UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| T | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009 |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ____ TO ____ |

Commission file number 0-24393

AURORA GOLD CORPORATION

(Exact Name of registrant as specified in its charter)

| Delaware | 13-3945947 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

Baarerstrasse 10, 1st Floor, Zug, Switzerland | 6300 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (+41) 7887-96966

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12 (g) of the Exchange Act:

| Common stock, par value $0.001 per share | Pink Sheets |

| Title of each class | Name of each exchange on which registered |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes T No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes T No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

T Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

T Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o Yes T No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer: o | Accelerated Filer: o |

Non-accelerated filer: o (Do not check if a smaller reporting company) | Smaller reporting company: T |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yes T No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

$14,145,830 as of June 30, 2009.

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 68,408,522 shares of Common Stock were outstanding as of March 31, 2010.

| Part I | |

| | | |

| Item 1. | | 4 |

| Item 1A | | 7 |

| Item 1B | | 11 |

| Item 2 | | 11 |

| Item 3 | | 18 |

| Item 4 | | 18 |

| | | |

| PART II | |

| | | |

| Item 5 | | 18 |

| Item 6 | | 19 |

| Item 7 | | 19 |

| Item 7A | | 27 |

| Item 8 | | 28 |

| Item 9 | | 29 |

| Item 9A | | 29 |

| Item 9B | | 32 |

| | | |

| PART III | |

| | | |

| Item 10 | | 32 |

| Item 11 | | 35 |

| Item 12 | | 37 |

| Item 13 | | 38 |

| Item 14 | | 39 |

| | | |

| PART IV | |

| | | |

| Item 15 | | 40 |

| | | |

| | | 44 |

PART I

This annual report contains statements that plan for or anticipate the future and are not historical facts. In this Report these forward looking statements are generally identified by words such as “anticipate,” “plan,” “believe,” “expect,” “estimate,” and the like. Because forward-looking statements involve future risks and uncertainties, these are factors that could cause actual results to differ materially from the estimated results. These risks and uncertainties are detailed in Item 1. “Description of Business,” Item 2. “Description of Properties,” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Item 8. “Financial Statements” and Item. 13 “Certain Relationships and Related Transactions and Director Independence”.

The Private Securities Litigation Reform Act of 1995, which provides a “safe harbor” for such statements, may not apply to this Report.

Business Development

We were incorporated under the laws of the State of Delaware on October 10, 1995, under the name "Chefs Acquisition Corp." Initially formed for the purpose of engaging in the food preparation business, we redirected our business efforts in late 1995 following a change of control, which occurred on October 30, 1995, to the acquisition, exploration and, if warranted, the development of mineral resource properties. We changed our name to “Aurora Gold Corporation” on August 20, 1996 to more fully reflect our resource exploration business activities.

Our general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. Our continued operations and the recoverability of mineral property costs is dependent upon the existence of economically recoverable mineral reserves, confirmation of our interest in the underlying properties, our ability to obtain necessary financing to complete the development and upon future profitable production.

Since 1996 we have acquired and disposed of a number of properties. We have not been successful in any of our exploration efforts to establish reserves on any of the properties that we owned or in which we have or have had an interest.

We currently have interest in four (4) properties none of which contain any reserves. Please refer to “Description of Properties.” We have no revenues, have sustained losses since inception, have been issued a going concern opinion by our auditors and rely upon the sale of our securities to fund operations. We will not generate revenues even if any of our exploration programs indicate that a mineral deposit may exist on our properties. Accordingly, we will be dependent on future financings in order to maintain our operations and continue our exploration activities.

We have not been involved in any bankruptcy, receivership or similar proceedings.

Our Principal Products and Their Markets

We are a junior mineral exploration company. Our strategy is to concentrate our investigations into: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities.

We are currently concentrating our property exploration activities in Brazil and Canada. We are also examining data relating to the potential acquisition of other exploration properties in the United States of America (the “USA”), Latin America and South America.

Our properties are in the exploration stage only and are without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors. Please refer to “Item 1A Risk Factors”

Significant Developments in fiscal 2009 and Subsequent Events

For the year ended December 31, 2009 we recorded exploration expenses of $67,973 compared to $77,273 in fiscal year 2008. The following is a breakdown of the exploration expenses by property: Brazil $65,956 (2008 - $74,723) and Canada, Kumealon property $2,017 (2008 - $2,550).

In September 2009, 3,000,000 common shares were authorized for issuance at $0.10 per share for cash proceeds of $300,000. The shares were physically issued in January 2010 to individuals and companies who reside outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). The Company’s agent was paid a commission of 420,000 shares of common stock of the Company. The shares were physically issued to the agent in January 2010.

In September 2009, convertible notes payable and related accrued interest aggregating $739,152 (AUD $850,479) were settled through the issuance of 5,000,000 shares of common stock of the Company. The shares were issued to a company who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder).

In November 2009, 100,000 shares were authorized for issuance in connection with debt settlements at $0.18 per share. The shares were physically issued in January 2010 to a company who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder).

In November 2009, 150,000 shares were authorized for issuance in connection with debt settlements at $0.24 per share. The shares were physically issued in January 2010 to a company who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder).

In November 2009, the Company signed a letter agreement with Global Minerals Limited which was subsequently amended on February 24, 2010, to acquire an initial 70% interest in the Front Range Gold Project located in Boulder County, Colorado. The Company paid $100,000 on signing the letter agreement. A further $400,000 is due on signing of the formal agreement on or before April 12, 2010.

In December 2009, 1,666,667 common shares were authorized for issuance at $0.30 per share for net cash proceeds of $500,000. The shares were physically issued in January 2010 to an individual who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder).

In January 2010, the Company received four (4) advances totalling $1,350,000. The advances are non-interest bearing and due on demand.

Distribution Methods of Our Products and Services

We are a mineral exploration company and are not in the business of distributing any products or services.

Status of Any Publicly Announced New Product or Service

We have no plans for new products or services that we do not already offer.

Competitive Business Conditions and Our Competitive Position in the Industry and Methods of Competition

Vast areas of Brazil have been explored and in some cases staked through mineral exploration programs. Vast areas also remain unexplored. The cost of staking and re-staking new mineral claims and the costs of most phase one exploration programs are relatively modest. Additionally, in many more prospective areas, extensive literature is readily available with respect to previous exploration activities. These facts make it possible for a junior mineral exploration company such as ours to be very competitive with other similar companies. We are also competitive with senior companies who are doing grass roots exploration. In the event our exploration activities uncover prospective mineral showings, we anticipate being able to attract the interest of better financed industry partners to assist on a joint venture basis in more extensive exploration. We are at a competitive disadvantage compared to established mineral exploration companies when it comes to being able to complete extensive exploration programs on claims which we hold or may hold in the future. If we are unable to raise capital to pay for extensive claim exploration, we will be required to enter into joint ventures with industry partners which will result in our interest in our claims being substantially diluted.

Management of our company remains committed to building a portfolio of mineral exploration properties principally through their own efforts. We are one small company in a large competitive industry with many other junior exploration companies who are evaluating and re-evaluating prospective mineral properties in Brazil.

Sources and Availability of Raw Materials and the Names of Principal Suppliers

As a mineral exploration company, we do not require sources of raw materials and do not have principal suppliers in the way which applies to manufacturing companies. Our raw materials are, in effect, mineral exploration properties which we may stake or acquire from third parties. Our management team seeks to assemble a portfolio of quality mineral exploration properties in Brazil and the USA. Initially, we will operate in the field with our president, Technical director and various consultants on an as needed basis. This will enable us to assemble a portfolio of properties through grass roots exploration and staking. We will also acquire new properties through option agreements when the new properties can be acquired on favorable terms.

Dependence on One or a Few Major Customers

We are in the business of mining exploration. We are not selling any product or service and therefore have no dependence on one or a few major customers.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts, Including Duration

Our Company does not own any patents or trademarks. We are not party to any labor agreements or contracts. Licenses, franchises, concessions and royalty agreements are not part of our business.

Need for any government approval of principal products or services

As a mineral exploration company, we are not in a business which requires extensive government approvals for principal products or services. The Department National Production Minerals (DNPM) of Brazil outlines and governs the work that can be done on mining claims in Brazil.

In the event mining claims which we acquire in the future prove to host viable ore bodies, we would likely sell or lease the deposit to a company whose business is the extraction and treatment of ore. This company would undertake the sale of metals or concentrates and pay us a net smelter royalty as specified in a future lease agreement. All responsibility for government approvals pertaining to mining methods, environmental impacts and reclamation would be the responsibility of this contractor. All costs to obtain the necessary government approvals would be factored into technical and viability studies in advance of a decision being made to proceed with development of an ore body.

The mining industry in Brazil is highly regulated. Our president and Technical director have extensive industry experience and are familiar with government regulations respecting the initial acquisition and early exploration of mining claims in Brazil. The Company is required under law to meet government standards relating to the protection of land and waterways, safe work practices and road construction. We are unaware of any proposed or probable government regulations which would have a negative impact on the mining industry in Brazil. We propose to adhere strictly to the regulatory framework which governs mining operations in Brazil.

Effect of existing or probable governmental regulations on our business.

Management is unaware of any existing or probable government regulations which would have a positive or negative impact on our company's business.

Costs and effects of compliance with environmental laws (federal, state and local)

At the present time, our costs of compliance with environmental laws are minimal. In the event that claims which we may acquire in the future host a viable ore body, the costs and affects of compliance with environmental laws will be incorporated in the exploration plan for these claims. These exploration plans will be prepared by qualified mining engineers.

Number of total employees and number of full time employees

As of March 31, 2010 we had five (5) part time employees.

We are an exploration stage company and have incurred substantial losses since inception.

We have never earned any revenues. In addition, we have incurred net losses of $15,471,179 for the period from our inception (October 10, 1995) through December 31, 2009 and, based upon our current plan of operation, we expect that we will incur losses for the foreseeable future.

Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such companies. We are subject to all of the risks inherent to an exploration stage business enterprise, such as limited capital, no defined mineral deposits on our properties, lack of manpower, and possible cost overruns associated with our exploration programs. Potential investors must also weigh the likelihood of success in light of any problems, complications, and delays that may be encountered with the exploration of our properties.

Because we are small and do not have much capital, we must limit our exploration activity. As such we may not be able to complete an exploration program that is as thorough as we would like. In that event, an existing ore body may go undiscovered. Without an ore body, we cannot generate revenues and you will lose your investment.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our independent registered public accounting firm has issued its report, which includes an explanatory paragraph for going concern uncertainty on our consolidated financial statements as of and for the year ended December 31, 2009. Because we have not yet generated revenues from our operations our ability to continue as a going concern is currently heavily dependent upon our ability to obtain additional financing to sustain our operations. Such financing may take the form of the issuance of common or preferred stock or debt securities, or may involve bank financing. Although we have completed several equity financings, the fact that our auditors have issued a “going concern” opinion may hinder our ability to obtain additional financing in the future. Currently, we have no commitments to obtain any additional financing, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all.

Because we do not have any revenues, we expect to incur operating losses for the foreseeable future.

We have never generated revenues and we have never been profitable. Prior to completing exploration on our mineral properties, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. If we are unable to generate financing to continue the exploration of our properties, we will fail and you will lose your entire investment in this offering.

None of the properties in which we have an interest or the right to earn an interest have any known reserves.

We currently have an interest or the right to earn an interest in four (4) properties, none of which have any reserves. Based on our exploration activities through the date of this Prospectus, we do not have sufficient information upon which to assess the ultimate success of our exploration efforts. If we do not establish reserves we may be required to curtail or suspend our operations, in which case the market value of our common stock may decline and you may lose all or a portion of your investment.

We have only completed the initial stages of exploration of our properties, and thus have no way to evaluate whether we will be able to operate our business successfully. To date, we have been involved primarily in organizational activities, acquiring interests in properties and in conducting preliminary exploration of properties. We have not earned any revenues and have not achieved profitability as of the date of this Prospectus.

We are subject to all the risks inherent to mineral exploration, which may have an adverse affect on our business operations.

Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. If we are unsuccessful in addressing these risks, our business will likely fail and you will lose your entire investment.

We are subject to the numerous risks and hazards inherent to the mining industry and resource exploration including, without limitation, the following:

| | · | interruptions caused by adverse weather conditions; |

| | · | unforeseen limited sources of supplies resulting in shortages of materials, equipment and availability of experienced manpower. |

The prices and availability of such equipment, facilities, supplies and manpower may change and have an adverse effect on our operations, causing us to suspend operations or cease our activities completely.

It is possible that our title for the properties in which we have an interest will be challenged by third parties.

We have not obtained title insurance for our properties. It is possible that the title to the properties in which we have our interest will be challenged or impugned. If such claims are successful, we may lose our interest in such properties.

Our failure to compete with our competitors in mineral exploration for financing, acquiring mining claims, and for qualified managerial and technical employees will cause our business operations to slow down or be suspended.

Our competition includes large established mineral exploration companies with substantial capabilities and with greater financial and technical mineralized materials than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We may also compete with other mineral exploration companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration programs may be slowed down or suspended.

Compliance with environmental regulations applicable to our operations may adversely affect our capital liquidity.

All phases of our operations in Brazil and Canada, where our properties are located, will be subject to environmental regulations. Environmental legislation in Brazil and Canada is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. It is possible that future changes in environmental regulation will adversely affect our operations as compliance will be more burdensome and costly.

Because we have not allocated any money for reclamation of any of our mining claims, we may be subject to fines if the mining claims are not restored to its original condition upon termination of our activities.

Our directors may face conflicts of interest in connection with our participation in certain ventures because they are directors of other mineral mineralized material companies.

Mr. Montgomery, who in addition to Mr. Pearl, serves as a director, may also be a director of other companies (including mineralized material exploration companies) and, if those other companies participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. It is possible that due to our directors’ conflicting interests, we may be precluded from participating in certain projects that we might otherwise have participated in, or we may obtain less favorable terms on certain projects than we might have obtained if our directors were not also directors of other participating mineral mineralized materials companies. In an effort to balance their conflicting interests, our directors may approve term s equally favorable to all of their companies as opposed to negotiating terms more favorable to us but adverse to their other companies. Additionally, it is possible that we may not be afforded certain opportunities to participate in particular projects because those projects are assigned to our directors’ other companies for which the directors may deem the projects to have a greater benefit

Our future performance is dependent on our ability to retain key personnel, loss of which would adversely affect our success and growth.

Our performance is substantially dependent on performance of our senior management. In particular, our success depends on the continued efforts of Mr. Pearl. The loss of his services could have a material adverse effect on our business, results of operations and financial condition as our potential future revenues would most likely dramatically decline and our costs of operations would rise. We do not have employment agreements in place with any of our officers or our key employees, nor do we have key person insurance covering our employees.

The value and transferability of our shares may be adversely impacted by the limited trading market for our shares.

There is only a limited trading market for our common stock on the Pink Sheets. This may make it more difficult for you to sell your stock if you so desire.

Our common stock is a penny stock and because "penny stock” rules will apply, you may find it difficult to sell the shares of our common stock.

Our common stock is a “penny stock” as that term is defined under Rule 3a51-1 of the Securities Exchange Act of 1934. Generally, a "penny stock" is a common stock that is not listed on a national securities exchange and trades for less than $5.00 a share. Prices often are not available to buyers and sellers and the market may be very limited. Penny stocks in start-up companies are among the riskiest equity investments. Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by the Securities and Exchange Commission. The document provides information about penny stocks and the nature and level of risks involved in investing in the penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information re garding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser's written agreement to the purchase. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also may affect the ability of purchasers of our stock to sell their shares in the secondary market. It may also cause fewer broker dealers to make a market in our stock.

Many brokers choose not to participate in penny stock transactions. Because of the penny stock rules, there is less trading activity in penny stock and you are likely to have difficulty selling your shares.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, Financial Industry Regulatory Authority (the “FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to r ecommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Future sales of shares by us may reduce the value of our stock.

If required, we will seek to raise additional capital through the sale of our common stock. Future sales of shares by us could cause the market price of our common stock to decline and may result in further dilution of the value of the shares owned by our stockholders.

Not Applicable.

| Item 2. | Description of Properties |

Office Premises

We conduct our activities from our principal and technical office located at Baarerstrasse 10, 1st Floor, Zug, 6300, Switzerland. These offices are provided to us on a month to month basis. We believe that these offices are adequate for our purposes. We do not own any real property. Management believes that this space will meet our needs for the next 12 months.

Mining Properties

Our properties are in the preliminary exploration stage and do not contain any known bodies of ore.

We conduct exploration activities from our principal and technical office located at Baarerstrasse 10, 1st Floor, Zug, 6300, Switzerland. The telephone number is (+41) 7887-96966. We believe that these offices are adequate for our purposes and operations.

Our strategy is to concentrate our efforts on: (i) existing operations where an infrastructure already exists; (ii) properties presently being developed and/or in advanced stages of exploration which have potential for additional discoveries; and (iii) grass-roots exploration opportunities.

We are currently concentrating our property exploration activities in Brazil and Canada. We are also examining data relating to the potential acquisition of other exploration properties in Latin America, South America.

Our properties are in the exploration stage only and are without a known body of mineral reserves. Development of the properties will follow only if satisfactory exploration results are obtained. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercially viable bodies of mineralization. The long-term profitability of our operations will be, in part, directly related to the cost and success of our exploration programs, which may be affected by a number of factors. Please refer to “Item 1A. Risk Factors.”

We currently have an interest in three (3) projects located in Tapajos gold province in Para State, Brazil and one property located in British Columbia, Canada. We have conducted only preliminary exploration activities to date and may discontinue such activities and dispose of the properties if further exploration work is not warranted.

| Figure 1. | Brazil, South America |

Properties

Brazil

São Domingos

Location and access

The São Domingos property lies in the Tapajos Province of Para State, Brazil. It is situated approximately 250 km SE of Itaituba, the regional centre, and includes an area of nearly 8000 ha. Small aircraft service Itaituba daily and on this occasion flights were sourced via Manaus. Access from Itaituba to site is by small aircraft or unsealed road of average to poor quality. The road is subject to seasonal closures and as the visit was at the end of the ‘wet’ season site access was granted via light aircraft utilizing the local airstrip.

Tenure

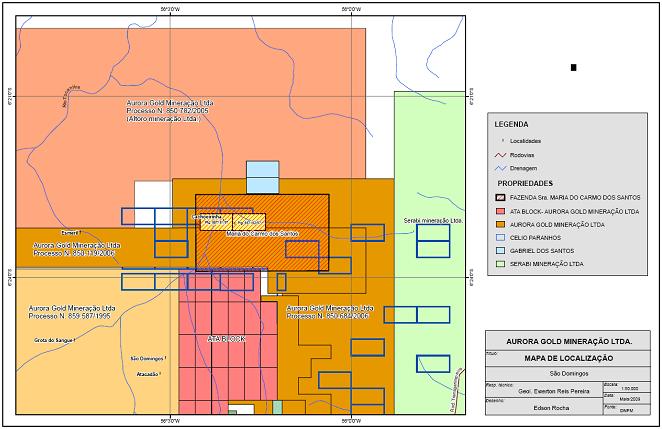

The project covers an area of 6.100 hectares and was granted in 1995 as exploration license number 859.587/1995 and 850.990/1995 to 851.019/1995 by the Brazilian National department of Mineral Production DNPM - Departamento Nacional de Produção Mineral, and expires in 2012. These licenses were restructured by adding further applications and reductions of some areas under option. Currently the Company has tenure over Processo Nos 850.782/2005, 850.119/2006, 850.684/2006, 859.1995/1995. For ease of reference please see the map below.

(DNPM Processes 850.684/06

The Company has good title over the mineral rights which were granted as DNPM Process number 850.684/06 and which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The São Domingos mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of Aurora. On September 13, 2006 the Company applied to the DNPM for the conversion of the Application to an Exploration Permit covering and area of 4914.18 hectares. The DNPM Process 850.684/06 had assured priority over 525 hectares and therefore, the area will be reduced from 4914.18 to 525 hectares. No payments or royalties are due regarding DNPM Process 850.384/06.

DNPM Processes 850.782/05:

The company has good title over the mineral rights which were granted as DNPM Process number 850.782/05 and which is valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The São Domingos mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of Aurora. On November 8, 2005 the Company applied to the DNPM for the conversion of the Application to an Exploration Permit covering and area of 5651.93 hectares. The Exploration Permit was granted on November 28, 2006 for a three (3) year period, renewable for three (3) additional years. On September 28, 2009 the Company applied for the renewal of the Exploration Permit but it has not yet been granted by the DNPM. No payments or royalties are due regarding DNPM Process 850.782/05.

Geology

The geology of the São Domingos property is predominantly composed of paleo-proterozoic Parauari Granites that play host to a number of gold deposits in the Tapajos Basin. Typical Granites of the younger Maloquinha Intrusive Suite have been noticed in the vicinity of Molly Gold Target, and basic rocks considered to be part of the mesoproterozoic Cachoeira Seca Intrusive Suite occur around the Esmeril target area.

The São Domingos property was a previous large alluvial operation, and the property area covers numerous areas of workings.

São João – Samba Minerals farm in agreement

In May 2008 the Company signed an agreement with Samba Minerals Limited (“Samba”), which was subsequently amended in August 2008, whereby Samba can earn up to an 80% participating interest in the São João project by funding exploration expenditures to completion of a feasibility study on the property. Upon completion of a feasibility study, the Company will immediately transfer an 80% participation interest in the property to Samba and enter into a formal joint venture agreement to govern the development and production of minerals from the property. Samba can terminate its participation by providing the Company 30 days notice in writing. Upon withdrawal from its participation, Samba would forfeit to the Company all of its rights in relation to the project and would be free of any and all payment commitments yet to be due. Samba will be the manager of the São João project. A feasibility study has not been completed as of December 31, 2008 and thus no joint venture has been formed as of that date.

Location and access

The Sao Joao property is located in the central portion of the Southern Tapajos basin and is accessed by light aircraft from the regional centre of Itaituba. Access is also possible by unsealed roads linking up to the Transgarimpeiro highway and by a purpose cut heavy vehicle access track linking Sao Joao to the exploration centre at the primary project at Sao Domingo.

Tenure - São João Project - DNPM Processes 851.533/94 to 851.592/94 inclusive:

The company has good title over the mineral rights which were granted in 1994 and 2005 by the Brazilian National department of Mineral Production DNPM - Departamento Nacional de Produção Mineral, as DNPM Process numbers 851.533/94 to 851.592/94 and which are valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The São João mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of the previous holder since an Exploration Permit has not yet been granted. The São João mineral rights comprise 60 Applications for Alluvial Mine of 50 hectares each which was presented to DNPM on May 16, 1994. On August 30, 2006 the previous holder of the Applications applied for the conversion of the Applications to Exploration Permits . When the conversion request is approved by the Authorities, the previous holder will be granted the Exploration Permit for an area of 3000 ha. The assignment of the São João mineral rights to Aurora can only be done after the approval of the Applications and the actual granting of an Exploration Permit to the previous Holder.

Option Agreement

The São João Option Agreement dated January 20, 2006 and amendments dated June 2, 2008 and December 2, 2008, allows the Company to perform geological surveys and assessment work necessary to ascertain the existence of possible mineral deposits which may be economically mined and to earn a 100% interest in the São João property mineral rights. Under the terms of the Option Agreement and amendments, a total amount of USD $1,435,000 (one million four hundred and thirty five thousand dollars) is due by Aurora for the acquisition of the São João mineral rights. The total option agreement payments for the mineral rights are structured as follows: April 12, 2006 – USD $20,000 (paid); September 12, 2006 – USD $25,000 (paid); September 12, 2007 – USD $60,000 (paid); June 25, 2008 - $100,000 (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); December 5, 2008 – USD $40.000 (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); January 15, 2009 – USD $30,000 (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); February 15, 2009 – USD $30,000 (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); April 30, 2009 to March 30, 2011 – USD $8,333.33 per month (April 30, 009 to December 31, 2009 paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); July 30, 2011 – USD $950,000. The vendor will have a 1.5% Net Smelter Royalty. The Royalty payment can be purchased at any time upon written notice to the vendor and payment in Reals (Brazilian currency) of the equivalent of USD $1,000,000. The option agreement can be terminated at any time upon written notice to the vendor and the Company will be free of any and all payment commitments yet to be due.

Geology

The prime targets for the São João property are located around and on the intersection of regional NW and NNW faults within the Pararui Intrusive Suite and this area has been the focus of large-scale alluvial workings. The Pararui Intrusive Suite has proven to host the vast majority of gold deposits elsewhere within the Tapajos Gold Province. We conducted a rock chip program over an area currently being excavated for gold in quartz systems via shallow underground workings. The sample results have demonstrated that the quartz vein systems are highly mineralized and considered continuous for at least 200m. We are confident that the quartz vein systems are much more extensive and are currently planning to increase the sample density of rock and soil sampling over, and adjacent to, the current wor kings to locate further mineralized vein systems, and to drill test their depth extensions in the near future.

Previous mining activity over a number of years focused on the alluvial deposits within its many tributaries, and has now progressed to include the saprolite host rock and out cropping quartz veins.

Comandante Araras - Samba Minerals farm in agreement

In May 2008 the Company signed an agreement with Samba, which was subsequently amended in August 2008, whereby Samba can earn up to an 80% participating interest in the Comandante Araras projects by funding exploration expenditures to completion of a feasibility study on the property. Upon completion of a feasibility study, the Company will immediately transfer an 80% participation interest to Samba and enter into a formal joint venture agreement to govern the development and production of minerals from the property. Samba can terminate its participation by providing the Company 30 days notice in writing. Upon withdrawal from its participation, Samba would forfeit to the Company all of its rights in relation to the project and would be free of any and all payment commitments yet to be due. Samba will be the manager of the Comandante Ar aras project. A feasibility study has not been completed as of December 31, 2009 and thus no joint venture has been formed as of that date.

Location and access

The Comandante Araras property is located in the central portion of the Southern Tapajos basin and is accessed by light aircraft from the regional centre of Itaituba. The project adjoins the São João project to the south east. Access is also possible by unsealed roads linking up to the Transgarimpeiro highway and by a purpose cut heavy vehicle access track linking São João to the exploration centre at the primary project at Sao Domingo.

Tenure - Comandante Araras Project - DNPM Processes 853.785/93 to 853.839/93 inclusive:

The Company has good title over the mineral rights which were granted by the Brazilian Department of Mines (Departamento Nacional de Produção Mineral – “DNPM”) as DNPM Process numbers 853.785/93 to 853.839/93 and which are valid and in force, free and clear of any judicial and extrajudicial encumbrances and taxes. The Comandante Araras mineral rights are located at the Municipality of Itaituba, State of Pará, and are registered in the name of the previous holder since an Exploration Permit has not yet been granted. The Comandante Arara mineral rights comprise 55 Applications for Alluvial Mine of 50 hectares each and the Applications for the rights were presented to DNPM on October 05, 1993. The conversion to Exploration Permits has not been applied for yet. The assignment of the Comandante Araras minera l rights to Aurora can only be done after the approval for the conversion of the Applications and the actual granting of an Exploration Permit to the previous Holder.

Option Agreement

The Comandante Araras Option Agreement dated July 2, 2007, and amendments dated June 2, 2008, November 10, 2008, and September 18, 2009, allows the Company to perform geological surveys and assessment work necessary to ascertain the existence of possible mineral deposits which may be economically mined and to earn a 100% interest in the Comandante Araras property mineral rights via structured cash payments. The total option agreement payments for the mineral rights are structured as follows: November 1, 2006 R$20,000 (paid); November 15, 2006 – R$40,000 (paid); December 15, 2006 R$40,000 (paid); May 18, 2007 - R$15,000 (paid); May 29, 2007 – R$50,000 (paid); June 25, 2008 – USD $80,000 (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); Nove mber 30, 2008 – USD $20,000 or 100,000 shares of Samba Minerals Limited at a deemed issue price of $0.20 per Samba share (paid by Samba Minerals Limited as part of the agreement with them discussed in note 4 to the consolidated financial statements); November 30, 2008 – 400,000 shares of Samba Minerals Limited at a deemed issue price of $0.20 per Samba share (to be issued by Samba when the Exploration Permit is granted and transferred to Aurora). The vendor will have a 1.5% Net Smelter Royalty. The Royalty payment can be purchased at any time upon written notice to the vendor and payment in Reals (Brazilian currency) of the equivalent of USD $1,000,000. The option agreement can be terminated at any time upon written notice to the vendor and the Company will be free of any and all payment commitments yet to be due.

Geology

The geology of the Comandante Araras property is dominated by two regional faults in the Parauari granite that strike North west in the northern half of the property and South east in the southern part of the property. The project was selected based on the potential trends of mineralisation striking towards Comandante Araras from the São João project.

British Columbia, Canada

Kumealon

Location and access

In February 1999, we acquired, by staking, a high grade limestone property three (3) square kilometres (741 acres) located on the north shore of Kumealon Inlet, 54 kilometres south-southeast of Prince Rupert, British Columbia, Canada.

This property is highlighted by consistence of purity and whiteness of the limestone zone outcropping along the southwest shore of Kumealon Lagoon. The zone is comprised mostly of white, recrystallized, fine to course grained limestone, striking 150 degrees and can be traced for at least 1200 meters. The zone is estimated to have an average stratigraphic thickness of 180 meters. Chip samples taken across the zone averaged 55.06% CaO, 2.11% insolubles and 43.51% ignition loss. This property has no known reserves.

We have conducted only preliminary exploration activities on these properties. None of the foregoing properties contain any known reserves.

The Company is not involved in any legal proceedings at this time.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our Common Stock is quoted on the Pink Sheets. The following table sets forth the high and low bid prices for the Common Stock for the calendar quarters indicated as reported by the NASD OTC Bulletin Board for the last two years. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

| | | First Quarter | | | Second Quarter | | | Third Quarter | | | Fourth Quarter | |

| 2010 – High | | $ | 0.61 | (1) | | | | | | | | | |

| 2010 – Low | | $ | 0.38 | (1) | | | | | | | | | |

| 2009 – High | | $ | 0.50 | | | $ | 0.33 | | | $ | 0.50 | | | $ | 0.70 | |

| 2009 – Low | | $ | 0.16 | | | $ | 0.17 | | | $ | 0.06 | | | $ | 0.26 | |

| 2008 – High | | $ | 0.51 | | | $ | 0.26 | | | $ | 0.12 | | | $ | 0.50 | |

| 2008 – Low | | $ | 0.21 | | | $ | 0.05 | | | $ | 0.04 | | | $ | 0.04 | |

Our stock is also quoted on the Frankfurt Exchange under the symbols “A4G.FSE,” and “A4G.ETR” and on the Berlin-Bremen Exchange under the symbol “A4G.BER”.

(1) The high and low bid prices for our Common Stock for the First Quarter of 2010 were for the period January 1, 2010 to March 31, 2010.

As of March 31, 2010, there were 718 holders of record of the Common Stock.

No cash dividends were paid in 2008, 2009 and the subsequent period to March 31, 2010. The amount and frequency of cash dividends are significantly influenced by metal prices, operating results and our cash requirements.

We do not have securities authorized for issuance under an equity compensation plan.

No securities were issued without registration under the Securities Act of 1933, as amended (the "Act") during the fourth quarter of 2009.

We did not effect any repurchases of our securities during the fourth quarter of Fiscal 2009.

Not applicable

| Item 7. | Management’s Discussion and analysis of Financial Condition and results of Operations |

We are a mineral exploration company engaged in the exploration of base, precious metals and industrial minerals worldwide. We were incorporated under the laws of the State of Delaware on October 10, 1995, under the name "Chefs Acquisition Corp." We conduct our exploration and property acquisition activities through our head office which is located at is located at Baarerstrasse 10, 1st Floor, Zug, 6300 Switzerland. The telephone number is (+41) 7887-96966. Our Field office for exploration activities in Brazil is located at Estrada Do Bis, 476, Bairro, Bom Jardim, Itaituba, in the Tapajos gold province of the State of Para, Brazil.

We had no revenues during fiscal 2009 and 2008. Funds raised in fiscal 2009 and 2008 were used for exploration of our properties and general administration.

Year Ended December 31, 2009 (Fiscal 2009) versus Year Ended December 31, 2008 (Fiscal 2008)

For the year ended December 31, 2009 we recorded a loss of $1,779,477 or $0.03 per share, compared to a loss of $520,105 or $0.01 per share in 2008.

General and administrative expenses – For the year ended December 31, 2009 we recorded general and administrative expenses of $697,039 (fiscal 2008 - $442,832). The fiscal 2009 amount includes professional fees - accounting $43,263 (fiscal 2008 - $56,898) and legal $10,787 (fiscal 2008 - $79,540). Recent developments in capital markets have restricted access to debt and equity financing for the Company. As a result, the Company reduced its 2009 capital spending requirements in light of the current and anticipated, global economic environment.

Exploration expenditures - For the year ended December 31, 2009 we recorded exploration expenses of $67,973 compared to $77,273 in fiscal 2008. The following is a breakdown of the exploration expenses by property: Brazil $65,956 (2008 - $74,723) and Canada, Kumealon property $2,017 (2008 - $2,550).

Depreciation expense – For the year ended December 31, 2009 we recorded depreciation expense of $13,172 compared to $14,426 in fiscal 2008.

| (C) | Capital Resources and Liquidity |

December 31, 2009 versus December 31, 2008:

Recent developments in capital markets have restricted access to debt and equity financing for many companies. The Company's exploration properties are in the exploration stage, have not commenced commercial production and consequently the Company has no history of earnings or cash flow from its operations. As a result, the Company is reviewing its 2010/2011 exploration and capital spending requirements in light of the current and anticipated, global economic environment.

The Company currently finances its activities primarily by the private placement of securities. There is no assurance that equity funding will be accessible to the Company at the times and in the amounts required to fund the Company’s activities. There are many conditions beyond the Company’s control which have a direct bearing on the level of investor interest in the purchase of Company securities. The Company may also attempt to generate additional working capital through the operation, development, sale or possible joint venture development of its properties, however, there is no assurance that any such activity will generate funds that will be available for operations. Debt financing has not been used to fund the Company’s property acquisitions and exploration activities and the Company has no current plans to use debt financing. The Company does not have “standby” credit facilities, or off-balance sheet arrangements and it does not use hedges or other financial derivatives. The Company has no agreements or understandings with any person as to additional financing.

At December 31, 2009, we had cash of $556,957 (2008 - $16,511) and a working capital deficiency of $893,013 (2008 working capital deficiency - $1,092,000). Total liabilities as of December 31, 2009 were $1,523,226 as compared to $1,691,579 at December 31, 2008, a decrease of $168,353. In September 2009, 3,000,000 common shares were authorized for issuance at $0.10 per share for cash proceeds of $300,000. The shares were physically issued in January 2010 to individuals and companies who reside outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). The Company’s agent was paid a commission of 420,000 shares of common stock of the Company. The shares were physically issued to the agent in January 2010. In September 2009, co nvertible notes payable and related accrued interest aggregating $739,152 (AUD $850,479) were settled through the issuance of 5,000,000 shares of common stock of the Company. The shares were issued to a company who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). In November 2009, 100,000 shares were authorized for issuance in connection with debt settlements at $0.18 per share. The shares were physically issued in January 2010 to a company who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). In November 2009, 150,000 shares were authorized for issuance in connection with debt settlements at $0.24 per share. The shares were physically issued in January 2010 to a company who resides outside the United States of America (in accordance with the exemption from registration requirements af forded by Regulation S as promulgated thereunder). In December 2009, 1,666,667 common shares were authorized for issuance at $0.30 per share for net cash proceeds of $500,000. The shares were physically issued in January 2010 to an individual who resides outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). In December 2008, 2,603,333 shares of the common stock of the Company were issued to settle debts of $156,200. The shares were issued to individuals and companies who reside outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder). Of the 2,603,333 common shares issued, 1,488,533 common shares were issued to a director in payment of his services valued at $75,108 and expenses valued at $14,204. In July 2008, the Company issued 250,000 shares of common stock of the Company valued at $25,000 to a direc tor of the Company’s subsidiary as consideration for arranging property acquisitions in the Tapajos Gold Province, State of Pará, Brazil. The shares were issued to an individual who reside outside the United States of America (in accordance with the exemption from registration requirements afforded by Regulation S as promulgated thereunder).

Our general business strategy is to acquire mineral properties either directly or through the acquisition of operating entities. Our consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America and applicable to a going concern which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. As discussed in note 1 to the consolidated financial statements, the Company has incurred recurring operating losses since inception, has not generated any operating revenues to date and used cash of $395,791 from operating activities in 2009. The Company requires additional funds to meet its obligations and maintain its operations. We do not have sufficient working capital to (i) pay our a dministrative and general operating expenses through December 31, 2010 and (ii) to conduct our preliminary exploration programs. Without cash flow from operations, we may need to obtain additional funds (presumably through equity offerings and/or debt borrowing) in order, if warranted, to implement additional exploration programs on our properties. While we may attempt to generate additional working capital through the operation, development, sale or possible joint venture development of its properties, there is no assurance that any such activity will generate funds that will be available for operations. Failure to obtain such additional financing may result in a reduction of our interest in certain properties or an actual foreclosure of its interest. We have no agreements or understandings with any person as to such additional financing.

Our exploration properties have not commenced commercial production and we have no history of earnings or cash flow from its operations. While we may attempt to generate additional working capital through the operation, development, sale or possible joint venture development of its property, there is no assurance that any such activity will generate funds that will be available for operations.

Cash Flow

Operating activities: The Company used cash of $395,791 (used cash in 2008 - $649,028) through the year ended December 31, 2009. The following is a breakdown of cash used for operating activities: Depreciation and amortization of $13,172 (2008 - $14,426), realized loss on debt settlement was $1,014,465 (2008 - $0), foreign exchange loss related to notes payable $144,701 (gain in 2008 - $169,235). Changes in prepaid expenses and other assets resulted in a decrease of $55,121 compared to a decrease of $19,190 in 2008. There was an increase in accounts payable and accrued expenses of $266,469 compared to an increase of $20,076 in 2008.

Investing Activities: During the year ended December 31, 2009 investing activities consisted of expenditures on the purchase of assets of $0 (2008 - $250) and proceeds from the disposal of assets of $0 (2008 - $2,312).

Financing Activities: The Company intends to finance its activities by raising capital through the equity markets. Proceeds from common stock were $800,000 (2008 - $0). During fiscal 2009 the Company did not repay any advances from a related party, in fiscal 2008 the Company repaid advances from a related party of $161,441.

Dividends

The Company has neither declared nor paid any dividends on its Common stock. The Company intends to retain it’s earnings to finance growth and expand its operations and does not anticipate paying any dividends on its Common shares in the foreseeable future.

Asset-Backed Commercial Paper

The Company has no asset-backed commercial paper.

Financial Instruments

Fair value estimates of financial instruments are made at a specific point in time, based on relevant information about financial markets and specific financial instruments. As these estimates are subjective in nature, involving uncertainties and matters of significant judgment, they cannot be determined with precision. Changes in assumptions can significantly affect estimated fair value.

The carrying value of cash, accounts payable and accrued expenses, accounts payable and accrued expenses – related parties, advances payable – related party, loans payable and loan payable - related party approximate their fair value because of the short-term nature of these instruments. The carrying value of the convertible notes payable approximate their fair value because interest rates of long-term convertible notes payable approximate market interest rates. Management is of the opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments.

The Company operates outside of the United States of America (primarily in Brazil) and is exposed to foreign currency risk due to the fluctuation between the currency in which the Company operates in and the U.S. dollar.

Share Capital

At March 31, 2010, the Company had:

| ° | Authorized share capital of 100,000,000 common shares with par value of $0.001 each. |

| ° | 68,408,522 common shares were issued and outstanding as at March 30, 2010 (December 31, 2009 – 68,408,522). If the holders were to acquire all 2,300,000 shares issuable upon the exercise of all incentive stock options outstanding, the Company would receive an additional $598,000. |

| ° | 2,300,000 stock options outstanding under the Company’s incentive stock option plan. The stock options are exercisable at of $0.26 per share, with expiry date of August 6, 2012. |

OUTLOOK

General Economic Conditions

Current problems in credit markets and deteriorating global economic conditions have lead to a significant weakening of exchange traded commodity prices in recent months, including precious and base metal prices. Volatility in these markets has also been unusually high. It is difficult in these conditions to forecast metal prices and demand trends for products that we would produce if we had current mining operations. Credit market conditions have also increased the cost of obtaining capital and limited the availability of funds. Accordingly, management is reviewing the effects of the current conditions on our business.

It is anticipated that for the foreseeable future, the Company will rely on the equity markets to meet its financing need. The Company will also consider entering into joint venture arrangements to advance its projects.

Capital and Exploration Expenditures

We are reviewing our capital and exploration spending in light of current market conditions. As a result of our review, the Company may curtail a portion of its capital and exploration expenditures during 2010/2011.

We are currently concentrating our exploration activities in Brazil and examining data relating to the potential acquisition or joint venturing of additional mineral properties in either the exploration or development stage.

Off-Balance Sheet Arrangements

During the year ended December 31, 2009, the Company was not a party to any off-balance-sheet arrangements that have, or are reasonably likely to have, a material current or future effect on the results of operations, financial condition, revenues or expenses, liquidity, capital expenditures or capital resources of the Company.

Market Risk Disclosures

The Company has not entered into derivative contracts either to hedge existing risks or for speculative purposes.

Forward-Looking Statements

This annual report contains forward-looking statements which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our technologies, our potential profitability, and cash flows (b) our growth strategies, (c) expectations from our ongoing sponsored research and development activities (d) anticipated trends in the technology industry, (e) our future financing plans and (f) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCI AL CONDITION AND RESULTS OF OPERATIONS” and “DESCRIPTIONS OF OUR BUSINESS AND PROPERTY,” as well as in this Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “RISK FACTORS” and matters described in this form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commissi on which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected. We will have little likelihood of long-term success unless we are able to continue to raise capital from the sale of our securities until, if ever, we generate positive cash flow from operations.

Plans for Next Twelve Months

The following Plan of Operation contains forward-looking statements that involve risks and uncertainties, as described below. The Company’s actual results could differ materially from those anticipated in these forward-looking statements. The following discussion should be read in conjunction with the audited consolidated financial statements and notes thereto.

Our audited consolidated financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

During the next 12 months we intend to raise additional funds through equity offerings and/or debt borrowing to meet our administrative/general operating expenses and to conduct work on our exploration properties. There is, of course, no assurance that we will be able to do so and we do not have any agreements or arrangements with respect to any such financing.

Our exploration properties have not commenced commercial production and we have no history of earnings or cash flow from its operations. While we may attempt to generate additional working capital through the operation, development, sale or possible joint venture development of its property, there is no assurance that any such activity will generate funds that will be available for operations.

We will concentrate our exploration activities on the Brazilian Tapajos properties and examine data relating to the potential acquisition or joint venturing of additional mineral properties in either the exploration or development stage in Brazil, United States, Canada and other South American countries. Additional employees will be hired on a consulting basis as required by the exploration properties.

Our exploration work program in 2010 will focus on the Brazilian properties and will entail surface mapping of geology, sampling of soils on a grid basis to delineate geochemical anomalies, stream sediment sampling, geophysical surveying and drilling.

We have set up a field operations centre at the São Domingos property and intend to continue to focus our exploration activities on anomalies associated with the São Domingos Property. We selected the São Domingos property based on its proximity to our other properties, and the logistics currently in place. Access to the São Domingos property is by light aircraft to a well-maintained strip, by road along the government maintained Trans Garimpeiro highway, and by boat along the multitude of waterways in the Amazon Basin.

In late May 2006 we followed up previous exploration of the Sao Domingos property with the initiation of a projected 5,000 metre diamond-drilling program. Drilling targeted various soil anomalies and lithogical trends outlined by mapping and sampling of out cropping rocks. Drilling tested areas around the Atacadau gold occurrence, the Esmeril occurrence and Fofoca area. These areas have been the focus of both alluvial and relatively shallow underground hard rock (oxidized) mining. The lithology is porphyritic Pararui granite containing stockwork quartz veins. Limited historical underground production was carried out via shafts sunk in the oxidized material peripheral to the dominant quartz veins. No dewatering was utilized and generally mining ceased, as water became a problem. Dri lling completed during 2006 resulted in a volume of mineralized material which was calculated on the first 17 drill holes targeting high grade gold in quartz veins and altered host rocks. Drill hole line spacing of 40m was used in the initial appraisal.

After reviewing the geology and grade continuity from 2006 drilling on the Mineralized material at the Sao Domingos- Fofoca project, the Company initiated further drilling during July 2007 to test target extensions of the current mineralized material as well as to infill current drilling to increase the confidence levels. The initial calculation resulted in a volume of mineralized material containing approximately 130,000 ounces of gold at 2.0 g/t using a cut off 0f 0.5 g/t.

Currently the mineralized material still remains open along strike in both directions and at depth. Aurora will continue to evaluate the potential, and is confident that Fofoca could evolve along strike and link up with other noted targets further along strike. To test the strike continuity a ground geophysical survey was conducted during the third quarter of 2007 along the Fofoca mineralized structure. The results demonstrated that geophysical anomalism, similar to that recognized over the known mineralisation of the Fofoca mineralisation, was noted and the anomaly continues further west to join up with the known mineralisation of the Cacheira area. The results also show that this mineralisation may split into other loads of mineralisation of similar proportions to that known over the current mineralisation. ; This has the potential to increase the known resource by at least 50%.

In 2010, we will continue to follow up exploration on the Fofoca area and to initiate further exploration programs on other areas of the Sao Domingos property. It is anticipated that we will drill a series of holes within the Fofoca area for engineering and metallurgical test work as well as to test for depth extensions of the known mineralisation. Other Exploration on the São Domingos property areas will involve further mapping of the outcrop geology and sampling soils and scree from shafts of previous workers in order to confirm lithologies and structural trends noted from drilling and published government maps. Currently, four anomalous areas on the Sao Domingos property have been identified from soil and rock chip sampling, at Atacadao, Esmeril, Fofoca and Cachoeira, and we plan to c onduct further investigation.

A recent discovery was made on the Atatcadau area and has been called Colibri. Here artisanal miners uncovered an area of stock work mineralisation that was subsequently sampled and returned some high-grade assays. Further sampling of material that was exposed by artisanal activity around the Colibri occurrence was conducted. Whilst monitoring the artisanal activity mapping and measurements of the structures and orientations of theoretical mineralisation channels were conducted. The results showed that there are possible correlations to the Atacadau mineralisation noted from previous mapping and drilling. We intend to cut trenches across the strike of the mineralizing structures to better understand the size both laterally and along strike. We will then test the strike e xtent with geophysics in a similar manner as that conducted on the Fofoca area.

Exploration on the São João, and the adjoining Comandante Araras properties during early 2007 included trenching and mapping. Sample results of a trench on the main vein resulted in 80m at 30.94 g/t gold. Recent sampling and mapping has shown this vein system to be extensive and a series of other veins have been located and sampled.

Together with our joint venture partner, Samba, we completed a ground geophysics program on the São João property. The program targeted areas of known mineralisation and covered the area along to the northeast to link up with other known mineralisation. Results to date show that the area has a geophysical trend continuing on from the known mineralisation. During the geophysics program, other veins were noted and sampled and returned anomalous gold grades. Together with Samba, in 2010, we intend to evaluate the geophysics and determine various targets to test the sub surface extent of the known mineralisation, and to test the geophysical anomalies within the area.

We are not planning to do any exploration work on the British Columbia Kumealon limestone property in 2010.

We are currently conducting due diligence on the Front Range Property in Boulder Colorado and should we go forward with the acquisition Aurora plans to update all permits and schedule operations with a view to recommencing the production of gold concentrate.

| (D) | Application of Critical Accounting Policies |

The accounting policies and methods we utilize in the preparation of our consolidated financial statements determine how we report our financial condition and results of operations and may require our management to make estimates or rely on assumptions about matters that are inherently uncertain. Our accounting policies are described in note 2 to our December 31, 2009 consolidated financial statements. Our accounting policies relating to mineral property and exploration costs and depreciation and amortization of property, plant and equipment are critical accounting policies that are subject to estimates and assumptions regarding future activities.

Depreciation is based on the estimated useful lives of the assets and is computed using the straight-line method. Equipment is recorded at cost. Depreciation is provided over the following useful lives: vehicles 10 years and office equipment, furniture and fixtures 2 to 10 years.

Exploration costs are charged to operations as incurred until such time that proven reserves are discovered. From that time forward, the Company will capitalize all costs to the extent that future cash flow from mineral reserves equals or exceeds the costs deferred. The deferred costs will be amortized over the recoverable reserves when a property reaches commercial production. As at December 31, 2009 and 2008, the Company did not have proven reserves.

Exploration activities conducted jointly with others are reflected at the Company's proportionate interest in such activities.

Costs related to site restoration programs are accrued over the life of the project.

US GAAP requires us to consider at the end of each accounting period whether or not there has been an impairment of the capitalized property, plant and equipment. This assessment is based on whether factors that may indicate the need for a write-down are present. If we determine there has been an impairment, then we would be required to write-down the recorded value of its property, plant and equipment costs which would reduce our earnings and net assets.

| (E) | Related Party Transactions |

During the fiscal year 2009, consulting fees of $86,380 (2008 – $134,558) were paid to directors of the Company and its subsidiary. The transactions were recorded at the exchange amount, being the value established and agreed to by the related parties.

Included in accounts payable - related parties at December 31, 2009 is $127,813 payable to directors of the Company for consulting fees and various expenses incurred on behalf of the Company.

Included in advances payable - related party at December 31, 2009 is $50,000 payable to a director of the Company. The advance is non-interest bearing and due on demand.

| (F) | Off-balance Sheet Arrangements and Contractual Obligations |

We do not have any off-balance sheet arrangements or contractual obligations that are likely to have or are reasonably likely to have a material current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that have not been disclosed in our consolidated financial statements.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

Not applicable

| Item 8. | Financial Statements and Supplementary Data |