As filed with the Securities and Exchange Commission on September 25, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

__________________________________________________

FORM 20-F

__________________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

Commission file number: 1-14616

__________________________________________________

SUPERMERCADOS UNIMARC S.A.

(Exact name of Registrant as specified in its charter)

UNIMARC SUPERMARKETS INC.

(Translation of Registrant’s name into English)

__________________________________________________

REPUBLIC OF CHILE

(Jurisdiction of incorporation or organization)

Avenida Presidente Eduardo Frei Montalva 1380

Santiago, Chile

011-56-2-687-7000

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

701,536 American depositary shares (evidenced by American depositary receipts) each representing 50 shares of common stock. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer’s classes of common stock as of December 31, 2006:

1,261,849,619 Shares of Common Stock |

__________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

| | Page |

| | |

| PRESENTATION OF INFORMATION | iii |

| FORWARD-LOOKING STATEMENTS | iv |

| EXCHANGE RATES | iv |

| | | |

| PART I | | |

| | | |

| Item 1. | Identity of Directors, Senior Management and Advisers | 1 |

| Item 2. | Offer Statistics and Expected Timetable | 1 |

| Item 3. | Key Information | 1 |

| Item 4. | Information on the Company | 12 |

| Item 5. | Operating and Financial Review and Prospects | 26 |

| Item 6. | Directors, Senior Management and Employees | 41 |

| Item 7. | Major Shareholders and Related Party Transactions | 43 |

| Item 8. | Financial Information | 46 |

| Item 9. | The Offer and Listing | 50 |

| Item 10. | Additional Information | 52 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 61 |

| Item 12. | Description of Securities Other than Equity Securities | 64 |

| | | |

| PART II | | |

| | | |

| Item 13. | Defaults, Late Dividends and Delinquencies | 65 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 67 |

| Item 15. | Controls and Procedures | 67 |

| Item 16A. | Audit Committee Financial Expert | 67 |

| Item 16B. | Code of Ethics | 67 |

| Item 16C. | Principal Accountant Fees and Services | 67 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 68 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 68 |

| | | |

| PART III | | |

| | | |

| Item 17. | Financial statements | 69 |

| Item 18. | Financial statements | 69 |

| Item 19. | Exhibits | 70 |

PRESENTATION OF INFORMATION

Supermercados Unimarc S.A. is a publicly held open stock corporation (sociedad anonima abierta) organized under the laws of the Republic of Chile. We completed our initial public offering of American Depositary Shares, or ADSs, representing our shares of common stock, and registered our ADSs on the New York Stock Exchange under the symbol “UNR”, in 1997. The NYSE suspended the listing of our ADSs on April 2, 2003 on the grounds that the average closing price of our ADSs had been less than U.S.$1.00 over a consecutive 30-day trading period, and we were unable to cure this non-compliance within the deadline prescribed by the NYSE. Our shares of common stock are registered in Chile with (1) the Bolsa de Comercio de Santiago, (2) the Bolsa Electronica de Chile and (3) the Bolsa de Corredores - Bolsa de Valores de Valparaiso. We refer to the Bolsa de Comercio de Santiago, the Bolsa Electronica de Chile and the Bolsa de Corredores - Bolsa de Valores de Valparaiso, as the “Chilean stock exchanges”. We are registered with the Superintendencia de Valores y Seguros de Chile. We are subject to the rules and regulations applicable to publicly held corporations in Chile and to the rules and regulations of the U.S. Securities and Exchange Commission, or the Commission. All of our directors and officers and certain experts named in this annual report reside outside the United States, principally in Chile and Argentina.

In this annual report (1) references to “U.S. dollars”, “U.S. Dollars”, “dollars”, “$”, U.S.$ or “U.S.$” are to U.S. dollars, the legal currency of the United States; (2) references to “pesos”, “Chilean pesos” or “Ch$” are to Chilean pesos, the legal currency of Chile; (3) references to “Argentine pesos” or “A$” are to Argentine pesos, the legal currency of Argentina; (4) references to “euros” or “€” are to euros, the legal currency of the European Union, and (5) references to “DM” are to German marks, the legal currency of Germany prior to the adoption of the euro. Certain figures contained in this annual report may not add to totals due to rounding. Unless the context requires otherwise, the terms “Unimarc”, “we”, “our” and “us” refer to Supermercados Unimarc S.A., together with its consolidated subsidiaries.

The terms below have the following meanings in this annual report:

| · | “supermarket” means a retail store that sells different foodstuff and household items (stock keeping units or “SKUs”) and that has three or more checkout counters. This definition is consistent with the definition of “supermarket” used by the Chilean Instituto Nacional de Estadisticas, the “Chilean National Institute of Statistics”, or the “INE”; |

| · | “supermarket chain” means two or more supermarkets that are under the same ownership; and |

| · | one “meter” equals to 3.2808 feet or 1.0936 yards and one square meter equals 10.7639 square feet. |

Chile is divided into political subdivisions, each referred to as a “region”. Regions are designated using Roman numbers (i.e., I-XV), except for the region which encompasses the capital of Chile, Santiago, which is known as the metropolitan region.

Information contained in this annual report with respect to (1) the contribution of the supermarket industry to the growth of the gross domestic product, or GDP, (2) the population per region, (3) the amounts and percentages of supermarket sales per region, (4) the number of supermarkets per region, and (5) the number of inhabitants per supermarket was obtained from information made available by the INE and research of the industry, as well as studies conducted by A.C. Nielsen Company. We obtained additional data from third parties, including both governmental and private entities, and from our own

research. We believe our estimates to be reliable, but we have not confirmed them with independent sources.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, or the Exchange Act. These statements are based on the current beliefs of our management, as well as on assumptions our management has made based on information regularly available to it. The words “expect”, “anticipate”, “want”, “plan”, “may”, “believe”, “seek”, “estimate” and similar expressions identify some of these forward-looking statements. Forward-looking statements appear throughout this annual report, including, without limitation, under “Item 3. Key Information — Risk Factors”, “Item 4. Information on the Company” and “Item 5. Operating and Financial Review”. These forward-looking statements relate, among other things, to:

| · | our plans and timing for the introduction or enhancement of our services and products, |

| · | our proposed acquisitions and |

| · | our plans for entering into strategic relationships as well as other expectations, intentions and plans other than historical facts. |

Forward-looking statements involve inherent risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed by or implicit in such forward-looking statements, including, but not limited to, changes in technology and changes in the supermarket industry. If our management’s assumptions prove incorrect, actual results may vary both materially and adversely from those anticipated or projected. Accordingly, we may not assure you that forward-looking statements will be realized. You are cautioned not to place undue reliance on forward-looking statements, as they refer only to their respective dates. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

EXCHANGE RATES

Before 1989, Chilean law permitted the purchase and sale of foreign exchange only in the events specifically authorized by Banco Central de Chile, or the Central Bank. The Central Bank Act of 1989, (Ley Organica Constitucional del Banco Central de Chile No. 18,840) liberalized the rules that govern the ability to buy and sell foreign currencies. Under this Central Bank Act, the Central Bank may require that certain types of purchases and sales of foreign currencies, as specified in the law, be carried out in the “Formal Exchange Market” (mercado cambiario formal). The Central Bank also determines which banks or other entities are authorized to engage in currency transactions in the formal exchange market. The translation of pesos into U.S. dollars of all payments and distributions by us, with respect to the ADSs, must be transacted at the “spot” market rate in the formal exchange market.

The reference exchange rate for the Formal Exchange Market is reset daily by the Chilean Central Bank, taking internal and external inflation into account, and is adjusted daily to reflect variations in parities between the peso and each of the U.S. dollar, the euro and the Japanese yen. The observed

exchange rate for a given date is the average exchange rate of the transactions conducted in the Formal Exchange Market on the immediately preceding banking day, as certified by the Chilean Central Bank.

Parities in these international markets are those determined by the Central Bank in its sole discretion based on information furnished to it by Reuters or Bloomberg, or otherwise through direct consultation with first class international banks.

The Central Bank publishes the value of the reference exchange rate before 10:00 AM on each banking day.

The observed dollar exchange rate for a given date is the average exchange rate for transactions conducted in the formal exchange market during the immediately preceding banking day, as certified by the Central Bank. Although the Central Bank is authorized to carry out its transactions at the reference exchange rate and at the spot exchange rate, it generally carries out its transactions at the spot exchange rate.

Until September 3, 1999, banks operating in Chile were permitted to carry out their transactions within a certain band above or below the reference exchange rate. In order to maintain the average exchange rate within such limits, the Central Bank started to sell and buy currencies in the formal exchange market. On September 2, 1999, the Central Bank decided to eliminate the exchange rate band as an instrument of monetary policy to introduce greater flexibility into the exchange market. To adopt this measure, the monetary authority took into consideration several factors, including the international financial scenario, the domestic inflation rate, the level of external accounts, and the development of financial instruments in the exchange market. At the same time, the Central Bank announced that it would interfere in the exchange market only in special and qualified events.

Purchases and sales of foreign currencies which may be affected outside the Formal Exchange Market can be carried out in the Informal Exchange Market. The Informal Exchange Market reflects transactions carried out at informal exchange rates by entities not expressly authorized to operate in the Formal Exchange Market, such as most foreign exchange houses and travel agencies. There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the observed exchange rate. At December 31, 2006, the average exchange rate in the Informal Exchange Market was approximately the same as the published observed exchange rate for such date, of Ch$532.39 per US$1.00. On September 20, 2007, the Chilean peso/U.S. dollar exchange rate was Ch$514.29 per U.S. dollar.

The table below shows the highest annual value, the lowest annual value, the average annual value, and the value at the end of the period for the observed exchange rate for U.S. dollars, beginning in 2002, as reported by the Central Bank.

Year ended as of December 31, | | | | | | | | | | | | |

| 2002 | | | 756.56 | | | | 641.75 | | | | 688.94 | | | | 718.61 | |

| 2003 | | | 758.21 | | | | 593.10 | | | | 691.40 | | | | 593.80 | |

| 2004 | | | 649.45 | | | | 557.40 | | | | 609.55 | | | | 557.40 | |

| 2005 | | | 592.75 | | | | 509.70 | | | | 559.86 | | | | 512.50 | |

| 2006 | | | 549.63 | | | | 511.44 | | | | 530.26 | | | | 532.39 | |

| March 2007 | | | 541.95 | | | | 535.36 | | | | 538.49 | | | | 539.21 | |

| April 2007 | | | 539.69 | | | | 527.08 | | | | 532.30 | | | | 525.96 | |

| May 2007 | | | 527.52 | | | | 517.64 | | | | 522.02 | | | | 525.10 | |

| June 2007 | | | 529.78 | | | | 524.10 | | | | 526.80 | | | | 526.86 | |

| July 2007 | | | 525.56 | | | | 513.00 | | | | 519.52 | | | | 521.17 | |

| August 2007 | | | 528.37 | | | | 518.19 | | | | 523.02 | | | | 523.25 | |

PART I

Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

SELECTED FINANCIAL DATA

The table below shows our selected consolidated financial and operating information as of the dates and for each of the periods indicated. You should read the information for the years ended December 31, 2004, 2005 and 2006 in conjunction with, and it is qualified in its entirety by, reference to our audited consolidated financial statements, included elsewhere in this annual report. Our audited consolidated financial statements were prepared in accordance with Chilean generally accepted accounting principles, or Chilean GAAP, which differs in certain important respects from U.S. generally accepted accounting principles, or U.S. GAAP. Note 38 to our consolidated financial statements provides a description of the principal differences between Chilean GAAP and U.S. GAAP and a reconciliation to U.S. GAAP of net loss and total shareholders’ equity reported under Chilean GAAP at December 31, 2004, 2005 and 2006.

As required by Chilean GAAP, our financial statements have been restated to reflect the effect of variations in the purchasing power of the Chilean peso due to inflation. These changes are based on the Chilean consumer price index, or CPI, as measured between December 1 and November 30 of each year. The financial information for the years ended December 31, 2001, 2002, 2003, 2004, 2005 and 2006 has been expressed in Chilean pesos as of December 31, 2006. See “Item 5. Operating and Financial Review”.

For your convenience, this annual report contains translations of certain Chilean peso amounts into U.S. dollars at specified exchange rates. Since the Federal Reserve Bank of New York does not report an exchange rate for the purchase of Chilean pesos, we made these translations using the observed dollar exchange rate as reported by the Central Bank at December 31, 2006, which was Ch$532.39 per U.S. dollar. You should not construe any translations of Chilean pesos into U.S. dollars included in this annual report as a representation that the amounts in pesos actually represent the amounts translated into dollars. Additionally, you should not construe any such translations as a representation that the amounts in pesos have been, could have been or may be translated into dollars at that or any other exchange rate. See “Exchange Rates”.

INCOME STATEMENT DATA:

| | | For the years ended December 31, |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2006 (1) | |

| | | (in millions of constant Ch$ and millions of U.S.$ as of December 31, 2006) (2) |

Chilean GAAP: | | | | | | | | | | | | | | | | | | |

| Net Sales | | | 133,972 | | | | 138,283 | | | | 126,343 | | | | 112,509 | | | | 118,091 | | | | 221.8 | |

| Cost of sales | | | (105,765 | ) | | | (108,890 | ) | | | (98,586 | ) | | | (85,055 | ) | | | (89,266 | ) | | | (167.7 | ) |

| Gross profit | | | 28,207 | | | | 29,393 | | | | 27,757 | | | | 27,453 | | | | 28,825 | | | | 54.1 | |

| Adm. and selling expenses | | | (36,300 | ) | | | (34,344 | ) | | | (32,319 | ) | | | (31,644 | ) | | | (32,261 | ) | | | (60.6 | ) |

| Operating income (loss) | | | (8,093 | ) | | | (4,951 | ) | | | (4,562 | ) | | | (4,190 | ) | | | (3,436 | ) | | | (6.5 | ) |

| Non operating income | | | 2,758 | | | | 1,534 | | | | 1,730 | | | | 456 | | | | 437 | | | | 0.8 | |

| Non operating expense | | | (7,797 | ) | | | (5,999 | ) | | | (6,378 | ) | | | (4,717 | ) | | | (4,124 | ) | | | (7.7 | ) |

| Price level restatement | | | 5,248 | | | | 2,422 | | | | 55 | | | | 300 | | | | 207 | | | | 0.4 | |

| Income taxes | | | 6,123 | | | | 1,499 | | | | 1,623 | | | | (151 | ) | | | (998 | ) | | | (1.9 | ) |

| Minority interest | | | 5 | | | | 5 | | | | 2 | | | | 3 | | | | 4 | | | | 0.0 | |

| Net income (loss) | | | (1,752 | ) | | | (4,607 | ) | | | (7,526 | ) | | | (8,294 | ) | | | (7,905 | ) | | | (14.8 | ) |

Net Income (loss) per share (3) | | | (0.13 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.64 | ) | | | (0.63 | ) | | | (0.00 | ) |

Net Income (loss) per ADS (3) | | | (6.86 | ) | | | (18.05 | ) | | | (17.42 | ) | | | (32.35 | ) | | | (31.32 | ) | | | (0.06 | ) |

| Dividends per share (Historical) | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Weighted average shares outstanding (000s) | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | |

U.S. GAAP:

| Net sales | | | 133,972 | | | | 133,848 | | | | 120,575 | | | | 109,950 | | | | 115,019 | | | | 214.4 | |

| Cost of sales | | | (105,766 | ) | | | (104,455 | ) | | | (92,818 | ) | | | (82,497 | ) | | | (86,194 | ) | | | (160.7 | ) |

| Gross profit | | | 28,206 | | | | 29,393 | | | | 27,757 | | | | 27,453 | | | | 28,825 | | | | 53.7 | |

| Administrative and selling expenses | | | (36,405 | ) | | | (34,424 | ) | | | (32,405 | ) | | | (31,705 | ) | | | (32,398 | ) | | | (60.4 | ) |

| Operating income | | | (8,199 | ) | | | (5,031 | ) | | | (4,648 | ) | | | (4,252 | ) | | | (3,573 | ) | | | (6.7 | ) |

| Non operating income | | | 3,884 | | | | 1,533 | | | | 1,729 | | | | 335 | | | | 437 | | | | 0.8 | |

| Non operating expense | | | (6,468 | ) | | | (4,215 | ) | | | (5,540 | ) | | | (3,464 | ) | | | (28,562 | ) | | | (53.6 | ) |

| Price level restatement | | | 5,248 | | | | 2,423 | | | | 55 | | | | 300 | | | | 207 | | | | 0.4 | |

| Income taxes | | | 5,191 | | | | 849 | | | | 383 | | | | (1,831 | ) | | | 3.369 | | | | 6.3 | |

| Minority interest | | | 5 | | | | 5 | | | | 2 | | | | 3 | | | | 4 | | | | 0.0 | |

| Net income (loss) | | | (339 | ) | | | (4,436 | ) | | | (8,019 | ) | | | (8,909 | ) | | | (28,118 | ) | | | (52.8 | ) |

| Net Income (loss) per share | | | (0.26 | ) | | | 0.34 | | | | (0.62 | ) | | | (0.69 | ) | | | (2.23 | ) | | | (0.00 | ) |

| Net Income (loss) per ADS | | | (5.42 | ) | | | (17.21 | ) | | | (31.12 | ) | | | (34.60 | ) | | | (111.42 | ) | | | (0.21 | ) |

| Weighted average shares outstanding (000s) | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | | | | 1,261,850 | |

_____________________________

| (1) | Unaudited Chilean peso amounts have been translated into U.S. dollars at the rate of Ch$536.39 per U.S. dollar, the Observed Exchange Rate on December 31, 2006. |

| (2) | Except ratios, shares outstanding, per share, per ADS and operating data. |

| (3) | In pesos and dollars not in millions. We calculated net income per share and per ADS based on the weighted average number of shares of common stock outstanding during the relevant period. |

BALANCE SHEET DATA: | | | | | | | | | | | | | | | | | | |

| | | For the years ended December 31, | |

| | | | | | | | | | | | | | | | | | | |

| | | (in millions of constant Ch$ and millions of U.S.$ as of December 31, 2006) (2) | |

Chilean GAAP: | | | | | | | | | | | | | | | | | | |

| Total current assets | | | 23,816 | | | | 27,711 | | | | 26,600 | | | | 17,821 | | | | 17,550 | | | | 33.0 | |

| Net property, plant and equipment | | | 165,034 | | | | 142,061 | | | | 132,848 | | | | 112,466 | | | | 109,433 | | | | 205.6 | |

| Total assets | | | 218,074 | | | | 195,514 | | | | 184,730 | | | | 157,622 | | | | 150,065 | | | | 281.9 | |

Short term debt (3) | | | 26,948 | | | | 10,143 | | | | 8,393 | | | | 5,397 | | | | 7,669 | | | | 14.4 | |

| Long term debt | | | 9,144 | | | | 18,726 | | | | 14,628 | | | | 9,841 | | | | 4,106 | | | | 7.7 | |

| Total shareholders’ equity | | | 118,070 | | | | 106,194 | | | | 96,152 | | | | 84,725 | | | | 77,240 | | | | 145.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total current assets | | | 23,865 | | | | 27,709 | | | | 26,600 | | | | 17,683 | | | | 22,516 | | | | 42.3 | |

| Net property, plant and equipment | | | 156,701 | | | | 137,590 | | | | 127,581 | | | | 107,263 | | | | 104,176 | | | | 195.7 | |

| Total assets | | | 203,314 | | | | 185,984 | | | | 169,965 | | | | 139,673 | | | | 142,741 | | | | 268.1 | |

Short term debt (3) | | | 26,948 | | | | 10,142 | | | | 8,393 | | | | 5,397 | | | | 7,669 | | | | 14.4 | |

| Long term debt | | | 9,144 | | | | 18,726 | | | | 14,627 | | | | 9,840 | | | | 4,106 | | | | 7.7 | |

| Total shareholders’ equity | | | 101,473 | | | | 94,161 | | | | 78,760 | | | | 66,936 | | | | 39,237 | | | | 73.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

OTHER FINANCIAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the years ended December 31, | |

| | | | | | | | | | | | | | | | | | | |

| | | (in millions of constant Ch$ and millions of U.S.$ as of December 31, 2006) (2) |

Other Financial Information (Chilean GAAP): | | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | | 1,361 | | | | 303 | | | | 716 | | | | 412 | | | | 511 | | | | 1.0 | |

| Depreciation and amortization | | | 8,718 | | | | 7,688 | | | | 5,988 | | | | 5,436 | | | | 5,193 | | | | 9.8 | |

Funds from operations (4) | | | -14,042 | | | | -4,822 | | | | 4,002 | | | | 4,276 | | | | 2,224 | | | | 4.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Financial Ratios (Chilean GAAP) Unaudited (5): | | | | | | | | | | | | | | | | | | | | | |

| Gross margin | | | 21.1 | % | | | 21.3 | % | | | 21.9 | % | | | 24.4 | % | | | 24,4 | % | | | 24.4 | % |

| Operating margin | | | -6.0 | % | | | -3.6 | % | | | -3.6 | % | | | -3.7 | % | | | -2,9 | % | | | -2.9 | % |

| Net margin | | | -1.3 | % | | | -3.3 | % | | | -6.0 | % | | | -7.4 | % | | | -6,7 | % | | | -6.7 | % |

| Current ratio | | | 38.3 | % | | | 59.9 | % | | | 54.2 | % | | | 44.4 | % | | | 37,3 | % | | | 37.3 | % |

| Total debt/total shareholders’ equity | | | 30.6 | % | | | 27.2 | % | | | 23.9 | % | | | 18.0 | % | | | 22,8 | % | | | 22.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Operating Data (Chilean GAAP) Unaudited: | | | | | |

| Number of supermarkets (at end of period) | | | 37 | | | | 39 | | | | 42 | | | | 41 | | | | 41 | | | | 41 | |

| Number of supermarkets remodeled or expanded (during period) | | | 7 | | | | 9 | | | | 8 | | | | 12 | | | | 11 | | | | 11 | |

| Total selling space of supermarkets (in square meters at period end) | | | 63,318 | | | | 63,370 | | | | 61,428 | | | | 61,768 | | | | 61,406 | | | | 61,406 | |

Average selling space per supermarket (6) | | | 1,712 | | | | 1,662 | | | | 1,474 | | | | 1,480 | | | | 1,498 | | | | 1,498 | |

Average sales per supermarket (7) | | | 3,253 | | | | 3,371 | | | | 2,986 | | | | 2,687 | | | | 2,547 | | | | 4.78 | |

| Total number of employees | | | 3,814 | | | | 4,022 | | | | 4,199 | | | | 4,691 | | | | 3,440 | | | | 3,440 | |

| (at period end) | | | | | | | | | | | | | | | | | | | | | | | | |

Sales (in thousands) per square meters(8) | | | 1,790 | | | | 2,028 | | | | 1,899 | | | | 1,784 | | | | 1,701 | | | | 3.2 | |

| Sales (in thousands) per employee | | | 27,693 | | | | 31,711 | | | | 28,446 | | | | 23,491 | | | | 30,362 | | | | 57.0 | |

_____________________________

| (1) | We translated unaudited Chilean peso amounts (except dividends) into U.S. dollars at the rate of Ch$532.39 per U.S. dollar, the Observed Exchange Rate at December 31, 2006. |

| (2) | Except ratios, shares outstanding, per share, per ADS and operating data. |

| (3) | Short-term debt consists of short-term obligations with banks plus the current portion of long-term liabilities. |

| (4) | Funds from operations are equivalent to working capital provided by operations and are applicable only under Chilean GAAP. Funds from operations are not a defined term under U.S. GAAP. |

| (5) | These ratios, which are expressed as percentages, were calculated as follows: Gross Margin = (Gross Profit) / (Sales); Operating Margin = (Operating income) / (Sales); Net margin = (Net income) / (Sales); Current Ratio = (Current Assets) / (Current Liabilities). |

| (6) | Total selling space at the end of each month, divided by the number of open supermarkets at the end of that month, averaged during the year. |

| (7) | Supermarket net sales for the period divided by the average number of supermarkets at the end of each month during the period. |

| (8) | Supermarket net sales for the period divided by the average square meters of selling space at the end of each month during the period. |

RISK FACTORS

Risks Relating to Unimarc

We are currently involved in various litigation proceedings.

We are currently involved in various litigation proceedings, some of which have been pending for several years, which could result in unfavorable decisions or financial penalties against us. We believe that we will continue to be subject to future litigation proceedings, which may be resolved against us and, if so, could have material adverse consequences to our business. Our financial condition or results from operations could be adversely affected in a material way if certain of these material claims are resolved against us. See “Item 8. Financial Information — Legal Proceedings”.

We have substantial outstanding liabilities, and we are in default on some of our debt obligations.

Our net sales (1) increased to Ch$118,091 million or 4.96% in 2006, from Ch$112,509 million in 2005 and (2) decrease to Ch$126,343 million or 8.6% in 2004, from Ch$138,283 million in 2003. Additionally, as of December 31, 2006 (1) our total current assets were Ch$17,550 million, while our total current liabilities were Ch$47,049 million, and (2) our total assets were Ch$150.065 million, while our total liabilities were Ch$72,826 million. Due to our financial difficulties we have been unable to repay some of our debt, and we have restructured the payment terms of our most important current liabilities. See “Item 5. Operating and Financial Review” and “Item 13. Defaults, Late Dividends and Delinquencies”.

As of December 31, 2006, our long-term debt totaled Ch$4,106 million, or U.S.$7.7 million, or 2.7% of our total consolidated assets, and principally consisted of five loans to us or to our affiliates from, Banco CorpBanca S.A., or CorpBanca, Banco Kreditanstalt fur Wiederaufbau, or Banco Kreditanstalt, Banco Do Brasil, Banco Supervielle and Banco Santander Santiago S.A. We have incurred payment defaults in connection with several long-term loans. See “Item 13. Defaults, Late Dividends and Delinquencies”.

As of December 31, 2006, we also had guaranteed the payment of certain debt incurred by our affiliates. In 1994 and 1996, a syndicate of financial institutions for whom State Street Bank and Trust Co., or State Street, acted as agent made a U.S.$50.0 million unsecured loan and a U.S.$65.0 million unsecured loan, respectively, to Inverraz. The payment terms of the 1994 loan were as follows: (1) principal was payable in semi-annual installments of U.S.$5,555,555, in March and September of every calendar year, beginning on September 2, 1998 and ending on March 2, 2002; (2) interest was payable semi-annually at a rate of 9.45% per year; and (3) interest on any overdue principal and any overdue interest (to the extent permitted by applicable law) is payable at the rate of 10.45%. The payment terms of the 1996 loan were as follows: (1) principal was payable in semi-annual installments of U.S.$4,444,445 under the series A tranche of the loan, and semi-annual installments of U.S.$2,777,778 under the series B tranche of the loan, in March and September of every calendar year, beginning on March 8, 2000 and ending on March 8, 2004; (2) interest under the series A tranche was payable semi-annually at the rate of 9.45% per year, and interest under the series B tranche was payable semi-annually at the rate of 9.45% per year; and (3) interest on any overdue principal and any overdue interest (to the extent permitted by applicable law) is payable at the rate of 10.45% under the series A tranche and at the rate of 10.45% under the series B tranche.

We were one of the guarantors under the 1994 loan. We were also one of the guarantors under the 1996 loan. As guarantors, we agreed to guarantee the repayment obligations of Inverraz under the applicable loan (including the payment of principal, interest, fees, costs and any other charges related to

the applicable credit agreement) in an amount equal to our pro rata share, as specified in such loan, in accordance with our “attributable liability”. In each loan, our “attributable liability” is adjusted from time to time based on the outstanding balance of such loan. However, if State Street is unable to collect the attributable liability of one or more guarantors, or if one or more guarantors become subject to bankruptcy or similar proceedings or become affected by one of the events specified in the applicable credit agreement, the attributable liability of the other guarantors is subject to being increased pro rata by the amount of the attributable liability of the affected guarantors in the specified limited circumstances set forth in the loan agreements. The aggregate amount of the attributable liabilities of all guarantors under each loan is equal to 100% of the outstanding principal amount of such loan, together with any unpaid scheduled and default interest, and any other amounts payable by Inverraz under such loan.

In April 2001, following a default by Inverraz and the acceleration of the debt under the loans, State Street initiated legal proceedings in the U.S. District Court for the Southern District of New York against Inverraz, the loan guarantors (including us) and certain other entities claimed to be “loan guarantors” (collectively, the “Chilean Defendants”) seeking repayment of the loan. Refer to the case of State Street Bank and Trust Co. v. Inversiones Errazuriz Ltd. et al., No. 01 Civ. 3201 (RLC) (the “State Street Litigation”). The Chilean Defendants did not answer the complaint filed in the State Street Litigation on a timely basis, and a default judgment was entered on December 4, 2001 against all the Chilean Defendants, “jointly and severally”, for the full amount of the outstanding principal under the unsecured loans, a liquidated amount of “$57,283,874.86, with accrued pre-judgment interest at $20,011.63 per day from and including November 1, 2001” and “$79,180,000.12, with accrued pre-judgment interest at the rate of $21,599.47 per day from and including November 1, 2001”, for the 1994 and 1996 loans, respectively.

The Chilean Defendants sought to vacate the default judgment. During that legal process, we maintained that, pursuant to our capped attributable liability under the credit agreements, we were exposed to liability of $13,688,889 under the 1994 loan and $25,230,328 under the 1996 loan. However, the default judgment was upheld on appeal and became a final, binding U.S. judgment. The Chilean Supreme Court granted the exequatur sought by State Street and recognized the U.S. judgment as the equivalent of an enforceable Chilean judgment on May 14, 2007, as described in greater detail in “Item 8 – Financial Information – Legal Proceedings”. The Chilean Defendants intend to pursue all available defenses vigorously to enforcement of this judgment, but, in the event the Chilean courts reject these defenses, any and/or all of them, including us, could be held liable for the full amount awarded to State Street under the U.S. judgment, which, at present, exceeds $136 million, plus interest.

We have incurred certain contingent liabilities with respect to related party indebtedness.

We have guaranteed the repayment of certain debt of related parties, which exposes us to direct liability if our related party defaults under such debt. See “Item 7. Major Shareholders and Related Party Transactions” and “Item 8. Financial Information — Legal Proceedings”.

Our controlling shareholder holds a substantial majority of our capital and exercises significant influence over us and may have interests that differ from those of our other shareholders.

Inverraz is our ultimate, indirect parent company through its 97.2% ownership of Alimentos Nacionales S.A., which in turn owns 57.16% of our shares of common stock. Accordingly, Inverraz is in a position to direct our management and to determine the result of substantially all matters to be decided by vote of the shareholders, including the election of our board of directors. Additionally, if the Bank of New York, in its capacity as depositary of the ADSs, or the Depositary, does not receive instructions from a holder of ADSs with respect to the shares of common stock underlying the ADSs during or prior to the date established for such purpose, such holder is deemed, and the Depositary deems it to have instructed

the Depositary to give a discretionary proxy with full power of substitution to the President of our board of directors, or to a person designated by the President of our board of directors, to vote such shares of common stock. See “Item 4. Information on the Company — History and Development of the Company”.

Additionally, a disposition by Inverraz of a significant number of our shares of common stock, or the perception that such disposition might occur, could adversely affect the trading price of our shares of common stock in the Chilean stock exchanges and, consequently, the trading price of the ADSs.

Risks Relating to the Supermarket Industry

We face competition from growing Chilean and international supermarket chains as well as smaller retailers in Chile

The food retailing industry in Chile is highly competitive and is characterized by growing competition and increasing pressure on margins. The number and type of competitors and the degree of competition experienced by individual stores vary depending on their location. Competition occurs on the basis of prices, location, quality and product selection, service variety, and store conditions and brand recognition. We compete with regional and local supermarket chains and individual supermarkets, independent grocery stores, convenience stores, open-air markets and international supermarket chains. International supermarkets arrived in Chile in 1998 when Carrefour (France) opened its first supermarket. Disco Ahold International Holdings N.V. arrived through a joint venture with the owners of Velox Retail Holdings, or Velox. Velox was the owner of Santa Isabel S.A., or Santa Isabel, one of our main competitors until 2003, when Velox sold its interest in Santa Isabel to Cencosud S.A., a Chilean company owned by Hipermercados Jumbo S.A., or Jumbo, another competitor. It is also likely that certain international chains might elect to participate in the Chilean market through joint ventures with domestic chains or through the acquisition of a significant share in domestic supermarket chains.

Additionally, our principal competitors in Chile, including Distribucion y Servicios D&S S.A., or D&S, and Jumbo have opened new supermarkets and remodeled existing supermarkets in several regions, including regions where we operate. In 2004, D&S opened one hypermarket in the city of Ovalle, one hypermarket in Talagante, four supermarkets in the boroughs of Arica, Temuco, Puerto Varas and Punta Arenas, and it reopened stores it had in Santiago, which permitted D&S to increase its selling space by 21,659 square meters. In 2005, Jumbo opened four stores in the city of Santiago, Chillan, Puerto Montt and Copiapo which permitted it to increase its selling space by 26,568 square meters. Certain of our competitors in Chile, including D&S and Jumbo, have significant financial resources and could use these resources to take steps that could adversely affect our competitive and financial position. Competition may require us to (1) adjust our pricing policy, (2) modify our major expenditure plans, or (3) take other actions that may adversely affect our profitability. We may not assure you that competition in the future will not materially and adversely affect our business, our financial condition, operating results, cash flows or prospects.

According to the INE, during 2006, sales in the supermarket industry grew by 8.1%. At the end of 2006, there were 731 stores in Chile, as compared to 696 stores at the end of 2005. Since supermarket industry participants closed 37 supermarkets during 2006, the above information from the INE suggests that during 2005, industry participants opened 72 supermarkets.

Our results will depend to a significant extent on our ability to continue to open new stores and remodel existing ones, as well as to plan and operate such stores on a profitable basis

During 2006, we renovated several stores, including Grecia, Providencia, Maipu I, Machali, Vespucio, Irarrazabal, Temuco, La Florida, Curico, Quintero and Curacavi. Our ongoing expansion and renovation program includes the remodeling and opening of additional stores. The successful completion of our expansion and renovation program depends on several factors, including zoning, regulatory and other permit issues, the hiring and training of qualified personnel, and the level of existing and future competition in areas where new or remodeled stores are to be located and general macroeconomic conditions. We cannot assure you that we will complete our planned expansion within the time currently foreseen or that it will successfully manage any growth in our business. Furthermore, we cannot assure you that new store openings will not result in diversion of sales from existing stores.

We will need both internal and external sources of financing to complete our expansion and renovation program on schedule. If we are unable to fund any required capital resources from internally generated funds and from external financing, we would need to delay the opening and renovation of certain supermarkets until funds become available.

The lessors of the supermarkets that we operate could terminate the leases

At December 31, 2006, we operated 41 supermarkets in Chile, 7 of which we own, 17 of which we lease from other subsidiaries of Inverraz, and 17 of which we lease from third parties. Our lessors, including both affiliates and third party lessors, could terminate our lease contracts on their expiration date or upon the occurrence of certain events specified in such contracts. If a substantial number of our lessors terminate our lease contracts, our supermarket operations in Chile may be substantially reduced, which may have a material adverse affect on our operating income and our financial condition. See “Item 4. Information on the Company — Description of Property”.

Risks Relating to Chile

Our growth and profitability depend on the level of economic activity in Chile and in other emerging markets

Our financial condition and operating results may be adversely affected by changes beyond our control, including:

| · | the economic policies or other policies of the Chilean government, which have a substantial influence over many aspects of the private sector; |

| · | other economic developments in or affecting Chile; and |

| · | changes in administrative regulations or practices by Chilean authorities. |

At December 31, 2006, 74.3% of our total assets were located in Chile, and we derived 99.6% of our net sales from our operations in Chile. Our revenues depend on the financial condition of our clients, which are sensitive to the overall performance of the Chilean economy. Adverse local, regional or worldwide economic trends affecting the Chilean economy may have a material adverse effect on our financial condition and operating results. Although the Chilean economy grew each year between 1984 and 1997, in 1998 this trend changed significantly. According to information published by the Central Bank, the Chilean economy contracted at a rate of 0.8% in 1999 and grew at rates of 4.5% in 2000, 3.4% in 2001, 2.2% in 2002, 3.7% in 2003, 6.1% in 2004, 6.35% in 2005 and 4% in 2006, and we expect the

Chilean economy to grow to between 5.0% to 6.0% in 2007. During 2006, internal consumption increased by approximately 6%, and we expect it to increase by 7.5% during 2007. During 2006, the unemployment rate decreased from 6.90% in December 2005 to 6.01% in December 2006. In addition, during 2006, inflation was 2.6%. The Central Bank estimates that during 2007 inflation will be between 2.0% and 3.0%. During 2006, sales in the Chilean supermarket industry increased by 7.1%, in real terms, and by 8.9%, in nominal terms, as compared to 2005.

Our financial condition and operating results also depend to a certain extent on the level of economic activity in Latin America and other countries, especially the United States of America and certain countries in Asia. Although economic conditions differ from country to country, investors’ reactions to developments in one country may affect the securities of issuers in other countries, including Chile.

Currency fluctuations may increase our borrowing costs and adversely affect our financial condition and operating results and the value of our shares and ADSs

The Chilean government’s economic policies and any future changes in the value of the Chilean peso against the U.S. dollar could affect the dollar value of our common stock and our ADSs. The peso has been subject to large devaluations in the past and, more recently, periods of significant appreciation, and could be subject to significant fluctuations in the future. In the period from December 31, 2005 to December 31, 2006, the value of the Chilean peso relative to the U.S. dollar increased by 3.88%. The Observed Exchange Rate on September 20, 2007 was Ch$514.29 = US$1.00. Our results of operations may be affected by fluctuations in the exchange rates between the peso and the U.S. dollar.

In the event of a devaluation of the Chilean peso, our financial condition and results of operations, and our ability to meet obligations in foreign currencies, could be adversely affected. The Chilean government’s economic policies and future fluctuations in the value of the Chilean peso against the U.S. dollar could adversely affect our operating results and the dollar value of an investor’s return on an investment in the ADSs.

Chilean trading in the shares of our common stock that underlie our ADSs is conducted in pesos. Cash distributions with respect to shares of our common stock will be received in Chilean pesos by the depositary and converted by the depositary into U.S. dollars at the then-prevailing exchange rate for the purpose of making payments in respect of our ADSs. If the value of the Chilean peso falls relative to the U.S. dollar, the value of our ADSs and any distributions to be received from the depositary would be adversely affected. In addition, the depositary will incur customary currency conversion costs (to be borne by the holders of our ADSs) in connection with the conversion and subsequent distribution of dividends or other payments.

During the first quarter of 2007, the price of copper averaged US$2.69 per pound. The average price for the three years ending on December 31, 2006 was US$2.01 per pound. Since copper production accounts for 13.9% of Chile’s GDP (for the year 2007), the increase in price that copper has undergone during the first quarter of 2007 and continues to undergo as of the date of this report has put substantial pressure on the exchange rate between the Chilean peso and the U.S. dollar, leading to an appreciation of the peso. Such appreciation could have an impact on the value of our ADSs and any distributions to be received from the depositary. If the appreciation of the Chilean peso persists, the Chilean Central Bank may or may not deem such peso appreciation as a special and qualified case that justifies its intervention in the exchange market, whether through direct or indirect measures.

Inflation could adversely affect our financial condition, operating results and the value of our shares and ADSs

Although Chilean inflation has moderated in recent years, Chile has experienced high levels of inflation in the past. High levels of inflation in Chile could adversely affect the Chilean economy and have a material adverse effect on our financial condition and results of operations. The annual rates of inflation (as measured by changes in the CPI and as reported by the INE) in 2002, 2003, 2004, 2005 and 2006 were 2.8%, 1.1%, 2.4%, 3.7% and 2.6%, respectively. Chilean inflation may decrease significantly in the future. We generally pass on our increased costs resulting from inflation to our customers through increases in the prices of the products we sell. There can be no assurance, however, whether or to what extent we will pass on increased costs in the future. Further, the performance of the Chilean economy, our operating results or the value of the ADSs may be adversely affected by continuing or increased levels of inflation and Chilean inflation may increase significantly from the current level.

The market for our shares could be volatile and illiquid

The Chilean stock markets are substantially smaller, less liquid and more volatile than the stock markets in the United States. Companies registered with the Bolsa de Comercio de Santiago, the principal stock exchange in Chile, had (1) a market capitalization of approximately Ch$92,834,397 million, or U.S.$173,890 million at December 31, 2006 and (2) an average monthly trading volume of U.S.$33,832 million during 2006. The ten largest companies in terms of market capitalization at December 31, 2006 represented approximately 46.07% of the Santiago Stock Exchange’s aggregate market capitalization. The daily transaction volumes on the Bolsa de Comercio de Santiago are on average substantially lower than those on the principal national securities exchanges in the United States. During 2006, approximately 3% of the registered shares were traded on the Bolsa de Comercio de Santiago with an average presence of 45% in business days.

Additionally, shares traded in Chile are affected by developments in other emerging markets, particularly in other Latin American countries.

Economic problems in Argentina may have an adverse effect on the Chilean economy and on our operating results and on the price of our ADSs and shares

At December 31, 2006, 25.75% of our total assets were in Argentina, and we derived 0.43% of our net sales from our operations in Argentina. Argentina’s insolvency and recent default on the payment of its public debt, which deepened the existing financial, economic and political crisis in that country could adversely affect Chile, our business or the market price of our shares and ADSs.

The market value of securities of Chilean companies is, to varying degrees, influenced by economic and market considerations in other emerging market countries and by the U.S. economy. We cannot assure you that the Argentine economic crisis will not have an adverse effect on Chile, the price of our shares and ADSs, or our business.

Risks Relating to Chilean Law

Chile imposes controls on foreign investment and on the repatriation of investments that may affect investment in, and earnings from, our ADSs

Equity investments in Chile by non-Chilean residents generally are subject to various exchange control regulations that restrict the repatriation of investments and earnings from investments. The ADS facility, however, is the subject of a Foreign Investment Contract among the depositary, us and the

Chilean Central Bank, which grants the depositary and the holders of ADSs access to Chile’s Mercado Cambiario Formal, or Formal Exchange Market. Pursuant to current Chilean law, the Foreign Investment Contract may not be amended unilaterally by the Central Bank. Additionally, there are judicial precedents (although not binding on future judicial decisions) indicating that the Foreign Investment Contract may not be abrogated by future legislative changes. However, additional Chilean restrictions applicable to the holders of ADSs, to the disposition of underlying shares of common stock or to the repatriation of the proceeds from such disposition may be imposed in the future, and the duration or implications of any such restrictions that might be imposed are difficult to predict. If, for any reason, including changes in the Foreign Investment Contract or Chilean law, the depositary were unable to convert pesos to U.S. dollars, investors might receive dividends or other distributions in pesos. Transferees of shares withdrawn from the ADS facility will not be entitled to access the Formal Exchange Market unless the withdrawn shares are redeposited with the depositary. If transferees are unable to access the Formal Exchange Market, they may be unable to convert peso amounts to dollars in connection with the sale of these shares.

Cash and property dividends paid to a foreign person (non-Chilean) with respect to ADSs are subject to a 35.0% Chilean withholding tax. Stock dividends are not subject to Chilean taxes.

Chile has different corporate disclosure, governance and accounting standards than those you may be familiar with in the United States

The securities laws of Chile which govern open, or publicly held, corporations in Chile, such as us, impose regulatory requirements that are more limited than those in the United States in certain important respects. Additionally, although Chilean law imposes restrictions on insider trading and price manipulation, the Chilean securities markets are not as highly regulated and supervised as the U.S. securities markets. There are also important differences between Chilean and U.S. accounting and financial reporting standards. As a result, Chilean financial statements and reported earnings generally differ from those reported on the basis of the United States’ accounting and reporting standards. See Note 38 to our consolidated financial statements, which describes the main differences between the Chilean GAAP and the U.S. GAAP and the reconciliations to U.S. GAAP of net loss and total equity of the shareholders for the periods and dates indicated.

Pursuant to Chilean Law No. 19,705 (Ley de OPAs or Law of Public Offering of Securities), the controlling shareholders of an open corporation may only sell their controlling shares by way of an offer made to all the shareholders in which the bidder would have to buy all the offered shares up to the percentage determined by it, when the price paid is substantially higher than the market price (that is, when the price offered is higher than the average market price of a period starting 90 days before the proposed transaction and ending 30 days before such proposed transaction, plus 10%). Transitory Article 10 of Law No. 19,705 established a term of three years during which the controlling shareholders of an open stock corporation would be authorized to sell their controlling shares directly to a third party without requiring an offer to all shareholders, provided that such authorization was granted by an extraordinary shareholders’ meeting held within six months after the approval and enactment of Law No. 19,705. In our shareholders’ meeting held on April 27, 2001, our controlling shareholders decided to invoke this grace period granted by Transitory Article No. 10 of Law No. 19,705. This three-year grace period has expired.

Minority shareholders have fewer and less defined rights under Chilean law and under our Estatutos, which function as our Articles of Incorporation and our bylaws, than they might have as minority shareholders of a corporation incorporated in a U.S. jurisdiction.

You may be unable to exercise your preemptive rights

Chilean Corporations Law No. 18,046 (Ley de Sociedades Anonimas No.18,046) requires a Chilean company to grant preemptive rights to all of its existing shareholders to purchase a sufficient number of shares to maintain their existing percentage of ownership of such company whenever the company issues new shares for cash. Although any preemptive rights in connection with any future issuance of shares of common stock for cash will be offered to the Depositary as the registered owner of the common stock underlying the ADSs, the holders of ADSs are not entitled to exercise their preemptive rights unless a registration statement under the Securities Act is effective with respect to these rights and shares of common stock or an exemption from the registration requirements of the Securities Act is available. In addition, a Central Bank ruling published in November 1995 effectively makes it impracticable for ADS holders to participate in preemptive rights offerings. In accordance with such ruling, ADS holders may exercise their preemptive rights and thus convert the newly acquired shares into ADSs being offered through the preemptive rights offering only if the company issuing such shares has entered into a new foreign investment contract with the Central Bank in order to cover the newly issued shares under the benefits of Chapter XXVI of the Compendium of Foreign Exchange Norms of the Central Bank. See “Item 10. Additional Information — Exchange Controls”.

At the time of any preemptive rights offering, we intend to evaluate the practicability under Chilean law and Central Bank regulations of making such rights available to the holders of the ADSs, the costs and potential liabilities associated with registration of such rights and the related shares of common stock under the Securities Act. We can not assure you that we would file any such any registration statement. If we do not file a registration statement, and no exemption from the registration requirements under the Securities Act is available, the Depositary might attempt to sell holders’ preemptive rights and distribute any net proceeds of any such sale. We cannot assure you that a market would exist with respect to any such rights.

You may be unable to exercise fully your withdrawal rights

In accordance with Chilean laws and regulations, any shareholder that votes against certain actions or does not attend the meeting at which such actions are approved may withdraw its ownership in us and receive a payment for its shares according to a pre-established formula, provided that such shareholder exercises its rights within certain prescribed time periods. Such actions triggering withdrawal rights include the approval of:

| · | our transformation into an entity that is not a stock corporation (sociedad anonima) governed by the Chilean Corporations Law; |

| · | a merger with and/or into another company; |

| · | the sale of 50% or more of our assets, whether or not our liabilities are included, or the formulation of a business plan contemplating a sale on those terms; |

| · | the creation of personal securities or asset-backed securities for the purpose of guaranteeing third-party obligations in excess of 50% of our assets; |

| · | the creation of preemptive rights for a class of shares or an amendment to those already existing, in which case the right to withdraw only accrues to the dissenting shareholders of the class or classes of shares adversely affected; |

| · | the remedy of nullification of our documents of incorporation caused by a formality or an amendment to such documents resulting in the granting of a right to such remedy; and |

| · | such other cases as may be established by the bylaws (no such additional cases are currently specified in our bylaws). |

There is no judicial precedent indicating whether a shareholder voting both for and against a proposal (such as might be the case with respect to the Depositary) may exercise withdrawal rights with respect to those shares voted against the proposal. Accordingly, we cannot assure you that the holders of ADSs will be able to exercise withdrawal rights either directly or through the Depositary.

Item 4. | Information on the Company |

We are organized in Chile as an open stock corporation, and our operations are governed by Chilean laws. Our headquarters are located at Avenida Presidente Eduardo Frei Montalva, 1380, Santiago, Chile. Our telephone number in Santiago is 011-56-2-687-7000. We have been renamed several times as follows: (1) Supermercados Unimarc S.A. in 1982, (2) Supermercados Unimarc Ltda. in 1984, (3) Administradora de Inversiones y Supermercados Unimarc S.A. in 1987, (4) Comercial e Inmobiliaria Unimarc S.A. in 1988 and (5) Supermercados Unimarc S.A. in 1996.

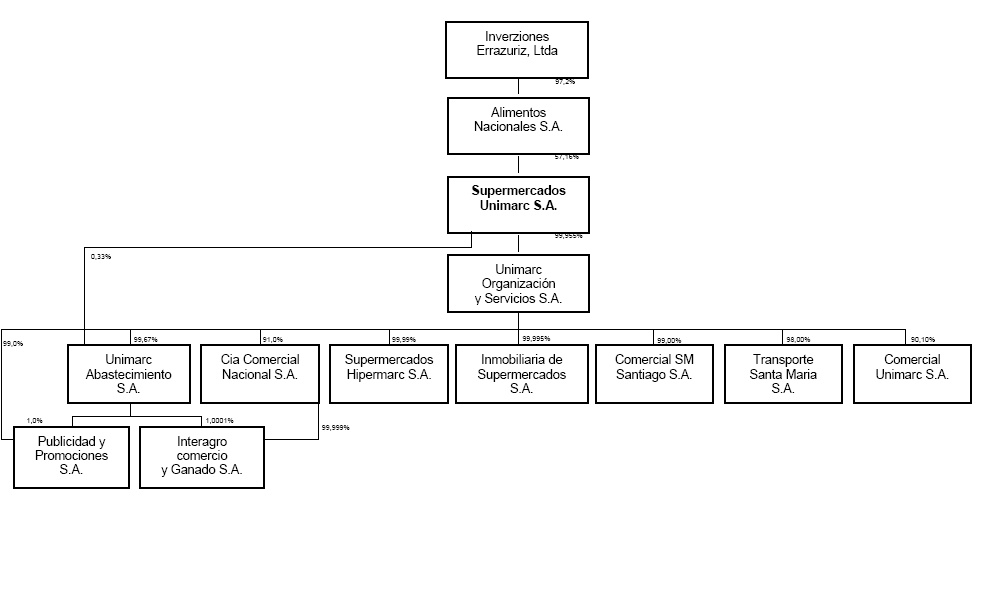

Alimentos Nacionales S.A. owns 57.16% of our shares. Alimentos Nacionales is a 97.2% owned subsidiary of Inversiones Errazuriz Ltda., or Inverraz, a business conglomerate owning several businesses in Chile, Argentina and Peru, including (1) automobile and machinery distribution businesses, (2) salmon farming, fishing, forestry and mining businesses, (3) life insurance and general insurance companies, (4) iodine and fertilizer companies, (5) real estate businesses and (6) agro businesses.

Unimarc was founded in 1961 under the name of “Unicoop Limitada”, or “Unicoop”. In 1982, Inverraz acquired Unicoop through an affiliate and renamed it “Unimarc”. At the time of the acquisition, Unicoop had 13 stores and net sales of Ch$51,341 million. During the period from 1982 to 1990, Unimarc undertook a significant expansion program through the addition of 13 new supermarkets and the introduction of the “Multiahorro” brand. Between 1990 and 1994, we consolidated our operations and developed strategies to improve operating margins. In 1994 we started to carry out our strategy of expansion through the application of a new expansion and renovation program.

Through a series of share purchases between 1995 and 1999, we acquired 99.9% of the shares of Supermercados Hipermarc S.A., or Hipermarc, our subsidiary in Argentina. At present, Hipermarc owns (1) four shopping malls with supermarkets, two of which have an aggregate of 18 movie theaters, and food courts, and (2) another supermarket.

In June 1999, Hipermarc leased four supermarkets to Supermercados Norte S.A., or Supermercados Norte, for a period of ten years, subject to total lease payments of Ch$7,072 million. In conjunction with this transaction, Hipermarc (1) transferred all inventories maintained in, and all fixed assets relating to, these stores to Supermercados Norte, (2) assumed certain commitments including the obligation to hold Supermercados Norte harmless against any claims from third parties made prior to and up to 60 months after the date of the lease transaction and (3) agreed not to compete against Supermercados Norte in the supermarket business in Argentina for a 10-year period. Supermercados Norte assumed all the accounts payable that Hipermarc owed to suppliers through the date of the lease transaction. Additionally, Unimarc issued two guaranties to Supermercados Norte as follows: (1) a guaranty in the amount of Ch$680 million to protect Supermercados Norte against any contingent liabilities resulting from disagreements with suppliers in connection with any accounts payable incurred up to the date of the lease transaction and (2) a Ch$1,209 million performance guaranty.

Principal capital expenditures and divestitures

The supermarket business is capital intensive. In the last five years we spent approximately U.S.$18 million, mainly in expanding the existing supermarkets and creating new supermarkets in Chile. Between 2006 and 2007, we expect to invest a total of U.S.$1.4 million to renovate several new stores in Chile. We have already opened ten new stores and expanded 18 stores since 1995. Our projected capital expenditures may vary substantially from the numbers set forth below due to market competition and the cost and availability of any necessary resources.

We project capital expenditures of approximately Ch$718 million, or U.S.$1.4 million, for 2007 and 2008, to remodel existing stores in Chile, which we expect to fund from internally generated resources. The table below shows our major capital expenditures during 2003, 2004 and 2005 our major projected capital expenditures for 2006 and 2007:

Capital expenditures

| | | | | | | | | | | | | | |

| | | (In millions of constant Ch$ as of December 31, 2006) | |

| Lands, buildings, plant and equipment | | | 504 | | | | 261 | | | | 302 | | | | 370 | |

| Vehicles | | | 41 | | | | 3 | | | | 14 | | | | 15 | |

| Remodeling | | | - | | | | - | | | | - | | | | 258 | |

| Other | | | 132 | | | | 140 | | | | 195 | | | | 75 | |

| Totals | | | 677 | | | | 404 | | | | 511 | | | | 718 | |

During the last three years, our largest divestitures totaled Ch$14,611 million. These divestitures consisted of dispositions of land, property, equipment, vehicles and investments in certain entities, including among others, the sale of supermarkets to affiliated entities. The table below sets forth our actual divestitures for 2004, 2005 and 2006 and projected divestitures for 2007 and 2008:

Divestitures

| | | | | | | | | | | | | | |

| | | (In millions of constant Ch$ as of December 31, 2006) | |

| Lands, buildings, plant and equipment | | | 2,778 | | | | 11,833 | | | | - | | | | - | |

| Investments | | | - | | | | - | | | | - | | | | - | |

| Other | | | - | | | | - | | | | - | | | | - | |

| Total | | | 2,778 | | | | 11,833 | | | | - | | | | - | |

Overview of the Food Retailing Industry in Chile

The Chilean food retailing industry is characterized by strong regional competition among supermarket chains. Supermarkets also compete with smaller grocery stores, convenience stores and open air markets. At present, none of the supermarket chains in Chile operates in every region in the country.

Accordingly, the level of competition and the identity of competitors vary from region to region. Supermarket chains in Chile, including us, generally compete on the basis of location, price, service, product quality and selection, as well as type and frequency of promotions.

The following tables provide our estimates regarding population and supermarket industry in Chile as of December 31, 2006, 2005 and 2004, respectively:

| | Percentage Contribution to GDP (1) | | | | | | Supermarket Net Sales (in millions of Ch$) (4) | | | Percentage of Total Supermarket Net Sales | | | | | | Number of inhabitants per Supermarket | |

| I | | | 3.6 | % | | | 428,594 | | | | 86,039 | | | | 2.1 | % | | | 13 | | | | 32,969 | |

| II | | | 8.8 | % | | | 493,984 | | | | 184,270 | | | | 4.5 | % | | | 28 | | | | 17,642 | |

| III | | | 2.6 | % | | | 254,336 | | | | 91,295 | | | | 2.2 | % | | | 22 | | | | 11,561 | |

| IV | | | 2.7 | % | | | 603,210 | | | | 173,789 | | | | 4.2 | % | | | 29 | | | | 20,800 | |

V (3) | | | 8.4 | % | | | 1,539,852 | | | | 412,254 | | | | 10.0 | % | | | 77 | | | | 19,998 | |

VI (3) | | | 4.5 | % | | | 780,627 | | | | 198,724 | | | | 4.8 | % | | | 51 | | | | 15,306 | |

VII (3) | | | 4.0 | % | | | 908,097 | | | | 171,178 | | | | 4.1 | % | | | 47 | | | | 19,321 | |

VIII (3) | | | 8.4 | % | | | 1,861,562 | | | | 398,642 | | | | 9.7 | % | | | 103 | | | | 18,073 | |

IX (3) | | | 2.4 | % | | | 869,535 | | | | 172,654 | | | | 4.2 | % | | | 58 | | | | 14,992 | |

X (3) | | | 4.3 | % | | | 1,073,135 | | | | 284,452 | | | | 6.9 | % | | | 57 | | | | 18,827 | |

| XI | | | 0.5 | % | | | 91,492 | | | | 26,642 | | | | 0.6 | % | | | 5 | | | | 18,298 | |

| XII | | | 2.0 | % | | | 150,826 | | | | 71,670 | | | | 1.7 | % | | | 13 | | | | 11,602 | |

Santiago, M.R. (3) | | | 47.8 | % | | | 6,061,185 | | | | 1,858,505 | | | | 45.0 | % | | | 228 | | | | 26,584 | |

| Total / Average | | | 100.0 | % | | | 15,116,435 | | | | 4,130,114 | | | | 100.0 | % | | | 731 | | | | 20,679 | |

__________________

| (1) | For the year ended December 31, 1998, the last year for which data is available. |

| (2) | Population estimated at April 2002. |

| (3) | Regions where we operate. |

| (4) | In millions of Chilean pesos at December 31, 2006 |

| | Percentage Contribution to GDP (1) | | | | | | Supermarket Net Sales (in millions of Ch$) (4) | | | Percentage of Total Supermarket Net Sales | | | | | | Number of inhabitants per Supermarket | |

| I | | | 3.6 | % | | | 428,594 | | | | 82,180 | | | | 2.2 | % | | | 12 | | | | 35,716 | |

| II | | | 8.8 | % | | | 493,984 | | | | 161,659 | | | | 4.3 | % | | | 26 | | | | 18,999 | |

| III | | | 2.6 | % | | | 254,336 | | | | 71,825 | | | | 1.8 | % | | | 21 | | | | 12,111 | |

| IV | | | 2.7 | % | | | 603,210 | | | | 153,595 | | | | 3.9 | % | | | 29 | | | | 20,800 | |

V (3) | | | 8.4 | % | | | 1,539,852 | | | | 392,167 | | | | 10.0 | % | | | 73 | | | | 21,094 | |

VI (3) | | | 4.5 | % | | | 780,627 | | | | 184,251 | | | | 4.9 | % | | | 51 | | | | 15,306 | |

VII (3) | | | 4.0 | % | | | 908,097 | | | | 155,762 | | | | 4.1 | % | | | 45 | | | | 20,180 | |

VIII (3) | | | 8.4 | % | | | 1,861,562 | | | | 370,494 | | | | 9.8 | % | | | 102 | | | | 18,251 | |

IX (3) | | | 2.4 | % | | | 869,535 | | | | 159,390 | | | | 4.0 | % | | | 58 | | | | 14,992 | |

X (3) | | | 4.3 | % | | | 1,073,135 | | | | 253,837 | | | | 6.7 | % | | | 50 | | | | 21,463 | |

| XI | | | 0.5 | % | | | 91,492 | | | | 23,634 | | | | 0.6 | % | | | 5 | | | | 18,298 | |

| XII | | | 2.0 | % | | | 150,826 | | | | 64,747 | | | | 1.5 | % | | | 14 | | | | 10,773 | |

Santiago, M.R. (3) | | | 47.8 | % | | | 6,061,185 | | | | 1,723,464 | | | | 46.2 | % | | | 210 | | | | 28,863 | |

| Total / Average | | | 100.0 | % | | | 15,116,435 | | | | 3,797,007 | | | | 100.0 | % | | | 696 | | | | 21,719 | |

__________________

| (1) | For the year ended December 31, 1998, the last year for which data is available. |

| (2) | Population estimated at April 2002. |

| (3) | Regions where we operate. |

| (4) | In millions of Chilean pesos at December 31, 2005. |

| | Percentage Contribution to GDP (1) | | | | | | Supermarket Net Sales (4) | | | Percentage of Total Supermarket Net Sales | | | | | | Number of inhabitants per Supermarket | |

| I | | | 3.6 | % | | | 428,594 | | | | 76,548 | | | | 2.2 | % | | | 12 | | | | 35,716 | |

| II | | | 8.8 | % | | | 493,984 | | | | 147,537 | | | | 4.3 | % | | | 26 | | | | 18,999 | |

| III | | | 2.6 | % | | | 254,336 | | | | 62,857 | | | | 1.8 | % | | | 19 | | | | 13,386 | |

| IV | | | 2.7 | % | | | 603,210 | | | | 135,060 | | | | 3.9 | % | | | 31 | | | | 19,458 | |

V (3) | | | 8.4 | % | | | 1,539,852 | | | | 347,295 | | | | 10.0 | % | | | 72 | | | | 21,387 | |

VI (3) | | | 4.5 | % | | | 780,627 | | | | 170,156 | | | | 4.9 | % | | | 49 | | | | 15,931 | |

VII (3) | | | 4.0 | % | | | 908,097 | | | | 144,035 | | | | 4.1 | % | | | 41 | | | | 22,149 | |

VIII (3) | | | 8.4 | % | | | 1,861,562 | | | | 339,516 | | | | 9.8 | % | | | 97 | | | | 19,191 | |

IX (3) | | | 2.4 | % | | | 869,535 | | | | 139,811 | | | | 4.0 | % | | | 55 | | | | 15,810 | |

X (3) | | | 4.3 | % | | | 1,073,135 | | | | 231,101 | | | | 6.7 | % | | | 54 | | | | 19,873 | |

| XI | | | 0.5 | % | | | 91,492 | | | | 22,079 | | | | 0.6 | % | | | 5 | | | | 18,298 | |

| XII | | | 2.0 | % | | | 150,826 | | | | 52,435 | | | | 1.5 | % | | | 15 | | | | 10,055 | |

Santiago, M.R. (3) | | | 47.8 | % | | | 6,061,185 | | | | 1,602,714 | | | | 46.2 | % | | | 206 | | | | 29,423 | |

| Total / Average | | | 100.0 | % | | | 15,116,435 | | | | 3,471,144 | | | | 100.0 | % | | | 682 | | | | 22,165 | |

__________________

| (1) | For the year ended December 31, 1998, the last year for which data is available. |

| (2) | Population estimated at April 2002. |

| (3) | Regions where we operate. |

| (4) | Millions of Chilean pesos at December 31, 2004. |

Major Industry Participants

General. Based on estimates that the INE supplied, as of December 31, 2006, 731 supermarkets operated in Chile, and the industry’s gross sales totaled U.S.$7,844 million, or 5.5% of the Chilean GDP.

The supermarket industry is very concentrated. As of December 31 2006, only two supermarket chains accounted for 63.1% of the sales by all industry participants in Chile, as follows: (1) D&S accounted for 33.3% of the sales; (2) Cencosud accounted for 29.8% of the sales; (3) Supermercados San Francisco S.A. accounted for 4.1% of the sales; and (4) Unimarc accounted for 2.5% of the sales. D&S operates a total of 103 supermarkets with an average selling space of 4,514 square meters. The second largest participant in the supermarket industry, Cencosud, owns Jumbo, Santa Isabel, Montecarlo, Supermercados Tops and Supermercados Las Brisas S.A. During 2006, Cencosud accounted for 29.8% of the sales in the supermarket industry. Jumbo operates twenty one hypermarkets with an average selling space of approximately 7,902 square meters, ten of which are located in the metropolitan region and seven of which are located in the Rancagua, Temuco, Copiapo, Chillan, Puerto Montt and Vina del Mar regions.

As of December 2006, we were the fourth largest chain in the supermarket industry in Chile, with Ch$104.436 million, or 2.5%, of all supermarket sales during the year. We operate 41 supermarkets with an average space of 1,498 square meters. During 2006, our sales represented 2.5% of all sales by Chilean industry participants. Our stores are located in several regions of Chile, including (1) the metropolitan region, (2) region V, in Vina del Mar and Quintero, (3) region VI, in Rancagua and Pichilemu, (4) region VII, in Curico, (5) region VIII, in Talcahuano, Concepcion and Chillan, (6) region IX, in Temuco, Villarrica, Pitrufquen and Loncoche, and (7) Region X, in Panguipulli.

Metropolitan Region. At December 31, 2006, there were 27 supermarkets in the metropolitan region, distributed throughout all the cities in this region. D&S, Cencosud and Unimarc accounted for 87% of all sales by industry participants in the region, with 137 supermarkets. D&S accounted for 45% of all sales by industry participants in the metropolitan region, and operated 52 supermarkets with an average space of 4,981 square meters. Cencosud accounted 38% of all sales by industry participants, and

operated 58 supermarkets with an average space of 3,018 square meters. Unimarc accounted for 4% of all sales by industry participants and operated 27 supermarkets with an average space of 1,480 square meters.

According to market information available from the INE, in 2006 sales in the Chilean supermarket industry increased by 8.9%, in real terms, as compared to 2005, showing a higher growth than that experienced by the overall Chilean economy, which grew by 4.2%, as reported by the Central Bank in its preliminary figures.

Our Operations

As of December 31, 2006, we operated 41 supermarkets in Chile, 7 of which entities we own, 17 of which we lease from Inverraz subsidiaries, and 17 of which we lease from third parties. Of the 41 supermarkets we operate in Chile, 27 are located in the metropolitan region, which has the highest population density and income of any region in Chile. We hold a market share of 4% in this region. See “—Property, Plant and Equipment”.

A substantial number of our stores are located in first class locations for retail sales, where the development of new supermarkets is not feasible due to the population density, and zoning and environmental restrictions. We believe that our presence in the metropolitan region provides us with an advantage in both competitive and strategic terms. We have established distribution and operation activities linked to a computer network in the metropolitan region. This network also enables us to communicate with our networks outside the metropolitan region in order to control distribution and costs.

Our total sales space is 61,406 square meters. The size of our supermarket ranges from 277 square meters to 7,680 square meters. Our largest supermarket has 7,680 square meters of selling space and stocks approximately 15,000 different SKUs, whereas supermarkets with 1,000 to 2,000 square meters of selling space stock approximately 12.500 SKUs and supermarkets with less than 1,000 square meters of selling space operate approximately 8,000 SKUs. We sell a wide range of food items, including fresh products, baked goods, fresh seafood, fresh meats and poultry, cold cuts, dairy and frozen products, beverages, prepared foods and other edible goods. Our supermarkets also offer a wide variety of specialty services including full service bakeries, prepared food departments, meat and seafood departments, health and beauty aides and photograph development centers. Various concessionaires also operate seafood departments, pharmacies, video centers, bank teller machines and other services in our supermarkets.

The table below shows our net sales and sales per square meter for each of our supermarkets for the year ended December 31, 2006:

| | | | | | | | | | | | Annual Sales per Square Meter (1) | | | Monthly sales per Square Meter (2) | |

| | | | | | | (Ch$ millions) | | | | | | (Ch$ thousands) | | | (U.S.$) | |

Santiago, metropolitan region | | | | | | | | | | | | | | | | |

| Vitacura | | Unimarc | | Vitacura | | | 3,127 | | | | 1,474 | | | | 2,122 | | | | 332 | |

| La Florida | | Unimarc | | La Florida | | | 3,596 | | | | 7,680 | | | | 468 | | | | 73 | |

| Irarrazabal | | Unimarc | | Ñuñoa | | | 2,348 | | | | 1,017 | | | | 2,308 | | | | 361 | |

| A. Vespucio | | Unimarc | | Las Condes | | | 4,750 | | | | 952 | | | | 4,989 | | | | 781 | |

| Manquehue | | Unimarc | | Las Condes | | | 2,466 | | | | 886 | | | | 2,783 | | | | 436 | |

| Gran Avenida | | Unimarc | | San Miguel | | | 2,967 | | | | 1,280 | | | | 2,318 | | | | 363 | |

| Providencia | | Unimarc | | Providencia | | | 7,687 | | | | 1,874 | | | | 4,102 | | | | 642 | |

| D. Portales | | Unimarc | | Santiago | | | 3,177 | | | | 1,027 | | | | 3,093 | | | | 484 | |

| Santa María | | Unimarc | | Vitacura | | | 3,808 | | | | 1,180 | | | | 3,227 | | | | 505 | |

| La Reina | | Unimarc | | La Reina | | | 4,265 | | | | 1,358 | | | | 3,141 | | | | 492 | |

| Maipu I | | Unimarc | | Maipu | | | 2,967 | | | | 1,750 | | | | 1,695 | | | | 265 | |

| Los Leones | | Unimarc | | Ñuñoa | | | 4,444 | | | | 2,734 | | | | 1,625 | | | | 254 | |

| Maipu II | | Unimarc | | Maipu | | | 4,762 | | | | 2,677 | | | | 1,779 | | | | 278 | |

| Santa Rosa | | Unimarc | | La Granja | | | 1,011 | | | | 536 | | | | 1,887 | | | | 295 | |

| J. A. Rios | | Unimarc | | Independencia | | | 1,795 | | | | 460 | | | | 3,902 | | | | 611 | |

| Cordillera | | Unimarc | | La Florida | | | 3,168 | | | | 3,719 | | | | 852 | | | | 133 | |

| Tranqueras | | Unimarc | | Vitacura | | | 4,214 | | | | 2,998 | | | | 1,406 | | | | 220 | |

| M. Montt | | Unimarc | | Providencia | | | 3,311 | | | | 916 | | | | 3,615 | | | | 566 | |

| Grecia | | Unimarc | | Ñuñoa | | | 1,617 | | | | 1,143 | | | | 1,415 | | | | 221 | |