VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES |

| | | |

| | | |

| Contents |

| | | |

| | | |

| | | |

| | | |

| Letter to Shareholders | | 2 |

| | | |

| Selected Financial Data | | 3 |

| | | |

| Unaudited Quarterly Financial Data | | 3 |

| | | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. | | 4 |

| | | |

| Consolidated Balance Sheets | | 10 |

| | | |

| Consolidated Statements of Operations | | 11 |

| | | |

Consolidated Statements of Shareholders’ Equity and Comprehensive Income | | 12 |

| | | |

| Consolidated Statements of Cash Flows | | 13 |

| | | |

| Notes to Consolidated Financial Statements | | 14 |

| | | |

Management’s Report on Internal Control over Financial Reporting | | 27 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 27 |

| | | |

| Stock Price and Dividend Information | | 28 |

| | | |

| Corporate Directory | Inside back cover |

1

VILLAGE SUPER M ARKET, INC. AND SUBSIDIARIES

Dear Fellow Shareholders

The supermarket industry, and our customers, faced significant challenges this year. Our customers reacted to the weak economy and high unemployment by spending cautiously. Customers traded down to lower priced items, used more coupons, and bought more items on sale. The deflationary trend that began in the second half of fiscal 2009 continued in fiscal 2010. As a result of these factors, same store sales declined .7% in fiscal 2010.

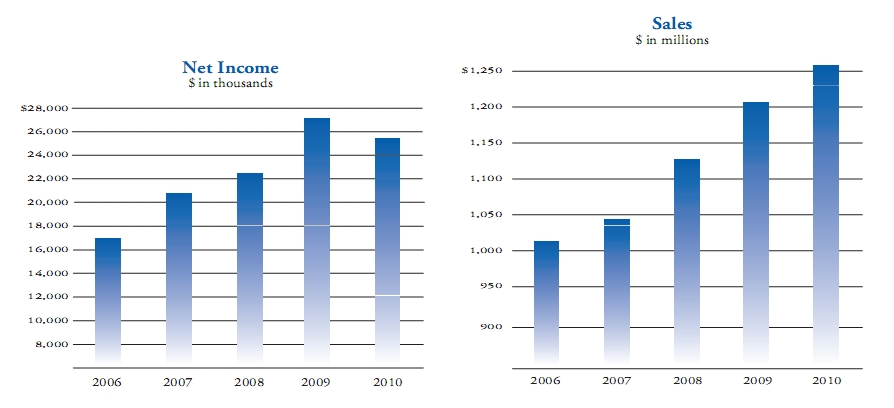

Despite these challenges, we achieved solid results in fiscal 2010. Net income was $25.4 million, a decrease of 7%. Excluding the $1.2 million estimated positive impact of a 53rd week this year and the $.7 million litigation charge last year, net income decreased 13%. This is the second highest net income in our Company’s 73 year history. Sales increased 4.4% to $1.26 billion.

Village spent $20.2 million on capital expenditures in fiscal 2010. On February 21, 2010, we opened a 62,700 sq. ft. replacement store in Washington, NJ. We installed 1,000 solar panels on the roof of the Garwood store, reducing both carbon emissions and energy costs. Village has a high cash position and virtually no debt other than leases. This financial strength provides us the liquidity and flexibility to capitalize on any opportunities these difficult markets may provide us.

We continue to develop new ways to interact with customers to improve the shopping experience. Customers can now save on- line coupons directly to their PricePlus card. ShopRite® introduced an app for smart phones this year enabling customers to browse our circular, create and edit shopping lists, and essentially bring the power of shoprite.com to smart phones.

We continue to create ways to provide more value to customers. ShopRite® began selling a 90 day supply of over 300 generic drugs for $9.99 a year ago. This year we added a 30 day supply of certain generics for $3.99, and free generic diabetes drugs and antibiotics.

The Board increased the dividend again in fiscal 2010, distributing a total of $10.8 million to shareholders. The annualized dividend is currently $1.00 per Class A share and $.65 per Class B share.

While this is a challenging environment, Village’s performance has remained strong. Our 4,900 associates adapted to the difficult environment to continue to execute our priorities: offer a wide variety of high quality products at consistently low prices, provide superior customer service, create unique marketing initiatives, and continually improve our stores.

As always, we thank you for your support.

Chairman of the Board

October 2010

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Selected Financial Data

(Dollars in thousands except per share and square feet data)

| | | July 31, | | | July 25, | | | July 26, | | | July 28, | | | July 29, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| For year | | | | | | | | | | | | | | | |

| Sales | | $ | 1,261,825 | | | $ | 1,208,097 | | | $ | 1,127,762 | | | $ | 1,046,435 | | | $ | 1,016,817 | |

| Net income | | | 25,381 | | | | 27,255 | | | | 22,543 | | | | 20,503 | | | | 16,487 | |

| Net income as a % of sales | | | 2.01 | % | | | 2.26 | % | | | 2.00 | % | | | 1.96 | % | | | 1.62 | % |

Net income per share(1): | | | | | | | | | | | | | | | | | | | | |

| Class A common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 2.28 | | | $ | 2.46 | | | $ | 2.04 | | | $ | 1.91 | | | $ | 1.54 | |

| Diluted | | | 1.88 | | | | 2.02 | | | | 1.67 | | | | 1.56 | | | | 1.26 | |

| Class B common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 1.48 | | | | 1.60 | | | | 1.33 | | | | 1.24 | | | | 1.00 | |

| Diluted | | | 1.47 | | | | 1.59 | | | | 1.33 | | | | 1.22 | | | | .99 | |

| Cash dividends per share | | | | | | | | | | | | | | | | | | | | |

| Class A | | | .970 | | | | .765 | | | | 1.91 | | | | .345 | | | | .202 | |

| Class B | | | .631 | | | | .498 | | | | 1.24 | | | | .224 | | | | .132 | |

At year-end

| Total assets | | $ | 357,129 | | | $ | 338,810 | | | $ | 305,380 | | | $ | 283,123 | | | $ | 269,475 | |

| Long-term debt | | | 41,831 | | | | 32,581 | | | | 27,498 | | | | 21,767 | | | | 27,110 | |

| Working capital | | | 41,201 | | | | 30,856 | | | | 8,871 | | | | 22,359 | | | | 44,096 | |

| Shareholders’ equity | | | 205,775 | | | | 187,398 | | | | 171,031 | | | | 167,565 | | | | 150,505 | |

| Book value per share | | | 15.35 | | | | 14.03 | | | | 12.90 | | | | 12.87 | | | | 11.63 | |

| Other data | |

| Same store sales increase (decrease) | | | (.7 | %) | | | 4.8 | % | | | 2.5 | % | | | 2.9 | % | | | 3.3 | % |

| Total square feet | | | 1,483,000 | | | | 1,462,000 | | | | 1,394,000 | | | | 1,272,000 | | | | 1,272,000 | |

| Average total sq. ft. per store | | | 57,000 | | | | 56,000 | | | | 56,000 | | | | 55,000 | | | | 55,000 | |

| Selling square feet | | | 1,171,000 | | | | 1,155,000 | | | | 1,103,000 | | | | 1,009,000 | | | | 1,009,000 | |

| Sales per average square foot of selling space | | $ | 1,085 | | | $ | 1,070 | | | $ | 1,068 | | | $ | 1,037 | | | $ | 1,008 | |

| Number of stores | | | 26 | | | | 26 | | | | 25 | | | | 23 | | | | 23 | |

| Sales per average number of stores | | $ | 48,532 | | | $ | 47,376 | | | $ | 46,990 | | | $ | 45,497 | | | $ | 44,209 | |

| Capital expenditures | | $ | 20,204 | | | $ | 26,625 | | | $ | 24,898 | | | $ | 15,692 | | | $ | 14,296 | |

Unaudited Quarterly Financial Data

(Dollars in thousands except per share amounts)

| | | First Quarter | | | Second Quarter | | | Third Quarter | | | Fourth Quarter | | | Fiscal Year | |

| 2010 | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 302,784 | | | $ | 315,309 | | | $ | 300,991 | | | $ | 342,741 | | | $ | 1,261,825 | |

| Gross profit | | | 80,568 | | | | 86,156 | | | | 82,413 | | | | 93,788 | | | | 342,925 | |

| Net income | | | 4,542 | | | | 6,737 | | | | 5,205 | | | | 8,897 | | | | 25,381 | |

| Net income per share: | | | | | | | | | | | | | | | | | | | | |

| Class A common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | .41 | | | | .61 | | | | .47 | | | | .80 | | | | 2.28 | |

| Diluted | | | .34 | | | | .50 | | | | .39 | | | | .66 | | | | 1.88 | |

| Class B common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | .27 | | | | .39 | | | | .30 | | | | .52 | | | | 1.48 | |

| Diluted | | | .26 | | | | .39 | | | | .30 | | | | .51 | | | | 1.47 | |

| | | | | | | | | | | | | | | | | | | | | |

| 2009 | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 290,984 | | | $ | 312,714 | | | $ | 293,474 | | | $ | 310,925 | | | $ | 1,208,097 | |

| Gross profit | | | 79,471 | | | | 85,061 | | | | 80,070 | | | | 85,943 | | | | 330,545 | |

| Net income | | | 6,367 | | | | 7,956 | | | | 6,252 | | | | 6,680 | | | | 27,255 | |

Net income per share(1): | | | | | | | | | | | | | | | | | | | | |

| Class A common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | .58 | | | | .72 | | | | .56 | | | | .60 | | | | 2.46 | |

| Diluted | | | .47 | | | | .59 | | | | .46 | | | | .49 | | | | 2.02 | |

| Class B common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | .38 | | | | .47 | | | | .37 | | | | .39 | | | | 1.60 | |

| Diluted | | | .37 | | | | .46 | | | | .36 | | | | .39 | | | | 1.59 | |

Fiscal 2010 contains 53 weeks, with the additional week included in the fourth quarter. All other fiscal years contain 52 weeks.

(1) Net income per share amounts for prior periods have been revised to reflect the adoption of a new accounting standard requiring share-based awards containing non-forfeitable rights to dividends be treated as participating securities. See note 1 to the consolidated financial statements.

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in thousands except per share and per square foot data)

OVERVIEW

Village Super Market, Inc. (the “Company” or “Village”) operates a chain of 26 ShopRite supermarkets in New Jersey and northeastern Pennsylvania. Village opened a replacement store in Washington, NJ on February 21, 2010. Village is the second largest member of Wakefern Food Corporation (“Wakefern”), the nation’s largest retailer-owned food cooperative and owner of the ShopRite name. This ownership interest in Wakefern provides Village many of the economies of scale in purchasing, distribution, advanced retail technology and advertising associated with larger chains .

The Company’s stores, five of which are owned, average 57,000 total square feet. Larger store sizes enable Village to offer the specialty departments that customers desire for one-stop shopping, including pharmacies, natural and organic departments, ethnic and international foods, and home meal replacement. During fiscal 2010, sales per store were $48,532 and sales per square foot of selling space were $1,085. Management believes these figures are among the highest in the supermarket industry.

The supermarket industry is highly competitive. The Company competes directly with multiple retail formats, including national, regional and local supermarket chains as well as warehouse clubs, supercenters, drug stores, discount general merchandise stores, fast food chains, dollar stores and convenience stores. Village competes by using low pricing, superior customer service, and a broad range of consistently available quality products, including ShopRite private labeled products. The ShopRite Price Plus card and the co-branded ShopRite credit card also strengthen customer loyalty.

We consider a variety of indicators to evaluate our performance, such as same store sales, percentage of total sales by department (mix); shrink; departmental gross profit percentage; sales per labor hour; and hourly labor rates.

During fiscal 2010, the supermarket industry was impacted by changing consumer behavior due to the weak economy and high unemployment. Consumers are increasingly cooking meals at home, but spending cautiously by trading down to lower priced items, including private label, and concentrating their buying on sale items. The deflationary trend in food prices that began during the second half of fiscal 2009 continued in fiscal 2010. As a result of these trends, same store sales, excluding the 53rd week, declined .7% in fiscal 2010. This com pares to a same store sales increase in fiscal 2009 of 4.8%.

The Company’s leasehold interest in the old Washington store had been the subject of litigation related to the lease-end date, rent amounts and other matters. On July 30, 2009, the Company settled all litigation with the landlord and purchased the land and building for $3,100. During the fourth quarter of fiscal 2009, the Company recorded a pre-tax charge of $1,200 related to this litigation. This charge was based on the consideration paid in excess of the fair value of the property. In addition to settling the litigation, the purchase of the old Washington store property eliminated any potential time period between the closing of the old Washingto n store and the opening of the replacement store. The property is currently being marketed for sale.

The Company utilizes a 52 - 53 week fiscal year, ending on the last Saturday in the month of July. Fiscal 2010 contains 53 weeks. The inclusion of the 53rd week in fiscal 2010 had an estimated positive impact on net income of $1,200. Fiscal 2009 and 2008 contain 52 weeks.

RESULTS OF OPERATIONS

The following table sets forth the components of the Consolidated Statements of Operations of the Company as a percentage of sales:

| | | July 31, 2010 | | | July 25, 2009 | | | July 26, 2008 | |

| Sales | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % |

| Cost of sales | | | 72.82 | | | | 72.64 | | | | 72.94 | |

| Gross profit | | | 27.18 | | | | 27.36 | | | | 27.06 | |

| Operating and administrative expense | | | 22.25 | | | | 22.15 | | | | 22.41 | |

| Depreciation and amortization | | | 1.34 | | | | 1.27 | | | | 1.22 | |

| Operating income | | | 3.59 | | | | 3.94 | | | | 3.43 | |

| Interest expense | | | (.29 | ) | | | (.25 | ) | | | (.26 | ) |

| Interest income | | | .16 | | | | .17 | | | | .27 | |

| Income before income taxes | | | 3.46 | | | | 3.86 | | | | 3.44 | |

| Income taxes | | | 1.45 | | | | 1.60 | | | | 1.44 | |

| Net income | | | 2.01 | % | | | 2.26 | % | | | 2.00 | % |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

SALES

Sales were $1,261,825 in fiscal 2010, an increase of $53,728, or 4.4% from the prior year. Sales increased due to opening of the Marmora, NJ store on May 31, 2009 and the opening of the Washington, NJ replacement store on February 21, 2010. In addition, sales increased approximately $21,000, or 1.7%, due to fiscal 2010 containing 53 weeks. Same store sales, excluding the impact of the 53rd week, declined .7%. Same store sales declined due to cannibalization from the opening of the Marmora store and reduced sales in three stores due to competitive store openings. In addition, sales were impacted in fiscal 2010 by deflatio n and changing consumer behavior due to economic weakness, which has resulted in increased coupon usage, sale item penetration and trading down. Same store sales in the fourth quarter of fiscal 2010, excluding the 53rd week, were flat. The Company expects same store sales, excluding the impact of the 53rd week, for fiscal 2011 to range from 0% to 2% as we expect the deflationary trend to end. New stores and replacement stores are included in same store sales in the quarter after the store has been in operation for four full quarters. Store renovations are included in same store sales immediately.

Sales were $1,208,097 in fiscal 2009, an increase of $80,335, or 7.1% from the prior year. Sales increased primarily due to a same store sales increase of 4.8%, a full year’s operations of the Galloway, NJ and Franklin, NJ stores, which opened on October 3, 2007 and November 7, 2007, respectively, and the opening of a new store in Marmora on May 31, 2009. Same store sales increased 4.8% in fiscal 2009 due to higher sales at the Galloway and Franklin stores after their inclusion in same stores sales, and improved transaction counts at most stores. Inflation in the second half of fiscal 2009 was lower than inflation in fiscal 2008 and the first half of fiscal 2009.

GROSS PROFIT

Gross profit as a percentage of sales decreased .18% in fiscal 2010 compared to the prior year primarily due to decreased departmental gross margin percentages (.22%), higher promotional spending (.14%) and increased warehouse assessment charges from Wakefern (.07%). These decreases were partially offset by higher patronage dividends (.12%), a LIFO benefit in fiscal 2010 compared to a charge in 2009 (.11%) and improved product mix (.04%).

Gross profit as a percentage of sales increased .30% in fiscal 2009 compared to the prior year, principally due to improved departmental gross margin percentages, as changes in product mix, promotional spending, warehouse assessment charges and LIFO charges had minimal impact on gross profit as a percentage of sales.

OPERATING AND ADMINISTRATIVE EXPENSE

Operating and administrative expense increased .10% as a percentage of sales in fiscal 2010 compared to the prior year primarily due to increased fringe benefit (.18%) and snow removal (.04%) costs, and the loss of operating leverage from the .7% same store sales decline in the current year. These increases were partially offset by the prior year including a charge (.10%) for litigation related to the old Washington store and leverage provided by the additional sales week in fiscal 2010.

Operating and administrative expense decreased .26% as a percentage of sales in fiscal 2009 compared to the prior year due to reduced payroll costs (.42%) and other operating leverage resulting from the 4.8% same store sales increase. These decreases were partially offset by a charge (.10%) for litigation related to the current Washington store in fiscal 2009 and the prior year including refunds of property and liability insurance premiums (.07%).

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expense was $16,900, $15,319 and $13,713 in fiscal 2010, 2009 and 2008, respectively. Depreciation and amortization expense increased in fiscal 2010 and 2009 compared to the prior years due to depreciation related to fixed asset additions, including the new stores.

INTEREST EXPENSE

Interest expense was $3,660, $3,016 and $2,986 in fiscal 2010, 2009 and 2008, respectively. Interest expense increased in fiscal 2010 and 2009 compared to the prior years due to interest on the Marmora store financing lease, partially offset by lower interest expense due to payments on loans.

INTEREST INCOME

Interest income was $2,020, $2,064 and $3,030 in fiscal 2010, 2009 and 2008, respectively. Interest expense was similar in fiscal 2010 compared to fiscal 2009 as amounts invested and interest rates were comparable. Interest income declined in fiscal 2009 due to lower interest rates received.

INCOME TAXES

The Company’s effective income tax rate was 41.8%, 41.5% and 41.9% in fiscal 2010, 2009 and 2008, respectively.

CRITICAL ACCOUNTING POLICIES

Critical accounting policies are those accounting policies that management believes are important to the portrayal of the Company’s financial condition and results of operations. These policies require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

IMPAIRMENT

The Company reviews the carrying values of its long-lived assets, such as property, equipment and fixtures for possible impairment whenever events or changes in circumstances indicate that the carrying amount of assets may not be recoverable. Such review analyzes the undiscounted estimated future cash flows from asset groups at the store level to determine if the carrying value of such assets are recoverable from their respective cash flows. If an impairment is indicated, it is measured by comparing the fair value of the long-lived asset groups held for use to their carrying value.

Goodwill is tested for impairment at the end of each fiscal year, or more frequently if circumstances dictate. Since the Company’s stock is not widely traded, management utilizes valuation techniques, such as earnings multiples, in addition to the Company’s market capitalization to assess goodwill for impairment. Calculating the fair value of a reporting unit requires the use of estimates. Management believes the fair value of Village’s one reporting unit exceeds its carrying value at July 31, 2010. Should the Company’s carrying value of its one reporting unit exceed its fair value, the amount of any resulting goodw ill impairment may be material to the Company’s financial osition and results of operations.5

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

PATRONAGE DIVIDENDS

As a stockholder of Wakefern, Village earns a share of Wakefern’s earnings, which are distributed as a “patronage dividend” (see Note 3). This dividend is based on a distribution of substantially all of Wakefern’s operating profits for its fiscal year (which ends September 30) in proportion to the dollar volume of purchases by each member from Wakefern during that fiscal year. Patronage dividends are recorded as a reduction of cost of sales as merchandise is sold. Village accrues estimated patronage dividends due from Wakefern quarterly based on an estimate of the annual Wakefern patronage dividend and an estimate of Village’s share of this annual dividend based on Village’s estimated proportion al share of the dollar volume of business transacted with Wakefern that year. The amount of patronage dividends receivable based on these estimates were $8,758 and $7,446 at July 31, 2010 and July 25, 2009, respectively.

PENSION PLANS

The determination of the Company’s obligation and expense for Company-sponsored pension plans is dependent, in part, on Village’s selection of assumptions used by actuaries in calculating those amounts. These assumptions are described in Note 8 and include, among others, the discount rate, the expected long-term rate of return on plan assets and the rate of increase in compensation costs. Actual results that differ from the Company’s assumptions are accumulated and amortized over future periods and, therefore, generally affect recognized expense in future periods. While management believes that its assumptions are appropriate, significant differences in actual experience or significant changes in the Company’s assumptions may materially affect cash flows, pension obligations and future expense.

The objective of the discount rate assumption is to reflect the rate at which the Company’s pension obligations could be effectively settled based on the expected timing and amounts of benefits payable to participants under the plans. Our methodology for selecting the discount rate as of July 31, 2010 was to match the plans cash flows to that of a yield curve on high- quality fixed-income investments. Based on this method, we utilized a weighted-average discount rate of 5.19% at July 31, 2010 compared to 5.87% at July 25, 2009. The 68 basis point dec rease in the discount rate, and a change in the mortality table utilized, increased the projected benefit obligation at July 31, 2010 by approximately $2,429. Village evaluated the expected long-term rate of return on plan assets of 7.5% and the expected increase in compensation costs of 4 to 4.5% and concluded no changes in these assumptions were necessary in estimating pension plan obligations and expense.

Sensitivity to changes in the major assumptions used in the calculation of the Company’s pension plans is as follows:

| | | | Projected benefit | | |

| | Percentage | | obligation | | Expense |

| | point change | | decrease (increase) | | decrease (increase) |

| Discount rate | +/- 1.0% | | $3,867 ($4,696) | | $ 93 ($ 110) |

| Expected return on assets | +/- 1.0% | | — | | $ 229 ($ 229) |

Village contributed $3,045 and $3,080 in fiscal 2010 and 2009, respectively, to these Company-sponsored pension plans. Village expects to contribute $3,000 in fiscal 2011 to these plans. The 2010, 2009 and expected 2011 contributions are substantially all voluntary contributions.

SHARE-BASED EMPLOYEE COMPENSATION

All share-based payments to employees are recognized in the financial statements as compensation expense based on the fair market value on the date of grant. Village determines the fair market value of stock option awards using the Black-Scholes option pricing model. This option pricing model incorporates certain assumptions, such as a risk-free interest rate, expected volatility, expected dividend yield and expected life of options, in order to arrive at a fair value estimate.

UNCERTAIN TAX POSITIONS

The Company is subject to periodic audits by various taxing authorities. These audits may challenge certain of the Company’s tax positions such as the timing and amount of deductions and the allocation of income to various tax jurisdictions. Accounting for these uncertain tax positions requires significant management judgment. Actual results could materially differ from these estimates and could significantly affect the effective tax rate and cash flows in future years.

LIQUIDITY and CAPITAL RESOURCES

CASH FLOWS

Net cash provided by operating activities was $35,313 in fiscal 2010 compared to $47,863 in fiscal 2009. This decrease is primarily attributable to a decrease in payables in fiscal 2010 compared to an increase in payables in fiscal 2009. The changes in payables balances outstanding were due to differences in the timing of payments.

During fiscal 2010, Village used cash to fund capital expenditures of $20,204, dividends of $10,820 and debt payments of $5,448. Capital expenditures include the completion of construction and equipment for the replacement store in Washington, installation of a solar energy system at the Garwood store, and several small remodels. Debt payments include the final installment of $4,286 on Village’s unsecured Senior Notes.

Net cash provided by operating activities was $47,863 in fiscal 2009 compared to $45,339 in fiscal 2008. This increase is primarily attributable to improved net income and higher depreciation in fiscal 2009 and a smaller increase in inventories in fiscal 2009 than in fiscal 2008. These improvements were partially offset by a smaller increase in payables in fiscal 2009 than in fiscal 2008. Inventories increased less in fiscal 2009 than in fiscal 2008 due to the addition of only one new store in fiscal 2009 compared to two new stores in fiscal 2008. The changes in payables balances outstanding are due to differences in the timing of payments.

During fiscal 2009, Village used cash to fund capital expenditures of $26,625, dividends of $8,471 and debt payments of $5,618. Capital expenditures consisted primarily of construction and equipment for the new store in Marmora, NJ, which opened May 31, 2009, and construction of the replacement store in Washington, NJ. Debt payments made include the sixth installment of $4,286 on Village’s unsecured Senior Notes.6

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

LIQUIDITY and DEBT

Working capital was $41,201, $30,856 and $8,871 at July 31, 2010, July 25, 2009 and July 26, 2008, respectively. Working capital ratios at the same dates were 1.49, 1.33 and 1.10 to one, respectively. The increased working capital in fiscal 2010 is primarily due to a reduction in short term notes payable and accounts payable. The Company’s working capital needs are reduced since inventory is generally sold before payments to Wakefern and other suppliers are due.

Village has budgeted approximately $12,000 for capital expenditures in fiscal 2011. Planned expenditures include the purchase of land for future development and several small remodels. The Company’s primary sources of liquidity in fiscal 2011 are expected to be cash and cash equivalents on hand at July 31, 2010 and operating cash flow generated in fiscal 2011.

At July 31, 2010, the Company had a $18,204 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 30, 2011. On December 8, 2009, a $15,822 note receivable from Wakefern matured and is currently invested in overnight deposits at Wakefern.

On December 19, 2008, Village amended its unsecured revolving credit agreement, which would have expired on September 16, 2009. The amended agreement increased the maximum amount available for borrowing to $25,000 from $20,000. This loan agreement expires on December 31, 2011 with two one-year extensions available if exercised by both parties. Other terms of the amended revolving loan agreement, including covenants, are similar to the previous agreement. The revolving credit line can be used for general corporate purposes. Indebtedness under this agreement bears interest at the prime rate, or at the Eurodollar rate, at the Company’s option, plus applicable margins based on the Company’s fixed charge coverage ratio. There were no amounts outstanding at July 31, 2010 or July 25, 2009 under this facility.

The revolving loan agreement contains covenants that, among other conditions, require a maximum liabilities to tangible net worth ratio, a minimum fixed charge coverage ratio and a positive net income. At July 31, 2010, the Company was in compliance with all terms and covenants of the revolving loan agreement. Under the above covenants, Village had approximately $118,000 of net worth available at July 31, 2010 for the payment of dividends.

During fiscal 2010, Village paid cash dividends of $10,820. Dividends in fiscal 2010 consist of $.97 per Class A common share and $.631 per Class B common share.

During fiscal 2009, Village paid cash dividends of $8,471. Dividends in fiscal 2009 consist of $.765 per Class A common share and $.498 per Class B common share.

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The table below presents significant contractual obligations of the Company at July 31, 2010:

| | | Payments due by fiscal period | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | Thereafter | | | Total | |

| Capital and financing leases (2) | | $ | 4,025 | | | $ | 4,025 | | | $ | 4,025 | | | $ | 4,285 | | | $ | 4,475 | | | $ | 92,946 | | | $ | 113,781 | |

| Operating leases (2) | | | 8,788 | | | | 7,601 | | | | 6,505 | | | | 5,957 | | | | 5,658 | | | | 50,831 | | | | 85,340 | |

| Notes payable to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Related party | | | 341 | | | | 347 | | | | 365 | | | | 365 | | | | 264 | | | | 139 | | | | 1,821 | |

| | | $ | 13,154 | | | $ | 11,973 | | | $ | 10,895 | | | $ | 10,607 | | | $ | 10,397 | | | $ | 143,916 | | | $ | 200,942 | |

| (1) | In addition, the Company is obligated to purchase 85% of its primary merchandise requirements from Wakefern (see Note 3). |

| (2) | The above amounts for capital, financing and operating leases include interest, but do not include certain obligations under these leases for other charges. These charges consisted of the following in fiscal 2010: Real estate taxes - $3,892; common area maintenance -$2,256; insurance - $218; and contingent rentals - $932. |

| (3) | Pension plan funding requirements are excluded from the above table as estimated contribution amounts for future years are uncertain. Required future contributions will be determined by, among other factors, actual investment performance of plan assets, interest rates required to be used to calculate pension obligations, and changes in legislation. The Company expects to contribute $3,000 in fiscal 2011 to fund Company-sponsored defined benefit pension plans compared to actual contributions of $3,045 in fiscal 2010. The table also excludes contributions under various multi-employer pension plans, which totaled $5,895 in fiscal 2010. |

| (4) | The amount of unrecognized tax benefits of $6,662 at July 31, 2010 has been excluded from this table because a reasonable estimate of the timing of future tax settlements cannot be determined. |

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

RECENTLY ISSUED ACCOUNTING STANDARDS

In June 2009, new accounting standards were issued which change how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance. These standards are effective beginning August 1, 2010 and earlier application is prohibited. We are currently evaluating the impact these standards may have on our consolidated financial position and results of operations.

RECENTLY ADOPTED ACCOUNTING STANDARDS

Effective July 26, 2009, the Company adopted a new accounting standard defining fair value and establishing a framework for measurement of fair value for non-financial assets and liabilities that are not remeasured at fair value on a recurring basis. This includes fair value calculated in impairment assessments of goodwill and other long-lived assets. The adoption had no impact on the Company’s consolidated financial position or results of operations

On July 26, 2009, the Company adopted a new accounting standard requiring unvested share-based payment awards that contain nonforfeitable rights to dividends be treated as participating securities and therefore included in computing net income per share using the two-class method. All prior period net income per share data has been adjusted to reflect the new standard.

OUTLOOK

This annual report contains certain forward-looking statements about Village’s future performance. These statements are based on management’s assumptions and beliefs in light of information currently available. Such statements relate to, for example: economic conditions; expected pension plan contributions; projected capital expenditures; cash flow requirements; inflation expectations; and legal matters; and are indicated by words such as “will,” “expect,” “should,” “intend,” “anticipates”, “believes” and similar words or phrases. The Company cautions the reader that there is no assurance that actual results or business conditions will not differ materially from the results expressed, suggested or implied by such forward-looking statements. The Company undertakes no obligation to update forward- looking statements to reflect developments or information obtained after the date hereof.

| ● | We expect same store sales to range from 0% to 2% in fiscal 2011, excluding the impact of the 53rd week that occurred in fiscal 2010. |

| During fiscal 2010, the supermarket industry was impacted by changing consumer behavior due to the weak economy and high unemployment. Consumers are increasingly cooking meals at home, but spending cautiously by trading down to lower priced items, including private label, and concentrating their buying on sale items. Management expects these trends to continue at least through the first half of fiscal 2011. |

| We expect slight retail price inflation in fiscal 2011. Fiscal 2010 was deflationary. |

| We have budgeted $12,000 for capital expenditures in fiscal 2011, which includes the purchase of land for future development and several small remodels. |

| We believe cash flow from operations and other sources of liquidity will be adequate to meet anticipated requirements for working capital, capital expenditures and debt payments for the foreseeable future. |

| ● | We expect our effective income tax rate in fiscal 2011 to be 41-42%. |

| We expect operating expenses will be affected by increased costs in certain areas, such as medical and pension costs, and credit card fees. |

Various uncertainties and other factors could cause actual results to differ from the forward-looking statements contained in this report. These include:

| The supermarket business is highly competitive and characterized by narrow profit margins. Results of operations may be materially adversely impacted by competitive pricing and promotional programs, industry consolidation and competitor store openings. Village competes with national and regional supermarkets, local supermarkets, warehouse club stores, supercenters, drug stores, convenience stores, dollar stores, discount merchandisers, restaurants and other local retailers. Some of these competitors have greater financial resources, lower merchandise acquisition cost and lower operating expenses than we do. |

| The Company’s stores are concentrated in New Jersey, with one store in northeastern Pennsylvania. We are vulnerable to economic downturns in New Jersey in addition to those that may affect the country as a whole. Economic conditions such as inflation, deflation, interest rates, energy costs and unemployment rates may adversely affect our sales and profits. |

| Village purchases substantially all of its merchandise from Wakefern. In addition, Wakefern provides the Company with support services in numerous areas including supplies, advertising, liability and property insurance, technology support and other store services. Further, Village receives patronage dividends and other product incentives from Wakefern. Any material change in Wakefern’s method of operation or a termination or material modification of Village’s relationship with Wakefern could have an adverse impact on the conduct of the Company’s business and could involve additional expense for Village. The failure of any Wakefern member to fulfill its obligations to Wakefern or a member’s insolvency or withdrawal from Wakefern could result in increased costs to the Company. Additionally, an adverse change in Wakefern’s results of operations co uld have an adverse effect on Village’s results of operations. |

| Approximately 93% of our employees are covered by collective bargaining agreements. Any work stoppages could have an adverse impact on our financial results. If we are unable to control health care and pension costs provided for in the collective bargaining agreements, we may experience increased operating costs. |

| Village could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations. |

8

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

| ● | We believe a number of the multi-employer plans to which we contribute are underfunded. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of our collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under very complex actuarial and allocation rules. The failure of a withdrawing employer to fund these obligations can impact remaining employers. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations and the actual return on assets held in the plans, among other factors. |

| ● | Our effective tax rate may be impacted by the results of tax examinations and changes in tax laws. |

RELATED PARTY TRANSACTIONS

The Company holds an investment in Wakefern, its principal supplier. Village purchases substantially all of its merchandise from Wakefern in accordance with the Wakefern Stockholder Agreement. As part of this agreement, Village is required to purchase certain amounts of Wakefern common stock. At July 31, 2010, the Company’s indebtedness to Wakefern for the outstanding amount of this stock subscription was $1,821. The maximum per store investment, which is currently $750, increased by $25 in both fiscal 2010 and 2009, resulting in additional investments of $590 and $550, respectively. Wakefern distributes as a “patronage dividend” to each member a share of its earnings in proportion to the dollar volume of purchas es by the member from Wakefern during the year. Wakefern provides the Company with support services in numerous areas including advertising, supplies, liability and property insurance, technology support and other store services. Additional information is provided in Note 3 to the consolidated financial statements.

At July 31, 2010, the Company had a $18,204 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 30, 2011. On December 8, 2009, a $15,822 note receivable from Wakefern matured and is currently invested in overnight deposits at Wakefern.

At July 31, 2010, Village had demand deposits invested at Wakefern in the amount of $51,174. These deposits earn overnight money market rates.

On August 11, 2007, the Company acquired the fixtures and lease of a store location in Galloway Township, NJ from Wakefern for $3,500.

The Company subleases the Galloway and Vineland stores from Wakefern at combined current annual rents of $1,227. Both leases contain normal periodic rent increases and options to extend the lease.

Village leases a supermarket from a realty firm partly owned by officers of Village. The Company paid rent to this related party of $595 in fiscal years 2010, 2009 and 2008. This lease expires in fiscal 2016 with options to extend at increasing annual rents.

The Company has ownership interests in three real estate partnerships. Village paid aggregate rents to two of these partnerships for leased stores of approximately $781, $750 and $727 in fiscal years 2010, 2009 and 2008, respectively.

IMPACT OF INFLATION AND CHANGING PRICES

Although the Company cannot accurately determine the precise effect of inflation or deflation on its operations, it estimates that product prices overall experienced deflation in fiscal 2010 compared to inflation in fiscal 2009 and 2008. The Company recorded a pre-tax LIFO benefit of $418 in fiscal 2010 compared to a pre-tax LIFO charge of $964 and $742 in fiscal 2009 and 2008, respectively. The Company calculates LIFO based on CPI indices published by the Department of Labor, which indicated weighted- average CPI changes of (1.3%), 3.3%, and 2.7% in fiscal 2010, 2009 and 2008, respectively.

MARKET RISK

At July 31, 2010, the Company had demand deposits of $51,174 at Wakefern earning interest at overnight money market rates, which are exposed to the impact of interest rate changes.

At July 31, 2010 the Company had a $18,204 15-month note receivable due from Wakefern earning a fixed rate of 7%. This note is automatically extended for additional, recurring 90-day periods, unless, not later than one year prior to the due date, the Company notifies Wakefern requesting payment on the due date. This note currently is scheduled to mature on August 30, 2011.

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands)

| | | July 31, | | | July 25, | |

| | | 2010 | | | 2009 | |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | | $ | 69,043 | | | $ | 54,966 | |

| Merchandise inventories | | | 36,256 | | | | 34,273 | |

| Patronage dividend receivable | | | 8,758 | | | | 7,446 | |

| Note receivable from Wakefern | | | — | | | | 15,684 | |

| Other current assets | | | 11,825 | | | | 12,189 | |

| | | | | | | | | |

| Total current assets | | | 125,882 | | | | 124,558 | |

| | | | | | | | | |

| Note receivable from Wakefern | | | 18,204 | | | | 16,983 | |

| Property, equipment and fixtures, net | | | 175,286 | | | | 162,261 | |

| Investment in Wakefern | | | 20,263 | | | | 19,673 | |

| Goodwill | | | 10,605 | | | | 10,605 | |

| Other assets | | | 6,889 | | | | 4,730 | |

| | | | | | | | | |

| | | $ | 357,129 | | | $ | 338,810 | |

| LIABILITIES and SHAREHOLDERS’ EQUITY | | | | | | |

| Current Liabilities | | | | | | | | |

| Notes payable | | $ | — | | | $ | 4,286 | |

| Capital and financing lease obligations | | | 13 | | | | 269 | |

| Notes payable to Wakefern | | | 341 | | | | 269 | |

| Accounts payable to Wakefern | | | 47,088 | �� | | | 53,487 | |

| Accounts payable and accrued expenses | | | 12,609 | | | | 14,558 | |

| Accrued wages and benefits | | | 11,825 | | | | 11,481 | |

| Income taxes payable | | | 12,805 | | | | 9,352 | |

| | | | | | | | | |

| Total current liabilities | | | 84,681 | | | | 93,702 | |

| | | | | | | | | |

| Long-term Debt | | | | | | | | |

| Capital and financing lease obligations | | | 40,351 | | | | 30,752 | |

| Notes payable to Wakefern | | | 1,480 | | | | 1,829 | |

| | | | | | | | | |

| Total long-term debt | | | 41,831 | | | | 32,581 | |

| | | | | | | | | |

| Deferred income taxes | | | 1,372 | | | | 2,397 | |

| Pension liabilities | | | 18,299 | | | | 17,315 | |

| Other liabilities | | | 5,171 | | | | 5,417 | |

| | | | | | | | | |

| Commitments and Contingencies (Notes 3, 4, 5, 6 and 9) | | | | | | | | |

| | | | | | | | | |

| Shareholders’ Equity | | | | | | | | |

| Preferred stock, no par value: | | | | | | | | |

| Authorized 10,000 shares, none issued | | | — | | | | — | |

| Class A common stock, no par value: | | | | | | | | |

| Authorized 20,000 shares; issued 7,541 shares at July 31, 2010 and 7,538 shares at July 25, 2009 | | | 32,434 | | | | 28,982 | |

| Class B common stock, no par value: | | | | | | | | |

| Authorized 20,000 shares; issued and outstanding 6,376 shares | | | 1,035 | | | | 1,035 | |

| Retained earnings | | | 185,790 | | | | 171,229 | |

| Accumulated other comprehensive loss | | | (10,421 | ) | | | (10,535 | ) |

| Less treasury stock, Class A, at cost (513 shares | | | | | | | | |

| at July 31, 2010 and 555 shares at July 25, 2009) | | | (3,063 | ) | | | (3,313 | ) |

| | | | | | | | | |

| Total shareholders’ equity | | | 205,775 | | | | 187,398 | |

| | | | | | | | | |

| | | $ | 357,129 | | | $ | 338,810 | |

See notes to consolidated financial statements.

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(In thousands, except per share amounts)

| | | July 31, 2010 | | | Years ended July 25, 2009 | | | July 26, 2008 | |

| | | | | | | | | | | | | |

| Sales | | $ | 1,261,825 | | | $ | 1,208,097 | | | $ | 1,127,762 | |

| Cost of sales | | | 918,900 | | | | 877,552 | | | | 822,564 | |

| | | | | | | | | | | | | |

| Gross profit | | | 342,925 | | | | 330,545 | | | | 305,198 | |

| | | | | | | | | | | | | |

| Operating and administrative expense | | | 280,767 | | | | 267,667 | | | | 252,739 | |

| Depreciation and amortization | | | 16,900 | | | | 15,319 | | | | 13,713 | |

| | | | | | | | | | | | | |

| Operating income | | | 45,258 | | | | 47,559 | | | | 38,746 | |

| | | | | | | | | | | | | |

| Interest expense | | | (3,660 | ) | | | (3,016 | ) | | | (2,986 | ) |

| Interest income | | | 2,020 | | | | 2,064 | | | | 3,030 | |

| | | | | | | | | | | | | |

| Income before income taxes | | | 43,618 | | | | 46,607 | | | | 38,790 | |

| Income taxes | | | 18,237 | | | | 19,352 | | | | 16,247 | |

| | | | | | | | | | | | | |

| Net income | | $ | 25,381 | | | $ | 27,255 | | | $ | 22,543 | |

| | | | | | | | | | | | | |

Net income per share: Class A common stock: | | | | | | | | | | | | |

| Basic | | $ | 2.28 | | | $ | 2.46 | | | $ | 2.04 | |

| Diluted | | $ | 1.88 | | | $ | 2.02 | | | $ | 1.67 | |

| | | | | | | | | | | | | |

| Class B common stock: | | | | | | | | | | | | |

| Basic | | $ | 1.48 | | | $ | 1.60 | | | $ | 1.33 | |

| Diluted | | $ | 1.47 | | | $ | 1.59 | | | $ | 1.33 | |

See notes to consolidated financial state ments.

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity and Comprehensive Income

(in thousands)

Years ended July 31, 2010, July 25, 2009 and July 26, 2008

| | | | | | | | | | | | | | | | | | Accumulated | | | | | | | | | | |

| | | Class A | | | Class B | | | | | | other | | | Treasury stock | | | Total | |

| | | Common stock | | | Common stock | | | Retained | | | comprehensive | | | Class A | | | shareholders’ | |

| | | Shares issued | | | Amount | | | Shares issued | | | Amount | | | earnings | | | gain (loss) | | | Shares | | | Amount | | | equity | |

| Balance, July 28, 2007 | | | 7,272 | | | $ | 22,649 | | | | 6,376 | | | $ | 1,035 | | | $ | 150,596 | | | $ | (4,526 | ) | | | 624 | | | $ | (2,189 | ) | | $ | 167,565 | |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 22,543 | | | | — | | | | — | | | | — | | | | 22,543 | |

Recognition of pension actuarial loss, net of tax of $188 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | 283 | | | | — | | | | — | | | | 283 | |

Reduction of pension liability, net of tax of $115 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | 172 | | | | — | | | | — | | | | 172 | |

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 22,998 | |

| Uncertain tax position adjustment | | | — | | | | — | | | | — | | | | — | | | | 399 | | | | — | | | | — | | | | — | | | | 399 | |

| Dividends | | | — | | | | — | | | | — | | | | — | | | | (21,093 | ) | | | — | | | | — | | | | — | | | | (21,093 | ) |

| Exercise of stock options | | | — | | | | 236 | | | | — | | | | — | | | | — | | | | — | | | | (62 | ) | | | 352 | | | | 588 | |

| Treasury stock purchases | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 80 | | | | (1,999 | ) | | | (1,999 | ) |

Share-based compensation expense | | | 250 | | | | 1,725 | | | | — | | | | — | | | | –– | | | | — | | | | — | | | | — | | | | 1,725 | |

Excess tax benefits from exercise of stock options and restricted share vesting | | | — | | | | 848 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 848 | |

| Balance, July 26, 2008 | | | 7,522 | | | | 25,458 | | | | 6,376 | | | | 1,035 | | | | 152,445 | | | | (4,071 | ) | | | 642 | | | | (3,836 | ) | | | 171,031 | |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 27,255 | | | | — | | | | — | | | | — | | | | 27,255 | |

Recognition of pension actuarial loss, net of tax of $201 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | 303 | | | | — | | | | — | | | | 303 | |

Increase in pension liability, net of tax of $4,511 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | (6,767 | ) | | | — | | | | — | | | | (6,767 | ) |

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 20,791 | |

| Dividends | | | — | | | | — | | | | — | | | | — | | | | (8,471 | ) | | | — | | | | — | | | | — | | | | (8,471 | ) |

| Exercise of stock options | | | — | | | | 406 | | | | — | | | | — | | | | — | | | | — | | | | (87 | ) | | | 523 | | | | 929 | |

Share-based compensation expense | | | 16 | | | | 2,573 | | | | — | | | | — | | | | –– | | | | — | | | | — | | | | — | | | | 2,573 | |

Excess tax benefits from exercise of stock options and restricted share vesting | | | — | | | | 545 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 545 | |

| Balance, July 25, 2009 | | | 7,538 | | | | 28,982 | | | | 6,376 | | | | 1,035 | | | | 171,229 | | | | (10,535 | ) | | | 555 | | | | (3,313 | ) | | | 187,398 | |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 25,381 | | | | — | | | | — | | | | — | | | | 25,381 | |

Recognition of pension actuarial loss, net of tax of $496 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | 744 | | | | — | | | | — | | | | 744 | |

Increase in pension liability, net of tax of $420 | | | — | | | | — | | | | — | | | | — | | | | –– | | | | (630 | ) | | | — | | | | — | | | | (630 | ) |

| Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 25,495 | |

| Dividends | | | — | | | | — | | | | — | | | | — | | | | (10,820 | ) | | | — | | | | — | | | | — | | | | (10,820 | ) |

| Exercise of stock options | | | — | | | | 236 | | | | — | | | | — | | | | — | | | | — | | | | (42 | ) | | | 250 | | | | 486 | |

Share-based compensation expense | | | 3 | | | | 2,929 | | | | — | | | | — | | | | –– | | | | — | | | | — | | | | — | | | | 2,929 | |

Excess tax benefits from exercise of stock options and restricted share vesting | | | — | | | | 287 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 287 | |

| Balance, July 31, 2010 | | | 7,541 | | | $ | 32,434 | | | | 6,376 | | | $ | 1,035 | | | $ | 185,790 | | | $ | (10,421 | ) | | | 513 | | | $ | (3,063 | ) | | $ | 205,775 | |

1See notes to consolidated financial statements.

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(In thousands)

| | | | | | Years ended | | | | |

| | | July 31, 2010 | | | July 25, 2009 | | | July 26, 2008 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net income | | $ | 25,381 | | | $ | 27,255 | | | $ | 22,543 | |

| Adjustments to reconcile net income to net cash | | | | | | | | | | | | |

| provided by operating activities: | | | | | | | | | | | | |

| Depreciation and amortization | | | 16,900 | | | | 15,319 | | | | 13,713 | |

| Non-cash share-based compensation | | | 2,929 | | | | 2,573 | | | | 1,725 | |

| Deferred taxes | | | (900 | ) | | | (16 | ) | | | 58 | |

| Provision to value inventories at LIFO | | | (418 | ) | | | 964 | | | | 742 | |

| Changes in assets and liabilities: | | | | | | | | | | | | |

| Merchandise inventories | | | (1,565 | ) | | | (2,164 | ) | | | (4,023 | ) |

| Patronage dividend receivable | | | (1,312 | ) | | | (568 | ) | | | (478 | ) |

| Accounts payable to Wakefern | | | (6,399 | ) | | | 1,142 | | | | 10,435 | |

| Accounts payable and accrued expenses | | | (1,949 | ) | | | 885 | | | | (2,084 | ) |

| Accrued wages and benefits | | | 344 | | | | 1,459 | | | | 1,295 | |

| Income taxes payable | | | 3,453 | | | | 311 | | | | 3,177 | |

| Other assets and liabilities | | | (1,151 | ) | | | 703 | | | | (1,764 | ) |

| | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 35,313 | | | | 47,863 | | | | 45,339 | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | | | | |

| Capital expenditures | | | (20,204 | ) | | | (26,625 | ) | | | (24,898 | ) |

| Maturity of (investment in) note receivable from Wakefern | | | 14,463 | | | | (1,546 | ) | | | (1,880 | ) |

| Acquisition of Galloway store assets | | | — | | | | — | | | | (3,500 | ) |

| | | | | | | | | | | | | |

| Net cash used in investing activities | | | (5,741 | ) | | | (28,171 | ) | | | (30,278 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

| Repayment of construction loan | | | — | | | | — | | | | 6,776 | |

| Proceeds from exercise of stock options | | | 486 | | | | 929 | | | | 588 | |

| Excess tax benefit related to share-based compensation | | | 287 | | | | 545 | | | | 848 | |

| Principal payments of long-term debt | | | (5,448 | ) | | | (5,618 | ) | | | (6,138 | ) |

| Dividends | | | (10,820 | ) | | | (8,471 | ) | | | (21,093 | ) |

| Treasury stock purchases | | | — | | | | — | | | | (1,999 | ) |

| | | | | | | | | | | | | |

| Net cash used in financing activities | | | (15,495 | ) | | | (12,615 | ) | | | (21,018 | ) |

| | | | | | | | | | | | | |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | 14,077 | | | | 7,077 | | | | (5,957 | ) |

| | | | | | | | | | | | | |

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR | | | 54,966 | | | | 47,889 | | | | 53,846 | |

| | | | | | | | | | | | | |

| CASH AND CASH EQUIVALENTS, END OF YEAR | | $ | 69,043 | | | $ | 54,966 | | | $ | 47,889 | |

| | | | | | | | | | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH PAYMENTS MADE FOR: | | | | | | | | | | | | |

| Interest | | $ | 3,771 | | | $ | 3,150 | | | $ | 3,142 | |

| Income taxes | | $ | 15,171 | | | $ | 18,527 | | | $ | 13,457 | |

| | | | | | | | | | | | | |

| NONCASH SUPPLEMENTAL DISCLOSURES: | | | | | | | | | | | | |

| Financing and capital lease obligations | | $ | 9,638 | | | $ | 9,144 | | | $ | 2,684 | |

| Investment in Wakefern | | $ | 590 | | | $ | 1,382 | | | $ | 1,900 | |

See notes to consolidated financial statements .13

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES

(All amounts are in thousands, except per share and sq. ft. data)

Nature of operations

Village Super Market, Inc. (the “Company” or “Village”) operates a chain of 26 ShopRite supermarkets in New Jersey and eastern Pennsylvania. The Company is a member of Wakefern Food Corporation (“Wakefern”), the largest retailer-owned food cooperative in the United States.

Principles of consolidation

The consolidated financial statements include the accounts of Village Super Market, Inc. and its subsidiaries, which are wholly owned. Intercompany balances and transactions have been eliminated.

Fiscal year

The Company and its subsidiaries utilize a 52-53 week fiscal year ending on the last Saturday in the month of July. Fiscal 2010 contains 53 weeks. Fiscal 2009 and 2008 contain 52 weeks.

Reclassifications

Certain amounts have been reclassified in the 2009 and 2008 consolidated balance sheets and statements of cash flows to conform to the 2010 presentation.

Industry segment

The Company consists of one operating segment, the retail sale of food and nonfood products.

Revenue recognition

Merchandise sales are recognized at the point of sale to the customer. Sales tax is excluded from revenue. Discounts provided to customers through ShopRite coupons and loyalty programs are recognized as a reduction of sales as the products are sold.

Cash and cash equivalents

The Company considers all highly liquid investments purchased with a maturity of three months or less and proceeds due from credit and debit card transactions with settlement terms of less than five days to be cash equivalents. Included in cash and cash equivalents at July 31, 2010 and July 25, 2009 are $51,174 and $37,764, respectively, of demand deposits invested at Wakefern at overnight money market rates.

Merchandise inventories

Approximately 67% of merchandise inventories are stated at the lower of LIFO (last-in, first-out) cost or market. If the FIFO (first-in, first-out) method had been used, inventories would have been $13,829 and $14,247 higher than reported in fiscal 2010 and 2009, respectively. All other inventories are stated at the lower of FIFO cost or market.

Vendor allowances and rebates

The Company receives vendor allowances and rebates, including the patronage dividend and amounts received as a pass through from Wakefern, related to the Company’s buying and merchandising activities. Vendor allowances and rebates are recognized as a reduction in cost of sales when the related merchandise is sold or when the required contractual terms are completed.

Property, equipment and fixtures

Property, equipment and fixtures are recorded at cost. Interest cost incurred to finance construction is capitalized as part of the cost of the asset. Maintenance and repairs are expensed as incurred.

Depreciation is provided on a straight-line basis over estimated useful lives of thirty years for buildings, ten years for store fixtures and equipment, and three years for vehicles. Leasehold improvements are amortized over the shorter of the related lease terms or the estimated useful lives of the related assets.

When assets are sold or retired, their cost and accumulated depreciation are removed from the accounts, and any gain or loss is reflected in the consolidated financial statements.

Investments

The Company’s investments in its principal supplier, Wakefern, and a Wakefern affiliate, Insure-Rite, Ltd., are stated at cost (see Note 3). Village evaluates its investments in Wakefern and Insure-Rite, Ltd. for impairment through consideration of previous, current and projected levels of profit of those entities.

The Company’s 20%-50% investments in certain real estate partnerships are accounted for under the equity method. One of these partnerships is a variable interest entity which does not require consolidation as Village is not the primary beneficiary (see Note 6).

Store opening and closing costs

All store opening costs are expensed as incurred. The Company records a liability for the future minimum lease payments and related costs for closed stores from the date of closure to the end of the remaining lease term, net of estimated cost recoveries that may be achieved through subletting, discounted using a risk-adjusted interest rate.

Leases

Leases that meet certain criteria are classified as capital leases, and assets and liabilities are recorded at amounts equal to the lesser of the present value of the minimum lease payments or the fair value of the leased properties at the inception of the respective leases. Such assets are amortized on a straight- line basis over the shorter of the related lease terms or the estimated useful lives of the related assets. Amounts representing interest expense relating to the lease obligations are recorded to effect constant rates of interest over the terms of the leases. Leases that do not qualify as capital leases are classified as operating leases. The Company accounts for rent holidays, escalating rent provisions, and construction allowances on a straight-line basis over the term of the lease.

For leases in which the Company is involved with the construction of the store, if Village concludes that it has substantively all of the risks of ownership during construction of the leased property and therefore is deemed the owner of the project for accounting purposes, an asset and related financing obligation are recorded for the costs paid by the landlord. Once construction is complete, the Company considers the requirements for sale-leaseback treatment. If the arrangement does not qualify for sale- leaseback treatment, the Company amortizes the financing obligation and depreciates the building over the lease term.14

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES (continued)

Advertising

Advertising costs are expensed as incurred. Advertising expense was $8,972, $8,449, and $8,284 in fiscal 2010, 2009 and 2008, respectively.

Income taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment date.

The Company recognizes a tax benefit for uncertain tax positions if it is “more likely than not” that the position is sustainable, based on its technical merits. The tax benefit of a qualifying position is the largest amount of tax benefit that is greater than 50% likely of being realized upon effective settlement with a taxing authority having full knowledge of all relevant information.

Use of estimates

In conformity with U.S. generally accepted accounting principles, management of the Company has made a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of expenses during the reporting period. Some of the more significant estimates are patronage dividends, pension accounting assumptions, share-based compensation assumptions, accounting for uncertain tax positions, accounting for contingencies and the impairment of long-lived assets and goodwill. Actual results could differ from those estimates.

Fair value

Fair value is defined as the exit price that would be received to sell an asset or paid to transfer a liability. Fair value is a market-based measurement that should be determined using assumptions that market participants would use in pricing an asset or liability. The fair value guidance establishes a three-level hierarchy to prioritize the inputs used in measuring fair value. The levels within the hierarchy range from Level 1 having the highest priority to Level 3 having the lowest.

Cash and cash equivalents, patronage dividends receivable, accounts payable and accrued expenses are reflected in the consolidated financial statements at carrying value, which approximates fair value because of the short-term maturity of these instruments. The carrying values of the Company’s notes receivable from Wakefern and short and long-term notes payable approximate their fair value based on the current rates available to the Company for similar instruments. As the Company’s investments in Wakefern can only be sold to Wakefern at amounts that approximate the Company’s cost, it is not practicable to estimate the fair value of such investments.

Long-lived assets

The Company reviews long-lived assets, such as property, equipment and fixtures on an individual store basis for impairment when circumstances indicate the carrying amount of an asset group may not be recoverable. Such review analyzes the undiscounted estimated future cash flows from such assets to determine if the carrying value of such assets are recoverable from their respective cash flows. If an impairment is indicated, it is measured by comparing the fair value of the long-lived assets to their carrying value.

Goodwill

Goodwill is tested at the end of each fiscal year, or more frequently if circumstances dictate, for impairment. An impairment loss is recognized to the extent that the carrying amount of goodwill exceeds its implied fair value. Village operates as a single reporting unit for purposes of evaluating goodwill for impairment and primarily considers earnings multiples and other valuation techniques to measure fair value, in addition to the value of the Company’s stock, as its stock is not widely traded.15

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES (continued)

Net income per share

The Company has two classes of common stock. Class A common stock is entitled to cash dividends as declared 54% greater than those paid on Class B common stock. Shares of Class B common stock are convertible on a share-for-share basis for Class A common stock at any time.

The Company utilizes the two-class method of computing and presenting net income per share. The two-class method is an earnings allocation formula that calculates basic and diluted net income per share for each class of common stock separately based on dividends declared and participation rights in undistributed earnings. Under the two-class method, Class A common stock is assumed to receive a 54% greater participation in undistributed earnings than Class B common stock, in accordance with the classes respective dividend rights.

Diluted net income per share for Class A common stock is calculated utilizing the if-converted method, which assumes the conversion of all shares of Class B common stock to Class A common stock on a share-for- share basis, as this method is more dilutive than the two-class method. Diluted net income per share for Class B common stock does not assume conversion of Class B common stock to shares of Class A common stock.

On July 26, 2009, the Company adopted a new accounting standard requiring unvested share-based payment awards that contain nonforfeitable rights to dividends be treated as participating securities and therefore included in computing net income per share using the two-class method. All prior period net income per share data has been adjusted to reflect the new standard. Net income per share amounts for the prior year periods as previously reported were as follows:

| | | 2009 | | | 2008 | |

| | | Class A | | | Class B | | | Class A | | | Class B | |

| Basic | | $ | 2.52 | | | $ | 1.64 | | | $ | 2.11 | | | $ | 1.38 | |

| Diluted | | $ | 2.06 | | | $ | .1.61 | | | $ | 1.71 | | | $ | 1.38 | |

The tables below reconcile the numerators and denominators of basic and diluted net income per share for all periods presented.

| | | 2010 | | | 2009 | | | 2008 | |

| | | Class A | | | Class B | | | Class A | | | Class B | | | Class A | | | Class B | |

| Numerator: | | | | | | | | | | | | | | | | | | |

| Net income allocated, basic | | $ | 15,351 | | | $ | 9,435 | | | $ | 16,422 | | | $ | 10,201 | | | $ | 13,245 | | | $ | 8,491 | |

| Conversion of Class B to Class A shares | | | 9,435 | | | | — | | | | 10,201 | | | | — | | | | 8,491 | | | | — | |

| Effect of share-based compensation | | | | | | | | | | | | | | | | | | | | | | | | |

| on allocated net income | | | 59 | | | | (57 | ) | | | 78 | | | | (93 | ) | | | 6 | | | | (9 | ) |

| Net income allocated, diluted | | $ | 24,845 | | | $ | 9,378 | | | $ | 26,701 | | | $ | 10,108 | | | $ | 21,742 | | | $ | 8,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Denominator: | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares | | | | | | | | | | | | | | | | | | | | | | | | |

| outstanding, basic | | | 6,740 | | | | 6,376 | | | | 6,665 | | | | 6,376 | | | | 6,495 | | | | 6,376 | |

| Conversion of Class B to Class A shares | | | 6,376 | | | | — | | | | 6,376 | | | | — | | | | 6,376 | | | | — | |

| Dilutive effect of share-based compensation | | | 119 | | | | — | | | | 148 | | | | — | | | | 181 | | | | — | |

| Weighted average shares | | | | | | | | | | | | | | | | | | | | | | | | |

| outstanding, diluted | | | 13,235 | | | | 6,376 | | | | 13,189 | | | | 6,376 | | | | 13,052 | | | | 6,376 | |

Net income per share is as follows:

| | | 2010 | | | 2009 | | | 2008 | |

| | | Class A | | | Class B | | | Class A | | | Class B | | | Class A | | | Class B | |

| Basic | | $ | 2.28 | | | $ | 1.48 | | | $ | 2.46 | | | $ | 1.60 | | | $ | 2.04 | | | $ | 1.33 | |

| Diluted | | $ | 1.88 | | | $ | 1.47 | | | $ | 2.02 | | | $ | 1.59 | | | $ | 1.67 | | | $ | 1.33 | |

Outstanding stock options to purchase Class A shares of 36, 6 and 208 were excluded from the calculation of diluted net income per share at July 31, 2010, July 25, 2009 and July 26, 2008, respectively, as a result of their anti-dilutive effect. In addition, 256, 266 and 251 non-vested restricted Class A shares, which are considered participating securities, and their allocated net income were excluded from the diluted net income per share calculation at July 31, 2010, July 25, 2009 and July 26,2008, respectively, due to their anti-dilutive effect.16

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 1 — SUMMARY of SIGNIFICANT ACCOUNTING POLICIES (continued)

Share-based compensation

All share-based payments to employees are recognized in the financial statements as compensation costs based on the fair market value on the date of the grant.

Benefit plans

The Company recognizes the funded status of its retirement plans on the consolidated balance sheet. Actuarial gains or losses, prior service costs or credits and transition obligations not previously recognized are recorded as a component of Accumulated Other Comprehensive Income.

Recently issued accounting standards

In June 2009, new accounting standards were issued which change how a company determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance. These standards are effective beginning August 1, 2010 and earlier application is prohibited. We are currently evaluating the impact these standards may have on our consolidated financial position and results of operations.

Recently adopted accounting standards

Effective July 26, 2009, the Company adopted a new accounting standard defining fair value and establishing a framework for measurement of fair value for non-financial assets and liabilities that are not remeasured at fair value on a recurring basis. This includes fair value calculated in impairment assessments of goodwill and other long-lived assets. The adoption had no impact on the Company’s consolidated financial position or results of operations

On July 26, 2009, the Company adopted a new accounting standard requiring unvested share-based payment awards that contain nonforfeitable rights to dividends be treated as participating securities and therefore included in computing net income per share using the two-class method. All prior period net income per share data has been adjusted to reflect the new standard.11

VILLAGE SUPER MARKET, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Continued)

NOTE 2 — PROPERTY, EQUIPMENT and FIXTURES

Property, equipment and fixtures are comprised as follows:

| | | July 31, 2010 | | | July 25, 2009 | |

| Land and buildings | | $ | 78,019 | | | $ | 73,419 | |

| Store fixtures and equipment | | | 154,113 | | | | 140,476 | |

| Leasehold improvements | | | 74,859 | | | | 64,935 | |

| Leased property under capital leases | | | 21,686 | | | | 15,723 | |

| Construction in progress | | | — | | | | 11,127 | |

| Vehicles | | | 1,756 | | | | 1,606 | |

| | | | | | | | | |

| | | | 330,433 | | | | 307,286 | |

| Accumulated depreciation | | | (149,008 | ) | | | (139,347 | ) |

| Accumulated amortization of property under capital leases | | | (6,139 | ) | | | (5,678 | ) |

| | | | | | | | | |

| Property, equipment and fixtures, net | | $ | 175,286 | | | $ | 162,261 | |

Amortization of leased property under capital and financing leases is included in depreciation and amortization expense.

NOTE 3 — RELATED PARTY INFORMATION - WAKEFERN

The Company’s ownership interest in its principal supplier, Wakefern, which is operated on a cooperative basis for its stockholder members, is 14.1% of the outstanding shares of Wakefern at July 31, 2010. The investment is pledged as collateral for any obligations to Wakefern. In addition, all obligations to Wakefern are personally guaranteed by the principal shareholders of Village.

The Company is obligated to purchase 85% of its primary merchandise requirements from Wakefern until ten years from the date that stockholders representing 75% of Wakefern sales notify Wakefern that those stockholders request that the Wakefern Stockholder Agreement be terminated. If this purchase obligation is not met, Village is required to pay Wakefern’s profit contribution shortfall attributable to this failure. Similar payments are due if Wakefern loses volume by reason of the sale of Company stores or a merger with another entity. Village fulfilled the above obligation in fiscal 2010, ; 2009 and 2008. The Company also has an investment of approximately 7.7% in Insure-Rite, Ltd., a Wakefern affiliated company, that provides Village with liability and property insurance coverage.