UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

Wayne Savings Bancshares, Inc. |

(Name of Registrant as Specified in Its Charter) |

| |

Stilwell Value Partners VII, L.P. Stilwell Activist Fund, L.P. Stilwell Activist Investments, L.P. Stilwell Partners, L.P. Stilwell Value LLC Joseph Stilwell STEPHEN S. BURCHETT MARK D. ALCOTT |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

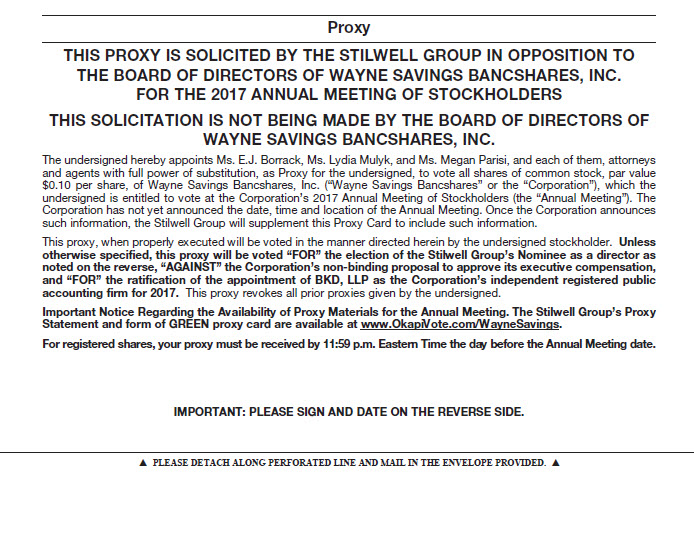

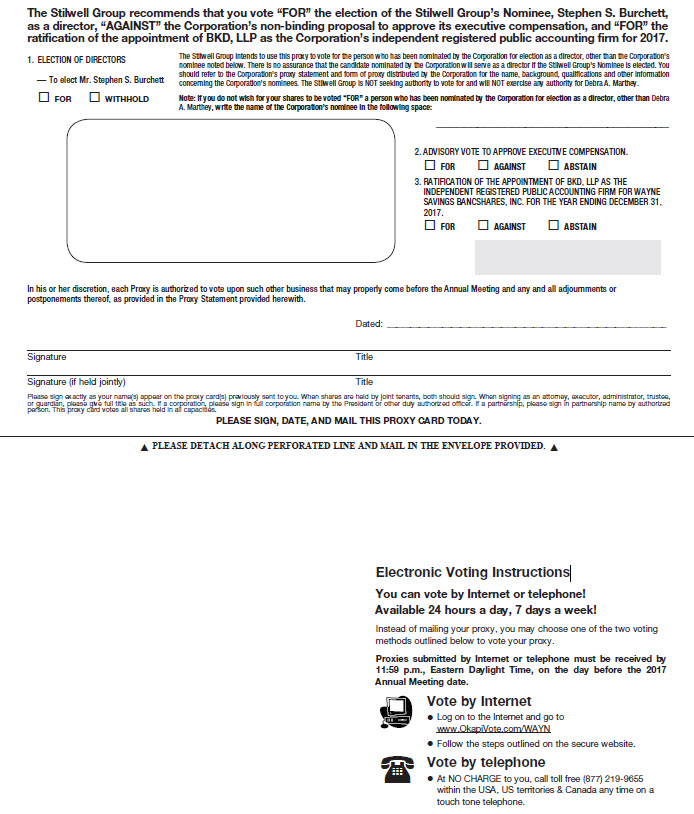

The Stilwell Group, together with the other participants named herein, has filed a definitive proxy statement and accompanying GREEN proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its director nominee at the 2017 annual meeting of stockholders of Wayne Savings Bancshares, Inc.

On March 14, 2017, the Stilwell Group delivered the following letter and GREEN proxy card to stockholders of Wayne Savings Bancshares, Inc.

The Stilwell Group

111 Broadway, 12th Floor

New York, NY 10006

(212) 269-1551

INFO@STILWELLGROUP.COM

Dear Fellow Stockholder,

We have been the largest public stockholder of Wayne Savings for well over five years now. After these many years, we recognize Wayne as a thoroughly disappointing company. Consequently, we are calling for Wayne’s sale to a better managed community bank.

| · | Wayne has had four CEOs in the past seven years! |

| · | In the last five years, the average savings bankearned over 50% more than Wayne’s average profit per dollar of stockholders’ funds! Additionally,Wayne was only half as efficient as the average savings bank at using its assets to generate earnings!1 |

| · | The current board memberscombined own a meager 2% of the Companyincluding shares given to them by the Company! Why don’t they have more skin in the game?2 |

| · | Both directors standing for re-election own thebare minimum of Wayne stock required by the board. One of them has been on the board since 2005!3 |

| · | The board recently chose the director with theleast amount of Wayne stock to be Wayne’s interim CEO. The Chair of the Board herself doesn’t own much more!2 |

The board seemingly won’t acknowledge how poorly it has done overseeing Wayne and how poorly it represents stockholders’ interests.

If you agree that it is time for the board to find a well-managed buyer for Wayne, please sign, date and return the enclosedGREENproxy card today FOR the election of our stockholder-friendly nominee, Stephen S. Burchett, at the Company’s 2017 Annual Meeting.

Wayne Savings – Thoroughly Disappointing.

Thank you for your support.

| | Sincerely, |

| | |

| |  |

| | Megan Parisi |

| | 917-881-8076 |

| | mparisi@stilwellgroup.com |

1 Using data available from the FDIC website, www.fdic.gov, the average return on equity (“ROE”) for all insured savings institutions for years 2012 to 2016 was 9.83%, or 7.11% for institutions with a similar asset size to Wayne Savings Bancshares, Inc. (“WAYN”). WAYN's average ROE for those years was 5.14%. The average return on assets (“ROA”) for all insured savings institutions for years 2012 to 2016 was 1.13%, or 0.89% for institutions with a similar asset size to WAYN. WAYN's average ROA for those years was 0.50%.SeeWAYN's Form 10-K filed with the SEC on March 11, 2016, p. 40; Form 8-K filed with the SEC on February 13, 2017;see alsohttps://www5.fdic.gov/qbp/2012dec/sav3.html, https://www5.fdic.gov/qbp/2013dec/sav3.html, https://www5.fdic.gov/qbp/2014dec/sav3.html, https://www.fdic.gov/bank/analytical/qbp/2015dec/sav3.html, and https://www.fdic.gov/bank/analytical/qbp/2016dec/sav3.html

| ROE (%) | 2012 | 2013 | 2014 | 2015 | 2016 | Average |

| All FDIC Savings Institutions | 8.92 | 9.07 | 9.87 | 9.93 | 11.37 | 9.83% |

| Institutions $100M - $1B in assets | 4.64 | 7.02 | 7.18 | 8.33 | 8.39 | 7.11% |

| ROE (%) | 2012 | 2013 | 2014 | 2015 | 2016 | Average |

| WAYN | 4.28 | 5.24 | 6.60 | 4.11 | 5.46 | 5.14% |

| ROA (%) | 2012 | 2013 | 2014 | 2015 | 2016 | Average |

| All FDIC Savings Institutions | 1.06 | 1.08 | 1.16 | 1.12 | 1.25 | 1.13% |

| Institutions $100M - $1B in assets | 0.55 | 0.86 | 0.91 | 1.06 | 1.07 | 0.89% |

| ROA (%) | 2012 | 2013 | 2014 | 2015 | 2016 | Average |

| WAYN | 0.43 | 0.51 | 0.64 | 0.39 | 0.51 | 0.50% |

2See WAYN’s Form DEF 14A filed with the SEC on April 21, 2016, pp. 21-22.

3See WSBI Director Stock Ownership Guidelines (dated 5/28/15) provided on the Company's website at ir.waynesavings.com/govdocs;see also WAYN’s Form DEF 14A filed with the SEC on April 21, 2016, pp. 17, 21.