EXHIBIT 99.2

inTEST Corporation

THIRD QUARTER 2019 EARNINGS ANNOUNCEMENT

CONFERENCE CALL SUPPLEMENTAL INFORMATION

NOVEMBER 8, 2019

inTEST Corporation is providing Supplemental Information in conjunction with our 2019 third quarter press release in order to provide shareholders and analysts with additional time and detail for analyzing our financial results in advance of our quarterly conference call. The conference call will begin today, Friday, November 8, 2019, at 8:30 am EST. To access the conference call, please dial (646) 828-8193 or (888) 394-8218. The passcode for the live call is 6975622. In addition, a live webcast will be available on inTEST’s website, www.intest.com under the “Investors” section and a replay of the webcast will be available for one year following the live broadcast.

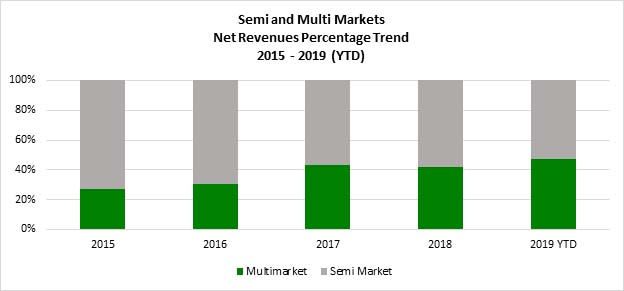

We are referring to our business somewhat differently in an effort to more crisply define the Company’s product mix and our strategic direction; which encompasses maximizing semiconductor related opportunities, as well as growing our business outside of semiconductor markets, both organically and through acquisition. Our historical roots are in the more cyclical Semiconductor market (or “Semi”), which is an important part of our business. “Multimarket” refers to the many other large, more diversified and growing markets for our precision equipment.

Please see the “Reconciliation of Net Earnings (Loss) (GAAP) to EBITDA (Non-GAAP)” later in this document for more details on non-GAAP financial measures, as well as a reconciliation from net earnings (loss) to EBITDA, a non-GAAP financial measure.

Summary of Business and Financial Highlights

Today we reported the following results for the third quarter of 2019:

| | ● | Bookings were $13.9 million, down 13% from $15.9 million reported for Q2 2019, and down 31% from $20.0 million reported for Q3 2018. Multimarket bookings were 52% of total bookings for Q3 2019, compared to 46% in Q2 2019 and 47% in Q3 2018. |

| | ● | Net revenues were $14.6 million, up 2% from $14.4 million reported for Q2 2019, and down 27% from $20.2 million reported for Q3 2018. Multimarket net revenues were 51% of total net revenues for Q3 2019, compared to 47% in Q2 2019 and 43% in Q3 2018. |

| | ● | Gross margin was $7.2 million or 49%, up from $6.7 million or 47% reported for Q2 2019, and down from $10.1 million or 50% reported for Q3 2018. |

| | ● | Operating income was $806,000, up from operating loss of ($294,000) reported for Q2 2019 and up from operating income of $219,000 reported for Q3 2018. |

| | ● | Net earnings were $647,000 or $0.06 per diluted share, up from net loss of ($187,000) or ($0.02) per diluted share reported for Q2 2019, and up from net loss of ($566,000) or ($0.05) per diluted share reported for Q3 2018. |

Summary of Bookings and Net Revenues

Bookings by end market served in dollars and as a percentage of total bookings and net revenues by end market served in dollars and as a percentage of total net revenues for the periods presented:

($ in 000s) | | Three Months Ended | |

| | | | | | | | | | | | | | | | | | | Change | | | | | | | | | | | Change | |

| | | 9/30/2019 | | | 6/30/2019 | | | $ | | | % | | | 9/30/2018 | | | $ | | | % | |

Bookings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industrial | | $ | 4,978 | | | | 35.9 | % | | $ | 4,623 | | | | 29.0 | % | | $ | 355 | | | | 7.7 | % | | $ | 5,365 | | | | 26.9 | % | | $ | (387 | ) | | | -7.2 | % |

Electronic Test | | | 2,277 | | | | 16.5 | % | | | 2,669 | | | | 16.8 | % | | | (392 | ) | | | -14.7 | % | | | 4,023 | | | | 20.1 | % | | | (1,746 | ) | | | -43.4 | % |

Multimarket (Non-Semi) | | $ | 7,255 | | | | 52.4 | % | | $ | 7,292 | | | | 45.8 | % | | $ | (37 | ) | | | -0.5 | % | | $ | 9,388 | | | | 47.0 | % | | $ | (2,133 | ) | | | -22.7 | % |

Semi Market | | | 6,602 | | | | 47.6 | % | | | 8,629 | | | | 54.2 | % | | | (2,027 | ) | | | -23.5 | % | | | 10,606 | | | | 53.0 | % | | | (4,004 | ) | | | -37.8 | % |

| | | $ | 13,857 | | | | 100.0 | % | | $ | 15,921 | | | | 100.0 | % | | $ | (2,064 | ) | | | -13.0 | % | | $ | 19,994 | | | | 100.0 | % | | $ | (6,137 | ) | | | -30.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Revenues | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industrial | | $ | 5,758 | | | | 39.3 | % | | $ | 4,279 | | | | 29.8 | % | | $ | 1,479 | | | | 34.6 | % | | $ | 5,576 | | | | 27.7 | % | | $ | 182 | | | | 3.3 | % |

Electronic Test | | | 1,748 | | | | 12.0 | % | | | 2,432 | | | | 17.0 | % | | | (684 | ) | | | -28.1 | % | | | 3,169 | | | | 15.7 | % | | | (1,421 | ) | | | -44.8 | % |

Multimarket (Non-Semi) | | $ | 7,506 | | | | 51.3 | % | | $ | 6,711 | | | | 46.8 | % | | $ | 795 | | | | 11.8 | % | | $ | 8,745 | | | | 43.4 | % | | $ | (1,239 | ) | | | -14.2 | % |

Semi Market | | | 7,126 | | | | 48.7 | % | | | 7,641 | | | | 53.2 | % | | | (515 | ) | | | -6.7 | % | | | 11,415 | | | | 56.6 | % | | | (4,289 | ) | | | -37.6 | % |

| | | $ | 14,632 | | | | 100.0 | % | | $ | 14,352 | | | | 100.0 | % | | $ | 280 | | | | 2.0 | % | | $ | 20,160 | | | | 100.0 | % | | $ | (5,528 | ) | | | -27.4 | % |

Third quarter Multimarket bookings were $7.3 million, or 52% of total bookings, compared with $7.3 million, or 46% of total bookings in the 2019 second quarter.

Third quarter Multimarket net revenues were $7.5 million, or 51% of total net revenues, compared with $6.7 million, or 47% of total net revenues in the 2019 second quarter.

Summary of Component Material Costs, Cost of Revenues and Gross Margin

Component material costs, cost of revenues and gross margin by segment in dollars and as a percentage of total net revenues in the periods presented:

Gross Margin ($ in 000s) | | Three Months Ended | |

| | | 9/30/2019 | | | 6/30/2019 | | | 9/30/2018 | |

Thermal | | | | | | | | | | | | | | | | | | | | | | | | |

Component material costs | | $ | 3,335 | | | | 31.4 | % | | $ | 3,259 | | | | 31.0 | % | | $ | 5,010 | | | | 34.3 | % |

Cost of revenues | | $ | 5,542 | | | | 52.2 | % | | $ | 5,607 | | | | 53.3 | % | | $ | 7,561 | | | | 51.7 | % |

Gross margin | | $ | 5,080 | | | | 47.8 | % | | $ | 4,912 | | | | 46.7 | % | | $ | 7,055 | | | | 48.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

EMS | | | | | | | | | | | | | | | | | | | | | | | | |

Component material costs | | $ | 1,260 | | | | 31.4 | % | | $ | 1,382 | | | | 36.0 | % | | $ | 1,838 | | | | 33.2 | % |

Cost of revenues | | $ | 1,885 | | | | 47.0 | % | | $ | 2,026 | | | | 52.9 | % | | $ | 2,506 | | | | 45.2 | % |

Gross margin | | $ | 2,125 | | | | 53.0 | % | | $ | 1,807 | | | | 47.1 | % | | $ | 3,037 | | | | 54.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | | | | | | | | | | | | | | | | | | | | | | |

Component material costs | | $ | 4,595 | | | | 31.4 | % | | $ | 4,641 | | | | 32.3 | % | | $ | 6,848 | | | | 34.0 | % |

Cost of revenues | | $ | 7,427 | | | | 50.8 | % | | $ | 7,633 | | | | 53.2 | % | | $ | 10,068 | | | | 49.9 | % |

Gross margin | | $ | 7,205 | | | | 49.2 | % | | $ | 6,719 | | | | 46.8 | % | | $ | 10,092 | | | | 50.1 | % |

Third quarter gross margin was $7.2 million, or 49%, as compared with $6.7 million, or 47%, in the 2019 second quarter. The improvement in the gross margin was the result of a decrease in our fixed manufacturing costs as a percentage of net revenues as well as a reduction in our component material costs as a percentage of our net revenues. Consolidated component material costs decreased from 32.3% in Q2 2019 to 31.4% in Q3 2019, reflecting lower component material costs in our EMS segment.

The decrease in the component material costs in our EMS segment, which declined from 36.0% in the 2019 second quarter to 31.4% in the 2019 third quarter, was due to a more favorable product and customer mix in the third quarter as compared to the second quarter. This decline was partially offset by a slight increase in the component material costs of our Thermal segment, which saw its component material costs grow from 31.0% in the second quarter to 31.4% in the third quarter, reflecting a less favorable product and customer mix.

Fixed manufacturing costs declined $125,000, or 5% sequentially, to $2.4 million in Q3 2019, and were more favorably absorbed in the third quarter due to the higher net revenues. As a result, these costs represented 16.1% of our net revenues in the third quarter as compared to 17.3% in the 2019 second quarter. The reduction in the dollar amount of our fixed manufacturing costs was driven by reduced salary and benefits in our Thermal segment as well as improved machine shop utilization in our EMS segment.

Summary of Results of Operations

Results of operations in dollars and as a percentage of total net revenues in the periods presented:

($ in 000s, except per share data) | | Three Months Ended | |

| | | | | | | | | | | | | | | | | | | Change | | | | | | | | | | | Change | |

| | | 9/30/2019 | | | 6/30/2019 | | | $ | | | % | | | 9/30/2018 | | | $ | | | % | |

Net revenues | | $ | 14,632 | | | | 100.0 | % | | $ | 14,352 | | | | 100.0 | % | | $ | 280 | | | | 2.0 | % | | $ | 20,160 | | | | 100.0 | % | | $ | (5,528 | ) | | | -27.4 | % |

Cost of revenues | | | 7,427 | | | | 50.8 | % | | | 7,633 | | | | 53.2 | % | | | (206 | ) | | | -2.7 | % | | | 10,068 | | | | 49.9 | % | | | (2,641 | ) | | | -26.2 | % |

Gross margin | | | 7,205 | | | | 49.2 | % | | | 6,719 | | | | 46.8 | % | | | 486 | | | | 7.2 | % | | | 10,092 | | | | 50.1 | % | | | (2,887 | ) | | | -28.6 | % |

Selling expense | | | 2,044 | | | | 14.0 | % | | | 2,087 | | | | 14.5 | % | | | (43 | ) | | | -2.1 | % | | | 2,291 | | | | 11.4 | % | | | (247 | ) | | | -10.8 | % |

R&D expense | | | 1,261 | | | | 8.6 | % | | | 1,208 | | | | 8.4 | % | | | 53 | | | | 4.4 | % | | | 1,207 | | | | 6.0 | % | | | 54 | | | | 4.5 | % |

G&A expense | | | 3,094 | | | | 21.1 | % | | | 3,718 | | | | 25.9 | % | | | (624 | ) | | | -16.8 | % | | | 3,318 | | | | 16.5 | % | | | (224 | ) | | | -6.8 | % |

Adjust to CCL | | | - | | | | 0.0 | % | | | - | | | | 0.0 | % | | | - | | | | - | | | | 3,057 | | | | 15.2 | % | | | (3,057 | ) | | | -100.0 | % |

Operating expenses | | | 6,399 | | | | 43.7 | % | | | 7,013 | | | | 48.8 | % | | | (614 | ) | | | -8.8 | % | | | 9,873 | | | | 49.1 | % | | | (3,474 | ) | | | -35.2 | % |

Operating income (loss) | | | 806 | | | | 5.5 | % | | | (294 | ) | | | -2.0 | % | | | 1,100 | | | | -374.1 | % | | | 219 | | | | 1.0 | % | | | 587 | | | | 268.0 | % |

Other income (expense) | | | (12 | ) | | | -0.1 | % | | | (6 | ) | | | -0.1 | % | | | (6 | ) | | | 100.0 | % | | | (57 | ) | | | -0.3 | % | | | 45 | | | | 78.9 | % |

Pre-tax income (loss) | | | 794 | | | | 5.4 | % | | | (300 | ) | | | -2.1 | % | | | 1,094 | | | | -364.7 | % | | | 162 | | | | 0.8 | % | | | 632 | | | | 390.1 | % |

Income tax expense (benefit) | | | 147 | | | | 1.0 | % | | | (113 | ) | | | -0.8 | % | | | 260 | | | | 230.1 | % | | | 728 | | | | 3.6 | % | | | (581 | ) | | | -79.8 | % |

Net income (loss) | | $ | 647 | | | | 4.4 | % | | $ | (187 | ) | | | -1.3 | % | | $ | 834 | | | | 446.0 | % | | $ | (566 | ) | | | -2.8 | % | | $ | 1,213 | | | | 214.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted EPS | | $ | 0.06 | | | | | | | $ | (0.02 | ) | | | | | | | | | | | | | | $ | (0.05 | ) | | | | | | | | | | | | |

Weighted Avg Shares - diluted | | | 10,430 | | | | | | | | 10,411 | | | | | | | | | | | | | | | | 10,356 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 1,276 | | | | 8.7 | % | | $ | 199 | | | | 1.4 | % | | $ | 1,077 | | | | 541.2 | % | | $ | 3,750 | | | | 18.6 | % | | $ | (2,474 | ) | | | -66.0 | % |

Selling expense declined from $2.1 million for the 2019 second quarter to $2.0 million for the 2019 third quarter, a decrease of $43,000 or 2%. The reduction in selling expense was primarily driven by reduced commission expense, as well as reductions in advertising and warranty expenses. These reductions were partially offset by increased sales travel costs.

Engineering and product development expense increased from $1.2 million for the 2019 second quarter to $1.3 million in the 2019 third quarter, an increase of $53,000 or 4% sequentially. The increase was driven by higher levels of legal costs related to our intellectual property, increased spending on product development consultants and development materials.

General and administrative expense declined from $3.7 million for the 2019 second quarter to $3.1 million for the 2019 third quarter, a decrease of $624,000 or 17%. Non-recurring items in second quarter G&A expense included $351,000 of acquisition-related expense from the transaction that did not close in the second quarter and $223,000 of expense related to consolidation of Ambrell’s European facilities.

When adjusted to remove these non-recurring costs, our 2019 third quarter G&A expense would have declined $50,000 or 2.0% sequentially, and the decrease was primarily related to reduced levels of profit-related bonuses. We expect the consolidation of Ambrell’s European facilities will reduce future operating expenses by $345,000 annually. On an after-tax basis, these non-recurring costs represented $358,000 or $0.03 per diluted share in Q2 2019.

Other expense was $12,000 in the 2019 third quarter as compared to $6,000 in the 2019 second quarter.

We accrued income tax expense of $147,000 for the 2019 third quarter, compared to an income tax benefit of ($113,000) recorded in the 2019 second quarter. Our effective tax rate was 19% in Q3, compared to 38% in the second quarter. Our unusually high effective tax rate in the second quarter was the result of adjustments made to reduce our year-to-date effective tax rate to 18%. We currently expect our 2019 annual effective tax rate to be between 17% and 18%.

For the quarter ended September 30, 2019, we had net earnings of $647,000 or $0.06 per diluted share, compared to a net loss of ($187,000) or ($0.02) per diluted share for the 2019 second quarter.

Diluted weighted average shares outstanding were 10,429,536 at September 30, 2019. We issued 16,900 shares of restricted stock during the third quarter and repurchased 39,158 shares in our buyback, which began on September 18, 2019.

Depreciation expense was $170,000 for the 2019 third quarter, while acquired intangible amortization was $312,000, both relatively unchanged from the 2019 second quarter. Restricted stock compensation expense was $242,000 for the 2019 third quarter.

EBITDA increased from $199,000 for the 2019 second quarter to $1.3 million reported for the 2019 third quarter.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents at the end of the 2019 third quarter were $8.0 million, up $431,000 from June 30, 2019. During the quarter we spent $179,000 on the repurchase of our common stock and today cash stands at $7.0 million.

We currently expect cash and cash equivalents to grow sequentially through year-end, excluding the impact of any potential acquisition-related and/or stock buyback activities.

Accounts receivable was flat at $9.2 million, or 58 DSO, at September 30, 2019.

Inventories increased $538,000 to $7.7 million at September 30, 2019, which corresponded to 150 days of inventory, which is at the high end of our normal range.

Capital expenditures during the 2019 third quarter were $115,000, down from $157,000 in the 2019 second quarter.

Backlog at the end of September was $8.0 million, down from $8.8 million at June 30, 2019.

Reconciliation of Net Earnings (Loss) (GAAP) to Adjusted EBITDA (Non-GAAP)

($ in 000s) | | Three Months Ended | |

| | | 9/30/2019 | | | 6/30/2019 | | | 9/30/2018 | |

| | | | | | | | | | | | | |

Net earnings (loss) (GAAP) | | $ | 647 | | | $ | (187 | ) | | $ | (566 | ) |

Acquired intangible amortization | | | 312 | | | | 315 | | | | 323 | |

Interest expense | | | - | | | | - | | | | 1 | |

Income tax expense (benefit) | | | 147 | | | | (113 | ) | | | 728 | |

Depreciation | | | 170 | | | | 184 | | | | 207 | |

EBITDA (Non-GAAP) | | | 1,276 | | | | 199 | | | | 693 | |

Contingent consideration liability adjustment | | | - | | | | - | | | | 3,057 | |

Adjusted EBITDA (Non-GAAP) | | $ | 1,276 | | | $ | 199 | | | $ | 3,750 | |

Non-GAAP Results

In addition to disclosing results that are determined in accordance with GAAP, we also disclose adjusted EBITDA, which is a non-GAAP financial measure. Adjusted EBITDA is derived by adding acquired intangible amortization, interest expense, income tax expense, depreciation and the contingent consideration liability adjustment to net earnings (loss). This non-GAAP financial measure is provided as a complement to the results provided in accordance with GAAP. Adjusted EBITDA is a non-GAAP financial measure presented to provide investors with meaningful, supplemental information regarding our baseline performance before acquired intangible amortization charges, interest expense, income tax expense (benefit), depreciation and the contingent consideration liability adjustment as these expenses or income items may not be indicative of our current core business or future outlook. This non-GAAP financial measure is used by management to make operational decisions, to forecast future operational results, and for comparison with our business plan, historical operating results and the operating results of our peers. A reconciliation from net earnings (loss) to adjusted EBITDA, is contained in the table above. The presentation of a non-GAAP financial measure is not meant to be considered in isolation, as a substitute for, or superior to, financial measures or information provided in accordance with GAAP.

Semi Market and Multi Markets Net Revenues Percentage Trend (2015 - 2019 YTD)

###

Page 9 of 9