WELCOME 2012 Annual Shareholders’ Meeting Wayne Savings Bancshares, Inc. May 24, 2012

CALL TO ORDER Opening Remarks Peggy Schmitz Director

DIRECTORS James C. Morgan, Chairman Daniel R. Buehler Jonathan Ciccotelli, CPA Terry A. Gardner Debra Marthey Rod Steiger, President & CEO

NOMINEES David L. Lehman Glenn W. Miller, CPA

EMERITUS DIRECTORS Phillip Becker Russell Harpster Joseph Retzler

Executive Management Rod Steiger - President & CEO H. Stewart Fitz Gibbon III - EVP, COO, CRO, Corporate Secretary/Treasurer Wendy S. Blosser - SVP, Senior Trust Officer Joel D. Beckler - SVP, Senior Loan Officer Myron Swartzentruber, CPA - SVP, CFO

Also present Becky Rose - VP Internal Audit/Compliance Brittany Hartzler - AVP, Shareholder Services and Assistant Corporate Secretary BKD LLP Representatives Craig Liechty, CPA - Partner Brett Merkel, CPA - Senior Manager

INSTRUCTIONS ON PROCEDURES

OPENING OF THE POLLS

CLOSING OF THE POLLS

BUSINESS OVERVIEW Rod Steiger, President & CEO

COMMUNITY BENEFIT • Annual wages: $6 million • 411 hours of employee volunteerism • Taxes for schools, cities, etc. • $$$$$ paid to local vendors • CRA

STRATEGIC GOALS • Position Wayne Savings as the area’s premier community - minded bank • Create strong name - brand recognition with a reputation for strength and integrity

STRATEGIC GOALS • Operate safely and soundly • Emphasize local decision - making • Build customer relationships

MY VISION • A place that customers want to come • Employees want to work • Investors want to invest • Corporate community citizen • Profitable • Independent

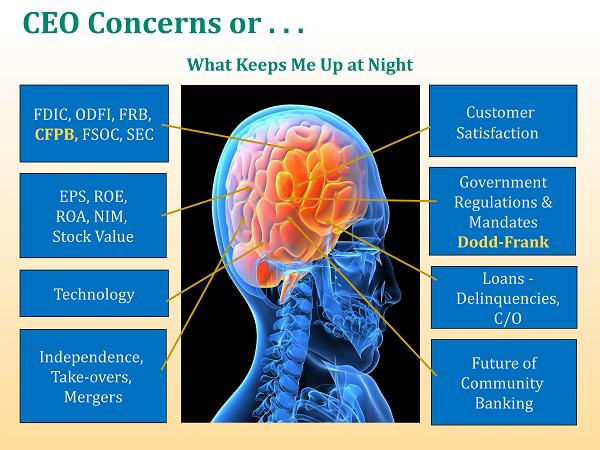

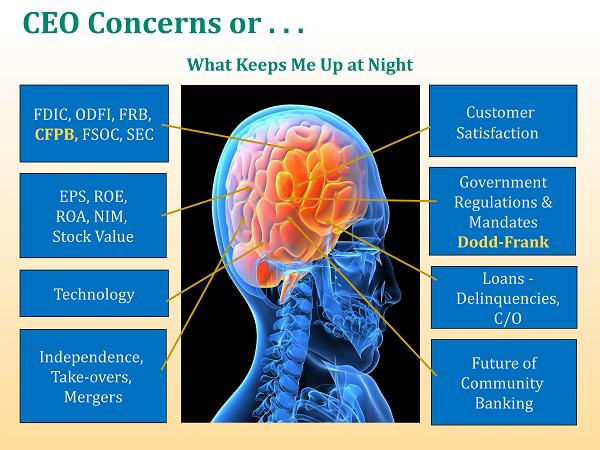

FDIC, ODFI, FRB, CFPB, FSOC, SEC EPS, ROE, ROA, NIM, Stock Value Independence, Take - overs, Mergers Future of Community Banking Technology Customer Satisfaction Government Regulations & Mandates Dodd - Frank Loans - Delinquencies, C/O CEO Concerns or . . . What Keeps Me Up at Night

“JOBS” ACT • Modernizes Federal Securities Exchange Law • Easier and less costly to raise capital • Increases shareholder threshold to register with SEC from 500 to 2000

“JOBS” ACT • Increases shareholder threshold to deregister from 300 to 1200 • Bank and Bank Holding Companies • Expect the SEC to include Thrifts

2011 IN REVIEW • New On - line training system • First FDIC exam • New Compliance Council • New IT Steering Committee

2011 IN REVIEW • Implemented Enterprise Risk Management (ERM) and CRO • New on - line performance appraisal system • Changed our year - end

2011 IN REVIEW • Board Retreats • Rewrote Strategic Plan with focus on three main initiatives: • Marketing & Sales • Facilities & Staffing • Trust Services

MARKETING & SALES • Development of a comprehensive program to increase top - line revenue through loans and fee - income generating activities

FACILITIES & STAFF Comprehensive review of all physical locations and staffing to identify opportunities for cost - effective reductions to improve operational efficiency.

TRUST SERVICES • Evaluation of alternative approaches for the delivery of products and services to ensure profitable operation of the department • Began to research alternatives

TRUST DEPARTMENT • Talked with many people • How can we Partner with a third - party, keep the product and service and yet be profitable?

28

29

Stewart Fitz Gibbon, EVP/COO/CRO BUSINESS OVERVIEW Enterprise Risk Management (ERM)

Enterprise Risk Management Capital Asset Quality Management Earnings Liquidity Sensitivity C A M E L S

Other ERM Elements • Strategic Risk – business decisions made to sustain earnings over the long term • Reputation Risk – headlines, litigation • Operational Risk – information security/cyber crime, facilities, vendors

Tactical Initiatives • Loan Growth • Customer Growth • Expense Reduction

Tactical Initiatives • SEC Deregistration • Branches • Other departments and lines of business

Tactical Initiatives Information Technology • Mobile Banking • Information Security Communication

QUESTIONS

REPORT OF THE INSPECTOR OF ELECTION Becky Rose, VP Internal Audit/Compliance

THANK YOU