Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

| |

|

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under Rule 14a-12 |

| |

|

FirstBank NW Corp.

|

(Name of Registrant as Specified in Its Charter) |

| |

|

|

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

N/A

|

| (2) | Aggregate number of securities to which transaction applies: |

N/A

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

N/A

|

| (4) | Proposed maximum aggregate value of transaction: |

N/A

|

| (5) | Total fee paid: |

N/A

|

| [ ] | Fee paid previously with preliminary materials: |

N/A

|

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

| (1) | Amount previously paid: |

N/A

|

| (2) | Form, schedule or registration statement no.: |

N/A

|

| (3) | Filing party: |

N/A

|

| (4) | Date filed: |

N/A

|

<PAGE>

June 17, 2005

Dear Shareholder: You are cordially invited to attend the Annual Meeting of Shareholders of FirstBank NW Corp. The meeting will be held at the Quality Inn, 700 Port Drive, Clarkston, Washington, on Wednesday, July 20, 2005, at 2:00 p.m., local time. The Company is the holding company for FirstBank Northwest.

The Notice of Annual Meeting of Shareholders and Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of Moss Adams LLP, will be present to respond to appropriate questions of shareholders.

It is important that your shares be represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

Sincerely, /s/Clyde E. Conklin

Clyde E. Conklin

President and Chief Executive Officer

<PAGE>

FIRSTBANK NW CORP.

1300 16TH AVENUE

CLARKSTON, WASHINGTON 99403

(509) 295-5100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On July 20, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of FirstBank NW Corp. ("Company") will be held at the Quality Inn, 700 Port Drive, Clarkston, Washington, on Wednesday, July 20, 2005, at 2:00 p.m., local time, for the following purposes:

(1) To elect three directors;

(2) To amend the Articles of Incorporation to increase the authorized number of shares of common stock from

5,000,000 to 49,500,000 shares;

(3) To ratify the appointment of Moss Adams LLP as the Company's independent auditors for the fiscal year

ending March 31, 2006; and

(4) To consider and act upon such other matters as may properly come before the meeting or any

adjournments or postponements thereof. NOTE: The Board of Directors is not aware of any other business to come before the meeting.

Any action may be taken on the foregoing proposals at the meeting on the date specified above or on any date or dates to which the meeting may be adjourned or postponed. Shareholders of record at the close of business on June 3, 2005 are entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

Please complete and sign the enclosed form of proxy, which is solicited by the Board of Directors, and mail it promptly in the enclosed envelope. The proxy will not be used if you attend the meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Larry K. Moxley

LARRY K. MOXLEY SecretaryClarkston, Washington

June 17, 2005

IMPORTANT: The prompt return of proxies will save the Company the expense of further requests for proxies in order to ensure a quorum. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States.<PAGE>

PROXY STATEMENT

OF

FIRSTBANK NW CORP.

1300 16TH AVENUE

CLARKSTON, WASHINGTON 99403

ANNUAL MEETING OF SHAREHOLDERS

JULY 20, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of FirstBank NW Corp. ("Company"), the holding company for FirstBank Northwest ("Bank"), to be used at the Annual Meeting of Shareholders ("Annual Meeting") of the Company. The Annual Meeting will be held at the Quality Inn, 700 Port Drive, Clarkston, Washington, on Wednesday, July 20, 2005, at 2:00 p.m., local time. This Proxy Statement and the enclosed proxy card are being first mailed to shareholders on or about June 17, 2005.

VOTING AND PROXY PROCEDURE

Shareholders Entitled to Vote. Shareholders of record as of the close of business on June 3, 2005 ("Voting Record Date") are entitled to one vote for each share of common stock ("Common Stock") of the Company then held. As of the close of business on the Voting Record Date, the Company had 2,929,891shares of Common Stock issued and outstanding.

As provided in the Company's Articles of Incorporation, record holders of the Company's Common Stock who beneficially own, either directly or indirectly, in excess of 10% of the Company's outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

If you are a beneficial owner of Company Common Stock held by a broker, bank or other nominee (i.e., in "street name"), you will need proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Company Common Stock held in street name in person at the Annual Meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Voting Your Shares. If you are the registered owner of your shares (i.e., your shares are not held in street name), you must complete and return a written proxy card in order to vote your shares. If your shares are held in street name, you can vote your shares using one of the following methods:

- Vote through the Internet at www.proxyvote.com;

- Vote by telephone using the toll-free number shown on the proxy card; or

- Complete and return a written proxy card.

Votes submitted through the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on July 8, 2005. Internet and telephone voting are available 24 hours a day, and if you use one of those methods, you do not need to return a proxy card.

You can also vote in person at the Annual Meeting, and submitting your voting instructions by any of the methods mentioned above will not affect your right to attend the Annual Meeting and vote.

Quorum. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker

<PAGE>

non-votes will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining the existence of a quorum.

Proxies; Proxy Revocation Procedures. The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on the election of the director nominees and the proposals to be considered at the Annual Meeting. When a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. If a shareholder of record attends the Annual Meeting, he or she may vote by ballot. Where no instructions are indicated, proxies will be voted in accordance with the recommendations of the Board of Directors. The Board recommends a vote:

- FOR the election of the nominees for director;

- FOR the amendment of the Articles of Incorporation to increase the authorized number of

shares of common stock from 5,000,000 to 49,500,000 shares; and

- FOR the ratification of Moss Adams LLP as the Company's independent auditors for the

fiscal year ending March 31, 2006.

Shareholders who execute proxies retain the right to revoke them at any time before they are voted. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by filing a later proxy prior to a vote being taken on a particular proposal at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a proxy, but a shareholder in attendance may request a ballot and vote in person, thereby revoking a prior granted proxy.

Participants in the Bank's ESOP or 401(k) Profit Sharing Plan. If you are a participant in the FirstBank Northwest Employee Stock Ownership Plan (the "ESOP") or if you hold shares through the Bank's 401(k) Profit Sharing Plan, the proxy card represents a voting instruction to the trustees as to the number of shares in your plan account. Each participant in the ESOP and 401(k) Profit Sharing Plan may direct the trustees as to the manner in which shares of Common Stock allocated to the participant's plan account are to be voted. Unallocated shares of Common Stock held by the ESOP and allocated shares for which no voting instructions are received will be voted by the trustees in their sole discretion. The deadline for returning your voting instructions to the trustees is July 8, 2005.

If your Common Stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

Voting. The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors. Pursuant to the Company's Articles of Incorporation, shareholders are not permitted to cumulate their votes for the election of directors. With respect to the election of directors, votes may be cast for or withheld from one or more nominees. Votes that are withheld and broker non-votes will have no effect on the outcome of the election. Director nominees receiving the greatest number of votes will be elected.

The approval of the proposed Amendment to the Articles of Incorporation requires the affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

The ratification of the appointment of Moss Adams LLP as the Company's independent auditors for the fiscal year ending March 31, 2006 requires the affirmative vote of a majority of the outstanding shares of the Common Stock present in person or by proxy and entitled to vote at the Annual Meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

2

<PAGE>

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups who beneficially own in excess of 5% of the Company's Common Stock are required to file certain reports with the Securities and Exchange Commission ("SEC") and provide a copy to the Company, disclosing such ownership pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act"). Based on such reports, the following table sets forth, as of the Voting Record Date, certain information as to those persons who were beneficial owners of more than 5% of the outstanding shares of Common Stock. Management knows of no persons other than those set forth below who beneficially owned more than 5% of the outstanding shares of Common Stock at the close of business on the Voting Record Date.

| Number of Shares

Beneficially Owned

| Percent of Shares

Outstanding

|

Beneficial Owners of More Than 5%

|

|

| Crescent Capital VI, L.L.C. | 269,746 (2) | 8.69% |

| Jeffrey D. Gow |

| 11624 S.E. 5th Street, Suite 200 |

| Bellevue, Washington 98005 |

________| (1) | Information concerning the shares owned by Crescent Capital VI, L.L.C. and Mr. Gow was obtained from a Schedule 13D/A dated March 10, 2004. According to this filing, Crescent Capital VI, L.L.C. and Mr. Gow, the managing member of Crescent Capital VI, L.L.C., have sole voting and dispositive power over 269,746 shares. |

The following table sets forth, as of the close of business on the Voting Record Date, information as to the shares of Common Stock beneficially owned by each director, by the executive officers named in the summary compensation table below ("named executive officers") and by all executive officers and directors of the Company as a group. | Number of Shares | Percent of Shares |

Name

| Beneficially Owned (1)(2)

| Outstanding

|

| | |

| Directors | | |

| Steve R. Cox | 36,500 | 1.18% |

| John W. Gentry | 43,766 | 1.41 |

| W. Dean Jurgens | 26,500 | * |

| James N. Marker | 14,641 | * |

| Sandra T. Powell | -- | * |

| Russell H. Zenner | 19,906 | * |

| | | |

| Named Executive Officers | | |

| Clyde E. Conklin (3) | 79,130 | 2.55 |

| Larry K. Moxley (3) | 84,260 | 2.71 |

| Terence A. Otte | 29,505 | * |

| Donn L. Durgan | 23,153 | * |

| Richard R. Acuff | 18,322 | * |

| | | |

| All Executive Officers and Directors as a Group (11 persons) | 373,064 | 12.02% |

________

| * | Less than 1% of shares outstanding. |

| (1) | In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Common Stock over which he or she has voting or investment power and of which he or she has the right to acquire beneficial ownership within 60 days of the Voting Record Date. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for |

| | |

| (footnotes continued on following page) |

3

<PAGE>

| | |

| the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table may possess voting and/or investment power. |

| (2) | The amounts shown include the following amounts of Common Stock which the indicated individuals have the right to acquire within 60 days on the Voting Record Date through the exercise of stock options granted pursuant to the Company's 1998 Stock Option Plan: Mr. Cox, 6,000; Mr. Jurgens, 5,500; Mr. Marker, 6,890; Mr. Zenner, 3,500; Mr. Conklin, 24,000; Mr. Moxley, 24,000; Mr. Otte, 8,000; Mr. Durgan, 8,000; and Mr. Acuff, 2,500. In addition, Mr. Gentry has the right to acquire 16,569 shares within 60 days of the Voting Record Date under the Oregon Trail 1998 Stock Option Plan, which was assumed by the Company in connection with its acquisition of Oregon Trail Financial Corp. All executive officers and directors as a group have the right to acquire a total of 106,359 shares within 60 days of the Voting Record Date. |

| (3) | Messrs. Conklin and Moxley are also directors of the Company and the Bank. |

PROPOSAL 1 - ELECTION OF DIRECTORS

The Company's Board of Directors consists of eight members. The Board of Directors is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. James N. Marker, Sandra T. Powell and Russell H. Zenner have been nominated for election, each to serve for a three-year term, or until their respective successors have been elected and qualified. Each of the nominees for election as director is a current member of the Board of Directors of the Company and the Bank. Ms. Powell was appointed to the Board of Directors effective as of January 1, 2005 and former directors Robert S. Coleman, Sr. and William J. Larson retired from the Board in March 2005.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the above named nominees. If a nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote "FOR" the election of Messrs. Marker and Zenner and Ms. Powell.

The following table sets forth certain information regarding the nominees for election at the Annual Meeting, as well as information regarding those directors continuing in office after the Annual Meeting.

Name

| Age as of

March 31, 2005

| Year First Elected

or Appointed Director (1)

| Term to Expire

|

|

| NOMINEES |

| |

| James N. Marker | 68 | 1974 | 2008 (2) |

| Sandra T. Powell | 61 | 2005 | 2008 (2) |

| Russell H. Zenner | 59 | 2003 | 2008 (2) |

| |

CONTINUING DIRECTORS |

| |

| W. Dean Jurgens | 73 | 1969 | 2006 |

| Clyde E. Conklin | 54 | 1997 | 2006 |

| Steve R. Cox | 58 | 1986 | 2006 |

| John W. Gentry | 57 | 2003 | 2007 |

| Larry K. Moxley | 54 | 1997 | 2007 |

________| (1) | Includes prior service on the Board of Directors of the Bank. |

| (2) | Assuming the individual is re-elected. |

4

<PAGE>

The present principal occupation and other business experience during the last five years of each nominee for election and each director continuing in office is set forth below:

James N. Marker is President and owner of Idaho Truck Sales Co., Inc., a heavy duty truck dealership.

Sandra T. Powell isa former executive officer ofPotlatch Corporation, a diversified forest products company, where she was employed from 1967 until her retirement in March 2000. From 1998 until her retirement, Ms. Powell served as Senior Vice President of Finance and Chief Financial Officer of Potlatch Corporation. Ms. Powell is a certified public accountant (retired status) and obtained a Bachelor of Science in Business Administration with a major in Accounting from the University of Idaho.

Russell H. Zenner has been the owner of Russ Zenner Farms since 1993. Mr. Zenner has experience in the agricultural lending industry, as well as a Bachelor of Science degree in Agricultural Economics from the University of Idaho. He has served on several agricultural industry leadership and advisory positions and was founding President of the Pacific Northwest Direct Seed Association.

W. Dean Jurgens, a retired certified public accountant, is former President and co-owner of Jurgens & Co., P.A.

Clyde E. Conklin, who joined the Bank in 1987, has served as the Chief Executive Officer of the Bank since February 1996 and as President and Chief Executive Officer of the Company since its formation in 1997. From September 1994 to February 1996, Mr. Conklin served as Senior Vice President - Lending. From 1993 to 1999, Mr. Conklin served as Vice President - Lending. Prior to that time, Mr. Conklin served as Agricultural Lending Manager.

Steve R. Cox is the President and a stockholder of Randall, Blake & Cox, P.A., a law firm in Lewiston, Idaho, and is a non-practicing certified public accountant.

John W. Gentry has been President and General Manager of Gentry Ford Sales, Inc., an automobile dealership located in Ontario, Oregon, since 1985. He served as Vice President of that company between 1972 and 1985.

Larry K. Moxley, who joined the Bank in 1973, currently serves as Chief Financial Officer of the Bank, which position he has held since February 1996. Mr. Moxley has served as Executive Vice President, Chief Financial Officer and Secretary of the Company since its formation in 1997. Mr. Moxley served as Senior Vice President - Finance from 1993 to February 1996 and as Vice President - Finance from 1984 to 1993.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Boards of Directors of the Company and the Bank conduct their business through meetings of the Boards and through their committees. During the year ended March 31, 2005, the Board of Directors of the Company held 16 meetings and the Board of Directors of the Bank held 21 meetings. No director of the Company or the Bank attended fewer than 75% of the total meetings of the Boards and committees on which such person served during this period. A majority of the Board of Directors is comprised of independent directors, in accordance with the requirements for companies quoted on The Nasdaq Stock Market, Inc. The Board of Directors has determined that Directors Cox, Gentry, Jurgens, Marker, Powell and Zenner are independent.

Committees of the Company's Board. The Company's Board of Directors has an Audit Committee, a Corporate Governance and Nominating Committee and a Compensation Committee.

The Audit Committee, consisting of Directors Cox (Chairman), Jurgens, Gentry and Powell, oversees management's fulfillment of its financial reporting responsibilities and maintenance of an appropriate internal control system. It also has the sole authority to appoint or replace the Company's independent auditors and oversees the activities of the Company's internal audit functions. Each member of the Audit Committee is "independent," in accordance with the requirements for companies quoted on The Nasdaq Stock Market. The Board of Directors has

5

<PAGE>

designated Director Powell as the "audit committee financial expert," as defined by the SEC. The Audit Committee met eight times during the year ended March 31, 2005.

The Compensation Committee, consisting of Directors Marker (Chairman) and Zenner and ex-officio members, Directors Cox and Michael F. Reuling (a director of the Bank), sets salary policies and levels for senior management and oversees all salary and incentive compensation programs for the Company. The Compensation Committee has a Charter which specifies its obligations and the Committee believes it has fulfilled its responsibilities under the Charter. Each member of the Committee is "independent," in accordance with the requirements for companies quoted on The Nasdaq Stock Market. The Compensation Committee met nine times during the year ended March 31, 2005.

The Corporate Governance and Nominating Committee, consisting of Directors Zenner (Chairman), Cox and Marker, ensures that the Company maintains the highest standards and best practices in all critical areas relating to the management of the business of the Company. The Committee also selects nominees for the election of directors and develops a list of nominees for board vacancies. The Corporate Governance and Nominating Committee has a charter which specifies its obligations, a copy of which is available on the Company's website at www.fbnw.com. Each member of the Committee is "independent," in accordance with the requirements for companies quoted on The Nasdaq Stock Market. The Corporate Governance and Nominating Committee met ten times during the year ended March 31, 2005.

The Corporate Governance and Nominating Committee met on March 3, 2005 to nominate directors for election at the Annual Meeting. Only those nominations made by the Committee or properly presented by shareholders will be voted upon at the Annual Meeting. In its deliberations for selecting candidates for nominees as director, the Corporate Governance and Nominating Committee considers the candidate's knowledge of the banking business and involvement in community, business and civic affairs, and also considers whether the candidate would provide for adequate representation of its market area. Any nominee for director made by the Committee must be highly qualified with regard to some or all these attributes. In searching for qualified director candidates to fill vacancies in the Board, the Committee solicits its current Board of Directors for names of potentially qualified candidates. Additionally, the Committee may request that members of the Board of Directors pursue their own business contacts for the names of potentially qualified candidates. The Committee would then consider the potential pool of director candidates, select the candidate the Committee believes best meets the then-current needs of the Board, and conduct a thorough investigation of the proposed candidate's background to ensure there is no past history, potential conflict of interest or regulatory issue that would cause the candidate not to be qualified to serve as a director of the Company. The Committee will consider director candidates recommended by the Company's shareholders. If a shareholder submits a proposed nominee, the Committee would consider the proposed nominee, along with any other proposed nominees recommended by members of the Company's Board of Directors, in the same manner in which the Committee would evaluate its nominees for director. For a description of the proper procedure for shareholder nominations, see "Shareholder Proposals and Nominations" in this proxy statement.

Committees of the Bank's Board. The Bank's Board of Directors has standing Audit and Executive Committees.

The Audit Committee, consisting of Directors Cox (Chairman), Jurgens, Gentry, Powell and K. John Young, meets with the independent auditors to discuss the results of the annual audit and to identify and assign audit duties. The Audit Committee met six times during the fiscal year ended March 31, 2005. The Executive Committee, consisting of Directors Cox (Chairman), Jurgens, Conklin and Moxley, is responsible for specific orders of business for the Bank that requires expedient action. The Executive Committee did not meet during the fiscal year ended March 31, 2005.

Board Policies Regarding Communications with the Board of Directors and Attendance at Annual Meetings

The Board of Directors maintains a process for shareholders to communicate with the Board of Directors. Shareholders wishing to communicate with the Board of Directors should send any communication to the Secretary, FirstBank NW Corp., 1300 16th Avenue, Clarkston, Washington 99403. Any communication must state the number of shares beneficially owned by the shareholder making the communication. The Secretary will forward such

6

<PAGE>

communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Secretary has the authority to discard the communication or take appropriate legal action. The Company does not have a policy regarding Board member attendance at annual meetings of shareholders. Last year, all nine members of the Board of Directors attended the annual meeting, with the exception of Mr. Gentry, who had a prior commitment which could not be rescheduled.

Corporate Governance The Company and the Bank are committed to establishing and maintaining high standards of corporate governance. The Company's and the Bank's executive officers and the Board of Directors have worked together to establish a comprehensive set of corporate governance initiatives that they believe will serve the long-term interests of the Company's shareholders and employees. These initiatives are intended to comply with the provisions contained in the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC adopted thereunder, and the Nasdaq Stock Market. The Board will continue to evaluate, and improve the Company's and the Bank's corporate governance principles and policies as necessary and as required.

Code of Ethics. On January 15, 2004, the Board of Directors adopted the Officer and Director Code of Ethics, which was reviewed and approved by the Board on September 16, 2004 in conjunction with the review and approval of the Bank's Personnel Policy and Procedures. On March 3, 2005, the Code of Ethics was reviewed by the Corporate Governance and Nominating Committee and no changes or amendments were recommended. The Code is applicable to each of the Company's officers and employees, including the principal executive officer and senior financial officers, and requires individuals to maintain the highest standards of professional conduct. A copy of the Code of Ethics is available on the Company's website at www.fbnw.com.

DIRECTORS' COMPENSATION

During the year ended March 31, 2005, non-employee directors received an annual retainer of $9,600, and $500 for each regular meeting, special meeting and committee meeting attended with committee chairs receiving an additional $100 per committee meeting attended. The Chairman of the Board received an additional annual retainer of $10,400. Directors of the Company who are also employees receive an annual retainer of $7,680 and $400 for each meeting attended. All directors also are paid $500 per day for any approved board training day. The Company and the Bank paid total fees to directors of $225,960 for the fiscal year ended March 31, 2005.

Additionally, during the fiscal year ended March 31, 2005, non-qualified options totaling 7,000 were granted to Director Powell at a price of $26.81.

7

<PAGE>

EXECUTIVE COMPENSATION

Summary Compensation Table

The following information is furnished for the Chief Executive Officer and each of the other executive officers of the Company or the Bank who received salary and bonus in excess of $100,000 during the year ended March 31, 2005. | | Annual Compensation

| |

| | | | Other Annual

Compensation ($)(1)

| All Other

Compensation ($)(2)

|

Name and Position

| Year

| Salary ($)

| Bonus ($)

|

|

| Clyde E. Conklin | 2005 | 160,710 | 61,070 | 13,280 | 71,617 |

| President, Chief Executive | 2004 | 146,100 | 58,440 | 17,280 | 59,480 |

| Officer and Director | 2003 | 107,100 | 92,106 | 11,880 | 62,682 |

| | |

| Larry K. Moxley | 2005 | 145,584 | 55,322 | 12,880 | 70,638 |

| Executive Vice President, Chief | 2004 | 134,800 | 53,920 | 17,280 | 60,308 |

| Financial Officer and Director | 2003 | 100,800 | 86,688 | 11,880 | 62,776 |

| | | | | | |

| Terence A. Otte | 2005 | 125,400 | 34,485 | | 28,322 |

| Executive Vice President and | 2004 | 116,100 | 29,025 | -- | 31,087 |

| Chief Operations Officer | 2003 | 86,600 | 49,686 | -- | 25,633 |

| | | | | | |

| Donn L. Durgan | 2005 | 123,100 | 33,853 | | 36,873 |

| Executive Vice President and | 2004 | 113,950 | 28,488 | -- | 39,351 |

| Chief Lending Officer | 2003 | 84,450 | 43,576 | -- | 31,896 |

| | | | | | |

| Richard R. Acuff | 2005 | 95,920 | 26,378 | | 20,534 |

| Executive Vice President and | 2004 | 81,583 | 26,400 | -- | 18,135 |

| Chief Information Officer | 2003 | 63,000 | 34,056 | -- | 17,505 |

________

| (1) | Consists of directors fees. Does not include perquisites which did not exceed the lesser of $50,000 or 10% of salary and bonus. Also does not include interest earned on deferred compensation and split dollar life premium allocations. |

| (2) | Amounts for 2005 reflect (a) contributions of $7,472, $7,464, $5,452, $5,381 and $4,216 to the ESOP for Messrs. Conklin and Moxley, Otte, Durgan and Acuff, respectively, (b) contributions of $58,128, $58,371, $18,144, $26,772 and $12,648 to the Executive Non-Qualified Retirement Plan for Messrs. Conklin, Moxley, Otte, Durgan and Acuff, respectively, and (c) matching contributions of $6,017, $4,803, $4,726, $4,720 and $3,670 to the 401(k) Plan for Messrs. Conklin, Moxley, Otte, Durgan and Acuff, respectively. |

Option Grants. There were no stock options granted to Messrs. Conklin, Moxley, Otte, Durgan or Acuff during the fiscal year ended March 31, 2005.

8

<PAGE>

Option Exercise/Value Table. The following table sets forth information with respect to the number and value of stock options held by the Chief Executive Officer and the named executive officers at March 31, 2005.

| | | Number of

Securities Underlying

Unexercised Options

at Fiscal Year End (#)

| | |

| | | Value of Unexercised

In-the-Money Options

at Fiscal Year End ($)(1)

|

| | Shares

Acquired on | |

| | Value |

Name

| Exercise (#)

| Realized ($)

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

| | | | | | |

| Clyde E. Conklin | -- | -- | 24,000 | -- | 292,560 | -- |

| Larry K. Moxley | -- | -- | 24,000 | -- | 292,560 | -- |

| Terence A. Otte | 3,000 | 36,600 | 8,000 | -- | 97,520 | -- |

| Donn L. Durgan | 3,000 | 38,070 | 8,000 | -- | 97,520 | -- |

| Richard R. Acuff | -- | -- | 2,500 | -- | 30,475 | -- |

________

| (1) | Represents the difference between the fair market value of the Common Stock at March 31, 2005 and the exercise price of the option. The exercise price of the option is $15.81. The market price of the Common Stock at the close of business on March 31, 2005 was $28.00. Options are in the money only if the market value of the shares covered by the options is greater than the option exercise price. |

Employment and Severance Agreements Employment Agreements. On July 1, 1997, the Company and the Bank (collectively, the "Employers") entered into three-year employment agreements with Mr. Conklin and Mr. Moxley. The base salaries under the agreements for Messrs. Conklin and Moxley are currently $160,710 and $145,584, respectively, which amounts are paid by the Bank and may be increased at the discretion of the Board of Directors or an authorized committee of the Board. On each anniversary of the commencement date of the agreements, the term of the agreements may be extended for an additional year. The agreements are terminable by the Employers at any time, or by the executive if he is assigned duties inconsistent with his initial position, duties, responsibilities and status, or upon the occurrence of certain events specified by federal regulations. In the event that an executive's employment is terminated without cause or upon the executive's voluntary termination following the occurrence of an event described in the preceding sentence, the Bank would be required to honor the terms of the agreement for a period of one year, including payment of current cash compensation and continuation of employee benefits.

The employment agreements provide for severance payments and other benefits in the event of involuntary termination of employment in connection with any change in control of the Employers. Severance payments also will be provided on a similar basis in connection with a voluntary termination of employment where, subsequent to a change in control, the executive is assigned duties inconsistent with his position, duties, responsibilities and status immediately prior to such change in control. The term "change in control" is defined in the agreements as having occurred when, among other things, (a) a person other than the Company purchases shares of Common Stock pursuant to a tender or exchange offer for such shares, (b) any person (as such term is used in Sections 13(d) and 14(d)(2) of the Exchange Act) is or becomes the beneficial owner, directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company's then outstanding securities, (c) the membership of the Board of Directors changes as the result of a contested election, or (d) shareholders of the Company approve a merger, consolidation, sale or disposition of all or substantially all of the Company's assets, or a plan of partial or complete liquidation.

The severance payment from the Employers will equal three times the executive's average annual compensation during the five-year period preceding the change in control. Such amount will be paid in a lump sum within ten business days following the termination of employment. Assuming that a change in control had occurred at March 31, 2005, Mr. Conklin and Mr. Moxley would be entitled to severance payments of approximately $669,485 and $629,792, respectively. Section 280G of the Internal Revenue Code of 1986, as amended, states that severance payments which equal or exceed three times the base compensation of the individual for the most recently completed five taxable years are deemed to be "excess parachute payments" if they are contingent upon a change in control. Individuals receiving

9

<PAGE>

excess parachute payments are subject to a 20% excise tax on the amount of such excess payments, and the Employers would not be entitled to deduct the amount of such excess payments.

The agreements restrict the executive's right to compete against the Employers for a period of one year from the date of termination of the agreement if the executive voluntarily terminates employment, except in the event of a change in control.

Severance Agreements. On April 18, 2003, the Employers entered into severance agreements with Terence A. Otte, Executive Vice President, Chief Operating Officer, and Donn L. Durgan, Executive Vice President, Chief Lending Officer. Each agreement is for a three-year term, and may be extended by the Boards of Directors for one year on each April 1. Each agreement provides that if a "change in control" of the Company or the Bank occurs, and within 12 months thereafter the executive's employment is involuntarily terminated without just cause, or the executive voluntarily terminates his employment for good reason, as defined in the agreement, he will be entitled to receive a severance payment equal to 2.99 times his "base amount" as determined under section 280G of the Internal Revenue Code of 1986, as amended,. Assuming that a change in control had occurred at March 31, 2005, Messrs. Otte and Durgan would be entitled to severance payments of approximately $450,778 and $429,319, respectively.

Executive Non-Qualified Retirement Plan Effective December 2001, the Bank adopted an Executive Non-Qualified Retirement Plan ("Non-Qualified Retirement Plan") that provides supplemental retirement benefits to selected executives. Participation in the Non-Qualified Retirement Plan is limited to a "select group of management and highly compensated employees," who are selected by the Plan Committee to participate. With respect to any participant, benefits are provided pursuant to a participation agreement entered into between the Bank and the participant. Upon a participant's termination of employment on or after attaining his retirement age (set forth in the participant's participation agreement), the participant will commence receiving the monthly amount set forth in his participation agreement, payable for life. If provided for in the participant's participation agreement, the monthly amount may be increased annually to reflect a specified cost of living increase. If the participant terminates employment before his retirement age, then he will receive a partial benefit, determined based on the length of his service with the Bank, commencing on the participant's retirement age, and payable for life. If the participant dies while actively employed with the Bank or an affiliate, then the Participant's beneficiary will receive a monthly partial benefit (determined as if the participant terminated employment immediately prior to his death) over 240 months. If the participant dies after his benefits commence and before 240 payments have been made, his beneficiary will continue to receive monthly payments until the cumulative number of payments made to or on behalf of the participant equals 240. The Committee may accelerate the payment of monthly benefits at any time. Participants are 100% vested in the benefits at all times, except upon termination for cause. No benefits will be paid on account of a participant's termination for cause.

Under their respective agreements under the Non-Qualified Retirement Plan, Messrs. Conklin, Moxley, Otte, Durgan and Acuff (the "Executives") will receive lifetime benefits of $5,396, $5,079, $4,000, $4,000 and $4,000 per month, respectively, upon termination of employment after attaining age 60 for Messrs. Conklin and Moxley or age 62 for Messrs. Otte, Durgan and Acuff ("retirement age"), subject to an annual increase of 2.5 percent for inflation beginning on the first anniversary of the date the benefits commence. The Executives are entitled to a partial accrued benefit in the event of termination of employment prior to retirement age, other than on account of death or termination for cause. The payment of such benefits, however, will not commence until the first day of the month after the Executive turns the retirement age (if he is then living). If the Executive is not living at that time, his designated beneficiary will receive a partial accrued benefit commencing when the Executive would have attained the retirement age.

The Bank previously entered into salary continuation agreements with Mr. Conklin and Mr. Moxley. Benefits payable under the salary continuation agreements, however, shall be paid only in the event of the cancellation of the Executive Non-Qualified Retirement Plan. Under the agreements, if the Executive Non-Qualified Retirement Plan is canceled, then Messrs. Conklin and Moxley would receive lifetime benefits of $4,583 and $4,375 per month, respectively, upon retirement at or after attaining the retirement age. The monthly benefit would be reduced proportionately in accordance with a specified vesting schedule in the event of termination of employment prior to the retirement age. The agreements also provide for payment of a reduced benefit in the event of disability and a lump sum

10

<PAGE>

death benefit in the event of death while employed by the Bank. In the event of a change in control of the Bank, the agreements provide that the executive would be entitled to a lump sum payment based on his vested benefit when the change in control occurred.

Deferred Compensation Plan In 2001, the Bank adopted the FirstBank Northwest Deferred Compensation Plan (the "Plan"). Participation in the Plan is limited to a "select group of management and highly compensated employees" and directors of the Bank and the Company, who are selected by the Plan Committee to participate. The Plan permits participants to make annual elections to defer all or a portion of the cash compensation they receive from the Bank or its related entities. The deferred amounts are credited to the participants' accounts, which do not hold assets but are maintained only for record-keeping purposes. The amounts deferred under the Plan are credited at a fixed interest rate as determined by the Plan Committee. Participant accounts are fully vested and nonforfeitable. Within 60 days after a Participant's retirement, his account will be distributed in installments over a number of months selected by the participant (not less than sixty). Within 60 days after a Participant's termination of employment or death while actively employed, his account will be distributed in installments over a number of months equal to the number of months during which the participant made compensation deferrals into the Plan. During the year ended March 31, 2005, the Bank had accrued $232,620 to reflect the anticipated liability. The Plan constitutes an unfunded and unsecured obligation of the Bank. Directors Cox, Zenner, Conklin and Moxley and Bank Director Young currently participate in the Plan.

AUDIT COMMITTEE MATTERS

Audit Committee Charter. The Audit Committee operates pursuant to a Charter approved by the Company's Board of Directors. In March 2004, the Board of Directors adopted a revised Audit Committee Charter to reflect the new responsibilities imposed by the Sarbanes-Oxley Act of 2002. This Charter was further revised in May 2005, and a copy is attached to this proxy statement as Appendix A. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent auditors, the internal audit department and management of the Company. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company.

Report of the Audit Committee. The Audit Committee reports as follows with respect to the Company's audited financial statements for the year ended March 31, 2005:

* The Audit Committee has completed its review and discussion with management of the Company's

2005 audited financial statements; * The Audit Committee has discussed with the independent auditors, Moss Adams LLP, the matters

required to be discussed by Statement on Auditing Standards ("SAS") No. 61,Communication with

Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters

related to the conduct of the audit of the Company's financial statements; * The Audit Committee has received written disclosures, as required by Independence Standards Board

Standard No. 1,Independence Discussions with Audit Committee, indicating all relationships, if any,

between the independent auditor and its related entities and the Company and its related entities

which, in the auditors' professional judgment, reasonably may be thought to bear on the auditors'

independence, and the letter from the independent auditors confirming that, in its professional judgment,

it is independent from the Company and its related entities, and has discussed with the auditors the

auditors' independence from the Company; and * The Audit Committee has, based on its review and discussions with management of the Company's

2005 audited financial statements and discussions with the independent auditors, recommended to the

11<PAGE>

Board of Directors that the Company's audited financial statements for the year ended March 31, 2005

be included in the Company's Annual Report on Form 10-K.

Audit Committee: Steve R. Cox, Chairman

John W. Gentry

W. Dean Jurgens

Sandra T. Powell

COMPENSATION COMMITTEE MATTERS

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

Report of the Compensation Committee. Under rules established by the SEC, the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company's Chief Executive Officer and other executive officers. The disclosure requirements for the Chief Executive Officer and other executive officers include the use of tables and a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting those individuals. The Compensation Committee sets salary policies and levels for senior management and oversees all salary and incentive compensation programs for the Company.

General. The Compensation Committee's duties are to recommend and administer policies that govern executive compensation. The Committee evaluates individual executive performance, compensation policies and salaries. The Committee is responsible for evaluating the performance of the Chief Executive Officer and the Chief Financial Officer of the Company and the Bank, while the Chief Executive Officer of the Company and the Bank evaluates the performance of other senior officers of the Bank and makes recommendations to the Committee regarding compensation levels.

Compensation Policies. The executive compensation policies of the Bank are designed to establish an appropriate relationship between executive pay and the Company's and Bank's annual performance, to reflect the attainment of short- and long-term financial performance and other goals, and to enhance the ability of the Company and the Bank to attract and retain qualified executive officers. The principles underlying the executive compensation policies include the following:

* To attract and retain key executives who are vital to the long-term success of the Company and the Bank

and are of the highest caliber;

* To provide levels of compensation competitive with those offered throughout the financial industry and

consistent with the Company's and the Bank's level of performance;

* To motivate executives to enhance long-term shareholder value by building their equity interest in the

Company; and

* To integrate the compensation program with the Company's and the Bank's annual and long-term strategic

planning and performance measurement processes.

The Committee considers a variety of subjective and objective factors in determining the compensation package for individual executives, including: (1) the performance of the Company and the Bank as a whole with emphasis on annual performance factors and long-term objectives; (2) the responsibilities assigned to each executive; and (3) the performance of each executive of assigned responsibilities as measured by the progress of the Company and the Bank during the year.

12

<PAGE>

Base Salary. The Bank's current compensation plan involves a combination of salary, annual cash bonuses to reward short-term performance and deferred compensation. The salary levels of executive officers are designed to be competitive within the banking and financial services industries. In setting competitive salary levels, the Compensation Committee continually evaluates current salary levels by surveying similar institutions in the Pacific Northwest with comparable asset size and business plan and other common factors. The Compensation Committee has identified 12 financial institutions in the Pacific Northwest that it considers to be its peer group for this analysis. Specifically, the Compensation Committee annually reviews the Moss Adams LLP Banker Compensation Survey covering 121 financial institutions located in the Northwest, and the Northwest Financial Industry Salary Survey covering 110 financial institutions located in the Northwest.

Incentive Compensation. During the fiscal year ended March 31, 2005, two short-term incentive bonus plans were in effect for the executive officers of the Bank, which were designed to compensate for performance. Under the Income Performance Bonus Plan, a targeted percentage of the executive officer's base salary paid annually is based on the net income performance of the Company. The percentage paid fluctuates within a range of the target percentage, with set minimum and maximum percentages of 0% and 80%, respectively. Executive officers were also entitled to receive short-term incentive bonuses under the Key Strategies Bonus Plan. This plan provides that a targeted percentage of the executive officer's base salary paid annually is at the discretion of the Board's Compensation Committee. The percentage paid is based primarily on regulatory compliance issues, and development of action plans in connection with long and short term strategies and specific tasks assigned periodically by the Board of Directors.

Deferred Compensation. Deferred compensation is available to independent and employee directors of the Company and the Bank for the purpose of providing an opportunity to plan for additional retirement resources, other than those programs that are limited by applicable law. Deferred compensation is provided in the form of bank time deposits. Deferrals are elected annually and cannot be changed during the deferral period.

Long Term Incentive Compensation. In connection with the Company's reorganization into the holding company structure, the Company adopted the 1998 Stock Option Plan and the 1998 Management Development and Recognition Plan for executive officers, employees and directors of the Company. These plans were approved by the shareholders of the Company in 1998. Under the plans, directors, executive officers and other employees may receive grants and awards. The Company believes that stock ownership by the Company's and the Bank's executives is a significant factor in aligning the interests of the executives with those of shareholders. Stock options and awards under such plans were allocated based upon regulatory practices and policies, and the practices of other publicly traded financial institutions as verified by external surveys and were based upon the executive officers' level of responsibility and contributions to the Company and the Bank. Current amounts awarded were established based on title, position and responsibility at the grant date.

Compensation of the Chief Executive Officer. During the fiscal year ended March 31, 2005, the base salary of Mr. Conklin was $160,710. In addition, he received a bonus of $61,070 and Board fees of $13,280, and was credited with $65,600 in other compensation (comprised of ESOP contribution of $7,472, Executive Non-Qualified Retirement Plan contribution of $58,128 and 401(k) contribution of $6,017), as set forth in the preceding Summary Compensation Table. Mr. Conklin's compensation consists of base salary, annual incentive compensation and long term incentive compensation that are based upon the same pay for performance philosophy and criteria as that of other executive officers. Fiscal performance criteria include net income, income growth, earnings per share growth, return on equity, asset growth, and efficiency ratio, in addition to other subjective strategic initiative criteria specified periodically by the Company's Board of Directors. For the fiscal year ended March 31, 2005, 74% of Mr. Conklin's bonus was attributable to fiscal performance criteria, and 26% was attributable to subjective strategic initiatives.

Based upon the Committee's annual evaluation of Mr. Conklin, which was completed in May 2005, Mr. Conklin earned 70% of the targeted Income Performance Bonus Plan of $44,999 and $16,071 for the Key Strategies Bonus Plan for a total of $61,070. Mr. Conklin was provided the same health, welfare and retirement benefits as other employees and other non-qualified retirement benefits disclosed under "Executive Compensation" in this Proxy Statement.

13

<PAGE>

The Committee believes that Mr. Conklin's compensation is consistent with his performance as Chief Executive Officer of the Company and with the compensation of other chief executive officers of comparable financial institutions.

Compensation Committee of the Board of Directors: James N. Marker, Chairman

Russell H. Zenner

Steve R. Cox (Ex-officio member)

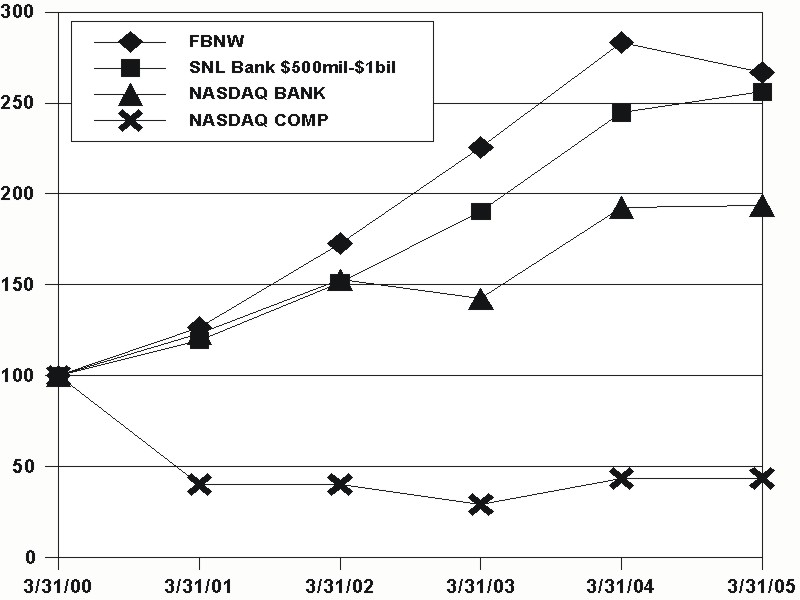

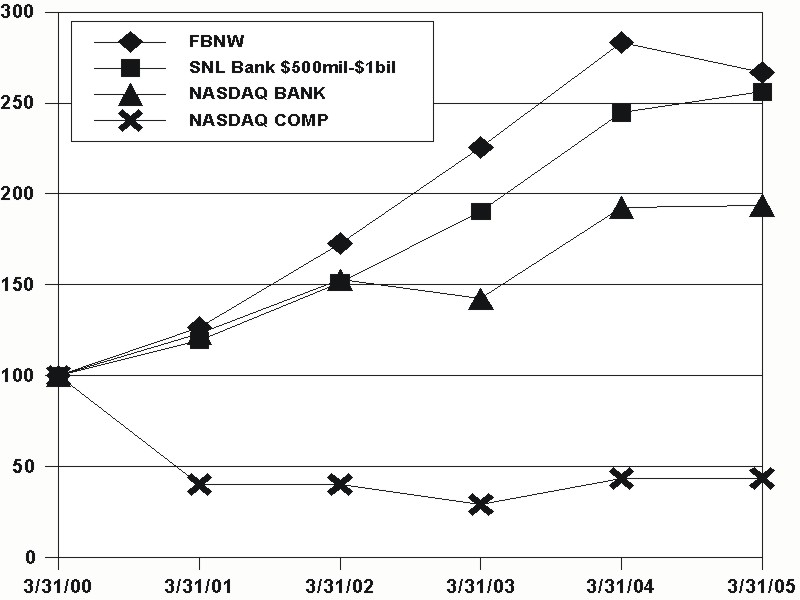

Compensation Committee Interlocks and Insider Participation.No members of the Compensation Committee were officers or employees of the Company or any of its subsidiaries during the year ended March 31, 2005, were formerly Company officers or had any relationships otherwise requiring disclosure. Performance Graph. The following graph compares the cumulative total shareholder return on the Common Stock with the cumulative total return on the Nasdaq (U.S. Stock) Index, a peer group of the SNL $500 Million to $1 Million Asset Bank Index and a peer group of the SNL Nasdaq Bank Index. Total return assumes the reinvestment of all dividends.

| Period Ending

|

Index*

| 3/31/00

| 3/31/01

| 3/31/02

| 3/31/03

| 3/31/04

| 3/31/05

|

| FirstBank NW Corp. | $100.00 | 126.76 | 172.86 | 225.62 | 283.33 | 266.67 |

| SNL $500M-$1B Bank Index | 100.00 | 119.52 | 151.46 | 190.24 | 244.61 | 256.14 |

| SNL Nasdaq Bank Index | 100.00 | 123.37 | 152.79 | 142.35 | 192.64 | 193.88 |

| Nasdaq Total Composite | 100.00 | 40.24 | 40.35 | 29.33 | 43.61 | 43.72 |

* Assumes $100 invested in the Common Stock at the closing price per share and each index on March 31, 2000 and that all dividends were reinvested. Information for the graph was provided by SNL Financial L.C.@2005

14

<PAGE>

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than 10% of any registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms provided to the Company by the above referenced persons, the Company believes that, during the fiscal year ended March 31, 2005, all transactions which were required to be filed were filed in a timely manner, with the exception of a filing on Form 4, Statement of Changes in Beneficial Ownership, for Sandra T. Powell, which was inadvertently not filed within the required two-day period.

TRANSACTIONS WITH MANAGEMENT

Federal regulations require that all loans or extensions of credit to executive officers and directors must be made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons (unless the loan or extension of credit if made under a benefit program generally available to all employees and does not give preference to any insider over any other employee) and must not involve more than the normal risk of repayment or present other unfavorable features. The Bank is therefore prohibited from making any new loans or extensions of credit to the Bank's executive officers and directors and at different rates or terms than those offered to the general public and has adopted a policy to this effect. The aggregate amount of loans by the Bank to its executive officers and directors was approximately $1.8 million at March 31, 2005. Such loans (i) were made in the ordinary course of business, (ii) were made on substantially the same terms and conditions, including interest rates and collateral, as those prevailing at the time for comparable transactions with the Bank's other customers, and (iii) did not involve more than the normal risk of collectibility or present other unfavorable features when made.

PROPOSAL 2 -AMENDMENT OF THE ARTICLES OF INCORPORATION TO

INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

On April 20, 2005, the Company's Board of Directors unanimously adopted a resolution recommending that the Company's Articles of Incorporation be amended to increase the number of authorized shares of the Common Stock, having a par value of $.01 per share, from 5,000,000 shares to 49,500,000 shares (the "Amendment"). The Board of Directors further directed that the Amendment be submitted for consideration by shareholders at the Company's Annual Meeting. In the event the Amendment is approved by shareholders, the Company will thereafter execute and submit to the Washington Secretary of State for filing Articles of Amendment of the Articles of Incorporation providing for the Amendment. The Amendment will become effective at the close of business on the date the Articles of Amendment are accepted for filing by the Washington Secretary of State.

As of the Voting Record Date for the Annual Meeting, there were 2,929,891 shares of Common Stock issued and outstanding and another 162,126 shares of Common Stock were reserved for issuance upon exercise of options previously granted from the Company's stock option plans or issuable under other outstanding stock awards. While the Company's authorized but unissued shares currently available for issuance are sufficient to meet its obligations to deliver shares under these previously granted stock options and outstanding stock awards, after the issuance of shares to meet all such obligations the Company would have available for future issuance only approximately 1,907,983 shares of Common Stock, plus additional shares resulting from stock repurchases from time to time, should the Amendment not be approved by the Company's shareholders.

The Board of Directors believes that it is in the Company's best interest to increase the number of authorized but unissued shares of Common Stock in order to meet our Company's possible future business and financing needs as they arise. While management has no current specific plans, agreements or understandings for the issuance of the additional shares, the Board of Directors believes that the availability of such additional shares will provide the Company15

<PAGE>

with the capability and flexibility to issue Common Stock for a variety of purposes that the Board of Directors may deem advisable in the future. These purposes could include, among other things: raising additional capital; issuing stock splits or stock dividends to the shareholders; providing equity incentives to the Company's officers, directors and employees; issuing stock for possible acquisition transactions; or for other corporate and business purposes. The additional shares authorized would be identical in all respects to the Company's currently authorized shares of Common Stock. The Company's Articles of Incorporation provide that shareholders shall not have preemptive rights for the Company's capital stock. Management's and the Board of Directors' determination that the authorized Common Stock should be increased took into account the historical and anticipated issuance patterns of the Company, the potential issuance of stock splits or dividends in the future based on market conditions and the fact that as the Bank grows into a significantly larger financial institution, the use of authorized shares for additional financing or expansion may be appropriate to enhance shareholder value.

The proposed increase in the number of authorized shares of Common Stock would give our Board of Directors authority to issue additional shares of Common Stock from time to time without delay or further action by the shareholders except as may be required by applicable law or the rules of the Nasdaq Stock Market. Subject to its fiduciary duties to shareholders, the Board of Directors would have the authority to issue additional shares in transactions that might make an unsolicited acquisition of control of the Company more difficult or expensive; however, the Board of Directors has no plans to utilize the authorized shares in that manner and is not aware of any effort by any third parties to acquire control of the Company. Any issuance of additional shares of Common Stock could have the effect, at least in the short term, of diluting earnings per share and the book value of the outstanding Common Stock; however, the Board of Directors would take those factors into account before authorizing any new issuance of shares.

The issuance of additional shares of Common Stock for any of the corporate purposes listed above could have a dilutive effect on earnings per share, depending on the circumstances, and could dilute a shareholder's percentage voting power in the Company.

In the event shareholders approve the Amendment, Article IV of the Company's Articles of Incorporation will be amended to increase the number of shares of Common Stock which the Company is authorized to issue from 5,000,000 to 49,500,000. The par value of the common stock will remain one cent ($.01) per share. Currently, the Company's Articles of Incorporation also authorizes the issuance of 500,000 shares of preferred stock, par value $.01 per share; however, no shares of preferred stock are outstanding, and the Company has no present intention to issue any such shares. The number of authorized shares of preferred stock will not be affected by the Amendment. Upon effectiveness of the Amendment, Section A of Article IV of the Company's Articles of Incorporation will read as follows:

A. The total number of shares of all classes of stock which the Corporation shall have authority to

issue is 50,000,000 consisting of:

1. 500,000 shares of Preferred Stock, par value one cent ($.01) per share (the

"Preferred Stock"); and

2. 49,500,000 shares of Common Stock, par value one cent ($.01) per share

(the "Common Stock").

Approval of the Amendment will require the affirmative vote of a majority of the outstanding shares entitled to vote thereon. Proxies received in response to the Board's solicitation will be voted "FOR" approval of the Amendment if no specific instructions are included thereon for Proposal 2.

The Board of Directors recommends a vote "FOR" the amendment of the Articles of Incorporation to increase the number of authorized shares of Common Stock.

16

<PAGE>

PROPOSAL 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Moss Adams LLP served as the Company's independent auditors for the fiscal year ended March 31, 2005. The Audit Committee of the Board of Directors has appointed Moss Adams LLP as the independent auditors for the fiscal year ending March 31, 2006, subject to shareholder approval. A representative of Moss Adams LLP will be present at the Annual Meeting to respond to shareholders' questions and will have the opportunity to make a statement if he or she so desires.

The following table sets forth the aggregate fees billed, or expected to be billed, to the Company by Moss Adams LLP for professional services rendered for the fiscal years ended March 31, 2005 and 2004.

| Year Ended

March 31,

|

| 2005

| 2004

|

| Audit Fees | $124,282 | $103,001 |

| Audit-Related Fees | 41,050 | 63,347 |

| Tax Fees | 10,550 | 30,500 |

| All Other Fees | -- | 285,978(1) |

_________

| (1) | Includes fees related to the merger with Oregon Trail Financial Corp. |

The Audit Committee will establish general guidelines for the permissible scope and nature of any permitted non-audit services to be provided by the independent auditors in connection with its annual review of its Charter. Pre-approval may be granted by action of the full Audit Committee or by delegated authority to one or more members of the Audit Committee. If this authority is delegated, all approved non-audit services will be presented to the Audit Committee at its next meeting. In considering non-audit services, the Audit Committee or its delegate will consider various factors, including but not limited to, whether it would be beneficial to have the service provided by the independent auditors and whether the service could compromise the independence of the independent auditors.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE APPROVAL OF THE APPOINTMENT OF MOSS ADAMS LLP AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING MARCH 31, 2006.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Annual Meeting other than those matters described above in this Proxy Statement. However, if any other matters should properly come before the Annual Meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the judgment of the person or persons voting the proxies.

MISCELLANEOUS

The cost of solicitation of proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of common stock. Directors, officers and employees of the Company and/or the Bank may solicit proxies personally, or by telephone, facsimile or electronic mail, without additional compensation. In addition, the Company has engaged Regan & Associates, Inc. to assist in distributing proxy materials and contacting record and beneficial owners of the Company's common stock, and has agreed to pay a fee of $6,000, including out-of-pocket expenses, for its services to be rendered on behalf of the Company.

17

<PAGE>

Financial and Other Information. The Company's 2005 Annual Report to Shareholders, including financial statements ("Annual Report"), has been mailed to all shareholders of record as of the close of business on the Voting Record Date. Any shareholder who has not received a copy of such annual report may obtain a copy by writing to the Company. The financial and other information required pursuant to Item 13(a) of the SEC Proxy Rules is incorporated by reference to the Annual Report, which is being delivered to shareholders with this proxy statement.

A copy of the Company's Form 10-K for the fiscal year ended March 31, 2005, as filed with the SEC, will be furnished without charge to shareholders of record as of the close of business on the Voting Record Date upon written request to Larry K. Moxley, Corporate Secretary, FirstBank NW Corp., 1300 16th Avenue, Clarkston, Washington 99403.

SHAREHOLDER PROPOSALS AND NOMINATIONS

Proposals of shareholders intended to be presented at the Company's Annual Meeting expected to be held in July 2006 must be received by the Company no later than February 17, 2006 to be considered for inclusion in the proxy materials and form of proxy relating to such meeting. Any such proposals shall be subject to the requirements of the proxy rules adopted under the Exchange Act.

The Company's Articles of Incorporation provide that in order for a shareholder to make nominations for the election of directors or proposals for business to be brought before the Annual Meeting, a shareholder must deliver notice in writing of such nominations and/or proposals to the Secretary not less than 30 nor more than 60 days prior to the date of the Annual Meeting; provided that if less than 31 days' notice of the Annual Meeting is given to shareholders, such notice must be delivered not later than the close of the tenth day following the day on which notice of the Annual Meeting was mailed to shareholders. As specified in the Articles of Incorporation, the notice with respect to nominations for election of directors must set forth certain information regarding each nominee for election as a director, including such person's written consent to being named in the proxy statement as a nominee and to serving as a director, if elected, and certain information regarding the shareholder giving such notice. The notice with respect to business proposals to be brought before the Annual Meeting must state the shareholder's name, address and number of shares of Common Stock held, and briefly discuss the business to be brought before the Annual Meeting, the reasons for conducting such business at the Annual Meeting and any interest of the shareholder in the proposal.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Larry K. Moxley

LARRY K. MOXLEY

&nb sp; Secretary

Clarkston, Washington

June 17, 2005

18

<PAGE>

APPENDIX A

FIRSTBANK NW CORP.AUDIT COMMITTEE CHARTER

I. The Committee's Purpose.The Committee is appointed by the Board of Directors for the primary purposes of:

Assisting the Board of Directors in its oversight of the following:

* the quality and integrity of the Company's financial statements;

* the Company's compliance with legal and regulatory requirements;

* the Company's risk management profile;

* the independent auditor's qualifications and independence; and

* the performance of the Company's internal audit function and independent auditors.

Preparing the annual Audit Committee report to be included in the Company's proxy statement. Appointing the independent auditors for the Company.

The role of the Audit Committee ("Committee") is to provide oversight on matters relating to accounting,

financial reporting, internal controls, auditing, legal and regulatory compliance activities and other matters

as the Board of Directors deems appropriate. It is not the duty of the Audit Committee to plan or conduct

audits or to determine that the Company's financial statements and disclosures are complete and accurate

and are in accordance with generally accepted accounting principles and applicable rules and regulations

or to determine that internal controls are adequate and appropriate. These are the responsibilities of

management and the independent auditor. In adopting this Charter, the Board of Directors acknowledges

that the Audit Committee members are not providing any expert or special assurance as to the Company's

financial statements or any professional certification as to the independent auditor's work or auditing

standards. Each member of the Audit Committee is entitled to rely on the integrity of those persons and

organizations within and outside of the Company that provide information to the Audit Committee and the

accuracy and completeness of the financial and other information provided to the Audit Committee by such

persons and organizations absent actual knowledge to the contrary.

II. Committee Composition and Meetings

The Committee shall be comprised of three or more directors, all of whom must qualify as independent directors

("Independent Directors") under the listing standards of the Nasdaq Stock Market, Inc. ("NASDAQ") and the

requirements of the Securities and Exchange Commission ("SEC"). In addition, each member shall be free from any

relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her

independent judgment. Each Committee member also shall meet any additional independence or experience

requirements as may be established from time to time by the NASDAQ or the SEC and applicable to the Audit

Committee.

A-1

<PAGE>

The Board of Directors shall endeavor to appoint at least one member to the Audit Committee, who shall be

deemed a "financial expert" as such term may be defined from time to time by the SEC.

The members shall be appointed annually to one-year terms by the Board of Directors. The Committee shall

designate one member of the Committee as its Chairperson. The members shall serve until their resignation,

retirement, removal by the Board or until their successors shall be appointed. No member of the Audit Committee

shall be removed except by majority vote of the Independent Directors on the Board then in office.

The Committee shall fix its own rules of procedure, which shall be consistent with the Bylaws of the Company and

this Charter.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Committee

Chairperson shall prepare, approve and circulate an agenda in advance of each meeting. The Committee shall meet

privately in separate executive sessions at least annually with members of management, the Company's Quality

Assurance Manager, and the independent auditors. In addition, the Committee should meet with management and

the independent auditors quarterly to review the Company's financial statements and significant findings based

upon the independent auditors' limited review procedures. The Chairperson of the Committee or a majority of the members of the Committee may call a special meeting of

the Committee.

A majority of the members of the Committee shall constitute a quorum.

The Committee may request that any Directors, officers or employees of the Company, or other persons whose

advice and counsel are sought by the Committee, attend any meeting of the Committee to provide such pertinent

information as the Committee requests.

Following each of its meetings, the Chairperson of the Committee shall deliver a report on the meeting to the

Board of Directors, including a description of all actions taken by the Committee at the meeting. The Committee shall keep written minutes of its meetings, which minutes shall be maintained with the books and

records of the Company.

III. The Committee's Responsibilities and Duties

The following shall be the common recurring responsibilities and duties of the Audit Committee in carrying

out its oversight role. These responsibilities and duties are set forth below as a guide to the Committee with

the understanding that the Committee may alter or supplement them as appropriate under the circumstances

to the extent permitted by applicable law, regulation or listing standard.

A. Review Procedures.

*Review and reassess the adequacy of this Charter at least annually. Submit the Charter to the Board of

Directors for its approval.

*Review with the independent auditors and management the Company's annual audited financial

statements, including the Company's disclosures under "Management's Discussion and Analysis of