CONFIDENTIAL

Paul O’Connor

Managing Director

312-269-0346

paul.oconnor@ryanbeck.com

May 17, 2005

Fairness Review

For Luxemburg Bancshares, Inc.

Private and Confidential

The attached materials have been compiled and prepared by Ryan Beck & Co., Inc. solely for

the use and information of the board of directors and management of Luxemburg Bancshares,

Inc. Such materials are not intended for viewing by any other person or party for any purpose,

and no such review should be undertaken without the prior written consent of Ryan Beck & Co.,

Inc. through one or more of its authorized officers.

Portions of the information contained herein are not publicly available and are not intended for

public dissemination. The public disclosure or personal use of such information may be

actionable under applicable federal and/or state securities laws.

Table of Contents

Page 3

1.

Transaction Summary

2.

Luxemburg Bancshares, Inc. Overview

3.

Valuation of Luxemburg Bancshares, Inc.

Discounted Dividend Analysis

Peer Group Comparison

4.

Control Premium Valuation

5.

Repurchase Analysis

6.

Conclusion

7.

Ryan Beck Relationship

Tab 1

Transaction Summary

Luxemburg Bancshares, Inc. (“LUX” or “Luxemburg”) has engaged Ryan Beck & Co. to assist it in de-

registering from the SEC. LUX intends to de-register from the SEC due to the costs associated with

SEC filing requirements and Sarbanes Oxley. Additionally, being a registered company has brought

very limited benefit to LUX relative to the trading in its stock. It is management’s assessment that

Luxemburg can serve its customers and enhance its returns to shareholders better without the burdens

placed upon it by the SEC.

Luxemburg management realizes that its projected total capital ratio, after taking into consideration the

share buy-back contemplated in this transaction, will be below the Federal Reserve’s “well-capitalized”

minimum of 10.0%. To alleviate any regulatory capital concerns, LUX has decided to finance the buy-

back of shares with subordinated debt.

In December of 2004, The Department of Financial Institutions for the State of Wisconsin and the FDIC

placed LUX under a Memorandum of Understanding. In the 8-K filed by LUX, management stated that

they were taking a $550,000 additional provision for loan losses due to the deterioration of two separate

loans identified by the FDIC and State of Wisconsin during its most recent examination. To repurchase

the proposed number of shares, LUX will need Federal Reserve approval.

LUX is represented by Godfrey & Kahn, Milwaukee, Wisconsin, and Ryan Beck is represented by

Pitney Hardin.

Page 5

Transaction Summary

De-registering from the SEC will be accomplished by using a reverse stock split to reduce the number of current

shareholders to below 300 (the “Transaction”).

LUX has requested our opinion as investment bankers of the fair value of 92,412 shares, the amount to be

repurchased as part of the reverse stock split, of Luxemburg Bancshares, Inc. common stock. The number

of shares to be redeemed through the Transaction is equal to approximately 16.5% of the outstanding

shares. The consummation of the Transaction will reduce Luxemburg’s shareholder base to 203

shareholders, a 75.1% reduction in the number of current shareholders. The Transaction will target

shareholders owning less than 500 shares.

The fair value range that we provide is expected to be used by Luxemburg’s Board of Directors to support

their determination of an offer price for its shareholders that will be cashed-out as a result of the Transaction.

By factoring in a control premium to the estimated current market value of Luxemburg common stock, we

were able to determine a fair value range of $52.00 to $56.00 per share. Luxemburg does not trade on any

exchange, the OTC Bulletin Board or the Pink Sheets. Management has kept a record of trades of which it is

aware. Luxemburg’s records indicate that during the last twelve months, 3,195 shares (0.57% of outstanding

shares) have traded. All shares have been exchanged in the range of $40.00 - $52.00 per share. The last

traded price was $52.00 per share. Given the lack of volume and infrequency of trades, we have not factored

in the most recent stock price of $52.00 into our analysis.

In addition, we have made no adjustment to reflect the potential negative impact the MOU could have on the

fair value of Luxemburg’s common stock.

Page 6

Transaction Summary

Page 7

Transaction Summary

We believe we have followed the court rulings for determining fair value to arrive at our

range. However, courts have not provided a precise formula. It is ultimately the

responsibility of the Board of Directors to set the repurchase price.

We have been advised by Luxemburg’s Wisconsin counsel that the Company will pay

“fair value” under the statutory dissenters rights under Wisconsin law, even though

shareholders will not have dissenters rights. Under Chapter 180, subchapter XIII, a

shareholder may dissent from and obtain payment of the “fair value” of his or her

shares in the event of certain corporate actions.

“Fair Value” is defined in Section 180.1301(4), Wisconsin Statutes as:

“Fair Value,” with respect to a dissenter’s shares other than in a business

combination, means the value of the shares immediately before the effectuation

of the corporate action to which the dissenter objects, excluding any

appreciation or depreciation in anticipation of the corporate action unless

exclusion would be inequitable.

Since the Transaction is not voluntary, the valuation criteria must reflect the June 2000

decision by the Wisconsin Supreme Court in the HMO-W Inc. v. SSM Healthcare

Systems case. The Supreme Court of Wisconsin quoted a leading Delaware case as

follows: “Where there is no objective market data available, the appraisal process is

not intended to reconstruct a pro forma sale but to assume that the shareholder was

willing to maintain his investment position, however slight, had the merger not

occurred…To fail to accord to a minority shareholder the full proportionate value of his

shares imposes a penalty for lack of control, and unfairly enriches the majority

shareholders who may reap a windfall from the appraisal process by cashing out a

dissenting shareholder, a clearly undesirable result.”

Additionally, the Court cited with approval an ALI Principle, which states that the fair

value of shares should reflect the value of the shareholder’s “proportionate interest in

the corporation, without any discount for minority status or, absent extraordinary

circumstances, lack of marketability.”

Transaction Summary

Page 8

As part of our analysis, we asked Luxemburg’s Wisconsin legal counsel whether

Wisconsin Statutes and/or Wisconsin published court decisions specifically addresses

the applicability of a control premium in connection with the determination of fair value

under Wisconsin law. According to Luxemburg’s Wisconsin legal counsel, if our use of

the control premium is to eliminate a minority share discount, then our analysis should

include one. In our analysis, we have included a control premium but not an acquisition

premium (i.e., a premium an acquirer would pay due to potential synergies associated

with actions following the transaction).

Transaction Summary

Page 9

As part of the valuation process, Ryan Beck has:

Performed due diligence of the company to identify the company’s strengths/weaknesses and

future prospects.

Discussed with management the financial condition, businesses, assets, earnings and

management’s views about the future performance of the company.

Reviewed certain publicly available financial information, both audited and unaudited, as well as

other internally generated financial reports.

Reviewed certain financial forecasts and projections of Luxemburg Bancshares prepared by its

management.

Reviewed certain information about the market prices and trading history of the common stock of

Luxemburg Bancshares.

Reviewed certain aspects of the financial performance of Luxemburg Bancshares and compared it

to similar available financial and stock trading data for a peer group of selected financial

institutions.

Reviewed the terms and conditions of the plan to reduce the number of shareholders to below

300.

Page 10

Transaction Summary

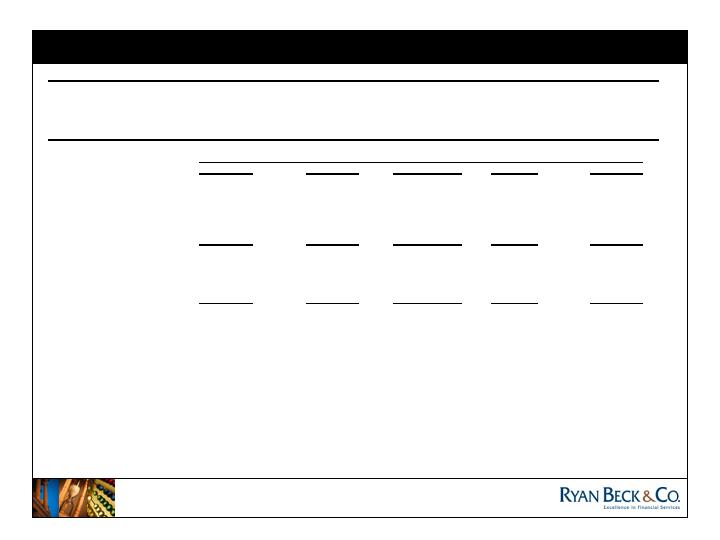

The cost of this transaction will be financed with subordinated debt and cash on hand. The cost of the

subordinated debt is estimated at the three year forward rate for three-month LIBOR (4.41%) plus 265

bps. Luxemburg has negotiated a subordinated debt agreement with Associated Bank in Green Bay,

Wisconsin.

One-time expenses have been estimated by management and included in the total cost of the reverse

stock split Transaction. They are summarized as follows:

Legal: $65,000

Accounting: $5,000

Ryan Beck: $85,000

Printing: $5,000

Subordinated Debt Fee: $32,500

Total: $192,500

Luxemburg Bancshares has provided an estimated range of cost savings related to the de-registration of

their securities with $375,000 being at the low end and $670,000 being at the high end. We have

chosen to include the low end of that range to be conservative in our analysis.

Page 11

Transaction Summary

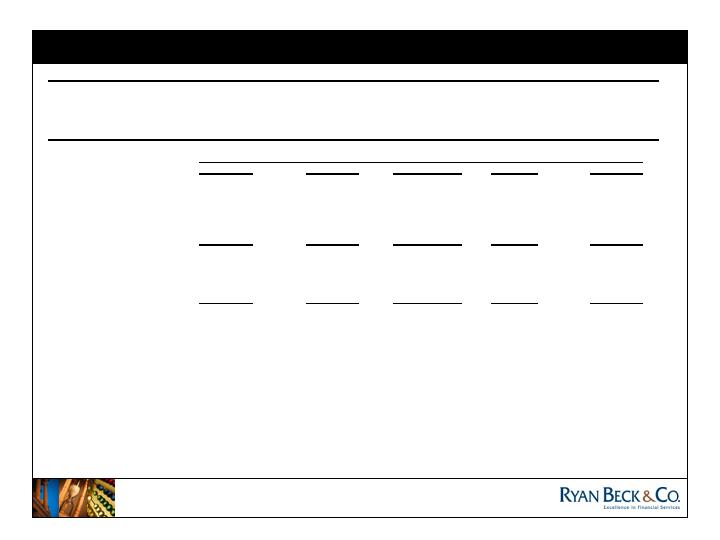

Transaction Summary

Note: Assumes repurchase occurs on January 1, 2005.

(1) Based on the Ryan Beck’s estimate of the current market value of Luxemburg’s common stock.

Page 12

(dollars in thousands except per share data)

Repurchase Amount:

16.48%

(as a % of shares outstanding)

Current

(1)

15.71%

20.16%

24.61%

Luxemburg Bancshares Repurchase Price

$44.94

$52.00

$54.00

$56.00

Cost of Repurchase

$4,998

$5,183

$5,368

Shares Repurchased (000's)

92

92

92

Price/ 2005 Diluted Est. EPS

13.4x

12.9x

13.4x

14.0x

EPS Accretion

20.37%

20.10%

19.84%

Price/ Book Value

136.88%

181.58%

191.20%

201.09%

Price/ Tangible Book Value

136.88%

181.58%

191.20%

201.09%

Tangible Equity/ Assets

10.59%

7.72%

7.62%

7.52%

Leverage Ratio

10.28%

7.76%

7.66%

7.56%

Tier 1 Risk-Based Capital Ratio

10.84%

7.91%

7.81%

7.71%

Total Risk-Based Capital Ratio

12.09%

12.09%

11.99%

11.90%

ROAE (based on 2005 net income)

10.44%

14.54%

14.72%

14.90%

Premium to Current Market Value

(1)

Tab 2

Luxemburg Bancshares, Inc. Overview

Financial Highlights

Page 14

* Bank level data.

As of or for the 12

months ended

2000*

2001*

2002*

2003

2004

March 31, 2005

Balance Sheet Highlights

Total Assets

$124,229

$138,718

$153,117

$167,925

$180,642

$173,748

Total Loans

$94,645

$103,337

$117,477

$133,984

$151,216

$148,909

Loans/Assets (%)

76.19

74.49

76.72

79.79

83.71

85.70

Total Deposits

$108,321

$121,132

$133,560

$147,366

$158,124

$151,502

Loans/Deposits (%)

87.37

85.31

87.96

90.92

95.63

98.29

Performance Measures

Net Income

$1,190

$1,510

$1,919

$2,072

$1,436

$1,695

ROAA (%)

1.03

1.16

1.31

1.28

0.83

0.99

ROAE (%)

11.96

12.99

14.62

12.61

8.15

9.43

Noninterest Income/AA (%)

1.03

1.58

1.77

1.94

1.18

1.24

Noninterest Expense/AA (%)

3.11

3.09

3.06

3.22

3.20

3.34

Net Interest Margin (%)

3.85

3.67

3.9

3.69

4.12

4.35

Efficiency Ratio (%)

64.6

60.4

56.54

60.07

64.76

64.01

Capitalization

Equity Capital

$10,787

$12,200

$13,956

$16,979

$17,794

$18,406

Tier 1 Capital

$10,780

$11,964

$13,420

$16,435

$17,549

$18,273

Equity Capital/Total Assets (%)

8.68

8.79

9.11

10.11

9.85

10.59

Tang Equity/Tang Assets (%)

8.68

8.79

9.11

10.11

9.85

10.59

Tier 1 Risk Based Capital Ratio (%)

12.78

12.11

12.21

11.37

10.30

10.84

Total Risk Based Capital Ratio (%)

11.64

11.08

11.00

12.65

11.54

12.09

Leverage Ratio (%)

9.09

8.67

8.72

9.93

10.02

10.28

As of or for the years ended December 31,

Financial Highlights

Page 15

* Bank level data.

As of or for the 12

months ended

2000*

2001*

2002*

2003

2004

March 31, 2005

Loan Composition

Constr & Dev/Tot Lns (%)

7.19

11.21

9.71

9.23

8.36

7.44

1-4 Family/Tot Lns (%)

34.95

26.67

26.95

23.98

22.42

22.71

Multifamily/Tot Lns (%)

0.41

0.26

0.00

0.17

1.15

0.07

Farmland/ Tot Lns (%)

0.54

0.17

0.27

0.63

0.72

0.73

Cmrcl RE Loans/Tot Lns (%)

0.61

0.84

4.46

11.08

12.97

13.80

Total RE Loans/Tot Lns (%)

43.69

39.15

41.38

45.10

45.62

44.77

Tot C&I Loans/Tot Lns (%)

39.45

44.24

43.43

39.88

39.44

40.25

Tot Consumer Loans/Tot Lns (%)

8.78

7.60

7.38

6.94

6.53

6.62

Agricultural Prod/Tot Lns (%)

6.71

7.75

6.79

6.69

6.86

6.87

Deposit Composition

Nonint Bear Deps/Total Deposits (%)

13.47

13.97

16.93

14.87

14.88

14.36

Trans Accts/Total Deposits (%)

18.91

19.30

22.29

20.99

20.95

20.29

Savings+MMDAs/Total Deposits (%)

22.32

26.31

25.32

26.85

27.92

27.87

Retail CDs/Total Deposits (%)

47.31

42.58

40.25

38.34

35.47

37.46

Jumbo CDs/Total Deposits (%)

11.46

11.80

12.14

13.82

15.66

14.38

Asset Quality

NPLs/ Total Loans (%)

0.27

0.59

2.15

3.36

2.27

1.75

NPAs/Total Assets (%)

0.21

0.54

1.65

2.73

2.09

1.62

NPAs + 90s/Total Assets (%)

1.19

0.56

1.65

2.73

2.09

1.62

Reserves/Loans (%)

1.12

1.07

1.25

1.40

1.39

1.47

Reserves/NPAs (%)

410.85

145.90

58.06

41.06

55.54

77.38

NCOs/Average Loans (%)

-0.01

0.26

0.11

0.09

0.72

0.73

As of or for the years ended December 31,

Ownership Profile

Page 16

Total Insider Ownership of Luxemburg Bancshares, Inc.:

6.0%

All Directors and Executive

Officers of the Company

Shares Held

% Held

Raymond J. Balza

825

0.1

Lois M. Hoida

3,430

0.6

Sheri L. Knope

285

0.1

Ronald A. Ledvina

5,578

1.0

David Luebbers

6,625

1.2

Donald E. Pritzl

1,551

0.3

Thomas J. Rueckl

6,748

1.2

Stephan L. Seidl

1,147

0.2

John A. Slatky

7,457

1.3

Peter J. Tillman

30

0.0

Totals:

33,676

6.0

Tab 3

Valuation of Luxemburg Bancshares, Inc.

Discounted Dividend Analysis

Peer Group Comparison

Discounted Dividend Analysis

Page 19

Discounted Dividend Analysis

Luxemburg Bancshares Provided Assumptions:

5 years of earnings projections were provided:

2005: $1.9 million

2006: $2.0 million

2007: $2.2 million

2008: $2.4 million

2009: $2.6 million

Resulting 5-year CAGR from earnings projections of 8.0%

We note that management’s earnings estimate for 2005 represents an increase of 31% over

2004 earnings and is substantially higher than the 8.0% projected growth rate for years 2005 –

2009. Management expects to return to normal operating earnings in 2005, after having to

take a special loan loss provision in 2004 for the charge-off of a nonperforming loan. The

2005 earnings estimate will have Luxemburg generating an ROAA of approximately 1.0% for

2005. The Company’s historical ROAA has ranged from 1.0% - 1.3%.

Asset growth rate of 8.0%.

Tax rate of 35%.

Page 20

Discounted Dividend Analysis

Discounted Dividend Analysis Assumptions Cont.

A minimum capital ratio of 7.0% to reflect LUX’s asset growth rate and increased regulatory

scrutiny.

To determine an appropriate discount rate range, we first looked at Luxemburg’s current

ROAE. Luxemburg’s current ROAE of 9.43%, driven by a significant loan loss provision, is not

a reasonable proxy for a discount rate in this analysis. Historically, Luxemburg’s ROAE has

ranged from approximately 12.0% - 14.0%. Management expects ROAE levels to return to the

historical range and therefore we determined that 12.0% - 14.0% was an appropriate discount

rate range.

The terminal multiple range of 13.0x – 15.0x is based on historical trading multiples of the

banking industry.

Discounted Dividend Analysis

Page 21

(Dollars in thousands, except per share data)

MAINTAIN TANGIBLE EQUITY RATIO OF 7.00%.

LUXEMBURG BANCSHARES, INC. EARNINGS AS ESTIMATES

ASSUMES NO RESTRUCTURING CHARGE

Five Year Projections

2005

2006

2007

2008

2009

Beginning Equity (a)

$11,692

$12,628

$13,638

$14,729

$15,907

Unadjusted Net Income (a,b)

1,877

2,027

2,189

2,364

2,554

After Tax Income Impact (c)

(153)

(161)

(170)

(180)

(191)

Synergies/Restructuring Charge (d)

0

0

0

0

0

Adjusted Net Income (e)

$1,724

$1,866

$2,019

$2,184

$2,363

Dividends (f)

(789)

(856)

(928)

(1,006)

(1,090)

Ending Equity

12,628

13,638

14,729

15,907

17,180

Intangibles (g)

0

0

0

0

0

Ending Tangible Equity

$12,628

$13,638

$14,729

$15,907

$17,180

Net Change in Equity (h)

(367)

(400)

(436)

(474)

(516)

Cumulative Change in Equity

(7,081)

(7,480)

(7,916)

(8,390)

(8,906)

Total Assets (a,b)

$180,397

$194,828

$210,415

$227,248

$245,428

Asset Growth Rate

3.83%

8.00%

8.00%

8.00%

8.00%

Net Income Growth Rate (i)

NM

8.23%

8.20%

8.18%

8.17%

Return on Average Assets

1.04%

1.08%

1.08%

1.08%

1.08%

Adjusted ROAA

0.96%

0.99%

1.00%

1.00%

1.00%

Adjusted ROAE

14.18%

14.21%

14.24%

14.26%

14.28%

Equity / Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Tangible Equity/ Tangible Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Discounted Dividend Analysis

Page 22

Aggregate Net Present Value - Per Share (j)

Discount Rate:

12.00%

13.00%

14.00%

Terminal Year

13.00

$48.30

$46.77

$45.31

Multiple of

Earnings

14.00

$50.66

$49.02

$47.47

Adj. for Intangible

Amortization (k)

15.00

$53.02

$51.28

$49.62

Discounted Dividend Analysis

Page 23

Footnotes

Methodology: The Discounted Dividend Analysis produces values given earnings estimates and projections of achievable synergies,

over a range of discount rates and terminal year earnings multiples. An initial dividend for tangible capital in excess of a

specified target is assumed; earnings in subsequent years are adjusted to reflect the opportunity cost of this distribution.

Earnings in excess of those required to maintain Luxemburg Bancshares, Inc.’s tangible equity ratio at the specified targets are

dividendable. It should be noted that “Synergies” is defined as cost savings and revenue enhancements which are assumed to

approximate 0.00% of Luxemburg Bancshares, Inc.’s non-interest expenses in 2006.

* Present value = NPV of dividend stream plus terminal year multiple applied to net income less intangible amortization.

a)

Beginning equity for Luxemburg Bancshares, Inc. represents total equity for the period ended March 31, 2005, after an initial

dividend to reduce Luxemburg Bancshares, Inc.’s tangible equity to assets to specified target tangible capital levels.

b)

Earnings assumption based on Luxemburg Bancshares, Inc. projections for 2005, and are assumed to grow at 8.00% per

annum thereafter. Asset projections are assumed to grow at an annual rate of 8.00%.

c)

Assumes a pre-tax rate of 3.50% is earned/(lost) on any capital retained/(dividended) in excess of assumed regular dividend

payout. Assumes a tax rate of 35.00%.

d)

No synergies/revenue enhancements are assumed.

e)

Adjusted for income impact of paying dividends in excess of assumed regular dividend payout ratio.

f)

Assumed to pay the maximum dividend possible while maintaining a tangible equity/asset ratio of 7.00%.

g)

Intangibles assumed to be amortized at a rate of $000 per year.

h)

Represents dividends paid in excess of estimated payout ratio of 22.50%.

i)

Includes income impact of cumulative increase (decrease) in equity.

j)

Per share data is based on 560,635 diluted shares outstanding.

k)

The terminal year multiple, when applied to terminal year adjusted earnings produces a value which approximates the net

present value of the earnings in perpetuity, given certain assumptions regarding growth rates and discount rates.

Peer Group Comparison

Peer Group Comparison

Page 25

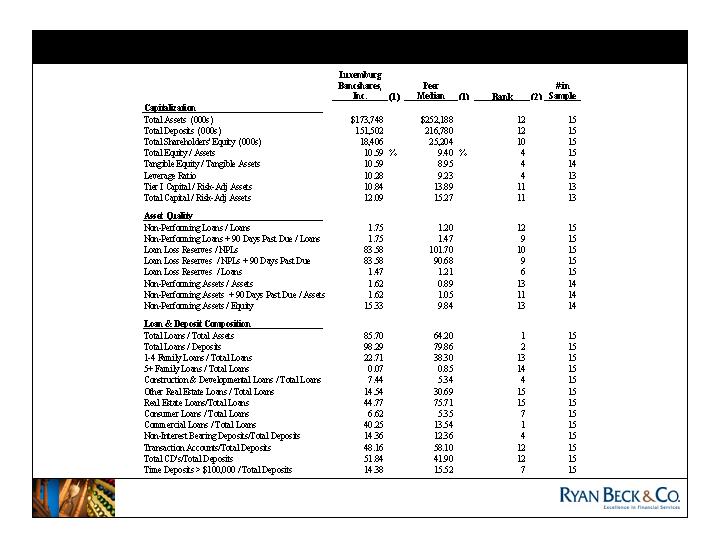

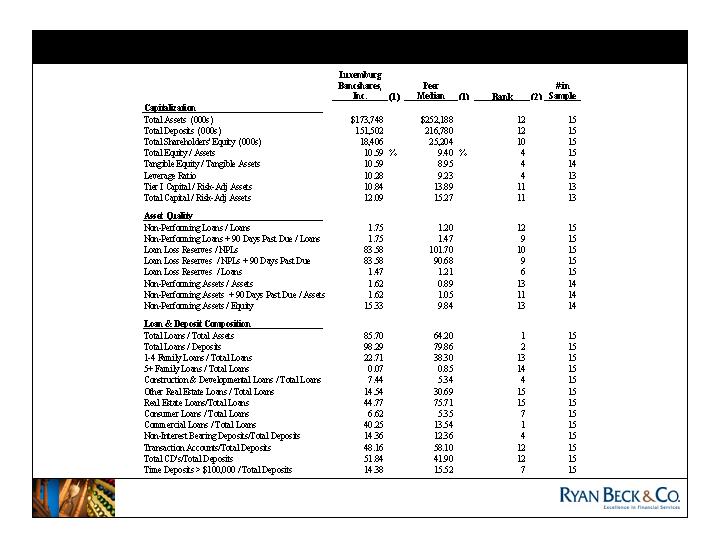

We chose the following peer group based upon these parameters:

Publicly traded.

Comparable profitability – LTM ROAA > 0.50%.

Comparable asset quality – NPL’s/Loans > 0.75%

Assets between $100 million and $500 million.

Excludes companies that have entered into an agreement to be

acquired.

Query resulted in 14 companies.

Page 26

Peer Group Comparison

(1) For the 12 months ended March 31, 2005.

(2) The highest rank is 1 (from best performer in category to worst).

Page 27

Peer Group Comparison

Luxemburg

Bancshares,

Inc.

(1)

Peer

Median

(1)

Rank

(2)

# in

Sample

Performance

Return on Average Assets

0.99

0.91

6

15

Core Return on Average Assets

0.84

0.90

10

15

Return on Average Equity

9.43

10.17

12

15

Core Return on Average Equity

7.95

10.16

12

15

Net Interest Margin

4.35

3.96

3

15

Non Interest Income / Average Assets

1.24

0.93

4

15

Non Interest Expense/Avg Assets

3.34

2.75

11

15

Efficiency Ratio

64.01

66.06

6

15

Growth Rates

Asset Growth

3.15

3.68

9

15

Loan Growth Rate

6.27

3.27

6

15

Deposit Growth Rate

4.28

3.08

7

15

Revenue Growth Rate

4.05

1.24

6

14

Market Statistics

Price / LTM EPS

13.44

x

Price / LTM Core EPS

13.57

Price / Book Value

131.38

%

Price / Tangible Book Value

137.39

Market Capitalization ($M)

$31.79

Dividend Yield

2.16

%

(1) For the 12 months ended March 31, 2005.

(2) The highest rank is 1 (from best performer in category to worst).

Page 28

Peer Group Comparison

Number

States

Total

of

of

Assets

Name

Ticker

State

Offices

Operation

($000)

Benton Financial Corporation

BTOF

IN

4

IN(4)

118,875

Blackhawk Bancorp, Inc.

BHWB

WI

9

IL(6),WI(3)

425,596

Brotherhood Bancshares, Inc.

BHDB

KS

7

KS(7)

434,786

Community National Corporation

CMNC

OH

5

OH(5)

135,504

Cortland Bancorp

CLDB

OH

13

OH(13)

446,393

Eastern Michigan Financial Corp

EFIN

MI

9

MI(9)

228,061

Empire Bancshares, Inc.

EBSH

OH

3

OH(2),IN(1)

142,250

Heartland Bancshares, Inc.

HRTB

IN

4

IN(4)

185,837

ICNB Financial Corporation

ICNB

MI

9

MI(9)

228,592

Landmark Bancorp, Inc.

LARK

KS

17

KS(17)

444,021

Ohio Legacy Corp

OLCB

OH

4

OH(4)

200,476

Pontiac Bancorp, Incorporated

PONT

IL

5

IL(5)

275,783

PSB Group, Inc.

PSBG

MI

11

MI(11)

461,342

West Pointe Bancorp, Incorporated

WTPT

IL

5

IL(5)

444,021

Median

6

252,188

Luxemburg Bancshares, Inc.

WI

7

WI(7)

173,748

Page 29

Our objective in preparing a comparable peer group analysis is to determine the implied price range

that Luxemburg would trade at if its shares were highly liquid and traded on a major stock

exchange. By making this adjustment, we eliminate the lack of marketability discount in

Luxemburg’s share value range.

In reviewing Luxemburg’s financial performance against this peer group, the results have shown

that LUX ranks in the middle overall with respect to balance sheet statistics and performance

measures.

Core earnings is defined as net income before extraordinary items less the after-tax portion of gains

(losses) from investment securities and nonrecurring items. For the latest twelve months ended

March 31, 2005, Luxemburg had $419,000 of realized pre-tax gains from the sale of available-for-

sale securities, resulting in a Core EPS for Luxemburg of $2.55 compared to the reported EPS for

the latest twelve months of $3.02.

We noted that there were four estimates in the peer group for 2005 EPS and two estimates for 2006

EPS.

The average of the implied values for Luxemburg produced by the peer group is $40.86 per share.

Peer Group Comparison

Page 31

Market Value Conclusion

By taking the average of the

implied values produced from the

discounted dividend analysis and

the peer group analysis, we believe

that the current market value of

Luxemburg common stock is

$44.94 per share.

Implied Value Per Share

Discounted Dividend Analysis

$49.02

Peer Group Analysis

$40.86

Average

$44.94

Tab 4

Control Premium Valuation

Page 33

In the Comparable Peer Group analysis, we eliminated the lack of marketability

discount. We used a 10.0% - 20.0% control premium to eliminate the minority share

discount in the implied valuation range. This adjustment complies with the

requirements of Wisconsin Statute, which requires that fair value have no discounts for

minority status or lack of marketability.

A typical control premium falls in the range of 10.0% - 20.0% of the implied market

value. Applying this range to the estimated current market value of Luxemburg’s

common stock established in the previous section results in the following per share

values.

Estimated current market value = $44.94

Implied value per share based on:

10% Premium = $49.43

15% Premium = $51.68

20% Premium = $53.93

Control Premium Valuation

Page 34

Based on the historical trading multiple

range of 13.0x – 15.0x for the banking

industry, we have assumed a terminal

multiple range of 16.0x – 18.0x to factor in a

control premium.

Incorporating a control premium into the

terminal multiple range while keeping all

other assumptions the same produced the

following per share price range.

Control Premium Valuation – Discounted Dividend Analysis

Aggregate Net Present Value - Per Share (j)

Discount Rate:

12.00%

13.00%

14.00%

Terminal Year

16.00

$55.38

$53.53

$51.78

Multiple of

Earnings

17.00

$57.74

$55.79

$53.93

Adj. for Intangible

Amortization (k)

18.00

$60.10

$58.04

$56.09

Page 35

Control Premium Valuation – Discounted Dividend Analysis

(Dollars in thousands, except per share data)

MAINTAIN TANGIBLE EQUITY RATIO OF 7.00%.

LUXEMBURG BANCSHARES, INC. EARNINGS AS ESTIMATES

ASSUMES NO RESTRUCTURING CHARGE

Five Year Projections

2005

2006

2007

2008

2009

Beginning Equity (a)

$11,692

$12,628

$13,638

$14,729

$15,907

Unadjusted Net Income (a,b)

1,877

2,027

2,189

2,364

2,554

After Tax Income Impact (c)

(153)

(161)

(170)

(180)

(191)

Synergies/Restructuring Charge (d)

0

0

0

0

0

Adjusted Net Income (e)

$1,724

$1,866

$2,019

$2,184

$2,363

Dividends (f)

(789)

(856)

(928)

(1,006)

(1,090)

Ending Equity

12,628

13,638

14,729

15,907

17,180

Intangibles (g)

0

0

0

0

0

Ending Tangible Equity

$12,628

$13,638

$14,729

$15,907

$17,180

Net Change in Equity (h)

(367)

(400)

(436)

(474)

(516)

Cumulative Change in Equity

(7,081)

(7,480)

(7,916)

(8,390)

(8,906)

Total Assets (a,b)

$180,397

$194,828

$210,415

$227,248

$245,428

Asset Growth Rate

3.83%

8.00%

8.00%

8.00%

8.00%

Net Income Growth Rate (i)

NM

8.23%

8.20%

8.18%

8.17%

Return on Average Assets

1.04%

1.08%

1.08%

1.08%

1.08%

Adjusted ROAA

0.96%

0.99%

1.00%

1.00%

1.00%

Adjusted ROAE

14.18%

14.21%

14.24%

14.26%

14.28%

Equity / Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Tangible Equity/ Tangible Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Page 36

Control Premium Valuation – Discounted Dividend Analysis

Footnotes

Methodology: The Discounted Dividend Analysis produces values given earnings estimates and projections of achievable synergies,

over a range of discount rates and terminal year earnings multiples. An initial dividend for tangible capital in excess of a

specified target is assumed; earnings in subsequent years are adjusted to reflect the opportunity cost of this distribution.

Earnings in excess of those required to maintain Luxemburg Bancshares, Inc.’s tangible equity ratio at the specified targets are

dividendable. It should be noted that “Synergies” is defined as cost savings and revenue enhancements which are assumed to

approximate 0.00% of Luxemburg Bancshares, Inc.’s non-interest expenses in 2006.

* Present value = NPV of dividend stream plus terminal year multiple applied to net income less intangible amortization.

a)

Beginning equity for Luxemburg Bancshares, Inc. represents total equity for the period ended March 31, 2005, after an initial

dividend to reduce Luxemburg Bancshares, Inc.’s tangible equity to assets to specified target tangible capital levels.

b)

Earnings assumption based on Luxemburg Bancshares, Inc. projections for 2005, and are assumed to grow at 8.00% per

annum thereafter. Asset projections are assumed to grow at an annual rate of 8.00%.

c)

Assumes a pre-tax rate of 3.50% is earned/(lost) on any capital retained/(dividended) in excess of assumed regular dividend

payout. Assumes a tax rate of 35.00%.

d)

No synergies/revenue enhancements are assumed.

e)

Adjusted for income impact of paying dividends in excess of assumed regular dividend payout ratio.

f)

Assumed to pay the maximum dividend possible while maintaining a tangible equity/asset ratio of 7.00%.

g)

Intangibles assumed to be amortized at a rate of $000 per year.

h)

Represents dividends paid in excess of estimated payout ratio of 22.50%.

i)

Includes income impact of cumulative increase (decrease) in equity.

j)

Per share data is based on 560,635 diluted shares outstanding.

k)

The terminal year multiple, when applied to terminal year adjusted earnings produces a value which approximates the net

present value of the earnings in perpetuity, given certain assumptions regarding growth rates and discount rates.

Tab 5

Repurchase Analysis

Repurchase Analysis

Page 38

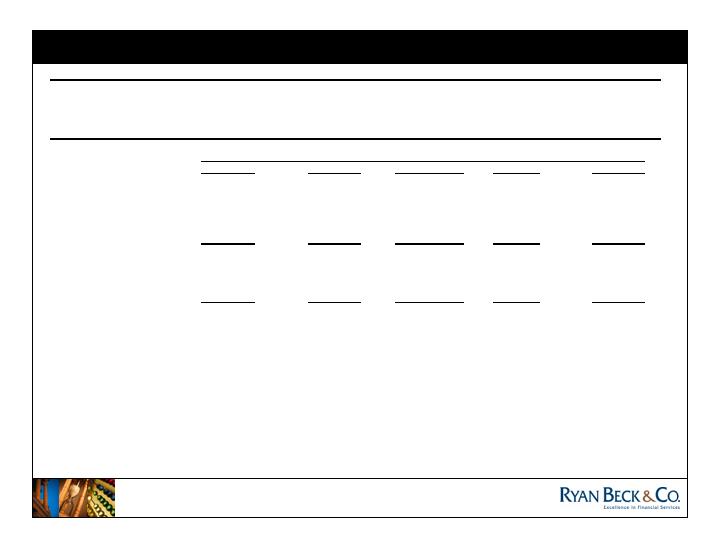

Financials as of 03/31/05.

16.48%

16.48%

16.48%

Repurchase Data

Repurchase Price

$44.94

$52.00

$54.00

$56.00

Premium to Market Price

15.71%

20.16%

24.61%

Source of Cash and Amount

Sub Debt

$4,998

$5,183

$5,368

After-tax Cost of Cash

2.28%

2.28%

2.28%

2.28%

After-tax Cost of Trust Preferred

3.25%

3.25%

3.25%

3.25%

After-tax Cost of Debt 1/

4.59%

4.59%

4.59%

4.59%

Shares Repurchased

92

92

92

Basic Shares Outstanding

561

468

468

468

Diluted Shares Outstanding

561

468

468

468

Income Statement Data

Net Income (2005 Est. of $3.35 per share)

$1,877

$1,877

$1,877

$1,877

Income Adjustment 2/

10

6

2

Proforma Net Income

1,887

1,883

1,879

Balance Sheet Data

Assets

173,748

173,750

173,565

173,380

Average Assets

171,095

171,097

170,912

170,727

Risk-adjusted Assets

168,590

168,592

168,413

168,233

Equity

18,406

13,409

13,224

13,039

Goodwill and Intangible Assets

-

-

-

-

Tangible Equity

18,406

13,409

13,224

13,039

Average Equity

17,974

12,976

12,791

12,606

Trust Preferred

-

-

-

-

Sub Debt

-

5,000

5,000

5,000

Diluted Share Data

Basic Shares Outstanding

561

468

468

468

Diluted Shares Outstanding

561

468

468

468

Footnotes

Note: Assumes $5 million of subordinated debt raised to fund repurchase. Repurchase occurs on January 1, 2005.

1/ Debt cost is 3 mo. LIBOR 3 years forward plus 265 basis points to reflect the expectation of rising interest rates.

2/ Includes estimated pre-tax cost savings of $375,000.

(dollars in thousands except per share data)

Repurchased at Price of

Proforma for Stock Repurchase of

Repurchase Analysis

Page 39

Current

16.48%

16.48%

16.48%

Repurchase Price

$44.94

$52.00

$54.00

$56.00

Market Value Data

Price / 2005 Diluted Est. EPS (x)

13.4

12.9

13.4

14.0

Price / Stated Book - Current & Pro Forma 1/

136.88%

181.58%

191.20%

201.09%

Price / Tangible Book - Current & Pro Forma 1/

136.88%

181.58%

191.20%

201.09%

Market Capitalization 1/

$25,195

$24,348

$25,284

$26,220

Fully Diluted Per Share Data

Diluted Net Income (2005 Est.) 2/

$3.35

$4.03

$4.02

$4.01

Percent Change

20.37%

20.10%

19.84%

Stated Book Value

$32.83

$28.64

$28.24

$27.85

Percent Change

-12.78%

-13.98%

-15.18%

Tangible Book Value

$32.83

$28.64

$28.24

$27.85

Percent Change

-12.78%

-13.98%

-15.18%

Ratios

Equity/Assets

10.59%

7.72%

7.62%

7.52%

Tangible Equity/Assets

10.59%

7.72%

7.62%

7.52%

Leverage Ratio

10.28%

7.76%

7.66%

7.56%

Tier 1 Ratio

10.84%

7.91%

7.81%

7.71%

Total Capital Ratio

12.09%

12.09%

11.99%

11.90%

ROAA (based on 2005 net income)

1.10%

1.10%

1.10%

1.10%

ROAE (based on 2005 net income)

10.44%

14.54%

14.72%

14.90%

Footnotes

Note: Assumes repurchase occurs on January 1, 2005. Management earnings estimate used.

1/ Assumes stock price stays at repurchase price.

2/ Includes estimated pre-tax cost savings of $375,000.

(dollars in thousands except per share data)

Proforma for Stock Repurchase of

Tab 6

Conclusion

Page 41

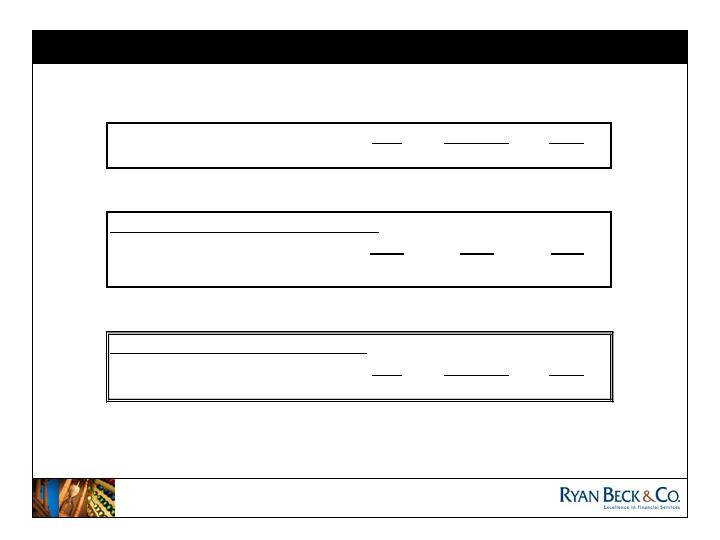

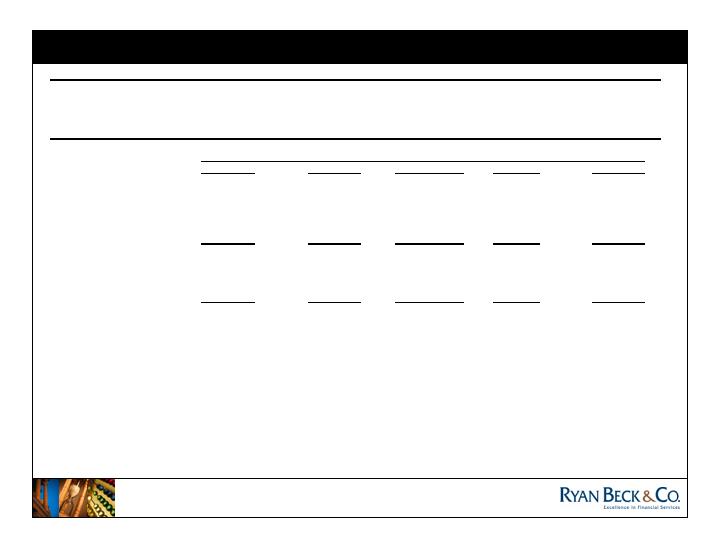

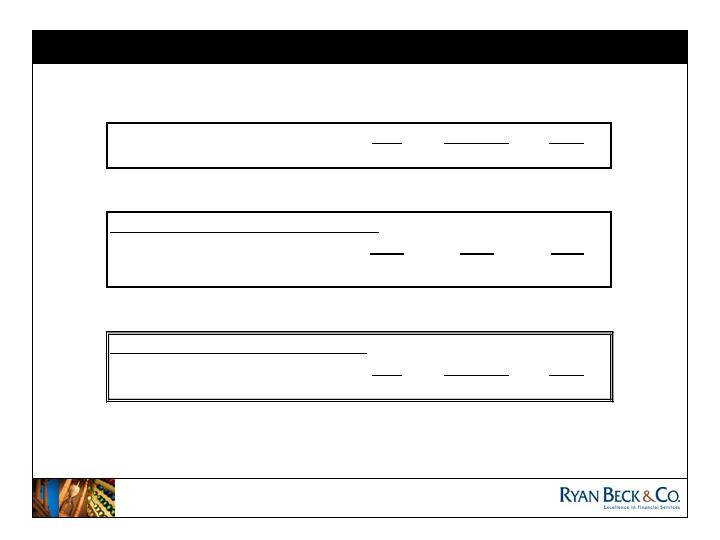

Summary of Control Premium Values

Low

Midpoint

High

Discounted Dividend Analysis

$51.78

$55.79

$60.10

Premium Over Current Market Value

10%

15%

20%

Current Market Value - $44.94

$49.43

$51.68

$53.93

Average of Control Premium Values

Low

Midpoint

High

Average Value

$50.61

$53.73

$57.01

Page 42

Conclusion

Our opinion is directed to the Board of Directors of Luxemburg solely for

their use in valuing Luxemburg common stock. We have not considered,

nor are we expressing any opinion herein with respect to the price at which

Luxemburg common stock will trade subsequent to the share repurchase

and de-registration from the SEC.

It is the opinion of Ryan Beck that:

THE FAIR VALUE OF THE 92,412 SHARES, THE AMOUNT TO BE

REPURCHASED AS PART OF THE REVERSE STOCK SPLIT, OF

LUXEMBURG BANCSHARES, INC. COMMON STOCK IS WITHIN A

RANGE OF $52.00 AND $56.00 PER SHARE.

Tab 7

Ryan Beck Relationship

Ryan Beck has not had a prior Investment Banking relationship with Luxemburg

Bancshares. Ryan Beck’s research department does not provide published

investment analysis on Luxemburg Bancshares. Ryan Beck does not act as a

market maker in Luxemburg Bancshares common stock.

In the ordinary course of our business as a broker-dealer, we may actively trade

equity securities of Luxemburg Bancshares for our own account and the account

of our customers and, accordingly, may at any time hold long or short positions in

such securities.

Page 44

Relationship with Ryan Beck