UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to

| | |

| Commission file number 001-14768 | | I.R.S. Employer Identification Number 04-3466300 |

NSTAR

(Exact name of registrant as specified in its charter)

| | |

| Massachusetts | | 800 Boylston Street, Boston, Massachusetts |

| (State or other jurisdiction of incorporation or organization) | | (Address of principal executive offices) |

| |

| 617-424-2000 | | 02199 |

| (Registrant’s telephone number, including area code) | | (Zip code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Shares, par value $1 per share | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, as defined in Rule 12b-2 of the Exchange Act.

|

| Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

The aggregate market value of the 103,586,727 shares of voting stock of the registrant held by non-affiliates of the registrant, computed as the average of the high and low market prices of the common shares as reported on the New York Stock Exchange consolidated transaction reporting system for NSTAR Common Shares as of the last business day of the registrant’s most recently completed second fiscal quarter: $4,765,507,375.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

| | |

Class | | Outstanding at February 3, 2012 |

| Common Shares, par value $1 per share | | 103,586,727 shares |

Documents Incorporated by Reference

Certain information required by Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K will be filed with the Securities and Exchange Commission within 120 days of the end of the Registrant’s year ended December 31, 2011.

NSTAR

Index to Annual Report on Form 10-K

Year Ended December 31, 2011

i

Glossary of Terms

The following is a glossary of abbreviated names or acronyms frequently used throughout this report.

| | |

NSTAR Companies | | |

NSTAR | | NSTAR (Holding company), Company or NSTAR and its subsidiaries (as the context requires) |

NSTAR Electric | | NSTAR Electric Company |

NSTAR Gas | | NSTAR Gas Company |

NSTAR Electric & Gas | | NSTAR Electric & Gas Corporation |

MATEP | | Medical Area Total Energy Plant, Inc. |

NPT | | Northern Pass Transmission, LLC. |

NTV | | NSTAR Transmission Ventures, Inc. (holds a 25% interest in Northern Pass Transmission LLC) |

AES | | Advanced Energy Systems, Inc. (Parent company of MATEP) |

NSTAR Com | | NSTAR Communications, Inc. |

Hopkinton | | Hopkinton LNG Corp. |

HEEC | | Harbor Electric Energy Company |

Unregulated operations | | Represents non rate-regulated operations of NSTAR Com and Hopkinton |

Discontinued operations | | Represents discontinued operations of MATEP |

| |

Regulatory and Other Authorities | | |

CCC | | Cape Cod Commission |

DOE | | U.S. Department of Energy |

DOER | | Massachusetts Department of Energy Resources |

DPU | | Massachusetts Department of Public Utilities |

EFSB | | Massachusetts Energy Facilities Siting Board |

FASB | | Financial Accounting Standards Board |

FERC | | Federal Energy Regulatory Commission |

IASB | | International Accounting Standards Board |

IRS | | U.S. Internal Revenue Service |

ISO-NE | | ISO (Independent System Operator) - New England Inc. |

Moody’s | | Moody’s Investors Service |

MPUC | | Maine Public Utilities Commission |

NHPUC | | New Hampshire Public Utilities Commission |

NRC | | U.S. Nuclear Regulatory Commission |

NYMEX | | New York Mercantile Exchange |

PURA | | Connecticut Public Utilities Regulatory Authority |

SEC | | U.S. Securities and Exchange Commission |

S&P | | Standard & Poor’s |

| |

Other | | |

AFUDC | | Allowance for Funds Used During Construction |

AOCI | | Accumulated Other Comprehensive Income |

ARO | | Asset Retirement Obligation |

ASC | | Financial Accounting Standards Board (U.S.) Accounting Standards Codification |

ASR | | Accelerated Share Repurchase program |

BBtu | | Billions of British thermal units |

Bcf | | Billion cubic feet |

CAP | | IRS Compliance Assurance Process |

CGAC | | Cost of Gas Adjustment Clause |

CPSL | | Capital Projects Scheduling List |

ii

| | |

CY | | Connecticut Yankee Atomic Power Company |

EEI Index | | Edison Electric Institute Stock Index of U.S. Shareholder - Owned Electric Utilities |

EERF | | Energy Efficiency Reconciling Factor |

EPS | | Earnings Per Common Share |

GAAP | | Accounting principles generally accepted in the United States of America |

GCA | | Massachusetts Green Communities Act |

GHG | | Greenhouse Gas |

GWSA | | Massachusetts Global Warming Solutions Act |

HCERA | | Health Care and Education Reconciliation Act |

HQ | | Hydro-Quebec |

ISFSI | | Independent Spent Fuel Storage Installation |

kW | | Kilowatt (equal to one thousand watts) |

kWh | | Kilowatthour (the basic unit of electric energy equal to one kilowatt of power supplied for one hour) |

LBR | | Lost Base Revenues |

LDAC | | Local Distribution Adjustment Clause |

LNG | | Liquefied Natural Gas |

MD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

MGP | | Manufactured Gas Plant |

MMbtu | | Millions of British thermal units |

MW | | Megawatts |

MWh | | Megawatthour (equal to one million watthours) |

MY | | Maine Yankee Atomic Power Company |

NAV | | Net Asset Value |

NEH | | New England Hydro-Transmission Electric Company, Inc. |

NHH | | New England Hydro-Transmission Corporation |

NU | | Northeast Utilities |

OATT | | Open Access Transmission Tariff |

PAM | | Pension and PBOP Rate Adjustment Mechanism |

PBOP | | Postretirement Benefit Obligation other than Pensions |

PPA | | Pension Protection Act |

PPACA | | Patient Protection and Affordable Care Act |

PSU | | Performance Share Unit |

RMR | | Reliability Must Run |

ROE | | Return on Equity |

RTO | | Regional Transmission Organization |

SIP | | Simplified Incentive Plan |

SQI | | Service Quality Indicators |

TSA | | Transmission Service Agreement |

WRERA | | Worker, Retiree and Employer Recovery Act |

YA | | Yankee Atomic Electric Company |

| |

N/A | | Not applicable |

iii

Cautionary Statement Regarding Forward-Looking Information

This Annual Report on Form 10-K contains statements that are considered forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements may also be contained in other filings with the SEC, in press releases, and oral statements. You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements contain words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are based on the current expectations, estimates or projections of management and are not guarantees of future performance. Some or all of these forward-looking statements may not turn out to be what NSTAR expected. Actual results could differ materially from these statements. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved.

Examples of some important factors that could cause our actual results or outcomes to differ materially from those discussed in the forward-looking statements include, but are not limited to, the following:

| | • | | adverse financial market conditions including changes in interest rates and the availability and cost of capital |

| | • | | adverse economic conditions |

| | • | | changes to prevailing local, state and federal governmental policies and regulatory actions (including those of the DPU, other state regulatory agencies, and the FERC) with respect to allowed rates of return, rate structure, continued recovery of regulatory assets and energy costs, financings, municipalization, and operation and construction of facilities |

| | • | | acquisition and disposition of assets |

| | • | | changes in tax laws and policies |

| | • | | changes in, and compliance with, environmental and safety laws and policies |

| | • | | new governmental regulations or changes to existing regulations that impose additional operating requirements or liabilities |

| | • | | changes in available information and circumstances regarding legal issues and the resulting impact on our estimated litigation costs |

| | • | | weather conditions that directly influence the demand for electricity and natural gas |

| | • | | ability to continue cost control processes |

| | • | | ability to maintain current credit ratings |

| | • | | impact of uninsured losses |

| | • | | impact of adverse union contract negotiations |

| | • | | damage from major storms and other natural events and disasters |

| | • | | impact of conservation measures and self-generation by our customers |

| | • | | changes in financial accounting and reporting standards |

| | • | | changes in hazardous waste site conditions and the cleanup technology |

| | • | | prices and availability of operating supplies |

| | • | | failures in operational or information systems or infrastructure, or those of third parties, that disrupt business activities, result in the disclosure of confidential information or otherwise adversely affect financial reporting and/or the Company’s reputation |

| | • | | catastrophic events that could result from terrorism, cyber attacks, or attempts to disrupt the Company’s businesses, or the businesses of third parties, that may impact operations in unpredictable ways and adversely affect financial results and liquidity |

1

| | • | | impact of service quality performance measures and standards of performance for emergency preparation and restoration of service; and |

| | • | | impact of the expected timing and likelihood of completion of the pending merger with Northeast Utilities, either of which could be adversely affected by, among other things, (i) the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending merger; (ii) litigation brought in connection with the pending merger; (iii) the ability to maintain relationships with customers, employees or suppliers as well as the ability to successfully integrate the businesses; and (iv) the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. |

Any forward-looking statement speaks only as of the date of this filing and NSTAR undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. You are advised, however, to consult all further disclosures NSTAR makes in its filings to the SEC. Other factors in addition to those listed here could also adversely affect NSTAR. This Annual Report also describes material contingencies and critical accounting policies and estimates in the accompanying Part I, Item 1A,“Risk Factors,” in Part II, Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in the accompanying Part II, Item 8,Notes to Consolidated Financial Statements and NSTAR encourages a review of these items.

2

Part I

(a) General Development of Business

NSTAR (or the Company) is a holding company engaged through its subsidiaries in the energy delivery business serving approximately 1.4 million customers in Massachusetts, including approximately 1.1 million electric distribution customers in 81 communities and approximately 300,000 natural gas distribution customers in 51 communities. Utility operations accounted for approximately 99% of consolidated operating revenues from continuing operations in 2011, 2010, and 2009. The remaining revenue is generated from its unregulated operations. NSTAR was chartered as a Massachusetts Business Trust on April 20, 1999. Its principal subsidiaries, NSTAR Electric Company and NSTAR Gas Company, both Massachusetts corporations, were incorporated in 1886 and 1851, respectively.

Pending Merger with Northeast Utilities

On October 16, 2010, upon unanimous approval from their respective Boards of Trustees, NSTAR and Northeast Utilities (NU) entered into an Agreement and Plan of Merger (the Merger Agreement). The transaction will be a merger of equals in a stock-for-stock transfer. Upon the terms and subject to the conditions set forth in the Merger Agreement, at closing, NSTAR will become a wholly-owned subsidiary of NU. On March 4, 2011, shareholders of each company approved the merger and adopted the Merger Agreement. Under the terms of the Merger Agreement, NSTAR shareholders will receive 1.312 NU common shares for each NSTAR common share that they own. Following completion of the merger, it is anticipated that NU shareholders will own approximately 56 percent of the post-merger company and former NSTAR shareholders will own approximately 44 percent of the post-merger company.

The post-merger company will provide electric and gas energy delivery services through six regulated electric and gas utilities in Connecticut, Massachusetts and New Hampshire serving nearly 3.5 million electric and gas customers. Completion of the merger is subject to various customary conditions, including receipt of required regulatory approvals. Acting pursuant to the terms of the Merger Agreement, on October 14, 2011, NU and NSTAR formally extended the date by which either party has the right to terminate the Merger Agreement should all required closing conditions not be satisfied, including receipt of all required regulatory approvals, from October 16, 2011 to April 16, 2012.

Regulatory Approvals on Pending Merger with Northeast Utilities

Federal

On January 4, 2011, NSTAR and NU received approval from the Federal Communications Commission. On February 10, 2011, the applicable Hart-Scott-Rodino waiting period expired. On July 6, 2011, NSTAR and NU received approval from the Federal Energy Regulatory Commission (FERC). Consent of the Nuclear Regulatory Commission (NRC) was received on December 20, 2011.

Massachusetts

On November 24, 2010, NSTAR and NU filed a joint petition requesting the DPU’s approval of their proposed merger. On March 10, 2011, the DPU issued an order that modified the standard of review to be applied in the review of mergers involving Massachusetts utilities from a “no net harm” standard to a “net benefits” standard, meaning that the companies must demonstrate that the pending merger provides benefits that outweigh the costs. Applicable state law provides that mergers of Massachusetts utilities and their respective holding companies must be “consistent with the public interest.” The order states that the DPU has flexibility in applying the factors applicable to the standard of review. NSTAR and NU filed supplemental testimony with the DPU on April 8, 2011 indicating the merger could provide post-merger net savings of approximately $784 million in the

3

first ten years following the closing of the merger and provide environmental benefits with respect to Massachusetts emissions reductions, global warming policies, and furthering the goals of Massachusetts’ Green Communities Act.

The DPU held public evidentiary hearings during July 2011. Upon conclusion of the public evidentiary hearings on July 28, 2011, the DPU issued a briefing schedule that arranged for a series of intervenor and NSTAR and NU briefs and reply briefs culminating in the delivery of the final NSTAR and NU reply briefs on September 19, 2011. Subsequently, NSTAR and NU agreed to different intervenor motions to extend the briefing schedule, and the DPU consented to these motions. The final NSTAR and NU reply briefs were filed on October 31, 2011.

On July 15, 2011, the Massachusetts Department of Energy Resources (DOER) filed a motion for an indefinite stay in the proceedings. On July 21, 2011, NSTAR and NU filed a response objecting to this motion. The DPU originally scheduled Oral Arguments for November 17, 2011 regarding the DOER’s Motion to Stay the proceeding, which were postponed during the fourth quarter of 2011 while NSTAR, NU and other parties made attempts to narrow and discuss the issues presented by the DOER’s Motion to Stay. On January 6, 2012, the Oral Arguments were conducted regarding the DOER’s Motion to Stay. At the Oral Argument, DOER withdrew its request for a fully adjudicated rate case, which would have required an extended stay of the proceeding. NSTAR and NU await approval of the merger from the DPU.

Connecticut

On June 1, 2011, the Connecticut Public Utilities Regulatory Authority (PURA), formerly the Connecticut Department of Public Utility Control (DPUC), issued a declaratory ruling stating that it lacked jurisdiction to review the NSTAR merger with NU. On June 30, 2011, the Connecticut Office of Consumer Counsel filed a Petition for Administrative Appeal in Connecticut Superior Court requesting that the Superior Court remand the decision back to the PURA with instructions to reopen the docket and review the merger transaction.

On January 4, 2012, the PURA issued a draft decision in Docket No. 10-12-05RE01 that revised its earlier declaratory ruling of June 1, 2011, which had concluded it did not have jurisdiction to review the pending merger between NU and NSTAR. Following oral arguments on January 12, 2012, the PURA issued its final decision on January 18, 2012 that concluded that NU and NSTAR must seek approval to merge from the PURA pursuant to Connecticut state law. On January 19, 2012, NU and NSTAR filed their merger review application with the PURA. On January 20, 2012, the PURA issued a procedural schedule that includes a draft decision on March 26, 2012 and a final decision on April 2, 2012.

New Hampshire

On April 5, 2011, the New Hampshire Public Utilities Commission (NHPUC) issued an order finding that it does not have statutory authority to approve or reject the merger.

Maine

On May 11, 2011, the Maine Public Utilities Commission issued an order approving the merger contingent upon approval by the FERC. The FERC approval was received on July 6, 2011.

Utility Operations

NSTAR’s utility operations derive their operating revenues primarily from electric and natural gas sales, distribution, and transmission services to customers. NSTAR’s earnings are impacted by fluctuations in unit sales of electric kWh and natural gas MMbtu, which have an effect on the level of distribution revenues recognized. In accordance with the regulatory rate structure in which NSTAR operates, its recovery of energy and certain

4

energy-related costs are fully reconciled with the level of energy revenues currently recorded and, therefore, do not have an impact on earnings. As a result of this rate structure, any variability in the cost of energy supply purchased will have an impact on the purchased power and transmission and cost of gas sold expenses, but will not affect the Company’s net income as the Company recognizes a corresponding change in revenues.

Sale of MATEP

On June 1, 2010, NSTAR completed the sale of its stock ownership interest in Medical Area Total Energy Plant, Inc. (MATEP), an unregulated district energy operation in Boston’s Longwood Medical Area. MATEP provides chilled water, steam, and electricity to several hospitals, medical research and biotechnology centers, and teaching institutions. Revenues earned by MATEP represented approximately 3% of total consolidated revenues in 2009. MATEP has been accounted for as a discontinued operation in the accompanying consolidated financial statements. Refer to the“Sale of MATEP” section of the accompanying Item 7“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for more details.

(b) Financial Information about Industry Segments

NSTAR’s principal operating segments or line of regulated utility businesses are electric and natural gas distribution operations that provide energy transmission and delivery services in 107 cities and towns in Massachusetts. Refer to Note N,“Segment and Related Information” of the accompanyingNotes to Consolidated Financial StatementsinItem 8, “Financial Statements and Supplementary Data”for specific financial information related to NSTAR’s electric utility and natural gas utility operations segments.

In the second quarter of 2010, with the completion of the sale of MATEP, NSTAR changed its reportable segments and recast prior period information to conform with the presentation that eliminates separate presentation of the Company’s unregulated operations. Although the telecommunications and liquefied natural gas subsidiaries are separate legal entities, NSTAR has aggregated the results of operations and assets of its telecommunications subsidiary with the electric utility operations, and aggregated the liquefied natural gas service subsidiary with gas utility operations. The telecommunications subsidiary, liquefied natural gas service subsidiary and MATEP were previously aggregated as unregulated operations for purposes of segment reporting. Since the sale of MATEP, it is no longer necessary to present the unregulated segment separately due to immateriality. The new segment presentation reflects the ongoing profile of NSTAR’s operations as primarily comprised of electric and gas utility operations.

(c) Narrative Description of Business

Principal Products and Services

NSTAR Electric

NSTAR Electric provides distribution and transmission electricity service at retail to an area of 1,702 square miles. The territory served is located in Massachusetts and includes the City of Boston and 80 surrounding cities and towns, including Cambridge, New Bedford, Plymouth, and the geographic area comprising Cape Cod and Martha’s Vineyard. The population of this area is approximately 2.5 million.

NSTAR Electric’s operating revenues and sales percentages by customer class for the years 2011, 2010, and 2009 consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Revenues ($) | | | Retail Electric Sales (mWh) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2011 | | | 2010 | | | 2009 | |

Retail: | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | | 54 | % | | | 52 | % | | | 52 | % | | | 68 | % | | | 68 | % | | | 68 | % |

Residential | | | 45 | % | | | 47 | % | | | 47 | % | | | 31 | % | | | 31 | % | | | 31 | % |

Other | | | 1 | % | | | 1 | % | | | 1 | % | | | 1 | % | | | 1 | % | | | 1 | % |

5

Regulated Electric Distribution Rates

Retail electric delivery rates are established by the DPU and are comprised of:

| | • | | a distribution charge, which includes a fixed customer charge and a demand and/or energy charge to collect the costs of building and expanding the infrastructure to deliver power to its destination, as well as ongoing operating costs. The distribution charge also includes the recovery, on a fully reconciling basis, of certain DPU-approved safety and reliability programs costs, a Pension and PBOP Rate Adjustment Mechanism (PAM) to recover incremental pension and pension benefit costs, a reconciling rate adjustment mechanism to recover costs associated with the residential assistance adjustment clause, a net-metering reconciliation surcharge to collect the lost revenues and credits associated with net-metering facilities installed by customers, and an Energy Efficiency Reconciling Factor (EERF) to recover energy efficiency program costs and lost base revenues in addition to those charges recovered in the energy conservation charge; |

| | • | | a basic service chargerepresents the collection of energy costs, including costs related to charge-offs of uncollected energy costs, through DPU-approved rate mechanisms. Electric distribution companies in Massachusetts are required to obtain and resell power to retail customers through Basic Service for those who choose not to buy energy from a competitive energy supplier. Basic Service rates are reset every six months (every three months for large commercial and industrial customers). The price of Basic Service is intended to reflect the average competitive market price for electric power. Additionally, the DPU has authorized the Company to recover the cost of its Dynamic Pricing Smart Grid Pilot Program through the Basic Service charge; |

| | • | | a transition charge represents the collection of costs to be collected primarily from previously held investments in generating plants and costs related to existing above-market power contracts, and contract costs related to long-term power contracts buy-outs; |

| | • | | a transmission charge represents the collection of annual costs of moving the electricity over high voltage lines from generating plants to substations located within NSTAR’s service area including costs allocated to NSTAR Electric by ISO-NE to maintain the wholesale electric market; |

| | • | | an energy conservation chargerepresents a legislatively-mandated charge to collect costs for energy efficiency programs; and |

| | • | | a renewable energy charge represents a legislatively-mandated charge to collect the costs to support the development and promotion of renewable energy projects. |

Rate Settlement Agreement

NSTAR Electric is operating under a DPU-approved Rate Settlement Agreement (Rate Settlement Agreement) that expires December 31, 2012. From 2007 through 2012, the Rate Settlement Agreement establishes for NSTAR Electric, among other things, annual inflation-adjusted distribution rates including a productivity offset, that are generally offset by an equal and corresponding adjustment to transition rates. Refer to the“Rate Settlement Agreement”section of the accompanying Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for more details. Pursuant to a 2008 DPU order, Massachusetts electric utilities must adopt rate structures that decouple the volume of energy sales from the utility’s revenues in their next rate case. The exact timing of the next rate case has not yet been determined.

Massachusetts Regulatory Environment

The Secretary of Energy and Environmental Affairs oversees the Commonwealth Utilities Commission, consisting of three commissioners. The Commonwealth Utilities Commission leads the DPU, an agency that has jurisdiction over electric, natural gas, water, and transportation matters. Massachusetts has joined the Regional Greenhouse Gas Initiative, a ten-state group that supports implementation of programs to reduce the production of greenhouse gases by electric power plants.

6

In July 2008, the Massachusetts Legislature enacted the Green Communities Act (GCA) – energy policy legislation designed: (1) to substantially increase energy efficiency, (2) foster the development of renewable energy resources and (3) provide for a reduction of greenhouse gas emissions in Massachusetts.

In 2008, the Massachusetts Global Warming Solutions Act (GWSA) was enacted. In December 2010, a portfolio of policies designed to help reduce greenhouse gas emissions was released by the Massachusetts Executive Office of Energy and Environmental Affairs. At this time, NSTAR cannot predict the effect of the GWSA on its future results of operations, financial position, or cash flows.

Refer to the“Massachusetts Regulatory Environment” section of the accompanying Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for more details on the GCA and GWSA.

Electric and Gas Rate Decoupling

On July 16, 2008, the DPU issued an order to all Massachusetts’ electric and gas distribution utility companies that requires them to develop plans to decouple their distribution rates/revenues from sales volumes. This action is intended to encourage utility companies to help their customers reduce energy consumption. Decoupling of rates will allow utility companies to carry out the mandates of the GCA and at the same time collect the adequate level of revenues to maintain the quality and reliability of electric and gas services. This order allows companies to file for a revenue adjustment representing partial recovery of lost base revenues caused by incremental energy efficiency spending until their decoupling rate plans are approved. Once decoupled rate plans are approved, revenues will be set at a level designed to recover the utility companies’ incurred costs plus a return on their investment. This revenue level will be reconciled with actual revenues received from decoupled rates on an annual basis and any over or under collection will be refunded to or recovered from customers in the subsequent year. NSTAR Electric and NSTAR Gas have not yet applied for decoupled rate structures.

Sources and Availability of Electric Power Supply

For Basic Service power supply, NSTAR Electric makes periodic market solicitations consistent with DPU regulations. NSTAR Electric enters into short-term power purchase agreements to meet its Basic Service supply obligation, ranging in term from three to twelve months. NSTAR Electric fully recovers its payments to suppliers through DPU-approved rates billed to customers.

In accordance with the requirements of the GCA, in September 2010 NSTAR Electric along with other Massachusetts investor-owned utilities began to solicit bids for renewable energy supplies for approximately 3% of total annual load for between 10 and 15 year periods. In August 2011, the DPU approved three long-term renewable energy purchase agreements, representing approximately 1.6% of NSTAR Electric’s load, originally executed in December 2010. These three contracts call for NSTAR Electric to purchase all of the output and associated renewable energy credits of three wind facilities to be constructed. At December 31, 2011, the estimated commitment associated with these new contracts is approximately $9 million in 2012, $30 million in each year 2013 – 2016, and $176 million in 2017 and beyond. Refer to“Capital Expenditures and Contractual Obligations”in the“Liquidity, Commitments and Capital Resources”section of the accompanying Item 7“Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more details.

Market and Transmission Regulation

NSTAR Electric and most other New England electric utilities, generation owners, and marketers are parties to a series of agreements that provide for coordinated planning and operation of the region’s generation and transmission facilities and the rules by which they participate in the wholesale markets and acquire transmission services. Under these arrangements, ISO New England Inc. (ISO-NE), a non-profit corporation whose board of directors and staff are independent from all market participants, serves as the Regional Transmission Operator

7

(RTO) of the New England Transmission System. ISO-NE works to ensure the reliability of the system, administers the Transmission, Markets and Services Tariff subject to FERC approval, intervenes in pertinent regulatory proceedings, oversees the efficient and competitive functioning of the regional wholesale power market and determines which costs of NSTAR’s major transmission facilities are regionalized throughout New England. NSTAR Electric is a New England Transmission Owner subject to FERC regulation and is a member of ISO-NE. Refer to the“FERC Transmission ROE” section of the accompanying Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for more details.

Transmission Rates

Transmission revenues are based on formula rates that are approved by the FERC. Tariffs are set by FERC and primarily include the Regional Network Service (RNS) and Local Network Service (LNS) rate schedules. The RNS rate, administered by ISO-NE and billed to all New England distribution companies, is reset on June 1 of each year and recovers the revenue requirements associated with transmission facilities that benefit the New England region. The LNS rate, which NSTAR Electric administers, is reset annually and recovers the revenue requirements for local transmission facilities. The LNS rate calculation recovers total transmission revenue requirements net of revenues received from other sources, thereby ensuring that NSTAR Electric recovers all regional and local revenue requirements as prescribed in the tariffs.

Transmission Capital Improvements – NSTAR Electric

NSTAR Electric continues to evaluate needs for transmission improvements throughout the NSTAR service area. ISO-NE transmission project upgrades maintain transmission system reliability, improve the economic performance of the system, and are fully coordinated with other power regions. Over the next five to ten years, ISO-NE transmission projects are expected to enhance the region’s ability to support a robust, competitive wholesale power market by reliably moving power from various internal and external sources to the region’s load centers.

Additional transmission plans have been developed to further reduce the dependence on certain generating units needed for reliability and the exposure to special load-shedding contingency procedures. At various times, generating units in New England have been in “must-run” situations to maintain area reliability. Transmission improvements placed in-service have reduced costs associated with Reliability Must Run Agreements and second-contingency and voltage-control payments.

The Lower Southeastern Massachusetts (SEMA) Project consists of an expansion and upgrade of existing transmission infrastructure, and construction of a new 31 mile, 345kV transmission line that will cross the Cape Cod Canal. On December 16, 2011, ISO-NE issued formal approval for the Lower SEMA 345 kV Transmission Project to be included in the Pool Transmission Facility regional rates. At a hearing held on January 12, 2012, the Massachusetts Energy Facilities Siting Board (EFSB) voted unanimously to direct the EFSB Staff to prepare tentative decisions for public comment based on the EFSB’s approval of the project subject to the conditions of NSTAR Electric providing reports to the EFSB every six months on project costs and schedule of construction. Further conditions may be imposed. The Cape Cod Commission (CCC) unanimously approved the project on January 19, 2012. The cost estimate of this project is approximately $110 million; NSTAR Electric anticipates that the project will be in-service in 2012 or early 2013 dependent on the timing of final regulatory approvals.

NSTAR Transmission Ventures

NSTAR Transmission Ventures, Inc. (NTV) is a wholly-owned subsidiary of NSTAR. NTV holds a 25% interest in Northern Pass Transmission LLC (NPT). NPT is a joint venture of NSTAR and NU that plans to build a $1.1 billion, 1,200 megawatt transmission line from the Canadian border to Deerfield, New Hampshire.

NSTAR Gas

NSTAR Gas distributes natural gas to approximately 300,000 customers in 51 communities in central and eastern Massachusetts covering 1,067 square miles and having an aggregate population of 1.3 million. Twenty-five of

8

these communities are also served with electricity by NSTAR Electric. Some of the larger communities served by NSTAR Gas include the Hyde Park area of Boston, Cambridge, Dedham, Framingham, New Bedford, Plymouth, Somerville, and Worcester.

NSTAR Gas’ operating revenues and sales percentages by customer class for the years 2011, 2010, and 2009, consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Revenues ($) | | | Retail Gas Sales (therms) | |

| | | 2011 | | | 2010 | | | 2009 | | | 2011 | | | 2010 | | | 2009 | |

Gas Sales and Transportation: | | | | | | | | | | | | | | | | | | | | | | | | |

Residential | | | 59 | % | | | 63 | % | | | 62 | % | | | 43 | % | | | 43 | % | | | 43 | % |

Commercial and Industrial | | | 27 | % | | | 25 | % | | | 28 | % | | | 46 | % | | | 46 | % | | | 44 | % |

Other | | | 5 | % | | | 5 | % | | | 5 | % | | | 6 | % | | | 6 | % | | | 6 | % |

Off-System and Contract sales | | | 9 | % | | | 7 | % | | | 5 | % | | | 5 | % | | | 5 | % | | | 7 | % |

Gas Rates

NSTAR Gas generates revenues primarily through the sale and/or transportation of natural gas. Gas sales and transportation services are divided into two categories: firm, whereby NSTAR Gas must supply gas and/or transportation services to customers on demand; and interruptible, whereby NSTAR Gas may, generally during colder months, temporarily discontinue service to high volume commercial and industrial customers. Sales and transportation of gas to interruptible customers have no impact on NSTAR Gas’ operating income because a substantial portion of the margin for such service is returned to its firm customers as rate reductions.

Retail natural gas delivery and supply rates are established by the DPU and are comprised of:

| | • | | a distribution charge consists of a fixed customer charge and a demand and/or energy charge that collects the costs of building and expanding the natural gas infrastructure to deliver natural gas supply to its customers’ destination. This also includes collection of ongoing operating costs; |

| | • | | a seasonal cost of gas adjustment clause (CGAC) represents the collection of natural gas supply costs, pipeline and storage capacity, costs related to charge-offs of uncollected energy costs and working capital related costs. The CGAC is reset every six months. In addition, NSTAR Gas files interim changes to its CGAC factor when the actual costs of natural gas supply vary from projections by more than 5%; and |

| | • | | a local distribution adjustment clause (LDAC) primarily represents the collection of energy efficiency program costs, environmental costs, PAM related costs, and costs associated with the residential assistance adjustment clause. The LDAC is reset annually and provides for the recovery of certain costs applicable to both sales and transportation customers. |

NSTAR Gas purchases financial contracts based on NYMEX natural gas futures in order to reduce cash flow variability associated with the purchase price for approximately one-third of its natural gas purchases. This practice attempts to minimize the impact of fluctuations in prices to NSTAR’s firm gas customers. These financial contracts do not procure gas supply. All costs incurred or benefits realized when these contracts are settled are included in the CGAC.

Gas Supply, Transportation and Storage

NSTAR Gas maintains a flexible resource portfolio consisting of natural gas supply contracts, transportation contracts on interstate pipelines, market area storage and peaking services.

NSTAR Gas purchases transportation, storage, and balancing services from Tennessee Gas Pipeline Company and Algonquin Gas Transmission Company, as well as other upstream pipelines that transport gas from major producing regions in the U.S., including Gulf Coast, Mid-continent, and Appalachian Shale supplies to the final

9

delivery points in the NSTAR Gas service area. NSTAR Gas purchases all of its natural gas supply from a firm portfolio management contract with a term of one year, which has a maximum quantity of 139,606 MMBtu/day.

In addition to the firm transportation and natural gas supplies mentioned above, NSTAR Gas utilizes contracts for underground storage and LNG facilities to meet its winter peaking demands. The LNG facilities, described below, are located within NSTAR Gas’ distribution system and are used to liquefy and store pipeline gas during the warmer months for vaporization and use during the heating season. During the summer injection season, excess pipeline capacity and supplies are used to deliver and store natural gas in market area underground storage facilities located in the New York and Pennsylvania region. Stored natural gas is withdrawn during the winter season to supplement flowing pipeline supplies in order to meet firm heating demand. NSTAR Gas has firm underground storage contracts and total storage capacity entitlements of approximately 7.9 Bcf.

A portion of the storage of natural gas supply for NSTAR Gas during the winter heating season is provided by Hopkinton, a wholly-owned subsidiary of NSTAR. The facilities consist of an LNG liquefaction and vaporization plant and three above-ground cryogenic storage tanks in Hopkinton, MA having an aggregate capacity of 3.0 Bcf of liquefied natural gas. The Company also has access to facilities in Acushnet, MA that include additional storage capacity of 0.5 Bcf and additional vaporization capacity.

Based on information currently available regarding projected growth in demand and estimates of availability of future supplies of pipeline natural gas, NSTAR Gas believes that its present sources of natural gas supply are adequate to meet existing load and allow for future growth in sales.

Franchises

Through their charters, which are unlimited in time, NSTAR Electric and NSTAR Gas have the right to engage in the business of delivering and selling electricity and natural gas within their respective service territories, and have powers incidental thereto and are entitled to all the rights and privileges of and subject to the duties imposed upon electric and natural gas companies under Massachusetts laws. The locations in public ways for electric transmission and distribution lines and gas distribution pipelines are obtained from municipal and other state authorities who, in granting these locations, act as agents for the state. In some cases the actions of these authorities are subject to appeal to the DPU. The rights to these locations are not limited in time and are subject to the action of these authorities and the legislature. Under Massachusetts law, with the exception of municipal-owned utilities, no other entity may provide electric or gas delivery service to retail customers within NSTAR’s service territory without the written consent of NSTAR Electric and/or NSTAR Gas. This consent must be filed with the DPU and the municipality so affected.

Unregulated Operations

NSTAR’s unregulated operations include telecommunications and liquefied natural gas service. Telecommunications services are provided through NSTAR Com, which installs, owns, operates, and maintains a wholesale data transport network for other telecommunications service providers in the metropolitan Boston area to deliver voice, video, data, and internet services to customers. Revenues earned from NSTAR’s unregulated operations accounted for less than 1% of consolidated operating revenues in 2011, 2010, and 2009.

In December 2010, NSTAR Com entered into a six-year indefeasible right to use agreement relating to the remaining available capacity on its dark fiber network. Effective January 2011, this agreement provides annual payments of $6 million in 2011, which will gradually escalate to $13 million in 2016. Separately, NSTAR Com entered into an option agreement with the same counterparty exercisable at the end of the six-year term to extend the right to use agreement for a ninety-nine year period in exchange for a one-time lump-sum payment.

Regulation

NSTAR Gas, NSTAR Electric and NSTAR Electric’s wholly-owned regulated subsidiary, Harbor Electric Energy Company, operate primarily under the authority of the DPU, whose jurisdiction includes supervision over

10

retail rates for distribution of electricity, natural gas, and financing and investing activities. In addition, the FERC has jurisdiction over various phases of NSTAR Electric and NSTAR Gas utility businesses, conditions under which natural gas is sold at wholesale, facilities used for the transmission or sale of that energy, certain issuances of short-term debt, and regulation of accounting. These companies are also subject to various other state and municipal regulations with respect to environmental, employment, and general operating matters.

Plant Expenditures and Financings – Regulated Utilities

The most recent estimates of plant expenditures and long-term debt maturities for 2012 and the years 2013-2016 are as follows:

| | | | | | | | |

(in millions) | | 2012 | | | 2013-2016 | |

Plant expenditures: | | | | | | | | |

Electric | | $ | 455 | | | $ | 1,355 | |

Gas | | | 65 | | | | 185 | |

| | | | | | | | |

| | $ | 520 | | | $ | 1,540 | |

| | | | | | | | |

Long-term debt | | $ | 450 | | | $ | 352 | |

| | | | | | | | |

In the five-year period 2012 through 2016, plant expenditures are forecasted for system reliability and performance improvements, customer service enhancements, and capacity expansion in NSTAR’s service territory. Of the $455 million planned electric expenditures for 2012, approximately $190 million is for transmission system improvements. The amounts stated above exclude expenditures for NSTAR’s proposed transmission investment with Northeast Utilities as these costs will be incurred by NPT to hold those assets (further discussed in the“Northern Pass Transmission Project”section in Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations”).

Management continuously reviews its capital expenditure and financing programs. These programs and, therefore, the estimates included in this Form 10-K are subject to revision due to changes in regulatory requirements, operating requirements, environmental standards, availability and cost of capital, interest rates and other assumptions. Refer to the accompanying“Cautionary Statement Regarding Forward-Looking Information”preceding Item 1,“Business”and the“Liquidity, Commitments and Capital Resources”section of Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Seasonal Nature of Business

NSTAR Electric’s kilowatt-hour sales and revenues are typically higher in the winter and summer than in the spring and fall as sales tend to vary with weather conditions. NSTAR Gas’ sales are positively impacted by colder weather because a substantial portion of its customer base uses natural gas for space heating purposes. Refer to the accompanying“Selected Quarterly Consolidated Financial Data” section in Item 6,“Selected Consolidated Financial Data” for specific financial information by quarter for 2011 and 2010.

Competitive Conditions

As a rate-regulated distribution and transmission utility company, NSTAR is not subject to a significantly competitive business environment. NSTAR Electric and NSTAR Gas have the exclusive right and privilege to engage in the business of delivering energy services within their granted territory. Under Massachusetts law, with the exception of municipal-owned utilities, no other entity may provide electric or natural gas delivery service to retail customers within NSTAR’s service territory without the written consent of NSTAR Electric and/or NSTAR Gas. Refer to the accompanying“Franchises” section of this Item 1 and to Item 1A,“Risk Factors” for a further discussion of NSTAR’s rights and competitive pressures within its service territory.

11

Environmental Matters

NSTAR’s subsidiaries are subject to numerous federal, state and local standards with respect to the management of wastes and other environmental considerations. NSTAR subsidiaries face possible liabilities as a result of involvement in several multi-party disposal sites, state-regulated sites or third party claims associated with contamination remediation. NSTAR generally expects to have only a small percentage of the total potential liability for the majority of these sites. Noncompliance with certain standards can, in some cases, also result in the imposition of monetary civil penalties. Refer to the accompanying“Contingencies – Environmental Matters” section in Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and toNotes to Consolidated Financial Statements, Note P,“Commitments and Contingencies,” for more information.

Management believes that its facilities are in substantial compliance with currently applicable statutory and regulatory environmental requirements.

Number of Employees and Employee Relations

At December 31, 2011, NSTAR has approximately 3,000 employees, including approximately 2,100 of whom are represented by two labor unions covered by separate collective bargaining contracts.

Substantially all management, engineering, finance and support services are provided to the operating subsidiaries of NSTAR by NSTAR Electric & Gas. NSTAR has the following labor union contracts:

| | | | | | |

Union | | Percent of Union to Total

NSTAR Employees | | Supports | | Contract Expiration

Date |

Local 369 of the Utility Workers of America (AFL-CIO) | | 61% | | Utility Operations | | June 1, 2012 |

Local 12004 of the United Steelworkers of America | | 8% | | Utility Operations | | March 31, 2013 |

NSTAR’s contract with Local 369 of the Utility Workers Union of America, AFL-CIO, expires on June 1, 2012. Management is optimistic that a new labor contract will be agreed upon prior to that date. NSTAR’s contract with Local 12004 of the United Steelworkers of America is set to expire on March 31, 2013. Management believes that it has satisfactory relations with its employees.

(d) Financial Information about Geographic Areas

NSTAR is a holding company engaged through its subsidiaries in the energy delivery business in Massachusetts. None of NSTAR’s subsidiaries have any foreign operations or export sales.

(e) Available Information

NSTAR files its Forms 10-K, 10-Q, and 8-K reports, proxy statements, and other information with the SEC. You may access materials free of charge on the SEC’s website atwww.sec.gov or on NSTAR’s website at:www.nstar.com: select “Investor Relations,” “Financial Information,” then select “SEC Filings” from the drop-down list. Copies of NSTAR’s SEC filings may also be obtained free of charge by writing to NSTAR’s Investor Relations Department at the address on the cover of this Form 10-K or by calling 781-441-8338.

NSTAR’s Board of Trustees has several committees, including an Audit, Finance and Risk Management Committee, an Executive Personnel Committee and a Board Governance and Nominating Committee. The Board of Trustees also has a standing Executive Committee. The Board of Trustees has adopted the NSTAR Board of Trustees Guidelines on Significant Corporate Governance Issues, a Code of Ethics for the Principal Executive Officer, General Counsel, and Senior Financial Officers pursuant to Section 406 of the Sarbanes-Oxley Act, and a Code of Ethics and Business Conduct for Trustees, Officers and Employees (Code of Conduct). NSTAR intends to disclose any amendment to, and any waiver from, a provision of the Code of Ethics that applies to the

12

Chief Executive Officer or Chief Financial Officer or any other executive officer and that relates to any element of the Code of Ethics definition enumerated in Item 406(b) of Regulation S-K, in a press release, on our website or on Form 8-K, within four business days following the date of such amendment or waiver. NSTAR’s Corporate Governance documents, including charters, guidelines and codes, and any amendments to such charters, guidelines and codes that are applicable to NSTAR’s executive officers, senior financial officers or trustees can be accessed free of charge on NSTAR’s website at:www.nstar.com:select “Investor Relations” and “Company Information.”

The certifications of NSTAR’s Chief Executive Officer and Chief Financial Officer pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act are attached to this Annual Report on Form 10-K as Exhibits 31.1, 31.2, 32.1, and 32.2.

NSTAR’s future performance is subject to a variety of risks, including, but not limited to those described below. If any of the following risks actually occur, the Company’s business could be harmed and the market price of NSTAR’s Common Shares could decline. In addition to the other information in this Annual Report on Form 10-K, shareholders or prospective investors should carefully consider the following risk factors.

NSTAR’s electric and gas operations are highly regulated, and any adverse regulatory changes could have a significant impact on the Company’s results of operations and its financial position.

NSTAR’s electric and gas operations, including the rates charged, are regulated by the FERC and the DPU. In addition, NSTAR’s accounting policies are prescribed by GAAP, the FERC, and the DPU. Adverse regulatory changes in rates and accounting policies by a regulatory authority could have a significant impact on the Company’s results of operations and its financial condition.

Potential municipalization or technological developments may adversely affect the Company’s regulated electricity and natural gas businesses.

Under Massachusetts law, no other entity may provide electric or gas delivery service to retail customers within NSTAR’s service territory without the written consent of NSTAR Electric and/or NSTAR Gas. One potential exception is municipalization, whereby a city or town establishes its own municipal-owned utility. Although there have been no recent municipalization activities in Massachusetts, NSTAR’s operating utility companies could be exposed to municipalization risk, whereby a municipality could acquire the electric or natural gas delivery assets located in that city or town and take over the customer delivery service, thereby reducing NSTAR’s revenues. Any such action would require numerous legal and regulatory consents and approvals. Municipalization would require that NSTAR be compensated for its assets assumed. In addition, there is also the risk that technological developments could lead to more wide-spread use of distributed generation among NSTAR’s customer base reducing such customers’ use of NSTAR’s utility system.

Changes in environmental laws and regulations affecting NSTAR’s business could increase the Company’s costs and could curtail its activities.

NSTAR and its subsidiaries are subject to a number of environmental laws and regulations that are currently in effect, including those related to the handling, disposal, and treatment of hazardous materials. Changes in compliance requirements or the interpretation by governmental authorities of existing requirements may impose additional costs, all of which could have an adverse impact on NSTAR’s results of operations.

The Company may be required to conduct environmental remediation activities for power generating sites and potentially other unidentified sites.

NSTAR is subject to actual or potential claims and lawsuits involving environmental remediation activities for power generating sites previously owned and other potentially unidentified sites. NSTAR divested all of its regulated generating assets under terms that generally require the buyer to assume all responsibility for past and

13

present environmental harm. Based on NSTAR’s current assessment of its environmental responsibilities, existing legal requirements and regulatory policies, NSTAR does not believe that its known environmental remediation responsibilities will have a material adverse effect on NSTAR’s results of operations, cash flows or financial position. However, discovery of currently unknown conditions at existing sites, failure of current owners to assume responsibility, identification of additional waste sites or changes in environmental regulation, could have a material adverse impact on NSTAR’s results of operations, cash flows or financial position.

NSTAR’s electric and gas operations could face negative impact from terrorism, cyber attacks, sabotage, acts of war, or other catastrophic events.

NSTAR’s electric and natural gas delivery infrastructure facilities and the generation and transmission infrastructure facilities of third parties could be direct targets of terrorism, cyber attacks, sabotage, or acts of war, etc. The costs to repair any damage to operating facilities from destructive events could be substantial. Such actions could also result in political, economic and financial market instability, which could have a material adverse impact on the Company’s operations. While it is not possible to predict the impact of a particular event of this type, the impact that any threat of terrorism, cyber attack, act of war or other catastrophic event might have on the energy industry and on NSTAR’s business in particular could be material.

Our business operations could be disrupted if our information technology systems fail to perform adequately or we are unable to protect the integrity and security of our customers’ information.

NSTAR operates in a highly regulated industry that requires and depends on the continued operation of sophisticated information technology systems and network infrastructure. Systems-related problems could adversely affect our ability to provide electric and gas service to our customers. NSTAR maintains appropriate security measures around these systems and requires its vendors to maintain appropriate security measures; but technology can be vulnerable to failures or unauthorized access. NSTAR’s systems and those of its vendors could fail or be compromised, resulting in disruptions in NSTAR’s ability to deliver energy and provide customer service.

NSTAR and its vendors take measures to protect nonpublic customer information such as personal information, customer payment card and check information pursuant to Federal and state laws. Unauthorized compromises of such information or of NSTAR’s systems, particularly by those with malicious intent, could have a material adverse effect on NSTAR’s ability to perform important business functions. Failure to maintain the security of our customers’ confidential information, or data belonging to us, could result in the deterioration of the confidence that our customers and regulators have in us. This would subject us to potential litigation and liability, and fines and penalties, resulting in a possible material effect on NSTAR’s results of operations, cash flows or financial position.

NSTAR is subject to operational risk that could cause us to incur substantial costs and liabilities.

NSTAR’s business, which involves the transmission and distribution of natural gas and electricity that is used as an energy source by customers, is subject to various operational risks, including incidents that expose the Company to potential claims for property damages or personal injuries beyond the scope of NSTAR’s insurance coverage, and equipment failures that could result in performance below assumed levels. For example, operational performance below established target benchmark levels could cause NSTAR to incur penalties imposed by the DPU, up to a maximum of two and one-half percent of transmission and distribution revenues, under applicable Service Quality Indicators. Violations of standards of performance for emergency preparation and restoration of service for gas and electric customers could also result in DPU imposed penalties up to $20 million for any related series of violations.

Increases in interest rates due to financial market conditions or changes in the Company’s credit ratings, could have an adverse impact on NSTAR’s access to capital markets at favorable rates, or at all, and could otherwise increase NSTAR’s costs of doing business.

NSTAR frequently accesses the capital markets to finance its working capital requirements, capital expenditures and to meet its long-term debt maturity obligations. Increased interest rates, or adverse changes in the Company’s

14

credit ratings or further deterioration in the availability of credit, would increase NSTAR’s cost of borrowing and other costs that could have an adverse impact on the Company’s results of operations and cash flows and ultimately have an adverse impact on the market price of NSTAR’s Common Shares. In addition, an adverse change in the Company’s credit ratings could increase borrowing costs, trigger requirements that the Company obtain additional security for performance, such as a letter of credit, related to its energy procurement agreements. Refer to the accompanying Item 7A,“Quantitative and Qualitative Disclosures About Market Risk,” for a further discussion.

NSTAR’s electric and gas businesses are sensitive to variations in weather and have seasonal variations. In addition, severe natural events and disasters could adversely affect the Company.

Sales of electricity and natural gas to residential and commercial customers are influenced by temperature fluctuations. Significant fluctuations in heating or cooling degree-days could have a material impact on energy sales for any given period. In addition, extremely severe storms, such as hurricanes and ice storms, could cause damage to NSTAR’s facilities that may require additional costs to repair and have a material adverse impact on the Company’s results of operations, cash flows or financial position. To the extent possible, NSTAR’s rate regulated subsidiaries would seek recovery of these costs through the regulatory process.

An economic downturn, increased costs of energy supply and customers’ conservation efforts could adversely affect energy consumption and could adversely affect the Company’s results of operations.

Energy consumption is significantly impacted by the general level of economic activity and cost of energy supply. Economic downturns or periods of high energy supply costs typically lead to reductions in energy consumption and increased conservation measures. These conditions could adversely impact the level of energy sales and result in less demand for energy delivery. A recession or a prolonged lag of a subsequent recovery could have an adverse effect on NSTAR’s results of operations, cash flows or financial position.

The ability of NSTAR to maintain future cash dividends at the level currently paid to shareholders is dependent upon the ability of its subsidiaries to pay dividends to NSTAR.

As a holding company, NSTAR does not have any operating activity and therefore is substantially dependent on dividends from its subsidiaries and from external borrowings at variable rates of interest to provide the cash necessary for repayment of debt obligations, to pay administrative costs, to meet contractual obligations that may not be met by NSTAR’s subsidiaries and to pay common share dividends to NSTAR’s shareholders. Regulatory and other legal restrictions may limit the Company’s ability to transfer funds freely, either to or from its subsidiaries. These laws and regulations may hinder the Company’s ability to access funds that NSTAR may need to make payments on its obligations. As the holding company’s sources of cash are limited to dividends from its subsidiaries and external borrowings, the ability to maintain future cash dividends at the level currently paid to shareholders will be dependent upon cash flows of NSTAR’s subsidiaries.

NSTAR’s subsidiaries do have certain limitations that could impact the payment of dividends to the Holding company. Refer to the“Sources of Additional Capital and Financial Covenant Requirements” section of the accompanying Item 7,“Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

NSTAR’s electric and gas operations may be impacted if generation supply or its transportation or transmission availability is limited or unreliable.

NSTAR’s electric and natural gas delivery businesses are reliant on generation, transportation and transmission facilities that the Company does not own or control. The Company’s ability to provide energy delivery services depends on the operations and facilities of third parties, including the independent system operator, electric generators that supply NSTAR’s customers’ energy requirements and natural gas pipeline operators from which

15

the Company receives delivery of its natural gas supply. Should NSTAR’s ability to receive electric or natural gas supply be disrupted due either to operational issues or to inadequacy of transmission capacity, it could impact the Company’s ability to serve its customers. It could also force NSTAR to secure alternative supply at significantly higher costs.

Financial market performance and other changes may decrease the Company’s pension and postretirement benefit plans’ assets and could require additional funding beyond historic levels.

A sustained decline in the global financial markets may have a material adverse effect on the value of NSTAR’s pension and postretirement benefit plans’ assets. This situation may increase the Company’s benefit plans’ funding requirements.

NSTAR will be subject to various uncertainties and contractual restrictions while the merger with NU is pending that could adversely affect the Company’s financial results.

As discussed above in the accompanying Item 1“Business,” NSTAR is party to a Merger Agreement with NU. Before the merger may be completed, the parties must satisfy all conditions set forth in the Merger Agreement, including obtaining shareholder approval in connection with the proposed merger and receipt of various regulatory approvals.

It is possible that uncertainty about the effect of the merger on employees, suppliers, customers and others may have an adverse effect on NSTAR. These uncertainties may impair NSTAR’s ability to attract, retain and motivate key personnel until the merger is completed and for a period of time thereafter, and could cause suppliers and others that deal with NSTAR to seek to change existing business relationships.

The pursuit of the merger and the preparation for the integration of the companies may place a significant burden on NSTAR’s management and internal resources. Any significant diversion of management attention away from ongoing business and any difficulties encountered in the merger integration process could adversely affect the Company’s financial results.

In addition, the Merger Agreement restricts NSTAR, without NU’s consent, from making certain acquisitions and dispositions and taking other specified actions. Under certain conditions these restrictions may prevent the Company from pursuing certain acquisitions or dispositions and making other changes to NSTAR’s business prior to completion of the merger or termination of the Merger Agreement.

NSTAR may be unable to obtain the approvals required to complete the merger in the anticipated time frame, or at all, or such approvals may contain material restrictions or conditions.

The merger is subject to the approval of various government agencies, including the DPU, PURA, FERC, and the U.S. Department of Justice. Such approvals may impose conditions on the completion, or require changes to the terms of the merger, including restrictions on the business, operations or financial performance of the combined company. These conditions or changes could also delay or increase the cost of the merger or limit the revenues of the combined company.

Failure to complete the merger with NU could negatively impact NSTAR’s future business and financial results.

Satisfying the conditions of the Merger Agreement and completing the merger may take longer than expected and could cost more than NSTAR expects. NSTAR must pay its own incurred costs related to the merger, including legal, accounting and other professional fees. NSTAR cannot make any assurances that it will be able to satisfy all the conditions to the merger or succeed in any litigation brought in connection with the merger. If the merger with NU is not completed, the Company’s financial results, share price and credit ratings may be affected.

16

The Merger Agreement contains certain termination rights for both NSTAR and NU, including the right to terminate the Merger Agreement if the merger is not consummated on or before October 16, 2011. On October 14, 2011, in accordance with certain provisions of the Merger Agreement, as amended, NSTAR and NU exchanged mutual notices extending the Merger Agreement to April 16, 2012, the date after which either party has the option to terminate the Merger Agreement if the conditions precedent to closing have not then been satisfied. The Merger Agreement further provides that, upon termination of the Merger Agreement under specified circumstances, NSTAR or NU may be required to pay to the other a termination fee of $135 million and reimburse the other party for expenses up to $35 million.

If completed, the merger with NU may not achieve its intended results.

NSTAR entered into the Merger Agreement with the expectation that the merger would result in various benefits. Achieving the anticipated benefits of the merger is subject to a number of uncertainties, including whether NSTAR’s businesses can be integrated in an efficient and effective manner. Failure to achieve these anticipated benefits could result in increased costs and decreases in the amount of expected revenues generated by the combined company.

Executive Officers of Registrant

Identification of Executive Officers

Listed below are the executive officers of the Company as of December 31, 2011, each of whom, unless otherwise indicated below, has held the position indicated during the past five years. There are no family relationships between any of the executive officers, and there is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected. Executive officers are elected annually by the Board of Trustees to hold office until their respective successors are elected and qualified, or until earlier resignation or removal.

| | | | | | | | | | | | | | |

Name of Officer | | Position and Business Experience | | Years in

Current

Position | | | Years as

an Officer | | | Age at

December 31, 2011 | |

Thomas J. May | | Chairman, President and Chief Executive Officer and an NSTAR Trustee | | | 17 | | | | 25 | | | | 64 | |

| | | | |

James J. Judge | | Senior Vice President and Chief Financial Officer | | | 16 | | | | 16 | | | | 55 | |

| | | | |

Douglas S. Horan | | Senior Vice President - Strategy, Law and Policy, Secretary and General Counsel | | | 16 | | | | 16 | | | | 62 | |

| | | | |

Joseph R. Nolan, Jr. | | Senior Vice President - Customer & Corporate Relations | | | 11 | | | | 11 | | | | 48 | |

| | | | |

Werner J. Schweiger | | Senior Vice President - Operations | | | 10 | | | | 10 | | | | 52 | |

| | | | |

Christine M. Carmody (a) | | Senior Vice President - Human Resources | | | 4 | | | | 4 | | | | 48 | |

| | | | |

Robert J. Weafer, Jr. | | Vice President, Controller and Chief Accounting Officer | | | 23 | | | | 23 | | | | 64 | |

| (a) | Ms. Carmody was elected Senior Vice President – Human Resources in August 2008. She had served as Vice President of Organizational Effectiveness from July 2006 to August 2008. |

| Item 1B. | Unresolved Staff Comments |

None

NSTAR Electric properties include an integrated system of transmission and distribution lines and substations, an interest in a jointly owned administration office building and other structures such as garages and service centers

17

that are located in eastern Massachusetts. NSTAR’s high-voltage transmission lines are generally located on land either owned or subject to perpetual and exclusive easements in its favor. Its low-voltage distribution lines are located principally on public property under permits granted by municipal and other state authorities.

At December 31, 2011, NSTAR Electric’s primary and secondary distribution and transmission system consisted of 20,775 circuit miles of overhead lines, 12,145 circuit miles of underground lines, 258 substation facilities and approximately 1,183,000 active customer meters.

NSTAR Gas’ principal natural gas properties consist of distribution mains, services and meters necessary to maintain reliable service to customers. In addition, it shares an interest in a jointly owned administration office and service building, and owns three district office buildings and several natural gas receiving and take stations. As of December 31, 2011, the gas system included approximately 3,154 miles of gas distribution lines, approximately 191,350 services and approximately 281,600 customer meters together with the necessary measuring and regulating equipment. In addition, Hopkinton owns a liquefaction and vaporization plant and above ground cryogenic storage tanks. NSTAR Gas and Hopkinton own a satellite vaporization plant and above ground cryogenic storage tanks. Combined, the tanks have an aggregate storage capacity equivalent to 3.5 Bcf of natural gas.

NSTAR Com owns 279 miles of fiber optic network that represents approximately 85,000 fiber miles of network.

In the normal course of its business, NSTAR and its subsidiaries are involved in certain legal matters, including civil litigation, for which it has appropriately recognized legal liabilities. Management has reviewed the range of reasonably possible court-ordered damages, settlement amounts, and related litigation costs (legal liabilities) that could be in excess of amounts recognized and amounts covered by insurance, and determined that the range of reasonably possible legal liabilities would not be material. Based on the information currently available, NSTAR does not believe that it is probable that any such legal liabilities will have a material impact on its consolidated financial position. However, it is reasonably possible that additional legal liabilities that may result from changes in circumstances could have a material impact on its results of operations, financial condition and cash flows.

| Item 4. | Mine Safety Disclosures – Not Applicable |

PART II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

(a) Market Information and (c) Dividends

The NSTAR Common Shares, $1 par value, are listed on the New York Stock Exchange under the symbol “NST.” NSTAR’s Common Shares closing market prices at December 31, 2011 and 2010 were $46.96 and $42.19 per share, respectively.

The NSTAR Common Shares high and low market prices per common share as reported by the New York Stock Exchange composite transaction reporting system and dividends declared per common share for each of the quarters in 2011 and 2010 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2010 | |

| | | Market Prices | | | Dividends

Declared | | | Market Prices | | | Dividends

Declared | |

| | | High | | | Low | | | | High | | | Low | | |

First quarter | | $ | 46.56 | | | $ | 41.07 | | | $ | 0.425 | | | $ | 37.04 | | | $ | 32.53 | | | $ | 0.400 | |

Second quarter | | $ | 47.45 | | | $ | 43.33 | | | $ | 0.425 | | | $ | 37.68 | | | $ | 33.60 | | | $ | 0.400 | |

Third quarter | | $ | 47.00 | | | $ | 38.92 | | | $ | 0.425 | | | $ | 39.84 | | | $ | 34.46 | | | $ | 0.400 | |

Fourth quarter | | $ | 47.40 | | | $ | 40.80 | | | $ | 0.283 | | | $ | 42.94 | | | $ | 38.90 | | | $ | 0.425 | |

18

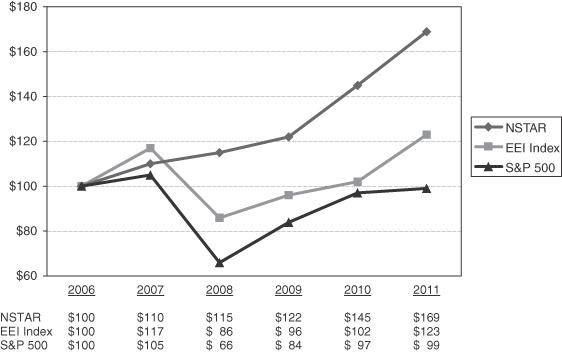

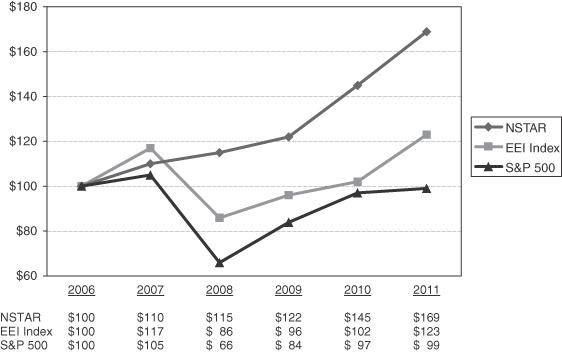

NSTAR paid common share dividends to shareholders of $176.1 million and $168.3 million in 2011 and 2010, respectively. The fourth quarter of 2011 dividend was a pro rata dividend declared to synchronize the dividend payment timing with NU in anticipation of completing the pending merger with NU. This pro rata dividend amount of $0.28332 per common share is a 60 day period equivalent to the most recent quarterly dividend rata of $0.425. NSTAR changed its regular quarterly dividend schedule to end of quarter common dividends payments. Future common dividends, when declared, are expected to be paid on the last business day of March, June, September and December.