Filed by Northeast Utilities Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-6

Under the Securities Exchange Act of 1934

Subject Company: NSTAR

Commission File No.: 333-170754

| 780 N. Commercial Street, Manchester, NH 03101 | |

Public Service Company of New Hampshire | ||

| P. O. Box 330 | ||

| Manchester, NH 03105-0330 | ||

| (603) 634-3355 | ||

| (603) 634-2438 - fax | ||

bersara@psnh.com | ||

A Northeast Utilities Company | ||

Robert A. Bersak | ||

| Assistant Secretary and | ||

| Assistant General Counsel |

February 1, 2011

Ms. Debra A. Howland

Executive Director and Secretary

New Hampshire Public Utilities Commission

21 S. Fruit Street, Suite 10

Concord, New Hampshire 03301-2429

| Re: | Northeast Utilities-NSTAR Merger Review |

| Docket No. DE 11-014 |

Dear Secretary Howland:

By Secretarial letter dated January 18, 2011, the Commission initiated this docket to gather information regarding any impacts that the proposed merger transaction involving Northeast Utilities (“NU”) and NSTAR might have on Public Service Company of New Hampshire (“PSNH”) and its customers. The Commission further instructed NU and PSNH to present detailed information regarding the proposed merger’s expected impact on PSNH and its affiliates, with special attention paid to any expected effects on PSNH’s rates, terms, services or operations and any changes in the provision of services currently provided by NU’s service-company affiliates to PSNH.

The merger transaction is undergoing approvals or reviews from myriad agencies, including,inter alia, the U.S. Securities and Exchange Commission, the Federal Energy Regulatory Commission, the Department of Justice, the Nuclear Regulatory Commission, the Federal Communications Commission, the Massachusetts Department of Public Utilities, the Maine Public Utilities Commission, and the Connecticut Department of Public Utility Control.

In order to ensure that this Commission has complete and unabridged detailed information to understand the merger transaction, and to demonstrate that the transaction will not adversely affect PSNH’s rates, terms, services or operations nor adversely change the provision of services currently provided by NU’s service-company affiliates, PSNH is providing the Commission withall materials regarding the merger transaction provided by NU or NSTAR to the various approving or reviewing agencies. Enclosed with this letter is electronic media containing this information. Due to the amount of information being provided and since this is not an adjudicative proceeding, PSNH is not including the seven written copies of all documents

submitted normally required by Rule Puc 203.02. If the Commission deems it necessary, pursuant to Rule Puc 201.05 PSNH requests a waiver of Rule Puc 203.02 in this regard as compliance with this provision would be onerous given the volume of materials involved.

Included in the information being supplied are numerous data request responses inquiring into the proposed merger’s expected impact on PSNH’s affiliated operating companies (Western Massachusetts Electric Company, The Connecticut Light and Power Company, and Yankee Gas Services Company) and NSTAR’s operating companies (NSTAR Electric Company and NSTAR Gas Company). The merger transaction’s expected impact on PSNH will be identical to the impact expected on PSNH’s affiliated operating companies, as discussed in detail in these data request responses. As indicated throughout these data request responses, the merger is expected to have a favorable effect NU’s and NSTAR’s operating companies and on the customers of each company. The merger would combine the resources of NU and NSTAR creating opportunities to strengthen service quality and adopt best procedures which, over time, will yield savings to customers.

PSNH will continue to supply additional information filed with other agencies as it becomes available.

Again, PSNH looks forward to participating in the February 7, 2011 informational session, and appreciates this opportunity to provide further information on the NU/NSTAR transaction.

Sincerely, |

/s/ Robert A. Bersak |

Robert A. Bersak |

Assistant Secretary and |

Assistant General Counsel |

Enclosures

cc: Office of Consumer Advocate

| 780 N. Commercial Street, Manchester, NH 03101

Public Service Company of New Hampshire P. O. Box 330 Manchester, NH 03105-0330 (603) 634-3355 (603) 634-2438 - fax

bersara@psnh.com

A Northeast Utilities Company

Robert A. Bersak Assistant Secretary and Assistant General Counsel |

February 1, 2011

Ms. Debra A. Howland

Executive Director and Secretary

New Hampshire Public Utilities Commission

21 S. Fruit Street, Suite 10

Concord, New Hampshire 03301-2429

| Re: | Northeast Utilities-NSTAR Merger Review |

| Docket No. DE 11-014 |

Dear Secretary Howland:

In response to the Commission’s letter dated January 18, 2011, Northeast Utilities (“NU”) and Public Service Company of New Hampshire (“PSNH”, and together with NU, the “Companies”) welcome the opportunity to participate in the public informational session to be held by the Commission on February 7, 2011. In advance of that session, the Companies are submitting this letter to provide the Commission with background information on the merger agreement with NSTAR, including a description of the transaction structure and other details. In addition, this letter addresses the issue of the Commission’s jurisdiction over the transaction, and its expected effects on PSNH’s rates, terms, services or operations.

As explained in this letter, the transaction contemplated by the merger agreement will result in NU acquiring all of the shares of NSTAR, and NSTAR and its subsidiaries becoming subsidiaries of NU. Neither NU nor PSNH are being acquired, sold or merged as a result of this transaction. As described more fully below, the transaction will involve NSTAR being acquired by NU through mergers involving NSTAR and two specially created merger subsidiaries of NU.

The NU/NSTAR transaction will not result in a new company, will not result in a change of control over NU or PSNH, and will not change the existing holding company-public utility relationship of NU and PSNH. NU shares will continue to be traded before and after the transaction is completed. From a corporate and legal perspective, NU will be the same company following the proposed merger as it is today. PSNH will remain a wholly-owned, independent subsidiary of NU and will not merge with any other company. Accordingly, New Hampshire law does not require Commission approval of the proposed transaction.

Most importantly, however, the transaction will not change or limit the Commission’s continuing jurisdiction over PSNH. PSNH will continue to be regulated by the Commission as a public utility, all outstanding orders and commitments will remain effective, and the interests of customers will be fully protected following the merger, as they are today, through the Commission’s continuing authority over the rates, terms, services and operations of PSNH.

Description of the Transaction

NU is a Massachusetts business trust and the parent holding company of four regulated utility subsidiaries, including PSNH, which is a New Hampshire public utility.1 NSTAR is also a Massachusetts business trust and is the parent holding company of NSTAR Electric Company and NSTAR Gas Company, which together provide service to approximately 1.1 million electric distribution customers and approximately 300,000 natural gas distribution customers in Massachusetts. NSTAR has no plant, operations or customers in New Hampshire, and none of its subsidiaries are New Hampshire public utilities.2 NU and NSTAR entered into an Agreement and Plan of Merger dated October 16, 2010, as amended on November 1, 2010 and December 16, 2010 (the “Merger Agreement”), which provides for the acquisition of NSTAR by NU, subject to necessary approvals of shareholders and government regulatory authorities having jurisdiction over the transaction. NU and NSTAR first mailed to their respective shareholders a joint proxy statement/prospectus on January 5, 2011, which provides additional information regarding the companies, the transaction, and includes a copy of the Merger Agreement. The joint proxy statement/prospectus is enclosed with this letter as Attachment A.

Pursuant to the Merger Agreement, consideration for the proposed merger will be 100 percent equity, in the form of NU common shares (although cash will be paid in lieu of fractional shares). At closing, each holder of an NSTAR common share will be entitled to receive 1.312 NU common shares (the “exchange ratio”). The exchange ratio is based on the average closing share prices of NSTAR and NU over the 20 trading days immediately preceding the announcement of the Merger Agreement and reflects no merger premium for the shareholders of NU or NSTAR. See Attachment A, Merger Agreement, §1.6.

The proposed merger will be accomplished in a two-step process, as set forth in the Merger Agreement. As described therein, the transaction will consist first of a merger under Massachusetts law whereby NSTAR will merge with and into NU Holding Energy 1 LLC (“Merger Sub”), a new first tier, wholly owned subsidiary of NU created for the transaction. In this part of the transaction, Merger Sub will cease to exist and NSTAR will be the surviving entity (termed the “Surviving Trust”). Immediately thereafter, NSTAR, the Surviving Trust, will

| 1 | RSA 362:2(I) defines “public utility” to include “every corporation, company, association, joint stock association, partnership and person, their lessees, trustees or receivers appointed by any court, except municipal corporations and county corporations operating within their corporate limits, owning, operating or managing any plant or equipment or any part of the same for the conveyance of telephone or telegraph messages or for the manufacture or furnishing of light, heat, sewage disposal, power or water for the public, or in the generation, transmission or sale of electricity ultimately sold to the public . . . .” |

| 2 | NSTAR derives approximately 99% percent of its consolidated operating revenues from the utility operations of NSTAR Electric and NSTAR Gas, neither of which are New Hampshire public utilities. |

-2-

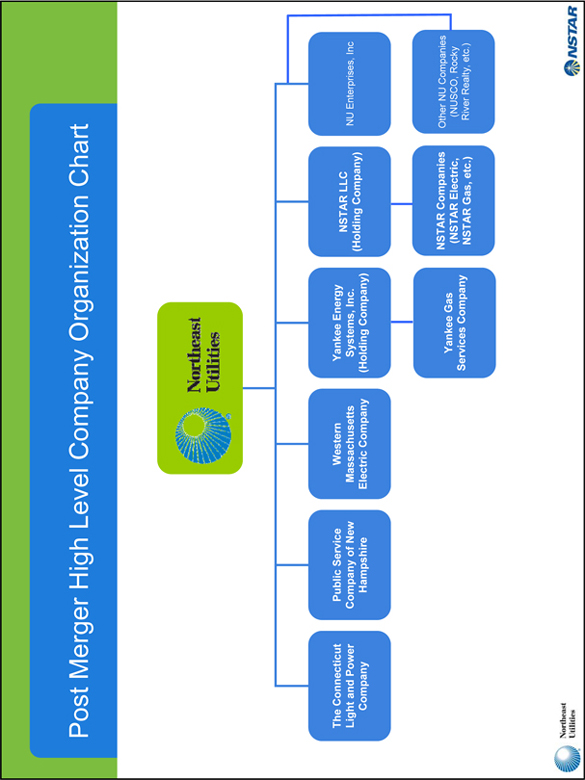

merge with and into NU Holding Energy 2 LLC (“Acquisition Sub”), a second, wholly-owned first tier subsidiary of NU created for the transaction. Acquisition Sub will be the surviving entity and, immediately following the second merger, will be renamed NSTAR LLC. As a consequence of the two sequential mergers, NSTAR will become a wholly owned, first tier subsidiary of NU in a transaction intended to be a tax-free exchange of stock for the present shareholders of NSTAR3. See Attachment A, Merger Agreement, §1.1. The corporate organization chart depicting NU’s subsidiaries following the transaction is attached as Attachment B.

The transaction is subject to a series of approvals by the NU shareholders. As described in the Merger Agreement, the NU shareholders must approve the issuance of the NU common shares constituting the merger consideration, and must also adopt the Merger Agreement and approve the proposed merger. See Merger Agreement, §3.3. The NU shareholders must also approve fixing the number of trustees of the NU board of trustees (“NU Board”) at 14. Existing NU shareholders are expected to hold approximately 56.3% of NU’s common shares outstanding immediately following the completion of the transaction. Therefore, the NU shareholders will determine whether the proposed merger may go 4 forward, as well as retain control over NU, including the NU Board, after the transaction.4

As a matter of law, NU from a corporate perspective will be the same company following the proposed merger as it is today. Although the Merger Agreement contemplates various changes to the NU Board and officers following the transaction, these changes do not amount to a “change of control” of NU.5 NU will continue to be publicly traded, owned and controlled by a large, diverse group of shareholders, none of which owns a controlling interest in the company. NU will continue in existence following the transaction, with no provision in the Merger Agreement calling for the creation of a new holding company that would exercise control over NU, PSNH or its other subsidiaries. The transaction will not combine holding companies, but rather, will combine NSTAR and two special purposesubsidiaries of NU created to effectuate the proposed merger. See Merger Agreement, §1.1.

Commission Jurisdiction

The Commission regulates the acquisition, sale and merger of public utilities and public utility holding companies doing business in New Hampshire. New Hampshire law requires Commission approval of any transaction in which a public utility or holding company would acquire a controlling interest in a public utility or public utility holding company incorporated in or doing business in New Hampshire. The Commission’s jurisdiction is based on whether the company being acquired is a New Hampshire public utility or a public utility holding company doing business in New Hampshire. The Commission’s jurisdiction is not triggered if the transaction involves an acquisition of an out-of-state utility or the holding company of an out-of-state utility (such as NSTAR), by the holding company of a New Hampshire public utility (such as NU). The Commission has consistently adhered to this jurisdictional threshold in prior cases.

| 3 | NSTAR Electric Company and NSTAR Gas Company will continue in their current form as separate corporations, subsidiaries of NSTAR LLC, with NU as the parent holding company. |

| 4 | With respect to NSTAR’s participation in the transaction, NSTAR shareholders must also approve the adoption of the Merger Agreement and consummation of the proposed merger.See Merger Agreement, §2.3. |

| 5 | The Commission also does not regulate management and personnel changes within a utility. |

-3-

The Commission typically reviews public utility acquisitions pursuant to its authority under RSA 374:33 and RSA 369:8, II(b).6 RSA 374:33 states as follows:

No public utility or public utility holding company . . . shall directly or indirectly acquire more than 10 percent, or more than the ownership level which triggers reporting requirements under 15 U.S.C., section 78-P, whichever is less, of the stocks or bonds of any other public utility or public utility holding companyincorporated in or doing business in this state, unless the commission finds that such acquisition is lawful, proper and in the public interest. . . .

RSA 374:33 (emphasis added). This statute expressly states that the Commission’s jurisdiction is triggered only if the company to be acquired is incorporated in or doing business in New Hampshire.”

RSA 369:8, II(b)(1) states as follows:

To the extent that the approval of the commissionis required by any other statute for any corporatemerger or acquisition involving parent companies of a public utility whose rates, terms, and conditions of service are regulated by the commission, the approval of the commission shall not be required if the public utility files with the commission a detailed written representation no less than 60 days prior to the anticipated completion of the transaction that the transaction will not have an adverse effect on rates, terms, service, or operation of the public utility within the state.

RSA 369:8, II(b)(1) (emphasis added). This statute establishes an expedited process for certain mergers or acquisitions, but the Commission’s authority is derivative and dependant upon whether the proposed transaction is in the first instance subject to its approval under another statute, such as RSA 374:33.7 Neither of these statutes authorizes the Commission to approve an acquisition of an out-of-state utility by the holding company parent of a New Hampshire public utility.

In addition to these two statutes, the Commission’s January 18, 2011 letter directs the Companies to also address RSA 369-B:3, IV, (b)(4) (the “Con Ed Merger Statute”) and RSA 374:30. The Con Ed Merger Statute was implemented in the year 2000, and sets forth required terms for inclusion in any financing orders for rate reduction bonds (“RRBs”). Among those

| 6 | See, e.g., DG 08-048,Unitil Corporation and Northern Utilities, Inc. Joint Petition for Approval of Stock Acquisition, Order No. 24,906, Oct. 10, 2008; DG 07-083,Iberdrola, S.A., et al, Joint Petition for Approval of the Acquisition of New Hampshire Gas Corporation, Order No. 24,812, Dec. 28, 2007 (“Iberdrola”); DG 06-107,National Grid plc, et al, Petition for Approval of Merger Transaction, Order No. 24,777, July 12, 2007. |

| 7 | The standard of review by the Commission is whether the proposed acquisition is “lawful, proper and in the public interest” pursuant to RSA 374:33, and whether there is “no adverse effect on the rates, terms, service or operation of the utility” pursuant to RSA 369:8, II(b), in essence a “no net harm” test.See, Iberdrola,at 7-8,citing Grafton County Electric Light and Power Co. v. State, 77 N.H. 539, 540 (1915);Parker-Young Co. v. State, 83 N.H. 551, 561-562 (1929);Appeal of Pinetree Power, 152 N.H. 92, 97 (2005). |

-4-

terms is a provision to require Commission approval “[i]n the event that PSNH or its parent companyis acquired or otherwise sold or merged” (emphasis added). This provision is inapplicable in the current case, because neither PSNH nor NU is being “acquired or otherwise sold or merged” with NSTAR. The transaction is structured as an acquisition of NSTAR by NU, as described above.

RSA 374:30 is also inapplicable to the transaction. This statute allows a public utility to “transfer or lease its franchise, works or system . . . exercised or located in this state, or contract for the operation of its works and system located in this state” upon approval of the Commission. The proposed merger will not change the ownership or operation of PSNH’s franchise, works or system. PSNH will continue as a wholly-owned subsidiary of NU, will retain all of its assets, and will not be merged with or transferred to another company. The transaction preserves the legal identity of PSNH and the current holding company-public utility relationship of NU and PSNH.

The Commission has previously determined that it does not have jurisdiction over the acquisition of an out-of-state utility holding company by the holding company of a New Hampshire public utility.See National Grid Group, PLC Petition for Approval of Merger, Order No. 23,640, 86 NH PUC 95 (2001) (“NGG Order”). In that case, the Commission was presented with an application for approval pursuant to RSA 374:33 and RSA 369:8, II, in which National Grid Group (“NGG”), the holding company parent of two New Hampshire public utilities, was subject to a “technical” change of control to a new corporate entity being created to facilitate NGG’s acquisition of Niagara Mohawk. In the transaction, which was approved by the Commission, the new corporate entity was taking the place of NGG as the parent holding company of its current subsidiaries, and would also become the parent holding company of Niagara Mohawk. In the Order, the Commission cited to prior cases in which it “discussed at some length the statutory framework within which it must act in consideringacquisitions of New Hampshire public utilities and/or their parent companies.” 86 NH PUC at 98 (emphasis added). The Commission further explained that upon completion of the NGG transaction, “the result would be no different from the situation in which NGG bought Niagara Mohawk outright,a transaction over which the Commission would have no jurisdiction.”Id.(emphasis added). The current case involving NU and NSTAR is identical to the scenario described by the Commission (i.e, if NGG had bought Niagara Mohawk outright). The NU/NSTAR transaction is a “transaction over which the Commission would have no jurisdiction,” because there is no change in control over a New Hampshire public utility or its parent holding company.

Finally, the Companies note that the NSTAR transaction is similar, although larger in scope, to NU’s acquisition of Yankee Energy System, Inc. in the year 2000. The Commission did not review or approve that transaction, because there was no change in control of NU, and because Yankee is not a New Hampshire public utility. The Commission’s posture with respect to NU’s acquisition of Yankee was consistent with a line of other recent cases that proceeded without Commission approval, in which the parent holding companies of various New Hampshire public

-5-

utilities acquired out-of-state utility.8 The transaction contemplated in the Merger Agreement is structured in a similar manner and is not subject to the Commission’s jurisdiction.

PSNH Customers Will Be Unaffected by the Merger

The Merger Agreement will not change or limit the Commission’s jurisdiction over PSNH. PSNH will continue to be locally-controlled and managed. The company will continue to be regulated by the Commission as a public utility. The Commission will retain its full jurisdiction with respect to PSNH’s provision of electric service, the condition of its plant and equipment, and its manner of operations.

The Commission also will retain its full authority over the rates and terms of service of PSNH. NU and NSTAR are not proposing any rate changes in connection with the transaction. PSNH’s rates will be unaffected by the proposed merger and will remain at current levels unless and until a change in rates is authorized by the Commission. In the future, to the extent that the proposed merger results in efficiencies, cost savings or potential new business practices for PSNH, these issues would ultimately be addressed by the Commission in future rate cases and related proceedings. PSNH will also continue to be subject to all compliance obligations under applicable statutes, rules and Commission orders. As a result, the interests of customers are fully protected.

Following the consummation of the transaction, via the normal ratemaking process, PSNH’s customers will benefit as a just and reasonable amount of any cost savings that result from such merger, acquisition or sale are allocated amongst all NU operating companies. Moreover, it is important to note that no acquisition premium is being paid by NU to consummate the transaction. Thus, there is no acquisition premium that could in any way increase rates at any time. And, as noted earlier, the transaction will not adversely affect rates, terms, service, or operation of the public utility within the state. The Companies will be providing the Commission with detailed written information substantiating these statements as part of this informational docket. Thus, notwithstanding that the NU/NSTAR transaction is a transaction over which the Commission has no jurisdiction, the transaction still is consistent with and complies with all New Hampshire statutory requirements.

| 8 | The following are three recent examples: In 2001, Energy East (parent company of New Hampshire Gas Corporation, a New Hampshire public utility) acquired RGS Energy (parent company of Rochester Gas & Electric). Further information is available at: |

http://www.sec.gov/Archives/edgar/data/1046861/000091205701509743/a2043268zs-4.txt

In 2005, FPL Group, Inc. (parent company of Florida Power and Light Co., a New Hampshire public utility due to its ownership of Seabrook transmission assets) acquired Gexa Corp. Further information is available at:

http://www.sec.gov/Archives/edgar/data/753308/000104746905011899/a2156967zs-4.htm

In 2005, Verizon Communications Inc. (parent company of Verizon New England, a New Hampshire public utility) acquired MCI. Further information is available at:

http://www.sec.gov/Archives/edgar/data/732712/000119312505074187/ds4.htm

-6-

PSNH looks forward to participating in the February 7, 2011 informational session, and appreciates this opportunity to provide further information on the NU/NSTAR transaction.

| Sincerely, |

/s/ Robert A. Bersak |

| Robert A. Bersak |

| Assistant Secretary and |

| Assistant General Counsel |

Enclosures

cc: Office of Consumer Advocate

-7-

Attachment A

(full printed copies provided)

|  |

PROPOSED MERGER—YOUR VOTE IS VERY IMPORTANT

Each of the boards of trustees of Northeast Utilities and NSTAR has unanimously approved a strategic business combination in what we intend to be a merger of equals. Northeast Utilities and NSTAR believe that the proposed merger brings together two companies with complementary distribution and transmission assets, reputations for operating excellence and talented employees. The merger will create a larger company with total assets of approximately $25 billion calculated on a pro forma historical basis as of September 30, 2010. The combined company will have 3,000,000 electric distribution customers and 500,000 gas distribution customers and will include 4,500 miles of electric transmission, 72,000 miles of electric distribution and 6,300 miles of gas distribution. Upon completion of the merger, the combined company will continue under the name Northeast Utilities.

On October 16, 2010, Northeast Utilities and NSTAR entered into an Agreement and Plan of Merger, as amended on November 1, 2010 and December 16, 2010, pursuant to which, Northeast Utilities and NSTAR will combine their businesses. The merger is subject to shareholder approvals and other customary closing conditions, including regulatory approvals.

Upon completion of the merger, NSTAR shareholders will receive 1.312 Northeast Utilities common shares for each NSTAR common share that they own. This exchange ratio is fixed and will not be adjusted to reflect share price changes prior to the closing of the merger. Based on the closing price of Northeast Utilities common shares on the New York Stock Exchange on October 15, 2010, the last trading day before public announcement of the merger, the exchange ratio represented approximately $40.28 in value for each NSTAR common share. Based on the closing price of Northeast Utilities common shares on the New York Stock Exchange on December 31, 2010, the latest practicable trading day before the date of this joint proxy statement/prospectus, the exchange ratio represented approximately $41.83 in value for each NSTAR common share. Northeast Utilities shareholders will continue to own their existing Northeast Utilities common shares. Northeast Utilities common shares are currently traded on the New York Stock Exchange under the symbol “NU,” and NSTAR common shares are currently traded on the New York Stock Exchange under the symbol “NST.”We urge you to obtain current market quotations of Northeast Utilities and NSTAR common shares.

Based on the estimated number of Northeast Utilities common shares and NSTAR common shares that will be outstanding immediately prior to the closing of the merger, we estimate that, upon such closing, former Northeast Utilities shareholders will own approximately 56.3% of the combined company and former NSTAR shareholders will own approximately 43.7% of the combined company.

Northeast Utilities and NSTAR will each hold special meetings of their respective shareholders in connection with the proposed merger.

We cannot complete the merger unless the holders of two-thirds of the shares of each company outstanding and entitled to vote approve the proposals made by such company.Your vote is very important, regardless of the number of shares you own. Whether or not you expect to attend either special meeting in person, please submit a proxy to vote your shares as promptly as possible so that your shares may be represented and voted at the Northeast Utilities or NSTAR special meeting, as applicable.

The Northeast Utilities board of trustees unanimously recommends that the Northeast Utilities shareholders vote “FOR” the adoption of the merger agreement and the approval of the merger, including the issuance of Northeast Utilities common shares to NSTAR shareholders pursuant to the merger, “FOR” the proposal to increase the number of Northeast Utilities common shares authorized for issuance and “FOR” the proposal to fix the number of trustees of the Northeast Utilities board of trustees at fourteen.

The NSTAR board of trustees unanimously recommends that the NSTAR shareholders vote “FOR” the proposal to adopt the merger agreement and approve the merger.

The obligations of Northeast Utilities and NSTAR to complete the merger are subject to the satisfaction or waiver of several conditions. The accompanying joint proxy statement/prospectus contains detailed information about Northeast Utilities, NSTAR, the special meetings, the merger agreement and the merger.You should read this joint proxy statement/prospectus carefully and in its entirety before voting, including the section entitled “Risk Factors” beginning on page 28.

We look forward to the successful combination of Northeast Utilities and NSTAR.

Sincerely,

/s/ Charles W. Shivery | /s/ Thomas J. May | |||

| Charles W. Shivery | Thomas J. May | |||

| Chairman, President and Chief Executive Officer | Chairman, President and Chief Executive Officer | |||

Northeast Utilities | NSTAR |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this joint proxy statement/prospectus or determined if this joint proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated January 5, 2011 and is first being mailed to Northeast Utilities and NSTAR shareholders on or about January 5, 2011.

Attachment B

Overview of the Announced NU/NSTAR Merger NHPUC Docket No. DE 11-014 February 7, 2011 |

2 Information Concerning Forward-Looking Statements Additional Information and Where To Find It Information Concerning Forward-Looking Statements In addition to historical information, this communication may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements relating to the proposed merger include, but are not limited to: statements about the benefits of the proposed merger involving NSTAR and Northeast Utilities, including future financial and operating results; NSTAR’s and Northeast Utilities’ plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and other statements relating to the merger that are not historical facts. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors could cause actual results to differ materially from those indicated by such forward-looking statements. With respect to the proposed merger, these factors include, but are not limited to: risks and uncertainties relating to the ability to obtain the requisite NSTAR and Northeast Utilities shareholder approvals; the risk that NSTAR or Northeast Utilities may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the length of time necessary to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; the effect of future regulatory or legislative actions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 (Registration No. 333-170754) that was filed by Northeast Utilities with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NSTAR’s and Northeast Utilities’ reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this document speak only as of the date of this document. Neither NSTAR nor Northeast Utilities undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this document. Additional Information and Where To Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Northeast Utilities and NSTAR, Northeast Utilities filed with the SEC a Registration Statement on Form S-4 (Registration No. 333-170754) that includes a joint proxy statement of Northeast Utilities and NSTAR that also constitutes a prospectus of Northeast Utilities. Northeast Utilities and NSTAR mailed the definitive joint proxy statement/prospectus to their respective shareholders, on or about January 5, 2011. Northeast Utilities and NSTAR urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger, as well as other documents filed with the SEC, because they contain important information. charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Northeast Utilities’ website (www.nu.com) under the tab “Investors” and then under the heading "Financial/SEC Reports.” You may also obtain these documents, free of charge, from NSTAR’s website (www.nstar.com) under the tab “Investor Relations.” You may obtain copies of all documents filed with the SEC regarding this proposed transaction, free of |

3 Agenda New Hampshire Public Utilities Commission, Docket No. DE 11-014 Rationale and Benefits of Merger Overview of NSTAR Merger Transaction Impacts on PSNH |

4 A Compelling Combination Larger, more diverse and better positioned to support infrastructure investment, economic growth and policy directives in New England Enhances customer service capabilities to the largest customer base in New England Highly experienced and complementary leadership team with proven track record Geographically situated partners, enhancing prospects for future savings, efficiencies and reliability benefits NSTAR Electric Service Area NSTAR Gas Service Area Northeast Utilities Electric Service Area Northeast Utilities Gas Service Area ME NY VT NH M A RI |

5 Specific Benefits to NU Companies and its Customers Combined company and operating subsidiaries will have an enhanced credit profile • Highest quality business profile • Highly diversified earnings and cash flow • 100% stock transaction – no new debt issued for merger Likely credit rating upgrades leading to lower long-term and short-term interest costs and a lower weighted cost of capital for customers Increased internally generated cash flow leading to less reliance on the financial markets to fund infrastructure investments and to meet day-to-day liquidity needs Enhanced opportunities to reduce operating costs over time and a larger customer platform to help rationalize future technology investments as we strive to meeting increasing customer expectations Lower financing and operating costs should lower cost-of service over time |

6 NSTAR – A Track Record of Strong Performance • High levels of customer service and reliability • Constructive regulatory outcomes • Solid, consistent financial results • Strong credit profile and positive cash flow |

7 NSTAR – Key Facts and Figures NSTAR is the largest Massachusetts-based investor-owned electric and gas utility NSTAR transmits and delivers electricity and gas to 1.1 million electric customers in 81 communities and approximately 300,000 gas customers in 51 communities Residential customers comprise 87% of the total electric customers and 90% of the total gas customers For the nine months ended September 30, 2010, NSTAR derived 86% of its operating revenues from electric operations and 14% from gas operations NSTAR employs more than 3,000 people NSTAR Electric Service Area NSTAR Gas Service Area Service Territory M A |

8 NSTAR Electric Provides distribution and transmission electricity service to 1.1 million customers over an area of 1,702 square miles Approximately 35,000 miles of distribution lines with 37% being under ground, and 951 miles of transmission lines Created January 1, 2007 through the merger of Commonwealth Electric Company, Cambridge Electric Light Company, and Boston Edison Company Currently operating under a 2007 – 2012 distribution rate settlement that establishes annual inflation-adjusted distribution rates that are generally offset by an equal reduction in transition rates (stranded cost charges) Distribution rate base at 12/31/09 of $2.5 billion Transmission rates set by the FERC as part of ISO-NE regional system (similar to NU) |

9 NSTAR Gas Distributes natural gas to approximately 300,000 customers over an area of 1,067 square miles Like Yankee Gas, the sales and transportation of gas are divided into two categories – firm and interruptible Supply portfolio consists of natural gas supply contracts, transportation contracts on interstate pipelines, market area storage and peaking services A portion of the gas supply storage is provided by Hopkinton, a wholly- owned subsidiary of NSTAR, with facilities consisting of LNG liquefaction and vaporization, and above-ground storage tanks Last rate proceeding was a settlement in 2005 Commercial, industrial, and residential customers can choose their supplier of natural gas Rate base at 12/31/09 of $500 million |

10 History of Disciplined Cost Control $453 2005 $431 2006 2007 Operations & Maintenance Expense $447 $ IN MILLIONS 2008 $454 2009 $431 • Productivity & automation • Performance driven culture • Engaged workforce and constructive union relations • Continuous improvement philosophy Key Drivers |

11 Highest Credit Rating in the Industry NSTAR A+ FPL Group, Inc. A Southern Company A Consolidated Edison, Inc. A- Dominion Resources, Inc. A- DPL Inc. A- Duke Energy Corporation A- Energy East Corporation A- KeySpan Corp. A- Niagara Mohawk Power Corporation A- Vectren Corporation A- ALLETE, Inc. BBB+ Alliant Energy Corporation BBB+ Integrys Energy Group, Inc. BBB+ Kentucky Utilities Company BBB+ Louisville Gas and Electric Company BBB+ MDU Resources Group, Inc. BBB+ MidAmerican Energy Holdings Company BBB+ OGE Energy Corp. BBB+ PG&E Corporation BBB+ Portland General Electric Company BBB+ Progress Energy, Inc. BBB+ SCANA Corporation BBB+ Sempra Energy BBB+ Wisconsin Energy Corporation BBB+ Xcel Energy Inc. BBB+ American Electric Power Company, Inc. BBB CenterPoint Energy, Inc. BBB Cleco Corporation BBB El Paso Electric Company BBB Energy Corporation BBB Exelon Corporation BBB FirstEnergy Corp. BBB Great Plains Energy Inc. BBB Green Mountain Power Corporation BBB Hawaiian Electric Industries, Inc. BBB IDACORP, Inc. BBB Northeast Utilities BBB North Western Corporation BBB Pepco Holdings, Inc. BBB PPL Corporation BBB Public Service Enterprise Group Inc. BBB TECO Energy, Inc. BBB UIL Holdings Corporation BBB Allegheny Energy, Inc. BBB- Ameren Corporation BBB- Avista Corporation BBB- Black Hills Corporation BBB- CMS Energy Corporation BBB- Constellation Energy Group, Inc. BBB- Duquesne Light Company BBB- Edison International BBB- Empire District Electric Company BBB- IPALCO Enterprises, Inc. BBB- NiSource Inc. BBB- Otter Tail Corporation BBB- Pinnacle West Capital Corporation BBB- Westar Energy, Inc. Puget Energy, Inc. BBB- Puget Energy, Inc. BB+ NV Energy, Inc. BB PNM Resources, Inc. BB- Energy Future Holdings Corp. B- #1 NSTAR A+ *As published by EEI |

12 Key Merger Terms Chuck Shivery to be non-executive Chairman Tom May to be President and CEO 14 Board members 7 nominated by Northeast Utilities including Chuck Shivery 7 nominated by NSTAR including Tom May Governance: Timing / Approvals: Expected to close within 9 – 12 months Shareholders, federal, and state Headquarters: Dual – Hartford and Boston Company Name: Northeast Utilities Consideration: 100% NU shares No acquisition premium Exchange Ratio: 1.312 shares of NU per NSTAR share Pro Forma Ownership: 56% NU shareholders 44% NSTAR shareholders Balanced Terms and Governance |

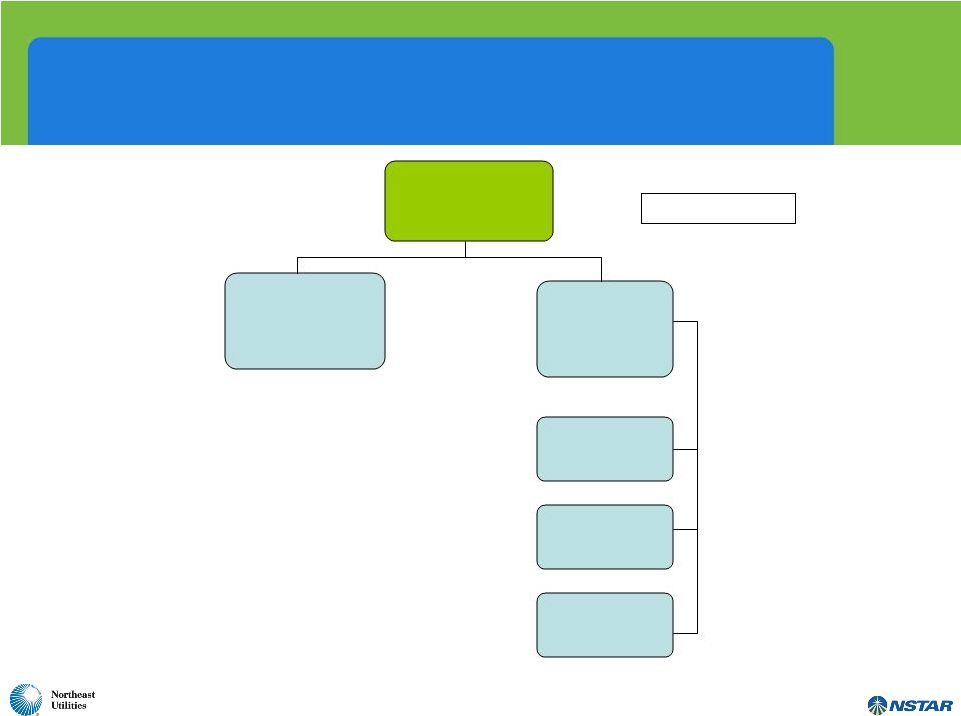

13 Merger Transaction Current Organizations Northeast Utilities Existing Subsidiaries (e.g., PSNH, CL&P, Yankee Gas, WMECO, etc.) NU Holding Energy 2, LLC NU Holding Energy 1, LLC NSTAR NSTAR Electric NSTAR Gas Other Existing NSTAR Subsidiaries |

14 Northeast Utilities Existing Subsidiaries (e.g., PSNH, CL&P, Yankee Gas, WMECO, etc.) NU Holding Energy 1, LLC NU Holding Energy 2, LLC NSTAR Gas NSTAR Electric NSTAR Other NSTAR subsidiaries Step One Step One • NU Holding Energy 1, LLC merges with and into NSTAR, and NSTAR survives as a subsidiary of Northeast Utilities Merger Transaction Step 1 |

15 Northeast Utilities Existing Subsidiaries (e.g., PSNH, CL&P, Yankee Gas, WMECO, etc.) NU Holding Energy 2, LLC NSTAR Gas NSTAR Electric NSTAR Other NSTAR subsidiaries Step Two Step Two • NSTAR merges with and into NU Holding Energy 2, LLC and NU Holding Energy 2, LLC survives as a subsidiary of Northeast Utilities • NU Holding Energy 2, LLC renamed “NSTAR LLC” Step One Complete Merger Transaction Step 2 |

16 Northeast Utilities Existing Subsidiaries (e.g., PSNH, CL&P, Yankee Gas, WMECO, etc.) NSTAR Gas NSTAR Electric NSTAR LLC Other NSTAR subsidiaries Step Two Complete Merger Transaction Completed |

17 Post Merger High Level Company Organization Chart The Connecticut Light and Power Company Yankee Energy Systems, Inc. (Holding Company) NU Enterprises, Inc Public Service Company of New Hampshire Western Massachusetts Electric Company NSTAR LLC (Holding Company) NSTAR Companies (NSTAR Electric, NSTAR Gas, etc.) Other NU Companies (NUSCO, Rocky River Realty, etc.) Yankee Gas Services Company |

18 Executive Management Organization Tom May President & Chief Executive Officer Greg Butler General Counsel David McHale Chief Administrative Officer Lee Olivier Chief Operating Officer Christine Carmody Human Resources Jim Judge Chief Financial Officer Joe Nolan Corporate Relations Chuck Shivery Non-Executive Chairman BOARD OF TRUSTEES |

19 Regulatory Timeline Oct 2010 Closing Expected in 9 – 12 months Q4 2010 Q1 2011 Q2 2011 Q3 2011 Merger Announced Commence Regulatory Filings File Joint Proxy Statement/Prospectus Regulatory Processes FERC, SEC, NRC, DOJ, MDPU, FCC, Maine PUC Northeast Utilities and NSTAR Shareholder Meetings Develop Transition Implementation Plans Receive Regulatory Approvals Close Merger |

20 Impact on PSNH No changes to the rates or services of PSNH (or other NU affiliates) are planned or contemplated as a condition of the merger There is no consolidation of NSTAR Electric, NSTAR Gas, PSNH (or other NU affiliates) that would result from the merger The merger will not result in a change of control of NU The merger will not result in a change of control of PSNH (or other NU affiliates) and they will continue to be first-tier subsidiaries of NU The merger will strengthen the financial integrity and investment capability of NU; a corollary effect will be the enhancement of PSNH’s capability to maintain reliable and cost-effective delivery systems Over time, the integration of NSTAR and NU is anticipated to produce net savings in costs that will be passed on to customers through reduced costs of service No adverse effect on rates, terms, service, or operation of PSNH within the state |

21 Questions? David R. McHale Executive Vice President and Chief Financial Officer, Northeast Utilities Douglas S. Horan Senior Vice President, Secretary and General Counsel, NSTAR Gregory B. Butler Senior Vice President and General Counsel, Northeast Utilities |

Information Concerning Forward-Looking Statements

In addition to historical information, this communication may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements relating to the proposed merger include, but are not limited to: statements about the benefits of the proposed merger involving NSTAR and Northeast Utilities, including future financial and operating results; NSTAR’s and Northeast Utilities’ plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and other statements relating to the merger that are not historical facts. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors could cause actual results to differ materially from those indicated by such forward-looking statements. With respect to the proposed merger, these factors include, but are not limited to: risks and uncertainties relating to the ability to obtain the requisite NSTAR and Northeast Utilities shareholder approvals; the risk that NSTAR or Northeast Utilities may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the length of time necessary to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; the effect of future regulatory or legislative actions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 (Registration No. 333-170754) that was filed by Northeast Utilities with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NSTAR’s and Northeast Utilities’ reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this document speak only as of the date of this document. Neither NSTAR nor Northeast Utilities undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this document.

Additional Information and Where To Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Northeast Utilities and NSTAR, Northeast Utilities filed with the SEC a Registration Statement on Form S-4 (Registration No. 333-170754) that includes a joint proxy statement of Northeast Utilities and NSTAR that also constitutes a prospectus of Northeast Utilities. Northeast Utilities and NSTAR mailed the definitive joint proxy statement/prospectus to their respective shareholders, on or about January 5, 2011. Northeast Utilities and NSTAR urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger, as well as other documents filed with the SEC, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this proposed transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Northeast Utilities’ website (www.nu.com) under the tab “Investors” and then under the heading “Financial/SEC Reports.” You may also obtain these documents, free of charge, from NSTAR’s website (www.nstar.com) under the tab “Investor Relations.”