Filed by Northeast Utilities Pursuant to Rule 425

Under the Securities Act of 1933

Subject Company: NSTAR

Commission File No.: 333-170754

Investor Meetings MARCH 10-14, 2011 |

2 This presentation contains statements concerning NU’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, a listener or reader can identify these forward-looking statements through the use of words or phrases such as “estimate”, “expect”, “anticipate”, “intend”, “plan”, “project”, “believe”, “forecast”, “should”, “could”, and other similar expressions. Forward-looking statements are based on the current expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations, estimates, assumptions or projections may vary materially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that could cause our actual results to differ materially from those contained in our forward- looking statements, including, but not limited to, actions or inaction of local, state and federal regulatory and taxing bodies; changes in business and economic conditions, including their impact on interest rates, bad debt expense and demand for our products and services; changes in weather patterns; changes in laws, regulations or regulatory policy; changes in levels and timing of capital expenditures; disruptions in the capital markets or other events that make our access to necessary capital more difficult or costly; developments in legal or public policy doctrines; technological developments; changes in accounting standards and financial reporting regulations; fluctuations in the value of our remaining competitive contracts; actions of rating agencies; the effects and outcome of our pending merger with NSTAR; and other presently unknown or unforeseen factors. Other risk factors are detailed from time to time in our reports to the Securities and Exchange Commission (SEC). Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update the information contained in any forward-looking statements to reflect developments or circumstances occurring after the statement is made or to reflect the occurrence of unanticipated events. This presentation references actual and projected EPS by business. EPS by business is a non-GAAP (not determined using generally accepted accounting principles) measure that is calculated by dividing the net income or loss attributable to controlling interests of each business by the weighted average diluted NU parent common shares outstanding for the period. Management uses this non-GAAP financial measure to evaluate earnings results and to provide details of earnings results and guidance by business. This presentation also includes non-GAAP financial measures referencing our 2010 earnings and EPS excluding expenses related to the proposed merger and certain non- recurring benefits from the settlement of tax issues. In addition, our 2011 earnings guidance excludes certain non-recurring charges related to merger costs we expect to incur during 2011, which is a non-GAAP financial measure. Management believes that these non-GAAP financial measurements are useful to investors to evaluate the actual and projected financial performance and contribution of NU’s businesses. Non- GAAP financial measures should not be considered as alternatives to NU consolidated net income attributable to controlling interests or EPS determined in accordance with GAAP as indicators of NU’s operating performance. Safe Harbor Provisions |

3 Information Concerning Forward-Looking Statements In addition to historical information, this communication may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements relating to the proposed merger include, but are not limited to: statements about the benefits of the proposed merger involving NSTAR and Northeast Utilities, including future financial and operating results; NSTAR’s and Northeast Utilities’ plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and other statements relating to the merger that are not historical facts. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors could cause actual results to differ materially from those indicated by such forward-looking statements. With respect to the proposed merger, these factors include, but are not limited to: the risk that NSTAR or Northeast Utilities may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the length of time necessary to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger- related issues; the effect of future regulatory or legislative actions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 (Registration No. 333-170754) that was filed by Northeast Utilities with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NSTAR’s and Northeast Utilities’ reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this document speak only as of the date of this document. Neither NSTAR nor Northeast Utilities undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this document. Additional Information and Where To Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Northeast Utilities and NSTAR, Northeast Utilities filed with the SEC a Registration Statement on Form S-4 (Registration No. 333-170754) that includes a joint proxy statement of Northeast Utilities and NSTAR that also constitutes a prospectus of Northeast Utilities. Northeast Utilities and NSTAR mailed the definitive joint proxy statement/prospectus to their respective shareholders, on or about January 5, 2011. Northeast Utilities and NSTAR urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger, as well as other documents filed with the SEC, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this proposed transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Northeast Utilities’ website (www.nu.com) under the tab “Investors” and then under the heading "Financial/SEC Reports.” You may also obtain these documents, free of charge, from NSTAR’s website (www.nstar.com) under the tab “Investor Relations.” Please refer to our reports to the SEC for further details concerning the matters described in this presentation. Safe Harbor Provisions |

4 Topics for Today • Merger status • NU - 2010 results and stand-alone 2011 outlook • NU - Transmission segment • NU - Electric distribution/generation segment • NSTAR – Company update |

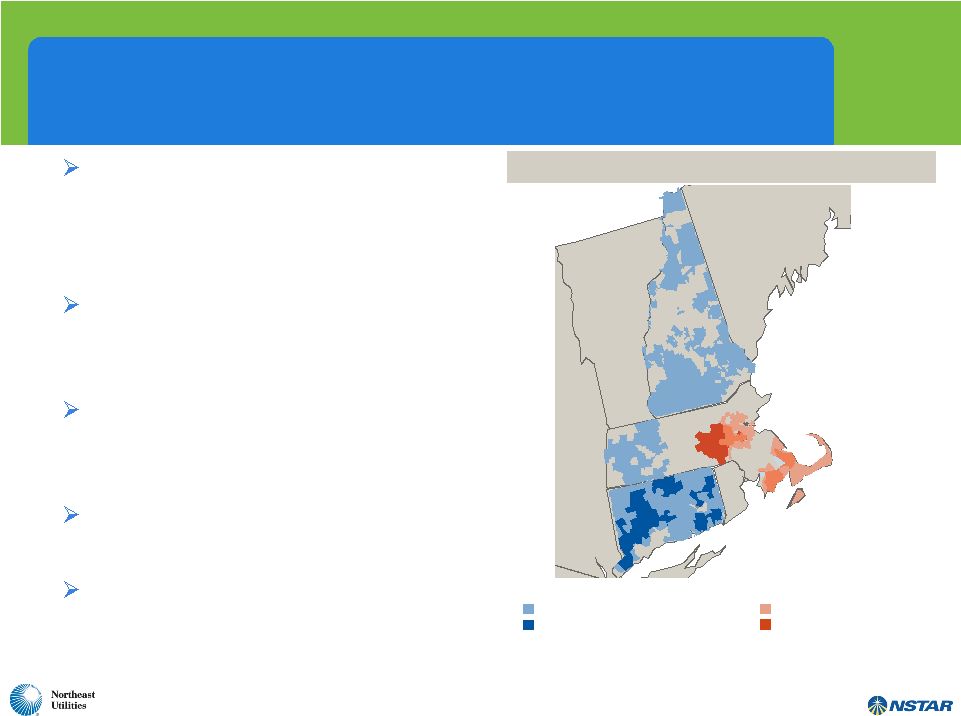

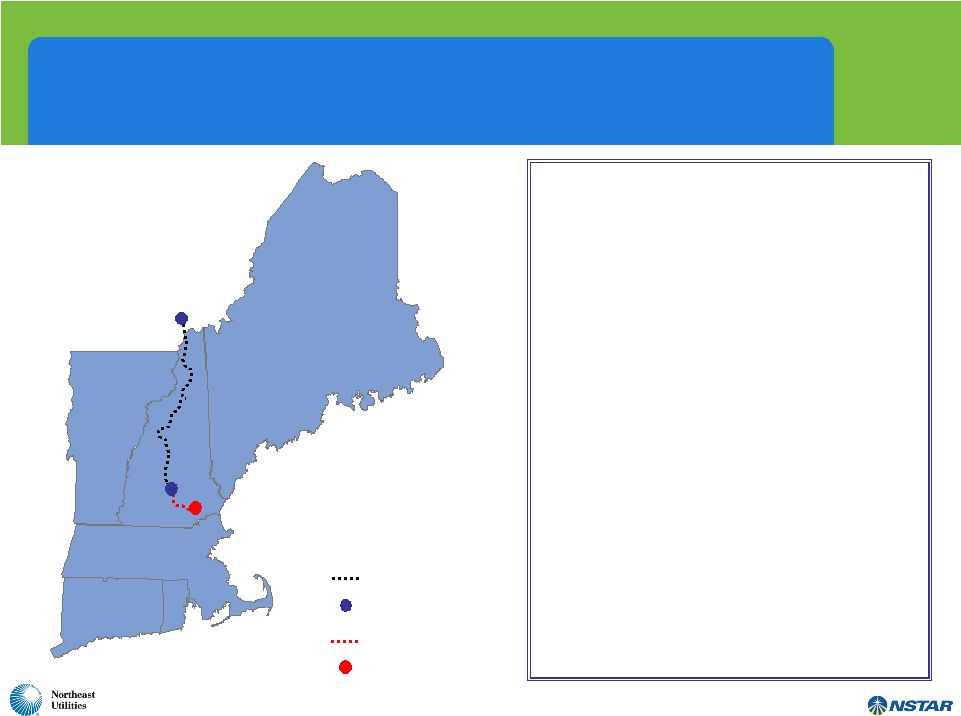

5 A Compelling Combination – Creates Largest Utility Company in New England Significant transmission investment opportunities combined with balance sheet strength provides for substantial growth potential Larger, more diverse and better positioned to support economic growth and renewables in New England Accretive to earnings in Year 1 and provides enhanced total shareholder return proposition Enhances service quality capabilities to the largest customer base in New England Highly experienced and complementary leadership team with proven track record NSTAR Electric Service Area NSTAR Gas Service Area Northeast Utilities Electric Service Area Northeast Utilities Gas Service Area ME NY VT NH M A RI Combined Service Territory |

6 Key Merger Terms Expected to close in the second half of 2011 Timing / Approvals: Headquarters: Dual – Hartford and Boston Company Name: Northeast Utilities Consideration: 100% stock Exchange Ratio: 1.312 shares of Northeast Utilities per NSTAR share Pro Forma Ownership: 56% Northeast Utilities shareholders 44% NSTAR shareholders Pro Forma Dividend: At close, dividend increase for Northeast Utilities shareholders Dividend parity for NSTAR shareholders Governance: Chuck Shivery to be non-executive Chairman Tom May to be President and CEO 14 Board members 7 nominated by Northeast Utilities including Chuck Shivery 7 nominated by NSTAR including Tom May Balanced Terms and Governance |

7 NU-NSTAR Merger Status • NU and NSTAR shareholders approved the merger by needed two-thirds votes on March 4 • Hart-Scott-Rodino waiting period expired in February without objection • FCC review complete without objection • FERC, NRC reviews pending • MA DPU discovery under way, ruling expected soon on standard of review • CT DPUC initially disclaimed jurisdiction. Now awaiting informational session and final decision |

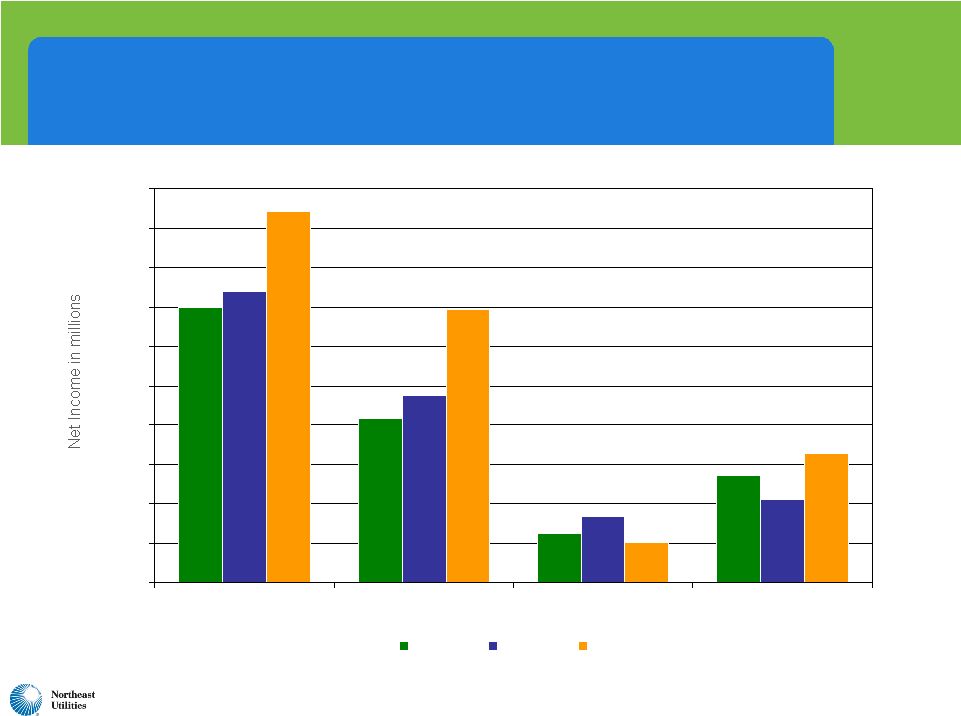

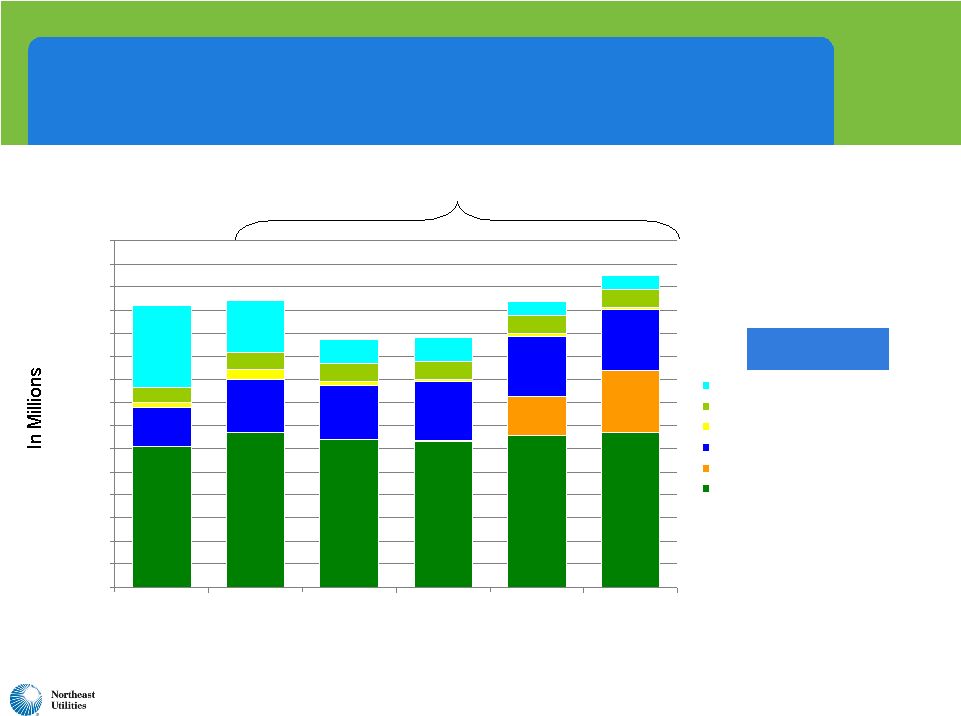

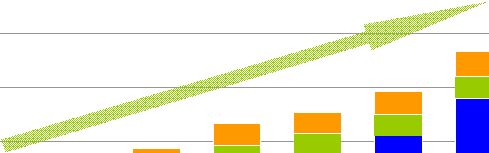

8 $27.1 $47.5 $12.3 $41.4 $70.0 $21.0 $16.7 $74.0 $32.7 $10.1 $69.3 $94.1 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 CL&P PSNH WMECO Yankee Gas 2008 2009 2010 Improving Earnings in Distribution/Generation Businesses |

9 2010 Results and Standalone 2011 Guidance 2009 Actual 2010 Actual 2011 Guidance NU Consolidated EPS (GAAP) $1.91 $2.19 $2.10 - $2.25 Distribution/Generation $0.92 $1.16 $1.25 - $1.35 Transmission $0.95 $1.00 $1.05 – $1.10 Competitive $0.09 $0.05 N/A NU Parent/Other ($0.05) ($0.05)* ($0.05)** NU Consolidated EPS (Non-GAAP) $1.91 $2.16 $2.25 – $2.40 * Excludes a $0.09/share fourth quarter non-recurring tax gain at NU Parent and approximately $0.06 of NU-NSTAR merger related expenses that were recorded in the fourth quarter. **Excludes $0.15/share of expected NU-NSTAR merger-related costs. Includes competitive results. |

10 Final Resolution of All Three Electric Rate Cases • Five-year settlement approved by NHPUC on 6/28/2010 • $45.5 million increase on 7/1/10 in addition to 8/1/09 temporary increase of $25.6 million • $2.9 million decrease on 7/1/11 • 2012 & 2013 projected increases of $9.5 million & $11.1 million • Authorized ROE remains 9.67% (2010 distribution/ generation ROE was 10.2%) • Recovery of ice storm costs over 7 years • Final decision 6/30/2010 • $63.4 million increase effective 7/1/10 • $38.5 million increase effective 7/1/11 • Authorized 9.4% ROE at 6/30/10 (2010 ROE was 7.9%) • 49.2% equity in capital structure • Deferring initial increase until 1/1/11 • Ruling on health care issue deferred to next rate case • Capex plan approved PSNH CL&P • Final decision 1/31/11 • $16.8 million increase effective 2/1/11 • Authorized 9.6% ROE (2010 ROE was 4.6%) • Decoupling approved • Capital investment recovery mechanism rejected • $2.1 million write-off taken in fourth quarter 2010 WMECO |

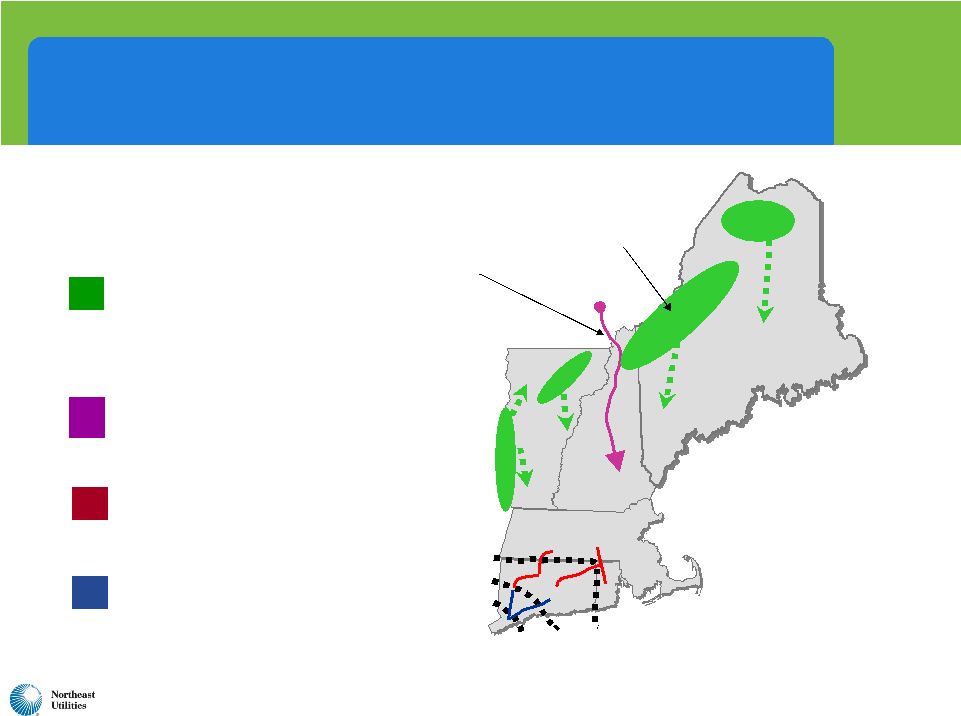

11 Southwest Connecticut Reliability: Projects Complete 1 Connecticut Borders (MA, RI): NEEWS Projects Under Way 2 Transmission Business Strategy: Major Initiatives Expanding Across Wider New England Geography NPT HVDC 3 Northern Pass Transmission (NPT) Line between Quebec and New Hampshire Renewables & Clean Energy (ME/NH/VT) : Projects in Development/ High Wind potential areas 4 Potential Wind Sites ´ |

12 NEEWS Projects Advance Current Status Report Greater Springfield Reliability Project • Received siting approval in CT and MA • Development and Management Plans approved by CT Siting Council • Substation construction commenced in MA in Dec. 2010 • Commenced overhead construction in MA in February 2011 • Commence overhead construction in CT in early 2012 • Project in-service: late 2013 Interstate Reliability Project • Joint project with National Grid (NU in CT; NGrid in MA & RI) • ISO-NE confirmed need date in August 2010 • File siting application in CT in late 2011 • Siting decision in CT in mid/late 2013 • Commence construction: late 2013/early 2014 • Project in-service: late 2015 SPRINGFIELD HARTFORD 345-kV Substation Generation Station 345-kV ROW 115-kV ROW Central Connecticut Reliability Project Interstate Reliability Project Greater Springfield Reliability Project Central Connecticut Reliability Project • Awaiting completion of ISO-NE’s reassessment of need and need date • Project milestones estimated 12 months behind IRP |

13 Northern Pass Transmission – a $1.1 Billion Capital Investment ´ • To be owned by Northern Pass Transmission LLC - NU (75%) and NSTAR (25%) • 1,200 MW transfer capability • Northern terminus at Des Cantons (Québec), southern terminus in Franklin (New Hampshire) • Québec terminal will convert the power from AC to DC (rectifier) • US terminal will convert the power from DC to AC (inverter) • 345kV AC leg from Franklin to Deerfield, NH • Capital cost estimate for US segment: $1.1 billion • TSA signed in October 2010 and accepted by FERC on February 11, 2011 • Permitting process began October 14, 2010 with U.S. DOE application • PPAs under discussion Des Cantons HVDC Line HVDC Converter Station 345-kV Line Existing Deerfield Substation Deerfield Franklin |

14 Q4 2011 Begin long lead time material procurement $ 1.1 Billion Project cost - (U.S. side) Late 2015 In-Service Date Q1 2013 Complete siting approvals 2013 Begin Construction Q4 2011 New Hampshire Siting (SEC) application filed Oct 2010 DOE Presidential Permit application filed Oct 2010 Transmission Service Agreement (TSA) signed Q1 2011 Execute Term Sheets for EPC Feb 2011 FERC accepts TSA Dec 2010 TSA FERC filing Oct 2010 ISO Technical Approval application filed May 2009 FERC declaratory order received Dec 2008 Initial FERC filing for declaratory order Milestone Date Milestone Northern Pass Transmission - Project Milestones as of 3/1/11 |

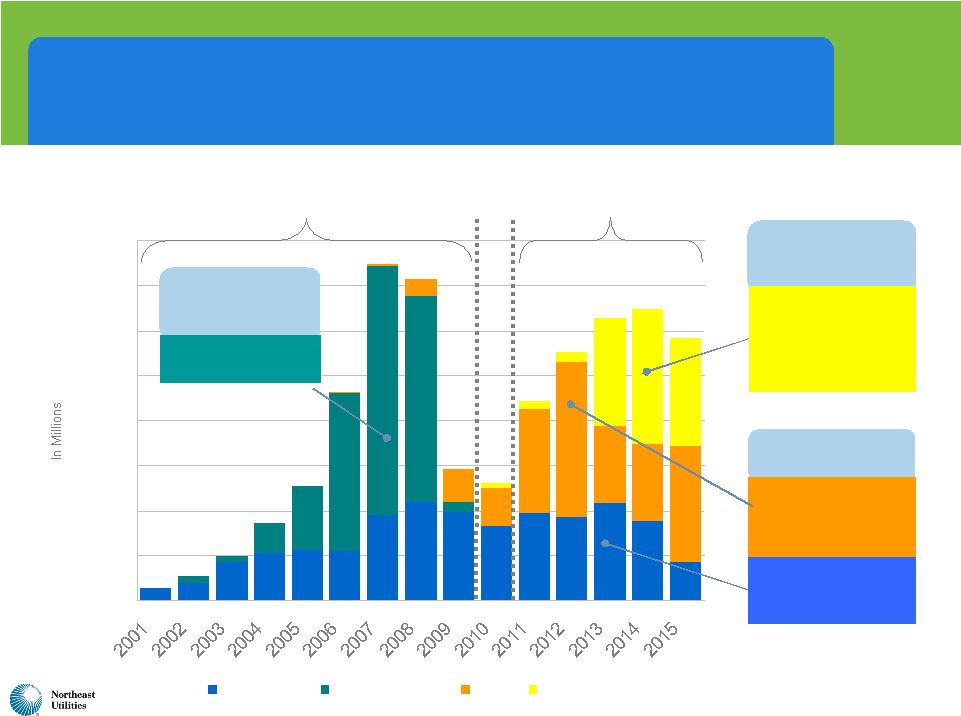

15 NEEWS projects ramping up 2001-2015 Transmission Capital Expenditures $0 $100 $200 $300 $400 $500 $600 $700 $800 Base Reliability Major Southwest CT NEEWS Northern Pass Historic Forecast $2.9 Billion $2.8 Billion NU’s share of NEEWS project estimated at $1.449 billion $845 million of additional forecasted projects $261 Million Northern Pass HVDC Line to Canada US portion estimated at $1.1 billion with $830 million NU ownership share Successful completion of SWCT projects SWCT projects total $1.6 billion |

16 NU Actual and Projected Transmission Year-End Rate Base $2,099 $2,178 $2,234 $2,394 $2,552 $315 $341 $360 $406 $406 $505 $183 $269 $459 $650 $730 $803 $2,149 $2,114 $540 $834 $830 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2009 Actual 2010 Actual 2011 2012 2013 2014 2015 CL&P PSNH WMECO Northern Pass Transmission Rate Base CAGR of 10.5% $ 2,597 $ 2,759 $3,234 $3,370 $ 3,733 $ 4,725 *100% CWIP assumed for NEEWS projects $ 2,933 **NU share of this project is depicted as traditional rate base which accrues AFUDC during construction ** * * |

17 Efforts Under Way to Bring Northern New England Wind Generation to Market • New England RPS requirements are 21% by 2020, and existing resources provide only 6% • Complement current ISO-NE regional planning and potential FERC changes • Create efficiencies by optimizing multiple wind sites and required transmission • Get clean renewable energy to New England’s load sites • Utilize a “beneficiary-pay” model that provides transparency for customers and regulators NU, NSTAR, National Grid, and United Illuminating working collectively on this model |

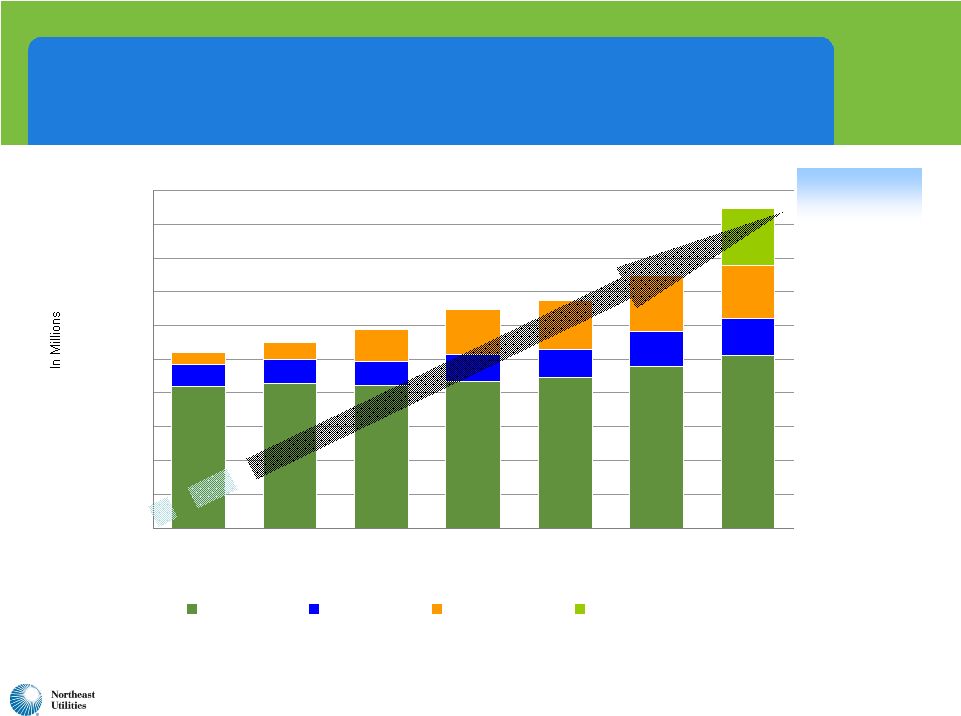

18 $305 $337 $320 $317 $329 $336 $83 $133 $84 $113 $117 $127 $132 $132 $10 $22 $9 $5 $5 $5 $33 $36 $39 $39 $40 $177 $112 $52 $52 $29 $1 $40 $29 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 $700 $750 2010 Actual 2011 2012 2013 2014 2015 PSNH - Generation ($274M total) WMECO - Distribution ($194M total) WMECO - Generation ($46M total) PSNH - Distribution ($621M total) CL&P - AMI/Smart Grid ($217M total)* CL&P - Distribution ($1,639M total) Electric Distribution and Generation Capital Expenditures – By Company 2011-2015 Projected Electric Distribution and Generation Spending $3 Billion $609 $675 $618 $541 $537 $620 *Total AMI-related capex through 2016 expected to be approximately $300 million 2011 – 2015 Capital Expenditures |

NU Generation Strategy WMECO Solar Initiative PSNH Generation Business Plan Installation of 6 MW solar projected by 2012 Estimated cost: $41 million Completed 1.8 MW of solar at first site in Pittsfield, MA in October 2010 4.2 MW site in Springfield, MA on capped landfill, identified for second project Constructive regulatory model – fully tracking, segmented rate base Five-year strategy preserves existing 1,200 MW New Hampshire fleet Completes the Merrimack Scrubber Estimated cost reduced from $457 million to $430 million $296.5 million capitalized at 12/31/10 Ahead of schedule: 82% complete as of 2/28/11 Assesses additional growth opportunities in renewables 19 |

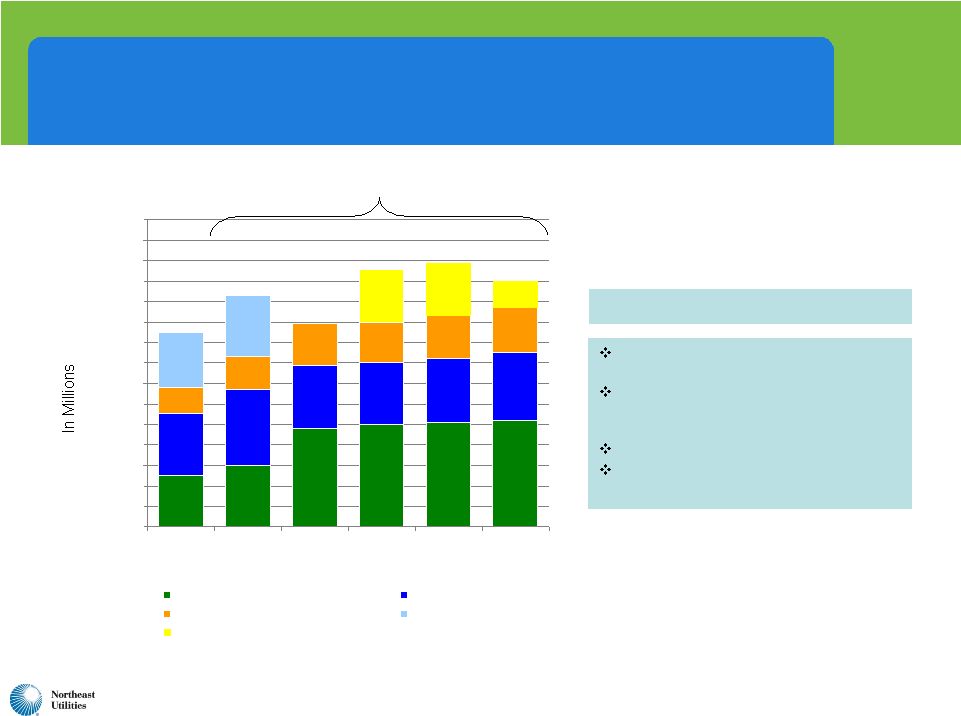

20 Yankee Gas Capital Expenditures $25 $30 $48 $50 $51 $52 $30 $37 $31 $30 $31 $33 $13 $16 $20 $20 $21 $22 $27 $30 $13 $26 $26 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 2010 Actual 2011 2012 2013 2014 2015 Aging Infrastructure Basic Business Peak Load / New Business WWL Gas supply infrastructure 2011-2015 Projected Yankee Gas Capital Spending $587 Million $95 $120 $129 $126 $99 $113 Investing $587 million, leveraging natural gas as “the fuel of choice” Distribution system expansion: $30 million for 16-mile Waterbury to Wallingford Line (WWL) Gas supply infrastructure Sales growth opportunities to supply renewable generation (fuel cells, DG) Yankee Gas Strategy |

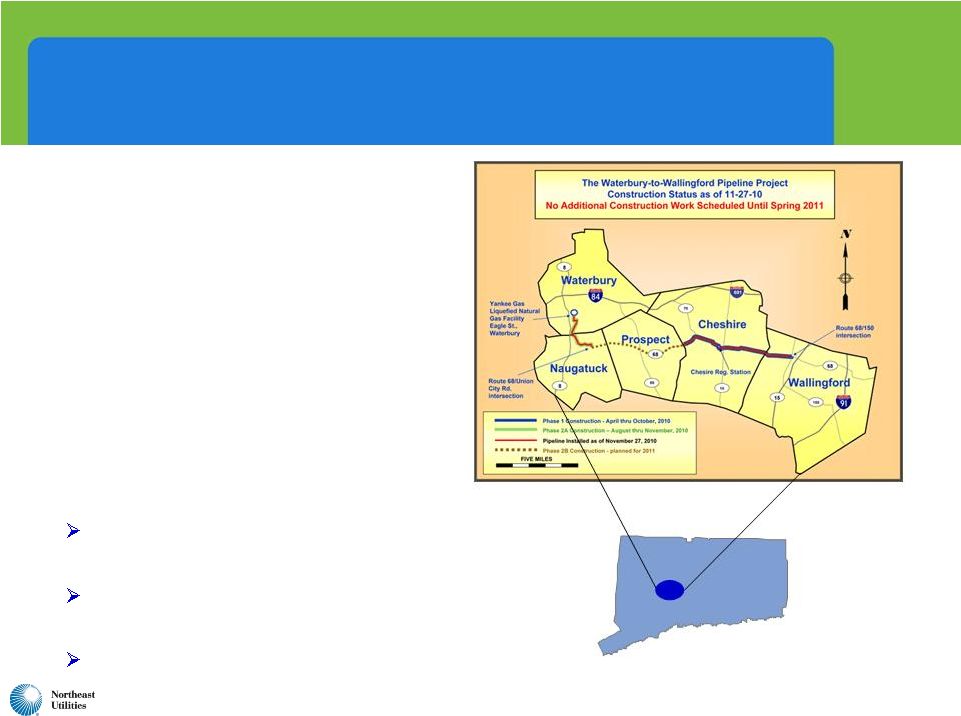

21 • Fills gaps in supply portfolio • Eliminates system constraint in Cheshire area • Increases vaporization capacity of Waterbury LNG project • Yankee Gas’ $57.6 million expansion project began in April 2010 (Waterbury to Wallingford Line Project); $26.6 million invested in 2010 • Key elements of current Yankee Gas rate case $32.8 million increase effective 7/1/11 $13 million increase effective 7/1/12 Maintain current 10.1% ROE Waterbury to Wallingford Project to Add Needed Supply for System Demand |

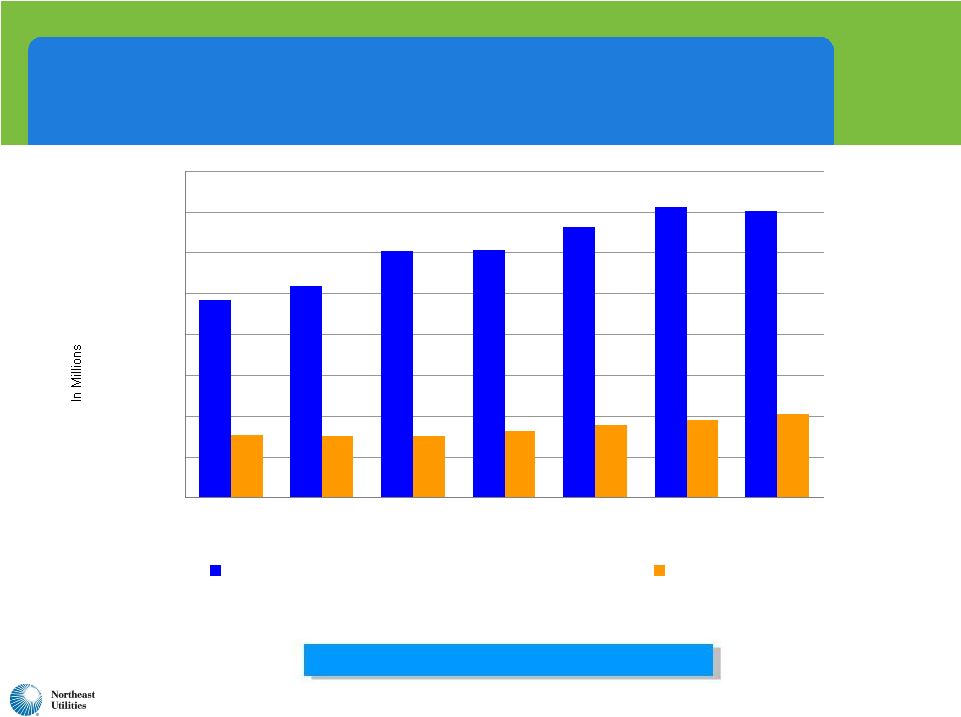

22 2009-2015: NU Actual and Projected Capital Expenditures and Depreciation $1,036 $1,209 $1,216 $969 $1,407 $1,428 $1,331 $310 $301 $305 $332 $359 $382 $413 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2009 Actual 2010 Actual 2011 2012 2013 2014 2015 Total Capex (incl. cost of removal and AFUDC)* Depreciation Significant capital spending through 2015 *Totals include capex at corporate service companies on behalf of operating companies of $53 million in 2009 and $69 million in 2010 and estimated at $32 million in 2011, $28 million in 2012, $35 million in 2013, $34 million in 2014, and $28 million in 2015. |

23 $2,597 $2,933 $3,234 $3,370 $3,733 $4,725 $3,303 $3,670 $3,912 $4,171 $4,516 $4,893 $407 $405 $758 $773 $773 $763 $691 $682 $743 $756 $790 $2,759 $3,488 $426 $847 $969 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 2009 Actual 2010 Actual 2011E 2012E 2013E 2014E 2015E Transmission Distribution Generation Yankee Gas Capital Program Benefits Customers and Produces Attractive Rate Base Growth $7,334 $8,660 $7,772 $9,104 Actual and Projected Total Rate Base 2009-2015 CAGR of 8.4% (using 2009 as base year) $6,998 $9,869 Projected Electric Distribution CAGR of 6.8% Projected Transmission CAGR of 10.5% $11,350 Projected Generation CAGR of 11.0% Projected Natural Gas Distribution CAGR of 5.8% |

NSTAR Company Update March 10, 2011 |

25 NSTAR Safe Harbor Information Concerning Forward-Looking Statements In addition to historical information, this presentation may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements relating to the proposed merger include, but are not limited to: statements about the benefits of the proposed merger involving NSTAR and Northeast Utilities, including future financial and operating results; NSTAR’s and Northeast Utilities’ plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and other statements relating to the merger that are not historical facts. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors could cause actual results to differ materially from those indicated by such forward-looking statements. With respect to the proposed merger, these factors include, but are not limited to: the risk that NSTAR or Northeast Utilities may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the length of time necessary to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; the effect of future regulatory or legislative actions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the definitive proxy statement that was filed by NSTAR with the Securities and Exchange Commission (SEC) on January 5, 2011 and the Registration Statement on Form S-4 (Registration No. 333-170754) that was filed by Northeast Utilities with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NSTAR’s and Northeast Utilities’ reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this document speak only as of the date of this document. Neither NSTAR nor Northeast Utilities undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this document. Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed merger between Northeast Utilities and NSTAR, Northeast Utilities filed with the SEC a Registration Statement on Form S-4 (Registration No. 333-170754) that includes a joint proxy statement of Northeast Utilities and NSTAR that also constitutes a prospectus of Northeast Utilities. Northeast Utilities and NSTAR first mailed the definitive joint proxy statement/prospectus to their respective shareholders, on or about January 5, 2011. Northeast Utilities and NSTAR urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger, as well as other documents filed with the SEC, because they contain important information. You may obtain copies of all documents filed with the SEC regarding this proposed transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Northeast Utilities’ website (www.nu.com) under the tab “Investors” and then under the heading "Financial/SEC Reports.” You may also obtain these documents, free of charge, from NSTAR’s website (www.nstar.com) under the tab “Investor Relations.” |

26 Premier Service Territory • • Solid, diverse customer base Solid, diverse customer base • • Sales growth better than U.S. Sales growth better than U.S. overall overall • • Positive outlook for economy Positive outlook for economy |

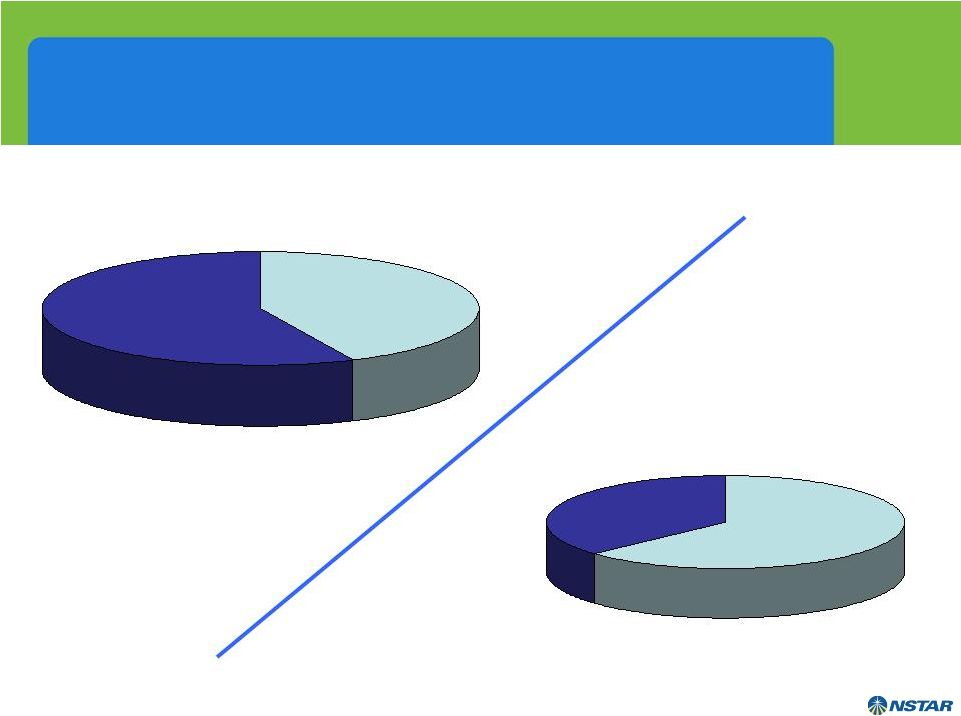

27 Customer Mix Provides Stability 57% Commercial & Industrial 43% Residential 63% Residential 37% Commercial & Industrial Electric ($2.5 billion) Gas ($.5 billion) •Health Care •Education •Biotech •Government •Financial |

28 A Long History of Negotiated, Multi-Year Distribution Rate Agreements • 25 years of rate agreements – last litigated rate increase in 1986 • Fully reconciling pension & post-retirement mechanism and recovery of energy supply • Current electric rate plan through December 31, 2012 • 10.5% ROE with +/- 2% neutral zone • Plan to pursue a new rate agreement effective in 2013 |

History of Disciplined Cost Control 2006 $431 2007 2008 Total Operations & Maintenance Expense $447 $ IN MILLIONS 2009 $454 2010 $431 • Productivity & automation focus • Performance driven culture • Engaged workforce and constructive union relations • Continuous improvement philosophy Key Drivers $447 29 |

…20 Consecutive Years of Operating Earnings Growth $2.37 2007 2008 $2.07 $2.22 2009 2010 $2.56 $2.60 - $2.75 2011 Guidance 30 |

Consistent, Above Average Dividend Growth …13 Consecutive Years of Increase… $1.30 $1.40 $1.50 2006 2007 $1.60 2008 2009 2010 $1.70 31 |

32 Solid Results For 2010 2009 - EPS 2.37 $ Higher electric sales (+3.3%) and performance-based adjustment 0.21 Gas sales (-2.8%) (0.02) Higher transmission revenue 0.07 Lower interest costs 0.09 Increase in operations and maintenance (0.12) Decline in mitigation incentive revenues - transition costs (0.03) Increase in depreciation, amortization and property taxes (0.04) Non-utility operations (0.01) Lower common shares outstanding 0.04 0.19 2010 - EPS before one-time items 2.56 Tax settlement (0.20) Merger-related costs, net (0.05) Gain on sale of discontinued operations 1.04 Reported EPS -2010 $3.35 |

33 1996 2010 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 S&P 500 Utility Index NSTAR Only Company in Any Industry to Deliver 14 Consecutive Years of Positive Total Shareholder Return Total Shareholder Return Outperforms the Industry |

34 Highest Credit Rating in the Industry NSTAR A+ FPL Group, Inc. A Southern Company A Consolidated Edison, Inc. A- Dominion Resources, Inc. A- DPL Inc. A- Duke Energy Corporation A- Energy East Corporation A- KeySpan Corp. A- Niagara Mohawk Power Corporation A- Vectren Corporation A- ALLETE, Inc. BBB+ Alliant Energy Corporation BBB+ Integrys Energy Group, Inc. BBB+ Kentucky Utilities Company BBB+ Louisville Gas and Electric Company BBB+ MDU Resources Group, Inc. BBB+ MidAmerican Energy Holdings Company BBB+ OGE Energy Corp. BBB+ PG&E Corporation BBB+ Portland General Electric Company BBB+ Progress Energy, Inc. BBB+ SCANA Corporation BBB+ Sempra Energy BBB+ Wisconsin Energy Corporation BBB+ Xcel Energy Inc. BBB+ American Electric Power Company, Inc. BBB CenterPoint Energy, Inc. BBB Cleco Corporation BBB El Paso Electric Company BBB Energy Corporation BBB Exelon Corporation BBB FirstEnergy Corp. BBB Great Plains Energy Inc. BBB Green Mountain Power Corporation BBB Hawaiian Electric Industries, Inc. BBB IDACORP, Inc. BBB Northeast Utilities BBB North Western Corporation BBB Pepco Holdings, Inc. BBB PPL Corporation BBB Public Service Enterprise Group Inc. BBB TECO Energy, Inc. BBB UIL Holdings Corporation BBB Allegheny Energy, Inc. BBB- Ameren Corporation BBB- Avista Corporation BBB- Black Hills Corporation BBB- CMS Energy Corporation BBB- Constellation Energy Group, Inc. BBB- Duquesne Light Company BBB- Edison International BBB- Empire District Electric Company BBB- IPALCO Enterprises, Inc. BBB- NiSource Inc. BBB- Otter Tail Corporation BBB- Pinnacle West Capital Corporation BBB- Westar Energy, Inc. Puget Energy, Inc. BBB- Puget Energy, Inc. BB+ NV Energy, Inc. BB PNM Resources, Inc. BB- Energy Future Holdings Corp. B- #1 NSTAR A+ *As published by EEI |

35 NSTAR System Has Significant Transmission Investment Ahead • Transmission Rate Base is expected to double within 5 years to approximately $1.6 billion • Growth/reliability spending averages $100 million per year • Incremental Major Projects • Cape Cod Line $120 million (2011-2012) • South Boston Circuit $45-$50 million (2014-2015) • Mid Cape Line $25-$30 million (2013-2014) • Northern Pass (2012-2015) $280 million |

36 JD Power Customer Surveys Recognize Our Efforts Company L Company K Company J Company I Company H Company G Company F Company E Company D Company C NSTAR Electric Company B Company A Company M East Region Average |