Annual Shareholders’ Meeting May 22, 2014

Forward Looking Statements In addition to the historical information contained herein, the following discussion contains forward - looking statements that involve risks and uncertainties . Economic circumstances, the Company’s operations, and actual results could differ significantly from those discussed in forward - looking statements . Some of the factors that could cause or contribute to such differences are discussed herein but also include changes in the economy and interest rates in the nation and the Company’s general market area . The forward - looking statements contained herein include, but are not limited to, those with respect to the following matters : ( 1 ) management’s determination of the amount and adequacy of the allowance for loan losses ; ( 2 ) the effect of changes in interest rates ; ( 3 ) management’s opinion as to the effects of recent accounting pronouncements on the Company’s consolidated financial statements ; and ( 4 ) management’s opinion as to the Bank’s ability to maintain regulatory capital at current levels .

Call To Order Peggy J. Schmitz Chair, Board of Directors

Directors Peggy Schmitz, Chair, Board of Directors Daniel R. Buehler (nominee for a new term) Jonathan Ciccotelli, CPA David L. Lehman Debra A. Marthey (nominee for a new term) Glenn W. Miller, CPA Rod Steiger, President & CEO

Executive Management Team Rod Steiger – President and CEO H. Stewart Fitz Gibbon III – Executive Vice President , COO, CRO, Secretary and Treasurer Joel D. Beckler – SVP, Senior Loan Officer Myron Swartzentruber, CPA – SVP, CFO

Also Present Becky Rose – VP, Internal Audit Brittany Hartzler - AVP , Assistant Corporate Secretary Craig Liechty , CPA - Partner, BKD LLP Scott Hopf , CPA – Senior Manager, BKD LLP Francis Grady – Grady & Associates

Instructions on Procedures

Opening of Polls

Closing of Polls

Rod Steiger Retirement Retiring on December 31, 2014 after 35 successful years in banking. “I am most proud of helping to navigate the Company through a long and difficult recession, leaving it in a better position than when I arrived. I wish continued success all of our stockholders, employees, customers, and communities .” Rod Steiger , President and CEO “Rod was instrumental in successfully steering the Bank through a period of challenging global economic conditions. With Wayne Savings’ solid foundation of service to the community for over 100 years, we have good reason to be excited about the bank’s future.” Peggy Schmitz, Board Chair

Business Overview Rod Steiger President and CEO

History □ 1899 - Wayne Building & Loan Company Mutual Company with $300,000 capital, 214 depositors and assets of $23,996 □ 1902 - Bought existing building on North Market Street for $900 □ 1964 - The Wayne Savings & Loan Company □ 1993 - Converted to Ohio - chartered capital stock savings association and listed on NASDAQ in “First - Step Conversion” □ 1997 - Wayne Savings Community Bank formed a holding company: Wayne Savings Bancshares, Inc. □ 2003 - ”Second Step” conversion was completed

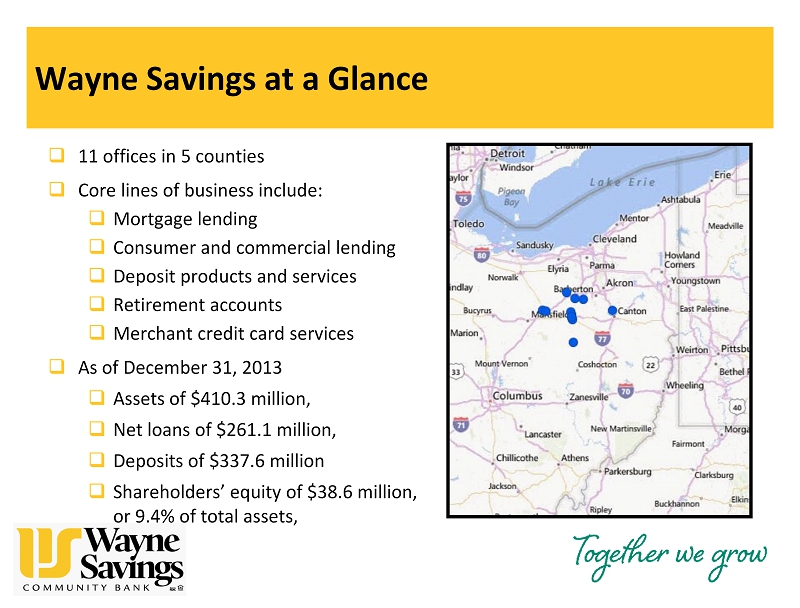

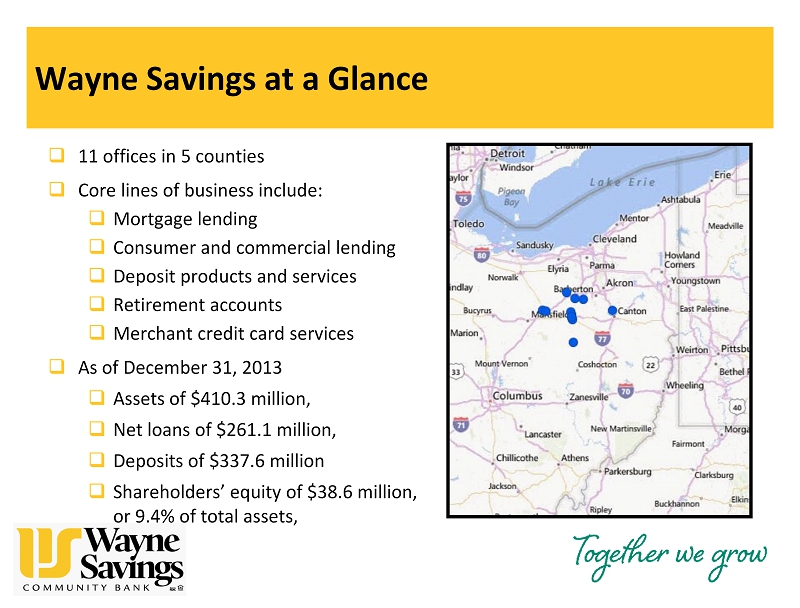

Wayne Savings at a Glance □ 11 offices in 5 counties □ Core lines of business include: □ Mortgage lending □ Consumer and commercial lending □ Deposit products and services □ Retirement accounts □ Merchant credit card services □ As of December 31, 2013 □ Assets of $410.3 million, □ Net loans of $261.1 million, □ Deposits of $337.6 million □ Shareholders’ equity of $38.6 million, or 9.4% of total assets,

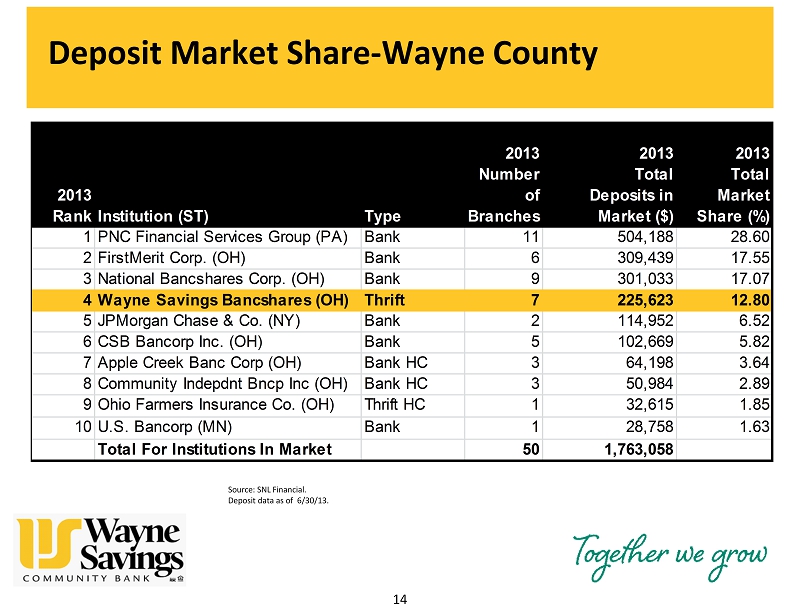

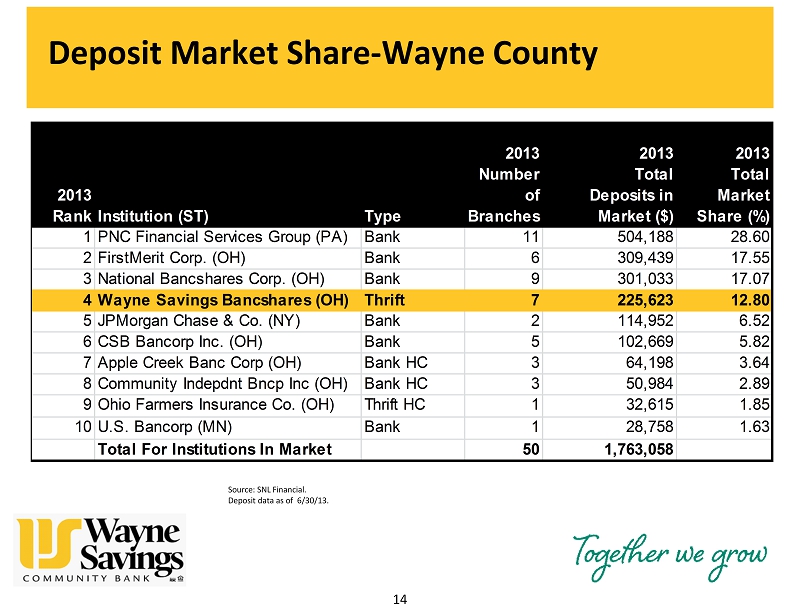

14 Deposit Market Share - Wayne County Source: SNL Financial. Deposit data as of 6/30/13. 2013 RankInstitution (ST) Type 2013 Number of Branches 2013 Total Deposits in Market ($) 2013 Total Market Share (%) 1PNC Financial Services Group (PA) Bank 11 504,188 28.60 2FirstMerit Corp. (OH) Bank 6 309,439 17.55 3National Bancshares Corp. (OH) Bank 9 301,033 17.07 4Wayne Savings Bancshares (OH) Thrift 7 225,623 12.80 5JPMorgan Chase & Co. (NY) Bank 2 114,952 6.52 6CSB Bancorp Inc. (OH) Bank 5 102,669 5.82 7Apple Creek Banc Corp (OH) Bank HC 3 64,198 3.64 8Community Indepdnt Bncp Inc (OH) Bank HC 3 50,984 2.89 9Ohio Farmers Insurance Co. (OH) Thrift HC 1 32,615 1.85 10U.S. Bancorp (MN) Bank 1 28,758 1.63 Total For Institutions In Market 50 1,763,058

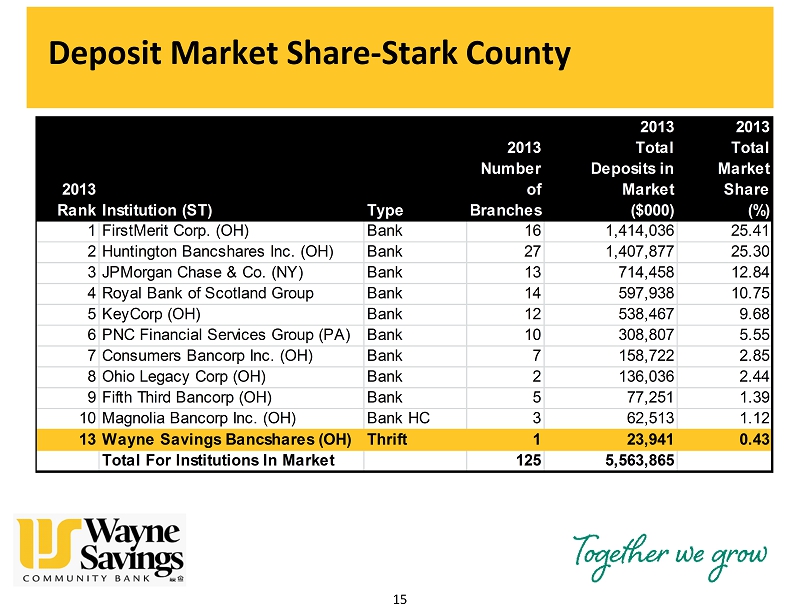

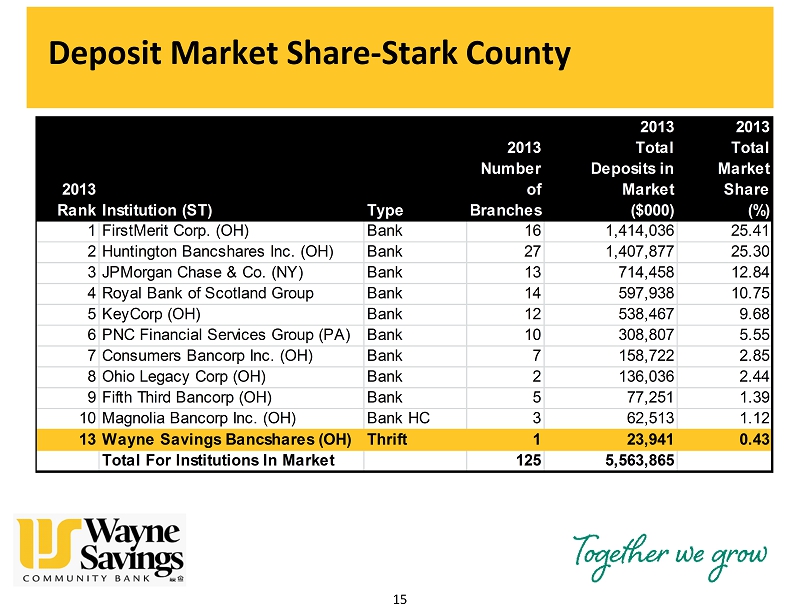

15 Deposit Market Share - Stark County 2013 RankInstitution (ST) Type 2013 Number of Branches 2013 Total Deposits in Market ($000) 2013 Total Market Share (%) 1FirstMerit Corp. (OH) Bank 16 1,414,036 25.41 2Huntington Bancshares Inc. (OH) Bank 27 1,407,877 25.30 3JPMorgan Chase & Co. (NY) Bank 13 714,458 12.84 4Royal Bank of Scotland Group Bank 14 597,938 10.75 5KeyCorp (OH) Bank 12 538,467 9.68 6PNC Financial Services Group (PA) Bank 10 308,807 5.55 7Consumers Bancorp Inc. (OH) Bank 7 158,722 2.85 8Ohio Legacy Corp (OH) Bank 2 136,036 2.44 9Fifth Third Bancorp (OH) Bank 5 77,251 1.39 10Magnolia Bancorp Inc. (OH) Bank HC 3 62,513 1.12 13Wayne Savings Bancshares (OH) Thrift 1 23,941 0.43 Total For Institutions In Market 125 5,563,865

Community Benefit □ Annual Wages: $6 Million+ □ Charitable Contributions : $23,000 + □ 450+ Hours of employee time donated for charity □ Taxes for schools, cities, etc. □ $$$$$$ paid to local vendors

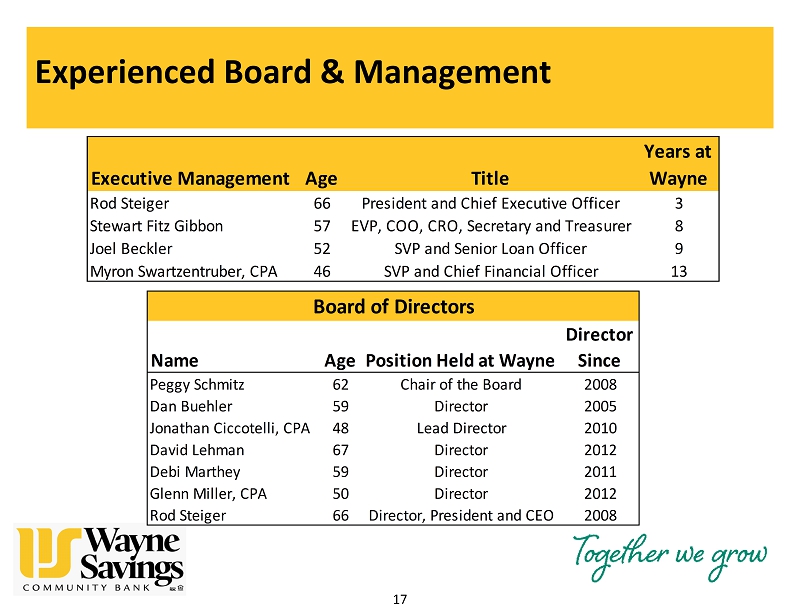

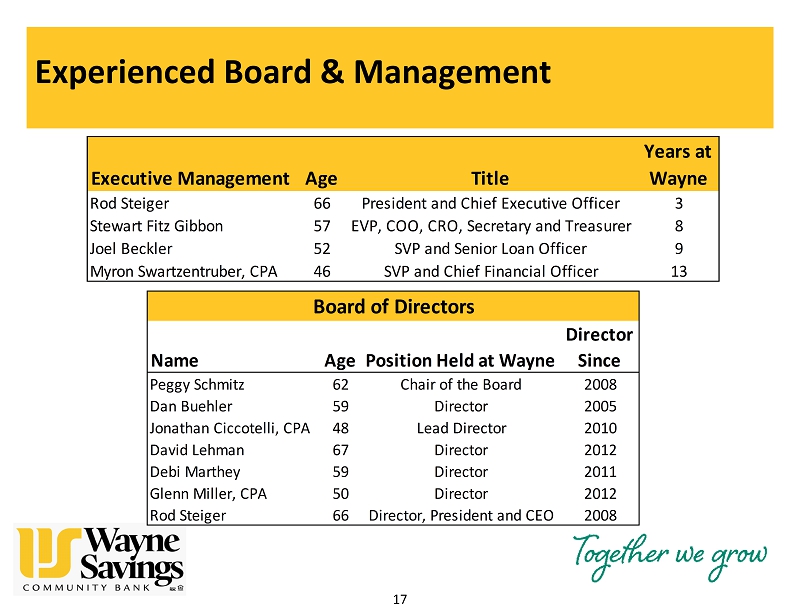

Experienced Board & Management 17 Executive Management Age Title Rod Steiger 66 President and Chief Executive Officer 3 Stewart Fitz Gibbon 57 EVP, COO, CRO, Secretary and Treasurer 8 Joel Beckler 52 SVP and Senior Loan Officer 9 Myron Swartzentruber, CPA 46 SVP and Chief Financial Officer 13 Years at Wayne Name Age Peggy Schmitz 62 Chair of the Board 2008 Dan Buehler 59 Director 2005 Jonathan Ciccotelli, CPA 48 Lead Director 2010 David Lehman 67 Director 2012 Debi Marthey 59 Director 2011 Glenn Miller, CPA 50 Director 2012 Rod Steiger 66 Director, President and CEO 2008 Board of Directors Director SincePosition Held at Wayne

Business Strategy 18 □ Continue to diversify our loan portfolio into small business lending, especially C&I □ Attract and retain lower - cost core deposits □ Maintain high asset quality levels □ Continue to operate as a community - oriented financial institution

Dodd Frank Act 19

Dodd Frank Act 20 Written to address systemic problems created with mega - banks, and has burdened the community banking landscape with the regulatory requirements originally written for the big banks. □ Increases regulatory compliance costs □ Adds uncertainty □ Adds complexity in planning □ Reduces efficiencies in operations

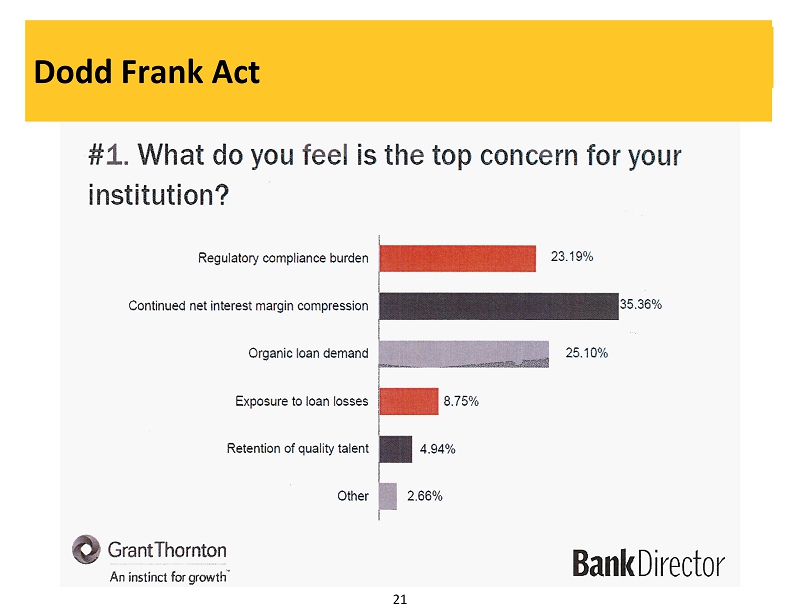

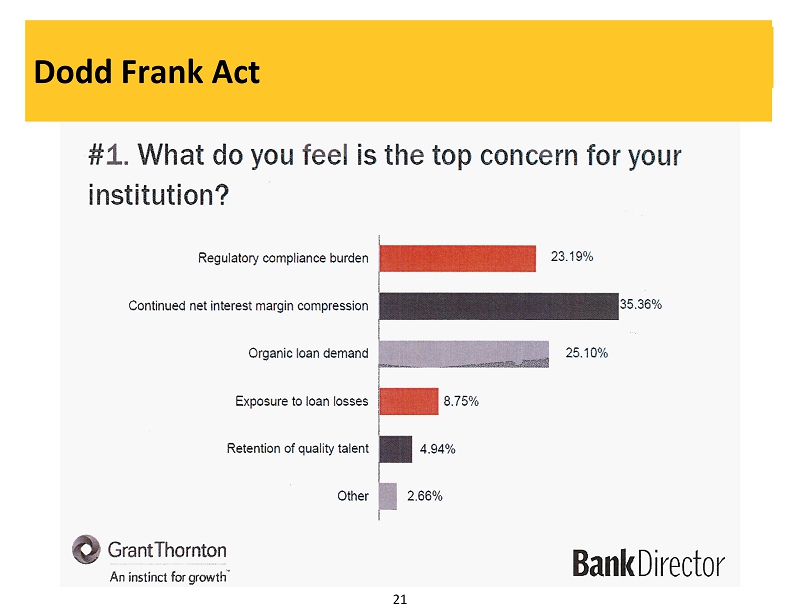

Dodd Frank Act 21 Dodd Frank Act

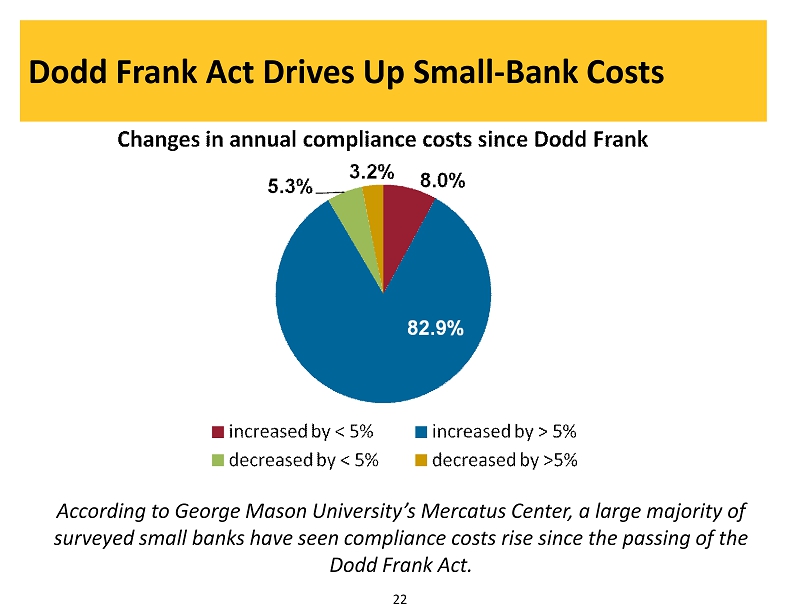

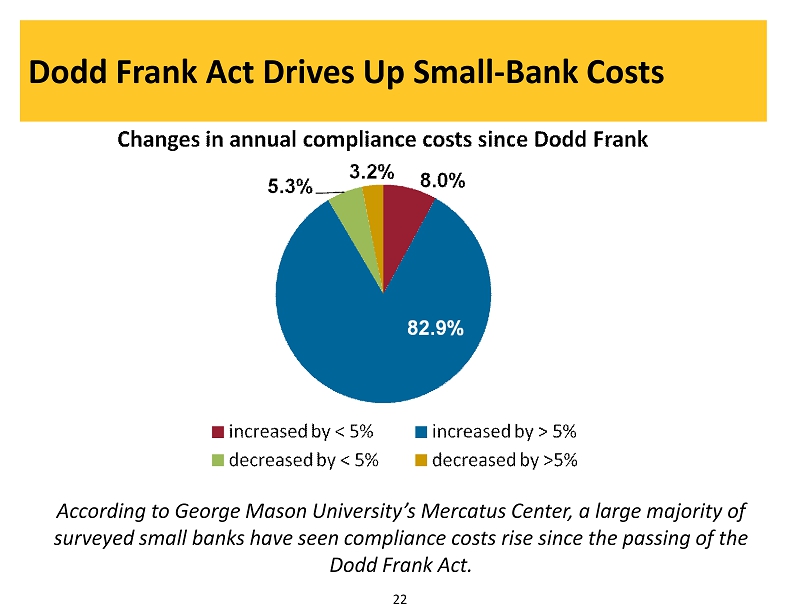

22 According to George Mason University’s Mercatus Center, a large majority of surveyed small banks have seen compliance costs rise since the passing of the Dodd Frank Act. Dodd Frank Act Drives Up Small - Bank Costs

2013 Noteworthy Achievements □ Worked substantially to improve our organizational culture and added emphasis on revenue generation □ Reduced expenses through a new branch staffing model and close analysis of operating expense □ Enhanced information technology systems to add products and improve operating efficiency

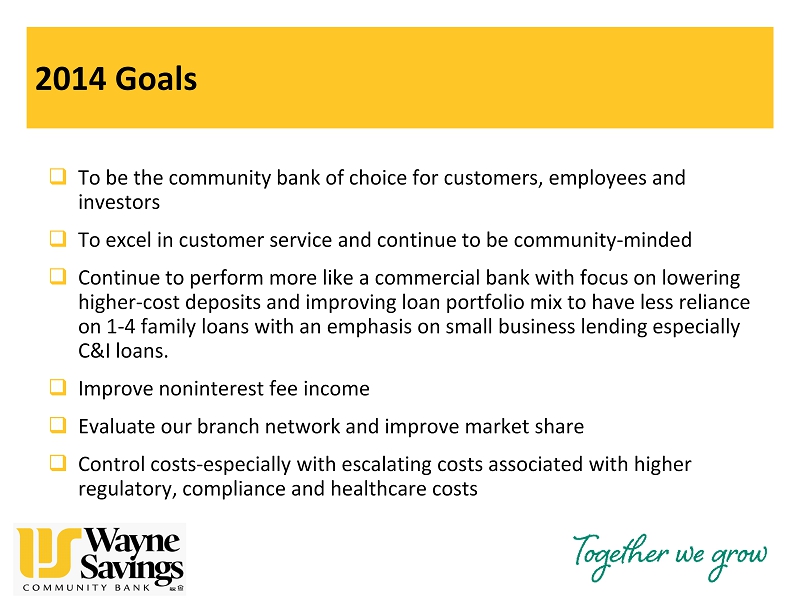

2014 Goals □ To be the community bank of choice for customers, employees and investors □ To excel in customer service and continue to be community - minded □ Continue to perform more like a commercial bank with focus on lowering higher - cost deposits and improving loan portfolio mix to have less reliance on 1 - 4 family loans with an emphasis on small business lending especially C&I loans. □ Improve noninterest fee income □ Evaluate our branch network and improve market share □ Control costs - especially with escalating costs associated with higher regulatory, compliance and healthcare costs

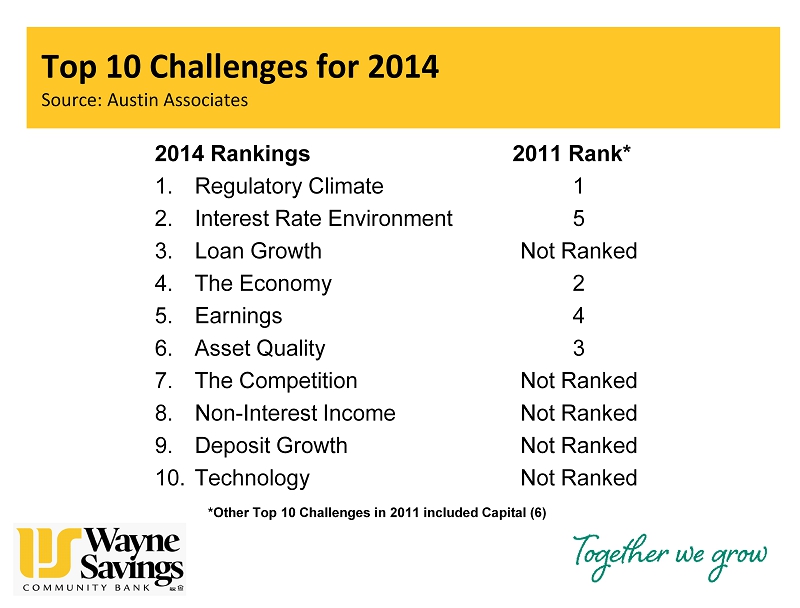

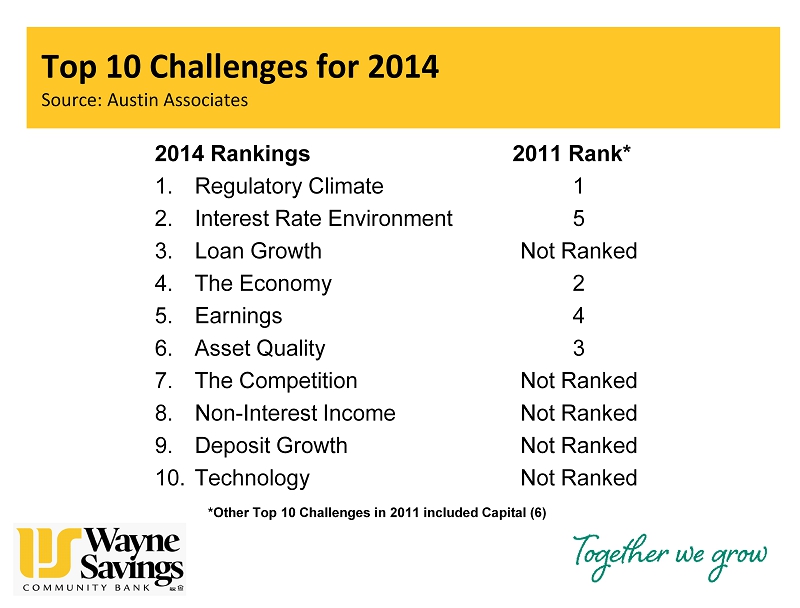

Top 10 Challenges for 2014 Source: Austin Associates 2014 Rankings 1. Regulatory Climate 2. Interest Rate Environment 3. Loan Growth 4. The Economy 5. Earnings 6. Asset Quality 7. The Competition 8. Non - Interest Income 9. Deposit Growth 10. Technology 2011 Rank* 1 5 Not Ranked 2 4 3 Not Ranked Not Ranked Not Ranked Not Ranked *Other Top 10 Challenges in 2011 included Capital (6)

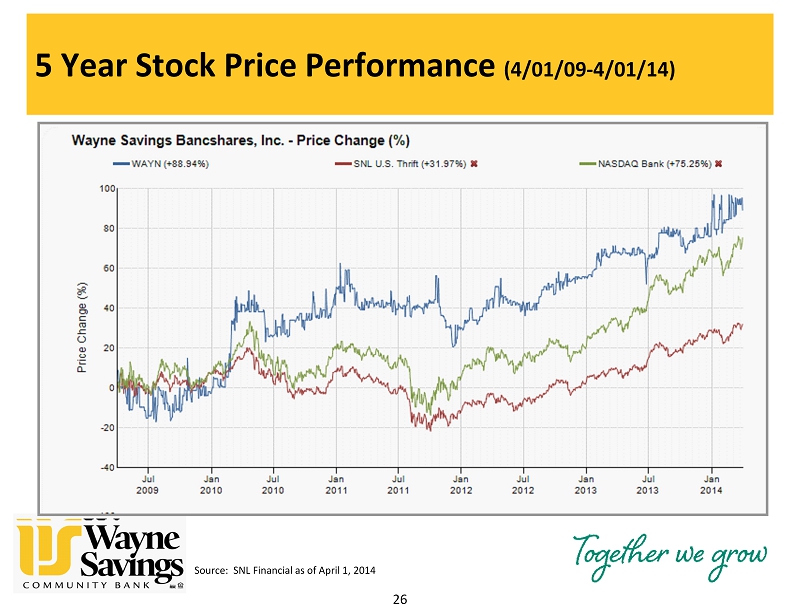

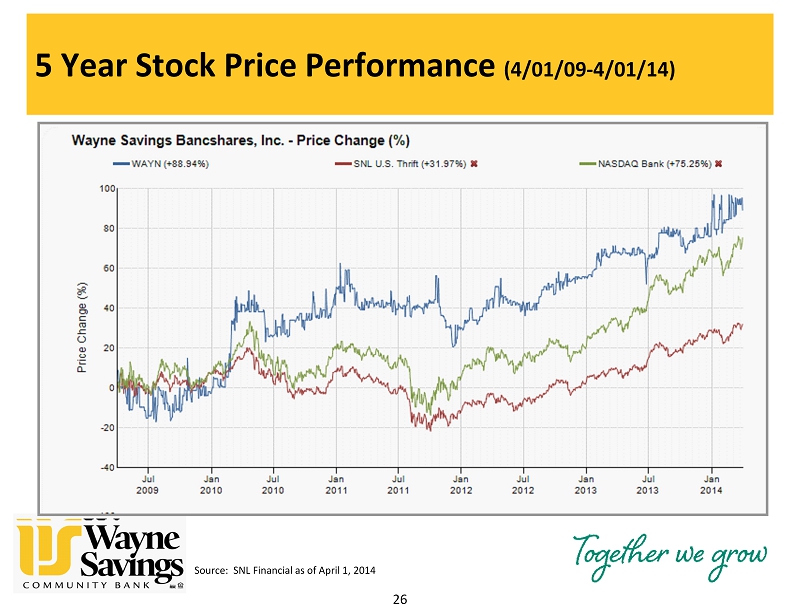

5 Year Stock Price Performance (4/01/09 - 4/01/14) 26 Source: SNL Financial as of April 1, 2014

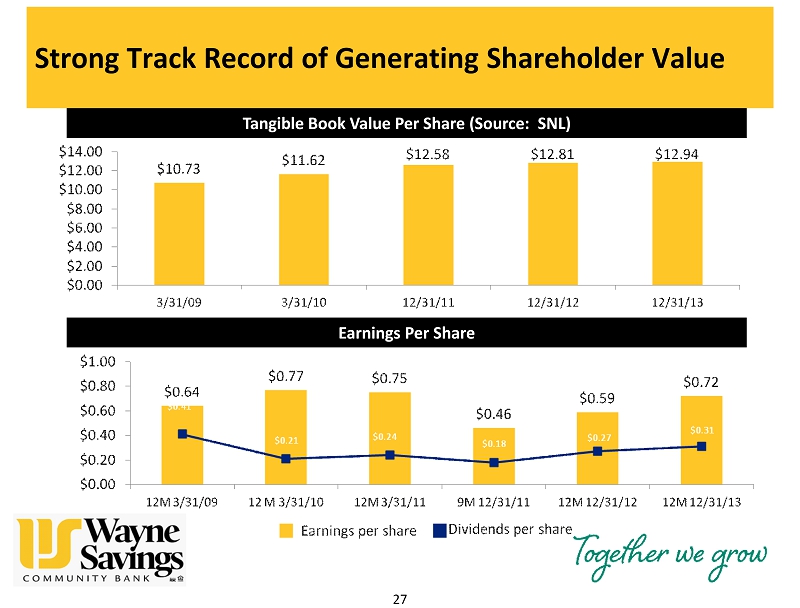

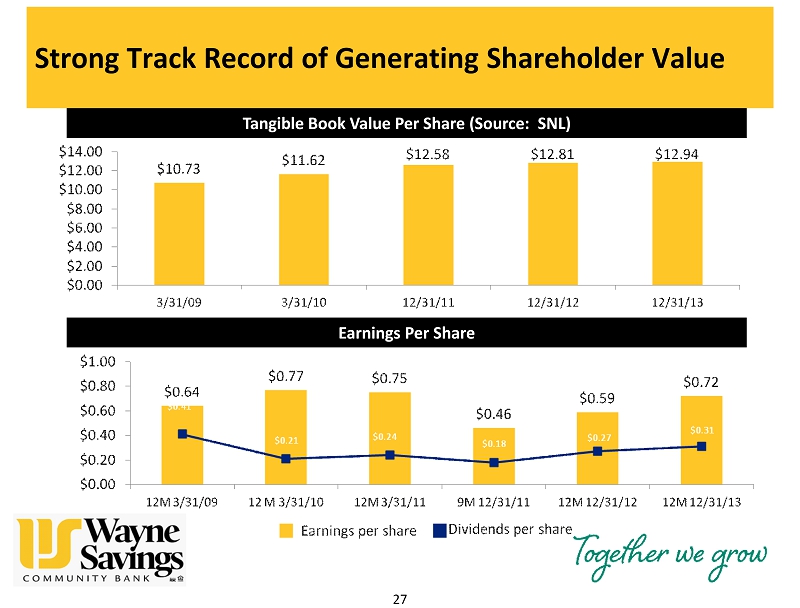

Strong Track Record of Generating Shareholder Value 27 Tangible Book Value Per Share (Source: SNL) Earnings Per Share

THANK YOU

H. Stewart Fitz Gibbon, III Executive Vice President , Chief Operating Officer, Chief Risk Officer, Secretary and Treasurer Financial Highlights

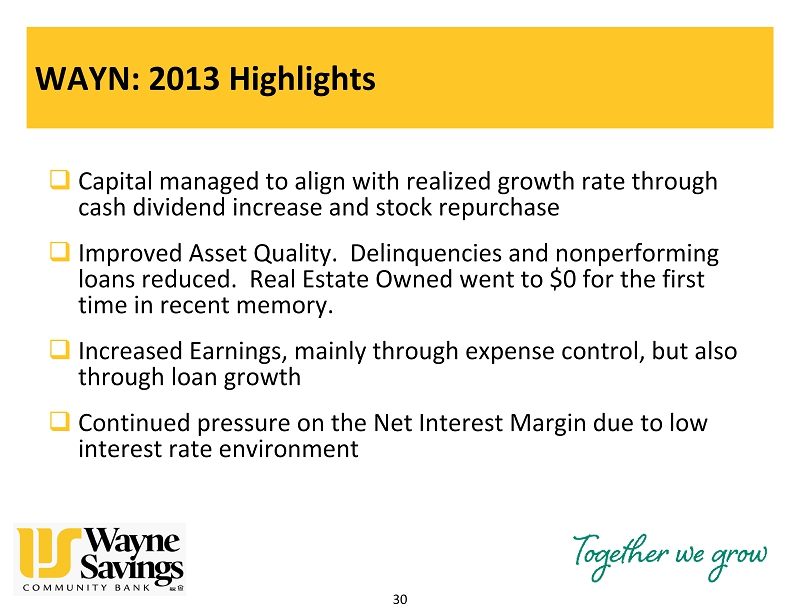

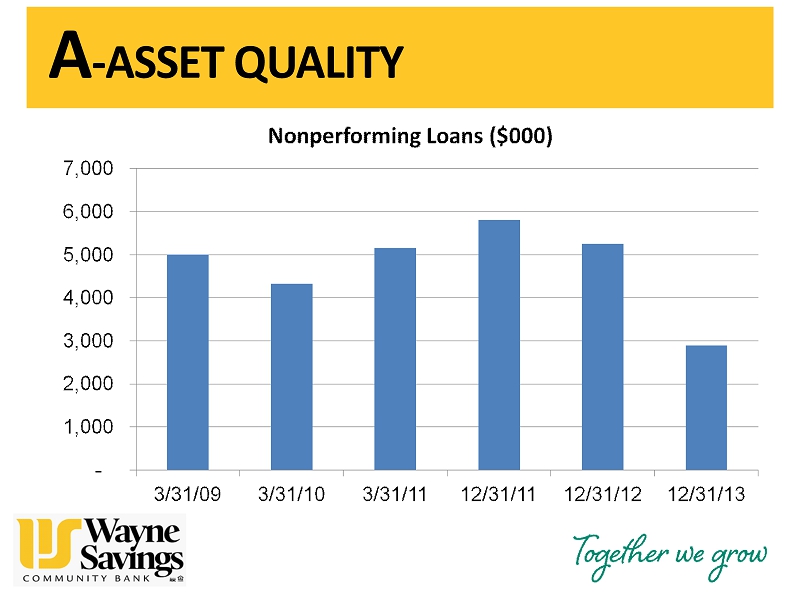

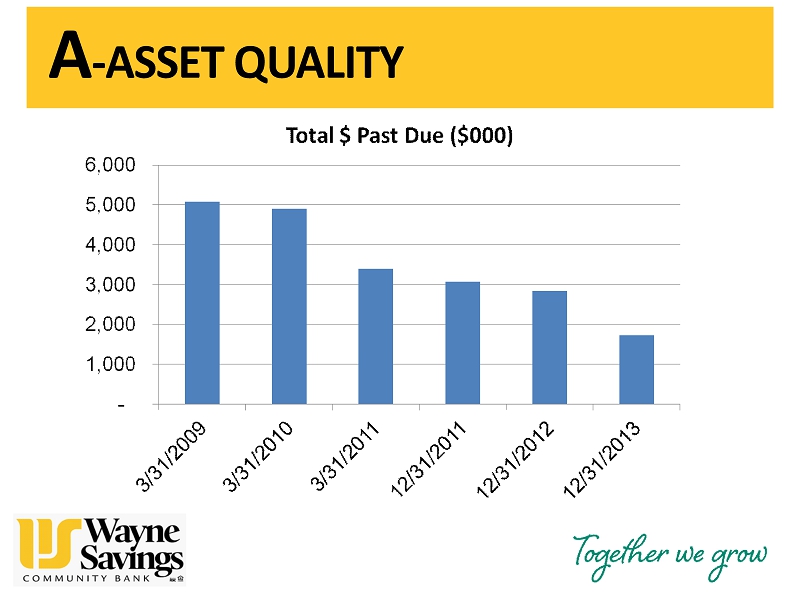

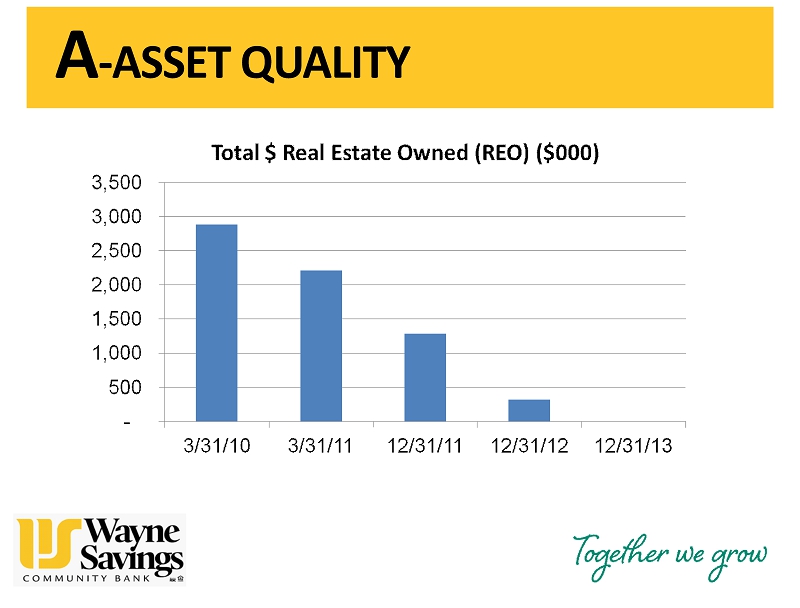

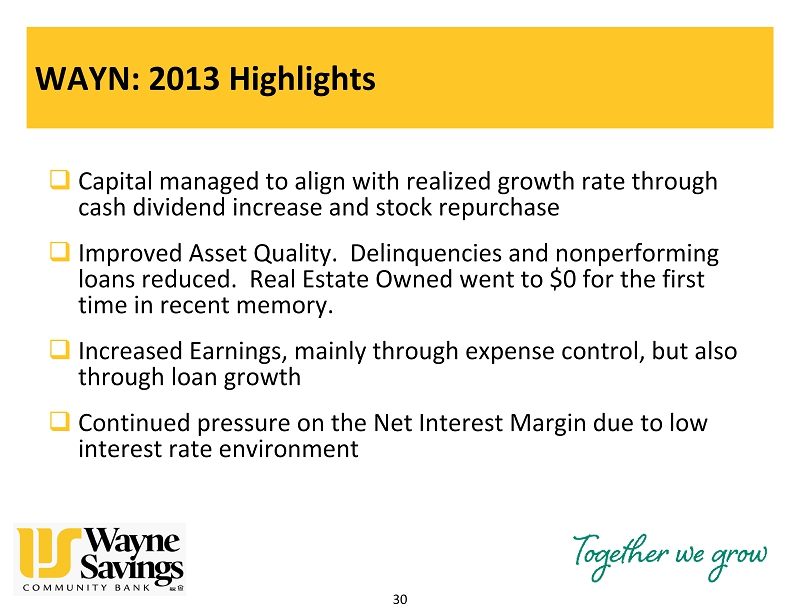

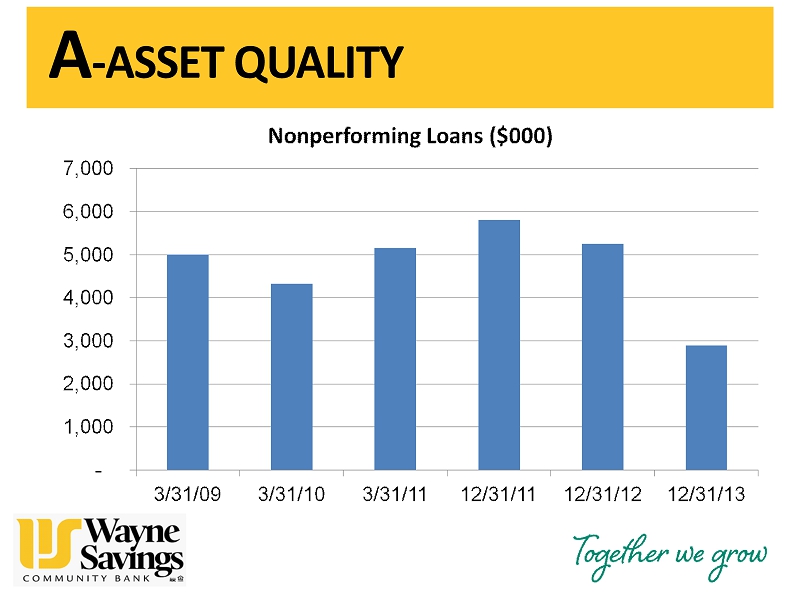

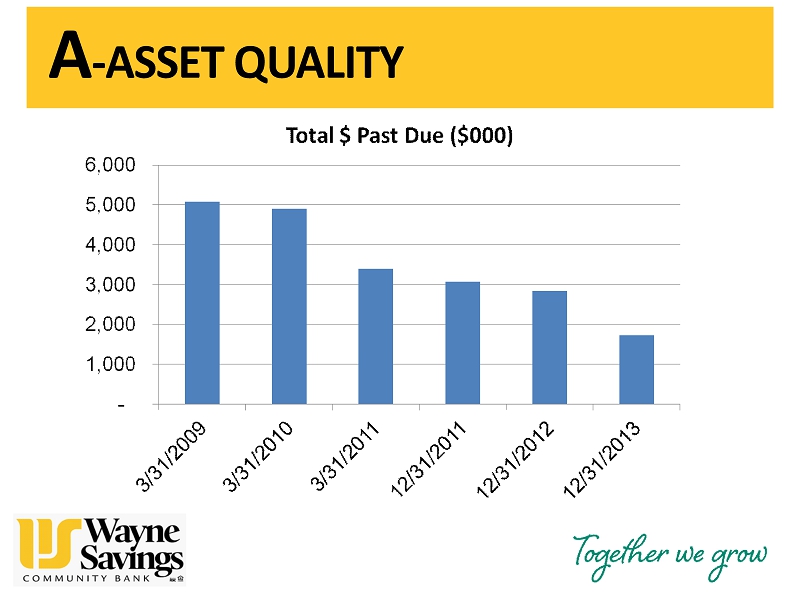

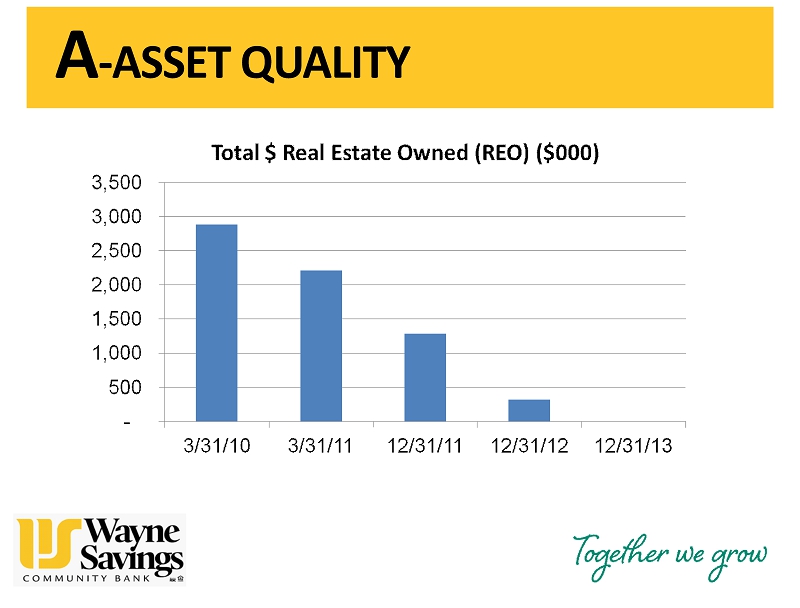

WAYN: 2013 Highlights □ Capital managed to align with realized growth rate through cash dividend increase and stock repurchase □ Improved Asset Quality. Delinquencies and nonperforming loans reduced. Real Estate Owned went to $0 for the first time in recent memory. □ Increased Earnings, mainly through expense control, but also through loan growth □ Continued pressure on the Net Interest Margin due to low interest rate environment 30

C - CAPITAL

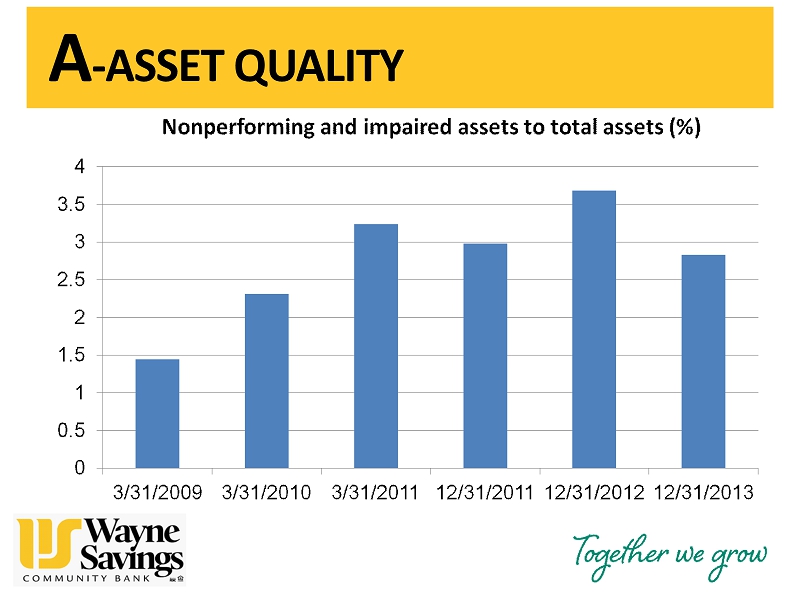

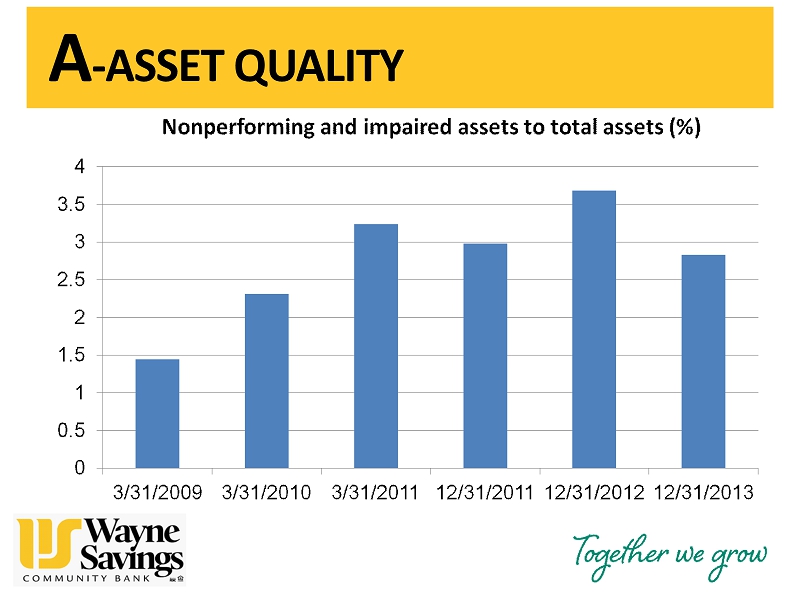

A - ASSET QUALITY

A - ASSET QUALITY

A - ASSET QUALITY

A - ASSET QUALITY

□ Everything not in C, A, E, L or S □ Strategy , Reputation, Operations, Compliance , Information Security □ Some acronyms you might have heard – CRA (Community Reinvestment Act) – BSA (Bank Secrecy Act) – GLBA (Gramm - Leach - Bliley Act) M - MANAGEMENT

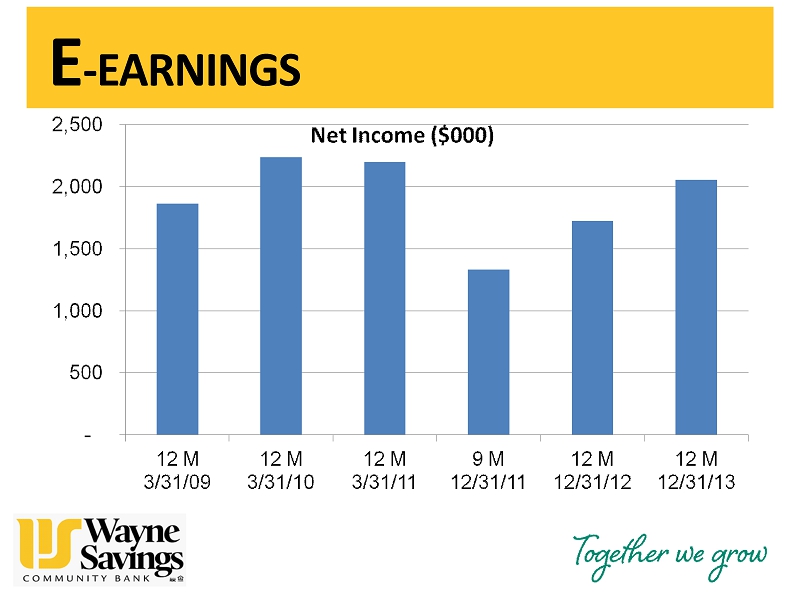

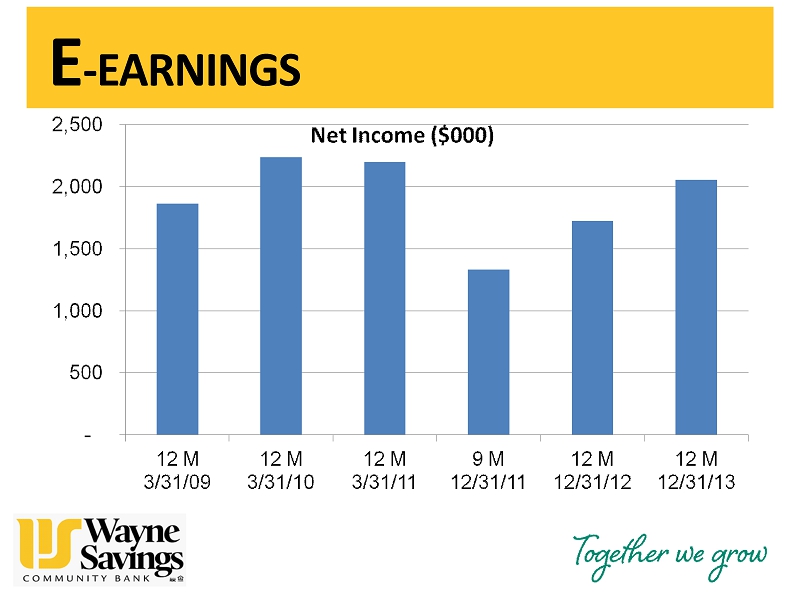

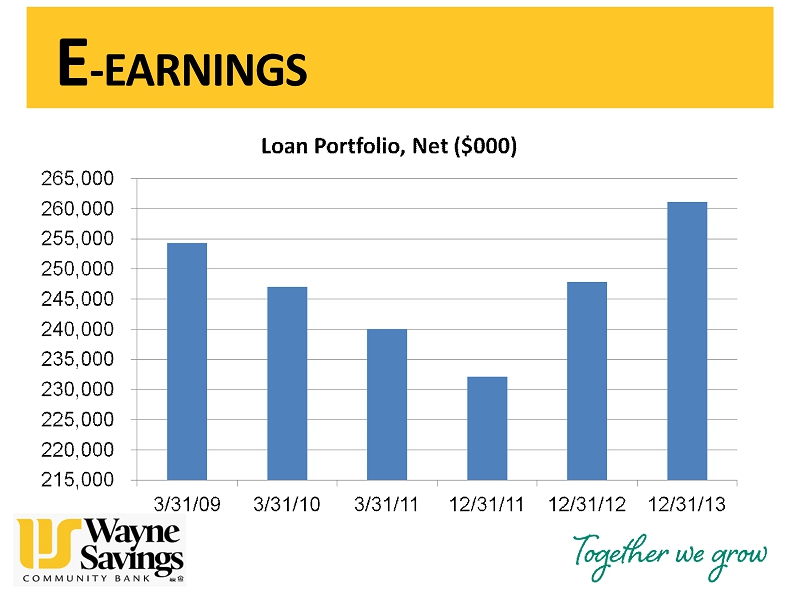

E - EARNINGS

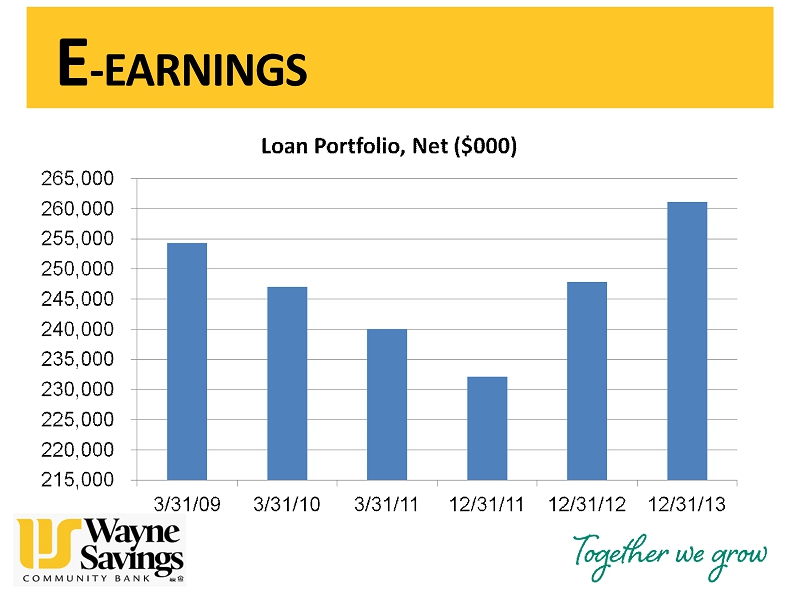

E - EARNINGS

L - LIQUIDITY □ Deposits are our principal source of funds. □ Two principal types – low - cost transaction accounts for everyday use by consumers and businesses and higher - cost time deposits, mainly by consumers. □ Liquidity is our ability to fund loans or deposit withdrawals when they occur – Investment Portfolio – Borrowed Funds

Interest Rate Risk □ Hard to measure due to lots of assumptions required to run models to estimate IRR. □ Falling rates - borrowers refinance loans at lower rates and securities pay down faster with reinvestment at lower rates. Asset yields generally fall faster than the cost of funds , reducing net income . S - SENSITIVITY

S - SENSITIVITY □ Rising rates – depositors move into higher yielding accounts. Cost of funds generally rises faster than asset yields, reducing net income.

S - SENSITIVITY □ Interest rates are low and have been low for an extended period since the financial crisis of 2008. □ When will rates go up? □ The Federal Reserve is holding rates down through monetary policy and has published criteria for when it will allow rates to rise.

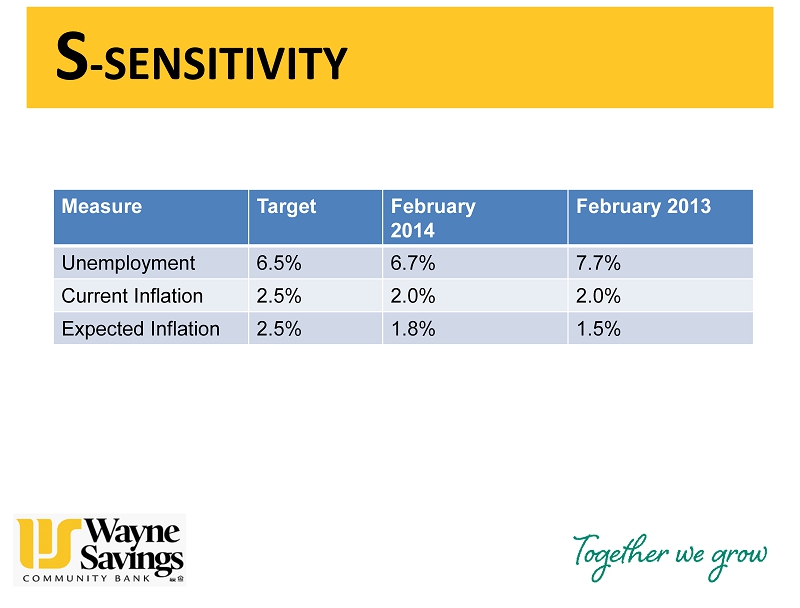

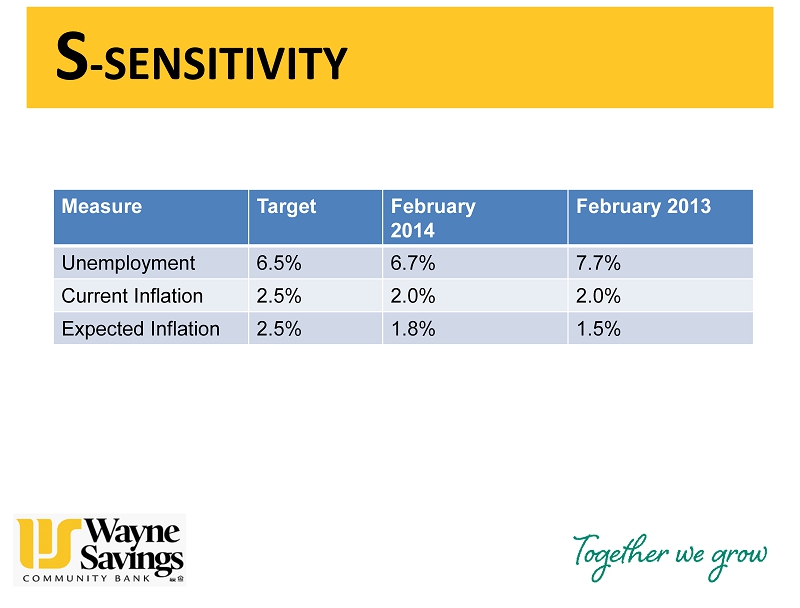

Measure Target February 2014 February 2013 Unemployment 6.5% 6.7% 7.7% Current Inflation 2.5% 2.0% 2.0% Expected Inflation 2.5% 1.8% 1.5% S - SENSITIVITY

S - SENSITIVITY

□ Branch traffic is decreasing, as transactions increasingly move to electronic channels. □ However , new accounts are still generally opened in branches, and service questions come to the branches. □ So , we’ve reduced staffing in our branches, but certain minimums are required for security and to provide adequate service levels . Operations

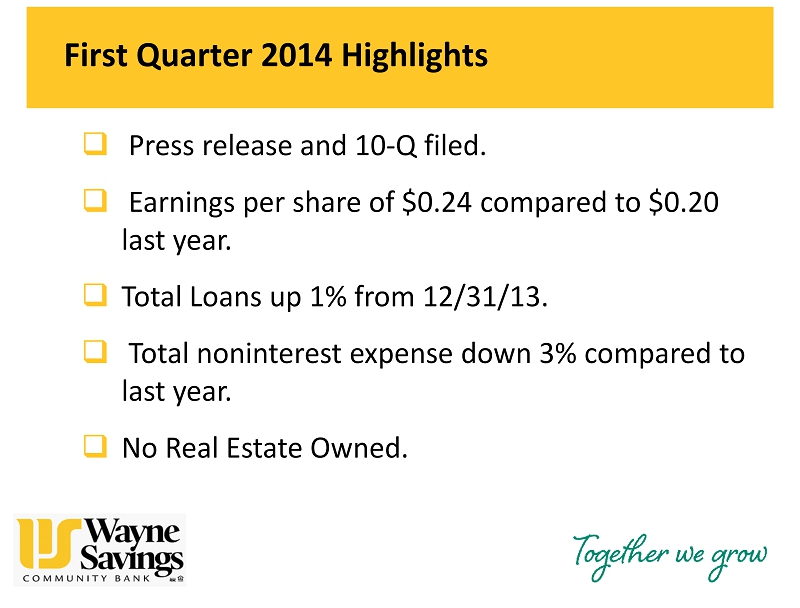

□ Press release and 10 - Q filed. □ Earnings per share of $0.24 compared to $0.20 last year. □ Total Loans up 1% from 12/31/13. □ Total noninterest expense down 3% compared to last year. □ No Real Estate Owned. First Quarter 2014 Highlights

REPORT OF THE INSPECTOR OF ELECTION Becky Rose, VP, Internal Audit

Adjournment Thank you for your support. Management will answer questions following the meeting.