The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JANUARY 16, 2024

PROSPECTUS

$1,281,900,000

2024 SENIOR SECURED DEFERRED FUEL COST BONDS

VIRGINIA ELECTRIC AND POWER COMPANY

SPONSOR, DEPOSITOR AND INITIAL SERVICER

Central Index Key Number: 0000103682

VIRGINIA POWER FUEL SECURITIZATION, LLC

ISSUING ENTITY

Central Index Key Number: 0002001186

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tranche

| | Expected

Weighted

Average

Life

(Years)*

| | | Principal

Amount

Offered*

| | | Scheduled

Final

Payment

Date*

| | | Final

Maturity

Date*

| | | Interest

Rate

| | | Initial

Price to

Public

| | | Underwriting

Discounts and

Commissions

| | | Proceeds to

Issuing

Entity

(Before

Expenses)

| |

A-1 | | | | | | $ | 439,300,000 | | | | | | | | | | | | | % | | | | % | | | | % | | $ | | |

A-2 | | | | | | $ | 842,600,000 | | | | | | | | | | | | | % | | | | % | | | | % | | $ | | |

| * | | Preliminary, subject to change. |

The total price to the public is $ . The total amount of the underwriting discounts and commissions is $ . The total amount of proceeds to Virginia Power Fuel Securitization, LLC before deduction of expenses (estimated to be $ ) is $ .

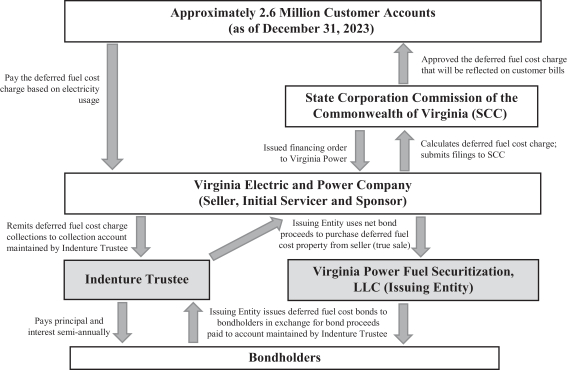

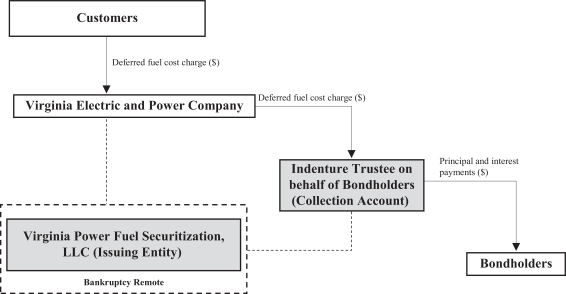

Virginia Electric and Power Company (Virginia Power), as depositor, is offering $1,281,900,000 of 2024 Senior Secured Deferred Fuel Cost Bonds (the bonds) in two tranches, to be issued by Virginia Power Fuel Securitization, LLC (VP Fuel Securitization), as the issuing entity. Virginia Power is also the seller, initial servicer and sponsor with regard to the bonds.

The bonds are senior secured obligations of VP Fuel Securitization and are its obligations only. The bonds are supported by the deferred fuel cost property, which consists of all rights and interests of VP Fuel Securitization under the financing order issued by the State Corporation Commission of the Commonwealth of Virginia (the SCC) on November 3, 2023 (the financing order), including the right to impose, bill, charge, collect and receive a nonbypassable charge paid by all Virginia Power electric retail customers in Virginia, except certain exempt customers, irrespective of their generation supplier and based on their electricity usage as described in this prospectus. This charge pays principal, interest and expenses related to the bonds and is known as the deferred fuel cost charge. Upon the issuance of the bonds, the deferred fuel cost charge may not be reduced, altered or impaired by the Commonwealth of Virginia or any of its agencies, including the SCC, until any and all principal, interest, premium, financing costs and other fees related to the bonds have been paid in full, except as adjusted pursuant to the true-up mechanism approved in the financing order. The true-up mechanism, as described in this prospectus, includes both mandatory and interim periodic adjustments to the deferred fuel cost charge as may be necessary to correct for any overcollection or undercollection from customers with respect to the deferred fuel cost charge or to otherwise ensure the timely payment of principal of and interest on the bonds when due, as well as other financing costs and required amounts and charges payable in connection with the bonds. In addition to the true-up mechanism, credit support for the bonds will be provided by a capital subaccount funded through a capital contribution by the depositor in an amount equal to 0.50% of the principal amount of the bonds issued.

Interest on each tranche of bonds, which will accrue from the date of issuance, is due and will be paid semi-annually. We will pay the principal of the bonds semi-annually and sequentially according to the sinking fund schedule included in this prospectus, although the principal of a specific tranche of bonds is not due until the final maturity date of such tranche. The payment dates for the bonds will be and of each year, beginning on , 2024. The bonds are not subject to optional redemption prior to maturity.

The bonds will not constitute a debt, liability or other obligation of, or interest in, Virginia Power or any of its affiliates (other than VP Fuel Securitization). The bonds will not be insured or guaranteed by Virginia Power, including in its capacity as sponsor, depositor, seller or servicer, or by its parent, Dominion Energy, Inc., any of their respective affiliates, the indenture trustee or any other person or entity. The bonds will be nonrecourse obligations, secured only by the collateral described in this prospectus. The bonds will not be a debt, general obligation, special obligation or other indebtedness of the Commonwealth of Virginia or any of its political subdivisions, agencies, or instrumentalities, including the SCC.

Virginia Power is the depositor, sponsor, seller and initial servicer with regard to the bonds. Virginia Power is the sole member of VP Fuel Securitization.

Investing in the bonds involves risks. See “Risk Factors” beginning on page 21 to read about factors you should consider before buying the bonds.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The bonds will be ready for delivery in book-entry form through the facilities of The Depository Trust Company (DTC) for the accounts of its direct participants, including Euroclear Bank SA/NV (Euroclear) and Clearstream Banking, société anonyme (Clearstream), on or about , 2024.

Joint Book-Running Managers

| | | | |

| Morgan Stanley | | ATLAS SP | | Wells Fargo Securities |

The date of this prospectus is , 2024