 77.42 | | $ | 77.97 | | $ | 73.26 | | $ | 70.00 |

Dividends per share – annualized | | $ | 1.88 | | $ | 1.80 | | $ | 1.80 | | $ | 1.80 | | $ | 1.40 |

Closing dividend yield – annualized | | 3.1% | | 2.3% | | 2.3% | | 2.5% | | 2.0% |

Common shares outstanding at the end of the quarter | | 61,463,839 | | 61,380,268 | | 55,049,730 | | 54,966,925 | | 54,891,638 |

Closing market value of outstanding common shares (in thousands) | | $ | 3,773,265 | | $ | 4,752,060 | | $ | 4,292,227 | | $ | 4,026,877 | | $ | 3,842,415 |

4

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Equity Research Coverage and Rating Agencies

September 30, 2011

Equity Research Coverage | | | | |

Argus Research | | The Goldman Sachs Group, Inc. | | Morningstar |

William Eddleman, Jr. | (212) 425-7500 | | Jonathan Habermann | (917) 343-4260 | | Phillip Martin | (312) 286-9905 |

| | | Sloan Bohlen | (212) 902-2796 | | Jason Ren | (312) 244-7008 |

| | | Conor Fennerty | (212) 902-4227 | | | |

| | | | | | | |

Banc of America Securities-Merrill Lynch | | Green Street Advisors | | RBC Capital Markets |

James Feldman | (646) 855-5808 | | John Stewart | (949) 640-8780 | | Dave Rodgers | (440) 715-2647 |

Jeffrey Spector | (646) 855-1363 | | Michael Knott | (949) 640-8780 | | Michael Carroll | (440) 715-2649 |

Ji Zhang | (646) 855-2926 | | Lukas Hartwich | (949) 640-8780 | | | |

| | | | | | | |

Barclays Capital | | International Strategy & Investment Group Inc | | RW Baird | |

Ross Smotrich | (212) 526-2306 | | Steve Sakwa | (212) 446-9462 | | David AuBuchon | (314) 445-6520 |

Matthew Rand | (212) 526-0248 | | George Auerbach | (212) 446-9459 | | Justin Webb | (314) 445-6515 |

| | | Gwen Clark | (212) 446-5611 | | | |

| | | | | | | |

Citigroup Global Markets | | JMP Securities | | Standard & Poor’s | |

Michael Bilerman | (212) 816-1383 | | William Marks | (415) 835-8944 | | Robert McMillan | (212) 438-9522 |

Quentin Velleley | (212) 816-6981 | | Rochan Raichura | (415) 835-3909 | | | |

David Shamis | (212) 816-5186 | | | | | | |

| | | | | | | |

Cowen and Company | | JP Morgan Securities | | UBS | |

James Sullivan | (646) 562-1380 | | Anthony Paolone | (212) 622-6682 | | Ross Nussbaum | (212) 713-2484 |

Michael Gorman | (646) 562-1381 | | Joseph Dazio | (212) 622-6416 | | Gabriel Hilmoe | (212) 713-3876 |

| | | | | | Jeremy Woods | (212) 713-1102 |

| | | | | | | |

Credit Suisse | | Keefe, Bruyette & Woods | | WJB Capital Group | |

Andrew Rosivach | (415) 249-7942 | | Sheila McGrath | (212) 887-7793 | | Jeffrey Langbaum | (646) 344-3310 |

| | | Kristin Brown | (212) 887-7738 | | | |

| | | | | | | |

Rating Agencies | | | | | | |

Moody’s Investors Service | | Standard & Poor’s | | | |

Philip Kibel | (212) 553-4569 | | Lisa Sarajian | (212) 438-2597 | | | |

Maria Maslovsky | (212) 553-4831 | | George Skoufis | (212) 438-2608 | | | |

Alexandria Real Estate Equities, Inc. is currently covered by the research analysts listed above. This list may not be complete and is subject to change as firms initiate or discontinue coverage of our company. Please note that any opinions, estimates, or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, forecasts, or predictions of Alexandria Real Estate Equities, Inc. or its management. Alexandria Real Estate Equities, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions, or recommendations. Interested persons may obtain copies of analysts’ reports on their own as we do not distribute these reports. Several of these firms may from time-to-time own our stock and/or hold other long or short positions in our stock, and may provide compensated services to us.

5

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Highlights

Three Months Ended September 30, 2011:

· Received Baa2/BBB- Stable Outlook Investment Grade Issuer Rating from Two Major Rating Agencies

· Three Months Ended September 30, 2011, Funds from Operations (“FFO”) Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $1.11 Before Loss on Early Extinguishment of Debt and Non-Cash Impairment Charge, Compared to Three Months Ended September 30, 2010, FFO Per Share (Diluted) of $1.11 Before Loss on Early Extinguishment of Debt

· Three Months Ended September 30, 2011, Earnings Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $0.40, Compared to Three Months Ended September 30, 2010, Earnings Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $0.45

· Executed 56 Leases for 985,000 Rentable Square Feet, Including 458,000 Rentable Square Feet of Redevelopment and Development Space; Second Highest Single Quarter of Leasing Activity in Company History

· Cash and GAAP Rental Rate Decrease of 3.0% and Increase of 2.8%, Respectively, on Renewed/Re-leased Space

· Cash and GAAP Same Property Net Operating Income Increase of 4.8% and Decrease of 0.2%, Respectively

· Occupancy of Operating Properties Increases to 94.6%; Occupancy of Operating and Redevelopment Properties Increases to 89.3%

· Repurchased, in Privately Negotiated Transactions, $121.1 Million of 3.70% Unsecured Convertible Notes

· Repaid Two Secured Loans Aggregating $11.2 Million

· Sold Parcel of Land Located in the San Diego Market for $17.3 Million

· Executed Long Term Lease for 307,000 Rentable Square Feet Single Tenant Ground-Up Development at Alexandria Center™ at Kendall Square Located in Cambridge, Massachusetts

· Completed Ground-up Development of a 97,000 Rentable Square Feet Single Tenant Building Located in the Research Triangle Park Market; 100% Leased

· Completed Redevelopment of 47,500 Rentable Square Feet Located in the Greater Boston Market; 100% Leased

· Completed Ground Lease of Land and Improvements in Canada to Tenant for Construction of a 783,255 Rentable Square Foot Laboratory Building

Nine Months Ended September 30, 2011:

· Nine Months Ended September 30, 2011, FFO Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $3.40 Before Loss on Early Extinguishment of Debt and Non-Cash Impairment Charge, Compared to Nine Months Ended September 30, 2010, FFO Per Share (Diluted) of $3.29 Before Loss on Early Extinguishment of Debt

· Nine Months Ended September 30, 2011, Earnings Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $1.29, Compared to Nine Months Ended September 30, 2010, Earnings Per Share (Diluted) Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders of $0.49

· Executed 143 Leases for 2,265,000 Rentable Square Feet, Including 634,000 Rentable Square Feet of Redevelopment and Development Space

· Cash and GAAP Rental Rate Decrease of 0.7% and Increase of 2.5%, Respectively, on Renewed/Re-leased Space

· Cash and GAAP Same Property Net Operating Income Increases of 5.5% and 0.2%, Respectively

· Repurchased, in Privately Negotiated Transactions, $217.1 Million of 3.70% Unsecured Convertible Notes

· Closed $750 Million Unsecured Term Loan

· Extended Maturity Date and Increased Commitments on Unsecured Line of Credit to $1.5 Billion

· Acquired 4755 Nexus Center Drive, a Newly and Partially Completed 41,710 Rentable Square Foot Development Project Located in University Town Center in the San Diego Market

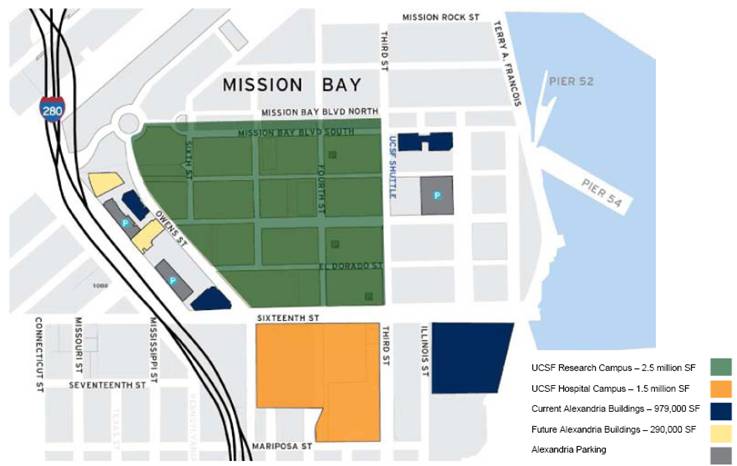

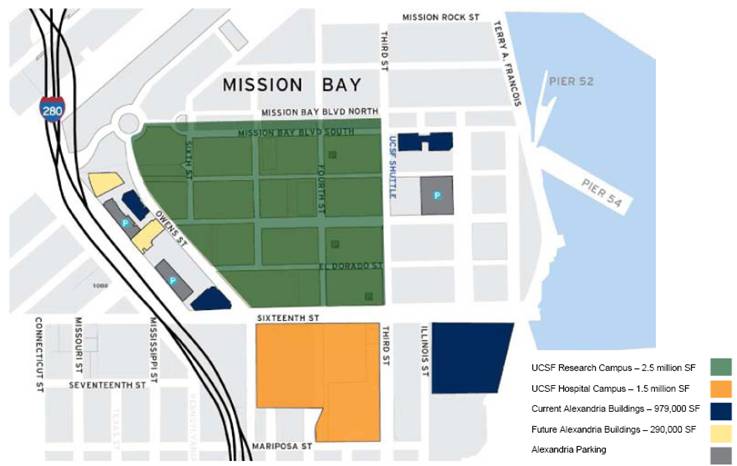

· Acquired 409 and 499 Illinois Street, a Newly and Partially Completed 453,256 Rentable Square Foot Development Project Located in Mission Bay, San Francisco

· Awarded LEED® Platinum Certification for 10300 Campus Pointe Drive, a Property Located in University Town Center in the San Diego Market

· Awarded LEED® Gold Certifications for Alexandria Center™ for Life Science – New York City, 199 E. Blaine Street, a Property Located in the Seattle Market, and 455 Mission Bay Blvd., a Property Located in the San Francisco Market

October 2011:

· Board of Directors Elects Stephen A. Richardson as Chief Operating Officer and Regional Market Director – San Francisco

· Extended 2011 Maturity Date of $76 Million Secured Loan Into 2012 and in Discussions for an Additional 3-5 Year Extension

· Sold a 30,000 Rentable Square Foot Property Located in the Suburbs of Boston, for $2.9 Million

· Repaid Two Secured Loans Aggregating $32.7 Million

6

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Financial Results

Revenue Trend – Past

For the three months ended September 30, 2011, we reported an increase in total revenues to $143,427,000 from $142,918,000 for the three months ended June 30, 2011. During the three months ended September 30, 2011, total rental revenue declined approximately $3 million. The decline in rental revenue was primarily due to the transition of three properties. Approximately $2 million of the decline in rental revenue related to 5200 Research Place, a property transitioning from a short term sale lease back with Biogen Idec Inc. to a 20 year triple net lease with Illumina, Inc. The original short-term lease with Biogen Idec Inc. was for an original term of 15 months. Upon execution of a lease with Illumina, Inc., we amended the short term lease with Biogen Idec Inc. in order to deliver space to Illumina, Inc. at an earlier date. The primary reason for the $2 million decline in rental revenue at this property was due to a $1.7 million decline in amortization of below market lease revenue. Annualized base rent per square foot at 5200 Research Place is expected to be approximately $38.26 per rentable square foot in the three months ended December 31, 2011, pursuant to a 20 year lease with Illumina, Inc. An additional $1 million decline in rental revenue from the three months ended June 30, 2011, to the three months ended September 30, 2011, was primarily due to 1) a decline in rental revenue for an office property located in Cambridge that will undergo a conversion into a laboratory building through redevelopment beginning in October 2011, and 2) another property located in the suburbs of Boston, in transition during the quarter from a prior tenant to a new tenant, resulting in a temporary decline in rental revenue. As of October 2011, the new tenant was in full occupancy of this property.

Revenue Trend – Future

Rental revenue and net operating income are projected to increase significantly quarter to quarter from the three months ended December 31, 2011, to the three months ended December 31, 2012. Annualized three months ended December 31, 2012, net operating income, when compared to annualized three months ended December 31, 2011, net operating income, is expected to increase by approximately $42 to $47 million primarily related to current and future redevelopment and development projects, a significant amount which is pre-leased. Additionally, the increase in net operating income is also due to annual contractual steps in cash rents, recent and anticipated leasing, and lease-up of vacant space.

Funds from Operations and Net Income Attributable to Alexandria Real Estate Equities, Inc.’s Common Stockholders

For the three months ended September 30, 2011, we reported FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $67,972,000, or $1.11 per share (diluted), before loss on early extinguishment of debt and non-cash impairment charge, compared to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $55,151,000, or $1.11 per share (diluted), before loss on early extinguishment of debt, for the three months ended September 30, 2010. For the nine months ended September 30, 2011, we reported FFO attributed to Alexandria Real Estate Equities, Inc.’s common stockholders of $198,237,000, or $3.40 per share (diluted), before loss on early extinguishment of debt and non-cash impairment charge, compared to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $163,686,000, or $3.29 per share (diluted), before loss on early extinguishment of debt, for the nine months ended September 30, 2010. During the nine months ended September 30, 2011, we recognized an aggregate loss on early extinguishment of debt of approximately $6.5 million related to the repurchases, in privately negotiated transactions, of approximately $217.1 million of certain of our 3.70% unsecured convertible notes and the partial and early repayment of our unsecured term loan. In addition, we recognized a non-cash impairment charge of approximately $1.0 million related to one property during the nine months ended September 30, 2011. We sold this property to a user in October 2011 for approximately $2.9 million. Including the aggregate loss on early extinguishment of debt and non-cash impairment charge, FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the three and nine months ended September 30, 2011, was $64,274,000, or $1.05 per share (diluted), and 190,826,000, or $3.27 per share (diluted), respectively.

7

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Financial Results (continued)

FFO is a non-GAAP measure widely used by real estate investment trusts. We compute FFO in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”) in its April 2002 White Paper and related implementation guidance. A reconciliation of net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders in accordance with United States generally accepted accounting principles (“GAAP”) to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders is included in the financial information accompanying this press release. The primary reconciling items between GAAP net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders and FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders are depreciation and amortization expense and gain on sales of property. Depreciation and amortization expense for the three months ended September 30, 2011 and 2010, was $39,990,000 and $32,009,000, respectively. Depreciation and amortization expense for the nine months ended September 30, 2011 and 2010, was $117,060,000 and $92,089,000, respectively. Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the three months ended September 30, 2011, was $24,662,000 or $0.40 per share (diluted), compared to net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $22,235,000, or $0.45 per share (diluted), for the three months ended September 30, 2010. Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the nine months ended September 30, 2011, was $75,013,000, or $1.29 per share (diluted), compared to net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders of $22,467,000, or $0.49 per share (diluted), for the nine months ended September 30, 2010.

The following table summarizes the significant items that impacted FFO (diluted) during each period presented (dollars in thousands, except per share amounts):

| | Three Months Ended | | Nine Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | | 9/30/11 | | 9/30/10 | |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for FFO per share (diluted), as reported | | $ | 64,274 | | $ | 65,921 | | $ | 60,636 | | $ | 58,474 | | $ | 53,862 | | $ | 190,826 | | $ | 121,292 | |

Loss on early extinguishment of debt | | 2,742 | | 1,248 | | 2,495 | | 2,372 | | 1,300 | | 6,485 | | 42,796 | |

Non-cash impairment charge | | 994 | | – | | – | | – | | – | | 994 | | – | |

Impact of unvested restricted stock awards | | (38 | ) | (11 | ) | (21 | ) | (20 | ) | (11 | ) | (68 | ) | (402 | ) |

FFO (diluted), as adjusted | | $ | 67,972 | | $ | 67,158 | | $ | 63,110 | | $ | 60,826 | | $ | 55,151 | | $ | 198,237 | | $ | 163,686 | |

| | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for FFO per share (diluted), as reported | | 61,310,016 | | 58,519,169 | | 54,973,802 | | 54,893,410 | | 49,864,225 | | 58,290,792 | | 49,745,649 | |

| | | | | | | | | | | | | | | |

FFO per share (diluted), as adjusted | | $ | 1.11 | | $ | 1.15 | | $ | 1.15 | | $ | 1.11 | | $ | 1.11 | | $ | 3.40 | | $ | 3.29 | |

8

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Leasing Activity

For the three months ended September 30, 2011, we executed a total of 56 leases for approximately 985,000 rentable square feet at 40 different properties (excluding month-to-month leases). Of this total, approximately 402,000 rentable square feet related to new or renewal leases of previously leased space (renewed/re-leased space) and approximately 583,000 rentable square feet related to developed, redeveloped, or previously vacant space. Of the 583,000 rentable square feet, approximately 458,000 rentable square feet were related to our development or redevelopment programs, with the remaining approximately 125,000 rentable square feet related to previously vacant space. Rental rates for these new or renewal leases (renewed/re-leased space) were on average approximately 2.8% higher on a GAAP basis than rental rates for the respective expiring leases.

For the nine months ended September 30, 2011, we executed a total of 143 leases for approximately 2,265,000 rentable square feet at 60 different properties (excluding month-to-month leases). Of this total, approximately 1,171,000 rentable square feet related to new or renewal leases of previously leased space (renewed/re-leased space) and approximately 1,094,000 rentable square feet related to developed, redeveloped, or previously vacant space. Of the 1,094,000 rentable square feet, approximately 634,000 rentable square feet were related to our development or redevelopment programs, and the remaining approximately 460,000 rentable square feet were related to previously vacant space. Rental rates for these new or renewal leases (renewed/re-leased space) were on average approximately 2.5% higher on a GAAP basis than rental rates for the respective expiring leases.

As of September 30, 2011, approximately 95% of our leases (on a rentable square footage basis) were triple net leases, requiring tenants to pay substantially all real estate taxes, insurance, utilities, common area, and other operating expenses (including increases thereto) in addition to base rent. Additionally, approximately 92% of our leases (on a rentable square footage basis) provided for the recapture of certain capital expenditures, and approximately 94% of our leases (on a rentable square footage basis) contained effective annual rent escalations that were either fixed or indexed based on the consumer price index or another index.

Investment Grade Rating

In July 2011, we received a Baa2 (stable outlook) and a BBB- (stable outlook) investment grade rating from two major rating agencies. Key strengths of our balance sheet and business which highlight our investment grade credit profile include, among others, solid liquidity on balance sheet, diverse and credit worthy tenant base, well located properties proximate to leading research institutions, favorable lease terms, solid and stable occupancy and cash flows, and proven life science and real estate expertise. This significant milestone broadens our access to another key source of capital and allows us to continue to pursue our long-term capital, investment, and operating strategies. Issuance of unsecured bonds will allow us to transition bank related debt financing to unsecured bonds, variable rate debt to fixed rate debt, and short tenured debt to long tenured debt.

Unsecured Credit Facility

In January 2011, we entered into a third amendment (the “Third Amendment”) to our second amended and restated credit agreement dated October 31, 2006, as further amended on December 1, 2006 and May 2, 2007 (the “Prior Credit Agreement,” and as amended by the Third Amendment, the “Amended Credit Agreement”), with Bank of America, N.A., as administrative agent, and certain lenders. The Third Amendment amended the Prior Credit Agreement to, among other things, increase the maximum permitted borrowings under the unsecured line of credit from $1.15 billion to $1.5 billion, plus a $750 million unsecured term loan (the “2012 Unsecured Term Loan” and together with the unsecured line of credit, the “Unsecured Credit Facility”) and provided an accordion option to increase commitments under the Unsecured Credit Facility by up to an additional $300 million. Borrowings under the Unsecured Credit Facility bear interest at LIBOR or the specified base rate, plus in either case a margin specified in the Amended Credit Agreement (the “Applicable Margin”). The Applicable Margin for LIBOR borrowings outstanding under the revolving credit facility was 2.3% as of September 30, 2011. The Applicable Margin for the LIBOR borrowings under the 2012 Unsecured Term Loan was not amended in the Third Amendment.

9

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Unsecured Credit Facility (continued)

Under the Third Amendment, the maturity date for the unsecured line of credit is January 2015, assuming we exercise our sole right under the amendment to extend this maturity date twice by an additional six months after each exercise. The maturity date of the 2012 Unsecured Term Loan is October 2012. The Third Amendment modified certain financial covenants with respect to the Unsecured Credit Facility, including the fixed charge coverage ratio, secured debt ratio, leverage ratio, and minimum book value, and added covenants relating to an unsecured leverage ratio and unsecured debt yield.

2016 Unsecured Term Loan

In February 2011, we entered into a $250 million unsecured term loan. In June 2011, we amended this $250 million unsecured term loan (as amended, the “2016 Unsecured Term Loan”) to, among other things, increase the borrowings from $250 million to $750 million and to extend the maturity from January 2015 to June 2016, assuming we exercise our sole right to extend the maturity date by one year. Borrowings under the 2016 Unsecured Term Loan bear interest at LIBOR or the specified base rate, plus in either case a margin specified in the amended unsecured term loan agreement. The applicable margin for the LIBOR borrowings under the 2016 Unsecured Term Loan as of September 30, 2011, was 1.65%. Under the 2016 Unsecured Term Loan agreement, the financial covenants were not amended and are identical to the financial covenants required under our existing Unsecured Credit Facility. The 2016 Unsecured Term Loan may be repaid at any date prior to maturity without a prepayment penalty. The net proceeds from this 2016 Unsecured Term Loan were used to reduce outstanding borrowings on the 2012 Unsecured Term Loan from $750 million to $250 million. As a result of this early repayment, in the three and six months ended June 30, 2011, we recognized a loss on early extinguishment of debt of approximately $1.2 million related to the write-off of unamortized loan fees.

3.70% Unsecured Convertible Notes

During the three months ended September 30, 2011, we repurchased, in privately negotiated transactions, approximately $121.1 million of certain of our 3.70% unsecured convertible notes at an aggregate cash price of approximately $122.8 million. As a result of these repurchases, we recognized an aggregate loss on early extinguishment of debt of approximately $2.7 million. As of September 30, 2011, approximately $84.3 million of our 3.70% unsecured convertible notes was outstanding, net of approximately $0.5 million of unamortized discount.

During the three months ended March 31, 2011, we repurchased, in privately negotiated transactions, approximately $96.1 million of certain of our 3.70% unsecured convertible notes at an aggregate cash price of approximately $98.6 million. As a result of these repurchases, we recognized an aggregate loss on early extinguishment of debt of approximately $2.5 million during the three months ended March 31, 2011.

Acquisitions

In June 2011, we acquired 285 Bear Hill Road, a 26,270 rentable square foot office property located in the Greater Boston market, for approximately $3.9 million. We plan to begin the redevelopment of this property into life science laboratory space in the three months ended December 31, 2011. Based on our view of existing market conditions and certain assumptions at the time of the acquisition, we expect to achieve a stabilized yield on a GAAP and cash basis for this property of approximately 8.6% and 8.0%, respectively. Stabilized yield on cost is calculated as the quotient of net operating income and our investment in the property at stabilization (“Stabilized Yield”).

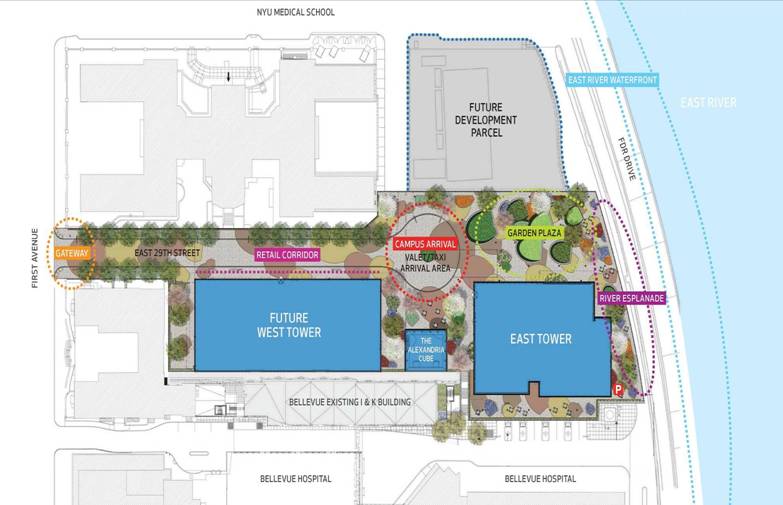

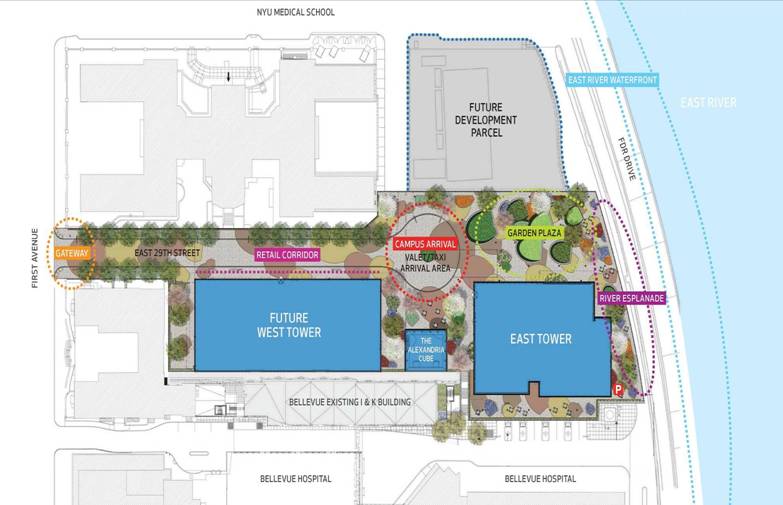

In April 2011, we acquired 409 and 499 Illinois Street, a newly and partially completed world-class 453,256 rentable square foot laboratory/office development project located on a highly desirable waterfront location in Mission Bay, San Francisco, for approximately $293 million. 409 Illinois Street is a 241,659 rentable square foot tower that is 97% leased to a life science company through November 2023. 499 Illinois Street is a vacant 211,597 rentable square foot tower in shell condition for which we plan to complete the development. Based on our view of existing market conditions and certain assumptions at the time of the acquisition, we expect to achieve a Stabilized Yield on a GAAP and cash basis for this property in the range of 7.2% to 7.6% and 6.5% to 7.0%, respectively.

10

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Dispositions

In August 2011, we sold a parcel of land located in San Diego, California for approximately $17.3 million at a gain of $46,000. The buyer is expected to construct a building with approximately 249,000 rentable square feet, representing a sale price of approximately $70 per rentable square foot.

During the three months ended September 30, 2011, 13-15 DeAngelo Drive, a vacant 30,000 rentable square foot property, located in the suburbs of Boston, Massachusetts, met the criteria for classification as “held for sale.” This property was occupied by a credit life science tenant through June 30, 2011. Upon move out, a user for the building presented an offer for the purchase of the building in the three months ended September 30, 2011. As a result, we recognized an impairment charge of approximately $1.0 million in the three months ended September 30, 2011, to adjust the carrying value to the estimated fair value less costs to sell. In October 2011, we sold 13-15 DeAngelo Drive to that user, for approximately $2.9 million, representing a sale price of approximately $97 per rentable square foot.

Development

In August 2011, we completed the ground-up development of 7 Triangle Drive, a 97,000 rentable square foot single-tenant building located in the Research Triangle Park market, which is currently 100% leased as of September 30, 2011. Our Stabilized Yield on a GAAP and cash basis for this property was approximately 9.3% and 8.3%, respectively.

In July 2011, we executed a new lease for a 307,000 rentable square feet ground-up development with Biogen Idec, Inc. at Alexandria CenterTM at Kendall Square. The ground breaking for this project will occur in late October 2011, and we will add the project to our disclosure of active ground-up development for the three months ended December 31, 2011.

11

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Earnings Outlook

Based on our current view of existing market conditions and certain current assumptions, we expect our FFO per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders and earnings per share (diluted) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the years ended December 31, 2011 and 2012 will be as follows:

| | Year Ended December 31, | |

| | 2011 | | 2012 | |

FFO per share (diluted) | | $4.38 | (1) | $4.50 - $4.54 | |

Earnings per share (diluted) | | $1.72 | (1) | $1.85 - $1.89 | |

(1) Includes loss on early extinguishment of debt and non-cash impairment charge of approximately $6.5 million and $1.0 million, respectively, or approximately $0.13 per share in aggregate, for the nine months ended September 30, 2011.

The following table provides a reconciliation of our prior FFO per share (diluted) guidance to our current guidance for year ended December 31, 2011:

| | As Disclosed in

Second Quarter

Earnings | | Change | | As Disclosed in

Third Quarter

Earnings | |

| | | | | | | |

Guidance range as reported on May 4, 2011, in connection with our first quarter 2011 earnings call | | $4.52 - $4.57 | | | | $4.52 - $4.57 | |

| | | | | | | |

Loss on early extinguishment of debt in June 2011 | | (0.02 | ) | – | | (0.02 | ) |

Loss on early extinguishment of debt in July 2011 | | (0.04 | ) | – | | (0.04 | ) |

Loss on early extinguishment of debt in August and September 2011 | | – | | (0.01 | ) | (0.01 | ) |

Refinancing of 2012 Unsecured Term Loan | | (0.02 | ) | – | | (0.02 | ) |

Deferral of unsecured debt financing assumption (previously estimated in 2011) | | (0.05 | ) | 0.05 | | – | |

Decrease in estimated acquisitions | | (0.01 | ) | (0.01 | ) | (0.02 | ) |

Timing of repurchases of convertible notes and extension of secured notes | | (0.01 | ) | (0.01 | ) | (0.02 | ) |

Non-cash impairment charge | | – | | (0.02 | ) | (0.02 | ) |

Increase in general and administrative expenses | | – | | (0.01 | ) | (0.01 | ) |

Non-recoverable operating expenses | | – | | (0.01 | ) | (0.01 | ) |

| | (0.15 | ) | (0.02 | ) | (0.17 | ) |

| | | | | | | |

Guidance, as reported | | $4.37 - $4.42 | | | | $4.38 | |

Rental revenue and net operating income are projected to increase significantly quarter to quarter from the three months ended December 31, 2011, to the three months ended December 31, 2012. Annualized three months ended December 31, 2012 net operating income, when compared to annualized three months ended December 31, 2011 net operating income, is expected to increase by approximately $42 to $47 million primarily related to current and future redevelopment and development projects, a significant amount which is pre-leased. Additionally, the increase in net operating income is also due to annual contractual steps in cash rents, recent and anticipated leasing, and lease-up of vacant space.

12

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Sources and Uses of Capital

We expect that our principal liquidity needs for the three months ended December 31, 2011, through three months ended December 31, 2012, will be satisfied by the following multiple sources of capital as shown in the table below (amounts in millions). For the three months ended December 31, 2011, and for the year ended December 31, 2012, we expect to have significant capital requirements, including amounts shown in the table below. There can be no assurance that our sources and uses of capital will not be materially higher or lower than these expectations.

Sources of Capital for Fourth Quarter 2011 Through Fourth Quarter 2012 | | 4Q11 through 4Q12 | |

Cash and cash equivalents as of September 30, 2011 | | $ | 73 | |

Restricted cash as of September 30, 2011 | | 28 | |

Net cash provided by operating activities | | 310 | (1) |

Asset sales | | 112 | (2) |

Availability under our $1.5 billion unsecured line of credit as of September 30, 2011 | | 686 | |

Extended 2011 maturity date of secured loan into 2012 | | 76 | (3) |

New unsecured term loan (see footnote (4) below) | | 450 | |

Unsecured senior notes | | TBD | (5) |

Total | | $ | 1,735 | |

| | Three Months

Ended December 31, | | Year Ended

December 31, | |

Uses of Capital | | 2011 | | 2012 | |

Acquisitions | | $ | 20 | | $ | – | |

Construction: | | | | | |

Redevelopment projects | | 62 | | 148 | |

Development projects | | 20 | | 147 | |

Projects in India and China | | 21 | | 62 | |

Preconstruction and other projects | | 16 | | 16 | |

Secured notes payable principal repayments | | 79 | (3) | 13 | |

Unsecured convertible note principal repayments | | – | | 85 | |

2012 Unsecured Term Loan principal repayment | | – | | 250 | (4) |

Preferred stock dividends | | 7 | | 28 | |

Common stock dividends | | 29 | | 116 | |

Total | | $ | 254 | (3) | $ | 865 | (4) |

(1) Represents net cash provided by operating activities for the nine months ended September 30, 2011, multiplied by 167.7% in order to estimate net cash provided by operating activities for the fourth quarter 2011 through fourth

quarter 2012.

(2) In light of current market conditions, we expect to implement a more aggressive asset disposition strategy, beyond estimated asset sales in this table, to provide capital for reinvestment into our business.

(3) Amount includes a $76 million secured bank loan. We extended the 2011 maturity date of this loan into 2012 and are in discussions for an additional 3-5 year extension.

(4) Our 2012 Unsecured Term Loan matures in October 2012. We are currently negotiating a new unsecured term loan with a target amount between $400 and $500 million. The proceeds of this new loan will be used initially to

reduce outstanding balances on our unsecured line of credit. Ultimately, a portion of these proceeds will provide funds to repay our 2012 Unsecured Term Loan.

(5) Amount and timing of issuance of unsecured bonds will be subject to the debt capital market environment.

13

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Third Quarter Ended September 30, 2011 Financial and Operating Results

Client Tenant Base

The quality, diversity, breadth, and depth of our significant relationships with our life science client tenants provide Alexandria Real Estate Equities, Inc. with solid cash flows. As of September 30, 2011, Alexandria’s multinational pharmaceutical client tenants represented approximately 25% of our annualized base rent, led by Novartis AG, Eli Lilly and Company, Roche Holding Ltd, Bristol-Myers Squibb Company, GlaxoSmithKline plc, and Pfizer Inc.; public biotechnology companies represented approximately 17% and included Amgen Inc., Gilead Sciences, Inc., Biogen Idec Inc., and Celgene Corporation; revenue-producing life science product and service companies represented approximately 22%, led by Illumina, Inc., Quest Diagnostics Incorporated, Qiagen N.V., Laboratory Corporation of America Holdings, and Monsanto Company; government agencies and renowned medical and research institutions represented approximately 16% and included Massachusetts Institute of Technology, The Scripps Research Institute, The Regents of the University of California, Fred Hutchinson Cancer Research Center, University of Washington, Sanford-Burnham Medical Research Institute, and the United States Government; private biotechnology companies represented approximately 15% and included high-quality, leading-edge companies with blue-chip venture and institutional investors, including FibroGen, Inc., Achaogen Inc., Intellikine, Inc., MacroGenics, Inc., and Forma Therapeutics, Inc.; and the remaining approximately 5% consisted of traditional office tenants. Alexandria’s strong life science underwriting skills, long-term life science industry relationships, and sophisticated management with both real estate and life science operating expertise set the Company apart from all other publicly traded REITs and real estate companies.

Earnings Call Information

We will host a conference call on Wednesday, October 26, 2011, at 3:00 p.m. Eastern Time (“ET”)/12:00 p.m. noon Pacific Time (“PT”) that is open to the general public to discuss our financial and operating results for the three months ended September 30, 2011. To participate in this conference call, dial (719) 457-2668 and confirmation code 7211433, shortly before 3:00 p.m. ET/12:00 p.m. noon PT. The audio web cast can be accessed at: www.are.com, in the Corporate Information section. A replay of the call will be available for a limited time from 6:00 p.m. ET/3:00 p.m. PT on Wednesday, October 26, 2011. The replay number is (719) 457-0820 and the confirmation code is 7211433.

Additionally, a copy of Alexandria Real Estate Equities, Inc.’s Supplemental Financial, Operating, & Property Information for the three months ended September 30, 2011, and this press release are available in the Corporate Information section of our website at www.are.com.

About the Company

Alexandria Real Estate Equities, Inc., Landlord of Choice to the Life Science Industry®, is the largest owner and preeminent REIT focused principally on cluster development through the ownership, operation, management, and selective acquisition, redevelopment, and development of properties containing life science laboratory space. Alexandria is the leading provider of high-quality, environmentally sustainable real estate, technical infrastructure, and services to the broad and diverse life science industry. Client tenants include institutional (universities and independent non-profit institutions), pharmaceutical, biotechnology, medical device, product, and service entities, and government agencies. Alexandria’s primary business objective is to maximize stockholder value by providing its stockholders with the greatest possible total return based on a multifaceted platform of internal and external growth. Alexandria’s operating platform is based on the principle of “clustering” with assets and operations located adjacent to life science entities driving growth and technological advances within each cluster.

As of October 25, 2011, we had 171 properties aggregating 14.9 million rentable square feet comprised of approximately 13.6 million rentable square feet of operating properties, approximately 747,248 rentable square feet undergoing active redevelopment, and approximately 531,486 rentable square feet undergoing active development. Our asset base will enable us to grow to approximately 33.4 million rentable square feet through additional ground-up development and other projects of approximately 18.5 million rentable square feet.

14

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Condensed Consolidated Statements of Income

(Dollars in thousands, except per share amounts)

(Unaudited)

| | Three Months Ended | | Nine Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | | 9/30/11 | | 9/30/10 | |

Revenues | | | | | | | | | | | | | | | |

Rental | | $ | 106,160 | | $ | 109,149 | | $ | 105,997 | | $ | 99,053 | | $ | 89,567 | | $ | 321,306 | | $ | 266,349 | |

Tenant recoveries | | 34,792 | | 32,843 | | 32,627 | | 30,211 | | 29,179 | | 100,262 | | 81,655 | |

Other income | | 2,475 | | 926 | | 794 | | 1,625 | | 1,568 | | 4,195 | | 3,555 | |

Total revenues | | 143,427 | | 142,918 | | 139,418 | | 130,889 | | 120,314 | | 425,763 | | 351,559 | |

| | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | |

Rental operations | | 42,608 | | 40,239 | | 40,697 | | 36,284 | | 33,154 | | 123,544 | | 94,275 | |

General and administrative | | 10,297 | | 10,758 | | 9,497 | | 8,601 | | 8,042 | | 30,552 | | 25,777 | |

Interest | | 14,273 | | 16,567 | | 17,810 | | 17,158 | | 16,078 | | 48,650 | | 52,351 | |

Depreciation and amortization | | 39,652 | | 40,069 | | 36,468 | | 34,289 | | 31,758 | | 116,189 | | 91,334 | |

Total expenses | | 106,830 | | 107,633 | | 104,472 | | 96,332 | | 89,032 | | 318,935 | | 263,737 | |

Income from continuing operations before loss on early extinguishment of debt | | 36,597 | | 35,285 | | 34,946 | | 34,557 | | 31,282 | | 106,828 | | 87,822 | |

| | | | | | | | | | | | | | | |

Loss on early extinguishment of debt | | (2,742 | ) | (1,248 | ) | (2,495 | ) | (2,372 | ) | (1,300 | ) | (6,485 | ) | (42,796 | ) |

Income from continuing operations | | 33,855 | | 34,037 | | 32,451 | | 32,185 | | 29,982 | | 100,343 | | 45,026 | |

| | | | | | | | | | | | | | | |

(Loss) income from discontinued operations, net | | (906 | ) | 274 | | 174 | | 373 | | 479 | | (458 | ) | 1,996 | |

| | | | | | | | | | | | | | | |

Gain on sales of land parcels | | 46 | | – | | – | | 59,442 | | – | | 46 | | – | |

Net income | | 32,995 | | 34,311 | | 32,625 | | 92,000 | | 30,461 | | 99,931 | | 47,022 | |

| | | | | | | | | | | | | | | |

Net income attributable to noncontrolling interests | | 966 | | 938 | | 929 | | 944 | | 920 | | 2,833 | | 2,785 | |

Dividends on preferred stock | | 7,089 | | 7,089 | | 7,089 | | 7,089 | | 7,089 | | 21,267 | | 21,268 | |

Net income attributable to unvested restricted stock awards | | 278 | | 298 | | 242 | | 726 | | 217 | | 818 | | 502 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 24,662 | | $ | 25,986 | | $ | 24,365 | | $ | 83,241 | | $ | 22,235 | | $ | 75,013 | | $ | 22,467 | |

| | | | | | | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common

stockholders – basic | | | | | | | | | | | | | | | |

Continuing operations | | $ | 0.41 | | $ | 0.44 | | $ | 0.44 | | $ | 1.51 | | $ | 0.44 | | $ | 1.30 | | $ | 0.45 | |

Discontinued operations, net | | (0.01 | ) | – | | – | | 0.01 | | 0.01 | | (0.01 | ) | 0.04 | |

Earnings per share – basic | | $ | 0.40 | | $ | 0.44 | | $ | 0.44 | | $ | 1.52 | | $ | 0.45 | | $ | 1.29 | | $ | 0.49 | |

| | | | | | | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common

stockholders – diluted | | | | | | | | | | | | | | | |

Continuing operations | | $ | 0.41 | | $ | 0.44 | | $ | 0.44 | | $ | 1.51 | | $ | 0.44 | | $ | 1.30 | | $ | 0.45 | |

Discontinued operations, net | | (0.01 | ) | – | | – | | 0.01 | | 0.01 | | (0.01 | ) | 0.04 | |

Earnings per share – diluted | | $ | 0.40 | | $ | 0.44 | | $ | 0.44 | | $ | 1.52 | | $ | 0.45 | | $ | 1.29 | | $ | 0.49 | |

15

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | September 30, | | June 30, | | March 31, | | December 31, | | September 30, | |

| | 2011 | | 2011 | | 2011 | | 2010 | | 2010 | |

Assets | | | | | | | | | | | |

Investments in real estate | | $ | 6,635,872 | | $ | 6,534,433 | | $ | 6,145,499 | | $ | 6,060,821 | | $ | 5,861,816 | |

Less: accumulated depreciation | | (710,580 | ) | (679,081 | ) | (647,034 | ) | (616,007 | ) | (588,167 | ) |

Investments in real estate, net | | 5,925,292 | | 5,855,352 | | 5,498,465 | | 5,444,814 | | 5,273,649 | |

Cash and cash equivalents | | 73,056 | | 60,925 | | 78,196 | | 91,232 | | 110,811 | |

Restricted cash | | 27,929 | | 23,432 | | 30,513 | | 28,354 | | 35,295 | |

Tenant receivables | | 6,599 | | 4,487 | | 7,018 | | 5,492 | | 4,929 | |

Deferred rent | | 132,954 | | 125,867 | | 123,091 | | 116,849 | | 108,303 | |

Investments | | 88,777 | | 88,862 | | 88,694 | | 83,899 | | 80,941 | |

Other assets | | 200,949 | | 184,359 | | 157,366 | | 135,221 | | 134,697 | |

Total assets | | $ | 6,455,556 | | $ | 6,343,284 | | $ | 5,983,343 | | $ | 5,905,861 | | $ | 5,748,625 | |

| | | | | | | | | | | |

Liabilities, Noncontrolling Interests, and Equity | | | | | | | | | | | |

Secured notes payable | | $ | 760,882 | | $ | 774,691 | | $ | 787,945 | | $ | 790,869 | | $ | 841,317 | |

Unsecured line of credit | | 814,000 | | 575,000 | | 679,000 | | 748,000 | | 554,000 | |

Unsecured term loans | | 1,000,000 | | 1,000,000 | | 1,000,000 | | 750,000 | | 750,000 | |

Unsecured convertible notes | | 84,484 | | 203,638 | | 202,521 | | 295,293 | | 374,146 | |

Accounts payable, accrued expenses, and tenant security deposits | | 330,044 | | 300,030 | | 283,013 | | 304,257 | | 294,833 | |

Dividends payable | | 35,287 | | 34,068 | | 31,172 | | 31,114 | | 25,554 | |

Total liabilities | | 3,024,697 | | 2,887,427 | | 2,983,651 | | 2,919,533 | | 2,839,850 | |

| | | | | | | | | | | |

Redeemable noncontrolling interests | | 15,931 | | 15,899 | | 15,915 | | 15,920 | | 15,945 | |

| | | | | | | | | | | |

Alexandria Real Estate Equities, Inc.’s stockholders’ equity: | | | | | | | | | | | |

Series C preferred stock | | 129,638 | | 129,638 | | 129,638 | | 129,638 | | 129,638 | |

Series D cumulative convertible preferred stock | | 250,000 | | 250,000 | | 250,000 | | 250,000 | | 250,000 | |

Common stock | | 614 | | 614 | | 551 | | 550 | | 549 | |

Additional paid-in capital | | 3,025,444 | | 3,024,603 | | 2,568,976 | | 2,566,238 | | 2,504,365 | |

Retained earnings | | – | | – | | 360 | | 734 | | – | |

Accumulated other comprehensive loss | | (32,202 | ) | (6,272 | ) | (7,193 | ) | (18,335 | ) | (33,348 | ) |

Alexandria Real Estate Equities, Inc.’s stockholders’ equity | | 3,373,494 | | 3,398,583 | | 2,942,332 | | 2,928,825 | | 2,851,204 | |

Noncontrolling interests | | 41,434 | | 41,375 | | 41,445 | | 41,583 | | 41,626 | |

Total equity | | 3,414,928 | | 3,439,958 | | 2,983,777 | | 2,970,408 | | 2,892,830 | |

Total liabilities, noncontrolling interests, and equity | | $ | 6,455,556 | | $ | 6,343,284 | | $ | 5,983,343 | | $ | 5,905,861 | | $ | 5,748,625 | |

16

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Earnings per Share

(Dollars in thousands, except per share amounts)

(Unaudited)

Earnings per Share

| | Three Months Ended | | Nine Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | | 9/30/11 | | 9/30/10 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for basic earnings per share | | $ | 24,662 | | $ | 25,986 | | $ | 24,365 | | $ | 83,241 | | $ | 22,235 | | $ | 75,013 | | $ | 22,467 | |

Effect of assumed conversion and dilutive securities: | | | | | | | | | | | | | | | |

Assumed conversion of 8% unsecured convertible notes | | – | | – | | – | | 2 | | – | | – | | – | |

Amounts attributable to unvested restricted stock awards | | – | | – | | – | | – | | – | | – | | – | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for diluted earnings per share | | $ | 24,662 | | $ | 25,986 | | $ | 24,365 | | $ | 83,243 | | $ | 22,235 | | $ | 75,013 | | $ | 22,467 | |

| | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for basic earnings per share | | 61,295,659 | | 58,500,055 | | 54,948,345 | | 54,865,654 | | 49,807,241 | | 58,271,270 | | 46,188,308 | |

Effect of assumed conversion and dilutive securities: | | | | | | | | | | | | | | | |

Assumed conversion of 8% unsecured convertible notes | | – | | – | | – | | 6,047 | | – | | – | | – | |

Dilutive effect of stock options | | 8,310 | | 13,067 | | 19,410 | | 21,709 | | 23,098 | | 13,475 | | 31,813 | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for diluted earnings per share | | 61,303,969 | | 58,513,122 | | 54,967,755 | | 54,893,410 | | 49,830,339 | | 58,284,745 | | 46,220,121 | |

| | | | | | | | | | | | | | | |

Earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | | | | | | | | | | | | | | |

Basic | | $ | 0.40 | | $ | 0.44 | | $ | 0.44 | | $ | 1.52 | | $ | 0.45 | | $ | 1.29 | | $ | 0.49 | |

Diluted | | $ | 0.40 | | $ | 0.44 | | $ | 0.44 | | $ | 1.52 | | $ | 0.45 | | $ | 1.29 | | $ | 0.49 | |

17

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Funds from Operations

(Dollars in thousands, except per share amounts)

(Unaudited)

Funds from Operations (“FFO”)

The following table presents a reconciliation of net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders, the most directly comparable financial measure calculated and presented in accordance with United States generally accepted accounting principles (“GAAP”), to FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders for the periods below:

| | Three Months Ended (1) | | Nine Months Ended (1) | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | | 9/30/11 | | 9/30/10 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 24,662 | | $ | 25,986 | | $ | 24,365 | | $ | 83,241 | | $ | 22,235 | | $ | 75,013 | | $ | 22,467 | |

Add: Depreciation and amortization | | 39,990 | | 40,363 | | 36,707 | | 34,551 | | 32,009 | | 117,060 | | 92,089 | |

Add: Net income attributable to noncontrolling interests | | 966 | | 938 | | 929 | | 944 | | 920 | | 2,833 | | 2,785 | |

Add: Net income attributable to unvested restricted stock awards | | 278 | | 298 | | 242 | | 726 | | 217 | | 818 | | 502 | |

Subtract: Gain on sales of property | | (46 | ) | – | | – | | (59,442 | ) | – | | (46 | ) | (24 | ) |

Subtract: FFO attributable to noncontrolling interests | | (933 | ) | (1,033 | ) | (1,065 | ) | (1,036 | ) | (1,053 | ) | (3,031 | ) | (3,190 | ) |

Subtract: FFO attributable to unvested restricted stock awards | | (647 | ) | (638 | ) | (547 | ) | (512 | ) | (491 | ) | (1,837 | ) | (1,090 | ) |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for basic FFO per share | | 64,270 | | 65,914 | | 60,631 | | 58,472 | | 53,837 | | 190,810 | | 113,539 | |

Effect of assumed conversion and dilutive securities: | | | | | | | | | | | | | | | |

Assumed conversion of 8% unsecured convertible notes | | 4 | | 7 | | 5 | | 2 | | 25 | | 16 | | 7,779 | |

Amounts attributable to unvested restricted stock awards | | – | | – | | – | | – | | – | | – | | (26 | ) |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – numerator for FFO per share (diluted) | | $ | 64,274 | | $ | 65,921 | | $ | 60,636 | | $ | 58,474 | | $ | 53,862 | | $ | 190,826 | | $ | 121,292 | |

| | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for basic FFO per share | | 61,295,659 | | 58,500,055 | | 54,948,345 | | 54,865,654 | | 49,807,241 | | 58,271,270 | | 46,188,308 | |

Effect of assumed conversion and dilutive securities: | | | | | | | | | | | | | | | |

Assumed conversion of 8% unsecured convertible notes | | 6,047 | | 6,047 | | 6,047 | | 6,047 | | 33,886 | | 6,047 | | 3,525,528 | |

Dilutive effect of stock options | | 8,310 | | 13,067 | | 19,410 | | 21,709 | | 23,098 | | 13,475 | | 31,813 | |

Weighted average shares of common stock outstanding for calculating FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for FFO per share (diluted) | | 61,310,016 | | 58,519,169 | | 54,973,802 | | 54,893,410 | | 49,864,225 | | 58,290,792 | | 49,745,649 | |

| | | | | | | | | | | | | | | |

FFO per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | | | | | | | | | | | | | | |

Basic | | $ | 1.05 | | $ | 1.13 | | $ | 1.10 | | $ | 1.07 | | $ | 1.08 | | $ | 3.27 | | $ | 2.46 | |

Diluted | | $ | 1.05 | | $ | 1.13 | | $ | 1.10 | | $ | 1.07 | | $ | 1.08 | | $ | 3.27 | | $ | 2.44 | |

(1) See page 8 for additional information on significant items impacting comparability of funds from operations.

18

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Adjusted Funds from Operations

(Dollars in thousands)

(Unaudited)

Adjusted Funds from Operations

The following table presents a reconciliation of FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders to adjusted funds from operations (“AFFO”) attributable to Alexandria Real Estate Equities, Inc.’s common stockholders:

| | Three Months Ended | | Nine Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | | 9/30/11 | | 9/30/10 | |

FFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 64,270 | | $ | 65,914 | | $ | 60,631 | | $ | 58,472 | | $ | 53,837 | | $ | 190,810 | | $ | 113,539 | |

Add/(deduct): | | | | | | | | | | | | | | | |

Major and recurring capital expenditures (1) | | (550 | ) | (698 | ) | (608 | ) | (260 | ) | (329 | ) | (1,856 | ) | (1,072 | ) |

Tenant improvements and leasing costs (1) | | (2,119 | ) | (1,595 | ) | (803 | ) | (2,583 | ) | (856 | ) | (4,517 | ) | (4,142 | ) |

Amortization of loan fees | | 2,144 | | 2,327 | | 2,278 | | 1,999 | | 1,795 | | 6,749 | | 5,893 | |

Amortization of debt premiums/discounts | | 750 | | 1,169 | | 1,335 | | 2,032 | | 2,092 | | 3,254 | | 7,967 | |

Amortization of acquired above and below market leases | | (940 | ) | (2,726 | ) | (4,854 | ) | (2,364 | ) | (1,927 | ) | (8,520 | ) | (5,504 | ) |

Deferred rent/straight-line rent | | (7,647 | ) | (2,885 | ) | (6,707 | ) | (9,092 | ) | (6,300 | ) | (17,239 | ) | (13,740 | ) |

Stock compensation | | 3,344 | | 2,749 | | 2,356 | | 2,767 | | 2,660 | | 8,449 | | 8,049 | |

Capitalized income from development projects | | 930 | | 1,078 | | 1,428 | | 1,486 | | 1,544 | | 3,436 | | 4,202 | |

Deferred rent/straight-line rent on ground leases | | 1,143 | | 1,099 | | 1,241 | | 1,424 | | 1,364 | | 3,483 | | 3,913 | |

Loss on early extinguishment of debt | | 2,742 | | 1,248 | | 2,495 | | 2,372 | | 1,300 | | 6,485 | | 42,796 | |

Impairment of real estate | | 994 | | – | | – | | – | | – | | 994 | | – | |

Allocation to unvested restricted stock awards | | (7 | ) | (14 | ) | 16 | | 19 | | (11 | ) | (6 | ) | (457 | ) |

AFFO attributable to Alexandria Real Estate Equities, Inc.’s common stockholders | | $ | 65,054 | | $ | 67,666 | | $ | 58,808 | | $ | 56,272 | | $ | 55,169 | | $ | 191,522 | | $ | 161,444 | |

| | | | | | | | | | | | | | | |

Weighted average shares of common stock outstanding for calculating earnings per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – denominator for basic earnings per share | | 61,295,659 | | 58,500,055 | | 54,948,345 | | 54,865,654 | | 49,807,241 | | 58,271,270 | | 46,188,308 | |

Add: Dilutive effect of stock options | | 8,310 | | 13,067 | | 19,410 | | 21,709 | | 23,098 | | 13,475 | | 31,813 | |

| | 61,303,969 | | 58,513,122 | | 54,967,755 | | 54,887,363 | | 49,830,339 | | 58,284,745 | | 46,220,121 | |

(1) See page 52 for further information.

19

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights

(Dollars in thousands, except per share amounts)

(Unaudited)

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | |

Balance Sheet Data | | | | | | | | | | | |

Investments in real estate | | $ | 6,635,872 | | $ | 6,534,433 | | $ | 6,145,499 | | $ | 6,060,821 | | $ | 5,861,816 | |

Accumulated depreciation | | $ | (710,580 | ) | $ | (679,081 | ) | $ | (647,034 | ) | $ | (616,007 | ) | $ | (588,167 | ) |

Investments in real estate, net | | $ | 5,925,292 | | $ | 5,855,352 | | $ | 5,498,465 | | $ | 5,444,814 | | $ | 5,273,649 | |

Tangible non-real estate assets | | $ | 237,277 | | $ | 210,113 | | $ | 237,805 | | $ | 240,873 | | $ | 272,259 | |

Total assets | | $ | 6,455,556 | | $ | 6,343,284 | | $ | 5,983,343 | | $ | 5,905,861 | | $ | 5,748,625 | |

Gross assets (excluding cash and restricted cash) | | $ | 7,065,151 | | $ | 6,938,008 | | $ | 6,521,668 | | $ | 6,402,282 | | $ | 6,190,686 | |

Secured notes payable | | $ | 760,882 | | $ | 774,691 | | $ | 787,945 | | $ | 790,869 | | $ | 841,317 | |

Unsecured line of credit | | $ | 814,000 | | $ | 575,000 | | $ | 679,000 | | $ | 748,000 | | $ | 554,000 | |

Unsecured term loans | | $ | 1,000,000 | | $ | 1,000,000 | | $ | 1,000,000 | | $ | 750,000 | | $ | 750,000 | |

3.7% unsecured convertible notes | | $ | 84,250 | | $ | 203,405 | | $ | 202,290 | | $ | 295,063 | | $ | 373,918 | |

8.0% unsecured convertible notes | | $ | 234 | | $ | 233 | | $ | 231 | | $ | 230 | | $ | 228 | |

Total unsecured debt | | $ | 1,898,484 | | $ | 1,778,638 | | $ | 1,881,521 | | $ | 1,793,293 | | $ | 1,678,146 | |

Total debt | | $ | 2,659,366 | | $ | 2,553,329 | | $ | 2,669,466 | | $ | 2,584,162 | | $ | 2,519,463 | |

Net debt | | $ | 2,558,381 | | $ | 2,468,972 | | $ | 2,560,757 | | $ | 2,464,576 | | $ | 2,373,357 | |

Total liabilities | | $ | 3,024,697 | | $ | 2,887,427 | | $ | 2,983,651 | | $ | 2,919,533 | | $ | 2,839,850 | |

Common shares outstanding | | 61,463,839 | | 61,380,268 | | 55,049,730 | | 54,966,925 | | 54,891,638 | |

Total market capitalization | | $ | 6,815,380 | | $ | 7,689,383 | | $ | 7,344,442 | | $ | 6,994,306 | | $ | 6,746,649 | |

| | | | | | | | | | | |

| | Three Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | |

Operating Data | | | | | | | | | | | |

Total revenues | | $ | 143,427 | | $ | 142,918 | | $ | 139,418 | | $ | 130,889 | | $ | 120,314 | |

Deferred rent/straight-line rent | | $ | 7,647 | | $ | 2,885 | | $ | 6,707 | | $ | 9,092 | | $ | 6,300 | |

Amortization of acquired above and below market leases | | $ | 940 | | $ | 2,726 | | $ | 4,854 | | $ | 2,364 | | $ | 1,927 | |

Non-cash amortization of discount on unsecured convertible notes | | $ | 675 | | $ | 1,117 | | $ | 1,268 | | $ | 1,971 | | $ | 2,000 | |

Non-cash amortization of discounts (premiums) on secured notes payable | | $ | 75 | | $ | 52 | | $ | 67 | | $ | 61 | | $ | 92 | |

Scheduled debt principal payments | | $ | 2,645 | | $ | 2,886 | | $ | 2,990 | | $ | 2,902 | | $ | 2,911 | |

Loss on early extinguishment of debt | | $ | 2,742 | | $ | 1,248 | | $ | 2,495 | | $ | 2,372 | | $ | 1,300 | |

Net income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders – diluted | | $ | 24,662 | | $ | 25,986 | | $ | 24,365 | | $ | 83,241 | | $ | 22,235 | |

Earnings per share – diluted | | $ | 0.40 | | $ | 0.44 | | $ | 0.44 | | $ | 1.52 | | $ | 0.45 | |

FFO attributable to Alexandria Real Estate, Inc.’s common stockholders – diluted | | $ | 64,274 | | $ | 65,921 | | $ | 60,636 | | $ | 58,474 | | $ | 53,862 | |

FFO per share – diluted | | $ | 1.05 | | $ | 1.13 | | $ | 1.10 | | $ | 1.07 | | $ | 1.08 | |

Weighted average common shares outstanding – EPS – diluted | | 61,303,969 | | 58,513,122 | | 54,967,755 | | 54,893,410 | | 49,830,339 | |

Weighted average common shares outstanding – FFO – diluted | | 61,310,016 | | 58,519,169 | | 54,973,802 | | 54,893,410 | | 49,864,225 | |

20

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights (continued)

(Dollars in thousands, except per share amounts)

(Unaudited)

| | Three Months Ended | |

| | 9/30/11 | | 6/30/11 | | 3/31/11 | | 12/31/10 | | 9/30/10 | |

Financial, Debt, and Other Ratios | | | | | | | | | | | |

Unencumbered net operating income as a percentage of total net operating income | | 67% | | 64% | | 65% | | 60% | | 58% | |

Unencumbered assets gross book value | | $ | 5,496,616 | | $ | 5,342,433 | | $ | 4,933,395 | | $ | 4,825,963 | | $ | 4,583,045 | |

Unencumbered assets gross book value as a percentage of gross assets | | 77% | | 76% | | 74% | | 74% | | 72% | |

Percentage outstanding on unsecured line of credit at end of period | | 54% | | 38% | | 45% | | 50% | | 48% | |

Operating margin | | 70% | | 72% | | 71% | | 72% | | 72% | |

Adjusted EBITDA margin | | 66% | | 67% | | 66% | | 68% | | 69% | |

General and administrative expense as a percentage of total revenues | | 7.2% | | 7.5% | | 6.8% | | 6.6% | | 6.7% | |

EBITDA – trailing 12 months | | $ | 409,419 | | $ | 400,742 | | $ | 346,393 | | $ | 335,304 | | $ | 269,923 | |

Adjusted EBITDA – quarter annualized | | $ | 377,168 | | $ | 380,968 | | $ | 368,100 | | $ | 357,756 | | $ | 330,164 | |

Adjusted EBITDA – trailing 12 months | | $ | 370,998 | | $ | 359,247 | | $ | 345,055 | | $ | 331,822 | | $ | 323,545 | |

Capitalized interest | | $ | 16,666 | | $ | 15,046 | | $ | 13,193 | | $ | 14,629 | | $ | 16,695 | |

Weighted average interest rate used for capitalization during period | | 4.54% | | 4.60% | | 4.57% | | 4.67% | | 4.59% | |

Net debt to Gross Assets (excluding cash and restricted cash) at end of period | | 36% | | 36% | | 39% | | 39% | | 38% | |

Secured debt as a percentage of gross assets at end of period | | 11% | | 11% | | 12% | | 12% | | 13% | |

Net debt to Adjusted EBITDA – quarter annualized | | 6.8x | | 6.5x | | 7.0x | | 6.9x | | 7.2x | |

Net debt to Adjusted EBITDA – trailing 12 months | | 6.9x | | 6.9x | | 7.4x | | 7.4x | | 7.3x | |

Fixed charge coverage ratio – quarter annualized | | 2.7x | | 2.7x | | 2.7x | | 2.6x | | 2.3x | |

Fixed charge coverage ratio – trailing 12 months | | 2.7x | | 2.6x | | 2.4x | | 2.2x | | 2.1x | |

Dividends per share on common stock | | $ | 0.47 | | $ | 0.45 | | $ | 0.45 | | $ | 0.45 | | $ | 0.35 | |

Dividend payout ratio (common stock) | | 43% | | 41% | | 40% | | 41% | | 35% | |

| | | | | | | | | | | |

| | 3Q11 | | 2Q11 | | 1Q11 | | 4Q10 | | 3Q10 | |

Asset Base Statistics | | | | | | | | | | | |

Number of properties at end of period | | 171 | | 171 | | 168 | | 167 | | 165 | |

Rentable square feet at end of period | | 14,868,859 | | 14,145,604 | | 13,700,490 | | 13,658,780 | | 12,867,728 | |

Occupancy of operating properties at end of period | | 94.6% | | 93.8% | | 94.2% | | 94.3% | | 94.0% | |

Occupancy including redevelopment properties at end of period | | 89.3% | | 88.3% | | 88.6% | | 88.9% | | 89.3% | |

Annualized base rent per leased rentable square foot | | $ | 34.39 | | $ | 34.06 | | $ | 33.90 | | $ | 33.95 | | $ | 31.91 | |

Leasing activity – YTD rentable square feet | | 2,265,421 | | 1,280,084 | | 551,622 | | 2,744,239 | | 1,670,004 | |

Leasing activity – Qtr rentable square feet | | 985,337 | | 728,462 | | 551,622 | | 1,074,235 | | 639,559 | |

Leasing activity – YTD percentage change in rental rates – GAAP basis | | 2.5% | | 2.4% | | 1.6% | | 4.9% | | 5.4% | |

Leasing activity – Qtr percentage change in rental rates – GAAP basis | | 2.8% | | 3.1% | | 1.6% | | 4.3% | | 8.1% | |

Leasing activity – YTD percentage change in rental rates – cash basis | | (0.7%) | | 1.0% | | 0.8% | | 2.0% | | 0.4% | |

Leasing activity – Qtr percentage change in rental rates – cash basis | | (3.0%) | | 1.5% | | 0.8% | | 4.2% | | 0.7% | |

Same property YTD percentage change in net operating income – GAAP basis | | 0.2% | | 0.5% | | 0.3% | | 0.4% | | 0.6% | |

Same property Qtr percentage change in net operating income – GAAP basis | | (0.2%) | | 1.7% | | 0.3% | | 1.3% | | 0.1% | |

Same property YTD percentage change in net operating income – cash basis | | 5.5% | | 6.5% | | 5.8% | | 1.5% | | 1.3% | |

Same property Qtr percentage change in net operating income – cash basis | | 4.8% | | 9.4% | | 5.8% | | 2.0% | | 2.3% | |

21

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Financial and Asset Base Highlights (continued)

(Unaudited)

Summary of Occupancy Percentage at End of Period

| | | | | | December 31, | |

| | Average | | 3Q11 | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating properties | | 95.2% | | 94.6% | | 94.3% | | 94.1% | | 94.8% | | 93.8% | | 93.1% | | 93.2% | | 95.2% | | 93.9% | | 96.3% | | 99.0% | | 98.4% | | 95.7% | | 96.2% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating and redevelopment properties | | 89.3% | | 89.3% | | 88.9% | | 89.4% | | 90.0% | | 87.8% | | 88.0% | | 87.7% | | 87.0% | | 88.4% | | 89.2% | | 88.6% | | 90.8% | | 91.5% | | 92.9% | |

Quarterly Percentage Change Same Property Net Operating Income

Summary of Percentage Change in Rental Rates on Renewed/Re-leased Space

22

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Properties

September 30, 2011

(Dollars in thousands)

(Unaudited)

| | Rentable Square Feet | | Number of | | | | | |

Markets | | Operating | | Redevelopment | | Development | | Total | | Properties | | Annualized Base Rent | |

| | | | | | | | | | | | | | | |

California – San Diego | | 2,035,798 | | 422,803 | | 165,140 | | 2,623,741 | | 37 | | $ | 62,924 | | 15% | |

| | | | | | | | | | | | | | | |

California – San Francisco | | 2,117,728 | | – | | 366,346 | | 2,484,074 | | 23 | | 80,019 | | 20 | |

| | | | | | | | | | | | | | | |

Greater Boston | | 3,280,873 | | 177,662 | | – | | 3,458,535 | | 38 | | 122,033 | | 30 | |

| | | | | | | | | | | | | | | |

NYC/New Jersey/Suburban Philadelphia | | 747,463 | | – | | – | | 747,463 | | 9 | | 32,456 | | 8 | |

| | | | | | | | | | | | | | | |

North Carolina – Research Triangle Park | | 809,847 | | 30,000 | | – | | 839,847 | | 13 | | 17,810 | | 4 | |

| | | | | | | | | | | | | | | |

Suburban Washington, D.C. | | 2,436,597 | | 116,783 | | – | | 2,553,380 | | 32 | | 54,053 | | 13 | |

| | | | | | | | | | | | | | | |

Washington – Seattle | | 937,205 | | – | | – | | 937,205 | | 11 | | 33,620 | | 8 | |

| | | | | | | | | | | | | | | |

Domestic markets | | 12,365,511 | | 747,248 | | 531,486 | | 13,644,245 | | 163 | | 402,915 | | 98 | |

| | | | | | | | | | | | | | | |

International (1) | | 1,069,651 | | – | | – | | 1,069,651 | | 5 | | 8,591 | | 2 | |

| | | | | | | | | | | | | | | |

Subtotal | | 13,435,162 | | 747,248 | | 531,486 | | 14,713,896 | | 168 | | $ | 411,506 | | 100% | |

| | | | | | | | | | | | | | | |

Discontinued Operations/“Held for Sale” | | 154,963 | | – | | – | | 154,963 | | 3 | | | | | |

| | | | | | | | | | | | | | | |

Total | | 13,590,125 | | 747,248 | | 531,486 | | 14,868,859 | | 171 | | | | | |

(1) Includes land and improvements subject to a ground lease with a tenant.

23

ALEXANDRIA REAL ESTATE EQUITIES, INC.

Summary of Occupancy Percentage

(Unaudited)

Summary of Occupancy Percentage at End of Period

| | | | | | December 31, | |

| | Average | | 3Q11 | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating properties | | 95.2% | | 94.6% | | 94.3% | | 94.1% | | 94.8% | | 93.8% | | 93.1% | | 93.2% | | 95.2% | | 93.9% | | 96.3% | | 99.0% | | 98.4% | | 95.7% | | 96.2% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |