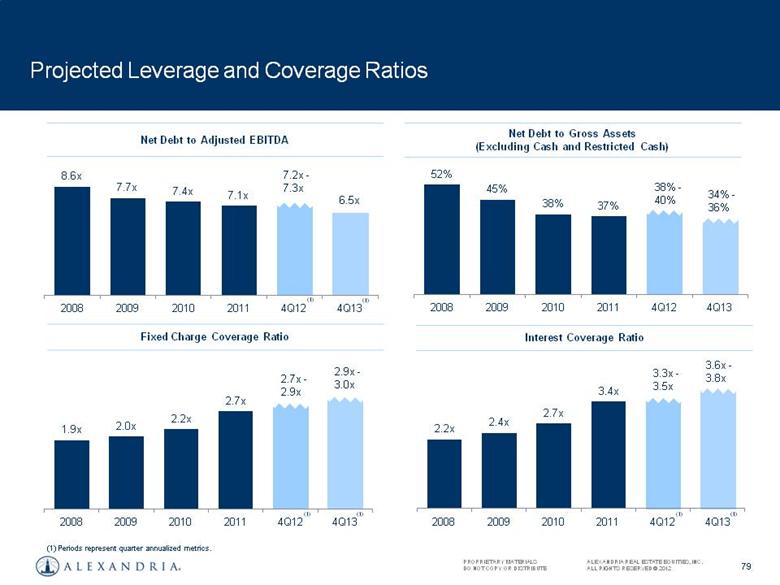

| Appendix A: Non-GAAP Measures (Dollars in thousands) Adjusted EBITDA 3Q12 2Q12 1Q12 4Q11 3Q11 4Q07 2011 2010 2009 2008 Net income 18,305 $ 25,641 $ 32,775 $ 35,462 $ 32,995 $ 24,992 $ 135,393 $ 139,022 $ 141,648 $ 120,097 $ Interest expense 17,094 17,922 16,227 14,757 14,273 24,013 63,443 69,642 82,273 86,548 Depreciation and amortization 48,173 52,355 43,405 40,966 39,990 26,969 158,026 126,640 118,508 108,743 EBITDA 83,572 95,918 92,407 91,185 87,258 75,974 356,862 335,304 342,429 315,388 Stock compensation expense 3,845 3,274 3,293 3,306 3,344 2,988 11,755 10,816 14,051 13,677 Loss (gain) on early extinguishment of debt - 1,602 623 - 2,742 - 6,485 45,168 (11,254) - Gain on sale of real estate (1,562) (2) - - - (2,901) (46) (59,466) (2,627) (20,401) Gain on sale of land parcel - - (1,864) - (46) - - - - - Impairment on investments - - - - - - - - - 13,251 Impairment of real estate 9,799 - - - 994 - 994 - - 4,650 Adjusted EBITDA 95,654 $ 100,792 $ 94,459 $ 94,491 $ 94,292 $ 76,061 $ 376,050 $ 331,822 $ 342,599 $ 326,565 $ Interest coverage and fixed charge coverage ratios 3Q12 2Q12 1Q12 4Q11 3Q11 4Q07 2011 2010 2009 2008 Adjusted EBITDA 95,654 $ 100,792 $ 94,459 $ 94,491 $ 94,292 $ 76,061 $ 376,050 $ 331,822 $ 342,599 $ 326,565 $ Interest expense 17,094 $ 17,922 $ 16,227 $ 14,757 $ 14,273 $ 24,013 $ 63,443 $ 69,642 $ 82,273 $ 86,548 $ Add: capitalized interest 16,763 15,825 15,266 16,151 16,666 16,609 61,056 72,835 76,884 74,194 Less: amortization of loan fees (2,470) (2,214) (2,643) (2,551) (2,144) (1,733) (9,300) (7,892) (7,958) (6,774) Less: amortization of debt premium/discounts (112) (110) (179) (565) (750) 164 (3,819) (9,999) (10,788) (7,973) Cash interest 31,275 $ 31,423 $ 28,671 $ 27,792 $ 28,045 $ 39,053 $ 111,380 $ 124,586 $ 140,411 $ 145,995 $ Dividends on preferred stock 6,471 6,903 7,483 7,090 7,089 2,715 28,357 28,357 28,357 24,225 Fixed charges 37,746 $ 38,326 $ 36,154 $ 34,882 $ 35,134 $ 41,768 $ 139,737 $ 152,943 $ 168,768 $ 170,220 $ Interest coverage ratio 3.1x 3.2x 3.3x 3.4x 3.4x 1.9x 3.4x 2.7x 2.4x 2.2x Fixed charge coverage ratio 2.5x 2.6x 2.6x 2.7x 2.7x 1.8x 2.7x 2.2x 2.0x 1.9x Net debt to adjusted EBITDA 3Q12 2Q12 1Q12 4Q11 3Q11 4Q07 2011 2010 2009 2008 Secured notes payable 719,350 $ 719,977 $ 721,715 $ 724,305 $ 760,882 $ 1,212,904 $ 724,305 $ 790,869 $ 937,017 $ 1,081,963 $ Unsecured senior notes payable 549,794 549,545 549,536 - - - - - - - Unsecured senior line of credit 413,000 379,000 167,000 370,000 814,000 750,000 370,000 748,000 476,000 675,000 Unsecured senior bank term loans 1,350,000 1,350,000 1,350,000 1,600,000 1,000,000 365,000 1,600,000 750,000 750,000 750,000 Unsecured senior convertible notes - 238 1,236 84,959 84,484 460,000 84,959 295,293 583,929 431,145 Less: cash and cash equivalents (94,904) (80,937) (77,361) (78,539) (73,056) (8,030) (78,539) (91,232) (70,628) (71,161) Less: restricted cash (44,863) (41,897) (39,803) (23,332) (27,929) (51,911) (23,332) (28,354) (47,291) (67,782) Net debt 2,892,377 $ 2,875,926 $ 2,672,323 $ 2,677,393 $ 2,558,381 $ 2,727,963 $ 2,677,393 $ 2,464,576 $ 2,629,027 $ 2,799,165 $ Adjusted EBITDA 95,654 $ 100,792 $ 94,459 $ 94,491 $ 94,292 $ 76,061 $ 376,050 $ 331,822 $ 342,599 $ 326,565 $ Adjusted EBITDA (annualized) 382,616 $ 403,168 $ 377,836 $ 377,964 $ 377,168 $ 304,244 $ Net debt to adjusted EBITDA 7.6x 7.1x 7.1x 7.1x 6.8x 9.0x 7.1x 7.4x 7.7x 8.6x Net debt to gross assets 3Q12 2Q12 1Q12 4Q11 3Q11 4Q07 2011 2010 2009 2008 Net debt 2,892,377 $ 2,875,926 $ 2,672,323 $ 2,677,393 $ 2,558,381 $ 2,727,963 $ 2,677,393 $ 2,464,576 $ 2,629,027 $ 2,799,165 $ Total assets 6,965,017 6,841,739 6,718,091 6,574,129 6,455,556 4,642,094 6,574,129 5,905,861 5,457,227 5,132,077 Add: accumulated depreciation 854,332 822,369 779,177 742,535 710,580 356,018 742,535 616,007 520,647 428,690 Less: cash and cash equivalents (94,904) (80,937) (77,361) (78,539) (73,056) (8,030) (78,539) (91,232) (70,628) (71,161) Less: restricted cash (44,863) (41,897) (39,803) (23,332) (27,929) (51,911) (23,332) (28,354) (47,291) (67,782) Gross assets 7,679,582 $ 7,541,274 $ 7,380,104 $ 7,214,793 $ 7,065,151 $ 4,938,171 $ 7,214,793 $ 6,402,282 $ 5,859,955 $ 5,421,824 $ Net debt/gross assets 38% 38% 36% 37% 36% 55% 37% 38% 45% 52% Year Ended Three Months Ended |