UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2011

Commission File No. 0-30148

PNI DIGITAL MEDIA INC.

(Translation of registrant's name into English)

590 - 425 Carrall Street, Vancouver, British Columbia V6B 6E3 Canada

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PNI DIGITAL MEDIA INC.

Date: May 26, 2011

| /s/ Simon Bodymore | |

| | |

| Simon Bodymore | |

| Chief Financial Officer | |

PNI Digital Media Inc.

Unaudited Interim Consolidated Financial Statements

For the three and six month periods ended March 31, 2011

NOTICE OF NO AUDITOR REVIEW OF INTERIM FINANCIAL STATEMENTS

The accompanying unaudited interim financial statements of PNI Digital Media Inc. (the “Company”) have been prepared by and are the responsibility of the Company’s management. The Company’s independent auditor has not performed a review of these financial statements in accordance with the standards established by the Canadian Institute of Chartered Accountants for a review of interim financial statements by an entity’s auditor.

| PNI Digital Media Inc. |

| Consolidated Balance Sheets |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| | | March 31, 2011 | | | September 30, 2010 | |

| | | | | | | |

| Assets | | | | | | |

| | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 4,745,436 | | | $ | 4,690,355 | |

| Accounts receivable (note 5) | | | 3,782,818 | | | | 5,302,865 | |

| Prepaid expenses and other current assets | | | 590,213 | | | | 541,026 | |

| Current portion of future income tax asset | | | 1,082,060 | | | | 1,026,651 | |

| | | | | | | | | |

| | | | 10,200,527 | | | | 11,560,897 | |

| | | | | | | | | |

| Property and equipment | | | 5,617,962 | | | | 5,230,829 | |

| Future income tax asset | | | 4,531,907 | | | | 4,953,934 | |

| Intangible assets | | | 691,821 | | | | 1,115,794 | |

| Goodwill | | | 634,603 | | | | 658,904 | |

| | | | | | | | | |

| | | $ | 21,667,946 | | | $ | 23,520,358 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 3,667,556 | | | $ | 5,471,878 | |

| Current portion of deferred revenue | | | 423,910 | | | | 613,081 | |

| Current portion of capital lease obligations | | | - | | | | 107,964 | |

| Future income tax liability | | | 109,772 | | | | 119,081 | |

| | | | | | | | | |

| | | | 4,201,238 | | | | 6,312,004 | |

| | | | | | | | | |

| Deferred revenue | | | 55,713 | | | | 78,876 | |

| | | | 4,256,951 | | | | 6,390,880 | |

| | | | | | | | | |

| Shareholders’ Equity (note 6) | | | | | | | | |

| | | | | | | | | |

| Share capital | | $ | 66,633,431 | | | $ | 66,200,215 | |

| Contributed surplus | | | 18,944,573 | | | | 18,933,619 | |

| | | | 85,578,004 | | | | 85,133,834 | |

| | | | | | | | | |

| Deficit | | | (65,453,778 | ) | | | (65,684,820 | ) |

| | | | | | | | | |

| Accumulated other comprehensive loss | | | (2,713,231 | ) | | | (2,319,536 | ) |

| | | | (68,167,009 | ) | | | (68,004,356 | ) |

| | | | 17,410,995 | | | | 17,129,478 | |

| | | $ | 21,667,946 | | | $ | 23,520,358 | |

| Approved by the Board of Directors | | |

| | | | |

| “Kyle Hall” | Director | “Peter Fitzgerald” | Director |

The accompanying notes are an integral part of these consolidated financial statements

PNI Digital Media Inc. |

| Consolidated Statements of (Loss) Earnings and Comprehensive (Loss) Gain |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Revenue (note 8) | | $ | 5,031,263 | | | $ | 5,261,722 | | | $ | 12,765,068 | | | $ | 13,017,935 | |

| | | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | | |

| Network delivery | | | 992,498 | | | | 1,238,269 | | | | 2,482,453 | | | | 3,185,953 | |

| Software development | | | 2,879,128 | | | | 1,922,796 | | | | 5,607,417 | | | | 3,847,388 | |

| General and administration | | | 1,056,037 | | | | 1,009,289 | | | | 2,079,828 | | | | 2,090,047 | |

| Sales and marketing | | | 257,919 | | | | 215,027 | | | | 561,029 | | | | 455,530 | |

| Amortization | | | 692,853 | | | | 1,322,910 | | | | 1,382,232 | | | | 2,695,726 | |

| | | | | | | | | | | | | | | | | |

| | | | 5,878,435 | | | | 5,708,291 | | | | 12,112,959 | | | | 12,274,644 | |

| | | | | | | | | | | | | | | | | |

| (Loss) earnings from operations before the undernoted | | | (847,172 | ) | | | (446,569 | ) | | | 652,109 | | | | 743,291 | |

| | | | | | | | | | | | | | | | | |

| Realized foreign exchange (loss) | | | (57,549 | ) | | | (40,434 | ) | | | (82,998 | ) | | | (60,575 | ) |

| Unrealized foreign exchange (loss) gain | | | (104,980 | ) | | | 458,835 | | | | 90,908 | | | | 626,808 | |

| | | | | | | | | | | | | | | | | |

| Interest income | | | - | | | | 253 | | | | 48 | | | | 679 | |

| | | | | | | | | | | | | | | | | |

| Interest expense – capital lease | | | - | | | | (21,915 | ) | | | (5,536 | ) | | | (49,238 | ) |

| | | | | | | | | | | | | | | | | |

| Interest expense - other | | | (15 | ) | | | - | | | | (15 | ) | | | (1,560 | ) |

| | | | | | | | | | | | | | | | | |

| Loss on disposal of property and equipment | | | (71,241 | ) | | | - | | | | (90,713 | ) | | | - | |

| Loss on settlement of asset retirement obligation | | | - | | | | (4,810 | ) | | | - | | | | (4,810 | ) |

| | | | | | | | | | | | | | | | | |

| | | | (233,785 | ) | | | 391,929 | | | | (88,306 | ) | | | 511,304 | |

| | | | | | | | | | | | | | | | | |

| (Loss) earnings before income taxes | | | (1,080,957 | ) | | | (54,640 | ) | | | 563,803 | | | | 1,254,595 | |

| | | | | | | | | | | | | | | | | |

| Current income tax benefit (expense) | | | - | | | | - | | | | - | | | | - | |

| Future income tax benefit (expense) | | | 228,478 | | | | (36,246 | ) | | | (332,761 | ) | | | (101,158 | ) |

| | | | | | | | | | | | | | | | | |

| Net (loss) earnings | | | (852,479 | ) | | | (90,886 | ) | | | 231,042 | | | | 1,153,437 | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive gain (loss): | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Unrealized foreign exchange gain (loss) on translation of self sustaining foreign operations | | | 62,942 | | | | (659,784 | ) | | | (393,695 | ) | | | (971,840 | ) |

| | | | | | | | | | | | | | | | | |

| Comprehensive (loss) gain | | $ | (789,537 | ) | | $ | (750,670 | ) | | $ | (162,653 | ) | | $ | 181,597 | |

| | | | | | | | | | | | | | | | | |

| (Loss) earnings per share (note 6) | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.03 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

| Fully diluted | | $ | (0.03 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

The accompanying notes are an integral part of these consolidated financial statements

| PNI Digital Media Inc. |

| Consolidated Statements of Deficit |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Balance, beginning of period | | $ | (64,601,299 | ) | | $ | (71,292,491 | ) | | $ | (65,684,820 | ) | | $ | (72,536,814 | ) |

| | | | | | | | | | | | | | | | | |

| Net (loss) earnings for the period | | | (852,479 | ) | | | (90,886 | ) | | | 231,042 | | | | 1,153,437 | |

| | | | | | | | | | | | | | | | | |

| Balance, end of the period | | $ | (65,453,778 | ) | | $ | (71,383,377 | ) | | $ | (65,453,778 | ) | | $ | (71,383,377 | ) |

The accompanying notes are an integral part of these consolidated financial statements

| PNI Digital Media Inc. |

| Consolidated Statements of Cash Flows |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Cash flows from operating activities | | | | | | | | | | | | |

| Net (loss) earnings for the period | | $ | (852,479 | ) | | $ | (90,886 | ) | | $ | 231,042 | | | $ | 1,153,437 | |

| Items not affecting cash | | | | | | | | | | | | | | | | |

| Amortization | | | 692,853 | | | | 1,322,910 | | | | 1,382,232 | | | | 2,695,726 | |

| Stock-based compensation expense | | | 160,303 | | | | 181,872 | | | | 359,400 | | | | 366,949 | |

| Unrealized foreign exchange loss (gain) | | | 104,980 | | | | (458,835 | ) | | | (90,908 | ) | | | (626,808 | ) |

| Allowance for doubtful accounts | | | - | | | | 16,656 | | | | 9,086 | | | | 28,516 | |

| Loss on disposal of property and equipment | | | 71,241 | | | | - | | | | 90,713 | | | | - | |

| Future income tax (benefit) expense | | | (228,478 | ) | | | 36,246 | | | | 332,761 | | | | 101,158 | |

| Loss on settlement of asset retirement obligation | | | - | | | | 4,810 | | | | - | | | | 4,810 | |

| Accretion expense included in general and administration expense | | | - | | | | 36,357 | | | | - | | | | 79,426 | |

| | | | (51,580 | ) | | | 1,049,130 | | | | 2,314,326 | | | | 3,803,214 | |

| Net change in non-cash working capital Items (note 12) | | | 1,370,849 | | | | (4,189,387 | ) | | | (1,128,367 | ) | | | (2,603,655 | ) |

| | | | | | | | | | | | | | | | | |

| Provision for unrecoverable lease payments | | | - | | | | (144,707 | ) | | | - | | | | (180,336 | ) |

| Payments made to settle asset retirement obligations | | | - | | | | (13,978 | ) | | | - | | | | (45,071 | ) |

| | | | 1,319,269 | | | | (3,298,942 | ) | | | 1,185,959 | | | | 974,152 | |

| | | | | | | | | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | | | | | | | | |

| Purchase of property and equipment | | | (479,393 | ) | | | (77,558 | ) | | | (857,417 | ) | | | (301,660 | ) |

| Proceeds on disposal of property and equipment | | | 1,650 | | | | | | | | 2,459 | | | | - | |

| | | | (477,743 | ) | | | (77,558 | ) | | | (854,958 | ) | | | (301,660 | ) |

| | | | | | | | | | | | | | | | | |

| Cash flows from financing activities | | | | | | | | | | | | | | | | |

| Proceeds on exercise of options | | | 364,720 | | | | - | | | | 364,720 | | | | - | |

| Repurchase of common shares | | | (139,589 | ) | | | - | | | | (279,950 | ) | | | - | |

| Repayment of loan payable | | | - | | | | - | | | | - | | | | (937,548 | ) |

| Repayment of capital lease obligations | | | - | | | | (100,602 | ) | | | (107,964 | ) | | | (195,799 | ) |

| Repayment of loan used to finance the acquisition of WorksMedia Limited | | | - | | | | (463,795 | ) | | | - | | | | (936,343 | ) |

| | | | 225,131 | | | | (100,602 | ) | | | (23,194 | ) | | | (2,069,690 | ) |

| | | | | | | | | | | | | | | | | |

| Effect of changes in foreign exchange rates on cash and cash equivalents | | | (58,785 | ) | | | (20,178 | ) | | | (252,726 | ) | | | (252,550 | ) |

| Increase (decrease) in cash and cash equivalents during the period | | | 1,007,872 | | | | (3,961,075 | ) | | | 55,081 | | | | (1,649,748 | ) |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents - beginning of period | | | 3,737,564 | | | | 6,548,611 | | | | 4,690,355 | | | | 4,237,284 | |

| | | | | | | | | | | | | | | | | |

| Cash and cash equivalents - end of period | | $ | 4,745,436 | | | $ | 2,587,536 | | | $ | 4,745,436 | | | $ | 2,587,536 | |

The accompanying notes are an integral part of these consolidated financial statements

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

On June 4, 2009, the Company changed its name from PhotoChannel Networks Inc. to PNI Digital Media Inc.

PNI Digital Media Inc. (the “Company”) offers the photofinishing retailer and its customers an online and in-store solution for producing prints and gifting products from their digital images. The Company’s online platform electronically connects the photofinishing retailer and its customers through the internet and provides digital image delivery, hosting, transaction processing and storage. In addition, the Company provides the photofinishing retailer with kiosk software which allows consumers to offload digital images from their digital media and order prints and gifting products within the retailer’s locations. The kiosk software is also connected to the Company’s online platform permitting customers in-store to order gifting products from the kiosk, which are then transmitted from the kiosk to a remote fulfillment facility via the online platform.

| 2. | Summary of significant accounting policies |

General

These unaudited interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) in Canada, using the same accounting policies as outlined in Note 2 to the audited consolidated financial statements for the year ended September 30, 2010. These unaudited interim consolidated financial statements do not include all disclosures required for annual financial statements and should be read in conjunction with the audited consolidated financial statements for the year ended September 30, 2010.

In the opinion of management, all adjustments (which include reclassifications and normal recurring adjustments) necessary to present fairly the consolidated financial position, consolidated earnings and comprehensive earnings, and consolidated cash flows as at and for the three months ended March 31, 2011 and for all periods presented, have been made. All amounts herein are expressed in Canadian dollars unless otherwise noted.

Basis of consolidation

These consolidated financial statements are prepared in accordance with generally accepted accounting principles (“GAAP”) in Canada, and include the accounts of the Company and each of its wholly-owned subsidiaries, PhotoChannel Capital Inc., PhotoChannel Management Inc., PNI Digital Media Ltd., PNI Digital Media Europe Ltd., Pixology Incorporated and WorksMedia Limited.

All material intercompany balances and transactions are eliminated upon consolidation.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Reporting currency and foreign currency translation

These consolidated financial statements are reported in Canadian dollars. Foreign currency denominated revenues and expenses are translated using average rates of exchange during the year. Foreign currency denominated assets and liabilities are translated at the rate of exchange in effect at the balance sheet date.

The Company translates the assets and liabilities of self-sustaining foreign operations to Canadian dollars at the rate of exchange prevailing at the balance sheet dates and revenues and expenses of those operations are translated using the average rates of exchange during the year. Gains and losses resulting from these translation adjustments for self-sustaining foreign operations are recorded in accumulated other comprehensive income, a component of shareholders’ equity, until there is a realized reduction in the net investment in the foreign operation.

| 3. | Recently issued accounting standards |

CICA Handbook Sections 1582, Business Combinations; 1601, Consolidated Financial Statements and 1602, Non-Controlling Interests

In January 2008, the CICA issued Handbook Sections 1582, Business Combinations; 1601, Consolidated Financial Statements and 1602, Non-Controlling Interests. These sections replace the former CICA Handbook Section 1581, Business Combinations and CICA 1600, Consolidated Financial Statements and establish a new section for accounting for a non-controlling interest in a subsidiary. These sections also provide the Canadian equivalent to IFRS 3, Business Combinations and IAS 27, Consolidated and Separate Financial Statements.

CICA 1582 is effective for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after January 1, 2011. CICA 1601 and CICA 1602 apply to interim and annual consolidated financial statements relating to years beginning on or after January 1, 2011.

EIC 175, Revenue Arrangements with Multiple Developments

In December 2009, the CICA issued Emerging Issue Committee Abstract (“EIC”) 175, Revenue Arrangement with multiple Deliverables an amendment to EIC 142, “Revenue Arrangements with Multiple Deliverables”. EIC 175 provides guidance on certain aspects of the accounting for arrangements under which the Company will perform multiple revenue-generating activities. Under the new guidance, when vendor specific objective evidence or third party evidence for deliverables in an arrangement cannot be determined, a best estimate of the selling price is required to separate deliverables and allocate arrangement consideration using the relative selling price method. EIC 175 also includes new disclosure requirements on how the application of the relative selling price method affects the timing and amount of revenue recognition. EIC 175 is effective prospectively, with retrospective adoption permitted, for revenue arrangements entered into or materially modified in fiscal years beginning on or after January 1, 2011.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Management is currently in the process of determining the impact of this EIC on the Company’s consolidated financial statements.

| 4. | Seasonality of operations |

Demand for photofinishing products is highly seasonal, with a significant proportion of recurring revenues being generated during the Company’s first fiscal (fourth calendar) quarter, ended December 31. The Company’s rapid growth over the past several years may have overshadowed seasonal or cyclical factors which might have influenced business to date. Due to the seasonal nature of the Company’s business, the results of operations for any interim period are not necessarily indicative of the results of operations to be expected for the fiscal year.

| | | As at March 31, 2011 | | | As at September 30, 2010 | |

| | | | | | | |

| Trade accounts receivable | | $ | 3,800,202 | | | $ | 5,425,805 | |

| Allowance for doubtful accounts | | | (182,766 | ) | | | (176,531 | ) |

| | | | 3,617,436 | | | | 5,249,274 | |

| | | | | | | | | |

| Commodity taxes recoverable | | | 144,562 | | | | 53,591 | |

| Other | | | 20,820 | | | | - | |

| Total | | $ | 3,782,818 | | | $ | 5,302,865 | |

Reconciliation of changes in allowance for doubtful accounts:

| | | As at March 31, 2011 | | | As at September 30, 2010 | |

| | | | | | | |

| Balance, beginning of period | | $ | 176,531 | | | $ | 154,945 | |

| Increase in allowance for doubtful accounts | | | 9,086 | | | | 33,781 | |

| Write-off of bad debts | | | - | | | | (9,945 | ) |

| Impact of foreign currency translation | | | (2,851 | ) | | | (2,250 | ) |

| Balance, end of period | | $ | 182,766 | | | $ | 176,531 | |

During the six month period ended March 31, 2011 the Company incurred bad debt expenses of $9,086 (six month period ending March 31, 2010 - $28,516).

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| 6. | Share capital and stock options |

a) Consolidated statement of shareholders’ equity

| | | Capital stock | | | | | | | | | | | | | |

| | | Number of Common Shares | | | Amount | | | Contributed surplus | | | Deficit | | | Accumulated other comprehensive loss | | | Total Shareholders’ equity | |

| | | | | | | | | | | | | | | | | | | |

| Balance - September 30, 2010 | | | 33,853,782 | | | $ | 66,200,215 | | | $ | 18,933,619 | | | $ | (65,684,820 | ) | | $ | (2,319,536 | ) | | $ | 17,129,478 | |

| Stock-based compensation recorded in net earnings | | | - | | | | - | | | | 103,539 | | | | - | | | | - | | | | 103,539 | |

| Compensation expense in connection with acquisition of WorksMedia Limited | | | - | | | | - | | | | 95,558 | | | | - | | | | - | | | | 95,558 | |

| Cancellation of shares repurchased | | | (115,200 | ) | | | (43,143 | ) | | | 43,143 | | | | - | | | | - | | | | - | |

| Purchase of share capital for cancellation (98,300 shares) | | | - | | | | (161,065 | ) | | | - | | | | - | | | | - | | | | (161,065 | ) |

| Net earnings for the period | | | - | | | | - | | | | - | | | | 1,083,521 | | | | - | | | | 1,083,521 | |

| Other comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | (456,637 | ) | | | (456,637 | ) |

| Balance – December 31, 2010 | | | 33,738,582 | | | $ | 65,996,007 | | | $ | 19,175,859 | | | $ | (64,601,299 | ) | | $ | (2,776,173 | ) | | $ | 17,794,394 | |

| Issuance of shares on exercise of options | | | 291,776 | | | | 498,937 | | | | (134,217 | ) | | | - | | | | - | | | | 364,720 | |

| Stock-based compensation recorded in net profit | | | - | | | | - | | | | 92,455 | | | | - | | | | - | | | | 92,455 | |

| Compensation expense in connection with acquisition of WorksMedia Limited | | | - | | | | - | | | | 67,848 | | | | - | | | | - | | | | 67,848 | |

| Issuance of shares held in escrow | | | 178,500 | | | | 290,952 | | | | (290,952 | ) | | | - | | | | - | | | | - | |

| Cancellation of shares repurchased | | | (88,500 | ) | | | (33,580 | ) | | | 33,580 | | | | - | | | | - | | | | - | |

| Purchase of share capital for cancellation (75,400 shares) | | | - | | | | (118,885 | ) | | | - | | | | - | | | | - | | | | (118,885 | ) |

| Net loss for the period | | | - | | | | - | | | | - | | | | (852,479 | ) | | | - | | | | (852,479 | ) |

| Other comprehensive gain | | | - | | | | - | | | | - | | | | - | | | | 62,942 | | | | 62,942 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance - March 31, 2011 | | | 34,120,358 | | | $ | 66,633,431 | | | $ | 18,944,573 | | | $ | (65,453,778 | ) | | $ | (2,713,231 | ) | | $ | 17,410,995 | |

| | The Company has a stock option plan (the “Plan”) which is described in note 12(d) to the most recent audited consolidated financial statements for the year ended September 30, 2010. The Plan grants to directors, employees and consultants of the Company the option to purchase common shares of the Company. The Plan allows for a maximum of 10% of the Company’s issued and outstanding common shares be reserved for issuance, less any previously granted and outstanding options. The exercise price of each option is determined by the market price of the Company’s stock on the date of the grant and an options’ maximum term is five years. Options vest over eighteen (18) months. |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

During the six month period ended March 31, 2011, the Company granted 500,000 options to officers and directors (period ended March 31, 2010: nil). The weighted average fair value of each option issued was estimated at the grant date using the Black-Scholes option-pricing model using the following assumptions:

| Description | | Six Months Ended March 31, 2011 | |

| | | | |

| Exercise price | | $ | 1.55 | |

| Market price on date of grant | | | 1.55 | |

| Expected volatility | | | 60 | % |

| Risk-free interest rate | | | 1.79 | % |

| Expected life (years) | | | 4.5 | |

| Expected dividend yield | | | 0 | % |

| Weighted average grant-date fair value ($ per share) | | $ | 0.77 | |

| | The Company recorded $132,156 in compensation expense associated with stock options. |

| c) | Performance Share Unit Awards |

A Performance Share Unit (“PSU”) is a right granted to an executive level employee to receive one common share of the Company. The PSU’s will be earned only if performance goals over the performance periods established by or under the direction of the Compensation Committee are met. PSU’s vest over three years in equal annual instalments on each anniversary of the date of grant and will be delivered in common stock at the end of each vesting period, based on the recipient’s actual performance compared to the target performance and may equal from zero percent (0%) to one hundred percent (100%) of the target award. The fair value of each PSU awarded is based upon the quoted price of the Company’s stock on the date of grant. The Company recognizes the expense based on an estimate at the end of each reporting period of the degree to which the performance goals are being met and adjusts the estimate at the conclusion of the performance period. The expense is amortized on a straight-line basis over the vesting period.

During the six months ended March 31, 2010, the Company granted 100,000 target PSU’s at a fair value of $1.55 per share. The Company recognized compensation expense of $11,238 during the six months ended March 31, 2011 (period ended March 31, 2010: nil).

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| d) | Restricted Share Unit Awards |

A Restricted Share Unit (“RSU”) is a right granted to a non-executive director or key employee to receive one common share of the Company on a time vested basis. The fair value of the restricted share awards is determined based upon the number of shares granted and the quoted price of the Company’s stock on the date of grant. Restricted shares vest over three years in equal annual instalments on each anniversary of the date of grant and will be delivered in common stock at the end of each vesting period. The Company recognizes the expense on a straight-line basis over the vesting period.

During the six month period ended March 31, 2011, 206,600 RSU’s were awarded at a fair value of $1.55 per share; consisting of 146,600 awarded to key employees and 60,000 awarded to non-executive directors of the Company. The Company recognized compensation expense of $52,600 during the six months ended March 31, 2011 (period ended March 31, 2010: nil).

In connection with the acquisition of WorksMedia Limited, which was completed in March 2009, 750,000 common shares of the Company were issued. 214,500 of these common shares have been included as part of the purchase consideration, while the remaining 535,500 common shares are only being released from escrow upon the continued employment of the Principle Vendors over a three year period.

On March 10, 2011, the Company released 250,000 common shares consisting of 71,500 common shares included as part of the purchase consideration while the remaining 178,500 common shares released related to the continued employment of the Principle Vendors. As at March 31, 2011, 178,500 common shares remain in escrow and have been excluded from the number of common shares shown as outstanding and will only be recognized as they are released from escrow.

| f) | Normal course issuer bid |

On April 15, 2010, the Company received approval from the TSX Venture Exchange (“TSX-V”) for a Normal Course Issuer Bid (the “Bid”) that enables the Company to purchase and cancel up to 340,000, or approximately 1%, of its outstanding common shares between May 1, 2010 and April 30, 2011. During the three month period ended December 31, 2010 the Company received approval from the TSX-V to revise the authorized purchase amount from 340,000 shares to approximately 1.7 million shares, or 5% of the outstanding common shares of the Company.

As at September 30, 2010, the Company held 30,000 shares that had been purchased for cancellation. During the six month period ended March 31, 2011, the Company purchased a further 173,700 shares under the Bid for a total purchase price of $279,950. As at March 31, 2011, all 203,700 of these shares have been cancelled.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

On cancellation of these 203,700 shares, $76,723, representing the difference between the purchase price and the average book value of the common shares was recorded as an adjustment to contributed surplus.

Since inception of the Bid, the Company has purchased 273,700 shares for a purchase price of $430,553.

The following is a reconciliation of the numerator and the denominators used for the computation of basic and diluted earnings per share amounts:

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Net (loss) earnings for the period (numerator) | | $ | (852,479 | ) | | $ | (90,866 | ) | | $ | 231,042 | | | $ | 1,153,437 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding (denominator) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Basic | | | 33,788,064 | | | | 33,749,332 | | | | 33,782,850 | | | | 33,728,278 | |

| | | | | | | | | | | | | | | | | |

| Effect of dilutive securities: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Stock options | | | - | | | | - | | | | 85,181 | | | | 133,516 | |

| RSU’s | | | - | | | | - | | | | 18,765 | | | | | |

| PSU’s | | | - | | | | - | | | | 7,535 | | | | | |

| | | | | | | | | | | | | | | | | |

| Total | | | 33,788,064 | | | | 33,749,332 | | | | 33,894,331 | | | | 33,861,794 | |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

The Company has two operating segments that have similar economic characteristics which are aggregated into a single reportable segment based on the manner in which the Company has organized its operations and provision of financial information to senior management.

The Company’s sales by geographical area are as follows:

| | | Three Months Ended | | | Six Months Ended | |

| Description | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Canada | | $ | 1,056,419 | | | $ | 1,086,378 | | | $ | 2,572,043 | | | $ | 2,693,919 | |

| United States | | | 2,797,333 | | | | 2,728,829 | | | | 7,620,472 | | | | 7,117,126 | |

| United Kingdom | | | 1,121,598 | | | | 1,355,921 | | | | 2,446,901 | | | | 2,994,009 | |

| Other | | | 55,913 | | | | 90,594 | | | | 125,652 | | | | 212,881 | |

| Total | | $ | 5,031,263 | | | $ | 5,261,722 | | | $ | 12,765,068 | | | $ | 13,017,935 | |

Revenue is attributed to the geographic location of the Company’s customer.

As at March 31, 2011 and September 30, 2010, the Company’s assets by geographical location are as follows:

| | | Canada | | | United Kingdom | | | Total | |

| March 31, 2011 | | | | | | | | | |

| Property and equipment | | $ | 5,613,002 | | | $ | 4,960 | | | $ | 5,617,962 | |

| Goodwill and intangible assets | | $ | 77,382 | | | $ | 1,249,042 | | | $ | 1,326,424 | |

| | | | | | | | | | | | | |

| September 30, 2010 | | | | | | | | | | | | |

| Property and equipment | | $ | 5,216,602 | | | $ | 14,227 | | | $ | 5,230,829 | |

| Goodwill and intangible assets | | $ | 77,382 | | | $ | 1,697,316 | | | $ | 1,774,698 | |

Major customers representing 10% or more of the Company’s sales for the period are as follows:

| | | Three Months Ended | | | Six Months Ended | |

| Description | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Customer A | | $ | 1,173,562 | | | $ | 1,292,861 | | | $ | 3,331,109 | | | $ | 3,725,437 | |

| Customer B | | $ | 663,330 | | | $ | 592,572 | | | $ | 1,789,416 | | | $ | 1,529,285 | |

| Customer C | | $ | 544,478 | | | $ | 638,888 | | | $ | 1,160,004 | | | $ | 1,356,079 | |

| Customer D | | $ | 1,884,424 | | | $ | 1,911,408 | | | $ | 4,900,674 | | | $ | 4,719,502 | |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| | | Three Months Ended | | | Six Months Ended | |

| Description | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

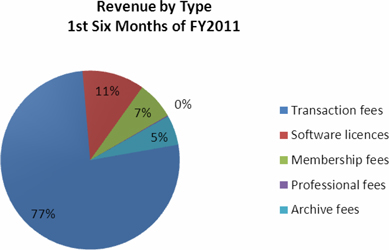

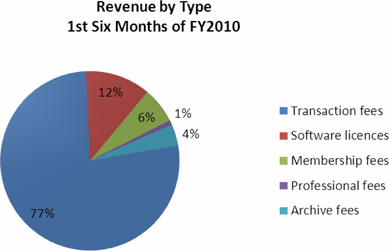

| Transaction fees | | $ | 3,454,606 | | | $ | 3,727,516 | | | $ | 9,754,267 | | | $ | 10,033,737 | |

| Software licenses and installation fees | | | 777,775 | | | | 756,983 | | | | 1,434,236 | | | | 1,532,348 | |

| Membership fees | | | 416,846 | | | | 445,777 | | | | 865,662 | | | | 842,179 | |

| Professional fees | | | 7,477 | | | | 62,236 | | | | 21,822 | | | | 109,293 | |

| Archive fees | | | 374,559 | | | | 269,210 | | | | 689,081 | | | | 500,378 | |

| Total | | $ | 5,031,263 | | | $ | 5,261,722 | | | $ | 12,765,068 | | | $ | 13,017,935 | |

Product revenue is presented in note 13(a)

| 9. | Related Party Transactions |

During the three month period ended March 31, 2011, the Company incurred legal fees of $32,004 (period ended March 31, 2010 - $31,382) for services provided by a law firm of which a director of the Company is a partner. Accounts payable and accrued liabilities at March 31, 2011 included $24,323 (September 30, 2010 $4,968) related to these services.

During the three month period ended March 31, 2011, the Company incurred consulting fees of $14,900 (period ended March 31, 2010 - $nil) for services provided by a company of which a Director and Officer of the Company controls. Accounts payable and accrued liabilities at March 31, 2011 included $nil (September 30, 2010 - $4,993) related to these services.

During the three month period ended March 31, 2011, the Company incurred expenses in relation to setting up e-mail marketing campaigns on behalf of a number of our retail customers of $nil (period ending March 31, 2010 - $11,316) and website services of $1,500 (period ended March 31, 2010 - $1,275) of which a director of the Company is Chairman and Chief Executive Officer. Accounts payable and accrued liabilities at March 31, 2011 included $500 (September 30, 2010 - $7,128) related to these services. The amounts charged were recorded at their exchange amount, which is the amount of consideration established and agreed to by the related parties and having normal trade terms.

The Company shares its UK premises with another company of which an Officer is a majority shareholder. During the three month period ended March 31, 2011, the Company was recharged its proportional share of office running costs totalling $54,132 (period ended March 31, 2010: $50,619) by this related party. In addition, during the three month period ended March 31, 2011, the Company used the software development services of this company, incurring costs of $17,064 (period ended March 31, 2010: $39,087). At March 31, 2011, accounts payable included $28,294 (September 30, 2010: $25,118) related to these services and cost recharges.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

At March 31, 2011, the Company was committed to purchase items of equipment with a cost of $39,073 (September 30, 2010 - $34,802).

The contractual obligations and payments due as at March 31, 2011 are as follows:

| | | Payments due by period | |

| | | Total | | | Less than 1 year | | | 1-3 years | | | 3-5 years | |

| Property leases | | | 877,939 | | | | 263,382 | | | | 526,763 | | | | 87,794 | |

| Other service agreements | | | 7,870,550 | | | | 1,615,560 | | | | 3,363,460 | | | | 2,891,530 | |

| Purchase obligations | | | 39,073 | | | | 39,073 | | | | - | | | | - | |

| | | | 8,787,562 | | | | 1,918,015 | | | | 3,890,223 | | | | 2,979,324 | |

During the year ended September 30, 2010, the Company received notice from a former customer that a possible patent infringement had been brought to their attention regarding software which in previous years had been sold by one of our subsidiaries and which is unrelated to the PNI Platform and to the Company’s kiosk software. During the quarter ended December 31, 2010, the Company received notice from its former customer that a settlement had been reached between it and the entity that had been making the claims of patent infringement. As a result, the Company’s former customer requested that the Company pay a portion of the settlement amount under an indemnification clause included in the contract that was in place during the previous relationship. After considering all of the available facts, including the expected legal costs of disputing the matter, the Company agreed to pay a contribution of the settlement charge, up to a maximum amount of US$100,000. Subsequent to the March 31, 2011, the Company continues to negotiate the final allocation of the settlement charge with the former customer and expects to conclude its discussions prior to the end of the three month period ended June 30, 2011. Included in the consolidated financial statements for the six month period ended March 31, 2011 is an accrual of US$80,000 representing the Company’s best estimate of the amount that it will be required to pay out.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

During the three month period ended December 31, 2010, the Company received notice from a customer that a claim had been brought against them from a United States based entity (the “entity”), alleging that certain services offered by the Company’s customer infringed on a patent licenced by the entity. A portion of the services that are alleged to be in breach of this patent are provided by the Company. The Company’s customer had previously requested that the Company indemnify them from any damages resulting from this claim. Subsequent to the period end, the claim made against the Company’s customer was dismissed in full without prejudice. No payments were required to be made by the Company as a result of this dismissal and no adjustment has been made in these financial statements.

In March 2010, the Company entered into a Credit Agreement with its bank (the “Bank”) which provides the Company with two separate credit facilities, being a $1,500,000 revolving demand facility (“Revolving Demand Facility) and a $750,000 reducing facility by way of Leases (“Lease Facility”). The two credit facilities and all other obligations of the Company to the Bank are secured by way of a General Security Agreement between the Bank and the Company, constituting a first ranking security interest in all personal property of the Company.

The Revolving Demand Facility bears interest at a rate of Bank prime + 1.50% and contains a financial covenant requiring us not to exceed a borrowing limit of 67% of good Canadian and US Accounts receivable less potential prior-ranking claims which include items such as sales and excise taxes, payroll liabilities, and overdue rent, property and business taxes. The Company has not drawn any amount with respect to the Revolving Demand Facility.

The Lease Facility will be subject to separate agreements between the Bank and the Company, and as at March 31, 2011 no amount has been drawn on this facility.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| 12. | Supplementary cash flow information |

Net change in non-cash working capital items

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Accounts receivable | | $ | 2,355,351 | | | $ | 786,718 | | | $ | 1,447,894 | | | $ | 369,690 | |

| | | | | | | | | | | | | | | | | |

| Prepaid expenses and other current assets | | | (40,611 | ) | | | 42,133 | | | | (51,723 | ) | | | 43,501 | |

| | | | | | | | | | | | | | | | | |

| Accounts payable and accrued liabilities | | | (764,333 | ) | | | (5,103,333 | ) | | | (2,330,537 | ) | | | (3,125,799 | ) |

| | | | | | | | | | | | | | | | | |

| Changes in deferred revenue | | | (179,558 | ) | | | 85,095 | | | | (194,001 | ) | | | 108,953 | |

| Total | | $ | 1,370,849 | | | $ | (4,189,387 | ) | | $ | (1,128,367 | ) | | $ | (2,603,655 | ) |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

| 13. | Reconciliation to accounting principles generally accepted in the United States of America |

The financial statements have been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”), which differ in certain material respects from those principles and practices that the Company would have followed had its financial statements been prepared in accordance with accounting principles and practices generally accepted in the United States (“US GAAP”).

| | a) | Statements of loss and comprehensive loss |

Net profit from operations, separately identifying revenue earned from the sale of tangible products and the sale of services, together with the respective costs associated with those sales is as follows:

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | |

| Service revenue | | $ | 4,934,588 | | | $ | 4,474,186 | | | $ | 12,360,388 | | | $ | 11,184,430 | |

| Product revenue | | | 96,675 | | | | 787,536 | | | | 404,680 | | | | 1,833,505 | |

| | | | 5,031,263 | | | | 5,261,722 | | | | 12,765,068 | | | | 13,017,935 | |

| | | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | | |

| Network delivery – service revenue | | | 901,823 | | | | 937,049 | | | | 2,106,796 | | | | 2,122,797 | |

| Network delivery – product revenue | | | 90,675 | | | | 301,220 | | | | 375,657 | | | | 1,063,156 | |

| Software development | | | 2,879,128 | | | | 1,922,796 | | | | 5,607,417 | | | | 3,847,388 | |

| General and administration | | | 1,056,037 | | | | 1,009,289 | | | | 2,079,828 | | | | 2,090,047 | |

| Sales and marketing | | | 257,919 | | | | 215,027 | | | | 561,029 | | | | 455,530 | |

| Amortization | | | 692,853 | | | | 1,322,910 | | | | 1,382,232 | | | | 2,695,726 | |

| Impairment of property and equipment (d) | | | 71,241 | | | | - | | | | 90,713 | | | | - | |

| | | | 5,949,676 | | | | 5,708,291 | | | | 12,203,672 | | | | 12,274,644 | |

| | | | | | | | | | | | | | | | | |

| Net (loss) earnings from operations | | $ | (918,413 | ) | | $ | (446,569 | ) | | $ | 561,396 | | | $ | 743,291 | |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

The reconciliation between Canadian GAAP and US GAAP of the net (loss) earnings for the period is as follows:

| | | Three Months Ended | | | Six Months Ended | |

| | | March 31, 2011 | | | March 31, 2010 | | | March 31, 2011 | | | March 31, 2010 | |

| | | | | | | | | | | | | |

| Net (loss) earnings for the period under Canadian GAAP | | $ | (852,479 | ) | | $ | (90,886 | ) | | $ | 231,042 | | | $ | 1,153,437 | |

| Deferred tax expense (g) | | | 26,706 | | | | - | | | | 53,412 | | | | - | |

| Net (loss) earnings for the period under US GAAP | | | (825,773 | ) | | | (90,886 | ) | | | 284,454 | | | | 1,153,437 | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive (loss) gain: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Unrealized foreign exchange loss on translation of foreign subsidiaries with different functional currencies | | | 63,363 | | | | (659,784 | ) | | | (393,274 | ) | | | (971,840 | ) |

| Comprehensive (loss) gain under US GAAP | | $ | (762,410 | ) | | $ | (750,670 | ) | | $ | (108,820 | ) | | $ | 181,597 | |

| (Loss) earnings per share under US GAAP | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.02 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

| Fully diluted | | $ | (0.02 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

The reconciliation of the balance sheet between Canadian GAAP and US GAAP is as follows:

| | | March 31, 2011 | | | September 30, 2010 | |

| | | Canadian GAAP | | | U.S. GAAP | | | Canadian GAAP | | | U.S. GAAP | |

| | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | |

| Current assets | | $ | 10,200,527 | | | $ | 10,200,527 | | | $ | 11,560,897 | | | $ | 11,560,897 | |

| Intangible assets | | | 691,821 | | | | 691,821 | | | | 1,115,794 | | | | 1,115,794 | |

| Goodwill (note f, g) | | | 634,603 | | | | 8,094,818 | | | | 658,904 | | | | 8,119,119 | |

| Deferred tax asset (g) | | | 4,523,033 | | | | 4,523,033 | | | | 4,953,934 | | | | 4,953,934 | |

| Other long-term assets | | | 5,617,962 | | | | 5,617,962 | | | | 5,230,829 | | | | 5,230,829 | |

| | | | | | | | | | | | | | | | | |

| Total assets | | $ | 21,667,946 | | | $ | 29,128,161 | | | $ | 23,520,358 | | | $ | 30,980,573 | |

| | | | | | | | | | | | | | | | | |

| Liabilities & Shareholders’ Equity | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Current liabilities | | $ | 4,201,238 | | | $ | 4,201,238 | | | $ | 6,312,004 | | | $ | 6,312,004 | |

| Long-term liabilities | | | 55,713 | | | | 55,713 | | | | 78,876 | | | | 78,876 | |

| | | | | | | | | | | | | | | | | |

| Shareholders’ Equity | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Share capital | | | 66,633,431 | | | | 66,579,470 | | | | 66,200,215 | | | | 66,199,666 | |

Contributed surplus (note c) | | | 18,944,573 | | | | 16,340,748 | | | | 18,933,619 | | | | 16,329,794 | |

| Deficit (note f, g) | | | (65,453,778 | ) | | | (55,335,777 | ) | | | (65,684,820 | ) | | | (55,620,231 | ) |

| Accumulated other comprehensive loss | | | (2,713,231 | ) | | | (2,713,231 | ) | | | (2,319,536 | ) | | | (2,319,536 | ) |

| | | | | | | | | | | | | | | | | |

| | | $ | 21,667,946 | | | $ | 29,128,161 | | | $ | 23,520,358 | | | $ | 30,980,573 | |

| (c) | Stock-based compensation |

Effective October 1, 2004, the Company adopted ASC 718, Compensation – Stock Compensation (formerly Financial Accounting Standard (“FAS”) No. 123, Accounting for Stock-Based Compensation, as subsequently revised by FAS No. 123(R) (“FAS 123(R)”), Share-Based Payment, effective October 1, 2006.) The adoption of this guidance, effective October 1, 2006 under the modified prospective method, had no material impact on the Company’s financial position or results of operations. Under US GAAP, the Company recognizes the grant-date fair value of stock-based compensation awards granted to employees and directors over the requisite service period for all awards granted, modified, repurchased or cancelled after October 1, 2004 and the unvested portions of outstanding awards as at October 1, 2004. The Company also adopted CICA Handbook Section 3870, Stock-Based Compensation and Other Stock-Based Payments effective October 1, 2004 for awards granted on or after October 1, 2002.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

As a result of these new accounting standards in Canada and the United States, there are no material GAAP differences related to the Company’s stock-based compensation awards during the period ended March 31, 2011 and 2010.

At March 31, 2011, the total compensation cost related to non-vested awards not yet recognized is as follows:

| Award type | | March 31, 2011 | | | March 31, 2010 | | Weighted average remaining vesting period |

| | | | | | | | |

| Stock options | | $ | 255,384 | | | $ | 193,555 | | 12 months |

| RSU’s | | | 262,981 | | | | - | | 30 months |

| PSU’s | | | 56,187 | | | | - | | 30 months |

| Total | | $ | 574,552 | | | $ | 193,555 | | |

No amount has been included for forfeitures as the amount is immaterial.

| (d) | Classification of impairment charges |

Losses recognized with respect to impairments of long-lived assets have been classified as having arisen from non-operating results for Canadian reporting purposes. Under US GAAP, these items are included in the determination of the Company’s loss from operations.

The Canadian accounting standard for the preparation of cash flow statements is consistent with the guidance provided by International Accounting Standard (IAS) 7, and accordingly, the cash flow statements presented herein have not been reconciled to US GAAP under the accommodation provided by the SEC.

| (f) | Redemption of Limited Partnership units |

During the year ended September 30, 2004, the Company redeemed limited partnership units and recorded the cost as a charge to deficit for Canadian GAAP purposes. Under US GAAP, the Company applied ASC 805, Business Combinations (formerly SFAS No. 141, “Business Combinations”), and allocated the cost of issuing the common shares and share purchase warrants to goodwill, after first considering any allocation to tangible and intangible assets acquired. This resulted in an increase of $6,511,063 in goodwill and shareholders’ equity. The Company applies ASC 350, Intangibles – Goodwill and Other, in determining if there is any impairment in value. As at March 31, 2011, no impairment in value has been recorded to date.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

The Company follows the liability method with respect to accounting for income taxes. Deferred tax assets and liabilities are determined based on temporary differences between the carrying amounts and the tax basis of assets and liabilities. Deferred income tax assets and liabilities are measured using enacted tax rates that will be in effect when these differences are expected to reverse. Deferred income tax assets are reduced by a valuation allowance, if based on the weight of available evidence; it is more likely than not that some portion or all of the deferred tax assets will not be realized.

In July 2006, the Financial Accounting Standards Board (the “FASB”) issued Financial Interpretation No. 48, Accounting for Uncertainty in Income Taxes, subsequently codified as ASC 740, which clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with Statement of Financial Accounting Standards No. 109, Accounting for Income Taxes. ASC 740 prescribes a recognition threshold and measurement process for recording in the financial statements uncertain tax positions taken or expected to be taken in a tax return. Additionally, ASC 740 provides guidance on the de-recognition, classification, interest and penalties, accounting in interim periods, and disclosure requirements for uncertain tax positions. The Company adopted the provisions of ASC 740 beginning October 1, 2007.

We file income tax returns in the U.S., Canada and the United Kingdom. We are subject to income tax examination by tax authorities in all jurisdictions from our inception to date. Our policy is to recognize interest expense and penalties related to income tax matters as tax expense. At June 30, 2010, we do not have any significant accruals for interest related to unrecognized tax benefits or tax penalties. Based on the Company’s evaluation, there are no significant uncertain tax positions requiring recognition or measurement in accordance with ASC 740.

During the year ended September 30, 2010, the Company recorded a deferred tax asset relating to the utilization of Pixology loss carryforwards to offset the current year income taxes payable in the amount of $363,728. The Company also determined that a portion of the previously unrecognized Pixology loss carry forwards should be recognized as the likelihood of realization of the tax asset was estimated to be more likely than not.

Canadian GAAP requires that a future income tax asset acquired in a business combination that was not recognized at the time of acquisition as an identifiable asset but is subsequently recognized by the acquirer should be applied to reduce goodwill and intangibles to zero, with any remaining amount recognized as a reduction to income tax expense.

Accordingly, an amount of $949,152 and $89,266 was credited against Pixology goodwill and intangibles respectively.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

US GAAP requires reversals of a valuation allowance related to acquired losses and deductible temporary differences to be recognized as a deferred tax benefit in the Statement of Earnings (Loss) and Comprehensive Gain (Loss).

During the year ended September 30, 2010, the Company determined that it was more likely than not to realize the loss carryforwards and other deductible temporary differences arising in Canada. As a result the Company reversed the valuation allowance relating to these items and recorded a future tax benefit. A portion of the valuation allowance of $107,611 related to share issue costs that are deductible for tax purposes. In accordance with Canadian GAAP, this was recorded as a future tax benefit within the Company’s Statement of Earnings (Loss) and Comprehensive Gain (Loss). US GAAP, however, requires the benefit associated with the reversal of a valuation allowance relating to equity items be recorded as an increase to share capital. Accordingly, for US GAAP an amount of $107,611 was recorded as an increase to share capital. During the six month period ended March 31, 2011, under Canadian GAAP the Company recorded a future tax expense of $53,412 associated with the realization of a portion of share issue costs; however under US GAAP the expense was recorded as a decrease to share capital.

| (h) | Recent adopted U.S. standards |

Accounting Standards Update 2009-05

Effective October 1, 2009, the Company adopted ASU 2009-05, “Fair Value Measurements and Disclosures”. The ASU provides a number of amendments to Subtopic 820-10, “Fair Value Measurements and Disclosures – Overall”, regarding the fair value measurements of liabilities. The adoption of this ASU did not have a significant impact on the financial statements of the Company.

Accounting Standards Update 2009-06

Effective October 1, 2009 the Company adopted ASU 2009-06, “Income Taxes”. ASU 2009-06 provides additional implementation guidance on accounting for uncertainty in income taxes. The adoption of this ASU has had no significant impact on the financial statements of the Company.

Accounting Standards Update 2009-13

In October 2009, the FASB released ASU 2009-13, “Multiple-deliverable revenue arrangements”. ASU 2009-13 is effective for revenue arrangements entered into or materially modified in years beginning on or after June 15, 2010 and provides another alternative for determining the selling price of deliverables and eliminates the residual method of allocating arrangement consideration. The adoption of this ASU has not had a significant impact on the financial statements of the Company.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Accounting Standards Update 2009-14

In October 2009, the FASB released ASU 2009-14, “Revenue arrangements that include software elements”. ASU 2009-14 is effective for revenue arrangements entered into or materially modified in years beginning on or after June 15, 2010 and removes non-software components of tangible products and certain software components of tangible products from the scope of existing software revenue guidance resulting in the recognition of revenue similar to that for other tangible products. The adoption of this ASU has not had a significant impact on the financial statements of the Company.

Accounting Standards Update 2010-02

In January 2010, the FASB released ASU 2010-02, “Consolidation (Topic 810): accounting and reporting for decreases in ownership of a subsidiary – a scope clarification”. ASU 2010-02 is effective at the beginning of the period ending on or after December 15, 2009 and describes amendments that clarify the types of transactions that should be accounted for as a decrease in ownership of a subsidiary as set forth in consolidations topic of the FASB Accounting Standards Codification (Subtopic 810-10). The Board’s objective in making the amendments is to remove the potential conflict between guidance in that Subtopic and asset de-recognition and gain or loss recognition guidance that may exist in other U.S. GAAP. The adoption of this ASU has had no impact on the financial statements of the Company.

Accounting Standards Update 2010-05

In January 2010, the FASB released ASU 2010-05, “Compensation – Stock Compensation (Topic 718): escrowed share arrangements and the presumption of compensation”. ASU 2010-05 codifies EITF Topic D-110, escrowed share arrangements and the Presumption of Compensation, and amends paragraphs 505-50-S25-3, 718-10-S25-1, and 718-10-S99-2. The adoption of these amendments had no impact on these financial statements.

Accounting Standards Update 2010-06

In January 2010, the FASB released ASU 2010-06, “Fair Value Measurements and Disclosures (Topic 820): improving disclosures about fair value measurements”. The ASU provides a number of amendments to Subtopic 820-10, that require new disclosures and that clarify certain existing disclosures related to fair value measurements. ASU 2010-06 is effective at the beginning of the period ending on or after December 15, 2009. The adoption of this ASU did not have a significant impact on these financial statements.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Accounting Standards Update 2010-08

In February 2010, the FASB released ASU 2010-08, “Technical corrections to various topics”. ASU 2010-08 was issued to amend certain US GAAP provisions to eliminate inconsistencies, outdated provisions and provide further clarifications where required. The Board concluded that the guidance in the amendments will not result in pervasive changes to current practice, and while none of the provisions in the amendments in this ASU fundamentally change U.S. GAAP, certain clarifications made to the guidance on embedded derivatives and hedging (Subtopic 815-15) may cause a change in the application of that Subtopic and, thus, special transition provisions are provided for accounting changes related to that Subtopic. The amendments in ASU 2010-08 are effective for the first reporting period beginning after issuance, except for certain amendments made to Topic 815 which are effective for fiscal years beginning after December 15, 2009. The amendments of this ASU have had no impact on the financial statements of the Company.

Accounting Standards Update 2010-09

In February 2010, the FASB released ASU 2010-09, “Subsequent Events (Topic 855): amendments to certain recognition and disclosure requirements. The amendments in ASU 2010-09 are effective upon issuance, and address certain implementation issues including: (i) eliminating the requirement for SEC filers to disclose the date through which it has evaluated subsequent events; (ii) clarifying the period through which conduit bond obligors must evaluate subsequent events; and (iii) refining the scope of the disclosure requirements for reissued financial statements. The Board’s objective in making the amendments is to remove potential conflicts between U.S. GAAP and SEC guidance. The adoption of this ASU has had no significant impact on the financial statements of the Company.

Accounting Standards Update 2010-11

In March 2010, the FASB released ASU 2010-11, “Derivatives and Hedging (Topic 815): scope exception related to embedded credit derivatives”. The amendments in ASU 2010-11 are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. ASU 2010-11 provides clarifications and related additional examples to improve financial reporting by resolving potential ambiguity about the breadth of the embedded credit derivative scope exception in paragraphs 815-15-15-8 through 15-9 of Topic 815. The adoption of this ASU has had no impact on the financial statements of the Company.

Accounting Standards Update 2010-12

In April 2010, the FASB released ASU 2010-12, “Income Taxes (Topic 740): accounting for certain tax effects of the 2010 health care reform acts”. ASU 2010-12 codifies Subtopic 740-10. The amendments have had no impact on the financial statements of the Company.

Accounting Standards Update 2010-20

In July 2010, the FASB released ASU 2010-20, “Receivables (Topic 310)”. ASU 2010-20 is effective for interim and annual reporting periods ending on or after December 15, 2010. The objective of ASU 2010-20 is to provide additional information to assist financial statement users in assessing an entity’s credit risk exposures and evaluating the adequacy of its allowance for credit losses as it relates to an entity’s portfolio of financing receivables. The amendments in ASU 2010-20 affect all entities with financing receivables, excluding short-term trade accounts receivable or receivables at fair value or lower of cost or fair value. The amendments have had no impact on the financial statements of the Company.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Accounting Standards Update 2010-21

In August 2010, the FASB released ASU 2010-21, “Accounting for Technical Amendments to Various SEC Rules and Schedules”. ASU 2010-21 amends various SEC paragraphs pursuant to the issuance of Release No. 33-9026: Technical Amendments to Rules, Forms, Schedules and Codification of Financial Reporting Policies. The amendments have had no impact on the financial statements of the Company.

Accounting Standards Update 2010-22

In August 2010, the FASB released ASU 2010-22, “Accounting for Various Topics”. ASU 2010-22 amends various SEC paragraphs based on external comments received and the issuance of SAB 112, which amends or rescinds portions of certain SAB topics. The amendments have had no impact on the financial statements of the Company.

Accounting Standards Update 2010-28

In December 2010, the FASB released ASU 2010-28, “Intangibles – Goodwill and Other (Topic 350): When to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying Amounts”. The amendments in ASU 2010-28 are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. The objective of ASU 2010-28 is to address circumstances where entities have concluded that despite factors that indicate goodwill assigned to a reporting unit may be impaired, Step 2 of the goodwill impairment test (measuring the amount of impairment loss) is not performed as reporting units with zero or negative carrying amounts will generally have a fair value greater than zero. ASU 2010-28 modifies Step 1 of the goodwill impairment test to require an entity to perform Step 2 of the goodwill impairment test, for reporting units with zero or negative carrying amounts if it is more likely than not that a goodwill impairment exists. The amendments have had no impact on the financial statements of the Company.

Business Combinations

In December 2007, the Financial Accounting Standards Board (FASB) issued new accounting guidance as outlined in ASC 805, Business Combinations regarding business combinations and non-controlling interests in consolidated financial statements. This new guidance retains the fundamental requirements in previous guidance for business combinations requiring that the use of the purchase method be used for all business combinations. The acquirer is required to recognize the assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree at the acquisition date, measured at their fair values as of that date. Additionally, business combinations will now require that acquisition costs to be expensed as incurred, the recognition of contingencies, restructuring costs associated with a business combination must generally be expensed and changes in deferred tax asset valuation allowances and income tax uncertainties after the acquisition date generally will affect income tax expense. This guidance applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008, which is the year ending September 30, 2010 for the Company. Since adoption of this standard, effective October 1, 2009, the Company has not undertaken any transactions to which these revised rules apply.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Non-controlling Interests in Consolidated Financial Statements

In December 2007, the FASB clarified guidance on non-controlling interests in consolidated financial statements. The clarification requires ownership interests in subsidiaries held by other parties to be classified as equity in the consolidated financial statements and changes in ownership interests in a subsidiary to be accounted for as equity transactions. Deconsolidation of a subsidiary is to be accounted for at fair value. This update is applicable for fiscal years beginning on or after December 15, 2008 on a prospective basis, except for the presentation and disclosure requirements which are to be applied to all periods presented. The Company does not currently have any partially owned subsidiaries and does not expect, based on its current structure, the adoption, effective October 1, 2009 to have any significant impact.

Determination of the Useful Life of Intangible Assets

Effective October 1, 2009 the Company adopted FASB’s updated guidance as outlined in ASC 350, Intangibles – Goodwill and Other regarding the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset. The intent of this revised guidance is to improve the consistency between the useful life of a recognized intangible and the period of expected cash flows used to measure the fair value of the asset. The adoption of this revised guidance has not had a significant impact on the financial statements of the Company.

| (i) | Recent U.S. announcements |

Accounting Standards Update 2010-13

In April 2010, the FASB released ASU 2010-13, “Compensation – Stock Compensation (Topic 718): effect of denominating the exercise price of a share based payment award in the currency of the market in which the underlying equity security trades – a consensus of the FASB Emerging Issues Task Force.” ASU 2010-13 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. ASU 2010-13 clarifies that a share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades should not be considered to contain a condition that is not a market, performance, or service condition, therefore such an award should not be classified as a liability. The Company does not anticipate the amendments of ASU 2010-13 will have a financial impact on the Company’s results.

| PNI Digital Media Inc. |

| Notes to Consolidated Financial Statements |

| Unaudited – Prepared by Management |

| (expressed in Canadian dollars) |

Accounting Standards Update 2010-29

In December 2010, the FASB released ASU 2010-29 “Business Combinations (Topic 805) – Disclosure of Supplementary Pro Forma Information for Business Combinations”. The objective of ASU 2010-29 is to address diversity in practice about the interpretation of the pro forma revenue and earnings disclosure requirements for business combinations. Under ASU 2010-29, if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination(s) that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. The amendments in ASU 2010-29 are effective prospectively for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2010. The amendments have had no impact on the financial statements of the Company.

PNI Digital Media Inc.

(TSX-V: PN / OTCBB: PNDMF)

Management’s Discussion & Analysis

For the Period Ended March 31, 2011

May 26, 2011

| PNI Digital Media Inc. | |

| Management’s Discussion and Analysis | |

| For the period ended March 31, 2011 | Page 1 |

This discussion and analysis is a review of the operating results, financial condition, and business risks of PNI Digital Media Inc. (“PNI”, the “Company”, “we” or “our”). This discussion should be read in conjunction with the Management’s Discussion and Analysis included in PNI’s 2010 Annual Report and our consolidated financial statements and accompanying notes for the year ended September 30, 2010 and for the period ended March 31, 2011. The financial information reported herein has been prepared in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”) and is presented in Canadian dollars, unless otherwise noted.

This discussion and analysis may contain forward-looking statements. Statements which are not historical facts reflect our views at May 26, 2011 with respect to future events and are subject to certain risks, uncertainties and assumptions. These risks and assumptions include, but are not limited to, changes in the market for our services, changes in the economy, increasing competition in our market, the risk of loss of current customers, risks related to changes in technology, risks related to our technology, employee retention, inability to deliver on contracts, failure of customers to adequately market the online photo-finishing services they provide, foreign exchange, and risks with respect to our financial capacity. Our actual results could differ materially from those expressed or implied by such forward-looking statements.

Business Highlights

Second Quarter Highlights

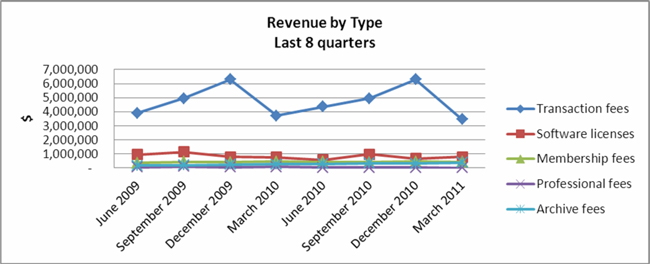

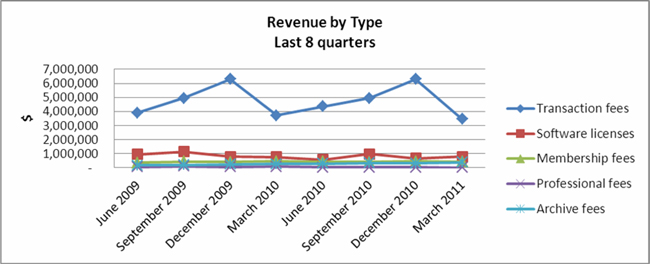

| · | Processed 3.6 million transactions during the period, compared to 3.3 million during the second quarter of fiscal 2010, a 10% increase |

| · | Revenue for the quarter was $5.0 million compared to $5.3 million in the second quarter of fiscal 2010 |

| · | Revenue on a constant currency basis was $5.2 million compared to $5.3 million in the second quarter of fiscal 2010 |

| · | Transactional revenue was $3.5 million, compared to $3.7 million in the second quarter of fiscal 2010 |

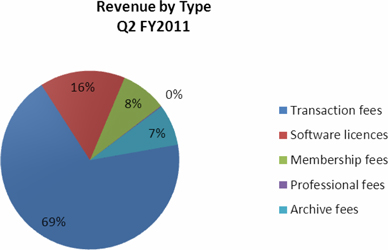

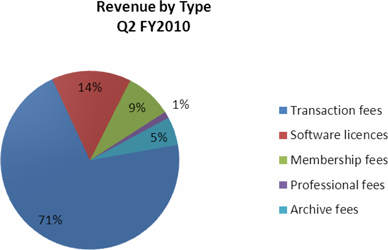

| · | Transaction fees represented 69% of total revenue vs. 71% during the same period of fiscal 2010 |

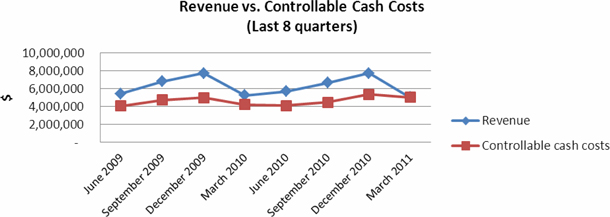

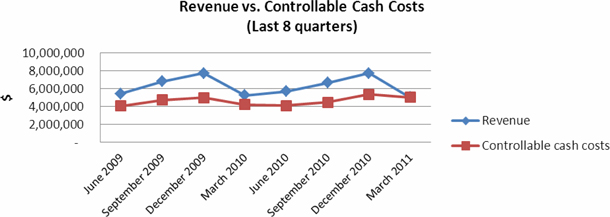

| · | Generated GAAP loss after income taxes for the quarter of $852,000 compared to $91,000 in the second quarter of fiscal 2010 |

| · | Non-GAAP adjusted EBITDA1 was negative $0.1 million during the second quarter of 2011, compared to a non-GAAP adjusted EBITDA of $1.0 million during the second quarter of 2010 |

1 – Adjusted EBITDA is a non-GAAP financial measure which the Company defines as net profit plus amortization, interest expense, tax expense, share-based compensation expense and un-realized foreign exchange loss (gain). A full reconciliation of the Company’s results between these non-GAAP figures and the results in accordance with GAAP is included on page 19 of this MD&A.

| PNI Digital Media Inc. | |

| Management’s Discussion and Analysis | |

| For the period ended March 31, 2011 | Page 2 |

Selected financial information

The following selected financial information has been prepared in accordance with generally accepted accounting principles in Canada and is presented in Canadian dollars.

| | | Three Months Ended March 31, | | | Six Months Ended March 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Revenue | | $ | 5,031,263 | | | $ | 5,261,722 | | | $ | 12,765,068 | | | $ | 13,017,935 | |

| (Loss) profit from operations | | $ | (847,172 | ) | | $ | (446,569 | ) | | $ | 652,109 | | | $ | 743,291 | |

| Net (loss) profit before income taxes | | $ | (1,080,957 | ) | | $ | (54,640 | ) | | $ | 563,803 | | | $ | 1,254,595 | |

| Net (loss) profit for the period | | $ | (852,479 | ) | | $ | (90,886 | ) | | $ | 231,042 | | | $ | 1,153,437 | |

| Basic (loss) earnings per common share | | $ | (0.03 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

| Fully diluted (loss) earnings per common share | | $ | (0.03 | ) | | $ | (0.00 | ) | | $ | 0.01 | | | $ | 0.03 | |

| | | As at | |

| | | March 31, 2011 | | | September 30, 2010 | |

| Total assets | | $ | 21,667,946 | | | $ | 23,520,358 | |

| Net assets | | $ | 17,410,995 | | | $ | 17,129,478 | |

| Working capital | | $ | 5,999,289 | | | $ | 5,248,893 | |

| PNI Digital Media Inc. | |

| Management’s Discussion and Analysis | |

| For the period ended March 31, 2011 | Page 3 |

Business Overview:

The Company operates the PNI Digital Media Platform, which provides transaction processing and order routing services for major retailers. The PNI Digital Media Platform connects consumer ordered digital content, whether from in-store kiosks, online sites or desktop software, with retailers that have on-demand manufacturing capabilities for the production of merchandise such as photos and business documents. The Company successfully generates and routes millions of transactions each year for a range of retailers enabling thousands of locations worldwide.

The Company’s customers include some of the largest retailers on a worldwide basis, including, Costco, SAM’s Club, Blacks, CVS/Pharmacy, Tesco, ASDA, Walmart Canada, Kodak and Fujifilm among others.