QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

NSTAR |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

800 Boylston Street

Boston, Massachusetts 02199

March 22, 2002

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of NSTAR to be held on Thursday, April 25, 2002 at 11:00 a.m. at the Copley Theatre, 225 Clarendon Street, Boston, Massachusetts 02116.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement set forth the business to come before this year's meeting.

Your vote on the business at the Annual Meeting is important, regardless of the number of shares that you own. Whether or not you plan to attend the Annual Meeting, please sign, date and return your proxy in the envelope provided, or vote your proxy by telephone or the Internet as provided in the instructions set forth on the proxy card, as soon as possible. At the Annual Meeting, management will report on operations and other matters affecting NSTAR and will respond to Shareholders' questions.

800 Boylston Street

Boston, Massachusetts 02199

Notice of Annual Meeting of Shareholders

to be held on April 25, 2002

To the Holders of NSTAR's Common Shares:

The Annual Meeting of Shareholders of NSTAR will be held at the Copley Theatre, 225 Clarendon Street, Boston, Massachusetts 02116, on Thursday, April 25, 2002 at 11:00 a.m., for the following purposes:

- 1.

- To elect three Class III trustees to serve until the Annual Meeting to be held in the year 2005 and until the election and qualification of their respective successors.

- 2.

- To approve an Amendment to the NSTAR 1997 Share Incentive Plan to authorize the issuance of an additional two million shares under the Plan.

- 3.

- To transact any other business which may properly come before the Annual Meeting or any adjournment thereof.

Further information as to the matters to be considered and acted on at the Annual Meeting can be found in the accompanying Proxy Statement.

Only the holders of Common Shares of NSTAR as of the close of business on March 4, 2002 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

Please sign, date and return the accompanying proxy in the enclosed addressed envelope, which requires no postage if mailed in the United States, or cast your vote by telephone or the Internet. Your proxy may be revoked at any time before the vote is taken by delivering to the Clerk a written or oral revocation or a proxy bearing a later date.

By Order of the Board of Trustees,

Douglas S. Horan

Senior Vice President, Clerk and General Counsel

Boston, Massachusetts

March 22, 2002

QUESTIONS AND ANSWERS

| Q: | | When and where is the Annual Meeting? |

A: |

|

We will be holding the 2002 Annual Meeting of Shareholders (the "Annual Meeting") of NSTAR ("NSTAR", or the "Company") on Thursday, April 25, 2002, at 11:00 a.m. at the Copley Theatre, 225 Clarendon Street, Boston, Massachusetts 02116. |

Q: |

|

What am I being asked to vote on at the Annual Meeting? |

A: |

|

We are asking you to vote on two proposals at the Annual Meeting: the election of three trustees to hold office for a three-year term and the approval of an Amendment to the NSTAR 1997 Share Incentive Plan to increase the number of shares reserved under the Plan from two million to four million. |

Q: |

|

How does the Board of Trustees recommend I vote on these proposals? |

A: |

|

The Board of Trustees of the Company recommends that you vote FOR the nominees for trustee and FOR the approval of the Amendment to the NSTAR 1997 Share Incentive Plan. |

Q: |

|

Who is entitled to vote at the Annual Meeting? |

A: |

|

You are entitled to vote at the Annual Meeting if you owned Common Shares on March 4, 2002, the record date for the Annual Meeting. On March 4, 2002, the Company had 53,032,546 Common Shares outstanding. |

Q: |

|

What vote of the Shareholders is needed to approve the proposals? |

A: |

|

The holders of a majority of the outstanding Common Shares, present in person or by proxy and entitled to vote, will constitute a quorum at the Annual Meeting. Provided that a quorum is present at the Annual Meeting, the affirmative vote of a plurality of votes is required for the election of trustees; the approval of a majority of the outstanding Common Shares represented and entitled to vote at the Annual Meeting is needed to approve the Amendment to the NSTAR 1997 Share Incentive Plan. |

Q: |

|

What does it mean if I receive more than one proxy card? |

A: |

|

It means that you have multiple accounts with the transfer agent or with brokers. Please complete and return all proxy cards to ensure that all of your shares are voted. |

Q: |

|

What do I need to do now? |

A: |

|

Please carefully read this Proxy Statement, and then if you are a registered Shareholder entitled to vote you may vote by telephone or the Internet (instructions for both are provided on your proxy card) or complete, sign and mail your proxy card in the enclosed return envelope as soon as possible. If you are not a registered Shareholder, but hold your shares in street name through a bank or brokerage firm, refer to the instructions provided on your proxy card. If you sign and send in your proxy card and do not mark how you want to vote, your proxy will be counted as a vote in favor of the nominees for trustee and for the approval of the Amendment to the NSTAR 1997 Share Incentive Plan. The approval of the Amendment to the NSTAR 1997 Share Incentive Plan cannot be accomplished unless a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting are voted in favor of the proposal. If you prefer, you can attend the Annual Meeting and vote your shares in person. |

|

|

|

i

Q: |

|

What do I do if my shares are held in "street name" by my broker? |

A: |

|

If your shares are held in street name by a broker as your nominee, your broker will send you a proxy card. Many brokers also offer the option of voting either by telephone or the Internet, instructions for which will be provided by your broker on your proxy card. |

Q: |

|

Can I change my mind after I have mailed in my signed proxy card or after I have voted by telephone or the Internet? |

A: |

|

Yes. There are three ways you may withdraw your proxy at any time before the vote takes place: (1) you may return to the Clerk of the Company another properly signed proxy card bearing a later date; (2) you may deliver a written revocation of your proxy to the Clerk of the Company; or (3) you may attend the Annual Meeting or any adjourned session thereof in person and vote the shares covered by the proxy. The mailing address for the Clerk of the Company is: Douglas S. Horan, Clerk, NSTAR, 800 Boylston Street, Boston, MA 02199. |

Q: |

|

Who should I call if I have any additional questions? |

A: |

|

If you hold your shares directly, please call NSTAR's Investor Relations Department at (617) 424-2658. If your shares are held in street name, please contact your broker at the telephone number provided by your broker on your proxy card. |

ii

NSTAR

800 Boylston Street

Boston, Massachusetts 02199

(617) 424-2000

PROXY STATEMENT

This Proxy Statement, together with the accompanying proxy and 2001 Annual Report to Shareholders, is being furnished to Shareholders of NSTAR, a Massachusetts business trust, in connection with the solicitation of proxies by the Board of Trustees of NSTAR to be voted at the Annual Meeting of Shareholders ("Annual Meeting"). The Annual Meeting will be held on Thursday, April 25, 2002 at the Copley Theatre, 225 Clarendon Street, Boston, Massachusetts, 02116. Due notice of the Annual Meeting is being given in accordance with the Company's Declaration of Trust for the purposes set forth in the foregoing Notice. The approximate date on which this Proxy Statement and accompanying proxy card will first be mailed to Shareholders is March 22, 2002.

The accompanying proxy, if properly executed and delivered by a Shareholder entitled to vote (or voted by telephone or the Internet), will be voted at the Annual Meeting as specified in the proxy, but may be revoked at any time before the vote is taken by delivery to the Clerk of the Company of a written revocation, by oral revocation in person to the Clerk at the Annual Meeting, or by a proxy bearing a later date. If choices are not specified on the accompanying proxy, the shares will be voted FOR the election of all of the nominees for trustee specified below and FOR the approval of the Amendment to the NSTAR 1997 Share Incentive Plan.

All the costs of preparing, assembling and mailing the enclosed material and any additional material which may be sent in connection with the solicitation of proxies will be paid by the Company, and no part thereof will be paid directly or indirectly by any other person. The Company has retained Georgeson Shareholder to assist in the solicitation of proxies at a fee of $1,500, plus actual out-of-pocket expenses. Some employees may devote a part of their time to the solicitation of proxies or for attendance at the Annual Meeting, but no additional compensation will be paid to them for the time so employed, and the cost of such additional solicitation will be nominal. The Company will reimburse brokerage firms, banks, trustees and others for their actual out-of-pocket expenses in forwarding proxy material to the beneficial owners of its Common Shares.

On March 4, 2002, there were issued and outstanding 53,032,546 NSTAR Common Shares. Only holders of record of NSTAR Common Shares at the close of business on that date shall be entitled to notice of and to vote at the Annual Meeting or any adjournments thereof, and those entitled to vote will have one vote for each Common Share held. The NSTAR Savings Plan owned beneficially 3,756,787 Common Shares, representing 7% of the outstanding Common Shares as of January 31, 2002. Members of the Plan are entitled to give voting instructions with respect to their interests.

The Annual Report to Shareholders of NSTAR for the year ended December 31, 2001, which includes financial statements, is being mailed to Shareholders with this Proxy Statement.

1

PROPOSAL NO. 1: ELECTION OF TRUSTEES

Information about the NSTAR Board, Nominees and Incumbent Trustees

NSTAR's Declaration of Trust provides for classification of the NSTAR Board of Trustees into three classes serving staggered three-year terms. Pursuant to NSTAR's Declaration of Trust, the Board of Trustees has fixed the number of trustees at ten. The three persons named below have been nominated by the NSTAR Board of Trustees for election as Class III trustees for a term expiring at the Annual Meeting to be held in the year 2005 and until their successors are duly elected and qualified. The remaining trustees will continue to serve as set forth below, with the Class I trustees having terms expiring in 2003 and the Class II trustees having terms expiring in 2004. If any of the nominees shall by reason of death, disability or resignation be unavailable as a candidate at the NSTAR Annual Meeting, votes pursuant to the proxy will be cast for a substitute candidate as may be designated by the NSTAR Board, or in the absence of such designation, in such other manner as the trustees may in their discretion determine.

At the time of the Annual Meeting, Dr. Sheldon A. Buckler will retire from the Board of Trustees. The Company thanks Dr. Buckler for his years of dedicated service to the Company. The Company is searching for a replacement to fill the vacancy on the Board of Trustees.

The NSTAR Board of Trustees held nine regular meetings during 2001. The NSTAR Board of Trustees has an Executive Committee, an Audit, Finance and Risk Management Committee, an Executive Personnel Committee and a Board Governance and Nominating Committee. The Executive Committee's duties include the review and recommendation of dividend payment and policy to the NSTAR Board of Trustees and the exercise of those powers of the NSTAR Board of Trustees which by the terms of the Declaration of Trust may be exercised by the Executive Committee between regular Board meetings. The Executive Committee met four times in 2001. The responsibilities and duties of the Audit, Finance and Risk Management Committee are described in the Report of the Committee. Please refer to the Report of the Audit, Finance and Risk Management Committee which begins on page 7. This Committee met three times in 2001. The Executive Personnel Committee, which is responsible for reviewing executive officer compensation, personnel planning and performance, certain benefit programs and human resources policies, met three times in 2001. The Board Governance and Nominating Committee, which establishes guidelines and monitors Board composition, membership, compensation and effectiveness, met three times in 2001. All trustees attended at least 75% of the meetings of the NSTAR Board and the Committees of the NSTAR Board on which such trustees served.

The NSTAR Board has adopted the following trustee retirement policy: trustees who are employees of NSTAR, with the exception of the Chief Executive Officer, retire from the Board when they retire from employment with the Company. Trustees who are not employees of NSTAR or who have served as Chief Executive Officer retire from the Board at the Annual Meeting of Shareholders following their seventieth birthday.

The names of the nominees as Class III trustees and the incumbent Class I and Class II trustees, their ages and certain information concerning each such trustee are shown in the following table. Unless otherwise indicated, all nominees and incumbent trustees have held their current or equivalent positions for the previous five years.

2

Nominees as Class III Trustees—Terms Expiring in 2005

Nominees

| | Principal Occupation and Directorships

|

|---|

Charles K. Gifford

Age: 59

Trustee since: 1999

Member: Executive and Board Governance and Nominating Committees | | President, Chief Executive Officer and a Director (since 2001) and President and Chief Operating Officer (1999-2001), FleetBoston Financial (Bank holding company); formerly Chairman and Chief Executive Officer (1997-1999) Chief Executive Officer (1996-1997), BankBoston; Director, Massachusetts Mutual Life Insurance Company. |

Paul A. La Camera

Age: 59

Trustee since: 1999

Member: Audit, Finance and Risk Management and Board Governance and Nominating Committees |

|

President and General Manager (since 1997), WCVB-TV Channel 5 Boston (Broadcasting); formerly Vice President and General Manager (1994-1997). |

Sherry H. Penney

Age: 64

Trustee since: 1999

Member: Executive Personnel and Board Governance and Nominating Committees |

|

Sherry H. Penney Professor of Leadership, College of Management (since 2001), University of Massachusetts at Boston; formerly Chancellor (1988-1995 and 1996-2000), University of Massachusetts System. |

3

Incumbent Class I Trustees—Terms Expiring in 2003

Trustees

| | Principal Occupation and Directorships

|

|---|

Thomas G. Dignan, Jr.(1)

Age: 61

Trustee since: 1999

Member: Executive Personnel and Board Governance and Nominating Committees | | Of Counsel (since 2000), Ropes & Gray (Law firm); formerly Partner (1997-2000). |

Franklin M. Hundley(1)

Age: 67

Trustee since: 1999

Member: Audit, Finance and Risk Management and Executive Personnel Committees |

|

Of Counsel, Rich, May, P.C. (Law firm); Member, Advisory Board, Berkshire Energy Resources (subsidiary of Energy East). |

Gerald L. Wilson

Age: 62

Trustee since: 1999

Member: Audit, Finance and Risk Management and Board Governance and Nominating Committees |

|

Vannevar Bush Professor of Engineering, Massachusetts Institute of Technology; Director, Analogics Corp. and SatCon Technology Corp. |

- (1)

- During 2001, NSTAR and its subsidiaries paid legal fees to the firms of Ropes & Gray and Rich, May, P.C.

4

Incumbent Class II Trustees—Terms Expiring in 2004

Trustees

| | Principal Occupation and Directorships

|

|---|

Gary L. Countryman

Age: 62

Trustee since: 1999

Member: Executive and Executive Personnel Committees | | Chairman Emeritus and a Director (since 2000), Liberty Mutual Holding Company Inc. (Financial services); formerly Chairman of the Board (1998-2000), Liberty Mutual Insurance Company and Liberty Mutual Fire Insurance Company; formerly Chief Executive Officer and President (2000-2001), Liberty Financial Companies, Inc.; Director, Liberty Mutual Insurance Company, Liberty Mutual Fire Insurance Company and Liberty Life Assurance Company of Boston; FleetBoston Financial and The Neiman-Marcus Group, Inc. |

Matina S. Horner

Age: 62

Trustee since: 1999

Member: Executive and Audit, Finance and Risk Management Committees |

|

Executive Vice President, Teachers Insurance and Annuity Association/College Retirement Equities Fund (Financial services); formerly President (1972-1989), Radcliffe College; Director, The Neiman-Marcus Group, Inc. |

Thomas J. May

Age: 54

Trustee since: 1999

Member: Executive Committee |

|

Chairman of the Board, President (since 2002), Chief Executive Officer and a Director/Trustee (since 1999), NSTAR and its subsidiaries; formerly Chairman of the Board, President and Chief Executive Officer and a Trustee (1998-1999), BEC Energy, and Chairman of the Board, President and Chief Executive Officer and a Director (1995-1999), Boston Edison Company; Director, FleetBoston Financial; Liberty Mutual Holding Company Inc.; New England Business Services, Inc. and RCN Corporation. |

5

Trustee Compensation

Each trustee who is not an employee of NSTAR receives an annual Board retainer of $20,000 in cash and $20,000 of value in NSTAR Common Shares. Trustees who are also members of the Executive Committee or who chair an NSTAR Board Committee receive an additional retainer of $3,000. Trustees who are not employees of NSTAR receive $1,000 for attendance in person at each meeting of the Board or a Committee and $500 for participating in such a meeting by telephone. Trustees may elect to defer part or all of their fees pursuant to NSTAR's Trustees' Deferred Fee Plan. The $20,000 of value in NSTAR Common Shares is automatically credited to a deferred compensation trust account established under that Plan.

Common Share Ownership by Trustees and Executive Officers

The following table sets forth the number of NSTAR Common Shares beneficially owned as of January 31, 2002 by each current trustee, each of the executive officers named in the Summary Compensation Table, and the trustees and executive officers of NSTAR as a group. None of the individual or collective holdings listed below exceeds 1% of the outstanding NSTAR Common Shares. Except as indicated below, all of the shares listed are held by the persons named with both sole voting and investment power.

Name of Beneficial Owner

| | Number of

NSTAR Common

Shares Beneficially Owned(1)(2)(3)

|

|---|

| Sheldon A. Buckler | | 8,746 |

| Gary L. Countryman. | | 6,957 |

| Thomas G. Dignan, Jr. | | 7,744 |

| Charles K. Gifford | | 5,751 |

| Douglas S. Horan | | 65,027 |

| Matina S. Horner | | 6,666 |

| Franklin M. Hundley | | 7,047 |

| James J. Judge | | 62,791 |

| Paul A. La Camera | | 1,893 |

| Thomas J. May | | 293,331 |

| Deborah A. McLaughlin | | 12,981 |

| Joseph R. Nolan, Jr | | 8,465 |

| Sherry H. Penney | | 6,696 |

| Gerald L. Wilson | | 3,683 |

| Russell D. Wright | | 139,624 |

| All trustees and executive officers as a group (15 persons) | | 637,402 |

6

- (1)

- Includes the following number of Common Share stock options which each of the Named Executive Officers has the right to acquire within 60 days of January 31, 2002: Mr. May, 232,667 shares; Mr. Wright, 114,000 shares; Mr. Horan, 51,667 shares; Mr. Judge, 50,067 shares; Ms. McLaughlin, 6,000 shares; and Mr. Nolan, 5,200 shares; all executive officers as a group, 459,601 shares.

- (2)

- Includes the following number of Common Shares held in NSTAR' s Deferred Compensation Trust: Mr. May, 49,235 shares; Mr. Wright, 16,822 shares; Mr. Horan, 9,383 shares; Mr. Judge, 8,972 shares; Ms. McLaughlin, 6,981 shares; and Mr. Nolan, 1,048 shares; all executive officers as a group, 92,441 shares. Participants in the Deferred Compensation Plan may instruct the Plan trustee to vote NSTAR Common Shares held in the trust in accordance with their allocable share of such deferrals, but have no dispositive power with respect to shares held in the trust.

- (3)

- Includes the following number of Common Shares held in the NSTAR's Savings Plan: Mr. May, 11,429 shares; Mr. Wright, 8,802 shares; Mr. Horan, 3,977 shares; Mr. Judge, 3,752 shares; Ms. McLaughlin, 0 shares; and Mr. Nolan, 2,217 shares; all executive officers as a group, 30,177 shares.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that trustees, executive officers and persons who beneficially own more than ten percent (10%) of the Company's Common Shares file initial reports of ownership on Form 3 and reports of changes in ownership on Form 4 and/or Form 5 with the Securities and Exchange Commission (the "SEC") and any national securities exchange on which NSTAR's Common Shares are traded. Trustees, executive officers and greater than ten percent (10%) beneficial owners are required by the SEC's regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based on a review of the forms furnished to the Company and written representations from the trustees and executive officers, the Company believes that all Section 16(a) filing requirements applicable to its trustees and executive officers were complied with for 2001.

AUDIT, FINANCE AND RISK MANAGEMENT COMMITTEE REPORT

The Audit, Finance and Risk Management Committee is composed of Dr. Matina S. Horner, Chair and Messrs. Franklin M. Hundley and Paul A. La Camera and Dr. Gerald L. Wilson.

The responsibility of the Audit, Finance and Risk Management Committee is to assist the Board of Trustees in the discharge of the Board's oversight responsibilities with respect to (i) the financial information provided to Shareholders and the independent audit thereof, and (ii) the accounting and financial reporting principles and policies and systems of internal controls and procedures established by management. The Committee also reviews the short and long-term financing requirements of NSTAR and its risk management and legal compliance programs. The Audit, Finance and Risk Management Committee recommends to the Board of Trustees the appointment of a firm of independent public accountants to audit the external financial statements of the Company for a three-year term, subject to an annual performance review. The Committee meets with such independent public accountants, the Company's internal auditor, the Chief Executive Officer and the senior management of the Company to review the scope and the results of the annual audit, the amount of audit fees, the Company's system of internal accounting controls, the financial statements contained in the Company's Annual Report to Shareholders and other related matters. A more detailed description of the responsibilities and functions of the Committee is set forth in the Audit, Finance and Risk Management Committee's Charter, which was attached to the 2001 Proxy Statement as Appendix A.

7

The Audit, Finance and Risk Management Committee has reviewed and discussed with management the financial statements for fiscal year 2001 audited by PricewaterhouseCoopers LLP, NSTAR's independent public accountants, and various matters related to the financial statements, including those matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU 380). Such matters include the initial selection and changes in accounting policies, management judgments and accounting estimates, significant audit adjustments and disagreements with management. The Audit, Finance and Risk Management Committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), has discussed with PricewaterhouseCoopers LLP those matters required to be disclosed by SAS 61, and has considered whether the provision of non-audit services by the independent public accountants is compatible with maintaining auditor independence, together with the issue of PricewaterhouseCoopers LLP's independence generally. Based upon such review and discussions, the Audit, Finance and Risk Management Committee has recommended to the Board of Trustees that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ending December 31, 2001 for filing with the SEC.

| | | By the Audit, Finance and Risk Management Committee, |

|

|

|

|

Matina S. Horner, Chair

Franklin M. Hundley

Paul A. La Camera

Gerald L. Wilson

|

2001 AUDIT AND RELATED FEES

The following sets forth fees incurred by NSTAR and its subsidiaries during 2001 for services provided by PricewaterhouseCoopers LLP, the Company's independent public accountants:

Financial Statement Fees

| | Implementation Systems Design

and Implementation Fees

| | All Other Fees(1)

|

|---|

| $ | 593,030 | | $ | 0 | | $216,069 |

- (1)

- Includes fees for ERISA Plan audits, tax matters and review of S-8 Registration Statement.

8

EXECUTIVE COMPENSATION

Report of the Executive Personnel Committee

Under the rules established by the SEC, NSTAR is required to provide certain data and information about the compensation and benefits provided to its executive officers, including NSTAR's Chief Executive Officer, the four other most highly compensated executive officers, and any executive officer who left the employ of the Company but who otherwise for that year would have been one of the four other most highly compensated executive officers (the "Named Executive Officers"). The disclosure requirements for the Named Executive Officers include the use of tables summarizing total compensation and a report explaining the rationale and considerations that led to fundamental executive compensation decisions affecting those individuals for the prior year. In fulfillment of this requirement, the Executive Personnel Committee, at the direction of the NSTAR Board of Trustees, has prepared the following report for inclusion in this Proxy Statement.

The Executive Personnel Committee

NSTAR's executive compensation program is administered by the Executive Personnel Committee, a committee of the NSTAR Board composed of the five non-employee trustees listed as signatories to this report. Except as discussed below, none of these non-employee trustees has any interlocking or other relationship with NSTAR that would require disclosure to the SEC. Generally, all decisions of the Executive Personnel Committee regarding the compensation of the Chief Executive Officer are subject to the approval of the non-employee trustees of NSTAR, none of whom is eligible to participate in the incentive plans described below. The Executive Personnel Committee also administers the NSTAR 1997 Share Incentive Plan discussed below.

Compensation Philosophy

The executive compensation philosophy of NSTAR is to provide competitive levels of compensation that advance NSTAR's annual and long-term performance objectives, reward corporate performance, and assist NSTAR in attracting, retaining and motivating highly qualified executives. The framework for the Committee's executive compensation program is to establish base salaries which are competitive with electric and gas utility companies in general and to provide incentives for excellent performance by providing executives with the opportunity to earn additional remuneration under the annual and long-term incentive plans. The incentive plan goals are designed to improve the effectiveness and enhance the efficiency of NSTAR's operations and to create value for Shareholders. The Committee also seeks to link executive and Shareholder interests through equity-based incentive plans. The Committee has recommended and the Board of Trustees has approved share ownership guidelines of five times base salary for the Chief Executive Officer, three times base salary for senior executive officers and two times base salary for all other executive officers. These guidelines allow the executives five years to achieve these levels of ownership.

Components of Compensation

Compensation paid to the Named Executive Officers, as reflected in the following tables, consists of three primary elements: base salary, annual incentive awards, and long-term incentive awards. NSTAR compares its compensation levels against those of other investor-owned electric and gas utility distribution companies. NSTAR's strategy is to establish total compensation (base salary and annual incentives) at the 60th percentile of the utility industry, and to compare its long-term incentive plan to the 50th percentile of companies from equally blended energy and general industry segments.

9

During 2001, the Committee reviewed and updated data collected by nationally recognized compensation experts, as well as data collected by NSTAR's human resources organization, to determine whether NSTAR's compensation strategy is being met. The review evaluated base salary and annual incentives of nearly all electric utility companies and the long-term incentives of a blend of utilities and general industry. The data demonstrated that NSTAR is in conformance with its compensation strategy to the satisfaction of the Committee.

Annual Incentive Plan

Annual incentive payments for 2001 made to the Named Executive Officers, reported in the fourth column of the Summary Compensation table below, were based in 2001 on corporate and business unit performance objectives. All such objectives and goals were derived from the respective corporate operating plans and approved by the Committee. Corporate performance objectives include a comparison of target to actual earnings per share from operations. Business unit performance objectives include predetermined levels for operating and capital budgets, as well as key operating goals. The annual incentive plan award for Mr. May was based on the earnings per share objective and on overall corporate performance. The annual incentive plan awards for the other Named Executive Officers were based on earnings per share, overall corporate performance and individual business unit performance.

Long-Term Compensation

Under the NSTAR 1997 Share Incentive Plan, the Named Executive Officers and other key employees are eligible to receive grants from time to time of stock-related awards of seven general types: (i) stock options, (ii) stock appreciation rights, (iii) restricted stock awards, (iv) deferred stock awards, (v) performance unit awards, (vi) dividend equivalent awards, and (vii) other stock-based awards. Grants made to the Named Executive Officers in 2001 consisted of non-qualified stock options, deferred shares and dividend equivalents on the deferred shares, and were based both upon the Committee's evaluation of performance towards key strategic objectives and on competitive award data provided by an external consultant. The Committee did not weight any of these factors. The options and the deferred shares vest at the rate of 33% per year over a three-year period from the date of grant, and the options may be exercised over a ten-year period.

Other Plans

NSTAR has adopted certain broad-based employee benefit plans in which officers, including the Named Executive Officers, are permitted to participate on the same terms as non-executive employees who meet applicable eligibility criteria. Such plans include pension, life, and health insurance plans, as well as a 401(k) savings plan which includes a company contribution equal to 50% of the first 8% of pay contributed by the employee, up to the maximum 401(k) contribution allowed by the Internal Revenue Code. In addition, NSTAR has a deferred compensation plan in which the Named Executive Officers may elect to participate. The Named Executive Officers also participate in the Supplemental Executive Retirement Plan, which provides eligible participants with supplementary retirement benefits of up to 60% of final average cash compensation, depending upon each participant's years of service, reduced by 50% of the participant's social security benefit and further reduced by benefits the participant receives under NSTAR's pension plan and excess plan. In addition, Mr. May can elect an alternative supplemental retirement benefit equal to 33% of final base salary annually for 15 years.

10

Mr. May's 2001 Compensation

The Executive Personnel Committee makes decisions regarding the compensation of the Chief Executive Officer using the same philosophy and criteria set forth above. As with the compensation of all executive officers, NSTAR compares compensation levels for the Chief Executive Officer to those of all other investor-owned electric and gas utility companies.

Each year NSTAR approves the adjustment of salary ranges for the Chief Executive Officer and other executive officers based on studies conducted by external executive compensation consultants and internal personnel. Based upon 2001 studies, NSTAR's executive compensation levels were adjusted to be within the approved 60th percentile position to market, and Mr. May's annual base salary was increased to $680,000.

Mr. May's annual incentive award, shown in the fourth column of the Summary Compensation Table below, was in conformance with the provisions of the annual incentive plan as described above, and was based on the Company's earnings per share from operations and on the degree of achievement of corporate objectives. The Committee's policy is to base individual long-term incentive awards on information derived from an annual study by the Company's compensation consultant comparing the value of long-term incentive grants to salary levels for a blend of electric and gas utility and general industry companies. The 22,000 deferred shares and 80,000 options granted Mr. May in April of 2001 reflect this policy.

Section 162(m) of the Internal Revenue Code

The income tax deductions of publicly traded companies may be limited to the extent total compensation for certain executive officers exceeds one million dollars during any year; however, the deduction limit does not apply to payments which qualify as "performance-based." The Committee has reviewed the regulations issued by the Internal Revenue Service and will continue to review the application of these rules to future compensation. However, the Committee intends to continue basing its executive compensation decisions primarily upon performance achieved, both corporate and individual, while retaining the right to make subjective decisions and to award compensation that may or may not meet all of the Internal Revenue Service's requirements for deductibility.

Compensation Committee Interlocks and Insider Participation

Charles K. Gifford, who is a member of the NSTAR Board of Trustees, is President, Chief Executive Officer and a Director of FleetBoston Financial. Thomas J. May, NSTAR's Chairman of the Board, President and Chief Executive Officer, serves on the Board of Directors of FleetBoston Financial and is a member of its Human Resources and Governance Committee.

Gary L. Countryman, who is a member of the NSTAR Board of Trustees and Chair of NSTAR's Executive Personnel Committee, is Chairman Emeritus and a Director of Liberty Mutual Holding Company Inc. Mr. May serves on the Board of Directors of Liberty Mutual Holding Company Inc.

| | | By the Executive Personnel Committee, |

|

|

|

|

Gary L. Countryman, Chair

Sheldon A. Buckler

Thomas G. Dignan, Jr.

Franklin M. Hundley

Sherry H. Penney

|

11

EXECUTIVE COMPENSATION TABLES

The following information is provided for the years 2001, 2000 and 1999 regarding annual and long-term compensation earned by NSTAR's Chief Executive Officer, the four other most highly compensated executive officers, and any executive officer who left the employ of the Company in 2001 but who would otherwise have been one of the four other most highly compensated executive officers.

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long-Term Compensation

|

|---|

| |

| | Annual Compensation

| | Awards

| | Payouts

| |

|

|---|

Name and Principal Position

| | Year

| | Salary(1)

| | Bonus

| | Other

Annual

Compen-

sation(2)

| | Deferred/

Restricted

Stock

Awards(3)

| | Securities

Underlying

Options/

SARs(#)

| | LTIP(4)

Payouts

| | All

Other

Compen-

sation(5)

|

|---|

Thomas J. May

Chairman of the Board and Chief Executive Officer | | 2001

2000

1999 | | $

| 670,000

645,000

571,667 | | $

| 500,000

750,000

650,000 | | —

—

— | | $

| 873,400

798,750

351,688 | | 80,000

60,000

79,000 | | | —

—

— | | $

| 6,800

6,800

9,600 |

Russell D. Wright(6)

President and Chief Operating Officer |

|

2001

2000

1999 |

|

$

|

516,667

506,667

416,475 |

|

$

|

0

400,000

272,963 |

|

—

—

— |

|

$

|

357,300

310,625

208,808 |

|

36,000

35,000

43,000 |

|

$ |

—

—

546,928 |

|

$

|

6,800

6,800

17,547 |

Douglas S. Horan

Senior Vice President/

Strategy, Law & Policy,

Clerk and General Counsel |

|

2001

2000

1999 |

|

$

|

295,000

281,667

238,000 |

|

$

|

150,000

200,000

200,000 |

|

—

—

— |

|

$

|

198,500

119,813

86,888 |

|

19,000

14,000

12,000 |

|

|

—

—

— |

|

$

|

6,800

6,800

9,600 |

James J. Judge

Senior Vice President,

Treasurer and Chief

Financial Officer |

|

2001

2000

1999 |

|

$

|

295,000

281,667

238,000 |

|

$

|

150,000

200,000

200,000 |

|

—

—

— |

|

$

|

198,500

119,813

86,888 |

|

19,000

14,000

12,000 |

|

|

—

—

— |

|

$

|

6,800

6,800

9,600 |

Deborah A. McLaughlin(7)

Executive Vice President

Customer Care/Shared Services |

|

2001

2000

1999 |

|

$

|

273,167

318,667

288,708 |

|

$

|

0

200,000

163,663 |

|

—

—

— |

|

$

|

198,500

164,188

116,544 |

|

20,000

18,000

24,000 |

|

$ |

—

—

216,266 |

|

$

|

6,800

6,800

14,439 |

Joseph R. Nolan, Jr

Senior Vice President/

Corporate Relations |

|

2001

2000

1999 |

|

$

|

166,667

—

— |

|

$

|

100,000

—

— |

|

—

—

— |

|

$

|

79,400

—

— |

|

7,000

—

— |

|

|

—

—

— |

|

$

|

5,784

—

— |

12

- (1)

- The amounts in this column represent the aggregate total of cash compensation received and compensation deferred by the above-named individuals. Compensation was deferred in 2001 pursuant to the provisions of NSTAR's Deferred Compensation Plan.

- (2)

- The dollar value of perquisites and other personal benefits, securities or properties totaling either $50,000 or 10% of total annual salary and bonus, together with various other earnings, amounts reimbursed for the payment of taxes and the dollar value of any stock discounts not generally available are required to be disclosed in this column. In 2001, there were no such perquisites, earnings, reimbursements or discounts paid or made in excess of such limits.

- (3)

- Deferred Common Share awards are valued at the closing market price as of the date of the grant. The awards vest one-third on each of the first, second and third anniversaries of the date of the grant. Dividends will accrue on the awards from the date of grant and are payable in the form of additional shares, which vest at the same time the awards vest. Aggregate deferred Common Share holdings and the value thereof based on the closing price of the Common Shares on December 31, 2001 are as follows: Mr. May, 36,833 shares ($1,651,960); Mr. Wright, 0 shares ($0); Mr. Horan, 7,500 shares ($336,375); Mr. Judge, 7,500 shares ($336,375); Ms. McLaughlin, 0 shares ($0); and Mr. Nolan, 2,933 shares ($131,545).

- (4)

- The amounts in this column represent for 1999 the value (as of August 25, 1999) of restricted common shares of Commonwealth Energy System awarded to Mr. Wright and Ms. McLaughlin under Commonwealth Energy System's Long-Term Incentive Plan, which shares vested and were exchanged for 1.05 NSTAR Common Shares for each Commonwealth Energy System share upon the merger of Commonwealth Energy System and BEC Energy.

- (5)

- The amounts in this column represent the aggregate contributions or account credits made by NSTAR during 2001 on behalf of the above-named individuals to the NSTAR Savings Plan. The NSTAR Savings Plan is a defined contribution plan. The Plan incorporates salary deferral provisions pursuant to Section 401(k) of the Internal Revenue Code for all employees who have elected to participate on that basis.

- (6)

- Mr. Wright retired from the Company on December 31, 2001.

- (7)

- Ms. McLaughlin resigned as Executive Vice President of the Company effective October 1, 2001.

13

| |

| | Option Grants in 2001

| |

| |

|

|---|

| | Individual Grants

| |

| |

|

|---|

Name

| | Number of

Securities

Underlying

Options

Granted (1)

| | % of Total

Options

Granted to

Employees

In 2001

| | Exercise

Or Base

Price

($/Sh.)

| | Expiration

Date

| | Grant

Date

Present

Value

($) (2)

|

|---|

| Thomas J. May | | 80,000 | | 33.3 | % | $ | 39.70 | | 4-25-11 | | $ | 408,000 |

| Russell D. Wright | | 36,000 | | 15.0 | % | $ | 39.70 | | 4-01-02 | | $ | 183,600 |

| Douglas S. Horan | | 19,000 | | 7.9 | % | $ | 39.70 | | 4-25-11 | | $ | 96,900 |

| James J. Judge | | 19,000 | | 7.9 | % | $ | 39.70 | | 4-25-11 | | $ | 96,900 |

| Deborah A. McLaughlin | | 20,000 | | 8.3 | % | $ | 39.70 | | 2-01-02 | | $ | 102,000 |

| Joseph R. Nolan, Jr. | | 7,000 | | 2.9 | % | $ | 39.70 | | 4-25-11 | | $ | 35,700 |

- (1)

- Options vest one-third annually beginning April 25, 2002.

- (2)

- Based on the closing price of $39.70 on April 25, 2001. The grant date present values were determined using the Black-Scholes option pricing model. There is no assurance that the value realized will be at or near the value estimated by the Black-Scholes model. Assumptions used for the model are as follows: stock volatility, 21%; risk-free rate of return, 4.82%; dividend yield, 5.34%; and time to exercise, four years.

| | Aggregated Option/SAR Exercises and Fiscal Year-End

| |

|

|---|

| | Option Value Table

| |

|

|---|

| |

| |

| | Number of Securities

Underlying Unexercised

Options At Fiscal Year-End (#)

| | Value of Securities

Underlying Unexercised

In-the-Money Options

At Fiscal Year-End ($)(1)

|

|---|

Name

| | Shares/SARs

Acquired on

Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable/Unexercisable

| | Exercisable/Unexercisable

|

|---|

| Thomas J. May | | 0 | | $ | 0 | | 232,667/146,333 | | $ | 2,383,518/$522,507 |

| Russell D. Wright | | 0 | | $ | 0 | | 114,000/0 | | $ | 383,700/$0 |

| Douglas S. Horan | | 0 | | $ | 0 | | 51,667/32,333 | | $ | 589,917/$116,183 |

| James J. Judge | | 0 | | $ | 0 | | 50,067/32,333 | | $ | 548,357/$116,183 |

| Deborah A. McLaughlin | | 16,000 | | $ | 54,000 | | 6,000/0 | | $ | 2,850/$0 |

| Joseph R. Nolan, Jr. | | 0 | | $ | 0 | | 5,200/10,000 | | $ | 19,583/$47,475 |

- (1)

- Based on the closing price of NSTAR Common Shares on December 31, 2001 of $44.85.

14

Retirement Benefits

The following table shows the estimated annual retirement benefits payable to executive officers under NSTAR's qualified pension plans and Supplemental Executive Retirement Plan, assuming retirement at age 65. The NSTAR Pension Plan is a non-contributory defined benefit plan which covers substantially all of the employees of the Company, including the Named Executive Officers. The Pension Plan provides benefits which vary according to pay, subject to a $170,000 limitation (as indexed) on eligible compensation. The benefit is payable following termination of employment either as a lump sum or in one of several annuity options. The Supplemental Executive Retirement Plan is a non-qualified pension plan providing a maximum benefit of 60% of compensation after attainment of 20 years of credited service and age 60 (age 62 as to executive officers appointed after 1996). The Supplemental Executive Retirement Plan provides the incremental benefits in excess of the benefits paid under the qualified plan necessary to reach the benefit shown in the table. The benefits presented are based on a straight life annuity and do not take into account a reduction in benefits of up to 50% of the participant's primary Social Security benefit.

PENSION PLAN TABLE

| | Years of Credited Service

|

|---|

Average Annual

Compensation

|

|---|

| | 10 Years

| | 5 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

|

|---|

| $ | 200,000 | | $ | 60,000 | | $ | 90,000 | | $ | 120,000 | | $ | 120,000 | | $ | 120,000 | | $ | 120,000 |

| | 400,000 | | | 120,000 | | | 180,000 | | | 240,000 | | | 240,000 | | | 240,000 | | | 240,000 |

| | 600,000 | | | 180,000 | | | 270,000 | | | 360,000 | | | 360,000 | | | 360,000 | | | 360,000 |

| | 800,000 | | | 240,000 | | | 360,000 | | | 480,000 | | | 480,000 | | | 480,000 | | | 480,000 |

| | 1,000,000 | | | 300,000 | | | 450,000 | | | 600,000 | | | 600,000 | | | 600,000 | | | 600,000 |

| | 1,200,000 | | | 360,000 | | | 540,000 | | | 720,000 | | | 720,000 | | | 720,000 | | | 720,000 |

| | 1,400,000 | | | 420,000 | | | 630,000 | | | 840,000 | | | 840,000 | | | 840,000 | | | 840,000 |

| | 1,600,000 | | | 480,000 | | | 720,000 | | | 960,000 | | | 960,000 | | | 960,000 | | | 960,000 |

| | 1,800,000 | | | 540,000 | | | 810,000 | | | 1,080,000 | | | 1,080,000 | | | 1,080,000 | | | 1,080,000 |

For purposes of computing retirement benefits, Mr. May, Mr. Wright, Mr. Horan, Mr. Judge, Ms. McLaughlin and Mr. Nolan currently have 26, 34, 24, 24, 22 and 17 years of credited service, respectively.

Final average compensation for purposes of calculating the benefits under the Supplemental Executive Retirement Plan is the highest average annual compensation of the participant during any consecutive 36-month period. Compensation taken into account in calculating the benefits described above includes salary and annual bonus, including any amounts deferred under the terms of the Deferred Compensation Plan.

15

Change in Control/Employment Agreements

Change in Control Agreements

NSTAR has entered into Change in Control Agreements (the "CIC Agreements") with certain key employees, including the Named Executive Officers, which provide severance benefits in the event of certain terminations of employment following a "Change in Control" (as defined below). If, following a Change in Control, a Named Executive Officer's employment were to be terminated other than for cause or for reasons specified in the CIC Agreements, the executive would receive severance pay in an amount equal to three times the sum of his or her annual base salary, at the rate in effect immediately prior to the date of termination or immediately before the Change in Control, whichever is higher, plus an amount equal to his or her actual bonus paid during the most recently completed fiscal year, or his or her target bonus for the fiscal year in which the termination occurs, whichever is higher. In addition, the CIC Agreements provide for a pro rated bonus payment for the year in which the termination occurs, the immediate vesting of bonus awards, immediate payment of deferred compensation amounts upon such termination and payments equal to the benefit the executive would have received under NSTAR's savings and pension plans, assuming the executive was vested and remained employed for an additional three years. For three years following any such termination of employment, the executive would be entitled to participate in all welfare plans provided by NSTAR. The CIC Agreements further provide for a "gross-up" payment under which, if amounts paid under such agreements would be subject to a federal excise tax on "excess parachute payments," NSTAR would pay the executive an additional amount, so that after payment of all such taxes by the executive, the executive will have received the amount otherwise payable in the absence of any such tax. A Change in Control under the agreement generally includes the following events: (i) a person or group becomes the beneficial owner of more than 30% of the voting power of NSTAR's Common Shares; (ii) continuing trustees cease to be a majority of the NSTAR Board; (iii) a consolidation, merger or other reorganization or sale or other disposition of all or substantially all of the assets of NSTAR (other than certain defined transactions); or (iv) approval by Common Shareholders of a complete liquidation or dissolution of NSTAR.

Employment Agreements

NSTAR has entered into an employment agreement with Mr. May. The term of the agreement is five years from August 25, 1999. Under the terms of his employment agreement, Mr. May will serve as the Chairman of the Board and Chief Executive Officer of NSTAR. In addition to base pay, Mr. May will be entitled to participate in NSTAR's incentive compensation, retirement and welfare programs available to executives of NSTAR as determined by the NSTAR Board of Trustees.

16

STOCK PERFORMANCE GRAPH

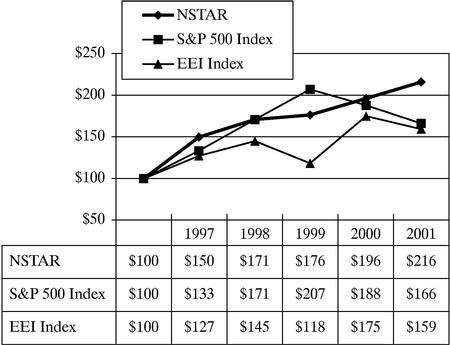

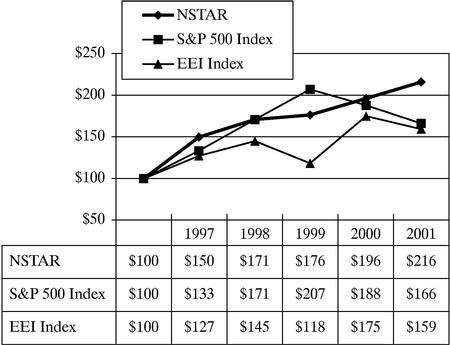

The line-graph presentation set forth below compares cumulative five-year shareholder returns with the S&P 500 Index and an index of peer companies selected by NSTAR. NSTAR has approved the use of the Edison Electric Industry Index (EEI Index), a recognized industry index of 69 investor-owned utility companies. Consistent with the stock price and stock/cash election terms which were approved by Shareholders in the 1999 merger, the graph describes performance of BEC Energy over the term preceding the BEC Energy/Commonwealth Energy System merger and of NSTAR from August 25, 1999 to December 31, 2001. Pursuant to the SEC's regulations, the graph below depicts the investment of $100 at the commencement of the measurement period, with dividends reinvested.

17

PROPOSAL NO. 2: APPROVAL OF AMENDMENT TO

THE NSTAR 1997 SHARE INCENTIVE PLAN

On January 24, 2002 the Board of Trustees approved an amendment (the "Amendment") to the NSTAR 1997 Share Incentive Plan (the "Plan"), subject to shareholder approval, to increase the number of shares reserved for issuance under the Plan from 2,000,000 to 4,000,000. The affirmative vote of the holders of a majority of the shares present and entitled to vote is required to approve the Amendment.

The Amendment reads as follows:

"Pursuant to Section 17 of the NSTAR 1997 Share Incentive Plan, NSTAR hereby amends said Plan, said amendment to become effective upon approval thereof by the Shareholders of NSTAR, as follows:

Section 4(a) of the Plan is amended by deleting the number "2,000,000" and inserting in lieu thereof the number "4,000,000."

General

The Plan permits a variety of stock and stock-based awards, including the granting of stock options and stock appreciation rights; the award of restricted shares; the award of dividend equivalents; the granting of rights to receive cash or shares on a deferred basis or based on performance; the awarding of cash fpayments sufficient to offset the ordinary income taxes of participants resulting from transactions under the Plan; the making of loans to participants in connection with awards; and the granting of other stock-based awards, all as more fully described below. By continuing to provide equity-related compensation, the Board believes that the participants will have a strong incentive to emphasize shareholder value.

The Plan is administered by the Executive Personnel Committee, a Committee of five non-employee Trustees (the "Committee"). The Committee has full authority, consistent with the Plan, to select who will receive awards, to determine the types of awards to be granted and the times of grant, to determine the number of shares to be covered by any award, to determine the terms and conditions of any award, to adopt, amend and rescind rules and regulations for the administration of the Plan, to interpret the Plan and to decide any questions and settle all controversies and disputes which may arise in connection with the Plan. The Board of Trustees has also delegated to the Chief Executive Officer the authority, in addition to the general authority of the Committee, to grant options and other awards to individuals who are not subject to Section 16 of the Securities Exchange Act of 1934 or whose compensation is not covered by Section 162(m) of the Internal Revenue Code.

Persons eligible to participate in the Plan are those executive officers and other key employees of the Company and its subsidiaries who, in the opinion of the Committee, are in a position to make a contribution to the success of NSTAR and whose number and identities are determined from time to time.

The Plan limits the terms of awards to ten years and prohibits the granting of awards more than ten years after the effective date (January 23, 1997) of the Plan. Awards and shares which are forfeited, reacquired by NSTAR, satisfied by a cash payment by NSTAR or otherwise satisfied or terminated without the issuance of NSTAR Common Shares are not counted. The Plan also authorizes the Committee to issue awards in substitution for awards held by employees of companies and businesses acquired by NSTAR on such terms and conditions as it deems appropriate.

18

The number of shares for which stock options and stock appreciation rights may be granted to any one participant in any calendar year is limited to 100,000 shares, and in no event may the total compensation awarded to any one participant in any one calendar year under all restricted stock awards and all awards intended to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code exceed the equivalent of 25,000 shares.

Stock Options. The Plan permits the granting of both non-transferable (unless otherwise determined by the Committee) incentive stock options under Section 422 of the Internal Revenue Code ("ISOs") and stock options that do not so qualify ("NSOs"). The exercise price of each option shall be determined by the Committee but, in the case of ISOs, shall not be less than 100% (110% in the case of an ISO granted to a 10% shareholder) of the fair market value of the shares on the date of grant. On March 4, 2002, the closing price of NSTAR Common Shares as reported on the New York Stock Exchange Composite Tape was $44.56.

The term of each option may not exceed ten years (five years in the case of an ISO granted to a 10% shareholder) from the date the option was granted or such earlier date as may be specified by the Committee at the time the option is granted. Options may be made exercisable in installments, and the exercisability of options may be accelerated by the Committee. In the event of termination of employment by reason of death or total permanent disability, each option held by an employee will become fully exercisable and will remain exercisable for two years in the case of death and one year in the case of disability (subject to the limitation relating to the maximum exercise period), all except as otherwise determined by the Committee.

Except as otherwise determined by the Committee, in the event of termination of employment other than by reason of death or total and permanent disability, all options held by an employee that are not then exercisable shall terminate. Options that are exercisable on the date of termination shall continue to be exercisable for a period of three months, subject to the stated term of the option, unless the employee has admitted to, or been convicted of, any act of fraud, theft or dishonesty arising in the course of, or in connection with, his or her employment with NSTAR and its subsidiaries, in which case all options terminate immediately, all except as otherwise determined by the Committee.

Stock Appreciation Rights. The Committee may also grant non-transferable (unless otherwise determined by the Committee) stock appreciation rights ("SARs"), alone or in conjunction with options, entitling the holder upon exercise to receive an amount in any combination of cash or NSTAR Common Shares, not greater in value than the increase since the date of grant in the value of the shares covered by such right. SARs are subject to such terms and conditions as may be determined by the Committee. SARs may be granted separately from or in tandem with the grant of options. In addition, the Committee may determine, if so requested by an option holder, that NSTAR will pay the optionee, in cancellation of an option not accompanied by a related SAR, any combination of cash, or NSTAR Common Shares, equal to the difference between the fair market value of the NSTAR Common Shares to have been purchased upon exercise and the aggregate consideration to have been paid upon exercise. The provisions described above relating to the exercisability of NSOs upon termination of employment as a result of death, disability or otherwise also apply to SARs.

Restricted Shares. The Committee may also grant restricted share awards, subject to such conditions and restrictions, including vesting, as the Committee may determine at the time of grant. The Committee may at any time waive such restrictions, including through accelerated vesting. Unless otherwise determined by the Committee, restricted shares are non-transferable, and if the employment of a participant who holds restricted shares terminates for any reason (other than death or total and permanent disability) prior to the lapse or waiver of the restrictions, NSTAR may require the forfeiture or repurchase of the shares in exchange for the amount, if any, which the participant paid for them. Except as otherwise determined by the Committee, if a participant's employment terminates because of death or total and permanent disability, all restrictions on restricted shares held by him or her shall

19

lapse. Prior to the lapse of restrictions on restricted shares, the participant will have all rights of a shareholder with respect to the shares, including voting and dividend rights, subject only to the conditions and restrictions generally applicable to restricted stock under the Plan or specifically set forth in the award agreement.

In determining the vesting schedule for each award of restricted shares, the Committee may impose whatever conditions to vesting as it determines to be appropriate. In order for an award of restricted shares to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, the Committee must provide that vesting of the restricted share awards is subject to one or more of the following performance goals: (1) earnings per share, (2) individual performance objectives, (3) net income, (4) pro forma net income, (5) return on designated assets, (6) return on revenues or (7) satisfaction of company-wide or department-based objectives. The Committee will pre-establish in writing one or more of the performance goals no later than ninety (90) days after the commencement of the period to which the performance relates (or any such other time as is required to satisfy the conditions of Section 162(m) of the Internal Revenue Code and the regulations thereunder).

Deferred Shares. The Committee may make deferred share awards under the Plan. These are non-transferable (unless otherwise determined by the Committee) awards entitling the recipient to receive NSTAR Common Shares without any payment in one or more installments at a future date or dates, as determined by the Committee. Receipt of deferred shares may be conditioned on such matters as the Committee shall determine, including continued employment or attainment of performance goals. Except as otherwise determined by the Committee, all such rights terminate upon the termination of the participant's employment for any reason (including death). In order to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, the same procedures for establishing and measuring performance goals described for restricted shares above must be used.

Performance Units. The Committee may award non-transferable (unless otherwise determined by the Committee) performance units entitling the recipient to receive NSTAR Common Shares or cash in such combinations as the Committee may determine upon the achievement of specified performance goals over a fixed or determinable period and such other conditions as the Committee may determine. Except as otherwise determined by the Committee, rights under a performance unit award shall terminate upon a participant's termination of employment for any reason (including death).

20

Performance units may be awarded independently or in connection with stock options or other awards under the Plan. Unless otherwise determined by the Committee, exercise of performance unit awards issued in tandem with another award reduces the number of shares subject to the other award on such basis as is specified in the award agreement. In order to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, the same procedures for establishing and measuring performance goals described for restricted shares above must be used.

Dividend Equivalent Awards. The Committee may award dividend equivalent awards entitling the participant to receive cash, NSTAR Common Shares, or other property equal in value to dividends paid with respect to a specified number of NSTAR Common Shares. Dividend equivalents may be awarded on a free-standing basis or in connection with another award, and may be paid currently or on a deferred basis. The Committee may provide at the date of grant or thereafter that the dividend equivalent award shall be paid or distributed when accrued or shall be deemed to have been reinvested in additional NSTAR Common Shares, or other investment vehicles as the Committee may specify, provided that dividend equivalent awards (other than free-standing dividend equivalent awards) shall be subject to all conditions and restrictions of the underlying awards to which they relate. Except as otherwise determined by the Committee, all such rights terminate upon the termination of the participant's employment for any reason (including death). In order to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, the same procedures for establishing and measuring performance goals described for restricted shares above must be used.

Other Stock-Based Awards. The Committee may grant other types of awards of, or based on, NSTAR Common Shares. Such awards may include debt securities convertible into or exchangeable for NSTAR Common Shares upon such conditions, including attainment of performance goals, as the Committee may determine. In order to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code, the same procedures for establishing and measuring performance goals described for restricted shares above must be used.

Supplemental Loans and Grants. The Committee may authorize loans in connection with awards granted or exercised under the Plan. Each loan shall be subject to such terms and conditions and shall bear such rates of interest, if any, as the Committee shall determine. However, the amount of any loan may not exceed the total exercise or purchase price plus an amount equal to the cash payment which could have been paid to the borrower in respect to taxes as described in the next paragraph.

The Committee may at any time grant to a participant the right to receive a cash payment in connection with taxable events (including the lapse of restrictions) under grants or awards. The amount of such payment may not exceed the amount which would be required in order to pay in full the federal, state and local income taxes due as a result of income recognized by the recipient in respect of such grant or award plus such cash payments based on the maximum marginal federal, state and local tax rates (or such lower rate as the Committee may determine) in effect at the times such taxable income is recognized.

Change in Control Provisions. The Plan provides that in the event of a Change in Control, all awards outstanding but not then exercisable will become immediately exercisable, and restrictions and conditions on all awards outstanding will automatically lapse or be deemed waived. A Change in Control under the Plan generally includes the following events: (i) a person or group becomes the beneficial owner of more than 30% of the voting power of NSTAR's Common Shares; (ii) a change in control required to be reported under certain provisions of the Securities Exchange Act; (iii) a consolidation, merger or other reorganization (other than such a consolidation, merger or other reorganization that (a) would result in the voting power immediately before to continue to represent more than 50% of the voting power thereafter, or (b) in which no person or group would acquire more than 20% of the voting power), or a sale of all or substantially all assets or a plan of liquidation; and (iv) continuing trustees cease to be a majority of the board.

21

Adjustments for Stock Dividends, Mergers, etc. The Committee is required to make appropriate adjustments in connection with awards to reflect stock dividends, stock splits and similar events. In the event of a merger, liquidation or similar event, in which NSTAR is not the surviving entity, all awards will terminate, but prior to such event, all awards outstanding but not then exercisable will become immediately exercisable and all restrictions and conditions on all awards outstanding will lapse; provided that so long as no Change in Control is involved, the Committee may arrange for substitute awards from the successor corporation.

Effect, Discontinuance, Amendment and Termination. The Committee may at any time discontinue granting awards under the Plan. The Committee may at any time or times amend the Plan or any outstanding award for the purpose of satisfying the requirements of any changes in applicable laws or regulations or for any other purpose which may at any time be permitted by law, or may at any time terminate the Plan as to any further grants of awards, provided that no such amendment shall, without the approval of the Shareholders, increase the maximum number of shares available under the Plan, change the group of employees eligible to receive awards, reduce the price at which ISOs may be granted, extend the time in which awards may be granted or change the amendment provisions of the Plan. However, no such action shall adversely affect any rights under outstanding awards without the holder's consent.

Plan Benefits. During 2001, options to purchase 181,000 NSTAR Common Shares were granted to the Company's Named Executive Officers, as set forth in the table captioned "Option Grants in 2001" above, and 48,000 Deferred Share awards were granted to the Company's Named Executive Officers, as set forth in the table captioned Deferred/Restricted Stock Awards. During 2001, options to purchase 240,500 NSTAR Common Shares were granted to all executive officers of the Company as a group at an average weighted exercise price of $39.70. In addition, 61,600 Deferred Share awards were granted to all of the Company's executive officers as a group and 36,250 Deferred Share awards were granted to the other participating employee group. The number of options or other awards to be granted in the future to the Company's executive officers and to other participating employees is not determinable at this time.

Federal Income Tax Consequences

The following discussion summarizes certain federal income tax consequences associated with stock option awards under the Plan. The summary does not purport to cover federal employment tax or other federal tax consequences that may be associated with the Plan, nor does it cover state, local or non-U.S. taxes.

22

Incentive Options. In general, no taxable income is realized by the optionee upon the grant or exercise of an ISO. However, the exercise of an ISO may result in alternative minimum tax liability for the optionee. With certain exceptions, a disposition of shares purchased under an ISO within two years from the date of grant or within one year after the date of exercise produces ordinary income to the optionee (and a deduction to NSTAR) equal to the excess of the value of the shares at the time of exercise over the option price. Any additional gain recognized in the disposition is treated as capital gain and any loss sustained will be capital loss (and no additional deduction will be allowed to NSTAR for federal income tax purposes).

Non-Statutory Options. No income is realized by an optionee at the time an NSO is granted. Generally, (a) at exercise, ordinary income is realized by the optionee in an amount equal to the difference between the option price and the fair market value of the shares on the date of exercise, and NSTAR receives a tax deduction for the same amount (subject to satisfaction of applicable withholding requirements), and (b) upon a later sale or exchange, appreciation or depreciation after the date of exercise is treated as either short-term or long-term capital gain or loss depending on how long the shares have been held.

Generally, an ISO that is exercised more than three months following termination of employment (other than termination by reason of death) is treated as a non-statutory option. ISOs are also treated as non-statutory options to the extent they first become exercisable in any one calendar year as to NSTAR Common Shares having a value (determined at the time the options were granted) in excess of $100,000.

Payments in Respect of a Change in Control. Under the so-called "golden parachute" provisions of the Internal Revenue Code, the vesting or accelerated exercisability of awards in connection with a Change in Control of NSTAR may be required to be valued and taken into account in determining whether participants have received compensatory payments, contingent on the Change in Control, in excess of certain limits. If these limits are exceeded, a substantial portion of amounts payable to the participant, including income recognized by reason of the grant, vesting or exercise of awards under the Plan, may be subject to an additional 20% federal tax and may be non-deductible to NSTAR.

Section 162(m). Section 162(m) of the Internal Revenue Code limits to $1 million the deduction a public corporation may claim in any year for compensation to any of certain key officers. There are a number of exceptions to this deduction limitation, including an exception for qualifying performance-based compensation. It is intended that stock options granted under the Plan will be eligible for this performance-based exception.

Recommendation of the Board of Trustees

The Board of Trustees has approved the Amendment to the NSTAR 1997 Share Incentive Plan and recommends that the Shareholders vote FOR Proposal No. 2. Proxies solicited by the Board of Trustees will be so voted unless Shareholders specify otherwise.

23

OTHER MATTERS

Voting Procedures

Pursuant to Massachusetts law and the terms of the NSTAR Declaration of Trust, a majority of the shares entitled to be cast on a particular matter, present in person or represented by proxy, constitutes a quorum as to such matter. Votes cast by proxy or in person at the Annual Meeting will be counted by persons appointed by the Company to act as election inspectors for the meeting.

Trustees will be elected by a plurality of the votes properly cast at the meeting. Proposal No. 2 requires the affirmative vote of a majority of the shares present and entitled to vote on the matter. The election inspectors will count the total number of votes cast "FOR" Proposal No. 2 for purposes of determining whether sufficient affirmative votes have been cast. As stated, votes may be cast by mail, telephone or the Internet. Instructions with respect to electronic voting are included on the proxy card. The election inspectors will count shares represented by proxies that withhold authority to vote for a nominee for election as a trustee or that reflect abstentions and "broker non-votes" (i.e., shares represented at the meeting held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) only as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum. Neither abstentions nor broker non-votes have any effect on the outcome of voting on the election of trustees. For purposes of Proposal No. 2, abstentions are considered in determining the number of votes required to obtain a majority of the shares present and entitled to vote and will have the same effect as votes cast against the proposal.

Adjournment of Meeting