QuickLinks -- Click here to rapidly navigate through this document As filed with the United States Securities and Exchange Commission on May 13, 2008

Registration No. 333-149663

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CYDEX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 2834 | | 74-2807105 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

10513 W. 84th Terrace

Lenexa, KS 66214

(913) 685-8850

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

JOHN M. SIEBERT, Ph.D.

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

CYDEX PHARMACEUTICALS, INC.

10513 W. 84th TERRACE

LENEXA, KS 66214

(913) 685-8850

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Brett D. White, Esq.

Eric H. Anderson, Esq.

Cooley Godward KronishLLP

Five Palo Alto Square

3000 El Camino Real

Palo Alto, CA 94306

(650) 843-5000 | | William C. Davisson, III, Esq.

Goodwin ProcterLLP

135 Commonwealth Drive

Menlo Park, CA 94025

(650) 752-3100 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filero | | Accelerated filero |

| Non-accelerated filerý (Do not check if a smaller reporting company) | | Smaller reporting company o |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 13, 2008

Shares

| CyDex Pharmaceuticals, Inc. |  |

Common Stock

$ per share

- •

- We are offering shares of common stock.

- •

- This is our initial public offering and no public market currently exists for our shares.

- •

- We anticipate the initial public offering price will be between $ and $ per share.

- •

- We have applied to have the common stock approved for listing on the Nasdaq Global Market under the symbol CYDX.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 10.

|

|

|

|

Per Share

|

|

Total

|

|---|

| Initial public offering price | | $ | | | $ | |

| Underwriting discount | | $ | | | $ | |

| Proceeds, before expenses, to CyDex Pharmaceuticals, Inc. | | $ | | | $ | |

|

|

|

|

|

|

|

|

|

We have granted the underwriters a 30-day option to purchase up to additional shares of common stock from us to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2008.

Pacific Growth Equities, LLC

JMP Securities

Fortis Securities LLC

, 2008

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 1 |

| Risk Factors | | 10 |

| Forward-Looking Statements and Industry Data | | 30 |

| Use of Proceeds | | 32 |

| Dividend Policy | | 32 |

| Capitalization | | 33 |

| Dilution | | 35 |

| Selected Consolidated Financial Data | | 37 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 39 |

| Business | | 57 |

| Management | | 85 |

| Certain Relationships and Related Persons Transactions | | 112 |

| Principal Stockholders | | 114 |

| Description of Capital Stock | | 117 |

| Certain United States Federal Tax Consequences to Non-United States Holders | | 121 |

| Shares Eligible for Future Sale | | 124 |

| Underwriting | | 126 |

| Legal Matters | | 129 |

| Experts | | 129 |

| Where You Can Find Additional Information | | 130 |

| Index to Consolidated Financial Statements | | F-1 |

PROSPECTUS SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider. After you read the following summary, you should read and consider carefully the more detailed information and financial statements and related notes that we include in this prospectus. If you invest in our common stock, you are assuming a high degree of risk. See the section of this prospectus entitled "Risk Factors."

Overview

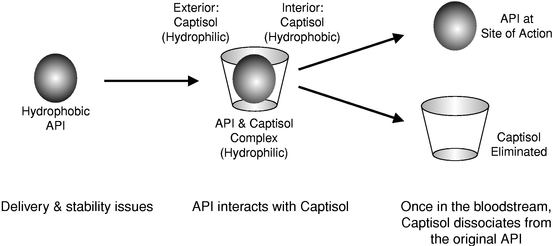

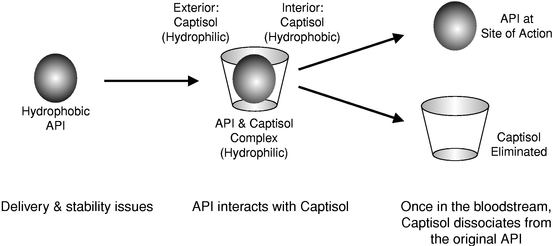

We are a specialty pharmaceutical company focused on the development and commercialization of drugs specifically designed to address limitations of current therapies in selected established markets. We have developed a broad portfolio of 12 product candidates utilizing our drug formulation technology using Captisol® cyclodextrins. Captisol cyclodextrins are a patent protected, specifically modified family of cyclodextrins designed to improve solubility, stability, bioavailability, safety and/or dosing of a number of active pharmaceutical ingredients, or APIs. Captisol cyclodextrins are ring-shaped molecules comprised of sugar molecules. A number of different types of APIs that are not otherwise readily soluble in water can interact with Captisol cyclodextrins, resulting in compounds that are more water-soluble than the API would be standing alone. By applying our Captisol technology to APIs with established safety and efficacy characteristics, we believe that we can create differentiated products with significant commercial opportunities, while simultaneously reducing development risk, costs and timelines as compared to the development of new chemical entities.

We generate revenue through a number of activities, including outlicensing our drug formulation technology to established pharmaceutical companies. Our technology has been validated by the launch of four Captisol-Enabled® products commercialized by Pfizer and Bristol-Myers Squibb, or BMS. Our outlicensing effort has allowed us to advance our Captisol technology, generate cash flow for our company and expand our strategy to capitalize on the growth opportunities and business lines enabled by Captisol. We intend to leverage the formulation, development, regulatory and intellectual property expertise garnered from our experience to facilitate the development and commercialization of our own product candidates for use in the acute care hospital setting. We refer to these product candidates as our retained product candidates. For those product candidates that will likely require more extensive development and commercialization efforts, which we refer to as our partner product candidates, we partner with established pharmaceutical or specialty pharmaceutical companies. All of our retained product candidates and partner product candidates are currently in development and have not yet been commercialized. We plan to continue to outlicense our Captisol technology to third parties for use in the development of their own products. The following table presents information

1

describing our seven leading product candidates, as well as the four Captisol-Enabled products currently marketed by Pfizer and BMS:

Captisol-Enabled Product Candidate or Product

| | Brand Name of

Approved Third-

Party Product

Containing

Chemically

Equivalent API

| | Target Indication

| | Stage of Development

| | Partner or Outlicensee

|

|---|

| Retained Product Candidates | | | | | | |

Captisol-Enabled Fosphenytoin IV and IM |

|

Cerebyx |

|

Status Epilepticus |

|

NDA Submission Anticipated in Late 2008 |

|

Retained by CyDex |

Captisol-Enabled Melphalan IV |

|

Alkeran |

|

Multiple Myeloma |

|

Preclinical |

|

Retained by CyDex |

Captisol-Enabled Topiramate IV |

|

Topamax |

|

Epilepsy |

|

Pre-IND Meeting Held in May 2008 |

|

Retained by CyDex |

Partner Product Candidates |

|

|

|

|

|

|

Captisol-Enabled Amiodarone IV |

|

Cordarone |

|

Arrhythmia |

|

NDA Submitted in 2008 |

|

Prism |

Captisol-Enabled Clopidogrel IV |

|

Plavix |

|

Atherothrombosis |

|

NDA Submission Anticipated in 2010 |

|

Prism |

Captisol-Enabled Budesonide solution for inhalation |

|

Pulmicort Respules |

|

Asthma |

|

Phase 2 Clinical Trials Completed in the U.K. |

|

AstraZeneca |

Captisol-Enabled Budesonide nasal spray |

|

Rhinocort |

|

Nasal Allergy |

|

Phase 2 Clinical Trial Completed in Canada |

|

Under discussion |

Marketed Products |

|

|

|

|

|

|

Geodon IM |

|

— |

|

Bipolar Disorder and Schizophrenia |

|

Market |

|

Pfizer |

Vfend IV |

|

— |

|

Antifungal |

|

Market |

|

Pfizer |

Abilify Injection IM |

|

— |

|

Bipolar Disorder and Schizophrenia |

|

Market |

|

BMS |

Cerenia |

|

— |

|

Canine Motion Sickness |

|

Market |

|

Pfizer |

Issued patents relating to our product candidates and the Captisol-Enabled products marketed by Pfizer and BMS expire between 2010 and 2022, as more fully described in the section entitled "Business—Intellectual Property."

All of our product candidates are formulations of APIs used in commercially available drug products that have been approved by the Food and Drug Administration, or the FDA, for which we can potentially improve delivery efficiency. We believe we will be able to leverage the known safety and efficacy characteristics of these APIs to rapidly develop and commercialize product candidates on a Section 505(b)(2) regulatory pathway, under which the FDA may approve new drug applications, in part, on the basis of the FDA's previous findings of safety and efficacy for other drug products. This means that, upon a showing of bioequivalence to an approved drug product, one or more of our new drug applications could be approved on the basis of literature or FDA findings of safety and efficacy

2

related to the currently marketed APIs used in our formulations. While the FDA has discretion to request additional data to support approval, we believe that in some cases this path to registration should only necessitate the completion of a single or a small number of clinical trials demonstrating bioequivalence to the existing, previously approved formulation.

Our Products and Product Candidates

Retained Product Candidates

We are developing six product candidates for use in the acute care hospital setting, and we intend to build a focused U.S.-based specialty sales force to market these product candidates. The following describes our three leading retained product candidates:

Captisol-Enabled Fosphenytoin IV and IM. Fosphenytoin is an approved injectable therapy marketed by Pfizer under the brand name Cerebyx for the acute treatment of status epilepticus. The current formulation of Cerebyx requires refrigeration, making it difficult to utilize in emergency settings that do not have access to a refrigeration unit, such as many ambulances or helicopters. Our product candidate is a Captisol-Enabled formulation of fosphenytoin for either intravenous, or IV, or intramuscular, or IM, injection that we have designed to not require refrigeration. We anticipate filing a new drug application, or NDA, for Captisol-Enabled Fosphenytoin IV and IM in late 2008.

Captisol-Enabled Melphalan IV. Melphalan, marketed by Celgene Corporation under the name Alkeran, is an injectable, palliative treatment for patients with multiple myeloma for whom oral therapy is not appropriate. The current formulation of melphalan is presented as two separate vials that must be reconstituted immediately prior to use and is stable for only a period of up to two hours. As the actual administration of each dose of Alkeran is done over a minimum of 15 minutes, the prepared product must be administered immediately after mixing. We have developed Captisol-Enabled Melphalan IV, which is a one-vial system that we believe will have a longer use time. Assuming we are able to demonstrate bioequivalence to Alkeran in anticipated clinical trials, we plan to submit an NDA for Captisol-Enabled Melphalan IV in late 2009.

Captisol-Enabled Topiramate IV. Topiramate is an orally administered drug marketed by Ortho-McNeil Neurologics under the brand name Topamax for the prevention of migraines and the treatment of epilepsy. Topiramate is an oral solid dosage form, which may take up to two hours to reach peak blood levels, making it a suboptimal treatment option for the acute treatment of either a migraine or a seizure. Additionally, many patients in the acute setting are unable to take oral medications and require IV formulated products. We are developing Captisol-Enabled Topiramate IV to be used for the treatment of epilepsy, which we believe will provide significantly faster therapeutic onset compared to the oral formulation. A pre-investigational new drug, or pre-IND, meeting was held with the FDA in May 2008.

Partner Product Candidates

We are developing six product candidates that we have either collaborated with, outlicensed or intend to outlicense to partners for further development and commercialization. To date, we have entered into agreements with respect to Captisol-Enabled Amiodarone IV, Captisol-Enabled Clopidogrel IV and Captisol-Enabled Budesonide solution for inhalation. We believe that these agreements validate our technology and our ability to identify, develop and subsequently outlicense these opportunities. The following describes our leading partner product candidates:

Captisol-Enabled Amiodarone IV. Amiodarone is currently marketed under the brand name Cordarone for the treatment of life-threatening recurrent ventricular arrhythmia when patients have

3

not responded to other available antiarrhythmics or when alternative agents could not be tolerated. Due to the poor water-solubility of this API, the injectable formulation utilizes a solvent system that is associated with a potential major adverse side effect, a rapid decrease in blood pressure. We have developed Captisol-Enabled Amiodarone IV, which does not contain the solvent system found in the current formulation. We believe this will offer a potentially safer therapeutic option for patients. We have outlicensed Captisol-Enabled Amiodarone IV to Prism Pharmaceuticals, Inc., or Prism, and Prism is developing this product candidate. Based on our communications with Prism, we understand that Prism submitted an NDA for this product candidate in 2008.

Captisol-Enabled Clopidogrel IV. Clopidogrel, marketed as Plavix, is available as a solid oral dose to reduce the incidence of clot formation associated with cardiovascular surgery and cardiovascular complications. Clopidogrel is highly insoluble in water, and there are currently no IV or oral liquid dosage forms of this API available. As a result, physicians must wait a number of hours prior to surgery in order to allow the active drug in the oral dose to reach maximum blood levels. We believe that Captisol-Enabled Clopidogrel IV has the potential to reach peak blood levels within 30 minutes of administration. Furthermore, we also believe that our formulation may enable physicians to administer a lower dose of Clopidogrel relative to Plavix while achieving equivalent levels of bioactivity. We have engaged in a collaboration with Prism to develop Captisol-Enabled Clopidogrel IV. Based on our communications with Prism, we believe that Prism could submit an NDA for this product candidate in 2010.

Captisol-Enabled Budesonide. Budesonide is a steroid currently approved for the treatment of multiple indications, including asthma, hay fever and other allergies. However, current formulations require a relatively high dose and can require a relatively long time to administer. We are currently developing three formulations of Captisol-Enabled Budesonide: an inhalation solution for the treatment of asthma; a nasal spray for the treatment of nasal allergies; and an ophthalmic solution for the treatment of allergies. When tested on human volunteers, we observed that the Captisol-Enabled Budesonide solution for inhalation produced similar plasma levels in approximately one-fourth of the time relative to a budesonide suspension prepared from the commercially available Pulmicort Respules. As compliance is a serious concern with asthma patients, especially pediatric patients, we believe that this improved administration profile could be a distinct commercial advantage. We have also observed that when using a more efficient nebulizer, we may be able to use a significantly lower concentration of budesonide to achieve the same bioactivity as Pulmicort Respules, thereby potentially reducing the amount of steroid delivered. In 2006, we entered into a license agreement with Verus Pharmaceuticals Inc., or Verus, for the North American rights to the Captisol-Enabled Budesonide solution for inhalation, which Verus recently assigned to AstraZeneca AB, or AstraZeneca, through its subsidiary Tika Läkemedel AB. In 2008, we entered into an option agreement with AstraZeneca pursuant to which we granted AstraZeneca an exclusive, irrevocable option to expand the territory covered by the North American license agreement and related supply agreement to include all the countries in the world. We and our partners have already carried out three Phase 1 and two Phase 2 proof-of-concept clinical trials with Captisol-Enabled Budesonide.

Captisol Outlicensing Pipeline

We have outlicensed our Captisol technology to a number of organizations, including Critical Therapeutics, Daiichi Asubio, Proteolix, Sunesis, Taisho and TargeGen, and we have over 30 agreements currently in place. We currently receive royalties from Pfizer and BMS on the sales of Captisol-Enabled Geodon IM, Vfend IV, Abilify Injection IM and Cerenia. In 2007, we earned $3.8 million in royalty revenue from these outlicensees.

4

Product Candidate Selection and Development

In order for us to initiate a clinical development program, a drug compound must have a strong technical fit with our Captisol technology and also address an important unmet medical need in a significant patient population. We believe that combining our Captisol technology with APIs that have known safety and efficacy characteristics will enable us to move our retained product candidates from initial screening through submission of an NDA in 18 to 36 months. If our clinical trials are successful, our goal is to submit one or more NDAs per year beginning in 2008 for the foreseeable future for our retained product candidates, as our resources permit. Simultaneously, we will continue to outlicense or enter into collaborations for non-core product candidates and outlicense our Captisol technology.

Our Strategy

Our goal is to become a leading integrated specialty pharmaceutical company. To accomplish this goal we intend to:

- •

- Focus our internal development efforts on low risk product opportunities targeting the acute care hospital setting. We believe that utilizing APIs that have known biological activity and established safety and efficacy profiles will enable us to bring our retained product candidates to market on a relatively shortened development and regulatory timeline and with lower risk than new chemical entities. We believe that a small specialty sales force can effectively market our products to hospitals. However, if we are unable to bring our retained product candidates to market on a

shortened timeline or if a more extensive sales force than anticipated is required, this strategy may not be successful.

- •

- Establish strategic partnerships for product opportunities that do not fit into our core strategy. We believe that this strategy will enable the commercialization of partner product candidates that require longer timelines and greater financial outlay than our retained product candidates, without requiring us to incur the full cost of development and the financial risk of commercialization. However, if we are not able to establish additional partnering arrangements or if our partnering arrangements require substantial resources on our part, impose unfavorable restrictions or are terminated, we may not realize the benefits of this strategy.

- •

- Utilize APIs that have known safety and efficacy characteristics to gain rapid market acceptance. We believe that physicians will be more likely to use APIs that have known safety and efficacy characteristics than new chemical entities. Nevertheless, perceptions of the safety and efficacy characteristics of APIs we utilize may subsequently change, which could make it more difficult for us to gain market acceptance.

- •

- Continue to build intellectual property around our product candidates and our Captisol technology. We continue to pursue intellectual property protection for our product candidates. We are also pursuing additional intellectual property protection to address the expiration of the Captisol composition of matter patents in the U.S. in 2010, and expiration of the Captisol composition of matter patents outside the U.S. between 2011 and 2013, with one expiring in 2016. However, if we are unsuccessful in obtaining additional intellectual property protection or if our intellectual property protection is inadequate to protect against generic competition, this strategy may be unsuccessful.

- •

- Maintain our technology outlicensing business. We plan to continue to outlicense Captisol to organizations on an opportunistic basis to provide us with revenue to support our

5

Risks Related to Our Business

We are subject to many risks that you should be aware of before you decide to buy our common stock. These risks could adversely affect our business, offset or eliminate any advantages of our approach or prevent us from successfully implementing our business strategy, and are discussed more fully in the section entitled "Risk Factors." For example:

- •

- We have a history of net losses, and although we achieved profitability in 2006, we may not be able to return to or maintain profitability.

- •

- We rely on our platform technology, Captisol, for the continuation of our business, and if any adverse events were to occur relating to our Captisol technology, our business would be seriously harmed.

- •

- The basic composition of matter patents relating to Captisol expire in 2010 in the U.S. and between 2011 and 2013 outside the U.S., with one expiring in 2016, which may enable competitors to sell generic versions of Captisol, which would substantially reduce our revenue from our technology outlicensing business and could result in generic competition for our products and product candidates.

- •

- There is a risk that our product candidates will not successfully complete clinical trials and will not advance to the regulatory approval stage.

- •

- Even if we or our partners complete clinical trials of product candidates, we or our partners may never succeed in obtaining regulatory approval for any product candidates. Without regulatory approval, we or our partners will be unable to commercialize product candidates, and our growth prospects will be materially impaired.

Company Information

Our business began as CyDex, L.C., a Kansas limited liability company. The members of CyDex, L.C. entered into member contribution agreements with CyDex, Inc., a Kansas corporation, whereby the members of CyDex, L.C. exchanged their membership interests for shares of stock in CyDex, Inc. in December 1996, leaving CyDex, Inc. as the sole member of CyDex, L.C. In connection with this exchange, CyDex, L.C. transferred its assets to CyDex, Inc. CyDex, Inc. reincorporated in Delaware on July 19, 2000 by merging the Kansas corporation into CyDex, Inc., a Delaware corporation, which was then a subsidiary of the Kansas corporation. In November 2007, we changed our name to CyDex Pharmaceuticals, Inc. Our principal executive offices are located at 10513 W. 84th Terrace, Lenexa, KS 66214, and our telephone number is (913) 685-8850. Our website address is www.cydexpharma.com. The information contained in, or that can be accessed through, our website is not part of this prospectus. Unless the context indicates otherwise, as used in this prospectus, the terms "CyDex," "we," "us" and "our" refer to CyDex Pharmaceuticals, Inc., a Delaware corporation.

CAPTISOL,Captisol-Enabled and our CD logo are registered trademarks of our company in the United States. We use CAPTISOL,Captisol-Enabled and the CyDex logo as trademarks in the United States and other countries. We have also filed trademark applications in the United States for CYDEX, CYDEX PHARMA, and CYDEX PHARMACEUTICALS. All references to "Captisol" in this prospectus refer to CAPTISOL® cyclodextrins, and all references to "Captisol-Enabled" in this prospectus refer toCaptisol-Enabled® products or product candidates. All other trademarks and tradenames mentioned in this prospectus are the property of their respective owners.

6

The Offering

| Common stock offered by us | | shares |

Common stock to be outstanding after this offering |

|

shares |

Use of proceeds |

|

We intend to use the net proceeds from this offering to support our clinical trials and further development and eventual commercialization of our retained product candidates, to further develop our partner product candidates to advance them to Phase 2 clinical trials, to build our internal infrastructure and capabilities, and for working capital and other general corporate purposes. |

Proposed Nasdaq Global Market symbol |

|

CYDX |

The foregoing information regarding the number of shares of our common stock to be outstanding after this offering is based on shares outstanding as of December 31, 2007 and excludes:

- •

- 7,695,668 shares of common stock issuable upon the exercise of outstanding options under our Amended and Restated 1997 Equity Compensation Plan with a weighted average exercise price of $0.77 per share;

- •

- 4,460,966 shares of common stock issuable upon the exercise of outstanding warrants with an exercise price of $0.01 per share; and

- •

- shares of common stock reserved for future issuance under our 2008 Equity Incentive Plan, our 2008 Employee Stock Purchase Plan and our 2008 Non-Employee Directors' Stock Option Plan, as well as automatic increases in the number of shares of our common stock reserved for future issuance under these benefit plans, each of which will become effective immediately upon the signing of the underwriting agreement for this offering.

Except as otherwise indicated, all information in this prospectus assumes:

- •

- a -for- reverse split of our common stock to be effected immediately prior to the effectiveness of this offering;

- •

- the conversion of all outstanding shares of our preferred stock into shares of common stock, immediately prior to the closing of this offering;

- •

- the approval of our 2008 Equity Incentive Plan, 2008 Employee Stock Purchase Plan and 2008 Non-Employee Directors' Stock Option Plan by our stockholders;

- •

- the filing of our amended and restated certificate of incorporation immediately following the closing of this offering; and

- •

- no exercise of the underwriters' over-allotment option.

7

Summary Consolidated Financial Data

The following tables summarize our historical consolidated financial data for the last three years. The consolidated statement of operations data for the years ended December 31, 2005, 2006 and 2007 and the balance sheet data as of December 31, 2007 are derived from our audited consolidated financial statements included elsewhere in this prospectus. You should read this data together with the consolidated financial statements and related notes included elsewhere in this prospectus and the information under "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our historical results are not necessarily indicative of our operating results or financial position to be expected in the future.

| | Years Ended December 31,

| |

|---|

| | 2005

| | 2006

| | 2007

| |

|---|

| | (in thousands, except share and per share data)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | |

Revenue: |

|

|

|

|

|

|

|

|

|

|

| | Milestone and license | | $ | 1,947 | | $ | 1,982 | | $ | 1,172 | |

| | Material sales | | | 4,164 | | | 5,671 | | | 6,819 | |

| | Royalties | | | 2,511 | | | 2,989 | | | 3,829 | |

| | Contract research | | | 158 | | | 845 | | | 683 | |

| | Other | | | 39 | | | 93 | | | 242 | |

| | |

| |

| |

| |

| | | Total revenue | | | 8,819 | | | 11,580 | | | 12,745 | |

| | |

| |

| |

| |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| | Cost of sales(1) | | | 2,566 | | | 2,482 | | | 2,508 | |

| | Research and development(1) | | | 4,419 | | | 4,435 | | | 9,078 | |

| | Selling, general and administrative(1) | | | 2,488 | | | 2,681 | | | 4,328 | |

| | |

| |

| |

| |

| | | Total operating expenses | | | 9,473 | | | 9,598 | | | 15,914 | |

| | |

| |

| |

| |

| | | Operating income (loss) | | | (654 | ) | | 1,982 | | | (3,169 | ) |

| | |

| |

| |

| |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

| | Interest income | | | 223 | | | 428 | | | 582 | |

| | Other, net | | | (7 | ) | | (2 | ) | | — | |

| | |

| |

| |

| |

| | | Total other income | | | 216 | | | 426 | | | 582 | |

| | |

| |

| |

| |

| | | Income (loss) before income taxes | | | (438 | ) | | 2,408 | | | (2,587 | ) |

| |

Provision for income taxes |

|

|

— |

|

|

53 |

|

|

— |

|

| | |

| |

| |

| |

| | | Net income (loss) | | | (438 | ) | | 2,355 | | | (2,587 | ) |

| | | Preferred dividends and accretion | | | 4,441 | | | 4,455 | | | 4,471 | |

| | |

| |

| |

| |

| | | Net loss attributable to common stockholders | | $ | (4,879 | ) | $ | (2,100 | ) | $ | (7,058 | ) |

| | |

| |

| |

| |

| Basic and diluted net loss per common share(2) | | $ | (0.87 | ) | $ | (0.35 | ) | $ | (1.04 | ) |

| | |

| |

| |

| |

| Shares used to compute basic and diluted net loss per common share(2) | | | 5,617,270 | | | 6,082,357 | | | 6,798,681 | |

| | |

| |

| |

| |

- (1)

- Effective January 1, 2006, we adopted Statement of Financial Accounting Standards, or SFAS, No. 123 (revised 2004),Share-Based Payment, or SFAS No. 123R. SFAS No. 123R superseded SFAS No. 123,Accounting for Stock-Based Compensation,

footnotes continued on following page

8

or SFAS No. 123, and Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees, or APB No. 25. SFAS No. 123R requires that all stock-based compensation be recognized as an expense in the financial statements and that such cost be measured at the fair value of the award. As we previously used the minimum value method, as defined by SFAS No. 123, for purposes of measuring the fair value of stock options, we adopted SFAS No. 123R using the prospective method of application, which requires us to recognize compensation cost based on fair value for any awards granted after January 1, 2006, and any existing awards modified after that date. Under the prospective method, we recorded stock-based compensation expense for awards granted prior to January 1, 2006 using the intrinsic value method of APB No. 25.

The periods presented above include employee stock-based compensation in the following amounts:

| | Years Ended December 31,

|

|---|

| | 2005

| | 2006

| | 2007

|

|---|

| | (in thousands)

|

|---|

| Cost of sales | | $ | 4 | | $ | 2 | | $ | 5 |

| Research and development | | | 39 | | | 15 | | | 21 |

| Selling, general and administrative | | | 6 | | | 23 | | | 177 |

| | |

| |

| |

|

| | Total | | $ | 49 | | $ | 40 | | $ | 203 |

| | |

| |

| |

|

- (2)

- See Notes 2(r) and 12 of the notes to our consolidated financial statements for an explanation of the method used to calculate basic and diluted net loss per common share.

| | As of December 31, 2007

|

|---|

| | Actual

| | Pro Forma

As Adjusted(1)

|

|---|

| | (in thousands)

|

|---|

| Consolidated Balance Sheet Data: | | | | | |

| Cash, cash equivalents and short-term investments | | $ | 8,109 | | |

| Working capital | | | 10,821 | | |

| Total assets | | | 18,432 | | |

| Redeemable convertible preferred stock | | | 34,600 | | |

| Accumulated deficit | | | (21,927 | ) | |

| Total stockholders' equity (deficit) | | | (19,032 | ) | |

- (1)

- On a pro forma as adjusted basis to give effect to the conversion of all outstanding shares of our preferred stock into an aggregate of shares of common stock immediately prior to the closing of this offering and the sale of shares of our common stock we are offering at an assumed initial public offering price of $ per share, after deducting estimated underwriting discounts and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed public offering price of $ per share would increase (decrease) each of cash, cash equivalents and short-term investments, working capital, total assets and stockholders' equity (deficit) by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and estimated offering expenses payable by us. The pro forma as adjusted information presented above is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing.

9

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should consider carefully the risks described below, together with the other information contained in this prospectus, including in our consolidated financial statements and the related notes appearing at the end of this prospectus, before you decide whether to buy shares of our common stock. If any of the following risks actually occur, our business, results of operations and financial condition could suffer significantly. In any of these cases, the market price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Related to Our Business

We have a history of net losses, and although we achieved profitability in 2006, we may not be able to return to or maintain profitability.

We have incurred significant net losses since the inception of our business through 2005. As of December 31, 2007, we had an accumulated deficit of $21.9 million. Although we had net income of $2.4 million in 2006, we had net losses of $2.6 million in 2007 and $438,000 in 2005. Our historical losses have resulted primarily from investing in our research and development programs. We expect to continue to make significant investments in our research and development programs, and our selling, general and administrative expenses have been and will continue to be a significant component of our cost structure. For example, we anticipate that in 2008 we will invest up to $8.0 million in research and development and will incur up to $5.0 million in general and administrative expenses. We expect to continue to incur significant and increasing expenses for the foreseeable future as we continue our research activities, conduct development of or seek regulatory approvals for our product candidates, incur the additional costs of operating as a public company, and establish a specialty sales and marketing organization to commercialize our products. As a result of these and other activities, we do not anticipate being profitable in 2008, and there is no guarantee that we will be able to return to profitability in the future. We also expect that expenses from these activities will exceed any revenue generated by the increased spending for at least the next two years. Even if we successfully develop and commercialize one or more of our product candidates, we may not be able to maintain profitability. Even if we do maintain profitability, we may not be able to increase profitability on a quarterly or annual basis. If we are unable to maintain or increase profitability, the market value of our common stock may decline and you could lose all or part of your investment.

We rely on our platform technology, Captisol, for the continuation of our business, and if any adverse events were to occur relating to our Captisol technology, our business would be seriously harmed.

All of our products and product candidates, as well as our technology that we outlicense, are based on Captisol. In addition, we or our partners are attempting to develop some product candidates that may contain significantly higher levels of Captisol than in any currently-approved product and at levels at which the FDA has previously expressed concerns regarding potential renal toxicity. If products or product candidates incorporating our Captisol technology were to cause any unexpected adverse events, whether in preclinical studies, clinical trials or as commercialized products, whether as a result of Captisol or otherwise, the perception of Captisol safety could be seriously harmed. If this were to occur, we may not be able to market our products unless and until we are able to demonstrate that the adverse event was unrelated to Captisol, which we may not be able to do. Further, whether or not the adverse event was a result of Captisol, we could be required by the FDA to submit to additional regulatory reviews or approvals, including extensive safety testing or clinical testing of products using Captisol, which would be expensive and, even if we were to demonstrate that the adverse event was unrelated to Captisol, would delay our marketing of Captisol-Enabled products and receipt of revenue related to those products.

10

The basic composition of matter patents relating to Captisol expire in 2010 in the U.S. and between 2011 and 2013 outside the U.S., with one expiring in 2016, which may enable competitors to sell generic versions of Captisol, which would substantially reduce our revenue from our technology outlicensing business and could result in generic competition for our products and product candidates.

The basic composition of matter patents relating to Captisol expire in 2010 in the U.S. and between 2011 and 2013 outside the U.S., with one expiring in 2016. We have obtained patent protection on a number of combinations of APIs and Captisol through three combination patents in the U.S., and we have applied for six additional combination patents in the U.S. relating to the combination of Captisol with specific APIs. Our U.S. combination patent relating to Fosphenytoin expires June 12, 2018 and our U.S. combination patent relating to Amiodarone expires May 4, 2022. Our U.S. combination patent relating to one of our early-stage product candidates expires March 19, 2022. There is no guarantee that these patents will be sufficient to prevent competitors from using Captisol after 2010 and competing against us, or from developing combination patents for products that will prevent us from developing products using those APIs. In addition, most of the agreements in our Captisol outlicensing business, including our agreements with Pfizer relating to Geodon IM, Vfend IV and Cerenia, provide that once the relevant patent expires, the amount of royalties we receive will be reduced or eliminated.

There is a risk that our product candidates will not successfully complete clinical trials and will not advance to the regulatory approval stage.

We or our partners will only receive regulatory approval to commercialize a product candidate if we or our partners can demonstrate to the satisfaction of the FDA, the European Medicines Agency, or EMEA, or other applicable regulatory authorities, in well designed and properly conducted clinical trials, that the product candidate is safe and effective and otherwise meets the appropriate standards required for approval for a particular indication. If lengthy or complex trials are required to support approval, we would have to decide whether to cease pursuit of regulatory approval of the product candidate. Factors we expect to consider in this decision would include the anticipated time, complexity and cost associated with continuing to pursue regulatory approval measured against the perceived benefit to be derived from successful completion. Historically, favorable results from preclinical studies and early clinical trials have often not been confirmed in later clinical trials. Many companies in the pharmaceutical industry have experienced significant setbacks in advanced clinical trials or during the regulatory approval process, despite promising initial results. The clinical effects of our product candidates may be different than expected or may include undesirable side effects that delay, extend or preclude regulatory approval or limit their commercial use if approved.

A number of events or factors, including any of the following, could delay the completion of our and our partners' ongoing and planned clinical trials and negatively impact the ability to obtain regulatory approval for, and to market and sell, our products and product candidates:

- •

- conditions imposed on us or our partners by the FDA, the EMEA or other applicable regulatory authorities, regarding the scope or design of clinical trials;

- •

- the results of clinical trials may not meet the level of statistical significance required for approval by the FDA, the EMEA or other applicable regulatory authorities;

- •

- the FDA, the EMEA or other applicable regulatory authorities may require additional or expanded clinical trials;

11

- •

- delays in obtaining, or the inability to obtain or maintain, required approvals from institutional review boards, or IRBs, or other reviewing entities at clinical sites selected for participation in clinical trials;

- •

- insufficient supply or deficient quality of product candidates or other materials necessary to conduct clinical trials;

- •

- difficulties in manufacturing;

- •

- difficulties enrolling subjects and high drop-out rates of subjects in clinical trials;

- •

- negative or inconclusive results from clinical trials, or results that are inconsistent with earlier results, that necessitate additional clinical trials;

- •

- serious or unexpected drug-related side effects experienced by subjects in clinical trials;

- •

- failure of our third-party contractors or our investigators to comply with regulatory requirements or otherwise meet their contractual obligations in a timely manner; or

- •

- lack of resources or expertise to fund, manage or monitor the clinical trial or third-party contractors.

Clinical trials may not begin as planned, may need to be redesigned, and may not be completed on schedule, if at all. In addition, standards enunciated by regulatory agencies are constantly subject to change as a result of factors outside of our control. For example, we have designed the clinical trials for our lead product candidates to meet FDA requirements; however, the FDA could change its requirements before we seek or obtain regulatory approval. Delays in clinical trials may result in increased development costs for our product candidates, which would cause the market price of our shares to decline and could require us to obtain additional financing, which may not be available on favorable terms or at all. In addition, if one or more clinical trials are delayed, our competitors may be able to bring products to market before we do, and the commercial viability of our product candidates could be significantly reduced.

Even if we or our partners complete clinical trials of product candidates, we or our partners may never succeed in obtaining regulatory approval for product candidates. Without regulatory approval, we or our partners will be unable to commercialize product candidates, and our growth prospects will be materially impaired.

All of our product candidates must successfully complete development and gain regulatory approval before we or our partners can market them. If we or our partners do not demonstrate the safety and efficacy of product candidates, we or our partners will not obtain the required regulatory approvals to commercialize these product candidates. Any product candidate that we or our partners seek to commercialize is subject to extensive regulation by the FDA, EMEA and other applicable regulatory authorities relating to research, development, testing, manufacture, quality control, safety, efficacy, record-keeping, labeling, packaging, storage, approval, advertising, marketing, promotion, sale and distribution and import and export. Satisfaction of these and other regulatory requirements is costly, time-consuming, uncertain and subject to unanticipated delays. In addition, approval of our product candidates may be delayed in some circumstances due to market exclusivity granted to other parties by the FDA. Our growth prospects may be materially impaired as a result of any delay in, or failure to receive, required regulatory approval for some or all of our product candidates.

12

We intend to seek FDA approval of our retained product candidates and partner product candidates utilizing Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act. 505(b)(2) allows the submission of an NDA that relies in part on data in the public domain or on the FDA's prior findings regarding the safety and effectiveness of approved drugs, which could expedite the development program for our product candidates by potentially decreasing the overall scope of work. If we or our partners are unable to utilize 505(b)(2), the development program for our retained product candidates and partner product candidates would be materially longer than we expect, and we or our partners would also have to conduct significantly more costly trials than we anticipate, which would harm our business. While we believe that in some cases the 505(b)(2) path to registration should only necessitate the completion of a single or a small number of clinical trials demonstrating bioequivalence to the existing, previously approved formulation, the FDA has discretion to request additional data to support approval. In addition, 505(b)(2) NDAs are subject to special requirements designed to protect the property rights of sponsors of previously approved drugs that are referenced in a 505(b)(2) NDA. These requirements may give rise to patent litigation and mandatory delays in approval of our NDAs for up to 30 months or longer depending on the outcome of any litigation. Moreover, even if we or our partners are able to utilize 505(b)(2), there is no guarantee that this would ultimately lead to faster drug development or to approval. None of the Captisol-Enabled products currently marketed by our outlicensees were approved under 505(b)(2).

We are a small company with limited experience in taking product candidates through the regulatory process and commercializing product candidates. If we are unable to hire additional experienced personnel and manage the regulatory process in an efficient manner, we may not be able to commercialize our product candidates.

During our existence as a privately-held company, we have operated with a very small number of employees, and have not taken any of our product candidates through the regulatory process with the FDA. In order to successfully commercialize our product candidates, we will need to significantly expand our internal resources and capabilities to improve and manage our regulatory compliance process. Attracting highly qualified scientific and other personnel to manage the regulatory process may be difficult, as competition exists among other companies and research and academic institutions for qualified personnel, and personnel with the skills that we require are difficult to find in the Kansas City area. If we cannot attract and retain sufficiently qualified personnel on acceptable terms to manage the regulatory process, we may experience significant delay in carrying out the regulatory compliance process or may not be able to develop and commercialize competitive products.

In addition, our growth and success depend on our ability to attract and retain additional highly qualified scientific, technical and sales personnel. Intense competition exists among other companies and research and academic institutions for qualified personnel. If we cannot attract and retain sufficiently qualified employees on acceptable terms, we may not be able to develop and commercialize competitive products.

We obtain Captisol from a sole source supplier, and if this supplier were to cease to be able to supply Captisol to us, or decline to supply Captisol to us, we would be unable to continue to derive revenue or continue to develop our product candidates until we obtained an alternative source, which could take a considerable length of time.

We currently have one supplier of Captisol, Hovione FarmaCiencia SA, or Hovione, through its agent Hovione LLC. Hovione is a major supplier of APIs and API intermediates located in Lisbon, Portugal. Hovione has a second production site in Macau, China, but that site is not yet qualified to make Captisol. If a major disaster were to happen at Hovione or Hovione were to suffer major production problems or were to fail to deliver Captisol to us for any other reason, there could be a significant interruption of our Captisol supply. While we carry a significant inventory of Captisol for this type of

13

occurrence, which should permit us to satisfy our existing supply obligations through mid-2010 under current and anticipated demand conditions, an unusually large order or two could rapidly deplete that inventory and cause significant problems with our licensees and disrupt our business. In addition, if we fail to supply Captisol under our supply agreements, our customers could obtain the right to have Captisol manufactured by other suppliers, which would significantly harm our business.

We depend on our senior management to manage our business, which dependence will become even greater as a public company, and if we are not able to retain our senior management, or attract and retain other senior management, our business would be harmed.

During our existence as a privately-held company, we have operated with a very small number of employees. However, given our transition to a public company, as well as our expected growth and the change in emphasis of our business model, our internal management needs will change. We will need to significantly expand our management team, which will require the hiring of significant additional personnel as well as the expansion of responsibilities by our current management team. We expect that we will need to hire a vice president of business development, a vice president of sales and marketing, a head of regulatory function and additional managerial and finance personnel. High demand exists for senior management and other key personnel in the pharmaceutical industry, and personnel with the skills that we require are difficult to find in the Kansas City area. The loss of any of our current management personnel, or failure to hire the additional management personnel that we will need, may negatively impact our ability to manage our company effectively and to carry out our business plan. Of the members of our senior management team, only our chief executive officer, Dr. Siebert, has an employment agreement. Notwithstanding his employment agreement, Dr. Siebert could resign at any time.

We have material weaknesses in our internal control over financial reporting, and these material weaknesses create a reasonable possibility that a material misstatement of our interim or annual financial statements will not be prevented or detected in a timely manner.

As a publicly-traded company, we must maintain effective disclosure controls and procedures and internal control over financial reporting. Our independent registered public accounting firm determined in February 2008 that we have five material weaknesses as follows:

- •

- our control environment is ineffective due to the operating style of our senior management, which does not consistently emphasize effective internal control over financial reporting or the importance of the financial reporting process;

- •

- we do not have an effective process for identifying financial reporting risks and evaluating whether adequate policies, procedures and control activities are implemented on a timely basis, particularly for complex or non-recurring transactions;

- •

- we are not able to effectively monitor whether our internal control over financial reporting is functioning properly because documentation of the operation of control activities and internal control policies and procedures is insufficient to assess performance, and responsibilities for our personnel involved in internal control over financial reporting are not clearly delineated;

- •

- we did not appropriately segregate duties, or implement alternative controls, relative to executing and accounting for new revenue arrangements; and

14

- •

- we do not have personnel with the necessary experience and training to ensure appropriate revenue recognition for key revenue streams; specifically, we lack employees with the expertise to analyze multiple element arrangements for appropriate revenue recognition.

While we have a number of material weaknesses that we are in the process of remediating, we do not have material weaknesses related to the policies and procedures that:

- •

- pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect our transactions and disposition of assets;

- •

- provide reasonable assurance that our receipts and expenditures are being made in accordance with authorizations of our management and directors; or

- •

- provide reasonable assurance that we will prevent or timely detect unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

As a result of these material weaknesses in internal control over financial reporting, material misstatements existed with respect to the accounting for revenue recognition, preferred stock and warrants and other items that resulted in a recent restatement of our consolidated financial statements for the years ended December 31, 2004, 2005 and 2006. Additionally, material misstatements were identified in our revenue recognition, research and development costs, stock-based compensation and other items for the year ended December 31, 2007, which were corrected prior to the issuance of the consolidated financial statements.

In order to improve and to maintain the effectiveness of our internal control over financial reporting and disclosure controls and procedures, significant resources and management oversight will be required. We have begun the process of remediating these material weaknesses, but this process will take time, and we will not be able to assert that we have remediated these material weaknesses until the procedures that we put in place have been working for a sufficient period of time for us to determine that they are effective. As a result of this and similar activities, management's attention may be diverted from other business concerns, which could have a material adverse effect on our business, financial condition and results of operations. If we are unable to remediate these material weaknesses, or in the future report one or more additional material weaknesses, there is a reasonable possibility that a material misstatement of our interim or annual financial statements will not be prevented or detected on a timely basis. This could result in a restatement of our financial statements or impact our ability to accurately report financial information on a timely basis, which could adversely affect our stock price.

We rely on contract manufacturers for the manufacture of our products and product candidates, and if these contract manufacturers fail to perform as we expect, we will incur delays in our ability to generate revenue and substantial additional expenses in obtaining new contract manufacturers.

We do not manufacture our products or product candidates, but rather contract with contract manufacturers for the manufacture of our products and product candidates. With respect to any specific product or product candidate, we only contract with one contract manufacturer due to the high cost of compliance with good manufacturing practices prior to the contract manufacturer being permitted to manufacture the product or product candidate for use in humans. If a contract manufacturer is unable or unwilling to continue to manufacture for us in the future, we would be required to contract with a new contract manufacturer for the specific product or product candidate. In the case of products, this would cause us to lose revenue during the qualification process, and in the

15

case of product candidates, this could cause a delay in the commercialization of the product candidate. In addition, in either case we would incur substantial additional expenses as a result of the new contract manufacturer becoming qualified. Further, if a contract manufacturer were to experience a delay in producing products or product candidates due to a failure to meet strict FDA manufacturing requirements or otherwise, we would also experience a delay in development and commercialization of the product candidate or, in the case of products, sales of the product. This risk is exacerbated in the case of manufacture of injectables, which require heightened sterility and other conditions as well as specialized facilities for preparation.

Our revenue is currently dependent upon our Captisol outlicensing business. If any or all of our current outlicensees were to fail in commercialization of their products, or if we fail to establish new licensing arrangements, our business and growth prospects would be materially harmed.

Revenue from our Captisol outlicensing business accounted for approximately 95%, 78% and 87% of our total revenue in 2005, 2006 and 2007, respectively. In particular, our revenue is currently dependent on royalties from two of our outlicensees, Pfizer and Bristol-Myers Squibb, or BMS. Pfizer accounted for 27% of our total revenue in 2006 and 40% of our total revenue in 2007, and BMS accounted for 9% of our total revenue in 2006 and 4% of our total revenue in 2007. We currently depend on our arrangements with our outlicensees to sell products using our Captisol technology. If our outlicensees discontinue sales of products using our Captisol technology, fail to obtain regulatory approval for their products using our Captisol technology, fail to satisfy their obligations under their agreements with us, or if we are unable to establish new licensing and marketing relationships, our financial results and growth prospects would be materially affected. Further, under most of our Captisol outlicenses, the amount of royalties we receive will be reduced or will cease when the relevant patent expires. The basic composition of matter patents relating to Captisol expire in 2010 in the U.S. and between 2011 and 2013 outside the U.S., with one expiring in 2016, and if our other intellectual property rights are not sufficient to prevent a generic form of Captisol from coming to market, the source of the vast majority of our revenue may cease to exist.

If we are not successful in establishing and maintaining our partnering relationships, we will not be able to grow our business.

An element of our business strategy is to establish relationships with third parties to accelerate the development of our partner product candidates. The process of establishing new partnering relationships is difficult, time-consuming and involves significant uncertainty. We face, and will continue to face, significant competition in seeking appropriate partners. Our obligations under these arrangements can include performance of development activities, such as feasibility studies, early-stage development activities, formulation optimization, stability testing and scale-up of the manufacturing process, supply of the product to the partner for clinical testing, assistance in the preparation of regulatory filings by our partner and supply of the product for sale by our partner. If we fail to meet any of these obligations, we may lose our rights to future development fees and future royalty and milestone payments, and our partners may have the right to terminate the agreement. In addition, our agreements sometimes allow for our partner to terminate the agreement with limited notice and without penalty or in the event the partner reasonably determines that the product candidate does not justify continued development or commercialization.

In addition, our partners may fail to fulfill their responsibilities under these arrangements or may seek to renegotiate or terminate their relationships with us due to unsatisfactory clinical results, a change in business strategy, a change in control or other reasons. If we are unable to establish and maintain development arrangements on acceptable terms, we may have to delay or discontinue further development of one or more of our partner product candidates, seek regulatory approval or undertake

16

commercialization activities at our own expense or find alternative sources of funding, and our growth prospects will be materially harmed.

We currently have no internal sales, marketing and distribution capabilities. If we are unable to develop our sales, marketing and distribution capabilities, we will not be successful in commercializing our products.

We do not currently plan to hire a vice president of sales and marketing to initiate the development of our internal sales, marketing and distribution capabilities until 2009. If Captisol-Enabled Fosphenytoin IV and IM, one of our lead retained product candidates, is approved in 2009, we intend to commercialize it in the United States by establishing our own sales force or contracting with a specialty sales and marketing organization with technical experience. We also expect to support distribution capabilities. We do not anticipate making significant expenditures to establish the organization to sell any potential product (including Captisol-Enabled Fosphenytoin IV and IM) in advance of knowing whether it has received FDA approval. Failure or delay in the establishment of a sales force or contracting with a specialty sales and marketing organization could delay any product launch.

We currently do not intend to sell any of our products directly outside the United States. Therefore, we must successfully enter into arrangements with third parties to register our products and perform these services outside the United States.

If we do not establish sales and distribution capabilities successfully, either on our own or in collaboration with third parties, we may not successfully commercialize any future products, and our future product revenue could suffer.

Development of pharmaceutical products is expensive, time-consuming and subject to uncertainties, and we may not realize a return on our investment in product development for a significant period of time, if at all.

Developing pharmaceutical products is expensive, and there is typically a significant amount of time prior to realizing a return on an investment in product development, if a return is realized at all. In 2005, 2006 and the 2007, our research and development expenses were $4.4 million, $4.4 million and $9.1 million, respectively, or approximately 50%, 38% and 71%, respectively, of our revenue. The increase in our research and development expenses in 2007 as compared to 2006 was primarily due to the timing of clinical trials. Our future plans include significant investments in research and development, including clinical trials and related product opportunities. We believe that we must continue to dedicate a significant amount of financial and operational resources to our research and development efforts to grow our business and maintain our competitive position. However, whether we or our partners will obtain regulatory approval for our product candidates is uncertain, and if we or our partners are not able to do so, we will have expended significant resources and received no benefit. Even if we or our partners are successful in obtaining regulatory approval, we do not expect that we will receive significant revenue from these investments for several years. If our cash flows and financial resources are not sufficient to fund the development of our products and product candidates, we would be required to raise additional capital to continue to develop our products and product candidates, which we may not be able to do on favorable financial terms, or at all. In addition, if we do raise equity capital, it could be dilutive to our stockholders.

17

We rely on third parties to conduct, supervise and monitor our clinical trials, and those third parties may perform in an unsatisfactory manner, such as by failing to meet established deadlines for the completion of these trials.

We rely on third parties such as contract research organizations, or CROs, medical institutions and clinical investigators to enroll qualified patients and conduct, supervise and monitor our clinical trials. Our reliance on these third parties for clinical development activities reduces our control over these activities. Our reliance on these third parties, however, does not relieve us of our regulatory responsibilities, including ensuring that our clinical trials are conducted in accordance with good clinical practices, or GCP, and the investigational plan and protocols contained in the relevant regulatory application, such as the investigational new drug application. In addition, the CROs with which we contract may not complete activities on schedule, or may not conduct our preclinical studies or clinical trials in accordance with regulatory requirements or our trial design. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, our efforts to obtain regulatory approvals for, and to commercialize, our product candidates may be delayed or prevented.

We may not be able to patent some formulations of our product candidates in development and may not be able to obtain adequate protection under the Hatch-Waxman Act to prevent generics from copying our product candidates.

Our product candidates utilize APIs that we believe are in or will be in the public domain. While we are working to obtain patent protection for our Captisol-Enabled formulations of these APIs, as well as manufacturing processes and uses of Captisol, there is no guarantee that we will be able to do so. In cases where no patent protection can be obtained, limited regulatory exclusivity providing protection against generic competition may in some circumstances be obtained under the Hatch-Waxman Act. There is no guarantee that we will receive exclusivity for any particular product candidate. If, as we believe, our retained product candidates only require bioequivalence trials as the basis for approval, they would not qualify for Hatch-Waxman exclusivity. Following the expiration of the basic Captisol composition of matter patents in the U.S. in 2010, biotechnology or pharmaceutical companies, which may have greater financial and personnel resources than we do, may be able to obtain regulatory approval to market one or more of our Captisol-Enabled formulations of these APIs before we are able to obtain regulatory approval. Such approval for our competitors' products could block our ability to obtain approval for up to three years. Failure to obtain patent protection or regulatory exclusivity will adversely impact our ability to commercialize our products and realize a positive return on our investment.

Even if our product candidates receive regulatory approval, they may not become commercially viable products.

Even if our product candidates are approved for commercialization, they may not become commercially viable products. For example, even if we or our partners receive regulatory approval to market a commercial product, any approval may be subject to limitations on the indicated uses for which we or our partners may market the product. A product or product candidate may not result in commercial success for other reasons, including:

- •

- lack of perceived differentiation of our Captisol-Enabled products from the pioneer drug or generic form of the API;

- •

- difficulty in large-scale manufacturing;

- •

- low market acceptance by physicians, healthcare payers, patients and the medical community as a result of lower demonstrated clinical safety or efficacy compared to other

18

If our product candidates do not receive commercial acceptance, our business, results of operations and financial condition will be adversely affected.

Our product candidates, if they receive regulatory approval for marketing, remain subject to ongoing regulatory requirements. If we or our partners fail to comply with these requirements, regulatory authorities could withdraw these approvals and the sales of any approved commercial products could be suspended.

After receipt of regulatory marketing approval, if any, each of our products remains subject to extensive regulatory requirements, including requirements relating to manufacturing, labeling, packaging, adverse event and manufacturing problem reporting, storage, advertising, promotion, distribution and record-keeping. Furthermore, the approval may be subject to limitations on the uses for which the product may be marketed or the conditions of approval, or contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product, which could reduce our revenue, increase our expenses and render the approved product candidate not commercially viable. In addition, as clinical experience with a drug expands after approval because it is typically used by a greater number and more diverse group of patients after approval than during clinical trials, side effects and other problems may be observed that were not seen or anticipated during pre-approval clinical trials or other studies. Any adverse effects observed after the approval and marketing of a product candidate could result in detrimental labeling changes, limitations on the use of the approved product or its withdrawal from the marketplace. Absence of long-term safety data may also limit the approved uses of our products, if any. If we or our partners fail to comply with the regulatory requirements of the FDA, the EMEA and other applicable regulatory authorities, or if previously unknown problems with any approved commercial products, manufacturers or manufacturing processes are discovered, we could be subject to administrative or judicially imposed sanctions or other setbacks, including:

- •

- restrictions on the products, manufacturers or manufacturing processes;

- •

- warning letters and untitled letters;

- •

- civil penalties and criminal prosecutions and penalties;

- •

- fines;

19

- •

- injunctions;

- •

- product seizures or detentions;

- •

- import or export bans or restrictions;

- •

- company-initiated or FDA-requested product recalls and related publicity requirements;

- •

- suspension or withdrawal of regulatory approvals;

- •

- total or partial suspension of production; and

- •

- refusal to approve pending applications for marketing approval of new products or of supplements to approved applications.

If we or our partners are slow or unable to adapt to changes in existing regulatory requirements or the promulgation of new regulatory requirements or policies, we or our partners may lose marketing approval for our products, resulting in decreased revenue from milestone payments, product sales or royalties.

We may be subject to fines, penalties or injunctions if we are determined to be promoting the use of our products for unapproved or "off-label" uses.

If our product candidates receive FDA clearance or approval, our promotional materials and training methods regarding physicians need to comply with FDA and other applicable laws and regulations. If the FDA determines that our promotional materials or training constitute promotion for an unapproved use, it could request that we modify our training or promotional materials or subject us to regulatory enforcement actions, including the issuance of a warning letter, injunction, seizure, civil fine and criminal penalties. It is also possible that other federal, state or foreign enforcement authorities might take action if they consider our promotional or training materials to constitute promotion for an unapproved use, which could result in significant fines or penalties under other statutory authorities, such as laws prohibiting false claims for reimbursement. In that event, our reputation could be damaged and adoption of our products would be impaired.

New legal and regulatory requirements could make it more difficult for us or our partners to obtain approvals for our product candidates and could limit or make more burdensome our or our partners' ability to commercialize any approved products.