Exhibit 10.2

SHAREHOLDERS AGREEMENT

IN RELATION TO NEXTEL HOLDINGS S.À R.L.

AMONG

NEXTEL HOLDINGS S.À R.L.

AINMT BRAZIL HOLDINGS B.V.

NII INTERNATIONAL TELECOM S.C.A.

SOLELY FOR PURPOSES OF SECTION 5.1, AINMT HOLDINGS AB

SOLELY FOR PURPOSES OF SECTIONS 2.4 AND 5.2, NII HOLDINGS, INC.

AND

SOLELY FOR THE PURPOSES OF SECTION 2.2, AINMT AS

DATED June 5, 2017

TABLE OF CONTENTS

| I. | DEFINITIONS |

| 1.1 | Definitions |

| 1.2 | Construction Rules and Interpretative Matters |

| II. | RIGHTS AND OBLIGATIONS WITH RESPECT TO TRANSFER |

| 2.1 | Transfers |

| 2.2 | NII Telecom Put Rights |

| 2.3 | Investor Call Right |

| 2.4 | Investor’s Right to Convert Its Shares |

| 2.5 | Right of First Refusal to Investor and (prior to Second Closing) Right of First Offer to NII Telecom on Transfers of Shares |

| 2.6 | Right of First Refusal with Respect to Opco |

| 2.7 | Tag-Along Rights |

| 2.8 | Drag-Along Rights |

| 2.9 | Provisions Applicable to Tag-Along/Drag-Along Rights |

| 2.10 | Improper Transfer |

| 2.11 | Certain Participation Rights |

| 2.12 | Fair Market Value |

| 2.13 | NII Telecom Existence |

| III. | BOARD OF MANAGERS |

| 3.1 | Powers and Duties of the Board |

| 3.2 | Composition of the Board |

| 3.3 | Term and Removal |

| 3.4 | Vacancies |

| 3.5 | Action by the Board of Managers |

| 3.6 | Meetings of the Board |

| 3.7 | Compensation and Reimbursement; Insurance |

| 3.8 | Limitation on Liability; Indemnification; General |

| 3.9 | Board committees |

| 3.10 | Meetings of Shareholders |

| 3.11 | Conflicting Provisions in Governing Documents |

| 3.12 | Shareholder Access |

| 3.13 | Confidentiality |

| IV. | CERTAIN ARRANGEMENTS |

| 4.1 | Effectiveness of Certain Minority Rights |

| 4.2 | Additional Investment Requirements |

| 4.3 | Financial Information of the Company |

| 4.4 | Financial Information of Subsidiaries |

| 4.5 | Actions Requiring NII Telecom’s Approval |

| 4.6 | Actions Requiring Investor’s Approval |

| 4.7 | Company Cure Right |

| 4.8 | Anti-Corruption and Internal Financial Controls |

| 4.9 | U.S. Tax |

| 4.10 | Management Fees |

| 4.11 | Treatment of Intercompany Arrangements |

| 4.12 | Termination of Existing Arrangements |

| 4.13 | Transitional arrangements |

| V. | MISCELLANEOUS |

| 5.1 | Investor Parent Guarantee |

| 5.2 | NII Parent Guarantee |

| 5.3 | Entire Agreement; Amendments and Waivers |

| 5.4 | Notices |

| 5.5 | Severability |

| 5.6 | Termination |

| 5.7 | Binding Effect; Assignment |

| 5.8 | Counterparts |

| 5.9 | Injunctive Relief |

| 5.10 | Governing Law; Submission to Jurisdiction |

| 5.11 | Waiver of Jury Trial |

| 5.12 | Legal Prohibitions |

| 5.13 | After-Acquired Shares; Options; Successor Shares |

| 5.14 | Further Assurances |

| 5.15 | No Announcements |

SHAREHOLDERS AGREEMENT

This SHAREHOLDERS AGREEMENT is executed on June 5, 2017 (the “Execution Date”), but to take effect only on the Initial First Closing Date (as hereafter defined, such date, the “Effective Date”), and contingent on the consummation of the Initial First Closing, and is by and among Nextel Holdings S.à r.l., a private limited liability company (société à responsabilité limitée) organized under the Laws of the Grand Duchy of Luxembourg with a registered office at 6, rue Eugène Ruppert, L-2453 Luxembourg and registered with the Luxembourg Trade and Companies Register under number B 150.303 (the “Company”), AINMT Brazil Holdings B.V., a corporation existing under the Laws of The Netherlands] (“Investor”), NII International Telecom S.C.A., a partnership limited by shares (société en commandite par actions) organized under the Laws of the Grand Duchy of Luxembourg with a registered office at 6, rue Eugène Rupert, L-2453 Luxembourg and registered with the Luxembourg Trade and Companies Register under number B 149.237 (“NII Telecom”), solely for purposes of Section 5.1, AINMT Holdings AB, a corporation existing under the Laws of Sweden (“Investor Parent”), solely for the purposes of Section 2.2 only, AINMT AS, a corporation existing under the Laws of Norway (“AINMT AS”), and, solely for purposes of Sections 2.4 and 5.2, NII Holdings, Inc., a Delaware corporation (“NII Parent”). Investor, NII Telecom and any other shareholder of the Company who from time to time becomes party to this Agreement by execution of a joinder agreement in substantially the form attached hereto as Exhibit A (the “Joinder Agreement”) may each be referred to herein individually as a “Shareholder” and collectively as the “Shareholders.” The Company, the Shareholders and, solely for purposes of Section 5.1, Investor Parent may each be referred to herein individually as a “Party” and collectively as the “Parties.” Unless otherwise specified, all capitalized terms used in this Agreement and not otherwise defined will have the meaning set forth in the Investment Agreement (as hereinafter defined).

RECITALS:

A. The Company indirectly owns all of the issued and outstanding capital stock of Nextel Telecomunicações Ltda. (“Opco”).

B. The Company, Investor, Investor Parent, AINMT AS, NII Telecom and NII Parent have entered into the Investment Agreement dated June 5, 2017 (the “Investment Agreement”), pursuant to which the Parties agreed that the Company would issue and allot, subject to completion of the Corporate Reorganization, Preferred Shares representing an Applicable Ownership Percentage of 19.9% and will issue and allot, subject to receipt of the Antitrust Approval, additional Preferred Shares representing an Applicable Ownership Percentage of 10.1% to Investor as provided therein.

C. Giving effect to the Initial First Closing, NII Telecom will own 116,666,667 Ordinary Shares, which represent an Applicable Ownership Percentage of 80.1% and, subject to receipt of the Antitrust Approval and further Preferred Shares being issued to Investor as contemplated by Recital B above, will represent an Applicable Ownership Percentage of 70%.

D. Immediately following the consummation of the Second Closing in accordance with and subject to the terms and conditions of the Investment Agreement, Investor and NII Telecom will hold an Applicable Ownership Percentage of 60% and 40%, respectively (subject to adjustment based on the amount of the Second Parent Capital Contribution).

E. The Company and each of the Shareholders desire to enter into this Agreement to regulate and limit certain rights relating to the Shares and to limit the sale, assignment, transfer, encumbrance or other disposition of such Shares and to regulate the management of the Company.

Accordingly, the Parties hereby agree as follows:

I. DEFINITIONS

1.1. Definitions. The following terms have the following meanings when used herein with initial capital letters:

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly through one or more intermediaries, Controls or is Controlled by, or is under common Control with, such Person.

“Agreement” means this Shareholders Agreement, any amendments hereto, and any exhibits, schedules, and attachments hereto, which are specifically incorporated herein by this reference.

“AINMT AS” is defined in the Preamble.

“AINMT AS Approval” means the affirmative vote of at least two-thirds of the votes properly cast at the AINMT AS Shareholders Meeting.

“AINMT AS Shareholders Meeting” a shareholders’ meeting of AINMT AS for the purpose of approving any issuance of AINMT AS Shares by AINMT AS required pursuant to Section 2.2.

“AINMT AS IPO” means the admission of any of the equity shares of AINMT AS to trading on a recognized securities exchange including, for the avoidance of doubt, Oslo Børs or Oslo Axess.

“AINMT AS IPO Shares” means shares in the capital of AINMT AS being admitted to trading in the AINMT AS IPO.

“AINMT AS Listing Value Per Share” means the final listing price per share of the AINMT AS IPO Shares on completion of an AINMT AS IPO.

“AINMT AS Shares” has the meaning specified in Section 2.2(c).

“AINMT AS Share Price” means (i) the volume weighted average price per share of AINMT AS Shares as reported by the applicable public stock exchange on which the AINMT AS Shares are listed and admitted to trading (including, if applicable, Oslo Børs or Oslo Axess) for the 30 trading-day period ending on the third day immediately preceding the AINMT Put Right Exercise Date or Call Right Exercise Date (as applicable) or (ii) if an AINMT AS IPO occurs after the AINMT Put Right Exercise Date or Call Right Exercise Date (as applicable) but before the AINMT Put Right Closing Date or Call Right Closing Date (as applicable), the AINMT AS Listing Value Per Share, in each case converted into dollars on the basis of the rate of exchange between Norwegian Krone (NOK) and dollars at the average mid-point NOK spot rate of exchange applicable to dollars as quoted in the Financial Times (London Edition) at or about 10.00 a.m. (London time) for each of

the three days immediately preceding the AINMT Put Right Exercise Date or Call Right Exercise Date, as the case may be.

“AINMT Put Purchase Price” has the meaning specified in Section 2.2(c).

“AINMT Put Right” has the meaning specified in Section 2.2(a).

“AINMT Put Right Closing Date” has the meaning specified in Section 2.2(d).

“AINMT Put Right Exercise Date” has the meaning specified in Section 2.2(b).

“AINMT Put Right Notice” has the meaning specified in Section 2.2(b).

“AINMT Put Right Shares” has the meaning specified in Section 2.2(a).

“Annual Budget” has the meaning specified in Section 4.3(g).

“Applicable Ownership Percentage” means, with respect to a Shareholder, the ratio of the number of Shares held by the Shareholder to the total of all then issued and outstanding Shares on a fully diluted basis, expressed as a percentage.

“Articles” means the Articles of Association (Statuts) of the Company, as may be amended from time to time.”

“Board” means the board of Managers (Conseil de Gérance) of the Company.

“Board Meeting Notice” has the meaning specified in Section 3.6(a).

“Business Day” means any day except a Saturday, Sunday or other day on which commercial banks in New York, New York, Luxembourg City, Luxembourg, Stockholm, Sweden or Amsterdam, The Netherlands, are authorized or required by Law to close.

“Business Plan” means the business plan and budget for the Group in the agreed form attached hereto as Exhibit C.

“Call Purchase Price” has the meaning specified in Section 2.3(c).

“Call Right” has the meaning specified in Section 2.3(a).

“Call Right Closing Date” has the meaning specified in Section 2.3(d).

“Call Right Exercise Date” has the meaning specified in Section 2.3(b).

“Call Right Notice” has the meaning specified in Section 2.3(b).

“Call Right Period” has the meaning specified in Section 2.3(a).

“Call Right Shares” has the meaning specified in Section 2.3(b).

“Capital Stock” means (a) with respect to any Person that is a corporation, any and all shares, interests, participation or other equivalents (however designated and whether or not voting) of

corporate stock, and (b) with respect to any Person that is not a corporation, any and all partnership or other equity interests of such Person.

“Change of Control” means an event or series of events by which a Person who did not previously exercise Control over the Company, NII Parent or Investor Parent (as applicable) acquires or otherwise becomes able to exercise such Control or where a Person who was previously able to exercise Control, directly or indirectly, over the Company, NII Parent or Investor Parent (as applicable) ceases to be in a position to do so; provided, however, that if the Person acquiring or otherwise becoming able to exercise such Control is an Affiliate of the Company, NII Parent or Investor Parent (as applicable) immediately prior to acquiring or otherwise becoming able to exercise such Control, such change shall not constitute a “Change of Control.”

“Company” has the meaning specified in the Preamble to this Agreement.

“Company Accountants” means the firm engaged by the Company at the time of any calculation or report required to be made by the Company Accountants under this Agreement and which shall be an internationally recognized certified public accounting firm.

“Confidential Information” means all intellectual property, documents, financial statements, records, business plans, recipes, reports and other information of whatever kind or nature, which has value to the Company, or which is treated by the Company as confidential and regardless of whether such information is marked “confidential,” except (a) such information that is or becomes generally available to the public through no action of the Party (including its limited partners, representatives, agents and Affiliates) to which such information was furnished, or (b) is or becomes available to the Party to which it was furnished on a non-confidential basis from a source, other than from the Company, its Affiliates or representatives, which the receiving Party believes, after reasonable inquiry, was not prohibited from so disclosing such information by a contractual, legal or fiduciary obligation.

“Control” (including the terms “Controlled by” and “under common Control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through ownership of voting securities, by contract or otherwise.

“Continuing Arrangements” has the meaning specified in Section 4.11.

“Conversion Closing Date” has the meaning specified in Section 2.4(d).

“Conversion Exercise Date” has the meaning specified in Section 2.4(b).

“Conversion Notice” has the meaning specified in Section 2.4(b).

“Conversion Price” has the meaning specified in Section 2.4(c).

“Conversion Right” has the meaning specified in Section 2.4(a).

“Convertible Shares” has the meaning specified in Section 2.4(a).

“Drag-Along Closing Date” has the meaning specified in Section 2.8(d).

“Drag-Along Disposition” has the meaning specified in Section 2.8(a).

“Drag-Along Notice” has the meaning specified in Section 2.8(a).

“Drag-Along Right” has the meaning specified in Section 2.8(a).

“Dragging Shareholder” has the meaning specified in Section 2.8(a).

“EBITDA” means the Group’s consolidated earnings before interest, tax, depreciation and amortization, excluding one-time or non-recurring items, with each of the foregoing calculated in accordance with US GAAP.

“Effective Date” has the meaning specified in the Preamble to this Agreement.

“Emergency Funding Situation” means a situation in which the Board reasonably believes that additional capital is required to cure any actual or potential event of default under the Company’s, or any of its Subsidiaries’, third party debt financing arrangements.

“Exchange Act” means the Securities Exchange Act 1934, as amended.

“Execution Date” has the meaning specified in the Preamble.

“Exercise Notice” has the meaning specified in Section 2.7(b).

“Existing Arrangements” has the meaning specified in Section 4.11.

“Fair Market Value” means the fair market value of the Shares as finally determined in accordance with Section 2.12.

“First Call Right Period” has the meaning specified in Section 2.3(a).

“First Put Right Period” has the meaning specified in Section 2.2(b).

“Grace Period” has the meaning specified in Section 4.10.

“Group” means the Company, NII International and its Subsidiaries and “Group Member” means any of them.

“Group Representatives” has the meaning specified in Section 4.8(b).

“Guaranteed Parties” has the meaning specified in Section 5.1(a).

“High FMV” has the meaning specified in Section 2.12(e).

“IFRS” means the International Financial Reporting Standards as issued by the International Accounting Standards Board, applied on a basis consistent in all material respects.

"Intercompany Debt" means the intercompany notes payable and intercompany notes receivable set forth in Section 4.9 SHA of the Company Disclosure Letter.

“Investment Agreement” has the meaning specified in the Recitals to this Agreement.

“Investor” has the meaning specified in the Preamble to this Agreement.

“Investor Drag Threshold” means:

(i)Investor achieving an IRR of 20% or more, in relation to a Drag-Along Disposition occurring:

(A)prior to earlier of (x) the Exercise Date, if applicable, or (y) the Option Expiration Date;

(B)if Investor has exercised the Investor Option, from the Exercise Date until the earlier of (x) the date of Parent Stockholders Meeting or (y) the Option Termination Date; or

(C)if Investor has exercised the Investor Option, the Parent Stockholders Meeting has occurred and the Parent Stockholder Approval is obtained, from the Parent Stockholders Meeting until the earlier of (x) Second Closing and (y) the Option Termination Date; or

(i)Investor achieving the higher of (x) an IRR of 20% or more or (y) Multiple of Money of 2x or more, in relation to a Drag-Along Disposition occurring:

(A)if Investor has not exercised the Investor Option prior to the Option Expiration Date, after the Option Expiration Date;

(B)if Investor has exercised the Investor Option and the Parent Stockholders Meeting has occurred but the Parent Stockholder Approval is not obtained, from and after the Parent Stockholders Meeting; or

(C)otherwise, if (ii)(A) or (ii)(B) do not apply, from the Option Termination Date.

“Investor Inflow” means the cash amount actually invested by Investor or an Affiliate of Investor (other than a Group Member) in Preferred Shares (or, if applicable, Shares) on or after the Initial First Closing Date to the completion date of a Drag-Along Disposition.

“Investor Manager” has the meaning specified in Section 3.2(a)(i).

“Investor Outflow” means the aggregate amount of cash proceeds received by Investor in connection with its investment in Preferred Shares in the Company after the Initial First Closing Date to (and including) the completion date of a Drag-Along Disposition, from all returns on such Preferred Shares, dividends on such Preferred Shares, redemptions of such Preferred Shares, buy backs of such Preferred Shares, returns of capital or proceeds, net of the payment of any reasonable out-of-pocket fees, costs, charges and expenses actually incurred by Investor in respect of the Drag-Along Disposition.

“Investor Parent” has the meaning specified in the Preamble to this Agreement.

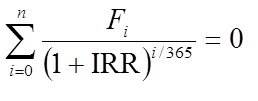

“IRR” means the annual internal rate of return that makes the sum of each Investor Inflow and Investor Outflow, discounted to their respective dates, equal to zero and computed in accordance with the following formula:

where:

| • | “Fi” corresponds to the Investor Inflow (if negative) or Investor Outflow (if positive); |

| • | “i” corresponds to days after the First Initial Closing Date and up until the date of receipt of the relevant Investor Outflow or the date of payment of the relevant Investor Inflow; and |

| • | “n” corresponds to the number of days between the First Initial Closing Date and the completion date of the Drag-Along Disposition. |

“Joinder Agreement” has the meaning specified in the Preamble to this Agreement.

“Law” means any Swedish, Luxembourg, Dutch, Norwegian, U.S., Brazilian or other federal, state or local law, statute, code, ordinance, rule or regulation, as applicable.

“Low FMV” has the meaning specified in Section 2.12(e).

“Management Fees” has the meaning specified in Section 4.10.

“Manager” means a member (gérant) of the Board.

“Marketable Securities” means shares admitted to trading and listed on a public stock exchange.

“Multiple of Money” means as of the date of completion of the Drag-Along Disposition, the multiple of money on the investment in the Group (in whatever form) made by Investor and Investor’s Affiliates (other than the Group) calculated by dividing (a) the aggregate of all Investor Outflows by (b) the aggregate of all Investor Inflows;

“New Securities” means any Capital Stock and any rights, options, warrants to purchase Capital Stock and securities of any type which are, or may become, convertible, or exchangeable for, Capital Stock, that is not issued and outstanding on the date hereof; provided, however, that “New Securities” does not include, after the Second Closing, the following: (a) securities issued (i) in connection with the acquisition of another business entity by the Company, whether by merger, business combination, joint venture, purchase of all or substantially all of the assets of such entity or otherwise or (ii) in connection with any lending, financing or leasing arrangement approved by the Board or (b) securities issued as a result of any stock split, dividend, distribution, reclassification or reorganization of the Company’s equity securities.

“NII Change of Control” means (i) any Person or "group" (within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act) becoming the "beneficial owner(s)" (as defined in Rule 13d-3 of the Exchange Act) of equity securities of NII Parent or any member of the Retained NII Group representing more than 50% of the total of all then outstanding voting securities of NII Parent or any member of the Retained NII Group or (ii) a merger or consolidation of NII Parent or any member of the Retained NII Group with or into another entity, other than a merger or consolidation that would result in the holders of NII Parent’s (or such member of the Retained NII Group’s) voting securities immediately prior thereto holding securities which represent immediately after such merger or consolidation more than 50% of the total combined voting power of the entity which

survives such merger or consolidation or the parent of the entity which survives such merger or consolidation.

“NII Investment Amount” means (i) the cash amount invested by NII Telecom or an Affiliate of NII Telecom (other than a Group Member) in a member of the Group on or after Initial First Closing Date (and for these purposes (A) the Initial Parent Capital Contribution shall be deemed to be $116,666,667 (to the extent the Pre Initial Closing Subscription Amount is paid) and (B) the Second Parent Capital Contribution shall be deemed to be $16,667,000 to the extent the full Second Parent Capital Contribution is made, and all other amounts invested into the Company pursuant to the 115 Account or share premium account of the Company on or after Initial First Closing shall be disregarded), less (ii) the amount of any indemnifiable Losses paid by NII Telecom to Investor pursuant to the Investment Agreement (and to the extent such claims have been satisfied by the transfer(s) of Shares held by NII Telecom to Investor pursuant to the terms of the Investment Agreement, the NII Investment Amount will be reduced by multiplying the NII Investment Amount by the quotient of the number of Shares held by NII Telecom after such transfer(s) divided by the total number of Shares held by NII Telecom prior to such transfer(s)).

“NII Manager” has the meaning specified in Section 3.2(a)(i).

“NII Parent” has the meaning specified in the Preamble to this Agreement.

“NII Parent Stockholders Meeting” means a meeting of NII Parent’s stockholders for the purpose of approving (to the extent required by applicable Law) any issuance of NII Shares required pursuant to Section 2.4.

“NII Share Price” means the volume weighted average price per share of NII Shares as reported by the public stock exchange on which the NII Shares are listed and admitted to trading for the 30-day trading-day period ending upon the third day immediately preceding the Conversion Exercise Date.

“NII Shares” has the meaning specified in Section 2.4(a).

“NII Stockholder Approval” means the affirmative vote of a majority of the votes properly cast (excluding any abstentions or broker non-votes) by holders of common stock, par value $0.001 per share, of NII Parent entitled to vote at the NII Parent Stockholders Meeting to approve any issuance of NII Shares required pursuant to Section 2.4.

“NII Telecom” has the meaning specified in the Preamble to this Agreement.

“Nominee” has the meaning specified in Section 3.4(a).

“Offer Price” has the meaning specified in Section 2.5(a).

“Offered Shares” has the meaning specified in Section 2.5(a).

“Opco” has the meaning specified in the Recitals to this Agreement.

“Opco Sale Notice” has the meaning specified in Section 2.6(a).

“Ordinary Shares” means the Ordinary Shares as set forth in the Articles, par value $1.00 per share, of the Company.

“Other Shareholders” means, at any given time, the Shareholders other than (a) for purposes of Section 2.7, the Transferring Shareholder, and (b) for purposes of Section 2.8, the Dragging Shareholder.

“Parties” has the meaning specified in the Preamble to this Agreement.

“PCAOB” the U.S. Public Company Accounting Oversight Board.

“Permitted Transferee” means, with respect to a Shareholder, any of its Affiliates, and, with respect to Investor after the Second Closing (if any), any Person.

“Person” means an individual, corporation, partnership, trust, association, limited liability company or any other entity or organization, including a government or political subdivision or an agency or instrumentality thereof.

“Preferred Shares” means the Preferred Shares as set forth in the Articles, par value $1.00 per share, of the Company.

“Proceeding” has the meaning specified in Section 3.8(a).

“Proposed Drag-Along Transferee” has the meaning specified in Section 2.8(a).

“Proposed Opco Transferee” has the meaning specified in Section 2.6(a).

“Proposed Purchase Price” has the meaning specified in Section 2.6(a).

“Proposed Tag-Along Transferee” has the meaning specified in Section 2.7(a).

“Proposed Transaction” has the meaning specified in Section 2.6(a).

“Proposed Transferee” has the meaning specified in Section 2.5(a).

“Sale Notice” has the meaning specified in Section 2.5(a).

“Selling Shareholder” has the meaning specified in Section 2.5(a).

“Shareholders” has the meaning specified in the Preamble to this Agreement.

“Shares” means the Preferred Shares, the Ordinary Shares and any Successor Shares.

“Subsidiary” means, with respect to any Person, a corporation, partnership, limited liability company or other entity of which such Person owns, directly or indirectly, such number of outstanding shares or other equity interests as to have: (a) more than 50% of the ordinary voting power for the election of directors or other managers of such corporation, partnership, limited liability company or other entity, or (b) the right to receive more than 50% of the surplus assets on a dissolution or winding-up of such corporation, partnership, limited liability company or other entity. Unless the context otherwise requires, each reference to Subsidiaries herein will be a reference to Subsidiaries of the Company.

“Successor Shares” means any securities issued or issuable in consideration of exchange for or otherwise in respect of, any Preferred Shares or Ordinary Shares or successor shares to the

foregoing in any merger, consolidation, recapitalization, reorganization or other transaction or by reason of a stock dividend, stock split or other similar transaction.

“Tag-Along Notice” has the meaning specified in Section 2.7(a).

“Tag-Along Period” has the meaning specified in Section 2.7(e).

“Tag-Along Ratio” has the meaning specified in Section 2.7(d).

“Tag-Along Transaction” has the meaning specified in Section 2.7(a).

“Transfer” means, (a) when used as a verb, to sell, transfer, assign, encumber, pledge, hypothecate, grant any right, option, profit participation or other interest in, or otherwise dispose of, directly or indirectly, voluntary or involuntarily, by operation of law or otherwise, and (b) when used as a noun, a direct or indirect, voluntary or involuntary, sale, transfer, assignment, encumbrance, pledge, hypothetication, grant of any right, option, profit participation or other interest, or other disposition by operation of law or otherwise, but shall not include, for the avoidance of doubt, in respect of Investor, any Transfers by any shareholders of Investor Parent or AINMT AS.

“Transferee” means any Person to whom any Shareholder Transfers any Shares.

“Transferring Shareholder” has the meaning specified in Section 2.7(a).

“Transitional Period” has the meaning specified in Section 4.13.

“Ultimate Valuation” has the meaning specified in Section 2.12(f).

“Ultimate Valuer” has the meaning specified in Section 2.12(f).

“U.S. GAAP” means generally accepted accounting principles in effect in the U.S. applied on a basis consistent in all material respects.

“Valuation” has the meaning specified in Section 2.12(d).

“Valuer” means the respective international investment bank appointed by each of Investor and NII Telecom, as applicable, as a “Valuer” pursuant to Section 2.12(b) or by the Company pursuant to Section 2.12(c), as applicable.

1.2. Construction Rules and Interpretative Matters. The following rules of construction and interpretation will apply:

(a)when calculating the period of time in which any act is to be performed pursuant to this Agreement, the date that is the reference date in calculating the beginning of such period will be excluded. If the last day of such period is a non-Business Day, the period in question will end on the next succeeding Business Day;

(b)to the extent the term “day” or “days” is used, it will mean calendar days;

(c)any reference in this Agreement to “$” or “dollars” will mean U.S. dollars and to “Real” or “R$” means Brazilian Reais;

(d)the Exhibits and Schedules to this Agreement are hereby incorporated and made a part hereof and are an integral part of this Agreement;

(e)unless the context otherwise requires, each of the Schedules will apply only to the corresponding Section or subsection of this Agreement;

(f)any reference in this Agreement to gender will include all genders, and words imparting the singular number only will include the plural and vice versa;

(g)the division of this Agreement into Articles, Sections and other subdivisions and the insertion of headings are for convenience of reference only and will not affect or be utilized in construing or interpreting this Agreement;

(h)all references in this Agreement to any “Section,” “Article” or “Schedule” are to the corresponding Section, Article or Schedule of this Agreement unless otherwise specified;

(i)words such as “herein”, “hereinafter”, “hereof” and “hereunder” refer to this Agreement as a whole and not merely to a subdivision in which such words appear unless the context otherwise requires;

(j)the word “including” or any variation thereof means “including, without limitation” and will not be construed to limit any general statement that it follows to the specific or similar items or matters immediately following it;

(k)any reference to the “date hereof” means the date of this Agreement;

(l)references to Laws mean a reference to such Laws as the same may be amended, modified, supplemented from time to time; and

(m)the Parties have participated jointly in the negotiation and drafting of this Agreement and, in the event an ambiguity or question of intent or interpretation arises, this Agreement will be construed as jointly drafted by the Parties and no presumption or burden of proof will arise favoring or disfavoring any Party by virtue of the authorship of any provision of this Agreement.

II. RIGHTS AND OBLIGATIONS WITH RESPECT TO TRANSFER

2.1. Transfers.

(a)No Shareholder will make any Transfer or attempt to make any Transfer in violation of the provisions set forth in this Article II.

(b)No Transfer by a Shareholder will be valid unless, in addition to complying with any other applicable requirements of this Article II, (i) the Transferee executes a Joinder Agreement prior to any Transfer; (ii) the Transfer complies in all respects with applicable securities Laws; and (iii) both the Shareholder whose Shares are the subject of the Transfer and the Transferee execute and deliver to the Company such documents as the Company may deem to be necessary or appropriate in order to evidence compliance with item (ii) above. Each Shareholder entitled to vote agrees that it will vote, or cause to be voted, its Shares or execute written consents, as the

case may be, and take all other necessary action (including causing the Company to call a special meeting of Shareholders) in order to ensure that any Shares are Transferred as permitted or required pursuant to the terms and subject to the conditions set forth in this Agreement and the Articles.

(c)No Shareholder may Transfer any Shares without the prior written consent of the other Shareholders, other than a Transfer (i) to a Permitted Transferee (provided that if a Permitted Transferee to whom Shares have been Transferred ceases to be a Permitted Transferee, such Transferee shall Transfer all such Shares back to the Shareholder from whom it received them or to another Permitted Transferee of such Shareholder), (ii) pursuant to the provisions of this Article II, (iii) as part of a sale of all of the issued and to be issued Shares of the Company pursuant to the terms of this Agreement, or (iv) as may be required pursuant to Section 8.6 of the Investment Agreement.

2.2. NII Telecom Put Rights. (a) From and after the Second Closing, NII Telecom shall have the right (but not be obliged) to require Investor or, at Investor’s option, AINMT AS, to purchase on the AINMT Put Right Closing Date, all, but not less than all, of the Shares held by NII Telecom and its Permitted Transferees at the AINMT Put Right Closing Date (the “AINMT Put Right Shares”) at the AINMT Put Purchase Price, determined in accordance with Section 2.2(c) (the “AINMT Put Right”).

(b) Exercise of the AINMT Put Right. NII Telecom may exercise the AINMT Put Right during the 45-day periods commencing (i) 12 months from the delivery of the Notice of Exercise by Investor pursuant to the Investment Agreement (if applicable) (the “First Put Right Period”) and (ii) the anniversary of the first day of the First Put Right Period, in the years 2019, 2020, 2021 and 2022, by giving a written notice to Investor and AINMT AS (such notice, the “AINMT Put Right Notice” and the date of such notice, the “AINMT Put Right Exercise Date”). The AINMT Put Right Notice will contain NII Telecom’s determination of the AINMT Put Purchase Price.

(c) AINMT Put Purchase Price. The “AINMT Put Purchase Price” will be the Fair Market Value of the Shares held by NII Telecom and its Permitted Transferees determined in accordance with Section 2.12, in each case net of all transfer taxes payable by the transferee in respect of the transfer of Shares held by NII Telecom and its Permitted Transferees, payable, at Investor’s election, either (i) in cash or (ii) by AINMT AS issuing NII Telecom a number of freely tradeable, fully paid and non-assessable shares of AINMT AS (the “AINMT AS Shares”) equal to the quotient of (A) the AINMT Put Purchase Price divided by (B) the AINMT AS Share Price.

(d)AINMT Put Right Terms and Conditions. The date of the AINMT Put Right Closing will be 10 Business Days following the later of (i) the final determination of the AINMT Put Purchase Price in accordance with Section 2.2(c), (ii) the date of which any mandatory regulatory conditions required in connection with such closing have been satisfied and (iii) the date of which the AINMT AS Approval has been obtained (the “AINMT Put Right Closing Date”). The purchase of all the Shares held by NII Telecom and its Permitted Transferees pursuant to the AINMT Put Right will be expressly subject to the written waiver by Investor or fulfillment of the following conditions on or prior to the AINMT Put Right Closing Date:

(i)Investor shall have received from NII Telecom and each of its Permitted Transferees that hold Shares, a duly executed instrument of assignment and any other documentation reasonably requested by Investor in order to confirm that the Shares held by NII Telecom and any of its Permitted Transferees, and all rights in respect thereof (including, without

limitation, all economic and voting rights) are being transferred to Investor free and clear of all liens (other than those arising by virtue of this Agreement) and Investor shall have received from the Company, evidence of the updated shareholders register of the Company reflecting the transfer of the Shares held by NII Telecom and any of its Permitted Transferees to Investor;

(ii)There shall not be any order of any Governmental Authority restraining or invaliding the transactions which are the subject of this Agreement;

(iii)The purchase and sale of the Shares held by NII Telecom would not violate any Laws applicable to Investor, AINMT AS, Investor Parent, NII Telecom or any Group Member;

(iv)NII Telecom giving customary representations and indemnification in respect of due authorization, execution and delivery of any agreement entered into in connection with the sale of its Shares, its authority to enter into such agreement and consummate the transactions contemplated thereby without the consent or approval of any other Person, NII Telecom’s title to its Shares and its ability to convey title thereto free and clear of any liens, encumbrances or adverse claims (other than those arising by virtue of this Agreement);

(v)If the AINMT Put Purchase Price is payable by the issuance of AINMT AS Shares, AINMT AS Approval being obtained in accordance with all applicable legal requirements;

(vi)NII Telecom entering into such customary lock-up, orderly market or other restrictions in respect of the AINMT Put Right where NII Telecom receives AINMT AS Shares, as reasonably recommended by any investment bank retained by AINMT AS in connection with the issue of the AINMT AS Shares (or, if AINMT is in the process of an AINMT AS IPO, as recommended by the underwriters or financial advisers to the AINMT AS IPO and to which any Affiliates of Investor are subject with respect to AINMT AS IPO Shares); and

(vii)The EBITDA of the Group exceeding, in aggregate. $100,000,000 in the combined four financial quarters (ending March, June, September and December) immediately preceding the date of the AINMT Put Right Notice.

(e)Approval by the shareholders of AINMT AS. Investor and Investor Parent will each use their commercial reasonable efforts to obtain any approvals required by applicable Law from the shareholders of Investor, Investor Parent or any of their Affiliates in connection with issuance of AINMT AS Shares. AINMT AS will call the AINMT AS Shareholders Meeting to be held within ten Business Days (or following any AINMT AS IPO, 20 Business Days) of the final determination of the AINMT Put Purchase Price in accordance with Section 2.2(c), and use commercial reasonable efforts to obtain any approvals required from the shareholders of AINMT AS, in each case in connection with any issuance of AINMT AS Shares required pursuant to this Section 2.2. The obligations of AINMT AS set out in the preceding sentence are (for the avoidance of doubt) subject to the fiduciary duties from time to time of its directors. For the avoidance of doubt, AINMT AS shall not be in breach of any obligation under Section 2.2 if compliance with such obligation would be in breach of its directors' fiduciary duties.

2.3. Investor Call Right. (a) Subject to NII Telecom not having served an AINMT Put Right Notice, during the Call Right Period Investor will have the right and option to purchase, and require NII to sell, all, but not less than all, of the Shares owned by NII Telecom and its Permitted Transferees

for the Call Purchase Price (on the terms and conditions set forth herein) (the “Call Right”). Investor may exercise the Call Right in accordance with Section 2.3(b) at any time during the 45-day periods commencing (i) on the day immediately following the termination of the First Put Right Period (if applicable) (the “First Call Right Period”) and (ii) the anniversary of the first day of the First Call Right Period, in the years 2019, 2020, 2021 and 2022 (each such period, including the First Call Right Period, the “Call Right Period”). If a Put Right Notice and a Call Right Notice are served on the same date, the Call Right Notice shall have priority and the Put Right Notice shall be of no effect.

(b) Exercise of the Call Right. Investor may exercise its Call Right at any time during the Call Right Period by giving written notice to NII Telecom (such notice, the “Call Right Notice” and the date of such notice, the “Call Right Exercise Date”). The Call Right Notice will contain the number of Shares that Investor is willing to purchase (the “Call Right Shares”) and Investor’s determination of the Call Purchase Price.

(c) Call Purchase Price. The “Call Purchase Price” for the Call Right Shares will be:

(i)for any Call Right exercised in the First Call Right Period, an amount in cash in U.S. dollars equal to the higher of (A) Fair Market Value of the Call Right Shares determined in accordance with Section 2.12 and (B) the NII Investment Amount multiplied by 1.2, payable either, at the option of NII Telecom (1) in cash, or (2) by issuance by AINMT AS of a number of AINMT AS Shares equal to the quotient of (x) the Call Purchase Price divided by (y) the AINMT AS Share Price.

(ii)for any Call Right exercised in any other Call Right Period, an amount in cash in U.S. dollars equal to the Fair Market Value of the Call Right Shares determined in accordance with Section 2.12 payable, at the option of Investor: (A) in cash, or (B) by issuance by AINMT AS of a number of AINMT AS Shares equal to the quotient of (1) the Call Purchase Price divided by (2) the AINMT AS Share Price.

(d) The date of the Call closing will be 20 Business Days following determination of the Call Purchase Price in accordance with Section 2.3(c) (the “Call Right Closing Date”). The purchase of the Call Right Shares will be expressly subject to the written waiver by Investor or fulfillment of the following conditions on or prior to the applicable Call Closing Date:

(i)Investor shall have received from NII Telecom, a duly executed instrument of assignment and any other documentation reasonably requested by Investor in order to confirm that such Call Right Shares, and all rights in respect thereof (including, without limitation, all economic and voting rights) are being transferred to Investor free and clear of all liens (other than those arising by virtue of this Agreement) and Investor shall have received from the Company, evidence of the updated shareholders register of the Company reflecting the transfer of NII Telecom’s Shares to Investor;

(ii)There shall not be any order of any Governmental Authority restraining or invaliding the transactions which are the subject of this Agreement;

(iii)The purchase and sale of the Call Right Shares would not violate any Laws applicable to Investor, NII Telecom or any Group Member; and

(iv)NII Telecom giving customary representations and indemnification in respect of due authorization, execution and delivery of any agreement entered into in connection with the sale of the Call Right Shares, its authority to enter into such agreement and consummate the transactions contemplated thereby without the consent or approval of any other Person, NII Telecom’s title to the Call Right Shares and its ability to convey title thereto free and clear of any liens, encumbrances or adverse claims (other than those arising by virtue of this Agreement).

2.4. Investor’s Right to Convert Its Shares.

(a)Without prejudice to its rights under Section 2.7, if Investor does not complete the Second Investor Capital Contribution, beginning on the date that is 12 months after the Option Expiration Date (subject to NII Stockholder Approval, if required), Investor shall have the right (but shall not be obligated to) to require NII Parent to issue, on the Conversion Closing Date, in exchange for all, but not less than all, of the Shares held by Investor and its Permitted Transferees at the Conversion Closing Date (the “Convertible Shares”), common stock of NII Parent (“NII Shares”), at Fair Market Value, on the terms of this Section 2.4 (such right, the “Conversion Right”), and may appoint an intermediary to hold such NII Shares.

(b)Exercise of the Conversion Right. Investor may exercise the Conversion Right, during the 90-day period immediately following the date that is 12 months following the Option Expiration Date, by giving a written notice to NII Telecom and NII Parent (such notice, the “Conversion Notice” and the date of such notice, the “Conversion Exercise Date”). The Conversion Notice will contain Investor’s determination of the Conversion Price.

(c)Conversion Price. The “Conversion Price” will be a number of freely tradable, fully paid and non-assessable shares of NII Parent (the “NII Shares”) equal to the quotient of (A) the Fair Market Value of the Shares held by Investor and its Permitted Transferees determined in accordance with Section 2.12 divided by (B) the NII Share Price, in each case net of all transfer taxes payable by the transferee in respect of the transfer of Shares held by Investor and its Permitted Transferees.

(d)Conversion Rights Terms and Conditions. The date of the Conversion Right Closing will be 10 Business Days following the later of (i) the final determination of the Conversion Price in accordance with Section 2.4(c), (ii) the date of which any mandatory regulatory conditions required in connection with such closing have been satisfied and (iii) the date of which any required NII Stockholder Approval has been obtained (the “Conversion Closing Date”). The purchase of all the Shares held by Investor and its Permitted Transferees pursuant to the Conversion Right will be expressly subject to the written waiver by NII Telecom or fulfillment of the following conditions on or prior to the Conversion Closing Date:

(i)NII Telecom shall have received from Investor and each of its Permitted Transferees that hold Shares, a duly executed instrument of assignment and any other documentation reasonably requested by NII Telecom in order to confirm that the Shares held by Investor and any of its Permitted Transferees, and all rights in respect thereof (including, without limitation, all economic and voting rights) are being transferred to NII Parent free and clear of all liens (other than those arising by virtue of this Agreement) and NII Telecom shall have received from the Company, evidence of the updated shareholders register of the Company reflecting the transfer of the Shares held by Investor and any of its Permitted Transferees to NII Parent;

(ii)There shall not be any order of any Governmental Authority restraining or invaliding the transactions which are the subject of this Agreement;

(iii)The purchase and sale of the Shares held by Investor would not violate any Laws applicable to NII Parent, NII Telecom or any Group Member;

(iv)Investor giving customary representations and indemnification in respect of due authorization, execution and delivery of any agreement entered into in connection with the sale of its Shares, its authority to enter into such agreement and consummate the transactions contemplated thereby without the consent or approval of any other Person, Investor’s title to its Shares and its ability to convey title thereto free and clear of any liens, encumbrances or adverse claims (other than those arising by virtue of this Agreement);

(v)NII Stockholder Approval being obtained in accordance with all applicable legal requirements; and

(vi)Investor entering into such customary lock-up, orderly market or other restrictions in respect of the Conversion Right where Investor receives NII Shares, as reasonably recommended by any investment bank retained by NII Parent in connection with the issue of the NII Shares.

(e)Approval by the shareholders of NII Parent. NII Telecom and NII Parent will each use their commercial reasonable efforts to obtain any approvals required by applicable Law from the shareholders of NII Telecom, NII Parent or any of their Affiliates in connection with issuance of NII Shares. NII Parent will prepare and send the necessary documentation and filings in order to call the NII Parent Stockholders Meeting within 20 Business Days of the final determination of the Conversion Price in accordance with Section 2.4(c), and use commercially reasonable efforts to obtain any approvals required by applicable Law from the shareholders of NII Parent, in each case in connection with any issuance of NII Shares required pursuant to this Section 2.4. The obligations of NII Parent set out in the preceding sentence are (for the avoidance of doubt) subject to the fiduciary duties from time to time of its directors. For the avoidance of doubt, NII Parent shall not be in breach of any obligation under Section 2.4 if compliance with such obligation would be in breach of its directors' fiduciary duties.

2.5. Right of First Refusal to Investor and (prior to Second Closing) Right of First Offer to NII Telecom on Transfers of Shares.

Right of First Refusal

(a)If NII Telecom desires to Transfer any Shares to any Person other than a Permitted Transferee, before Transferring any Shares NII Telecom will provide written notice (the “Sale Notice”) to Investor. The Sale Notice will state NII Telecom’s intention to effect such a Transfer, and will identify the proposed Transferee (the “Proposed Transferee”), the number of Shares proposed to be Transferred (the “Offered Shares”), the consideration to be paid for the Offered Shares (the “Offer Price”), and the other material terms and conditions of the proposed Transfer (which will include the obligation of the Proposed Transferee to execute a Joinder Agreement and assume and be bound by the obligations of this Agreement) and shall be accompanied by a copy of all material agreements entered into or to be entered into in connection with such proposed

Transfer. If the consideration consists in part or in whole of consideration other than cash, NII Telecom will provide such information, to the extent reasonably available to NII Telecom, relating to such consideration as Investor may reasonably request in order to evaluate such non-cash consideration. The Sale Notice shall require that the consummation of any sale of the Offered Shares to Investor occur on a date that is no less than 30 Business Days before, and no more than 60 Business Days after the later of (i) the date of the Sale Notice and (ii) the date on which all applicable third-party approvals have been unconditionally obtained.

(b)Upon receipt of the Sale Notice, Investor will have a non-transferable and irrevocable right to purchase, at the Offer Price and otherwise on the terms and conditions described in the Sale Notice, all (but not less than all) of the Offered Shares, and Investor will, within 20 Business Days from receipt of the Sale Notice, indicate to NII Telecom if it desires to purchase the Offered Shares by sending irrevocable written notice of such acceptance to NII Telecom to purchase the Shares and Investor will then be obligated to purchase the Shares on the terms and conditions set forth in the Sale Notice.

(c)If Investor does not exercise its option to purchase the Offered Shares and NII Telecom has not completed the sale of the Offered Shares to the Proposed Transferee described in Section 2.5(a) within six months from the date of the Sale Notice, then the provisions of this Section 2.5 will again apply, and NII Telecom will not Transfer or offer to Transfer such Shares without again complying with this Section 2.5.

(d)Upon exercise by Investor of its rights of first refusal under this Section 2.5, Investor and NII Telecom will be legally obligated to consummate the purchase contemplated thereby and will use their reasonable best efforts to comply as soon as reasonably practicable with all applicable Laws, to obtain all regulatory or other approvals required and to take all such other actions and to execute such additional documents as are reasonably necessary or appropriate in connection therewith and to consummate the purchase of the Offered Shares as promptly as practicable.

(e)The Company will take all reasonable steps necessary to assist and cooperate with Investor and NII Telecom to facilitate the Transfer of Offered Shares to Investor.

Right of First Offer (prior to Second Closing)

(f)If, from the Effective Date and prior to Second Closing, Investor wishes to transfer any of its Shares (other than to a Permitted Transferee, pursuant to Section 2.7 (Tag-Along) or if NII Telecom elects to, and does operate, the provisions of Section 2.8 (Drag Along)), then before Investor transfers any Shares, Investor shall give notice in writing (the "ROFO Transfer Notice") to NII Telecom of its desire to do so and it will not transfer such Shares unless the following procedures of this Section 2.5(f) to (h) have been observed.

(g)The ROFO Transfer Notice shall:

(i)specify the number and class of Shares proposed to be transferred (the "Offered Securities");

(ii)specify the price per Share at which Investor proposes to Transfer the Offered Securities (the "Prescribed Price");

(iii)state whether the ROFO Transfer Notice is conditional upon all (and not part only) of the Offered Securities being sold pursuant to the provisions of this Section 2.5(f) to (h); and

(iv)not be withdrawn except as provided in Section 2.5(h).

(h)NII Telecom shall have 20 days to agree and sign a binding sale and purchase agreement for the purchase of the Offered Securities from Investor. If no agreement is reached within this period, Investor may: (i) withdraw the ROFO Transfer Notice; or (ii) proceed with the transfer of the Offered Securities to a third party within 9 months at a price not lower than the Prescribed Price and otherwise on not materially worse terms for Investor than those offered by NII Telecom to Investor.

2.6. Right of First Refusal with Respect to Opco. (a) If the Company or the Shareholders desire to Transfer all or substantially all of Opco’s business or assets to any proposed Transferee (which must be an unaffiliated third Person) (the “Proposed Opco Transferee”), at such time, the Company will provide a sale notice (the “Opco Sale Notice”) to Investor for so long as Investor’s Applicable Ownership Percentage is at least 20%. The Opco Sale Notice will state the Company’s intention to effect such a Transfer, and will identify the Proposed Opco Transferee, a description of the proposed Transfer (the “Proposed Transaction”), the proposed purchase price (the “Proposed Purchase Price”) for the Proposed Transaction and the other material terms and conditions of the Proposed Transaction, and shall be accompanied by a copy of all material agreements entered into or to be entered into in connection with the Proposed Transaction. If the consideration consists in part or in whole of consideration other than cash, the Company will provide such information, to the extent reasonably available, relating to such consideration as Investor may reasonably request in order to evaluate such non-cash consideration. The Opco Sale Notice shall require Investor to consummate the Proposed Transaction (if at all) no less than 30 Business Days before, and no more than 60 Business Days after the later of (i) the date of the Opco Sale Notice and (ii) the date on which all applicable third-party approvals have been unconditionally obtained and all closing conditions have been fulfilled.

(b) Upon receipt of the Opco Sale Notice, Investor will have a non-transferable and irrevocable right to purchase, at the Proposed Purchase Price and otherwise on the terms and conditions described in the Opco Sale Notice, all (but not less than all) of the assets included in the Proposed Transaction, and Investor will, within 20 Business Days from receipt of the Opco Sale Notice, indicate to the Company if it desires to take the place of the Proposed Opco Transferee by sending a written notice of acceptance and such Investor will then be obligated to consummate the Proposed Transaction on the terms and conditions set forth in the Opco Sale Notice.

(c) If Investor does not exercise its right of first refusal under this Section 2.6, and the Company has not consummated the Proposed Transaction with the Proposed Opco Transferee within six months from the date of the Opco Sale Notice or the drop-dead date set forth in the underlying acquisition agreement, whichever is later, then the provisions of this Section 2.6 will again apply, and the Company may not consummate or offer the Proposed Transaction without again complying with this Section 2.6.

(d) Upon exercise by an Investor of its rights of first refusal under this Section 2.6, such Investor will be legally obligated to consummate the Proposed Transaction and will use its

reasonable best efforts to comply as soon as reasonably practicable with all applicable Laws, to obtain all regulatory or other approvals required and to take all such other actions and to execute such additional documents as are reasonably necessary or appropriate in connection therewith and to consummate the Proposed Transaction as promptly as practicable.

2.7. Tag-Along Rights. (a) Subject to first complying with the provisions of Section 2.5, as applicable, if (i) between the Effective Date and the Second Closing (if any), NII Telecom (and/or any of its Permitted Transferees) enters into a binding agreement to Transfer such number of its Shares to a Person as would cause NII Telecom’s Applicable Ownership Percentage to be less than 50%, or (ii) after the Effective Date NII Telecom, NII Parent, any member of the Retained NII Group or any of NII Parent’s stockholders enters into a binding agreement as would cause an NII Change of Control as a result of a transfer or issuance of shares or stock in the capital of NII Parent or any member of the Retained NII Group to any Person, or, (iii) from and after the Second Closing (if any), Investor and/or any of its Permitted Transferees) enters into a binding agreement to Transfer any of its Shares to another Person (each of the Persons described in clauses (i), (ii) and (iii) above, other than NII Telecom and Investor, a “Proposed Tag-Along Transferee”, and such proposals a “Tag-Along Transaction”), the applicable Shareholder entering into such binding agreement (being NII Telecom, the member of the Retained NII Group and/or NII Parent in case of (ii) above) (the “Transferring Shareholder”) will provide written notice of such Tag-Along Transaction (the “Tag-Along Notice”) to the Company and to the Other Shareholders in the manner set forth in this Section 2.7. Such Tag-Along Notice will identify the Proposed Tag-Along Transferee, the number of Shares (or shares or stock in NII Parent or the relevant member of the Retained NII Group if applicable) proposed to be purchased from the Transferring Shareholder (or, if applicable, purchased from or issued to NII Parent’s stockholders in case of (ii) above) (or if greater, the number of Shares such Proposed Tag-Along Transferee is willing to purchase), the Tag-Along Ratio (as defined below if applicable), the consideration offered and any other material terms and conditions of the Tag-Along Transaction, and the price to be offered to the Other Shareholders for their Shares shall be calculated in accordance with Section 8.2 of the Articles. If the offer price consists in part or in whole of consideration other than cash, the Transferring Shareholder will provide such information, to the extent reasonably available to the Transferring Shareholder, relating to such consideration as the Other Shareholders may reasonably request in order to evaluate such non-cash consideration.

(b)The Other Shareholders will have the right, exercisable as set forth below, to accept the Tag-Along Transaction for the number of Shares determined pursuant to Section 2.7(d) (and if the Other Shareholders have provided an Exercise Notice in accordance with this Section 2.7 such Tag-Along Transaction will not complete unless, subject to the Other Shareholder’s compliance with this Section 2.7, such Tag-Along Transaction includes the transfer of the Other Shareholder’s Shares to the Proposed Tag-Along Transferee on the terms of this Section 2.7). The Other Shareholders may elect to exercise their right, within 10 Business Days after receipt of the Tag-Along Notice from the Transferring Shareholder, by providing the Transferring Shareholder with an irrevocable written notice specifying the number of Shares each such Other Shareholder agrees to Transfer (the “Exercise Notice”), which number will not exceed the number as contemplated above, and will simultaneously provide a copy of such Exercise Notice to the Company. If the Other Shareholders do not accept the Tag Along Offer within 10 Business Days following receipt by delivering an Exercise Notice in accordance with this Section 2.7(b), it will be deemed to have irrevocably waived any and all rights under this Section 2.7 with respect to the Transfer of Shares pursuant to such Tag-Along Transaction. Delivery of the Exercise Notice by the Other Shareholders will constitute an irrevocable acceptance of the Tag-Along Transaction by such Other Shareholders for the number of Shares determined in accordance with Section 2.7(d) at the

price and on the terms and conditions specified as being offered to Transferring Shareholder in the Tag-Along Transaction. In case of a Tag-Along Transaction pursuant to Section 2.7(a)(ii), the price offered to Investor for its Shares to be sold as part of the Tag-Along Transaction (the “Investor Tagged Shares”) shall be the Fair Market Value of the Investor Tagged Shares determined in accordance with Section 2.12.

(c)If the Other Shareholders have accepted the Tag-Along Transaction, then not less than 10 Business Days prior to the proposed date of any sale (or issuance, if applicable) pursuant to a Tag-Along Transaction, the Transferring Shareholder will notify the Other Shareholders of such proposed date. Not less than two Business Days prior to such proposed date, such Other Shareholders will deliver to the Company to hold in escrow all documents required to be executed in connection with such Tag-Along Transaction.

(d)The Other Shareholders will have the right to Transfer (and the Transferring Shareholder will, to the extent necessary, reduce the amount or number of Shares to be sold by the Transferring Shareholder by a corresponding amount), pursuant to the Tag-Along Transaction: (A) in the case of Section 2.7(a)(i) and (iii) above, a number of Shares that is equal to the product of (i) the total number of Shares offered to be purchased as set forth in such Tag-Along Transaction and (ii) a fraction (the “Tag-Along Ratio”), the numerator of which will be the aggregate number of Shares held by such Other Shareholders and the denominator of which will be the aggregate number of Shares at issue; and (B) in the case of Section 2.7(a)(ii) above, all of the Shares held by Investor.

(e)The Transferring Shareholder will have 30 days after all conditions to the closing of the Transfer of the Shares to be sold pursuant to the Tag-Along Transaction and the Shares of the Other Shareholders that it is bound to Transfer following delivery of an Exercise Notice have been satisfied or waived (the “Tag-Along Period”) in which to consummate the Transfer of such Shares at the price and on the terms contained in such notice; provided, however, that the amount and nature of the consideration payable for the Shares contained in such notice may only be materially modified during the Tag-Along Period to the extent mutually agreed in writing by the Transferring Shareholder and the Other Shareholders. If, at the end of the Tag-Along Period, the Transferring Shareholder has not completed such Transfer (for any reason other than the failure of the Other Shareholders to perform their obligations under this Section 2.7), such Other Shareholders shall cease to be bound to sell their Shares pursuant to the Tag-Along Offer; provided that the Transferring Shareholder may serve another Tag-Along Notice in respect of such proposed Transfer and shall be free to consummate such Transfer subject to complying again with the provisions of this Section 2.7. Notwithstanding anything in this Agreement to the contrary, all Shareholders will participate in all escrow arrangements, promissory notes, holdbacks, reserves or escrows agreed to by the Transferring Shareholder, contingent payments, working capital adjustments and any other similar arrangements ratably on the basis of their respective percentage holding of shares and will be entitled to receive its portion, in accordance with the economic entitlement of the Shares held by such Shareholder under Articles, of such sums from any such escrow arrangements, promissory notes, holdbacks, reserves or escrows, contingent payments, working capital adjustments and other similar arrangements if and when the Transferring Shareholder receives such payments.

(f)If the Other Shareholders have accepted the Tag Along Transaction, the Other Shareholders shall pay their pro rata share (based on the total proceeds allocable to such Other Shareholders from the sale pursuant to this Section 2.7) of the total costs and expenses (including

attorneys’ fees) incurred by them and by the Transferring Shareholder in connection with the consummation of the transactions described in a Tag-Along Notice and such shares of costs and expenses may be deducted from any amounts otherwise payable to such Other Shareholders in connection with such Transfer.

(g)Notwithstanding anything contained in this Section 2.7, there will be no liability on the part of the Transferring Shareholder to the Other Shareholders if the Transfer of Shares pursuant to this Section 2.7 is not consummated for whatever reason. The determination of whether or not to effect a Transfer of Shares pursuant to this Section 2.7 is in the sole and absolute discretion of the Transferring Shareholder.

(h)If the Other Shareholders fail to close any transaction as to which it they have delivered an Exercise Notice then, without limiting any other rights or obligations of the Parties, such Other Shareholders will no longer have any rights (but will be subject to all limitations and obligations) under this Section 2.7.

(i)The Other Shareholders will effect any Transfer in connection with a Tag-Along Transaction in which they participate, and, if requested by the Proposed Tag-Along Transferee making the Tag-Along Transaction, will enter into agreements with the Proposed Tag-Along Transferee containing terms and conditions relating to the Tag-Along Transaction that are the same as the terms and conditions applicable to the Transferring Shareholder in connection with the Tag-Along Transaction and in accordance with the terms of the proposed transaction as set forth in the Tag-Along Notice.

2.8. Drag-Along Rights. (a) If, (i) between the Effective Date and the Second Closing (if any), NII Telecom proposes to Transfer all of the Shares to a third party, or, (ii) from and after the Second Closing (if any) Investor proposes to Transfer Shares to a third party and such Transfer would result in a Change of Control (each of the third parties described in clauses (i) and (ii) above, a “Proposed Drag-Along Transferee” and, such proposal, a “Drag-Along Disposition”), the proposing Shareholder (the “Dragging Shareholder”) will have the right (a “Drag-Along Right”) at any time to require each Other Shareholder to participate in such Drag-Along Disposition with such Proposed Drag-Along Transferee by selling the same proportion of such other Shareholder’s Shares as is equal to the proportion of the Dragging Shareholder’s Shares being sold under the Drag-Along Disposition on the same terms and conditions and in the same ratio as are set forth in the written notice provided to the Other Shareholders given not less than 30 days prior to the closing of the transactions contemplated by the proposed Drag-Along Disposition in accordance with Section 2.8(b) (the “Drag-Along Notice”); provided, that where the Dragging Shareholder is NII Telecom, NII Telecom shall only be entitled to exercise its Drag-Along Right either: (i) where Investor achieves the Investor Drag Threshold pursuant to the Drag-Along Disposition; or (ii) where the condition in (i) is not met, if NII Telecom pays to Investor, at the same time as the transfer of the Shares by Investor under the terms of set out in this Section 2.8, an amount in immediately available cash or, if applicable, such Marketable Securities received by NII Telecom pursuant to the Drag-Along Disposition (in the same proportion as received by NII Telecom) equal to the difference between (i) the amount required to satisfy the Investor Drag Threshold and (ii) the consideration received by Investor for the transfer of their Shares on the terms of set out in this Section 2.8. Each Shareholder transferring Shares pursuant to this Section 2.8 will pay its pro rata share (based on the total proceeds allocable to such Shareholder from the sale pursuant to this Section 2.8) of the costs and expenses (including attorneys’ fees) incurred by the Dragging Shareholder and the

Company in connection with such Drag-Along Disposition. The consideration payable to the Other Shareholders pursuant to any Proposed Drag-Along Disposition shall only take the form of cash or Marketable Securities. If the consideration payable to the Dragging Shareholder takes the form of cash and/or Marketable Securities, such Dragging Shareholder may at its option elect that the Other Shareholders transferring their Shares in the Drag-Along Disposition shall receive cash in lieu of such Marketable Securities.

(b)The Drag-Along Notice will set forth: (i) the name and address of the Proposed Drag-Along Transferee, (ii) the proposed terms and conditions of the Drag-Along Disposition, and (iii) the allocation of the proposed purchase price as among the Shareholders with respect to each of their holdings of Shares, such price being calculated in accordance with Section 8.2 of the Articles, it being understood and agreed that such proposed purchase price and proposed terms and conditions may change in the course of negotiations and the Dragging Shareholder will use reasonable efforts to keep the Other Shareholders apprised of any such changes.

(c)The Other Shareholders will cooperate in effecting any Drag-Along Disposition in which any of them participates, and, if requested by the Proposed Drag-Along Transferee, will enter into agreements with the Proposed Drag-Along Transferee containing terms and conditions relating to the Drag-Along Disposition that are the same as the terms and conditions applicable to the Dragging Shareholder in connection with the Drag-Along Disposition; provided, however, that the representations and indemnification obligations of each such Other Shareholder in any such agreements will be limited to due authorization, execution and delivery of any agreement entered into in connection with such Drag-Along Disposition, its authority to enter into such agreement and consummate the transactions contemplated thereby without the consent or approval of any other Person, such Other Shareholder’s title to its Shares and its ability to convey title thereto free and clear of any liens, encumbrances or adverse claims (other than those arising by virtue of this Agreement). Notwithstanding anything in this Agreement to the contrary, all Shareholders will participate in all escrow arrangements, promissory notes, holdbacks, reserves or escrows agreed to by Investor, contingent payments, working capital adjustments and any other similar arrangements ratably on the basis of their respective percentage holding of shares and will be entitled to receive its portion, in accordance with the Articles, of such sums from any such escrow arrangements, promissory notes, holdbacks, reserves or escrows, contingent payments, working capital adjustments and other similar arrangements if and when Investor receives such payments.

(d)The Dragging Shareholder will notify the Other Shareholders of the date set for consummation of the Transfers of the Shares to the Proposed Drag-Along Transferee pursuant to this Section 2.8 (the “Drag-Along Closing Date”) as soon as reasonable practicable after such date becoming set and in any event not less than 20 Business Days before such date. On the Drag-Along Closing Date, in addition to any other terms of Transfer as provided in the Drag-Along Notice, the Dragging Shareholder and each Other Shareholder will deliver to the Proposed Drag-Along Transferee (i) documentation representing the Transfer of the Shares which, upon delivery to the Proposed Drag-Along Transferee, will vest in the Proposed Drag-Along Transferee good and valid title to the Shares to be Transferred, free and clear of all liens (other than those arising by virtue of this Agreement) and (ii) duly executed instrument of assignment, against delivery by the Proposed Drag-Along Transferee of all of the consideration, net of all expenses allocated pro rata amongst the Shareholders, to be received by each such Shareholder, as provided in the Drag-Along Notice. Upon notice of the consummation of the Transfers to the Proposed Drag-Along Transferee, the Company will also cause such Transfers to be reflected on the books of the Company.

2.9. Provisions Applicable to Tag-Along/Drag-Along Rights. The provisions of Sections 2.7 and 2.8 will apply to any Transfer for value to any Proposed Tag-Along Transferee or Proposed Drag-Along Transferee (as applicable), including by way of merger, consolidation, recapitalization or other sale transaction.

2.10. Improper Transfer. (a) Any attempt to Transfer any Shares not in compliance with this Agreement will be null and void and of no force or effect and neither the Company nor any transfer agent of the Company will register, or otherwise recognize in the Company’s records, any such improper Transfer.

(b) No Shareholder will enter into any transaction or series of transactions for the purpose or with the effect of, directly or indirectly, denying or impairing the rights or obligations of any Person under this Article II, and any such transaction will be null and void and, to the extent that such transaction requires any action by an Company, it will not be registered or otherwise recognized in the Company’s records or otherwise.

2.11. Certain Participation Rights. (a) Except for an issuance of New Securities to Investor or its Affiliates in connection with an Emergency Funding Situation, the Company will not issue any New Securities without offering by notice given to all Shareholders concurrently with such issuance, the right to purchase such Shareholder’s pro rata share of such New Securities on the same terms as such New Securities are to be issued. Any Shareholder that does not, within 15 days after receiving any notice referred to in the preceding sentence, irrevocably agree to purchase in full such Shareholder’s share of the New Securities referenced in such notice will be deemed to have irrevocably waived any and all rights under this Section 2.11 to purchase such New Securities. The procedures for the acceptance of any such offer and the closing of any such issuance will be determined by the Board. For purposes of this Section 2.11, a Shareholder’s pro rata share of New Securities is the ratio of (a) the sum of the total number of Shares owned by such Shareholder immediately prior to the issuance of the New Securities (assuming full conversion of all outstanding Preferred Shares, and the exercise of all outstanding rights, options and warrants to purchase Shares, held by such Shareholder), to (b) the total number of Shares issued and outstanding immediately prior to the issuance of the New Securities (assuming full conversion of all outstanding Preferred Shares, and the exercise of all outstanding rights, options and warrants to purchase Shares, held by all Shareholders). In the event that any Shareholder does not elect to purchase its allotment of the New Securities in full, then each other Shareholder who has elected to purchase a number of New Securities in excess of its allotment will have the right to purchase those New Securities which such Shareholder elected not to purchase, which such unsubscribed shares will be allocated among all overallotment offerees pro rata (up to the number of New Securities specified in such offeree’s notice) based on the number of Securities held by such overallotment offerees immediately prior to receipt of such written notice from the Company; provided, however, that no such offeree will be required to purchase more than the number of New Securities specified in its election notice.

(b)Where there has been an issuance of New Securities in connection with an Emergency Funding Situation, a Shareholder who has not been issued its pro rata share of New Securities concurrently with such issuance of New Securities may within 60 days of such issue (of which the Company will provide to each such Shareholder at the time of issuance) elect to purchase in full such Shareholder’s pro rata share of the New Securities from the other Shareholders to whom they were issued rather than directly from the Company. A purchase pursuant to this Section

2.11(b) will be on the same terms as the issuance of the New Securities pursuant to the Emergency Funding Situation.

2.12. Fair Market Value. (a) The “Fair Market Value” of the Call Right Shares, the AINMT Put Right Shares, the Investor Tagged Shares or the Convertible Shares will be determined in accordance with this Section 2.12.

(b)Each of (i) Investor and (ii) NII Telecom shall appoint a reputable international investment bank as Valuer to establish Fair Market Value as at the date of certification of Fair Market Value by that Valuer.