Exhibit 99.1

| Comfort Systems USA (NYSE: FIX) May 8, 2013 |

| Disclosures Safe Harbor Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” or other similar expressions are intended to identify forward-looking statements, which are generally not historic in nature. These forward-looking statements are based on the current expectations and beliefs of Comfort Systems USA, Inc. and its subsidiaries (collectively, the “Company”) concerning future developments and their effect on the Company. While the Company’s management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting the Company will be those that it anticipates. All comments concerning the Company’s expectations for future revenues and operating results are based on the Company’s forecasts for its existing operations and do not include the potential impact of any future acquisitions. The Company’s forward-looking statements involve significant risks and uncertainties (some of which are beyond the Company’s control) and assumptions that could cause actual future results to differ materially from the Company’s historical experience and its present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the use of incorrect estimates for bidding a fixed-price contract; undertaking contractual commitments that exceed the Company’s labor resources; failing to perform contractual obligations efficiently enough to maintain profitability; national or regional weakness in construction activity and economic conditions; financial difficulties affecting projects, vendors, customers, or subcontractors; the Company’s backlog failing to translate into actual revenue or profits; difficulty in obtaining or increased costs associated with bonding and insurance; impairment to goodwill; errors in the Company’s percentage-of-completion method of accounting; the result of competition in the Company’s markets; the Company’s decentralized management structure; material failure to comply with varying state and local laws, regulations or requirements; debarment from bidding on or performing government contracts; shortages of labor and specialty building materials; retention of key management; seasonal fluctuations in the demand for HVAC systems; the imposition of past and future liability from environmental, safety, and health regulations including the inherent risk associated with self-insurance; adverse litigation results; and other risks detailed in our reports filed with the Securities and Exchange Commission. For additional information regarding known material factors that could cause the Company’s results to differ from its projected results, please see its filings with the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events, or otherwise. Non-GAAP Measures Certain measures in this presentation are not measures calculated in accordance with generally accepted accounting principles (GAAP). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnote. See the Appendices for a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures. 2 |

| Comfort Systems USA Overview Who We Are Leading HVAC and mechanical systems installation and service provider Focused on commercial, industrial, and institutional HVAC markets What We Do Applied Systems Piping Retrofit Service 3 |

| Broad Nationwide Footprint 4 36 companies | 87 locations in 72 cities | 6,700+ employees |

| Our Customers 5 Omni Orlando Resort at ChampionsGate Orlando, Florida University Hospital Little Rock, Arkansas Navy Federal Credit Union Pensacola, Florida MedImmune FMC Expansion Frederick, Maryland |

| Areas of Strength Long-term local relationships Collaboration Safety excellence Purchasing economics National service capability Bonding and insurance Balance sheet strength 6 |

| Our Safety Record is No Accident 7 Lost Time Injury Rate 73% below the industry average OSHA Incident Rate 39% below the industry average Source: Bureau of Labor Statistics, Standard Industry Classification (SIC) Code 20 1711–Specialty Trades Contractors–HVAC and Plumbing & North American Industry Classification System (NAICS) Code 23822 OSHA Recordable Incident Rate 0 2 4 6 8 10 12 14 1998 2000 2002 2004 2006 2008 2010 2012 Comfort Systems USA (March 2013 data) Industry Average (December 2011 – All Company Sizes) Latest Available Data |

| Energy Efficiency Energy costs drive the need for efficiency. HVAC accounts for 30%–50% of electricity usage. Energy Star (Department of Energy/EPA)/LEED (USGBC). 2–4 year payouts depending on electric rates, usage, age, and incentives. 8 Use Our Energy to Save Yours!™ |

| Revenue/Stock Price History 9 Revenue ($ in millions) Acquisition Phase and Industry Growth Sale of Assets New Acquisitions Stock Price at 12/31 $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $25.00 $20.00 $15.00 $10.00 $5.00 $- |

| Revenue by Activity 10 New Construction/Installation Replacement Service & Maintenance 2008 2013 YTD 57% 13% 30% 45% 16% 39% |

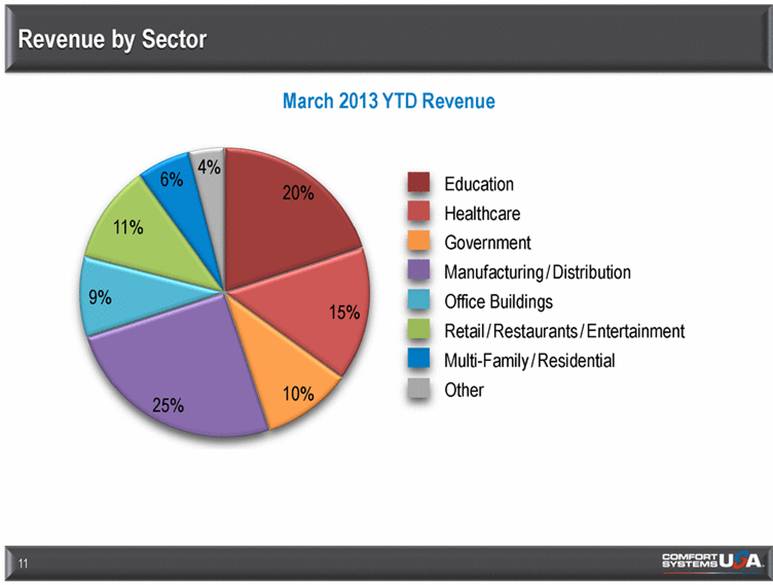

| Revenue by Sector 11 Education Healthcare Government Manufacturing/Distribution Office Buildings Retail/Restaurants/Entertainment Multi-Family/Residential Other March 2013 YTD Revenue 9% 11% 6% 4% 20% 15% 10% 25% |

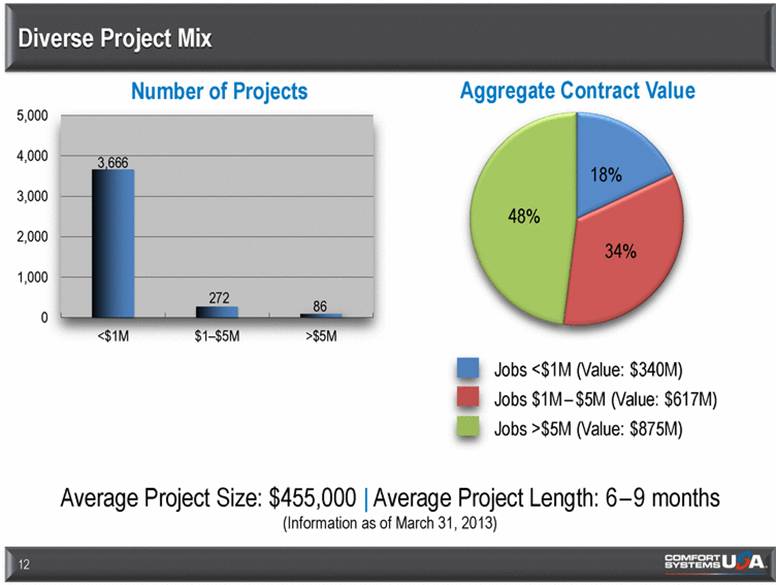

| Diverse Project Mix 12 Average Project Size: $455,000 | Average Project Length: 6–9 months (Information as of March 31, 2013) Aggregate Contract Value Jobs <$1M (Value: $340M) Jobs $1M–$5M (Value: $617M) Jobs >$5M (Value: $875M) Number of Projects 5,000 4,000 3,000 2,000 1,000 0 3,666 272 86 <$1M $1-$5M >$5M |

| Book of Business 13 ($ in millions) Construction Backlog $1,000 $800 $600 $400 $200 $0 1Q 2009 1Q 2010 1Q 2011 1Q 2012 1Q 2013 Service Maintenance Base $200 $150 $100 $50 $0 1Q 2009 1Q 2010 1Q 2011 1Q 2012 1Q 2013 |

| Historical Financial Summary ($ in millions, except per share information) 14 (1) Adjusted EPS is a non-GAAP financial measure. Adjusted EPS excludes goodwill impairments, changes in the fair value of contingent earn-out obligations and tax valuation allowances. See Appendix V for a GAAP reconciliation to Adjusted EPS (2) Adjusted EBITDA is a non-GAAP financial measure. See the Appendix III for a GAAP reconciliation to Adjusted EBITDA. Revenue $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 Operating Cash Flow $100 $80 $60 $40 $20 $0 2008 2009 2010 2011 2012 Adjusted (1) $1.40 $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $0.00 Adjusted EBITDA (2) $100 $80 $60 $40 $20 $0 2008 2009 2010 2011 2012 |

| QTD Financial Performance 15 Three Months Ended ($ in millions, except per share information) 3/31/13 3/31/12 Revenue $ 325.9 $ 326.9 Net Income (Loss) from Continuing Operations Attributable to Comfort Systems USA, Inc. $ 2.6 $ (0.8) Diluted EPS from Continuing Operations Attributable to Comfort Systems USA, Inc. $ 0.07 $ (0.02) Adjusted EBITDA (1) $ 9.7 $ 2.0 Operating Cash Flow $ (10.4) $ (19.8) (1)Adjusted EBITDA is a non-GAAP financial measure. See Appendix II for a GAAP reconciliation to Adjusted EBITDA. |

| Key Financial Statistics 16 As of ($ in millions) 3/31/13 12/31/12 Cash $ 25.4 $ 40.8 Working Capital $ 107.0 $ 104.0 Goodwill and Intangible Assets $ 157.2 $ 159.1 Total Debt $ 7.4 $ 7.4 Equity $ 288.8 $ 287.3 |

| Balance Sheet Strength $25.4M cash at March 31, 2013 Positive free cash flow for 14 consecutive years Debt capacity $7.4M debt at 3/31/2013 $125M revolving credit facility 2016 maturity 17 |

| Profile for Growth 18 Time Earnings Grow Service Innovate Acquire Service Commercial HVAC Grow Construction |

| Industry Environment: McGraw Hill Construction 19 Source: McGraw Hill Construction 1Q 2013 CMFS Data History Forecast 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Nonresidential 243.0 169.3 163.2 165.0 153.4 162.0 183.8 227.4 257.4 265.7 % Change +2 -30 -4 +1 -7 +6 +13 +24 +13 +3 Total Nonresidential Construction Starts Billions of Current Dollars Comfort Systems USA in the Next Cycle Expanding service Growing markets Investing in our workforce Focusing on our customers Commercial, Industrial, Institutional HVAC–A $40B+ Industry 300 250 200 150 100 50 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 |

| Quality People. Building Solutions Appendices |

| Appendix I —Income Statement (QTD) 21 ($ in thousands, except per share information) (1)Adjusted EBITDA is a non-GAAP financial measure. See Appendix II for a GAAP Reconciliation to Adjusted EBITDA. 2013 Revenue 325,890 $ 100.0% 326,902 $ 100.0% Cost of Services 274,423 84.2% 283,971 86.9% Gross Profit 51,467 15.8% 42,931 13.1% Selling, General and Administrative Expenses 46,520 14.3% 46,051 14.1% Gain on Sale of Assets (139) 0.0% (117) 0.0% Operating Income (Loss) 5,086 $ 1.6% (3,003) $ -0.9% Net Income (Loss) from Continuing Operations Attributable to Comfort Systems 2,586 $ 0.8% (792) $ -0.2% Diluted EPS from Continuing Operations 0.07 $ (0.02) $ Adjusted EBITDA (1) 9,714 $ 3.0% 1,986 $ 0.6% 2012 Three Months Ended March 31, |

| Appendix II—GAAP Reconciliation to Adjusted EBITDA 22 ($ in thousands) Note: The Company defines adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) as net income (loss) including noncontrolling interests, excluding discontinued operation, income taxes, other (income) expense, net, changes in the fair value of contingent earn-out obligations, interest expense, net, gain on sale of assets, goodwill impairment and depreciation and amortization. Other companies may define Adjusted EBITDA differently. Adjusted EBITDA is presented because it is a financial measure that is frequently requested by third parties. However, Adjusted EBITDA is not considered under generally accepted accounting principles as a primary measure of an entity’s financial results, and accordingly, Adjusted EBITDA should not be considered an alternative to operating income (loss), net income (loss), or cash flows as determined under generally accepted accounting principles and as reported by the Company. Three Months Ended March 31, 2013 2012 Net Income (Loss) Including Noncontrolling Interests 2,695 $ (2,668) $ Discontinued Operation 54 237 Income Taxes 2,043 (944) Other (Income) Expense, net (64) (51) Changes in the Fair Value of Contingent Earn-out Obligations 27 30 Interest Expense, net 331 393 Gain on Sale of Assets (139) (117) Depreciation and Amortization 4,767 5,106 Adjusted EBITDA 9,714 $ 1,986 $ |

| ($ in thousands) Appendix III—GAAP Reconciliation to Adjusted EBITDA (Historical) 23 Note: The Company defines adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) as net income (loss) including noncontrolling interests, excluding discontinued operation, income taxes, other (income) expense, net, changes in the fair value of contingent earn-out obligations, interest expense, net, gain on sale of assets, goodwill impairment and depreciation and amortization. Other companies may define Adjusted EBITDA differently. Adjusted EBITDA is presented because it is a financial measure that is frequently requested by third parties. However, Adjusted EBITDA is not considered under generally accepted accounting principles as a primary measure of an entity’s financial results, and accordingly, Adjusted EBITDA should not be considered an alternative to operating income (loss), net income (loss), or cash flows as determined under generally accepted accounting principles and as reported by the Company. 2008 2009 2010 2011 2012 Net Income (Loss) Including Noncontrolling Interests 49,690 $ 34,182 $ 14,740 $ ($36,492) $11,849 Discontinued Operations 107 (1,282) 5,824 4,018 (355) Income Taxes 30,855 20,307 11,193 (5,463) 10,045 Other (Income) Expense, net (68) (17) (247) (934) (145) Changes in the Fair Value of Contingent Earn-out Obligations - - (1,574) (5,528) (662) Interest (Income) Expense, net (1,154) 622 1,506 1,758 1,571 Gain on Sale of Assets (290) (106) (527) (236) (491) Goodwill Impairment - - - 57,354 - Depreciation and Amortization 12,325 12,635 16,718 18,982 20,569 Adjusted EBITDA 91,465 $ 66,341 $ 47,633 $ 33,459 $ 42,381 $ Year Ended December 31, |

| ($ in thousands) Appendix IV—Supplemental Non-GAAP Information (Historical) 24 Note 1: Operating results from continuing operations attributable to Comfort Systems USA, Inc., excluding goodwill impairment, changes in the fair value of contingent earn-out obligations and tax valuation allowances are presented because the Company believes it reflects the results of the core ongoing operations of the Company, and because we believe it is responsive to frequent questions we receive from third parties. However, this measure is not considered a primary measure of an entity’s financial results under generally accepted accounting principles, and accordingly, this amount should not be considered an alternative to operating results as determined under generally accepted accounting principles and as reported by the Company. Note 2: Net income (loss) from continuing operations attributable to Comfort Systems USA, Inc. is income (loss) from continuing operations less net income attributable to noncontrolling interests. Note 3: The tax rate on these items was computed using the pro forma effective tax rate of the Company exclusive of these charges. 2008 2009 2010 2011 2012 Net income (loss) from continuing operations attributable to Comfort Systems USA, Inc. 49,797 $ 32,900 $ 20,564 $ ($32,812) $13,108 Goodwill impairment (after tax) - - - 44,805 - Changes in the fair value of contingent earn-out obligations (after tax) - - (934) (5,276) (597) Tax valuation allowances (after tax) - - - 2,056 - Net income from continuing operations attributable to Comfort Systems USA, Inc. excluding goodwill and other intangible asset impairments, changes in the fair value of contingent earn-out obligations and tax valuation allowances 49,797 $ 32,900 $ 19,630 $ 8,773 $ 12,511 $ Year Ended December 31, |

| Appendix V—GAAP Reconciliation to Adjusted EPS (Historical) 25 Note 1: Operating results from continuing operations attributable to Comfort Systems USA, Inc., excluding goodwill and other intangible asset impairments, changes in the fair value of contingent earn-out obligations and tax valuation allowances are presented because the Company believes it reflects the results of the core ongoing operations of the Company, and because we believe it is responsive to frequent questions we receive from third parties. However, this measure is not considered a primary measure of an entity’s financial results under generally accepted accounting principles, and accordingly, this amount should not be considered an alternative to operating results as determined under generally accepted accounting principles and as reported by the Company. Note 2: Net income (loss) from continuing operations attributable to Comfort Systems USA, Inc. is income (loss) from continuing operations less net income attributable to noncontrolling interests. Note 3: The tax rate on these items was computed using the pro forma effective tax rate of the Company exclusive of these charges. 2008 2009 2010 2011 2012 Diluted income (loss) per share from continuing operations attributable to Comfort Systems USA, Inc. 1.24 $ 0.86 $ 0.54 $ (0.88) $ 0.35 $ Goodwill and other intangible asset impairments - - - 1.20 - Changes in the fair value of contingent earn-out obligations - - (0.02) (0.14) (0.02) Tax valuation allowances - - - 0.05 - Diluted income per share from continuing operations attributable to Comfort Systems USA, Inc. excluding goodwill and other intangible asset impairments, changes in the fair value of contingent earn-out obligations and tax valuation allowances 1.24 $ 0.86 $ 0.52 $ 0.23 $ 0.33 $ Year Ended December 31, |

| Contact 26 Bill George Executive Vice President and CFO 1-800-723-8431 bill.george@comfortsystemsusa.com www.comfortsystemsusa.com |